Position and Agree on ROI to Maximize the Impact of Data and Analytics

- Because ROI is a financial concept, it can be difficult to apply ROI to anything that produces intangible value.

- It is a lot harder to apply ROI to functions like data and analytics than it is to apply it to functions like sales without misrepresenting its true purpose.

Our Advice

Critical Insight

- The standard ROI formula cannot be easily applied to data and analytics and other critical functions across the organization.

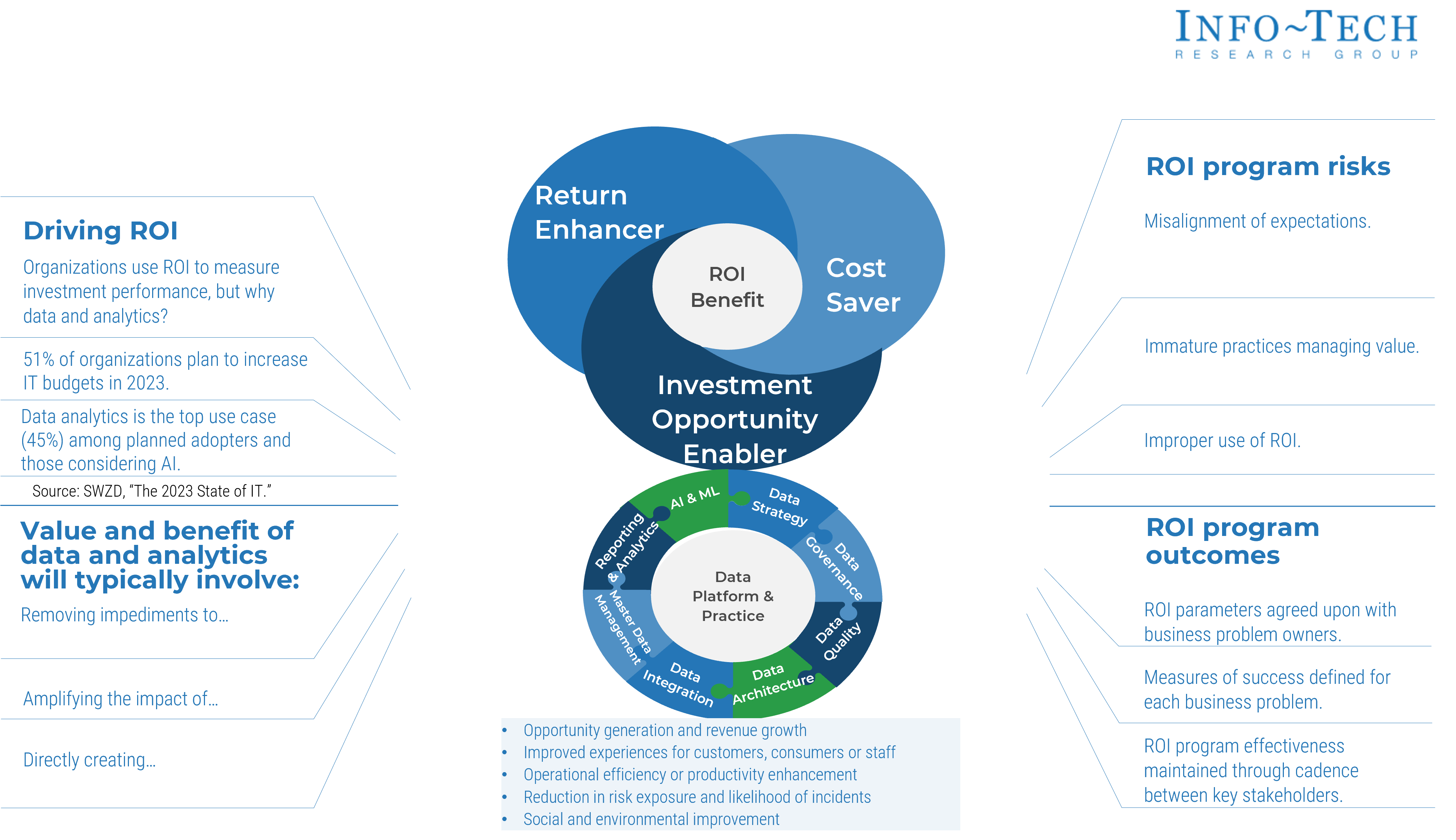

- Data and analytics ROI strategy is based on the business problem being solved.

- The ROI score itself doesn’t have to be perfect. Key decision makers need to agree on the parameters and measures of success.

Impact and Result

- Agreed-upon ROI parameters

- Defined measures of success

- Optimized ROI program effectiveness by establishing an appropriate cadence between key stakeholders

Position and Agree on ROI to Maximize the Impact of Data and Analytics Research & Tools

Besides the small introduction, subscribers and consulting clients within this management domain have access to:

1. Data and Analytics ROI Strategy Deck – A guide for positioning ROI to maximize the value of data and analytics.

This research is meant to ensure that data and analytics executives are aligned with the key business decision makers. Focus on the value you are trying to achieve rather than perfecting the ROI score.

- Position and Agree on ROI to Maximize the Impact of Data and Analytics Storyboard

2. Data and Analytics Service to Business ROI Map – An aligned ROI approach between key decision makers and data and analytics.

A tool to be used by business and data and analytics decision makers to facilitate discussions about how to approach ROI for data and analytics.

- Data and Analytics Service to Business ROI Map

Further reading

Position and Agree on ROI to Maximize the Impact of Data and Analytics

Data and analytics ROI strategy is based on the business problem being solved and agreed-upon value being generated.

Analyst Perspective

Missing out on a significant opportunity for returns could be the biggest cost to the project and its sponsor.

|

|

This research is directed to the key decision makers tasked with addressing business problems. It also informs stakeholders that have any interest in ROI, especially when applying it to a data and analytics platform and practice. While organizations typically use ROI to measure the performance of their investments, the key to determining what investment makes sense is opportunity cost. Missing out on a significant opportunity for return could be the biggest cost to the project and its sponsor. By making sure you appropriately estimate costs and value returned for all data and analytics activities, you can prioritize the ones that bring in the greatest returns. |

|---|---|---|

| Ibrahim Abdel-Kader Research Analyst, Data & Analytics Practice Info-Tech Research Group |

Ben Abrishami-Shirazi Technical Counselor Info-Tech Research Group |

Executive Summary – ROI on Data and Analytics

Your Challenge |

Common Obstacles |

Info-Tech’s Approach |

|---|---|---|

Return on investment (ROI) is a financial term, making it difficult to articulate value when trying to incorporate anything that produces something intangible. The more financial aspects there are to a professional function (e.g. sales and commodity-related functions), the easier it is to properly assess the ROI. However, for functions that primarily enable or support business functions (such as IT and data and analytics), it is a lot harder to apply ROI without misrepresenting its true purpose. |

|

Approach ROI for data and analytics appropriately:

|

Info-Tech Insight

ROI doesn’t have to be perfect. Parameters and measures of success need to be agreed upon with the key decision makers.

Glossary

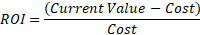

Return on Investment (ROI): A financial term used to determine how much value has been or will be gained or lost based on the total cost of investment. It is typically expressed as a percentage and is supported by the following formula:

Payback: How quickly money is paid back (or returned) on the initial investment.

Business Problem Owner (BPO): A leader in the organization who is accountable and is the key decision maker tasked with addressing a business problem through a series of investments. BPOs may use ROI as a reference for how their financial investments have performed and to influence future investment decisions.

Problem Solver: A key stakeholder tasked with collaborating with the BPO in addressing the business problem at hand. One of the problem solver’s responsibilities is to ensure that there is an improved return on the BPO’s investments.

Return Enhancers: A category for capabilities that directly or indirectly enhance the return of an investment.

Cost Savers: A category for capabilities that directly or indirectly save costs in relation of an investment.

Investment Opportunity Enablers: A category for capabilities that create or enable a new investment opportunity that may yield a potential return.

Game Changing Components: The components of a capability that directly yield value in solving a business problem.

ROI strategy on data and analytics

ROI roles

Typical roles involved in the ROI strategy across the organization

CDOs and CAOs typically have their budget allocated from both IT and business units.

This is evidenced by the “State of the CIO Survey 2023” reporting that up to 63% of CDOs and CAOs have some budget allocated from within IT; therefore, up to 37% of budgets are entirely funded by business executives.

This signifies the need to be aligned with peer executives and to use mechanisms like ROI to maximize the performance of investments.

Source: Foundry, “State of the CIO Survey 2023.”

Buying Options

Position and Agree on ROI to Maximize the Impact of Data and Analytics

IT Risk Management · IT Leadership & Strategy implementation · Operational Management · Service Delivery · Organizational Management · Process Improvements · ITIL, CORM, Agile · Cost Control · Business Process Analysis · Technology Development · Project Implementation · International Coordination · In & Outsourcing · Customer Care · Multilingual: Dutch, English, French, German, Japanese · Entrepreneur

Tymans Group is a brand by Gert Taeymans BV

Gert Taeymans bv

Europe: Koning Albertstraat 136, 2070 Burcht, Belgium — VAT No: BE0685.974.694 — phone: +32 (0) 468.142.754

USA: 4023 KENNETT PIKE, SUITE 751, GREENVILLE, DE 19807 — Phone: 1-917-473-8669

Copyright 2017-2022 Gert Taeymans BV