Mergers & Acquisitions: The Sell Blueprint

There are four key scenarios or entry points for IT as the selling/divesting organization in M&As:

- IT can suggest a divestiture to meet the business objectives of the organization.

- IT is brought in to strategy plan the sale/divestiture from both the business’ and IT’s perspectives.

- IT participates in due diligence activities and complies with the purchasing organization’s asks.

- IT needs to reactively prepare its environment to enable the separation.

Consider the ideal scenario for your IT organization.

Our Advice

Critical Insight

Divestitures are inevitable in modern business, and IT’s involvement in the process should be too. This progression is inspired by:

- The growing trend for organizations to increase, decrease, or evolve through these types of transactions.

- A maturing business perspective of IT, preventing the difficulty that IT is faced with when invited into the transaction process late.

- Transactions that are driven by digital motivations, requiring IT’s expertise.

- There never being such a thing as a true merger, making the majority of M&A activity either acquisitions or divestitures.

Impact and Result

Prepare for a sale/divestiture transaction by:

- Recognizing the trend for organizations to engage in M&A activity and the increased likelihood that, as an IT leader, you will be involved in a transaction in your career.

- Creating a standard strategy that will enable strong program management.

- Properly considering all the critical components of the transaction and integration by prioritizing tasks that will reduce risk, deliver value, and meet stakeholder expectations.

Mergers & Acquisitions: The Sell Blueprint Research & Tools

Start here – read the Executive Brief

Read our concise Executive Brief to find out how your organization can excel its reduction strategy by engaging in M&A transactions. Review Info-Tech’s methodology, and understand the four ways we can support you in completing this project.Besides the small introduction, subscribers and consulting clients within this management domain have access to:

- Mergers & Acquisitions: The Sell Blueprint – Phases 1-4

- M&A Sell Playbook

1. Proactive Phase

Be an innovative IT leader by suggesting how and why the business should engage in an acquisition or divestiture.

- One-Pager: M&A Proactive

- Case Study: M&A Proactive

- Information Asset Audit Tool

- Data Valuation Tool

- Enterprise Integration Process Mapping Tool

- Risk Register Tool

- Security M&A Due Diligence Tool

- Service Catalog Internal Service Level Agreement Template

2. Discovery & Strategy

Create a standardized approach for how your IT organization should address divestitures or sales.

- One-Pager: M&A Discovery & Strategy – Sell

- Case Study: M&A Discovery & Strategy – Sell

3. Due Diligence & Preparation

Comply with due diligence, prepare the IT environment for carve-out possibilities, and establish the separation project plan.

- One-Pager: M&A Due Diligence & Preparation – Sell

- Case Study: M&A Due Diligence & Preparation – Sell

- IT Due Diligence Charter

- IT Culture Diagnostic

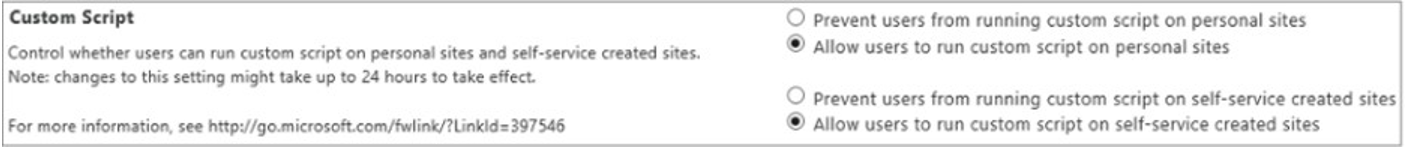

- M&A Separation Project Management Tool (SharePoint)

- SharePoint Template: Step-by-Step Deployment Guide

- M&A Separation Project Management Tool (Excel)

4. Execution & Value Realization

Deliver on the separation project plan successfully and communicate IT’s transaction value to the business.

- One-Pager: M&A Execution & Value Realization – Sell

- Case Study: M&A Execution & Value Realization – Sell

Infographic

Workshop: Mergers & Acquisitions: The Sell Blueprint

Workshops offer an easy way to accelerate your project. If you are unable to do the project yourself, and a Guided Implementation isn't enough, we offer low-cost delivery of our project workshops. We take you through every phase of your project and ensure that you have a roadmap in place to complete your project successfully.

1 Pre-Transaction Discovery & Strategy

The Purpose

Establish the transaction foundation.

Discover the motivation for divesting or selling.

Formalize the program plan.

Create the valuation framework.

Strategize the transaction and finalize the M&A strategy and approach.

Key Benefits Achieved

All major stakeholders are on the same page.

Set up crucial elements to facilitate the success of the transaction.

Have a repeatable transaction strategy that can be reused for multiple organizations.

Activities

1.1 Conduct the CIO Business Vision and CEO-CIO Alignment diagnostics.

1.2 Identify key stakeholders and outline their relationship to the M&A process.

1.3 Understand the rationale for the company's decision to pursue a divestiture or sale.

1.4 Assess the IT/digital strategy.

1.5 Identify pain points and opportunities tied to the divestiture/sale.

1.6 Create the IT vision statement and mission statement and identify IT guiding principles and the transition team.

1.7 Document the M&A governance.

1.8 Establish program metrics.

1.9 Create the valuation framework.

1.10 Establish the separation strategy.

1.11 Conduct a RACI.

1.12 Create the communication plan.

1.13 Prepare to assess target organizations.

Outputs

Business perspectives of IT

Stakeholder network map for M&A transactions

Business context implications for IT

IT’s divestiture/sale strategic direction

Governance structure

M&A program metrics

IT valuation framework

Separation strategy

RACI

Communication plan

Prepared to assess target organization(s)

2 Mid-Transaction Due Diligence & Preparation

The Purpose

Establish the foundation.

Discover the motivation for separation.

Identify expectations and create the carve-out roadmap.

Prepare and manage employees.

Plan the separation roadmap.

Key Benefits Achieved

All major stakeholders are on the same page.

Methodology identified to enable compliance during due diligence.

Employees are set up for a smooth and successful transition.

Separation activities are planned and assigned.

Activities

2.1 Gather and evaluate the stakeholders involved, M&A strategy, future-state operating model, and governance.

2.2 Review the business rationale for the divestiture/sale.

2.3 Establish the separation strategy.

2.4 Create the due diligence charter.

2.5 Create a list of IT artifacts to be reviewed in the data room.

2.6 Create a carve-out roadmap.

2.7 Create a service/technical transaction agreement.

2.8 Measure staff engagement.

2.9 Assess the current culture and identify the goal culture.

2.10 Create employee transition and functional workplans.

2.11 Establish the separation roadmap.

2.12 Establish and align project metrics with identified tasks.

2.13 Estimate integration costs.

Outputs

Stakeholder map

IT strategy assessed

IT operating model and IT governance structure defined

Business context implications for IT

Separation strategy

Due diligence charter

Data room artifacts

Carve-out roadmap

Service/technical transaction agreement

Engagement assessment

Culture assessment

Employee transition and functional workplans

Integration roadmap and associated resourcing

3 Post-Transaction Execution & Value Realization

The Purpose

Establish the transaction foundation.

Discover the motivation for separation.

Plan the separation roadmap.

Prepare employees for the transition.

Engage in separation.

Assess the transaction outcomes.

Key Benefits Achieved

All major stakeholders are on the same page.

Separation activities are planned and assigned.

Employees are set up for a smooth and successful transition.

Separation strategy and roadmap are executed to benefit the organization.

Review what went well and identify improvements to be made in future transactions.

Activities

3.1 Identify key stakeholders and outline their relationship to the M&A process.

3.2 Gather and evaluate the M&A strategy, future-state operating model, and governance.

3.3 Review the business rationale for the divestiture/sale.

3.4 Establish the separation strategy.

3.5 Prioritize separation tasks.

3.6 Establish the separation roadmap.

3.7 Establish and align project metrics with identified tasks.

3.8 Estimate separation costs.

3.9 Measure staff engagement.

3.10 Assess the current culture and identify the goal culture.

3.11 Create employee transition and functional workplans.

3.12 Complete the separation by regularly updating the project plan.

3.13 Assess the service/technical transaction agreement.

3.14 Confirm separation costs.

3.15 Review IT’s transaction value.

3.16 Conduct a transaction and separation SWOT.

3.17 Review the playbook and prepare for future transactions.

Outputs

M&A transaction team

Stakeholder map

IT strategy assessed

IT operating model and IT governance structure defined

Business context implications for IT

Separation strategy

Separation roadmap and associated resourcing

Engagement assessment

Culture assessment

Employee transition and functional workplans

Updated separation project plan

Evaluated service/technical transaction agreement

SWOT of transaction

M&A Sell Playbook refined for future transactions

Further reading

Mergers & Acquisitions: The Sell Blueprint

For IT leaders who want to have a role in the transaction process when their business is engaging in an M&A sale or divestiture.

EXECUTIVE BRIEF

Analyst Perspective

Don’t wait to be invited to the M&A table, make it.

Brittany Lutes

Research Analyst,

CIO Practice

Info-Tech Research Group

Ibrahim Abdel-Kader

Research Analyst,

CIO Practice

Info-Tech Research Group

IT has always been an afterthought in the M&A process, often brought in last minute once the deal is nearly, if not completely, solidified. This is a mistake. When IT is brought into the process late, the business misses opportunities to generate value related to the transaction and has less awareness of critical risks or inaccuracies.

To prevent this mistake, IT leadership needs to develop strong business relationships and gain respect for their innovative suggestions. In fact, when it comes to modern M&A activity, IT should be the ones suggesting potential transactions to meet business needs, specifically when it comes to modernizing the business or adopting digital capabilities.

IT needs to stop waiting to be invited to the acquisition or divestiture table. IT needs to suggest that the table be constructed and actively work toward achieving the strategic objectives of the business.

Executive Summary

Your Challenge

There are four key scenarios or entry points for IT as the selling/divesting organization in M&As:

- IT can suggest a divestiture to meet the business objectives of the organization.

- IT is brought in to strategy plan the sale/divestiture from both the business’ and IT’s perspectives.

- IT participates in due diligence activities and complies with the purchasing organization’s asks.

- IT needs to reactively prepare its environment to enable the separation.

Consider the ideal scenario for your IT organization.

Common Obstacles

Some of the obstacles IT faces include:

- IT is often told about the transaction once the deal has already been solidified and is now forced to meet unrealistic business demands.

- The business does not trust IT and therefore does not approach IT to define value or reduce risks to the transaction process.

- The people and culture element is forgotten or not given adequate priority.

These obstacles often arise when IT waits to be invited into the transaction process and misses critical opportunities.

Info-Tech's Approach

Prepare for a sale/divestiture transaction by:

- Recognizing the trend for organizations to engage in M&A activity and the increased likelihood that, as an IT leader, you will be involved in a transaction in your career.

- Creating a standard strategy that will enable strong program management.

- Properly considering all the critical components of the transaction and integration by prioritizing tasks that will reduce risk, deliver value, and meet stakeholder expectations.

Info-Tech Insight

As the number of merger, acquisition, and divestiture transactions continues to increase, so too does IT’s opportunity to leverage the growing digital nature of these transactions and get involved at the onset.

The changing M&A landscape

Businesses will embrace more digital M&A transactions in the post-pandemic world

- When the pandemic occurred, businesses reacted by either pausing (61%) or completely cancelling (46%) deals that were in the mid-transaction state (Deloitte, 2020). The uncertainty made many organizations consider whether the risks would be worth the potential benefits.

- However, many organizations quickly realized the pandemic is not a hindrance to M&A transactions but an opportunity. Over 16,000 American companies were involved in M&A transactions in the first six months of 2021 (The Economist). For reference, this had been averaging around 10,000 per six months from 2016 to 2020.

- In addition to this transaction growth, organizations have increasingly been embracing digital. These trends increase the likelihood that, as an IT leader, you will engage in an M&A transaction. However, it is up to you when you get involved in the transactions.

The total value of transactions in the year after the pandemic started was $1.3 billion – a 93% increase in value compared to before the pandemic. (Nasdaq)

71% of technology companies anticipate that divestitures will take place as a result of the COVID-19 pandemic. (EY, 2020)

Your challenge

IT is often not involved in the M&A transaction process. When it is, it’s often too late.

- The most important driver of an acquisition is the ability to access new technology (DLA Piper), and yet 50% of the time, IT isn’t involved in the M&A transaction at all (IMAA Institute, 2017).

- Additionally, IT’s lack of involvement in the process negatively impacts the business:

- Most organizations (60%) do not have a standardized approach to integration (Steeves and Associates), let alone separation.

- Two-thirds of the time, the divesting organization and acquiring organization will either fail together or succeed together (McKinsey, 2015).

- Less than half (47%) of organizations actually experience the positive results sought by the M&A transaction (Steeves and Associates).

- Organizations pursuing M&A and not involving IT are setting themselves up for failure.

Only half of M&A deals involve IT (Source: IMAA Institute, 2017)

Common Obstacles

These barriers make this challenge difficult to address for many organizations:

- IT is rarely afforded the opportunity to participate in the transaction deal. When IT is invited, this often happens later in the process where separation will be critical to business continuity.

- IT has not had the opportunity to demonstrate that it is a valuable business partner in other business initiatives.

- One of the most critical elements that IT often doesn’t take the time or doesn’t have the time to focus on is the people and leadership component.

- IT waits to be invited to the process rather then actively involving themselves and suggesting how value can be added to the process.

In hindsight, it’s clear to see: Involving IT is just good business.

47% of senior leaders wish they would have spent more time on IT due diligence to prevent value erosion. (Source: IMAA Institute, 2017)

“Solutions exist that can save well above 50 percent on divestiture costs, while ensuring on-time delivery.” (Source: SNP)

Info-Tech's approach

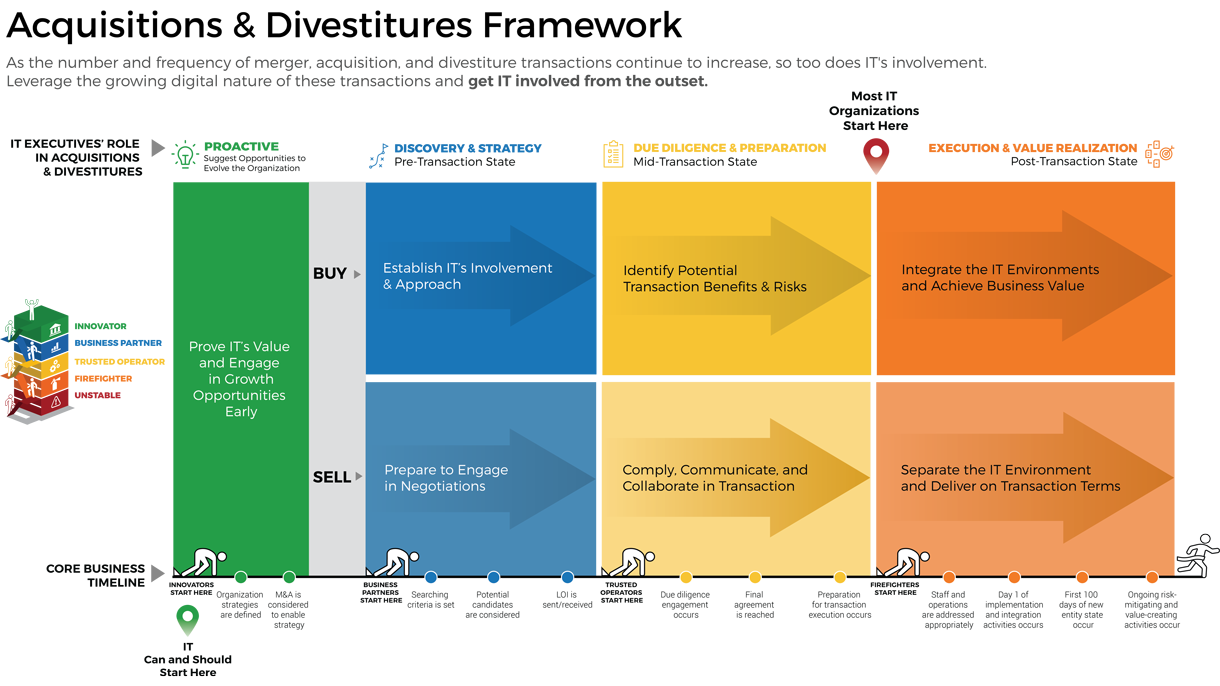

Acquisitions & Divestitures Framework

Acquisitions and divestitures are inevitable in modern business, and IT’s involvement in the process should be too. This progression is inspired by:

- The growing trend for organizations to increase, decrease, or evolve through these types of transactions.

- Transactions that are driven by digital motivations, requiring IT’s expertise.

- A maturing business perspective of IT, preventing the difficulty that IT is faced with when invited into the transaction process late.

- There never being such a thing as a true merger, making the majority of M&A activity either acquisitions or divestitures.

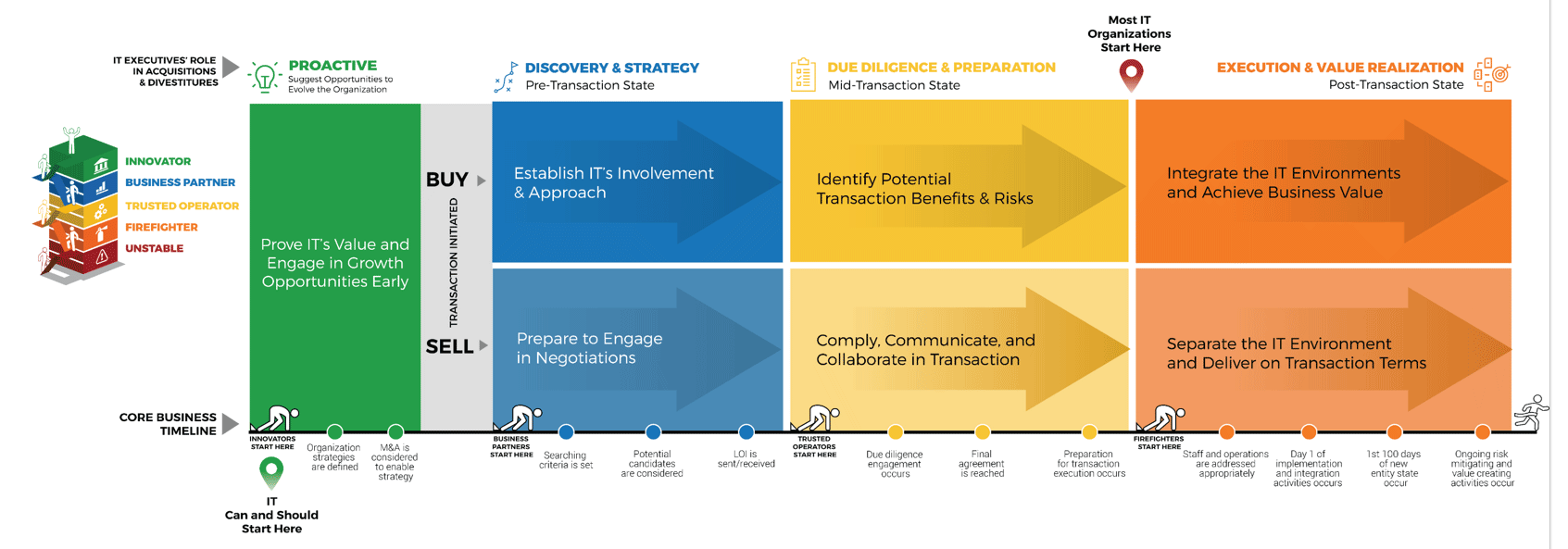

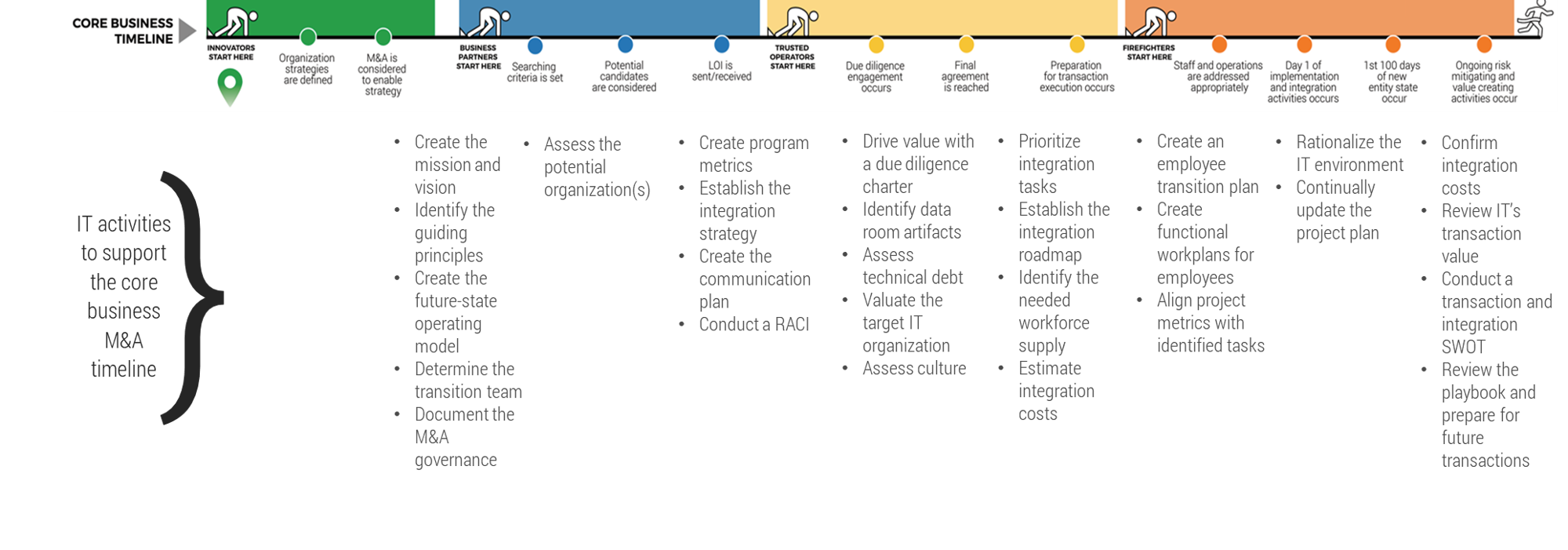

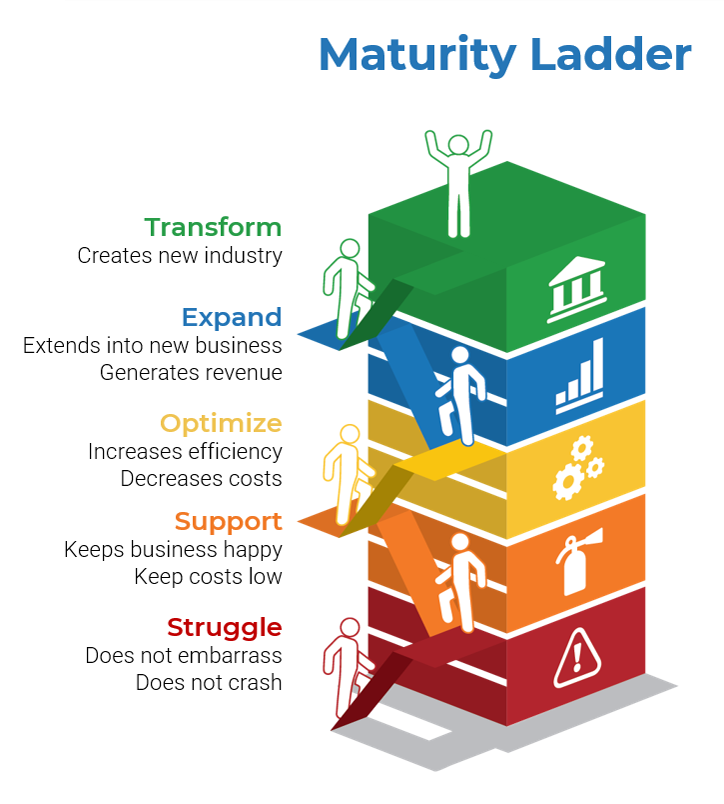

The business’ view of IT will impact how soon IT can get involved

There are four key entry points for IT

- Innovator: IT suggests a sale or divestiture to meet the business objectives of the organization.

- Business Partner: IT is brought in to strategy plan the sale/divestiture from both the business’ and IT’s perspective.

- Trusted Operator: IT participates in due diligence activities and complies with the purchasing organization’s asks.

- Firefighter: IT needs to reactively prepare its environment in order to enable the separation.

Merger, acquisition, and divestiture defined

Merger

A merger looks at the equal combination of two entities or organizations. Mergers are rare in the M&A space, as the organizations will combine assets and services in a completely equal 50/50 split. Two organizations may also choose to divest business entities and merge as a new company.

Acquisition

The most common transaction in the M&A space, where an organization will acquire or purchase another organization or entities of another organization. This type of transaction has a clear owner who will be able to make legal decisions regarding the acquired organization.

Divestiture

An organization may decide to sell partial elements of a business to an acquiring organization. They will separate this business entity from the rest of the organization and continue to operate the other components of the business.

Info-Tech Insight

A true merger does not exist, as there is always someone initiating the discussion. As a result, most M&A activity falls into acquisition or divestiture categories.

Selling vs. buying

The M&A process approach differs depending on whether you are the selling or buying organization

This blueprint is only focused on the sell side:

- Examples of sell-related scenarios include:

- Your organization is selling to another organization with the intent of keeping its regular staff, operations, and location. This could mean minimal separation is required.

- Your organization is selling to another organization with the intent of separating to be a part of the purchasing organization.

- Your organization is engaging in a divestiture with the intent of:

- Separating components to be part of the purchasing organization permanently.

- Separating components to be part of a spinoff and establish a unit as a standalone new company.

- As the selling organization, you could proactively seek out suitors to purchase all or components of your organization, or you could be approached by an organization.

The buy side is focused on:

- More than two organizations could be involved in a transaction.

- Examples of buy-related scenarios include:

- Your organization is buying another organization with the intent of having the purchased organization keep its regular staff, operations, and location. This could mean minimal integration is required.

- Your organization is buying another organization in its entirety with the intent of integrating it into your original company.

- Your organization is buying components of another organization with the intent of integrating them into your original company.

- As the purchasing organization, you will probably be initiating the purchase and thus will be valuating the selling organization during due diligence and leading the execution plan.

For more information on acquisitions or purchases, check out Info-Tech’s Mergers & Acquisitions: The Buy Blueprint.

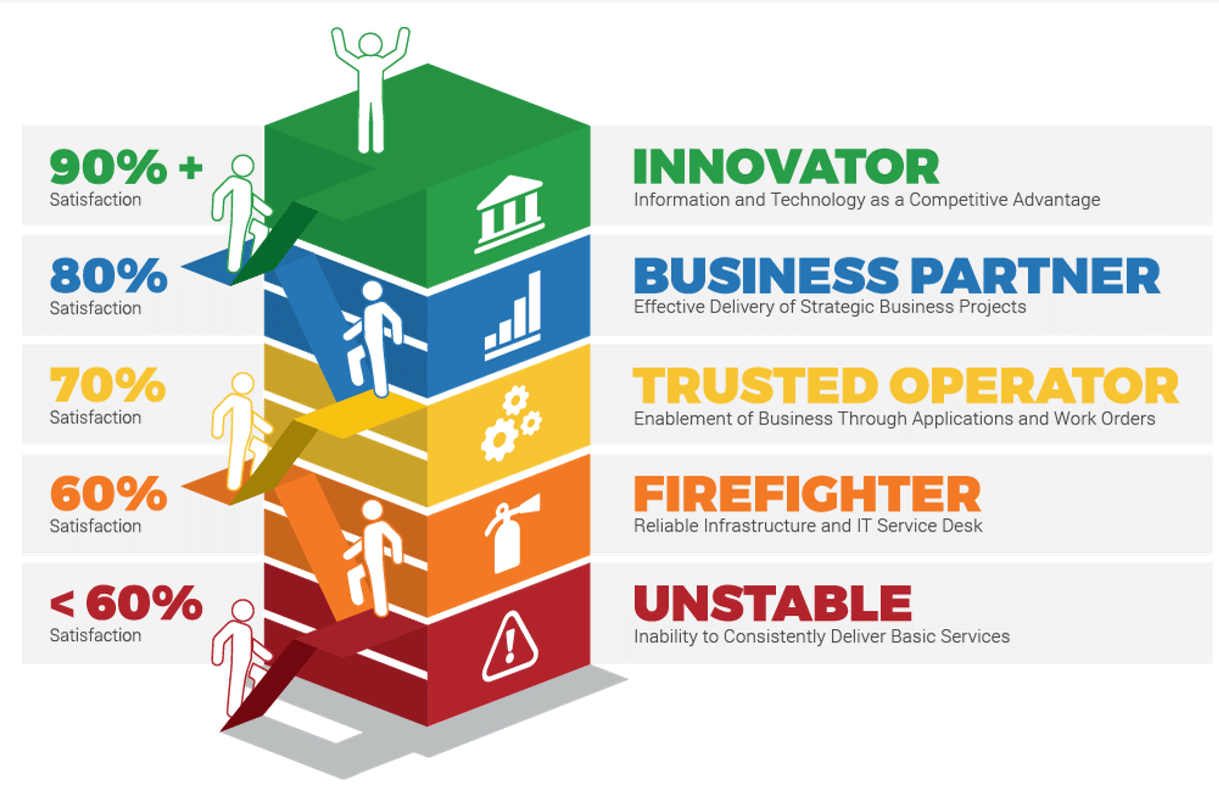

Core business timeline

For IT to be valuable in M&As, you need to align your deliverables and your support to the key activities the business and investors are working on.

Info-Tech’s methodology for Selling Organizations in Mergers, Acquisitions, or Divestitures

1. Proactive |

2. Discovery & Strategy |

3. Due Diligence & Preparation |

4. Execution & Value Realization |

|

Phase Steps |

|

|

|

|

Phase Outcomes |

Be an innovative IT leader by suggesting how and why the business should engage in an acquisition or divestiture. |

Create a standardized approach for how your IT organization should address divestitures or sales. |

Comply with due diligence, prepare the IT environment for carve-out possibilities, and establish the separation project plan. |

Deliver on the separation project plan successfully and communicate IT’s transaction value to the business. |

Metrics for each phase

1. Proactive | 2. Discovery & Strategy | 3. Valuation & Due Diligence | 4. Execution & Value Realization |

|

|

|

|

IT's role in the selling transaction

And IT leaders have a greater likelihood than ever of needing to support a merger, acquisition, or divestiture.

-

Reduced Risk

IT can identify risks that may go unnoticed when IT is not involved. -

Increased Accuracy

The business can make accurate predictions around the costs, timelines, and needs of IT. -

Faster Integration

Faster integration means faster value realization for the business. -

Informed Decision Making

IT leaders hold critical information that can support the business in moving the transaction forward. -

Innovation

IT can suggest new opportunities to generate revenue, optimize processes, or reduce inefficiencies.

The IT executive’s critical role is demonstrated by:

Reduced Risk

47% of senior leaders wish they would have spent more time on IT due diligence to prevent value erosion (IMAA Institute, 2017).Increased Accuracy

Sellers often only provide 15 to 30 days for the acquiring organization to decide (Forbes, 2018), increasing the necessity of accurate pricing.Faster Integration

36% of CIOs have visibility into only business unit data, making the divestment a challenge (EY, 2021).Informed Decision Making

Only 38% of corporate and 22% of private equity firms include IT as a significant aspect in their transaction approach (IMAA Institute, 2017).Innovation

Successful CIOs involved in M&As can spend 70% of their time on aspects outside of IT and 30% of their time on technology and delivery (CIO).

Playbook benefits

IT Benefits

- IT will be seen as an innovative partner to the business, and its suggestions and involvement in the organization will lead to benefits, not hindrances.

- Develop a streamlined method to prepare the IT environment for potential carve-out and separations, ensuring risk management concerns are brought to the business’ attention immediately.

- Create a comprehensive list of items that IT needs to do during the separation that can be prioritized and actioned.

Business Benefits

- The business will get accurate and relevant information about its IT environment in order to sell or divest the company to the highest bidder for a true price.

- Fewer business interruptions will happen, because IT can accurately plan for and execute the high-priority separation tasks.

- The business can obtain a high-value offer for the components of IT being sold and can measure the ongoing value the sale will bring.

Insight summary

Overarching Insight

IT controls if and when it gets invited to support the business through a purchasing growth transaction. Take control of the process, demonstrate the value of IT, and ensure that separation of IT environments does not lead to unnecessary and costly decisions.

Proactive Insight

CIOs on the forefront of digital transformation need to actively look for and suggest opportunities to acquire or partner on new digital capabilities to respond to rapidly changing business needs.

Discovery & Strategy Insight

IT organizations that have an effective M&A program plan are more prepared for the transaction, enabling a successful outcome. A structured strategy is particularly necessary for organizations expected to deliver M&As rapidly and frequently.

Due Diligence & Preparation Insight

IT often faces unnecessary separation challenges because of a lack of preparation. Secure the IT environment and establish how IT will retain employees early in the transaction process.

Execution & Value Realization Insight

IT needs to demonstrate value and cost savings within 100 days of the transaction. The most successful transactions are when IT continuously realizes synergies a year after the transaction and beyond.

Blueprint deliverables

Key Deliverable: M&A Sell Playbook

The M&A Sell Playbook should be a reusable document that enables your IT organization to successfully deliver on any divestiture transaction.

M&A Sell One-Pager

See a one-page overview of each phase of the transaction.

M&A Sell Case Studies

Read a one-page case study for each phase of the transaction.

M&A Separation Project Management Tool (SharePoint)

Manage the separation process of the divestiture/sale using this SharePoint template.

M&A Separation Project Management Tool (Excel)

Manage the separation process of the divestiture/sale using this Excel tool if you can’t or don’t want to use SharePoint.

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit |

Guided Implementation |

Workshop |

Consulting |

| "Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful." | "Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track." | "We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place." | "Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project." |

Diagnostics and consistent frameworks used throughout all four options

Guided Implementation

What does a typical GI on this topic look like?

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is between 6 to 10 calls over the course of 2 to 4 months.

- Call #1: Scope requirements, objectives, and your specific challenges.

- Call #2: Determine stakeholders and business perspectives on IT.

- Call #3: Identify how M&A could support business strategy and how to communicate.

- Call #4: Establish a transaction team and divestiture/sale strategic direction.

- Call #5: Create program metrics and identify a standard separation strategy.

- Call #6: Prepare to carve out the IT environment.

- Call #7: Identify the separation program plan.

- Call #8: Establish employee transitions to retain key staff.

- Call #9: Assess IT’s ability to deliver on the divestiture/sale transaction.

Proactive Phase

Discovery & Strategy Phase

Due Diligence & Preparation Phase

Execution & Value Realization Phase

The Sell Blueprint

Phase 1

Proactive

Phase 1 |

Phase 2 | Phase 3 | Phase 4 |

|

|

|

|

This phase will walk you through the following activities:

- Conduct the CEO-CIO Alignment diagnostic

- Conduct the CIO Business Vision diagnostic

- Visualize relationships among stakeholders to identify key influencers

- Group stakeholders into categories

- Prioritize your stakeholders

- Plan to communicate

- Valuate IT

- Assess the IT/digital strategy

- Determine pain points and opportunities

- Align goals to opportunities

- Recommend reduction opportunities

This phase involves the following participants:

- IT and business leadership

What is the Proactive phase?

Embracing the digital drivers

As the number of merger, acquisition, or divestiture transactions driven by digital means continues to increase, IT has an opportunity to not just be involved in a transaction but actively seek out potential deals.

In the Proactive phase, the business is not currently considering a transaction. However, the business could consider one to reach its strategic goals. IT organizations that have developed respected relationships with the business leaders can suggest these potential transactions.

Understand the business’ perspective of IT, determine who the critical M&A stakeholders are, valuate the IT environment, and examine how it supports the business goals in order to suggest an M&A transaction.

In doing so, IT isn’t waiting to be invited to the transaction table – it’s creating it.

Goal: To support the organization in reaching its strategic goals by suggesting M&A activities that will enable the organization to reach its objectives faster and with greater-value outcomes.

Proactive Prerequisite Checklist

Before coming into the Proactive phase, you should have addressed the following:

- Understand what mergers, acquisitions, and divestitures are.

- Understand what mergers, acquisitions, and divestitures mean for the business.

- Understand what mergers, acquisitions, and divestitures mean for IT.

Review the Executive Brief for more information on mergers, acquisitions, and divestitures for selling organizations.

Proactive

Step 1.1

Identify M&A Stakeholders and Their Perspective of IT

Activities

- 1.1.1 Conduct the CEO-CIO Alignment diagnostic

- 1.1.2 Conduct the CIO Business Vision diagnostic

- 1.1.3 Visualize relationships among stakeholders to identify key influencers

- 1.1.4 Group stakeholders into categories

- 1.1.5 Prioritize your stakeholders

- 1.16 Plan to communicate

This step involves the following participants:

- IT executive leader

- IT leadership

- Critical M&A stakeholders

Outcomes of Step

Understand how the business perceives IT and establish strong relationships with critical M&A stakeholders.

Business executives' perspectives of IT

Leverage diagnostics and gain alignment on IT’s role in the organization

- To suggest or get involved with a merger, acquisition, or divestiture, the IT executive leader needs to be well respected by other members of the executive leadership team and the business.

- Specifically, the Proactive phase relies on the IT organization being viewed as an Innovator within the business.

- Identify how the CEO/business executive currently views IT and where they would like IT to move within the Maturity Ladder.

- Additionally, understand how other critical department leaders view IT and how they view the partnership with IT.

Misalignment in target state requires further communication between the CIO and CEO to ensure IT is striving toward an agreed-upon direction.

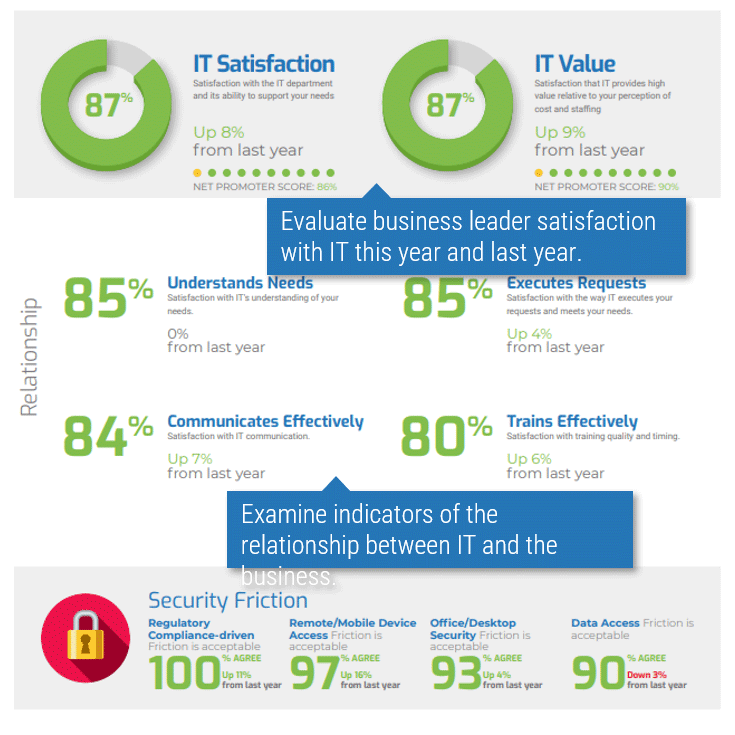

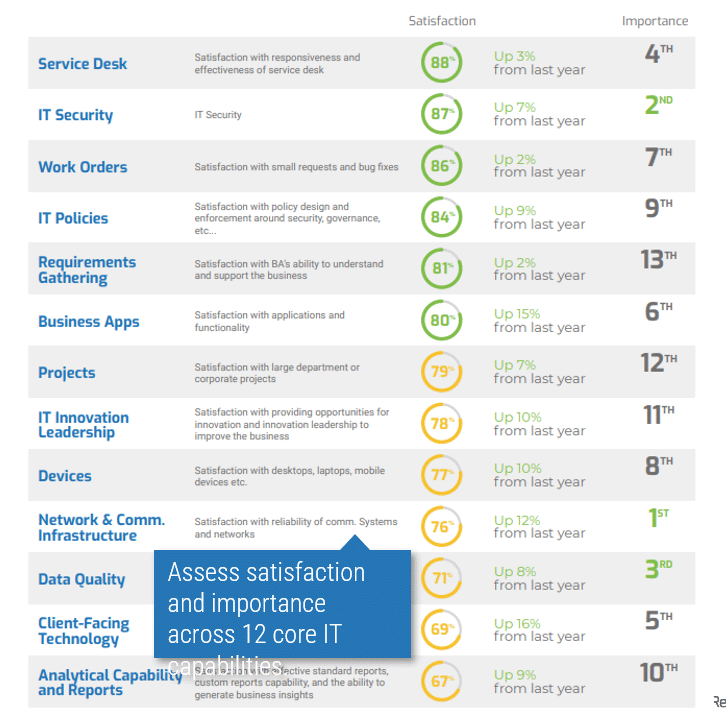

Info-Tech’s CIO Business Vision (CIO BV) diagnostic measures a variety of high-value metrics to provide a well-rounded understanding of stakeholder satisfaction with IT.

Business Satisfaction and Importance for Core Services

The core services of IT are important when determining what IT should focus on. The most important services with the lowest satisfaction offer the largest area of improvement for IT to drive business value.

1.1.1 Conduct the CEO-CIO Alignment diagnostic

2 weeksInput: IT organization expertise and the CEO-CIO Alignment diagnostic

Output: An understanding of an executive business stakeholder’s perception of IT

Materials: M&A Sell Playbook, CEO-CIO Alignment diagnostic

Participants: IT executive/CIO, Business executive/CEO

- The CEO-CIO Alignment diagnostic can be a powerful input. Speak with your Info-Tech account representative to conduct the diagnostic. Use the results to inform current IT capabilities.

- You may choose to debrief the results of your diagnostic with an Info-Tech analyst. We recommend this to help your team understand how to interpret and draw conclusions from the results.

- Examine the results of the survey and note where there might be specific capabilities that could be improved.

- Determine whether there are any areas of significant disagreement between the you and the CEO. Mark down those areas for further conversations. Additionally, take note of areas that could be leveraged to support transactions or support your rationale in recommending transactions.

Download the sample report.

Record the results in the M&A Sell Playbook.

1.1.2 Conduct the CIO Business Vision diagnostic

2 weeks

Input: IT organization expertise, CIO BV diagnostic

Output: An understanding of business stakeholder perception of certain IT capabilities and services

Materials: M&A Buy Playbook, CIO Business Vision diagnostic

Participants: IT executive/CIO, Senior business leaders

- The CIO Business Vision (CIO BV) diagnostic can be a powerful tool for identifying IT capability focus areas. Speak with your account representative to conduct the CIO BV diagnostic. Use the results to inform current IT capabilities.

- You may choose to debrief the results of your diagnostic with an Info-Tech analyst. We recommend this to help your team understand how to interpret the results and draw conclusions from the diagnostic.

- Examine the results of the survey and take note of any IT services that have low scores.

- Read through the diagnostic comments and note any common themes. Especially note which stakeholders identified they have a favorable relationship with IT and which stakeholders identified they have an unfavorable relationship. For those who have an unfavorable relationship, identify if they will have a critical role in a growth transaction.

Download the sample report.

Record the results in the M&A Sell Playbook.

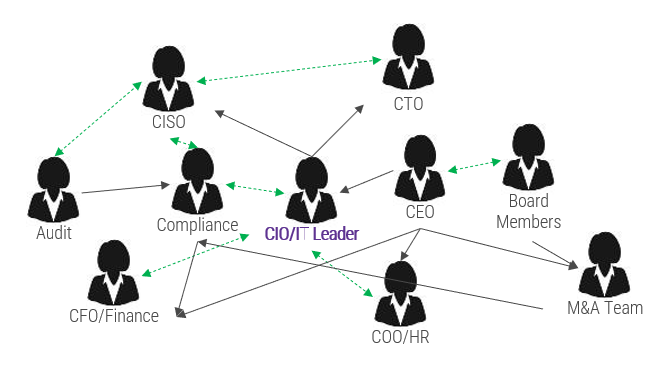

Create a stakeholder network map for M&A transactions

Follow the trail of breadcrumbs from your direct stakeholders to their influencers to uncover hidden stakeholders.

Example:

- Legend

- Black arrows indicate the direction of professional influence

- Dashed green arrows indicate bidirectional, informal influence relationships

Info-Tech Insight

Your stakeholder map defines the influence landscape that the M&A transaction will occur within. This will identify who holds various levels of accountability and decision-making authority when a transaction does take place.

Use connectors to determine who may be influencing your direct stakeholders. They may not have any formal authority within the organization, but they may have informal yet substantial relationships with your stakeholders.

1.1.3 Visualize relationships among stakeholders to identify key influencers

1-3 hours

Input: List of M&A stakeholders

Output: Relationships among M&A stakeholders and influencers

Materials: Flip charts, Markers, Sticky notes, M&A Sell Playbook

Participants: IT executive leadership

- The purpose of this activity is to list all the stakeholders within your organization that will have a direct or indirect impact on the M&A transaction.

- Determine the critical stakeholders, and then determine the stakeholders of your stakeholders and consider adding each of them to the stakeholder list.

- Assess who has either formal or informal influence over your stakeholders; add these influencers to your stakeholder list.

- Construct a diagram linking stakeholders and their influencers together.

- Use black arrows to indicate the direction of professional influence.

- Use dashed green arrows to indicate bidirectional, informal influence relationships.

Record the results in the M&A Sell Playbook.

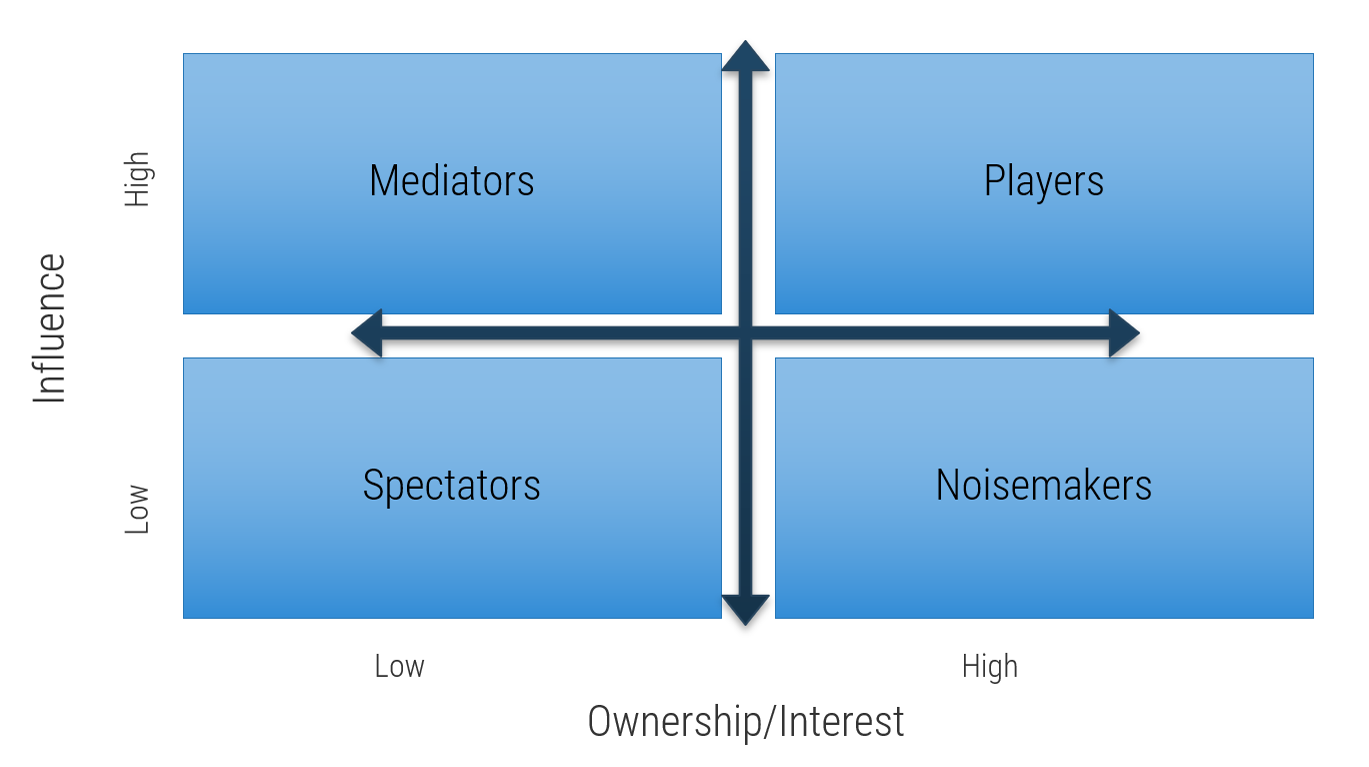

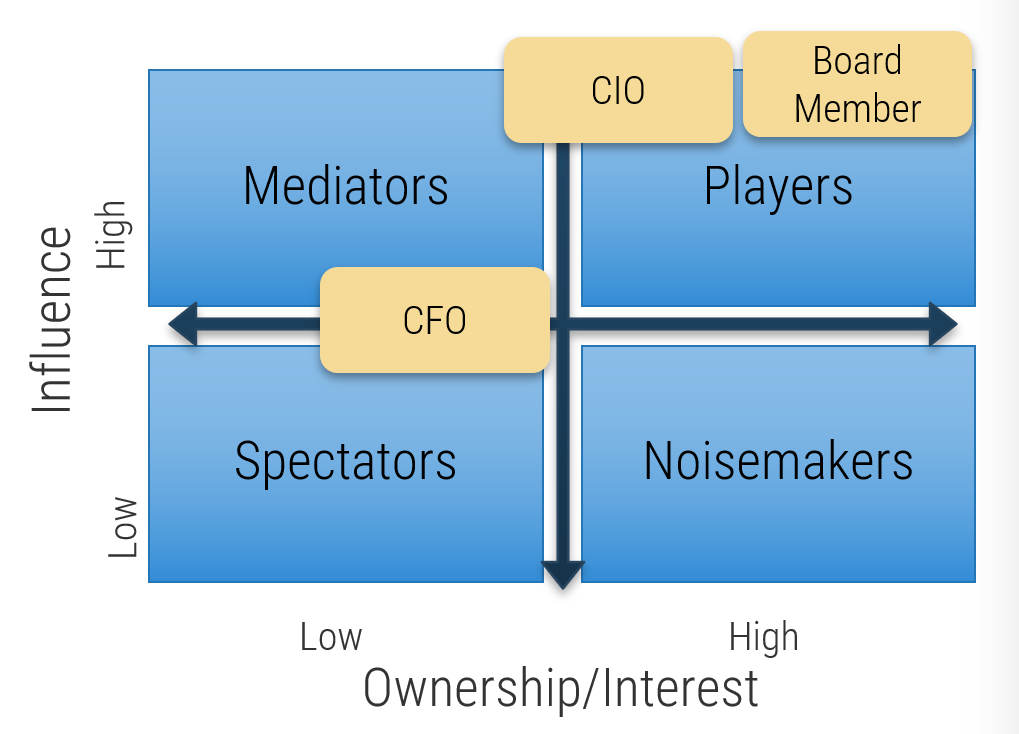

Categorize your stakeholders with a prioritization map

A stakeholder prioritization map helps IT leaders categorize their stakeholders by their level of influence and ownership in the merger, acquisition, or divestiture process.

There are four areas in the map, and the stakeholders within each area should be treated differently.

Players – players have a high interest in the initiative and the influence to effect change over the initiative. Their support is critical, and a lack of support can cause significant impediment to the objectives.

Mediators – mediators have a low interest but significant influence over the initiative. They can help to provide balance and objective opinions to issues that arise.

Noisemakers – noisemakers have low influence but high interest. They tend to be very vocal and engaged, either positively or negatively, but have little ability to enact their wishes.

Spectators – generally, spectators are apathetic and have little influence over or interest in the initiative.

1.1.4 Group stakeholders into categories

30 minutes

Input: Stakeholder map, Stakeholder list

Output: Categorization of stakeholders and influencers

Materials: Flip charts, Markers, Sticky notes, M&A Sell Playbook

Participants: IT executive leadership, Stakeholders

- Identify your stakeholders’ interest in and influence on the M&A process as high, medium, or low by rating the attributes below.

- Map your results to the model to the right to determine each stakeholder’s category.

Level of Influence

- Power: Ability of a stakeholder to effect change.

- Urgency: Degree of immediacy demanded.

- Legitimacy: Perceived validity of stakeholder’s claim.

- Volume: How loud their “voice” is or could become.

- Contribution: What they have that is of value to you.

Level of Interest

How much are the stakeholder’s individual performance and goals directly tied to the success or failure of the product?

Record the results in the M&A Sell Playbook.

Prioritize your stakeholders

There may be too many stakeholders to be able to manage them all. Focus your attention on the stakeholders that matter most.

| Level of Support | |||||

Supporter |

Evangelist |

Neutral |

Blocker |

||

| Stakeholder Category | Player | Critical | High | High | Critical |

| Mediator | Medium | Low | Low | Medium | |

| Noisemaker | High | Medium | Medium | High | |

| Spectator | Low | Irrelevant | Irrelevant | Low |

Consider the three dimensions for stakeholder prioritization: influence, interest, and support. Support can be determined by answering the following question: How significant is that stakeholder to the M&A or divestiture process?

These parameters are used to prioritize which stakeholders are most important and should receive your focused attention.

1.1.5 Prioritize your stakeholders

30 minutes

Input: Stakeholder matrix

Output: Stakeholder and influencer prioritization

Materials: Flip charts, Markers, Sticky notes, M&A Sell Playbook

Participants: IT executive leadership, M&A/divestiture stakeholders

- Identify the level of support of each stakeholder by answering the following question: How significant is that stakeholder to the M&A transaction process?

- Prioritize your stakeholders using the prioritization scheme on the previous slide.

Stakeholder |

Category |

Level of Support |

Prioritization |

| CMO | Spectator | Neutral | Irrelevant |

| CIO | Player | Supporter | Critical |

Record the results in the M&A Sell Playbook.

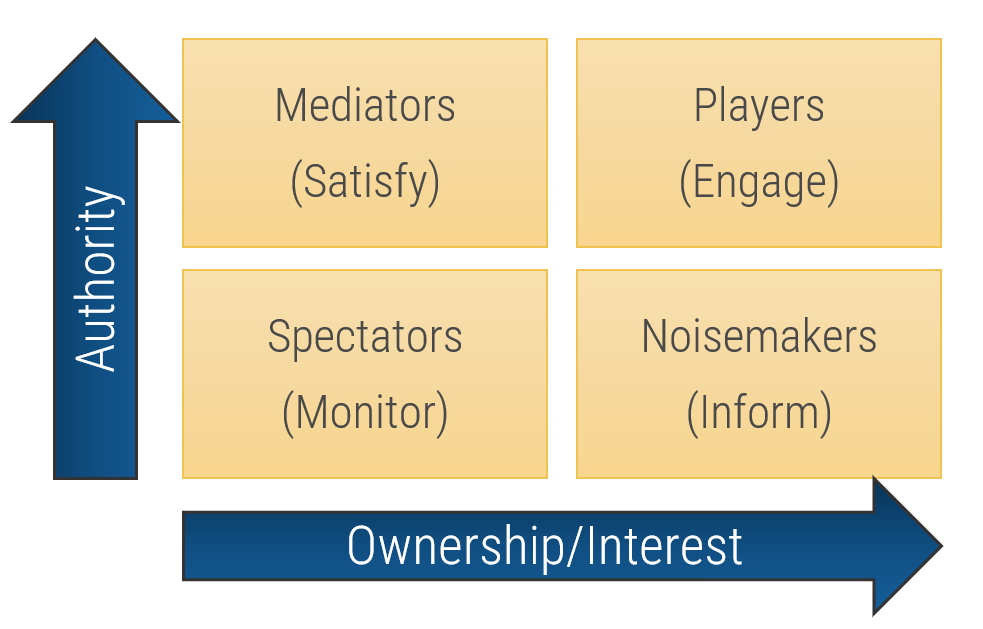

Define strategies for engaging stakeholders by type

Type |

Quadrant |

Actions |

| Players | High influence, high interest – actively engage | Keep them updated on the progress of the project. Continuously involve Players in the process and maintain their engagement and interest by demonstrating their value to its success. |

| Mediators | High influence, low interest – keep satisfied | They can be the game changers in groups of stakeholders. Turn them into supporters by gaining their confidence and trust and including them in important decision-making steps. In turn, they can help you influence other stakeholders. |

| Noisemakers | Low influence, high interest – keep informed | Try to increase their influence (or decrease it if they are detractors) by providing them with key information, supporting them in meetings, and using Mediators to help them. |

| Spectators | Low influence, low interest – monitor | They are followers. Keep them in the loop by providing clarity on objectives and status updates. |

Info-Tech Insight

Each group of stakeholders draws attention and resources away from critical tasks. By properly identifying stakeholder groups, the IT executive leader can develop corresponding actions to manage stakeholders in each group. This can dramatically reduce wasted effort trying to satisfy Spectators and Noisemakers while ensuring the needs of Mediators and Players are met.

1.1.6 Plan to communicate

30 minutes

Input: Stakeholder priority, Stakeholder categorization, Stakeholder influence

Output: Stakeholder communication plan

Materials: Flip charts, Markers, Sticky notes, M&A Sell Playbook

Participants: IT executive leadership, M&A/divestiture stakeholders

The purpose of this activity is to make a communication plan for each of the stakeholders identified in the previous activities, especially those who will have a critical role in the M&A transaction process.

- In the M&A Sell Playbook, input the type of influence each stakeholder has on IT, how they would be categorized in the M&A process, and their level of priority. Use this information to create a communication plan.

- Determine the methods and frequency of communication to keep the necessary stakeholder satisfied and maintain or enhance IT’s profile within the organization.

Record the results in the M&A Sell Playbook.

Proactive

Step 1.2

Assess IT’s Current Value and Method to Achieve a Future State

Activities

- 1.2.1 Valuate IT

- 1.2.2 Assess the IT/digital strategy

This step involves the following participants:

- IT executive leader

- IT leadership

- Critical stakeholders to M&A

Outcomes of Step

Identify critical opportunities to optimize IT and meet strategic business goals through a merger, acquisition, or divestiture.

How to valuate your IT environment

And why it matters so much

- Valuating your current organization’s IT environment is a critical step that all IT organizations should take, whether involved in an M&A or not, to fully understand what it might be worth.

- The business investments in IT can be directly translated into a value amount. For every $1 invested in IT, the business might be gaining $100 in value back or possibly even loosing $100.

- Determining, documenting, and communicating this information ensures that the business takes IT’s suggestions seriously and recognizes why investing in IT is so critical.

- There are three ways a business or asset can be valuated:

- Cost Approach: Look at the costs associated with building, purchasing, replacing, and maintaining a given aspect of the business.

- Market Approach: Look at the relative value of a particular aspect of the business. Relative value can fluctuate and depends on what the markets and consequently society believe that particular element is worth.

- Discounted Cash Flow Approach: Focus on what the potential value of the business could be or the intrinsic value anticipated due to future profitability.

(Source: “Valuation Methods,” Corporate Finance Institute)

Four ways to create value through digital

- Reduced costs

- Improved customer experience

- New revenue sources

- Better decision making (Source: McKinsey & Company)

1.2.1 Valuate IT

1 day

Input: Valuation of data, Valuation of applications, Valuation of infrastructure and operations, Valuation of security and risk

Output: Valuation of IT

Materials: Relevant templates/tools listed on the following slides, Capital budget, Operating budget, M&A Sell Playbook

Participants: IT executive/CIO, IT senior leadership

The purpose of this activity is to demonstrate that IT is not simply an operational functional area that diminishes business resources. Rather, IT contributes significant value to the business.

- Review each of the following slides to valuate IT’s data, applications, infrastructure and operations, and security and risk. These valuations consider several tangible and intangible factors and result in a final dollar amount.

- Input the financial amounts identified for each critical area into a summary slide. Use this information to determine where IT is delivering value to the organization.

Info-Tech Insight

Consistency is key when valuating your IT organization as well as other IT organizations throughout the transaction process.

Record the results in the M&A Sell Playbook.

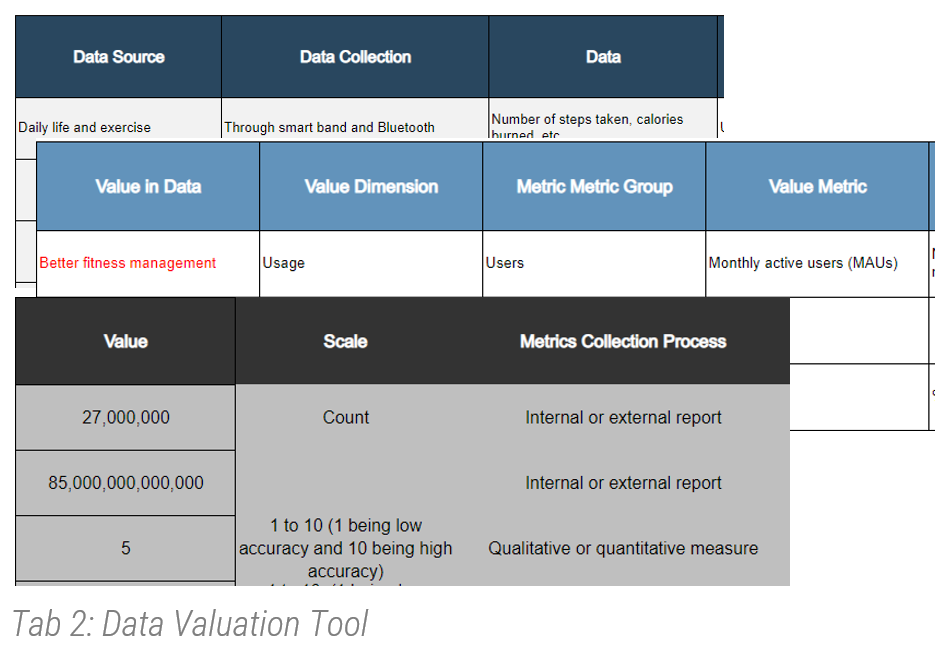

Data valuation

Data valuation identifies how you monetize the information that your organization owns.

Create a data value chain for your organization

When valuating the information and data that exists in an organization, there are many things to consider.

Info-Tech has two tools that can support this process:

- Information Asset Audit Tool: Use this tool first to take inventory of the different information assets that exist in your organization.

- Data Valuation Tool: Once information assets have been accounted for, valuate the data that exists within those information assets.

Data Collection |

Insight Creation |

Value Creation |

Data Valuation |

| 01 Data Source

02 Data Collection Method 03 Data |

04 Data Analysis

05 Insight 06 Insight Delivery |

07 Consumer

08 Value in Data |

09 Value Dimension

10 Value Metrics Group 11 Value Metrics |

Instructions

- Using the Data Valuation Tool, start gathering information based on the eight steps above to understand your organization’s journey from data to value.

- Identify the data value spectrum. (For example: customer sales service, citizen licensing service, etc.)

- Fill out the columns for data sources, data collection, and data first.

- Capture data analysis and related information.

- Then capture the value in data.

- Add value dimensions such as usage, quality, and economic dimensions.

- Remember that economic value is not the only dimension, and usage/quality has a significant impact on economic value.

- Collect evidence to justify your data valuation calculator (market research, internal metrics, etc.).

- Finally, calculate the value that has a direct correlation with underlying value metrics.

Application valuation

Calculate the value of your IT applications

When valuating the applications and their users in an organization, consider using a business process map. This shows how business is transacted in the company by identifying which IT applications support these processes and which business groups have access to them. Info-Tech has a business process mapping tool that can support this process:

- Enterprise Integration Process Mapping Tool: Complete this tool first to map the different business processes to the supporting applications in your organization.

Instructions

- Start by calculating user costs. This is the multiplication of: (# of users) × (% of time spent using IT) × (fully burdened salary).

- Identify the revenue per employee and divide that by the average cost per employee to calculate the derived productivity ratio (DPR).

- Once you have calculated the user costs and DPR, multiply those total values together to get the application value.

- Once the total application value is established, calculate the combined IT and business costs of delivering that value. IT and business costs include inflexibility (application maintenance), unavailability (downtime costs, including disaster exposure), IT costs (common costs statistically allocated to applications), and fully loaded cost of active (full-time equivalent [FTE]) users.

- Calculate the net value of applications by subtracting the total IT and business costs from the total application value calculated in step 3.

User Costs |

Total User Costs |

Derived Productivity Ratio (DPR) |

Total DPR |

Application Value |

|||

| # of users | % time spent using IT | Fully burdened salary | Multiply values from the 3 user costs columns | Revenue per employee | Average cost per employee | (Revenue P.E) ÷ (Average cost P.E) | (User costs) X (DPR) |

IT and Business Costs |

Total IT and Business Costs |

Net Value of Applications |

|||

| Application maintenance | Downtime costs (include disaster exposure) | Common costs allocated to applications | Fully loaded costs of active (FTE) users | Sum of values from the four IT and business costs columns | (Application value) – (IT and business costs) |

(Source: CSO)

Infrastructure valuation

Assess the foundational elements of the business’ information technology

The purpose of this exercise is to provide a high-level infrastructure valuation that will contribute to valuating your IT environment.

Calculating the value of the infrastructure will require different methods depending on the environment. For example, a fully cloud-hosted organization will have different costs than a fully on-premises IT environment.

Instructions:

- Start by listing all of the infrastructure-related items that are relevant to your organization.

- Once you have finalized your items column, identify the total costs/value of each item.

- For example, total software costs would include servers and storage.

- Calculate the total cost/value of your IT infrastructure by adding all of values in the right column.

Item |

Costs/Value |

| Hardware Assets Total Value | +$3.2 million |

| Hardware Leased/Service Agreement | -$ |

| Software Purchased | +$ |

| Software Leased/Service Agreement | -$ |

| Operational Tools | |

| Network | |

| Disaster Recovery | |

| Antivirus | |

| Data Centers | |

| Service Desk | |

| Other Licenses | |

| Total: |

For additional support, download the M&A Runbook for Infrastructure and Operations.

Risk and security

Assess risk responses and calculate residual risk

The purpose of this exercise is to provide a high-level risk assessment that will contribute to valuating your IT environment. For a more in-depth risk assessment, please refer to the Info-Tech tools below:

- Risk Register Tool

- Security M&A Due Diligence Tool

Instructions

- Review the probability and impact scales below and ensure you have the appropriate criteria that align to your organization before you conduct a risk assessment.

- Identify the probability of occurrence and estimated financial impact for each risk category detail and fill out the table on the right. Customize the table as needed so it aligns to your organization.

Probability of Risk Occurrence |

Occurrence Criteria

|

| Negligible | Very Unlikely; ‹20% |

| Very Low | Unlikely; 20 to 40% |

| Low | Possible; 40 to 60% |

| Moderately Low | Likely; 60 to 80% |

| Moderate | Almost Certain; ›80% |

Note: If needed, you can customize this scale with the severity designations that you prefer. However, make sure you are always consistent with it when conducting a risk assessment.

Financial & Reputational Impact |

Budgetary and Reputational Implications

|

| Negligible | (‹$10,000; Internal IT stakeholders aware of risk event occurrence) |

| Very Low | ($10,000 to $25,000; Business customers aware of risk event occurrence) |

| Low | ($25,000 to $50,000; Board of directors aware of risk event occurrence) |

| Moderately Low | ($50,000 to $100,000; External customers aware of risk event occurrence) |

| Moderate | (›$100,000; Media coverage or regulatory body aware of risk event occurrence) |

Risk Category Details |

Probability of Occurrence |

Estimated Financial Impact |

Estimated Severity (Probability X Impact) |

| Capacity Planning | |||

| Enterprise Architecture | |||

| Externally Originated Attack | |||

| Hardware Configuration Errors | |||

| Hardware Performance | |||

| Internally Originated Attack | |||

| IT Staffing | |||

| Project Scoping | |||

| Software Implementation Errors | |||

| Technology Evaluation and Selection | |||

| Physical Threats | |||

| Resource Threats | |||

| Personnel Threats | |||

| Technical Threats | |||

| Total: |

1.2.2 Assess the IT/digital strategy

4 hours

Input: IT strategy, Digital strategy, Business strategy

Output: An understanding of an executive business stakeholder’s perception of IT, Alignment of IT/digital strategy and overall organization strategy

Materials: Computer, Whiteboard and markers, M&A Sell Playbook

Participants: IT executive/CIO, Business executive/CEO

The purpose of this activity is to review the business and IT strategies that exist to determine if there are critical capabilities that are not being supported.

Ideally, the IT and digital strategies would have been created following development of the business strategy. However, sometimes the business strategy does not directly call out the capabilities it requires IT to support.

- On the left half of the corresponding slide in the M&A Sell Playbook, document the business goals, initiatives, and capabilities. Input this information from the business or digital strategies. (If more space for goals, initiatives, or capabilities is needed, duplicate the slide).

- On the other half of the slide, document the IT goals, initiatives, and capabilities. Input this information from the IT strategy and digital strategy.

For additional support, see Build a Business-Aligned IT Strategy.

Record the results in the M&A Sell Playbook.

Proactive

Step 1.3

Drive Innovation and Suggest Growth Opportunities

Activities

- 1.3.1 Determine pain points and opportunities

- 1.3.2 Align goals with opportunities

- 1.3.3 Recommend reduction opportunities

This step involves the following participants:

- IT executive leader

- IT leadership

- Critical M&A stakeholders

Outcomes of Step

Establish strong relationships with critical M&A stakeholders and position IT as an innovative business partner that can suggest reduction opportunities.

1.3.1 Determine pain points and opportunities

1-2 hours

Input: CEO-CIO Alignment diagnostic, CIO Business Vision diagnostic, Valuation of IT environment, IT-business goals cascade

Output: List of pain points or opportunities that IT can address

Materials: Computer, Whiteboard and markers, M&A Sell Playbook

Participants: IT executive/CIO, IT senior leadership, Business stakeholders

The purpose of this activity is to determine the pain points and opportunities that exist for the organization. These can be external or internal to the organization.

- Identify what opportunities exist for your organization. Opportunities are the potential positives that the organization would want to leverage.

- Next, identify pain points, which are the potential negatives that the organization would want to alleviate.

- Spend time considering all the options that might exist, and keep in mind what has been identified previously.

Opportunities and pain points can be trends, other departments’ initiatives, business perspectives of IT, etc.

Record the results in the M&A Sell Playbook.

1.3.2 Align goals with opportunities

1-2 hours

Input: CEO-CIO Alignment diagnostic, CIO Business Vision diagnostic, Valuation of IT environment, IT-business goals cascade, List of pain points and opportunities

Output: An understanding of an executive business stakeholder’s perception of IT, Foundations for reduction strategy

Materials: Computer, Whiteboard and markers, M&A Sell Playbook

Participants: IT executive/CIO, IT senior leadership, Business stakeholders

The purpose of this activity is to determine whether a growth or separation strategy might be a good suggestion to the business in order to meet its business objectives.

- For the top three to five business goals, consider:

- Underlying drivers

- Digital opportunities

- Whether a growth or reduction strategy is the solution

- Just because a growth or reduction strategy is a solution for a business goal does not necessarily indicate M&A is the way to go. However, it is important to consider before you pursue suggesting M&A.

Record the results in the M&A Sell Playbook.

1.3.3 Recommend reduction opportunities

1-2 hours

Input: Growth or separation strategy opportunities to support business goals, Stakeholder communication plan, Rationale for the suggestion

Output: M&A transaction opportunities suggested

Materials: M&A Sell Playbook

Participants: IT executive/CIO, Business executive/CEO

The purpose of this activity is to recommend a merger, acquisition, or divestiture to the business.

- Identify which of the business goals the transaction would help solve and why IT is the one to suggest such a goal.

- Leverage the stakeholder communication plan identified previously to give insight into stakeholders who would have a significant level of interest, influence, or support in the process.

Info-Tech Insight

With technology and digital driving many transactions, leverage your organizations’ IT environment as an asset and reason why the divestiture or sale should happen, suggesting the opportunity yourself.

Record the results in the M&A Sell Playbook.

By the end of this Proactive phase, you should:

Be prepared to suggest M&A opportunities to support your company’s goals through sale or divestiture transactions

Key outcome from the Proactive phase

Develop progressive relationships and strong communication with key stakeholders to suggest or be aware of transformational opportunities that can be achieved through sale or divestiture strategies.

Key deliverables from the Proactive phase

- Business perspective of IT examined

- Key stakeholders identified and relationship to the M&A process outlined

- Ability to valuate the IT environment and communicate IT’s value to the business

- Assessment of the business, digital, and IT strategies and how M&As could support those strategies

- Pain points and opportunities that could be alleviated or supported through an M&A transaction

- Sale or divestiture recommendations

The Sell Blueprint

Phase 2

Discovery & Strategy

| Phase 1 | Phase 2 | Phase 3 | Phase 4 |

|

|

|

|

This phase will walk you through the following activities:

- Create the mission and vision

- Identify the guiding principles

- Create the future-state operating model

- Determine the transition team

- Document the M&A governance

- Create program metrics

- Establish the separation strategy

- Conduct a RACI

- Create the communication plan

- Assess the potential organization(s)

This phase involves the following participants:

- IT executive/CIO

- IT senior leadership

- Company M&A team

Workshop Overview

Contact your account representative for more information.

workshops@infotech.com 1-888-670-8889

Pre-Work | Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | |

| Establish the Transaction Foundation | Discover the Motivation for Divesting or Selling | Formalize the Program Plan | Create the Valuation Framework | Strategize the Transaction | Next Steps and Wrap-Up (offsite) | |

Activities |

|

|

|

|

|

|

Deliverables |

|

|

|

|

|

|

What is the Discovery & Strategy phase?

Pre-transaction state

The Discovery & Strategy phase during a sale or divestiture is a unique opportunity for many IT organizations. IT organizations that can participate in the transaction at this stage are likely considered a strategic partner of the business.

For one-off sales/divestitures, IT being invited during this stage of the process is rare. However, for organizations that are preparing to engage in many divestitures over the coming years, this type of strategy will greatly benefit from IT involvement. Again, the likelihood of participating in an M&A transaction is increasing, making it a smart IT leadership decision to, at the very least, loosely prepare a program plan that can act as a strategic pillar throughout the transaction.

During this phase of the pre-transaction state, IT may be asked to participate in ensuring that the IT environment is able to quickly and easily carve out components/business lines and deliver on service-level agreements (SLAs).

Goal: To identify a repeatable program plan that IT can leverage when selling or divesting all or parts of the current IT environment, ensuring customer satisfaction and business continuity

Discovery & Strategy Prerequisite Checklist

Before coming into the Discovery & Strategy phase, you should have addressed the following:

- Understand the business perspective of IT.

- Know the key stakeholders and have outlined their relationship to the M&A process.

- Be able to valuate the IT environment and communicate IT's value to the business.

- Understand the rationale for the company's decision to pursue a sale or divestiture and the opportunities or pain points the sale should address.

Discovery & Strategy

Step 2.1

Establish the M&A Program Plan

Activities

- 2.1.1 Create the mission and vision

- 2.1.2 Identify the guiding principles

- 2.1.3 Create the future-state operating model

- 2.1.4 Determine the transition team

- 2.1.5 Document the M&A governance

- 2.1.6 Create program metrics

This step involves the following participants:

- IT executive/CIO

- IT senior leadership

- Company M&A team

Outcomes of Step

Establish an M&A program plan that can be repeated across sales/divestitures.

The vision and mission statements clearly articulate IT’s aspirations and purpose

The IT vision statement communicates a desired future state of the IT organization, whereas the IT mission statement portrays the organization’s reason for being. While each serves its own purpose, they should both be derived from the business context implications for IT.

Vision Statements |

Mission Statements |

|

Characteristics |

|

|

Samples |

To be a trusted advisor and partner in enabling business innovation and growth through an engaged IT workforce. (Source: Business News Daily) | IT is a cohesive, proactive, and disciplined team that delivers innovative technology solutions while demonstrating a strong customer-oriented mindset. (Source: Forbes, 2013) |

2.1.1 Create the mission and vision statements

2 hours

Input: Business objectives, IT capabilities, Rationale for the transaction

Output: IT’s mission and vision statements for reduction strategies tied to mergers, acquisitions, and divestitures

Materials: Flip charts/whiteboard, Markers, M&A Sell Playbook

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to create mission and vision statements that reflect IT’s intent and method to support the organization as it pursues a reduction strategy.

- Review the definitions and characteristics of mission and vision statements.

- Brainstorm different versions of the mission and vision statements.

- Edit the statements until you get to a single version of each that accurately reflects IT’s role in the reduction process.

Record the results in the M&A Sell Playbook.

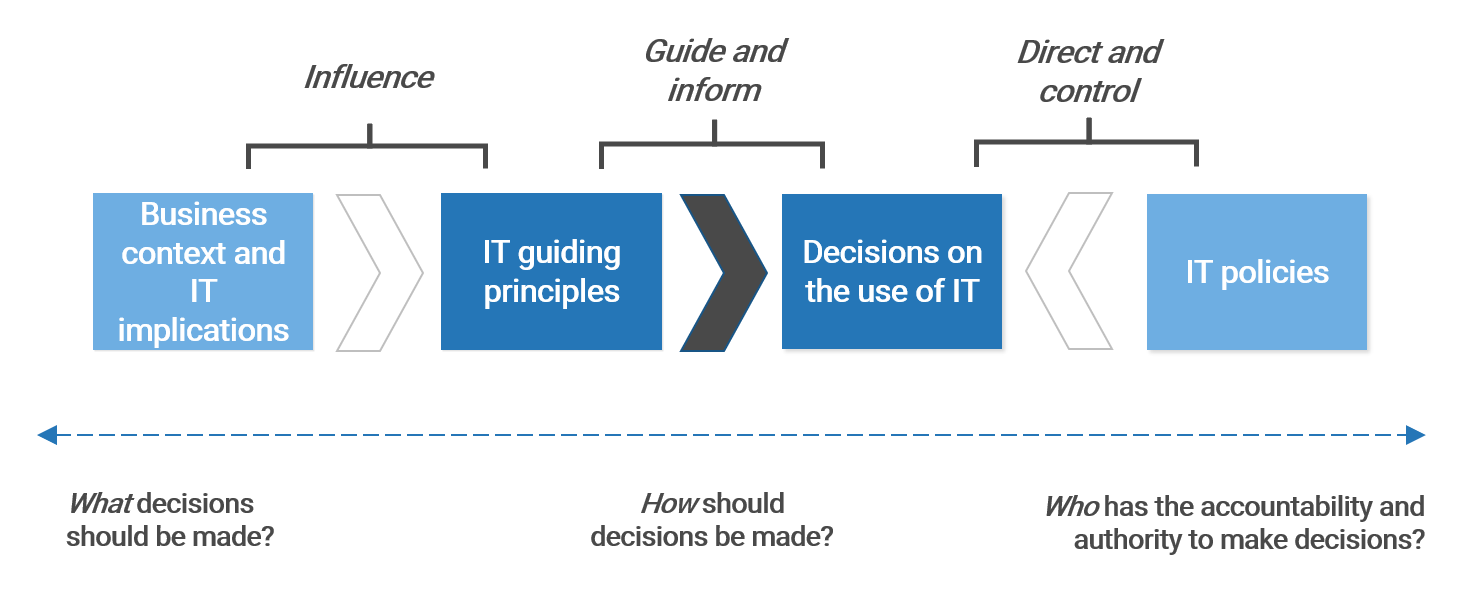

Guiding principles provide a sense of direction

IT guiding principles are shared, long-lasting beliefs that guide the use of IT in constructing, transforming, and operating the enterprise by informing and restricting IT investment portfolio management, solution development, and procurement decisions.

IT principles must be carefully constructed to make sure they are adhered to and relevant

Info-Tech has identified a set of characteristics that IT principles should possess. These characteristics ensure the IT principles are relevant and followed in the organization.

Approach focused. IT principles should be focused on the approach – how the organization is built, transformed, and operated – as opposed to what needs to be built, which is defined by both functional and non-functional requirements.

Business relevant. Create IT principles that are specific to the organization. Tie IT principles to the organization’s priorities and strategic aspirations.

Long lasting. Build IT principles that will withstand the test of time.

Prescriptive. Inform and direct decision making with actionable IT principles. Avoid truisms, general statements, and observations.

Verifiable. If compliance can’t be verified, people are less likely to follow the principle.

Easily Digestible. IT principles must be clearly understood by everyone in IT and by business stakeholders. IT principles aren’t a secret manuscript of the IT team. IT principles should be succinct; wordy principles are hard to understand and remember.

Followed. Successful IT principles represent a collection of beliefs shared among enterprise stakeholders. IT principles must be continuously communicated to all stakeholders to achieve and maintain buy-in.

In organizations where formal policy enforcement works well, IT principles should be enforced through appropriate governance processes.

Consider the example principles below

IT Principle Name |

IT Principle Statement |

| 1. Risk Management | We will ensure that the organization’s IT Risk Management Register is properly updated to reflect all potential risks and that a plan of action against those risks has been identified. |

| 2. Transparent Communication | We will ensure employees are spoken to with respect and transparency throughout the transaction process. |

| 3. Separation for Success | We will create a carve-out strategy that enables the organization and clearly communicates the resources required to succeed. |

| 4. Managed Data | We will handle data creation, modification, separation, and use across the enterprise in compliance with our data governance policy. |

| 5.Deliver Better Customer Service | We will reduce the number of products offered by IT, enabling a stronger focus on specific products or elements to increase customer service delivery. |

| 6. Compliance With Laws and Regulations | We will operate in compliance with all applicable laws and regulations for both our organization and the potentially purchasing organization. |

| 7. Defined Value | We will create a plan of action that aligns with the organization’s defined value expectations. |

| 8. Network Readiness | We will ensure that employees and customers have immediate access to the network with minimal or no outages. |

| 9. Value Generator | We will leverage the current IT people, processes, and technology to turn the IT organization into a value generator by developing and selling our services to purchasing organizations. |

2.1.2 Identify the guiding principles

2 hours

Input: Business objectives, IT capabilities, Rationale for the transaction, Mission and vision statements

Output: IT’s guiding principles for reduction strategies tied to mergers, acquisitions, and divestitures

Materials: Flip charts/whiteboard, Markers, M&A Sell Playbook

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to create the guiding principles that will direct the IT organization throughout the reduction strategy process.

- Review the role of guiding principles and the examples of guiding principles that organizations have used.

- Brainstorm different versions of the guiding principles. Each guiding principle should start with the phrase “We will…”

- Edit and consolidate the statements until you have a list of approximately eight to ten statements that accurately reflect IT’s role in the reduction process.

- Review the guiding principles every six months to ensure they continue to support the delivery of the business’ reduction strategy goals.

Record the results in the M&A Sell Playbook.

Create two IT teams to support the transaction

IT M&A Transaction Team

- The IT M&A Transaction Team should consist of the strongest members of the IT team who can be expected to deliver on unusual or additional tasks not asked of them in normal day-to-day operations.

- The roles selected for this team will have very specific skills sets or deliver on critical separation capabilities, making their involvement in the combination of two or more IT environments paramount.

- These individuals need to have a history of proving themselves very trustworthy, as they will likely be required to sign an NDA as well.

- Expect to have to certain duplicate capabilities or roles across the M&A Team and Operational Team.

IT Operational Team

- This group is responsible for ensuring the business operations continue.

- These employees might be those who are newer to the organization but can be counted on to deliver consistent IT services and products.

- The roles of this team should ensure that end users or external customers remain satisfied.

Key capabilities to support M&A

Consider the following capabilities when looking at who should be a part of the IT Transaction Team.

Employees who have a significant role in ensuring that these capabilities are being delivered will be a top priority.

Infrastructure & Operations

- System Separation

- Data Management

- Helpdesk/Desktop Support

- Cloud/Server Management

Business Focus

- Service-Level Management

- Enterprise Architecture

- Stakeholder Management

- Project Management

Risk & Security

- Privacy Management

- Security Management

- Risk & Compliance Management

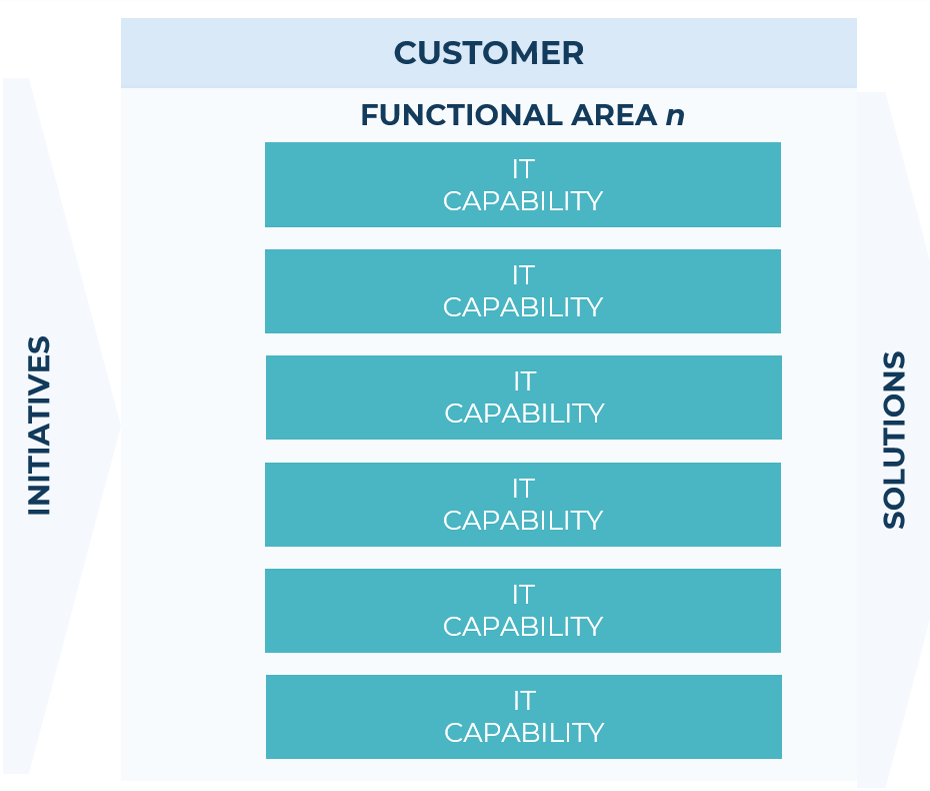

Build a lasting and scalable operating model

An operating model is an abstract visualization, used like an architect’s blueprint, that depicts how structures and resources are aligned and integrated to deliver on the organization’s strategy.

It ensures consistency of all elements in the organizational structure through a clear and coherent blueprint before embarking on detailed organizational design.

The visual should highlight which capabilities are critical to attaining strategic goals and clearly show the flow of work so that key stakeholders can understand where inputs flow in and outputs flow out of the IT organization.

As you assess the current operating model, consider the following:

- Does the operating model contain all the necessary capabilities your IT organization requires to be successful?

- What capabilities should be duplicated?

- Are there individuals with the skill set to support those roles? If not, is there a plan to acquire or develop those skills?

- A dedicated project team strictly focused on M&A is great. However, is it feasible for your organization? If not, what blockers exist?

Info-Tech Insight

Investing time up-front getting the operating model right is critical. This will give you a framework to rationalize future organizational changes, allowing you to be more iterative and allowing your model to change as the business changes.

2.1.3 Create the future-state operating model

4 hours

Input: Current operating model, IT strategy, IT capabilities, M&A-specific IT capabilities, Business objectives, Rationale for the transaction, Mission and vision statements

Output: Future-state operating model for divesting organizations

Materials: Operating model, Capability overlay, Flip charts/whiteboard, Markers, M&A Sell Playbook

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to establish what the future-state operating model will be if your organization needs to adjust to support a divestiture transaction. If your organization plans to sell in its entirety, you may choose to skip this activity.

- Ensuring that all the IT capabilities are identified by the business and IT strategy, document your organization’s current operating model.

- Identify what core capabilities would be critical to the divesting transaction process and separation. Highlight and make copies of those capabilities in the M&A Sell Playbook. As a result of divesting, there may also be capabilities that will become irrelevant in your future state.

- Ensure the capabilities that will be decentralized are clearly identified. Decentralized capabilities do not exist within the central IT organization but rather in specific lines of businesses, products, or locations to better understand needs and deliver on the capability.

An example operating model is included in the M&A Sell Playbook. This process benefits from strong reference architecture and capability mapping ahead of time.

Record the results in the M&A Sell Playbook.

2.1.4 Determine the transition team

3 hoursInput: IT capabilities, Future-state operating model, M&A-specific IT capabilities, Business objectives, Rationale for the transaction, Mission and vision statements

Output: Transition team

Materials: Reference architecture, Organizational structure, Flip charts/whiteboard, Markers

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to create a team that will support your IT organization throughout the transaction. Determining which capabilities and therefore which roles will be required ensures that the business will continue to get the operational support it needs.

- Based on the outcome of activity 2.1.3, review the capabilities that your organization will require on the transition team. Group capabilities into functional groups containing capabilities that are aligned well with one another because they have similar responsibilities and functionalities.

- Replace the capabilities with roles. For example, stakeholder management, requirements gathering, and project management might be one functional group. Project management and stakeholder management might combine to create a project manager role.

- Review the examples in the M&A Sell Playbook and identify which roles will be a part of the transition team.

For more information, see Redesign Your Organizational Structure

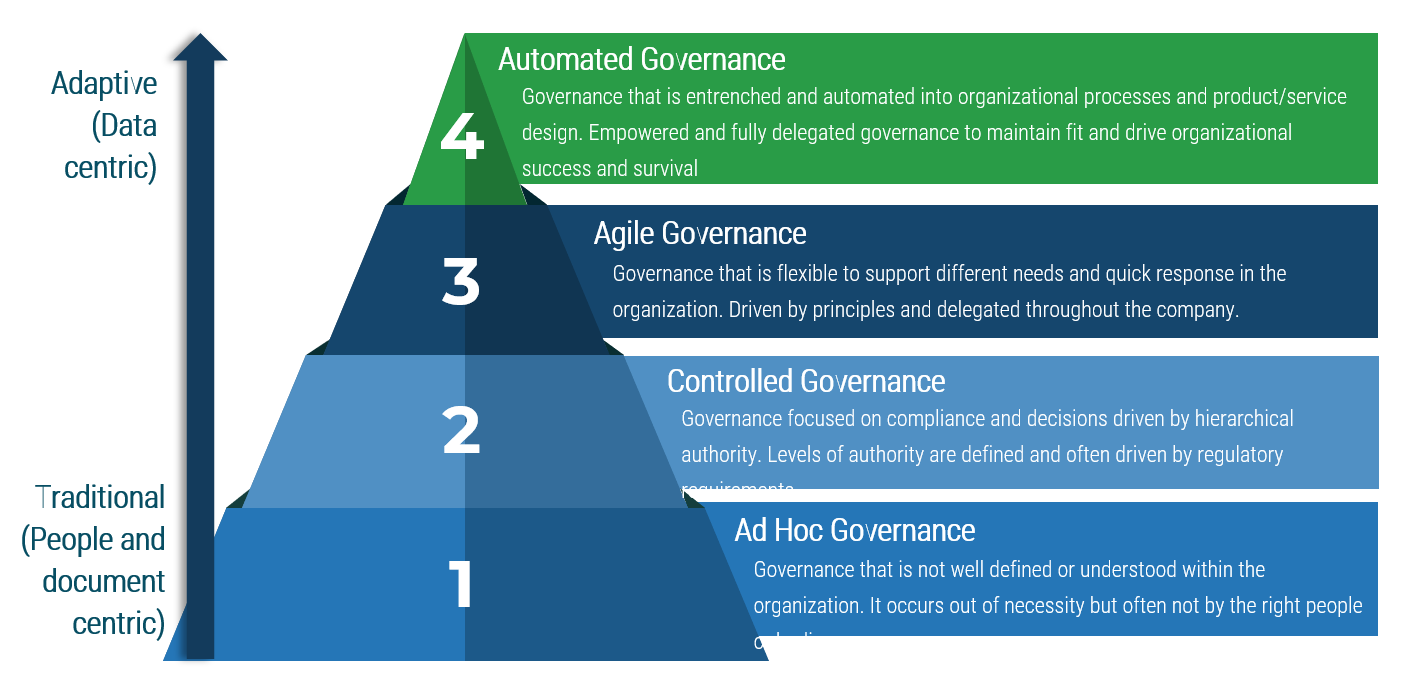

What is governance?

And why does it matter so much to IT and the M&A process?

- Governance is the method in which decisions get made, specifically as they impact various resources (time, money, and people).

- Because M&A is such a highly governed transaction, it is important to document the governance bodies that exist in your organization.

- This will give insight into what types of governing bodies there are, what decisions they make, and how that will impact IT.

- For example, funds to support separation need to be discussed, approved, and supplied to IT from a governing body overseeing the acquisition.

- A highly mature IT organization will have automated governance, while a seemingly non-existent governance process will be considered ad hoc.

2.1.5 Document M&A governance

1-2 hours

Input: List of governing bodies, Governing body committee profiles, Governance structure

Output: Documented method on how decisions are made as it relates to the M&A transaction

Materials: Flip charts/whiteboard, Markers, M&A Sell Playbook

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to determine the method in which decisions are made throughout the M&A transaction as it relates to IT. This will require understanding both governing bodies internal to IT and those external to IT.

- First, determine the other governance structures within the organization that will impact the decisions made about M&A. List out these bodies or committees.

- Create a profile for each committee that looks at the membership, purpose of the committee, decision areas (authority), and the process of inputs and outputs. Ensure IT committees that will have a role in this process are also documented. Consider the benefits realized, risks, and resources required for each.

- Organize the committees into a structure, identifying the committees that have a role in defining the strategy, designing and building, and running.

Record the results in the M&A Sell Playbook.

Current-state structure map – definitions of tiers