Create a Transparent and Defensible IT Budget

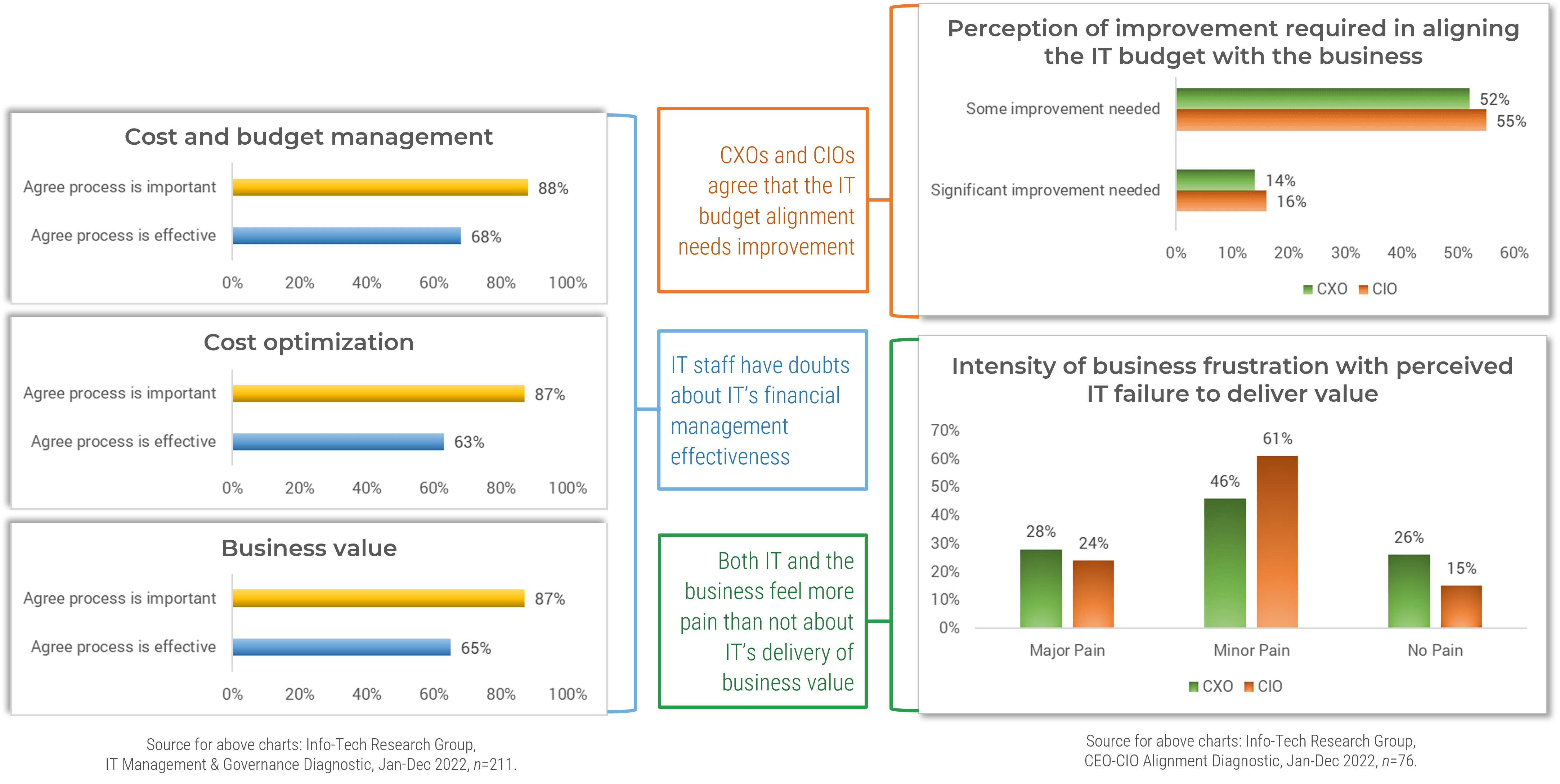

- IT struggles to gain budget approval year after year, largely driven by a few key factors:

- For a long time, IT has been viewed as a cost center whose efficiency needs to be increasingly optimized over time. IT’s relationship to strategy is not yet understood or established in many organizations.

- IT is one of the biggest areas of cost for many organizations. Often, executives don’t understand or even believe that all that IT spending is necessary to advance the organization’s objectives, let alone keep it up and running.

Our Advice

Critical Insight

Internal and external obstacles beyond IT’s control make these challenges with gaining IT budget approval even harder to overcome:

- Economic pressures can quickly drive IT’s budgetary focus from strategic back to tactical.

- Corporate-driven categorizations of expenditure, plus disconnected approval mechanisms for capital vs. operational spend, hide key interdependencies and other aspects of IT’s financial reality.

- Connecting the dots between IT activities and business benefits rarely forms a straight line.

Impact and Result

- CIOs need a straightforward way to create and present an approval-ready budget.

- Info-Tech recognizes that connecting the dots to demonstrate value is key to budgetary approval.

- Info-Tech also recognizes that key stakeholders require different perspectives on the IT budget.

- This blueprint provides a framework, method, and templated exemplars for creating and presenting an IT budget to stakeholders that will speed up the approval process and ensure more of it is approved.

Create a Transparent and Defensible IT Budget Research & Tools

Besides the small introduction, subscribers and consulting clients within this management domain have access to:

1. Create a Transparent and Defensible IT Budget Storyboard – A step-by-step guide to developing a proposed IT budget that’s sensitive to stakeholder perspectives and ready to approve.

This deck applies Info-Tech’s proven ITFM Cost Model to the IT budgeting process and offers five phases that cover the purpose of your IT budget and what it means to your stakeholders, key budgeting resources, forecasting, selecting and fine-tuning your budget message, and delivering your IT budget executive presentation for approval.

- Create a Transparent and Defensible IT Budget Storyboard

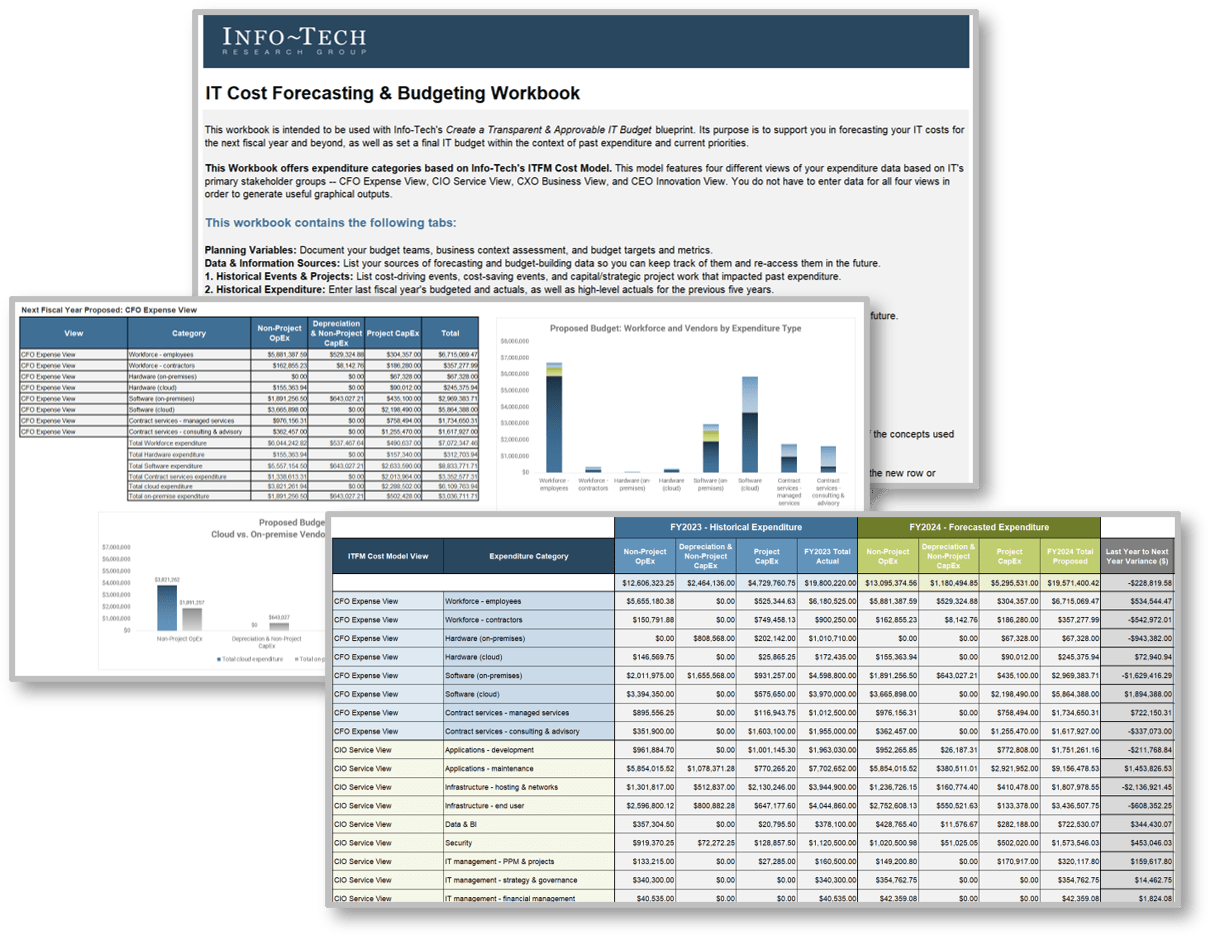

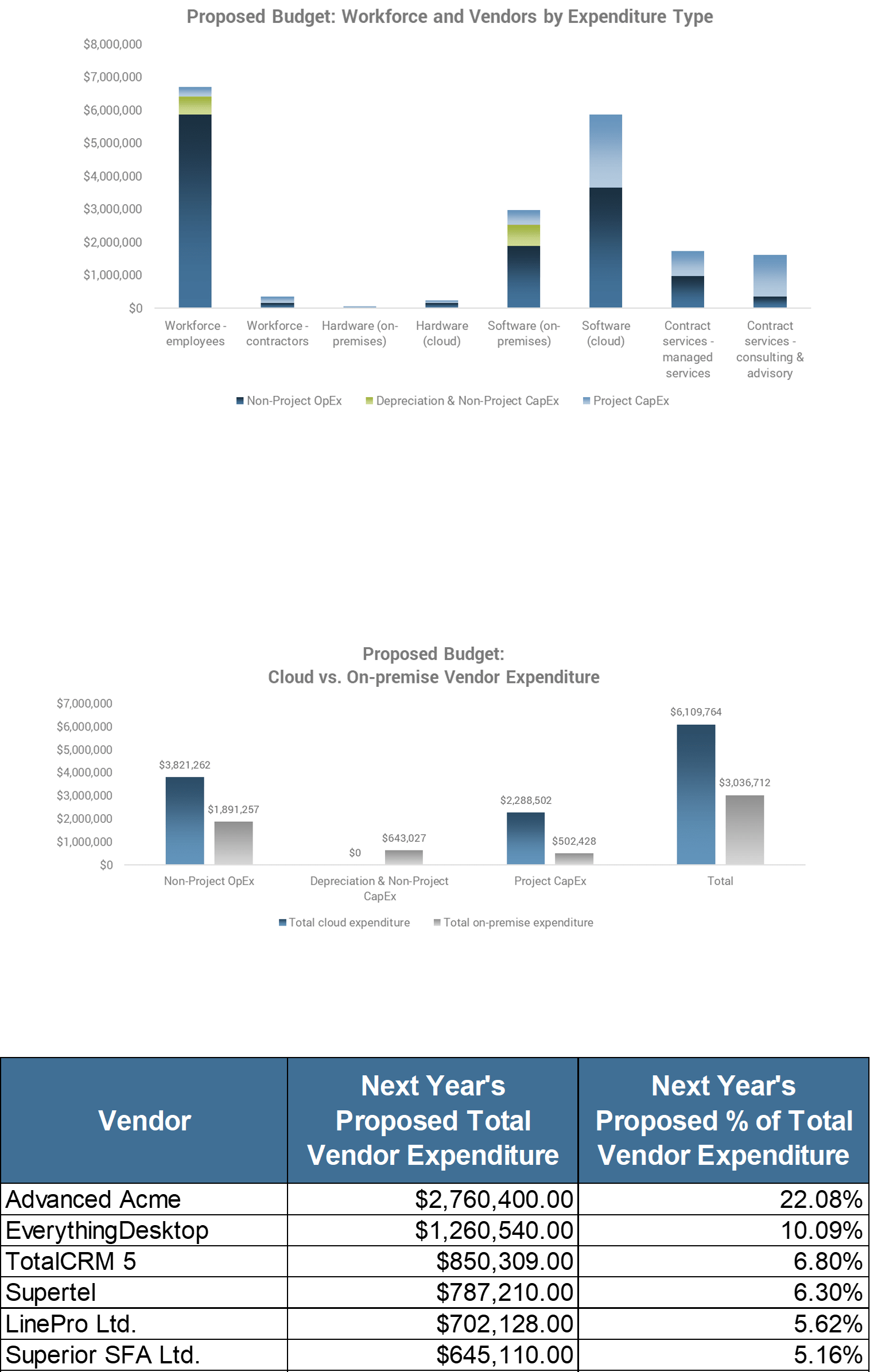

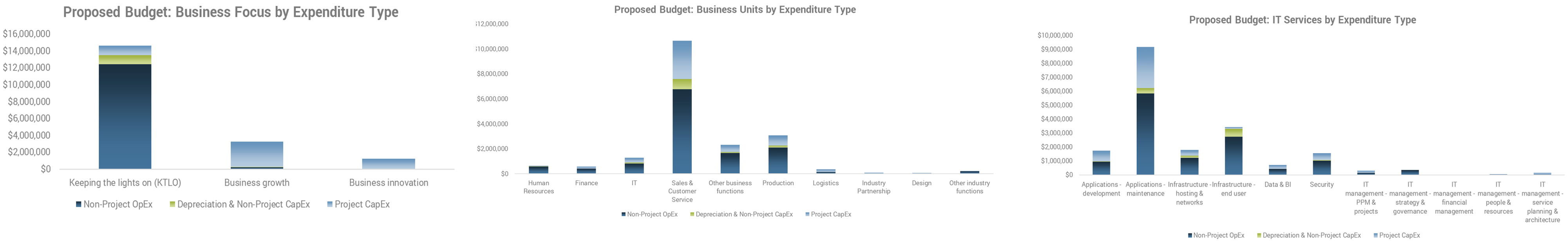

2. IT Cost Forecasting and Budgeting Workbook – A structured Excel tool that allows you to forecast your IT budget for next fiscal year across four key stakeholder views, analyze it in the context of past expenditure, and generate high-impact visualizations.

This Excel workbook offers a step-by-step approach for mapping your historical and forecasted IT expenditure and creating visualizations you can use to populate your IT budget executive presentation.

- IT Cost Forecasting and Budgeting Workbook

3. Sample: IT Cost Forecasting and Budgeting Workbook – A completed IT Cost Forecasting & Budgeting Workbook to review and use as an example.

This sample workbook offers a completed example of the “IT Cost Forecasting and Budgeting Workbook” that accompanies the Create a Transparent & Defensible IT Budget blueprint.

- Sample: IT Cost Forecasting and Budgeting Workbook

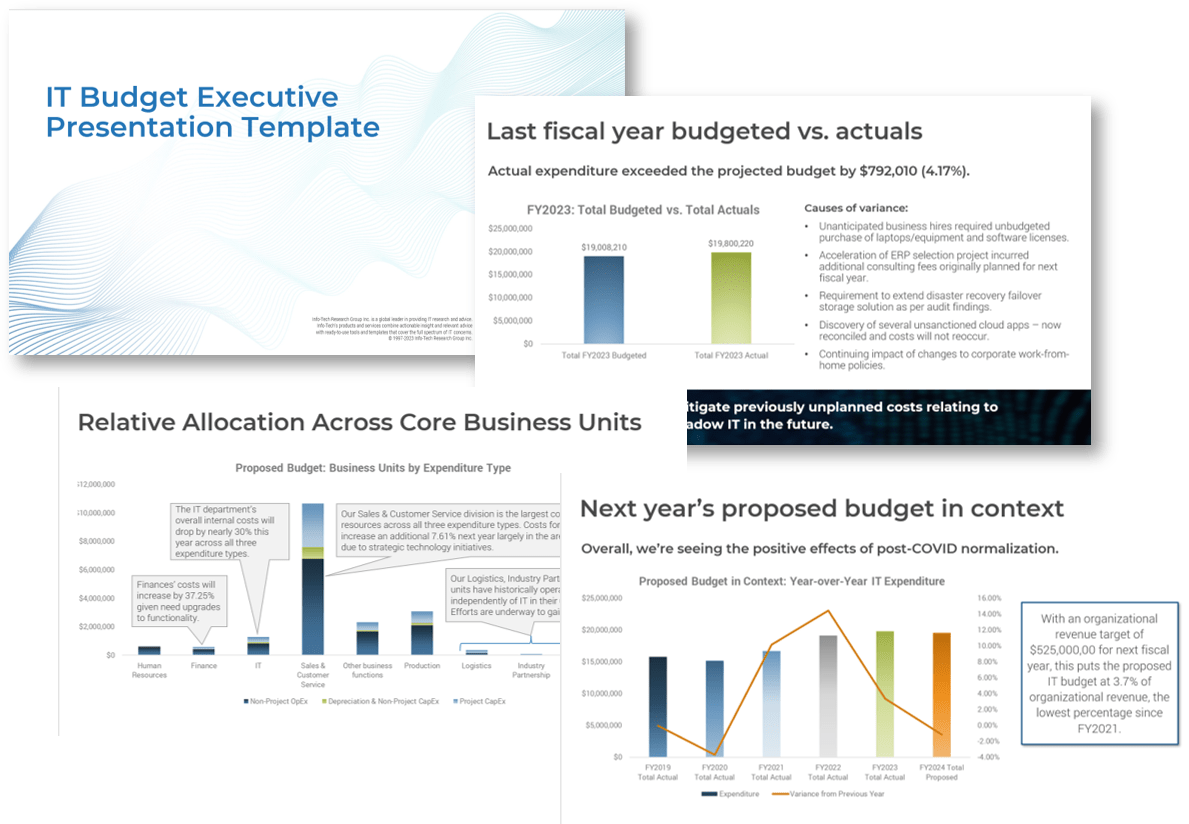

4. IT Budget Executive Presentation – A PowerPoint template and full example for pulling together your proposed IT budget presentation.

This presentation template offers a recommended structure for presenting your proposed IT budget for next fiscal year to your executive stakeholders for approval.

Workshop: Create a Transparent and Defensible IT Budget

Workshops offer an easy way to accelerate your project. If you are unable to do the project yourself, and a Guided Implementation isn't enough, we offer low-cost delivery of our project workshops. We take you through every phase of your project and ensure that you have a roadmap in place to complete your project successfully.

1 Get into budget-starting position

The Purpose

Understand your IT budget in the context of your organization and key stakeholders, as well as gather your budgeting data and review previous years’ financial performance.

Key Benefits Achieved

Understand your organization’s budget process and culture.

Understand your stakeholders’ priorities and perspectives regarding your IT budget.

Gain insight into your historical IT expenditure.

Set next fiscal year’s IT budget targets.

Activities

1.1 Review budget purpose.

1.2 Understand stakeholders and approvers.

1.3 Gather your data.

1.4 Map and review historical financial performance.

1.5 Rationalize last year’s variances and set next year's budget targets.

Outputs

Budget process and culture assessment.

Stakeholder alignment assessment and pre-selling strategy.

Data prepared for next steps.

Mapped historical expenditure.

Next fiscal year’s budget targets.

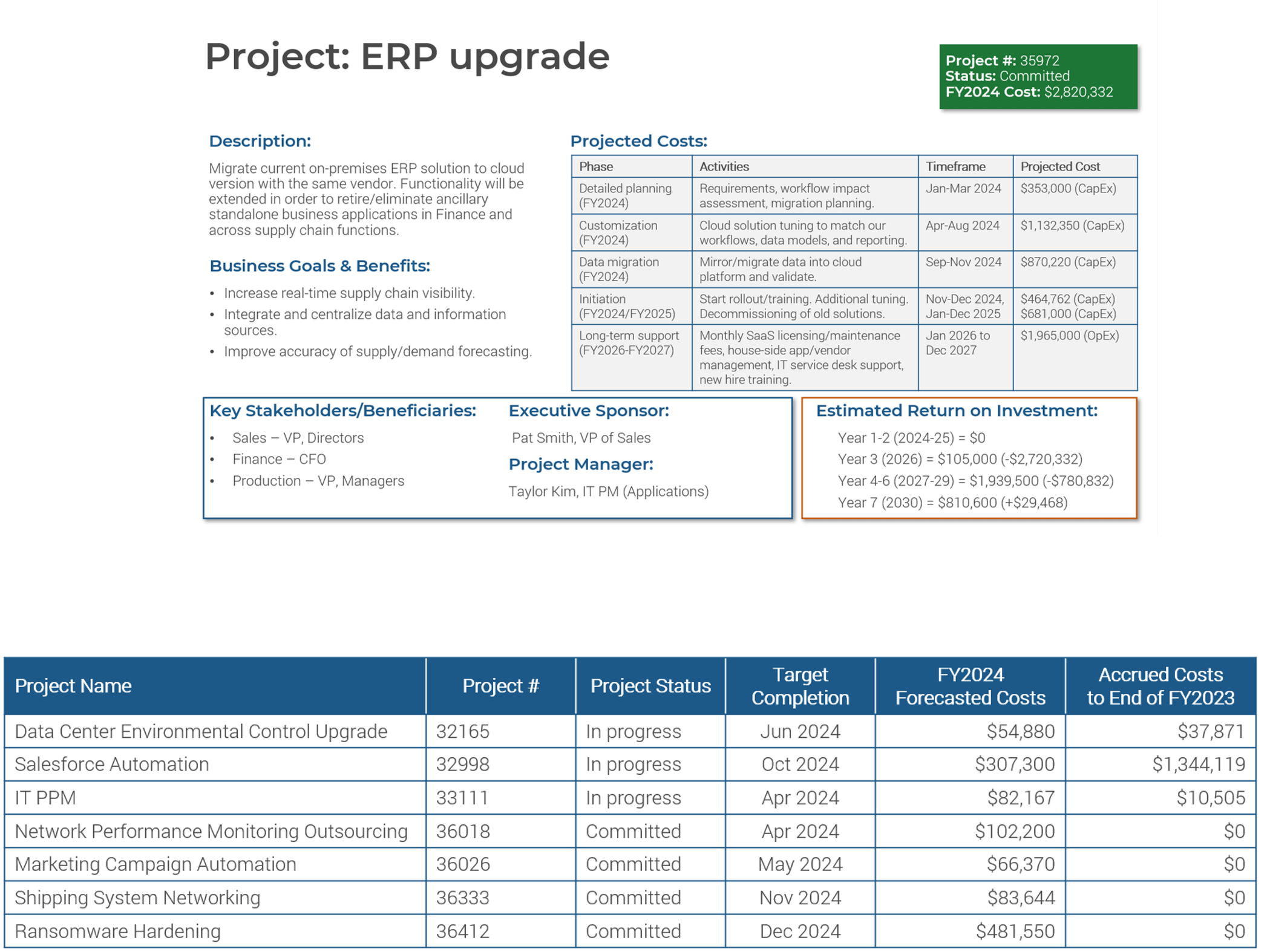

2 Forecast project CapEx

The Purpose

Develop a forecast of next fiscal year’s proposed capital IT expenditure driven by your organization’s strategic projects.

Key Benefits Achieved

Develop project CapEx forecast according to the four different stakeholder views of Info-Tech’s ITFM Cost Model.

Ensure that no business projects that have IT implications (and their true costs) are missed.

Activities

2.1 Review the ITFM cost model

2.2 List projects.

2.3 Review project proposals and costs.

2.4 Map and tally total project CapEx.

2.5 Develop and/or confirm project-business alignment, ROI, and cost-benefit statements.

Outputs

Confirmed ITFM cost mdel.

A list of projects.

Confirmed list of project proposals and costs.

Forecasted project-based capital expenditure mapped against the four views of the ITFM Cost Model.

Projects financials in line.

3 Forecast non-project CapEx and OpEx

The Purpose

Develop a forecast of next fiscal year’s proposed “business as usual” non-project capital and operating IT expenditure.

Key Benefits Achieved

Develop non-project CapEx and non-project OpEx forecasts according to the four different stakeholder views of Info-Tech’s ITFM Cost Model.

Make “business as usual” costs fully transparent and rationalized.

Activities

3.1 Review non-project capital and costs.

3.2 Review non-project operations and costs.

3.3 Map and tally total non-project CapEx and OpEx.

3.4 Develop and/or confirm proposed expenditure rationales.

Outputs

Confirmation of non-project capital and costs.

Confirmation of non-project operations and costs.

Forecasted non-project-based capital expenditure and operating expenditure against the four views of the ITFM Cost Model.

Proposed expenditure rationales.

4 Finalize budget and develop presentation

The Purpose

Aggregate and sanity-check your forecasts, harden your rationales, and plan/develop the content for your IT budget executive presentation.

Key Benefits Achieved

Create a finalized proposed IT budget for next fiscal year that offers different views on your budget for different stakeholders.

Select content for your IT budget executive presentation that will resonate with your stakeholders and streamline approval.

Activities

4.1 Aggregate forecast totals and sanity check.

4.2 Generate graphical outputs and select content to include in presentation.

4.3 Fine-tune rationales.

4.4 Develop presentation and write commentary.

Outputs

Final proposed IT budget for next fiscal year.

Graphic outputs selected for presentation.

Rationales for budget.

Content for IT Budget Executive Presentation.

5 Next steps and wrap-up (offsite)

The Purpose

Finalize and polish the IT budget executive presentation.

Key Benefits Achieved

An approval-ready presentation that showcases your business-aligned proposed IT budget backed up with rigorous rationales.

Activities

5.1 Complete in-progress deliverables from previous four days.

5.2 Set up review time for workshop deliverables and to discuss next steps.

Outputs

Completed IT Budget Executive Presentation.

Review scheduled.

Further reading

Create a Transparent and Defensible IT Budget

Build in approvability from the start.

EXECUTIVE BRIEF

Analyst Perspective

A budget’s approvability is about transparency and rationale, not the size of the numbers.

|

It’s that time of year again – budgeting. Most organizations invest a lot of time and effort in a capital project selection process, tack a few percentage points onto last year’s OpEx, do a round of trimming, and call it a day. However, if you want to improve IT financial transparency and get your business stakeholders and the CFO to see the true value of IT, you need to do more than this. Yourcrea IT budget is more than a once-a-year administrative exercise. It’s an opportunity to educate, create partnerships, eliminate nasty surprises, and build trust. The key to doing these things rests in offering a range of budget perspectives that engage and make sense to your stakeholders, as well as providing iron-clad rationales that tie directly to organizational objectives. The work of setting and managing a budget never stops – it’s a series of interactions, conversations, and decisions that happen throughout the year. If you take this approach to budgeting, you’ll greatly enhance your chances of creating and presenting a defensible annual budget that gets approved the first time around. |

Jennifer Perrier |

Executive Summary

Your Challenge |

Common Obstacles |

Info-Tech’s Approach |

|---|---|---|

IT struggles to gain budget approval year after year, largely driven by a few key factors:

|

Internal and external obstacles beyond IT’s control make these challenges even harder to overcome:

|

CIOs need a straightforward way to create and present an approval-ready budget.

|

Info-Tech Insight

CIOs need a straightforward way to create and present an approval-ready IT budget that demonstrates the value IT is delivering to the business and speaks directly to different stakeholder priorities.

IT struggles to get budgets approved due to low transparency and failure to engage

Capability challenges |

Administrative challenges |

Operating challenges |

Visibility challenges |

Relationship challenges |

||

|---|---|---|---|---|---|---|

IT is seen as a cost center, not an enabler or driver of business strategy. |

IT leaders are not seen as business leaders. |

Economic pressures drive knee-jerk redirection of IT’s budgetary focus from strategic initiatives back to operational tactics. |

The vast majority of IT’s |

Most business leaders don’t know how many IT resources their business units are really consuming. |

Other departments in the organization see IT as a competitor for funding, not a business partner. |

Lack of transparency |

IT and the business aren’t speaking the same language. |

IT leaders don’t have sufficient access to information about, or involvement in, business decisions and objectives. |

Outmoded finance department expenditure categorizations don’t accommodate IT’s real cost categories. |

IT absorbs unplanned spend because business leaders don’t realize or consider the impact of their decisions on IT. |

The business doesn’t understand what IT is, what it does, or what it can offer. |

IT and the business don’t have meaningful conversations about IT costs, opportunities, or investments. |

|

Defining and demonstrating the value of IT and its investments isn’t straightforward. |

IT leaders may not have the financial literacy or acumen needed to translate IT activities and needs into business terms. |

CapEx and OpEx approval and tracking mechanisms are handled separately when, in reality, they’re highly interdependent. |

IT activities usually have an indirect relationship with revenue, making value calculations more complicated. |

Much of IT, especially infrastructure, is invisible to the business and is only noticed if it’s not working. |

The relationship between IT spending and how it supports achievement of business objectives is not clear. |

Reflect on the numbers…

To move forward, first you need to get unstuck

Today’s IT budgeting challenges have been growing for a long time. Overcoming these challenges means untangling yourself from the grip of the root causes.

Principle 1: |

Principle 2: |

Principle 3: |

|---|

The three principles above are all about IT’s changing relationship to the business. IT leaders need a systematic and repeatable approach to budgeting that addresses these principles by:

- Clearly illustrating the alignment between the IT budget and business objectives.

- Showing stakeholders the overall value that IT investment will bring them.

- Demonstrating where IT is already realizing efficiencies and economies of scale.

- Gaining consensus on the IT budget from all parties affected by it.

“The culture of the organization will drive your success with IT financial management.”

– Dave Kish, Practice Lead, IT Financial Management Practice, Info-Tech Research Group

Info-Tech’s approach

CIOs need a straightforward way to convince approval-granting CFOs, CEOs, boards, and committees to spend money on IT to advance the organization’s strategies.

IT budget approval cycle

The Info-Tech difference:

This blueprint provides a framework, method, and templated exemplars for building and presenting your IT budget to different stakeholders. These will speed the approval process and ensure that a higher percentage of your proposed spend is approved.

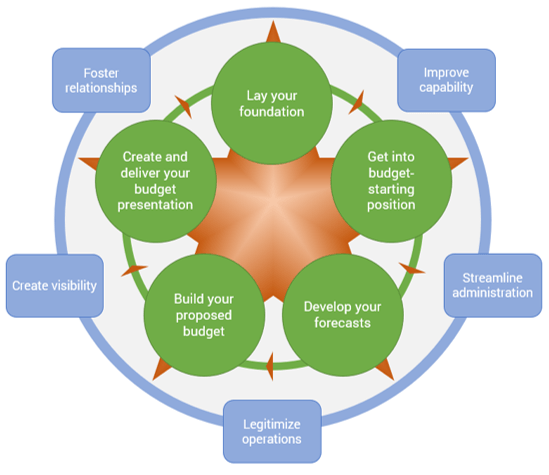

Info-Tech’s methodology for how to create a transparent and defensible it budget

1. Lay Your Foundation |

2. Get Into Budget-Starting Position |

3. Develop Your Forecasts |

4. Build Your Proposed Budget |

5. Create and Deliver Your Budget Presentation |

|

|---|---|---|---|---|---|

Phase steps |

|

|

|

|

|

Phase outcomes |

An understanding of your stakeholders and what your IT budget means to them. |

Information and goals for planning next fiscal year’s IT budget. |

Completed forecasts for project and non-project CapEx and OpEx. |

A final IT budget for proposal including scenario-based alternatives. |

An IT budget presentation. |

Insight summary

Overarching insight: Create a transparent and defensible IT budget

CIOs need a straightforward way to create and present an approval-ready IT budget that demonstrates the value IT is delivering to the business and speaks directly to different stakeholder priorities.

Phase 1 insight: Lay your foundation

IT needs to step back and look at it’s budget-creation process by first understanding exactly what a budget is intended to do and learning what the IT budget means to IT’s various business stakeholders.

Phase 2 Insight: Get into budget-starting position

Presenting your proposed IT budget in the context of past IT expenditure demonstrates a pattern of spend behavior that is fundamental to next year’s expenditure rationale.

Phase 3 insight: Develop your forecasts

Forecasting costs according to a range of views, including CapEx vs. OpEx and project vs. non-project, and then positioning it according to different stakeholder perspectives, is key to creating a transparent budget.

Phase 4 insight: Build your proposed budget

Fine-tuning and hardening the rationales behind every aspect of your proposed budget is one of the most important steps for facilitating the budgetary approval process and increasing the amount of your budget that is ultimately approved.

Phase 5 insight: Create and deliver your budget presentation

Selecting the right content to present to your various stakeholders at the right level of granularity ensures that they see their priorities reflected in IT’s budget, driving their interest and engagement in IT financial concerns.

Blueprint deliverables

Each step of this blueprint is accompanied by supporting deliverables to help you accomplish your goals:

IT Cost Forecasting and Budgeting Workbook This Excel tool allows you to capture and work through all elements of your IT forecasting from the perspective of multiple key stakeholders and generates compelling visuals to choose from to populate your final executive presentation. |

|

Also download this completed sample:

Sample: IT Cost Forecasting and Budgeting Workbook

Key deliverable

IT Budget Executive Presentation Template

Phase 5: Create a focused presentation for your proposed IT budget that will engage your audience and facilitate approval.

Blueprint benefits

IT benefits |

Business benefits |

|---|---|

|

|

Measure the value of this blueprint

Ease budgetary approval and improve its accuracy.

Near-term goals

- Percentage of budget approved: Target 95%

- Percentage of IT-driven projects approved: Target 100%

- Number of iterations/re-drafts required to proposed budget: One iteration

Long-term goal

- Variance in budget vs. actuals: Actuals less than budget and within 2%

In Phases 1 and 2 of this blueprint, we will help you understand what your approvers are looking for and gather the right data and information.

In Phase 3, we will help you forecast your IT costs it terms of four stakeholder views so you can craft a more meaningful IT budget narrative.

In Phases 4 and 5, we will help you build a targeted presentation for your proposed IT budget.

Value you will receive:

- Increased forecast accuracy through using a sound cost-forecasting methodology.

- Improved budget accuracy by applying more thorough and transparent techniques.

- Increased budget transparency and completeness by soliciting input earlier and validating budgeting information.

- Stronger alignment between IT and enterprise goals through building a better understanding of the business values and using language they understand.

- A more compelling budget presentation by offering targeted, engaging, and rationalized information.

- A faster budgeting rework process by addressing business stakeholder concerns the first time.

An analogy…

“A budget isn’t like a horse and cart – you can’t get in front of it or behind it like that. It’s more like a river…

When developing an annual budget, you have a good idea of what the OpEx will be – last year’s with an annual bump. You know what that boat is like and if the river can handle it.

But sometimes you want to float bigger boats, like capital projects. But these boats don’t start at the same place at the same time. Some are full of holes. And does your river even have the capacity to handle a boat of that size?

Some organizations force project charters by a certain date and only these are included in the following year’s budget. The project doesn’t start until 8-12 months later and the charter goes stale. The river just can’t float all these boats! It’s a failed model. You have to have a great governance processes and clear prioritization so that you can dynamically approve and get boats on the river throughout the year.”

– Mark Roman, Managing Partner, Executive Services,

Info-Tech Research Group and Former Higher Education CIO

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit

“Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful.”

Guided Implementation

“Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track.”

Workshop

“We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place.”

Consulting

“Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project.”

Diagnostics and consistent frameworks used throughout all four options

Guided Implementation

Phase 1: Lay Your Foundation |

Phase 2: Get Into Budget-Starting Position |

Phase 3: Develop Your Forecasts |

Phase 4: Build Your Proposed Budget |

Phase 5: Create and Deliver Your Budget Presentation |

|---|---|---|---|---|

Call #1: Discuss the IT budget, processes, and stakeholders in the context of your unique organization. |

Call #2: Review data requirements for transparent budgeting. Call #3: Set budget goals and process improvement metrics. |

Call #4: Review project CapEx forecasts. Call #5: Review non-project CapEx and OpEx forecasts. |

Call #6: Review proposed budget logic and rationales. |

Call #7: Identify presentation inclusions and exclusions. Call #8: Review final budget presentation. |

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is 8 to 12 calls over the course of 4 to 6 months.

Workshop Overview

Contact your account representative for more information.

workshops@infotech.com 1-888-670-8889

| Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | |

|---|---|---|---|---|---|

Get into budget-starting position |

Forecast project CapEx |

Forecast non-project CapEx and OpEx |

Finalize budget and develop presentation |

Next Steps and |

|

Activities |

1.1 Review budget purpose. 1.2 Understand stakeholders and approvers. 1.3 Gather your data. 1.4 Map and review historical financial performance. 1.5 Rationalize last year’s variances. 1.5 Set next year’s budget targets. |

2.1 Review the ITFM Cost Model. 2.2 List projects. 2.3 Review project proposals and costs. 2.4 Map and tally total project CapEx. 2.5 Develop and/or confirm project-business alignment, ROI, and cost-benefit statements. |

3.1 Review non-project capital and costs. 3.2 Review non-project operations and costs. 3.3 Map and tally total non-project CapEx and OpEx. 3.4 Develop and/or confirm proposed expenditure rationales. |

4.1 Aggregate forecast totals and sanity check. 4.2 Generate graphical outputs and select content to include in presentation. 4.3 Fine-tune rationales. 4.4 Develop presentation and write commentary. |

5.1 Complete in-progress deliverables from previous four days. 5.2 Set up review time for workshop deliverables and to discuss next steps. |

Deliverables |

|

|

|

|

|

Phase 1

Lay Your Foundation

Lay Your |

Get Into Budget-Starting Position |

Develop Your |

Build Your |

Create and Deliver Your Presentation |

|---|---|---|---|---|

1.1 Understand what your budget is 1.2 Know your stakeholders 1.3 Continuously pre-sell your budget |

2.1 Assemble your resources 2.2 Understand the four views of the ITFM Cost Model 2.3 Review last year’s budget vs. 2.4 Set your high-level goals |

3.1 Develop assumptions and 3.2 Forecast your project CapEx 3.3 Forecast your non-project CapEx and OpEx |

4.1 Aggregate your numbers 4.2 Stress test your forecasts 4.3 Challenge and perfect your |

5.1 Plan your content 5.2 Build your presentation 5.3 Present to stakeholders 5.4 Make final adjustments and submit your IT budget |

This phase will walk you through the following activities:

- Seeing your budget as a living governance tool

- Understanding the point of view of different stakeholders

- Gaining tactics for setting future IT spend expectations

This phase involves the following participants:

- Head of IT

- IT Financial Lead

- Other IT Management

Lay Your Foundation

Before starting any process, you need to understand exactly why you’re doing it.

This phase is about understanding the what, why, and who of your IT budget.

- Understand what your budget is and does. A budget isn’t just an annual administrative event – it’s an important governance tool. Understand exactly what a budget is and your budgetary accountabilities as an IT leader.

- Know your stakeholders. The CFO, CEO, and CXOs in your organization have their own priorities, interests, and professional mandates. Get to know what their objectives are and what IT’s budget means to them.

- Continuously pre-sell your budget. Identifying, creating, and capitalizing on opportunities to discuss your budget well in advance of its formal presentation will get influential stakeholders and approvers on side, foster collaborations, and avoid unpleasant surprises on all fronts.

“IT finance is more than budgeting. It’s about building trust and credibility in where we’re spending money, how we’re spending money. It’s about relationships. It’s about financial responsibility, financial accountability. I rely on my entire leadership team to all understand what their spend is. We are a steward of other people’s money.”

– Rick Hopfer, CIO, Hawaii Medical Service Association

What does your budget actually do?

A budget is not just a painful administrative exercise that you go through once a year.

Most people know what a budget is, but it’s important to understand its true purpose and how it’s used in your organization before you engage in any activity or dialogue about it.

In strictly objective terms:

- A budget is a calculated estimate of income vs. expenditure for a period in the future, often one year. Basically, it’s an educated guess about how much money will come into a business entity or unit and how much money will go out of it.

- A balanced budget is where income and expenditure amounts are equal.

- The goal in most organizations is for the income component of the budget to match or exceed the expenditure component.

If it doesn’t, this results in a deficit that may lead to debt.

Simply put, a budget’s fundamental purpose is to plan and communicate how an organization will avoid deficit and debt and remain financially viable while meeting its various accountabilities and responsibilities to its internal and external stakeholders.

“CFOs are not thinking that they want to shut down IT spend. Nobody wants to do that. I always looked at things in terms of revenue streams – where the cash inflow is coming from, where it’s going to, and if I can align my cash outflows to my revenue stream. Where I always got suspicious as a CFO is if somebody can’t articulate spending in terms of a revenue stream. I think that’s how most CFOs operate.”

– Carol Carr, Technical Counselor,

Info-Tech Research Group and Former CFO

Put your IT budget in context

Your IT budget is just one of several budgets across your organization that, when combined, create an organization-wide budget. In this context, IT’s in a tough spot.

It’s a competition: The various units in your organization are competing for the biggest piece they can get of the limited projected income pie. It’s a zero-sum game. The organization’s strategic and operational priorities will determine how this projected income is divvied up.

Direct-to-revenue units win: Business units that directly generate revenue often get bigger relative percentages of the organizational budget since they’re integral to bringing in the projected income part of the budget that allows the expenditure across all business units to happen in the first place.

Indirect-to-revenue units lose: Unlike sales units, for example, IT’s relationship to projected income tends to be indirect, which means that IT must connect a lot more dots to illustrate its positive impact on projected income generation.

In financial jargon, IT really is a cost center: This indirect relationship to revenue also explains why the focus of IT budget conversations is usually on the expenditure side of the equation, meaning it doesn’t have a clear positive impact on income.

Contextual metrics like IT spend as a percentage of revenue, IT OpEx as a percentage of organizational OpEx, and IT spend per organizational employee are important baseline metrics to track around your budget, internally benchmark over time, and share, in order to illustrate exactly where IT fits into the broader organizational picture.

Budgeting isn’t a once-a-year thing

Yet, many organizations treat it like a “one and done” point of annual administration. This is a mistake that misses out on the real benefits of budgeting.

Many organizations have an annual budgeting and planning event that takes place during the back half of the fiscal year. This is where all formal documentation around planned projects and proposed spend for the upcoming year is consolidated, culminating in final presentation, adjustment, and approval. It’s basically a consolidation and ranking of organization-wide priorities at the highest level.

If things are running well, this culmination point in the overall budget development and management process is just a formality, not the beginning, middle, and end of the real work. Ideally:

- Budgets are actually used: The whole organization uses budgets as tools to actively manage day-to-day operations and guide decision making throughout the year in alignment with priorities as opposed to something that’s put on a shelf or becomes obsolete within a few months.

- Interdependencies are evident: No discrete area of spend focus is an island – it’s connected directly or indirectly with other areas of spend, both within IT and across the organization. For example, one server interacts with multiple business applications, IT and business processes, multiple IT staff, and even vendors or external managed service providers. Cost-related decisions about that one server – maintain, repurpose, consolidate, replace, discard – will drive other areas of spend up or down.

- There are no surprises: While this does happen, your budget presentation isn’t a great time to bring up a new point of significant spend for the first time. The items in next year’s proposed budget should be priorities that are already known, vetted, supported, and funded.

"A well developed and presented budget should be the numeric manifestation of your IT strategy that’s well communicated and understood by your peers. When done right, budgets should merely affirm what’s already been understood and should get approved with minimal pushback.“

– Patrick Gray, TechRepublic, 2020

Understand your budgetary responsibilities as the IT leader

It’s in your job description. For some stakeholders, it’s the most important part of it.

While not a contract per se, your IT budget is an objective and transparent statement made in good faith that shows:

- You know what it takes to keep the organization viable.

- You understand the organization’s accountabilities and responsibilities as well as those of its leaders.

- You’re willing and able to do your part to meet these accountabilities and responsibilities.

- You know what your part of this equation is, as well as what parts should and must be played by others.

When it comes to your budget (and all things financial), your job is to be ethical, careful, and wise:

- Be honest. Business ethics matter.

- Be as accurate as possible. Your expenditure predictions won’t be perfect, but they need to be best-effort and defensible.

- Respect the other players. They have their own roles, motivations, and mandates. Accept and respect these by being a supporter of their success instead of an obstacle to them achieving it.

- Connect the dots to income. Always keep the demonstration of business value in your sights. Often, IT can’t draw a straight line to income, but demonstrating how IT expenditure supports and benefits future, current, and past (but still relevant) business goals and strategies, which in turn affect income, is the best course.

- Provide alternatives. There are only so many financial levers your organization can pull. An action on one lever will have wanted and unwanted consequences on another. Aim to put financial discussions in terms of risk-focused “what if” stories and let your business partners decide if those risks are satisfactory.

Budgeting processes tend to be similar – it’s budgeting cultures that drive differences

The basic rules of good budgeting are the same everywhere. Bad budgeting processes, however, are usually caused by cultural factors and can be changed.

What’s the same everywhere… |

What’s unchangeable… |

What’s changeable… |

|---|---|---|

For right or wrong, most budgeting processes follow these general steps: |

There are usually only three things about an organization’s budgeting process that are untouchable and can’t be changed: |

Budgeting processes are rarely questioned. It never occurs to most people to challenge this system, even if it doesn’t work. Who wants to challenge the CFO? No one. Review your organization’s budgeting culture to discover the negotiable and non-negotiable constraints. Specifically, look at these potentially-negotiable factors if they’re obstacles to IT budgeting success: |

|

|

|

1.1 Review your budgeting process and culture

1 hour

- Review the following components of your budget process using the questions provided for each as a guideline.

- Legal and regulatory mandates. What are the external rules that govern how we do financial tracking and reporting? How do they manifest in our processes?

- Accounting rules used. What rules does our finance department use and why? Do these rules allow for more meaningful representations of IT spend? Are there policies or practices in place that don’t appear to be backed by any external standards?

- Timeframes and deadlines. Are we starting the budgeting process too late? Do we have enough time to do proper due diligence? Will expenditures approved now be out of date when we go to execute? Are there mechanisms to update spend plans mid-cycle?

- Order of operations. What areas of spend do we always look at first, such as CapEx? Are there any benefits to changing the order in which we do things, such as examining OpEx first?

- Areas of focus. Is CapEx taking up most of our budgeting cycle time? Are we spending enough time examining OpEx? Is IT getting enough time from the CFO compared to other units?

- Funding sources and ownership. Is IT footing most of the technology bills? Are business unit leaders fronting any technology business case pitches? Is IT appropriately included in business case development? Is there any benefit to implementing show-back or charge-back?

- Review/approval mechanisms. Are strategies and priorities used to rank proposed spend clear and well communicated? Are spend approvers objective in their decision making? Do different approvers apply the same standards and tools?

- Templates and tools. Are the ones provided by Finance, the PMO, and other groups sufficient to document what we need to document? Are they accessible and easy to use? Are they automated and integrated so we only have to enter data once?

- On the slide following these activity instructions, rate how effective each of the above is on a scale of 1-10 (where 10 is very effective) in supporting the budgeting process. Note specific areas of challenge and opportunity for change.

1.1 Review your budgeting process and culture

| Input | Output | Materials | Participants |

|---|---|---|---|

|

|

|

|

Budget process and culture assessment

Document the outcomes of your assessment. Examples are provided below.

Budgeting area of assessment |

Rating 1 = very ineffective 10 = very effective |

Challenges |

Opportunities for change |

|---|---|---|---|

Legal and regulatory mandates |

7 | Significant regulation but compliance steps not clear or supported within departments. |

Create, communicate, and train management on compliance procedures and align the financial management tools accordingly. |

Accounting rules |

6 | IT not very familiar with them. |

Learn more about them and their provisions to see if IT spend can be better represented. |

Timeframes and deadlines |

5 | Finalize capital project plans for next fiscal four months before end of current fiscal. |

Explore flexible funding models that allow changes to budget closer to project execution. |

Order of operations |

3 | Setting CapEx before OpEx leads to paring of necessary OpEx based on CapEx commitments. |

Establish OpEx first as a baseline and then top up to target budget with CapEx. |

Areas of focus |

6 | Lack of focus on OpEx means incremental budgeting – we don’t know what’s in there. |

Perform zero-based budgeting on OpEx every few years to re-rationalize this spend. |

Funding sources and ownership |

4 | IT absorbing unplanned mid-cycle spend due to impact of unknown business actions. |

Implement a show-back mechanism to change behavior or as precursor to limited charge-back. |

Review/approval mechanisms |

8 | CFO is fair and objective with information presented but could demand more evidence. |

Improve business sponsorship/fronting of new initiative business cases and IT partnership. |

Templates and tools |

2 | Finance budget template largely irrelevant and unreflective of IT: only two relevant categories. |

Adjust account buckets over a period of time, starting with SW/HW and cloud breakouts. |

Receptive audiences make communication a lot easier

To successfully communicate anything, you need to be heard and understood.

The key to being heard and understood is first to hear and understand the perspective of the people with whom you’re trying to communicate – your stakeholders. This means asking some questions:

- What context are they operating in?

- What are their goals and responsibilities?

- What are their pressures and stresses?

- How do they deal with novelty and uncertainty?

- How do they best take in information and learn?

The next step of this blueprint shows the perspectives of IT’s key stakeholders and how they’re best able to absorb and accept the important information contained in your IT budget. You will:

- Learn a process for discovering these stakeholders’ IT budget information needs within the context of your organization’s industry, goals, culture, organizational structure, personalities, opportunities, and constraints.

- Document key objectives and messages when communicating with these various key stakeholders.

There are certain principles, mandates, and priorities that drive your stakeholders; they’ll want to see these reflected in you, your work, and your budget.

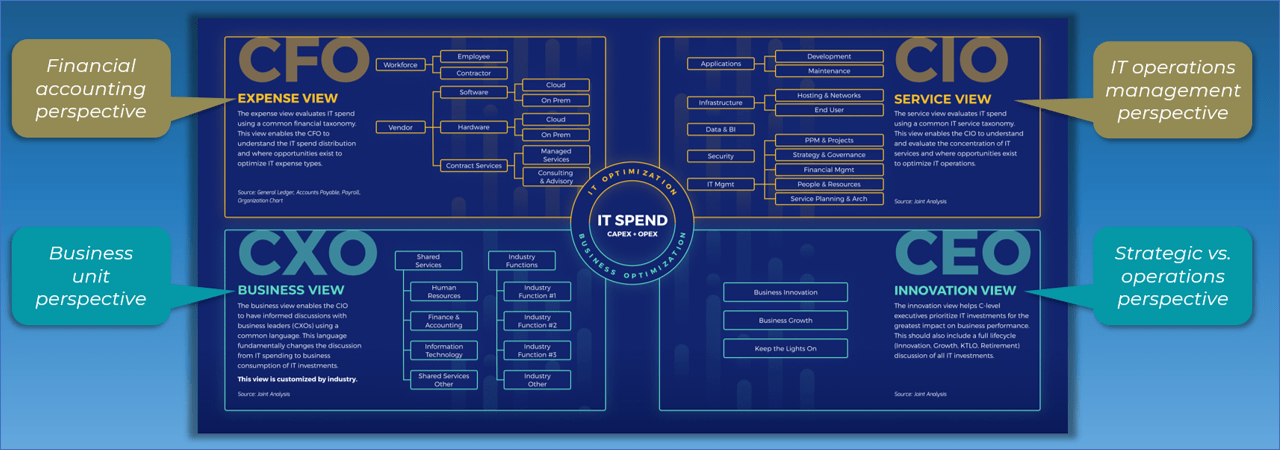

Your IT budget means different things to different stakeholders

Info-Tech’s ITFM Cost Model lays out what matters most from various points of view.

The CFO: Understand their role

The CFO is the first person that comes to mind in dealing with budgets. They’re personally and professionally on the line if anything runs amiss with the corporate purse.

What are the CFO’s role and responsibilities?

- Tracking cash flow and balancing income with expenditures.

- Ensuring fiscal reporting and legal/regulatory compliance.

- Working with the CEO to ensure financial-strategic alignment.

- Working with business unit heads to set aligned budgets.

- Seeing the big picture.

What’s important to the CFO?

- Costs

- Benefits

- Value

- Analysis

- Compliance

- Risk Management

- Strategic alignment

- Control

- Efficiency

- Effectiveness

- Reason

- Rationale

- Clarity

- Objectivity

- Return on investment

“Often, the CFO sees IT requests as overhead rather than a need. And they hate increasing overhead.”

– Larry Clark, Executive Counselor, Info-Tech Research Group and Former CIO

The CFO carries big responsibilities focused on mitigating organizational risks. It’s not their job to be generous or flexible when so much is at stake. While the CEO appears higher on the organizational chart than the CFO, in many ways the CFO’s accountabilities and responsibilities are on par with, and in some cases greater than, those of the CEO.

The CFO: What they want from the IT budget

What they need should look familiar, so do your homework and be an open book.

Your CFO’s IT budget to-do list: |

Remember to: |

|---|---|

|

|

The CFO: Budget challenges and opportunities

Budget season is a great time to start changing the conversation and building trust.

Potential challenges |

Low trust Poor financial literacy and historical sloppiness among business unit leaders means that a CFO may come into budget conversations with skepticism. This can put them on the offensive and put you on the defensive. You have to prove yourself. |

Competition You’re not the only department the CFO is dealing with. Everyone is competing for their piece of the pie, and some business unit leaders are persistent. A good CFO will stay out of the politics and not be swayed by sweet talk, but it can be an exhausting experience for them. |

Mismatched buckets IT’s spend classes and categories probably won’t match what’s in Finance’s budget template or general ledger. Annual budgeting isn’t the best time to bring this up. Respect Finance’s categories, but plan to tackle permanent changes at a less busy time. |

|---|---|---|---|

Potential opportunities |

Build confidence Engaging in the budgeting process is your best chance to demonstrate your knowledge about the business and your financial acumen. The more that the CFO sees that you get it and are taking it seriously, the more confidence and trust they’ll have in you. |

Educate The CFO will not know as much as you about the role technology could and should play in the organization. Introduce new language around technology focused on capabilities and benefits. This will start to shift the conversation away from costs and toward value. |

Initiate alignment An important governance objective is to change the way IT expenditure is categorized and tracked to better reveal and understand what’s really happening. This process should be done gradually over time, but definitely communicate what you want to do and why. |

The CXO: Understand their role

CXOs are a diverse group who lead a range of business functions including admin, operations, HR, legal, production, sales and service, and marketing, to name a few.

What are the CXO’s role and responsibilities?

Like you, the CXO’s job is to help the organization realize its goals and objectives. How each CXO does this is specific to the domain they lead. Variations in roles and responsibilities typically revolve around:

- Law and regulation. Some functions have compliance as a core mandate, including legal, HR, finance, and corporate risk groups.

- Finance and efficiency. Other functions prioritize time, money, and process such as finance, sales, customer service, marketing, production, operations, and logistics units.

- Quality. These functions prioritize consistency, reliability, relationship, and brand such as production, customer service, and marketing.

What’s important to the CXO?

- Staffing

- Skills

- Reporting

- Funding

- Planning

- Performance

- Predictability

- Customers

- Visibility

- Inclusion

- Collaboration

- Reliability

- Information

- Knowledge

- Acknowledgement

Disagreement is common between business-function leaders – they have different primary focus areas, and conflict and misalignment are natural by-products of that fact. It’s also hard to make someone care as much about your priorities as you do. Focus your efforts on sharing and partnering, not converting.

The CXO: What they want from the IT budget

Focus on their unique part of the organization and show that you see them.

Your CXO’s IT budget to-do list: | Remember to: |

|---|---|

|

|

The CXO: Budget challenges and opportunities

Seek out your common ground and be the solution for their real problems.

Potential challenges | Different priorities Other business unit leaders will have bigger concerns than your IT budget. They have their own budget to figure out plus other in-flight issues. The head of sales, for instance, is going to be more concerned with hitting sales goals for this fiscal year than planning for next. | Perceived irrelevance Some business unit leaders may be completely unaware of how they use IT, how much they use, and how they could use it more or differently to improve their performance. They may have a learning curve to tackle before they can start to see your relationship as collaborative. | Bad track record If a business unit has had friction with IT in the past or has historically been underserved, they may be hesitant to let you in, may be married to their own solutions, or perhaps do not know how to express what they need. |

|---|---|---|---|

Potential opportunities | Start collaborating You and other business unit leaders have a lot in common. You all share the objective of helping the organization succeed. Focus in on your shared concerns and how you can make progress on them together before digging into your unique challenges. | Practice perspective taking Be genuinely curious about the business unit, how it works, and how they overcome obstacles. See the organization from their point of view. For now, keep your technologies completely out of the discussion – that will come later on. | Build relationships You only need to solve one problem for a business unit to change how they think of you. Just one. Find that one thing that will make a real difference – ideally small but impactful – and work it into your budget. |

The CEO: Understand their role

A CEO sets the tone for an organization, from its overall direction and priorities to its values and culture. What’s possible and what’s not is usually determined by them.

What are the CEO’s role and responsibilities?

- Assemble an effective team of executives and advisors.

- Establish, communicate, and exemplify the organizations core values.

- Study the ecosystem within which the organization exists.

- Identify and evaluate opportunities.

- Set long-term directions, priorities, goals, and strategies.

- Ensure ongoing organizational performance, profitability, and growth.

- Connect the inside organization to the outside world.

- Make the big decisions no one else can make.

What’s important to the CEO?

- Strategy

- Leadership

- Vision

- Values

- Goals

- Priorities

- Performance

- Metrics

- Accountability

- Stakeholders

- Results

- Insight

- Growth

- Cohesion

- Context

Unlike the CFO and CXOs, the CEO is responsible for seeing the big picture. That means they’re operating in the realm of big problems and big ideas – they need to stay out of the weeds. IT is just one piece of that big picture, and your problems and ideas are sometimes small in comparison. Use any time you get with them wisely.

The CEO: What they want from the IT budget

The CEO wants what the CFO wants, but at a higher level and with longer-term vision.

Your CEO’s IT budget to-do list: | Remember to: |

|---|---|

|

|

The CEO: Budget challenges and opportunities

Strategically address the big issues, but don’t count on their direct assistance.

Potential challenges | Lack of interest Your CEO may just not be enthusiastic about technology. For them, IT is strictly a cost center operating on the margins. If they don’t have a strategic vision that includes technology, IT’s budget will always be about efficiency and cost control and not investment. | Deep hierarchy The executive-level CIO role isn’t yet pervasive in every industry. There may be one or more non-IT senior management layers between IT and the office of the CEO, as well as other bureaucratic hurdles, which prohibit your direct access. | Uncertainty What’s happening on the outside will affect what needs to be done on the inside. The CEO has to assess and respond quickly, changing priorities and plans in an instant. An indecisive CEO that’s built an inflexible organization will make it difficult to pivot as needed. |

|---|---|---|---|

Potential opportunities | Grow competency Sometimes, IT just needs to wait it out. The biggest shifts in technology interest often come with an outright change in the organization’s leadership. In the meantime, fine-tune your operational excellence, brush up on business skills, and draft out your best ideas on paper. | Build partnerships Other business-function executives may need to be IT’s voice. Investment proposals may be more compelling coming from them anyway. Behind-the-scenes partnerships and high-profile champions are something you want regardless of your degree of CEO access. | Bake in resilience Regardless of who’s at the helm, systematic investment in agile and flexible solutions that can be readily scaled, decoupled, redeployed, or decommissioned is a good strategy. Use recent crises to help make the strategic case for a more resilient posture. |

What about the CIO view on the IT budget?

IT leaders tend to approach budgeting from an IT services perspective. After all, that’s how their departments are typically organized.

The CFO expense view, CXO business view, and CEO innovation view represent IT’s stakeholders. The CIO service view, however, represents you, the IT budget creator. This means that the CIO service view plays a slightly different role in developing your IT budget communications.

An IT team effort… |

A logical starting point |

A supporting view |

|---|---|---|

Most budget drafts start with internal IT management discussion. These managers are differentially responsible for apps dev and maintenance, service desk and user support, networks and data center, security, data and analytics, and so forth. |

These common organizational units and their managers tend to represent discrete IT service verticals. This means the CIO service view is a natural structural starting point for your budget-building process. Stakeholder views of your budget will be derived from this first view. |

You probably don’t want to lead your budget presentation with IT’s perspective – it won’t make sense to your stakeholders. Instead, select certain impactful pieces of your view to drop in where they provide valued information and augment the IT budget story. |

Things to bring forward… |

Things to hold back… |

|---|---|

|

|

1.2 Assess your stakeholders

1 hour

- Use the “Stakeholder alignment assessment” template slide following this one to document the outcomes of this activity.

- As an IT management team, identify your key budget stakeholders and specifically those in an approval position.

- Use the information provided in this blueprint about various stakeholder responsibilities, areas of focus, and what’s typically important to them to determine each key stakeholder’s needs regarding the information contained in your IT budget. Note their stated needs, any idiosyncrasies, and IT’s current relationship status with the stakeholder (positive, neutral, or negative).

- Assess previous years’ IT budgets to determine how well they targeted each different stakeholder’s needs. Note any gaps or areas for future improvement.

- Develop a high-level list of items or elements to stop, start, or continue during your next budgeting cycle.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Stakeholder alignment assessment

Document the outcomes of your assessment below. Examples are provided below.

Stakeholder |

Relationship status |

Understanding of needs |

Budget changes/additions |

|---|---|---|---|

CFO |

Positive |

Wants at least 30% of budget to be CapEx. Needs more detail concerning benefits and tracking of realization. |

Do more detailed breakouts of CapEx vs. OpEx as 30% CapEx not realistic – pre-meet. Talk to Enterprise PMO about improving project benefits statement template. |

VP of Sales |

Negative |

Only concerned with hitting sales targets. Needs to respond/act quickly based on reliable data. |

Break out sales consumption of IT resources in detail focusing on CRM and SFA tool costs. Propose business intelligence enhancement project. |

Director of Marketing |

Neutral |

Multiple manual processes – would benefit from increased automation of campaign management and social media posting. |

Break out marketing consumption of IT resources and publicly share/compare to generate awareness/support for tech investment. Work together to build ROI statements |

[Name/Title] |

[Positive/Neutral/Negative] |

[Insert text] |

[Insert text] |

[Name/Title] |

[Positive/Neutral/Negative] |

[Insert text] |

[Insert text] |

[Name/Title] |

[Positive/Neutral/Negative] |

[Insert text] |

[Insert text] |

[Name/Title] |

[Positive/Neutral/Negative] |

[Insert text] |

[Insert text] |

[Name/Title] |

[Positive/Neutral/Negative] |

[Insert text] |

[Insert text] |

[Name/Title] |

[Positive/Neutral/Negative] |

[Insert text] |

[Insert text] |

[Name/Title] |

[Positive/Neutral/Negative] |

[Insert text] |

[Insert text] |

[Name/Title] |

[Positive/Neutral/Negative] |

[Insert text] |

[Insert text] |

Set your IT budget pre-selling strategy

Pre-selling is all about ongoing communication with your stakeholders. This is the most game-changing thing you can do to advance a proposed IT budget’s success.

When IT works well, nobody notices. When it doesn’t, the persistent criticism about IT not delivering value will pop up, translating directly into less funding. Cut this off at the pass with an ongoing communications strategy based on facts, transparency, and perspective taking.

- Know your channels

- Identify partners

- Always be prepared

- Don’t be annoying

- Communicate IT initiatives at launch

- Communicate IT successes

Identify all the communication channels you can leverage including meetings, committees, reporting cycles, and bulletins. Set up new channels if they don’t exist.

Nothing’s better than having a team of supporters when pitch day comes. Quietly get them on board early and be direct about the role each of you will play.

Have information and materials about proposed initiatives at-the-ready. You never know when you’ll get your chance. But if your facts are still fuzzy, do more homework first.

Talking about IT all the time will turn people off. Plan chats that don’t mention IT at all. Ask questions about their world and really listen. Empathy’s a powerful tool.

Describe what you will be doing and how it will benefit the business in language that makes sense to the beneficiaries of the initiative.

Carry the same narrative forward through to the end and tell the whole story. Include comments from stakeholders and beneficiaries about the value they’re receiving.

Pre-selling with partners

The thing with pre-selling to partners is not to take a selling approach. Take a collaborative approach instead.

A partner is an influencer, advocate, or beneficiary of the expenditure or investment you’re proposing. Partners can:

- Advise you on real business impacts.

- Voice their support for your funding request.

- Present the initial business case for funding approval themselves.

- Agree to fund all or part of an initiative from their own budget.

When partners agree to pitch or fund an initiative, IT can lose control of it. Make sure you set specific expectations about what IT will help with or do on an ongoing basis, such as:

- Calculating the upfront and ongoing technology maintenance/support costs of the initiative.

- Leading the technology vetting and selection process, including negotiating with vendors, setting service-level agreements, and finalizing contracts.

- Implementing selected technologies and training users.

- Maintaining and managing the technology, including usage metering.

- Making sure the bills get paid.

A collaborative approach tends to result in a higher level of commitment than a selling approach.

Put yourself in their shoes using their language. Asking “How will this affect you?” focuses on what’s in it for them.

Example:

CIO: “We’re thinking of investing in technology that marketing can use to automate posting content to social media. Is that something you could use?”

CMO: “Yes, we currently pay two employees to post on Facebook and Twitter, so if it could make that more efficient, then there would be cost savings there.”

Pre-selling with approvers

The key here is to avoid surprises and ensure the big questions are answered well in advance of decision day.

An approver is the CFO, CEO, board, council, or committee that formally commits funding support to a program or initiative. Approvers can:

- Point out factors that could derail realization of intended benefits.

- Know that a formal request is coming and factor it into their planning.

- Connect your idea with others to create synergies and efficiencies.

- Become active advocates.

When approvers cool to an idea, it’s hard to warm them up again. Gradually socializing an idea well in advance of the formal pitch gives you the chance to isolate and address those cooling factors while they’re still minor. Things you can address if you get an early start with future approvers include:

- Identify and prepare for administrative, regulatory, or bureaucratic hurdles.

- Incorporate approvers’ insights about organizational realities and context.

- Further reduce the technical jargon in your language.

- Fine tune the relevance and specificity of your business benefits statements.

- Get a better sense of the most compelling elements to focus on.

Blindsiding approvers with a major request at a budget presentation could trigger an emotional response, not the rational and objective one you want.

Make approvers part of the solution by soliciting their advice and setting their expectations well in advance.

Example:

CIO: “The underwriting team and I think there’s a way to cut new policyholder approval turnaround from 8 to 10 days down to 3 or 4 using an online intake form. Do you see any obstacles?”

CFO: “How do the agents feel about it? They submit to underwriting differently and might not want to change. They’d all need to agree on it. Exactly how does this impact sales?”

1.3 Set your budget pre-selling strategy

1 hour

- Use the “Stakeholder pre-selling strategy” template slide following this instruction slide to document the outcomes of this activity.

- Carry forward your previously-generated stakeholder alignment assessment from Step 1.2. As a management team, discuss the following for each stakeholder:

- Forums and methods of contact and interaction.

- Frequency of interaction.

- Content or topics typically addressed during interactions.

- Discuss what the outcomes of an ideal interaction would look like with each stakeholder.

- List opportunities to change or improve the nature of interactions and specific actions you plan to take.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Stakeholder pre-selling strategy

Document the outcomes of your discussion. Examples are provided below.

Stakeholder | Current interactions | Opportunities and actions | ||

|---|---|---|---|---|

Forum | Frequency | Content | ||

CFO | One-on-one meeting | Monthly | IT expenditure updates and tracking toward budgeted amount. | Increase one-on-one meeting to weekly. Alternate focus – retrospective update one week, future-looking case development the next. Invite one business unit head to future-looking sessions to discuss their IT needs. |

VP of Sales | Executive meeting | Quarterly | General business update - dominates. | Set up bi-weekly one-on-one meeting – initially focus on what sales does/needs, not tech. Later, when the relationship has stabilized, bring data that shows Sales’ consumption of IT resources. |

Director of Marketing | Executive meeting | Quarterly | General business update - quiet. | Set up monthly one-on-one meeting. Temporarily embed BA to better discover/understand staff processes and needs. |

[Name/Title] | [Insert text] | [Insert text] | [Insert text] | [Insert text] |

[Name/Title] | [Insert text] | [Insert text] | [Insert text] | [Insert text] |

[Name/Title] | [Insert text] | [Insert text] | [Insert text] | [Insert text] |

[Name/Title] | [Insert text] | [Insert text] | [Insert text] | [Insert text] |

[Name/Title] | [Insert text] | [Insert text] | [Insert text] | [Insert text] |

[Name/Title] | [Insert text] | [Insert text] | [Insert text] | [Insert text] |

[Name/Title] | [Insert text] | [Insert text] | [Insert text] | [Insert text] |

Phase recap: Lay your foundation

Build in the elements from the start that you need to facilitate budgetary approval.

You should now have a deeper understanding of the what, why, and who of your IT budget. These elements are foundational to streamlining the budget process, getting aligned with peers and the executive, and increasing your chances of winning budgetary approval in the end.

In this phase, you have:

- Reviewed what your budget is and does. Your budget is an important governance and communication tool that reflects organizational priorities and objectives and IT’s understanding of them.

- Taken a closer look at your stakeholders. The CFO, CEO, and CXOs in your organization have accountabilities of their own to meet and need IT and its budget to help them succeed.

- Developed a strategy for continuously pre-selling your budget. Identifying opportunities and approaches for building relationships, collaborating, and talking meaningfully about IT and IT expenditure throughout the year is one of the leading things you can do to get on the same page and pave the way for budget approval.

“Many departments have mostly labor for their costs. They’re not buying a million and a half or two million dollars’ worth of software every year or fixing things that break. They don’t share IT’s operations mindset and I think they get frustrated.”

– Matt Johnson, IT Director Governance and Business Solutions, Milwaukee County

Phase 2

Get Into Budget-Starting Position

Lay Your | Get Into Budget-Starting Position | Develop Your | Build Your | Create and Deliver Your Presentation |

|---|---|---|---|---|

1.1 Understand what your budget is 1.2 Know your stakeholders 1.3 Continuously pre-sell your budget | 2.1 Assemble your resources 2.2 Understand the four views of the ITFM Cost Model 2.3 Review last year’s budget vs. 2.4 Set your high-level goals | 3.1 Develop assumptions and 3.2 Forecast your project CapEx 3.3 Forecast your non-project CapEx and OpEx | 4.1 Aggregate your numbers 4.2 Stress test your forecasts 4.3 Challenge and perfect your | 5.1 Plan your content 5.2 Build your presentation 5.3 Present to stakeholders 5.4 Make final adjustments and submit your IT budget |

This phase will walk you through the following activities:

- Putting together your budget team and gather your data.

- Selecting which views of the ITFM Cost Model you’ll use.

- Mapping and analyzing IT’s historical expenditure.

- Setting goals and metrics for the next budgetary cycle.

This phase involves the following participants:

- Head of IT

- IT Financial Lead

- Other IT Management

Get into budget-starting position

Now’s the time to pull together your budgeting resources and decision-making reference points.

This phase is about clarifying your context and defining your boundaries.

- Assemble your resources. This includes the people, data, and other information you’ll need to maximize insight into future spend requirements.

- Understand the four views of the IT Cost Model. Firm up your understanding of the CFO expense view, CIO service view, CXO business view, and CEO innovation view and decide which ones you’ll use in your analysis and forecasting.

- Review last year’s budget versus actuals. You need last year’s context to inform next year’s numbers as well as demonstrate any cost efficiencies you successfully executed.

- Review five-year historical trends. This long-term context gives stakeholders and approvers important information about where IT fits into the business big picture and reminds them how you got to where you are today.

- Set your high-level goals. You need to decide if you’re increasing, decreasing, or holding steady on your budget and whether you can realistically meet any mandates you’ve been handed on this front. Set a target as a reference point to guide your decisions and flag areas where you might need to have some tough conversations.

“A lot of the preparation is education for our IT managers so that they understand what’s in their budgets and all the moving parts. They can actually help you keep it within bounds.”

– Trisha Goya, Director, IT Governance & Administration, Hawaii Medical Service Association

Gather your budget-building team

In addition to your CFO, CXOs, and CEO, there are other people who will provide important information, insight, and skill in identifying IT budget priorities and costs.

Role |

Skill set |

Responsibilities |

|---|---|---|

IT Finance Lead |

|

IT finance personnel will guide the building of cost forecasting methodologies for operating and capital costs, help manage IT cash flows, help identify cost reduction options, and work directly with the finance department to ensure they get what they need. |

IT Domain Managers |

|

They will be active participants in budgeting for their specific domains, act as a second set of eyes, assist with and manage their domain budgets, and engage with stakeholders. |

Project Managers |

|

Project managers will assist in capital and operational forecasting and will review project budgets to ensure accuracy. They will also assist in forecasting the operational impacts of capital projects. |

As the head of IT, your role is as the budgeting team lead. You understand both the business and IT strategies, and have relationships with key business partners. Your primary responsibilities are to guide and approve all budget components and act as a liaison between finance, business units, and IT.

Set expectations with your budgeting team

Be clear on your goals and ensure everyone has what they need to succeed.

Your responsibilities and accountabilities.

|

Goals and requirements.

|

Budgeting fundamentals.

|

Their responsibilities and accountabilities.

|

Timeframes and deadlines.

|

Available resources.

|

2.1 Brief and mobilize your IT budgeting team

2 hours

- Download the IT Cost Forecasting and Budgeting Workbook

- Organize a meeting with your IT department management team, team leaders, and project managers.

- Review their general financial management accountabilities and responsibilities.

- Discuss the purpose and context of the budgeting exercise, different budget components, and the organization’s milestones/deadlines.

- Identify specific tasks and activities that each member of the team must complete in support of the budgeting exercise.

- Set up additional checkpoints, working sessions, or meetings that will take you through to final budget submission.

- Document your budget team members, responsibilities, deliverables, and due dates on the “Planning Variables” tab in the IT Cost Forecasting & Budgeting Workbook.

Download the IT Cost Forecasting and Budgeting Workbook

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Leverage the ITFM Cost Model

Each of the four views breaks down IT costs into a different array of categories so you and your stakeholders can see expenditure in a way that’s meaningful for them.

You may decide not to use all four views based on your goals, audience, and available time. However, let’s start with how you can use the first two views, the CFO expense view and the CIO service view.

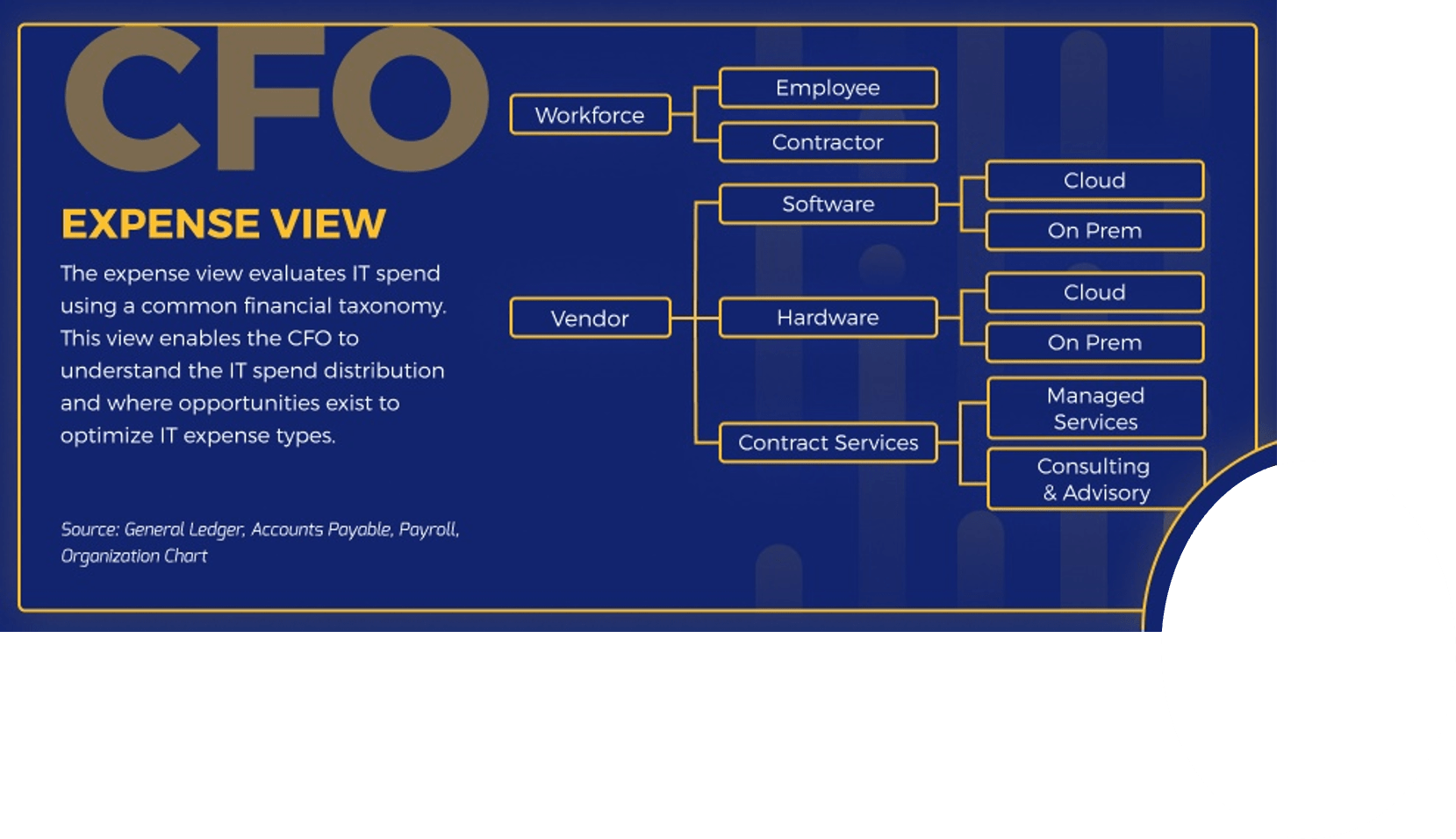

The CFO expense view is fairly traditional – workforce and vendor. However, Info-Tech’s approach breaks down the vendor software and hardware buckets into on-premises and cloud. Making this distinction is increasingly critical given key differences in CapEx vs. OpEx treatment. Forecasting this view is mandatory |

These two views provide information that will help you optimize IT costs. They’re designed to allow the CFO and CIO to find a common language that will allow them to collaboratively make decisions about managing IT expenditure effectively. |

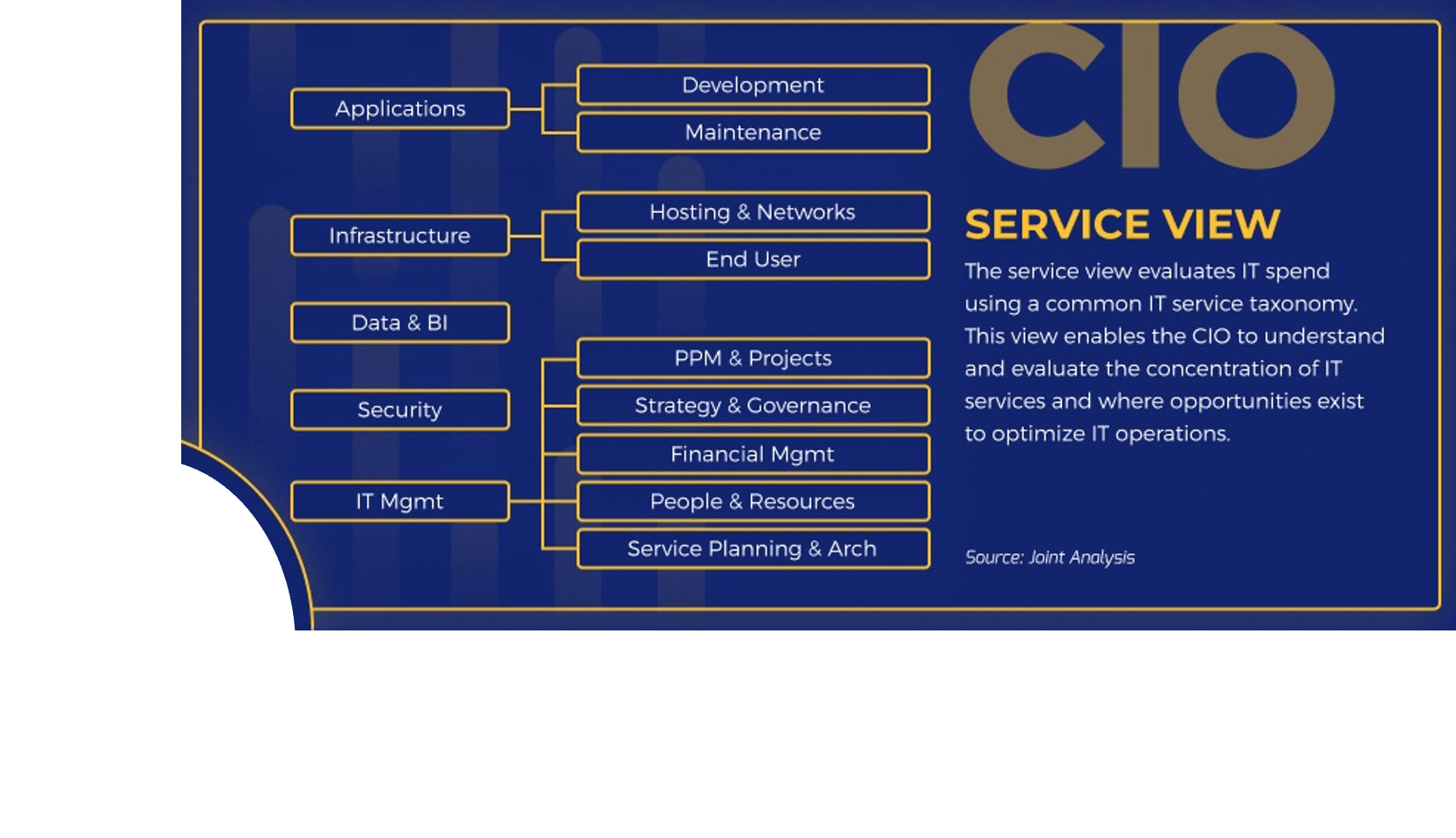

The CIO service view is your view, i.e. it’s how IT tends to organize and manage itself and is often the logical starting point for expenditure planning and analysis. Sub-categories in this view, such as security and data & BI, can also resonate strongly with business stakeholders and their priorities. Forecasting this view is recommended |

Extend your dialogue to the business

Applying the business optimization views of the ITFM Cost Model can bring a level of sophistication to your IT cost analysis and forecasting efforts.

Some views take a bit more work to map out, but they can be powerful tools for communicating the value of IT to the business. Let’s look at the last two views, the CXO business view and the CEO innovation view.

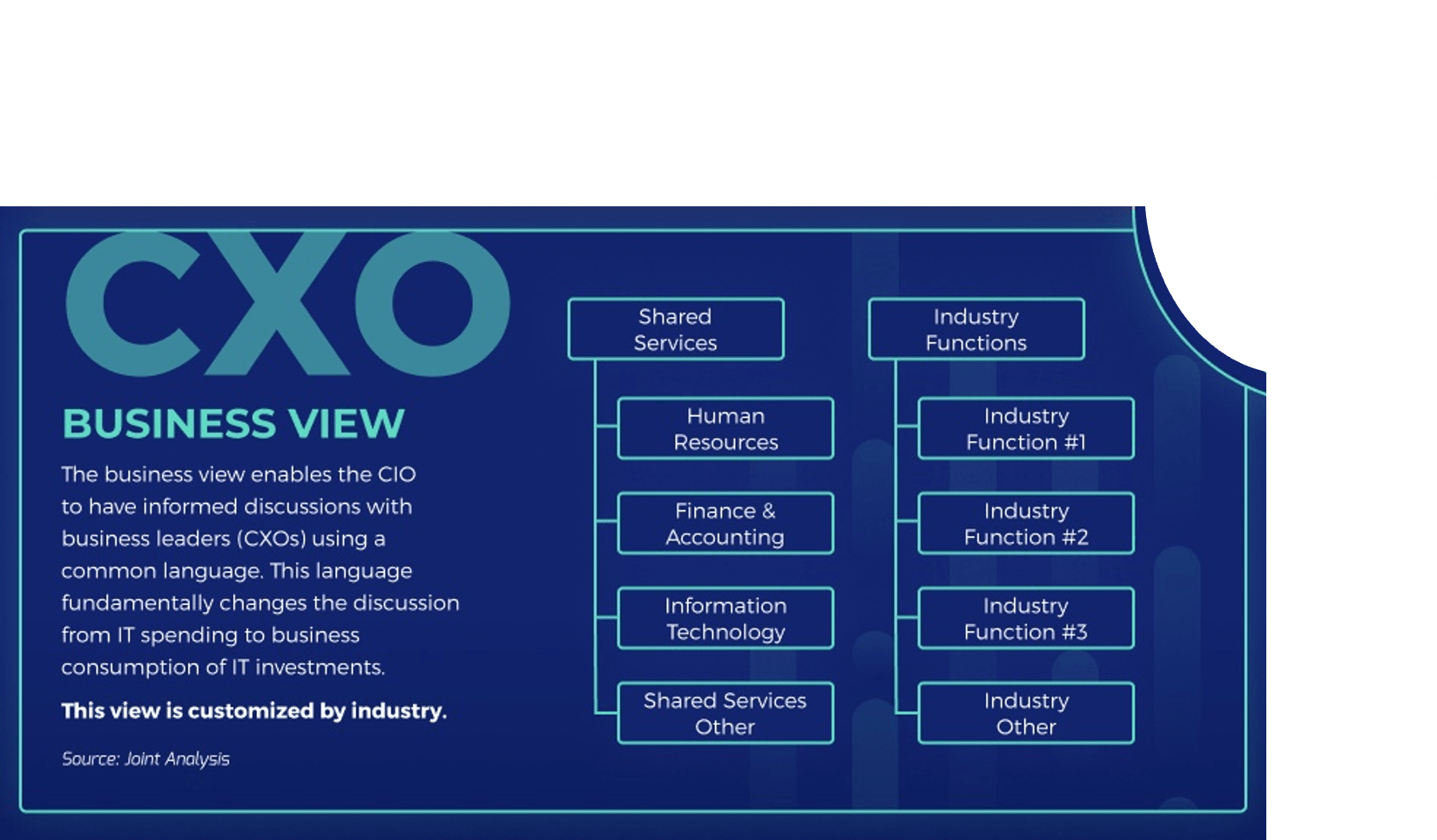

The CXO business view looks at IT expenditure business unit by business unit so that each can understand their true consumption of IT resources. This view relies on having a fair and reliable cost allocation formula, such as one based on relative headcount, so it runs the risk of inaccuracy. Forecasting this view is recommended

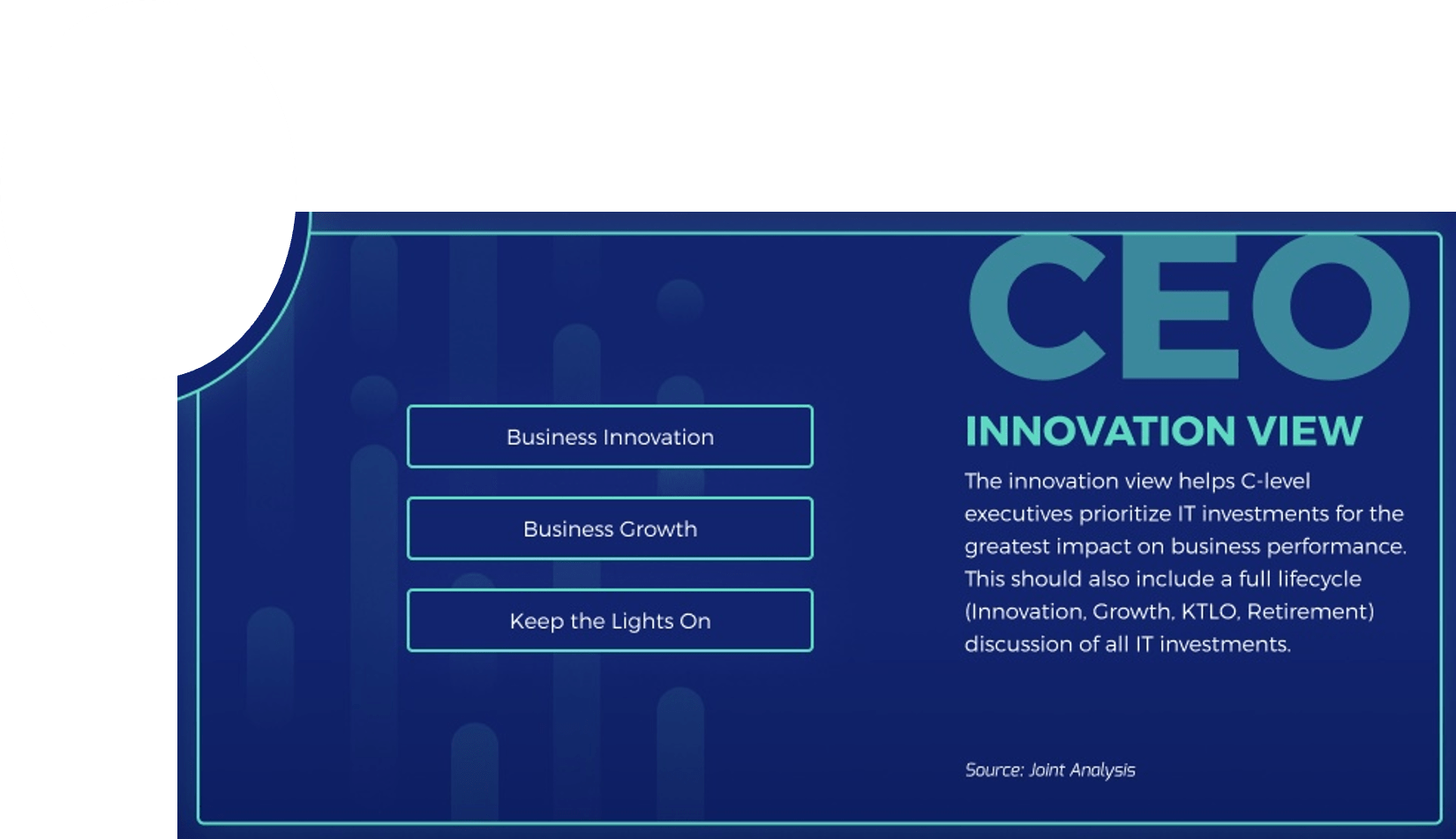

| These two views provide information that will help you optimize IT support to the business. These views also have a collaborative goal in mind, enabling IT to talk about IT spend in terms that will promote transparency and engage business stakeholders. | The CEO innovation view is one of the hardest to analyze and forecast since a single spend item may apply to innovation, growth, and keeping the lights on. However, if you have an audience with the CEO and they want IT to play a more strategic or innovative role, then this view is worth mapping. Forecasting this view is optional

|

2.2 Select the ITFM Cost Model views you plan to complete based on your goals

30 minutes

The IT Cost Forecasting and Budgeting Workbook contains standalone sections for each view, as well as rows for each lowest-tier sub-category in a view, so each view can be analyzed and forecasted independently.

- Review Info-Tech’s ITFM Cost Model and the expenditure categories and sub-categories each view contains.

- Revisit your stakeholder analysis for the budgeting exercise. Plan to:

- Complete the CFO expense view regardless.

- Complete the CIO service view – consider doing this one first for forecasting purposes as it may be most familiar to you and serve as an easier entry point into the forecasting process.

- Complete the CXO business view – consider doing this only for select business units if you have the objective of enhancing awareness of their true consumption of IT resources or if you have (or plan to have) a show-back/chargeback mechanism.

- Complete the CEO innovation view only if your data allows it and there’s a compelling reason to discuss the strategic or innovative role of IT in the organization.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Gather your budget-building data

Your data not only forms the content of your budget but also serves as the supporting evidence for the decisions you’ve made.

Ensure you have the following data and information available to you and your budgeting team before diving in:

Past data

- Last fiscal year’s budget.

- Actuals for the past five fiscal years.

- Pre-set capital depreciation/amortization amounts to be applied to next fiscal year’s budget.

Current data

- Current-year IT positions and salaries.

- Active vendor contracts with payment schedules and amounts (including active multi-year agreements).

- Cost projections for remainder of any projects that are committed or in-progress, including projected OpEx for ongoing maintenance and support.

Future data

- Estimated market value for any IT positions to be filled next year (both backfill of current vacancies and proposed net-new positions).

- Pricing data on proposed vendor purchases or contracts.

- Cost estimates for any capital/strategic projects that are being proposed but not yet committed, including resulting maintenance/support OpEx.

- Any known pending credits to be received or applied in the next fiscal year.

If you’re just getting started building a repeatable budgeting process, treat it like any other project, complete with a formal plan/ charter and a central repository for all related data, information, and in-progress and final documents.

Once you’ve identified a repeatable approach that works for you, transition the budgeting project to a regular operational process complete with policies, procedures, and tools.

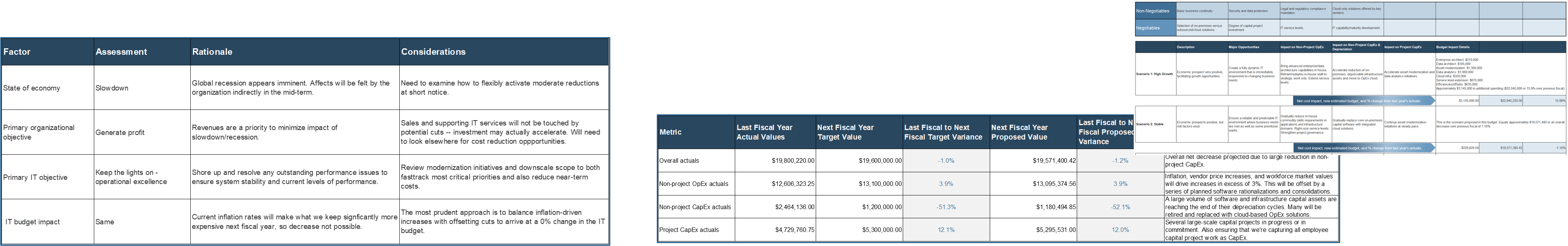

Review last year’s budget vs. actuals

This is the starting point for building your high-level rationale around what you’re proposing for next fiscal year.

But first, some quick definitions:

- Budgeted: What you planned to spend when you started the fiscal year.

- Actual: What you ended up spending in real life by the end of the fiscal year.

- Variance: The difference between budgeted expenditure and actual expenditure.

For last fiscal year, pinpoint the following metrics and information:

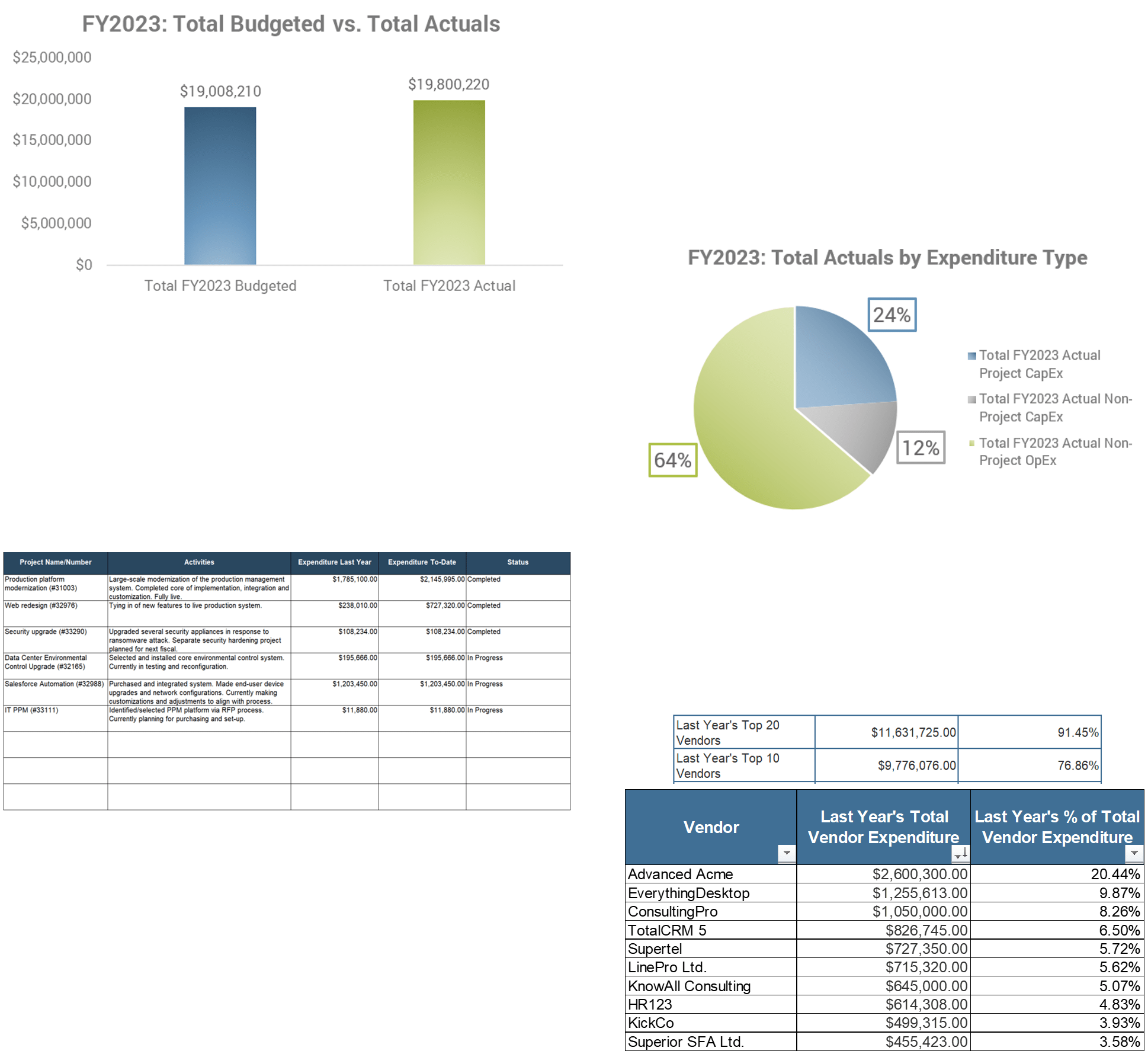

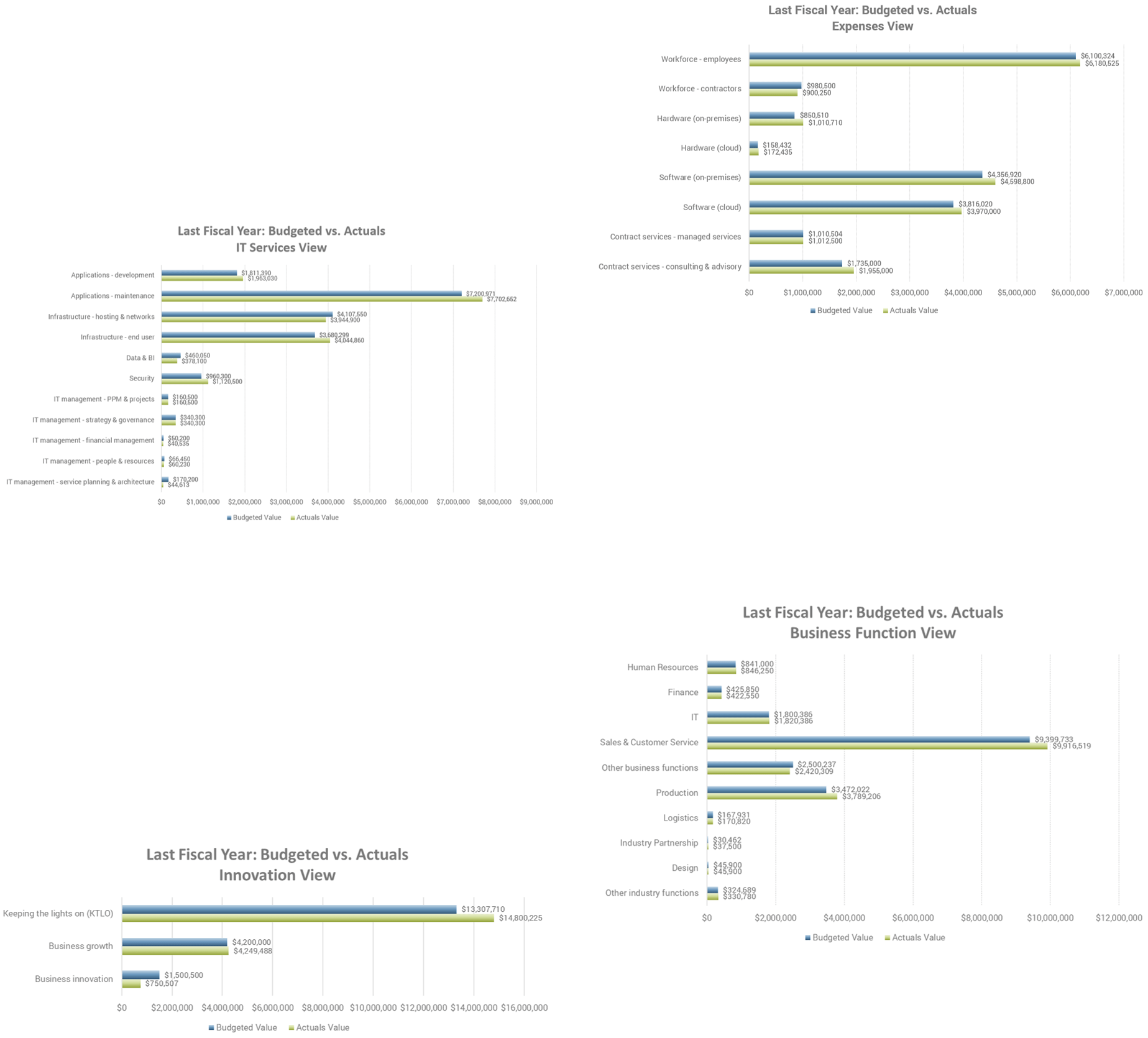

Budgeted and actual IT expenditure overall and by major cost category. Categories will include workforce (employees/contractors) and vendors (hardware, software, contracted services) at a minimum. |

Actual IT expenditure as a percentage of organizational revenue. This is a widely-used benchmark that your CFO will expect to see. |

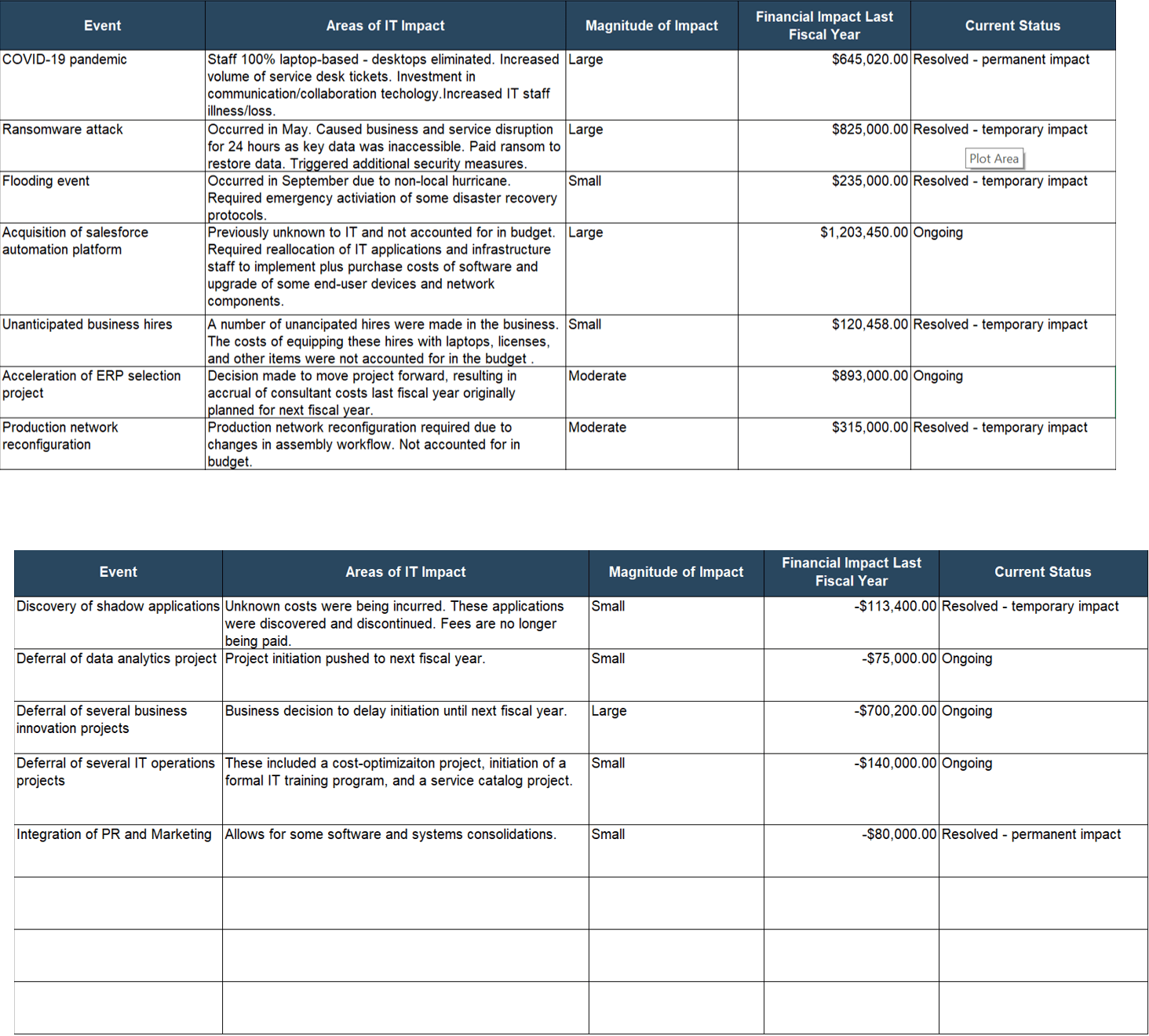

The known and likely drivers behind budgeted vs. actual variances. Your rationales will affect your perceived credibility. Be straightforward, avoid defending or making excuses, and just show the facts. Ask your CFO what they consider acceptable variance thresholds for different cost categories to guide your variance analysis, such as 1% for overall IT expenditure. |

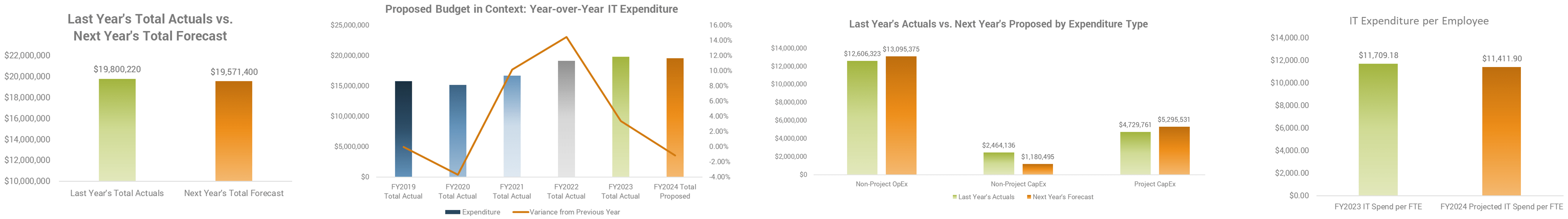

Actual IT CapEx and OpEx. CapEx is often more variable than OpEx over time. Separate them so you can see the real trends for each. Consider:

|

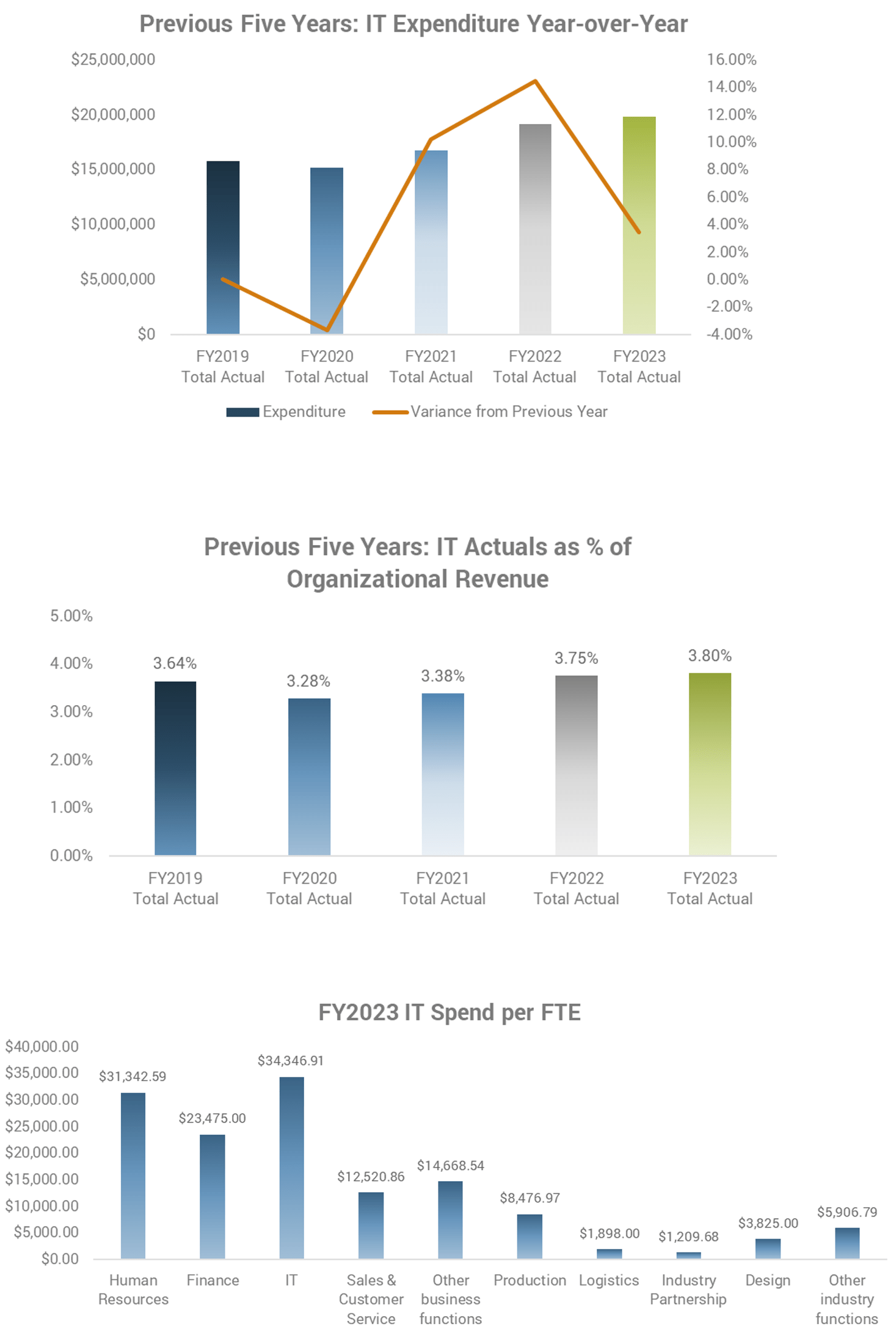

Next, review your five-year historical expenditure trends

The longer-term pattern of IT expenditure can help you craft a narrative about the overarching story of IT.

For the previous five fiscal years, focus on the following:

Actual IT expenditure as a percentage of organizational revenue.

Again, for historical years 2-5, you can break this down into granular cost categories like workforce, software, and infrastructure like you did for last fiscal year. Avoid getting bogged down and focusing on the past – you ultimately want to redirect stakeholders to the future.

Percentage expenditure increase/decrease year to year.

You may choose to show overall IT expenditure amounts, breakdowns by CapEx and OpEx, as well as high-level cost categories.

As you go back in time, some data may not be available to you, may be unreliable or incomplete, or employ the same cost categories you’re using today. Use your judgement on the level of granularity you want to and can apply when going back two to five years in the past.

So, what’s the trend? Consider these questions:

- Is the year-over-year trend on a steady trajectory or are there notable dips and spikes?

- Are there any one-time capital projects that significantly inflated CapEx and overall spend in a given year or that forced maintenance-and support-oriented OpEx commitments in subsequent years?

- Does there seem to be an overall change in the CapEx-to-OpEx ratio due to factors like increased use of cloud services, outsourcing, or contract-based staff?

Take a close look at financial data showcasing the cost-control measures you’ve taken

Your CFO will look for evidence that you’re gaining efficiencies by controlling costs, which is often a prerequisite for them approving any new funding requests.

Your objective here is threefold:

- Demonstrate IT’s track record of fiscal responsibility and responsiveness to business priorities.

- Acknowledge and celebrate your IT-as-cost-center efficiency gains to clear the way for more strategic discussions.

- Identify areas where you can potentially source and reallocate recouped funds to bolster other initiatives or business cases for net-new spend.

This step is about establishing credibility, demonstrating IT value, building trust, and showing the CFO you’re on their team.

Do the following: