The ESG Imperative and Its Impact on Organizations

- Global regulatory climate disclosure requirements are still evolving and are not consistent.

- Sustainability is becoming a corporate imperative, but IT’s role is not fully clear.

- The environmental, social, and governance (ESG) data challenge is large and continually expanding in scope.

- Collecting the necessary data and managing ethical issues across supply chains is a daunting task.

- Communicating long-term value is difficult when customer and employee expectations are shifting.

Our Advice

Critical Insight

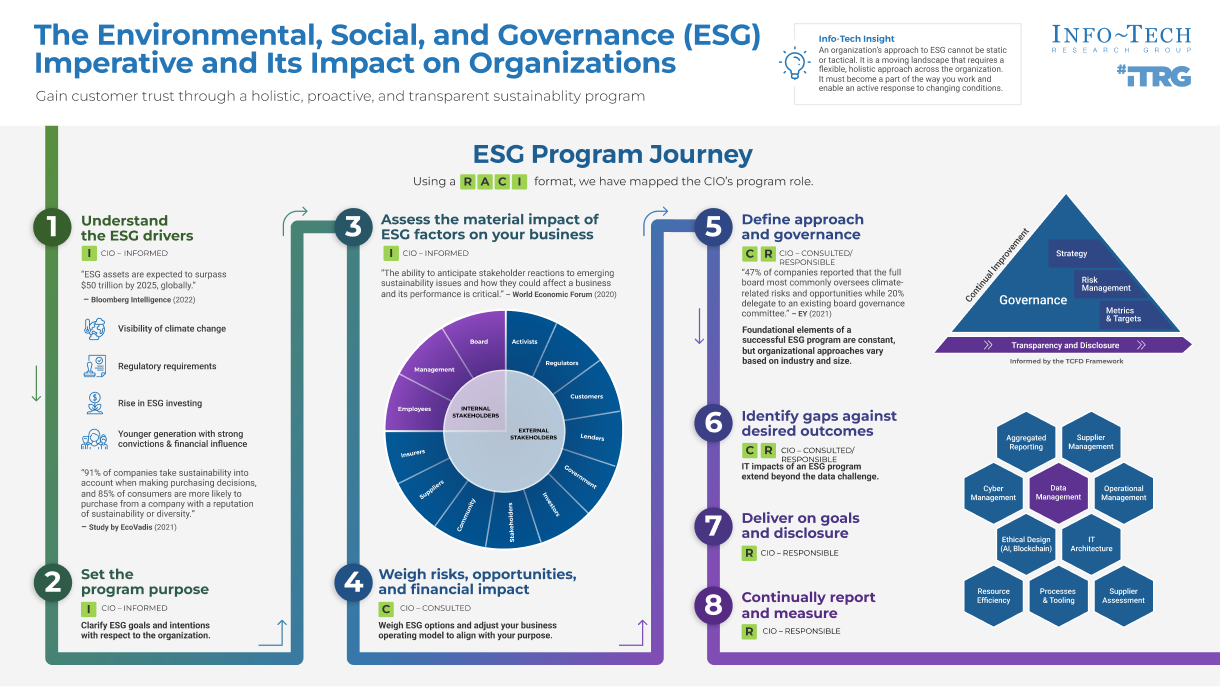

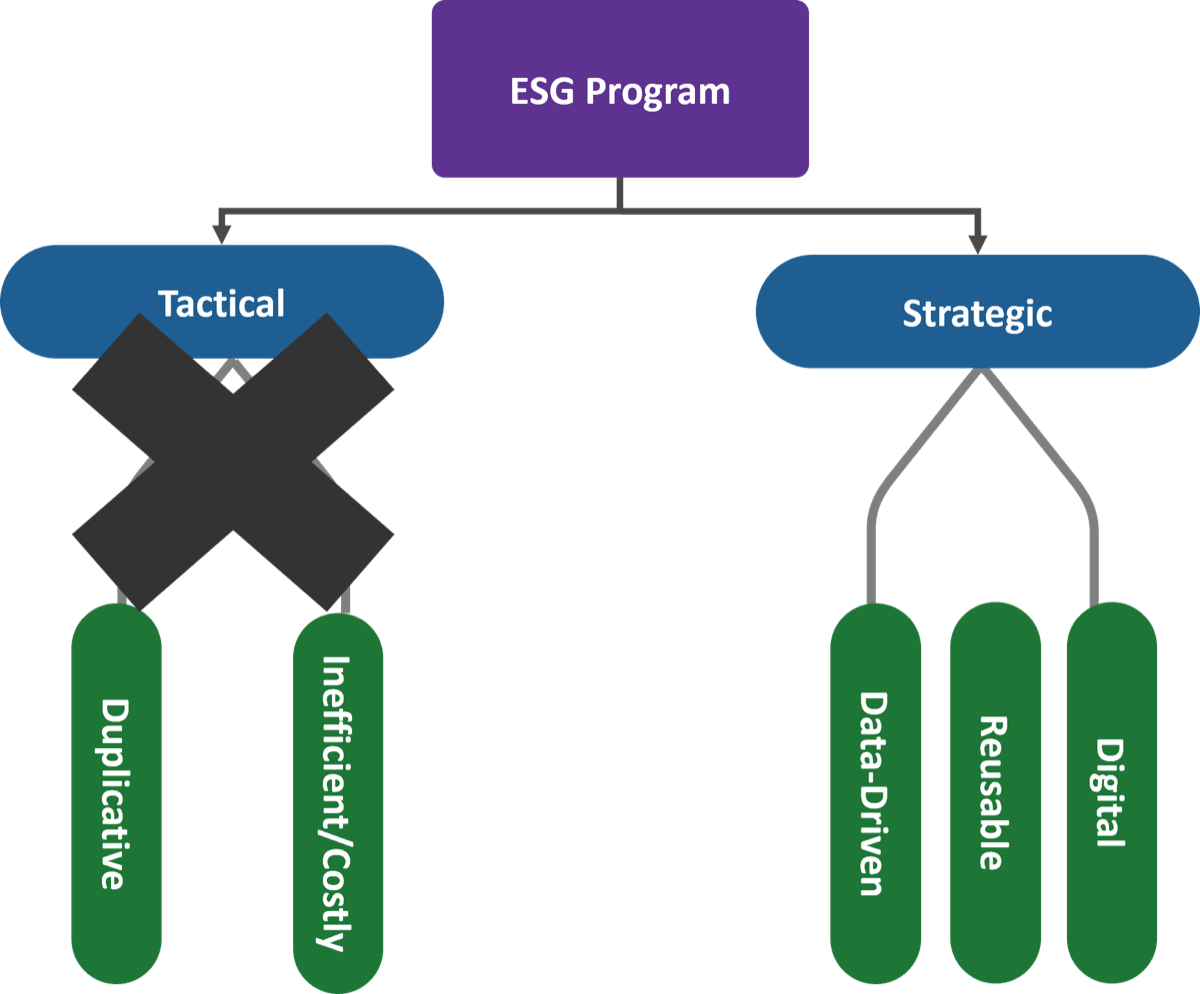

- An organization's approach to ESG cannot be static or tactical. It is a moving landscape that requires a flexible, holistic approach across the organization. Cross-functional coordination is essential in order to be ready to respond to changing conditions.

- Even though the ESG data requirements are large and continually expanding in scope, many organizations have well-established data frameworks and governance practices in place to meet regulatory obligations such as Sarbanes–Oxley that should used as a starting point.

Impact and Result

- Organizations will have greater success if they focus their ESG program efforts on the ESG factors that will have a material impact on their company performance and their key stakeholders.

- Continually evaluating the evolving ESG landscape and its impact on key stakeholders will enable organizations to react quickly to changing conditions.

- A successful ESG program requires a collaborative and integrated approach across key business stakeholders.

- Delivering high-quality metrics and performance indicators requires a flexible and digital data approach, where possible, to enable data interoperability.

The ESG Imperative and Its Impact on Organizations Research & Tools

Besides the small introduction, subscribers and consulting clients within this management domain have access to:

1. The ESG Imperative and Its Impact on Organizations Deck – Learn why sustainability is becoming a key measurement of corporate performance and how to set your organization up for success.

Understand the foundational components and drivers of the broader concept of sustainability: environmental, social, and governance (ESG) and IT’s roles within an organization’s ESG program. Learn about the functional business areas involved, the roles they play and how they interact with each other to drive program success.

- The ESG Imperative and Its Impact on Organizations Storyboard

Infographic

Further reading

The ESG Imperative and Its Impact on Organizations

Design to enable an active response to changing conditions.

Analyst Perspective

Environmental, social, and governance (ESG) is a corporate imperative that is tied to long-term value creation. An organization's social license to operate and future corporate performance depends on managing ESG factors well.

Central to an ESG program is having a good understanding of the ESG factors that may have a material impact on enterprise value and key internal and external stakeholders. A comprehensive ESG strategy supported by strong governance and risk management is also essential to success.

Capturing relevant data and applying it within risk models, metrics, and internal and external reports is necessary for sharing your ESG story and measuring your progress toward meeting ESG commitments. Consequently, the data challenges have received a lot of attention, and IT leaders have a role to play as strategic partner and enabler to help address these challenges. However, ESG is more than a data challenge, and IT leaders need to consider the wider implications in managing third parties, selecting tools, developing supporting IT architecture, and ensuring ethical design.

For many organizations, the ESG program journey has just begun, and collaboration between IT and risk, procurement, and compliance will be critical in shaping program success.

Donna Bales

Principal Research Director

Info-Tech Research Group

Executive Summary

Your Challenge

- Global regulatory climate disclosure requirements are still evolving and are not consistent.

- Sustainability is becoming a corporate imperative, but IT's role is not fully clear.

- The ESG data challenge is large and continually expanding in scope.

- Collecting the necessary data and managing ethical issues across supply chains is a daunting task.

- Communicating long-term value is difficult when customer and employee expectations are shifting.

Common Obstacles

- The data necessary for data-driven insights and accurate disclosure is often hampered by inaccurate and incomplete primary data.

- Other challenges include:

- Approaching ESG holistically and embedding it into existing governance, risk, and IT capabilities.

- Building knowledge and adapting culture throughout all levels of the organization.

- Monitoring stakeholder sentiment and keeping strategy aligned to expectations.

Info-Tech's Approach

- Use this blueprint to educate yourself on ESG factors and the broader concept of sustainability.

- Learn about Info-Tech's ESG program approach and use it as a framework to begin your ESG program journey.

- Identify changes that may be needed in your organizational operating model, strategy, governance, and risk management approach.

- Discover areas of IT that may need to be prioritized and resourced.

Info-Tech Insight

An organization's approach to ESG cannot be static or tactical. ESG is a moving landscape that requires a flexible, holistic approach across the organization. It must become part of the way you work and enable an active response to changing conditions.

Putting ESG in context

ESG has moved beyond the tipping point to corporate table stakes

- In recent years, ESG issues have moved from voluntary initiatives driven by corporate responsibility teams to an enterprise-wide strategic imperative.

- Organizations are no longer being measured by financial performance but by how they contribute to a sustainable and equitable future, such as how they support sustainable innovation through their business models and their focus on collaboration and inclusion.

- A corporation's efforts toward sustainability is measured by three components: environmental, social, and governance.

Sustainability

The ability of a corporation and broader society to endure and survive over the long term by managing adverse impacts well and promoting positive opportunities.

Source: United Nations

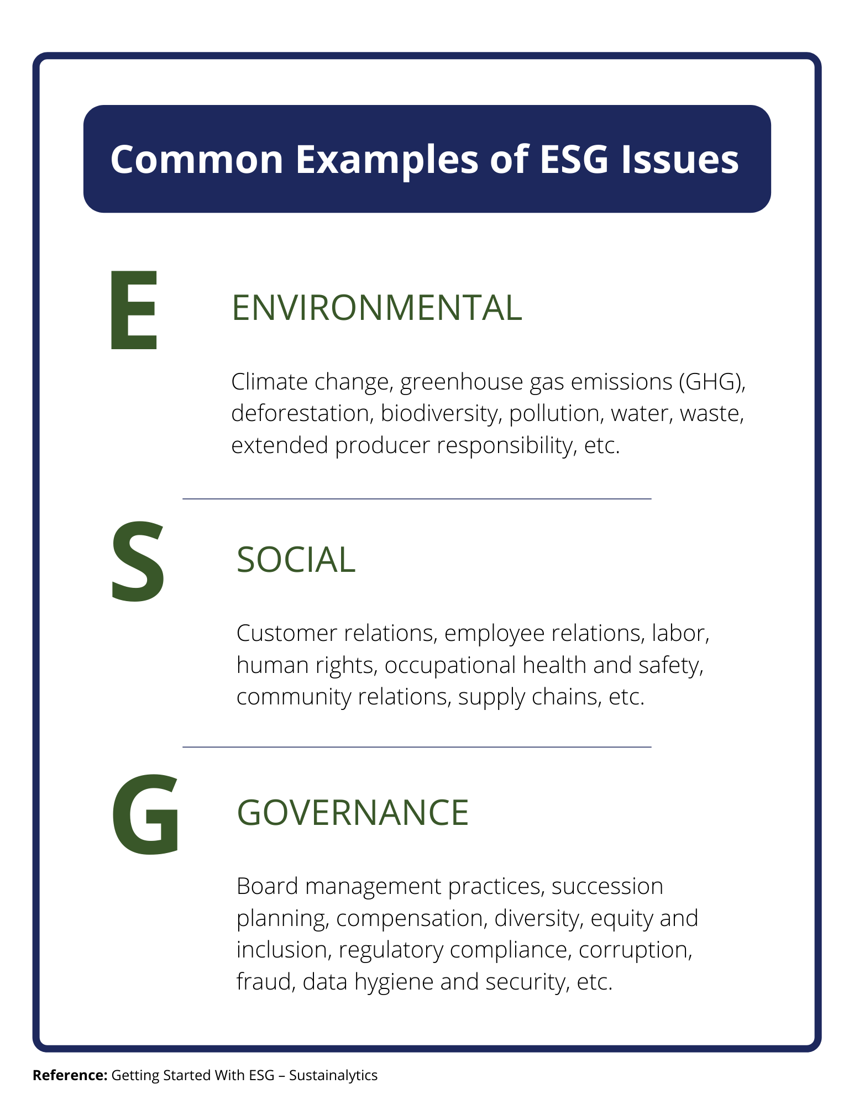

Putting "E," "S," and "G" in context

Corporate sustainability depends on managing ESG factors well

- Environmental, social, and governance are the component pieces of a sustainability framework that is used to understand and measure how an organization impacts or is affected by society as a whole.

- Human activities, particularly fossil fuel burning since the mid twentieth century, have increased greenhouse gas concentration, resulting in observable changes to the atmosphere, ocean, cryosphere, and biosphere.

- The E in ESG relates to the positive and negative impacts an organization may have on the environment, such as the energy it takes in and the waste it discharges.

- The S in ESG is the most ambiguous component in the framework, as social impact relates not only to risks but also prosocial behaviour. It's the most difficult to measure but can have significant financial and reputational impact on corporations if material and poorly managed.

- The G in ESG is foundational to the realization of S and E. It encompasses how well an organization integrates these considerations into the business and how well the organization engages with key stakeholders, receives feedback, and is transparent with its intentions.

Understanding the drivers behind ESG

$30 trillion is expected to be transferred from the baby boomers to Generation Z and millennials over the next decade

– Accenture

Drivers

- The rapid rise of ESG investing

- The visibility of climate change is driving governments, society, and corporations to act and to initiate and support net zero goals.

- A younger demographic that has strong convictions and financial influence

- A growing trend toward mandatory climate and diversity, equity, and inclusion (DEI) disclosures required by global regulators

- Recent emphasis by regulators on board accountability and fiduciary duty

- Greater societal awareness of social issues and sustainability

- A new generation of corporate leadership that is focused on sustainable innovation

The evolving regulatory landscape

Global regulators are mobilizing toward mandatory regulatory climate disclosure

Canada

- Canadian Securities Administrators (CSA) NI 51-107 Disclosure of Climate-related Matters

Europe

- European Commission, Sustainable Finance Disclosure Regulation (SFDR)

- European Commission, EU Supply Chain Act

- Germany – The German Supply Chain Act (GSCA)

- Financial Conduct Authority UK, Proposal (DP 21/4) Sustainability Disclosure Requirements and investment labels

- UK Modern Slavery Act, 2015

United States

- Securities and Exchange Commission (SEC) 33-11042– The Enhancement and Standardization of Climate-Related Disclosures for Investors

- SEC 33-11038 Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure

- Nasdaq Board Diversity Rule (5605(f))

New Zealand

- New Zealand, The Financial Sector (Climate-related Disclosures and Other Matters) Amendment Act 2021

Begin by setting your purpose

Consider your role as a corporation in society and your impact on key stakeholders

- The impact of a corporation can no longer be solely measured by financial impact but also its impact on social good. Corporations have become real-world actors that impact and are affected by the environment, people, and society.

- An ESG program should start with defining your organization's purpose in terms of corporate responsibility, the role it will play, and how it will endure over time through managing adverse impacts and promoting positive impacts.

- Corporations should look inward and outward to assess the material impact of ESG factors on their organization and key internal and external stakeholders.

- Once stakeholders are identified, consider how the ESG factors might be perceived by delving into what matters to stakeholders and what drives their behavior.

Understanding your stakeholder landscape is essential to achieving ESG goals

Assess ESG impact

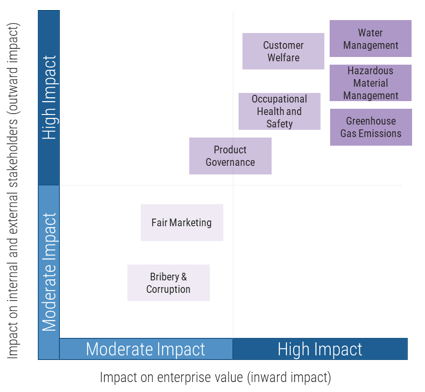

Materiality assessments help to prioritize your ESG strategy and enable effective reporting

- The concept of materiality as it relates to ESG is the process of gaining different perspectives on ESG issues and risks that may have significant impact (both positive and negative) on or relevance to company performance.

- The objective of a materiality assessment is to identify material ESG issues most critical to your organization by looking a broad range of social and environmental factors. Its purpose is to narrow strategic focus and enable an organization to assess the impact of financial and non-financial risks aggregately.

- It helps to make the case for ESG action and strategy, assess financial impact, get ahead of long-term risks, and inform communication strategies.

- Organizations can leverage assessment tools from Sustainalytics or SASB Standards to help assess ESG risks or use guidance or benchmarking information from industry associations.

Info-Tech Insight

Survey key stakeholders to obtain a more holistic viewpoint of expectations and the industry landscape and gain credibility through the process.

Use a materiality matrix to understand ESG exposure

Example: Beverage Company

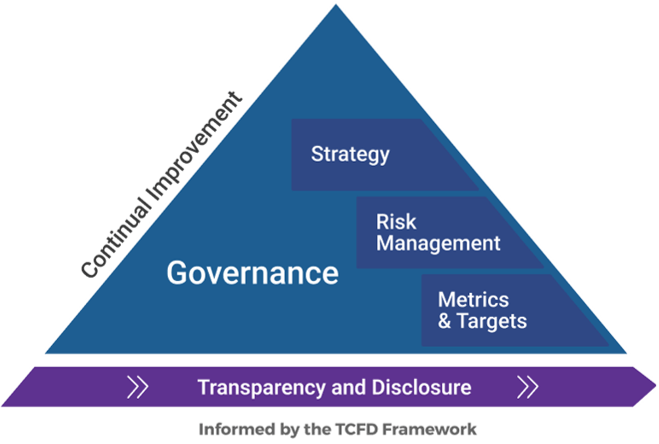

Follow a holistic approach

To deliver on your purpose, sustainability must be integrated throughout the organization

- An ESG program cannot be implemented in a silo. It must be anchored on its purpose and supported by a strong governance structure that is intertwined with other functional areas.

- Effective governance is essential to instill trust, support sound decision making, and manage ESG.

- Governance extends beyond shareholder rights to include many other factors, such as companies' interactions with competitors, suppliers, and governments. More transparency is sought on:

- Corporate behavior, executive pay, and oversight of controls.

- Board diversity, compensation, and skill set.

- Oversight of risk management, particularly risks related to fraud, product, data, and cybersecurity

"If ESG is the framework of non-financial risks that may have a material impact on the company's stakeholders, corporate governance is the process by which the company's directors and officers manage those risks."

– Zurich Insurance

Governance and organization approach

There is no one-size-fits-all approach

47% of companies reported that the full board most commonly oversees climate related risks and opportunities while 20% delegate to an existing board governance committee (EY Research, 2021).

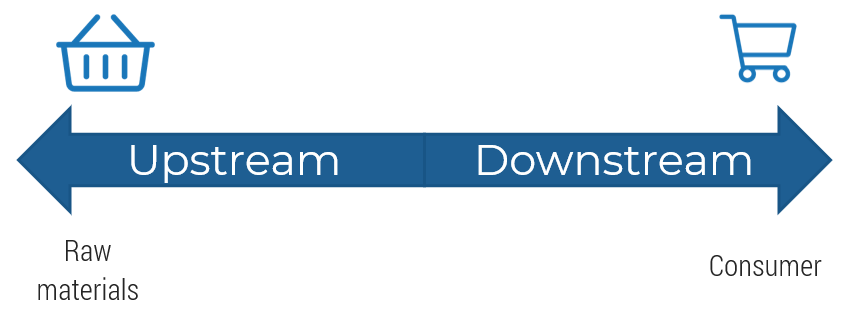

- The organizational approach to ESG will differ across industry segments and corporations depending on material risks and their upstream and downstream value change. However, the accountability for ESG sits squarely at the CEO and board level.

- Some organizations have taken the approach of hiring a Chief Sustainability Officer to work alongside the CEO on execution of ESG goals and stakeholder communication, while others use other members of the strategic leadership to drive the desired outcomes.

| Governance Layer | Responsibilities |

|---|---|

| Board |

|

| Oversight | |

| Executive leadership |

|

| Oversight and strategic direction | |

| Management |

|

| Execution |

Strategy alignment

"74% of finance leaders say that investors increasingly use nonfinancial information in their decision-making."

– "Aligning nonfinancial reporting..." EY, 2020

- Like any journey, the ESG journey requires knowing where you are starting from and where you are heading to.

- Once your purpose is crystalized, identify and surface gaps between where you want to go as an organization (your purpose and goals) and what you need to deliver as an organization to meet the expectations of your internal and external stakeholders (your output).

- Using the results of the materiality assessment, weigh the risk, opportunities, and financial impact to help prioritize and determine vulnerabilities and where you might excel.

- Finally, evaluate and make changes to areas of your business that need development to be successful (culture, accountability and board structure, ethics committee, etc.)

Gap analysis example for delivering reporting requirements

Organizational Goals

- Regulatory Disclosure

- Climate

- DEI

- Cyber governance

- Performance Tracking/Annual Reporting

- Corporate transparency on ESG performance via social, annual circular

- Evidence-Based Business Reporting

- Risk

- Board

- Suppliers

Risk-size your ESG goals

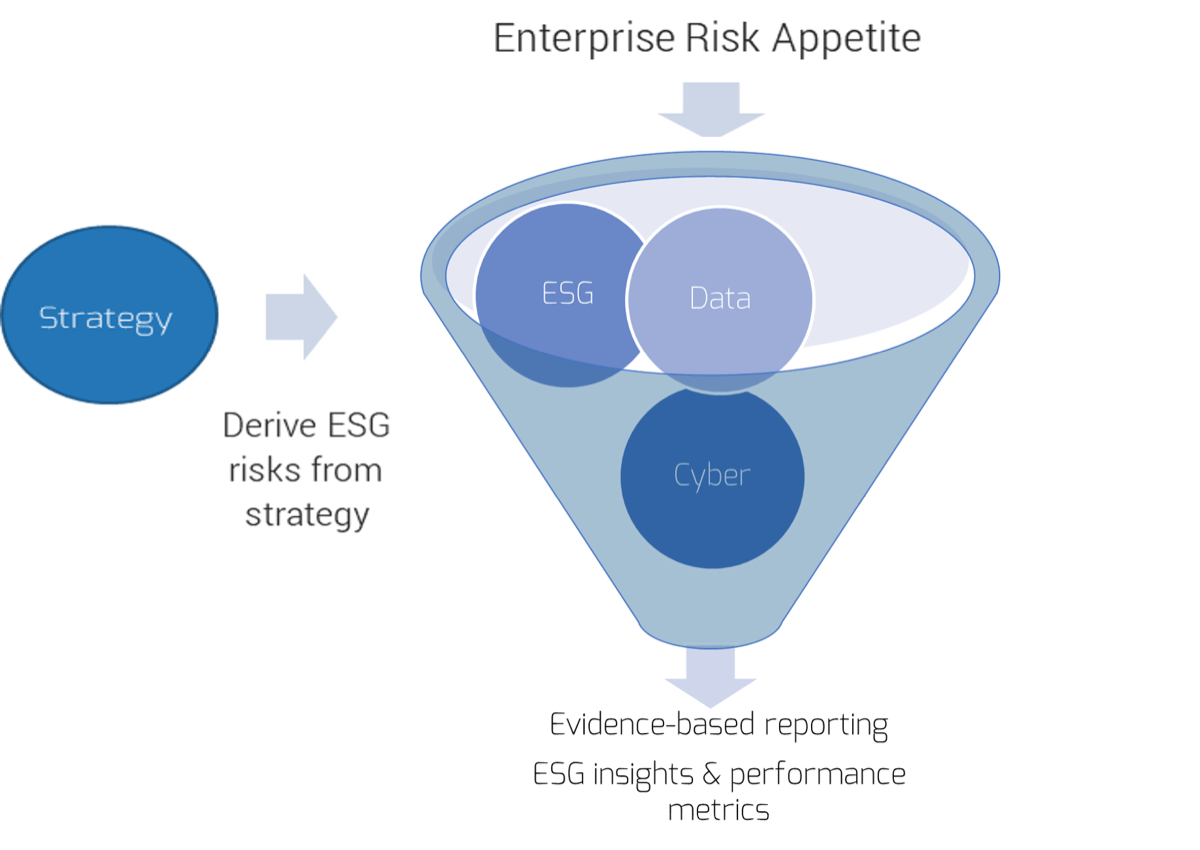

When integrating ESG risks, stick with a proven approach

- Managing ESG risks is central to making sound organizational decisions regarding sustainability but also to anticipating future risks.

- Like any new risk type, ESG risk should be interwoven into your current risk management and control framework via a risk-based approach.

- Yet ESG presents some new risk challenges, and some risk areas may need new control processes or enhancements.

| NET NEW | ENHANCEMENT |

|---|---|

| Climate disclosure | Data quality management |

| Assurance specific to ESG reporting | Risk sensing and assessment |

| Supply chain transparency tied back to ESG | Managing interconnections |

| Scenario analysis | |

| Third-party ratings and monitoring |

Info-Tech Insight

Integrate ESG risks early, embrace uncertainty by staying flexible, and strive for continual improvement.

Managing supplier risks

Suppliers are a critical input into an organization's ESG footprint

"The typical consumer company's supply chain ... [accounts] for more than 80% of greenhouse-gas emissions and more than 90% of the impact on air, land, water, biodiversity, and geological resources."

– McKinsey & Company, 2016

- Although companies are accustomed to managing third parties via procurement processes, voluntary due-diligence, and contractual provisions, COVID-19 surfaced fragility across global supply chains.

- The mismanagement of upstream and downstream risks of supply chains can harm the reputation, operations, and financial performance of businesses.

- To build resiliency to and visibility of supply chain risk, organizations need to adapt current risk management programs, procurement practices, and risk assessment tools and techniques.

- Procurement departments have an enhanced function, effectively acting as gatekeepers by performing due diligence, evaluating performance, and strengthening the supplier relationship through continual feedback and dialogue.

- Technologies such as blockchain and IoT are starting to play a more dominant role in supply chain transparency.

"Forty-five percent of survey respondents say that they either have no visibility into their upstream supply chain or that they can see only as far as their first-tier suppliers."

– "Taking the pulse of shifting supply chains," McKinsey & Company, 2022

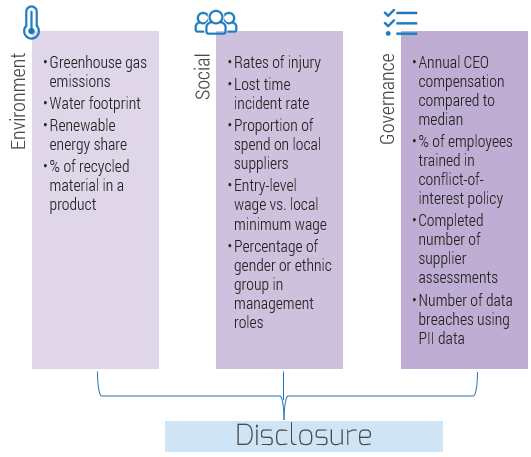

Metrics and targets

Metrics are key to stakeholder transparency, measuring performance against goals, and surfacing organizational blind spots

- ESG metrics are qualitative or quantitative insights that measure organizations' performance against ESG goals. Along with traditional business metrics, they assist investors with assessing the long-term performance of companies based on non-financial ESG risks and opportunities.

- Metrics, key performance indicators (KPIs), and key risk indicators (KRIs) are used to measure how ESG factors affect an organization and how an organization may impact any of the underlying issues related to each ESG factor.

- There are several reporting standards that offer specific ESG performance metrics, such as the Global Reporting Institute (GRI), Sustainability Accounting Standards Board (SASB), and World Economic Forum (WEF).

- For climate-related disclosures, global regulators are converging on the Task Force for Climate-related Disclosures (TCFD) and the International Sustainability Standards Board (ISSB).

Example metrics for ESG factors

The impact of ESG on IT

IT plays a critical role in achieving ESG goals

- IT groups have a critical role to play in helping organizations develop strategic plans to meet ESG goals, measure performance, monitor risks, and deliver on disclosure requirements.

- IT's involvement extends from the CIO providing input at a strategic level to leading the charge within IT to instill new goals and adapt the culture toward one focused on sustainability.

- To set the tone, CIOs should begin by updating their IT governance structure and setting ESG goals for IT.

- IT leaders will need to think about resource use and efficiency and incorporate this into their IT strategy.

Info-Tech Insight

IT leaders need to work collaboratively with risk management to optimize decision making and continually improve ESG performance and disclosure.

"A great strategy meeting is a meeting of the minds."

– Max McKeown

The data challenge

The ESG data requirement is large and continually expanding in scope

- To meet ESG objectives, corporations are challenged with collecting non-financial data from across functional business and geographical locations and from their supplier base and supply chains.

- One of the biggest impediments to ESG implementation is the lack of high-quality data and of mature processes and tools to support data collection.

- The data challenge is compounded by the availability and usability of data, immature and fragmented standards that hinder comparability, and workflow integration.

Info-Tech Insight

Keep your data model flexible and digital where possible to enable data interoperability.

"You can have data without information, but you cannot have information without data."

– Daniel Keys Moran

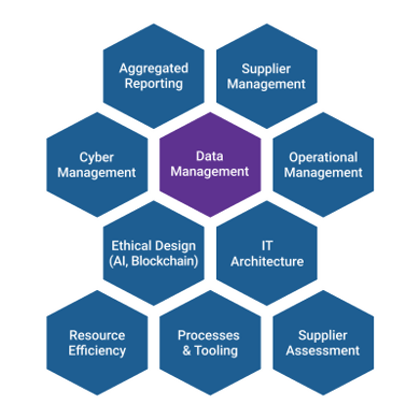

It's more than a data challenge

Organizations will rely on IT for execution, and IT leaders will need to be ready

Top impacts on IT departments

- ESG requires corporations to keep track of ESG-related risks of third parties. This will mean more robust assessments and monitoring.

- Many areas of ESG are new and will require new processes and tools.

- The SEC has upped the ante recently, requiring more rigorous accountability and reporting on cyber incidents.

- New IT systems and architecture may be needed to support ESG programs.

- Current reporting frameworks may need updating as regulators move to digital.

- Ethical design will need to be considered when AI is used to support risk/data management and when it is used as part of product solutions.

Key takeaways

- It's critical for organizations to look inward and outward to assess the material impact of ESG factors on their organization and key internal and external stakeholders.

- ESG requires a flexible, holistic approach across the organization. It must become part of the way you work and enable an active response to changing conditions.

- ESG introduces new risks that should not be viewed in isolation but interwoven into your current risk management and control framework via a risk-based approach.

- Identify and integrate risks early, embrace uncertainty by staying flexible, and strive for continual improvement.

- Metrics are key to telling your ESG story. Place the appropriate importance on the information that will be reported.

- Recognize that the data challenge is complex and evolving and design your data model to be flexible, interoperable, and digital.

- IT's role is far reaching, and IT will have a critical part in managing third parties, selecting tools, developing supporting IT architecture, and using ethical design.

Definitions

| TERM | DEFINITON |

|---|---|

| Corporate Social Responsibility | Management concept whereby organizations integrate social and environmental concerns in their operations and interactions with their stakeholders. |

| Chief Sustainability Officer | Steers sustainability commitments, helps with compliance, and helps ensure internal commitments are met. Responsibilities may extend to acting as a liaison with government and public affairs, fostering an internal culture, acting as a change agent, and leading delivery. |

| ESG | An acronym that stands for environment, social, and governance. These are the three components of a sustainability program. |

| ESG Standard | Contains detailed disclosure criteria including performance measures or metrics. Standards provide clear, consistent criteria and specifications for reporting. Typically created through consultation process. |

| ESG Framework | A broad contextual model for information that provides guidance and shapes the understanding of a certain topic. It sets direction but does not typically delve into the methodology. Frameworks are often used in conjunction with standards. |

| ESG Factors | The factors or issues that fall under the three ESG components. Measures the sustainability performance of an organization. |

| ESG Rating | An aggregated score based on the magnitude of an organization's unmanaged ESG risk. Ratings are provided by third-party rating agencies and are increasingly being used for financing, transparency to investors, etc. |

| ESG Questionnaire | ESG surveys or questionnaires are administered by third parties and used to assess an organization's sustainability performance. Participation is voluntary. |

| Key Risk Indicator (KRI) | A measure to indicate the potential presence, level, or trend of a risk. |

| Key Performance Indicator (KPI) | A measure of deviation from expected outcomes to help a firm see how it is performing. |

| Materiality | Material topics are topics that have a direct or indirect impact on an organization's ability to create, preserve, or erode economic, environment and social impact for itself and its stakeholder and society as a whole |

| Materiality Assessment | A materiality assessment is a tool to identify and prioritize the ESG issues most critical to the organization. |

| Risk Sensing | The range of activities carried out to identify and understand evolving sources of risk that could have a significant impact on the organization (e.g. social listening). |

| Sustainability | The ability of an organization and broader society to endure and survive over the long term by managing adverse impacts well and promoting positive opportunities. |

| Sustainalytics | Now part of Morningstar. Sustainalytics provides ESG research, ratings, and data to institutional investors and companies. |

| UN Guiding Principles on Business and Human Rights (UNGPs) | UN Guiding Principles on Business and Human Rights (UNGPs) provide an essential methodological foundation for how impacts across all dimensions should be assessed. |

Reporting & standard frameworks

| STANDARD | DEFINITION AND FOCUS |

|---|---|

| CDP | CDP has created standards and metrics for comparing sustainability impact. Focuses on environmental data (e.g. carbon, water, and forests) and on data disclosure and benchmarking. |

| (Formally Carbon Disclosure Project) | Audience: All stakeholders |

| Dow Jones Sustainability Indices (DJSI) | Heavy on corporate governance and company performance. Equal balance of economic, environmental, and social. |

| Audience: All stakeholders | |

| Global Reporting Initiative (GRI) | International standards organization that has a set of standards to help organizations understand and communicate their impacts on climate change and social responsibility. The standard has a strong emphasis on transparency and materiality, especially on social issues. |

| Audience: All stakeholders | |

| International Sustainability Standards Board (ISSB) | Standard-setting board that sits within the International Financial Reporting Standards (IFRS) Foundation. The IFRS Foundation is a not-for-profit, public-interest organization established to develop high-quality, understandable, enforceable, and globally accepted accounting and sustainability disclosure standards. |

| Audience: Investor-focused | |

| United Nations Sustainable Development Goals (UNSDG) | Global partnership across sectors and industries to achieve sustainable development for all (17 Global Goals) |

| Audience: All stakeholders | |

| Sustainability Accounting Standards Board (SASB) | Industry-specific standards to help corporations select topics that may impact their financial performance. Focus on material impacts on financial condition or operating performance. |

| Audience: Investor-focused | |

| Task Force Of Climate-related Disclosures (TCFD; created by the Financial Stability Board) | Standards framework focused on the impact of climate risk on financial and operating performance. More broadly the disclosures inform investors of positive and negative measures taken to build climate resilience and make transparent the exposure to climate-related risk. |

| Audience: Investors, financial stakeholders |

Bibliography

Anne-Titia Bove and Steven Swartz, McKinsey, "Starting at the source: Sustainability in supply chains", 11 November 2016

Accenture, "The Greater Wealth Transfer – Capitalizing on the intergenerational shift in wealth", 2012

Beth Kaplan, Deloitte, "Preparing for the ESG Landscape, Readiness and reporting ESG strategies through controllership playbook", 15 February 2022

Bjorn Nilsson et al, McKinsey & Company, "Financial institutions and nonfinancial risk: How corporates build resilience," 28 February 2022

Bolden, Kyle, Ernst and Young, "Aligning nonfinancial reporting with your ESG strategy to communicate long-term value", 18 Dec. 2020

Canadian Securities Administrators, "Canadian securities regulators seek comment on climate-related disclosure requirements", 18 October 2021

Carol A. Adams et al., Global Risk Institute, "The double-materiality concept, Application and issues", May 2021

Dunstan Allison-Hope et al, BSR, "Impact-Based Materiality, Why Companies Should-Focus Their Assessments on Impacts Rather than Perception", 3 February 2022

EcoVadis, "The World's Most Trusted Business Sustainability Ratings",

Ernst and Young, "Four opportunities for enhancing ESG oversight", 29 June 2021

Federal Ministry of Labour and Social Affairs, The Act on Corporate Due Diligence Obligations in Supply Chains (Gesetz über die unternehmerischen Sorgfaltspflichten in Lieferketten)", Published into Federal Law Gazette, 22, July 2021

"What Every Company Needs to Know", Sustainalytics

Global Risk Institute, The GRI Perspective, "The materiality madness: why definitions matter", 22 February 2022

John P Angkaw "Applying ERM to ESG Risk Management", 1 August 2022

Hillary Flynn et al., Wellington Management, "A guide to ESG materiality assessments", June 2022

Katie Kummer and Kyle Lawless, Ernst and Young, "Five priorities to build trust in ESG", 14 July 2022

Knut Alicke et al., McKinsey & Company, "Taking the pulse of shifting supply chains", 26 August 2022

Kosmas Papadopoulos and Rodolfo Arauj. The Harvard School Forum on Corporate Governance, "The Seven Sins of ESG Management", 23 September 2020

KPMG, Sustainable Insight, "The essentials of materiality assessment", 2014

Lorraine Waters, The Stack, "ESG is not an environmental issue, it's a data one", 20 May 2021

Marcel Meyer, Deloitte, "What is TCFD and why does it matter? Understanding the various layers and implications of the recommendations",

Michael W Peregnne et al., "The Harvard Law School Forum on Corporate Governance, The Important Legacy of the Sarbanes Oxley Act," 30 August 2022

Michael Posner, Forbes, "Business and Human Rights: Looking Ahead To The Challenges Of 2022", 15 December 2021

Myles Corson and Tony Kilmas, Ernst and Young, "How the CFO can balance competing demands and drive future growth", 3 November 2020

Novisto, "Navigating Climate Data Disclosure", 2022

Novisto, "XBRL is coming to corporate sustainability reporting", 17 April 2022

"Official Journal of the European Union, Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector", 9 December 2019

Osler, "ESG and the future of sustainability", Podcast, 01 June 2022

Osler, "The Rapidly Evolving World of ESG Disclosure: ISSB draft standards for sustainability and climate related disclosures", 19 May 2022

Sarwar Choudhury and Zach Johnston, Ernst and Young "Preparing for Sox-Like ESG Regulation", 7 June 2022

Securities and Exchange Commission, "The Enhancement and Standardization of Climate-related Disclosures for Investors", 12 May 2022

"Securities and Exchange Commission, SEC Proposes Rules on Cybersecurity, Risk Management, Strategy, Governance, and Incident Disclosure by Public Companies, 9 May 2022

Sean Brown and Robin Nuttall, McKinsey & Company, "The role of ESG and purpose", 4 January 2022

Statement by Chair Gary Gensler, "Statement on ESG Disclosure Proposal", 25 May 2022

Svetlana Zenkin and Peter Hennig, Forbes, "Managing Supply Chain Risk, Reap ESG Rewards", 22 June 2022

Task Force on Climate Related Financial Disclosures, "Final Report, Recommendations of the Task Force on Climate-related Financial Disclosures", June 2017

World Economic Forum, "Why sustainable governance and corporate integrity are crucial for ESG", 29 July 2022

World Economic Forum (in collaboration with PwC) "How to Set Up Effective Climate Governance on Corporate Boards, Guiding Principles and questions", January 2019

World Economic Forum, "Defining the "G" in ESG Governance Factors at the Heart of Sustainable Business", June 2022

World Economic Forum, "The Risk and Role of the Chief Integrity Officer: Leadership Imperatives in and ESG-Driven World", December 2021

World Economic Forum, "How to Set Up Effective Climate Governance on Corporate Boards Guiding principles and questions", January 2019

Zurich Insurance, "ESG and the new mandate for corporate governance", 2022

Buying Options

The ESG Imperative and Its Impact on Organizations

IT Risk Management · IT Leadership & Strategy implementation · Operational Management · Service Delivery · Organizational Management · Process Improvements · ITIL, CORM, Agile · Cost Control · Business Process Analysis · Technology Development · Project Implementation · International Coordination · In & Outsourcing · Customer Care · Multilingual: Dutch, English, French, German, Japanese · Entrepreneur

Tymans Group is a brand by Gert Taeymans BV

Gert Taeymans bv

Europe: Koning Albertstraat 136, 2070 Burcht, Belgium — VAT No: BE0685.974.694 — phone: +32 (0) 468.142.754

USA: 4023 KENNETT PIKE, SUITE 751, GREENVILLE, DE 19807 — Phone: 1-917-473-8669

Copyright 2017-2022 Gert Taeymans BV