Essentials of Vendor Management for Small Business

- Each year, SMB IT organizations spend more money “outsourcing” tasks, activities, applications, functions, and other items.

- Many SMBs lack the affordability of implementing a sophisticated vendor management initiative or office.

- The increased spend and associated outsourcing leads to less control, and more risk for IT organizations. Managing this becomes a higher priority for IT, but many IT organizations are ill-equipped to do this proactively.

Our Advice

Critical Insight

- Vendor management is not “plug and play” – each organization’s vendor management initiative (VMI) needs to fit its culture, environment, and goals. There are commonalities among vendor management initiatives, but the key is to adapt vendor management principles to fit your needs, not the other way around.

- All vendors are not of equal importance to an organization. Internal resources are a scarce commodity and should be deployed so that they provide the best return on the organization’s investment. Classifying or segmenting your vendors allows you to focus your efforts on the most important vendors first, allowing your VMI to have the greatest impact possible.

- Having a solid foundation is critical to the VMI’s ongoing success. Whether you will be creating a formal vendor management office or using vendor management techniques, tools, and templates “informally”, starting with the basics is essential. Make sure you understand why the VMI exists and what it hopes to achieve, what is in and out of scope for the VMI, what strengths the VMI can leverage and the obstacles it will have to address, and how it will work with other areas within your organization.

Impact and Result

- Build and implement a vendor management initiative tailored to your environment.

- Create a solid foundation to sustain your vendor management initiative as it evolves and matures.

- Leverage vendor management-specific tools and templates to manage vendors more proactively and improve communication.

- Concentrate your vendor management resources on the right vendors.

- Build a roadmap and project plan for your vendor management journey to ensure you reach your destination.

- Build collaborative relationships with critical vendors.

Essentials of Vendor Management for Small Business Research & Tools

Start here – read the Executive Brief

Read this Executive Brief to understand how changes in the vendor landscape and customer reliance on vendors have made a vendor management initiative indispensible.Besides the small introduction, subscribers and consulting clients within this management domain have access to:

- Essentials of Vendor Management Small Business – Phases 1-4

1. Plan

This phase helps you organize your VMI and document internal processes, relationships, roles, and responsibilities. The main outcomes from this phase are organizational documents, a baseline VMI maturity level, and a desired future state for the VMI.

- Essentials of Vendor Management for Small Business – Phase 1: Plan

- Phase 1 Small Business Tools and Templates Compendium

2. Build

This phase helps you configure and create the tools and templates that will help you run the VMI. The main outcomes from this phase are a clear understanding of which vendors are important to you, the tools to manage the vendor relationships, and an implementation plan.

- Essentials of Vendor Management for Small Business – Phase 2: Build

- Phase 2 Small Business Vendor Classification Tool

- Phase 2 Small Business Risk Assessment Tool

- Phase 2 Small Business Tools and Templates Compendium

3. Run

This phase helps you begin operating the VMI. The main outcomes from this phase are guidance and the steps required to implement your VMI.

- Essentials of Vendor Management for Small Business – Phase 3: Run

4. Review

This phase helps the VMI identify what it should stop doing, start doing, and continue doing as it improves and matures. The main outcomes from this phase are ways to advance the VMI and maintain internal alignment.

- Essentials of Vendor Management for Small Business – Phase 4: Review

Further reading

Essentials of Vendor Management for Small Business

Create and implement a vendor management framework to begin obtaining measurable results in 90 days.

EXECUTIVE BRIEF

Analyst Perspective

Vendor Management Challenge

Small businesses are often challenged by the growth and complexity of their vendor ecosystem, including the degree to which the vendors control them. Vendors are increasing, obtaining more and more budget dollars, while funding for staff or headcount is decreasing as a result of cloud-based applications and an increase in our reliance on Managed Service Providers. Initiating a vendor management initiative (VMI) vs. creating a fully staffed vendor management office will get you started on the path of proactively controlling your vendors instead of consistently operating in a reactionary mode. This blueprint is designed with that very thought: to assist small businesses in creating the essentials of a vendor management initiative.

Steve Jeffery

Principal Research Director, Vendor Management

Info-Tech Research Group

Executive Summary

Your Challenge

Each year, IT organizations "outsource" tasks, activities, functions, and other items. During 2021:

- Spend on as-a-service providers increased 38% over 2020.*

- Spend on managed service providers increased 16% over 2020.*

- IT service providers increased their merger and acquisition numbers by 47% over 2020.*

This leads to more spend, less control, and more risk for IT organizations. Managing this becomes a higher priority for IT, but many IT organizations are ill-equipped to do this proactively.

Common Obstacles

As new contracts are negotiated and existing contracts are renegotiated or renewed, there is a perception that the contracts will yield certain results, output, performance, solutions, or outcomes. The hope is that these will provide a measurable expected value to IT and the organization. Oftentimes, much of the expected value is never realized. Many organizations don't have a VMI to help:

- Ensure at least the expected value is achieved.

- Improve on the expected value through performance management.

- Significantly increase the expected value through a proactive VMI.

Info-Tech's Approach

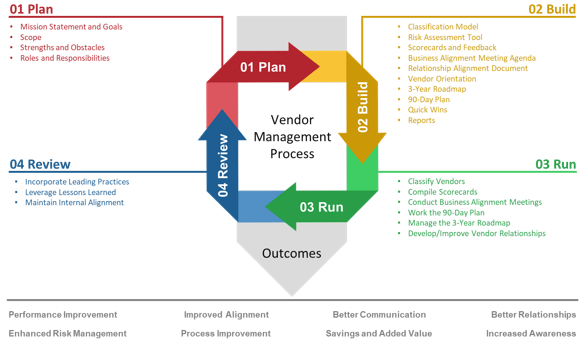

Vendor Management is a proactive, cross-functional lifecycle. It can be broken down into four phases:

- Plan

- Build

- Run

- Review

The Info-Tech process addresses all four phases and provides a step-by-step approach to configure and operate your VMI. The content in this blueprint helps you quickly establish your VMI and sets a solid foundation for its growth and maturity.

Info-Tech Insight

Vendor management is not a one-size-fits-all initiative. It must be configured:

- For your environment, culture, and goals.

- To leverage the strengths of your organization and personnel.

- To focus your energy and resources on your critical vendors.

Executive Summary

Your challenge

Spend on managed service providers and as-a-service providers continues to increase. In addition, IT services vendors continue to be active in the mergers and acquisitions arena. This increases the need for a VMI to help with the changing IT vendor landscape.

|

38% 2021 |

16% 2021 |

47% 2021 |

|---|---|---|

|

Spend on as-a-service providers |

Spend on managed services providers |

IT services merger & acquisition growth (transactions) |

Source: Information Services Group, Inc., 2022.

Executive Summary

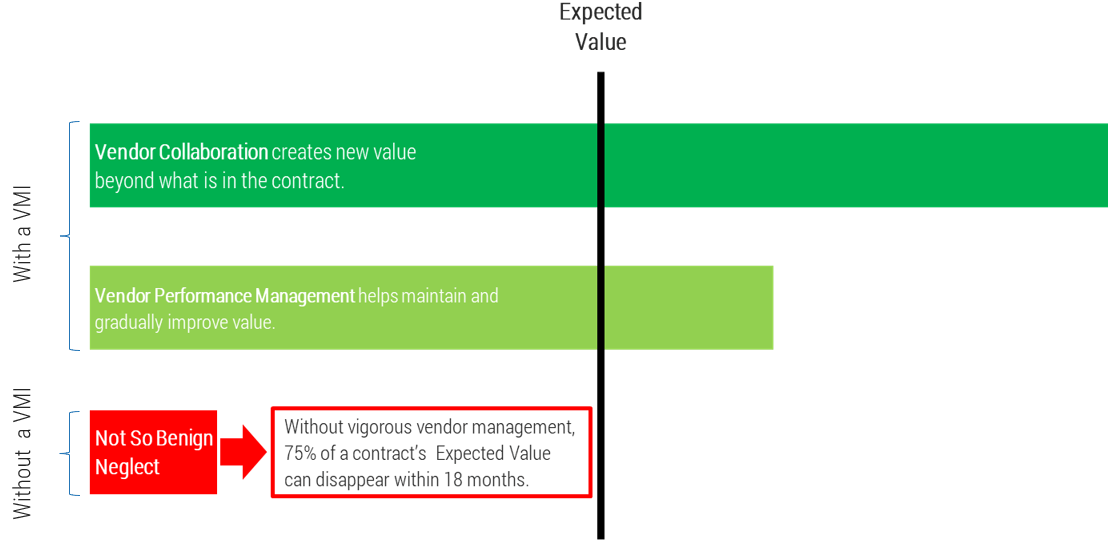

Common obstacles

When organizations execute, renew, or renegotiate a contract, there is an "expected value" associated with that contract. Without a robust VMI, most of the expected value will never be realized. With a robust VMI, the realized value significantly exceeds the expected value during the contract term.

A contract's realized value with and without a vendor management initiative

Source: Based on findings from Geller & Company, 2003.

Executive Summary

Info-Tech's approach

A sound, cyclical approach to vendor management will help you create a VMI that meets your needs and stays in alignment with your organization as they both change (i.e. mature and grow).

Info-Tech's methodology for creating and operating your vmi

| Phase 1 - Plan | Phase 2 - Build | Phase 3 - Run | Phase 4 - Review | |

|---|---|---|---|---|

| Phase Steps |

1.1 Mission Statement and Goals 1.2 Scope 1.3 Strengths and Obstacles 1.4 Roles and Responsibilities |

2.1 Classification Model 2.2 Risk Assessment Tool 2.3 Scorecards and Feedback 2.4 Business Alignment Meeting Agenda 2.5 Relationship Alignment Document 2.6 Vendor Orientation 2.7 3-Year Roadmap 2.8 90-Day Plan 2.9 Quick Wins2.10 Reports |

3.1 Classify Vendors 3.2 Compile Scorecards 3.3 Conduct Business Alignment Meetings 3.4 Work the 90-Day Plan 3.5 Manage the 3-Year Roadmap 3.6 Develop/Improve Vendor Relationships |

4.1 Incorporate Leading Practices 4.2 Leverage Lessons Learned 4.3 Maintain Internal Alignment |

| Phase Outcomes | This phase helps you organize your VMI and document internal processes, relationships, roles, and responsibilities. The main outcomes from this phase are organizational documents, a baseline VMI maturity level, and a desired future state for the VMI. | This phase helps you configure and create the tools and templates that will help you run the VMI. The main outcomes from this phase are a clear understanding of which vendors are important to you, the tools to manage the vendor relationships, and an implementation plan. | This phase helps you begin operating the VMI. The main outcomes from this phase are guidance and the steps required to implement your VMI. | This phase helps the VMI identify what it should stop doing, start doing, and continue doing as it improves and matures. The main outcomes from this phase are ways to advance the VMI and maintain internal alignment. |

Insight Summary

Insight 1

Vendor management is not "plug and play" – each organization's vendor management initiative (VMI) needs to fit its culture, environment, and goals. While there are commonalities and leading practices associated with vendor management, your initiative won't look exactly like another organization's. The key is to adapt vendor management principles to fit your needs.

Insight 2

All vendors are not of equal importance to your organization. Internal resources are a scarce commodity and should be deployed so that they provide the best return on the organization's investment. Classifying or segmenting your vendors allows you to focus your efforts on the most important vendors first, allowing your VMI to have the greatest impact possible.

Insight 3

Having a solid foundation is critical to the VMI's ongoing success. Whether you will be creating a formal vendor management office or using vendor management techniques, tools, and templates "informally", starting with the basics is essential. Make sure you understand why the VMI exists and what it hopes to achieve, what is in and out of scope for the VMI, what strengths the VMI can leverage and the obstacles it will have to address, and how it will work with other areas within your organization.

Blueprint benefits

IT benefits

- Identify and manage risk proactively.

- Reduce costs and maximize value.

- Increase visibility with your critical vendors.

- Improve vendor performance.

- Create a collaborative environment with key vendors.

- Segment vendors to allocate resources more effectively and more efficiently.

Business benefits

- Improve vendor accountability.

- Increase collaboration between departments.

- Improve working relationships with your vendors.

- Create a feedback loop to address vendor/customer issues before they get out of hand or are more costly to resolve.

- Increase access to meaningful data and information regarding important vendors.

Phase 1 - Plan

|

Phase 1 |

Phase 2 | Phase 3 | Phase 4 |

|---|---|---|---|

|

1.1 Mission Statement and Goals 1.2 Scope 1.3 Strengths and Obstacles 1.4 Roles and Responsibilities |

2.1 Classification Model 2.2 Risk Assessment Tool 2.3 Scorecards and Feedback 2.4 Business Alignment Meeting Agenda 2.5 Relationship Alignment Document 2.6 Vendor Orientation 2.7 3-Year Roadmap 2.8 90-Day Plan 2.9 Quick Wins 2.10 Reports |

3.1 Classify Vendors 3.2 Compile Scorecards 3.3 Conduct Business Alignment Meetings 3.4 Work the 90-Day Plan 3.5 Manage the 3-Year Roadmap 3.6 Develop/Improve Vendor Relationships |

4.1 Incorporate Leading Practices 4.2 Leverage Lessons Learned 4.3 Maintain Internal Alignment |

This phase will walk you through the following activity:

- Organizing your VMI and document internal processes, relationships, roles, and responsibilities. The main outcomes from this phase are organizational documents, and a desired future state for the VMI.

This phase involves the following participants:

- VMI team

- Applicable stakeholders and executives

- Procurement/Sourcing

- IT

- Others as needed

Vendor Management Initiative Basics for the Small/Medium Businesses

Phase 1 – Plan

Get Organized

Phase 1 – Plan focuses on getting organized. Foundational elements (Mission Statement, Goals, Scope, Strengths and Obstacles, Roles and Responsibilities, and Process Mapping) will help you define your VMI. These and the other elements of this Phase will follow you throughout the process of starting up your VMI and running it.

Spending time up front to ensure that everyone is on the same page will help avoid headaches down the road. The tendency is to skimp (or even skip) on these steps to get to "the good stuff." To a certain extent, the process provided here is like building a house. You wouldn't start building your dream home without having a solid blueprint. The same is true with vendor management. Leveraging vendor management tools and techniques without the proper foundation may provide some benefit in the short term, but in the long term it will ultimately be a house of cards waiting to collapse.

Step 1.1 – Mission statement and goals

Identify why the VMI exists and what it will achieve

Whether you are starting your vendor management journey or are already down the path, it is important to know why the vendor management initiative exists and what it hopes to achieve. The easiest way to document this is with a written declaration in the form of a Mission Statement and Goals. Although this is the easiest way to proceed, it is far from easy.

The Mission Statement should identify at a high level the nature of the services provided by the VMI, who it will serve, and some of the expected outcomes or achievements. The Mission Statement should be no longer than one or two sentences.

The complement to the Mission Statement is the list of goals for the VMI. Your goals should not be a reassertion of your Mission Statement in bullet format. At this stage it may not be possible to make them SMART (Specific, Measurable, Achievable/Attainable, Relevant, Time-Bound/Time-Based), but consider making them as SMART as possible. Without some of the SMART parameters attached, your goals are more like dreams and wishes. At a minimum, you should be able to determine the level of success achieved for each of the VMI goals.

Although the VMI's Mission Statement will stay static over time (other than for significant changes to the VMI or organization as a whole), the goals should be reevaluated periodically using a SMART filter, and adjusted as needed.

1.1.1 – Mission statement and goals

20 – 40 Minutes

- Meet with the participants and use a brainstorming activity to list, on a whiteboard or flip chart, the reasons why the VMI will exist.

- Review external mission statements for inspiration.

- Review internal mission statements from other areas to ensure consistency.

- Draft and document your Mission Statement in the Phase 1 Tools and Templates Compendium – Tab 1.1 Mission Statement and Goals.

- Continue brainstorming and identify the high-level goals for the VMI.

- Review the list of goals and make them as SMART (Specific, Measurable, Achievable/Attainable, Relevant, Time-Bound/Time-Based) as possible.

- Document your goals in the Phase 1 Tools and Templates Compendium– Tab 1.1 Mission Statement and Goals.

- Obtain signoff on the Mission Statement and goals from stakeholders and executives as required.

Input

- Brainstorming results

- Mission statements from other internal and external sources

Output

- Completed Mission Statement and Goals

Materials

- Whiteboard/Flip Charts

- Phase 1 Tools and Templates Compendium – Tab 1.1 Mission Statement and Goals

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 1 Tools and Templates Compendium

Step 1.2 – Scope

Determine what is in scope and out of scope for the VMI

Regardless of where your VMI resides or how it operates, it will be working with other areas within your organization. Some of the activities performed by the VMI will be new and not currently handled by other groups or individuals internally; at the same time, some of the activities performed by the VMI may be currently handled by other groups or individuals internally. In addition, executives, stakeholders, and other internal personnel may have expectations or make assumptions about the VMI. As a result, there can be a lot of confusion about what the VMI does and doesn't do, and the answers cannot always be found in the VMI's Mission Statement and Goals.

One component of helping others understand the VMI landscape is formalizing the VMI Scope. The Scope will define boundaries for the VMI. The intent is not to fence itself off and keep others out but provide guidance on where the VMI's territory begins and ends. Ultimately, this will help clarify the VMI's roles and responsibilities, improve workflow, and reduce errant assumptions.

When drafting your VMI scoping document, make sure you look at both sides of the equation (similar to what you would do when following best practices for a statement of work). Identify what is in scope and what is out of scope. Be specific when describing the individual components of the VMI Scope, and make sure executives and stakeholders are onboard with the final version.

1.2.1 – Scope

20 - 40 Minutes

- Meet with the participants and use a brainstorming activity to list, on a whiteboard or flip chart, the activities and functions in scope and out of scope for the VMI.

- Be specific to avoid ambiguity and improve clarity.

- Go back and forth between in scope and out of scope as needed; it is not necessary to list all the in-scope items and then turn your attention to the out-of-scope items.

- Review the lists to make sure there is enough specificity. An item may be in scope or out of scope, but not both.

- Use the Phase 1 Tools and Templates Compendium – Tab 1.2 Scope to document the results.

- Obtain signoff on the Scope from stakeholders and executives as required.

Input

- Brainstorming results

- Mission Statement and Goals

Output

- Completed list of items in and out of scope for the VMI

Materials

- Whiteboard/Flip Charts

- Phase 1 Tools and Templates Compendium – Tab 1.2 Scope

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 1 Tools and Templates Compendium

Step 1.3 – Strengths and obstacles

Pinpoint the VMI's strengths and obstacles

A SWOT analysis (strengths, weaknesses, opportunities, and threats) is a valuable tool, but it is overkill for your VMI at this point. However, using a modified and simplified form of this tool (strengths and obstacles) will yield significant results and benefit the VMI as it grows and matures.

Your output will be two lists: the strengths associated with the VMI and the obstacles the VMI is facing. For example, strengths could include items such as smart people working within the VMI and executive support. Obstacles could include items such as limited headcount and training required for VMI staff.

The goals are 1) to harness the strengths to help the VMI be successful and 2) to understand the impact of the obstacles and plan accordingly. The output can also be used to enlighten executives and stakeholders about the challenges associated with their directives or requests (e.g. human bandwidth may not be sufficient to accomplish some of the vendor management activities and there is a moratorium on hiring until the next budget year).

For each strength identified, determine how you will or can leverage it when things are going well or when the VMI is in a bind. For each obstacle, list the potential impact on the VMI (e.g. scope, growth rate, and number of vendors that can actively be part of the VMI).

As you do your brainstorming, be as specific as possible and validate your lists with stakeholders and executives as needed.

1.3.1 – Strengths and obstacles

20 - 40 Minutes

Meet with the participants and use a brainstorming activity to list, on a whiteboard or flip chart, the VMI's strengths and obstacles.

Be specific to avoid ambiguity and improve clarity.

Go back and forth between strengths and obstacles as needed; it is not necessary to list all the strengths first and then all the obstacles.

It is possible for an item to be a strength and an obstacle; when this happens, add details to distinguish the situations.

Review the lists to make sure there is enough specificity.

Determine how you will leverage each strength and how you will manage each obstacle.

Use the Phase 1 Tools and Templates Compendium – Tab 1.3 Strengths and Obstacles to document the results.

Obtain signoff on the strengths and obstacles from stakeholders and executives as required.

Input

- Brainstorming

- Mission Statement and Goals

- Scope

Output

- Completed list of items impacting the VMI's ability to be successful: strengths the VMI can leverage and obstacles the VMI must manage

Materials

- Whiteboard/Flip Charts

- Phase 1 Tools and Templates Compendium – Tab 1.3 Strengths and Obstacles

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 1 Tools and Templates Compendium

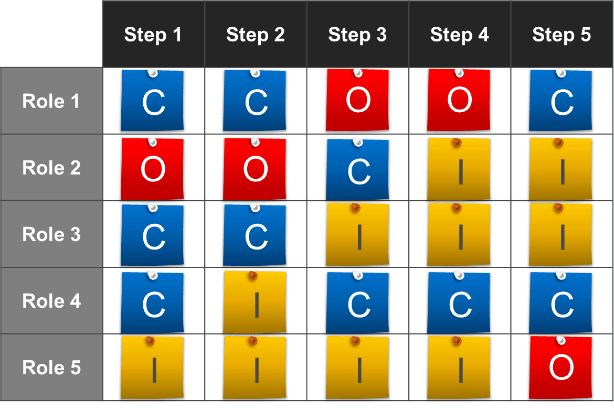

Step 1.4 – Roles and responsibilities

Obtain consensus on who is responsible for what

One crucial success factor for VMIs is gaining and maintaining internal alignment. There are many moving parts to an organization, and a VMI must be clear on the various roles and responsibilities related to the relevant processes. Some of this information can be found in the VMI's Scope referenced in Step 1.2, but additional information is required to avoid stepping on each other's toes; many of the processes require internal departments to work together. (For example, obtaining requirements for a request for proposal takes more than one person or department). While it is not necessary to get too granular, it is imperative that you have a clear understanding of how the VMI activities will fit within the larger vendor management lifecycle (which is comprised of many sub processes) and who will be doing what.

As we have learned through our workshops and guided implementations, a traditional RACI* or RASCI* Chart does not work well for this purpose. These charts are not intuitive, and they lack the specificity required to be effective. For vendor management purposes, a higher-level view and a slightly different approach provide much better results.

This step will lead your through the creation of an OIC* Chart to determine vendor management lifecycle roles and responsibilities. Afterward, you'll be able to say, "Oh, I see clearly who is involved in each part of the process and what their role is."

*RACI – Responsible, Accountable, Consulted, Informed

*RASCI – Responsible, Accountable, Support, Consulted, Informed

*OIC – Owner, Informed, Contributor

Step 1.4 – Roles and responsibilities (cont'd)

Obtain consensus on who is responsible for what

To start, define the vendor management lifecycle steps or process applicable to your VMI. Next, determine who participates in the vendor management lifecycle. There is no need to get too granular – think along the lines of departments, subdepartments, divisions, agencies, or however you categorize internal operational units. Avoid naming individuals other than by title; this typically happens when a person oversees a large group (e.g. the CIO [chief information officer] or the CPO [chief procurement officer]). Be thorough, but don't let the chart get out of hand. For each role and step of the lifecycle, ask whether the entry is necessary; does it add value to the clarity of understanding the responsibilities associated with the vendor management lifecycle? Consider two examples, one for roles and one for lifecycle steps. 1) Is IT sufficient or do you need IT Operations and IT Development? 2) Is "negotiate contract documents" sufficient or do you need negotiate the contract and negotiate the renewal? The answer will depend on your culture and environment but be wary of creating a spreadsheet that requires an 85-inch monitor to view it.

After defining the roles (departments, divisions, agencies) and the vendor management lifecycle steps or process, assign one of three letters to each box in your chart:

- O – Owner – who owns the process; they may also contribute to it.

- I – Informed – who is informed about the progress or results of the process.

- C – Contributor – who contributes or works on the process; it can be tangible or intangible contributions.

This activity can be started by the VMI or done as a group with representatives from each of the named roles. If the VMI starts the activity, the resulting chart should be validated by the each of the named roles.

1.4.1 – Roles and responsibilities

1 – 6 hours

- Meet with the participants and configure the OIC Chart in the Phase 1 Tools and Templates Compendium – Tab 1.4 OIC Chart.

- Review the steps or activities across the top of the chart and modify as needed.

- Review the roles listed along the left side of the chart and modify as needed.

- For each activity or step across the top of the chart, assign each role a letter – O for owner of that activity or step, I for informed, or C for contributor. Use only one letter per cell.

- Work your way across the chart. Every cell should have an entry or be left blank if it is not applicable.

- Review the results and validate that every activity or step has an O assigned to it; there must be an owner for every activity or step.

- Obtain signoff on the OIC Chart from stakeholders and executives as required.

Input

- A list of activities or steps to complete a project starting with requirements gathering and ending with ongoing risk management.

- A list of internal areas (departments, divisions, agencies, etc.) and stakeholders that contribute to completing a project.

Output

- Completed OCI chart indicating roles and responsibilities for the VMI and other internal areas.

Materials

- Phase 1 Tools and Templates Compendium – Tab 1.4 OIC Chart

Participants

- VMI team

- Procurement/Sourcing

- IT

- Representatives from other areas as needed

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 1 Tools and Templates Compendium

Phase 2 - Build

Create and configure tools, templates, and processes

Phase 1 | Phase 2 | Phase 3 | Phase 4 |

|---|---|---|---|

1.1 Mission Statement and Goals 1.2 Scope 1.3 Strengths and Obstacles 1.4 Roles and Responsibilities | 2.1 Classification Model 2.2 Risk Assessment Tool 2.3 Scorecards and Feedback 2.4 Business Alignment Meeting Agenda 2.5 Relationship Alignment Document 2.6 Vendor Orientation 2.7 3-Year Roadmap 2.8 90-Day Plan 2.9 Quick Wins 2.10 Reports | 3.1 Classify Vendors 3.2 Compile Scorecards 3.3 Conduct Business Alignment Meetings 3.4 Work the 90-Day Plan 3.5 Manage the 3-Year Roadmap 3.6 Develop/Improve Vendor Relationships | 4.1 Incorporate Leading Practices 4.2 Leverage Lessons Learned 4.3 Maintain Internal Alignment |

This phase will walk you through the following activities:

- Configuring and creating the tools and templates that will help you run the VMI. The main outcomes from this phase are a clear understanding of which vendors are important to you, the tools to manage the vendor relationships, and an implementation plan.

This phase involves the following participants:

- VMI team

- Applicable stakeholders and executives

- Human Resources

- Legal

- Others as needed

Vendor Management Initiative Basics for the Small/Medium Businesses

Phase 2 – Build

Create and configure tools, templates, and processes

Phase 2 – Build focuses on creating and configuring the tools and templates that will help you run your VMI. Vendor management is not a plug and play environment, and unless noted otherwise, the tools and templates included with this blueprint require your input and thought. The tools and templates must work in concert with your culture, values, and goals. That will require teamwork, insights, contemplation, and deliberation.

During this Phase you'll leverage the various templates and tools included with this blueprint and adapt them for your specific needs and use. In some instances, you'll be starting with mostly a blank slate; while in others, only a small modification may be required to make it fit your circumstances. However, it is possible that a document or spreadsheet may need heavy customization to fit your situation. As you create your VMI, use the included materials for inspiration and guidance purposes rather than as absolute dictates.

Step 2.1 – Classification model

Configure the COST vendor classification tool

One of the functions of a VMI is to allocate the appropriate level of vendor management resources to each vendor since not all vendors are of equal importance to your organization. While some people may be able intuitively to sort their vendors into vendor management categories, a more objective, consistent, and reliable model works best. Info-Tech's COST model helps you assign your vendors to the appropriate vendor management category so that you can focus your vendor management resources where they will do the most good.

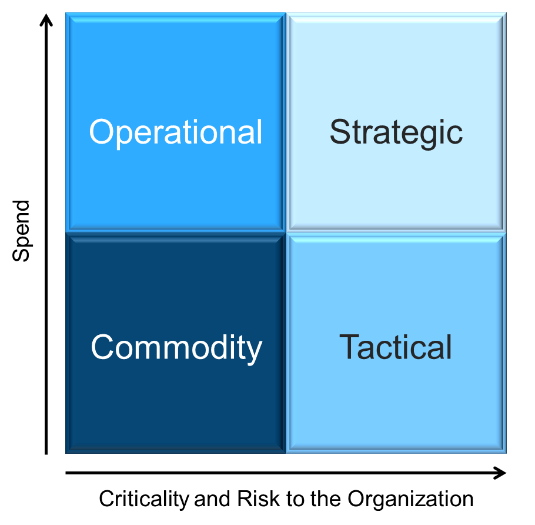

COST is an acronym for Commodity, Operational, Strategic, and Tactical. Your vendors will occupy one of these vendor management categories, and each category helps you determine the nature of the resources allocated to that vendor, the characteristics of the relationship desired by the VMI, and the governance level used.

The easiest way to think of the COST model is as a 2 x 2 matrix or graph. The model should be configured for your environment so that the criteria used for determining a vendor's classification align with what is important to you and your organization. However, at this point in your VMI's maturation, a simple approach works best. The Classification Model included with this blueprint requires minimal configuration to get your started, and that is discussed on the activity slide associated with this Step 2.1.

Step 2.1 – Classification model (cont'd)

Configure the COST vendor classification tool

Common characteristics by vendor management category

|

Operational |

Strategic |

|---|---|

|

|

|

Commodity |

Tactical |

|

|

Source: Compiled in part from Guth, Stephen. "Vendor Relationship Management Getting What You Paid for (And More)." 2015.

2.1.1 – Classification model

15 – 30 Minutes

- Meet with the participants to configure the spend ranges in Phase 2 Vendor Classification Tool – Tab 1. Configuration for your environment.

- Collect your vendors and their annual spend to sort by largest to lowest.

- Update cells F14-J14 in the Classification Model based on your actual data.

- Cell F14 – Set the boundary at a point between the spend for your 10th and 11th ranked vendors. For example, if the 10th vendor by spend is $1,009, 850 and the 11th vendor by spend is $980,763, the range for F14 would be $1,000,00+.

- Cell G14 – Set the bottom of the range at a point between the spend for your 30th and 31st ranked vendors; the top of the range will be $1 less than the bottom of the range specified in F14.

- Cell H14 – Set the bottom of the range slightly below the spend for your 50th ranked vendor; the top of the range will be $1 less than the bottom of the range specified in G14.

- Cells I14 and J14 – Divide the remaining range in half and split it between the two cells; for J14 the range will be $0 to $1 less than the bottom range in I14.

- Ignore the other variables at this time.

Input

- Phase 1 List of Vendors by Annual Spend

Output

- Configured Vendor Classification Tool

Materials

- Phase 2 Vendor Classification Tool – Tab 1. Configuration

Participants

- VMI team

Download the Info-Tech Phase 2 Vendor Classification Tool

Step 2.2 – Risk assessment tool

Identify risks to measure, monitor, and report on

One of the typical drivers of a VMI is risk management. Organizations want to get a better handle on the various risks their vendors pose. Vendor risks originate from many areas: financial, performance, security, legal, and others. However, security risk is the high-profile risk, and the one organizations often focus on almost exclusively, which leaves the organization vulnerable in other areas.

Risk management is a program, not a project; there is no completion date. A proactive approach works best and requires continual monitoring, identification, and assessment. Reacting to risks after they occur can be costly and have other detrimental effects on the organization. Any risk that adversely affects IT will adversely affect the entire organization.

While the VMI won't necessarily be quantifying or calculating the risk directly, it generally is the aggregator of risk information across the risk categories, which it then includes in its reporting function (see Steps 2.12 and 3.8).

At a minimum, your risk management strategy should involve:

- Identifying the risks you want to measure and monitor.

- Identifying your risk appetite (the amount of risk you are willing to live with).

- Measuring, monitoring, and reporting on the applicable risks.

- Developing and deploying a risk management plan to minimize potential risk impact.

Vendor risk is a fact of life, but you do have options for how to handle it. Be proactive and thoughtful in your approach, and focus your resources on what is important.

2.2.1 – Risk assessment tool

30 - 90 Minutes

- Meet with the participants to configure the risk indicators in Phase 2 Vendor Risk Assessment Tool – Tab 1. Set parameters for your environment.

- Review the risk categories and determine which ones you will be measuring and monitoring.

- Review the risk indicators under each risk category and determine whether the indicator is acceptable as written, is acceptable with modifications, should be replaced, or should be deleted.

- Make the necessary changes to the risk indicators; these changes will cascade to each of the vendor tabs. Limit the number of risk indicators to no more than seven per risk category.

- Gain input and approval as needed from sponsors, stakeholders, and executives as required.

Input

- Scope

- OIC Chart

- Process Maps

- Brainstorming

Output

- Configured Vendor Risk Assessment Tool

Materials

- Phase 2 Vendor Risk Assessment Tool – Tab 1. Set Parameters

Participants

- VMI team

Download the Info-Tech Phase 2 Vendor Classification Tool

Step 2.3 – Scorecards and feedback

Design a two-way feedback loop with your vendors

A vendor management scorecard is a great tool for measuring, monitoring, and improving relationship alignment. In addition, it is perfect for improving communication between you and the vendor.

Conceptually, a scorecard is similar to a school report card. At the end of a learning cycle, you receive feedback on how well you do in each of your classes. For vendor management, the scorecard is also used to provide periodic feedback, but there are some nuances and additional benefits and objectives when compared to a report card.

Although scorecards can be used in a variety of ways, the focus here will be on vendor management scorecards – contract management, project management, and other types of scorecards will not be included in the materials covered in this Step 2.3 or in Step 3.4.

Step 2.3 – Scorecards and feedback (cont'd)

Design a two-way feedback loop with your vendors

Anatomy

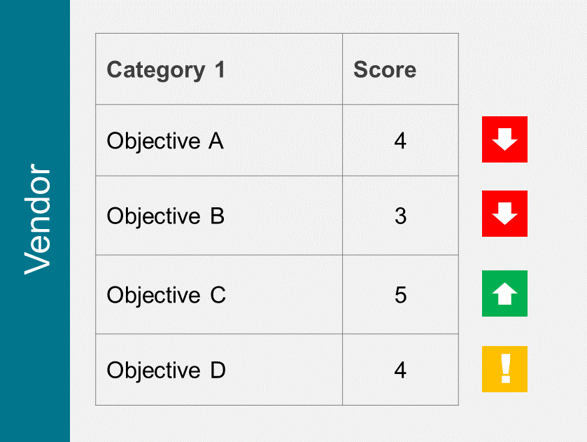

The Info-Tech scorecard includes five areas:

- Measurement categories. Measurement categories help organize the scorecard. Limit the number of measurement categories to three to five; this allows the parties to stay focused on what's important. Too many measurement categories make it difficult for the vendor to understand the expectations.

- Criteria. The criteria describe what is being measured. Create criteria with sufficient detail to allow the reviewers to fully understand what is being measured and to evaluate it. Criteria can be objective or subjective. Use three to five criteria per measurement category.

- Measurement category weights. Not all your measurement categories may be of equal importance to you; this area allows you to give greater weight to a measurement category when compiling the overall score.

- Rating. Reviewers will be asked to assign a score to each criteria using a 1 to 5 scale.

- Comments. A good scorecard will include a place for reviewers to provide additional information regarding the rating, or other items that are relevant to the scorecard.

An overall score is calculated based on the rating for each criteria and the measurement category weights.

Step 2.3 – Scorecards and feedback (cont'd)

Design a two-way feedback loop with your vendors

Goals and objectives

Scorecards can be used for a variety of reasons. Some of the common ones are:

- Improving vendor performance.

- Conveying expectations to the vendor.

- Identifying and recognizing top vendors.

- Increasing alignment between the parties.

- Improving communication with the vendor.

- Comparing vendors across the same criteria.

- Measuring items not included in contract metrics.

- Identifying vendors for "strategic alliance" consideration.

- Helping the organization achieve specific goals and objectives.

Identifying and resolving issues before they impact performance or the relationship.

Identifying your scorecard drivers first will help you craft a suitable scorecard.

Step 2.3 – Scorecards and feedback (cont'd)

Design a two-way feedback loop with your vendors

Info-Tech recommends starting with simple scorecards to allow you and the vendors to acclimate to the new process and information. As you build your scorecards, keep in mind that internal personnel will be scoring the vendors and the vendors will be reviewing the scorecard. Make your scorecard easy for your personnel to fill out, and containing meaningful content to drive the vendor in the right direction. You can always make the scorecard more complex in the future.

Our recommendation of five categories is provided below. Choose three to five of the categories that help you accomplish your scorecard goals and objectives:

- Timeliness – Responses, resolutions, fixes, submissions, completions, milestones, deliverables, invoices, etc.

- Cost – Total cost of ownership, value, price stability, price increases/decreases, pricing models, etc.

- Quality – Accuracy, completeness, mean time to failure, bugs, number of failures, etc.

- Personnel – Skilled, experienced, knowledgeable, certified, friendly, trustworthy, flexible, accommodating, etc.

- Risk – Adequate contractual protections, security breaches, lawsuits, finances, audit findings, etc.

Some criteria may be applicable in more than one category. The categories above should cover at least 80% of the items that are important to your organization. The general criteria listed for each category is not an exhaustive list, but most things break down into time, money, quality, people, and risk issues.

Step 2.3 – Scorecards and feedback (cont'd)

Design a two-way feedback loop with your vendors

Additional Considerations

- Even a good rating system can be confusing. Make sure you provide some examples or a way for reviewers to discern the differences between a 1, 2, 3, 4, and 5. Don't assume your "rating key" will be intuitive.

- When assigning weights, don't go lower than 10% for any measurement category. If the weight is too low, it won't be relevant enough to have an impact on the total score. If it doesn't "move the needle", don't include it.

- Final sign-off on the scorecard template should occur outside the VMI. The heavy lifting can be done by the VMI to create it, but the scorecard is for the benefit of the organization overall, and those impacted by the vendors specifically. You may end up playing arbiter or referee, but the scorecard is not the exclusive property of the VMI. Try to reach consensus on your final template whenever possible.

- You should notice improved ratings and total scores over time for your vendors. One explanation for this is the Pygmalion Effect: "The Pygmalion [E]ffect describes situations where someone's high expectations improves our behavior and therefore our performance in a given area. It suggests that we do better when more is expected of us."* Convey your expectations and let the vendors' competitive juices take over.

- While creating your scorecard and materials to explain the process to internal personnel, identify those pieces that will help you explain it to your vendors during vendor orientation (see Steps 2.6 and 3.4). Leveraging pre-existing materials is a great shortcut.

*Source: The Decision Lab, n.d.

Step 2.3 – Scorecards and feedback (cont'd)

Design a two-way feedback loop with your vendors

Vendor Feedback

After you've built your scorecard, turn your attention to the second half of the equation – feedback from the vendor. A communication loop cannot be successful without dialogue flowing both ways. While this can happen with just a scorecard, a mechanism specifically geared toward the vendor providing you with feedback improves communication, alignment, and satisfaction.

You may be tempted to create a formal scorecard for the vendor to use; avoid that temptation until later in your maturity or development of the VMI. You'll be implementing a lot of new processes, deploying new tools and templates, and getting people to work together in new ways. Work on those things first.

For now, implement an informal process for obtaining information from the vendor. Start by identifying information that you will find useful – information that will allow you to improve overall, to reduce waste or time, to improve processes, to identify gaps in skills. Incorporate these items into your business alignment meetings (see Steps 2.4 and 3.5). Create three to five good questions to ask the vendor and include these in the business alignment meeting agenda. The goal is to get meaningful feedback, and that starts with asking good questions.

Keep it simple at first. When the time is right, you can build a more formal feedback form or scorecard. Don't be in a rush; as long as the informal method works, keep using it.

2.3.1 – Scorecards and feedback

30 – 60 Minutes

- Meet with the participants and brainstorm ideas for your scorecard measurement categories:

- What makes a vendor valuable to your organization?

- What differentiates a "good" vendor from a "bad" vendor?

- What items would you like to measure and provide feedback on to the vendor to improve performance, the relationship, risk, and other areas?

- Select three, but no more than five, of the following measure categories: timeliness, cost, quality, personnel, and risk.

- Within each measurement category, list two or three criteria that you want to measure and track for your vendors. Choose items that are as universal as possible rather than being applicable to one vendor or one vendor type.

- Assign a weight to each measurement category, ensuring that the total weight is 100% for all measurement categories.

- Document your results as you go in Phase 2 Tools and Templates Compendium – Tab 2.3 Scorecard.

Input

- Brainstorming

Output

- Configured Scorecard template

Materials

- Phase 2 Tools and Templates Compendium – Tab 2.3 Scorecard

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 2 Tools and Templates Compendium

2.3.2 – Scorecards and feedback

15 to 30 Minutes

- Meet with the participants and brainstorm ideas for feedback to seek from your vendors during your business alignment meetings. During the brainstorming, identify questions to ask the vendor about your organization that will:

- Help you improve the relationship.

- Help you improve your processes or performance.

- Help you improve ongoing communication.

- Help you evaluate your personnel.

- Identify the top five questions you want to include in your business alignment meeting agenda. (Note: you may need to refine the actual questions from the brainstorming activity before they are ready to include in your business alignment meeting agenda.)

- Document both your brainstorming activity and your final results in Phase 2 Tools and Templates Compendium – Tab 2.3 Feedback. The brainstorming questions can be used in the future as your VMI matures and your feedback transforms from informal to formal. The results will be used in Steps 2.4 and 3.5.

Input

- Brainstorming

Output

- Feedback questions to include with the business alignment meeting agenda

Materials

- Phase 2 Tools and Templates Compendium – Tab 2.3 Feedback

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 2 Tools and Templates Compendium

Step 2.4 – Business alignment meeting agenda

Craft an agenda that meets the needs of the VMI

A business alignment meeting (BAM) is a multi-faceted tool to ensure the customer and the vendor stay focused on what is important to the customer at a high level. BAMs are not traditional operational meetings where the parties get into the details of the contracts, deal with installation problems, address project management issues, or discuss specific cost overruns. The focus of the BAM is the scorecard (see Step 2.3), but other topics are discussed, and other purposes are served. For example:

- You can use the BAM to develop the relationship with the vendor's leadership team so that if escalation is ever needed, your organization is more than just a name on a spreadsheet or customer list.

- You can learn about innovations the vendor is working on (without the meeting turning into a sales call).

- You can address high-level performance trends and request corrective action as needed.

- You can clarify your expectations.

- You can educate the vendor about your industry, culture, and organization.

- You can learn more about the vendor.

As you build your BAM Agenda, someone in your organization may say, "Oh, that's just a quarterly business review (QBR) or top-to-top meeting." In most instances, an existing QBRs or top-to-top meeting is not the same as a BAM. Using the term QBR or top-to-top meeting instead of BAM can lead to confusion internally. The VMI may say to the business unit, procurement, or another department, "We're going to start running some QBRs for our strategic vendors." The typical response is, "There's no need; we already run QBRs/top-to-top meetings with our important vendors." This may be accompanied by an invitation to join their meeting, where you may be an afterthought, have no influence, and get five minutes at the end to talk about your agenda items. Keep your BAM separate so that it meets your needs.

Step 2.4 – Business alignment meeting agenda (cont'd)

Craft an agenda that meets the needs of the VMI

As previously noted, using the term BAM more accurately depicts the nature of the VMI meeting and prevents confusion internally with other meetings already occurring. In addition, hosting the BAM yourself rather than piggybacking onto another meeting ensures that the VMI's needs are met. The VMI will set and control the BAM agenda and determine the invite list for internal personnel and vendor personnel. As you may have figured out by now, having the right customer and vendor personnel attend will be essential.

BAMs are conducted at the vendor level, not the contract level. As a result, the frequency of the BAMs will depend on the vendor's classification category (see Steps 2.1 and 3.1). General frequency guidelines are provided below, but they can be modified to meet your goals:

- Commodity vendors – Not applicable

- Operational vendors – Biannually or annually

- Strategic vendors – Quarterly

- Tactical vendors – Quarterly or biannually

BAMs can help you achieve some additional benefits not previously mentioned:

- Foster a collaborative relationship with the vendor.

- Avoid erroneous assumptions by the parties.

- Capture and provide a record of the relationship (and other items) over time.

Step 2.4 – Business alignment meeting agenda (cont'd)

Craft an agenda that meets the needs of the VMI

As with any meeting, building the proper agenda will be one of the keys to an effective and efficient meeting. A high-level BAM agenda with sample topics is set out below:

BAM Agenda

- Opening remarks

- Welcome and introductions

- Review of previous minutes

- Active discussion

- Review of open issues

- Scorecard and feedback

- Current status of projects to ensure situational awareness by the vendor

- Roadmap/strategy/future projects

- Accomplishments

- Closing remarks

- Reinforce positives (good behavior, results, and performance, value added, and expectations exceeded)

- Recap

- Adjourn

2.4.1 – Business alignment meeting agenda

20 – 45 Minutes

- Meet with the participants and review the sample agenda in Phase 2 Tools and Templates Compendium – Tab 2.4 BAM Agenda.

- Using the sample agenda as inspiration and brainstorming activities as needed, create a BAM agenda tailored to your needs.

- Select the items from the sample agenda applicable to your situation.

- Add any items required based on your brainstorming.

- Add the feedback questions identified during Activity 2.3.2 and documented in Phase 2 Tools and Templates Compendium – Tab 2.3 Feedback.

- Gain input and approval from sponsors, stakeholders, and executives as required or appropriate.

- Document the final BAM agenda in Phase 2 Tools and Templates Compendium –Tab 2.4 BAM Agenda.

Input

- Brainstorming

- Phase 2 Tools and Templates Compendium – Tab 2.3 Feedback

Output

- Configured BAM agenda

Materials

- Phase 2 Tools and Templates Compendium – Tab2 .4 BAM Agenda

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 2 Tools and Templates Compendium

Step 2.5 – Relationship alignment document

Draft a document to convey important VMI information to your vendors

Throughout this blueprint, alignment is mentioned directly (e.g. business alignment meetings [Steps 2.4 and 3.3]) or indirectly implied. Ensuring you and your vendors are on the same page, have clear and transparent communication, and understand each other's expectations is critical to fostering strong relationships. One component of gaining and maintaining alignment with your vendors is the Relationship Alignment Document (RAD). Depending upon the Scope of your VMI and what your organization already has in place, your RAD will fill in the gaps on various topics.

Early in the VMI's maturation, the easiest approach is to develop a short document (1 one page) or a pamphlet (i.e. the classic trifold) describing the rules of engagement when doing business with your organization. The RAD can convey expectations, policies, guidelines, and other items. The scope of the document will depend on:

- What you believe is important for the vendors to understand.

- Any other similar information already provided to the vendors.

The first step to drafting a RAD is to identify what information vendors need to know to stay on your good side. You may want vendors to know about your gift policy (e.g. employees may not accept vendor gifts above a nominal value, such as a pen or mousepad). Next, compare your list of what vendors need to know and determine if the content is covered in other vendor-facing documents such as a vendor code of conduct or your website's vendor portal. Lastly, create your RAD to bridge the gap between what you want and what is already in place. In some instances, you may want to include items from other documents to reemphasize them with the vendor community.

Info-Tech Insight

The RAD can be used with all vendors regardless of classification category. It can be sent directly to the vendors or given to them during vendor orientation (see Step 3.3)

2.5.1 – Relationship alignment document

1 to 4 Hours

- Meet with the participants and review the RAD sample and checklist in Phase 2 Tools and Templates Compendium – Tab 2.5 Relationship Alignment Doc.

- Determine:

- Whether you will create one RAD for all vendors or one RAD for strategic vendors and another RAD for tactical and operational vendors; whether you will create a RAD for commodity vendors.

- The concepts you want to include in your RAD(s).

- The format for your RAD(s) – traditional, pamphlet, or other.

- Whether signoff or acknowledgement will be required by the vendors.

- Draft your RAD(s) and work with other internal areas, such as Marketing to create a consistent brand for the RADS, and Legal to ensure consistent use and preservation of trademarks or other intellectual property rights and other legal issues.

- Review other vendor-facing documents (e.g. supplier code of conduct, onsite safety and security protocols) for consistencies between them and the RAD(s).

- Obtain signoff on the RAD(s) from stakeholders, sponsors, executives, Legal, Marketing, and others as needed.

Input

- Brainstorming

- Vendor-facing documents, policies, and procedures

Output

- Completed Relationship Alignment Document(s)

Materials

- Phase 2 Tools and Templates Compendium – Tab 2.5 Relationship Alignment Doc

Participants

- VMI team

- Marketing, as needed

- Legal, as needed

Download the Info-Tech Phase 2 Tools and Templates Compendium

Step 2.6 – Vendor orientation

Create a VMI awareness process to build bridges with your vendors

Your organization is unique. It may have many similarities with other organizations, but your culture, risk tolerance, mission, vision, and goals, finances, employees, and "customers" (those that depend on you) make it different. The same is true of your VMI. It may have similar principles, objectives, and processes to other organizations' VMIs, but yours is still unique. As a result, your vendors may not fully understand your organization and what vendor management means to you.

Vendor orientation is another means to helping you gain and maintain alignment with your important vendors, educate them on what is important to you, and provide closure when/if the relationship with the vendor ends. Vendor orientation is comprised of three components, each with a different function:

- Orientation

- Reorientation

- Debrief

Vendor orientation focuses on the vendor management pieces of the puzzle (e.g. the scorecard process) rather than the operational pieces (e.g. setting up a new vendor in the system to ensure invoices are processed smoothly).

Step 2.6 – Vendor orientation (cont'd)

Create a VMI awareness process to build bridges with your vendors

Reorientation

- Reorientation is either identical or similar to orientation, depending upon the circumstances. Reorientation occurs for several reasons, and each reason will impact the nature and detail of the reorientation content. Reorientation occurs whenever:

- There is a significant change in the vendor's products or services.

- The vendor has been through a merger, acquisition, or divestiture.

- A significant contract renewal/renegotiation has recently occurred.

- Sufficient time has passed from orientation; commonly 2 to 3 years.

- The vendor has been placed in a "performance improvement plan" or "relationship improvement plan" protocol.

- Significant turnover has occurred within your organization (executives, key stakeholders, and/or VMI personnel).

- Substantial turnover has occurred at the vendor at the executive or account management level.

- The vendor has changed vendor classification categories after the most current classification.

- As the name implies, the goal is to refamiliarize the vendor with your current VMI situation, governances, protocols, and expectations. The drivers for reorientation will help you determine the reorientation's scope, scale, and frequency.

Step 2.6 – Vendor orientation (cont'd)

Create a VMI awareness process to build bridges with your vendors

Debrief

To continue the analogy from orientation, debrief is like an exit interview for an employee when their employment is terminated. In this case, debrief occurs when the vendor is no longer an active vendor with your organization - all contracts have terminated or expired, and no new business with the vendor is anticipated within the next three months.

Similar to orientation and reorientation, debrief activities will be based on the vendor's classification category within the COST model. Strategic vendors don't go away very often; usually, they transition to operational or tactical vendors first. However, if a strategic vendor is no longer providing products or services to you, dig a little deeper into their experiences and allocate extra time for the debrief meeting.

The debrief should provide you with feedback on the vendor's experience with your organization and their participation in your VMI. Additionally, it can provide closure for both parties since the relationship is ending. Be careful that the debrief does not turn into a finger-pointing meeting or therapy session for the vendor. It should be professional and productive; if it is going off the rails, terminate the meeting before more damage can occur.

End the debrief on a high note if possible. Thank the vendor, highlight its key contributions, and single out any personnel who went above and beyond. You never know when you will be doing business with this vendor again – don't burn bridges!

Step 2.6 – Vendor orientation (cont'd)

Create a VMI awareness process to build bridges with your vendors

As you create your vendor orientation materials, focus on the message you want to convey.

- For orientation and reorientation:

- What is important to you that vendors need to know?

- What will help the vendors understand more about your organization and your VMI?

- What and how are you different from other organizations overall, and in your "industry"?

- What will help them understand your expectations?

- What will help them be more successful?

- What will help you build the relationship?

- For debrief:

- What information or feedback do you want to obtain?

- What information or feedback to you want to give?

The level of detail you provide strategic vendors during orientation and reorientation may be different from the information you provide tactical and operational vendors. Commodity vendors are not typically involved in the vendor orientation process. The orientation meetings can be conducted on a one-to-one basis for strategic vendors and a one-to-many basis for operational and tactical vendors; reorientation and debrief are best conducted on a one-to-one basis. Lastly, face-to-face or video meetings work best for vendor orientation; voice-only meetings, recorded videos, or distributing only written materials seldom hit their mark or achieve the desired results.

Step 2.7 – Three-year roadmap

Plot your path at a high level

- The VMI exists in many planes concurrently:

- It operates both tactically and strategically.

It focuses on different timelines or horizons (e.g., the past, the present, and the future). Creating a three-year roadmap facilitates the VMI's ability to function effectively across these multiple landscapes.

The VMI roadmap will be influenced by many factors. The work product from Phase 1 – Plan, input from executives, stakeholders, and internal clients, and the direction of the organization are great sources of information as you begin to build your roadmap.

To start, identify what you would like to accomplish in year 1. This is arguably the easiest year to complete: budgets are set (or you have a good idea what the budget will look like), personnel decisions have been made, resources have been allocated, and other issues impacting the VMI are known with a higher degree of certainty than any other year. This does not mean things won't change during the first year of the VMI, but expectations are usually lower, and the short event horizon makes things more predictable during the year-1 ramp-up period.

Years 2 and 3 are more tenuous, but the process is the same: identify what you would like to accomplish or roll out in each year. Typically, the VMI maintains the year-1 plan into subsequent years and adds to the scope or maturity. For example, you may start year 1 with BAMs and scorecards for three of your strategic vendors; during year 2, you may increase that to five vendors; and during year 3, you may increase that to nine vendors. Or, you may not conduct any market research during year 1, waiting to add it to your roadmap in year 2 or 3 as you mature.

Breaking things down by year helps you identify what is important and the timing associated with your priorities. A conservative approach is recommended. It is easy to overcommit, but the results can be disastrous and painful.

2.7.1 – Three-year roadmap

45 – 90 Minutes

- Meet with the participants and decide how to coordinate year 1 of your three-year roadmap with your existing fiscal year or reporting year. Year 1 may be shorter or longer than a calendar year.

- Review the VMI activities listed in Phase 2 Tools and Templates Compendium – Tab 2.7 Three-year roadmap. Use brainstorming and your prior work product from Phase 1 and Phase 2 to identify additional items for the roadmap and add them at the bottom of the spreadsheet.

- Starting with the first activity, determine when that activity will begin and put an X in the corresponding column; if the activity is not applicable, leave it blank or insert N/A.

- Go back to the top of the list and add information as needed.

- For any year-1 or year-2 activities, add an X in the corresponding columns if the activity will be expanded/continued in subsequent periods (e.g., if a Year 2 activity will continue in year 3, put an X in year 3 as well).

- Use the comments column to provide clarifying remarks or additional insights related to your plans or "X's". For example, "Scorecards begin in year 1 with three vendors and will roll out to five vendors in year 2 and nine vendors in year 3."

- Obtain signoff from stakeholders, sponsors, and executives as needed.

Input

- Phase 1 work product

- Steps 2.1 – 2.6 work product

- Brainstorming

Output

- High level three-year roadmap for the VMI

Materials

- Phase 2 Tools and Templates Compendium – Tab 2.7 Three-Year Roadmap

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 2 Tools and Templates Compendium

Step 2.8 – 90-day plan

Pave your short-term path with a series of detailed quarterly plans

Now that you have prepared a three-year roadmap, it's time to take the most significant elements from the first year and create action plans for each three-month period. Your first 90-day plan may be longer or shorter if you want to sync to your fiscal or calendar quarters. Aligning with your fiscal year can make it easier for tracking and reporting purposes; however, the more critical item is to make sure you have a rolling series of four 90-day plans to keep you focused on the important activities and tasks throughout the year.

The 90-day plan is a simple project plan that will help you measure, monitor, and report your progress. Use the Info-Tech tool to help you track:

Activities.

- Tasks comprising each activity.

- Who will be performing the tasks.

- An estimate of the time required per person per task.

- An estimate of the total time to achieve the activity.

- A due date for the activity.

- A priority of the activity.

The first 90-day plan will have the greatest level of detail and should be as thorough as possible; the remaining three 90-day plans will each have less detail for now. As you approach the middle of the first 90-day plan, start adding details to the next 90-day plan; toward the end of the first quarter add a high-level 90-day plan to the end of the chain. Continue repeating this cycle each quarter and consult the three-year roadmap and the leadership team, as necessary.

2.8.1 – 90-day plan

45 – 90 Minutes

- Meet with the participants and decide how to coordinate the first "90-day" plan with your existing fiscal year or reporting cycles. Your first plan may be shorter or longer than 90 days.

- Looking at the year-1 section of the three-year roadmap, identify the activities that will be started during the next 90 days.

- Using the Phase 2 Tools and Templates Compendium – Tab 2.8 90-Day Plan, enter the following information into the spreadsheet for each activity to be accomplished during the next 90 days:

- Activity description.

- Tasks required to complete the activity (be specific and descriptive).

- The people who will be performing each task.

- The estimated number of hours required to complete each task.

- The start date and due date for each task or the activity.

- Validate the tasks are a complete list for each activity and the people performing the tasks have adequate time to complete the tasks by the due date(s).

- Assign a priority to each Activity.

Input

- Three-Year Roadmap

- Phase 1 work product

- Steps 2.1 – 2.7 work product

- Brainstorming

Output

- Detailed plan for the VMI for the next quarter or "90" days

Materials

- Phase 2 Tools and Templates Compendium – Tab 2.8 90-Day Plan

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 2 Tools and Templates Compendium

Step 2.9 – Quick wins

Identify potential short-term successes to gain momentum and show value immediately

As the final step in the timeline trilogy, you are ready to identify some quick wins for the VMI. Using the first 90-day plan and a brainstorming activity, create a list of things you can do in 15 to 30 days that add value to your initiative and build momentum.

As you evaluate your list of potential candidates, look for things that:

- Are achievable within the stated timeline.

- Don't require a lot of effort.

- Involve stopping a certain process, activity, or task; this is sometimes known as a "stop doing stupid stuff" approach.

- Will reduce or eliminate inefficiencies; this is sometimes known as the war on waste.

- Have a moderate to high impact or bolster the VMI's reputation.

As you look for quick wins, you may find that everything you identify does not meet the criteria. That's okay; don't force the issue. Return your focus to the 90-day plan and three-year roadmap and update those documents if the brainstorming activity associated with Step 2.9 identified anything new.

2.9.1 – Quick wins

15 - 30 Minutes

- Meet with the participants and review the three-year roadmap and 90-day plan. Determine if any item on either document can be completed:

- Quickly (30 days or less).

- With minimal effort.

- To provide or show moderate to high levels of value or provide the VMI with momentum.

- Brainstorm to identify any other items that meet the criteria in step 1 above.

- Compile a comprehensive list of these items and select up to five to pursue.

- Document the list in the Phase 2 Tools and Templates Compendium – Tab 2.9 Quick Wins.

- Manage the quick wins list and share the results with the VMI team and applicable stakeholders and executives.

Input

- Three-Year Roadmap

- 90-Day Plan

- Brainstorming

Output

- A list of activities that require low levels of effort to achieve moderate to high levels of value in a short period

Materials

- Phase 2 Tools and Templates Compendium – Tab 2.9 Quick Wins

Participants

- VMI team

Download the Info-Tech Phase 2 Tools and Templates Compendium

Step 2.10 – Reports

Construct your reports to resonate with your audience

Issuing reports is a critical piece of the VMI since the VMI is a conduit of information for the organization. It may be aggregating risk data from internal areas, conducting vendor research, compiling performance data, reviewing market intelligence, or obtaining relevant statistics, feedback, comments, facts, and figures from other sources. Holding onto this information minimizes the impact a VMI can have on the organization; however, the VMI's internal clients, stakeholders, and executives can drown in raw data and ignore it completely if it is not transformed into meaningful, easily-digested information.

Before building a report, think about your intended audience:

- What information are they looking for? What will help them understand the big picture?

- What level of detail is appropriate, keeping in mind the audience may not be like-minded?

- What items are universal to all the readers and what items are of interest to one or two readers?

- How easy or hard will it be to collect the data? Who will be providing it, and how time consuming will it be?

- How accurate, valid, and timely will the data be?

- How frequently will each report need to be issued?

Step 2.10 – Reports (cont'd)

Construct your reports to resonate with your audience

Use the following guidelines to create reports that will resonate with your audience:

- Value information over data, but sometimes data does have a place in your report.

- Use pictures, graphics, and other representations more than words, but words are often necessary in small, concise doses.

- Segregate your report by user; for example, general information up top, CIO information below that on the right, CFO information to the left of CIO information, etc.

- Send a draft report to the internal audience and seek feedback, keeping in mind you won't be able to cater to or please everyone.

2.10.1 – Reports

15 – 45 Minutes

- Meet with the participants and review the applicable work product from Phase 1 and Phase 2; identify qualitative and quantitative items the VMI measures, monitors, tracks, or aggregates.

- Determine which items will be reported and to whom (by category):

- Internally to personnel within the VMI.

- Internally to personnel outside the VMI.

- Externally to vendors.

- Within each category above, determine your intended audiences/recipients. For example, you may have a different list of recipients for a risk report than you do a scorecard summary report. This will help you identify the number of reports required.

- Create a draft structure for each report based on the audience and the information being conveyed. Determine the frequency of each report and person responsible for creating for each report.

- Document your final choices in Phase 2 Tools and Templates Compendium – Tab 2.10 Reports.

Input

- Brainstorming

- Phase 1 work product

- Steps 2.1 – 2.11 work product

Output

- A list of reports used by the VMI

- For each report

- The conceptual content

- A list of who will receive or have access

- A creation/distribution frequency

Materials

- Phase 2 Tools and Templates Compendium – Tab 2.10 Reports

Participants

- VMI team

- Applicable stakeholders and executives (as needed)

Download the Info-Tech Phase 2 Tools and Templates Compendium

Phase 3 - Run

Implement your processes and leverage your tools and templates

Phase 1 | Phase 2 | Phase 3 | Phase 4 |

|---|---|---|---|

1.1 Mission Statement and Goals 1.2 Scope 1.3 Strengths and Obstacles 1.4 Roles and Responsibilities | 2.1 Classification Model 2.2 Risk Assessment Tool 2.3 Scorecards and Feedback 2.4 Business Alignment Meeting Agenda 2.5 Relationship Alignment Document 2.6 Vendor Orientation 2.7 3-Year Roadmap 2.8 90-Day Plan 2.9 Quick Wins 2.10 Reports | 3.1 Classify Vendors 3.2 Compile Scorecards 3.3 Conduct Business Alignment Meetings 3.4 Work the 90-Day Plan 3.5 Manage the 3-Year Roadmap 3.6 Develop/Improve Vendor Relationships | 4.1 Incorporate Leading Practices 4.2 Leverage Lessons Learned 4.3 Maintain Internal Alignment |

This phase will walk you through the following activity:

- Beginning to operate the VMI. The main outcomes from this phase are guidance and the steps required to initiate your VMI.

This phase involves the following participants:

- VMI team

- Applicable stakeholders and executives

- Others as needed

Vendor Management Initiative Basics for the Small/Medium Businesses

Phase 3 – Run

Implement your processes and leverage your tools and templates

All the hard work invested in Phase 1 – Plan and Phase 2 – Build begins to pay off in Phase 3 – Run. It's time to stand up your VMI and ensure that the proper level of resources is devoted to your vendors and the VMI itself. There's more hard work ahead, but the foundational elements are in place. This doesn't mean there won't be adjustments and modifications along the way, but you are ready to use the tools and templates in the real world; you are ready to begin reaping the fruits of your labor.

Phase 3 – Run guides you through the process of collecting data, monitoring trends, issuing reports, and conducting effective meetings to:

- Manage risk better.

- Improve vendor performance.

- Improve vendor relationships.

- Identify areas where the parties can improve.

- Improve communication between the parties.

- Increase the value proposition with your vendors.

Step 3.1 – Classify vendors

Begin classifying your top 25 vendors by spend

Step 3.1 sets the table for many of the subsequent steps in Phase 3 – Run. The results of your classification process will determine which vendors go through the scorecarding process (Step 3.2); which vendors participate in BAMs (Step 3.3), and which vendors you will devote relationship-building resources to (Step 3.6).

As you begin classifying your vendors, Info-Tech recommends using an iterative approach initially to validate the results from the classification model you configured in Step 2.1.

- Identify your top 25 vendors by spend.

- Run your top 10 vendors by spend through the classification model and review the results.

- If the results are what you expected and do not contain any significant surprises, go to 3. on the next page.

- If the results are not what you expected or do contain significant surprises, look at the configuration page of the tool (Tab 1) and adjust the weights or the spend categories slightly. Be cautious in your evaluation of the results before modifying the configuration page - some legitimate results are unexpected, or are surprises based on bias. If you modify the weighting, review the new results and repeat your evaluation. If you modify the spend categories, review the answers on the vendor tabs to ensure that the answers are still accurate; review the new results and repeat your evaluation.

Step 3.1 – Classify vendors (cont'd)

Review your results and adjust the classification tool as needed

- Run your top 11-through-25 vendors by spend through the classification model and review the results. Identify any unexpected results. Determine if further configuration makes sense and repeat the process outlined in 2.b., previous page, as necessary. If no further modifications are required, continue to 4., below.

- Share the preliminary results with the leadership team, executives, and stakeholders to obtain their approval or adjustments to the results.

- They may have questions and want to understand the process before approving the results.