Further reading

Build a Strong Technology Foundation for Customer Experience Management

Design an end-to-end technology strategy to enhance marketing effectiveness, drive sales, and create compelling customer service experiences.

ANALYST PERSPECTIVE

Technology is the catalyst to create – and keep! – your customers.

"Customers want to interact with your organization on their own terms, and in the channels of their choice (including social media, mobile applications, and connected devices). Regardless of your industry, your customers expect a frictionless experience across the customer lifecycle. They desire personalized and well-targeted marketing messages, straightforward transactions, and effortless service. Research shows that customers value – and will pay more for! – well-designed experiences.

Strong technology enablement is critical for creating customer experiences that drive revenue. However, most organizations struggle with creating a cohesive technology strategy for customer experience management (CXM). IT leaders need to take a proactive approach to developing a strong portfolio of customer interaction applications that are in lockstep with the needs of their marketing, sales, and customer service teams. It is critical to incorporate the voice of the customer into this strategy.

When developing a technology strategy for CXM, don’t just “pave the cow path,” but instead move the needle forward by providing capabilities for customer intelligence, omnichannel interactions, and predictive analytics. This blueprint will help you build an integrated CXM technology roadmap that drives top-line revenue while rationalizing application spend."

Ben Dickie

Research Director, Customer Experience Strategy

Info-Tech Research Group

Framing the CXM project

This Research Is Designed For:

- IT leaders who are responsible for crafting a technology strategy for customer experience management (CXM).

- Applications managers who are involved with the selection and implementation of critical customer-centric applications, such as CRM platforms, marketing automation tools, customer intelligence suites, and customer service solutions.

This Research Will Help You:

- Clearly link your technology-enablement strategy for CXM to strategic business requirements and customer personas.

- Build a rationalized portfolio of enterprise applications that will support customer interaction objectives.

- Adopt standard operating procedures for CXM application deployment that address issues such as end-user adoption and data quality.

This Research Will Also Assist:

- Business leaders in marketing, sales, and customer service who want to deepen their understanding of CXM technologies, and apply best practices for using these technologies to drive competitive advantage.

- Marketing, sales, and customer service managers involved with defining requirements and rolling out CXM applications.

This Research Will Help Them:

- Work hand-in-hand with counterparts in IT to deploy high-value business applications that will improve core customer-facing metrics.

- Understand the changing CXM landscape and use the art of the possible to transform the internal technology ecosystem and drive meaningful customer experiences.

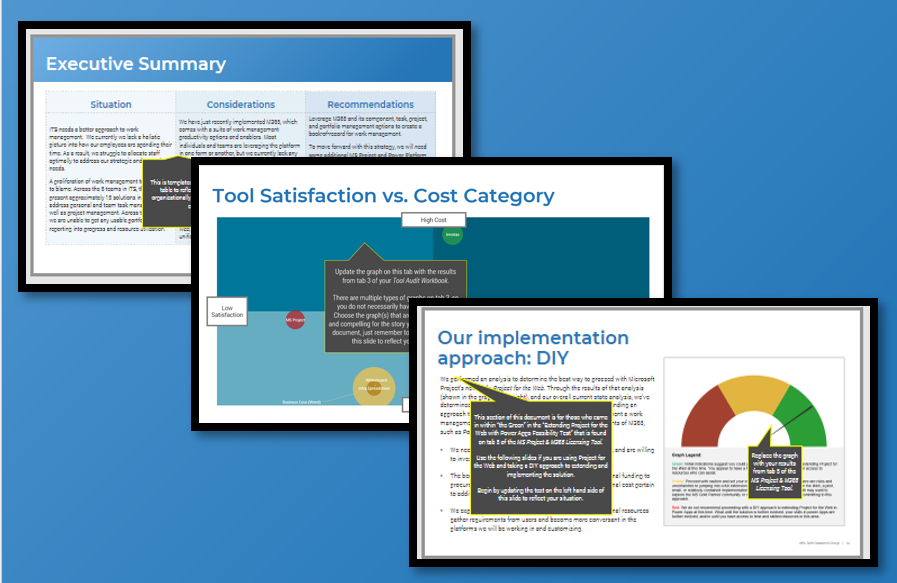

Executive summary

Situation

- Customer expectations for personalization, channel preferences, and speed-to-resolution are at an all-time high.

- Your customers are willing to pay more for high-value experiences, and having a strong customer CXM strategy is a proven path to creating sustainable value for the organization.

Complication

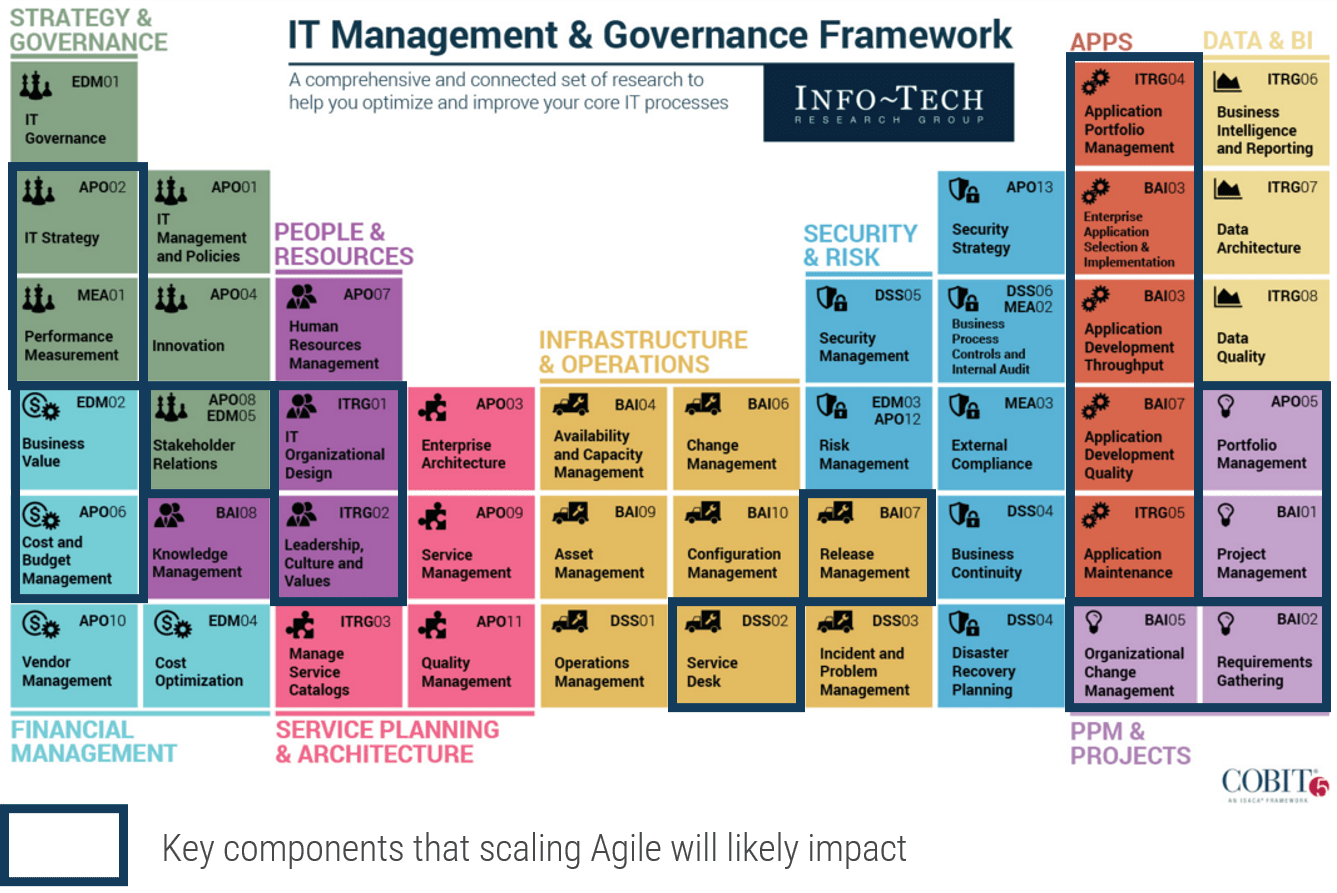

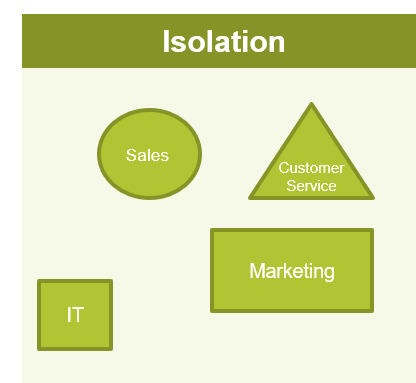

- Technology is a fundamental enabler of an organization’s CXM strategy. However, many IT departments fail to take a systematic approach to building a portfolio of applications to support Marketing, Sales, and Customer Service.

- The result is a costly, ineffective, and piecemeal approach to CXM application deployment (including high profile applications like CRM).

Resolution

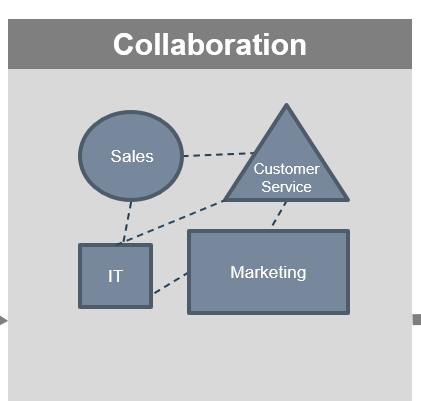

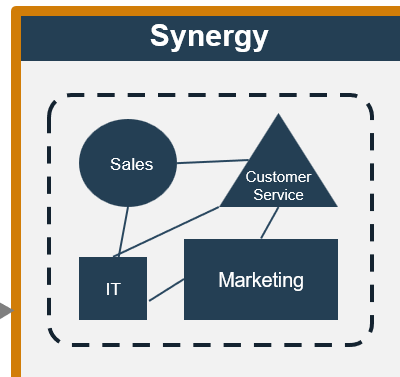

- IT must work in lockstep with their counterparts in marketing, sales, and customer service to define a unified vision, strategic requirements and roadmap for enabling strong customer experience capabilities.

- In order to deploy applications that don’t simply follow previously established patterns but are aligned with the specific needs of the organization’s customers, IT leaders must work with the business to define and understand customer personas and common interaction scenarios. CXM applications are mission critical and failing to link them to customer needs can have a detrimental effect on customer satisfaction – and ultimately revenue.

- IT must act as a valued partner to the business in creating a portfolio of CXM applications that are cost effective.

- Organizations should create a repeatable framework for CXM application deployment that addresses critical issues, including the integration ecosystem, customer data quality, dashboards and analytics, and end-user adoption.

Info-Tech Insight

- IT can’t hide behind the firewall. IT must understand the organization’s customers to properly support marketing, sales, and service efforts.

- IT – or Marketing – must not build the CXM strategy in a vacuum if they want to achieve a holistic, consistent, and seamless customer experience.

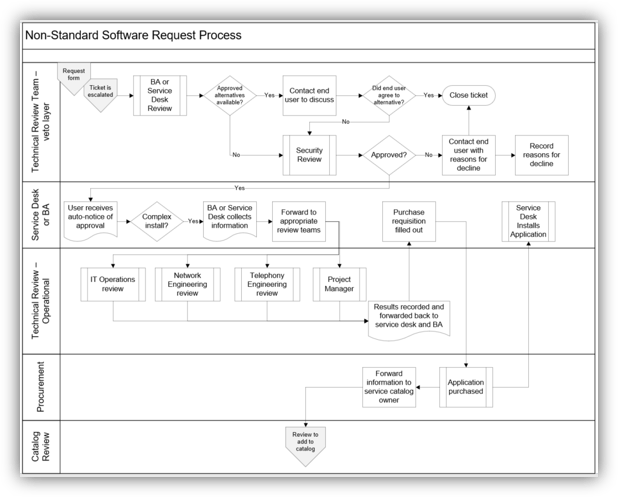

- IT must get ahead of shadow IT. To be seen as an innovator within the business, IT must be a leading enabler in building a rationalized and integrated CXM application portfolio.

Guide to frequently used acronyms

CXM - Customer Experience Management

CX - Customer Experience

CRM - Customer Relationship Management

CSM - Customer Service Management

MMS - Marketing Management System

SMMP - Social Media Management Platform

RFP - Request for Proposal

SaaS - Software as a Service

Customers’ expectations are on the rise: meet them!

Today’s consumers expect speed, convenience, and tailored experiences at every stage of the customer lifecycle. Successful organizations strive to support these expectations.

67% of end consumers will pay more for a world-class customer experience. 74% of business buyers will pay more for strong B2B experiences. (Salesforce, 2018)

5 CORE CUSTOMER EXPECTATIONS

- More personalization

- More product options

- Constant contact

- Listen closely, respond quickly

- Give front-liners more control

(Customer Experience Insight, 2016)

Customers expect to interact with organizations through the channels of their choice. Now more than ever, you must enable your organization to provide tailored customer experiences.

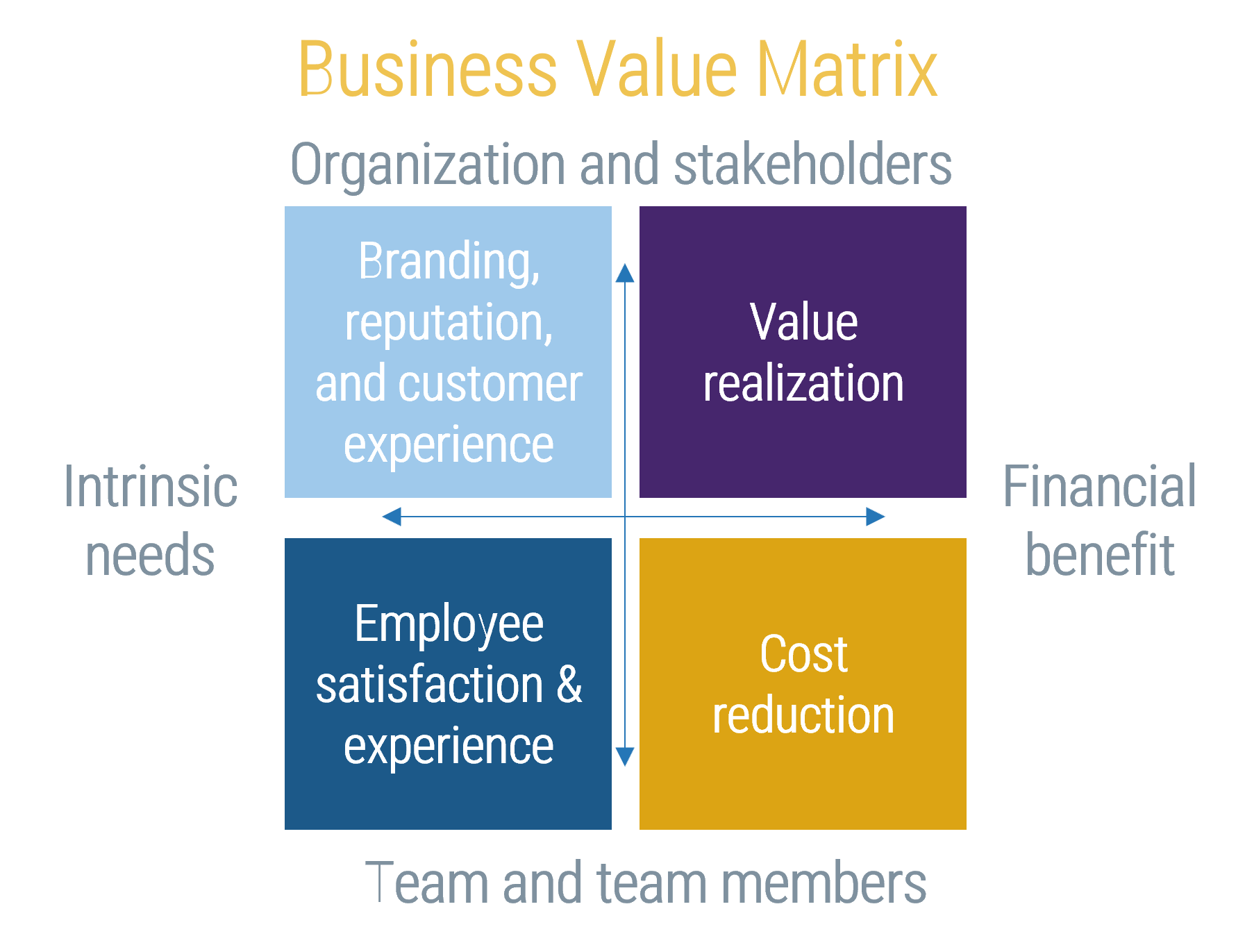

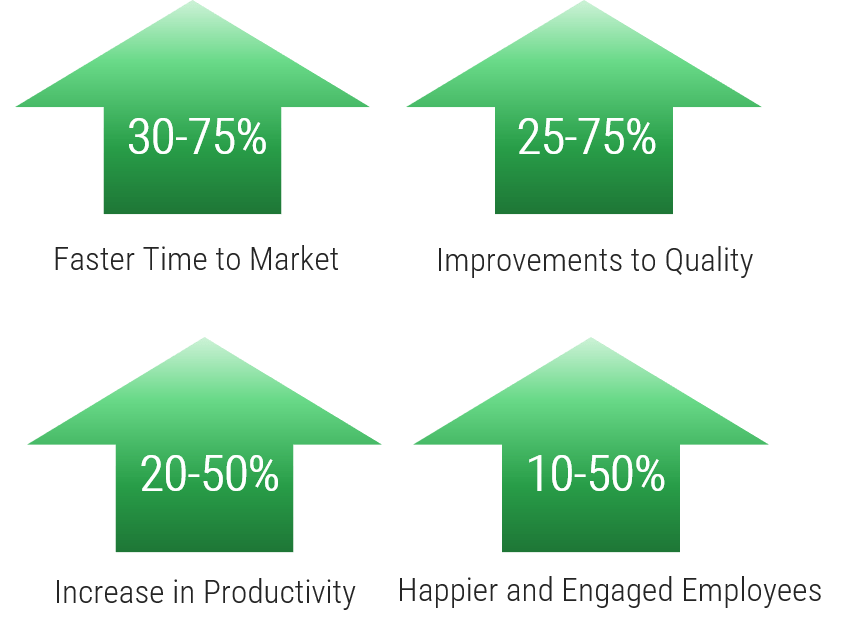

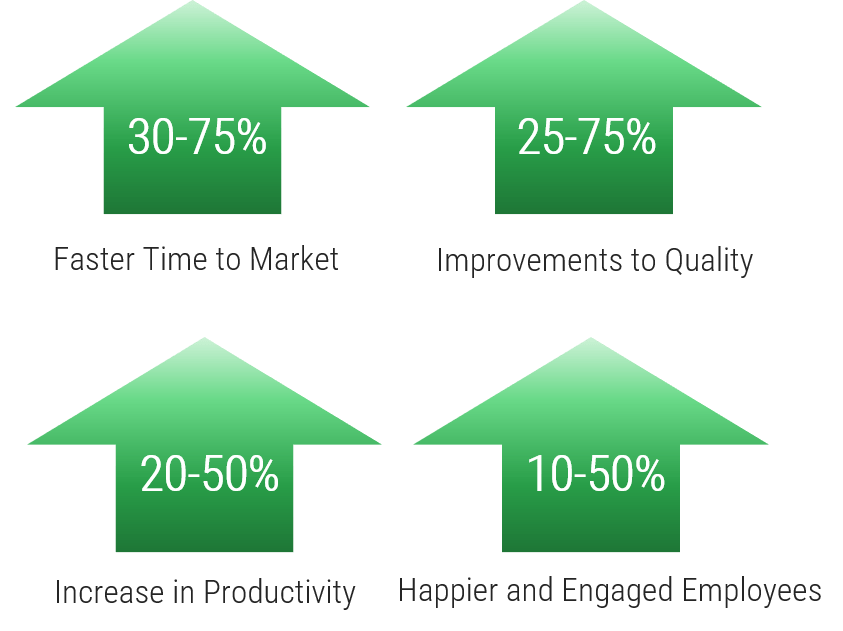

Realize measurable value by enabling CXM

Providing a seamless customer experience increases the likelihood of cross-sell and up-sell opportunities and boosts customer loyalty and retention. IT can contribute to driving revenue and decreasing costs by providing the business with the right set of tools, applications, and technical support.

Contribute to the bottom line

Cross-sell, up-sell, and drive customer acquisition.

67% of consumers are willing to pay more for an upgraded experience. (Salesforce, 2018)

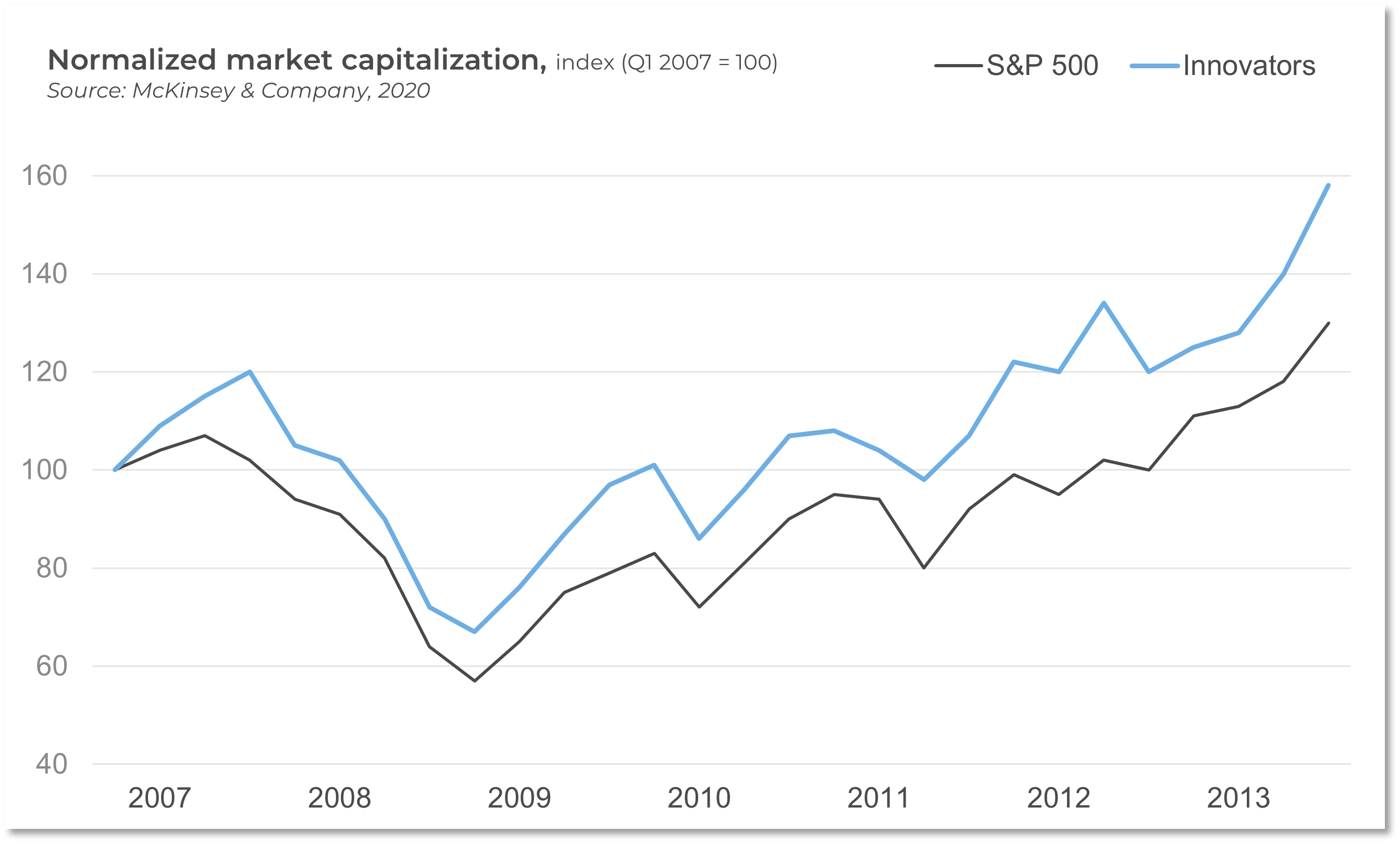

80%: The margin by which CX leaders outperformer laggards in the S&P 500.(Qualtrics, 2017)

59% of customers say tailored engagement based on past interactions is very important to winning their business. (Salesforce, 2018)

Enable cost savings

Focus on customer retention as well as acquisition.

It is 6-7x more costly to attract a new customer than it is to retain an existing customer. (Salesforce Blog, 2019)

A 5% increase in customer retention has been found to increase profits by 25% to 95%. (Bain & Company, n.d.)

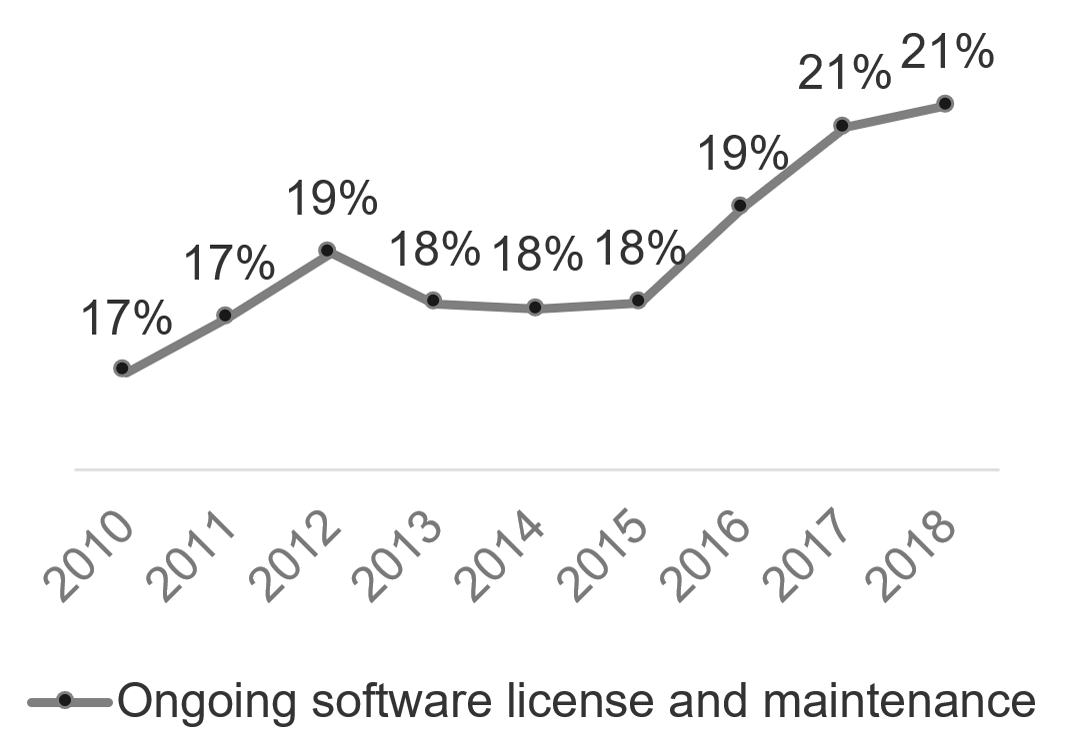

Strategic CXM is gaining traction with your competition

Organizations are prioritizing CXM capabilities (and associated technologies) as a strategic investment. Keep pace with the competition and gain a competitive advantage by creating a cohesive strategy that uses best practices to integrate marketing, sales, and customer support functions.

87% of customers share great experiences they’ve had with a company. (Zendesk, n.d.)

61% of organizations are investing in CXM. (CX Network, 2015)

53% of organizations believe CXM provides a competitive advantage. (Harvard Business Review, 2014)

Top Investment Priorities for Customer Experience

- Voice of the Customer

- Customer Insight Generation

- Customer Experience Governance

- Customer Journey Mapping

- Online Customer Experience

- Experience Personalization

- Emotional Engagement

- Multi-Channel Integration/Omnichannel

- Quality & Customer Satisfaction Management

- Customer/Channel Loyalty & Rewards Programs

(CX Network 2015)

Omnichannel is the way of the future: don’t be left behind

Get ahead of the competition by doing omnichannel right. Devise a CXM strategy that allows you to create and maintain a consistent, seamless customer experience by optimizing operations within an omnichannel framework. Customers want to interact with you on their own terms, and it falls to IT to ensure that applications are in place to support and manage a wide range of interaction channels.

Omnichannel is a “multi-channel approach to sales that seeks to provide the customer with a seamless transactional experience whether the customer is shopping online from a desktop or mobile device, by telephone, or in a bricks and mortar store.” (TechTarget, 2014)

97% of companies say that they are investing in omnichannel. (Huffington Post, 2015)

23% of companies are doing omnichannel well.

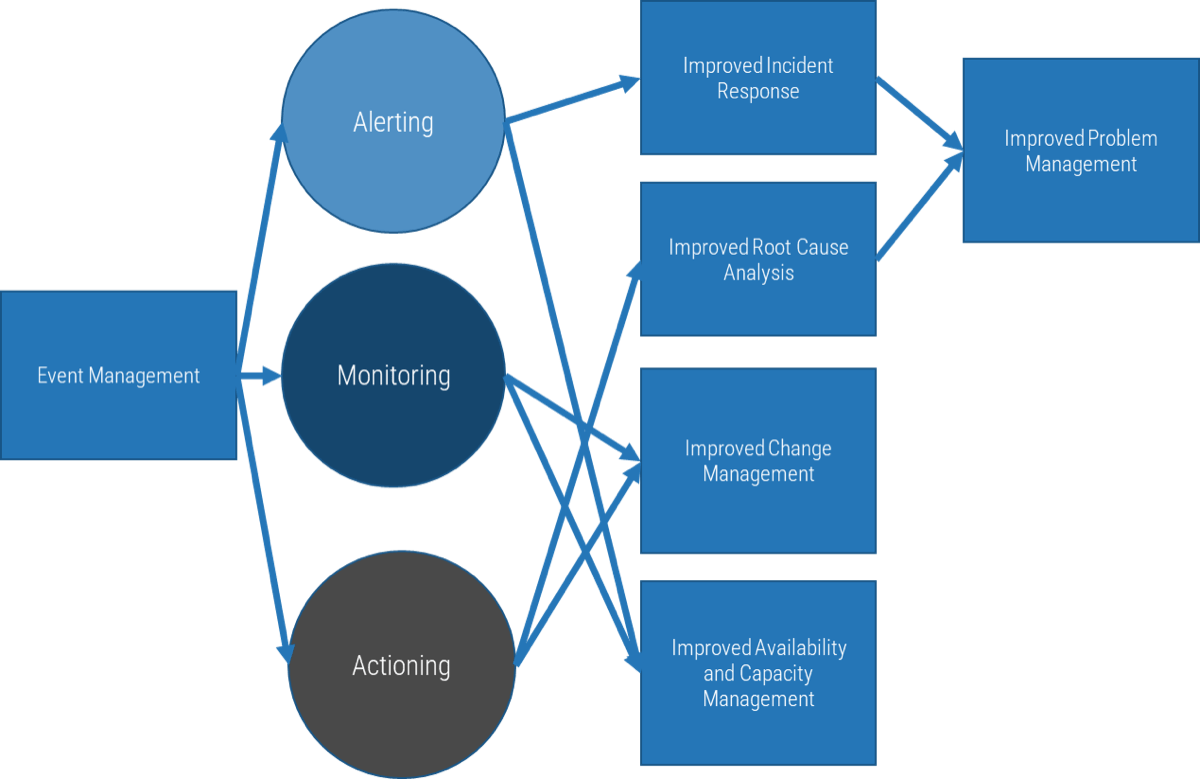

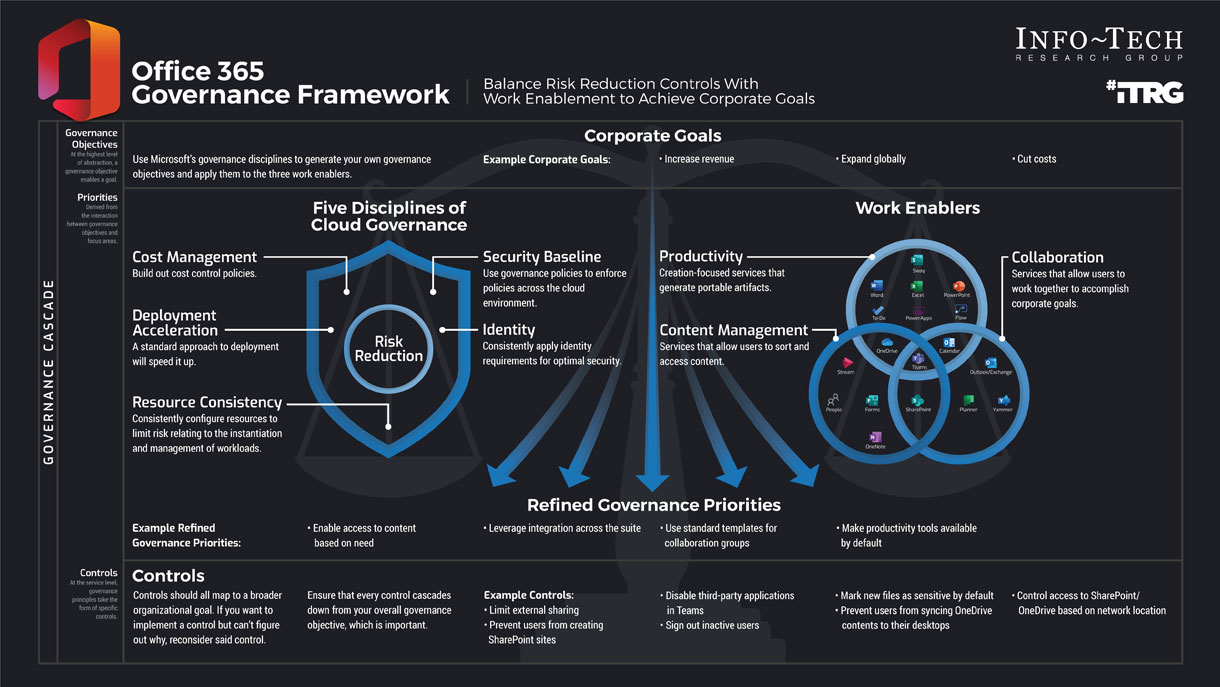

CXM applications drive effective multi-channel customer interactions across marketing, sales, and customer service

The success of your CXM strategy depends on the effective interaction of various marketing, sales, and customer support functions. To deliver on customer experience, organizations need to take a customer-centric approach to operations.

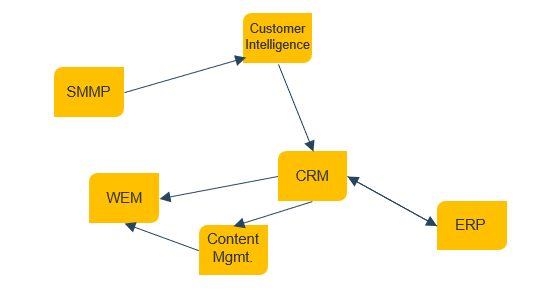

From an application perspective, a CRM platform generally serves as the unifying repository of customer information, supported by adjacent solutions as warranted by your CXM objectives.

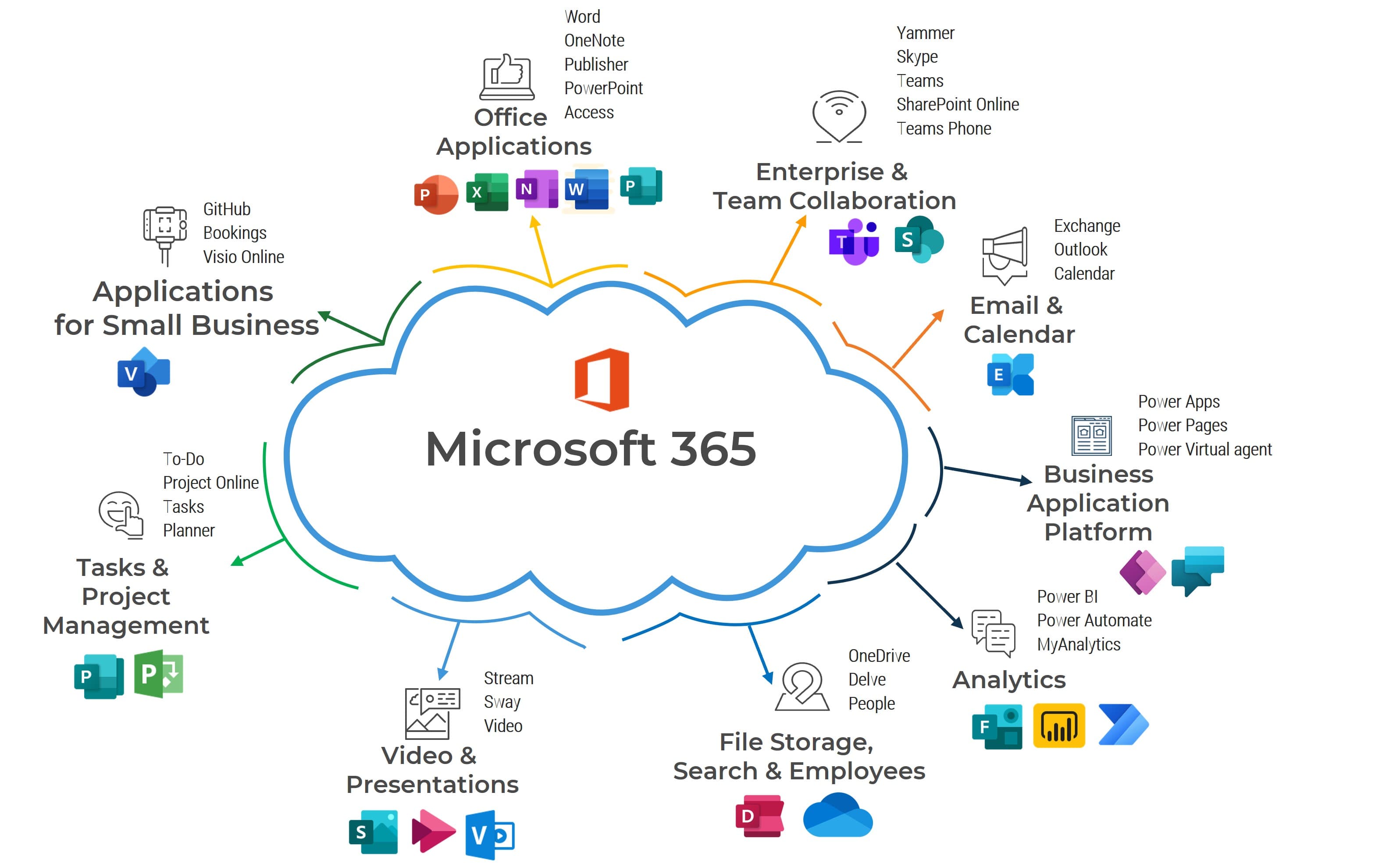

CXM ECOSYSTEM

Customer Relationship Management Platform

- Web Experience Management Platform

- E-Commerce & Point of Sale Solutions

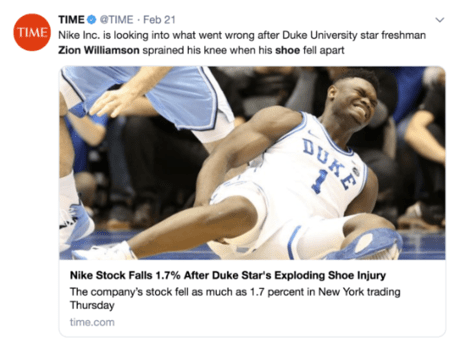

- Social Media Management Platform

- Customer Intelligence Platform

- Customer Service Management Tools

- Marketing Management Suite

Application spotlight: Customer experience platforms

Description

CXM solutions are a broad range of tools that provide comprehensive feature sets for supporting customer interaction processes. These suites supplant more basic applications for customer interaction management. Popular solutions that fall under the umbrella of CXM include CRM suites, marketing automation tools, and customer service applications.

Features and Capabilities

- Manage sales pipelines, provide quotes, and track client deliverables.

- View all opportunities organized by their current stage in the sales process.

- View all interactions that have occurred between employees and the customer, including purchase order history.

- Manage outbound marketing campaigns via multiple channels (email, phone, social, mobile).

- Build visual workflows with automated trigger points and business rules engine.

- Generate in-depth customer insights, audience segmentation, predictive analytics, and contextual analytics.

- Provide case management, ticketing, and escalation capabilities for customer service.

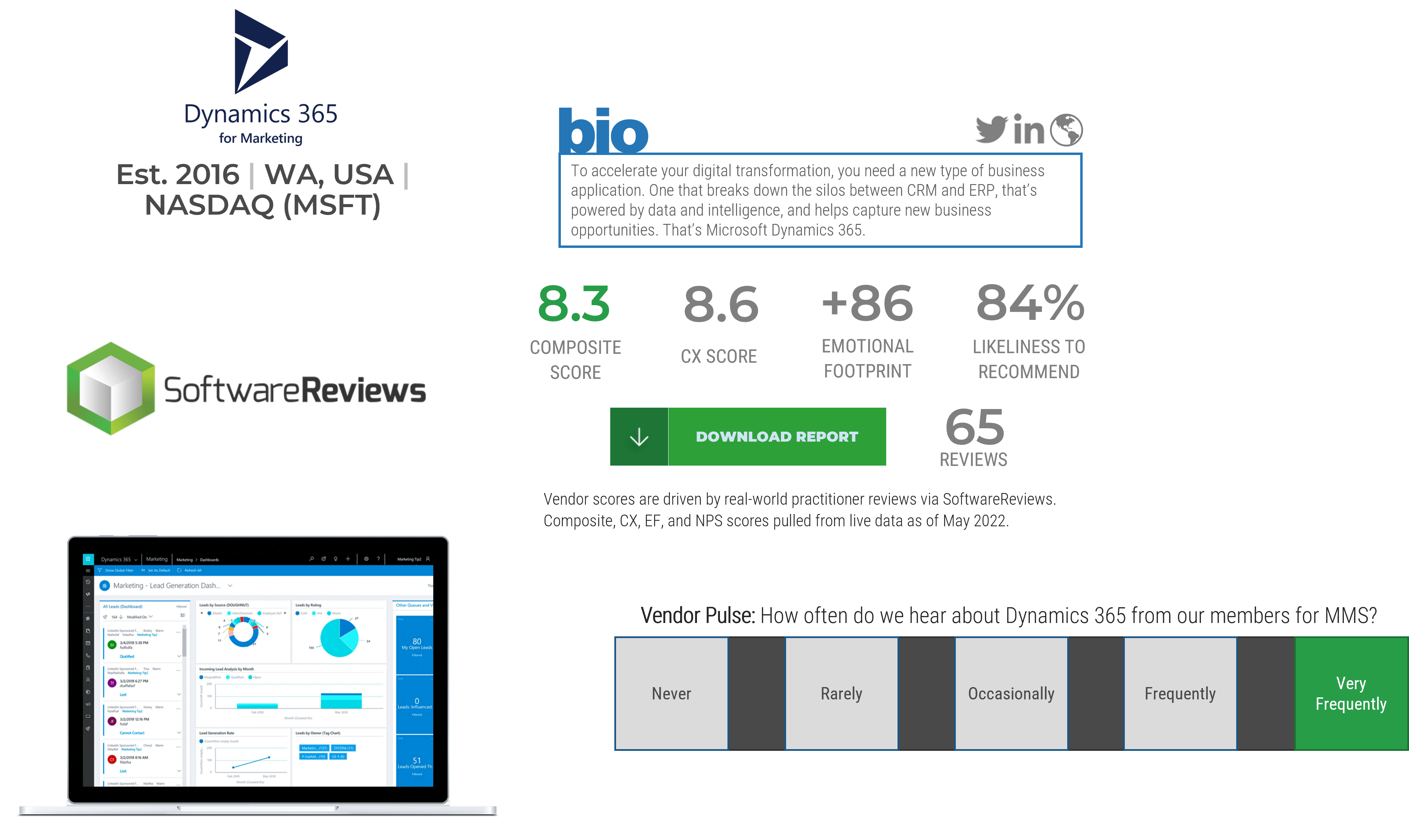

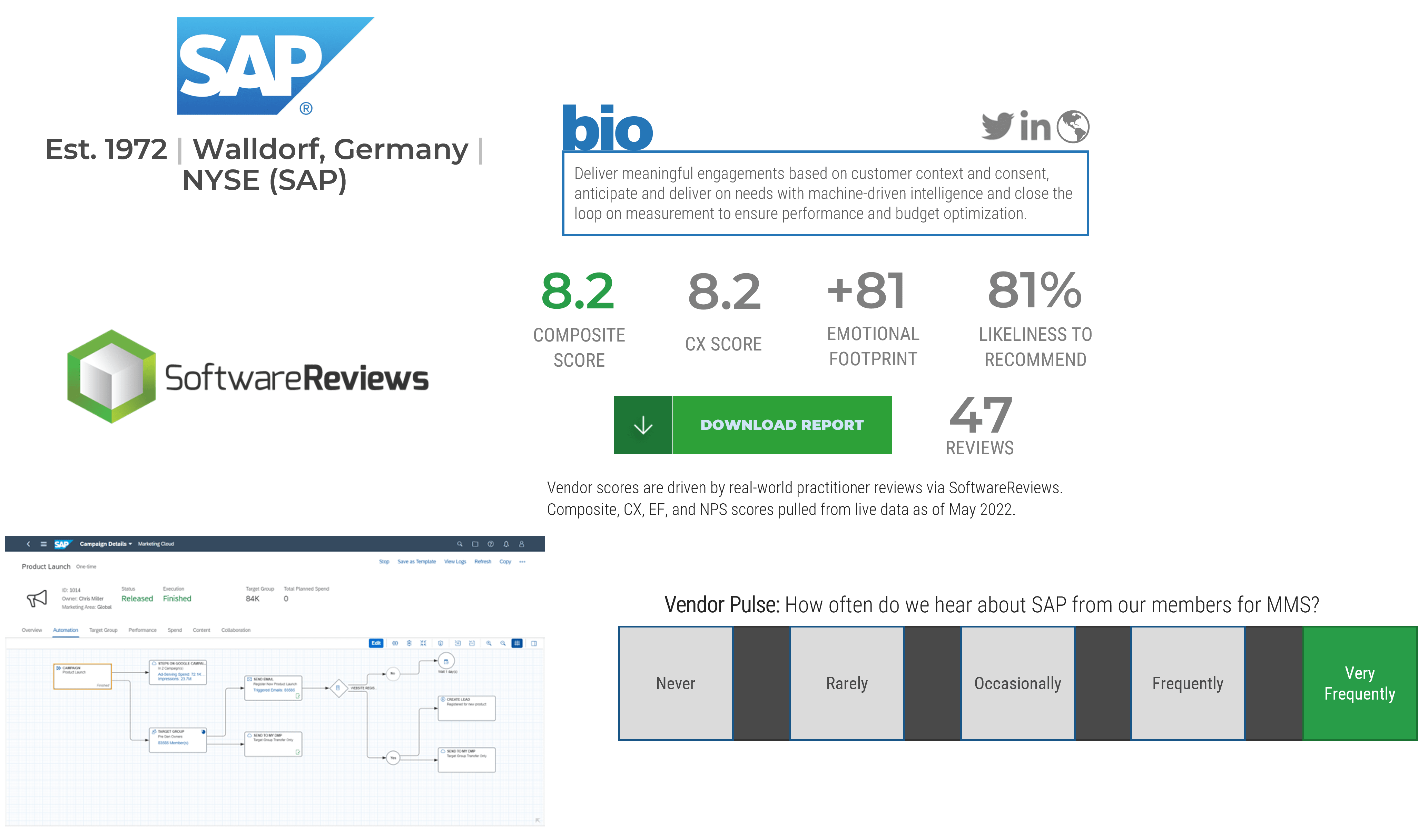

Highlighted Vendors

Microsoft Dynamics

Adobe

Marketo

sprinklr

Salesforce

SugarCRM

Application spotlight: Customer experience platforms

Key Trends

- CXM applications have decreased their focus on departmental silos to make it easier to share information across the organization as departments demand more data.

- Vendors are developing deeper support of newer channels for customer interaction. This includes providing support for social media channels, native mobile applications, and SMS or text-based services like WhatsApp and Facebook Messenger.

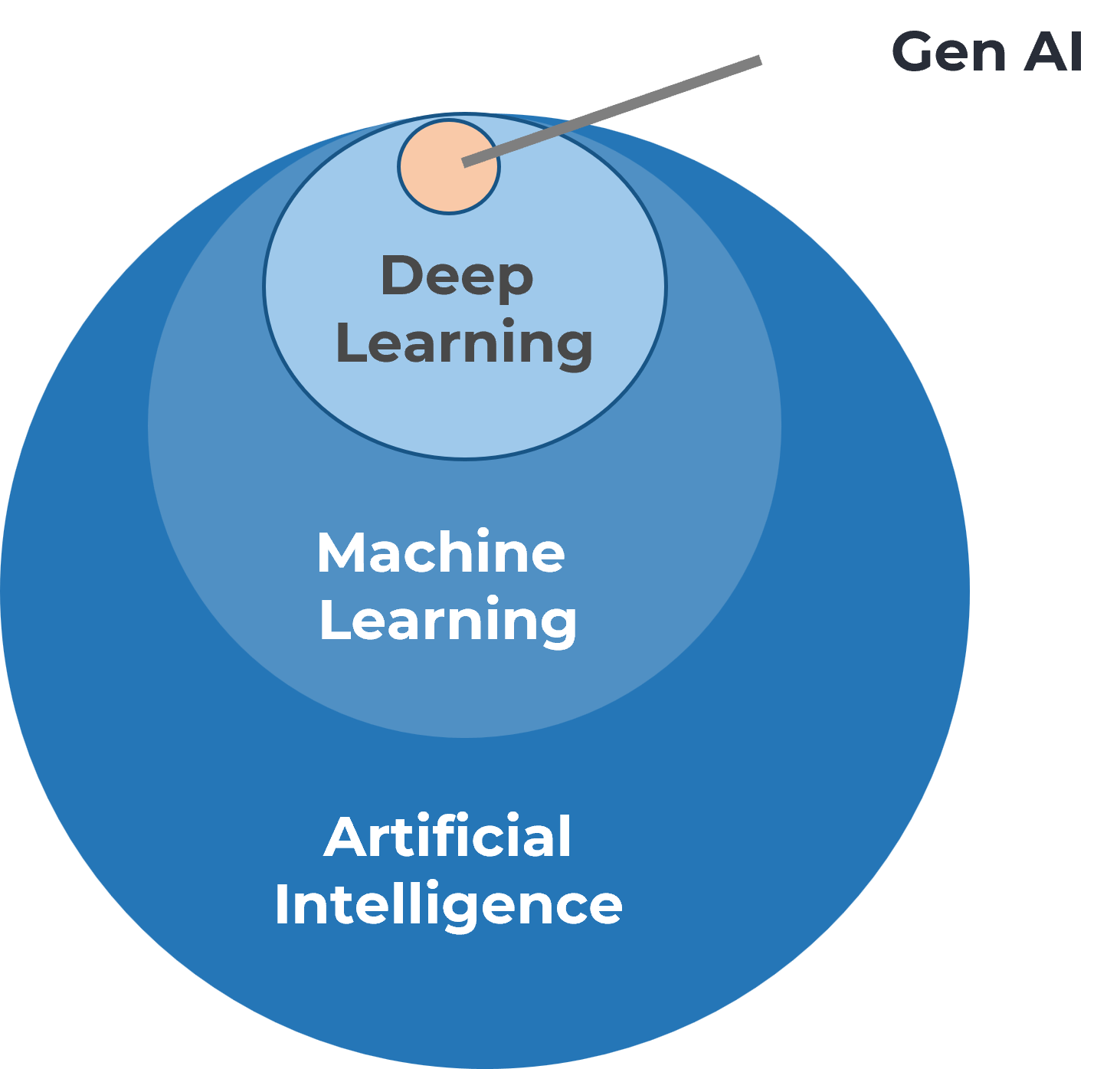

- Predictive campaigns and channel blending are becoming more feasible as vendors integrate machine learning and artificial intelligence into their applications.

- Content blocks are being placed on top of scripting languages to allow for user-friendly interfaces. There is a focus on alleviating bottlenecks where content would have previously needed to go through a specialist.

- Many vendors of CXM applications are placing increased emphasis on strong application integration both within and beyond their portfolios, with systems like ERP and order fulfillment.

Link to Digital Strategy

- For many organizations that are building out a digital strategy, improving customer experience is often a driving factor: CXM apps enable this goal.

- As part of a digital strategy, create a comprehensive CXM application portfolio by leveraging both core CRM suites and point solutions.

- Ensure that a point solution aligns with the digital strategy’s technology drivers and user personas.

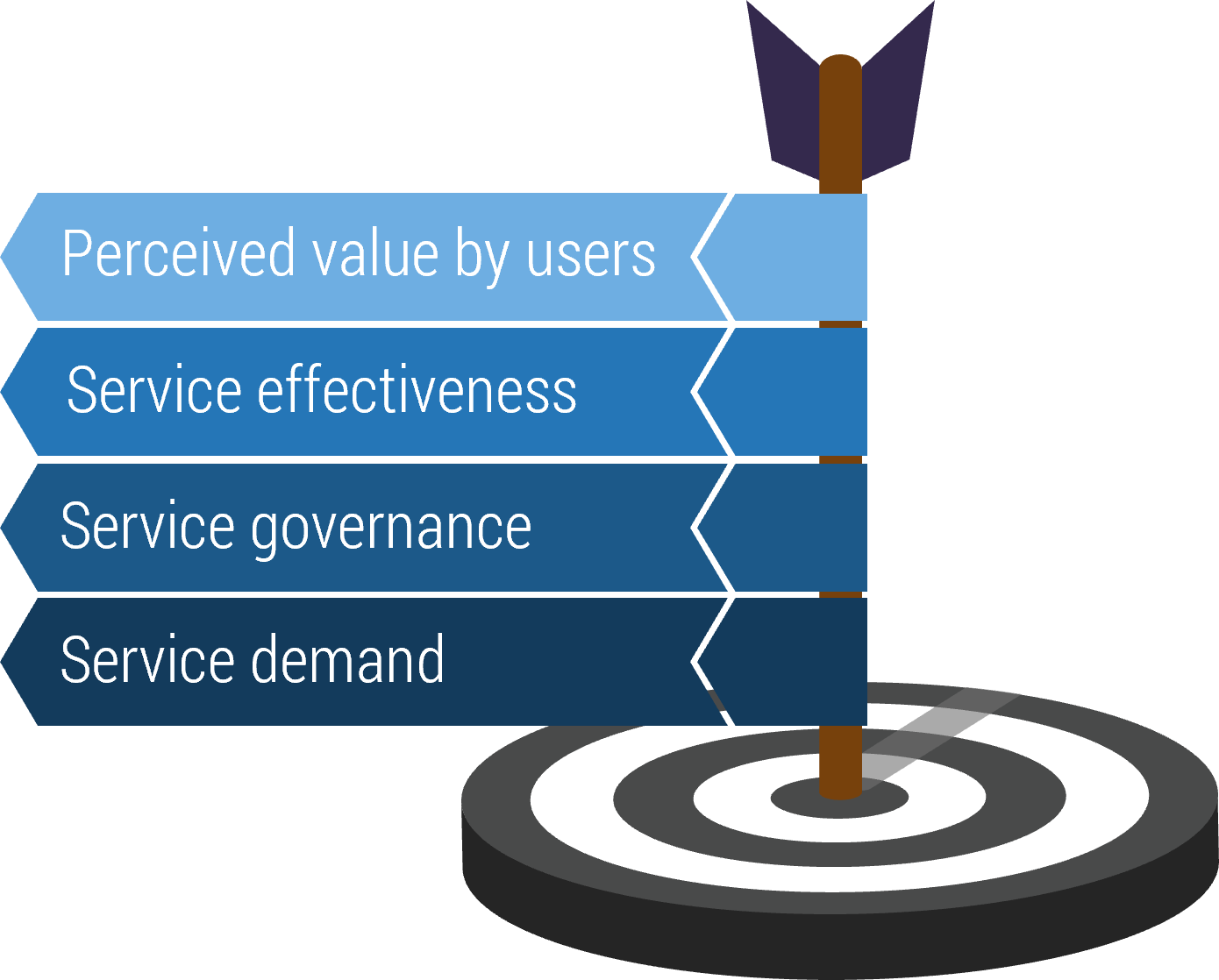

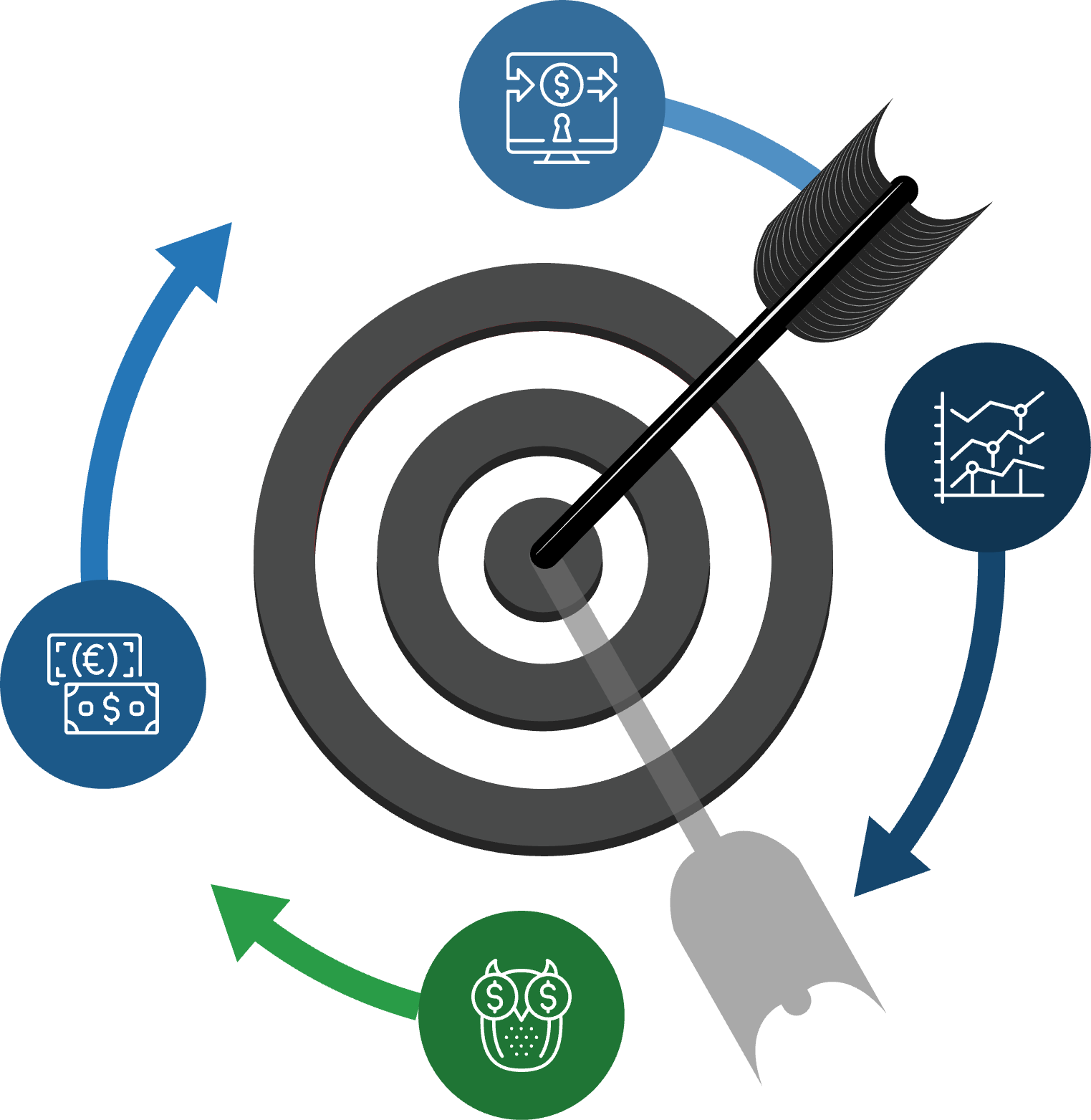

CXM KPIs

Strong CXM applications can improve:

- Lead Intake Volume

- Lead Conversion Rate

- Average Time to Resolution

- First-Contact Resolution Rate

- Customer Satisfaction Rate

- Share-of-Mind

- Share-of-Wallet

- Customer Lifetime Value

- Aggregate Reach/Impressions

IT is critical to the success of your CXM strategy

Technology is the key enabler of building strong customer experiences: IT must stand shoulder-to-shoulder with the business to develop a technology framework for CXM.

Top 5 Challenges with CXM for Marketing

- Maximizing customer experience ROI

- Achieving a single view of the customer

- Building new customer experiences

- Cultivating a customer-focused culture

- Measuring CX investments to business outcomes

Top 5 Obstacles to Enabling CXM for IT

- Systems integration

- Multichannel complexity

- Organizational structure

- Data-related issues

- Lack of strategy

(Harvard Business Review, 2014)

Only 19% of organizations have a customer experience team tasked with bridging gaps between departments. (Genesys, 2018)

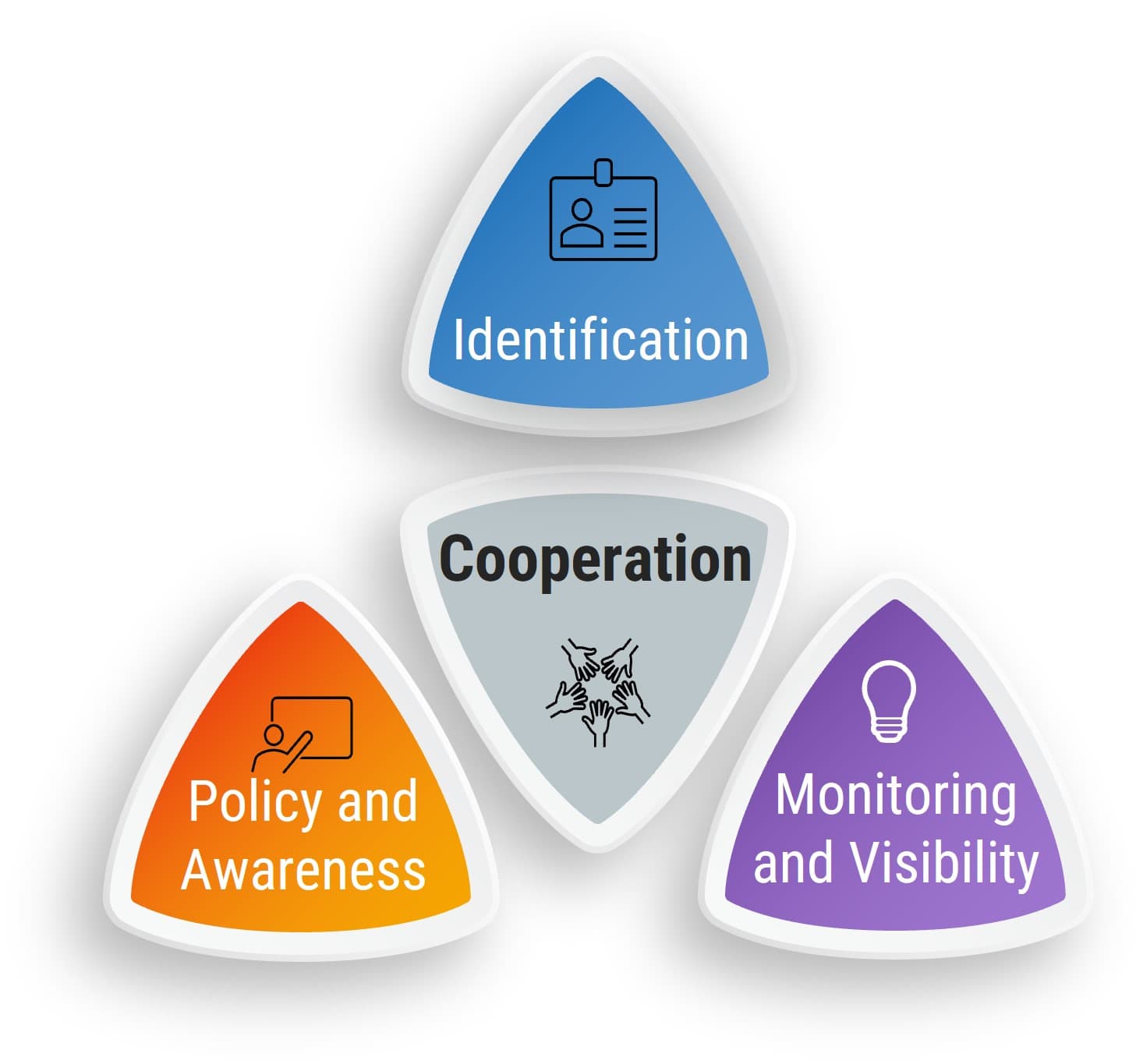

IT and Marketing can only tackle CXM with the full support of each other. The cooperation of the departments is crucial when trying to improve CXM technology capabilities and customer interaction and drive a strong revenue mandate.

CXM failure: Blockbuster

CASE STUDY

Industry Entertainment

Source Forbes, 2014

Blockbuster

As the leader of the video retail industry, Blockbuster had thousands of retail locations internationally and millions of customers. Blockbuster’s massive marketing budget and efficient operations allowed it to dominate the competition for years.

Situation

Trends in Blockbuster’s consumer market changed in terms of distribution channels and customer experience. As the digital age emerged and developed, consumers were looking for immediacy and convenience. This threatened Blockbuster’s traditional, brick-and-mortar B2C operating model.

The Competition

Netflix entered the video retail market, making itself accessible through non-traditional channels (direct mail, and eventually, the internet).

Results

Despite long-term relationships with customers and competitive standing in the market, Blockbuster’s inability to understand and respond to changing technology trends and customer demands led to its demise. The organization did not effectively leverage internal or external networks or technology to adapt to customer demands. Blockbuster went bankrupt in 2010.

Customer Relationship Management

- Web Experience Management Platform

- E-Commerce & Point of Sale Solutions

- Social Media Management

- Customer Intelligence

- Customer Service

- Marketing Management

Blockbuster did not leverage emerging technologies to effectively respond to trends in its consumer network. It did not optimize organizational effectiveness around customer experience.

CXM success: Netflix

CASE STUDY

Industry Entertainment

Source Forbes, 2014

Netflix

Beginning as a mail-out service, Netflix offered subscribers a catalog of videos to select from and have mailed to them directly. Customers no longer had to go to a retail store to rent a video. However, the lack of immediacy of direct mail as the distribution channel resulted in slow adoption.

The Situation

In response to the increasing presence of tech-savvy consumers on the internet, Netflix invested in developing its online platform as its primary distribution channel. The benefit of doing so was two-fold: passive brand advertising (by being present on the internet) and meeting customer demands for immediacy and convenience. Netflix also recognized the rising demand for personalized service and created an unprecedented, tailored customer experience.

The Competition

Blockbuster was the industry leader in video retail but was lagging in its response to industry, consumer, and technology trends around customer experience.

Results

Netflix’s disruptive innovation is built on the foundation of great CXM. Netflix is now a $28 billion company, which is tenfold what Blockbuster was worth.

Customer Relationship Management Platform

- Web Experience Management Platform

- E-Commerce & Point of Sale Solutions

- Social Media Management Platform

- Customer Intelligence Platform

- Customer Service Management Tools

- Marketing Management Suite

Netflix used disruptive technologies to innovatively build a customer experience that put it ahead of the long-time, video rental industry leader, Blockbuster.

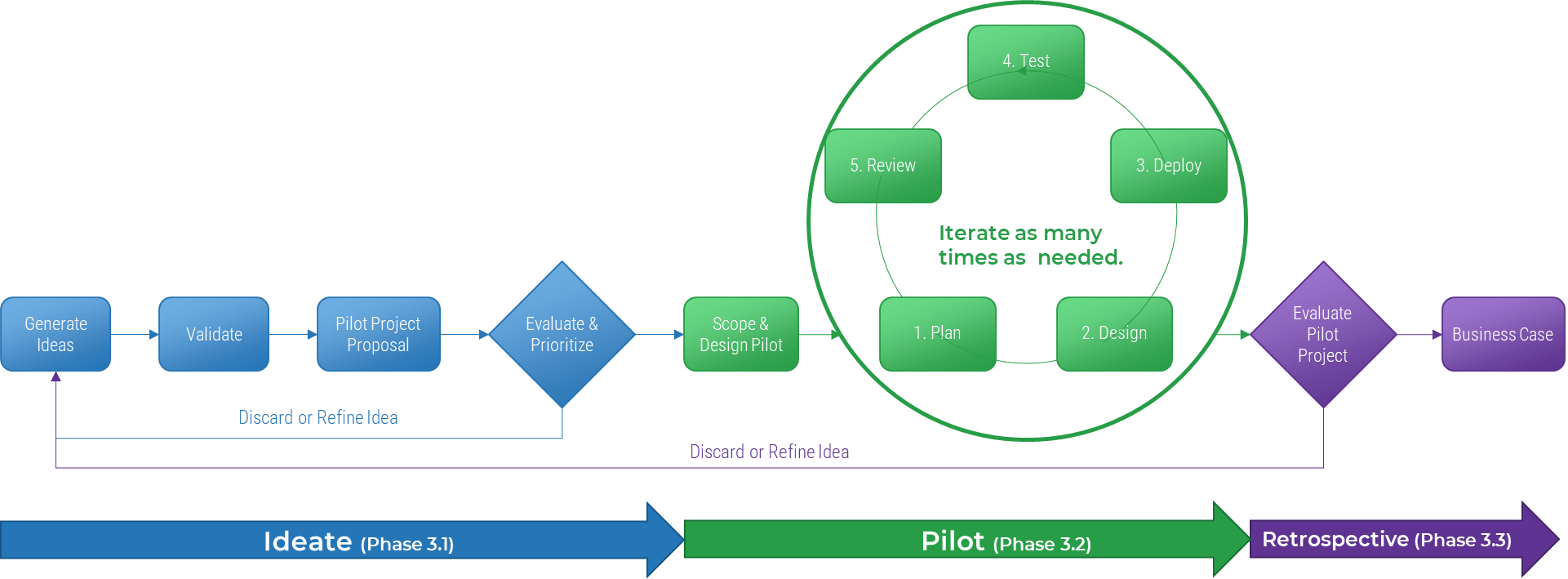

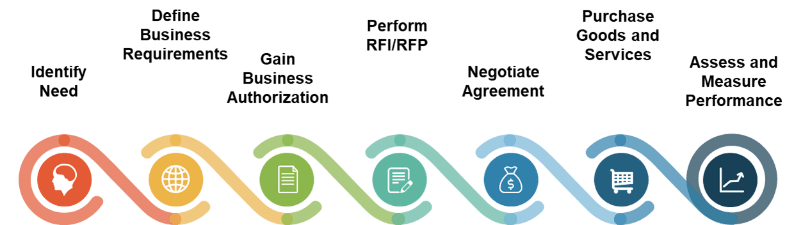

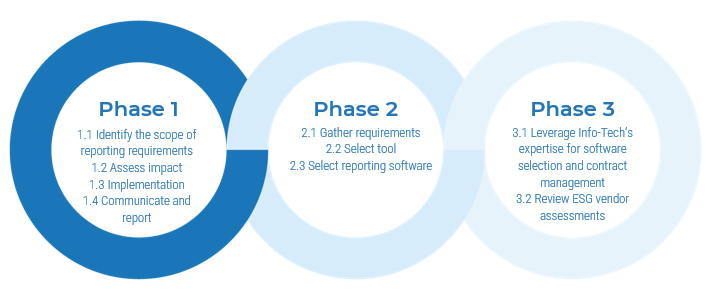

Leverage Info-Tech’s approach to succeed with CXM

Creating an end-to-end technology-enablement strategy for CXM requires a concerted, dedicated effort: Info-Tech can help with our proven approach.

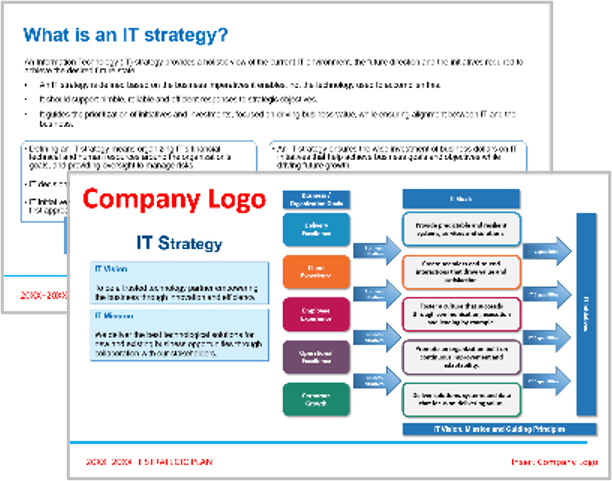

Build the CXM Project Charter

Conduct a Thorough Environmental Scan

Build Customer Personas and Scenarios

Draft Strategic CXM Requirements

Build the CXM Application Portfolio

Implement Operational Best Practices

Why Info-Tech’s Approach?

Info-Tech draws on best-practice research and the experiences of our global member base to develop a methodology for CXM that is driven by rigorous customer-centric analysis.

Our approach uses a unique combination of techniques to ensure that your team has done its due diligence in crafting a forward-thinking technology-enablement strategy for CXM that creates measurable value.

A global professional services firm drives measurable value for CXM by using persona design and scenario development

CASE STUDY

Industry Professionals Services

Source Info-Tech Workshop

The Situation

A global professional services firm in the B2B space was experiencing a fragmented approach to customer engagement, particularly in the pre-sales funnel. Legacy applications weren’t keeping pace with an increased demand for lead evaluation and routing technology. Web experience management was also an area of significant concern, with a lack of ongoing customer engagement through the existing web portal.

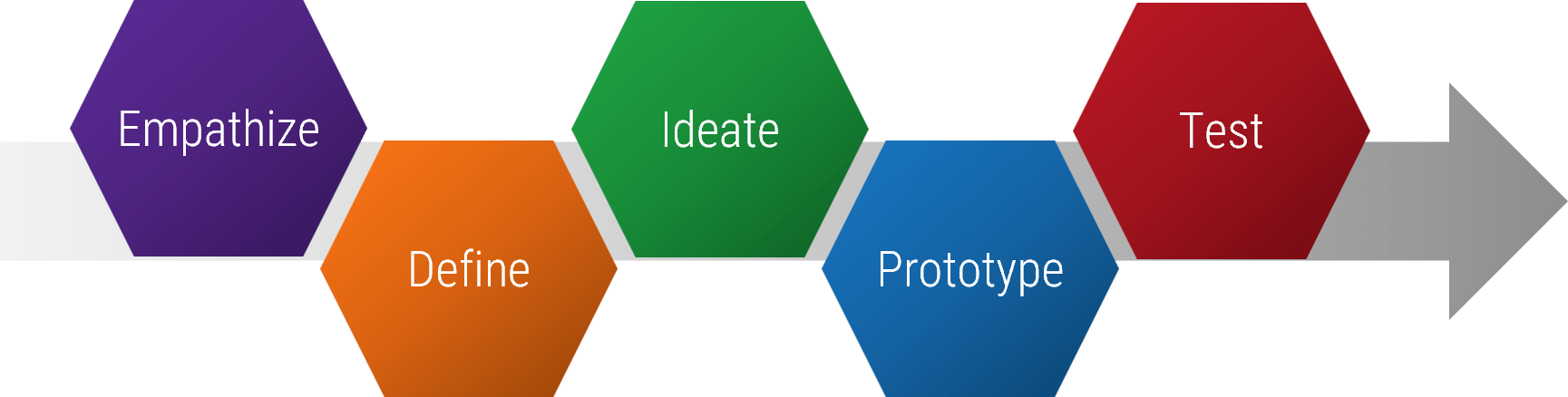

The Approach

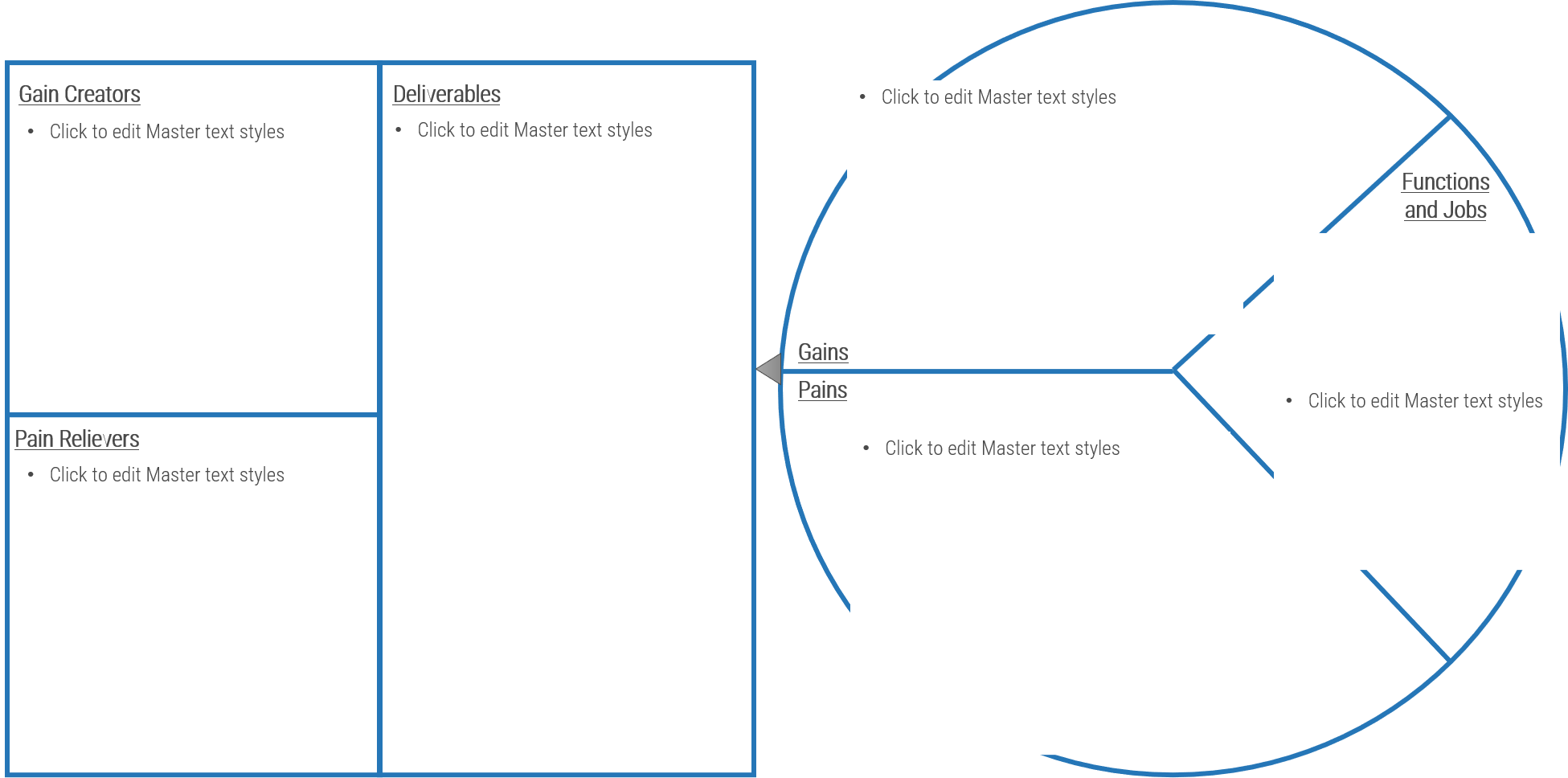

Working with a team of Info-Tech facilitators, the company was able to develop several internal and external customer personas. These personas formed the basis of strategic requirements for a new CXM application stack, which involved dedicated platforms for core CRM, lead automation, web content management, and site analytics.

Results

Customer “stickiness” metrics increased, and Sales reported significantly higher turnaround times in lead evaluations, resulting in improved rep productivity and faster cycle times.

| Components of a persona |

| Name |

Name personas to reflect a key attribute such as the persona’s primary role or motivation. |

| Demographic |

Include basic descriptors of the persona (e.g. age, geographic location, preferred language, education, job, employer, household income, etc.) |

| Wants, needs, pain points |

Identify surface-level motivations for buying habits. |

| Psychographic/behavioral traits |

Observe persona traits that are representative of the customers’ behaviors (e.g. attitudes, buying patterns, etc.). |

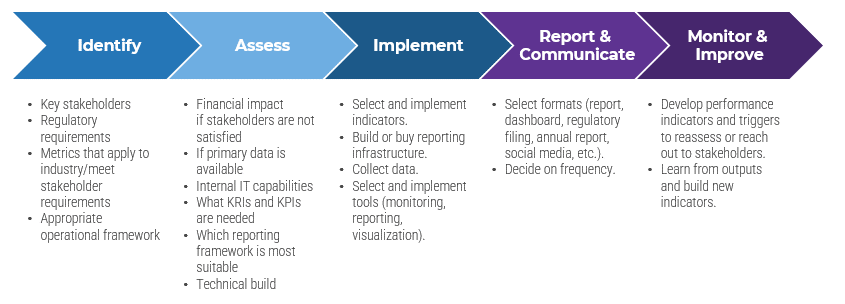

Follow Info-Tech’s approach to build your CXM foundation

Create the Project Vision

- Identify business and IT drivers

- Outputs:

- CXM Strategy Guiding Principles

Structure the Project

- Identify goals and objectives for CXM project

- Form Project Team

- Establish timeline

- Obtain project sponsorship

- Outputs:

- CXM Strategy Project Charter

Scan the External Environment

- Create CXM operating model

- Conduct external analysis

- Create customer personas

- Outputs:

- Conduct PEST analysis

- Create persona scenarios

- Outputs:

- CXM Strategic Requirements

Assess the Current State of CXM

- Conduct SWOT analysis

- Assess application usage and satisfaction

- Conduct VRIO analysis

- Outputs:

- CXM Strategic Requirements

Create an Application Portfolio

- Map current processes

- Assign business process owners

- Create channel map

- Build CXM application portfolio

- Outputs:

- CXM Application Portfolio Map

Develop Deployment Best Practices

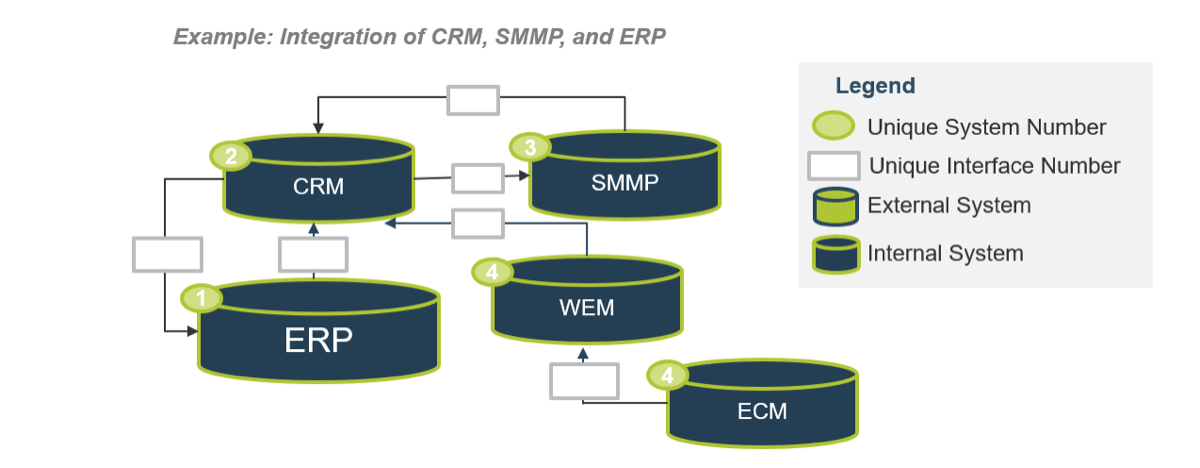

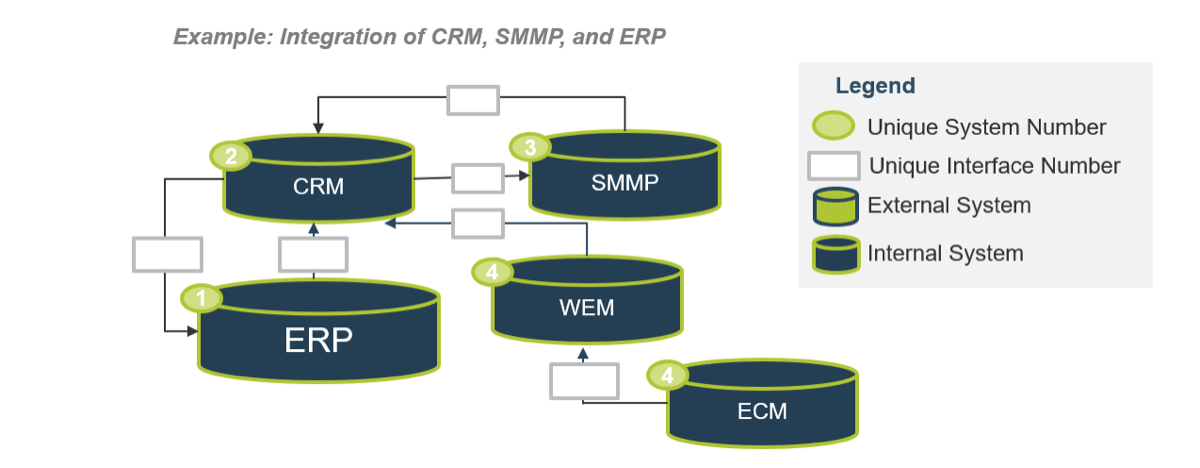

- Develop CXM integration map

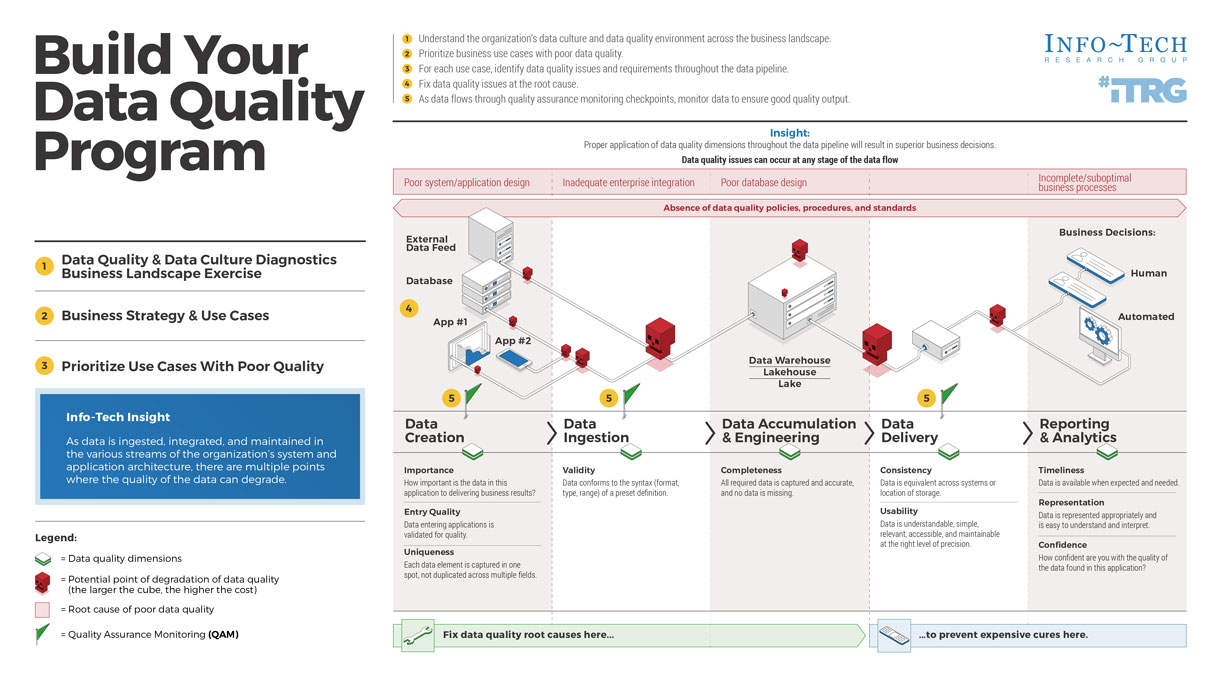

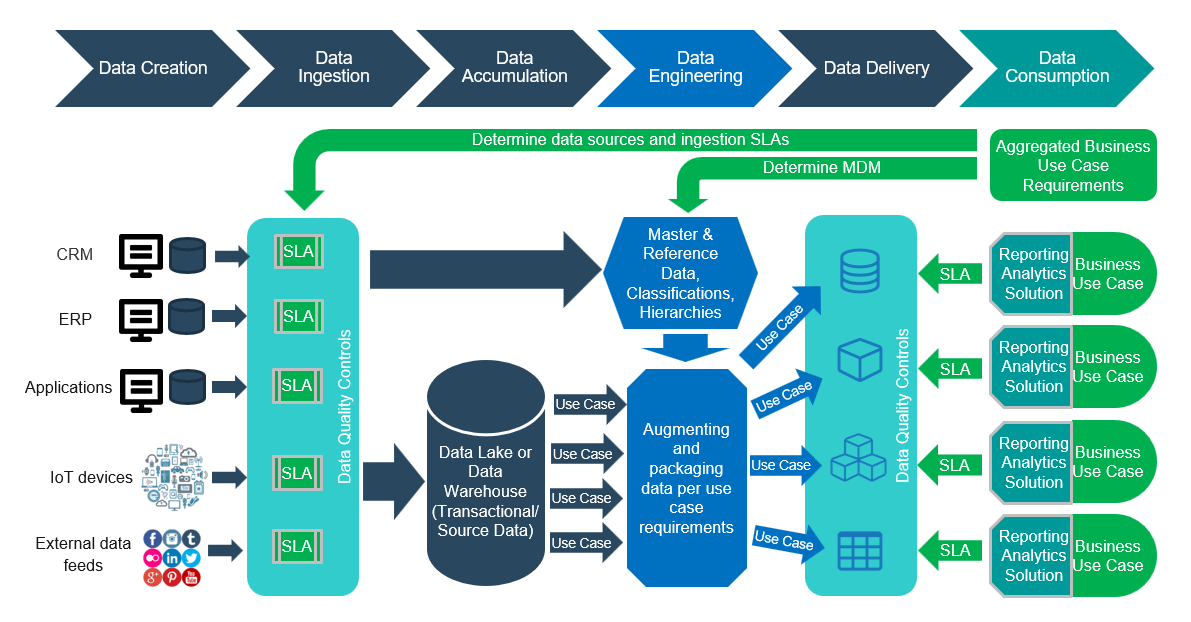

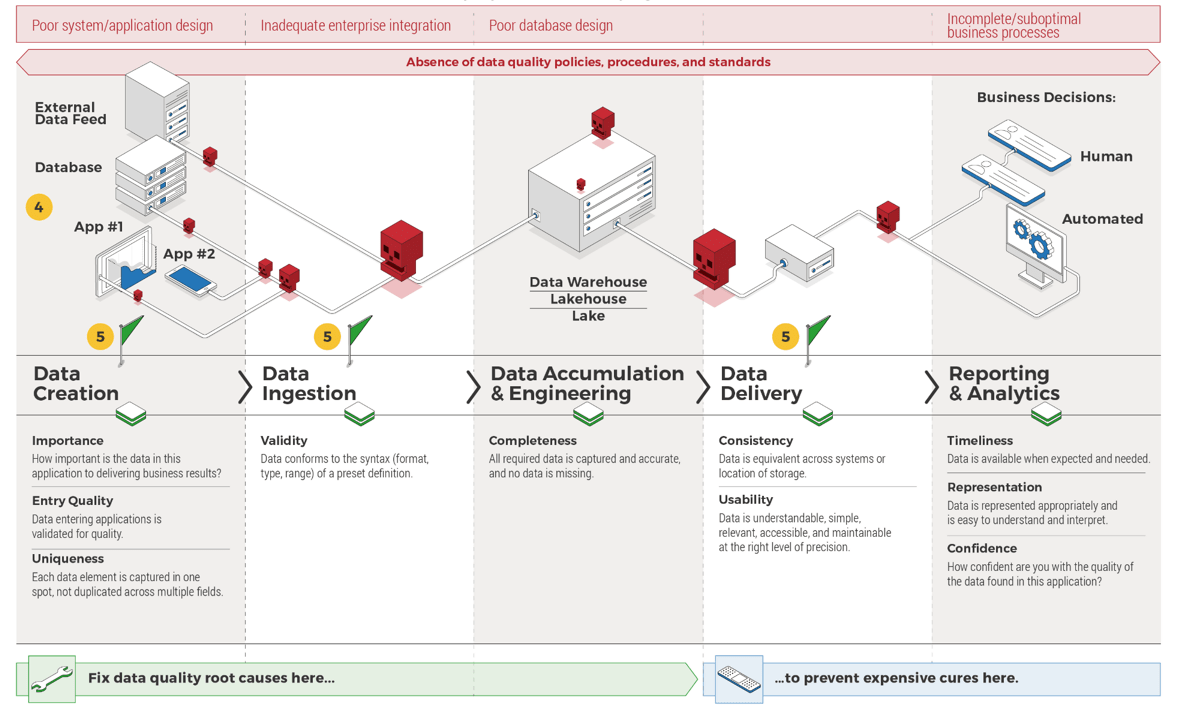

- Create mitigation plan for poor data quality

- Outputs:

- Data Quality Preservation Map

Create an Initiative Rollout Plan

- Create risk management plan

- Identify work initiative dependencies

- Create roadmap

- Outputs:

Confirm and Finalize the CXM Blueprint

- Identify success metrics

- Create stakeholder communication plan

- Present CXM strategy to stakeholders

- Outputs:

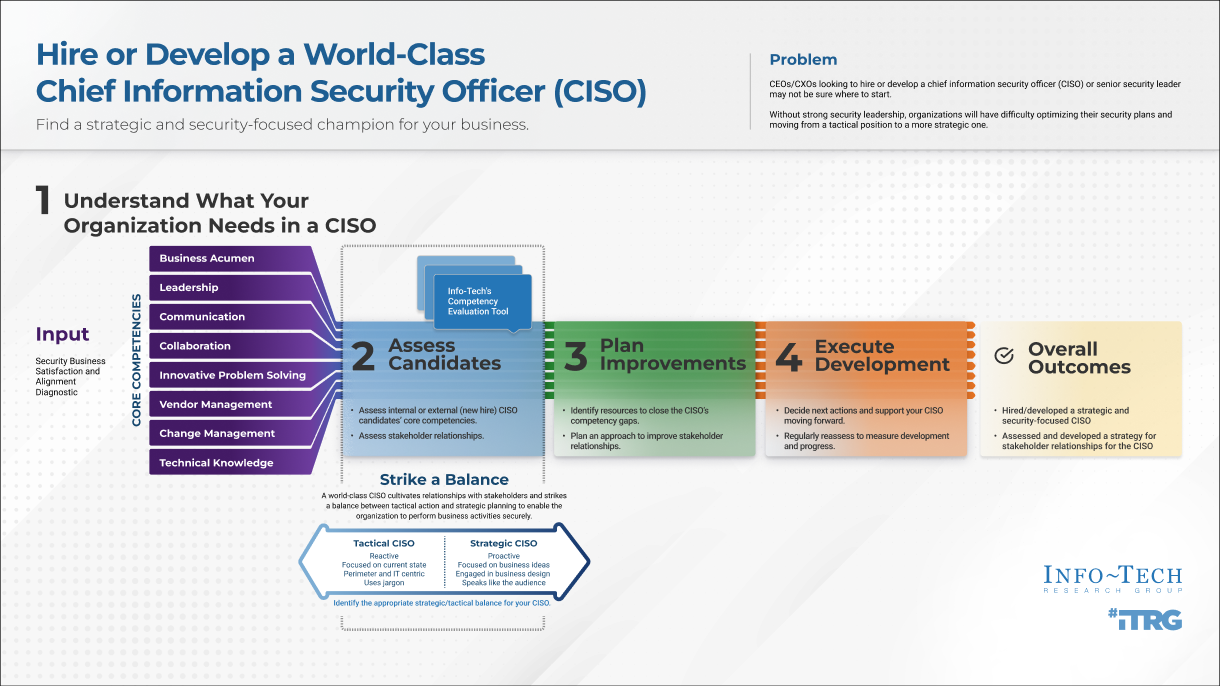

Info-Tech offers various levels of support to suit your needs

DIY Toolkit

“Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful.”

Guided Implementation

“Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track.”

Workshop

“We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place.”

Consulting

“Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project.”

Diagnostics and consistent frameworks used throughout all four options

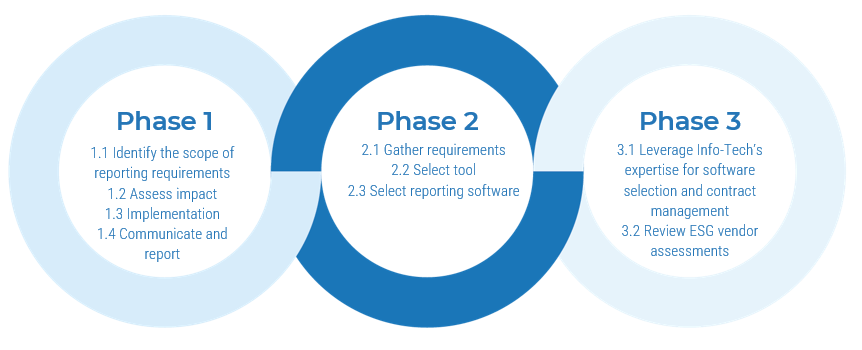

Build a Strong Technology Foundation for CXM – project overview

| |

1. Drive Value With CXM |

2. Create the Framework |

3. Finalize the Framework |

| Best-Practice Toolkit |

1.1 Create the Project Vision

1.2 Structure the CXM Project |

2.1 Scan the External Environment

2.2 Assess the Current State of CXM

2.3 Create an Application Portfolio

2.4 Develop Deployment Best Practices |

3.1 Create an Initiative Rollout Plan

3.2 Confirm and Finalize the CXM Blueprint |

| Guided Implementations |

- Determine project vision for CXM.

- Review CXM project charter.

|

- Review environmental scan.

- Review application portfolio for CXM.

|

- Confirm deployment best practices.

- Review initiatives rollout plan.

- Confirm CXM roadmap.

|

| Onsite Workshop |

Module 1: Drive Measurable Value with a World-Class CXM Program |

Module 2: Create the Strategic Framework for CXM |

Module 3: Finalize the CXM Framework |

| |

Phase 1 Outcome:

- Completed drivers

- Completed project charter

|

Phase 2 Outcome:

- Completed personas and scenarios

- CXM application portfolio

|

Phase 3 Outcome:

- Strategic summary blueprint

|

Workshop overview

Contact your account representative or email Workshops@InfoTech.com for more information.

| |

Workshop Day 1 |

Workshop Day 2 |

Workshop Day 3 |

Workshop Day 4 |

Workshop Day 5 |

| Activities |

Create the Vision for CXM Enablement

1.1 CXM Fireside Chat

1.2 CXM Business Drivers

1.3 CXM Vision Statement

1.4 Project Structure |

Conduct the Environmental Scan and Internal Review

2.1 PEST Analysis

2.2 Competitive Analysis

2.3 Market and Trend Analysis

2.4 SWOT Analysis

2.5 VRIO Analysis

2.6 Channel Mapping |

Build Personas and Scenarios

3.1 Persona Development

3.2 Scenario Development

3.3 Requirements Definition for CXM |

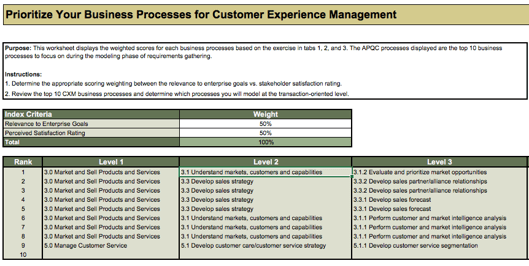

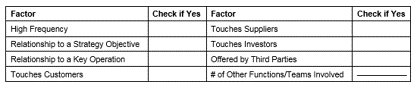

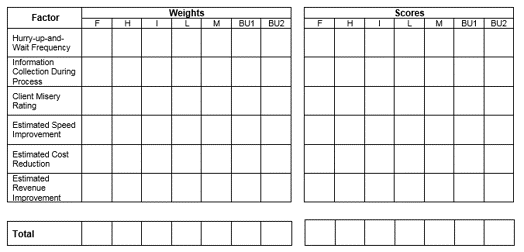

Create the CXM Application Portfolio

4.1 Build Business Process Maps

4.2 Review Application Satisfaction

4.3 Create the CXM Application Portfolio

4.4 Prioritize Applications |

Review Best Practices and Confirm Initiatives

5.1 Create Data Integration Map

5.2 Define Adoption Best Practices

5.3 Build Initiatives Roadmap

5.4 Confirm Initiatives Roadmap |

| Deliverables |

- CXM Vision Statement

- CXM Project Charter

|

- Completed External Analysis

- Completed Internal Review

- Channel Interaction Map

- Strategic Requirements (from External Analysis)

|

- Personas and Scenarios

- Strategic Requirements (based on personas)

|

- Business Process Maps

- Application Satisfaction Diagnostic

- Prioritized CXM Application Portfolio

|

- Integration Map for CXM

- End-User Adoption Plan

- Initiatives Roadmap

|

Phase 1

Drive Measurable Value With a World-Class CXM Program

Build a Strong Technology Foundation for Customer Experience Management

Phase 1 outline

Call 1-888-670-8889 or email GuidedImplementations@InfoTech.com for more information.

Complete these steps on your own, or call us to complete a guided implementation. A guided implementation is a series of

2-3 advisory calls that help you execute each phase of a project. They are included in most advisory memberships.

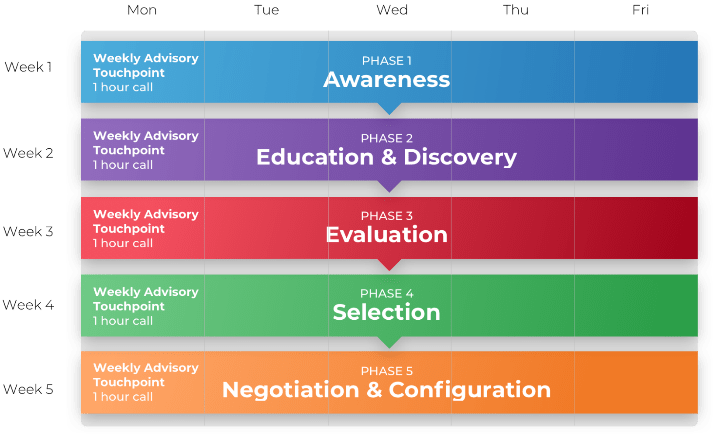

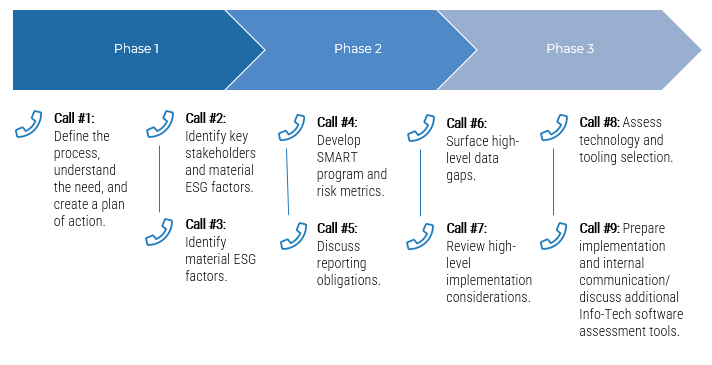

Guided Implementation 1: Drive Measurable Value With a World-Class CXM Program

Proposed Time to Completion: 2 weeks

Step 1.1: Create the Project Vision

Start with an analyst kick-off call:

- Review key drivers from a technology and business perspective for CXM

- Discuss benefits of strong technology enablement for CXM

Then complete these activities…

- CXM Fireside Chat

- CXM Business and Technology Driver Assessment

- CXM Vision Statement

With these tools & templates:

- CXM Strategy Stakeholder Presentation Template

Step 1.2: Structure the Project

Review findings with analyst:

- Assess the CXM vision statement for competitive differentiators

- Determine current alignment disposition of IT with different business units

Then complete these activities…

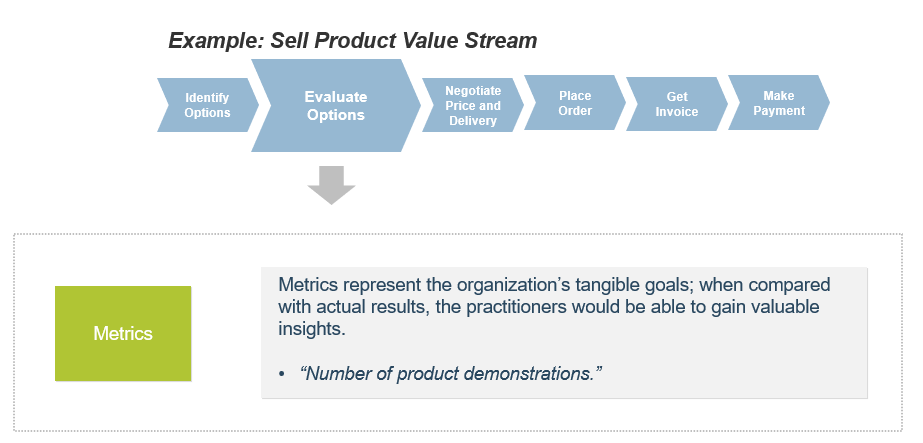

- Team Composition and Responsibilities

- Metrics Definition

With these tools & templates:

- CXM Strategy Project Charter Template

Phase 1 Results & Insights:

- Defined value of strong technology enablement for CXM

- Completed CXM project charter

Step 1.1: Create the Project Vision

Phase 1

1.1 Create the Project Vision

1.2 Structure the Project

Phase 2

2.1 Scan the External Environment

2.2 Assess the Current State of CXM

2.3 Create an Application Portfolio

2.4 Develop Deployment Best Practices

Phase 3

3.1 Create an Initiative Rollout Plan

3.2 Confirm and Finalize the CXM Blueprint

Activities:

- Fireside Chat: Discuss past challenges and successes with CXM

- Identify business and IT drivers to establish guiding principles for CXM

Outcomes:

- Business benefits of a rationalized technology strategy to support CXM

- Shared lessons learned

- Guiding principles for providing technology enablement for CXM

Building a technology strategy to support customer experience isn’t an option – it’s a mission-critical activity

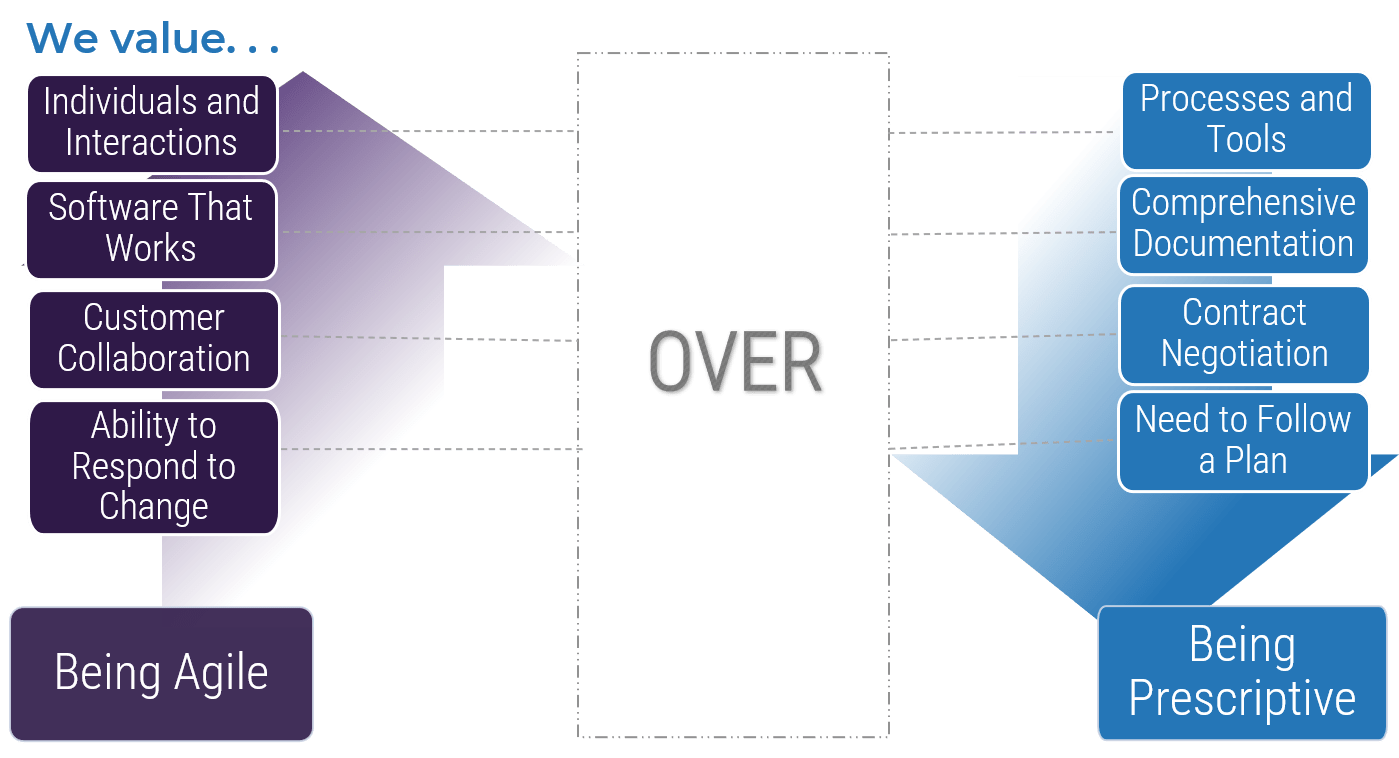

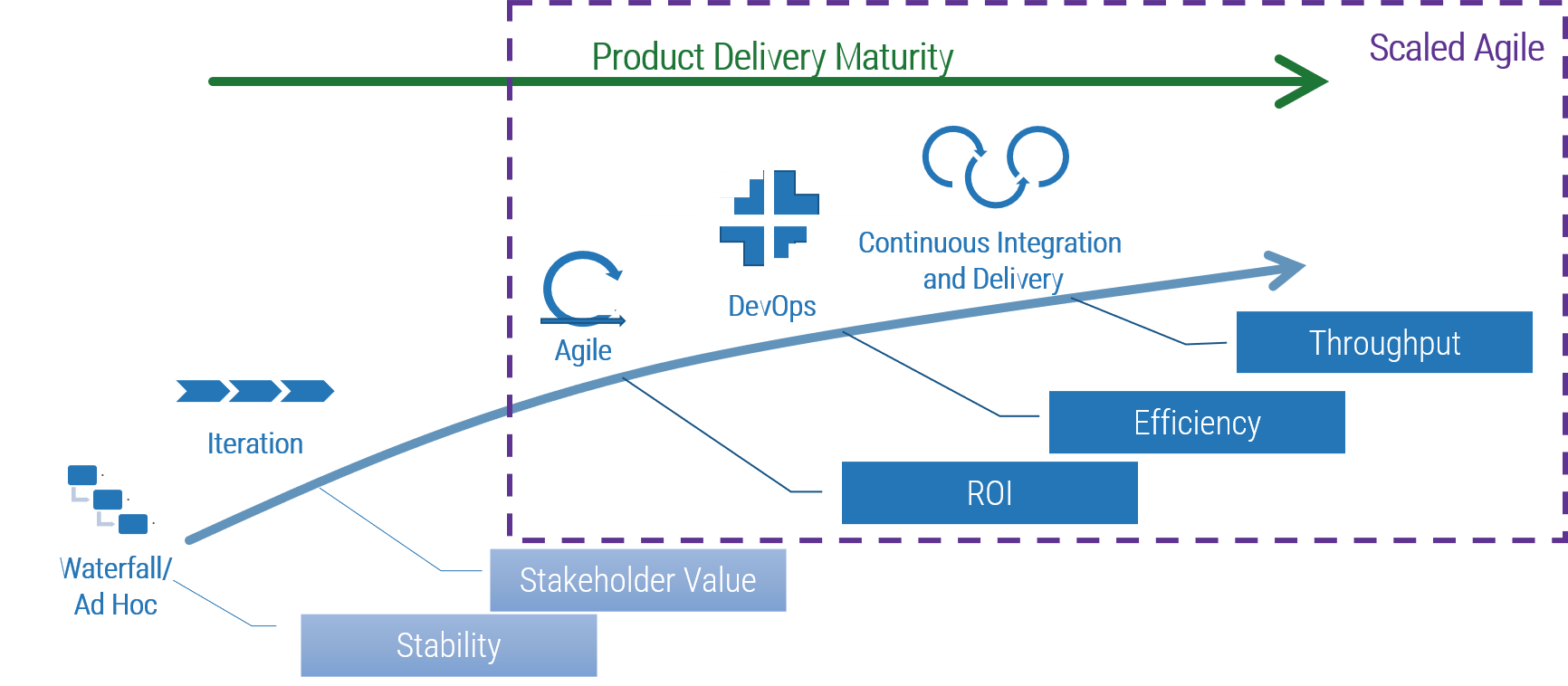

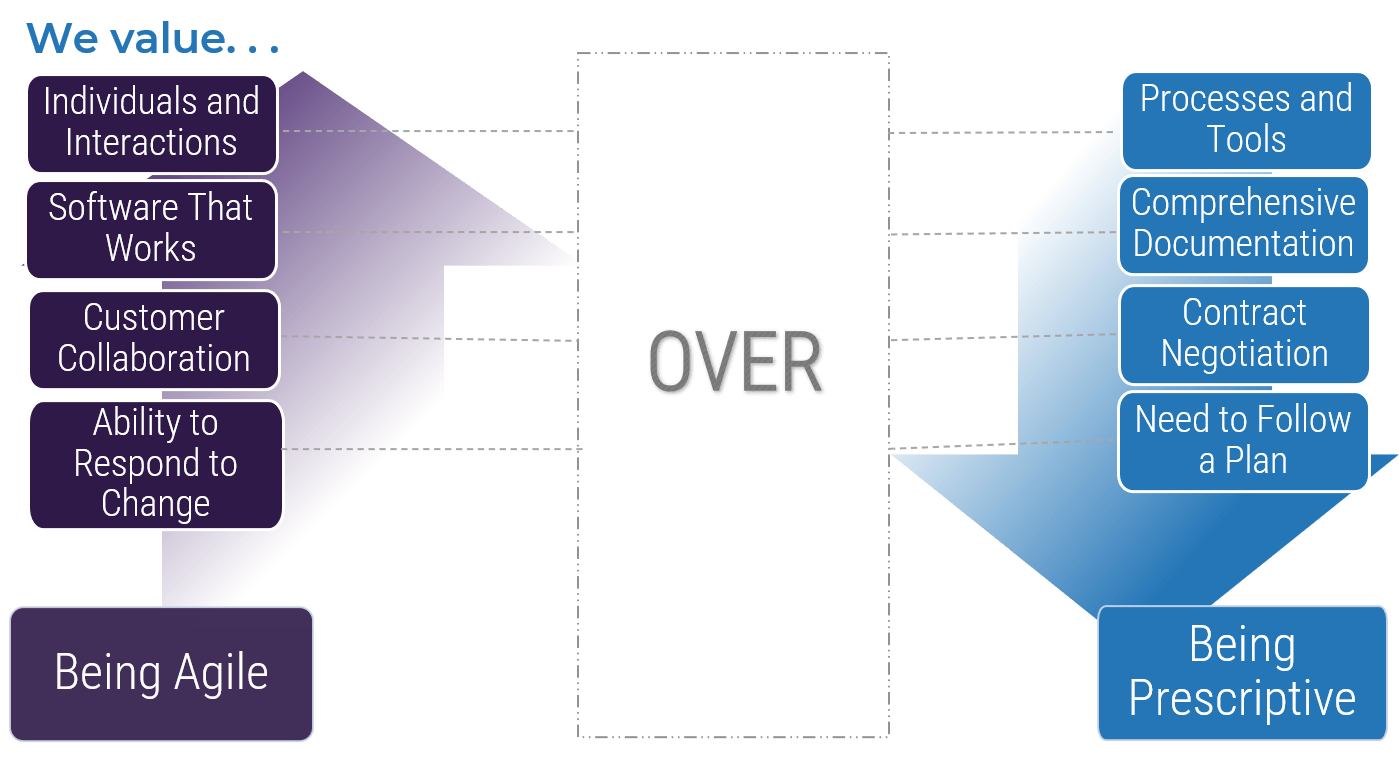

- Customer-facing departments supply the lifeblood of a company: revenue. In today’s fast-paced and interconnected world, it’s becoming increasingly imperative to enable customer experience processes with a wide range of technologies, from lead automation to social relationship management. CXM is the holistic management of customer interaction processes across marketing, sales, and customer service to create valuable, mutually beneficial customer experiences. Technology is a critical building block for enabling CXM.

- The parallel progress of technology and process improvement is essential to an efficient and effective CXM program. While many executives prefer to remain at the status quo, new technologies have caused major shifts in the CXM environment. If you stay with the status quo, you will fall behind the competition.

- However, many IT departments are struggling to keep up with the pace of change and find themselves more of a firefighter than a strategic partner to marketing, sales, and service teams. This not only hurts the business, but it also tarnishes IT’s reputation.

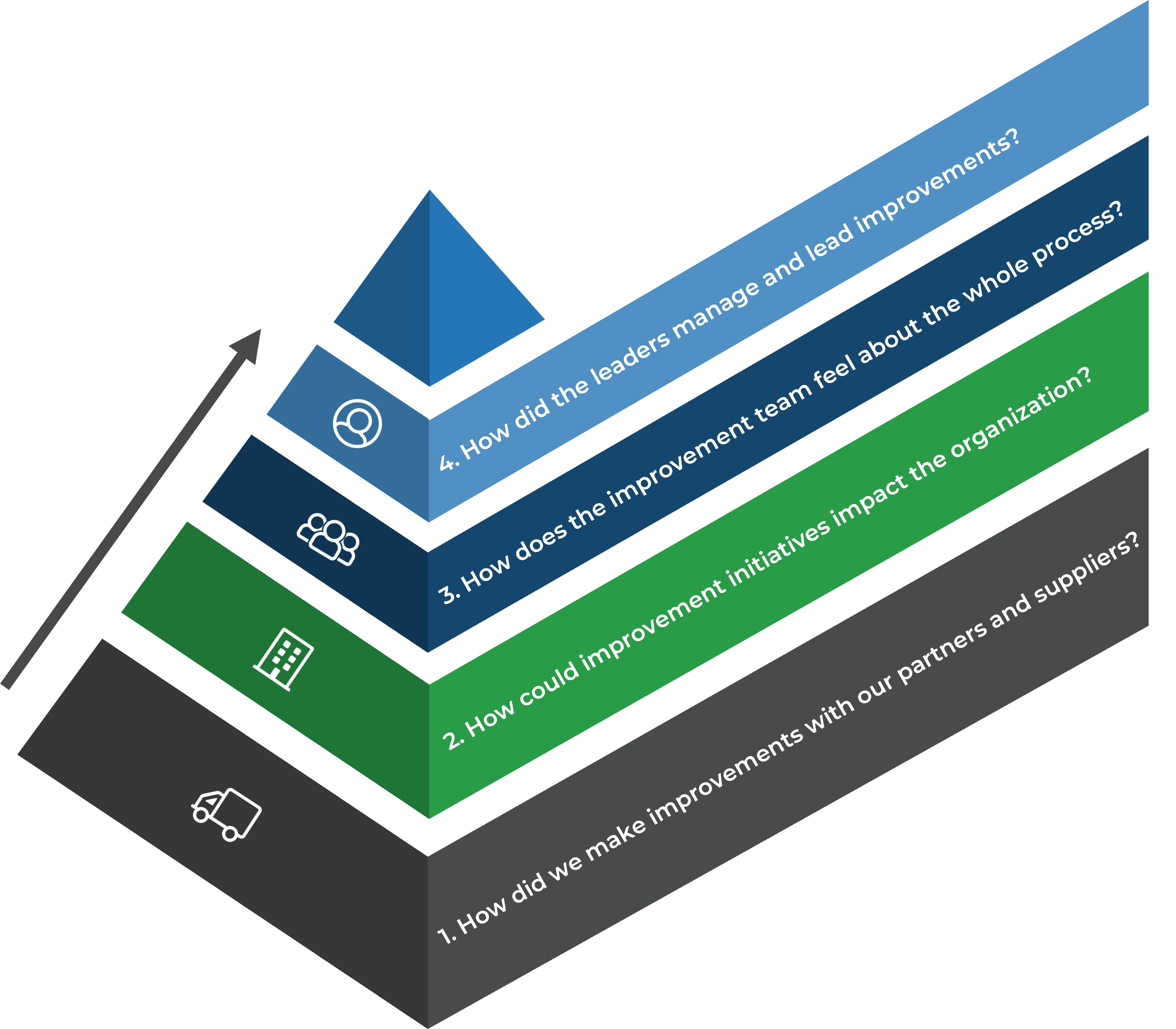

An aligned, optimized CX strategy is:

Rapid: to intentionally and strategically respond to quickly-changing opportunities and issues.

Outcome-based: to make key decisions based on strong business cases, data, and analytics in addition to intuition and judgment.

Rigorous: to bring discipline and science to bear; to improve operations and results.

Collaborative: to conduct activities in a broader ecosystem of partners, suppliers, vendors, co-developers, and even competitors.

(The Wall Street Journal, 2013)

Info-Tech Insight

If IT fails to adequately support marketing, sales, and customer service teams, the organization’s revenue will be in direct jeopardy. As a result, CIOs and Applications Directors must work with their counterparts in these departments to craft a cohesive and comprehensive strategy for using technology to create meaningful (and profitable) customer experiences.

Fireside Chat, Part 1: When was technology an impediment to customer experience at your organization?

1.1.1 30 minutes

Input

- Past experiences of the team

Output

Materials

Participants

Instructions

- Think about a time when technology was an impediment to a positive customer experience at your organization. Reflect on the following:

- What frustrations did the application or the technology cause to your customers? What was their reaction?

- How did IT (and the business) identify the challenge in the first place?

- What steps were taken to mitigate the impact of the problem? Were these steps successful?

- What were the key lessons learned as part of the challenge?

Fireside Chat, Part 2: What customer success stories has

your organization created by using new technologies?

1.1.2 30 minutes

Input

- Past experiences of the team

Output

Materials

Participants

Instructions

- Think about a time when your organization successfully leveraged a new application or new technology to enhance the experience it provided to customers. Reflect on this experience and consider:

- What were the organizational drivers for rolling out the new application or solution?

- What obstacles had to be overcome in order to successfully deploy the solution?

- How did the application positively impact the customer experience? What metrics improved?

- What were the key lessons learned as part of the deployment? If you had to do it all over again, what would you do differently?

Develop a cohesive, consistent, and forward-looking roadmap that supports each stage of the customer lifecycle

When creating your roadmap, consider the pitfalls you’ll likely encounter in building the IT strategy to provide technology enablement for customer experience.

There’s no silver bullet for developing a strategy. You can encounter pitfalls at a myriad of different points including not involving the right stakeholders from the business, not staying abreast of recent trends in the external environment, and not aligning sales, marketing, and support initiatives with a focus on the delivery of value to prospects and customers.

Common Pitfalls When Creating a Technology-Enablement Strategy for CXM

Senior management is not involved in strategy development.

Not paying attention to the “art of the possible.”

“Paving the cow path” rather than focusing on revising core processes.

Misalignment between objectives and financial/personnel resources.

Inexperienced team on either the business or IT side.

Not paying attention to the actions of competitors.

Entrenched management preferences for legacy systems.

Sales culture that downplays the potential value of technology or new applications.

IT is only one or two degrees of separation from the end customer: so take a customer-centric approach

IT →Marketing, Sales, and Service →External Customers

Internal-Facing Applications

- IT enables, supports, and maintains the applications used by the organization to market to, sell to, and service customers. IT provides the infrastructural and technical foundation to operate the function.

Customer-Facing Applications

- IT supports customer-facing interfaces and channels for customer interaction.

- Channel examples include web pages, mobile device applications and optimization, and interactive voice response for callers.

Info-Tech Insight

IT often overlooks direct customer considerations when devising a technology strategy for CXM. Instead, IT leaders rely on other business stakeholders to simply pass on requirements. By sitting down with their counterparts in marketing and sales, and fully understanding business drivers and customer personas, IT will be much better positioned to roll out supporting applications that drive customer engagement.

A well-aligned CXM strategy recognizes a clear delineation of responsibilities between IT, sales, marketing, and service

- When thinking about CXM, IT must recognize that it is responsible for being a trusted partner for technology enablement. This means that IT has a duty to:

- Develop an in-depth understanding of strategic business requirements for CXM. Base your understanding of these business requirements on a clear conception of the internal and external environment, customer personas, and business processes in marketing, sales, and customer service.

- Assist with shortlisting and supporting different channels for customer interaction (including email, telephony, web presence, and social media).

- Create a rationalized, cohesive application portfolio for CXM that blends different enabling technologies together to support strategic business requirements.

- Provide support for vendor shortlisting, selection, and implementation of CXM applications.

- Assist with end-user adoption of CXM applications (i.e. training and ongoing support).

- Provide initiatives that assist with technical excellence for CXM (such as data quality, integration, analytics, and application maintenance).

- The business (marketing, sales, customer service) owns the business requirements and must be responsible for setting top-level objectives for customer interaction (e.g. product and pricing decisions, marketing collateral, territory management, etc.). IT should not take over decisions on customer experience strategy. However, IT should be working in lockstep with its counterparts in the business to assist with understanding business requirements through a customer-facing lens. For example, persona development is best done in cross-functional teams between IT and Marketing.

Activity: Identify the business drivers for CXM to establish the strategy’s guiding principles

1.1.3 30 minutes

Input

Output

- Guiding principles for CXM strategy

Materials

Participants

Instructions

- Define the assumptions and business drivers that have an impact on technology enablement for CXM. What is driving the current marketing, sales, and service strategy on the business side?

| Business Driver Name |

Driver Assumptions, Capabilities, and Constraints |

Impact on CXM Strategy |

| High degree of customer-centric solution selling |

A technically complex product means that solution selling approaches are employed – sales cycles are long. |

There is a strong need for applications and data quality processes that support longer-term customer relationships rather than transactional selling. |

| High desire to increase scalability of sales processes |

Although sales cycles are long, the organization wishes to increase the effectiveness of rep time via marketing automation where possible. |

Sales is always looking for new ways to leverage their reps for face-to-face solution selling while leaving low-level tasks to automation. Marketing wants to support these tasks. |

| Highly remote sales team and unusual hours are the norm |

Not based around core hours – significant overtime or remote working occurs frequently. |

Misalignment between IT working only core hours and after-hours teams leads to lag times that can delay work. Scheduling of preventative sales maintenance must typically be done on weekends rather than weekday evenings. |

Activity: Identify the IT drivers for CXM to establish the strategy’s guiding principles

1.1.4 30 minutes

Input

Output

- Guiding principles for CXM strategy

Materials

Participants

Instructions

- Define the assumptions and IT drivers that have an impact on technology enablement for CXM. What is driving the current IT strategy for supporting marketing, sales, and service initiatives?

| IT Driver Name |

Driver Assumptions, Capabilities, and Constraints |

Impact on CXM Strategy |

| Sales Application Procurement Methodology |

Strong preference for on-premise COTS deployments over homebrewed applications. |

IT may not be able to support cloud-based sales applications due to security requirements for on premise. |

| Vendor Relations |

Minimal vendor relationships; SLAs not drafted internally but used as part of standard agreement. |

IT may want to investigate tightening up SLAs with vendors to ensure more timely support is available for their sales teams. |

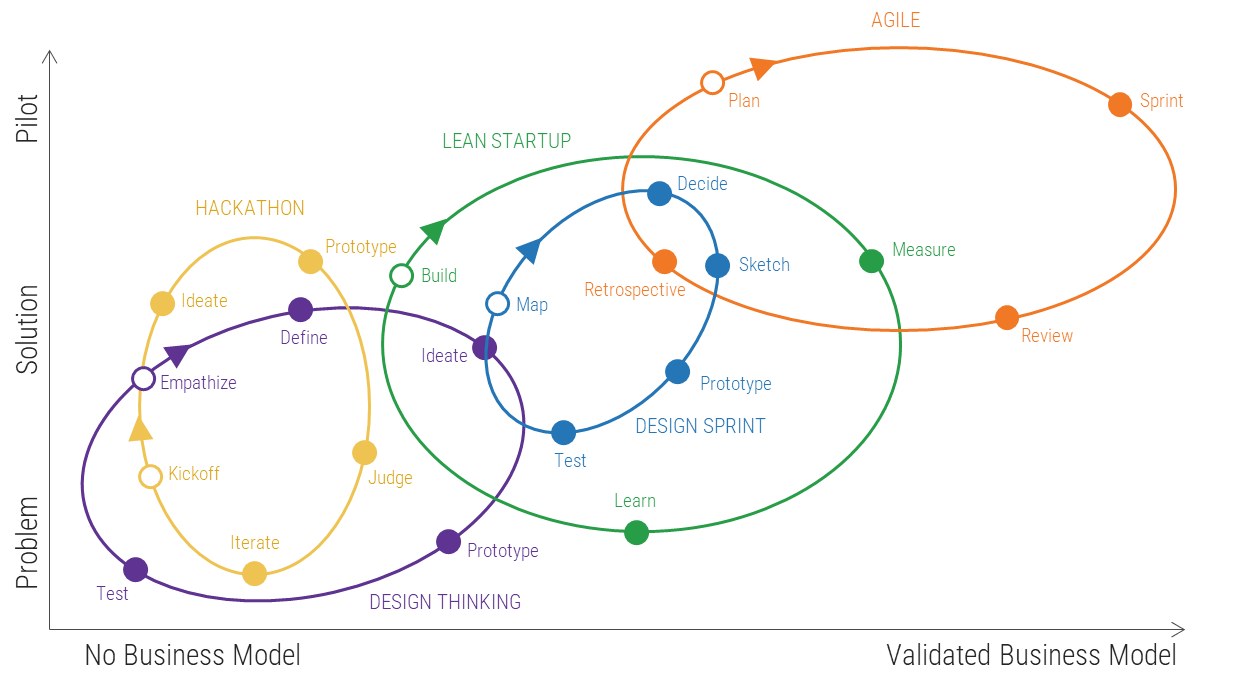

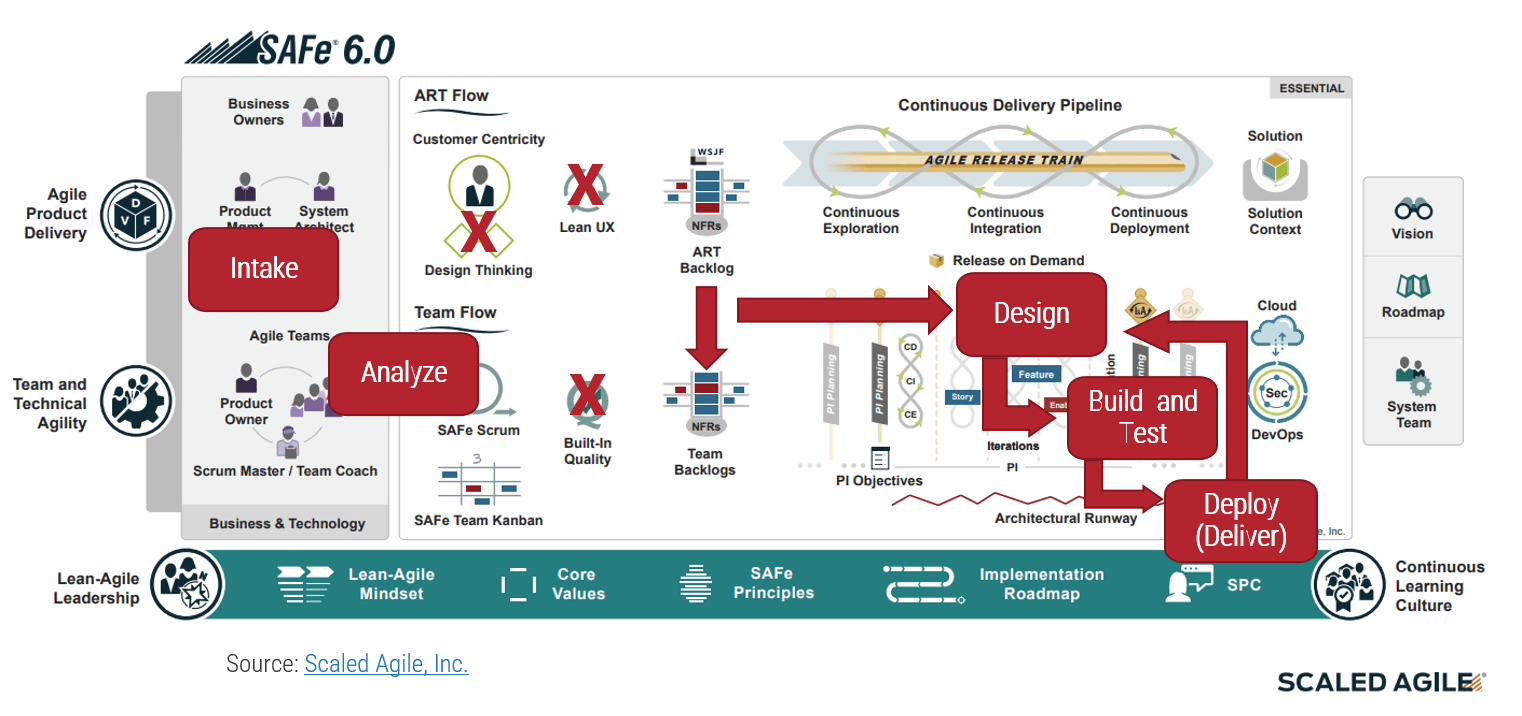

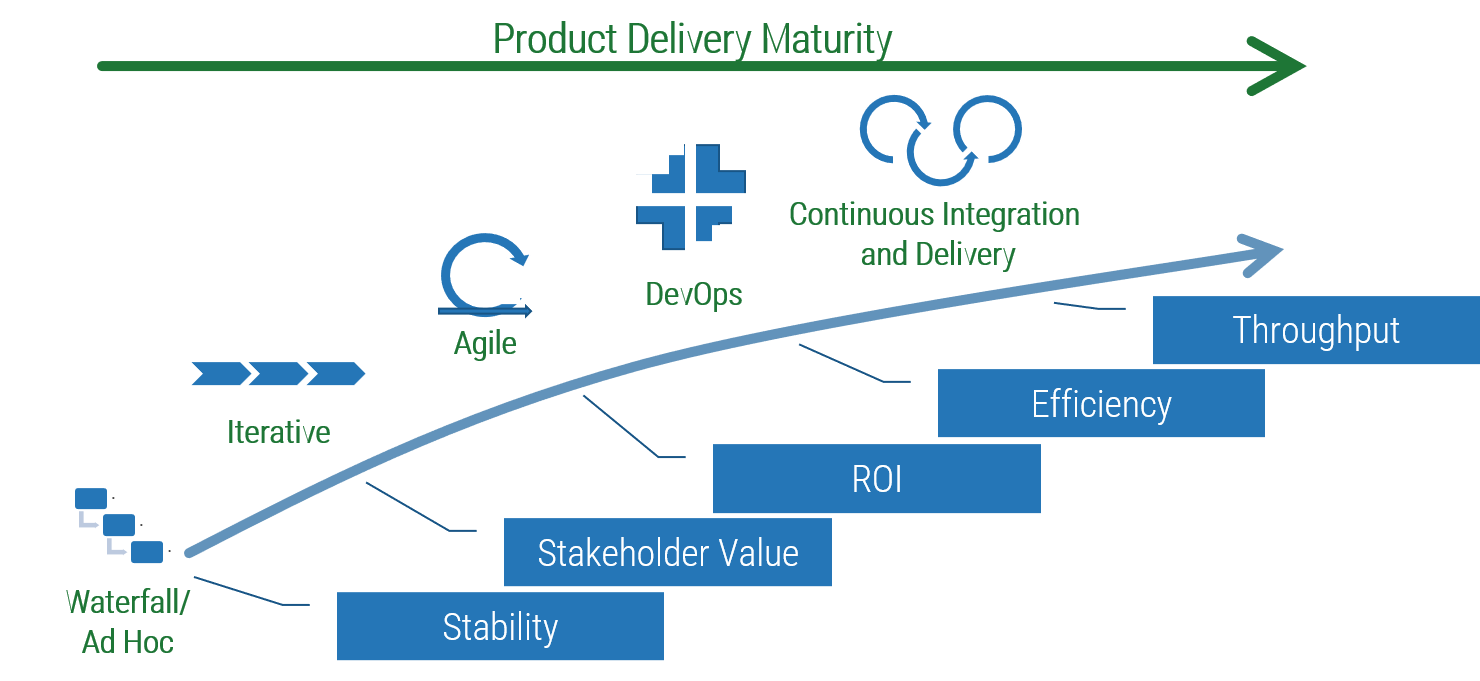

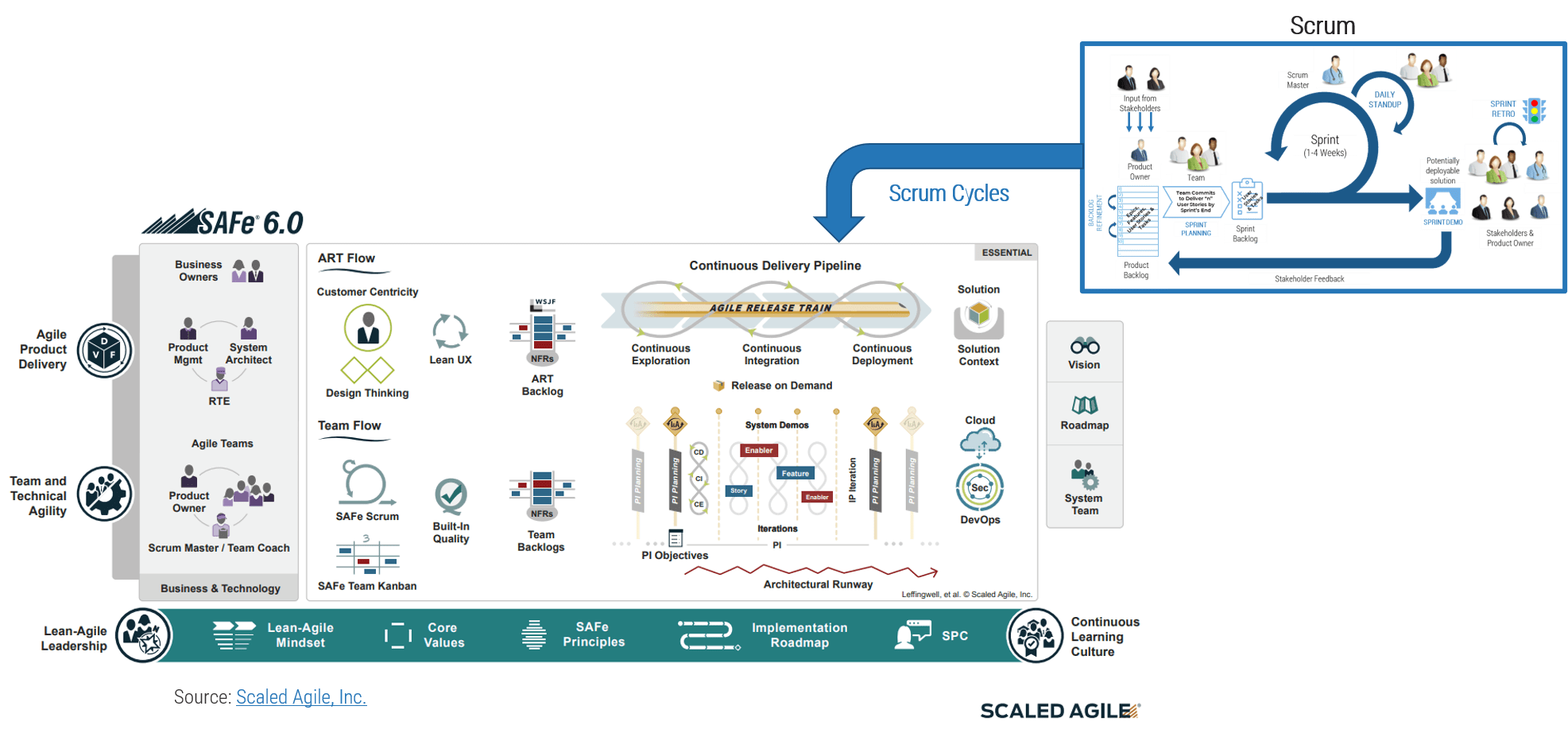

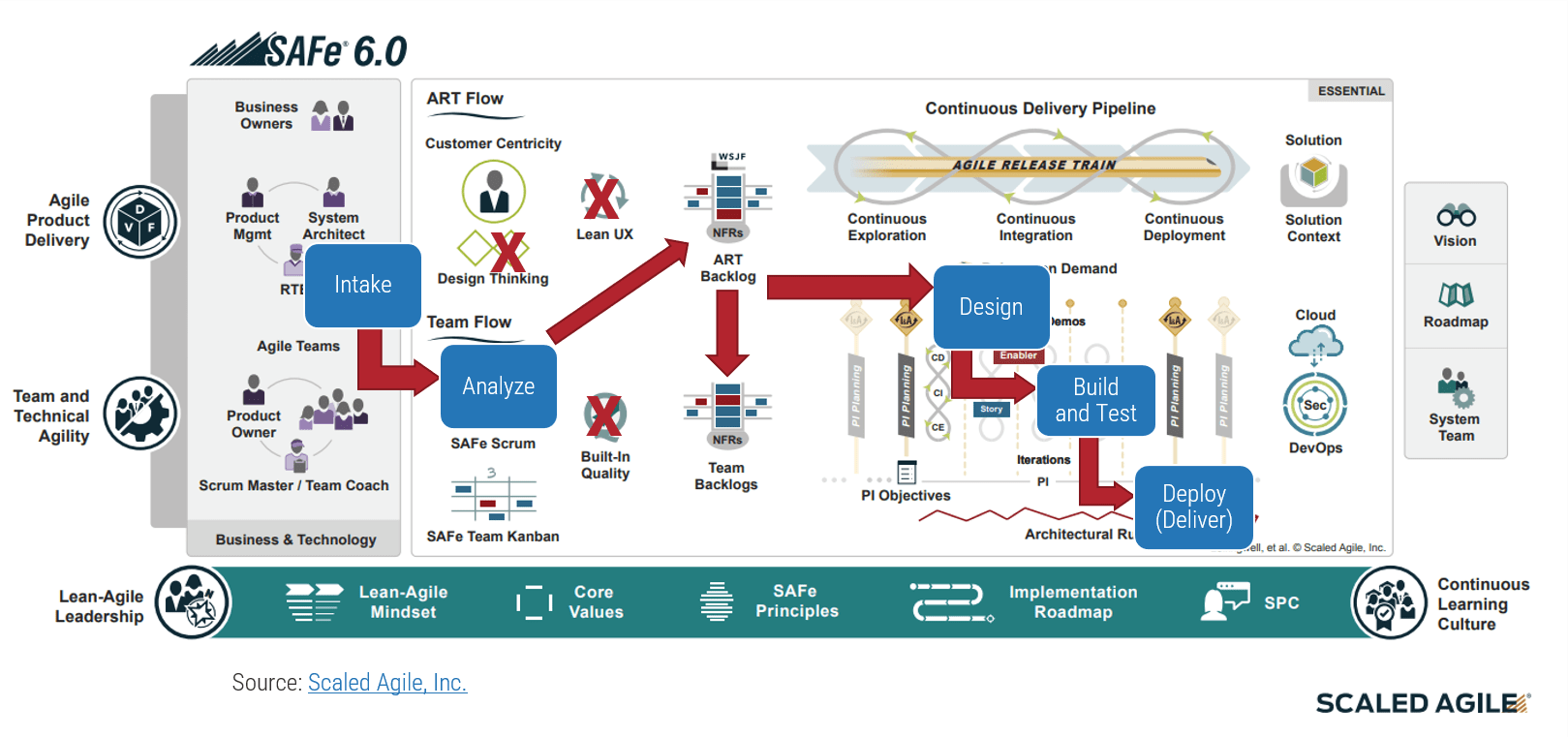

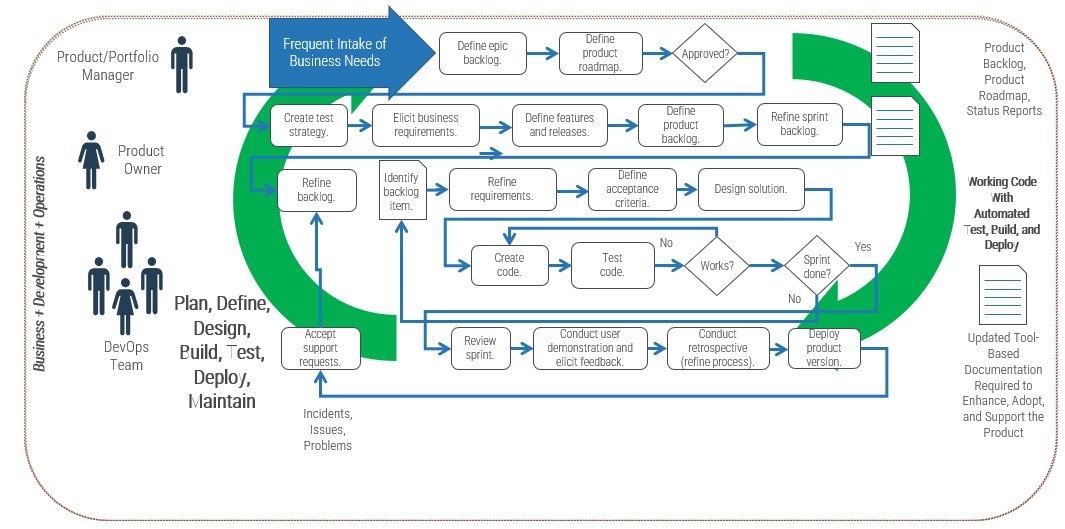

| Development Methodology |

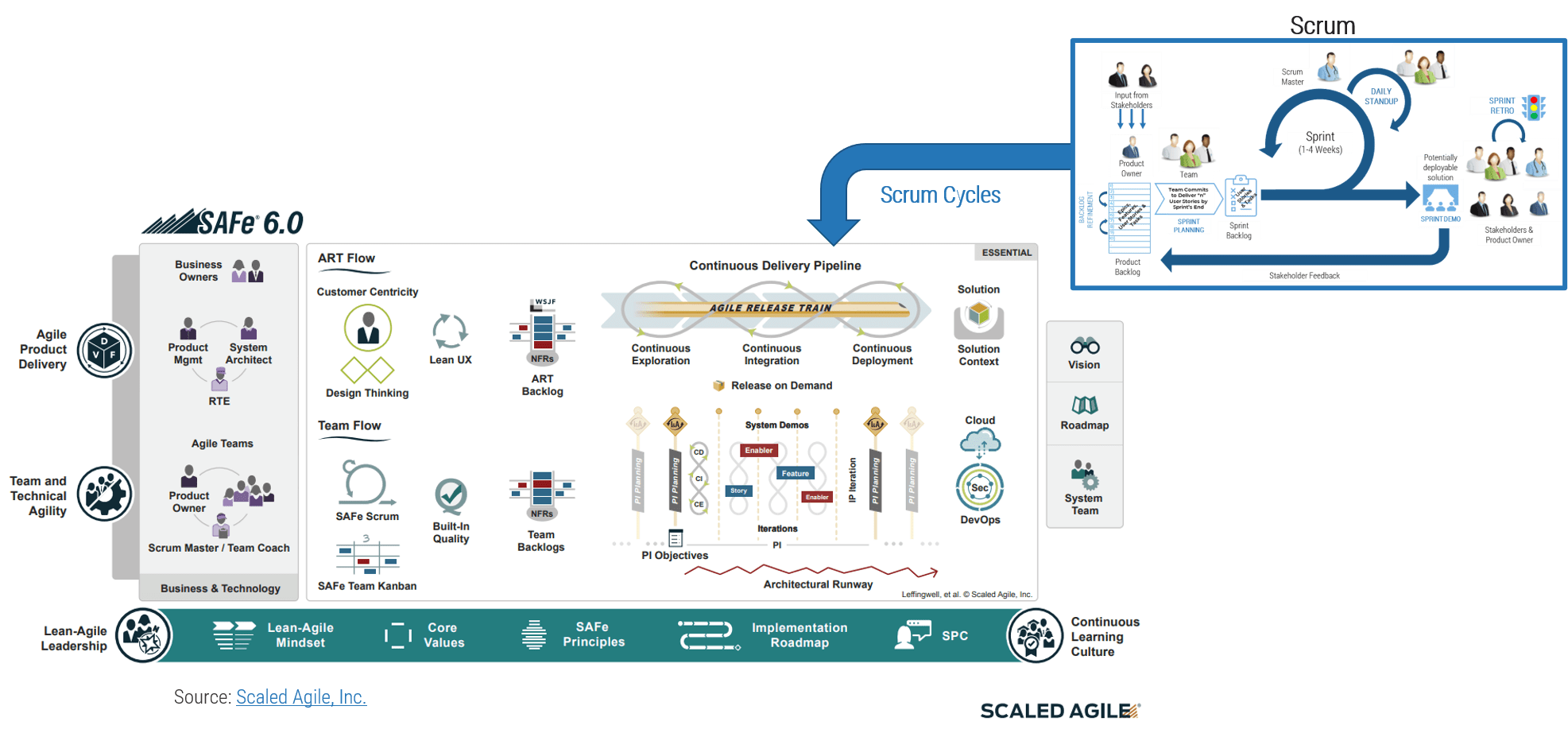

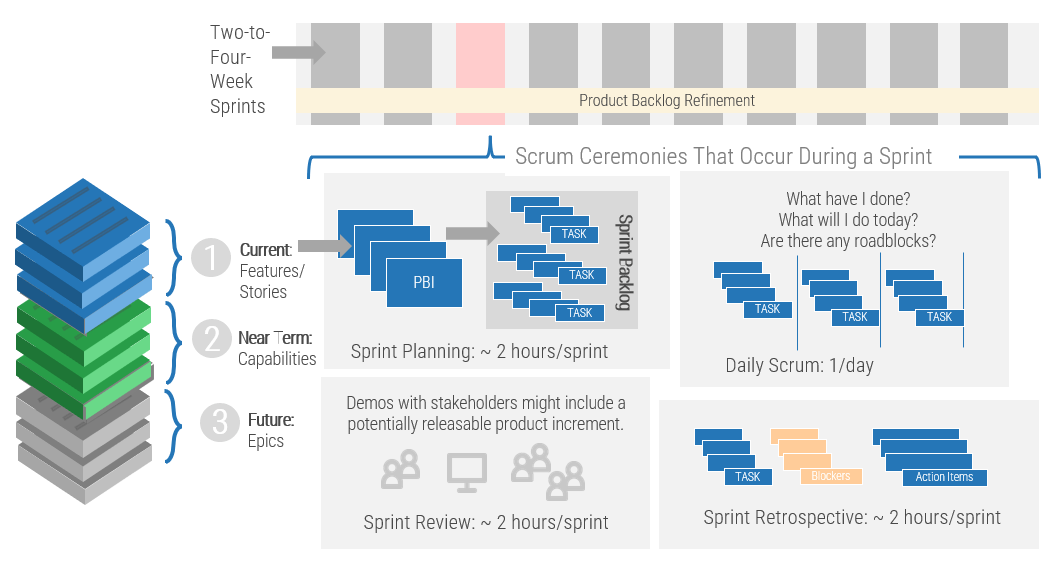

Agile methodology employed, some pockets of Waterfall employed for large-scale deployments. |

Agile development means more perfective maintenance requests come in, but it leads to greater responsiveness for making urgent corrective changes to non-COTS products. |

| Data Quality Approach |

IT sees as Sales’ responsibility |

IT is not standing as a strategic partner for helping to keep data clean, causing dissatisfaction from customer-facing departments. |

| Staffing Availability |

Limited to 9–5 |

Execution of sales support takes place during core hours only, limiting response times and access for on-the-road sales personnel. |

Activity: Use IT and business drivers to create guiding principles for your CXM technology-enablement project

1.1.5 30 minutes

Input

- Business drivers and IT drivers from 1.1.3 and 1.1.4

Output

Materials

Participants

Instructions

1. Based on the IT and business drivers identified, craft guiding principles for CXM technology enablement. Keep guiding principles in mind throughout the project and ensure they support (or reconcile) the business and IT drivers.

| Guiding Principle |

Description |

| Sales processes must be scalable. |

Our sales processes must be able to reach a high number of target customers in a short time without straining systems or personnel. |

| Marketing processes must be high touch. |

Processes must be oriented to support technically sophisticated, solution-selling methodologies. |

2. Summarize the guiding principles above by creating a CXM mission statement. See below for an example.

Example: CXM Mission Statement

To ensure our marketing, sales and service team is equipped with tools that will allow them to reach out to a large volume of contacts while still providing a solution-selling approach. This will be done with secure, on-premise systems to safeguard customer data.

Ensure that now is the right time to take a step back and develop the CXM strategy

Determine if now is the right time to move forward with building (or overhauling) your technology-enablement strategy for CXM.

Not all organizations will be able to proceed immediately to optimize their CXM technology enablement. Determine if the organizational willingness, backbone, and resources are present to commit to overhauling the existing strategy. If you’re not ready to proceed, consider waiting to begin this project until you can procure the right resources.

Do not proceed if:

- Your current strategy for supporting marketing, sales, and service is working well and IT is already viewed as a strategic partner by these groups. Your current strategy is well aligned with customer preferences.

- The current strategy is not working well, but there is no consensus or support from senior management for improving it.

- You cannot secure the resources or time to devote to thoroughly examining the current state and selecting improvement initiatives.

- The strategy has been approved, but there is no budget in place to support it at this time.

Proceed if:

- Senior management has agreed that technology support for CXM should be improved.

- Sub-divisions within IT, sales, marketing, and service are on the same page about the need to improve alignment.

- You have an approximate budget to work with for the project and believe you can secure additional funding to execute at least some improvement initiatives.

- You understand how improving CXM alignment will fit into the broader customer interaction ecosystem in your organization.

If you want additional support, have our analysts guide you through this phase as part of an Info-Tech workshop

Book a workshop with our Info-Tech analysts:

- To accelerate this project, engage your IT team in an Info-Tech workshop with an Info-Tech analyst team.

- Info-Tech analysts will join you and your team onsite at your location or welcome you to Info-Tech’s historic Toronto office to participate in an innovative onsite workshop.

- Contact your account manager (www.infotech.com/account), or email Workshops@InfoTech.com for more information.

The following are sample activities that will be conducted by Info-Tech analysts with your team:

1.1.3; 1.1.4; 1.1.5 - Identify business and IT drivers to create CXM guiding principles

The facilitator will work with stakeholders from both the business and IT to identify implicit or explicit strategic drivers that will support (or pose constraints on) the technology-enablement framework for the CXM strategy. In doing so, guiding principles will be established for the project.

Step 1.2: Structure the Project

Phase 1

1.1 Create the Project Vision

1.2 Structure the Project

Phase 2

2.1 Scan the External Environment

2.2 Assess the Current State of CXM

2.3 Create an Application Portfolio

2.4 Develop Deployment Best Practices

Phase 3

3.1 Create an Initiative Rollout Plan

3.2 Confirm and Finalize the CXM Blueprint

Activities:

- Define the project purpose, objectives, and business metrics

- Define the scope of the CXM strategy

- Create the project team

- Build a RACI chart

- Develop a timeline with project milestones

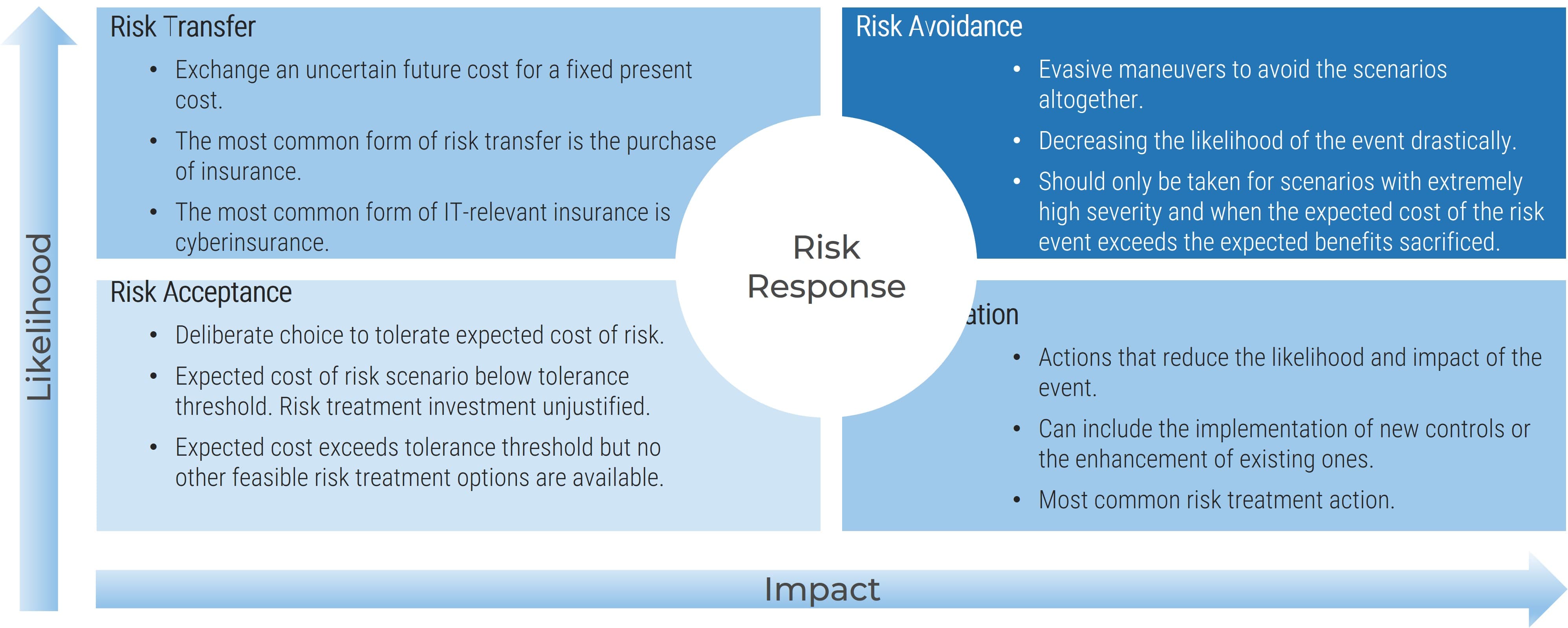

- Identify risks and create mitigation strategies

- Complete the strategy project charter and obtain approval

Outcomes:

CXM Strategy Project Charter Template

- Purpose, objectives, metrics

- Scope

- Project team & RACI

- Timeline

- Risks & mitigation strategies

- Project sponsorship

Use Info-Tech’s CXM Strategy Project Charter Template to outline critical components of the CXM project

1.2.1 CXM Strategy Project Charter Template

Having a project charter is the first step for any project: it specifies how the project will be resourced from a people, process, and technology perspective, and it clearly outlines major project milestones and timelines for strategy development. CXM technology enablement crosses many organizational boundaries, so a project charter is a very useful tool for ensuring everyone is on the same page.

Sections of the document:

- Project Drivers, Rationale, and Context

- Project Objectives, Metrics, and Purpose

- Project Scope Definition

- Project Team Roles and Responsibilities (RACI)

- Project Timeline

- Risk Mitigation Strategy

- Project Metrics

- Project Review & Approvals

INFO-TECH DELIVERABLE

CXM Strategy Project Charter Template

Populate the relevant sections of your project charter as you complete activities 1.2.2-1.2.8.

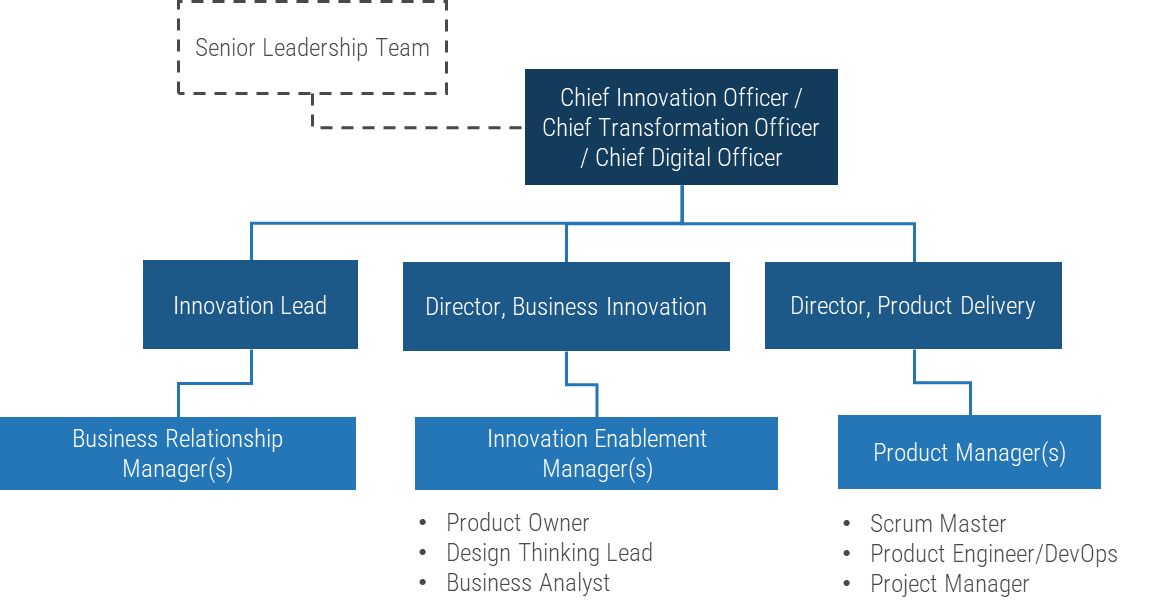

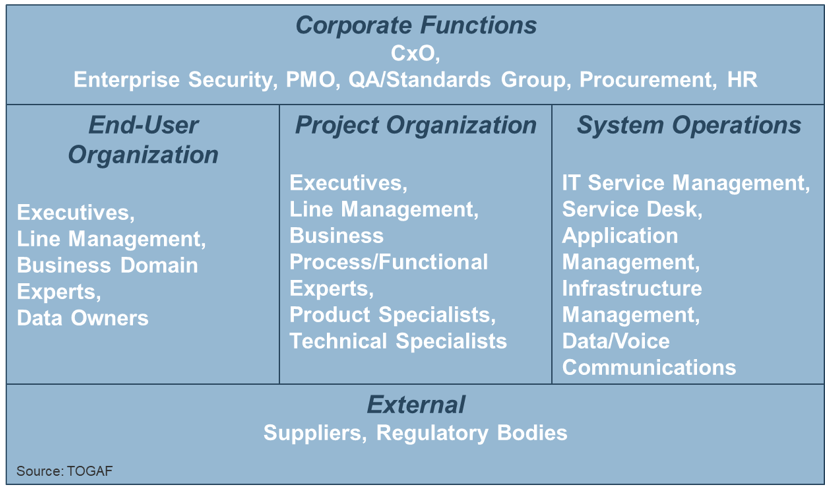

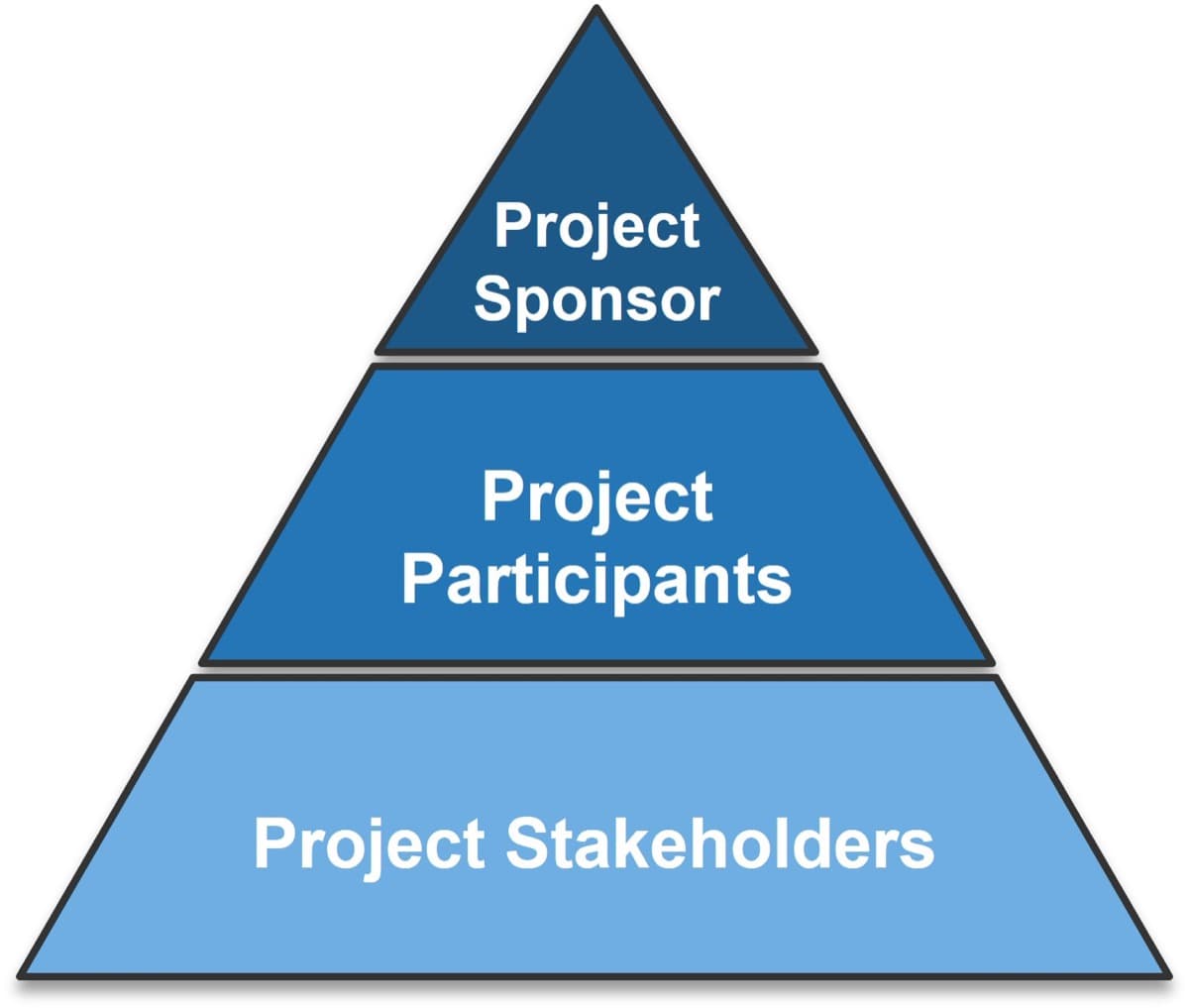

Understand the roles necessary to complete your CXM technology-enablement strategy

Understand the role of each player within your project structure. Look for listed participants on the activities slides to determine when each player should be involved.

| Title |

Role Within Project Structure |

| Project Sponsor |

- Owns the project at the management/C-suite level

- Responsible for breaking down barriers and ensuring alignment with organizational strategy

- CIO, CMO, VP of Sales, VP of Customer Care, or similar

|

| Project Manager |

- The IT individual(s) that will oversee day-to-day project operations

- Responsible for preparing and managing the project plan and monitoring the project team’s progress

- Applications or other IT Manager, Business Analyst, Business Process Owner, or similar

|

| Business Lead |

- Works alongside the IT PM to ensure that the strategy is aligned with business needs

- In this case, likely to be a marketing, sales, or customer service lead

- Sales Director, Marketing Director, Customer Care Director, or similar

|

| Project Team |

- Comprised of individuals whose knowledge and skills are crucial to project success

- Responsible for driving day-to-day activities, coordinating communication, and making process and design decisions. Can assist with persona and scenario development for CXM.

- Project Manager, Business Lead, CRM Manager, Integration Manager, Application SMEs, Developers, Business Process Architects, and/or similar SMEs

|

| Steering Committee |

- Comprised of C-suite/management level individuals that act as the project’s decision makers

- Responsible for validating goals and priorities, defining the project scope, enabling adequate resourcing, and managing change

- Project Sponsor, Project Manager, Business Lead, CFO, Business Unit SMEs and similar

|

Info-Tech Insight

Do not limit project input or participation to the aforementioned roles. Include subject matter experts and internal stakeholders at particular stages within the project. Such inputs can be solicited on a one-off basis as needed. This ensures you take a holistic approach to creating your CXM technology-enablement strategy.

Activity: Kick-off the CXM project by defining the project purpose, project objectives, and business metrics

1.2.2 30 minutes

Input

- Activities 1.1.1 to 1.1.5

Output

- Drivers & rationale

- Purpose statement

- Business goals

- Business metrics

- CXM Strategy Project Charter Template, sections 1.0, 2.0, and 2.1

Materials

Participants

- Project Sponsor

- Project Manager

- Business Lead

- Steering Committee

Instructions

Hold a meeting with IT, Marketing, Sales, Service, Operations, and any other impacted business stakeholders that have input into CXM to accomplish the following:

- Discuss the drivers and rationale behind embarking on a CXM strategy.

- Develop and concede on objectives for the CXM project, metrics that will gauge its success, and goals for each metric.

- Create a project purpose statement that is informed by decided-upon objectives and metrics from the steps above. When establishing a project purpose, ask the question, “what are we trying to accomplish?”

- Example: Project Purpose Statement

- The organization is creating a CXM strategy to gather high-level requirements from the business, IT, and Marketing, Sales, and Service, to ensure that the selection and deployment of the CXM meets the needs of the broader organization and provides the greatest return on investment.

Document your project drivers and rationale, purpose statement, project objectives, and business metrics in Info-Tech’s CXM Strategy Project Charter Template in sections 1.0 and 2.0.

Info-Tech Insight

Going forward, set up a quarterly review process to understand changing needs. It is rare that organizations never change their marketing and sales strategy. This will change the way the CXM will be utilized.

Establish baseline metrics for customer engagement

In order to gauge the effectiveness of CXM technology enablement, establish core metrics:

- Marketing Metrics: pertaining to share of voice, share of wallet, market share, lead generation, etc.

- Sales Metrics: pertaining to overall revenue, average deal size, number of accounts, MCV, lead warmth, etc.

- Customer Service Metrics: pertaining to call volumes, average time to resolution, first contact resolution, customer satisfaction, etc.

- IT Metrics: pertaining to end-user satisfaction with CXM applications, number of tickets, contract value, etc.

| Metric Description |

Current Metric |

Future Goal |

| Market Share |

25% |

35% |

| Share of Voice (All Channels) |

40% |

50% |

| Average Deal Size |

$10,500 |

$12,000 |

| Account Volume |

1,400 |

1,800 |

| Average Time to Resolution |

32 min |

25 min |

| First Contact Resolution |

15% |

35% |

| Web Traffic per Month (Unique Visitors) |

10,000 |

15,000 |

| End-User Satisfaction |

62% |

85%+ |

| Other metric |

|

|

| Other metric |

|

|

| Other metric |

|

|

Understand the importance of setting project expectations with a scope statement

Be sure to understand what is in scope for a CXM strategy project. Prevent too wide of a scope to avoid scope creep – for example, we aren’t tackling ERP or BI under CXM.

In Scope

Establishing the parameters of the project in a scope statement helps define expectations and provides a baseline for resource allocation and planning. Future decisions about the strategic direction of CXM will be based on the scope statement.

Scope Creep

Well-executed requirements gathering will help you avoid expanding project parameters, drawing on your resources, and contributing to cost overruns and project delays. Avoid scope creep by gathering high-level requirements that lead to the selection of category-level application solutions (e.g. CRM, MMS, SMMP, etc.), rather than granular requirements that would lead to vendor application selection (e.g. Salesforce, Marketo, Hootsuite, etc.).

Out of Scope

Out-of-scope items should also be defined to alleviate ambiguity, reduce assumptions, and further clarify expectations for stakeholders. Out-of-scope items can be placed in a backlog for later consideration. For example, fulfilment and logistics management is out of scope as it pertains to CXM.

| In Scope |

| Strategy |

| High-Level CXM Application Requirements |

CXM Strategic Direction |

Category Level Application Solutions (e.g. CRM, MMS, etc.) |

| Out of Scope |

| Software Selection |

| Vendor Application Review |

Vendor Application Selection |

Granular Application System Requirements |

Activity: Define the scope of the CXM strategy

1.2.3 30 minutes

Input

Output

- Project scope and parameters

- CXM Strategy Project Charter Template, section 3.0

Materials

Participants

- Project Sponsor

- Project Manager

- Business Lead

Instructions

- Formulate a scope statement. Decide which people, processes, and functions the CXM strategy will address. Generally, the aim of this project is to develop strategic requirements for the CXM application portfolio – not to select individual vendors.

- Document your scope statement in Info-Tech’s CXM Strategy Project Charter Template in section 3.0.

To form your scope statement, ask the following questions:

- What are the major coverage points?

- Who will be using the systems?

- How will different users interact with the systems?

- What are the objectives that need to be addressed?

- Where do we start?

- Where do we draw the line?

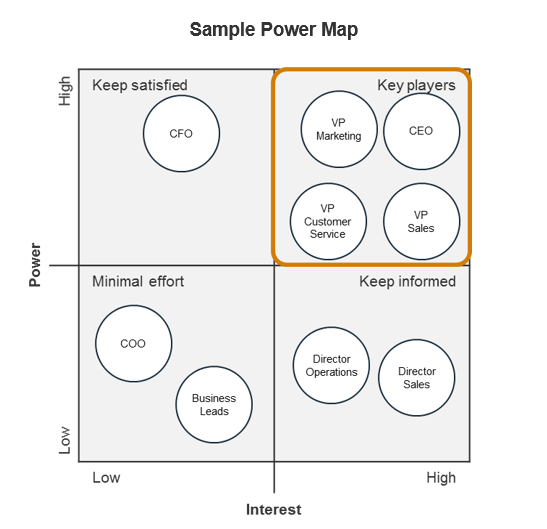

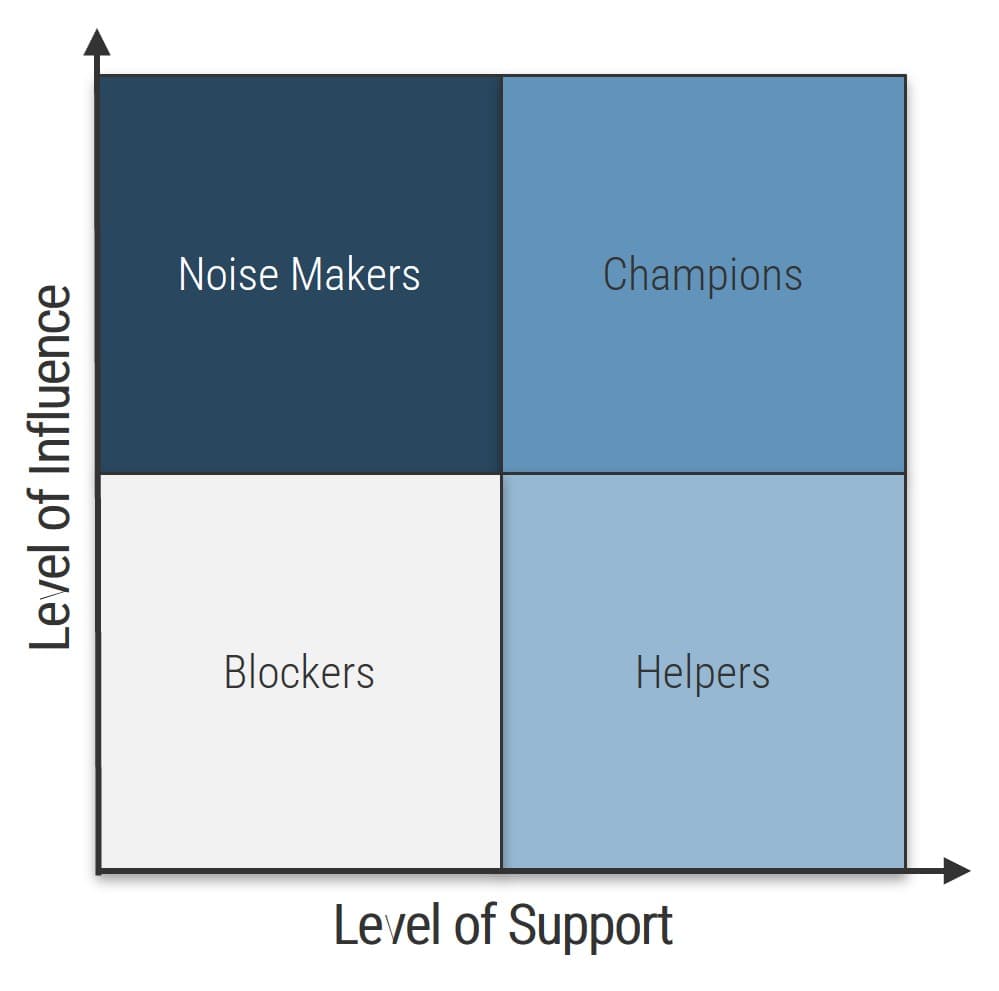

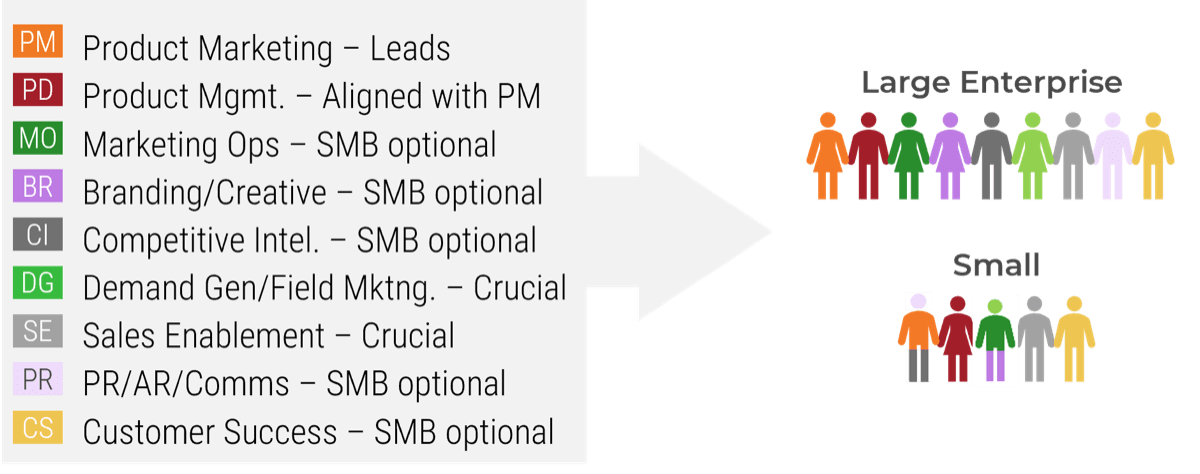

Identify the right stakeholders to include on your project team

Consider the core team functions when composing the project team. Form a cross-functional team (i.e. across IT, Marketing, Sales, Service, Operations) to create a well-aligned CXM strategy.

| Required Skills/Knowledge |

Suggested Project Team Members |

| IT |

- Application development

- Enterprise integration

- Business processes

- Data management

|

- CRM Application Manager

- Business Process Manager

- Integration Manager

- Application Developer

- Data Stewards

|

| Business |

- Understanding of the customer

- Departmental processes

|

- Sales Manager

- Marketing Manager

- Customer Service Manager

|

| Other |

- Operations

- Administrative

- Change management

|

- Operations Manager

- CFO

- Change Management Manager

|

Info-Tech Insight

Don’t let your project team become too large when trying to include all relevant stakeholders. Carefully limiting the size of the project team will enable effective decision making while still including functional business units such as marketing, sales, service, and finance, as well as IT.

Activity: Create the project team

1.2.4 45 minutes

Input

- Scope Statement (output of Activity 1.2.3).

Output

- Project Team

- CXM Strategy Project Charter Template, section 4.0

Materials

Participants

- Project Manager

- Business Lead

Instructions

- Review your scope statement. Have a discussion to generate a complete list of key stakeholders that are needed to achieve the scope of work.

- Using the previously generated list, identify a candidate for each role and determine their responsibilities and expected time commitment for the CXM strategy project.

- Document the project team in Info-Tech’s CXM Strategy Project Charter Template in section 4.0.

Define project roles and responsibilities to improve progress tracking

Build a list of the core CXM strategy team members, and then structure a RACI chart with the relevant categories and roles for the overall project.

Responsible - Conducts work to achieve the task

Accountable - Answerable for completeness of task

Consulted - Provides input for the task

Informed - Receives updates on the task

Info-Tech Insight

Avoid missed tasks between inter-functional communications by defining roles and responsibilities for the project as early as possible.

Benefits of Assigning RACI Early:

- Improve project quality by assigning the right people to the right tasks.

- Improve chances of project task completion by assigning clear accountabilities.

- Improve project buy-in by ensuring that stakeholders are kept informed of project progress, risks, and successes.

Activity: Build a RACI chart

1.2.5 30 minutes

Input

- Project Team (output of Activity 1.2.4)

Output

- RACI chart

- CXM Strategy Project Charter Template, section 4.2

Materials

Participants

- Project Manager

- Business Lead

Instructions

- Identify the key stakeholder teams that should be involved in the CXM strategy project. You should have a cross-functional team that encompasses both IT (various units) and the business.

- Determine whether each stakeholder should be responsible, accountable, consulted, and/or informed with respect to each overarching project step.

- Confirm and communicate the results to relevant stakeholders and obtain their approval.

- Document the RACI chart in Info-Tech’s CXM Strategy Project Charter Template in section 4.2.

| Example: RACI Chart |

Project Sponsor (e.g. CMO) |

Project Manager (e.g. Applications Manager) |

Business Lead (e.g. Marketing Director) |

Steering Committee (e.g. PM, CMO, CFO…) |

Project Team (e.g. PM, BL, SMEs…) |

| Assess Project Value |

I |

C |

A |

R |

C |

| Conduct a Current State Assessment |

I |

I |

A |

C |

R |

| Design Application Portfolio |

I |

C |

A |

R |

I |

| Create CXM Roadmap |

R |

R |

A |

I |

I |

| ... |

... |

... |

... |

... |

... |

Activity: Develop a timeline in order to specify concrete project milestones

1.2.6 30 minutes

Input

Output

- Project timeline

- CXM Strategy Project Charter Template, section 5.0

Materials

Participants

- Project Manager

- Business Lead

Instructions

- Assign responsibilities, accountabilities, and other project involvement to each project team role using a RACI chart. Remember to consider dependencies when creating the schedule and identifying appropriate subtasks.

- Document the timeline in Info-Tech’s CXM Strategy Project Charter Template in section 5.0.

| Key Activities |

Start Date |

End Date |

Target |

Status |

Resource(s) |

| Structure the Project and Build the Project Team |

|

|

|

|

|

| Articulate Business Objectives and Define Vision for Future State |

|

|

|

|

|

| Document Current State and Assess Gaps |

|

|

|

|

|

| Identify CXM Technology Solutions |

|

|

|

|

|

| Build the Strategy for CXM |

|

|

|

|

|

| Implement the Strategy |

|

|

|

|

|

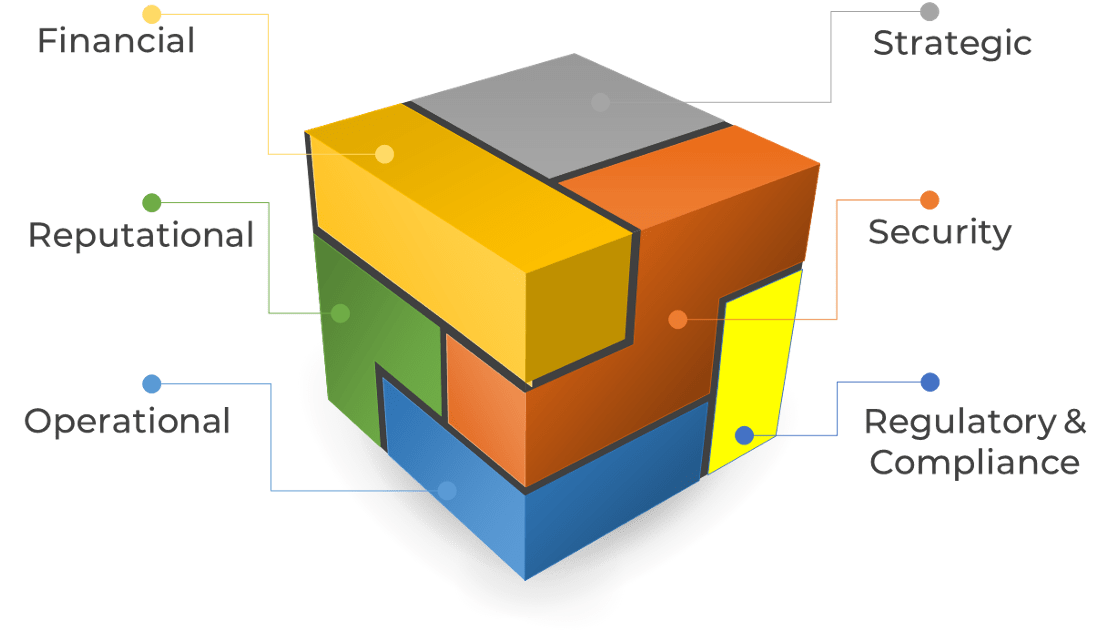

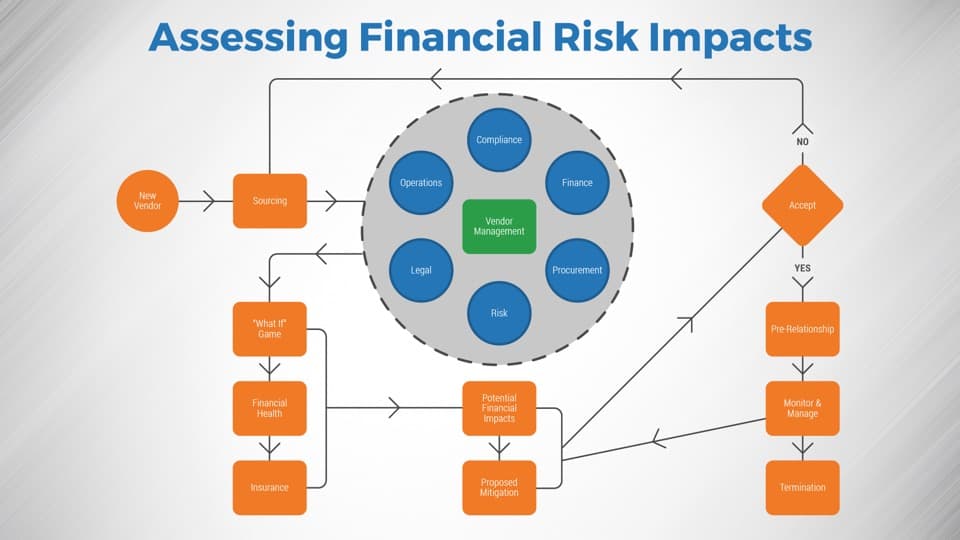

Assess project-associated risk by understanding common barriers and enablers

Common Internal Risk Factors

| |

Management Support |

Change Management |

IT Readiness |

| Definition |

The degree of understanding and acceptance of CXM as a concept and necessary portfolio of technologies. |

The degree to which employees are ready to accept change and the organization is ready to manage it. |

The degree to which the organization is equipped with IT resources to handle new systems and processes. |

| Assessment Outcomes |

- Is CXM enablement recognized as a top priority?

- Will management commit time to the project?

|

- Are employees resistant to change?

- Is there an organizational awareness of the importance of customer experience?

- Who are the owners of process and content?

|

- Is there strong technical expertise?

- Is there strong infrastructure?

- What are the important integration points throughout the business?

|

| Risk |

- Low management buy-in

- Lack of funding

- Lack of resources

|

- Low employee motivation

- Lack of ownership

- Low user adoption

|

- Poor implementation

- Reliance on consultants

|

Activity: Identify the risks and create mitigation strategies

1.2.7 45 minutes

Input

Output

- Risk mitigation strategy

- CXM Strategy Project Charter Template, section 6.0

Materials

Participants

- Project Manager

- Business Lead

- Project Team

Instructions

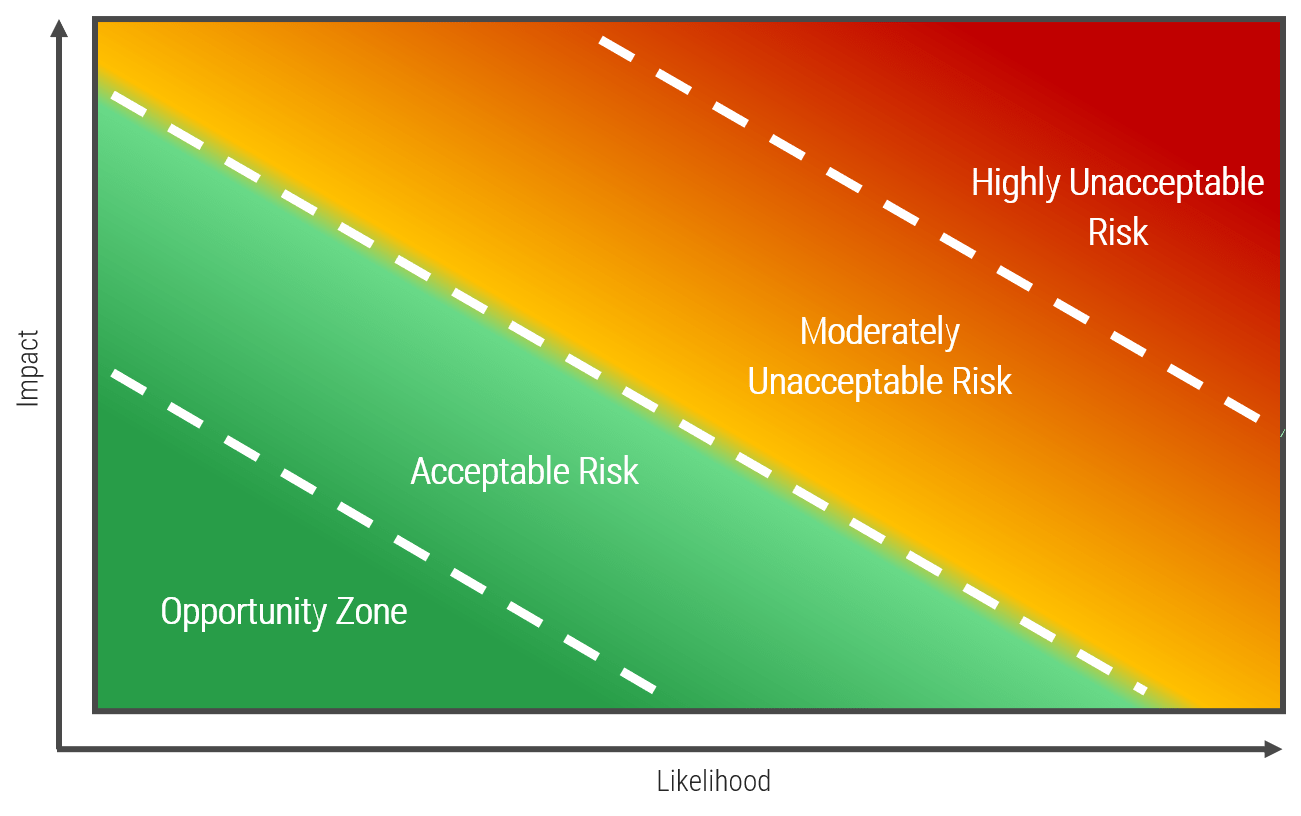

- Brainstorm a list of possible risks that may impede the progress of your CXM project.

- Classify risks as strategy based (related to planning) or systems based (related to technology).

- Brainstorm mitigation strategies to overcome each risk.

- On a scale of 1 to 3, determine the impact of each risk on project success and the likelihood of each risk occurring.

- Document your findings in Info-Tech’s CXM Strategy Project Charter Template in section 6.0.

Likelihood:

1 - High/Needs Focus

2 - Can Be Mitigated

3 - Unlikely

Impact

1 - High Impact

2 - Moderate Impact

3 - Minimal Impact

Example: Risk Register and Mitigation Tactics

| Risk |

Impact |

Likelihood |

Mitigation Effort |

| Cost of time and implementation: designing a robust portfolio of CXM applications can be a time consuming task, representing a heavy investment for the organization |

1 |

1 |

- Have a clear strategic plan and a defined time frame

- Know your end-user requirements

- Put together an effective and diverse strategy project team

|

| Availability of resources: lack of in-house resources (e.g. infrastructure, CXM application developers) may result in the need to insource or outsource resources |

1 |

2 |

- Prepare a plan to insource talent by hiring or transferring talent from other departments – e.g. marketing and customer service

|

Activity: Complete the project charter and obtain approval

1.2.8 45 minutes

Input

Output

- Project approval

- CXM Strategy Project Charter Template, section 8.0

Materials

Participants

- Project Manager

- Business Lead

- Project Team

Instructions

Before beginning to develop the CXM strategy, validate the project charter and metrics with senior sponsors or stakeholders and receive their approval to proceed.

- Schedule a 30-60 minute meeting with senior stakeholders and conduct a live review of your CXM strategy project charter.

- Obtain stakeholder approval to ensure there are no miscommunications or misunderstandings around the scope of the work that needs to be done to reach a successful project outcome. Final sign-off should only take place when mutual consensus has been reached.

- Obtaining approval should be an iterative process; if senior management has concerns over certain aspects of the plan, revise and review again.

Info-Tech Insight

In most circumstances, you should have your CXM strategy project charter validated with the following stakeholders:

- Chief Information Officer

- IT Applications Director

- CFO or Comptroller (for budget approval)

- Chief Marketing Office or Head of Marketing

- Chief Revenue Officer or VP of Sales

- VP Customer Service

If you want additional support, have our analysts guide you through this phase as part of an Info-Tech workshop

Book a workshop with our Info-Tech analysts:

1.2.2 Define project purpose, objectives, and business metrics

Through an in-depth discussion, an analyst will help you prioritize corporate objectives and organizational drivers to establish a distinct project purpose.

1.2.3 Define the scope of the CXM strategy

An analyst will facilitate a discussion to address critical questions to understand your distinct business needs. These questions include: What are the major coverage points? Who will be using the system?

1.2.4; 1.2.5; 1.2.6 Create the CXM project team, build a RACI chart, and establish a timeline

Our analysts will guide you through how to create a designated project team to ensure the success of your CXM strategy and suite selection initiative, including project milestones and team composition, as well as designated duties and responsibilities.

Phase 2

Create a Strategic Framework for CXM Technology Enablement

Build a Strong Technology Foundation for Customer Experience Management

Phase 2 outline: Steps 2.1 and 2.2

Call 1-888-670-8889 or email GuidedImplementations@InfoTech.com for more information.

Complete these steps on your own, or call us to complete a guided implementation. A guided implementation is a series of

2-3 advisory calls that help you execute each phase of a project. They are included in most advisory memberships.

Guided Implementation 2: Create a Strategic Framework for CXM Technology Enablement

Proposed Time to Completion: 4 weeks

Step 2.1: Scan the External Environment

Start with an analyst kick-off call:

- Discuss external drivers

- Assess competitive environment

- Review persona development

- Review scenarios

Then complete these activities…

- Build the CXM operating model

- Conduct a competitive analysis

- Conduct a PEST analysis

- Build personas and scenarios

With these tools & templates:

CXM Strategy Stakeholder Presentation Template

Step 2.2: Assess the Current State for CRM

Review findings with analyst:

- Review SWOT analysis

- Review VRIO analysis

- Discuss strategic requirements for CXM

Then complete these activities…

- Conduct a SWOT analysis

- Conduct a VRIO analysis

- Inventory existing applications

With these tools & templates:

CXM Strategy Stakeholder Presentation Template

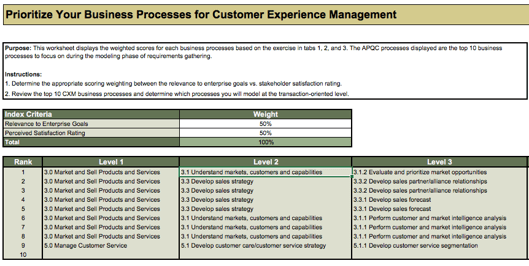

Phase 2 outline: Steps 2.3 and 2.4

Call 1-888-670-8889 or email GuidedImplementations@InfoTech.com for more information.

Complete these steps on your own, or call us to complete a guided implementation. A guided implementation is a series of

2-3 advisory calls that help you execute each phase of a project. They are included in most advisory memberships.

Guided Implementation 2: Create a Strategic Framework for CXM Technology Enablement

Proposed Time to Completion: 4 weeks

Step 2.3: Create an Application Portfolio

Start with an analyst kick-off call:

- Discuss possible business process maps

- Discuss strategic requirements

- Review application portfolio results

Then complete these activities…

- Build business maps

- Execute application mapping

With these tools & templates:

CXM Portfolio Designer

CXM Strategy Stakeholder Presentation Template

CXM Business Process Shortlisting Tool

Step 2.4: Develop Deployment Best Practices

Review findings with analyst:

- Review possible integration maps

- Discuss best practices for end-user adoption

- Discuss best practices for customer data quality

Then complete these activities…

- Create CXM integration ecosystem

- Develop adoption game plan

- Create data quality standards

With these tools & templates:

CXM Strategy Stakeholder Presentation Template

Phase 2 Results & Insights:

- Application portfolio for CXM

- Deployment best practices for areas such as integration, data quality, and end-user adoption

Step 2.1: Scan the External Environment

Phase 1

1.1 Create the Project Vision

1.2 Structure the Project

Phase 2

2.1 Scan the External Environment

2.2 Assess the Current State of CXM

2.3 Create an Application Portfolio

2.4 Develop Deployment Best Practices

Phase 3

3.1 Create an Initiative Rollout Plan

3.2 Confirm and Finalize the CXM Blueprint

Activities:

- Inventory CXM drivers and organizational objectives

- Identify CXM challenges and pain points

- Discuss opportunities and benefits

- Align corporate and CXM strategies

- Conduct a competitive analysis

- Conduct a PEST analysis and extract strategic requirements

- Build customer personas and extract strategic requirements

Outcomes:

- CXM operating model

- Organizational drivers

- Environmental factors

- Barriers

- Enablers

- PEST analysis

- External customer personas

- Customer journey scenarios

- Strategic requirements for CXM

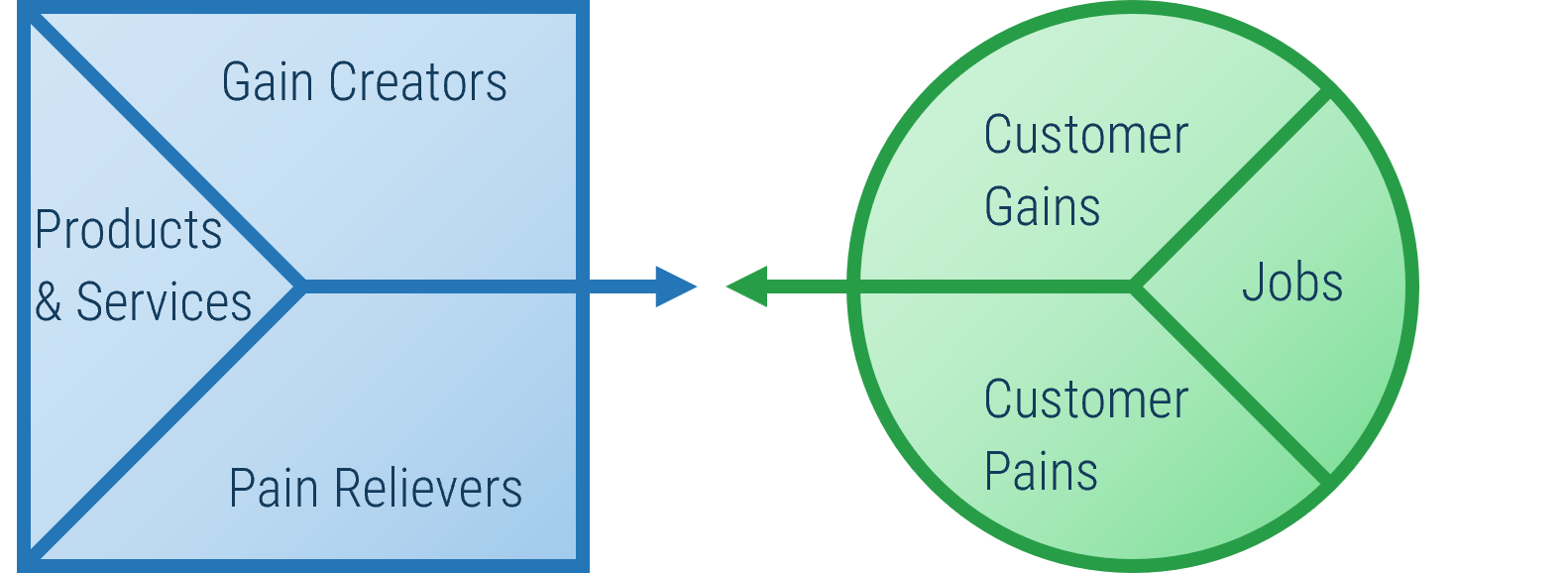

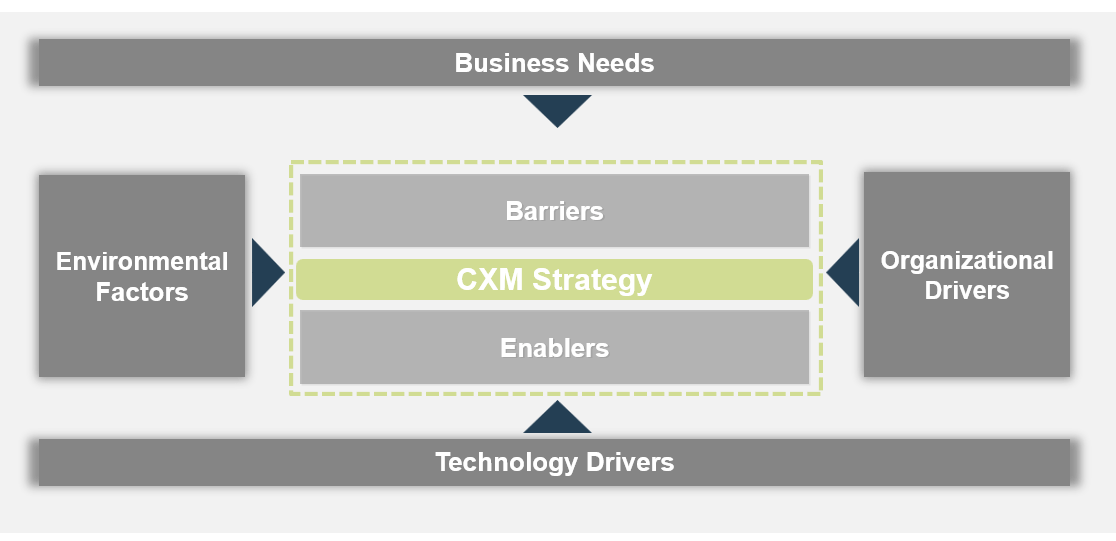

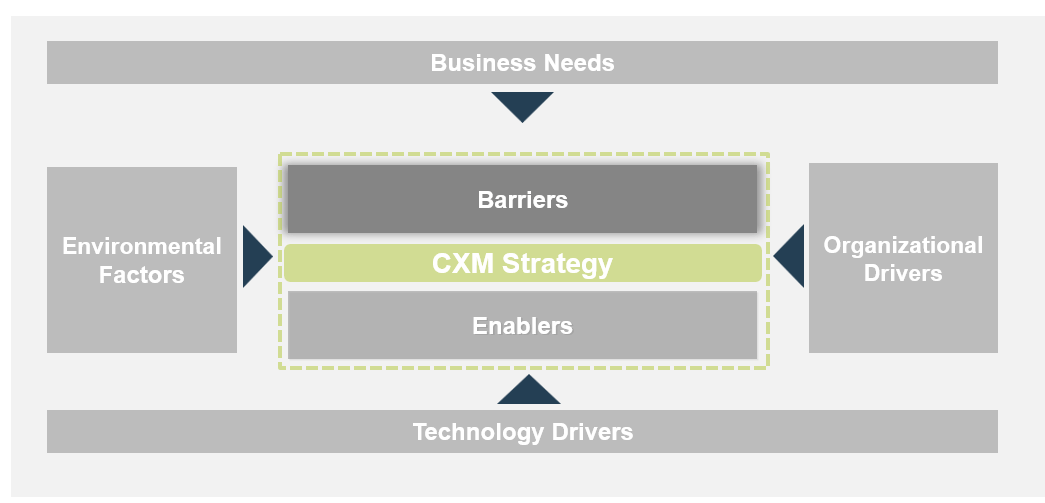

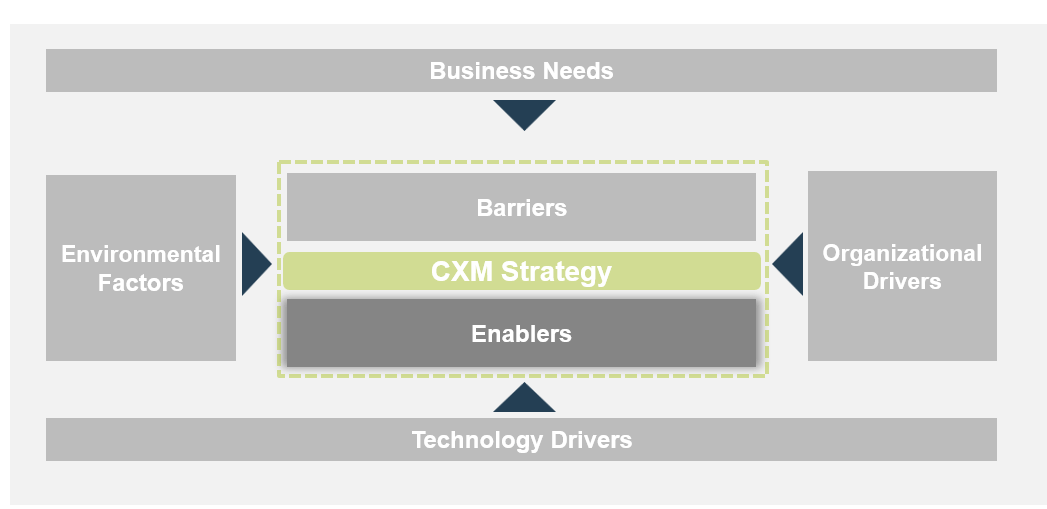

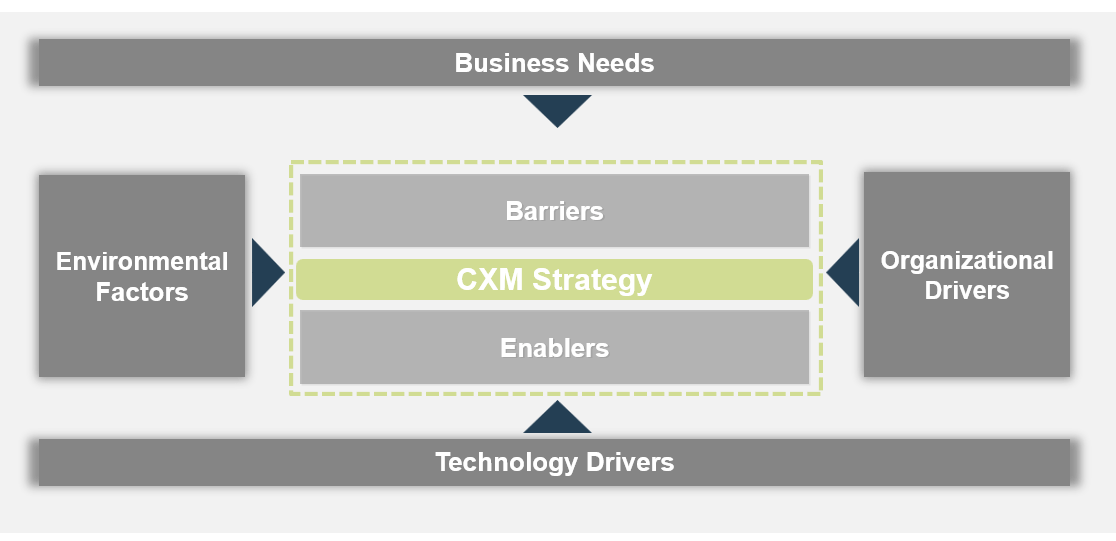

Develop a CXM technology operating model that takes stock of needs, drivers, barriers, and enablers

Establish the drivers, enablers, and barriers to developing a CXM technology enablement strategy. In doing so, consider needs, environmental factors, organizational drivers, and technology drivers as inputs.

CXM Strategy

- Barriers

- Lack of Resources

- Cultural Mindset

- Resistance to Change

- Poor End-User Adoption

- Enablers

- Senior Management Support

- Customer Data Quality

- Current Technology Portfolio

- Business Needs (What are your business drivers? What are current marketing, sales, and customer service pains?)

- Acquisition Pipeline Management

- Live Chat for Support

- Social Media Analytics

- Etc.

- Organizational Goals

- Increase Profitability

- Enhance Customer Experience Consistency

- Reduce Time-to-Resolution

- Increase First Contact Resolution

- Boost Share of Voice

- Environmental Factors (What factors that affect your strategy are out of your control?)

- Customer Buying Habits

- Changing Technology Trends

- Competitive Landscape

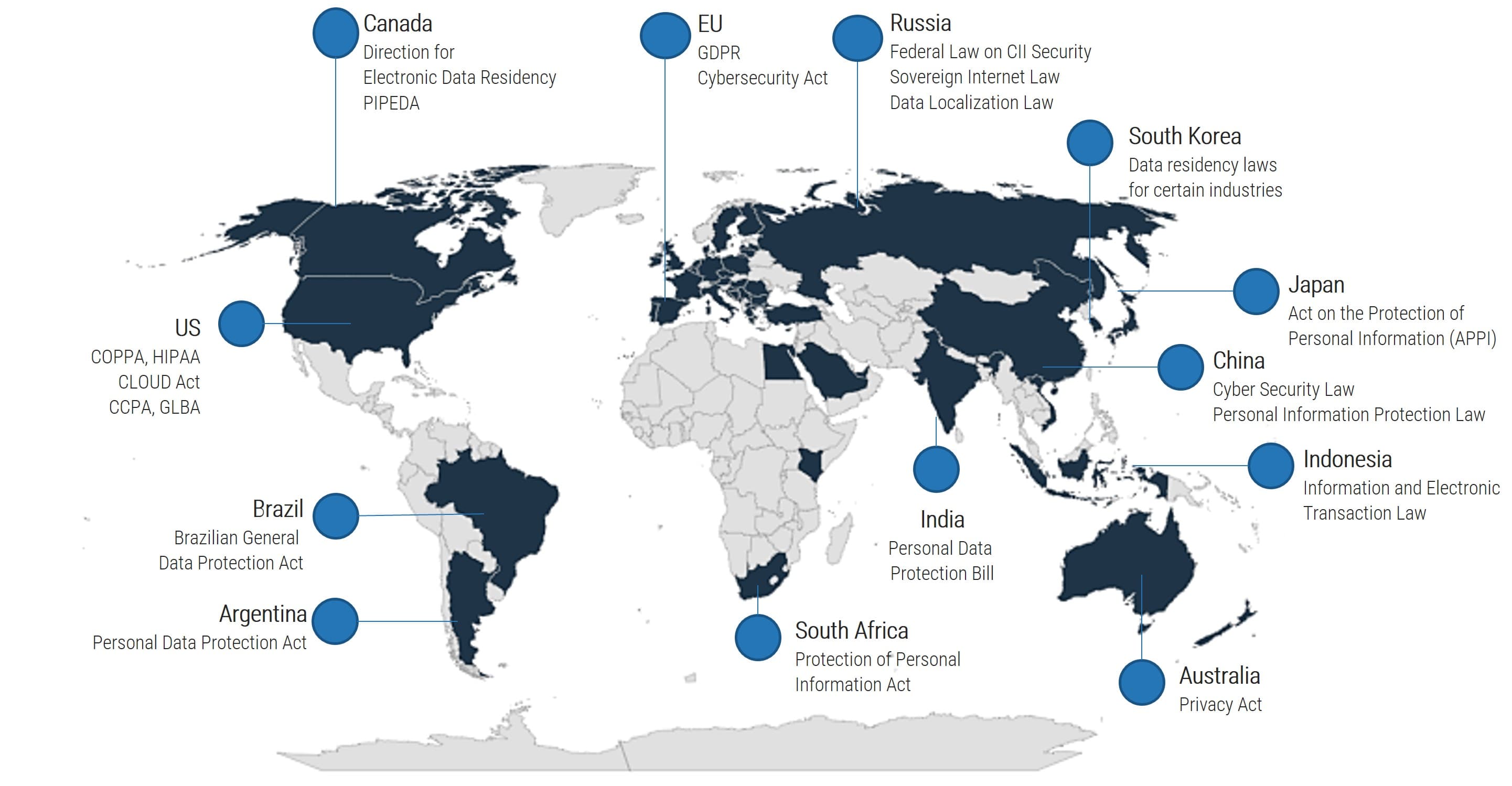

- Regulatory Requirements

- Technology Drivers (Why do you need a new system? What is the purpose for becoming an integrated organization?)

- System Integration

- Reporting Capabilities

- Deployment Model

Understand your needs, drivers, and organizational objectives for creating a CXM strategy

| |

Business Needs |

Organizational Drivers |

Technology Drivers |

Environmental Factors |

| Definition |

A business need is a requirement associated with a particular business process (for example, Marketing needs customer insights from the website – the business need would therefore be web analytics capabilities). |

Organizational drivers can be thought of as business-level goals. These are tangible benefits the business can measure such as customer retention, operation excellence, and financial performance. |

Technology drivers are technological changes that have created the need for a new CXM enablement strategy. Many organizations turn to technology systems to help them obtain a competitive edge. |

External considerations are factors taking place outside of the organization that are impacting the way business is conducted inside the organization. These are often outside the control of the business. |

| Examples |

- Web analytics

- Live chat capabilities

- Mobile self-service

- Social media listening

|

- Data quality

- Customer satisfaction

- Branding

- Time-to-resolution

|

- Deployment model (i.e. SaaS)

- Integration

- Reporting capabilities

- Fragmented technologies

|

- Economic factors

- Customer preferences

- Competitive influencers

- Compliance regulations

|

Info-Tech Insight

A common organizational driver is to provide adequate technology enablement across multiple channels, resulting in a consistent customer experience. This driver is a result of external considerations. Many industries today are highly competitive and rapidly changing. To succeed under these pressures, you must have a rationalized portfolio of enterprise applications for customer interaction.

Activity: Inventory and discuss CXM drivers and organizational objectives

2.1.1 30 minutes

Input

- Business needs

- Exercise 1.1.3

- Exercise 1.1.4

- Environmental factors

Output

- CXM operating model inputs

- CXM Strategy Stakeholder Presentation

Materials

- Info-Tech examples

- Whiteboard

- Markers

Participants

Instructions

- Brainstorm the business needs, organizational drivers, technology drivers, and environmental factors that will inform the CXM strategy. Draw from exercises 1.1.3-1.1.5.

- Document your findings in the CXM operating model template. This can be found in the CXM Strategy Stakeholder Presentation Template.

Understand challenges and barriers to creating and executing the CXM technology-enablement strategy

Take stock of internal challenges and barriers to effective CXM strategy execution.

Example: Internal Challenges & Potential Barriers

| |

Understanding the Customer |

Change Management |

IT Readiness |

| Definition |

The degree to which a holistic understanding of the customer can be created, including customer demographic and psychographics. |

The degree to which employees are ready to accept operational and cultural changes and the degree to which the organization is ready to manage it. |

The degree to which IT is ready to support new technologies and processes associated with a portfolio of CXM applications. |

| Questions to Ask |

- As an organization, do we have a true understanding of our customers?

- How might we achieve a complete understanding of the customer throughout different phases of the customer lifecycle?

|

- Are employees resistant to change?

- Are there enough resources to drive an CXM strategy?

- To what degree is the existing organizational culture customer-centric?

|

- Is there strong technical expertise?

- Is there strong infrastructure?

|

| Implications |

- Uninformed creation of CXM strategic requirements

- Inadequate understanding of customer needs and wants

|

- User acceptance

- Lack of ownership

- Lack of accountability

- Lack of sustainability

|

- Poor implementation

- Reliance on expensive external consultants

- Lack of sustainability

|

Activity: Identify CXM challenges and pain points

2.1.2 30 minutes

Input

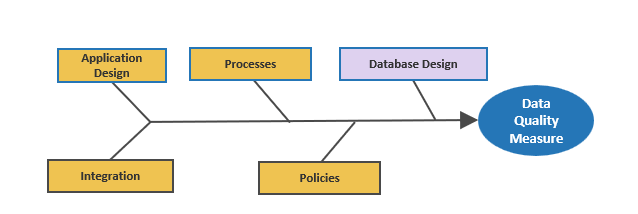

Output

- CXM operating model barriers

- CXM Strategy Stakeholder Presentation

Materials

- Info-Tech examples

- Whiteboard

- Markers

Participants

Instructions

- Brainstorm the challenges and pain points that may act as barriers to the successful planning and execution of a CXM strategy.

- Document your findings in the CXM operating model template. This can be found in the CXM Strategy Stakeholder Presentation Template.

Identify opportunities that can enable CXM strategy execution

Existing internal conditions, capabilities, and resources can create opportunities to enable the CXM strategy. These opportunities are critical to overcoming challenges and barriers.

Example: Opportunities to Leverage for Strategy Enablement

| |

Management Buy-In |

Customer Data Quality |

Current Technology Portfolio |

| Definition |

The degree to which upper management understands and is willing to enable a CXM project, complete with sponsorship, funding, and resource allocation. |

The degree to which customer data is accurate, consistent, complete, and reliable. Strong customer data quality is an opportunity – poor data quality is a barrier. |

The degree to which the existing portfolio of CXM-supporting enterprise applications can be leveraged to enable the CXM strategy. |

| Questions to Ask |

- Is management informed of changing technology trends and the subsequent need for CXM?

- Are adequate funding and resourcing available to support a CXM project, from strategy creation to implementation?

|

- Are there any data quality issues?

- Is there one source of truth for customer data?

- Are there duplicate or incomplete sets of data?

|

- Does a strong CRM backbone exist?

- What marketing, sales, and customer service applications exist?

- Are CXM-enabling applications rated highly on usage and performance?

|

| Implications |

- Need for CXM clearly demonstrated

- Financial and logistical feasibility

|

- Consolidated data quality governance initiatives

- Informed decision making

|

- Foundation for CXM technology enablement largely in place

- Reduced investment of time and money needed

|

Activity: Discuss opportunities and benefits

2.1.3 30 minutes

Input

Output

- Completed CXM operating model

- CXM Strategy Stakeholder Presentation

Materials

- Info-Tech examples

- Whiteboard

- Markers

Participants

Instructions

- Brainstorm opportunities that should be leveraged or benefits that should be realized to enable the successful planning and execution of a CXM strategy.

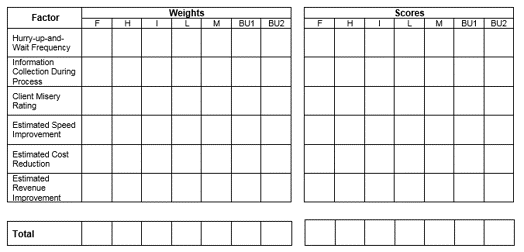

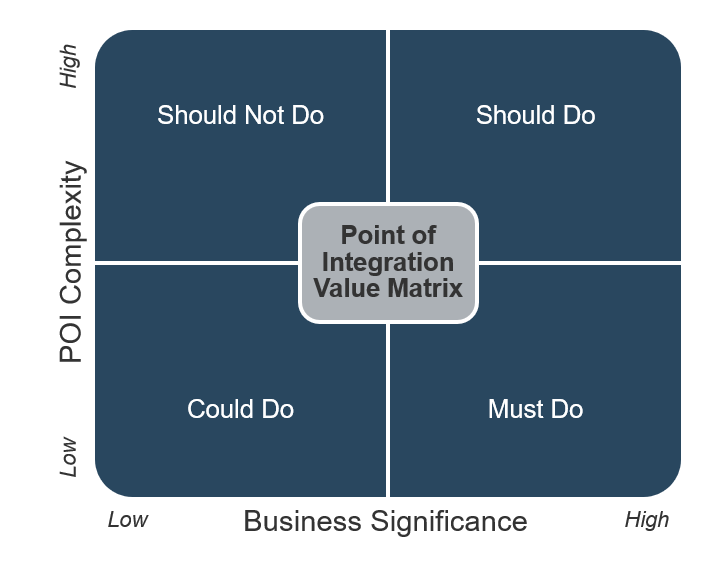

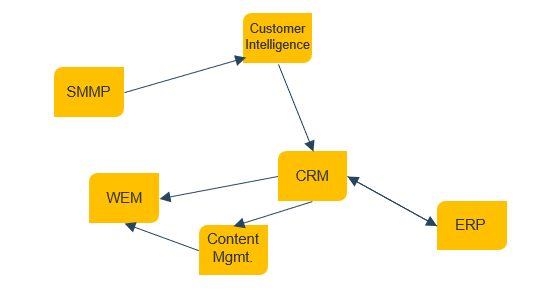

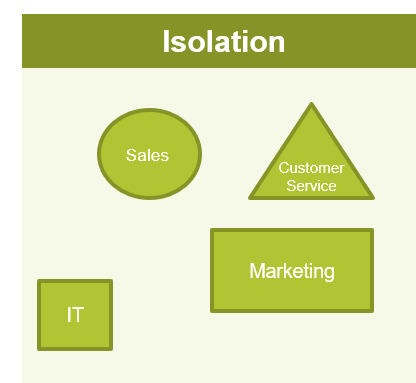

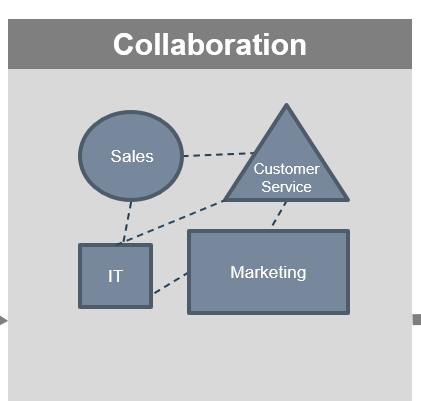

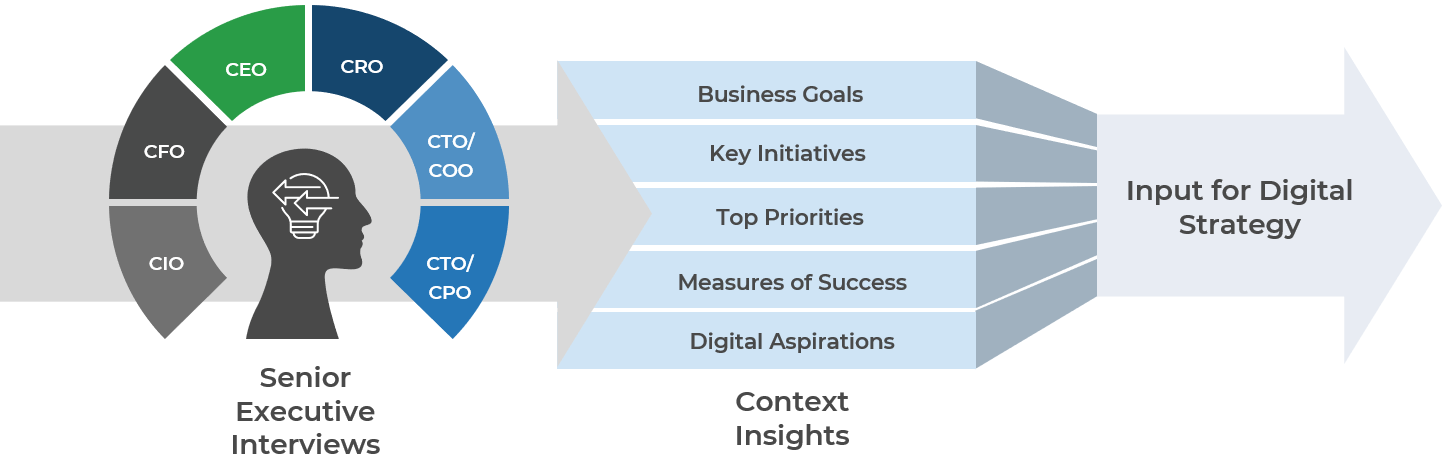

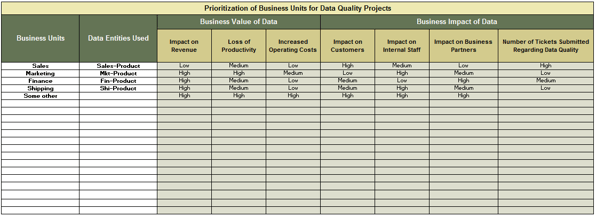

- Document your findings in the CXM operating model template. This can be found in the CXM Strategy Stakeholder Presentation Template.