Master the Secrets of Adobe’s Creative Cloud Contracts to Right-Size Your Adobe Spend

- Adobe operates in its own niche in the creative space, and Adobe users have grown accustomed to their products, making switching very difficult.

- With Adobe’s transition to a cloud-based subscription model, it’s important for organizations to actively manage licenses, software provisioning, and consumption.

- Without a detailed understanding of Adobe’s various purchasing models, overspending often occurs.

- Organizations have experienced issues in identifying commercial licensed packages with their install files, making it difficult to track and assign licenses.

Our Advice

Critical Insight

- Focus on user needs first. Examine which products are truly needed versus nice to have to prevent overspending on the Creative Cloud suite.

- Examine what has been deployed. Knowing what has been deployed and what is being used will greatly aid in completing your true-up.

- Compliance is not automatic with products that are in the cloud. Shared logins or computers that have desktop installs that can be access by multiple users can cause noncompliance.

Impact and Result

- Visibility into license deployments and needs

- Compliance with internal audits

Master the Secrets of Adobe’s Creative Cloud Contracts to Right-Size Your Adobe Spend Research & Tools

Start here – read the Executive Brief

Procuring Adobe software is not the same game as it was just a few years ago. Adopt a comprehensive approach to understanding Adobe licensing to avoid overspending and to maximize negotiation leverage.Besides the small introduction, subscribers and consulting clients within this management domain have access to:

- Master the Secrets of Adobe’s Creative Cloud Contracts to Right-Size Your Adobe Spend Storyboard

1. Manage your Adobe agreements

Use Info-Tech’s licensing best practices to avoid overspending on Adobe licensing and to remain compliant in case of audit.

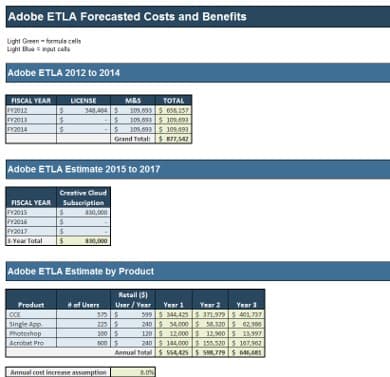

- Adobe ETLA vs. VIP Pricing Table

- Adobe ETLA Forecasted Costs and Benefits

- Adobe ETLA Deployment Forecast

Further reading

Master the Secrets of Adobe’s Creative Cloud Contracts to Right-Size Your Adobe Spend

Learn the essential steps to avoid overspending and to maximize negotiation leverage with Adobe.

ANALYST PERSPECTIVE

Only 18% of Adobe licenses are genuine copies: are yours?

"Adobe has designed and executed the most comprehensive evolution to the subscription model of pre-cloud software publishers with Creative Cloud. Adobe's release of Document Cloud (replacement for the Acrobat series of software) is the final nail in the coffin for legacy licensing for Adobe. Technology procurement functions have run out of time in which to act while they still retain leverage, with the exception of some late adopter organizations that were able to run on legacy versions (e.g. CS6) for the past five years. Procuring Adobe software is not the same game as it was just a few years ago. Adopt a comprehensive approach to understanding Adobe licensing, contract, and delivery models in order to accurately forecast your software needs, transact against the optimal purchase plan, and maximize negotiation leverage. "

Scott Bickley

Research Lead, Vendor Practice

Info-Tech Research Group

Our understanding of the problem

This Research is Designed For:

- IT managers scoping their Adobe licensing requirements and compliance position.

- CIOs, CTOs, CPOs, and IT directors negotiating licensing agreements in search of cost savings.

- ITAM/Software asset managers responsible for tracking and managing Adobe licensing.

- IT and business leaders seeking to better understand Adobe licensing options (Creative Cloud).

- Vendor management offices in the process of a contract renewal.

This Research Will Help You:

- Understand and simplify licensing per product to help optimize spend.

- Ensure agreement type is aligned to needs.

- Navigate the purchase process to negotiate from a position of strength.

- Manage licenses more effectively to avoid compliance issues, audits, and unnecessary purchases.

This Research Will Also Assist:

- CFOs and the finance department

- Enterprise architects

- ITAM/SAM team

- Network and IT architects

- Legal

- Procurement and sourcing

This Research Will Help Them:

- Understand licensing methods in order to make educated and informed decisions.

- Understand the future of the cloud in your Adobe licensing roadmap.

Executive summary

Situation

- Adobe’s dominant market position and ownership of the creative software market is forcing customers to refocus the software acquisition process to ensure a positive ROI on every license.

- In early 2017, Adobe announced it would stop selling perpetual Creative Suite 6 products, forcing future purchases to be transitioned to the cloud.

Complication

- Adobe operates in its own niche in the creative space, and Adobe users have grown accustomed to their products, making switching very difficult.

- With transition to a cloud-based subscription model, organizations need to actively manage licenses, software provisioning, and consumption.

- Without a detailed understanding of Adobe’s various purchasing models, overspending often occurs.

- Organizations have experienced issues in identifying commercial licensed packages with their install files, making it difficult to track and assign licenses.

Resolution

- Gain visibility into license deployments and needs with a strong SAM program/tool; this will go a long way toward optimizing spend.

- Number of users versus number of installs are not the same, and confusing the two can result in overspending. Device-based licensing historically would have required two licenses, but now only one may be required.

- Ensure compliance with internal audits. Adobe has a very high rate of piracy stemming from issues such as license overuse, misunderstanding of contract language, using cracks/keygens, virtualized environments, indirect access, and sharing of accounts.

- A handful of products are still sold as perpetual – Acrobat Standard/Pro, Captivate, ColdFusion, Photoshop, and Premiere Elements – but be aware of what is being purchased and used in the organization.

- Beware of products deployed on server, where the number of users accessing that product cannot easily be counted.

Info-Tech Insight

- Your user-need analysis has shifted in the new subscription-based model. Determine which products are needed versus nice to have to prevent overspending on the Creative Cloud suite.

- Examine what you need, not what you have. You can no longer mix and match applications.

- Compliance is not automatic with products that are in the cloud. Shared logins or computers with desktop installs that can be accessed by multiple users can cause noncompliance.

The aim of this blueprint is to provide a foundational understanding of Adobe

Why Adobe

In 2011 Adobe took the strategic but radical move toward converting its legacy on-premises licensing to a cloud-based subscription model, in spite of material pushback from its customer base. While revenues initially dipped, Adobe’s resolve paid off; the transition is mostly complete and revenues have doubled. This was the first enterprise software offering to effect the transition to the cloud in a holistic manner. It now serves as a case study for those following suit, such as Microsoft, Autodesk, and Oracle.

What to know

Adobe elected to make this market pivot in a dramatic fashion, foregoing a gradual transition process. Enterprise clients were temporarily allowed to survive on legacy on-premises editions of Adobe software; however, as the Adobe Creative Cloud functionality was quickly enhanced and new applications were launched, customer capitulation to the new subscription model was assured.

The Future

Adobe is now leveraging the power of connected customers, the availability of massive data streams, and the ongoing digitalization trend globally to supplement the core Creative Cloud products with online services and analytics in the areas of Creative Cloud for content, Marketing Cloud for marketers, and Document Cloud for document management and workflows. This blueprint focuses on Adobe's Creative Cloud and Document Cloud solutions and the enterprise term license agreement (ETLA).

Info-Tech Insight

Beware of your contract being auto-renewed and getting locked into the quantities and product subset that you have in your current agreement. Determining the number of licenses you need is critical. If you overestimate, you're locked in for three years. If you underestimate, you have to pay a big premium in the true-up process.

Learn the “Adobe way,” whether you are reviewing existing spend or considering the purchase of new products

- Legacy on-premises Adobe Creative Suite products used to be available in multiple package configurations, enabling right-sized spend with functionality. Adobe’s support for legacy Creative Suites CS6 products ended in May 2017.

- While early ETLAs allowed customer application packaging at a lower price than the full Creative Cloud suite, this practice has been discontinued. Now, the only purchasing options are the full suite or single-application subscriptions.

- Buyers must now assess alternative Adobe products as an option for non-power users. For example, QuarkXPress, Corel PaintShop Pro, CorelDRAW, Bloom, and Affinity Designer are possible replacements for some Creative Cloud applications.

- Document Cloud, Adobe’s latest step in creating an Acrobat-focused subscription model, limits the ability to reduce costs with an extended upgrade cycle. These changes go beyond the licensing model.

- Organizations need to perform a cost-benefit analysis of single app purchases vs. the full suite to right-size spend with functionality.

As Adobe’s dominance continues to grow, organizations must find new ways to maintain a value-added relationship

Adobe estimates the total addressable market for creative and document cloud to be $21 billion. With no sign of growth slowing down, Adobe customers must learn how to work within the current design monopoly.

Source: Adobe, 2017

"Adobe is not only witnessing a steady increase in Creative Cloud subscriptions, but it also gained more visibility into customers’ product usage, which enables it to consistently push out software updates relevant to user needs. The company also successfully transformed its sales organization to support the recurring revenue model."

– Omid Razavi, Global Head of Success, ServiceNow

Consider your route forward

Consider your route forward, as ETLA contract commitments, scope, and mechanisms differ in structure to the perpetual models previously utilized. The new model shortchanges technology procurement leaders in their expectations of cost-usage alignment and opex flexibility (White, 2016).

☑ Implement a user profile to assign licenses by version and limit expenditures. Alternatives can include existing legacy perpetual and Acrobat classic versions that may already be owned by the organization.

☑ Examine the suitability and/or dependency on Document Cloud functions, such as existing business workflows and e-signature integration.

☑ Involve stakeholders in the evaluation of alternate products for use cases where dependency on Acrobat-specific functionality is limited.

☑ Identify not just the installs and active use of the applications but also the depth and breadth of use across the various features so that the appropriate products can be selected.

Use Info-Tech’s Adobe toolkit to prepare for your new purchases or contract renewal

Info-Tech Insight

IT asset management (ITAM) and software asset management (SAM) are critical! An error made in a true-up can cost the organization for the remaining years of the ETLA. Info-Tech worked with one client that incurred a $600k error in the true-up that they were not able to recoup from Adobe.

Apply licensing best practices and examine the potential for cost savings through an unbiased third-party perspective

Establish Licensing Requirements

- Understand Adobe’s product landscape and transition to cloud.

- Analyze users and match to correct Adobe SKU.

- Conduct an internal software assessment.

- Build an effective licensing position.

Evaluate Licensing Options

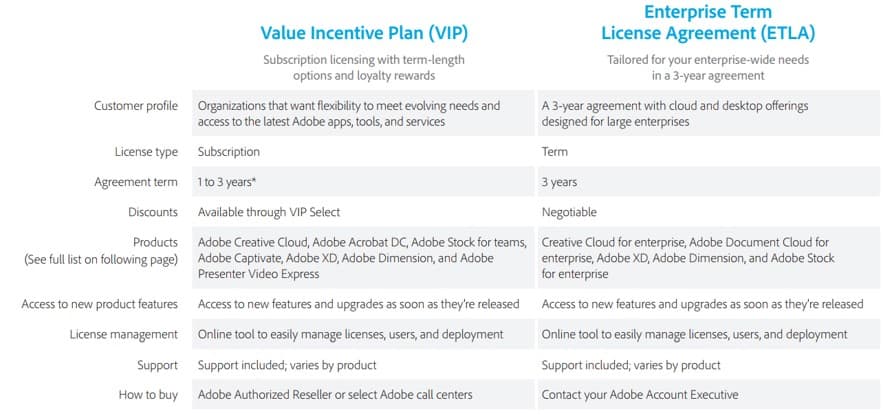

- Value Incentive Plan (VIP)

- Cumulative Licensing Program (CLP)

- Transactional Licensing Program (TLP)

- Enterprise Term License Agreement (ETLA)

Evaluate Agreement Options

- Price

- Discounts

- Price protection

- Terms and conditions

Purchase and Manage Licenses

- Learn negotiation tactics to enhance your current strategy.

- Control the flow of communication.

- Assign the right people to manage the environment.

Preventive practices can help find measured value ($)

Time and resource disruption to business if audited

Lost estimated synergies in M&A

Cost of new licensing

Cost of software audit, penalties, and back support

Lost resource allocation and time

Third party, legal/SAM partners

Cost of poor negotiation tactics

Lost discount percentage

Terms and conditions improved

Explore Adobe licensing and optimize spend – project overview

Establish Licensing Requirements |

Evaluate Licensing Options |

Evaluate Agreement Options |

Purchase and Manage Licenses |

|

|---|---|---|---|---|

Best-Practice Toolkit |

|

|

|

|

Guided Implementations |

|

|

|

|

PHASE 1

Manage Your Adobe Agreements

Phase 1 outline

Call 1-888-670-8889 or email GuidedImplementations@InfoTech.com for more information.

Complete these steps on your own, or call us to complete a guided implementation. A guided implementation is a series of 2-3 advisory calls that help you execute each phase of a project. They are included in most advisory memberships.

|

Guided Implementation 1: Managing Adobe Contracts Proposed Time to Completion: 3-6 weeks |

||

|---|---|---|

|

Step 1.1: Establish Licensing Requirements Start with a kick-off call:

Then complete these activities…

With these tools & templates: Adobe ETLA Deployment Forecast |

Step 1.2: Determine Licensing Options Review findings with analyst:

Then complete these activities…

With these tools & templates: Adobe ETLA vs. VIP Pricing Table Adobe ETLA Forecasted Costs and Benefits |

Step 1.3: Purchase and Manage Licenses Review findings with analyst:

Then complete these activities…

With these tools & templates: Adobe ETLA Deployment Forecast |

Adobe’s Cloud – Snapshot of what has changed

- Since Adobe has limited the procurement and licensing options with the introduction of Creative Cloud, there are three main choices:

- Direct online purchase at Adobe.com

- Value Incentive Plan (VIP): Creative Cloud for teams–based purchase with a volume discount (minimal, usually ~10%); may have some incentives or promotional pricing

- Enterprise Term License Agreement (ETLA): Creative Cloud for Enterprise (CCE)

- Adobe has discontinued support for legacy perpetual licenses, with the latest version being CS6, which is steering organizations to prioritize their options for products in the creative and document management space.

- Document Cloud (DC) is the cloud product replacing the Acrobat perpetual licensing model. DC extends the subscription-based model further and limits options to extend the lifespan of legacy on-premises licenses through a protracted upgrade process.

- The subscription model, coupled with limited discount options on transactional purchases, forces enterprises to consider the ETLA option. The ETLA brings with it unique term commitments, new pricing structures, and true-up mechanisms and inserts the "land and expand" model vs. license reassignment.

Info-Tech Insight

Adobe’s move from a perpetual license to a per-user subscription model can be positive in some scenarios for organizations that experienced challenges with deployment, management of named users vs. devices, and license tracking.

Core concepts of Adobe agreements: Discounting, pricing, and bundling

ETLA

Adobe has been systematically reducing discounts on ETLAs as they enter the second renewal cycle of the original three-year terms.

Adobe Cloud Bundling

Adobe cloud services are being bundled with ETLAs with a mandate that companies that do not accept the services at the proposed cost have Adobe management’s approval to unbundle the deal, generally with no price relief.

Custom Bundling

The option for custom bundling of legacy Creative Suite component applications has been removed, effectively raising the price across the board for licensees that require more than two Adobe applications who must now purchase the full Creative Cloud suite.

Higher and Public Education

Higher education/public education agreements have been revamped over the past couple of years, increasing prices for campus-wide agreements by double-digit percentages (~10-30%+). While they still receive an 80% discount over list price, IT departments in this industry are not prepared to absorb the budget increase.

Info-Tech Insight

Adobe has moved to an all-or-one bundle model. If you need more than two application products, you will likely need to purchase the full Creative Cloud suite. Therefore, it is important to focus on creating accurate user profiles to identify usage needs.

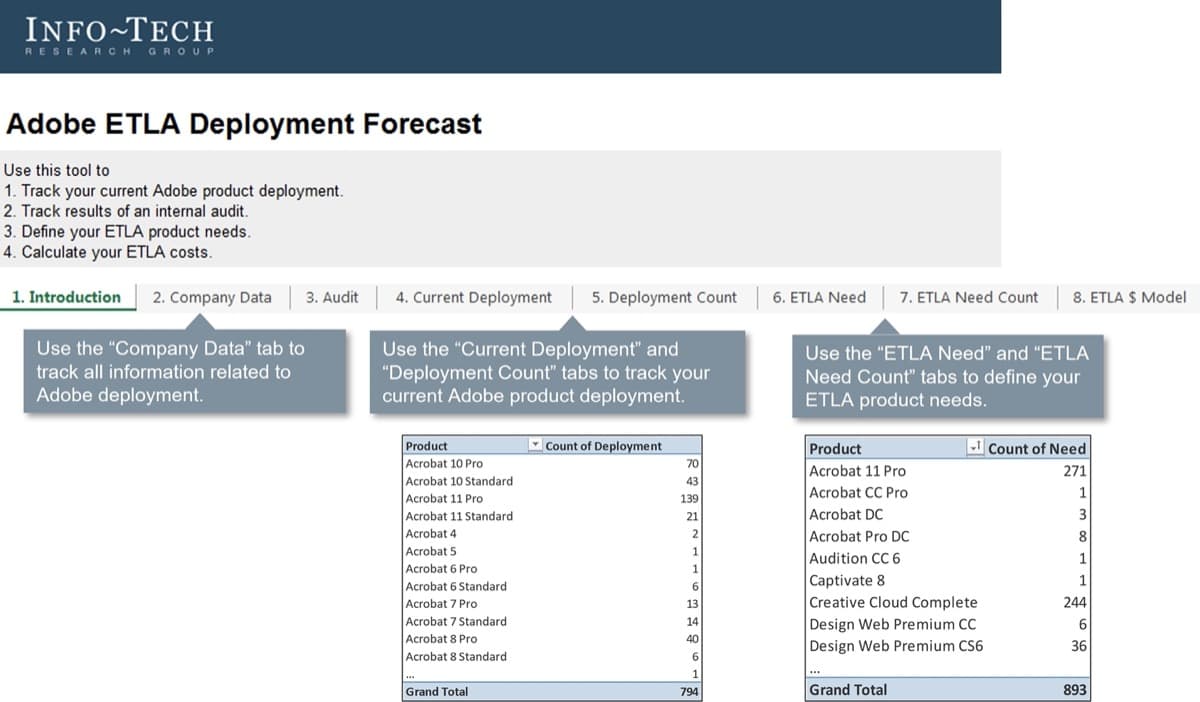

Use Info-Tech’s Adobe deployment tool for SAM: Track deployment and needs

Use Info-Tech’s Adobe deployment tool for SAM: Audit

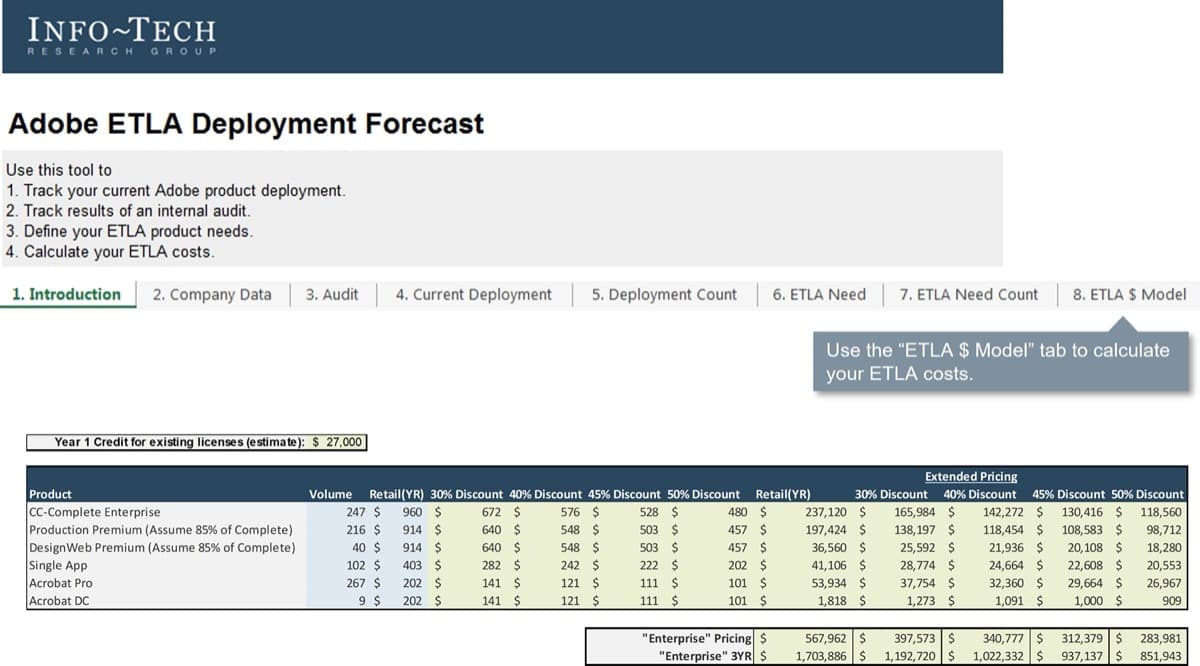

Use Info-Tech’s Adobe deployment tool for SAM: Cost

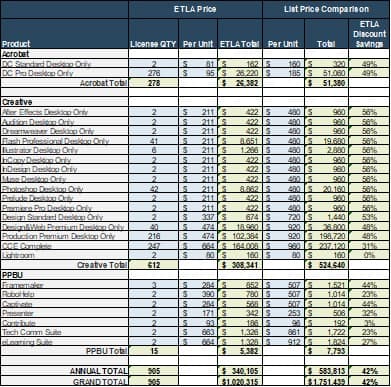

Use Info-Tech’s tools to compare ETLA vs. VIP and to document forecasted costs and benefits

Is the ETLA or VIP option better for your organization?

Use Info-Tech’s Adobe ETLA vs. VIP Pricing Table tool to compare ETLA costs against VIP costs.

Your ETLA contains multiple products and is a multi-year agreement.

Use Info-Tech’s ETLA Forecasted Costs and Benefits tool to forecast your ETLA costs and document benefits.

Adobe’s Creative Cloud Complete offering provides access to all Adobe creative products and ongoing upgrades

Why subscription model?

The subscription model forces customers to an annuity-based pricing model, so Adobe has recurring revenue from a subscription-based product. This increases customer lifetime value (CLTV) for Adobe while providing ongoing functionality updates that are not version/edition dependent.

Key Characteristics:

- Available as a month-to-month or annual subscription license

- Can be purchased for one user, for a team, or for an enterprise

- Subject to annual payment and true-up of license fees

- Can only true-up during lifespan of contract; quantities cannot be reduced until renewal

- May contain auto-renewal clauses – beware!

Key things to know:

- Applications can be purchased individually if users require only one specific product. A few products continue to have on-premises licensing options, but most are offered by per-user subscriptions.

- At the end of the subscription period, the organization no longer has any rights to the software and would have to return to a previously owned version.

- True-downs are not possible (in contrast to Microsoft’s Office 365).

- Downgrade rights are not included or are limited by default.

Which products are in the Creative Cloud bundle?

Adobe Digital Publishing Suite, Single Edition

Adobe offers different solutions for teams vs. enterprise licensing

Evaluate the various options for Creative Cloud, as they can be purchased individually, for teams, or for enterprise.

Bundle Name |

Target Customer |

Included Applications |

Features |

|---|---|---|---|

CC (for Individuals) |

Individual users |

The individual chooses |

|

CC for Teams (CCT) |

Small to midsize organizations with a small number of Adobe users who are all within the same team |

Depends on your team’s requirements. You can select all applications or specific applications. |

Everything that CC (for individuals) does, plus

|

CC for Enterprise (CCE) |

Large organizations with users who regularly use multiple Adobe products on multiple machines |

All applications including Adobe Stock for images and Adobe Enterprise Dashboard for managing user accounts |

Everything that CCT does, plus

|

For further information on specific functionality differences, reference Adobe’s comparison table.

A Cloud-ish solution: Considerations and implications for IT organizations

☑ True cloud products are typically service-based, scalable and elastic, shared resources, have usage metering, and rely upon internet technologies. Currently, Adobe’s Creative Cloud and Document Cloud products lack these characteristics. In fact, the core products are still downloaded and physically installed on endpoint devices, then anchored to the cloud provisioning system, where the software can be automatically updated and continuously verified for compliance by ensuring the subscription is active.

☑ Adobe Cloud allows Adobe to increase end-user productivity by releasing new features and products to market faster, but the customer will increase lock-in to the Adobe product suite. The fast-release approach poses a different challenge for IT departments, as they must prepare to test and support new functionality and ensure compatibility with endpoint devices.

☑ There are options at the enterprise level that enable IT to exert more granular control over new feature releases, but these are tied to the ETLA and the provided enterprise portal and are not available on other subscription plans. This is another mechanism by which Adobe has been able to spur ETLA adoption.

☑ Not all CIOs consider SaaS/subscription applications their first choice, but the Adobe’s dominant position in the content and document management marketplace is forcing the shift regardless. It is significant that Adobe bypassed the typical hybrid transition model by effectively disrupting the ability to continue with perpetual licensing without falling behind the functionality curve.

☑ VIP plans do allow for annual terms and payment, but you lose the price elasticity that comes with multi-year terms.

Download Info-Tech’s Adobe ETLA vs. VIP Pricing Table tool to compare ETLA costs against VIP costs.

When moving to Adobe cloud, validate that license requirements meet organizational needs, not a sales quota

Follow these steps in your transition to Creative Cloud.

Step 1: Make sure you have a software asset management (SAM) tool to determine Adobe installs and usage within your environment.

Step 2: Look at the current Adobe install base and usage. We recommend reviewing three months’ worth of reliable usage data to decide which users should have which licenses going forward.

Step 3: Understand the changes in Adobe packages for Creative Cloud (CC). Also, take into account that the license types are based on users, not devices.

Step 4: Identify those users who only need a single license for a single application (e.g. Photoshop, InDesign, Muse).

Step 5: Identify the users who require CC suites. Look at their usage of previous Adobe suites to get an idea of which CC suite they require. Did they have Design Suite Standard installed but only use one or two elements? This is a good way to ensure you do not overspend on Adobe licenses.

Source: The ITAM Review

Download Info-Tech’s Adobe ETLA Deployment Forecast tool to track Adobe installs within your environment and to determine usage needs.

Acquiring Adobe Software

Adobe offers four common licensing methods, which are reviewed in detail in the following slides.

Most common purchasing models |

Points for consideration |

|---|---|

|

|

"Customers are not even obliged to manage all the licenses themselves. The reseller partners have access to the cloud console and can manage licenses on behalf of their customers. Even better, they can seize cross and upsell opportunities and provide good insight into the environment. Additionally, Adobe itself provides optimization services."

– B-lay

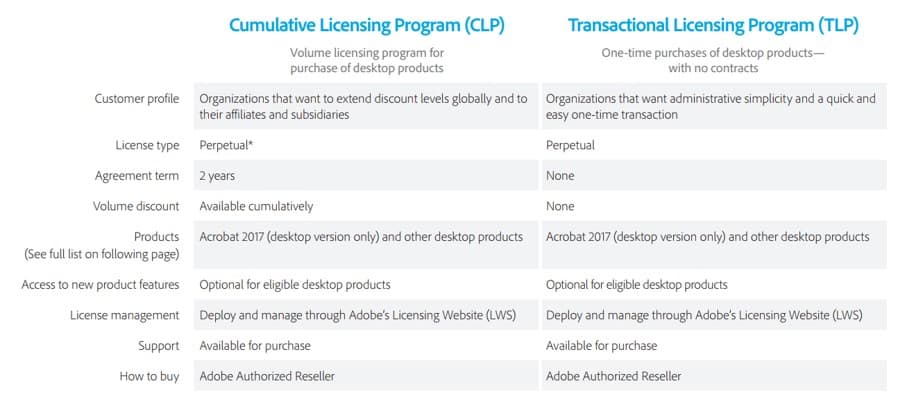

CLP and TLP

The CLP and TLP are transactional agreements generally used for the purchase of perpetual licenses. For example, they could be used for making Acrobat purchases if Creative Suite products are purchased on the ETLA.

Source: “Adobe Buying Programs Comparison Guide for Commercial and Government Organizations”

VIP and ETLA

The Value Incentive Plan is aimed at small- to medium-sized organizations with no minimum quantity required. However, there is limited flexibility to reduce licenses and limited price protection for future purchases. The ETLA is aimed at large organizations who wish to have new functionality as it comes out, license management portal, services, and security/IT control aspects.

Source: “Adobe Buying Programs Comparison Guide for Commercial and Government Organizations”

ETLA commitments risk creating “shelfware-as-a-service”

The Adobe ETLA’s rigid contract parameters, true-up process, and unique deployment/provisioning mechanisms give technology/IT procurement leaders fewer options to maximize cost-usage alignment and to streamline opex costs.

☑ No ETLA price book is publicly published; pricing is controlled by the Adobe enterprise sales team.

☑ Adobe's retail pricing is a good starting point for negotiating discounted pricing.

☑ ETLA commitments are usually for three years, and the lack of a true-down option increases the risk involved in overbuying licenses should the organization encounter a business downturn or adverse event.

☑ Pricing discounts are the highest at the initial ETLA signing for the upfront volume commitment. The true-up pricing is discounted from retail but still higher than the signing cost per license.

☑ Technical support is included in the ETLA.

☑ While purchases typically go through value-added resellers (VARs), procurement can negotiate directly with Adobe.

"For cloud products, it is less complex when it comes to purchasing and pricing. If larger quantities are purchased on a longer term, the discount may reach up to 15%. As soon as you enroll in the VIP program, you can control all your licenses from an ‘admin console’. Any updates or new functionalities are included in the original price. When the licenses expire, you may choose to renew your subscriptions or remove them. Partial renewal is also accepted. Of course, you can also re-negotiate your price if more subscriptions are added to your console."

– B-lay

ETLA recommendations

- Assess the end-user requirements with a high degree of scrutiny. Perform an analysis that matches the licensee with the correct Adobe product SKU to reduce the risk of overspending.

- Leverage metering data that identifies actual usage and lack thereof, match to user profile functional requirements, and then determine end users’ actual license requirements.

- Demand price transparency and granularity in the proposal process.

- Validate that volume discounts are appropriate and show through to the true-up line item pricing.

INFO-TECH TIP: For further guidance on ETLAs and pricing, contact your Info-Tech representative to set up a call with an analyst.

Use Info-Tech’s Adobe ETLA Deployment Forecast tool to match licensees with Adobe product SKUs.

Prepare for Adobe’s true-up process

How the true-up process works

When adding a license, the true-up price will be prorated to 50% of the license cost for previous year’s usage plus 100% of the license cost for the next year. This back-charging adds up to 150% of the overall true-up license cost. In some rare cases, Adobe has provided an “unlimited” quantity for certain SKUs; these Unlimited ETLAs generally align with FTE counts and limit FTE increases to about 5%. Procurement must monitor and work with SAM/ITAM and stakeholder groups to restrain unnecessary growth during the term of an Unlimited ETLA to avoid the risk of cost escalation at renewal time.

Higher-education specific

Higher-education clients can license under the ETLA based on a prescribed number of user and classroom/lab devices and/or on a FTE basis. In these cases, the combination of Creative Cloud and Acrobat Pro volume must equal the FTE total, creating an enterprise footprint. FTE calculations establish the full-time faculty plus one-third of part-time faculty plus one-half of part-time staff.

Info-Tech Insight

Compliance takes a different form in terms of the ETLA true-up process. The completion of Adobe's transition to cloud-based licensing and verification has improved compliance rates via phone home telemetry such that pirated software is less available and more easily detected. Adobe has actually decommissioned its audit arm in the Americas and EMEA.

Audits and software asset management with Adobe

Watch out for:

- Virtual desktops, freeware, and test and trial licenses

- Adobe products that may be bundled into a suite; a manual check will be needed to ensure the suite isn’t recognized as a standalone license

- Pirated licenses with a “crack” built into the software

Simplify your process – from start to finish – with these steps:

Determine License Entitlements

Obtain documentation from internal records and Adobe to track licenses and upgrades to determine what licenses you own and have the right to use.

Gather Deployment Information

Leverage a software asset management tool or process to determine what software is deployed and what is/is not being used.

Determine Effective License Position

Compare license entitlements with deployment data to uncover surpluses and deficits in licensing. Look for opportunities.

Plan Changes to License Position

Meet with IT stakeholders to discuss the enterprise license program (ELP), short- and long-term project plans, and budget allocation. Plan and document licensing requirements.

Adobe Genuine Software Integrity Service

- This service was started in 2014 to combat non-genuine software sold by non-authorized resellers.

- The service works hand in hand with the cloud movement to reduce piracy.

- Every Adobe product now contains an executable file that will scan your machine for non-genuine software.

- If non-genuine software is detected, the user will be notified and directed to the official Adobe website for next steps.

Detailed list of Adobe licensing contract types

The table below describes Adobe contract types beyond the four typical purchasing models explained in the previous slides:

Option |

What is it? |

What’s included? |

For |

Term |

|---|---|---|---|---|

CLP (Cumulative Licensing Program) |

10,000 plus points, support and maintenance optional |

Select Adobe perpetual desktop products |

Business |

2 years |

EA (Adobe Enterprise Agreement) |

100 licenses plus maintenance and support for eligible Adobe products |

All applications |

100+ users requirement |

3 years |

EEA (Adobe Enterprise Education Agreement) |

Creative Cloud enterprise agreement for education establishments |

Creative Cloud applications without services |

Education |

1 or 2 years |

ETLA (Enterprise Term License Agreement) |

Licensing program designed for Adobe’s top commercial, government, and education customers |

All Creative Cloud applications |

Large enterprise companies |

3 years |

K-12 – Enterprise Agreement |

Enterprise agreement for primary and secondary schools |

Creative Cloud applications without services |

Education |

1 year |

K-12 – School Site License |

Allows a school to install a Creative Cloud on up to 500 school-owned computers regardless of school size |

Creative Cloud applications without services |

Education |

1 year |

TLP (Transactional Licensing Program) |

Agreement for SMBs that want volume licensing bonuses |

Perpetual desktop products only |

Aimed at SMBs, but Enterprise customers can use the TLP for smaller requirements |

N/A |

Upgrade Plan |

Insurance program for software purchased under a perpetual license program such as CLP or TLP for Creative Cloud upgrade |

Dependent on the existing perpetual estate |

Anyone |

N/A |

VIP (Value Incentive Plan) |

VIP allows customers to purchase, deploy, and manage software through a term-based subscription license model |

Creative Cloud of teams |

Business, government, and education |

Insight breakdown

Insight 1

Adobe operates in its own niche in the creative space, and Adobe users have grown accustomed to their products, making switching very difficult.

Insight 2

Adobe has transitioned the vast majority of its software offerings to the cloud-based subscription model. Active management of licenses, software provisioning, and consumption of cloud services is now an ongoing job.

Insight 3

With the vendor lock-in process nearly complete via the transition to a SaaS subscription model, Adobe is raising prices on an annual basis. Advance planning and strategic use of the ETLA is key to avoid budget-breaking surprises.

Summary of accomplishment

Knowledge Gained

- The key pieces of licensing information that should be gathered about the current state of your own organization.

- An in-depth understanding of the required licenses across all of your products.

- Clear methodology for selecting the most effective contract type.

- Development of measurable, relevant metrics to help track future project success and identify areas of strength and weakness within your licensing program.

Processes Optimized

- Understanding of the importance of licensing in relation to business objectives.

- Understanding of the various licensing considerations that need to be made.

- Contract negotiation.

Deliverables Completed

- Adobe ETLA Deployment Forecast

- Adobe ETLA Forecasted Cost and Benefits

- Adobe ETLA vs. VIP Pricing Table

Related Info-Tech Research

Take Control of Microsoft Licensing and Optimize Spend

Create an Effective Plan to Implement IT Asset Management

Establish an Effective System of Internal IT Controls to Mitigate Risks

Optimize Software Asset Management

Take Control of Compliance Improvement to Conquer Every Audit

Bibliography

“Adobe Buying Programs: At-a-glance comparison guide for Commercial and government organizations.” Adobe Systems Incorporated, 2014. Web. 1 Feb. 2018.

“Adobe Buying Programs Comparison Guide for Commercial and Government Organizations.” Adobe Systems Incorporated, 2018. Web.

“Adobe Buying Programs Comparison Guide for Education.” Adobe Systems Incorporated, 2018. Web. 1 Feb 2018.

“Adobe Education Enterprise Agreement: Give your school access to the latest industry-leading creative tools.” Adobe Systems Incorporated, 2014. Web. 1 Feb. 2018.

“Adobe Enterprise Term License Agreement for commercial and government organizations.” Adobe Systems Incorporated, 2016. Web. 1 Feb. 2018.

Adobe Investor Presentation – October 2017. Adobe Systems Incorporated, 2017. Web. 1 Feb. 2018.

Cabral, Amanda. “Students react to end of UConn-Adobe contract.” The Daily Campus (Uconn), 5 April 2017. Web. 1 Feb. 2018.

de Veer, Patrick and Alecsandra Vintilescu. “Quick Guide to Adobe Licensing.” B-lay, Web. 1 Feb. 2018.

“Find the best program for your organization.” Adobe, Web. 1 Feb 2018.

Foxen, David. “Adobe Upgrade Simplified.” Snow Software, 7 Oct. 2016. Web.

Frazer, Bryant. “Adobe Stops Reporting Subscription Figures for Creative Cloud.” Studio Daily. Access Intelligence, LLC. 17 March 2016. Web.

“Give your students the power to create bright futures.” Adobe, Web. 1 Feb 2018.

Jones, Noah. “Adobe changes subscription prices, colleges forced to pay more.” BG Falcon Media. Bowling Green State University, 18 Feb. 2015. Web. 1 Feb. 2018.

Mansfield, Adam. “Is Your Organization Prepared for Adobe’s Enterprise Term License Agreements (ETLA)?” UpperEdge,30 April 2013. Web. 1 Feb. 2018.

Murray, Corey. “6 Things Every School Should Know About Adobe’s Move to Creative Cloud.” EdTech: Focus on K-12. CDW LLC, 10 June 2013. Web.

“Navigating an Adobe Software Audit: Tips for Emerging Unscathed.” Nitro, Web. 1 Feb. 2018.

Razavi, Omid. “Challenges of Traditional Software Companies Transitioning to SaaS.” Sand Hill, 12 May 2015. Web. 1 Feb. 2018.

Rivard, Ry. “Confusion in the Cloud.” Inside Higher Ed. 22 May 2013. Web. 1 Feb. 2018.

Sharwood, Simon. “Adobe stops software licence audits in Americas, Europe.” The Register. Situation Publishing. 12 Aug. 2016. Web. 1 Feb. 2018.

“Software Licensing Challenges Faced In The Cloud: How Can The Cloud Benefit You?” The ITAM Review. Enterprise Opinions Limited. 20 Nov. 2015. Web.

White, Stephen. “Understanding the Impacts of Adobe’s Cloud Strategy and Subscriptions Before Negotiating an ETLA.” Gartner, 22 Feb. 2016. Web.

Buying Options

Master the Secrets of Adobe’s Creative Cloud Contracts to Right-Size Your Adobe Spend

Client rating

Cost Savings

Days Saved

IT Risk Management · IT Leadership & Strategy implementation · Operational Management · Service Delivery · Organizational Management · Process Improvements · ITIL, CORM, Agile · Cost Control · Business Process Analysis · Technology Development · Project Implementation · International Coordination · In & Outsourcing · Customer Care · Multilingual: Dutch, English, French, German, Japanese · Entrepreneur

Tymans Group is a brand by Gert Taeymans BV

Gert Taeymans bv

Europe: Koning Albertstraat 136, 2070 Burcht, Belgium — VAT No: BE0685.974.694 — phone: +32 (0) 468.142.754

USA: 4023 KENNETT PIKE, SUITE 751, GREENVILLE, DE 19807 — Phone: 1-917-473-8669

Copyright 2017-2022 Gert Taeymans BV