Achieve IT Spend & Staffing Transparency

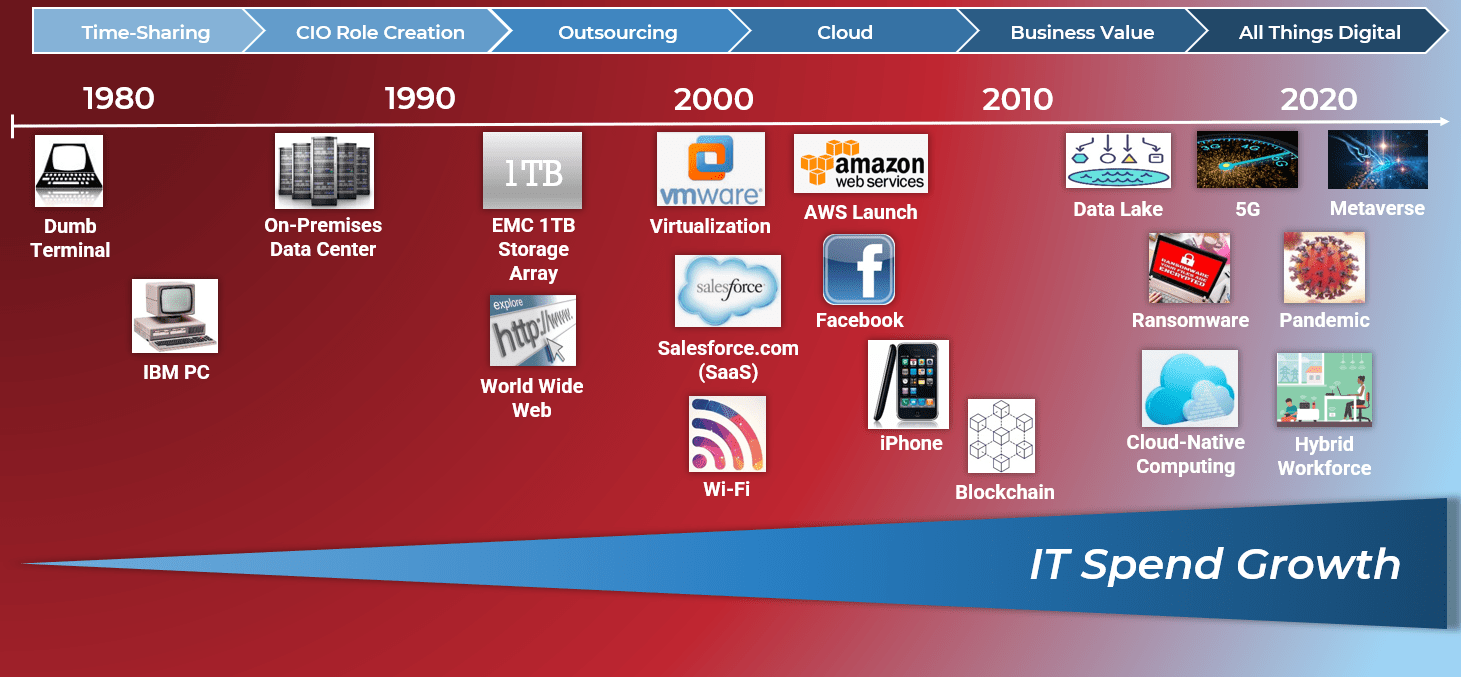

- IT spend has increased in volume and complexity, but how IT spend decisions are made has not kept pace.

- In most organizations, technology has evolved faster than the business’ understanding of what it is, how it works, and what it can do for them.

- How traditional financial accounting methods are applied to IT expenditure don’t align well to modern IT realities.

- IT is often directed to make cuts when cost optimization and targeted investment are what’s really needed to sustain and grow the organization in the long term.

Our Advice

Critical Insight

- Meaningful conversations about IT spend don’t happen nearly as frequently as they should. When they do happen, they are often inhibited by a lack of IT financial management (ITFM) maturity combined with the absence of a shared vocabulary between IT, the CFO, and other business function leaders.

- Supporting data about actual technology spend taking place that would inform decision making is often scattered and incomplete.

- Creating transparency in your IT financial data is essential to powering collaborative and informed technology spend decisions.

Impact and Result

- Understand the uses and benefits of making your IT spend more transparent.

- Discover and organize your IT financial data.

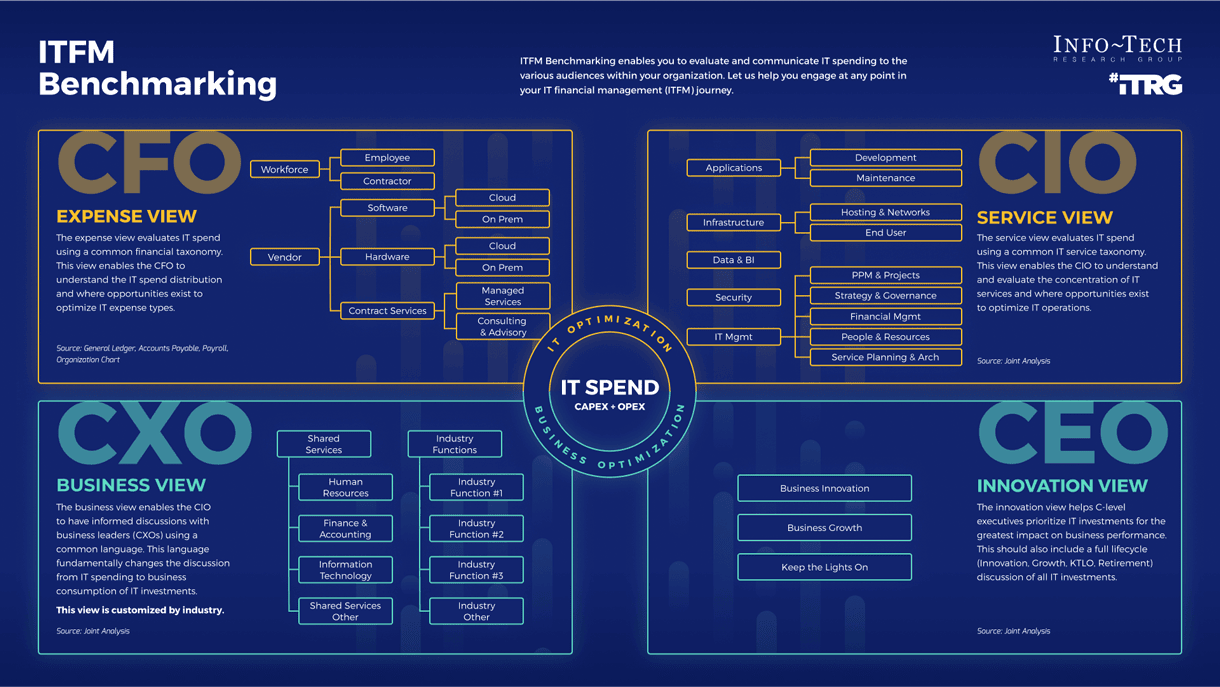

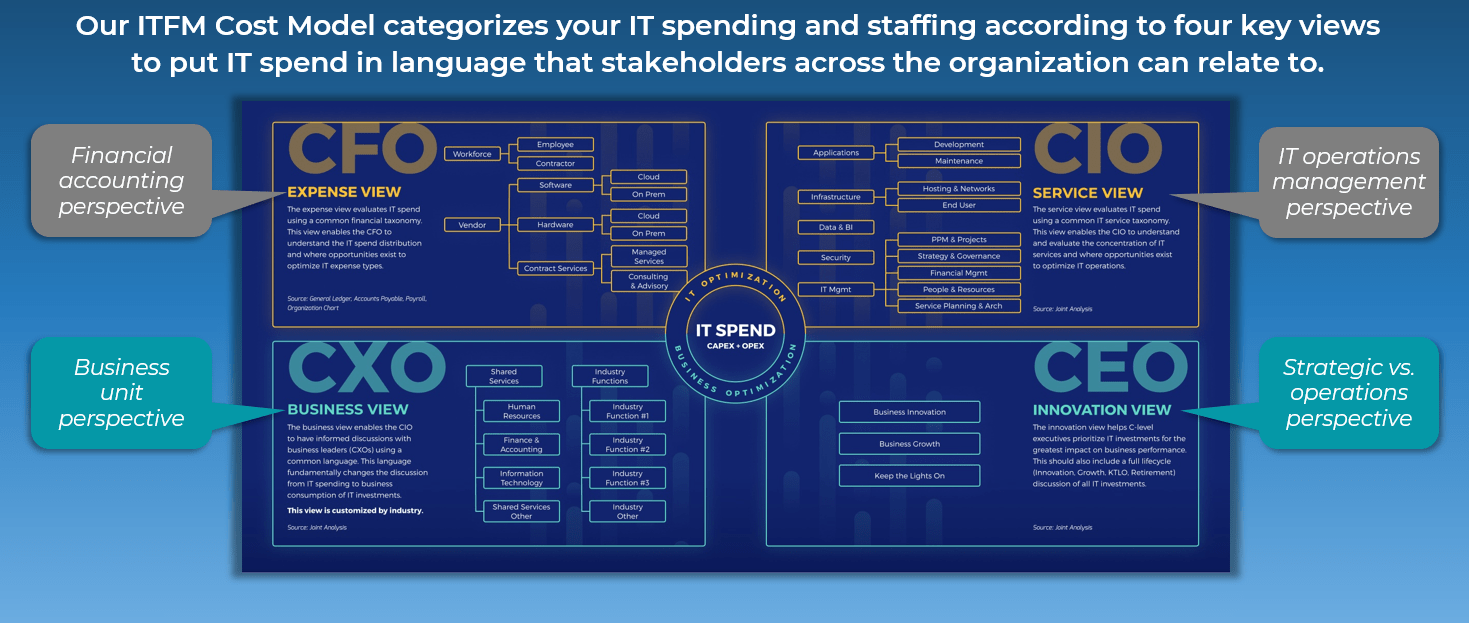

- Map your organization’s total technology spend against four IT stakeholder views: CFO, CIO, CXO, and CEO.

- Gain vocabulary and facts that will help you tell the true story of IT spend.

Members may also be interested in Info-Tech's IT Spend & Staffing Benchmarking Service.

Achieve IT Spend & Staffing Transparency Research & Tools

Besides the small introduction, subscribers and consulting clients within this management domain have access to:

1. Achieve IT Spend & Staffing Transparency Deck – A detailed, do-it-yourself framework and process for clearly mapping your organization’s total technology spend.

This deck mirrors Info-Tech’s own internal methods for delivering its IT Spend & Staffing Benchmarking Service in a do-it-yourself format. Based on Info-Tech’s proven ITFM Cost Model, it includes an IT spend mapping readiness assessment, expert advice for sourcing and organizing your financial data, a methodology for mapping IT staff and vendor spend according to four key stakeholder views (CFO, CIO, CXO, and CEO), and guidance on how to analyze and share your results.

- Achieve IT Spend & Staffing Transparency Storyboard

2. IT Spend & Staffing Transparency Workbook – A structured Excel tool that allows you to allocate your IT spend across four key stakeholder views and generate high-impact visualizations.

This workbook offers a step-by-step approach for mapping and visualizing your organization’s true IT spend.

- IT Spend & Staffing Transparency Workbook

3. IT Spend & Staffing Transparency Executive Presentation Template – A PowerPoint template that helps you summarize and showcase key results from your IT spend transparency exercise.

This presentation template offers a recommended structure for introducing key executive stakeholders to your organization’s true IT spending behavior and IT financial management as a whole.

- IT Spend & Staffing Transparency Executive Presentation Template

Infographic

Further reading

Achieve IT Spend & Staffing Transparency

Lay a foundation for meaningful conversations with the business.

Analyst Perspective

Take the first step in your IT spend journey.

Talking about money is hard. Talking to the CEO, CFO, and other business leaders about money is even harder, especially if IT is seen as just a cost center, is not understood by stakeholders, or is simply taken for granted. In times of economic hardship, already lean IT operations are tasked with becoming even leaner.

When there's little fat to trim, making IT spend decisions without understanding the spend's origin, location, extent, and purpose can lead to mistakes that weaken, not strengthen, the organization.

The first step in optimizing IT spend decisions is setting a baseline. This means having a comprehensive and transparent view of all technology spend, organization-wide. This baseline is the only way to have meaningful, data-driven conversations with stakeholders and approvers around what IT delivers to the business and the implications of making changes to IT funding.

Before stepping forward in your IT financial management journey, know exactly where you're standing today.

Jennifer Perrier

Principal Research Director, ITFM Practice

Info-Tech Research Group

Executive Summary

| Your Challenge | Common Obstacles | Info-Tech's Approach |

IT spend has increased in volume and complexity, but how IT spend decisions are made has not kept pace:

|

Meaningful conversations about IT spend don't happen nearly as much as they should. This is often due to:

|

Lay a foundation for meaningful conversations and informed decision-making around IT spend.

|

Info-Tech Insight

Create transparency in your IT financial data to power both collaborative and informed technology spend decisions.

IT spend has grown alongside IT complexity

Growth creates change ... and challenges

IT has become more integral to business operations and achievement of strategic goals, driving complexity in how IT funds are allocated and managed.

| How IT funds are spent has changed Value demonstration is two-pronged. The first is return on performance investment, focused on formal and objective goals, metrics, and KPIs. The second is stakeholder satisfaction, a more subjective measure driven by IT-business alignment and relationship. IT leaders must do both well to prove and promote IT's value. |

Funding decision cadence has sped up Many organizations have moved from three- to five-year strategic planning cycles to one-year planning horizons or less, most noticeably since the 2008/2009 recession. Not only has the pace of technological change accelerated, but so too has volatility in the broader business and economic environments, forcing rapid response. |

Justification rigor around IT spend has increased The need for formal business cases, proposals, and participation in formal governance processes has increased, as has demand for financial transparency. With many IT departments still reporting into the CFO, there's no getting around it - today's IT leaders need to possess financial management savvy. |

Clearly showing business value has become priority IT spend has moved from the purchase of discrete hardware and software tools traditionally associated with IT to the need to address larger-scale issues around interoperability, integration, and virtualized cloud solutions. Today's focus is more on big-picture architecture than on day-to-day operations. |

ITFM capabilities haven't grown with IT spend

IT still needs to prove itself.

Increased integration with the core business has made it a priority for the head of IT to be well-versed in business language and practice, specifically in the areas of measurement and financial management.

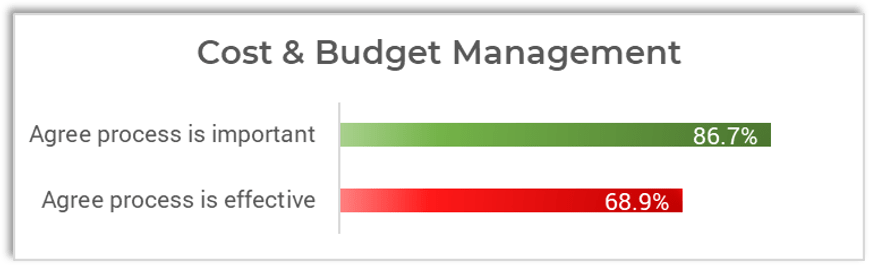

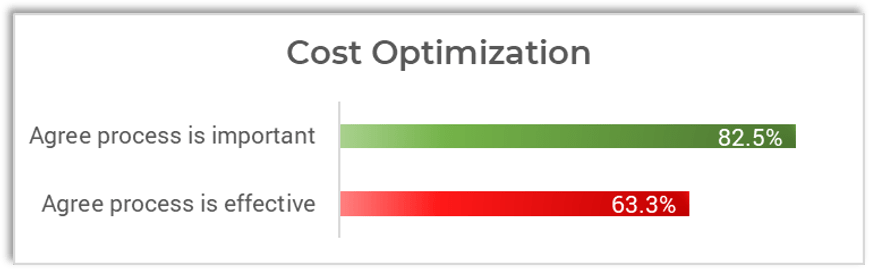

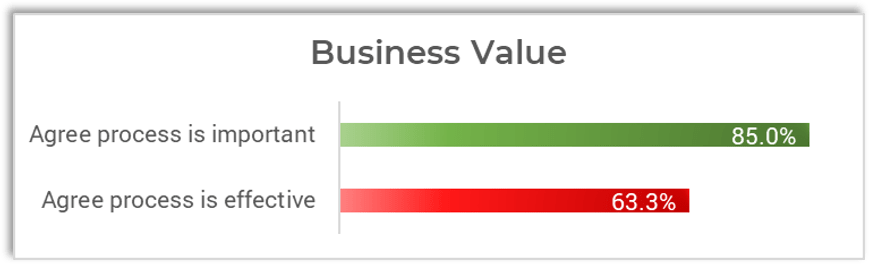

However, IT staff across all industries aren't very confident in how well IT is doing in managing its finances via three core processes:

- Accounting of costs and budgets.

- Optimizing costs to gain the best return on investment.

- Demonstrating IT's value to the business.

Recent data from 4,137 respondents to Info-Tech's IT Management & Governance Diagnostic shows that while most IT staff feel that these three financial management processes are important, notably fewer feel that IT management is effective at executing them.

IT leadership's capabilities around fundamental cost data capture appear to be lagging, not to mention the essential value-added capabilities around optimizing costs and showing how IT contributes to business value.

Source: IT Management & Governance Diagnostic, Info-Tech Research Group, 2022.

Take the perspective of key IT stakeholders as a first step in ITFM capability improvement

Other business unit leaders need to deliver on their own specific and unique accountabilities. Create true IT spend transparency by accounting for these multiple perspectives.

Exactly how is IT spending all that money we give them?

Many IT costs, like back-end infrastructure and apps maintenance, can be invisible to the business.

Why doesn't my department get more support from IT?

Some business needs won't align with spend priorities, while others seem to take more than their fair share.

Does the amount we spend on each IT service make sense?

IT will get little done or fall short of meeting service level requirements without appropriate funding.

I know what IT costs us, but what is it really worth?

Questions about value arise as IT investment and spend increase. How to answer these questions is critical.

At the end of the day, telling IT's spend story to the business is a significant challenge if you don't understand your audience, have a shared vocabulary, or use a repeatable framework.

Mapping your IT spend against a reusable framework helps generate transparency

A framework makes transparency possible by simplifying methods, creating common language, and reducing noise.

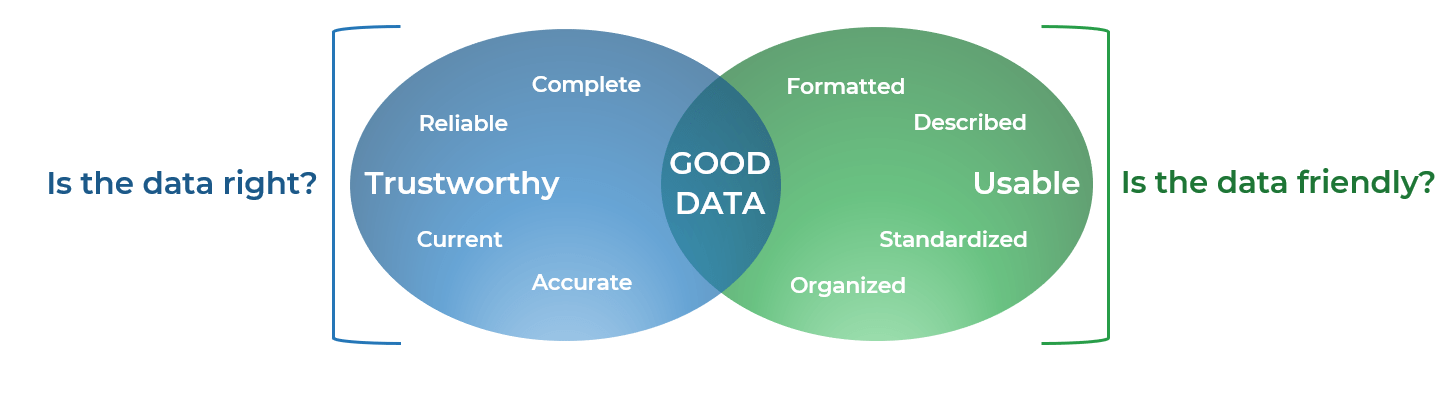

However, the best methodological framework won't work if the materials and information plugged into it are weak. With IT spend, the materials and information are your staff and your vendor financial data. To achieve true transparency, inputs must have the following three characteristics:

| Availability | Reliability | Usability |

|---|---|---|

| The data and information are up-to-date and accessible when needed. | The data and information are accurate, complete, and verifiable. | The data and information are clearly defined, consistently and predictably organized, consumable, and meaningful for decision-making. |

A framework is an organizing principle. When it comes to better understanding your IT spend, the things being organized by a framework are your method and your data.

If your IT spend information is transparent, you have an excellent foundation for having the right conversations with the right people in order to make strategically impactful decisions.

Info-Tech's approach enables meaningful dialogue with stakeholders about IT spend

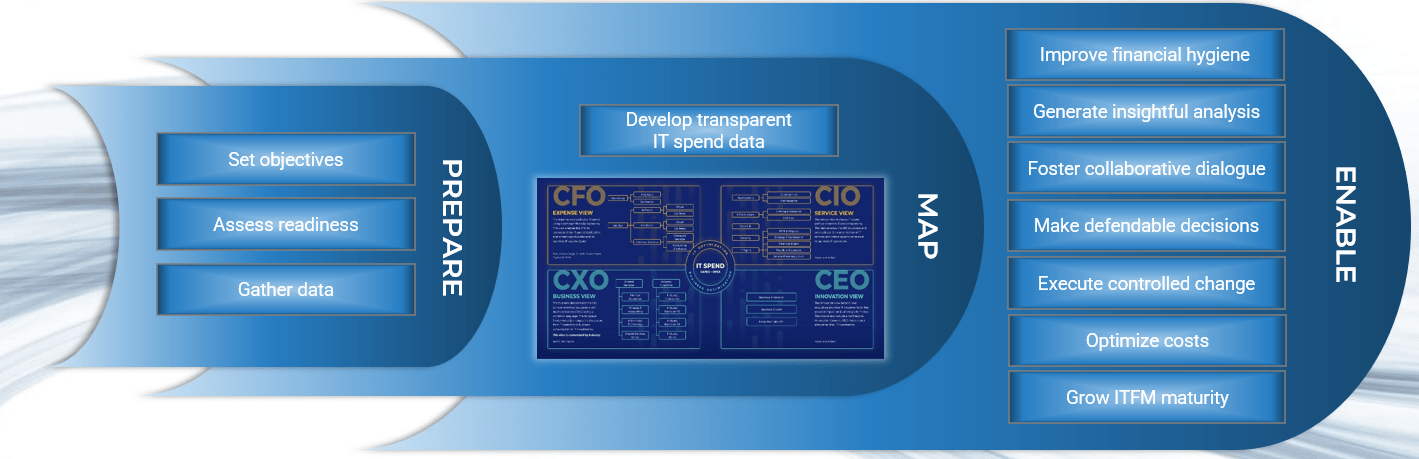

Investing time in preparing and mapping your IT spend data enables better IT governance

While other IT spend transparency methods exist, Info-Tech's is designed to be straightforward and tactical.

Put your data to work instead of being put to work by your data.

Introducing Info-Tech's methodology for creating transparency on technology spend

| 1. Know your objectives | 2. Gather required data | 3. Map your IT staff spend | 4. Map your IT vendor spend | 5. Identify implications for IT | |

|---|---|---|---|---|---|

| Phase Steps |

|

|

|

|

|

| Phase Outcomes | Goals and scope for your IT spend and staffing transparency effort. | Information and data required to perform the IT staff and vendor spend transparency initiative. | A mapping of the allocation of IT staff spend across the four views of the Info-Tech ITFM Cost Model. | A mapping of the allocation of IT vendor spend across the four views of the Info-Tech ITFM Cost Model. | An analysis of your results and a presentation to aid your communication of findings with stakeholders. |

Insight Summary

Overarching insight

Take the perspective of key stakeholders and lay out your organization's complete IT spend footprint in terms they understand to enable meaningful conversations and start evolving your IT financial management capability.

Phase 1 insight

Your IT spend transparency efforts are only useful if you actually do something with the outcomes of those efforts. Be clear about where you want your IT transparency journey to take you.

Phase 2 insight

Your IT spend transparency efforts are only as good as the quality of your inputs. Take the time to properly source, clean, and organize your data.

Phase 3 insight

Map your IT staff spend data first. It involves work but is relatively straightforward. Practice your mapping approach here and carry forward your lessons learned.

Phase 4 insight

The importance of good, usable data will become apparent when mapping your IT vendor spend. Apply consistent and meaningful vendor labels to enable true aggregation and insight.

Phase 5 insight

Communicating your final IT spend transparency mapping with executive stakeholders is your opportunity to debut IT financial management as not just an IT issue but an organization-wide concern.

Blueprint deliverables

Each step of this blueprint is accompanied by supporting deliverables to help you accomplish your goals.

Use this tool in Phases 1-4

IT Spend & Staffing Transparency Workbook

Input your IT staff and vendor spend data to generate visual outputs for analysis and presentation in your communications.

Key deliverable:

IT Spend & Staffing Transparency Executive Presentation

Create a showcase for your newly-transparent IT staff and vendor spend data and present it to key business stakeholders.

Use this tool in Phase 5

IT and business blueprint benefits

| IT Benefits | Business Benefits |

|---|---|

|

|

Measure the value of this blueprint

You will know that your IT spend and staffing transparency effort is succeeding when:

- Your understanding of where technology funds are really being allocated is comprehensive.

- You're having active and meaningful dialogue with key stakeholders about IT spend issues.

- IT spend transparency is a permanent part of your IT financial management toolkit.

In phase 1 of this blueprint, we will help you identify initiatives where you can leverage the outcomes of your IT spend and staffing transparency effort.

In phases 2, 3, and 4, we will guide you through the process of mapping your IT staff and vendor spend data so you can generate your own IT spend metrics based on reliable sources and verifiable facts.

Win #1: Knowing how to reliably source the financial data you need to make decisions.

Win #2: Getting your IT spend data in an organized format that you can actually analyze.

Win #3: Having a framework that puts IT spend in a language stakeholders understand.

Win #4: Gaining a practical starting point to mature ITFM practices like cost optimization.

Info-Tech offers various levels of support to best suit your needs

| DIY Toolkit | Guided Implementation | Workshop | Consulting |

|---|---|---|---|

| "Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful." | "Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track." | "We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place." | "Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project." |

Diagnostics and consistent frameworks are used throughout all four options.

Guided Implementation

Info-Tech recommends the following calls in your Guided Implementation.

| Phase 1: Know your objectives | Phase 2: Gather required data | Phase 3: Map your IT staff spend | Phase 4: Map your IT vendor spend | Phase 5: Identify implications for IT |

|---|---|---|---|---|

| Call #1: Discuss your IT spend and staffing transparency objectives and readiness. | Call #2: Review spend and staffing data sources and identify data organization and cleanup needs. | Call #3: Review your mapped IT staff spend and resolve lingering challenges. | Call #4: Review your mapped IT vendor spend and resolve lingering challenges. | Call #5: Analyze your mapping outputs for opportunities and devise next steps. |

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is between four to six calls over the course of two to three months.

Want even more help with your IT spend transparency effort?

Let us fast-track your IT spend journey.

The path to IT financial management maturity starts with knowing exactly where your money is going. To streamline this effort, Info-Tech offers an IT Spend & Staffing Benchmarking service that provides full transparency into where your money is going without any heavy lifting on your part.

This unique service features:

- A client-proven approach to meet your IT spend transparency goals.

- Vendor and staff spend mapping that reveals business consumption of IT.

- Industry benchmarking to compare your spending and staffing to that of your peers.

- Results in a fraction of the time with much less effort than going it alone.

- Expert review of results and ongoing discussions with Info-Tech analysts.

If you'd like Info-Tech to pave the way to IT spend transparency, contact your account manager for more information - we're happy to talk anytime.

Phase 1

Know Your Objectives

This phase will walk you through the following activities:

- Establish IT spend and staffing transparency uses and objectives

- Assess your readiness to tackle IT spend and staffing transparency

This phase involves the following participants:

- Head of IT

- IT financial lead

- Other members of IT management

Phase 1: Know your objectives

Envision what transparency can do.

You're at the very beginning of your IT spend transparency journey. In this phase you will:

- Set your objectives for making your IT spend and staffing transparent.

- Assess your readiness to tackle the exercise and gauge how much work you'll need to do in order to do it well.

"I've heard this a lot lately from clients: 'I've got my hands on this data, but it's not structured in a way that will allow me to make any decisions about it. I have these journal entries and they have some accounting codes, GL descriptors, cost objects, and some vendors, but it's not enough detail to make any decisions about my services, my applications, my asset spend.'"

- Angie Reynolds, Principal Research Director, ITFM Practice, Info-Tech Research Group

Transparency positively enables both business outcomes and the practice of business ethics

However, transparency's real superpower is in how it provides fact-based context.

- More accurate and relevant data for decision-making.

- Better managed and more impactful financial outcomes.

- Increased inclusion of people in the decisions that affect them.

- Clearer accountabilities for organizational efficiency and effectiveness goals.

- Concrete proof that business priorities and decisions are being acted on and implemented.

- Greater trust and respect between IT and the business.

- Demonstration of integrity in how funds are being used.

IT spend transparency efforts are only useful if you actually do something with the outputs

Identify in advance how you plan to leverage IT spend transparency outcomes.

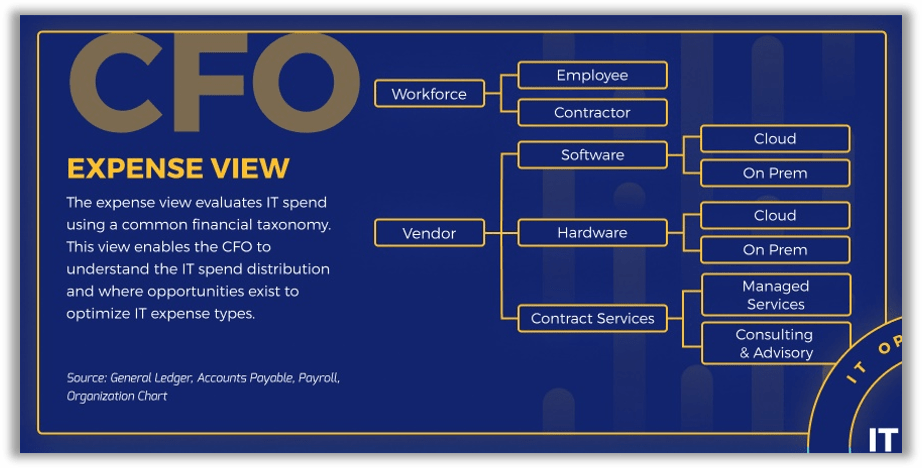

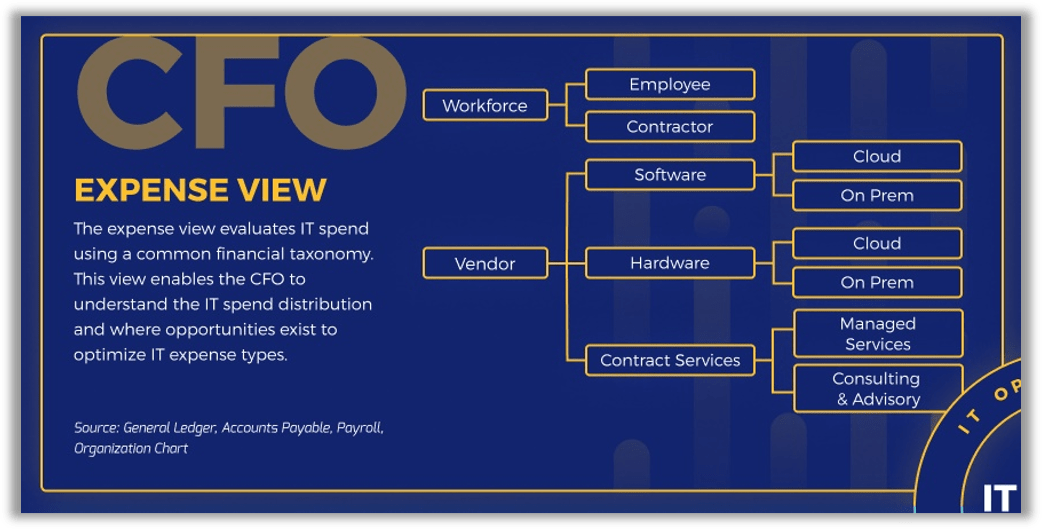

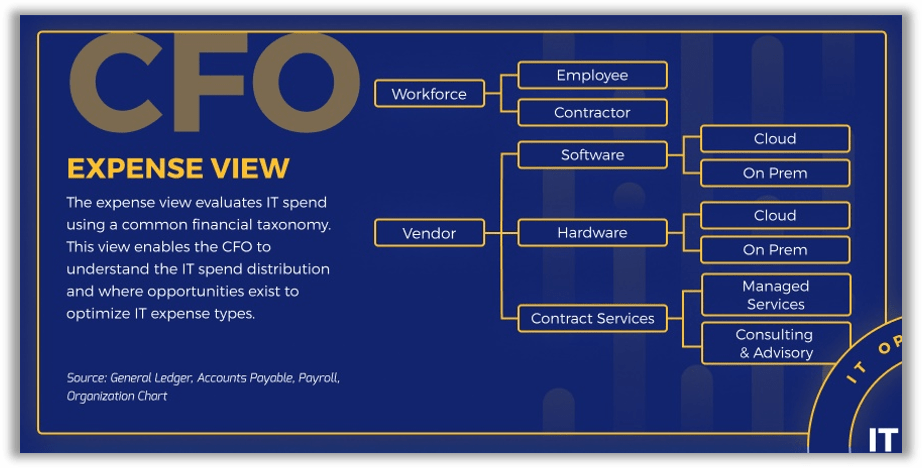

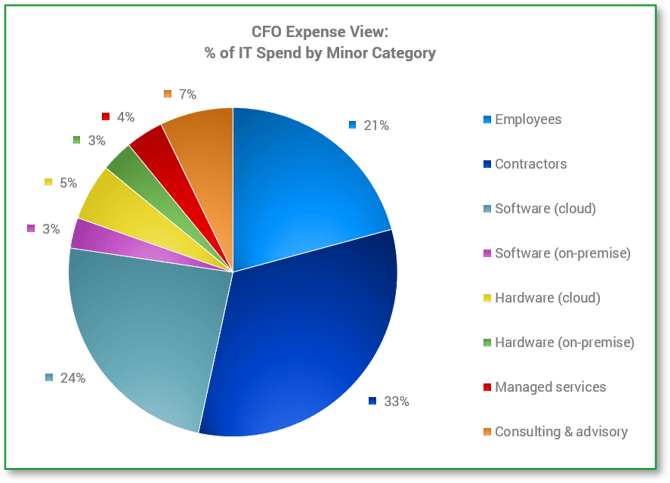

CFO expense view

- Demonstrate actual IT costs at the right level of granularity.

- Update/change the categories finance uses to track IT spend.

- Adjust the expected CapEx/OpEx ratio.

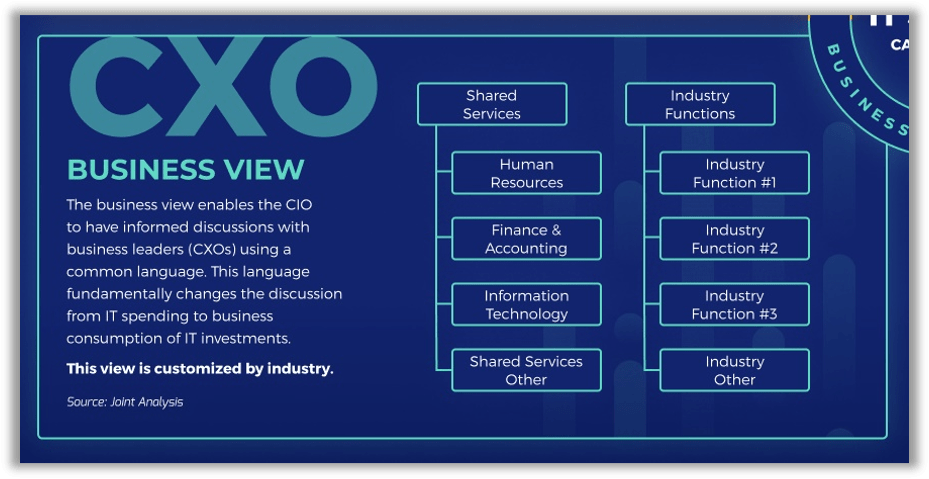

CXO business view

- Calculate consumption of IT resources by department.

- Implement a showback/chargeback mechanism.

- Change the funding conversation about proposed IT projects.

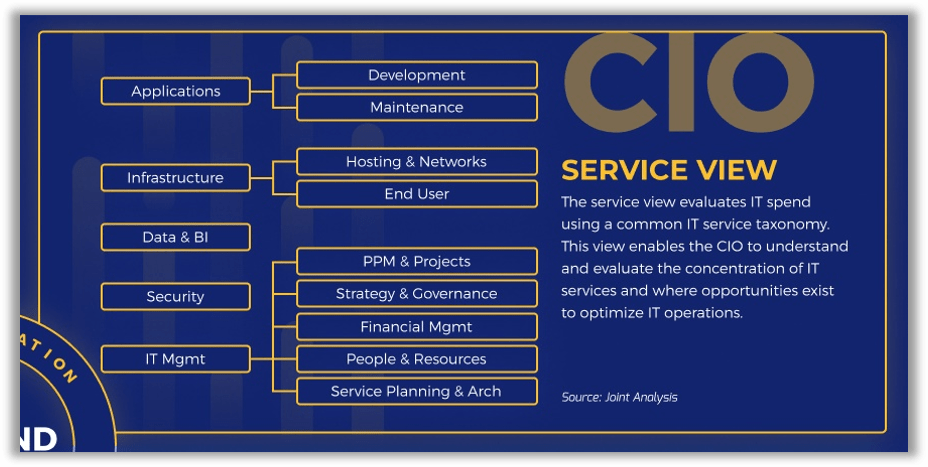

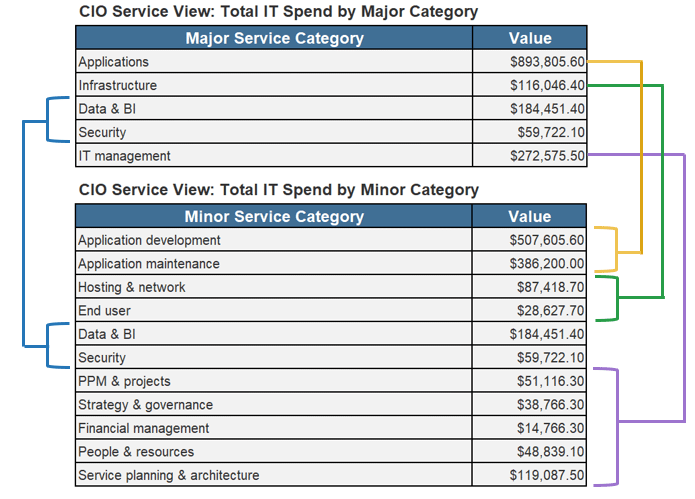

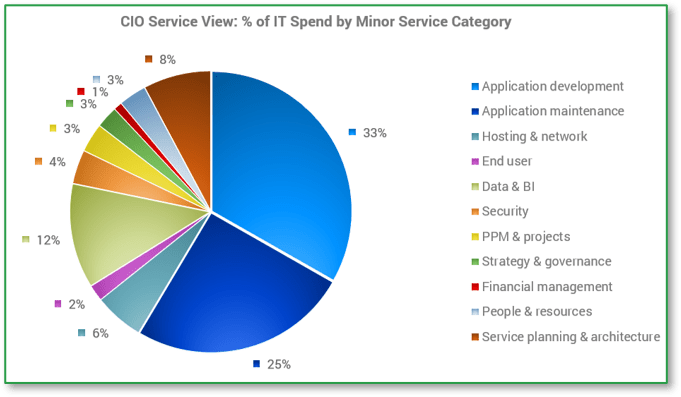

CIO service view

- Calculate the total cost to deliver a specific IT service.

- Adjust the IT service spend-to-value ratio as per business priorities.

- Rightsize IT service levels to reflect true value to the business.

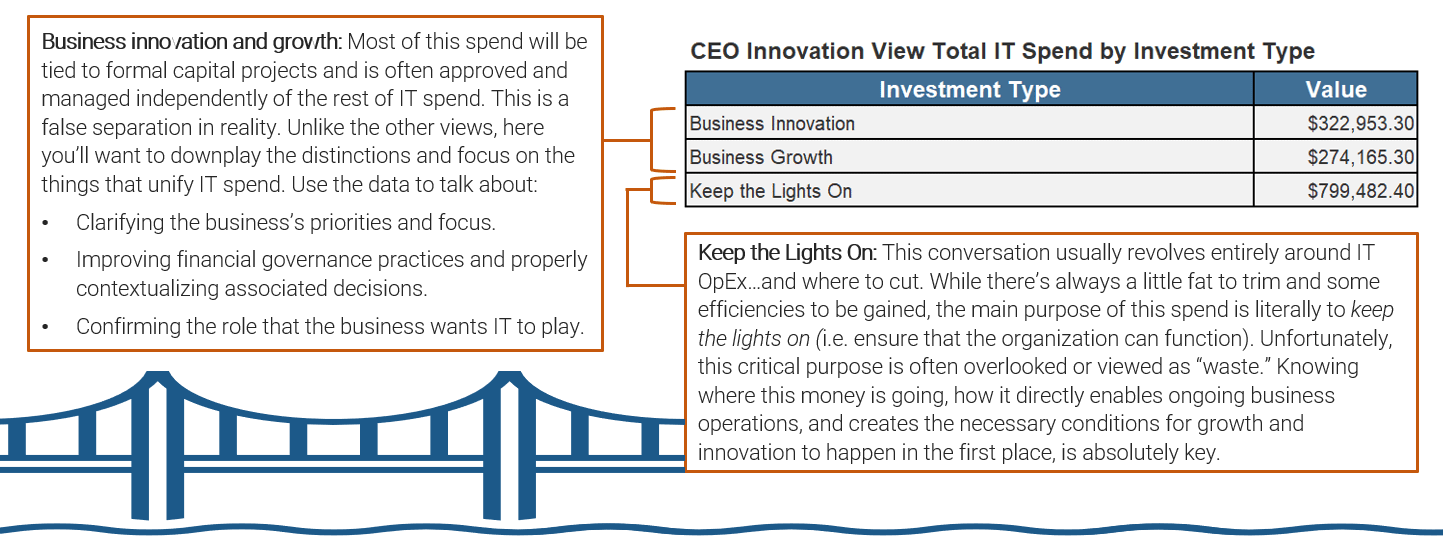

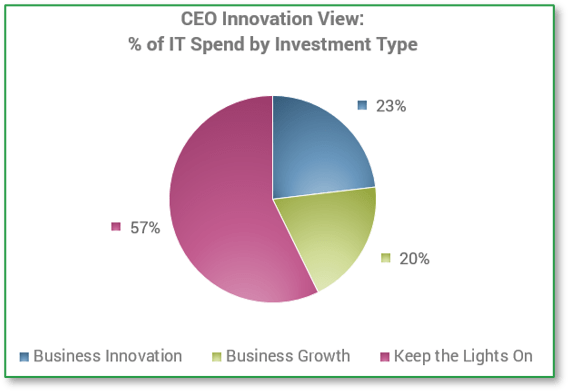

CEO innovation view

- Formalize the organization's position on use of cloud/outsourcing.

- Reduce the portion of spend dedicated to "keeping the lights on."

- Develop a plan for boosting commitment to innovation investment.

When determining your end objectives, think about the real questions IT is being asked by the business and how IT spend transparency will help you answer them.

CFO: Financial accounting perspective

IT spend used to be looked at from a strictly financial accounting perspective - this is the view of the CFO and the finance department. Their question, "exactly how is IT spending all that money we give them," is really about how money is distributed across different asset classes. This question breaks down into other questions that IT leaders needs to ask themselves in order to provide answers:

- How should I classify my IT costs? What are the standard categories you need to have that are meaningful to folks crunching the corporate numbers? If you're too detailed, it won't make sense to them. If you pick outmoded categories, you'll have to adjust in the future as IT evolves, which makes tracking year-over-year spend patterns harder.

- What information should I include in my plans and reports? This is about two things. One is about communicating with the finance department in language that reduces back-and-forth and eliminates misinterpretation. The other is about aligning with the categories the finance department uses to track financial data in the general ledger.

- How do I justify current spend? This is about clarity and transparency. Specifically itemizing spend into categories that are meaningful for your audience does a lot of justification work for you since you don't have to re-explain what everything means.

- How do I justify a budget increase? In a declining economy, this question may not be appropriate. However, establishing a baseline puts you in a better position to discuss spend requirements based on past performance and to focus the conversation.

Exactly how is IT spending all that money we give them?

| Example | |

|---|---|

| Asset Class | % IT Spend |

| Workforce | 42.72% |

| Software - Cloud | 9.26% |

| Software - On Prem | 13.61% |

| Hardware - Cloud | 0.59% |

| Hardware - On Prem | 15.68% |

| Contract Services | 18.14% |

| Info-Tech IT Spend & Staffing Studies, 2022. | |

CIO: IT operations management perspective

As the CIO role was adopted, IT spend was viewed from the IT operations management perspective. Optimizing the IT delivery model is a critical step to reducing time to provision services. For the IT leader, the questions they need to ask themselves are:

- What's the impact of cloud adoption on speed of delivery? Leveraging a SaaS solution can reduce time to deployment as well as increase your ability to scale; however, integration with other functionality will still be a challenge that will incur costs.

- Where can I improve spend efficiency? This is about optimizing spend in your IT delivery model. What service levels does the business require and what's the most cost-effective way to meet those levels without incurring significant technical debt?

- Is my support model optimized? By reviewing where support staff are focused and which services are using most of your resources, you can investigate underlying drivers of your staffing requirements. If staff costs in support of a business function are high, perhaps the portfolio of applications needs to be reviewed.

- How does our spend compare to others? Benchmarking against peers is a useful input, but reflects common practice, not best practice. For example, if you need to invest in IT security, your entire industry is lagging on this front, and you happen to be doing slightly better than most, then bringing forth this benchmark won't help you make the case. Starting with year-over-year internal benchmarking is essential - establish your categories, establish your baseline, and track it consistently.

Does the amount we spend on each IT service make sense?

| Example | |

|---|---|

| Service Area | % IT Spend |

| App Development | 9.06% |

| App Maintenance | 30.36% |

| Hosting/Network | 25.39% |

| End User | 18.59% |

| Data & BI | 3.58% |

| Security & Risk | 5.21% |

| IT Management | 7.82% |

| Info-Tech IT Spend & Staffing Studies, 2022. | |

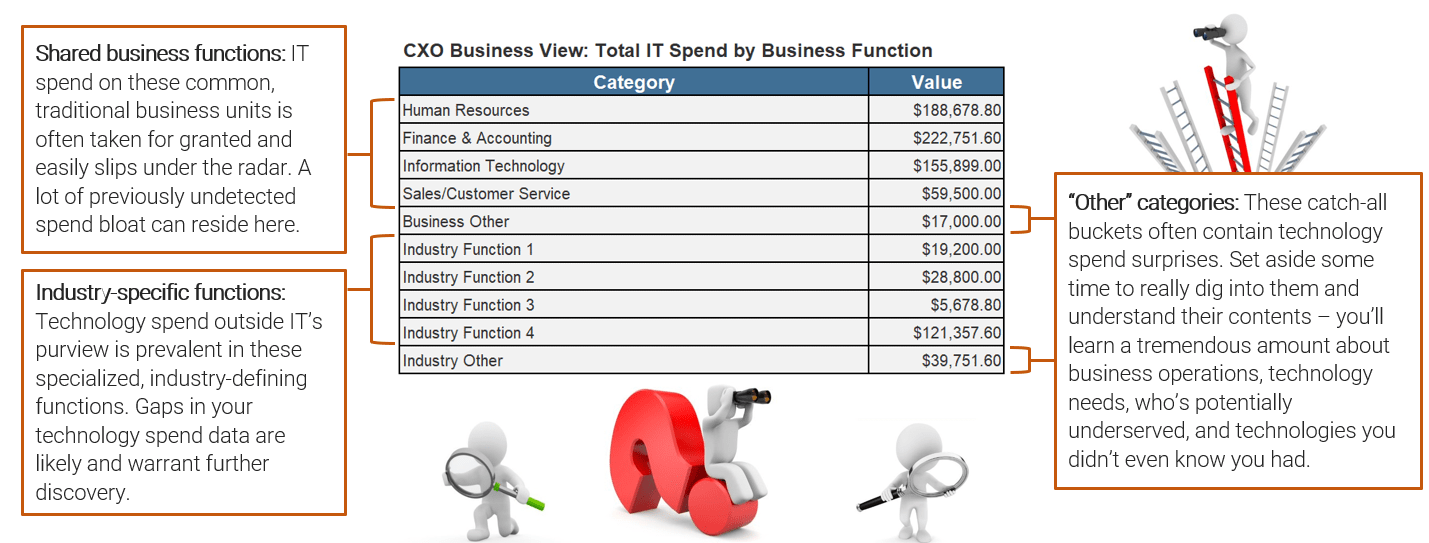

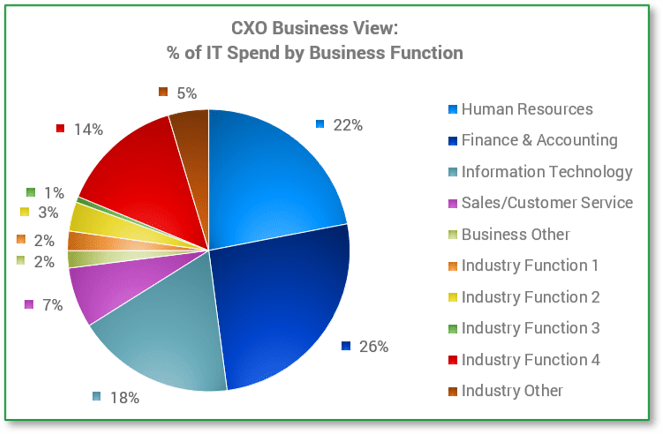

CXO: Business unit perspective

As business requests have increased, so too has the importance of the business unit perspective. Each business function has a unique mandate to fulfill in the organization and also competes with other business functions for IT resources. By understanding business consumption of IT, organizations can bring transparency and drive a different dialog with their business partners. Every IT leader should find out the answers to these questions:

- Which business units consume the most IT resources? By understanding consumption of IT by business function, IT organizations can clearly articulate which business units are getting the highest share of IT resources. This will bring much needed clarity when it comes to IT spend prioritization and investment.

- Which business units are underserved by IT? By providing full transparency into where all IT spend is consumed, organizations can determine if certain business functions may need increased attention in an upcoming budget cycle. Knowing which levers to pull is critical in aligning IT activities with delivering business value.

- How do I best communicate spend data internally? Different audiences need information presented to them differently. This is not just about the language - it's also about the frequency, format, and channel you use. Ask your audiences directly what methods of communication stand the best chance of you being seen and heard.

- Where do I need better business sponsorship for IT projects? If a lot of IT spend is going toward one or two business units, the leaders of those units need to be active sponsors of IT projects and associated spend that will benefit all users.

Why doesn't my business unit get more support from IT?

| Example | |

|---|---|

| Business Function | % IT Spend |

| HR Department | 6.16% |

| Finance Department | 15.15% |

| IT Department | 10.69% |

| Business Function 1 | 23.80% |

| Business Function 2 | 10.20% |

| Business Function 3 | 6.80% |

| Business Function 4 | 27.20% |

| Source: Info-Tech IT Spend & Staffing Studies, 2022. | |

CEO: Strategic vs. operations perspective

With a business view now available, evaluating IT spend from a strategic standpoint is critical. Simply put, how much is being spent keeping the lights on (KTLO) in the organization versus supporting business or organizational growth versus net-new business innovations? This view is not about what IT costs but rather how it is being prioritized to drive revenue, operating margin, or market share. Here are the questions IT leaders should be asking themselves along with the organization's executive leadership and the CEO:

- Why is KTLO spend so high? This question is a good gauge of where the line is drawn between operations and strategy. Many IT departments want to reduce time spent on maintenance and redeploy resource investment toward strategic projects. This reallocation must include retiring or eliminating technologies to free up funds.

- What should our operational spend priorities be? Maintenance and basic operations aren't going anywhere. The issue is what is necessary and what could be done more wisely. Are you throwing good money after bad on a high-maintenance legacy system?

- Which projects and investments should we prioritize? The answer to this question should tightly align with business strategic goals and account for the lion's share of growth and innovation spend.

- Are we spending enough on innovative initiatives? This is the ultimate dialogue between business partners, the CEO, and IT that needs to take place, yet often doesn't.

I know what IT costs us, but what is it really worth?

| Example | |

|---|---|

| Focus Area | % IT Spend |

| KTLO | 89.16% |

| Grow | 7.18% |

| Innovate | 3.66% |

| Info-Tech IT Spend Studies, 2022. | |

Be clear about where you want your IT spend transparency journey to take you in real life

Transparent IT spend data will allow you to have conversations you couldn't have before. Consider this example of how telling an IT spend story could evolve.

I want to ...

Analyze the impact of the cloud on IT operating expenditure to update finance's expectations of a realistic IT CapEx/OpEx ratio now and into the future.

To address the problem of ...

- Many of our key software vendors have eliminated on-premises products and only offer software as an OpEx service.

- Assumptions that modern IT solutions are largely on-premises and can be treated as capitalizable assets are out-of-date and don't reflect IT financial realities.

And will use transparency to ...

- Provide the CFO with specific, accurate, and annotated OpEx by product/service and vendor for all cloud-based and on-premises solutions.

- Facilitate a realistic calculation of CapEx/OpEx distribution based on actuals, as well as let us develop defendable projections of OpEx into the future based on typical annual service fee increases and anticipated growth in the number of users/licenses.

1.1 Establish ITFM objectives that leverage IT spend transparency

Duration: One hour

- Consider the problems or issues commonly voiced by the business about IT, as well as your own ongoing challenges in communicating with stakeholders. Document these problems/issues as questions or statements as spoken by a person. To help structure your brainstorming, consider these general process domains and examples:

- Spend tracking and reporting. E.g. Why is IT's OpEx so high? We need you to increase IT's percentage of CapEx.

- Service levels and business continuity. E.g. Why do we need to hire more service desk staff? There are more of them in IT than any other role.

- Project and operations resourcing. E.g. Why can't IT just buy this new app we want? It's not very expensive.

- Strategy and innovation. E.g. Did output increase or decrease last quarter per input unit? IT should be able to run those reports for us.

- For each problem/issue noted, identify:

- The source(s) of the question/concern (e.g. CEO, CFO, CXO, CIO).

- The financial process involved (e.g. accurate costing, verification of costs, building a business case to invest).

- For each problem/issue, identify a broader project-style initiative where having transparent IT spend data is a valuable input. One initiative may apply to multiple problems/issues. For each initiative:

- Give it a working title.

- State the goal for the initiative with reference to ITFM aspirations.

- Identify key stakeholders (these will likely overlap with the problem/issue source).

- Set general time frames for resolution.

Document your outputs on the slide immediately following the instruction slides for this exercise. Examples are included.

1.1 Establish ITFM objectives that leverage IT spend transparency

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

ITFM initiatives that leverage transparency

| Problem/Issue Statement | Source/ Stakeholder | Associated ITFM Process | Potential Initiative | Initiative Goal | Time Frame |

| "Why is IT's OpEx so high? We need you to increase IT's percentage of CapEx." | CFO | IT spend categorization and reporting. | Analyze the impact of the cloud on IT operating expenditure. | To update finance's expectations of a realistic IT CapEx/OpEx ratio. | <12 months |

| "Why do we need to hire more service desk staff? There are more of them in IT than any other role." | CFO, VP of HR | Business case for hiring IT staff. | Document ongoing IT support requirements for proposed ERP platform migration project. | To ensure sufficient resources for an anticipated increase in service desk tickets due to implementation of a new ERP system. | 1-3 months |

| "Why can't IT just buy this new app we want? It's not very expensive." | CEO, all CXOs/VPs | Total cost of technology ownership. | Develop a mechanism to review the lifecycle impact on IT of proposed technology purchases. | To determine if functionality of new tool already exists in the org. and the total cost of ownership of a new app. | <6 months |

| "Did output increase or decrease last quarter per input unit? IT should be able to run those reports for us." | CEO, CFO, VP of Production | IT service costing. | Develop an organizational business intelligence strategy. | To create a comprehensive plan for evolving BI capability in the organization and transferring report development to users. Select a department for pilot. | <12 months |

Your organization's governance culture will affect how you approach transparency

| Know your governance culture | Lower Governance

|

Higher Governance

|

| Determine impact on opportunities | How does your governance culture impact IT spend transparency opportunities? | |

|---|---|---|

| Resistance to formality and bureaucracy | Resistance to change and uncertainty | |

| Set expectations and approach | You have plenty of room to implement transparency rigor within the confines of IT, but getting others to give you the time and attention you want will be a challenge. One-on-one, informal relationship building to create goodwill and dialogue is needed before putting forth recommendations or numbers. | Many existing procedures must be accommodated and respected. While you can benefit by working with preexisting mechanisms and touchpoints, expect any changes you want to make to things like IT cost categories or CapEx/OpEx ratios to require a lot of time, meetings, and case-making. |

IT's current maturity around ITFM practice will also affect your approach to transparency

| Know your ITFM maturity level | Lower ITFM Maturity

|

Higher ITFM Maturity

|

| Determine stakeholders' financial literacy | How does your degree of ITFM maturity impact IT spend transparency opportunities? | |

|---|---|---|

| Improve your own financial literacy first | Determine stakeholders' financial literacy | |

| Set expectations and approach | Brush up on core financial management and accounting concepts before taking the discussion beyond IT's walls. Do start mapping your costs, but just know how to communicate what the data is saying before sharing it. | Not everyone will be at your level, familiar with ITFM language and concepts, or focused on the same things you are. Gauge where your audience is at so you can prepare for meaningful dialogue. |

1.2 Assess your readiness to tackle IT spend transparency

Duration: One hour

Note: This assessment is general in nature. It's intended to help you identify and prepare for potential challenges in your IT spend and staffing transparency effort.

- Rate your agreement with the "Data & Information" and "Experience, Expertise, & Support" statements listed on the slide immediately following the two instruction slides for this exercise. For each statement, indicate the extent to which you agree or disagree, where:

- 1 = Strongly disagree

- 2 = Disagree

- 3 = Neither agree nor disagree

- 4 = Agree

- 5 = Strongly agree

- Add up your numerical scores for all statements, where the highest possible score is 65.

- Assess your general readiness against the following guidelines:

- 50-65: Ready. The transparency exercise will involve work, but should be straightforward since you have the data, skills, tools, processes, and support to do it.

- 40-49: Ready, with caveats. The transparency exercise is doable but will require some preparatory legwork and investigation on your part around data sourcing, organization, and interpretation.

- 30-39: Challenged. The transparency exercise will present some obstacles. Expect to encounter data gaps, inconsistencies, errors, roadblocks, and frustrations that will need to be resolved.

- Less than 30: Not ready. You don't have the data, skills, tools, processes, and/or support to do the data transparency exercise. Take time to develop a stronger foundation of financial literacy and governance before tackling it.

Document your outputs on the slide immediately following the two instruction slides for this exercise.

1.2 Assess your readiness to tackle IT spend transparency

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

IT spend transparency readiness assessment

| Data & Information | |

| Statement | Rating |

| We know how to access all IT department spend records. | |

| We know how to access all non-IT-department technology spend records. | |

| We know how to access all IT vendor/contractor agreements. | |

| We know how to access data about our IT staff costs and allocation, such as organizational charts and salaries/benefits. | |

| Our financial and staffing data is up-to-date. | |

| Our financial and staffing data are labeled, described, and organized so that we know what they're referring to. | |

| Our financial and staffing data are in a format that we can easily manipulate (e.g. export, copy and paste, perform calculations). | |

| Experience, Expertise, & Support | |

| Statement | Rating |

| We have sufficient expertise within the IT department to navigate and accurately interpret financial records. | |

| We have reasonable access to expertise/resources in our finance department to support us in an IT spend transparency exercise. | |

| We can allocate sufficient time (about 40 hours) and resources in the near term to do an IT spend transparency exercise. | |

| We have current accountabilities to track and internally report financial information to others on at least a monthly basis. | |

| There are existing financial policies, procedures, and standards in the organization with which we must closely adhere and comply. | |

| We have had the experience of participating in, or responding to the results of, an internal or external audit. | |

Rating scale:

1 = Strongly Disagree; 2 = Disagree; 3 = Neither agree nor disagree; 4 = Agree; 5 = Strongly agree

Assessment scale:

Less than 30 = Not ready; 30-39 = Challenged; 40-49 = Ready with caveats; 50-65 = Ready

Take a closer look at the statements you rated 1, 2, or 3. These will be areas of challenge no matter what your total score on the assessment scale.

Phase 1: Know your objectives

Achievement summary

You've now completed the first two steps on your IT spend transparency journey. You have:

- Set your objectives for making your IT spend and staffing transparent.

- Assessed your readiness to tackle the exercise and know how much work you'll need to do in order to do it well.

"Mapping to a transparency model is labor intensive. You can do it once and never revisit it again, but we would never advise that. What it does is play well into an IT financial management maturity roadmap."

- Monica Braun, Research Director, ITFM Practice, Info-Tech Research Group

Phase 2

Gather Required Data

This phase will walk you through the following activities:

- Gather, clean, and organize your data

- Build your industry-specific business views

This phase involves the following participants:

- Head of IT

- IT financial lead

- Other members of IT management

Phase 2: Gather required data

Finish your preparation.

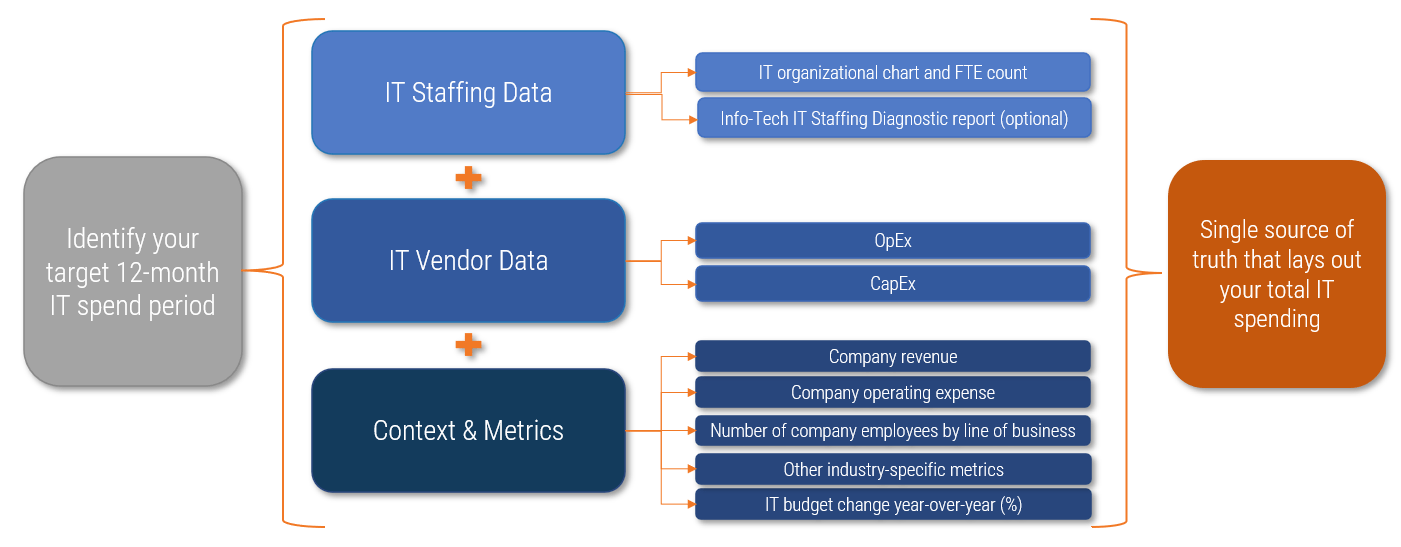

You're now ready to do the final preparation for your IT spend and staffing transparency journey. In this phase you will:

- Gather your IT spend and staffing data and information.

- Clean and organize your data to streamline mapping.

- Identify your baseline data points.

"Some feel like they don't have all the data, so they give up. Don't. Every data point counts."

- Rex Ding, Research Specialist, ITFM Practice, Info-Tech Research Group

Your IT spend transparency efforts are only as good as the quality of your inputs

Aim for a comprehensive, complete, and accurate set of data and information.

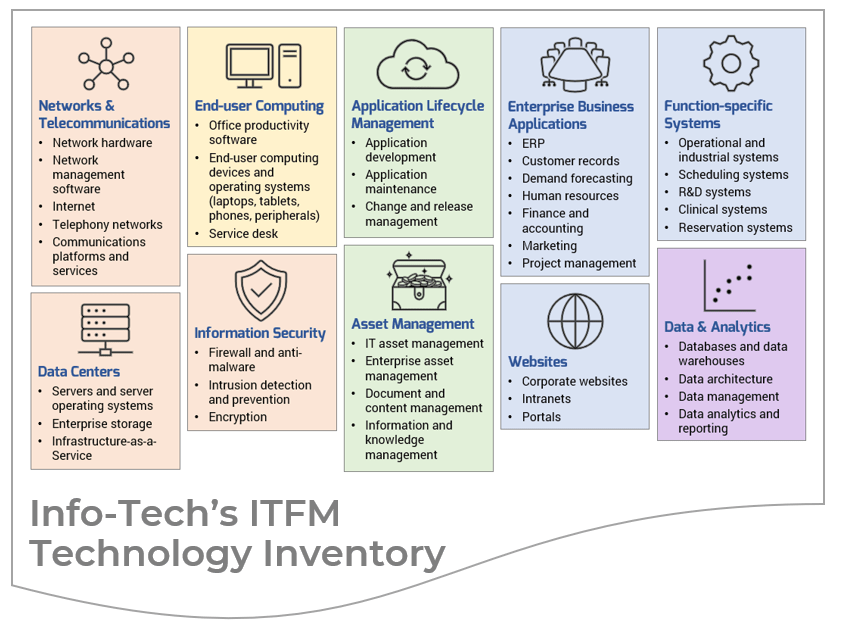

Start by understanding what's included in technology spend

In scope:

- All network, telecom, and data center equipment.

- All end-user productivity software and devices (e.g. laptops, peripheral devices, cell phones).

- Information security.

- All acquisition, development, maintenance, and management of business and operations software.

- All systems used for the storage and management of business assets, data, records, and information.

- All managed IT services.

- Third-party consulting services.

- All identifiable spend from the business for the above.

Expand your thinking: Total tech spend goes beyond what's under IT's operational umbrella

"Technology" means all technology in the organization regardless of where it lives, who bought it, who owns it, who runs it, or who uses it.

IT may have low or no visibility into technologies that exist in the broader business environment beyond IT. Accept that you won't gain 100% visibility right now. However, do get started and be persistent.

Where to look for non-IT technology ...

- Highly specialized business functions - niche tools that are probably used by only a few people.

- Power users and the "underserved" - cloud-based workflow, communication, and productivity tools they got on their own.

- Operational technology - network-connected industrial, building, or physical security sensors and control systems.

- Recently acquired/merged entities - inherited software.

Who might get you what you need ...

- Business unit and team leaders - identification of what they use and copies of their spend records and/or contracts.

- Finance - a report of the "software" expenditure category to spot unrecognized technologies and their owners.

- Vendors - copies of contracts if not forthcoming internally.

- Your service desk - informal knowledge gained about unknown technologies at play in the course of doing their job.

The IT spend and staffing transparency exercise is an opportunity to kick-start a technology discovery process that will give you and the business a true picture of your technology profile, use, and spend.

Seek out data at the right level of granularity with the right supporting information

Key data and information to seek out:

- Credits applied to appropriate debits that show net expense, or detailed descriptions of credits with no matching debit.

- Cash-based accounting (not accrual accounting). If accrual, will need to determine how to simplify the data for your uses.

- Vendor names, asset classes, descriptors, and departments.

- A total spend amount (CapEx + OpEx) that:

- Aligns with the spend period.

- Passes your gut check for total IT spend.

- Includes annual amounts for multi-year contracts (e.g. one year of a three-year Microsoft enterprise agreement).

- Includes technology spend from the business (e.g. OT that IT supports).

- Insights on large projects.

- Consolidated recurring payments, salaries and benefits, and other small expenses.

Look for these data descriptors in your files:

- Cost center/accounting unit

- Cost center/department description

- GL ACCT

- CL account description

- Activity description

- Status

- Program/business function/project description

- Accounting period

- Transaction amount

- Vendor/vendor name

- Product/product name

Avoid data that's hard to use or problematic as it will slow you down and bring limited benefits

Spend data that's out of scope:

- Depreciation/amortization.

- Gain or loss of asset write-off.

- Physical security (e.g. key cards, cameras, motion sensors, floodlights).

- Printer consumables costs.

- Heating and cooling costs (for data centers).

Challenging data formats:

- Large raw data files with limited or no descriptors.

- Major accounts (hardware and software) combined in the same line item.

- Line items (especially software) with no vendor reference information.

- PDF files or screenshots that you can't extract data from readily. Use Excel or CSV files whenever possible.

Getting at the data you need can be easy or hard – it all depends

This is where your governance culture and ITFM maturity start to come into play.

| Data source | Potential data and information | What to expect |

| IT | Current/past budget, vendor agreements, IT project records, discretionary spend, number of IT employees. | The rigor of your ITFM practice and centralization of data and documents will affect how straightforward this is. |

| Finance | General ledger, cash and income statements, contractor payments and other accounts payable, general revenue. | Secure their expertise early. Let them know what you're trying to do and what you need. They may be willing to prepare data for you in the format you need and help you decipher records. |

| Purchasing | List of vendors/suppliers, vendor agreements, purchase invoices. | Purchasing often has more descriptive information about vendors than finance. They can also point you to tech spend in other departments that you didn't know about. |

| Human Resources | Organizational chart, staff salaries and benefits, number of employees overall and by department. | Data about benefits costs is something you're not likely to have, and there's only one place you can reliably get it. |

| Other Business Units | Non-IT technology spend vendor agreements and purchase invoices, number of department employees. | Other departments may be tracking spend in an entirely different way than you. Be prepared to dig and reconcile. |

There may be some data or information you can't get without a Herculean effort. Don't worry about it too much - these items are usually relatively minor and won't significantly affect the overall picture.

Commit to finding out what you don't know

Many IT leaders don't have visibility into other departments' technology spend. In some cases, the fact that spend is even happening may be a complete surprise.

Near-term visibility fix ...

- Ask your finance department for a report on all technology-related spend categories. "Software" is a broad category that finance departments tend to track. Scan the report for items that don't look familiar and confirm the originating department or approver.

- Check in with the procurement office. See what technology-related contracts they have on record and which departments "own" them. Get copies of those contracts if possible.

- Contact individual department heads or technology spend approvers. Devise your contact shortlist based on what you already know or learned from finance and procurement. Position your outreach as a discovery process that supports your transparency effort. Avoid coming across as though you're judging their spend or planning to take over their technologies.

Long-term visibility fix ...

- Develop your relationships with other business unit leaders. This will help open the lines of communication permanently.

- Establish a cross-functional central technology office or group. The main task of this unit is to set and manage technology standards organization-wide, including standards for tracking and documenting technology costs and asset lifecycle factors.

- Ensure IT is formally involved in all technology spend proposals and plans. This gives IT the opportunity to assess them for security compliance, IT network/system interoperability, manageability, and IT support requirements prior to purchase.

- Ensure IT is notified of all technology financial transactions. This includes contracts, invoices, and payments for all one-time purchases, subscription fees, and maintenance costs.

Finally, note any potential anomalies in the IT spend period you're looking at

No two years have the exact same spend patterns. One-time spend for a big capital project, for example, can dramatically alter your overall spend landscape.

Look for the following anomalies:

- New or ongoing capital implementations or projects that span more than one fiscal year.

- Completed projects that have recently transitioned, or are transitioning, from CapEx (decreasing) to OpEx (increasing).

- A major internal reorganization or merger, acquisition, or divestiture event.

- Crises, disasters, or other rare emergencies.

- Changes in IT funding sources (e.g. new or expiring grants).

These anomalies often explain why IT spend is unusually high in certain areas. There's often a good business reason.

In many cases, doing a separate spend transparency exercise for these anomalous projects or events can isolate their costs from other spend so their true nature and impact can be better understood.

2.1 Gather your input data and information

Duration: Variable

- Develop a complete list of the spending and staffing data and information you need to complete the transparency mapping exercise. For each required item, note the following:

- Description of data needed (i.e. type, timeframe, and format).

- Ideal timeframe or deadline for receipt.

- Probable source(s) and contact(s).

- Additional facilitation/support required.

- Person on your transparency team responsible for obtaining it.

- Set up a data and information repository to store all files as soon as they're received. Ideally, you'll want all data/information files to be in an electronic format so that everything can be stored in one place. Avoid paper documents if possible.

- Conduct your outreach to obtain the input data and information on your list. This could include delegating it to a subordinate, sending emails, making phone calls, booking meetings, and so on.

- Review the data and information received to confirm that it's the right type of data, at the correct level of granularity, for the right timeframe, in a usable format, and is generally accurate.

- Enter documentation about your data and information sources in tab "1. Data & Information Sources" in the IT Spend & Staffing Transparency Workbook to reflect what you needed and where you got it in order to make the discovery process easier in the future.

- In the same tab in the IT Spend & Staffing Transparency Workbook, document any significant events that occurred that directly or indirectly impacted the selected year's spend values. These could include mergers/acquisitions/divestitures, major reorganizations or changes in leadership, significant shifts in product offerings or strategic direction, large capital projects, legal/regulatory changes, natural disasters, or changes in the economy.

Download the IT Spend & Staffing Transparency Workbook

2.1 Gather your input data and information

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Tidy up your data before beginning any spend mapping

Most organizations aren't immaculate in their tech spend documentation and tracking practices. This creates data rife with gaps that lives in hard-to-use formats.

The more preparation you do to approach the "good data" intersection point in the diagram below, the easier your mapping effort will be and the more useful and insightful your final findings.

Make your data "un-unique" to reduce the number of line items and make it manageable

There's a good chance that the IT spend data you've received is in the form of tens of thousands of unique line items. Use the checklist below to help you roll it up.

Warning: Never overwrite your original data. Insert new columns/rows and put your alternate information in these instead.

Step 1: Standardize vendor names

- Start with known large vendors.

- Select a standard name for the vendor.

- Brainstorm possible variations on the vendor name, including abbreviations and shortforms.

- Search for the vendor in your data and document the new standardized vendor name in the appropriate row.

- Repeat the above for all vendors.

- Sort the new vendor name column from A-Z. Look for instances where names remain unique or are missing entirely. Reconcile if needed and fill in missing data.

Step 2: Consolidate vendor spend

- Sort the new vendor name column from A-Z. Start with vendors that have the most line items.

- Add together related spend items from a given vendor. Create a new row for the consolidated spend item and flag it as consolidated. Keep the following item types in separate rows:

- Hardware vs. software spend for the same vendor.

- Cloud vs. on-premises spend for the same vendor.

- Repeat the above for all vendors.

- Consider breaking out separate rows for overly consolidated line items that contain too many different types of IT spend.

2.2 Clean and organize your data

Duration: Variable

- Check to ensure that you have all data and information required to conduct the IT spend transparency exercise.

- Conduct an initial scan to assess the data's current state of hygiene and overall usability. Flag anything of concern and follow up with the data/information provider to fix or reconcile any issues.

- Normalize your data to make it easier to work with. This includes selecting data format standards and changing anything that doesn't conform to those standards. This includes items such as date conventions, currencies, and so on.

- Standardize product and vendor naming/references throughout to enable searching, sorting, and grouping. For example, Microsoft Office may be variably referred to as "Microsoft", "Office", "Office 365", and "Office365" throughout your data. Pick one descriptor for the product/vendor and replace all related references with that descriptor.

- Consolidate and aggregate your data. Ideally, the data you received from your sources has already been simplified; however, you may need to further organize it to reduce the number of individual line items to a more manageable number. The transparency exercise uses relatively high-level categories, so combine data sets and aggregate where feasible without losing appropriate granularity.

- Archive any original copies of files that have been modified or replaced with consolidated/aggregated versions for future reference if needed.

2.2 Clean and organize your data

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Select IT spend "buckets" for the CXO Business View as your final preparatory step

Every organization has both industry-agnostic and industry-specific lines of business that are the direct beneficiaries of IT spend.

Common shared business functions:

- Human resources.

- Finance and accounting.

- Sales/customer service.

- Marketing and advertising.

- Legal services and regulatory compliance.

- Information technology.

It may seem odd to see IT on the business functions list since the purpose of this exercise is to map IT spend. For business view purposes, IT spend refers to what IT spends on itself to support its own internal operations.

Examples of industry-specific functions:

- Manufacturing: Product research and development; production operations; supply chain management.

- Retail banking: Core banking services; loan, mortgage and credit services; investment and wealth management services.

- Hospitals: Patient intake and admissions; patient diagnosis; patient treatment; patient recovery and ongoing care.

- Insurance: Actuarial analysis; policy creation; underwriting; claims processing.

See the Appendix of this blueprint for definitions of shared business functions plus sample industry-specific business view categories.

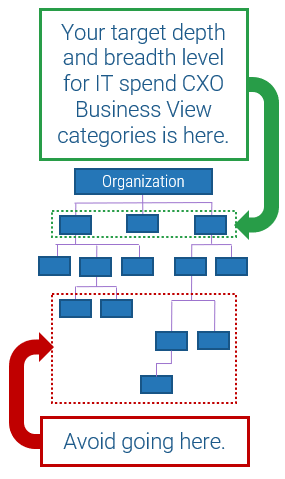

Define your CXO Business View categories to set yourself up well for future ITFM analyses

The CXO Business View buckets you set up today are tools you can and should reuse in your overall approach to ITFM governance. Spend some time to get them right.

Stay high-level

Getting too granular invites administrative headaches and overhead. Keep things high-level and general:

- Limit the number of direct stakeholders represented: This will reduce communication overhead and ensure you're dealing only with people who have real decision-making authority.

- Look to your org. chart: Note the departments or business units listed across the top of the chart that have one executive or top-ranking senior manager accountable for them. These business units often translate as-is into a tidy CXO Business View category.

Limit your number of buckets

Tracking IT spend across more than 8-10 shared and industry-specific business categories is impractical.

- Simplify your options: Too many buckets gets confusing and invites time-wasting doubt.

- Reduce future rework: Business structures will change, which means recategorizing spend data. Using a forklift is a lot easier than using tweezers.

- Stick to major business units: Create separate "Business Other" and "Industry Other" catch-all categories to track IT spend for smaller functions that fall outside of major business unit structures.

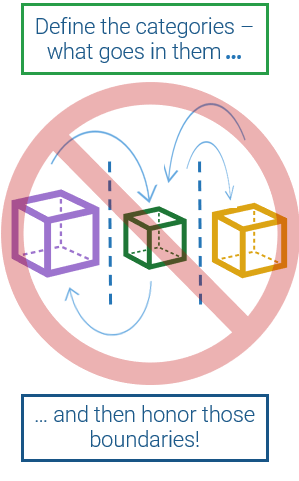

Be clear on what's in and what's out of your categories to keep everyone on the same page

Clear lines of demarcation between CXO Business View categories reduce confusion, doubt, and wheel-reinvention when deciding where to allocate IT spend.

Ensure clear boundaries

Mutual exclusivity is key when defining categories in any taxonomical structure.

- Avoid overlaps: Each high-level business function category should have few or no core function or process overlaps with another business function category. Aim for clear vertical separation.

- Be encompassing: When defining a category, list all the business capabilities and sub-functions included in that category. For example, if defining the finance and accounting function, remember to specify its less obvious accountabilities, like enterprise asset management if appropriate.

Identify exclusions

Listing what's out can be just as informative and clarifying as listing what's in.

- Beware odd bedfellows: Minor business groups are often tucked under a bigger organizational entity even though the two use different processes and technologies. Separate them if appropriate and state this exclusion in the bigger entity's definition.

- Draw a line: If a process crosses business function categories, state which sub-steps are out of scope.

- Document your decisions: This helps ensure you allocate IT spend the same way every time.

2.3 Build your industry-specific business views

Duration: Two hours

- Confirm your list of high-level shared business services (human resources, finance and accounting, etc.) as provided in Info-Tech's IT Spend & Staffing Transparency Workbook. Rename them if needed to match the nomenclature used in your organization.

- Set and define your additional list of high-level, industry-specific business categories that are unique to or define your industry. See the slides immediately following this exercise for tips on developing these categories, as well as the appendix of this blueprint for some examples of industry-specific categories and definitions.

- Create "Business Other" and "Industry Other" categories to capture minor groups and activities supported by IT that fall beyond the major shared and industry-specific business functions you've shortlisted. Briefly note the business groups/activities that fall under these categories.

- Edit/enter your shared and industry-specific business function categories and their definitions on tab "2. Business View Definitions" in the IT Spend & Staffing Transparency Workbook.

Download the IT Spend & Staffing Transparency Workbook

2.3 Build your industry-specific business views

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

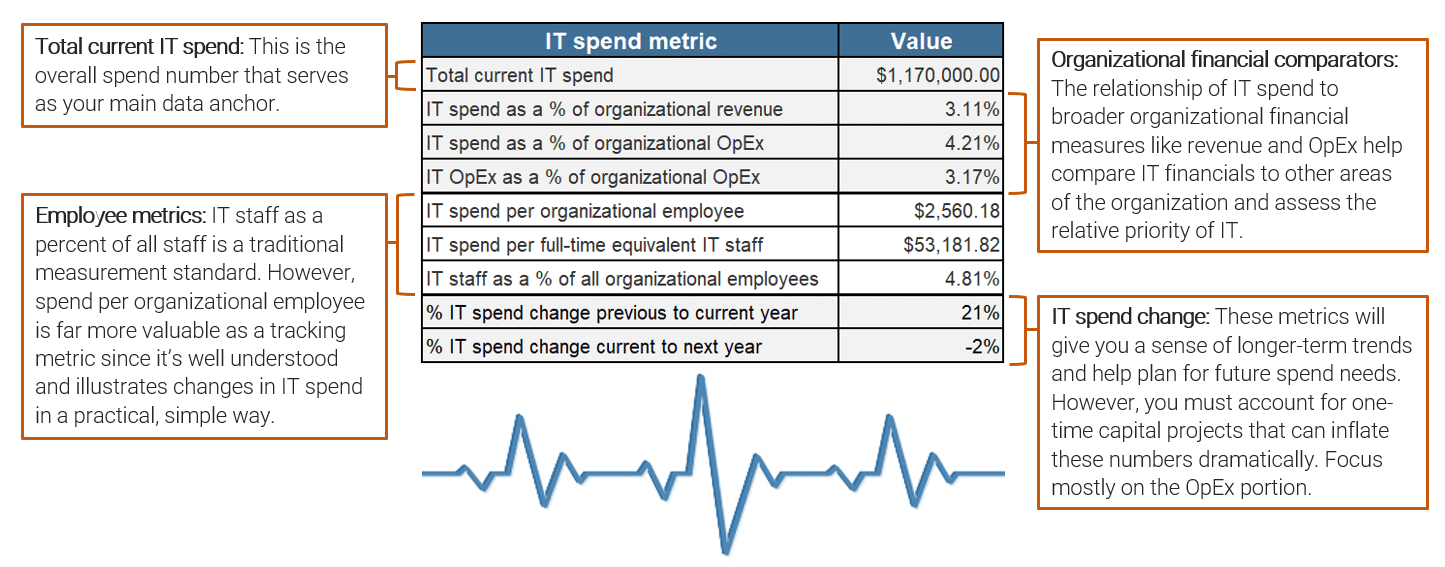

Lock in key pieces of baseline data

Calculating core IT spend metrics relies on a few key numbers. Settle these first based on known data before diving into detailed mapping.

These baseline data will allow you to calculate high-level metrics like IT spend as a percent of revenue and year-over-year percent change in IT spend, as well as more granular metrics like IT staff spend per employee for a specific IT service.

Baseline data checklist

- IT spend analysis period (date range).

- Currency used.

- Organizational revenue.

- Organizational OpEx.

- Total current year IT spend.

- Total current year IT CapEx and IT OpEx.

- Total previous-year IT spend.

- Total projected next-year IT spend.

- Number of organizational employees.

- Number of IT employees.

You may have discovered some things you didn't know about during the mapping process. Revisit your baseline data when your mapping is complete and make adjustments where needed.

2.4 Enter your baseline data

Duration: One hour

- Navigate to tab "3. Baseline Data" in the IT Spend & Staffing Transparency Workbook. Using the data you've gathered, enter the following information to set your baseline data for future calculations:

- Your IT spend analysis date range. This can be concrete dates, a fiscal year abbreviation, etc.

- The currency you will be using throughout the workbook. It's important that all monetary values entered are in the same currency.

- Your organization's total revenue and total operating expenditure (OpEx) for the spend analysis data range you've specified. Revenue includes all sources of funding/income.

- Your total IT OpEx and total IT capital expenditure (CapEx). The workbook will add your OpEx and CapEx values for you to arrive at a total IT spend value.

- Total IT spend for the year prior to the current IT spend analysis date range, as well as anticipated total IT spend for the year following.

- Total IT staff spend (salaries, benefits, training, travel, and fees for employees and contractors in a staff augmentation role) for the spend analysis date range.

- The total number of organizational employees and total number of IT employees. These are typically full-time equivalent (FTE) values and include contractors in a staff augmentation role.

- Make note of any issues that have influenced the values you entered.

Download the IT Spend & Staffing Transparency Workbook

2.4 Enter your baseline data

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Phase 2: Gather required data

Achievement summary

You've now completed all preparation steps for your IT spend transparency journey. You have:

- Gathered your IT spend and staffing data and information.

- Cleaned and organized your data to streamline mapping.

- Identified your baseline data points.

"As an IT person, you're not speaking the same language at all as the accounting department. There's almost always a session of education that's required first."

- Angie Reynolds, Principal Research Director, ITFM Practice, Info-Tech Research Group

Phase 3

Map Your IT Staff Spend

This phase will walk you through the following activities:

- Mapping your IT staff spend across the four views of the ITFM Cost Model

- Validating your mapping

This phase involves the following participants:

- Head of IT

- IT financial lead

- Other members of IT management

Phase 3: Map your IT staff spend

Allocate your workforce costs across the four views.

Now it's time to tackle the first part of your hands-on spend mapping effort, namely IT staff spend. In this phase you will:

- Allocate your IT staff spend across the four views of the ITFM Cost Model.

- Validate your mapping to ensure that it's accurate and complete.

"We're working towards the truth. We know the answer, but it's how to get it. Take Data & BI. For some organizations, four FTEs is too many. Are these people really doing Data & BI? Look at the big picture and see if something's missing."

- Rex Ding, Research Specialist, ITFM Practice, Info-Tech Research Group

Staffing costs comprise a significant percent of OpEx

Staffing is the first thing that comes to mind when it comes to spend. Intentionally bring it out of the shadows to promote constructive conversations.

- Total staffing costs stand out from other IT spend line items. This is because they're comparatively large, often comprising 30-50% of total IT costs.

- Standing out comes at a price. Staff costs are where business leadership looks first if they want cuts. If IT leadership doesn't bring forward ways to cut staffing costs as part of a broader cost-cutting mandate, it will be seen as ignorant of business priorities at best and outright insubordinate at worst.

- Staffing costs as a percentage of total costs vary between IT functions. On the business side, there's a lack of understanding about what functions IT staff serve and support and the real-world costs of obtaining (and keeping) needed IT skills. For example, IT security staffing costs as a percentage of that service's total OpEx will likely be higher than service desk staff given the scarcity and higher market value of the former. Trimming 20% of IT staffing costs from the IT security function has much different implications than cutting 20% of service desk staffing costs.

Staffing spend transparency can do a lot to change the conversation from one where the business thinks that IT management is just being self-protecting to one where they know that IT management is actually protecting the business.

Demonstrating the legitimate reasons behind IT staff spend is critical in both rationalizing past and current spend decisions as well as informing future decisions.

Info-Tech recommends that you map your IT staffing costs before all other IT costs

Mapping your IT staffing spend first is a good idea because:

- Staffing costs are usually documented more clearly, simply, and accurately than other IT costs.

- Gathering all your IT staffing data is usually a one-stop shop (i.e. the HR department).

- The comparative straightforwardness of mapping staff costs compared to other IT costs gives you the opportunity to:

- Get familiar with the ITFM Cost Model views and categories.

- Get the hang of the hands-on mapping process.

- Determine the kinds of speed bumps and questions you'll encounter down the road when you tackle the more complicated mappings.

"Some companies will say software developer. Others say application development specialist or engineer.

What are these things? You have to have conversations ..."

- Rex Ding, Research Specialist, ITFM Practice, Info-Tech Research Group

Understand the CFO Expense View: "Workforce" categories defined

For the staffing spend mapping exercise, we're defining the Workforce category here and will offer Vendor category definitions in the vendor spend mapping exercise later.

Workforce: The total costs of employing labor in the IT organization. This includes all salary/wages, benefits, travel/training, dues and memberships, and contractor pay. Managed services expenses associated with an external service provider should be excluded from Workforce and included in Contract Services.

Employee: A person employed by the IT organization on a permanent full-time or part-time basis. Costs include salary, benefits, training, travel and expenses, and professional dues and memberships. These relationships are managed under human resources and the bulk of spend transactions via payroll processes.

Contractor: A person serving in a non-permanent staff augmentation role. These relationships are typically managed under procurement or finance and spend transactions handled via invoicing and accounts payable processes. Labor costs associated with an external service provider are excluded.

Mapping your IT staff across the CFO Expense View is relatively cut-and-dried

The CFO Expense View is the most straightforward in terms of mapping IT staffing costs as it's made up of only two main categories: Workforce and Vendor.

In the CFO Expense View, all IT spend on staffing is allocated to the Workforce bucket under either Employee or Contractor.

What constitutes a Contractor can be confusing given increased use of long-term labor augmentation strategies, so being absolutely clear about this is imperative. For spend mapping purposes:

- Any staff members under independent contract where individuals are paid directly by your organization as opposed to indirectly via a service provider (e.g. staffing firm) are considered Workforce > Contractor.

- Any circumstances where you pay a third-party organization for labor is slotted under Vendor > Contract Services.

Understand the CIO Service View: Categories defined

We've provided definitions for the major categories that require clarification.

Applications Development: Purchase/development, testing, and deployment of application projects. Includes internally developed or packaged solutions.

Applications Maintenance: Software maintenance fees or maintaining current application functionality along with minor enhancements.

Hosting & Networks: Compute, storage, and network functionality for running/hosting applications and providing communications/connectivity for the organization.

End User: Procurement, provision, management, and maintenance (break/fix) of end-user devices (desktop, laptops, tablets, peripherals, and phones) as well as purchase/support and use of productivity software on these devices. The IT service desk is included here as well.

PPM & Projects: People, processes, and technologies dedicated to the management of IT projects and the IT project portfolio as a whole.

Data & BI: Strategy and oversight of the technology used to support data warehousing, business intelligence, and analytics.

IT Management: Senior IT leadership, IT finance, IT strategy and governance, enterprise architecture, process management, vendor management, talent management, and program and portfolio management oversight.

Security: Information security strategy and oversight, practices, procedures, compliance, and risk mitigation to protect and prevent unauthorized access to organizational data and technology assets.

Mapping your IT staff across the CIO Service View is a slightly harder exercise

The complexity of mapping staff across this view depends on how your IT department is organized and the degree of role specialization vs. generalization.

The CIO Service View mirrors how many IT departments are organized into teams or work groups. However, some partial percentage-based allocations are probably required, especially for smaller IT units with more generalized, cross-functional roles. For example:

- A systems administrator's costs may need to be allocated 80% to Hosting & Networks and 20% to Security.

- An app development team lead may spend about 40% of their time doing hands-on Development work and the other 60% on project management (i.e. PPM & Projects).

Info-Tech has found that allocating staffing costs for Data & BI raises the most doubts as it can be very entangled with Applications and other spend. Do the best you can.

Understand the CXO Expense View: Categories defined

Expand shared services and industry function categories as suits your organization.

Industry Functions: As listed and defined by you for your specific industry.

Human Resources: IT staff and specific application functionality in support of organizational human resource management.

Finance & Accounting: IT staff and specific application functionality in support of corporate finance and accounting.

Shared Services Other: IT staff and specific application functionality in support of all other shared enterprise functions.

Information Technology: IT staff and specific application functionality in support of IT performing its own internal IT operations functions.

Industry Other: IT staff and specific application functionality in support of all other industry-specific functions.

Mapping your IT staff across the CXO Business View warrants the most time

This view is probably the most difficult as many IT department roles are set up according to lines of IT service, not lines of business. Prepare to do a little math.

The CXO Expense View also requires percentage-based splitting of role spend, but to a greater extent.

- Start by mapping staff cost allocations for those roles that are at, or close to, 100% dedicated to a specific business function (if any).

- For IT roles that support organization-wide or multi-department functions, knowing the percent of employees that work in each relevant business unit and parceling IT staff spend by those same percentages may be easiest. For example, a general systems administrator's costs could be allocated as 4% to HR, 2% to finance, 25% to sales, 20% to production operations, and so on based on the percentage of employees in each of the supported business units.

Take a minute to figure out how you plan to map IT's indirect CXO Business View costs

Direct IT costs are those that are dedicated to a specific business unit or user group, such a marketing campaign management app, specialized devices used by a specific subset of workers in the field, or a business analyst embedded full-time in a sales organization.

VS

Indirect IT costs are pretty much everything else that's shared broadly across the organization and can't be tied to just one stakeholder or user group, such as network infrastructure, the service desk, and office productivity apps. These costs must be fairly and evenly distributed.

No indirect mapping method is perfect, but here's a suggestion:

- Take the respective headcount of all business functions sharing the IT resource/service in question.

- Calculate each business function's staff as a percentage of all organizational staff.

- Use this same percent of staff to calculate and allocate a business function's indirect staff and indirect vendor costs.

"There is always a conversation about indirect allocations. There's never been an organization I've heard of or worked for which has been able to allocate every technology cost directly to a business consumption or business unit."

Monica Braun, ITFM Research Director, Info-Tech Research Group

Example:

- A company of 560 employees has six HR staff (about 1.1% of total staff).

- Network admin staffing costs $143,000, so $1,573 (1.1%) would be allocated to HR.

- Internet services cost $40,000, so $440 (1.1%) would be allocated to HR.

Some indirect costs are shared by multiple business functions, but not all. In these cases, exclude non-participating business functions from the total number of organizational employees and re-calculate a new percent of staff for each participating business function.

Know where you're most likely to encounter direct vs. indirect IT staffing costs

Info-Tech has found that direct vs. indirect staffing spend is more commonly found in some areas than others. Use this insight to focus your work.

Direct IT staffing spend

Definition: Individuals or teams whose total time is formally dedicated to the support of one business unit/function.

- Data & BI (direct to one non-IT unit)

- IT Management (direct to IT)

- Service planning & Architecture

- Strategy & Governance

- Financial Management

- People & Resources

Hybrid IT staffing spend

Definition: Teams with a percent of time or entire FTEs formally dedicated to one business unit/function while the remainder of the time or team is generalized.

- Applications

- Applications Development

- Applications Maintenance

- IT Management

- PPM & Projects

Indirect IT staffing spend

Definition: Individuals or teams whose total time is generalized to the support of multiple or all business units or functions.

- Infrastructure

- Hosting & Networks

- End Users

- Security

Indirect staff spend only comes into play in the CXO Business View. Thoroughly map the CIO Service View first and leverage its outcomes to inform your allocations to individual business and industry functions.

Understand the CEO Innovation View: Categories defined

Be particularly clear on your understanding of the difference between business growth and business innovation.

Business Innovation: IT spend/ activities focused on the development of new business capability, new products and services, and/or introduction of existing products/ services into new markets. It does not include expansion or update of existing capabilities.

Business Growth: IT spend/activities focused on the expansion, scaling, or modernization of an existing business capability, product/service, or market. This is specifically related to growth within a current market.

Keep the Lights On: IT spend/activities focused on keeping the organization running on a day-to-day basis. This includes all activities used to ensure the smooth operation of business functions and overall business continuity.

Important Note

Info-Tech analysts often skip mapping staff for the CEO Innovation View when delivering the IT Spend & Staffing Benchmarking Service.