Select an Enterprise Application

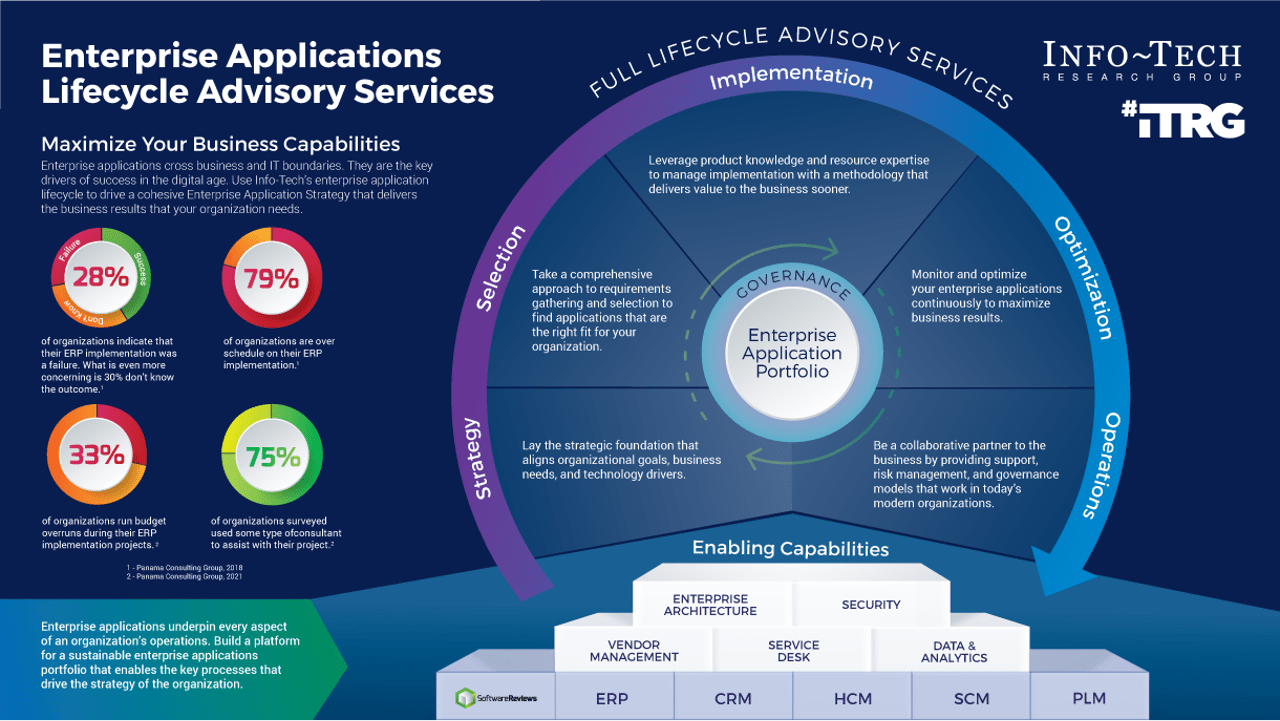

- Organizations rarely have both the sufficient knowledge and resources to properly evaluate, select, and implement an enterprise application software (EAS), forcing them to turn to external partnerships.

- Inadequate and incomplete requirements skew the EAS selection in one direction or another. Many EAS projects fail due to a lack of clear description and specification of functional requirements.

- The EAS technology market is so vast that it becomes nearly impossible to know where to start or how to differentiate between vendors and products.

Our Advice

Critical Insight

- Accountability for EAS success is shared between IT and the business. There is no single owner of an EAS. A unified approach to building your strategy promotes an integrated roadmap so all stakeholders have clear direction on the future state.

- While technology is the key enabler of building strong customer experiences, there are many other drivers of dissatisfaction. IT must stand shoulder-to-shoulder with the business to develop a technology framework for enterprise applications.

- EAS projects are more successful when the management team understands the strategic importance and the criticality of alignment. Time needs to be spent upfront aligning business strategies with EAS capabilities. Effective alignment between IT and the business should happen daily. Alignment doesn’t just occur at the executive level but at each level of the organization.

Impact and Result

- Conduct an EAS project preparedness assessment as a means to ensure you maximize the value of your time, effort, and spending.

- Gather the necessary resources to form the team to conduct the EAS selection.

- Gett the proper EAS requirement landscape by mapping out business capabilities and processes, translating into prioritized EAS requirements.

- Review SoftwareReviews’ vendor reports to shortlist vendors for your RFP process.

- Use Info-Tech’s templates and tools to gather your EAS requirements, build your RFP and evaluation scorecard, and build a foundational EAS selection framework.

Select an Enterprise Application Research & Tools

Besides the small introduction, subscribers and consulting clients within this management domain have access to:

1. Select an Enterprise Application Software Storyboard - A blueprint which prepares you for a proper and better enterprise application selection outcome.

Properly selecting and implementing an enterprise application requires a proper structure. This blueprint guides you with a framework to help in such project, including steps such as assessing readiness, plan for the right resources, requirements gathering, shortlisting, obtaining and evaluating vendor responses, and preparing for implementation.

- Select an Enterprise Application Software Storyboard

2. Select an Enterprise Application Readiness Assessment Checklist – a checklist to assess your readiness towards moving ahead with the selection process.

The EAS Readiness Checklist includes a list of essential tasks to be completed prior to the enterprise application selection and implementation project.

- EAS Readiness Assessment Checklist

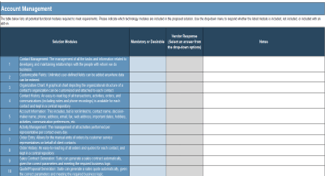

3. ERP/HRIS/CRM Requirements Templates – a set of templates to help build a list of requirements and features for the selection process.

These templates are specific to either ERP, HRIS, or CRM. Each template lists out a set of modules and features allowing you to easily build your requirements.

- ERP Requirements Template

- HRIS Requirements Template

- CRM Requirements Template

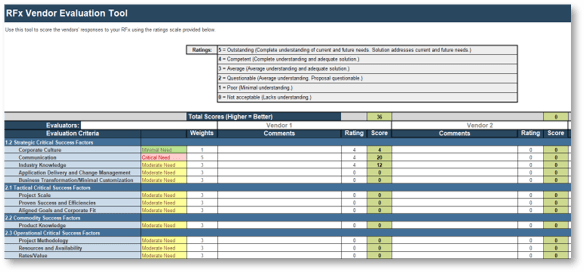

4. Vendor Solicitation (RFP) to Evaluation Suite of Tools – Use Info-Tech’s RFP, vendor response and evaluation tools and templates to increase your efficiency in your RFP and evaluation process.

Configure this time-saving suite of tools to your organizational culture, needs, and most importantly the desired outcome of your RFP initiative.

- EAS Request for Proposal Template

- EAS Vendor Response Template

- ERP Vendor Demonstration Script Template

- HRIS Vendor Demonstration Script Template

- CRM Vendor Demonstration Script Template

- EAS RFP and Demonstration Scoring Tool

Workshop: Select an Enterprise Application

Workshops offer an easy way to accelerate your project. If you are unable to do the project yourself, and a Guided Implementation isn't enough, we offer low-cost delivery of our project workshops. We take you through every phase of your project and ensure that you have a roadmap in place to complete your project successfully.

1 Workshop debrief – Prepare for implementation

The Purpose

Review evaluation framework.

Prepare for implementation.

Key Benefits Achieved

Activities

1.1 Support the project team in establishing the evaluation framework.

1.2 Discuss demo scripts scenarios.

1.3 Discuss next steps and key items in preparation for the implementation.

Outputs

Evaluation framework considerations.

Demo script considerations.

RFP considerations.

2 Workshop Preparation

The Purpose

The facilitator works with the team to verify organizational readiness for EAS project and form the EAS project team.

Key Benefits Achieved

Level-set on organizational readiness for EAS

Organizational project alignment

Activities

2.1 Introduce the workshop and complete an overview of activities.

2.2 Complete organizational context assessment to level-set understanding.

2.3 Complete EAS readiness assessment.

2.4 Form EAS selection team.

Outputs

EAS readiness assessment

Structured EAS selection team

3 Mapping Capabilities to Prioritizing Requirements

The Purpose

Determine the business capabilities and process impacted by the EAS.

Determine what the business needs to get out of the EAS solution.

Build the selection roadmap and project plan.

Key Benefits Achieved

Business and ERP solution alignment

Activities

3.1 Map business capabilities/processes.

3.2 Inventory application and data flow.

3.3 List EAS requirements.

3.4 Prioritize EAS requirements.

Outputs

Business capability/process map

List or map of application + data flow

Prioritized EAS requirements

4 Vendor Landscape and your RFP

The Purpose

Understand EAS market product offerings.

Readying key RFP aspects and expected vendor responses.

Key Benefits Achieved

Shortlist of vendors to elicit RFP response.

Translated EAS requirements into RFP.

Activities

4.1 Build RFP.

4.2 Build vendor response template.

Outputs

Draft of RFP template.

Draft of vendor response template.

5 How to Evaluate Vendors

The Purpose

Prepare for demonstration and evaluation.

Establish evaluation criteria.

Key Benefits Achieved

Narrow your options for ERP selection to best-fit vendors.

Activities

5.1 Run an RFP evaluation simulation.

5.2 Establish evaluation criteria.

5.3 Customize the RFP and Demonstration and Scoring Tool.

Outputs

Draft of demo script template.

Draft of evaluation criteria.

Draft of RFP and Demonstration and Scoring Tool.

Further reading

Select an Enterprise Application

Selecting a best-fit solution requires balancing needs, cost, and vendor capability.

Analyst Perspective

A foundational EAS strategy is critical to decision-making.

Enterprise application software (EAS) is a core tool that a business leverages to accomplish its goals. An EAS that is doing its job well is invisible to the business. The challenges come when the tool is no longer invisible. It has become a source of friction in the functioning of the business.

EAS systems are expensive, their benefits are difficult to quantify, and they often suffer from poor user satisfaction. Post-implementation, technology evolves, organizational goals change, and the health of the system is not monitored. This is complicated in today’s digital landscape with multiple integration points, siloed data, and competing priorities.

Too often organizations jump into selecting replacement systems without understanding the needs of the organization. Alignment between business and IT is just one part of the overall strategy. Identifying key pain points and opportunities, assessed in the light of organizational strategy, will provide a strong foundation to the transformation of the EAS system. Learning about different vendor product offerings with a rigorous approach and evaluation framework will pave way for a better selection outcome.

Hong Kwok

Research Director

Info-Tech Research Group

Executive Summary

| Your Challenge | Common Obstacles | Info-Tech’s Approach |

|---|---|---|

| Selecting and implementing an EAS is one of the most expensive and time-consuming technology transformations an organization can undertake. EAS projects are notorious for time and budget overruns, with only a margin of the anticipated benefits being realized. Making the wrong technology selection or failing to plan for an EAS implementation has significant – and possibly career-ending – implications. |

The EAS technology market is so vast that it is nearly impossible to know where to start or how to differentiate between vendors and products. Inadequate and incomplete requirements skew the EAS selection in one direction to another. Many EAS projects fail due to a lack of clear description and specification of functional requirements. Organizations rarely have both the sufficient knowledge and resources to properly evaluate, select, and implement an EAS, forcing them to turn to external partnerships. |

EAS selection must be driven by your organization’s overall strategy. Ensure you are ready to embark on this journey with the right resources. Determine what EAS solution fits your organization through a structured requirement gathering process to a vendor evaluation framework. Ensure strong points of integration between EAS and other software such as ERP to HRIS. No EAS should live in isolation. |

Info-Tech Insight

Accountability for EAS success is shared between IT and the business. There is no single owner of an EAS. A unified approach to building your strategy promotes an integrated roadmap so all stakeholders have clear direction on the future state.

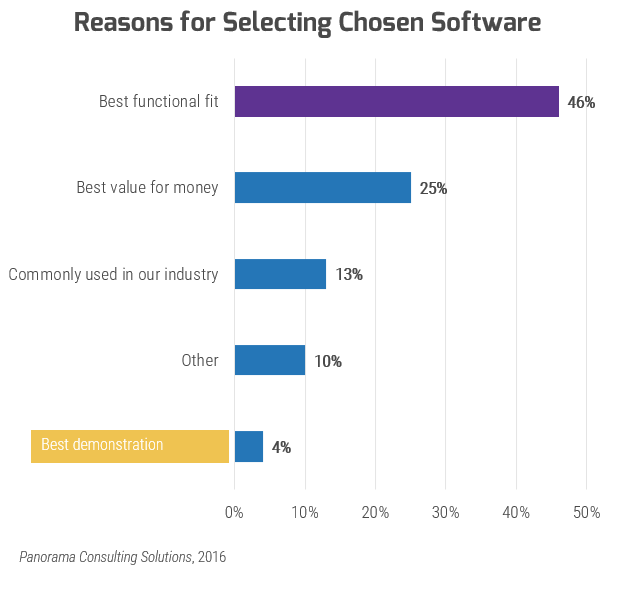

You are not just picking a piece of software, you are choosing a long-term technology partner

Decision making in selection often stands on functional fit; don’t forget to consider vendor fit.

As the ERP technology market becomes increasingly saturated and difficult to decode, vendors are trying to get ahead by focusing on building a partnership, not just making a sale.

68 % of organizations are satisfied with the overall ERP vendor experience, up from 54% in 2017.

Panorama Consulting Solutions, “Report,” 2018

What is an Enterprise Application?

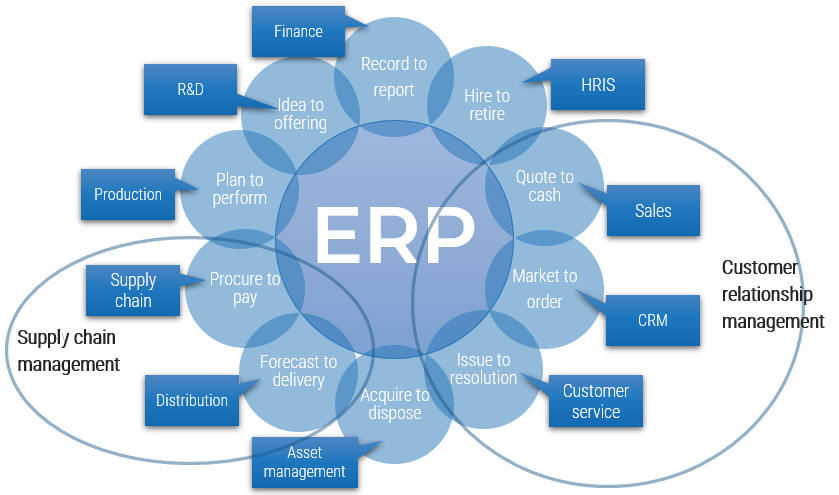

Our Definition: Enterprise Application Software (EAS) is a large software system that provides a broad and integrated set of features which supports a range of business operations and processes across an organization. The system is broadly deployed, provides a unified interface and data structure, allowing for higher business productivity and reporting efficiencies. Best known EAS solutions include Enterprise Resource Planning (ERP), Human Resource Information System (HRIS), and Customer Relationship Management (CRM).

More focused EAS solutions may also bring benefits to your organization, depending on the scale of operations, complexity of operations, and functions. Here are some examples:

PSA: Professional Services Automation

SCMS: Supply Chain Management System

WMS: Warehouse Management System

EAM: Enterprise Asset Management

PIMS: Product Information Management System

MES: Manufacturing Execution System

MA: Marketing Automation

Our other Selection Framework

When selecting personal or commodity applications, or mid-tier applications with spend below $100,000, use our Rapid Application Selection Framework.

Enterprise Resource Planning (ERP)

What is EPR

Enterprise resource planning (ERP) systems facilitate the flow of information across business units. They allow for the seamless integration of systems and create a holistic view of the enterprise to support decision making.

In many organizations, the ERP system is considered the lifeblood of the enterprise. Problems with this key operational system will have a dramatic impact on the ability of the enterprise to survive and grow.

An ERP system:

- Automates processes, reducing the amount of manual, routine work.

- Integrates with core modules, eliminating the fragmentation of systems.

- Centralizes information for reporting from multiple parts of the value chain to a single point.

| ERP use cases: | Product-centric Suitable for organizations that manufacture, assemble, distribute, or manage material goods. |

Service-centric Suitable for organizations that provide and manage field services and/or professional services. |

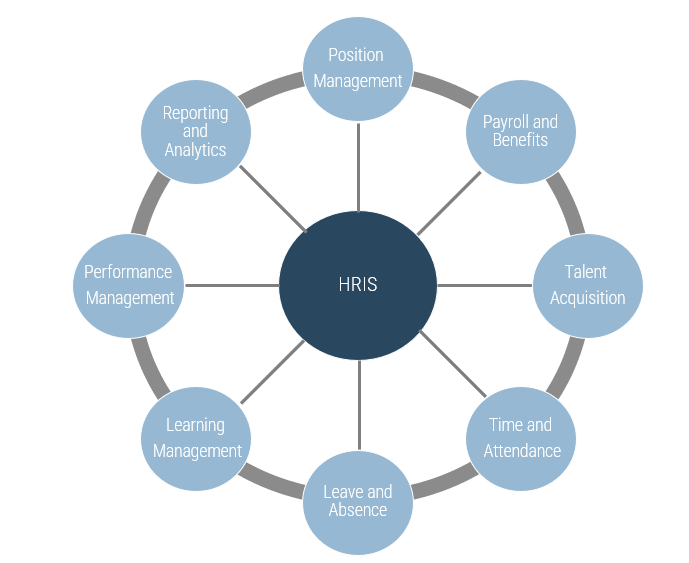

Human Resource Information System (HRIS)

What is HRIS?

An HRIS is used to acquire, store, manipulate, analyze, retrieve, and distribute information regarding an organization’s human resources. HRIS covers the entire employee lifecycle from recruit to retire.

An HRIS:

- Retains employee data in a single repository.

- Enhances employee engagement through self-service and visibility into their records.

- Enhances data security through role-based access control.

- Eliminates manual processes and enables workflow automation.

- Reduces transaction processing time and HR administrative tasks.

- Presents an end-to-end, comprehensive view of all HR processes.

- Reduces exposure to risk with compliance to rules and regulations.

- Enhances the business’s reporting capability on various aspects of human capital.

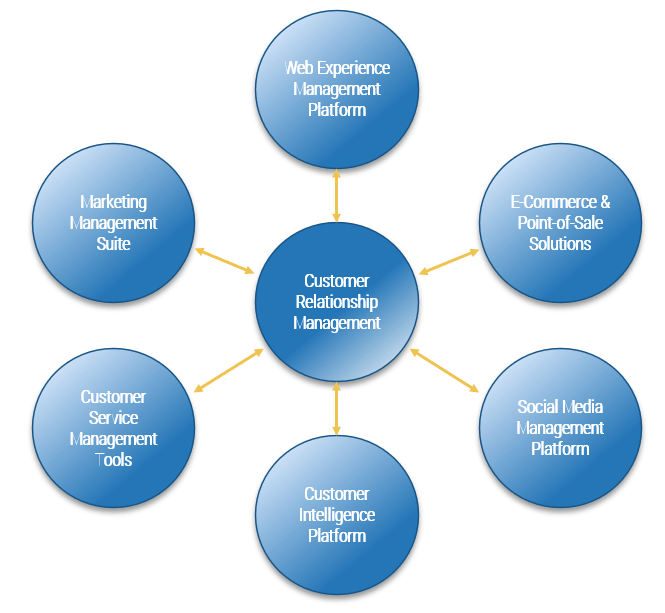

Customer relationship management (CRM)

What is CRM?

A CRM platform (or suite) is a core enterprise application that provides a broad feature set for supporting customer interaction processes, typically across marketing, sales and customer service. These suites supplant more basic applications for customer interaction management (such as the contact management module of an ERP or office productivity suite).

A CRM suite provides many key capabilities, including but not limited to:

- Account management

- Order history tracking

- Pipeline management

- Case management

- Campaign management

- Reports and analytics

- Customer journey execution

A CRM provides a host of native capabilities, but many organizations elect to tightly integrate their CRM solution with other parts of their customer experience ecosystem to provide a 360-degree view of their customers.

The good EAS numbers

There are many good reasons to support EAS implementation and use.

92% of organizations report that CRM use is important for accomplishing revenue objectives.

Source: Validity, 2020

Almost 26% of companies implement HRIS is to obtain greater functionalities, while other main reasons are to increase efficiencies, support growth, and consolidate systems.

Source: SoftwarePath, 2022

Functionality of an ERP is believed to be the most important aspect by almost 40% of companies.

Source: SelectHub, 2022

The ugly EAS numbers

Risks are high in EAS projects.

Statistical analysis of ERP projects indicates rates of failure vary from 50 to 70 percent. Taking the low end of those analyst reports, one in two ERP projects is considered a failure.

Source: Electric Journal of Information Systems Evaluation.

46% of HR technology projects exceed their planned timelines.

Source: Unleash, 2020

Almost 70% of all CRM implementation projects do not meet expected objectives.

Source: Future Computing and Informatics Journal

Enterprise Application dissatisfaction

Finance, IT, Sales, HR, and other users of the Enterprise Application system can only optimize with the full support of each other. Cooperation between departments is crucial when trying to improve the technology capabilities and customer interaction.

| Drivers of Dissatisfaction | |||

|---|---|---|---|

| Business | Data | People and teams | Technology |

|

|

|

|

Info-Tech Insight

While technology is the key enabler of building strong customer experiences, there are many other drivers of dissatisfaction. IT must stand shoulder-to-shoulder with the business to develop a technology framework for Enterprise Applications.

Case Study

Align strategy and technology to meet consumer demand.

NETFLIX

INDUSTRY

Entertainment

SOURCE

Forbes, 2017

|

Challenge Blockbuster was the industry leader in video retail but was lagging in its response to industry, consumer, and technology trends around customer experience. |

Solution |

Results Netflix used disruptive technologies to innovatively build a customer experience that put it ahead of the long-time video rental industry leader, Blockbuster. |

Info-Tech’s methodology for selecting an Enterprise Application

| 1. Build alignment and assemble the team | 2. Define your EAS | 3. Engage, evaluate, and select | 4. Next steps | |

| Phase steps |

|

|

|

|

| Phase outcomes | Discuss organizational goals and how to advance those using the EA system. Identify gaps and remediation steps in preparation of the selection. Assemble the EA selection team. | List and review business capabilities and translate into EAS requirements. Prioritize requirements for selection. | Gain an understanding of the product offerings on the market. Engage the vendors through RFPs and conduct a proper evaluation with an objective evaluation criteria and framework. | Review and discuss the different elements required in preparation for the implementation project. |

Blueprint deliverables

Each step of this blueprint is accompanied by supporting deliverables to help you accomplish your goals:

ERP/HRIS/CRM Requirements Template

Accelerate your requirement gathering with a pre-compiled list of common requirements.

RFx Demo Scoring Tool

Quickly compare the vendors who respond to the RFx to identify the best fit for your needs.

Key deliverable:

RFx templates

Use one of our templates to build a ready-for-distribution implementation partner RFx tailored to the unique success factors of your implementation.

Info-Tech offers various levels of support to best suit your needs

| DIY Toolkit | Guided Implementation | Workshop | Consulting |

|---|---|---|---|

| "Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful." | "Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track." | "We need to his the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place." | "Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project." |

Diagnostics and consistent frameworks are used throughout all four options

Guided Implementation

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is between six to ten calls over the course of four to six months.

What does a typical GI on this topic look like?

| Phase 1 | Phase 2 | Phase 3 | Phase 4 |

|---|---|---|---|

|

Call #1: Scoping call to understand the current situation. Call #2: Discuss readiness and resourcing needs. |

Call #3: Discuss the capabilities and application inventory. Call #4: Discuss requirement gathering and prioritization. |

Call #5: Go over SoftwareReviews and review draft RFx. Call #6: Discuss evaluation tool and evaluation process. |

Call #7: Discuss preparation for implementation. |

Workshop Overview

| Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | |

|---|---|---|---|---|---|

| Activities |

Organizational Strategic Needs 1.1 Review the business context. 1.2 Overview of the EAS Landscape 1.2 Assess EAS project readiness 1.3 Determine the members of the EAS selection team |

From Capabilities to Requirements 2.1 Map business capabilities 2.2 Inventory application and interactions 2.3 Gather requirements 2.4 Prioritize requirements |

Vendor Landscape and Your RFP 3.1 Understanding product offerings 3.2 Build a list of targeted vendors 3.3 Build RFP 3.4 Build vendor response template |

How to Evaluate Vendors 4.1 Run a RFP evaluation simulation 4.2 Build demo script 4.3 Establish evaluation criteria |

Next Steps and Wrap-Up (offsite) 5.1 Clean up in-progress deliverables from previous four days. 5.2 Set up review time for workshop deliverables and to discuss next steps. |

| Deliverables |

|

|

|

|

|

Contact your account representative for more information.

workshops@infotech.com 1-888-670-8889

Phase 1

Build alignment and assemble the Team

Phase 1

1.1 Enterprise Application Landscape

1.2 Validate Readiness

1.3 Determine Resourcing

Phase 2

1.1 Capability Mapping

1.2 Requirements Gathering Data Mapping

1.3 Requirements Prioritizing

Phase 3

3.1 Understanding Product Offerings

3.2 RFP & Demo Scripts

3.3 Evaluation

Select and Negotiate

Phase 4

4.1 Prepare for Implementation

This phase will walk you through the following activities:

Gain an understanding of recent EAS technology.

Validate readiness before starting EAS selection.

Assemble EAS selection team through identification of key players.

This phase involves the following participants:

Key stakeholders from the various areas of the business that will support the project, including:

- CxO (e.g. CIO, CFO)

- Departmental leaders

- Project management team

- Subject matter experts

Select an Enterprise Application

Create a compelling case that addresses strategic business objectives

When someone at the organization asks you WHY, you need to deliver a compelling case. The ERP project will receive pushback, doubt, and resistance; if you can’t answer the question WHY, you will be left back-peddling.

When faced with a challenge, prepare for the WHY.

- Why do we need this?

- Why are we spending all this money?

- Why are we bothering?

- Why is this important?

- Why did we do it this way?

- Why did we choose this vendor?

Most organizations can answer “What?”

Some organizations can answer “How?”

Very few organizations have an answer for “Why?”

Each stage of the project will be difficult and present its own unique challenges and failure points. Re-evaluate if you lose sight of WHY at any stage in the project.

Ensure you have completed the necessary prerequisites for EAS selection

Prior to embarking on selection, ensure you have set the right building blocks and completed the necessary prerequisites: your strategy and roadmap, and business case.

STRATEGY & ROADMAP

Whatever EAS is required, take the time to align your strategy and roadmap to business priorities. Right-size a technology strategy by assessing deployment model alternatives and future-state options with your EAS vision, operating model, and current-state assessment as inputs. Put your strategy to action with a living roadmap by following Info-Tech’s blueprint, Develop an Actionable Strategy and Roadmap.

EAS BUSINESS CASE

Use a business case to justify the business need for your EAS project and secure funding for moving forward with the proposal. A business case will further provide executive decision makers with the tools to compare and prioritize initiatives. Drive a consistent approach to promoting successful initiatives and holding the organization accountable to the projected benefits with Info-Tech’s blueprint, Reduce Time to Consensus With an Accelerated Business Case.

Align the EAS strategy with the corporate strategy

| Corporate strategy | Unified strategy | EAS strategy |

|---|---|---|

|

|

|

Info-Tech Insight

EAS projects are more successful when the management team understands the strategic importance and the criticality of alignment. Time needs to be spent upfront aligning business strategies with EAS capabilities. Effective alignment between IT and the business should happen daily. Alignment doesn’t just to occur at the executive level alone, but at each level of the organization.

Understand how EAS fits into your wider IT organization

Identify the IT drivers and opportunities to take advantage of when embarking on your EAS project.

Greenfield or brownfield: Do you currently have an EAS? Do you have multiple EASs? What is the history of your EAS deployment? How customized is it?

End of life: What lifecycle stage is it in?

Utilization: Are there point solutions in your application portfolio that support some EAS capabilities? Is functionality duplicated and/or underutilized?

Reason for change: What are your organizational drivers for this EAS project (e.g. acquisition/merger)?

APPLICATION PORTFOLIO STRATEGY

Business leaders need application managers to do more than support business operations. Applications must drive business growth, and application managers need their portfolios to be current and effective and to evolve continuously to support the business or risk being marginalized. Rationalize your applications with a roadmap that propels the business forward.

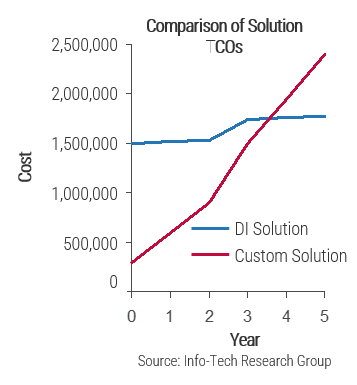

Before switching vendors, evaluate your existing EAS to see if it’s being underutilized or could use an upgrade

The cost of switching vendors can be challenging, but it will depend entirely on the quality of data and whether it makes sense to keep it.

- Achieving success when switching vendors first requires reflection. We need to ask why we are dissatisfied with our incumbent software.

- If the product is old and inflexible, the answer may be obvious, but don’t be afraid to include your incumbent in your evaluation if your issues might be solved with an upgrade.

- Look at your use-case requirements to see where you want to take the EAS solution and compare them to your incumbent’s roadmap. If they don’t match, switching vendors may be the only solution. If your roadmaps align, see if you’re fully leveraging the solution or will be able to start working through process improvements

Fully leveraging your current software now will have two benefits:

| 1 | It may turn out that poor leveraging of your incumbent software was the problem all along; switching vendors won’t solve the problem by itself. As the data to the right shows, a fifth of SMEs and a quarter of large enterprises do not fully leverage their incumbent software. |

| 2 | If you still decide to switch, you’ll be in a good negotiating position. If vendors can see you are engaged and fully leveraging your software, they will be less complacent during negotiations to win you over. |

| 20% Small/Medium Enterprises |

25% Large Enterprises |

| only occasionally or rarely/never use their software | |

Source: SoftwareReviews, 2020; N=45,027

Info-Tech Insight

Switching vendors won’t improve poor internal processes. To be fully successful and meet the goals of the business case, new software implementations must be accompanied by process review and improvement.

Familiarize yourself with the EAS market

| How it got here | Where it’s going |

|

|

Info-Tech Insight

Evaluating the EAS vendor landscape is becoming increasingly difficult as the playing field evens out in terms of functionality offerings. As such, it is becoming increasingly important to more meticulously evaluate vendors themselves as part of the selection process. This is especially important in EAS projects, as they tend to be multi-year in nature and result in long-term vendor partnerships.

What types of Enterprise solutions are at my disposal?

IT leaders typically compare EAS on-premises with SaaS options, but there are actually four different deployment scenarios.

| 1. On Premises | 3. Proprietary Cloud | 4. White-Label Cloud | 2. SaaS |

|---|---|---|---|

|

|

|

|

Info-Tech Insight

Cloud may apply in other ways to the EAS implementation. Most vendors offer particular EAS services delivered via the cloud. For example, some vendors offers CRM, project management, and payroll self-service as cloud-based options to augment on-premises ERP solutions.

Know when to adopt and when to bypass cloud EAS

Use the following guidelines to determine if your organization will benefit from the cloud, or if you should stick to a more traditional delivery model.

| Adopt a cloud-based EAS platform if you have: | Do not adopt a cloud-based EAS platform if you have: |

| Standard processes – Businesses that have standard, repeatable processes can benefit greatly from the cost savings that cloud provides, as the need for expensive customizations is greatly minimized. | Highly regulated industry – Although there is no hard evidence that says cloud-based solutions are not able to support security or compliance needs, in certain industries such as banking or insurance, cloud is not the norm and may be a tough sell for IT. |

| Lean IT operations – Organizations with lean IT or no formal IT departments supporting them will find SaaS EAS particularly appealing. Those with IT that can support day-to-day operations but are not prepared for disaster recovery should also consider cloud EAS, either hosted or SaaS-based. | Unreliable network – If the business regularly faces network outages or remote employees have unreliable internet connections, a cloud-based solution may not be the best option. IT would face many complaints from disgruntled workers unable to access data. |

| Mobile workforce – Telecommuting is becoming more common, as is the requirement for data to be readily available for those on the road. Using cloud is a good way to provide this functionality. | Unsavvy workforce – Organizations that prefer to be late adopters of technology may face strong resistance to taking their software to the cloud. Some employees may not like the idea of using a browser to connect to the system. |

Info-Tech Insight

Knowing when to choose a cloud EAS deployment comes down to two main factors: knowing the level of complexity required by the business, and knowing the available IT resources that can be dedicated to support and manage EAS.

Consider 3 classic scenarios when evaluating cloud EAS

Cloud EAS should be considered by all organizations, but these scenarios present the strongest opportunity.

| The Startup | The Spinoff | The Modernizer |

|---|---|---|

|

|

|

Make sure you are ready to proceed with selection

Organizational readiness is essential for maximizing the benefits realized from your ERP. Cover all critical elements of pre-work, resources, buy-in, and strategy and planning before embarking on ERP selection and/or implementation.

Pre-work

Current State Understanding

Business Process Improvement

Future State Vision

Resources

Project Team

Governance Structures

Third-Party Partners

Cost and Budget

Buy-in

Goals and Objectives

Exec Business Sponsorship

Stakeholder Engagement

Change Management

STRATEGY and PLANNING

ERP Strategy & Roadmap

Risk Management

Project Metrics

Without a preparedness assessment, organizations end up wasting a lot of time on resolving gaps in planning that could have been mitigated upfront, which ultimately makes the implementation project more challenging.

– Suanne McGrath-Kelly, President & Principal Consultant, Plan in Motion Inc., interviewed by Info-Tech, 2019.

Assess your EAS readiness before moving forward

To avoid common project pitfalls, complete the necessary prerequisites before proceeding with EAS. Consider whether the risks of proceeding unprepared fall within your organization’s risk tolerance. If they do not, pivot back to strategy.

| Preceding tasks | Risks of proceeding unprepared |

|---|---|

| Project Vision Project Scope EAS Business Case Current State Map Improvement Opportunity Analysis Future State Considerations Strategic Requirements Project Metrics and Benchmarks Risk Assessment EAS Strategic Roadmap EAS Project Work Initiatives |

Misalignment of project objectives Time and cost overruns Lack of executive buy-in or support Over- or under-investment in systems Unknown and unmet system requirements Product selection misfit Misalignment of requirements to needs Inability to measure project success Inability to proactively mitigate risk impact Lack of decision-making traceability Unclear expectations of tasks and roles |

1.2.1 Assess EAS selection readiness

1 – 2 hours

- As a group, review Section 1 of the EAS Readiness Assessment Checklist with the core project team and/or project sponsor, item by item. For completed items, tick the corresponding checkbox. Document all incomplete items in the Readiness Remediation Plan table in the first column (“Incomplete Readiness Item”).

- For each incomplete item, use your discretion to determine whether the completion is critical in preparation for EAS selection and implementation. This may vary given the complexity of your EAS project. If the item is critical to the project, indicate this with “Y” in the second column (“Criticality (Y/N)”).

- For each critical item, reflect on the barriers that have prevented or are preventing its completion. Possible barriers include incomplete task dependencies, low value to effort determination, lack of organizational knowledge or resources, pressure of deadlines, etc. Document these barriers in the third column (“Barriers to Completion”).

- Determine a remediation approach for each barrier identified. Document the approach in the fourth column (“Remediation Approach”).

- For each remediation activity, designate a due date and remediation owner. Document this in the fifth column (“Due Date and Owner”).

- Carry out the remediation of critical tasks and return to this blueprint to kick-start your selection and implementation project.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Download the EAS Readiness Assessment Checklist

Build a well-balanced core team to see the project through

Have a cross-departmental team define goals and objectives in order to significantly increase EAS success and improve communication.

- Hold a meeting with Finance, Operations, and IT stakeholders. The overall objective of the meeting is to confirm that all parties agree on the goals and metrics that gauge success of the EAS project.

- The kick-off process will significantly improve internal communications. Invite all impacted internal groups to work as a team to address any significant issues before the application process is formally activated.

- Set up a quarterly review process to understand changing needs. This will change the way the EAS system will be utilized.

“Each individual should understand at least one business area and have a hand in another.”

– Mark Earley

Senior Research Director,

Info-Tech Research Group

Info-Tech Insight

An EAS selection and implementation requires more than just a procurement team. The core EAS project team should be cross-functional. .

Be ready with a resourcing strategy for your EAS project

EAS selection and implementation is a giant undertaking that can rarely be supported by internal resources alone.

It is important to understand where your organization’s resourcing gaps are when embarking on a selection and implementation project. Once gaps are identified, the amount of external support needed from vendor(s), consultants, or system integrators can be determined.

Select from the three most commonly used resourcing strategies for EAS selection and implementation projects:

- Implement in-house using your own staff.

- Implement using a combination of your own staff and professional services from the vendor(s) and/or system integrator (SI).

- Implement using professional services.

Build your implementation team

Prioritize members from your core selection team. They will have strong insight into the tool and its envisioned position in the organization.

General Roles

- Integration Specialists

- Solution or Enterprise Architects

- QA Engineer

- IT Service Management Team

External Roles

- Vendor’s Implementation Team or Professional Services

- Systems Integrator (SI)

Right-size the EAS selection team to ensure you get the right information but are still able to move ahead quickly

Full-Time Resourcing: At least one member of these five team members must be allocated to the selection initiative as a full-time resource.

| IT Leader | Technical Lead | Business Analyst/ Project Manager |

Business Lead | Process Expert(s) |

|---|---|---|---|---|

| This team member is an IT director or CIO who will provide sponsorship and oversight from the IT perspective. | This team member will focus on application security, integration, and enterprise architecture. | This team member elicits business needs and translates them into technology requirements. | This team member will provide sponsorship from the business needs perspective. Typically, a CXO or SVP of a business function. | These team members are the business process owners who will help steer the requirements and direction. |

Info-Tech Insight

It is critical for the selection team to determine who has decision rights. Organizational culture will play the largest role in dictating which team member holds the final say for selection decisions. For more information on stakeholder management and involvement, see this guide.

Complete the project timeline required during your selection phase

Include as many steps as necessary to understand, validate, and compare vendor solutions so you can make a confident, well-informed decision.

Use Info-Tech’s 15-Step Selection Process:

- Initiate procurement.

- Select procurement manager.

- Prepare for procurement; check that prerequisites are met.

- Select appropriate procurement vehicle (RFI, RFP, RFQ, etc.).

- Assemble procurement teams.

- Create procurement project plan.

- Identify and notify vendors about procurement.

- Configure procurement process.

- Gather requirements.

- Prioritize requirements.

- Build the procurement documentation package.

- Issue the procurement.

- Evaluate proposals.

- Evaluate vendor demos and reference checks.

- Recommend a vendor.

Strengthen your procurement. If your organization lacks a clear selection process, refer to Info-Tech's Implement a Proactive and Consistent Vendor Selection Process research to help construct a formal process for procuring application technology.

Download the Implement a Proactive and Consistent Vendor Selection Process

Visualize what success looks like

Understand how success metrics are relevant at each stage of strategy formation by keeping the end in mind. Apply a similar thought model to your other success metrics for a holistic evaluation of your strategy.

| Implementation | |||||

|---|---|---|---|---|---|

| Pre-Implementation | Post-Implementation | ||||

| Baseline measure | Strategic insight | Strategic action | Success measure | End result | |

| Use data you already have. Any given pain point can act as your pre-implementation baseline. Previously, this measure may have been evaluated by asking “what?” or “how much?” | Move away from looking at your baseline measure as transactional data, and incorporate the ability to generate strategic insight with your EAS. Change the questions you are asking to drive insights: “who?” “why?” and “how does it affect the business?” | Support the business by putting your strategic analytics into action. Ensure there are capabilities built into your ERP to strategically address your baseline measure. Leverage these functions to act on your strategic insights. | In the interest of IT and business alignment, speak the same language when measuring success. Use a business success measurement to determine the contribution made by your EAS strategy. | Visualize your success in the context of the business as a whole. Projecting success in the interest of your stakeholders will gain and maintain buy-in, allowing you to leverage the strategic functionality of your new EAS. | |

| Example | Time to Procure | Delay in time to procure caused by bottleneck in requisition processing | ERP used to create advanced workflows to streamline requisition approval process | Time efficiencies gained free up employee time to focus on more strategic efforts | Contributed to strategic operational innovation |

Prove the value of your EAS through metrics

Establish baseline metrics early and measure throughout the project can iteratively prove the value of your EAS.

| Functional processes | IT resource efficiency | ||||

|---|---|---|---|---|---|

| Functional benefits and efficiencies gained through effectively diagnosing and meeting business needs. | Benefits enabled through reductions in IT system, network, and resource usage. | ||||

| Example metrics | Record to report |

|

Market to order |

|

|

| Quote to cash |

|

Issue to resolution |

|

||

| Procure to pay |

|

Forecast to delivery |

|

||

| Plan to perform |

|

Hire to retire |

|

||

Improve baseline metrics through…

- Increased help desk efficiency. Through training of personnel and increased efficiency of processes.

- Increased level of self-service for end users. Implementation of functionality that matches business needs will increase the efficiency of functional business tasks.

- Decreased time to escalation. Knowing when to escalate tasks sooner can decrease wasted effort by tier-one workers.

- Automation of simple, repetitive tasks. Automation frees time for more important tasks.

1.3.1 Assemble EAS selection team

1 hour

- Working as a group, list key players in the organization that should be in EAS selection team.

- Determine the role of each member.

- Define the level of commitment each member can have on the EAS selection team. Keep in mind their availabilities during the selection process.

- Determine who has decision rights.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Phase 2

Define your EAS

Phase 1

1.1 Enterprise Application Landscape

1.2 Validate Readiness

1.3 Determine Resourcing

Phase 2

2.1 Capability Mapping

2.2 Requirements Gathering Data Mapping

2.3 Requirements Prioritizing

Phase 3

3.1 Understanding Product Offerings

3.2 RFP & Demo Scripts

3.3 Evaluation

Select and Negotiate

Phase 4

4.1 Prepare for

Implementation

This phase will walk you through the following activities:

Identifying business processes , inventory applications and data flows, gathering requirements and prioritizing them.

This phase involves the following participants:

Key stakeholders from the various areas of the business that will support the project including:

- CxO (e.g. CIO, CFO)

- Departmental leaders

- Project management team

- Subject matter experts

- Core project team

Select an Enterprise Application

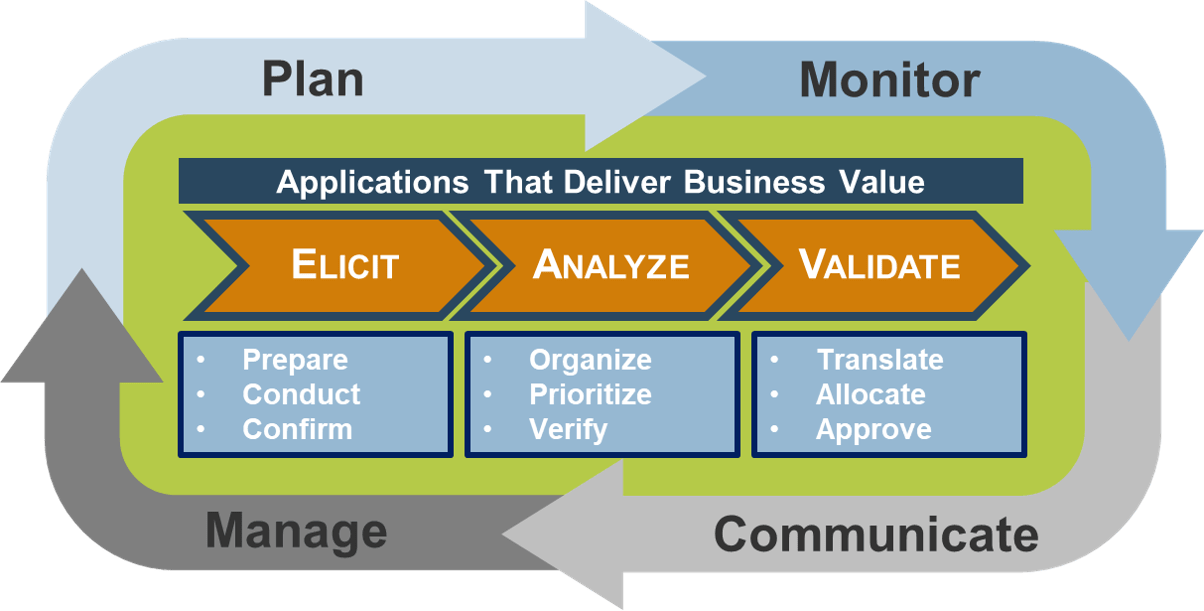

Leverage Info-Tech’s requirements gathering framework to serve as the basis for capturing your CRM requirements

Info-Tech’s Requirements Gathering Framework is a comprehensive approach to requirements management that can be scaled to any size of project or organization. This framework ensures that the application created will capture the needs of all stakeholders and deliver business value. Don’t treat elicitation, analysis, and validation in isolation: planning, monitoring, communicating, and managing must permeate all three stages in order to avoid makeshift solutions.

Capability vs. process vs. feature

Understanding the difference

When examining HRMS optimization it is important to approach it from the appropriate layer.

Capability:

- The ability of an entity (e.g. organization or department) to achieve its objectives (APQC, 2017).

- An ability that an organization, person, or system possesses. They are typically expressed in general and high-level terms and typically require a combination of organization, people, processes, and technology to achieve (TOGAF).

Process:

- Processes can be manual or technology enabled. A process is a series of interrelated activities that convert inputs into results (outputs).

- Processes consume resources, require standards for repeatable performance, and respond to control systems that direct the quality, rate, and cost of performance. The same process can be highly effective in one circumstance and poorly effective in another with different systems, tools, knowledge, and people (APQC, 2017).

Feature:

- A distinguishing characteristic of a software item (e.g. performance, portability, or functionality) (IEEE, 2005).

In today’s complex organizations, it can be difficult to understand where inefficiencies stem from and how performance can be enhanced.

To fix problems and maximize efficiencies, organizations must examine business capabilities and processes to determine gaps and areas of lagging performance.

Info-Tech’s HRIS framework and industry tools such as the APQC’s Process Classification Framework can help make sense of this.

Process inventory

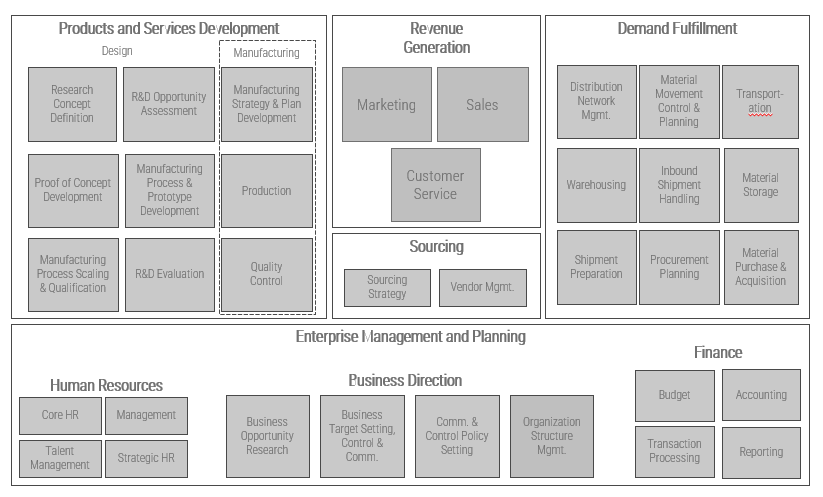

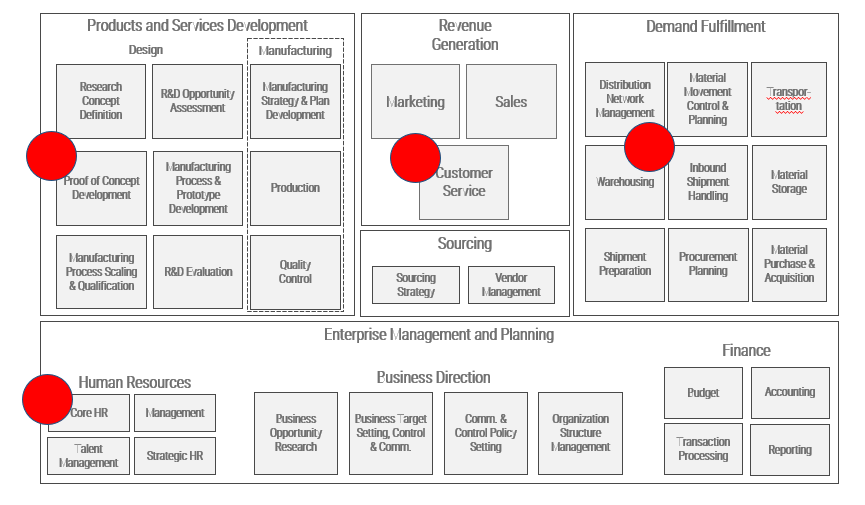

Business capability map (Level 0)

If you do not have a documented process model, you can use the APQC Framework to help define your inventory of business processes.

APQC’s Process Classification Framework is a taxonomy of cross-functional business processes intended to allow the objective comparison of organizational performance within and among organizations.

In business architecture, the primary view of an organization is known as a business capability map.

A business capability defines what a business does to enable value creation rather than how.

Business capabilities:

- Represent stable business functions.

- Are unique and independent of each other.

- Will typically have a defined business outcome.

A business capability map provides details that help the business architecture practitioner direct attention to a specific area of the business for further assessment.

EAS process mapping

| Objectives | The organization’s objectives are typically outcomes that the organization is looking to achieve as a result of the business strategy. |

| Value Streams | Value streams are external/internal processes that help the organization realize its goals. |

| Capabilities | The what: Business capabilities support value streams in the creation and capture of value. |

| Processes | The how: Business processes define how they will fulfill a given capability. |

The operating model

An operating model is a framework that drives operating decisions. It helps to set the parameters for the scope of EAS and the processes that will be supported. The operating model will serve to group core operational processes. These groupings represent a set of interrelated, consecutive processes aimed at generating a common output.

The value stream

Value stream defined:

| Value Streams | Design Product | Produce Product | Sell Product | Customer Service |

|---|---|---|---|---|

|

|

|

|

Value streams connect business goals to the organization’s value realization activities in the marketplace. Those activities are dependent on the specific industry segment in which an organization operates.

There are two types of value streams: core and support.

- Core value streams are mostly external-facing. They deliver value to either external or internal customers and they tie to the customer perspective of the strategy map.

- Support value streams are internal-facing and provide the foundational support for an organization to operate.

An effective method for ensuring all value streams have been considered is to understand that there can be different end-value receivers.

2.1.1 List your key processes

1-3 hours

- As a group, discuss the business capabilities, value streams, and business processes.

- For each capability determine the following:

- Is this capability applicable to our organization?

- What application, if any, supports this capability?

- Are there any missing capabilities to add?

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Activity 2.1.1 – Process inventory

| Core finance | Core HR | Workforce management | Talent Management | Warehouse management | Enterprise asset management | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Process | Technology | Process | Technology | Process | Technology | Process | Technology | Process | Technology | Process | Technology |

|

|

|

|

|

|

||||||

| Planning and budgeting | Strategic HR | Procurement | Customer relationship management | Facilities management | Project management | ||||||

| Process | Technology | Process | Technology | Process | Technology | Process | Technology | Process | Technology | Process | Technology |

|

|

|

|

|

|

||||||

Gaining Enterprise Architecture Oversight during application selection yields better user satisfaction results

Procurement/Legal Oversight and| Low satisfaction with software selection | High satisfaction with software selection | |||

|---|---|---|---|---|

| Process | % Used | % Used | Process | |

| Used ROI/Cost Benefit Analysis | 42% | 43% | Used ROI/Cost-Benefit Analysis | |

| Used Formal Decision Criteria | 39% | 41% | Used Formal Decision Criteria | |

| Approval | 33% | 37% | Enterprise Architecture Oversight and Approval | |

| Security Oversight and Approval | 27% | 36% | Security Oversight and Approval | |

| Used Third-Party Data Reports | 26% | 28% | Procurement/Legal Oversight and Approval | |

| Enterprise Architecture Oversight and Approval | 26% | 28% | Used Third-Party Data Reports | |

| Used a Consultant | 21% | 17% | Used a Consultant | |

High satisfaction was defined as a response of 8, 9, or 10 from the overall recommendation question. Low satisfaction was 7 or less.

Source: SoftwareReviews, 2018

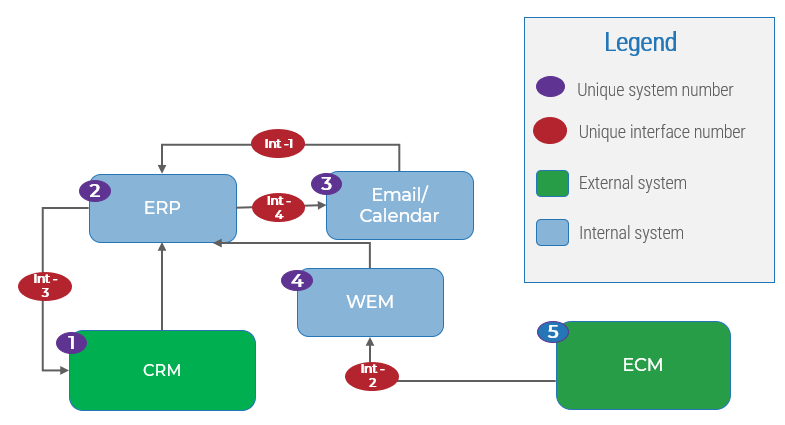

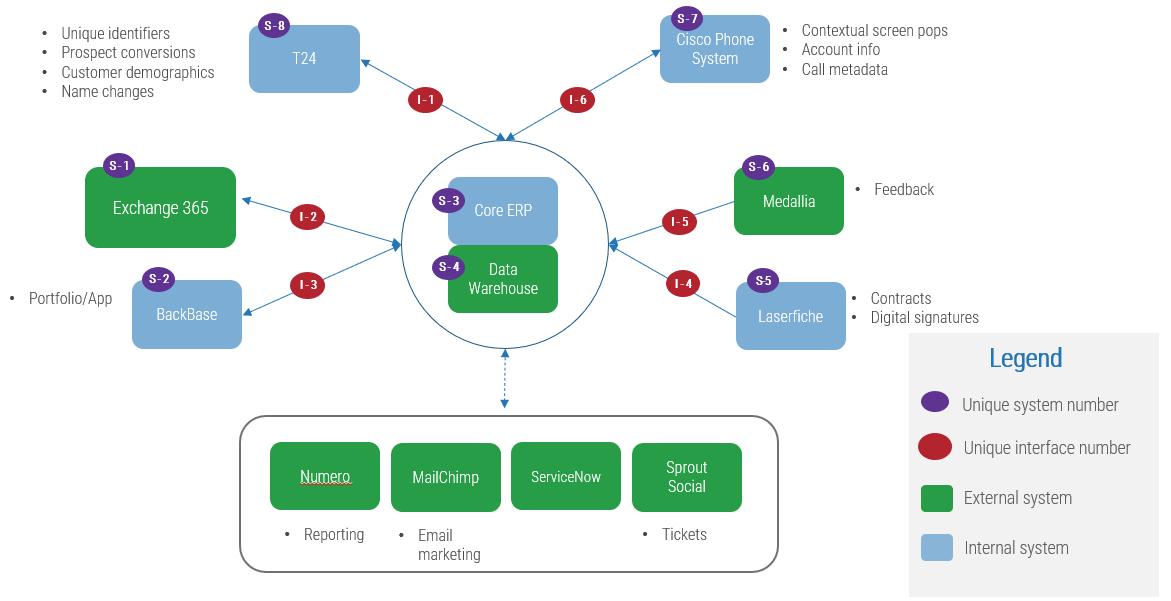

Map data flow

Example ERP data flow

When assessing the current application portfolio that supports your EAS, the tendency will be to focus on the applications under the EAS umbrella. These relate mostly to marketing, sales, and customer service. Be sure to include systems that act as input to, or benefit due to outputs from EAS or similar applications.

Be sure to include enterprise applications that are not included in the EAS application portfolio. Popular systems to consider for POIs include billing, directory services, content management, and collaboration tools.

Integration is paramount: your EAS application often integrates with other applications within the organization. Create an integration map to reflect a system of record and the exchange of data. To increase customer engagement, channel integration is a must (i.e. with robust links to unified communications solutions, email, and VoIP telephony systems).

Enterprise application landscape

2.1.2 Inventory applications and interactions

1-3 hours

- Individually list all electronic systems involved in the EAS function of the organization.

- Document data flows into and out of each system to the EAS. Refer to the example on the previous slides (ERP data flow) and sample Enterprise Application map.

- Review the processes in place (look at each functional area, including data moving into and out of systems.) Document manual processes. Identify integration points. If flow charts exist for these processes, it may be useful to provide these to the participants.

- If possible, diagram the system. Include information direction flow.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Understand how to navigate the complex web of stakeholders in ERP requirements gathering

Identify which stakeholders to include and what their level of involvement should be during requirements elicitation based on relevant topic expertise.

| Sponsor | End user | IT | Business | |

|---|---|---|---|---|

| Description | An internal stakeholder who has final sign-off on the ERP project. | Frontline users of the ERP technology. | Back-end support staff who are tasked with project planning, execution, and eventual system maintenance. | Additional stakeholders who will be impacted by any ERP technology changes. |

| Examples |

|

|

|

|

| Value | Executive buy-in and support is essential to the success of the project. Often, the sponsor controls funding and resource allocation. | End users determine the success of the system through user adoption. If the end user does not adopt the system, the system is deemed useless and benefits realization is poor. | IT is likely to be responsible for more in-depth requirements gathering. IT possesses critical knowledge concerning system compatibility, integration, and data. | Involving business stakeholders in the requirements gathering will ensure alignment between HR and organizational objectives. |

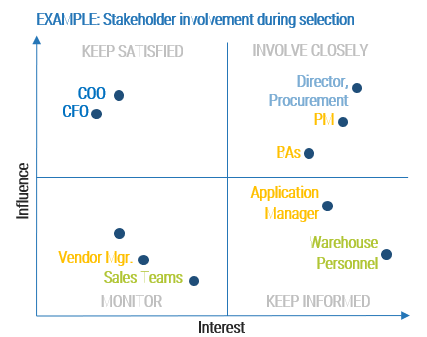

Stakeholder influence vs. interest

Large-scale EAS projects require the involvement of many stakeholders from all corners and levels of the organization, including project sponsors, IT, end users, and business stakeholders. Consider the influence and interest of stakeholders in contributing to the requirements elicitation process and involve them accordingly.

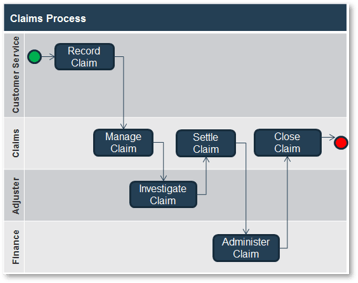

Extract functional and non-functional requirements from the customer interaction business process diagrams

Once the most significant processes have been mapped, the business requirements must be extracted from the maps and transformed into functional and non-functional requirements. The example below illustrates how to extract requirements from an insurance claim process for the Record Claim step.

| Task | Input | Output | Risks | Opportunities | Condition | Sample requirements |

|---|---|---|---|---|---|---|

| Record customer service claim | Customer email | Case record |

|

|

|

Business:

Non-functional:

Functional:

|

2.2.1 Capture your EAS requirements

Time required varies

- Focus groups of 10-20 individuals may be the best way to ensure complete coverage of business requirements for EAS. This group should be cross-functional, with manager- or director-level representation from the departments that have a vested interest in the EAS project.

- Use your organization’s standard internal tools or download Info-Tech’s ERP Requirements Template, HRIS Requirements Template, or CRM Requirements Template.

- Document the requirements from the elicitation sessions.

- The core team of business analysts should be present throughout, and the sessions should be led by an experienced facilitator (such as a senior business analyst).

- Requirements for EAS should focus on achieving the future state rather than replicating the current state.

- The facilitator should steer the team toward requirements that are solution-agnostic (i.e. not coached in terms of a particular vendor or product). Focus on customer and internal personas to help drive requirements.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Prioritize your EAS requirements to assist with the selection

Requirements prioritization ensures that the ERP selection project team focuses on the right requirements when putting together the RFP.

Prioritization is the process of ranking each requirement based on its importance to project success. Hold a meeting for the domain SMEs, implementation SMEs, project managers, and project sponsors to prioritize the requirements list. At the conclusion of the meeting, each requirement should be assigned a priority level. The implementation SMEs will use these priority levels to ensure efforts are targeted toward the proper requirements and to plan features available on each release.

Use the MoSCoW Model of Prioritization to effectively order requirements.

| The MoSCoW Model of Prioritization | |

| Must have | Requirements must be implemented for the solution to be considered successful. |

| Should have | Requirements that are high priority should be included in the solution if possible. |

| Could have | Requirements are desirable but not necessary and could be included if resources are available. |

| Won't have | Requirements won’t be in the next release, but will be considered for the future releases. |

The MoSCoW model was introduced by Dai Clegg of Oracle UK in 1994. MindTools.

Base your prioritization on the right set of criteria

Effective prioritization criteria

| Criteria | Description |

|---|---|

| Regulatory and legal compliance | These requirements will be considered mandatory. |

| Policy compliance | Unless an internal policy can be altered or an exception can be made, these requirements will be considered mandatory. |

| Business value significance | Give a higher priority to high-value requirements. |

| Business risk | Any requirement with the potential to jeopardize the entire project should be given a high priority and implemented early. |

| Likelihood of success | Especially in “proof of concept” projects, it is recommended that requirements have good odds. |

| Implementation complexity | Give a higher priority to low implementation difficulty requirements. |

| Alignment with strategy | Give a higher priority to requirements that enable the corporate strategy. |

| Urgency | Prioritize requirements based on time sensitivity. |

| Dependencies | A requirement on its own may be low priority, but if it supports a high-priority requirement, then its priority must match it. |

2.3.1 Prioritize your solution requirements

Time required varies

- Consolidate all duplicate requirements to form a mutually exclusive and collectively exhaustive list of functional and non-functional requirements.

- Identify the significance of each requirement for your solution evaluation according to the MoSCoW model. Control the number of mandatory requirements you document. Too many mandatory requirements could create an unrealistic framework for evaluating solutions.

- Categorize your requirements and delineate between functional (i.e. capabilities the system will be able to perform) and non-functional (i.e. environmental conditions of the system, such as technical and security requirements).

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Identify which vendors’ product and capabilities meet your must-have requirements

Highlight must-haves in the RFP

- Once you have prioritized your business requirements for the EAS initiative, it is time to package them into an RFP.

- It is critical to highlight must-have requirements in the RFP document. Doing so immediately eliminates vendors who do not feel that their products are suitable for your needs.

WATCH OUT!

Many vendors will try to stretch their capabilities to fit your must-have requirements. Leverage vendor demos in the next stage of selection to quickly rule out products that do not cover your critical requirements.

Identify key process areas where you require vendor knowledge

Completing a process inventory and a list of EAS requirements often shows process areas that need updates and improvement. Take this opportunity to highlight areas where you would benefit from knowing about most recent best practices and technologies.

Inquire about these when engaging the vendor to know their level of knowledge and how their products work best in your industry.

General product knowledge requests are not enough. Be specific.

Determine the product knowledge areas that are specific to your implementation.

| Product Knowledge | Proof of Concept Development | Customer Service | Warehousing | Core HR | Other | Overall |

| Data Security | * | |||||

| Process Improvements | * | * | ||||

| Configuration | ||||||

| Data Architecture | * | |||||

| Integration | ||||||

| On premise Infrastructure | ||||||

| Cloud Infrastructure | * | |||||

| Other |

Identify the product knowledge that is required in relation to your implementation. This can include core product knowledge and should be related to larger infrastructure and organizational requirements.

More than just functional requirements

| What to include | What to look at | What is differentiating |

|---|---|---|

|

|

|

Info-Tech Insight

Be wary of sunsetting products! Selecting the EAS based on a good knowledge of the vendor’s roadmap allows for business operations to continue without having to repeat a selection and implementation project in the near future.

Dominant use-case scenarios for potential ERP solutions

While an organization may be both product- and service-centric, most organizations fall into one of the two categories.

Use case: Public sector

The service-centric ERP use case is suitable for most organizations in the public sector. With that in mind, consider ERP solutions that offer grant disbursements, fleet management, and staffing/resourcing capabilities.

| Product-centric ERP | Service-centric ERP | |

|---|---|---|

| What it is | The product-centric ERP is suitable for organizations that manufacture, assemble, distribute, or manage material goods throughout a product lifecycle. ERP vendors and/or products that align to this use case usually cater to industries such as manufacturing, retail, aerospace and defense, distribution, and food and beverage. | The service-centric ERP use case is suitable for organizations that provide and manage field services and/or professional services throughout a project lifecycle. ERP vendors and/or products that align to this use case usually cater to industries such as utilities, maintenance and repair, government, education, and professional services (i.e. consulting, legal). |

| How it works | Product-centric ERP has strong functionality in supply chain management, manufacturing, procurement management, and material job and project management. | Service-centric ERP has strong functionality in resource job and project management, service management, and customer relationship management. |

EAS table stakes vs differentiating features

Make sure features align with your objectives first.

What are table stakes / standard features?

- For every type of EAS, such as ERP, HRIS, and CRM, certain features are standard, but that doesn’t mean they are all equal.

- The existence of features doesn’t guarantee quality or functionality to the standards you need. Never assume that yes in a features list means you don’t need to ask for a demo.

What is differentiating/additional feature?

- Differentiating features take two forms:

- Some platforms offer differentiating features that are vertical specific.

- Other platforms offer differentiating features that are considered cutting edge. These cutting-edge features may become table stakes over time.

- These features may increase productivity but also require process changes.

Info-Tech Insight

If table stakes are all you need from your EAS solution, the only true differentiator for the organization is price. Otherwise, dig deeper to find the best price to value for your needs.

Remove the product from your shortlist if table stakes are not met!

Reign-In Ballooning Scope for EAS Selection Projects

Stretching the EAS beyond its core capabilities is a short-term solution for a long-term problem. Educate stakeholders about the limits of EAS technology.

Common pitfalls for EAS selection

- Tangential capabilities may require separate solutions. It is common for stakeholders to list features such as content management as part of the new EAS platform. While content management goes hand in hand with the EAS’s ability to manage customer interactions, document management is best handled by a standalone platform.

Keeping stakeholders engaged and in line

- Ballooning scope leads to stakeholder dissatisfaction. Appeasing stakeholders by over customizing the platform will lead to integration and headaches down the road.

- Make sure stakeholders feel heard. Do not turn down ideas in the midst of an elicitation session. Once the requirements gathering sessions are completed, the project team has the opportunity to mark requirements as “out of scope”, and communicate the reasoning behind the decision.

- Educate stakeholders on the core functionality of EAS. Many stakeholders do not know the best-fit use cases for EAS platforms. Help end users understand what EAS is good at, and where additional technologies will be needed.

Phase 3

Engage, Evaluate, and Finalize Selection

Phase 1

1.1 Enterprise Application Landscape

1.2 Validate Readiness

1.3 Determine Resourcing

Phase 2

2.1 Capability Mapping

2.2 Requirements Gathering Data Mapping

2.3 Requirements Prioritizing

Phase 3

3.1 Understanding Product Offerings

3.2 RFP & Demo Scripts

3.3 Evaluation Select and Negotiate

Phase 4

4.1 Prepare for Implementation

This phase will walk you through the following activities:

In this phase of the project, you will review your RFx and build an initial list of vendors/implementors to reach out to. The final step is to build your evaluation checklist for rating the incoming responses.

This phase involves the following participants:

Key stakeholders from the various areas of the business that will support the project including:

- Evaluation team

- Vendor management team

- Project management team

- Core project team

Select an Enterprise Application

Products and vendors demystified

Knowing who can provide the solution will shorten the selection process and provide the most suitable set of features.

| The Product | The Vendor | The VAR |

|---|---|---|

| A product is the software, hardware, add-ins, and any value-added services or tools that are bundled together, e.g. SAP Rise (see What is RISE with SAP), SAP S4/HANA, etc. | A vendor can carry and sell multiple products or lines of products (e.g. Oracle sells Oracle Fusion and NetSuite, etc.). | The Value-added reseller (VAR) can sell a pre-packaged / pre-configured product. VARs are usually partners of the vendor and typically provide other packaged services including system hosting, customization, implementation, and integrations. |

Info-Tech Insight

Selecting an Enterprise Application is much more than just selecting a software or product; it is selecting a long-term platform and partner to help achieve long-term strategic goals. Refer to our blueprint Select an ERP Implementation Partner.

Consolidating the vendor shortlist up-front reduces downstream effort

Put the “short” back in shortlist!

- Radically reduce effort by narrowing the field of potential vendors earlier in the selection process. Too many organizations don’t funnel their vendor shortlist until near the end of the selection process. The result is wasted time and effort evaluating options that are patently not a good fit.

- Leverage external data (such as SoftwareReviews) and expert opinion to consolidate your shortlist into a smaller number of viable vendors before the investigative interview stage, and eliminate time spent evaluating dozens of RFP responses.

- Having fewer RFP responses to evaluate means you will have more time to do greater due diligence.

Review your use cases to start your shortlist

Your Info-Tech analysts can help you narrow down the list of vendors that will meet your requirements.

Next steps will include:

- Reviewing your requirements.

- Checking out SoftwareReviews.

- Creating the RFP.

- Conducting demos and detailed proposal reviews.

- Selecting and contracting with a finalist!

Evaluate software category leaders through vendor rankings and awards

SoftwareReviews

The Data Quadrant is a thorough evaluation and ranking of all software in an individual category to compare platforms across multiple dimensions.

Vendors are ranked by their Composite Score, based on individual feature evaluations, user satisfaction rankings, vendor capability comparisons, and likeliness to recommend the platform.

The Emotional Footprint is a powerful indicator of overall user sentiment toward the relationship with the vendor, capturing data across five dimensions.

Vendors are ranked by their Customer Experience (CX) Score, which combines the overall Emotional Footprint rating with a measure of the value delivered by the solution.

Speak with category experts to dive deeper into the vendor landscape

Fact-based reviews of business software from IT professionals.

Product and category reports with state-of-the-art data visualization.

Top-tier data quality backed by a rigorous quality assurance process.

User-experience insight that reveals the intangibles of working with a vendor.

SoftwareReviews is powered by Info-Tech.

Technology coverage is a priority for Info-Tech, and SoftwareReviews provides the most comprehensive unbiased data on today’s technology. The insights of our expert analysts provide unparalleled support to our members at every step of their buying journey.

CLICK HERE to access SoftwareReviews

Comprehensive software reviews to make better IT decisions.

We collect and analyze the most detailed reviews on enterprise software from real users to give you an unprecedented view into the product and vendor before you buy.

Case Study

Manufacturer and retailer utilizes Info-Tech for goal of unifying four separate ERP systems

INDUSTRY

Manufacturing

SOURCE

Info-Tech Consulting

| Challenge | Solution | Results |

|---|---|---|

|

An amalgamation of eight different manufacturing, retail, and supply brands that operated four separate ERP systems and processes across the United States had poor visibility into operations. The organization had plans to unify the brands from a systems perspective and accommodate the company’s growth in a scalable and repeatable way. Info-Tech was previously engaged to perform an Establish a Concrete ERP Foundation workshop to set the groundwork for the eventual ERP selection. |

The organization engaged Info-Tech’s consulting group to assist in requirements gathering and RFP development. Info-Tech consultants traveled to five different states to gather ERP requirements from stakeholders and identify solution requirements. Info-Tech developed an ERP requirements matrix from the organization’s processes, including technical requirements and operations/support services. |

Info-Tech matched the organization with a use case and weighted requirements to assist in future scoring. An RFP was constructed using the organization’s requirements. and distributed to 10 qualified vendors for completion. |

Strengthen your RFP process with a thorough review

Drive better sourcing outcomes.

A quality SOW is the result of a quality RFI/RFP (RFx).

Use Info-Tech’s RFP Review as a Service to review key items and ensure your RFP will generate quality responses and SOWs.

- Is it well structured, with a consistent use of fonts and bullets?

- Is it laid out in sections that are easily identifiable and that progress from high-level to more detailed information?

- Can a vendor quickly identify the ten (or fewer) things that are most important to you?

3.2.1 Prepare the RFP

1-2 hours

- Download Info-Tech’s ERP Request for Proposal Template or prepare internal best-practice RFP tools.

- Build your RFP.

- Complete the statement of work and general information sections to provide organizational context to your long-listed vendors.

- Outline the organization’s procurement instructions for vendors, including due diligence, assessment criteria, and dates.

- Input the business requirements document as created in Activity 1.3.1.

- Create a scenario overview to provide vendors with an opportunity to give an estimated price.

- Obtain approval for your RFP. Each organization has a unique procurement process; follow your own organization’s process as you submit your RFPs to vendors. Ensure compliance with your organization’s standard and gain approval for submitting your RFP.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Download the ERP Request for Proposal Template

Streamline your evaluation of vendor responses

Use Info-Tech’s ERP Vendor Response Template to standardize vendor responses.

- Vendors tend to use their own standard templates when responding, which complicates evaluations.

- Customize Info-Tech’s ERP Vendor Response Template to adjust for the scope and content of your project; input your organization’s procurement process and ERP requirements.

- The template is meant to streamline the evaluation of vendor responses by ensuring you achieve comprehensiveness and consistency across all vendor responses. The template requires vendors to prove their organizational viability, understanding of the problem, and tested technology and implementation methodologies.

Sections of the tool:

1 Executive Summary

2 About the Vendor

3 Understanding of the Challenge

4 Methodology

5 Proposed Solution

6 Project Plan and Timeline

7 Vendor Qualifications

8 References

9 Additional Value-Added Services

10 Additional Value-Added Goods

For an explanation of how advanced features are determined, see Information Presentation – Feature Ranks (Stoplights) in the Appendix.

What to look in vendor responses

Vendor responses to an RFP can be very revealing about whether their product offering aligns with your EAS roadmap.

Validate the vendor responses so that there are no misunderstandings with their offer. Here are key items to validate.

| Key items | Why is this important? |

| About the Vendor | This is where the vendor will describe itself and prove its organizational viability. |

| Understanding of the Challenge | Demonstrating understanding of the problem is the first step in being able to provide a solution. |

| Methodology | Shows the vendor has a proven methodology to approach and solve the challenge. |

| Proposed Solution | Describes how the vendor will address the challenge. This is a very important section as it will articulate what you will receive from the vendor as a solution. |

| Project Plan and Timeline | Provides an overview of the project management methodology, phases of the project, and what will be delivered and when. |

| Vendor Qualifications | Provides evidence of prior experience with delivering similar projects for similar clients. |

| References | Provides contact information for individuals or organizations for which the vendor has worked and who can vouch for the experience and success of working with this vendor. |

| Value-Added Services and Goods | Allows vendors an opportunity to set themselves apart from the competition with additional services and/or goods applicable to your project but not covered elsewhere in the template. |

3.2.2 Build a vendor response template

1-2 hours

- Download Info-Tech’s ERP Vendor Response Template.

- Validate that the provided template is comprehensive and will collect the information necessary for your organization to effectively evaluate the product and vendor and will inform a decision to invite the vendor in for a demonstration.

- Make the small customizations necessary to tailor the template to your organization (i.e. swap out “[Company X]” for your organization’s name).

Download the ERP Vendor Response Template

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

3.2.3 Evaluate RFP responses

Varies

- Customize Info-Tech’s EAS RFP and Demonstration Scoring Tool to build a vendor and product evaluation framework for your EAS selection team.

- Review all RFP responses together with the core project team and stakeholders from procurement (if necessary).

- Input vendor solution information into the EAS RFP and Demonstration Scoring Tool.

- Analyze the vendors against your evaluation framework by paying specific attention to costing, overall score, and evaluation notes and comments.