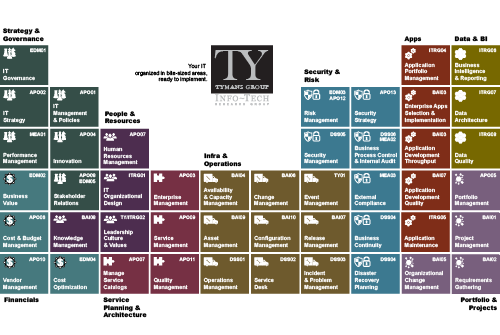

Define Requirements for Outsourcing the Service Desk

- Buy Link or Shortcode: {j2store}493|cart{/j2store}

- Parent Category Name: Service Desk

- Parent Category Link: /service-desk

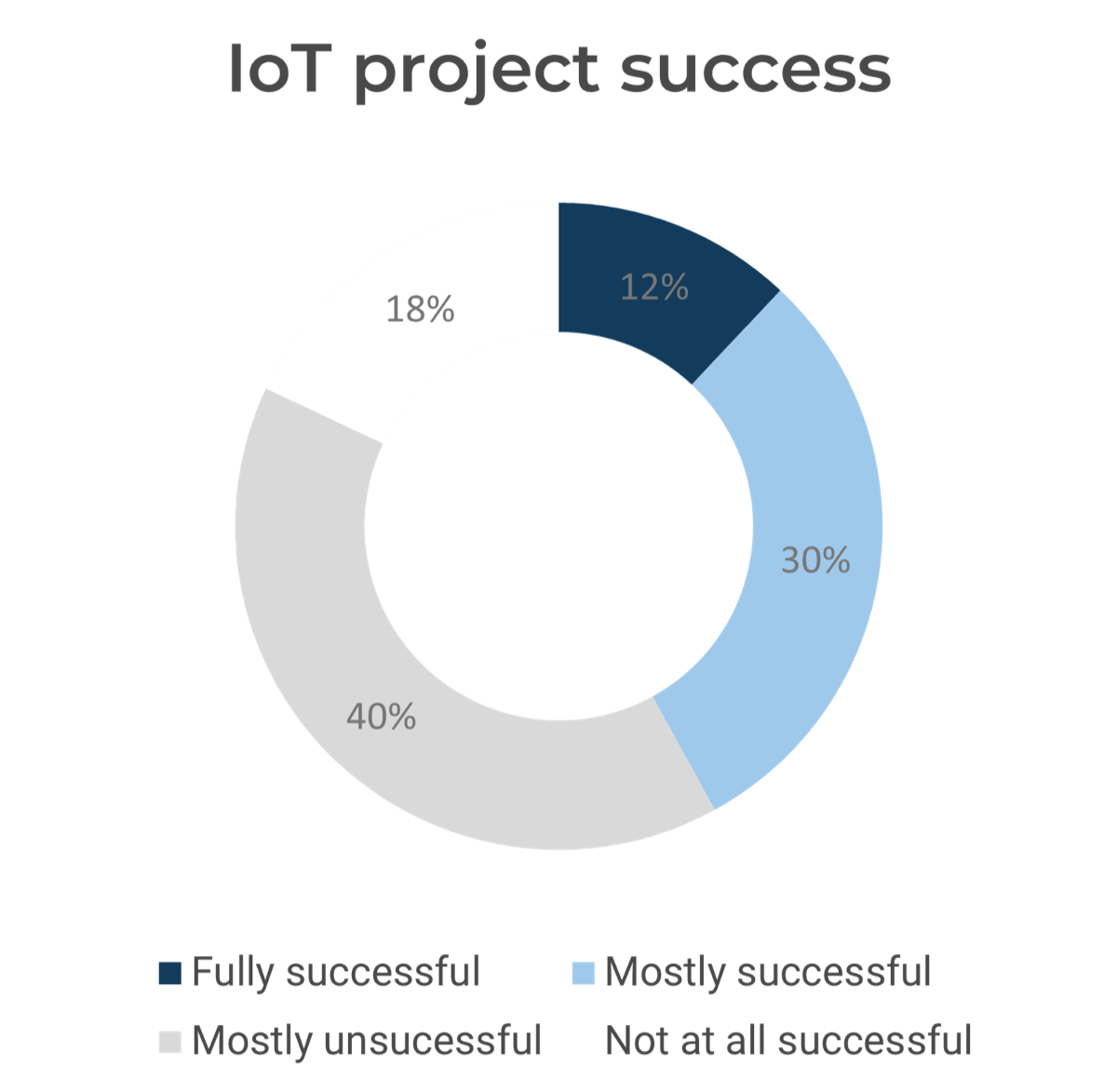

- In organizations where technical support is viewed as non-strategic, many see outsourcing as a cost-effective way to provide this support. However, outsourced projects often fall short of their goals in terms of cost savings and the quality of support.

- Significant administrative work and up-front costs are required to outsource the service desk, and poor planning often results in project failure and a decrease of end-user satisfaction.

- A complete turnover of the service desk can result in lost knowledge and control over processes, and organizations without an exit strategy can struggle to bring their service desk back in house and return the confidence of end users.

Our Advice

Critical Insight

- Outsourcing is easy. Realizing the expected cost, quality, and focus benefits is hard. Successful outsourcing without being directly involved in service desk management is almost impossible.

- You don’t need to standardize before you outsource, but you still need to conduct your due diligence. If you outsource without thinking about how you want the future to work, you will likely be unsatisfied with the result.

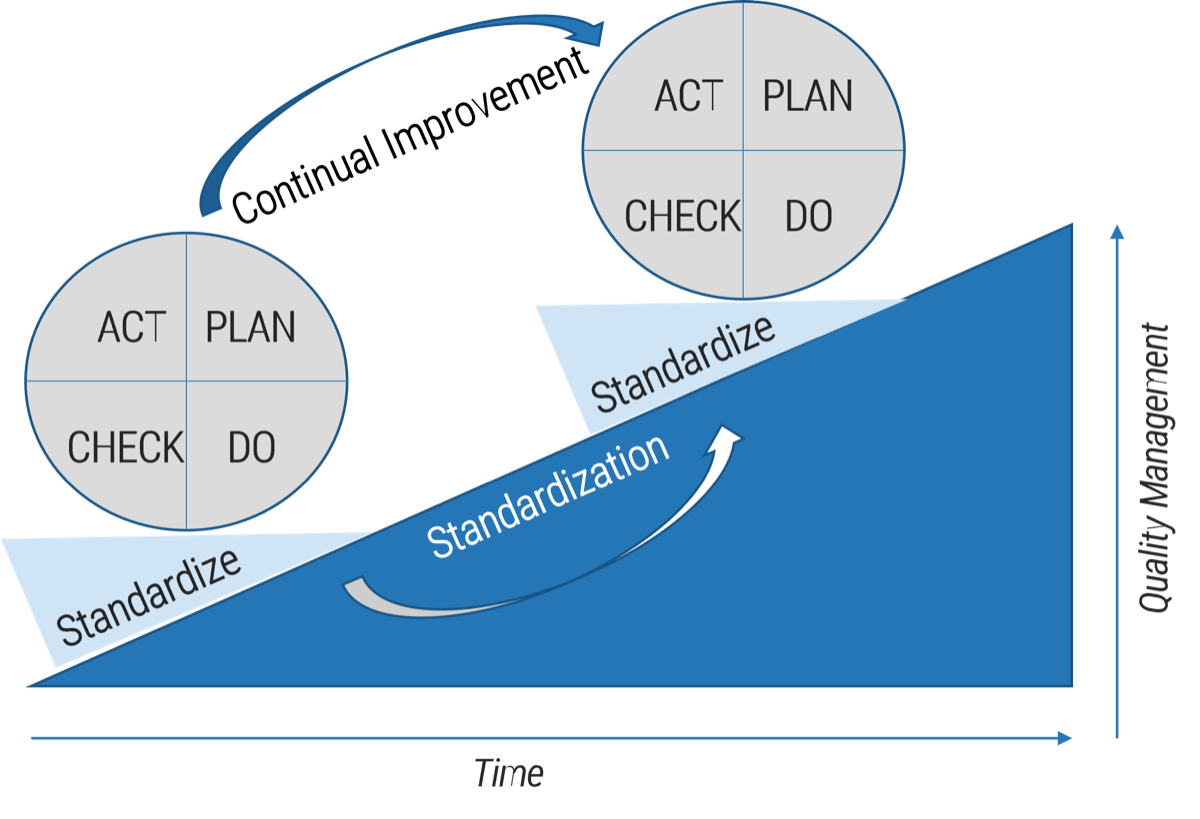

- If cost is your only driver for outsourcing, understand that it comes at a cost. Customer service quality will likely be less, and your outsourcer may not add on frills such as Continual Improvement. Be careful that your specialists don’t end up spending more time working on incidents and service requests.

Impact and Result

- First decide if outsourcing is the correct step; there may be more preliminary work to do beforehand.

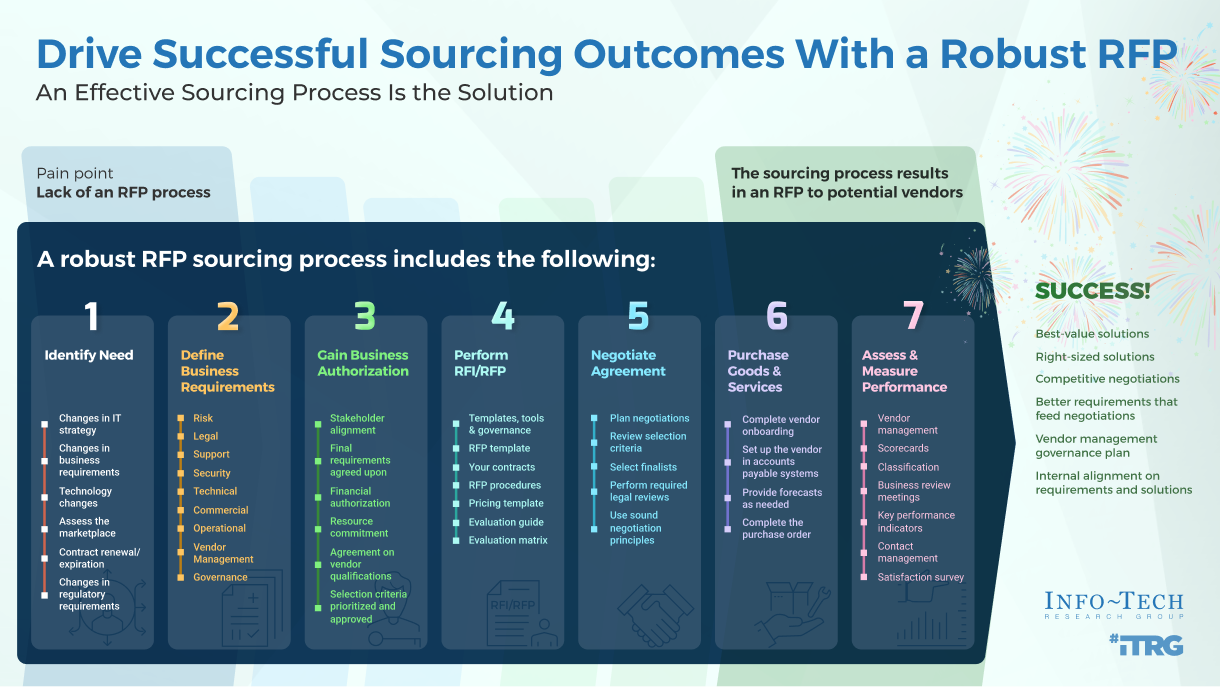

- Assess requirements and make necessary adjustments before developing an outsource RFP.

- Clearly define the project and produce an RFP to provide to vendors.

- Plan for long-term success, not short-term gain.

- Prepare to retain some of the higher-level service desk work.

Define Requirements for Outsourcing the Service Desk Research & Tools

Besides the small introduction, subscribers and consulting clients within this management domain have access to:

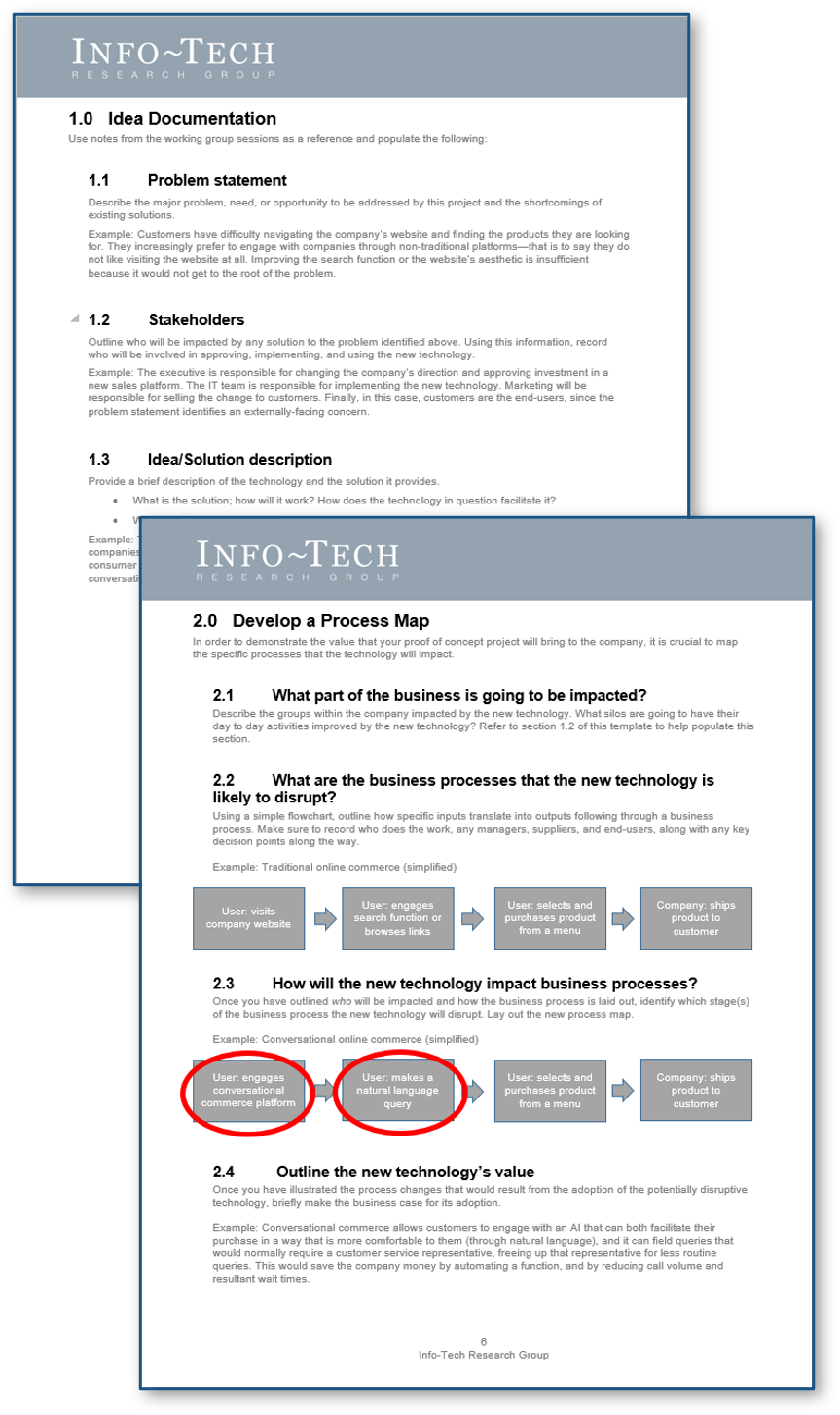

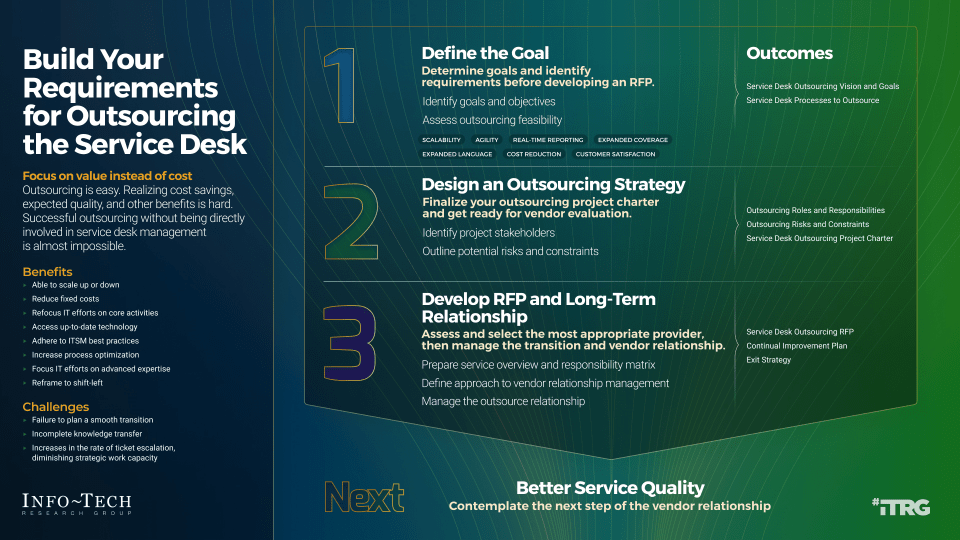

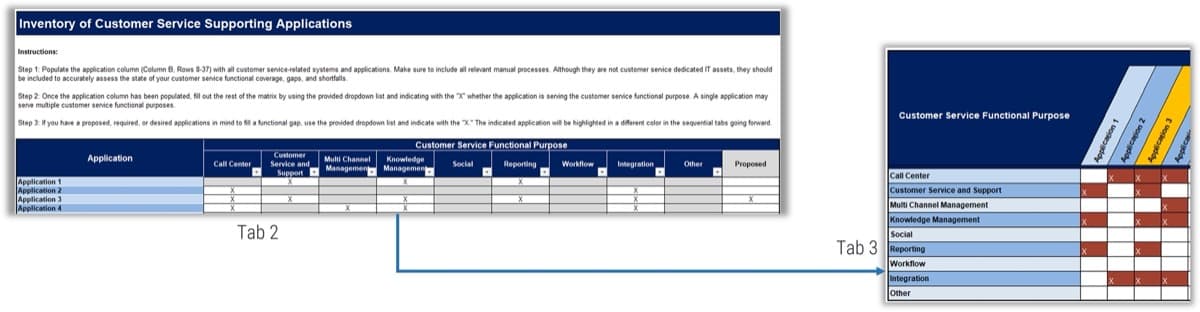

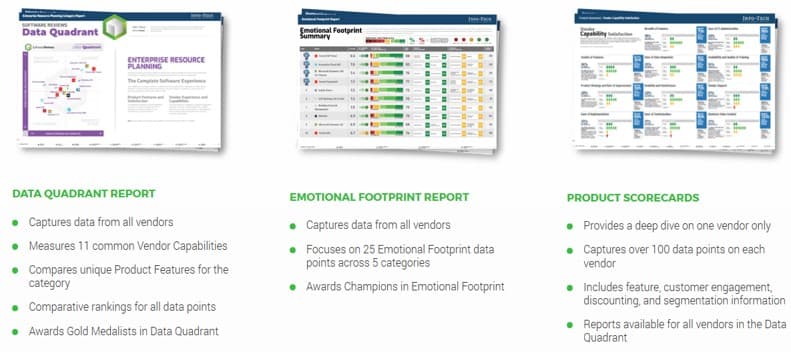

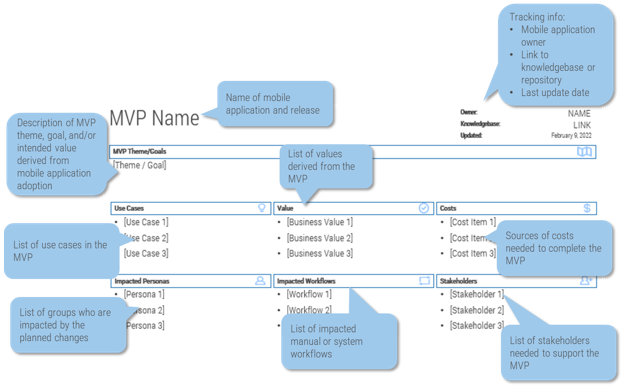

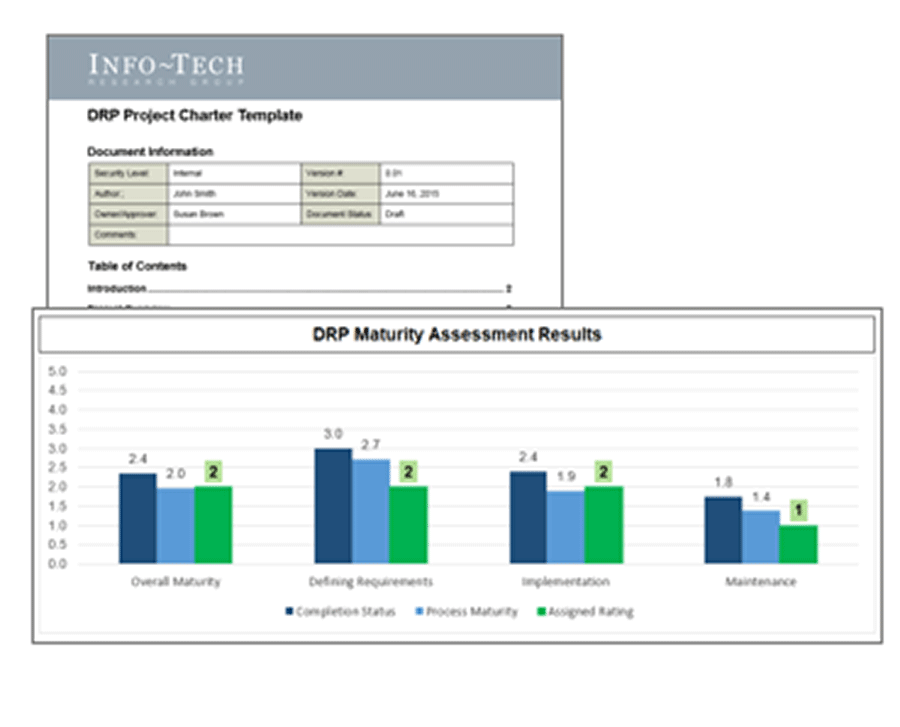

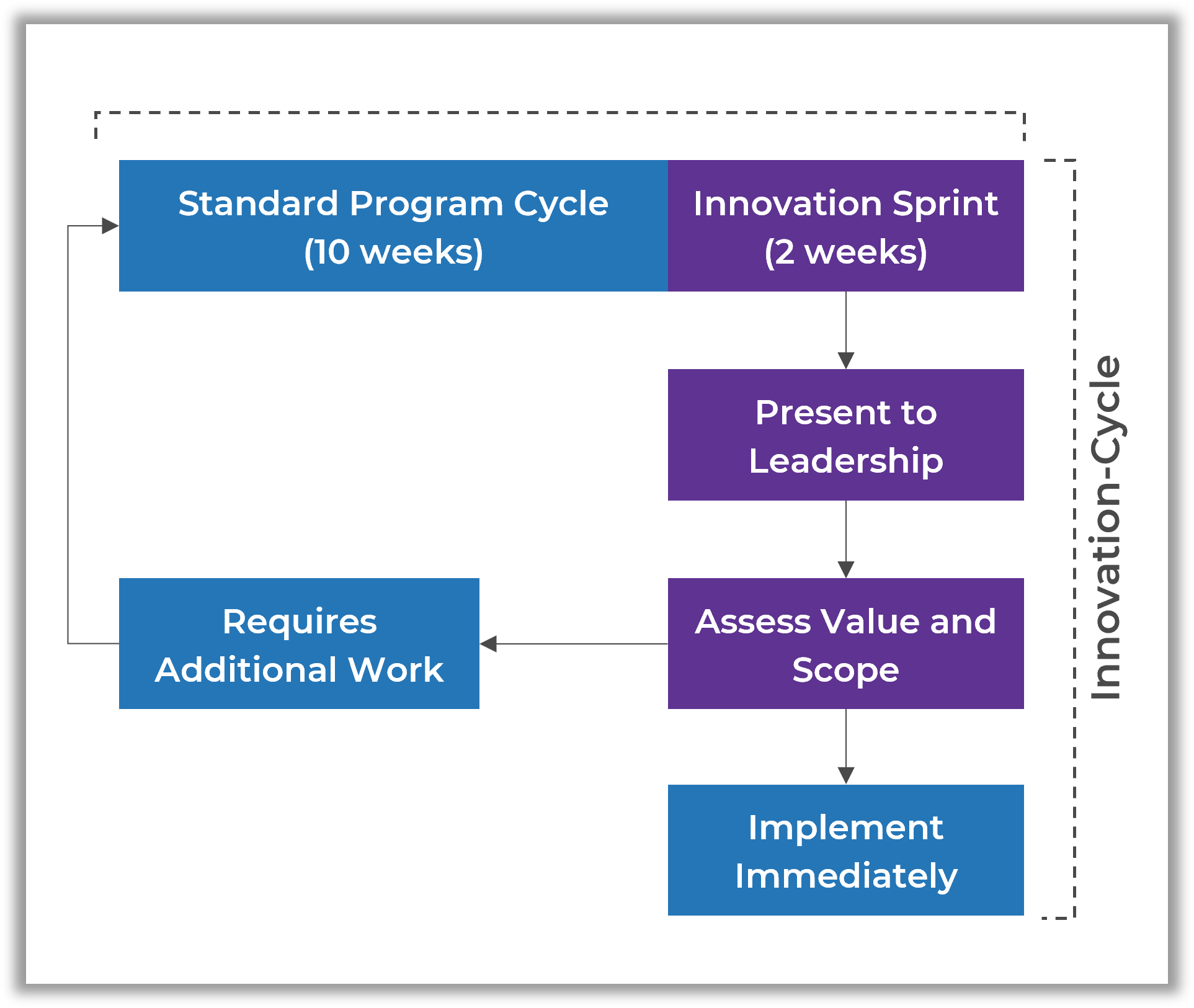

1. Define Requirements for Outsourcing the Service Desk Deck – A step-by-step document to walk you through building a strategy for efficient service desk outsourcing.

This storyboard will help you craft a project charter, create an RFP, and outline strategies to build a long-term relationship with the vendor.

- Define Requirements for Outsourcing the Service Desk – Storyboard

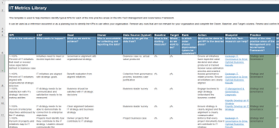

- Service Desk Outsourcing Requirements Database Library

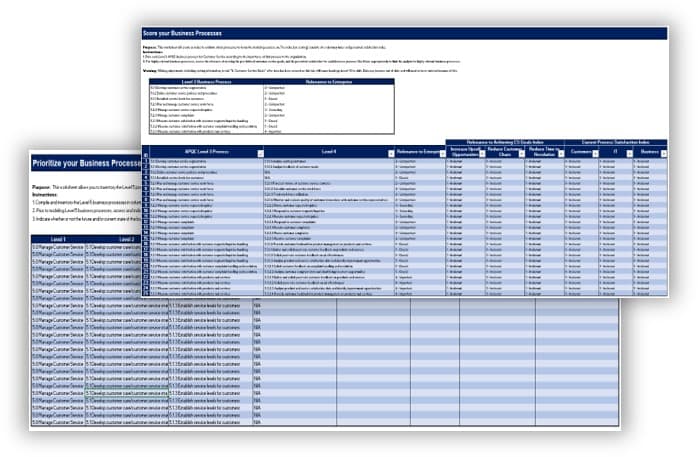

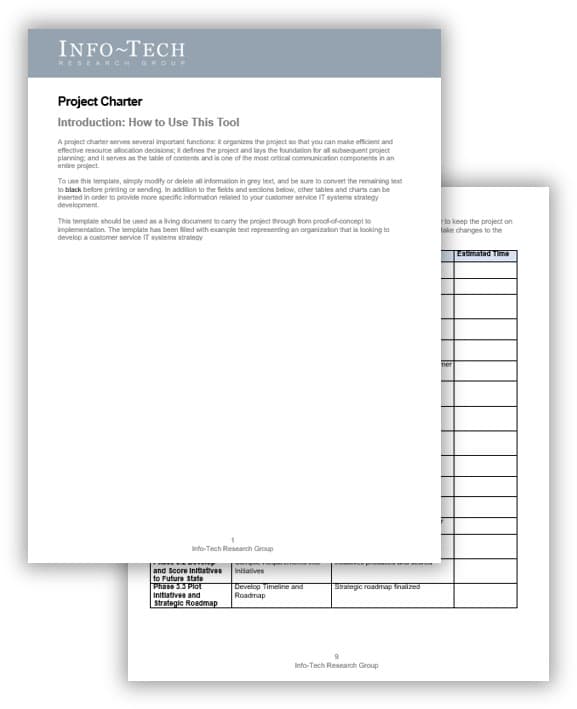

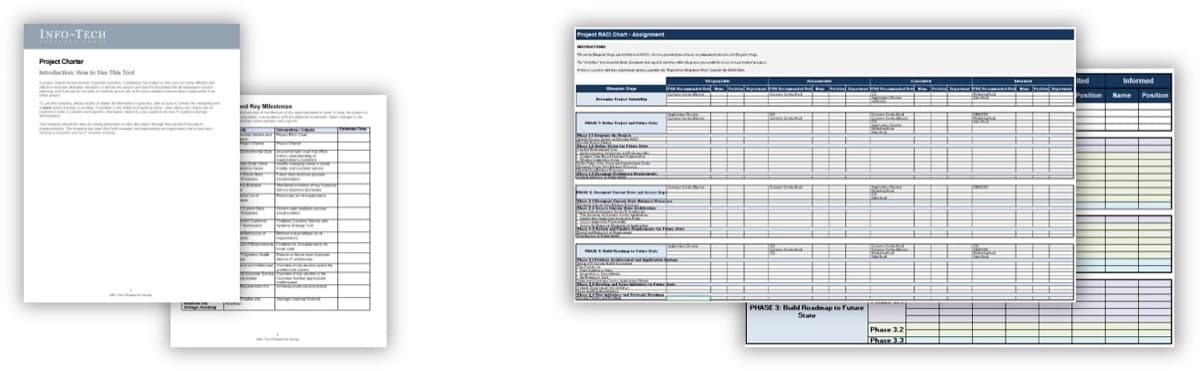

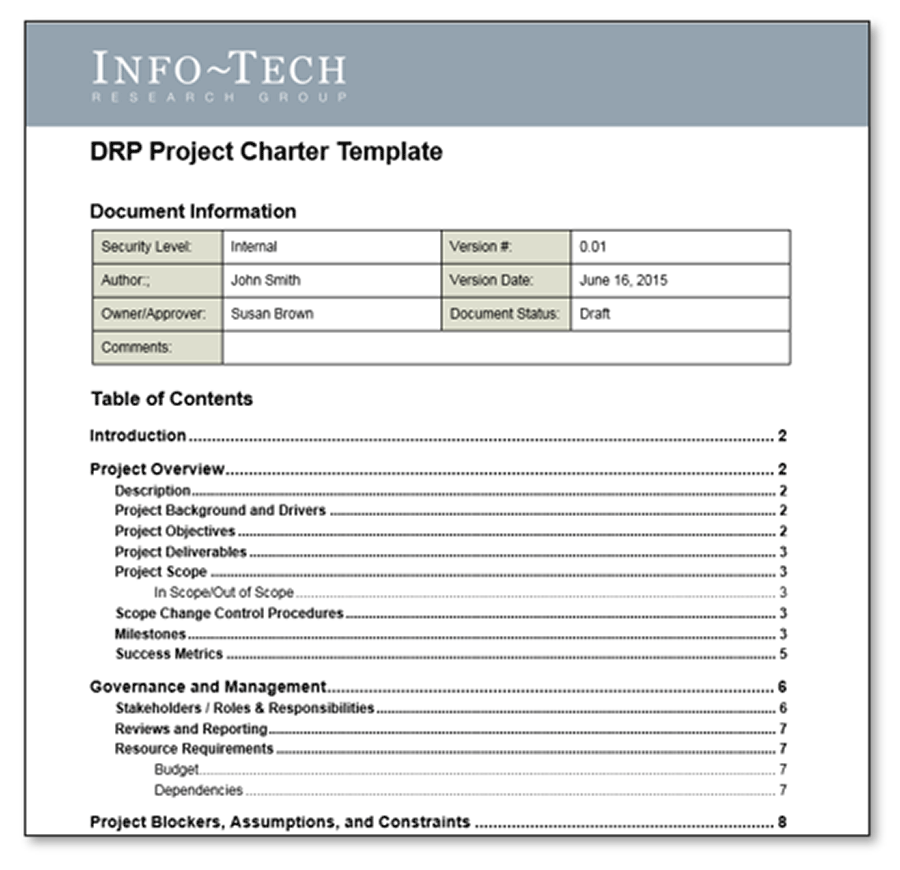

2. Service Desk Outsourcing Project Charter Template and Requirements Library – Best-of-breed templates to help you determine processes and build a strategy to outsource them.

These templates will help you determine your service desk requirements and document your proposed service desk outsourcing strategy.

- Service Desk Outsourcing Project Charter Template

3. Service Desk Outsourcing RFP Template – A structured document to help you outline expectations and communicate requirements to managed service providers.

This template will allow you to create a detailed RFP for your outsourcing agreement, document the statement of work, provide service overview, record exit conditions, and document licensing model and estimated pricing.

- Service Desk Outsourcing RFP Template

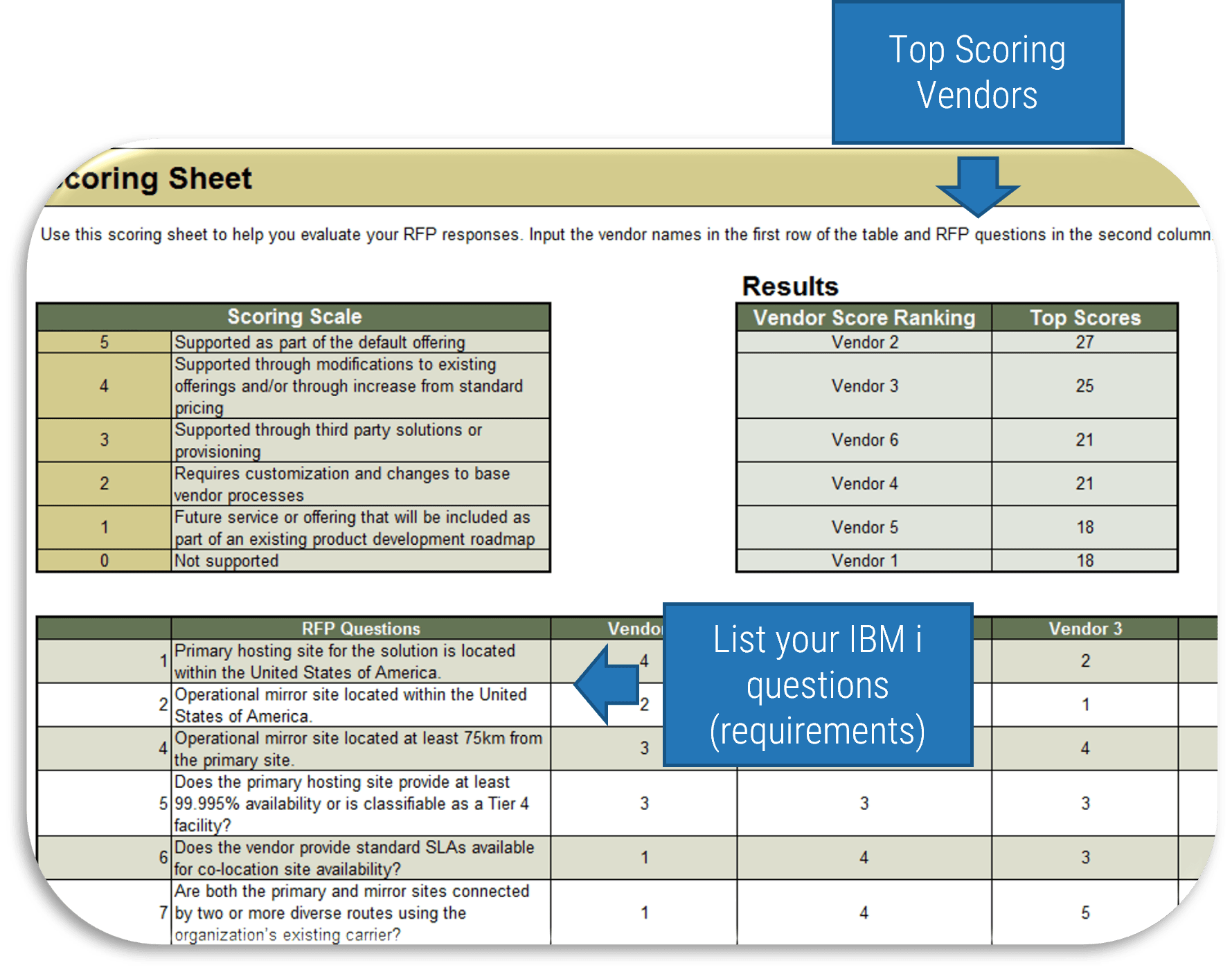

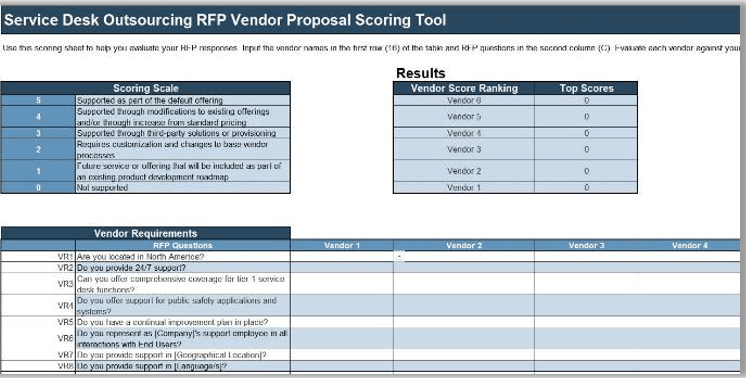

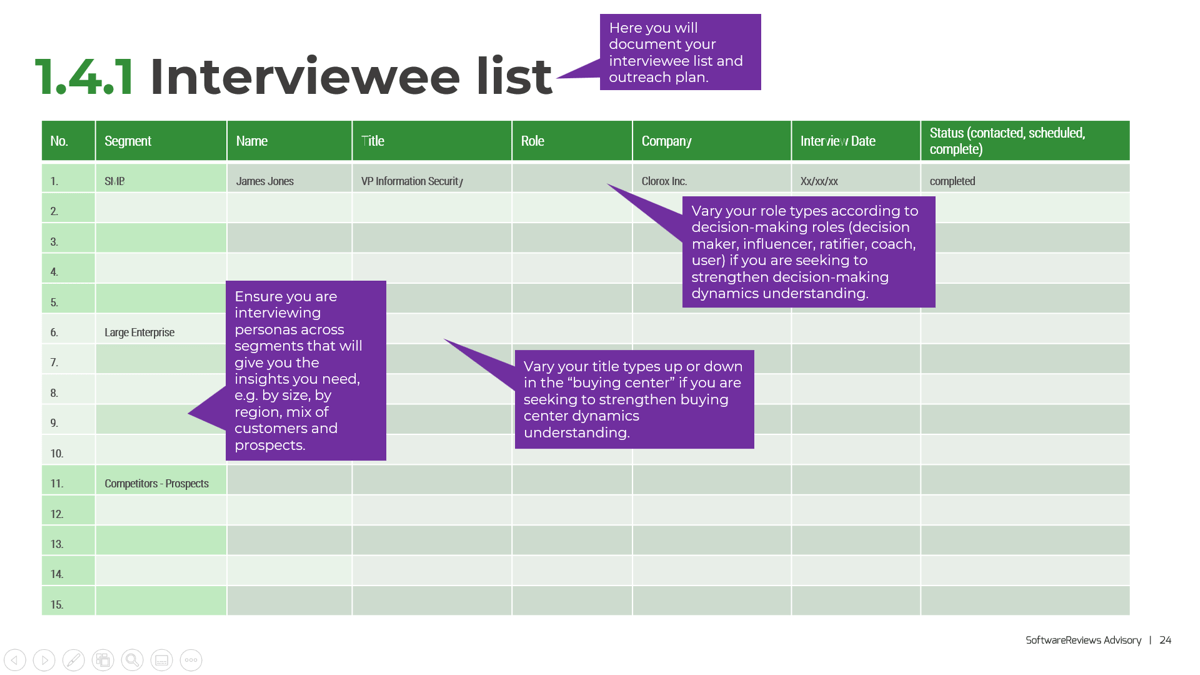

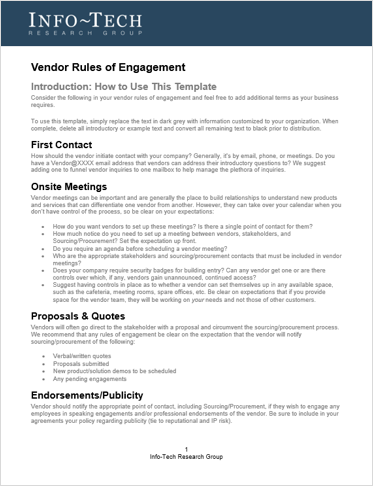

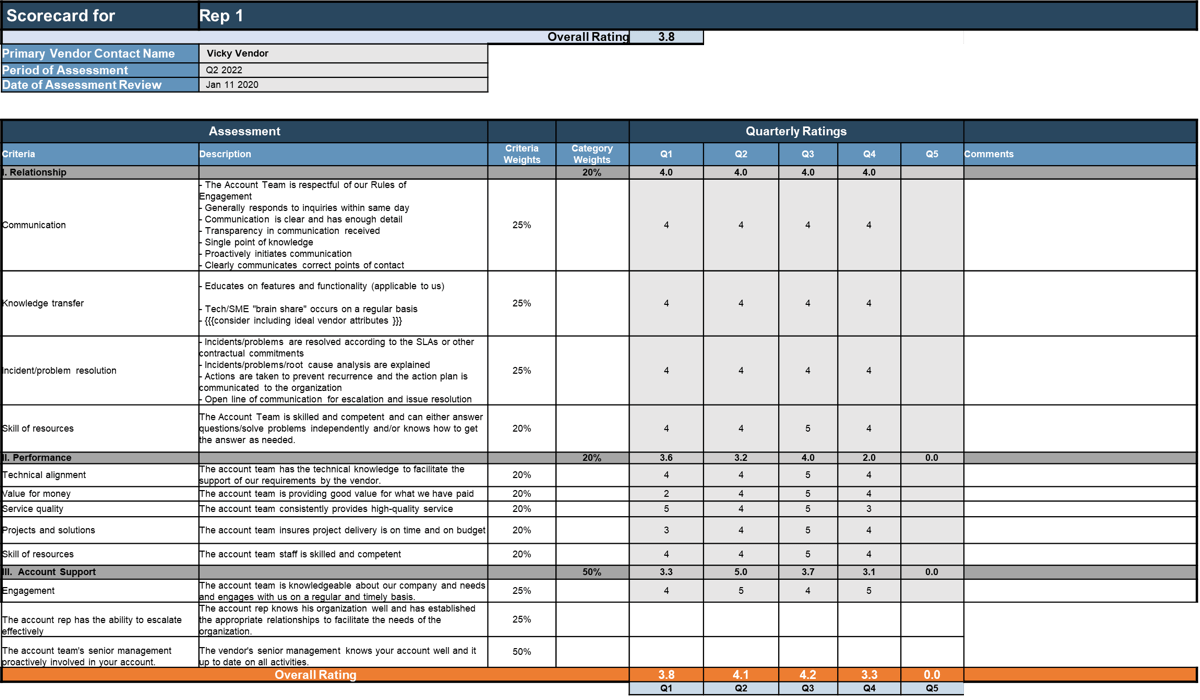

4. Service Desk Outsourcing Reference Interview Template and Scoring Tool – Materials to help you conduct efficient briefings and select the best vendor to fulfill your service desk requirements.

Use the Reference Interview Template to outline a list of questions for interviewing current/previous customers of your candidate vendors. These interviews will help you with unbiased vendor scoring. The RFP Vendor Scoring Tool will help you facilitate vendor briefings with your list of questions and score candidate vendors efficiently through quantifying evaluations.

- Service Desk Outsourcing Reference Interview Template

- Service Desk Outsourcing RFP Scoring Tool

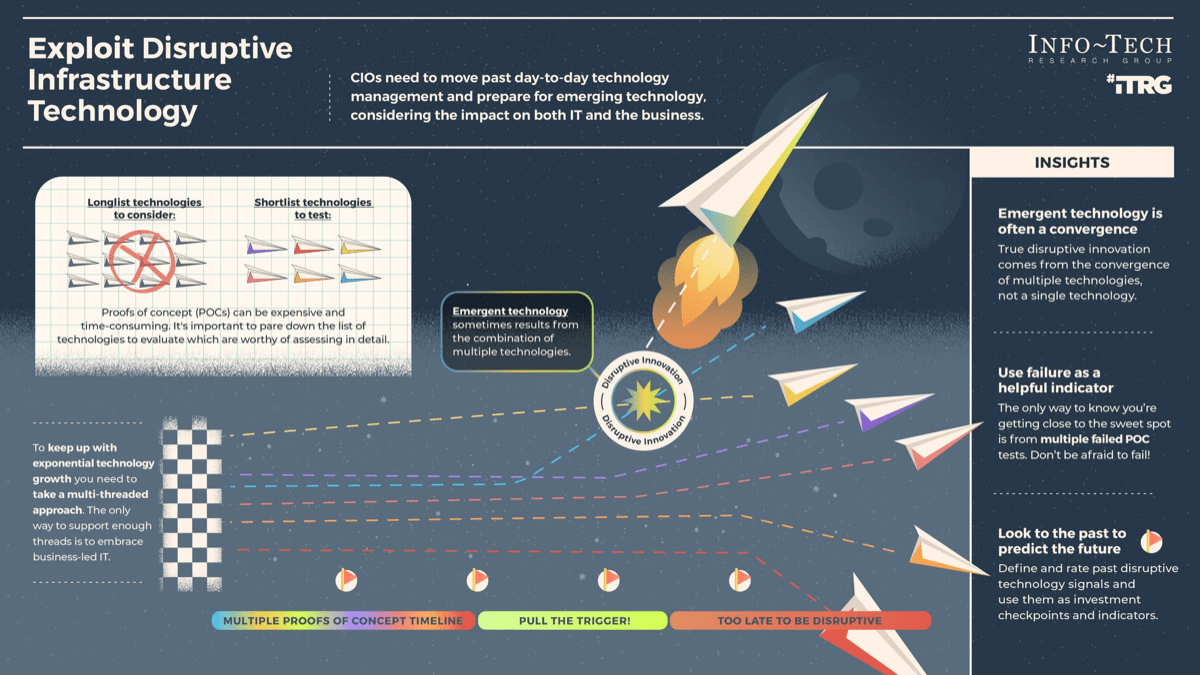

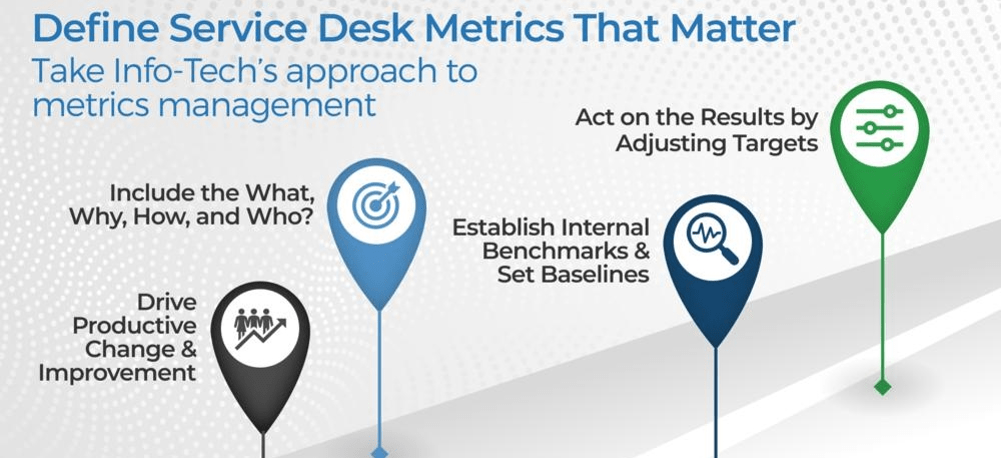

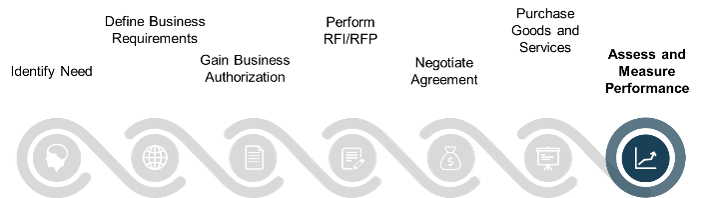

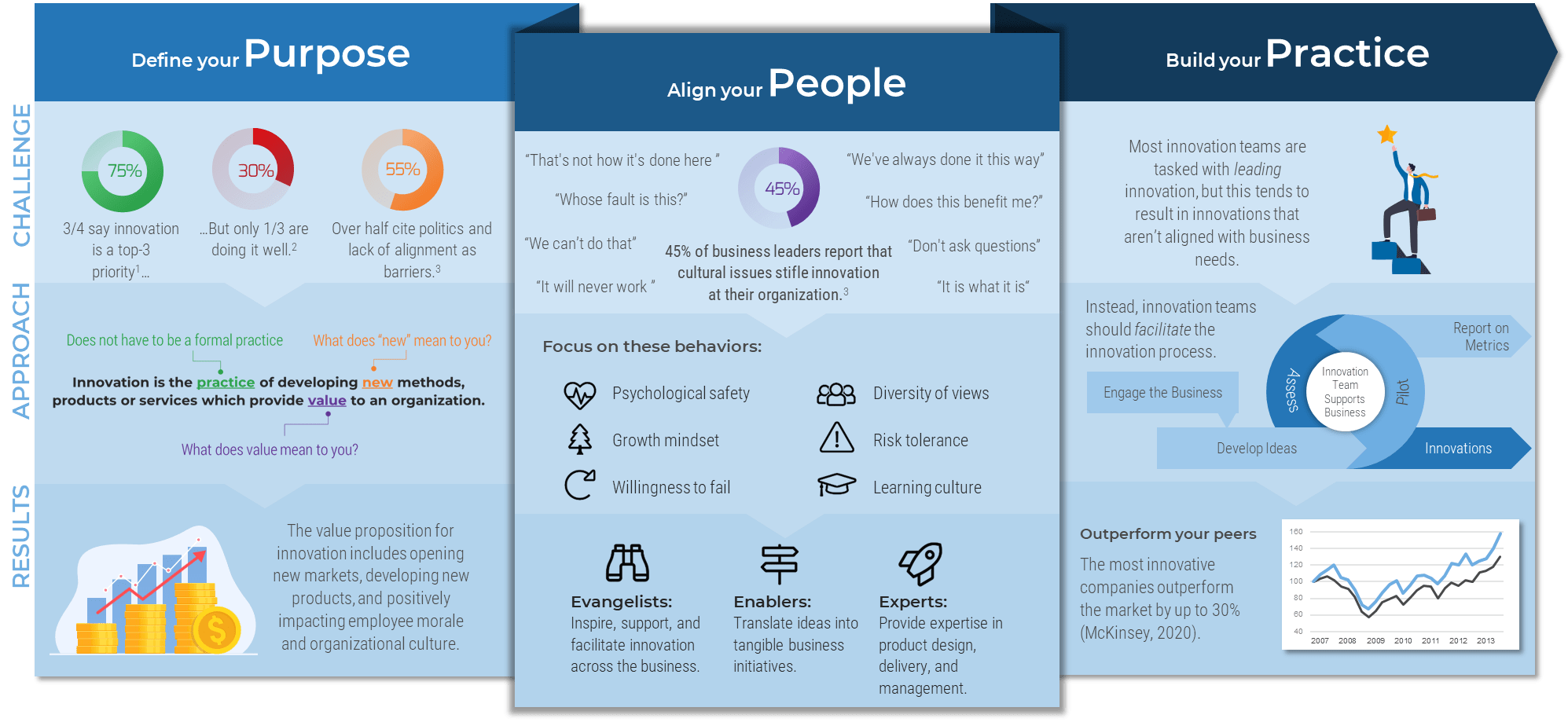

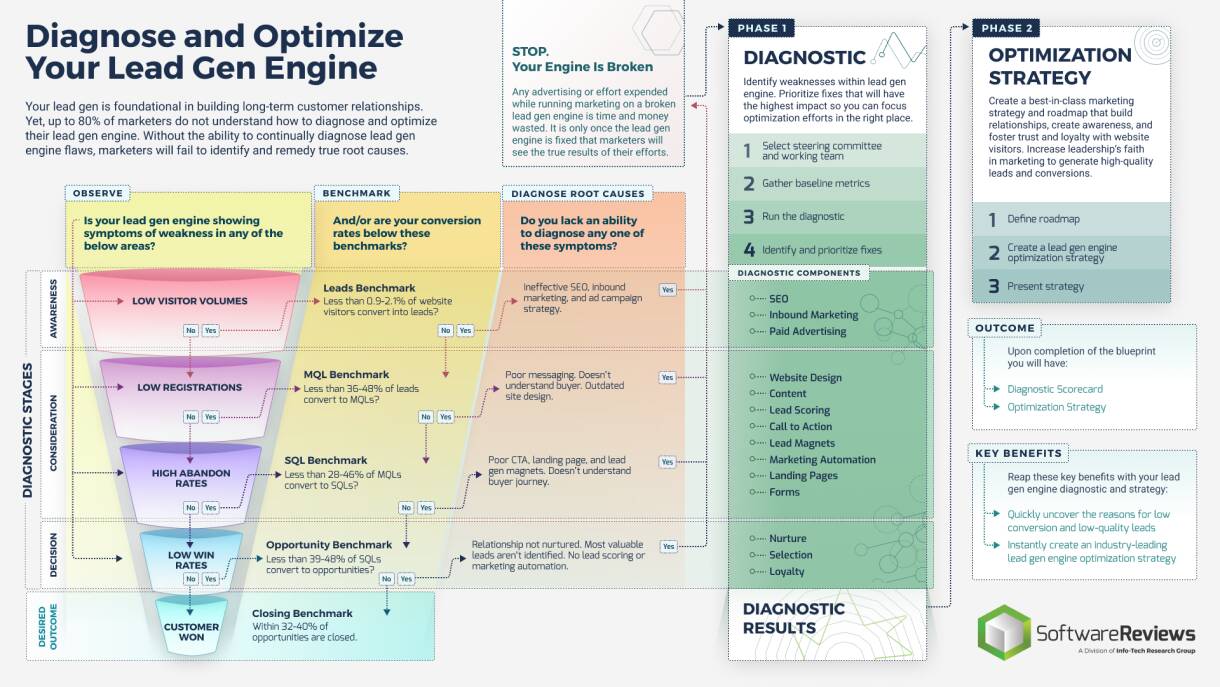

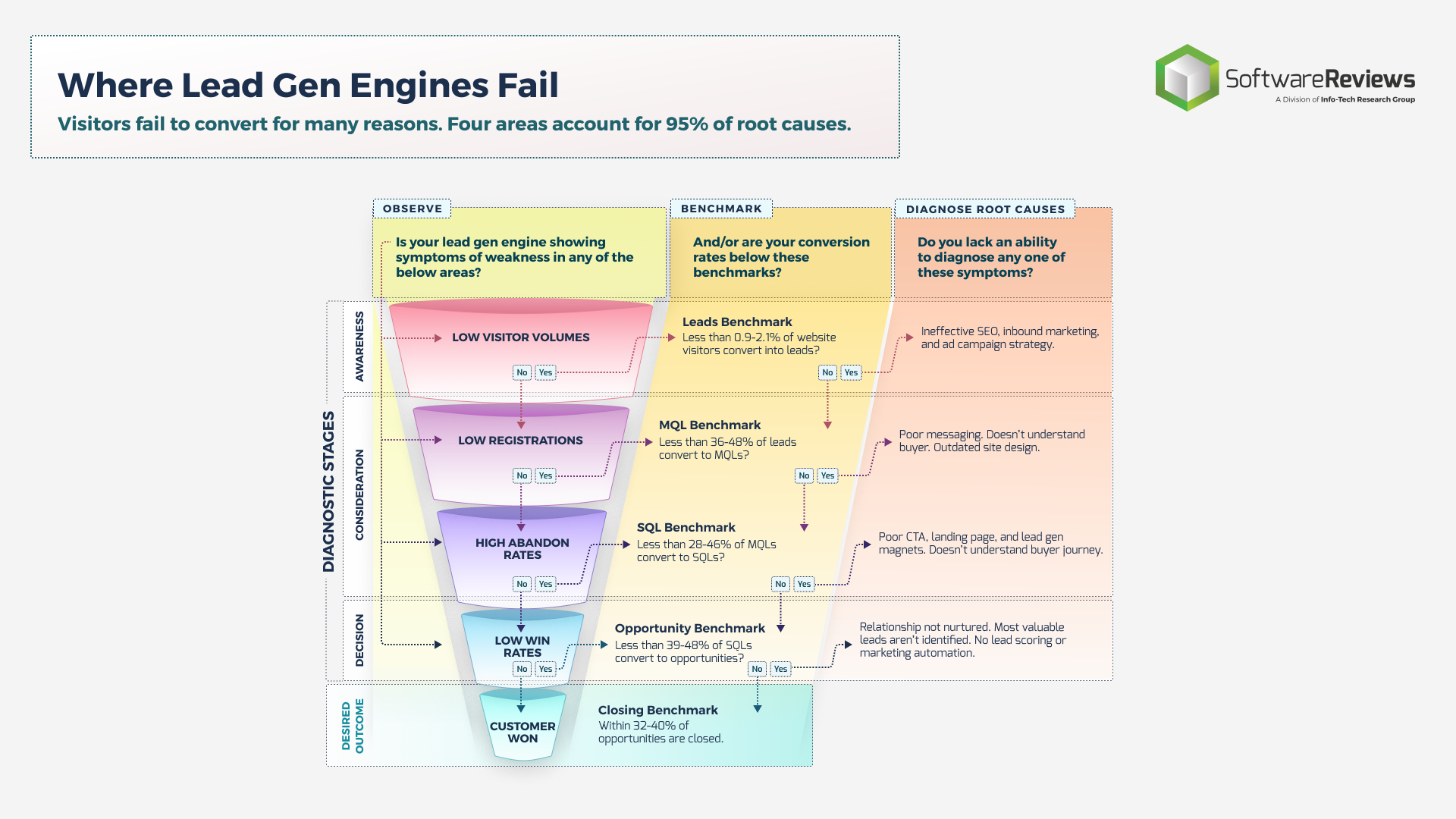

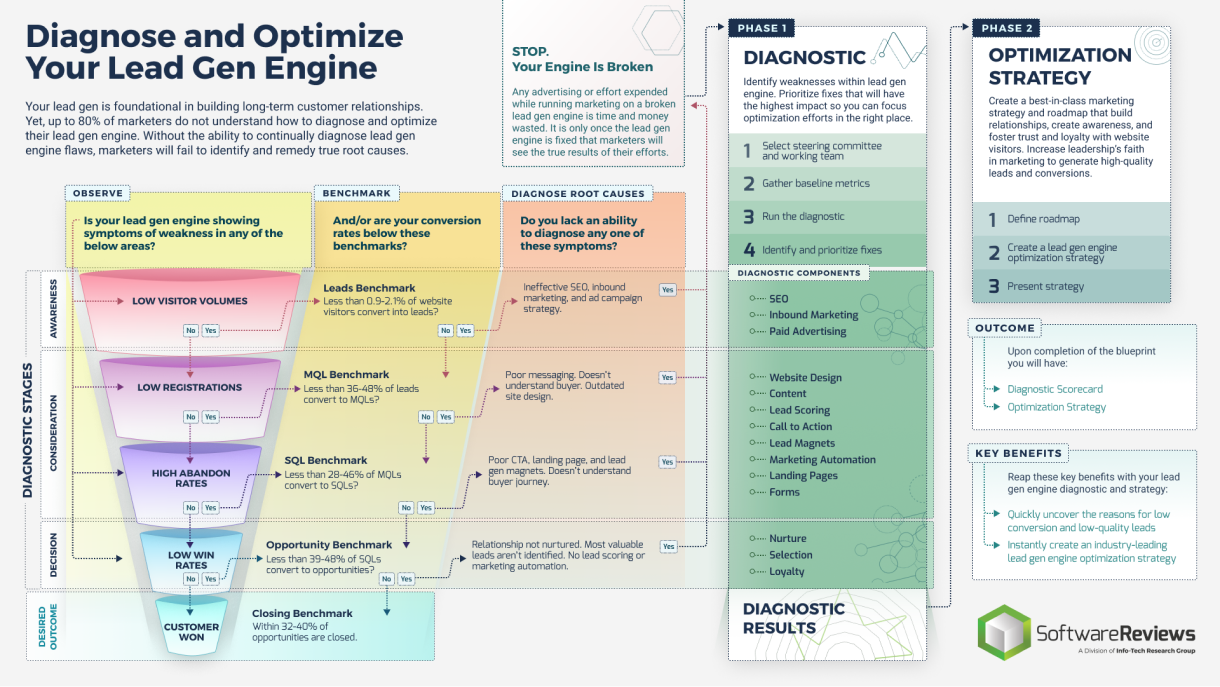

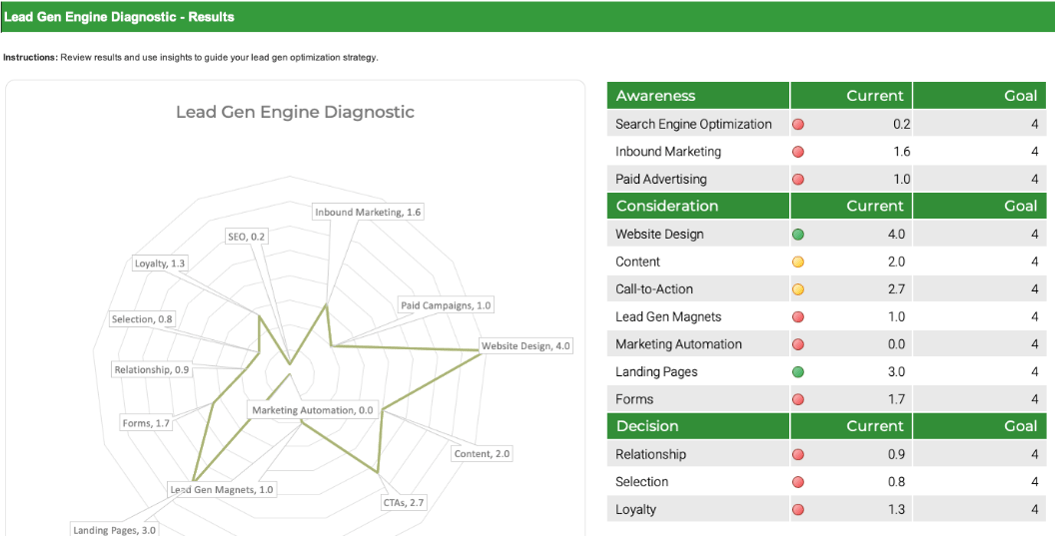

Infographic

Further reading

Define Requirements for Outsourcing the Service Desk

Prepare your RFP for long-term success, not short-term gains

Define Requirements for Outsourcing the Service Desk

Prepare your RFP for long-term success, not short-term gains

EXECUTIVE BRIEF

Analyst Perspective

Outsource services with your eyes wide open.

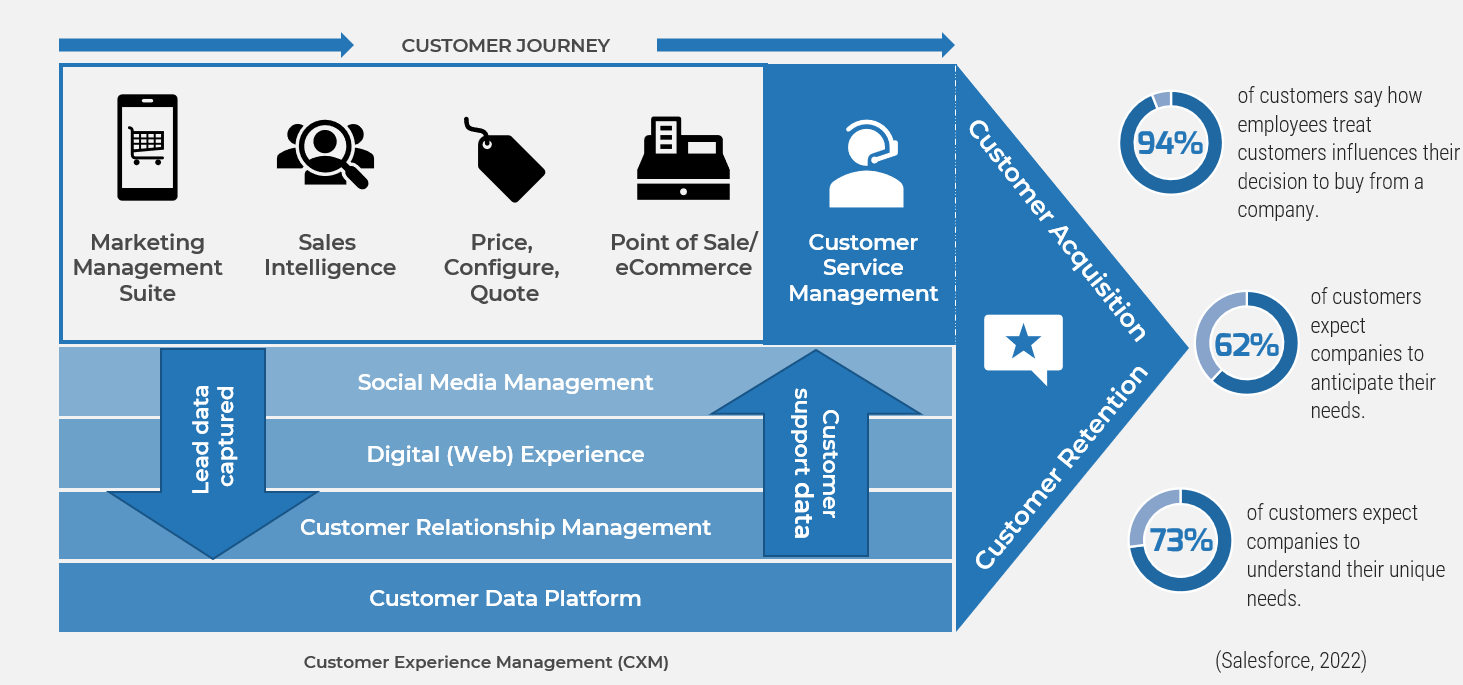

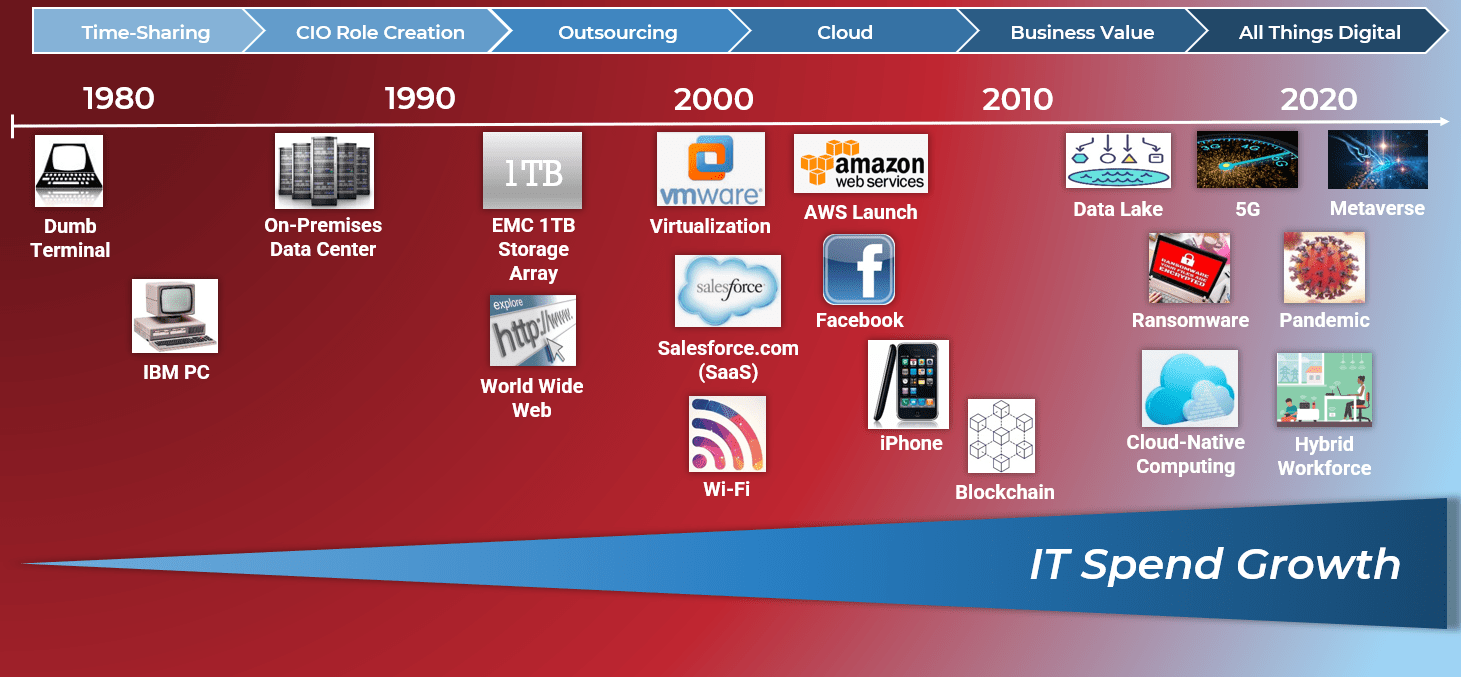

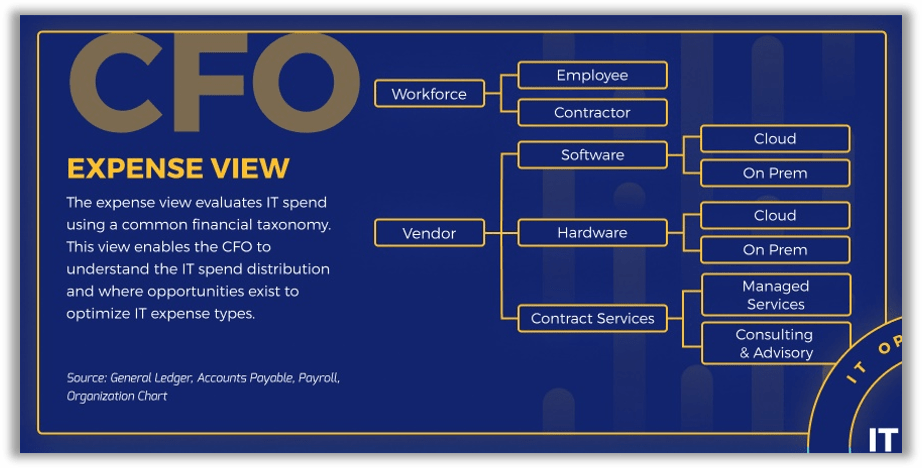

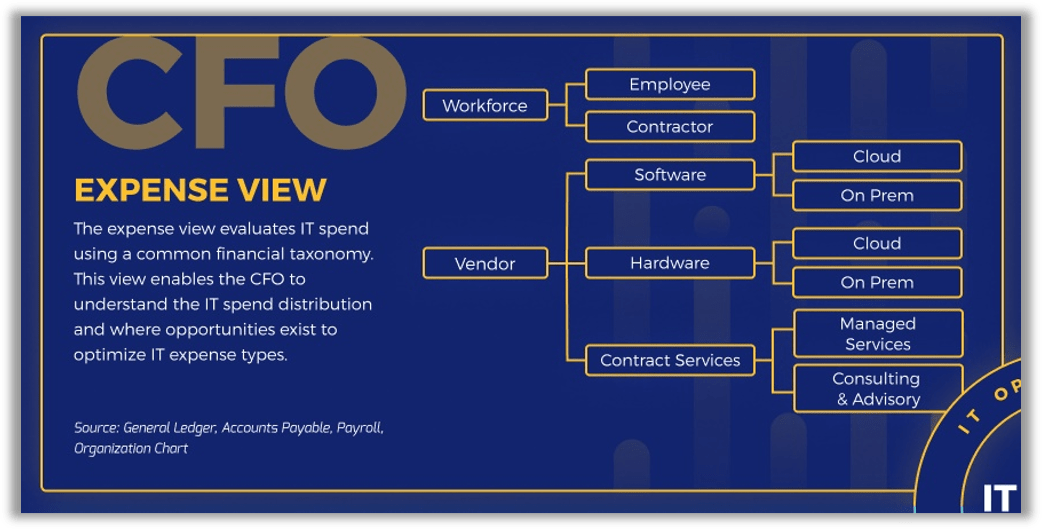

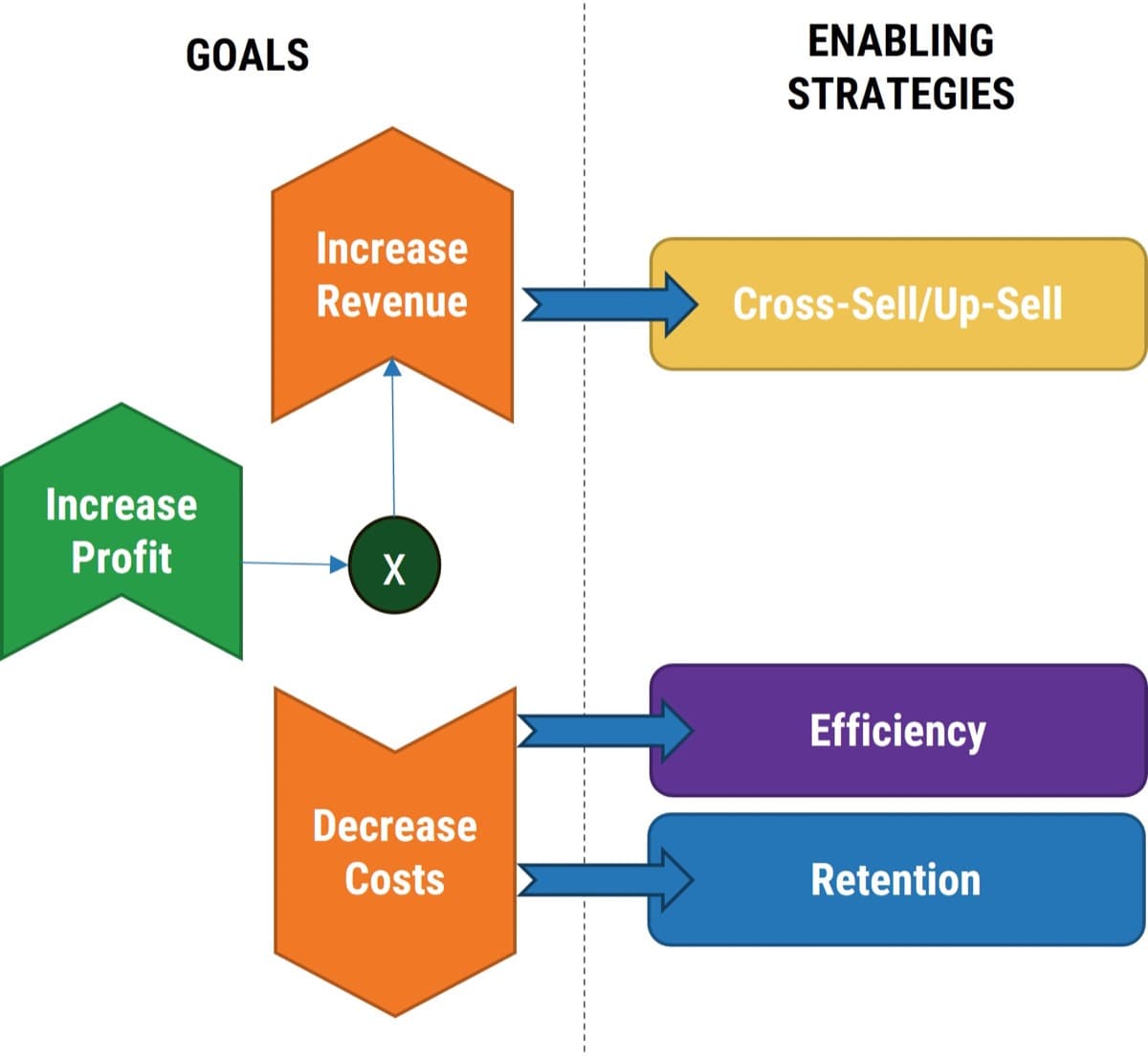

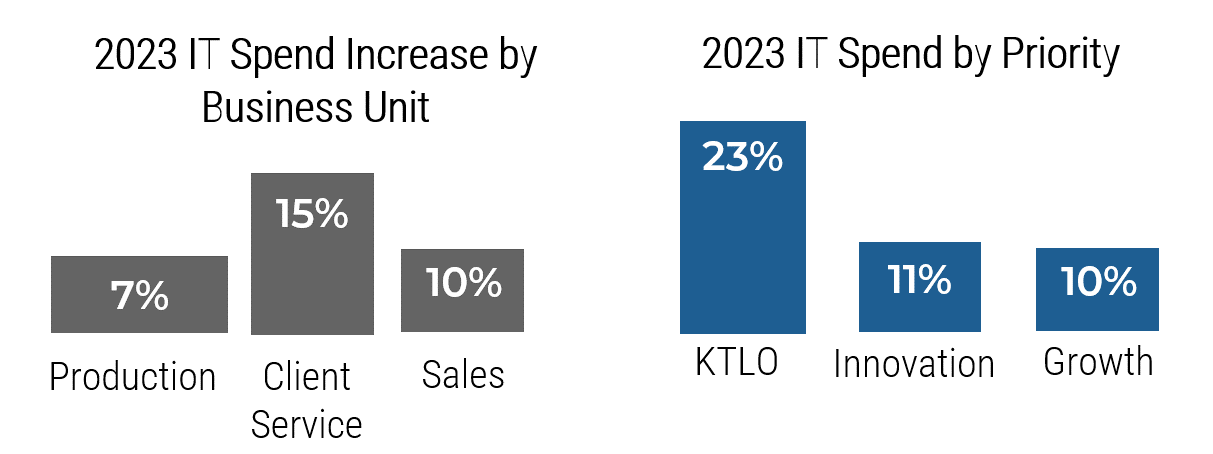

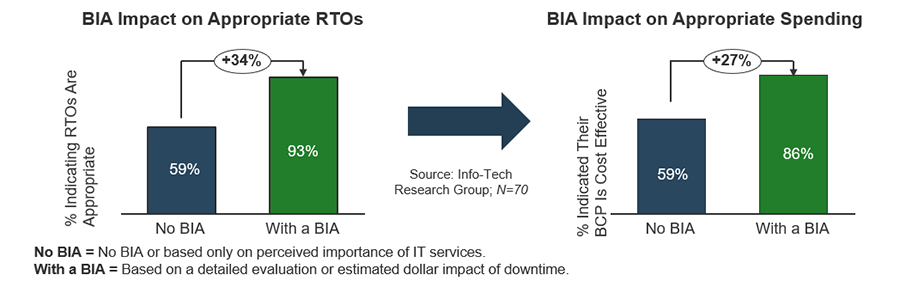

Cost reduction has traditionally been an incentive for outsourcing the service desk. This is especially the case for organizations that don't have minimal processes in place and those that need resources and skills to fill gaps.

Although cost reduction is usually the main reason to outsource the service desk, in most cases service desk outsourcing increases the cost in a short run. But without a proper model, you will only outsource your problems rather than solving them. A successful outsourcing strategy follows a comprehensive plan that defines objectives, assigns accountabilities, and sets expectations for service delivery prior to vendor outreach.

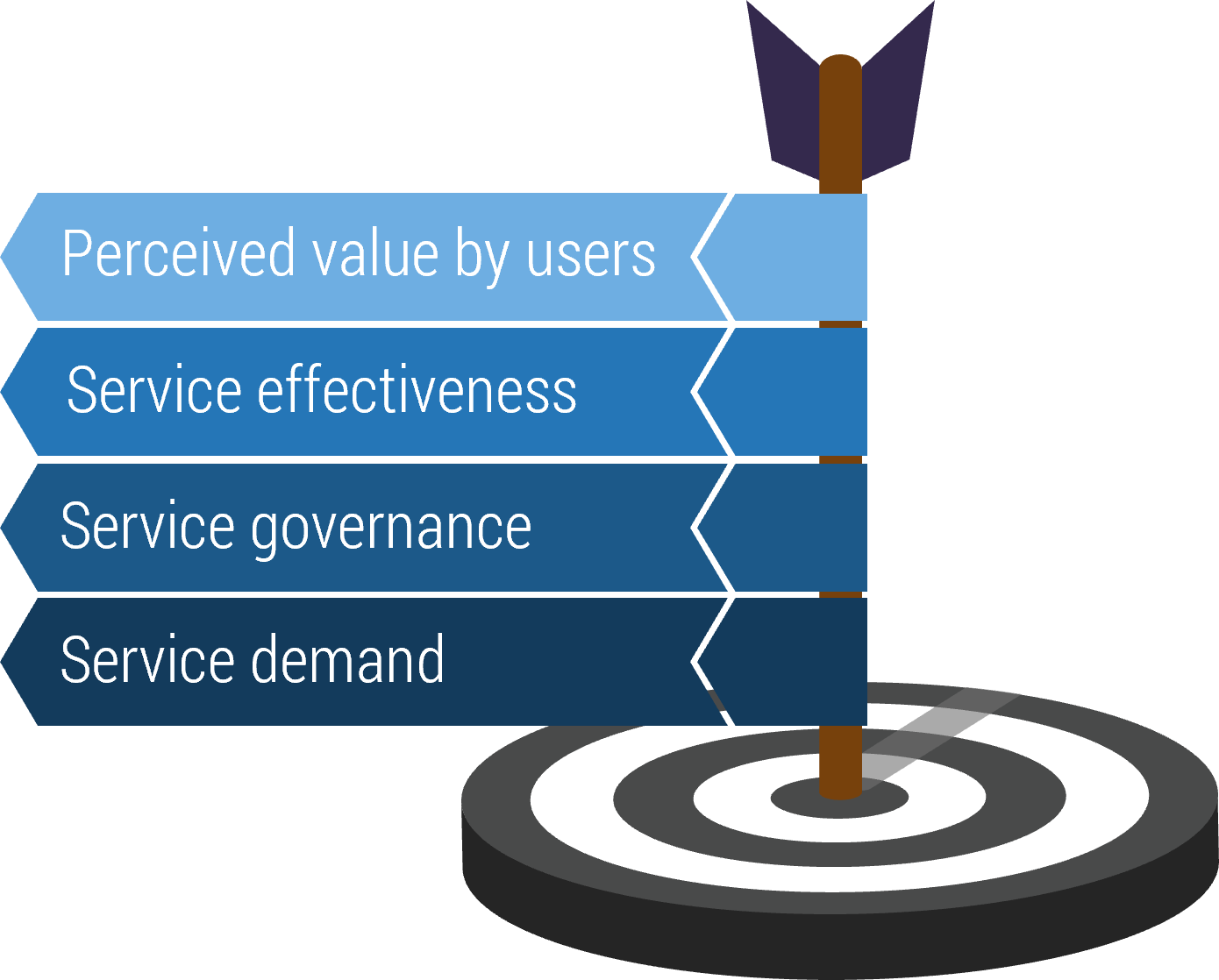

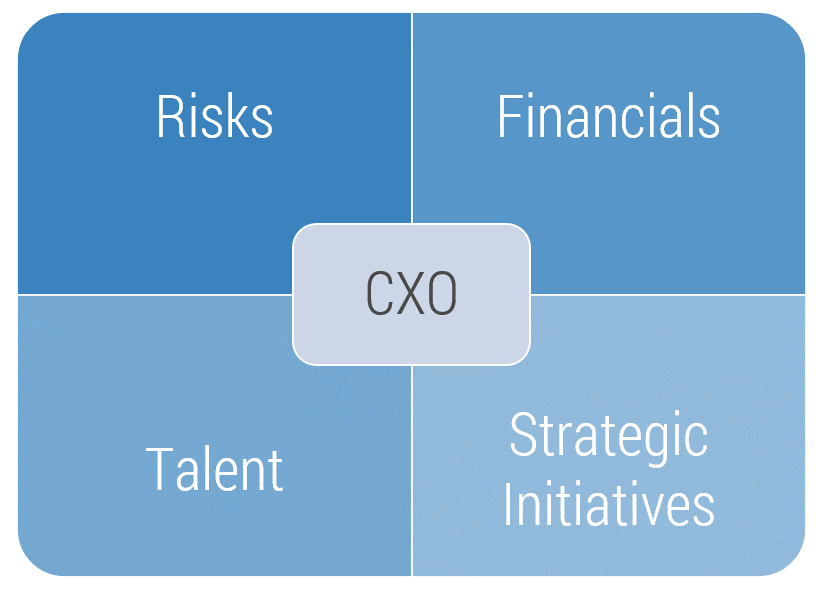

For outsourcing the service desk, you should plan ahead, work as a group, define requirements, prepare a strong RFP, and contemplate tension metrics to ensure continual improvement. As you build a project charter to outline your strategy for outsourcing your IT services, ensure you focus on better customer service instead of cost optimization. Ensure that the outsourcer can support your demands, considering your long-term achievement.

Think about outsourcing like a marriage deed. Take into account building a good relationship before beginning the contract, ensure to include expectations in the agreement, and make it possible to exit the agreement if expectations are not satisfied or service improvement is not achieved.

Mahmoud Ramin, PhD

Senior Research Analyst

Infrastructure and Operations

Info-Tech Research Group

Executive Summary

Your Challenge

In organizations where technical support is viewed as non-strategic, many see outsourcing as a cost-effective way to provide this support. However, outsourcing projects often fall short of their goals in terms of cost savings and quality of support.

Common Obstacles

Significant administrative work and up-front costs are required to outsource the service desk, and poor planning often results in project failure and the decrease of end-user satisfaction.

A complete turnover of the service desk can result in lost knowledge and control over processes, and organizations without an exit strategy can struggle to bring their service desk back in house and reestablish the confidence of end users.

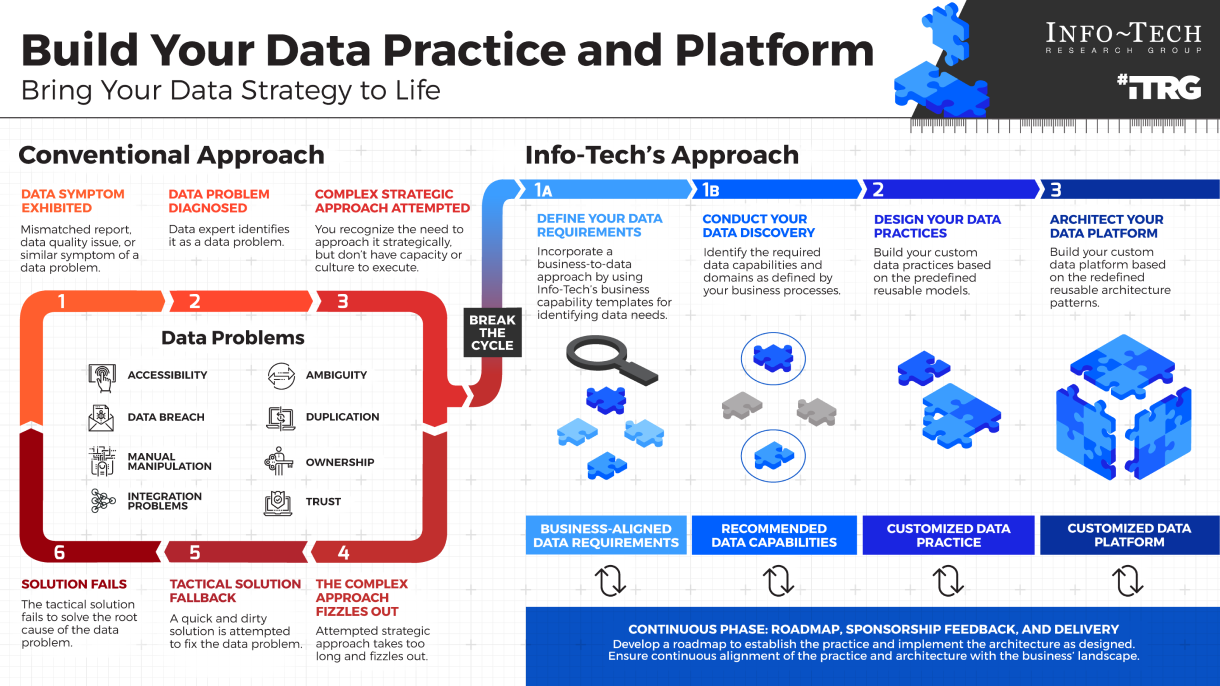

Info-Tech's Approach

- First decide if outsourcing is the correct step; there may be more preliminary work to do beforehand.

- Assess requirements and make necessary adjustments before developing an outsource RFP.

- Clearly define the project and produce an RFP to provide to vendors.

- Plan for long-term success, not short-term gains.

- Prepare to retain some of the higher-level service desk work.

Info-Tech Insight

Outsourcing is easy. Realizing all of the expected cost, quality, and focus benefits is hard. Successful outsourcing without being directly involved in service desk management is almost impossible.

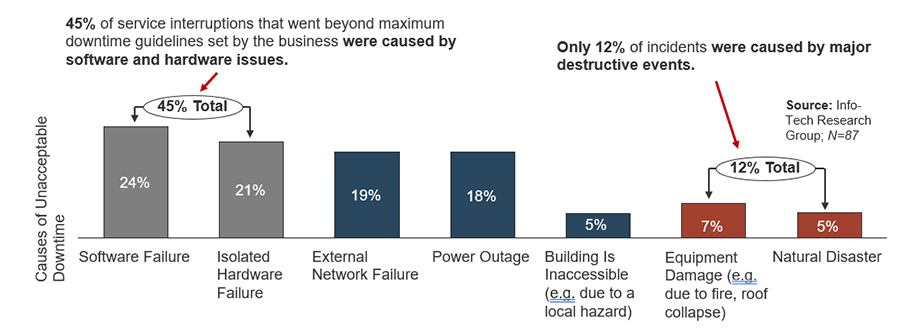

Your challenge

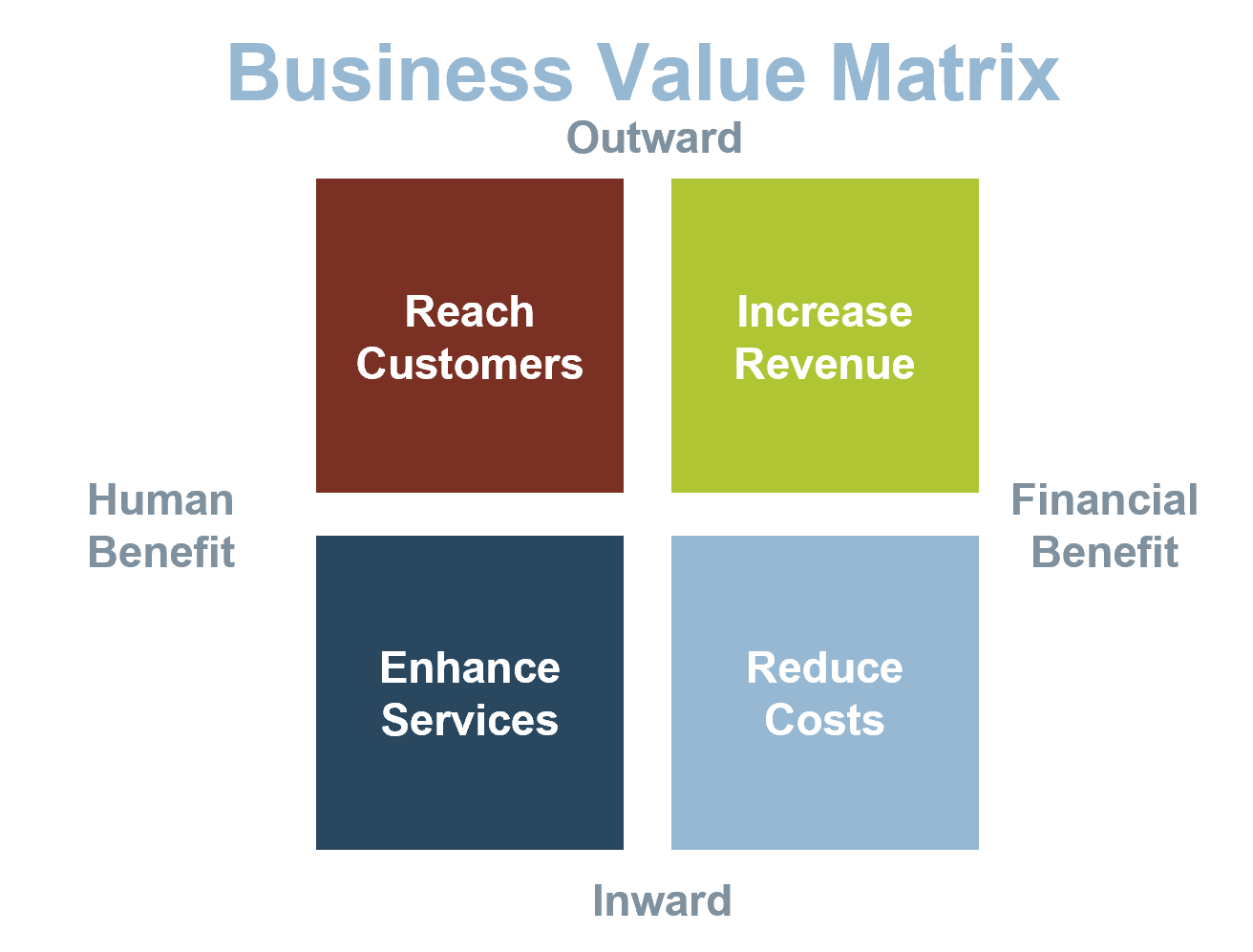

This research is designed to help organizations that need to:

- Outsource the service desk or portions of service management to improve service delivery.

- Improve and repatriate existing outsourcing outcomes by becoming more engaged in the management of the function. Regular reviews of performance metrics, staffing, escalation, knowledge base content, and customer satisfaction are critical.

- Understand the impact that outsourcing would have on the service desk.

- Understand the potential benefits that outsourcing can bring to the organization.

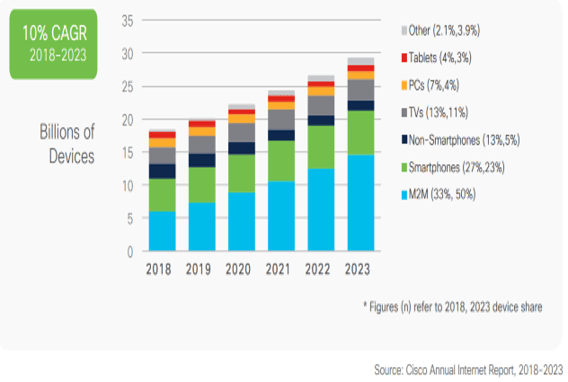

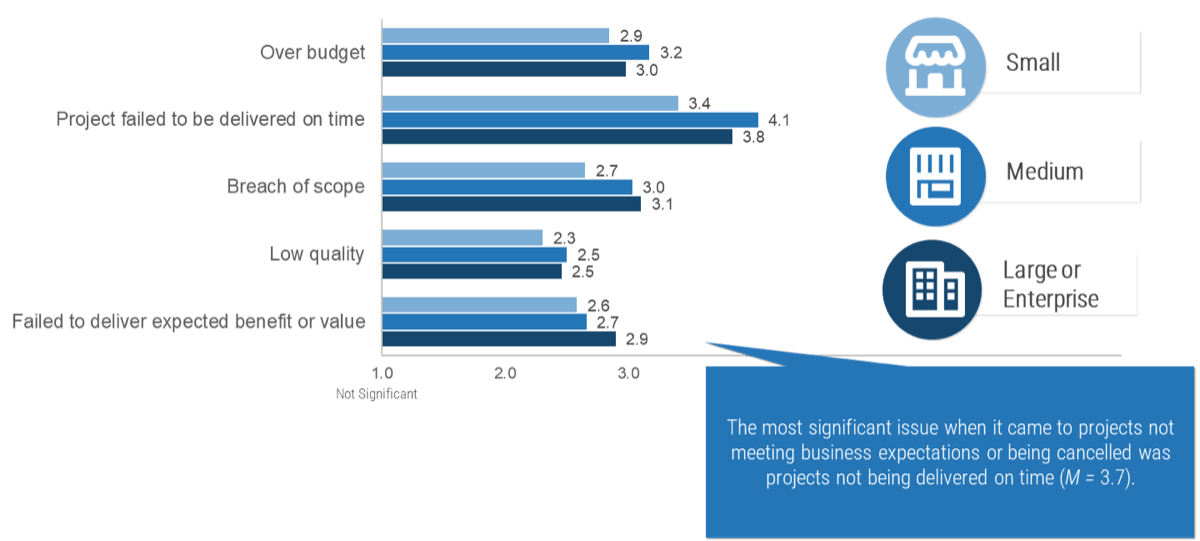

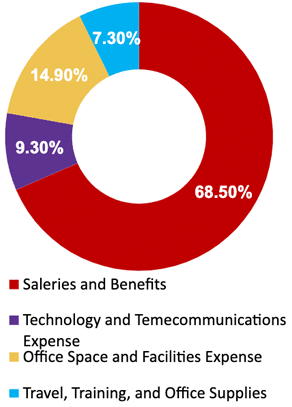

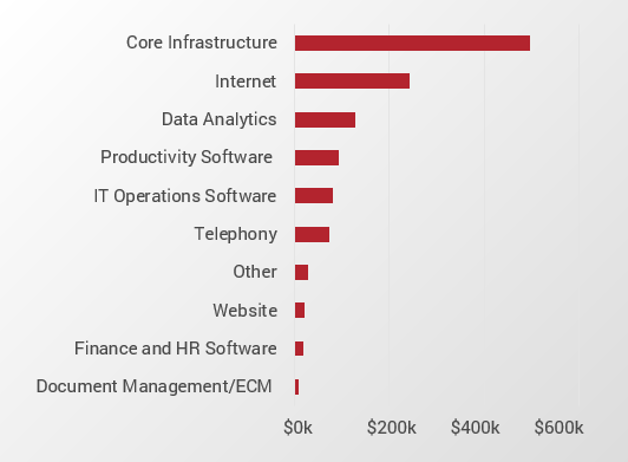

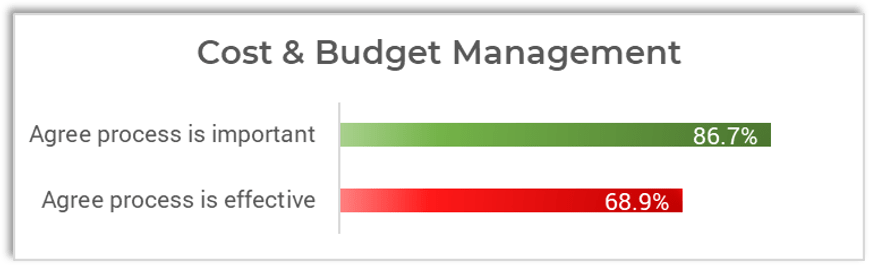

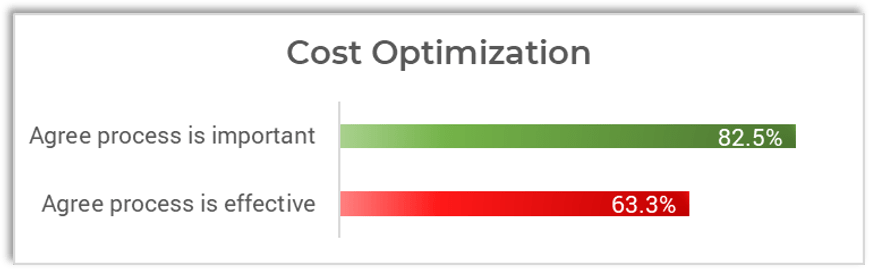

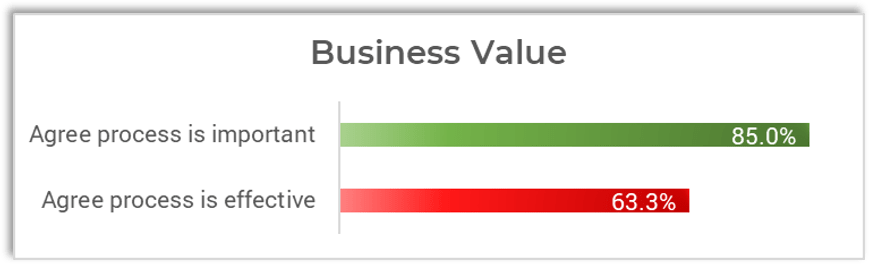

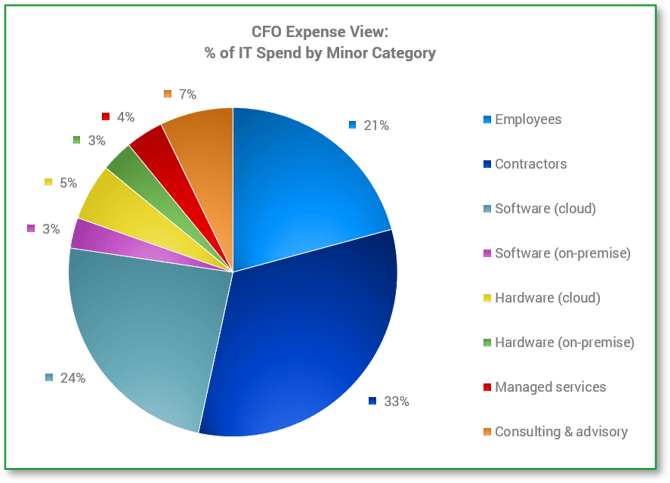

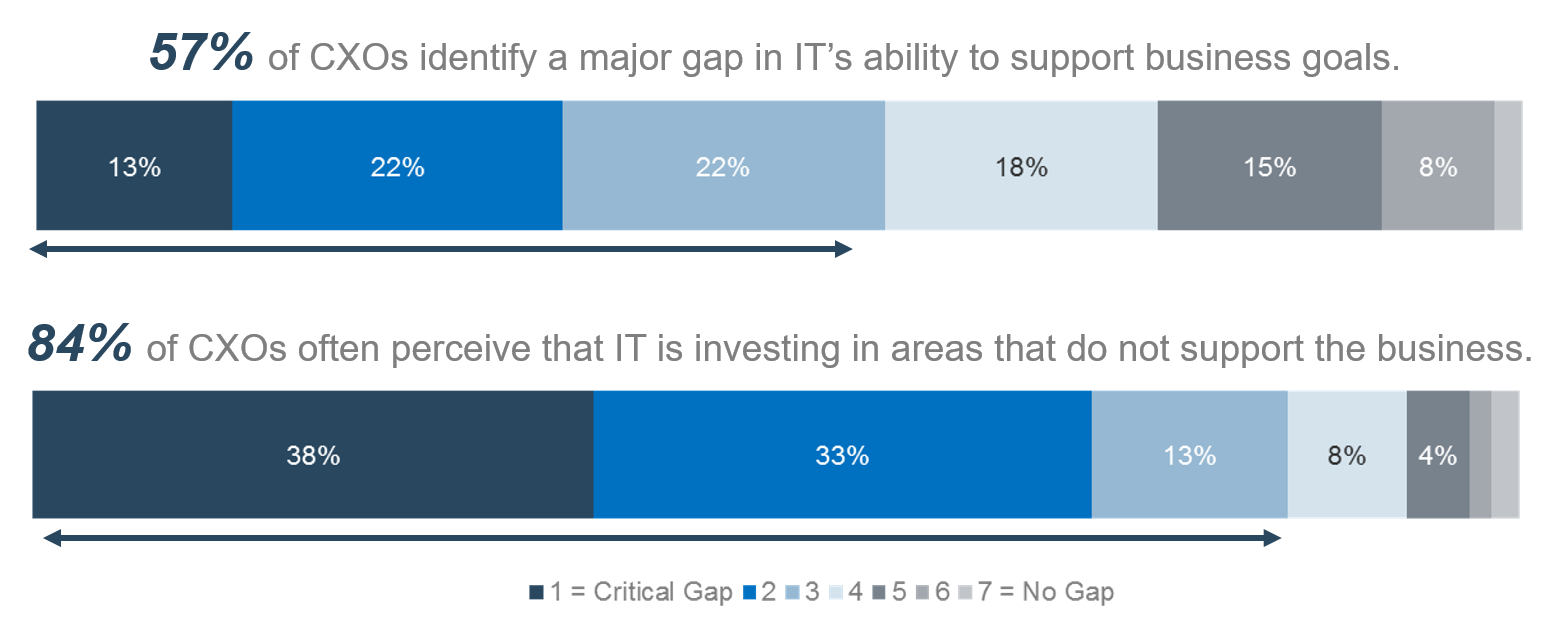

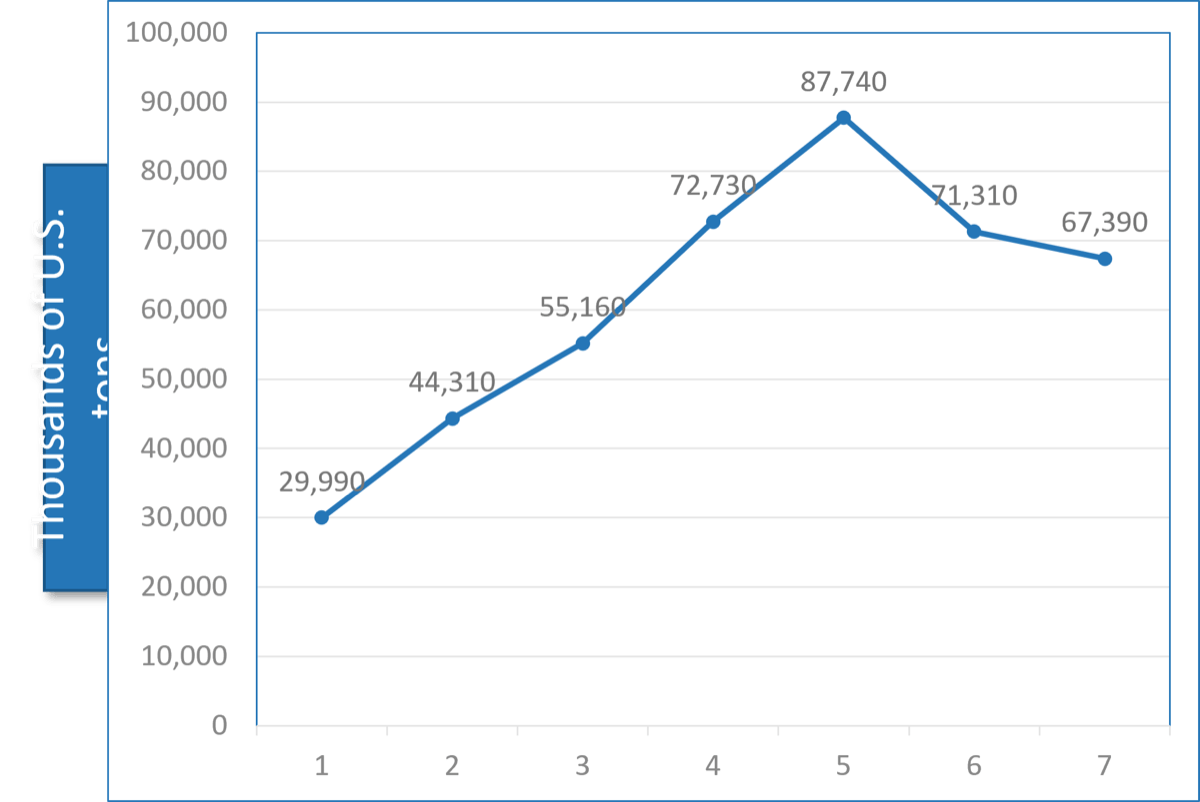

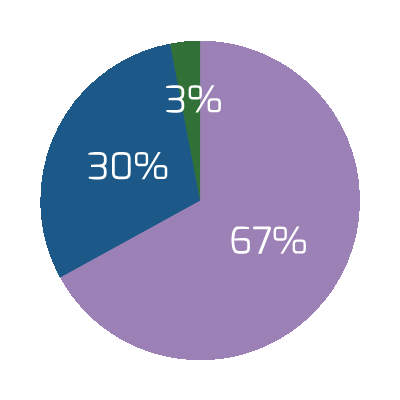

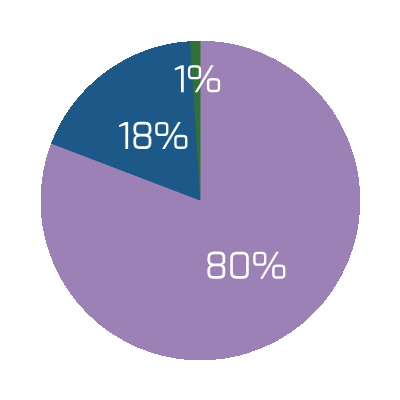

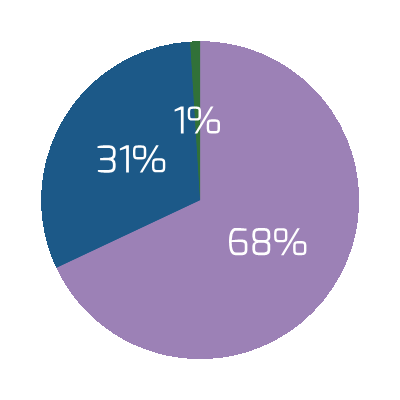

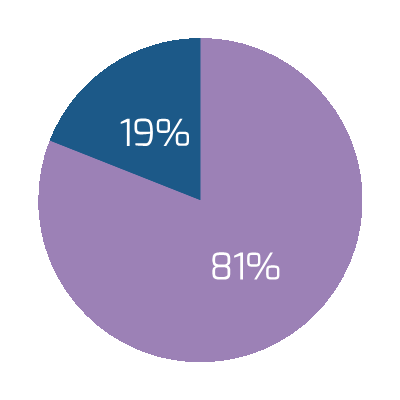

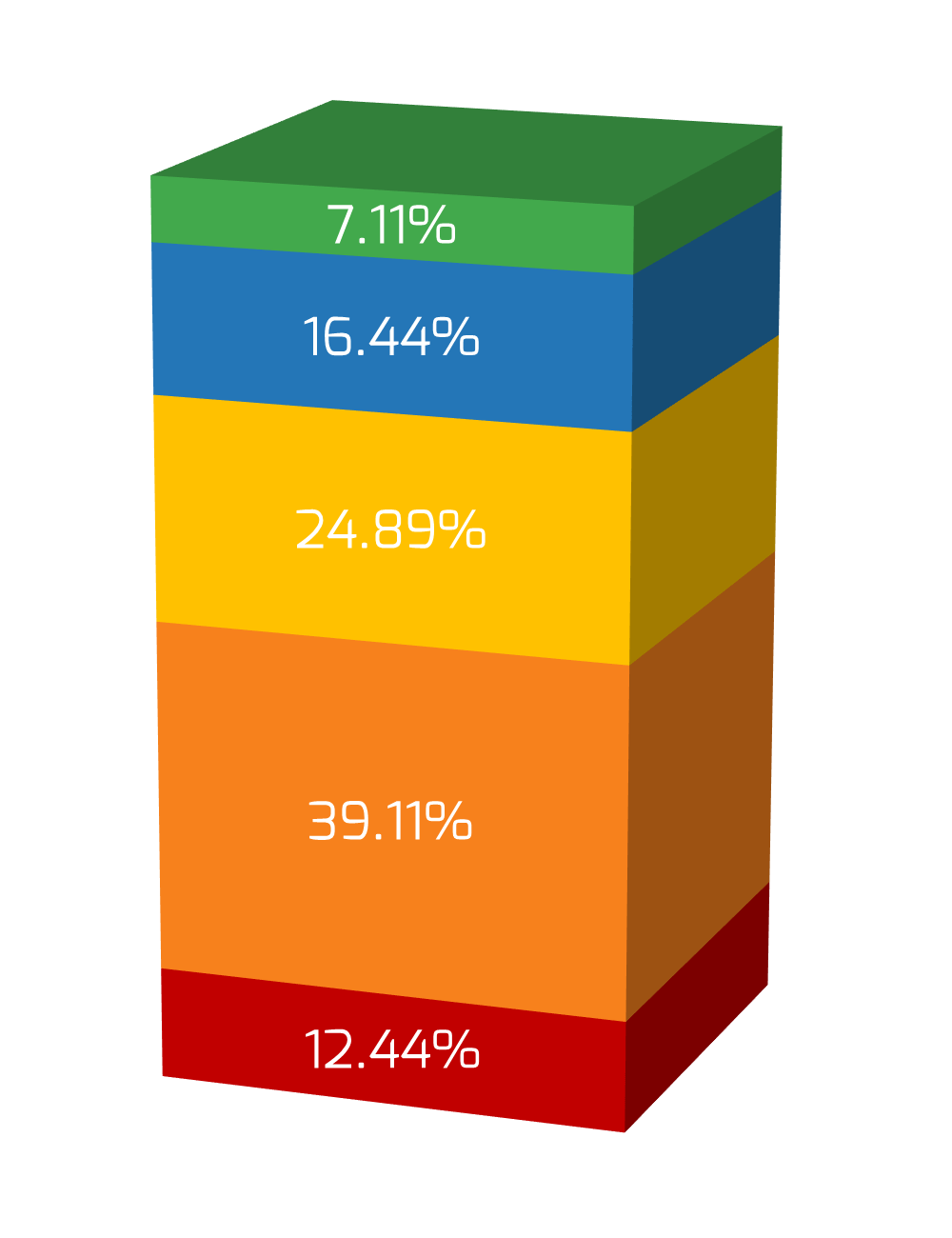

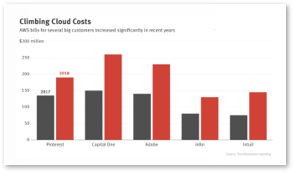

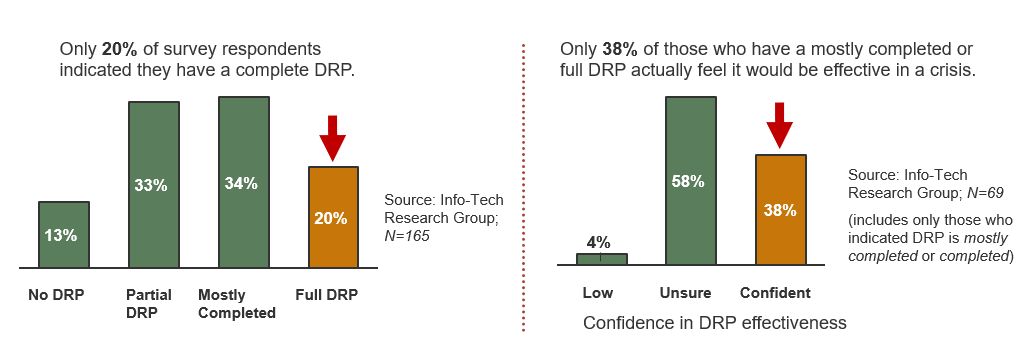

Source: HDI 2017 | About 68.5% of the service desk fund is allocated to agent salaries, while only 9.3% of the service desk fund is spent on technology. The high ratio of salaries and expenses over other expense drives organizations to outsource their service desk without taking other considerations into account. |

Info-Tech Insight

The outsourcing contract must preserve your control, possession, and ownership of the intellectual property involved in the service desk operation. From the beginning of the process, repatriation should be viewed as a possibility and preserved as a capability.

Your challenge

This research helps organizations who would like to achieve these goals:

- Determine objectives and requirements to outsource the service desk.

- Develop a project charter and build an outsourcing strategy to efficiently define processes to reduce risk of failure.

- Build an outsourcing RFP and conduct interviews to identify the best candidate for service delivery.

- Build a long-term relationship with an outsourcing vendor, making sure the vendor is able to satisfy all requirements.

- Include a continual improvement plan in the outsourcing strategy and contain the option upon service delivery dissatisfaction.

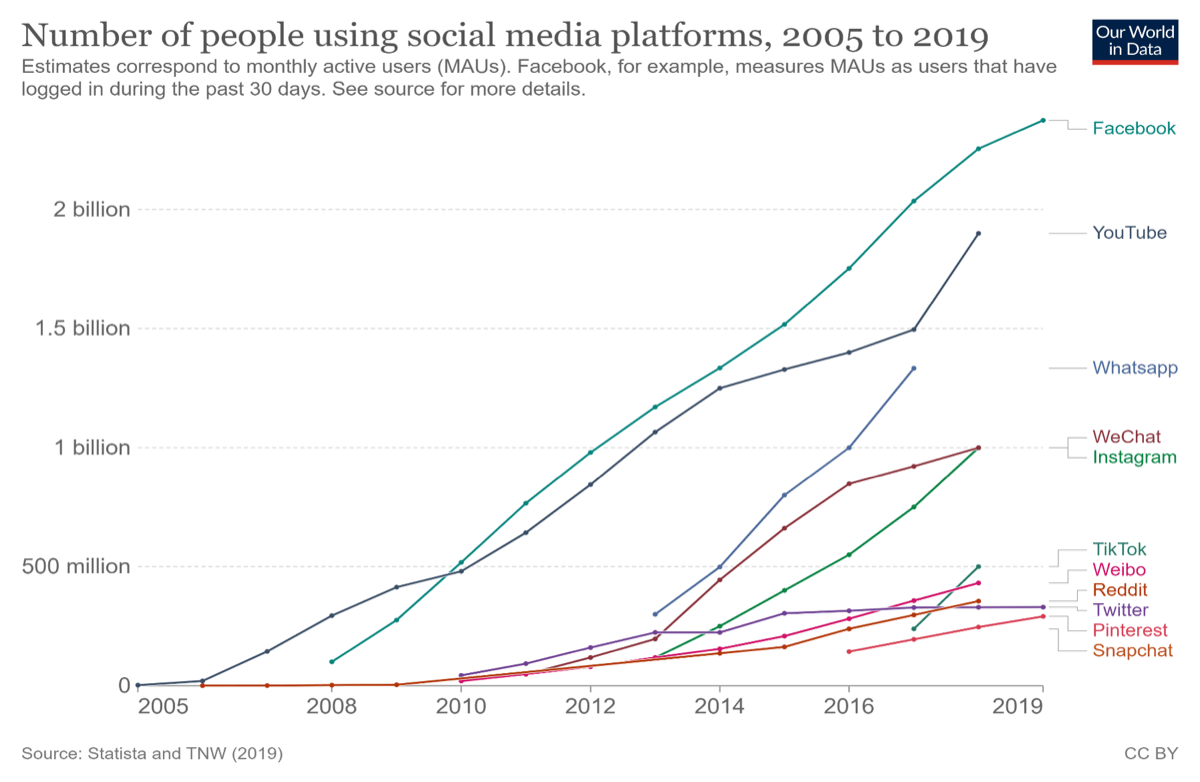

New hires require between 10 and 80 hours of training (Forward Bpo Inc., 2019).

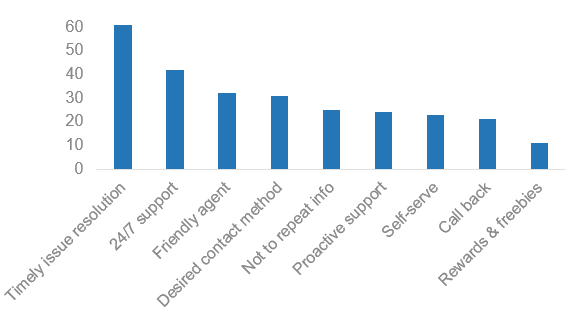

A benchmark study by Zendesk from 45,000 companies reveals that timely resolution of issues and 24/7 service are the biggest factors in customer service experience.

These factors push many businesses to consider service desk outsourcing to vendors that have capabilities to fulfill such requirements.

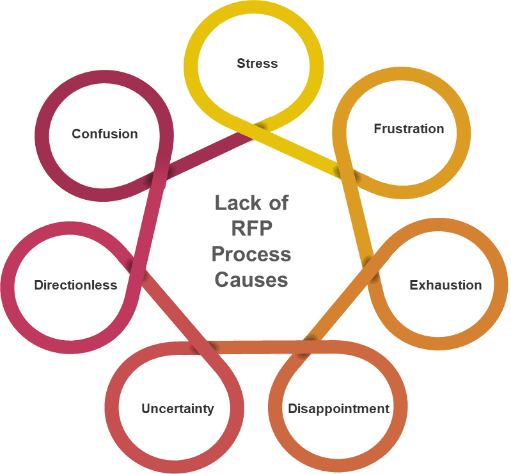

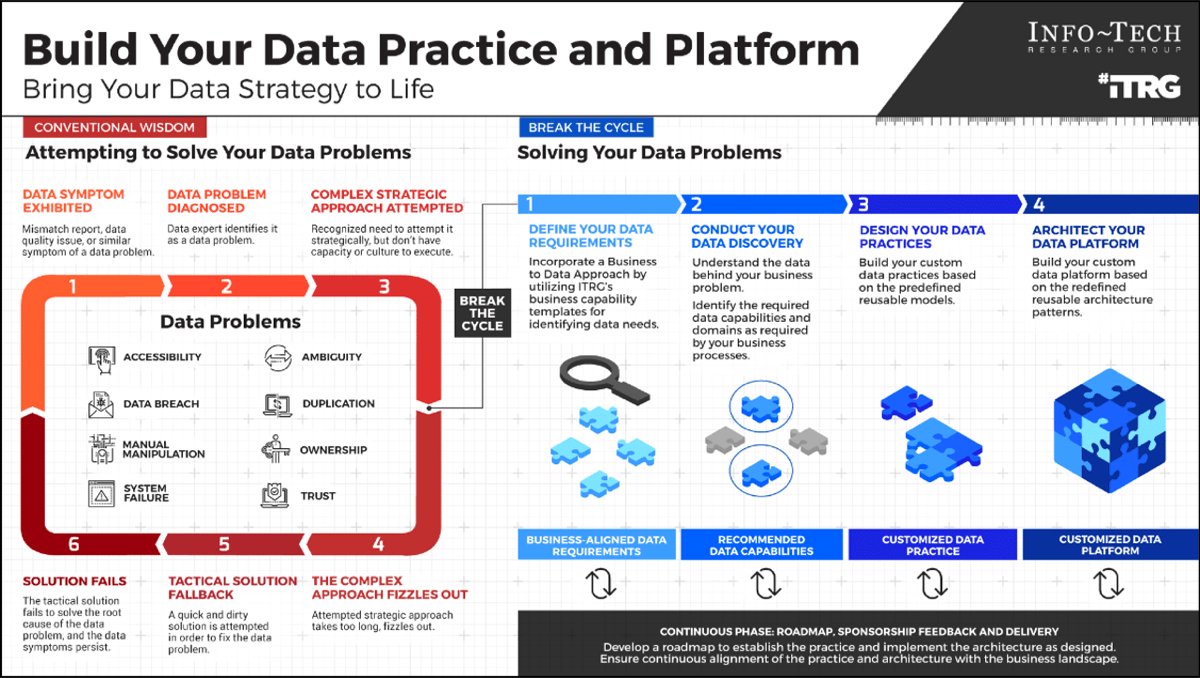

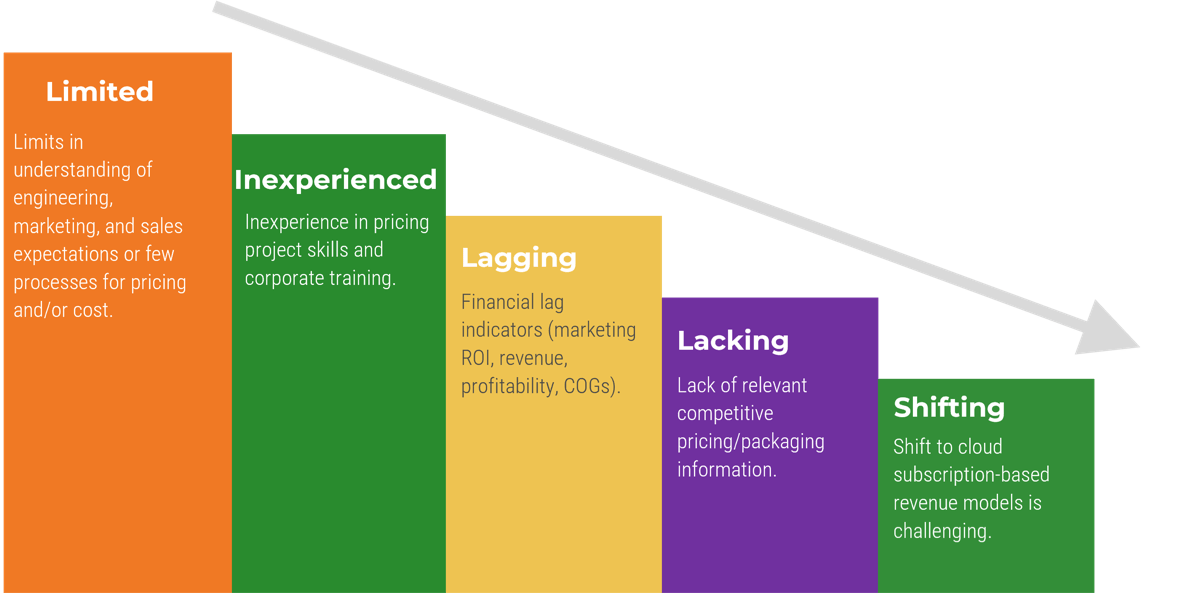

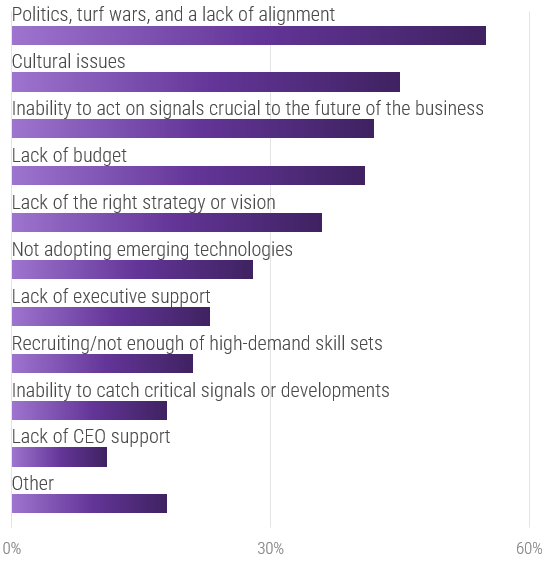

Common obstacles

These barriers make this challenge difficult to address for many organizations:

- In most cases, organizations must perform significant administrative work before they can make a move. Those that fail to properly prepare impede a smooth transition, the success of the vendor, and the ability to repatriate.

- Successful outsourcing comes from the recognition that an organization is experiencing complete turnover of its service desk staff. These organizations engage the vendor to transition knowledge and process to ensure continuity of quality.

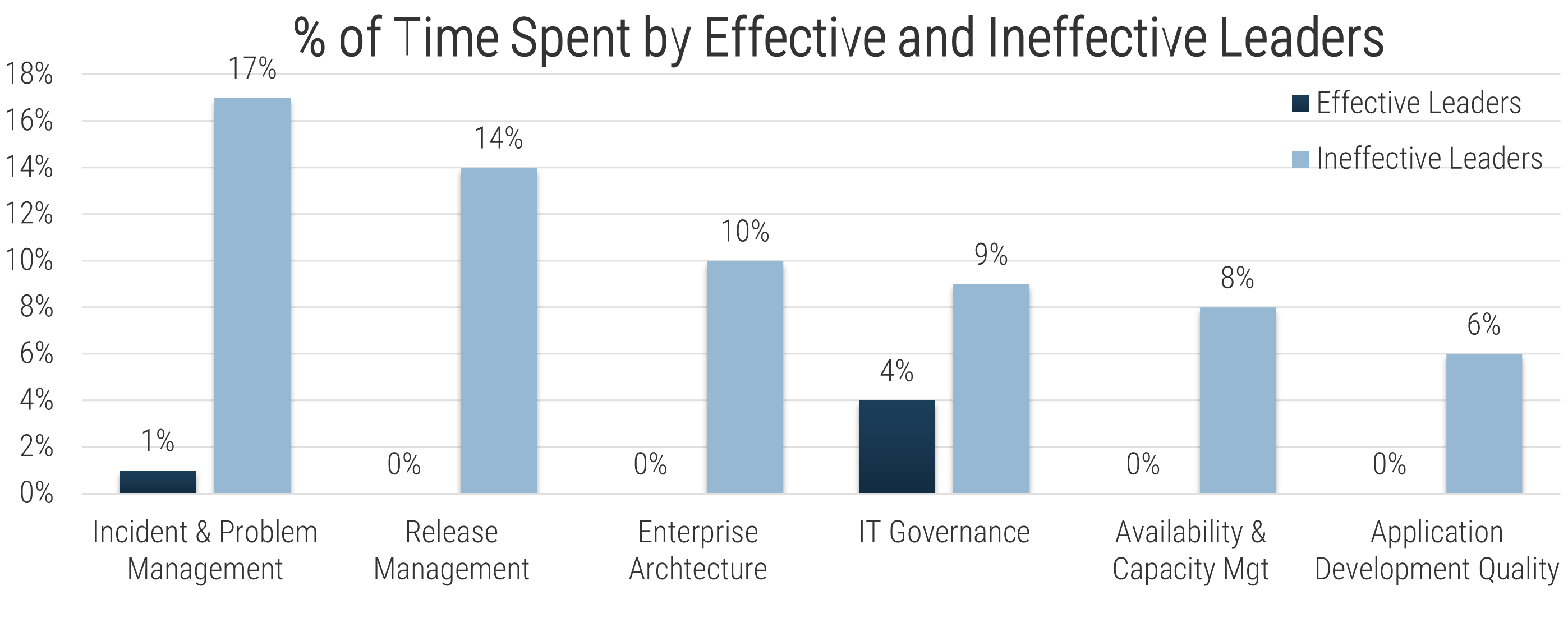

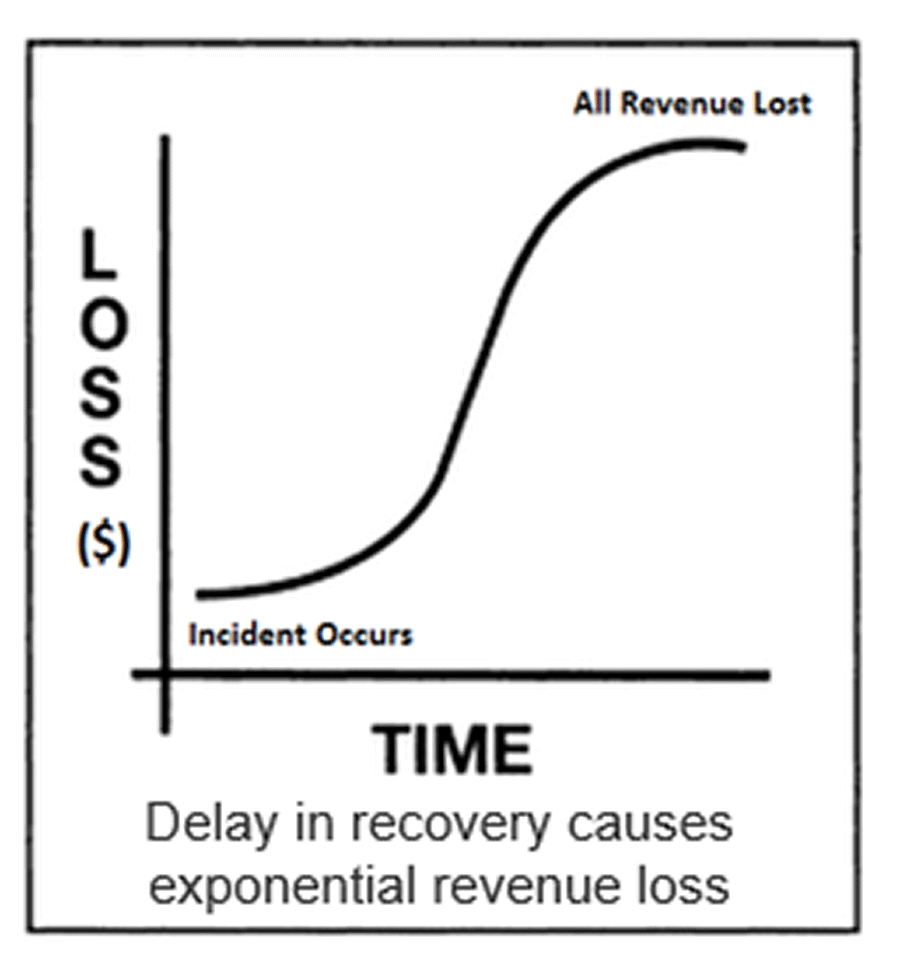

- IT realizes the most profound hidden costs of outsourcing when the rate of ticket escalation increases, diminishing the capacity of senior technical staff for strategic project work.

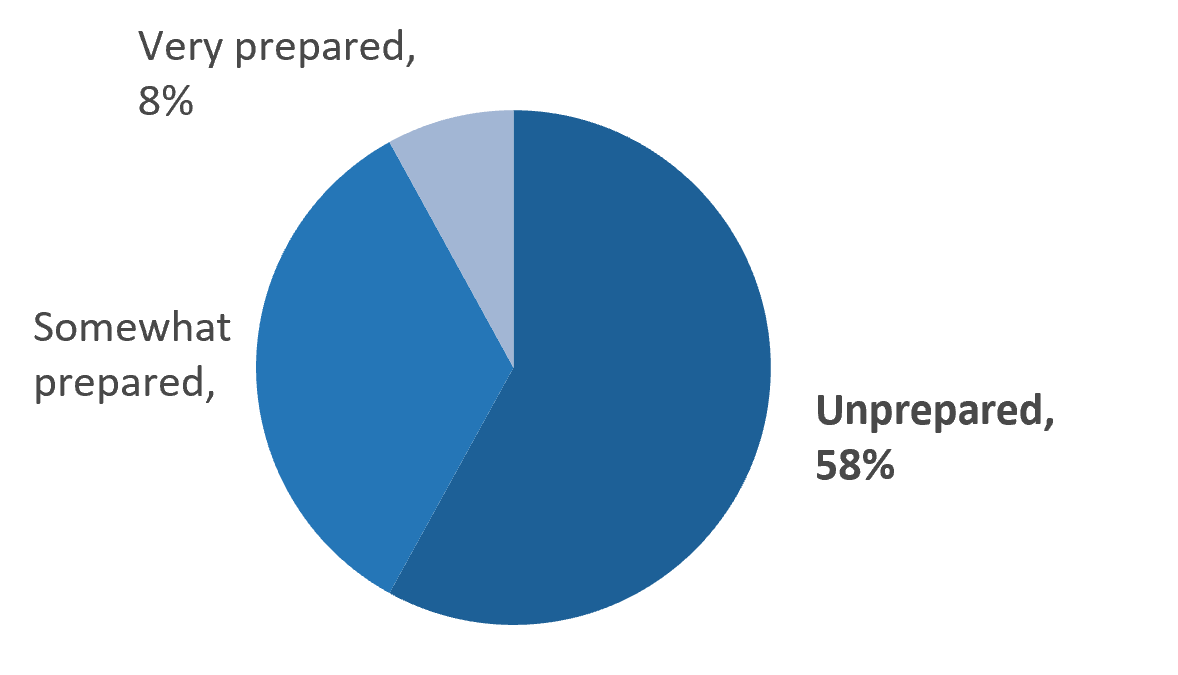

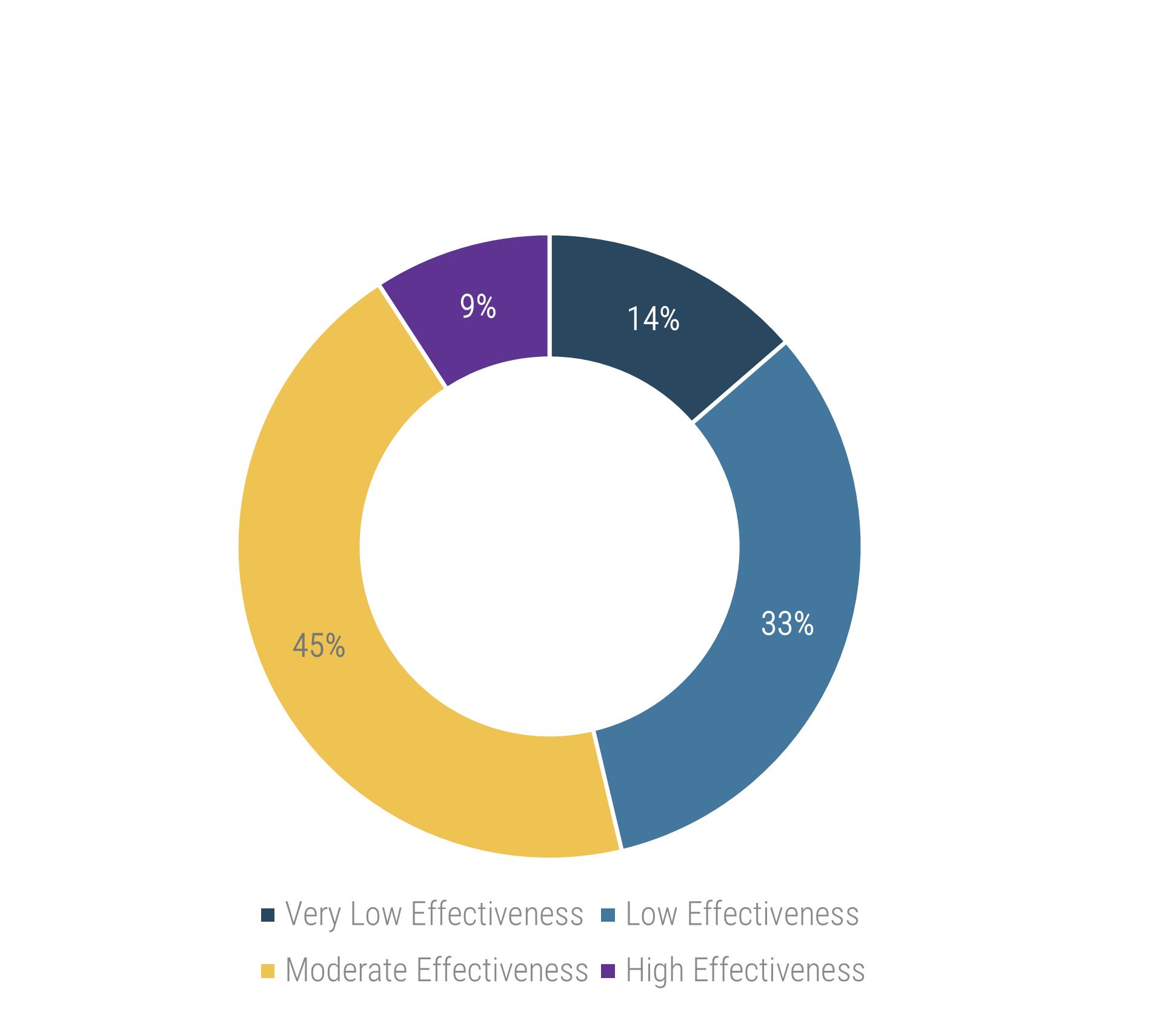

Many organizations may not get the value they expect from outsourcing in their first year.

Common Reasons:

- Overall lack of due diligence in the outsourcing process

- Unsuitable or unclear service transition plan

- Poor service provider selection and management

Poor transition planning results in delayed benefits and a poor relationship with your outsourcing service provider. A poor relationship with your service provider results in poor communication and knowledge transfer.

Key components of a successful plan:

- Determine goals and identify requirements before developing an RFP.

- Finalize your outsourcing project charter and get ready for vendor evaluation.

- Assess and select the most appropriate provider; manage the transition and vendor relationship.

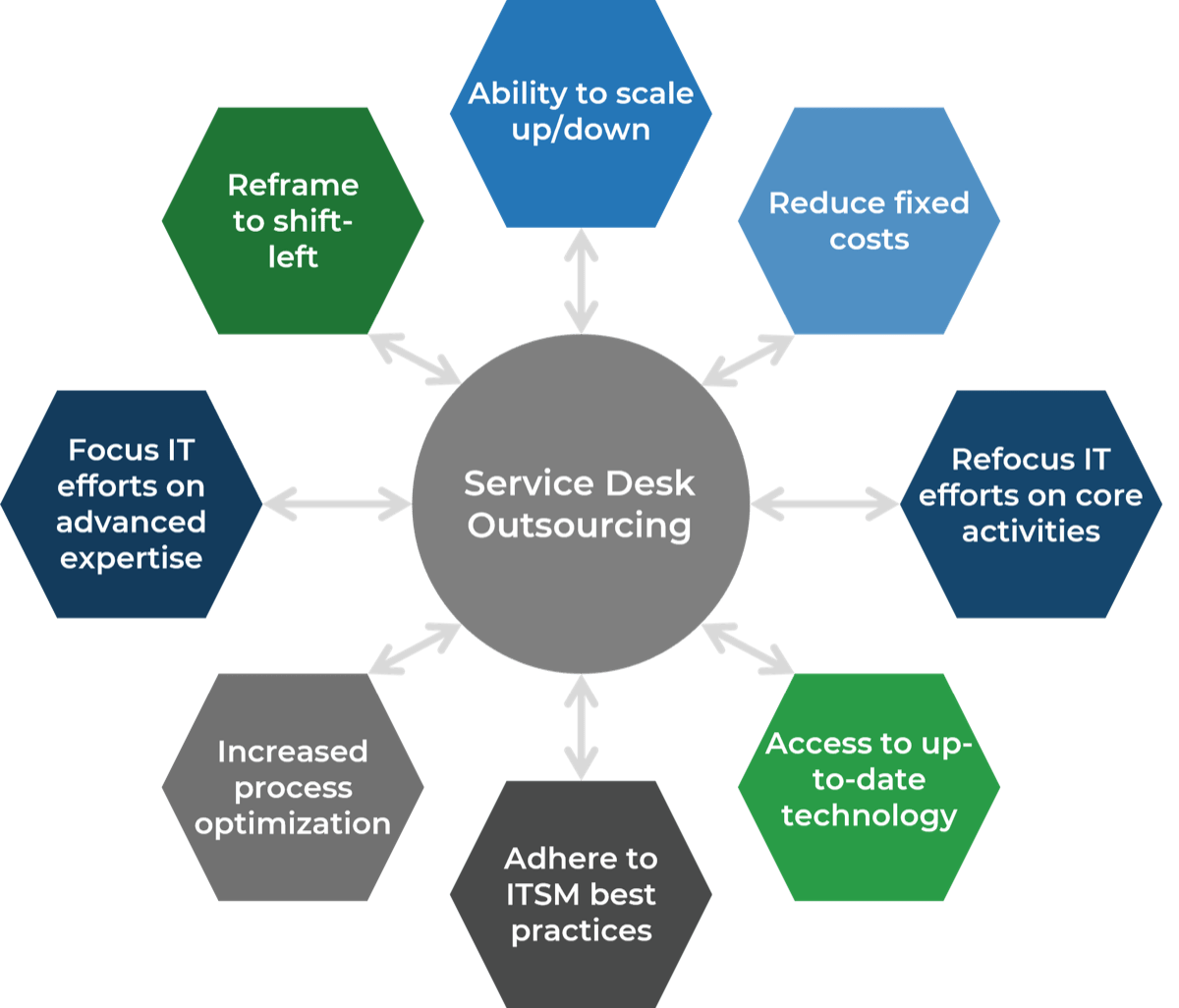

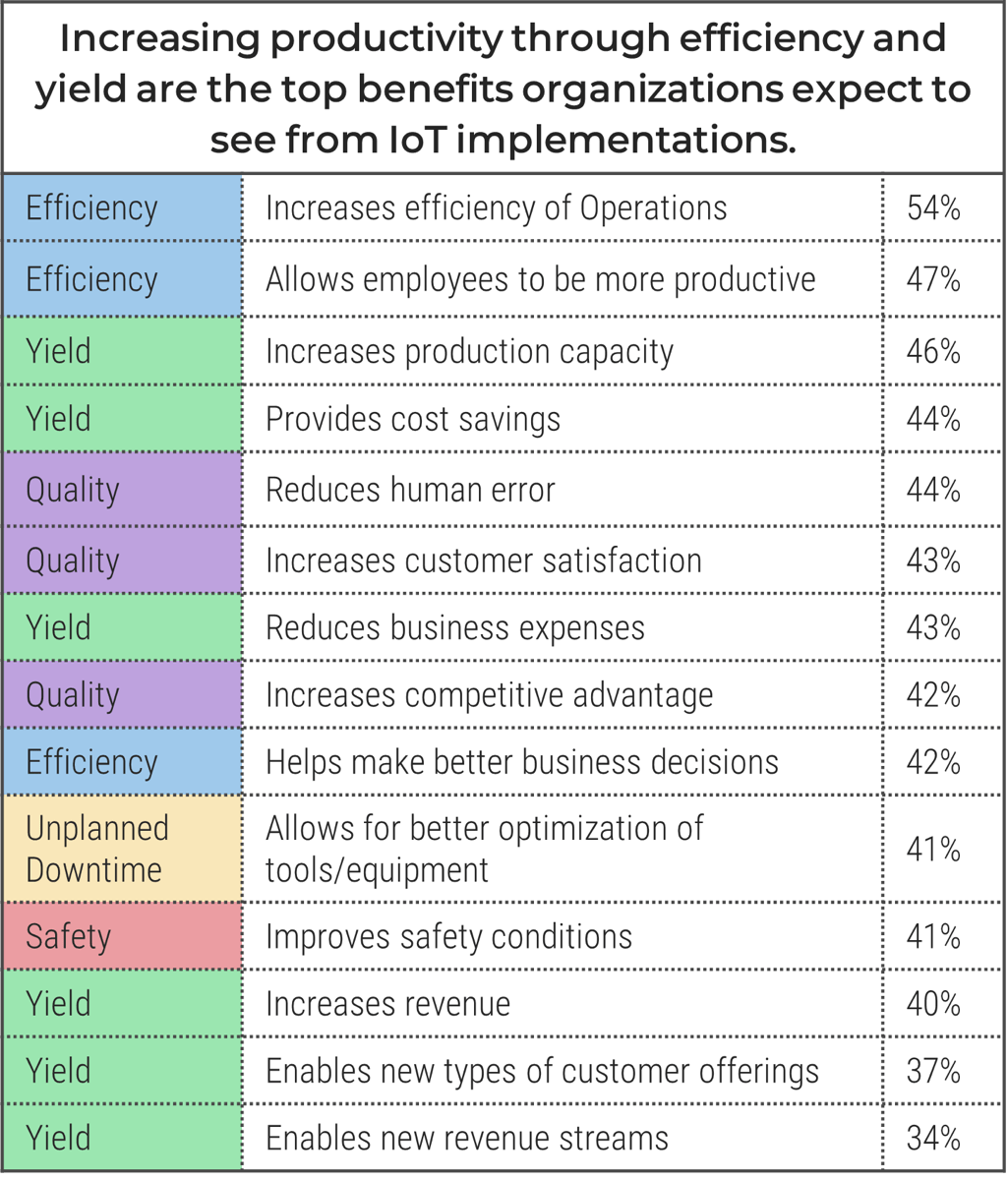

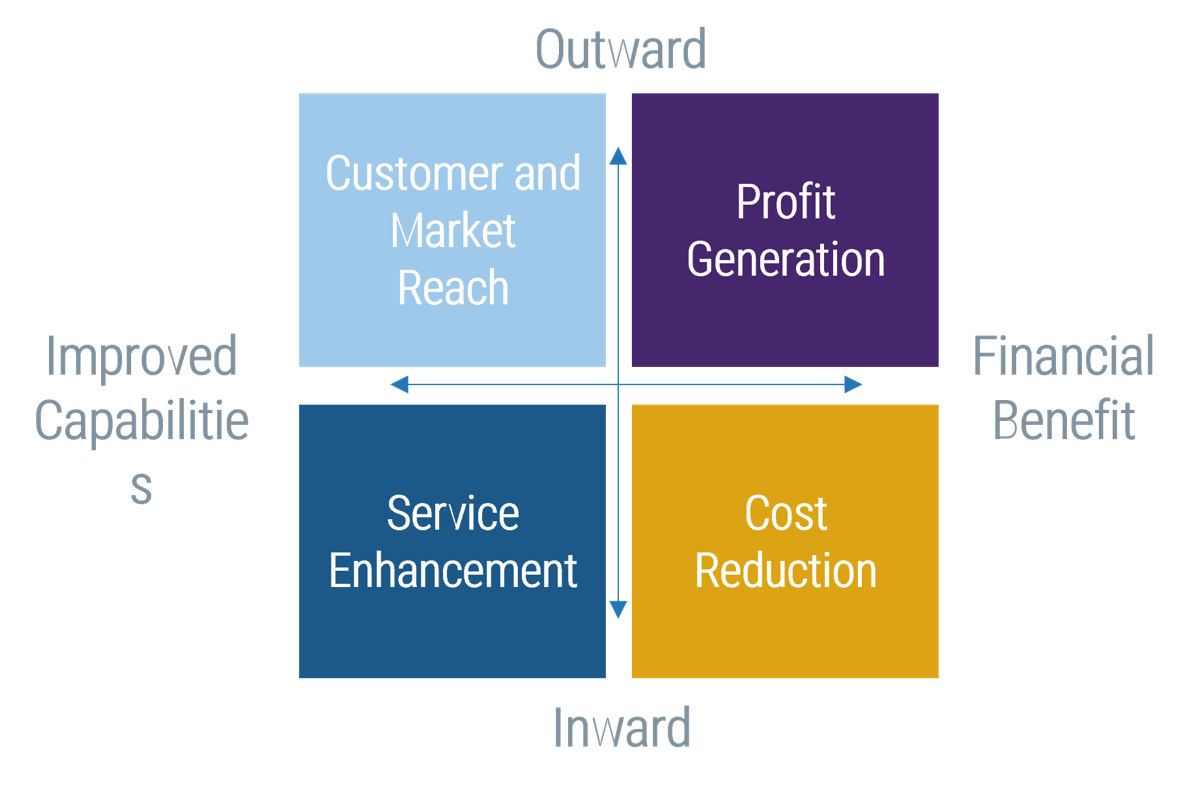

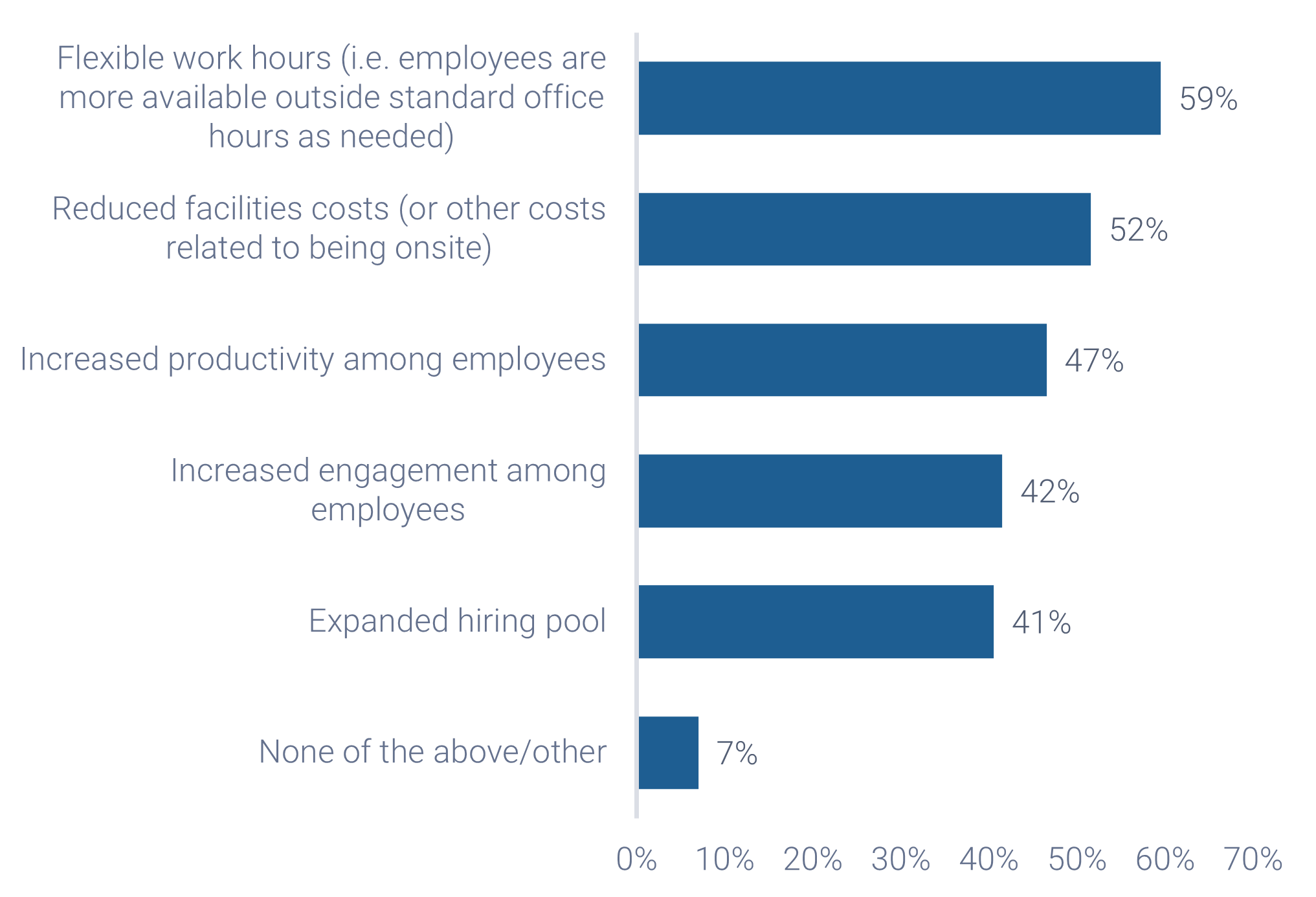

Outsource the service desk properly, and you could see a wide range of benefits

Info-Tech Insight

In your service desk outsourcing strategy, rethink downsizing first-level IT service staff. This can be an opportunity to reassign resources to more valuable roles, such as asset management, development or project backlog. Your current service desk staff are most likely familiar with the current technology, processes, and regulations within IT. Consider the ways to better use your existing resources before reducing headcount.

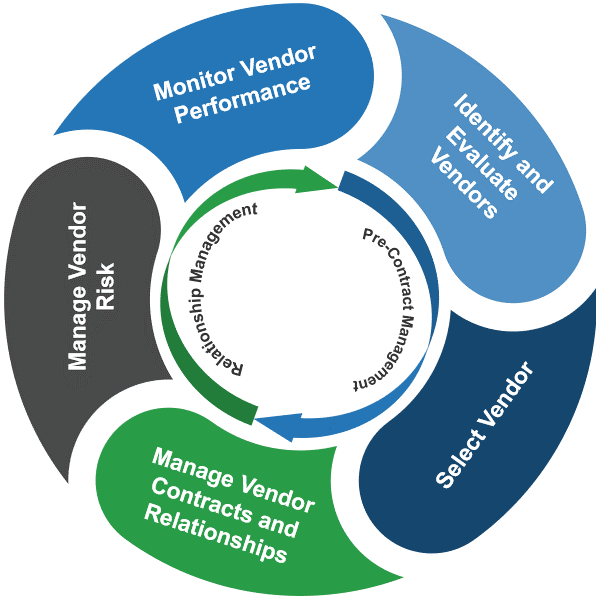

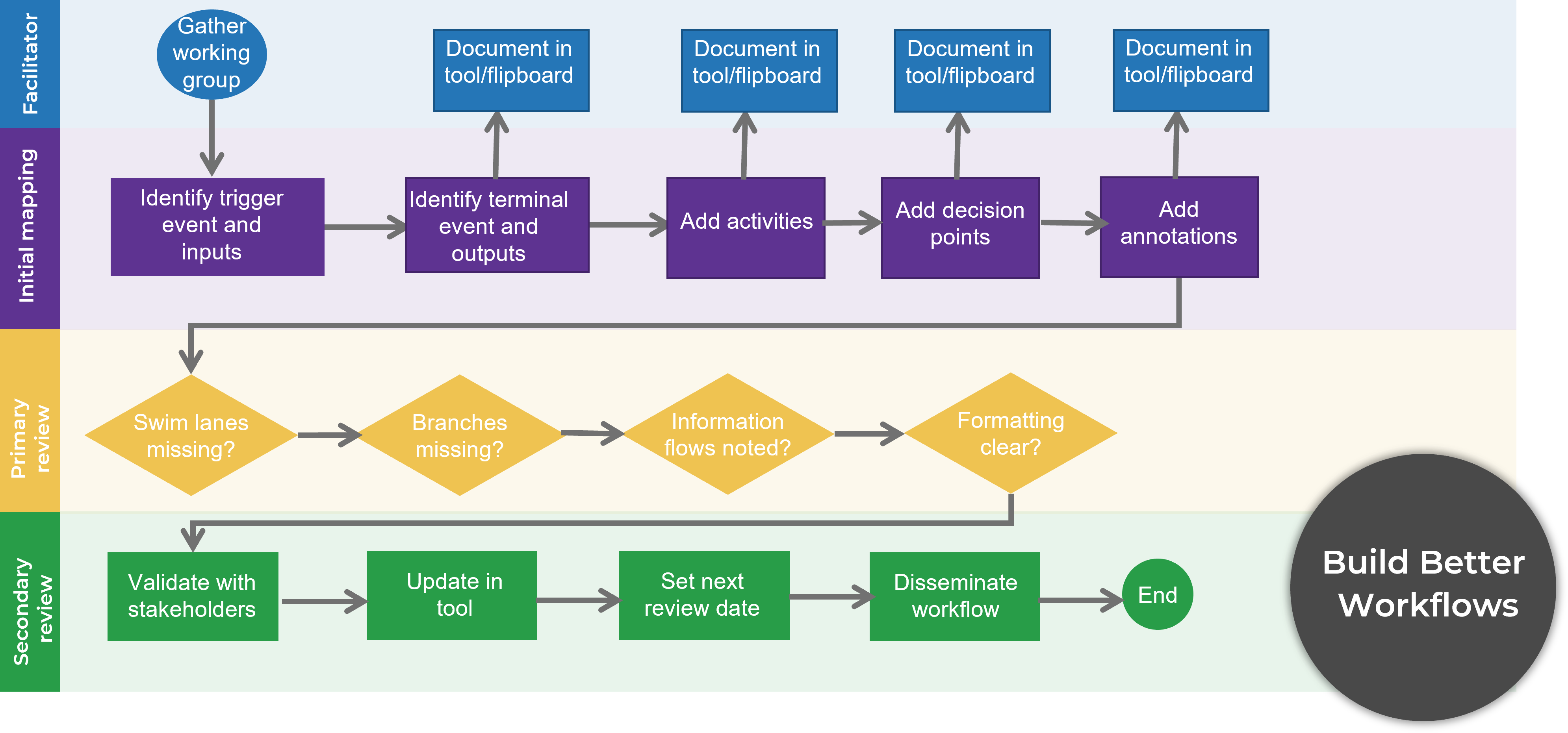

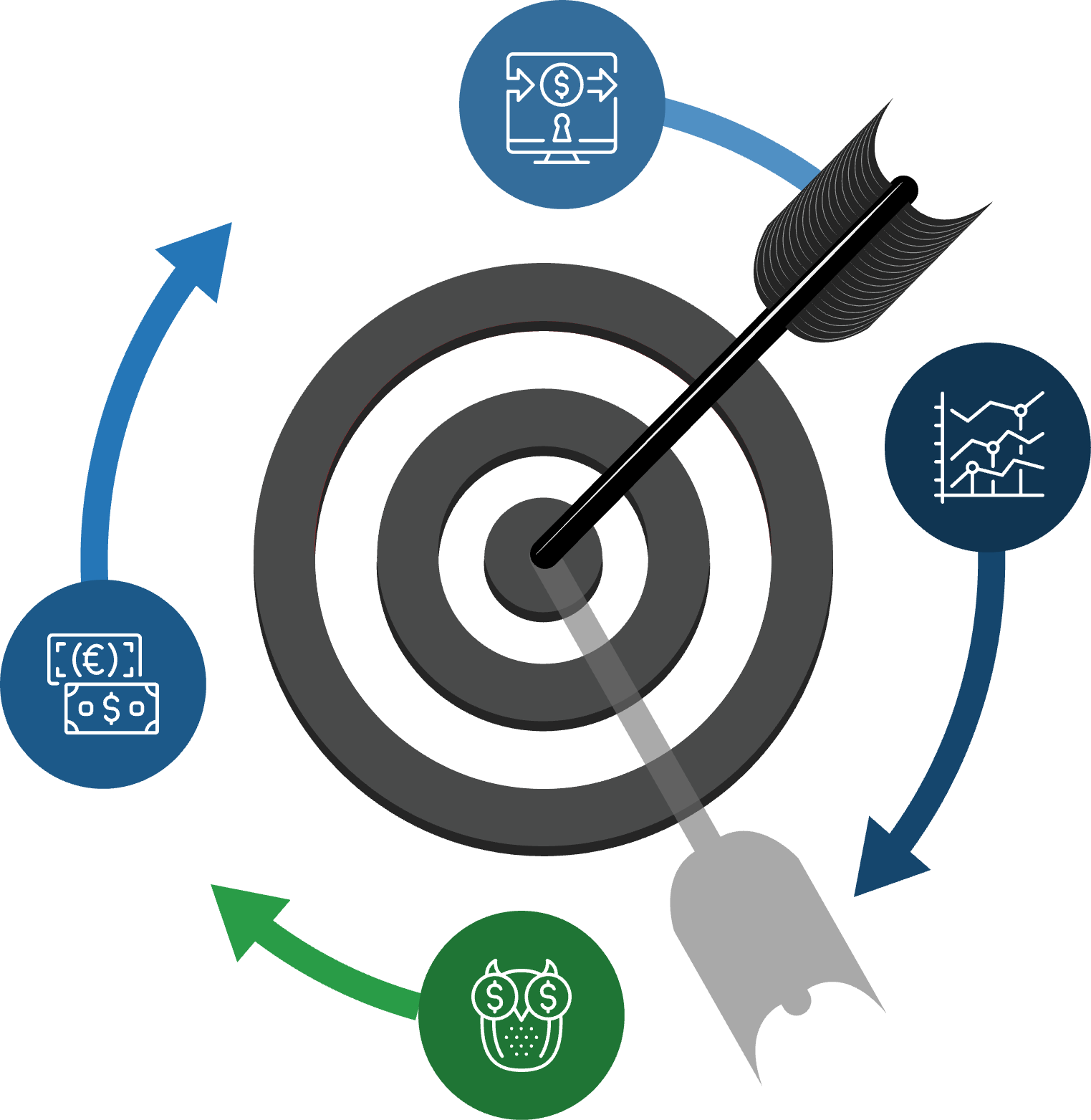

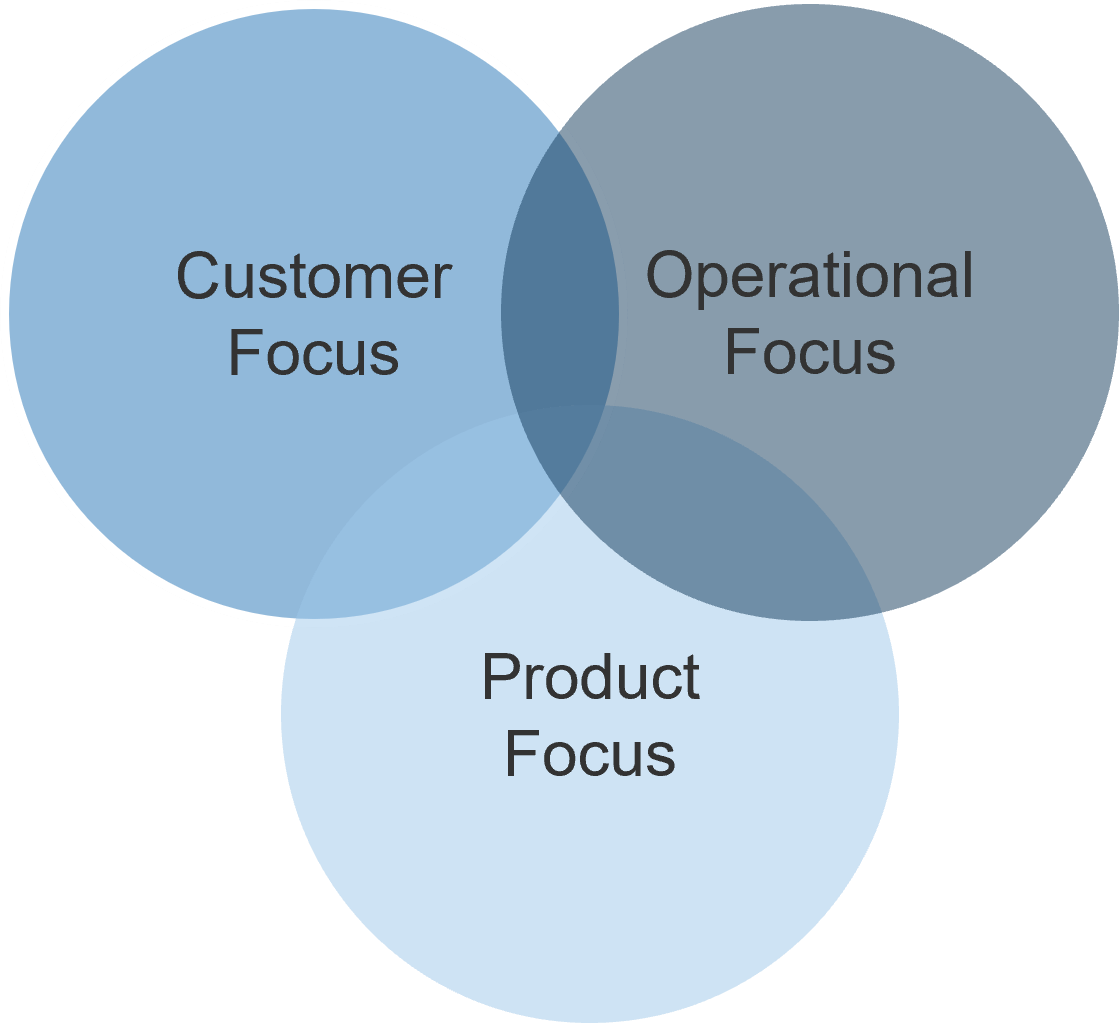

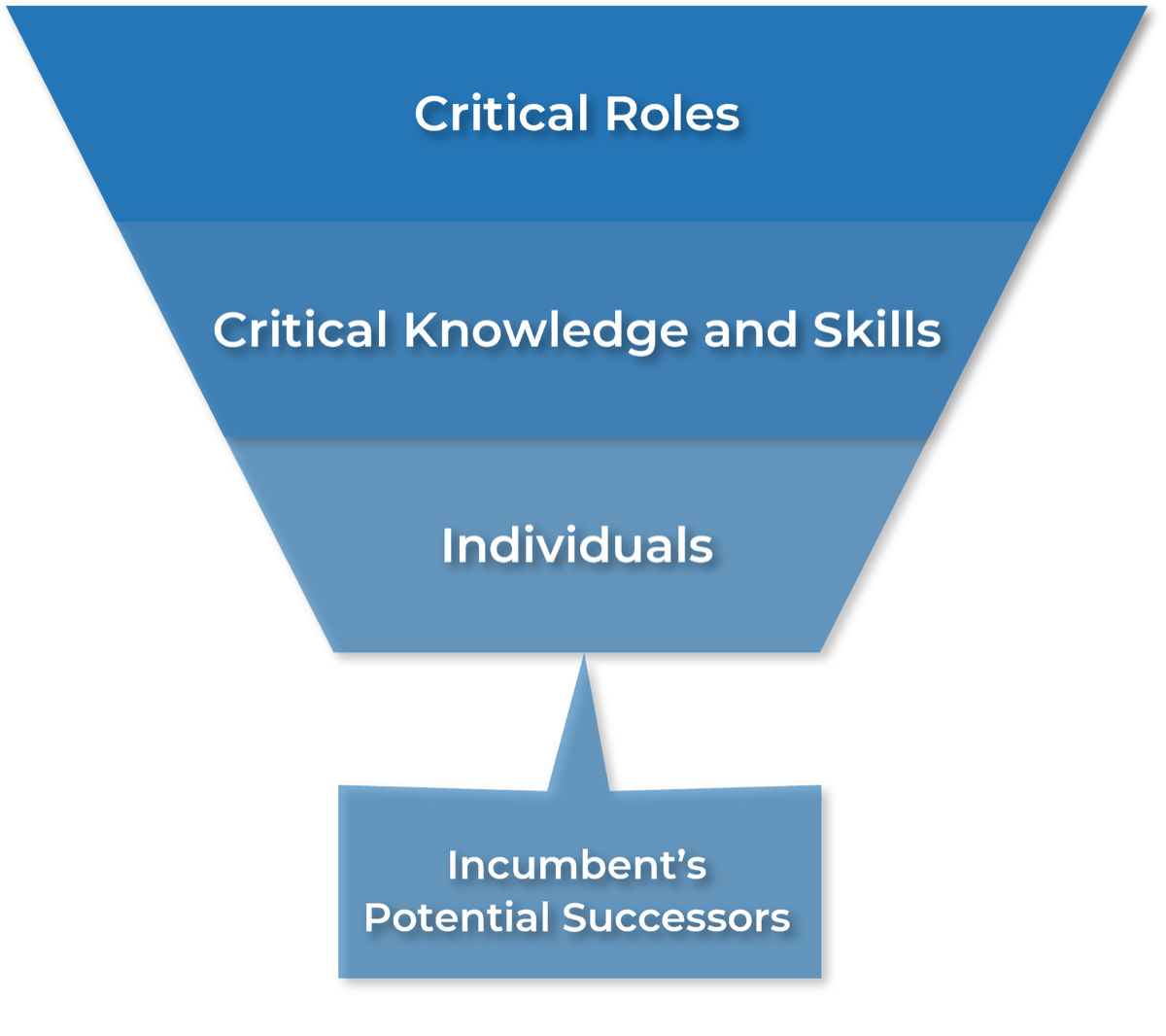

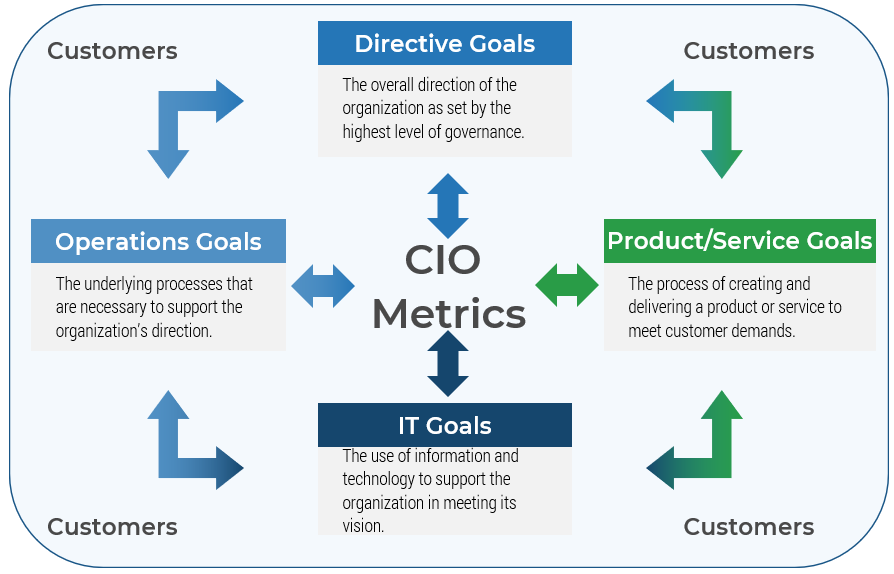

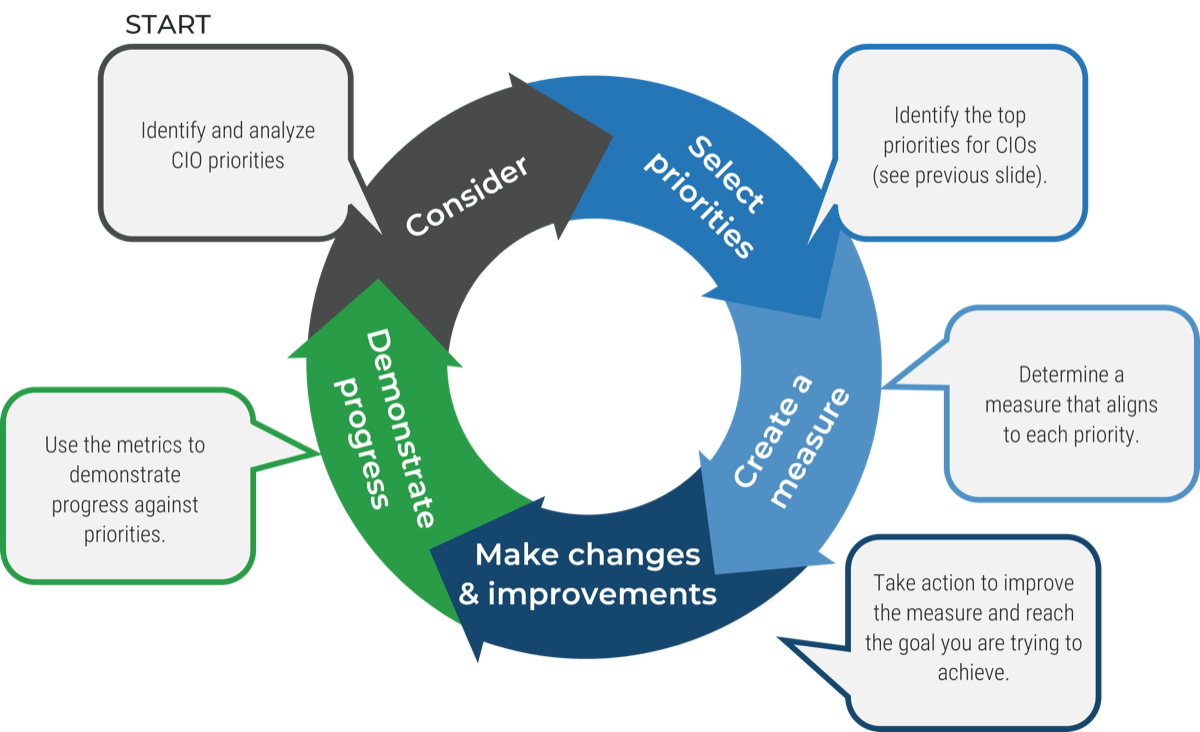

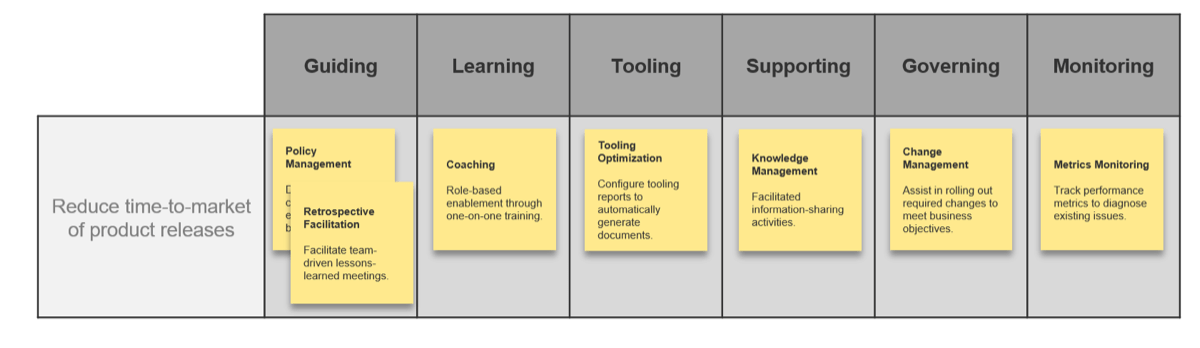

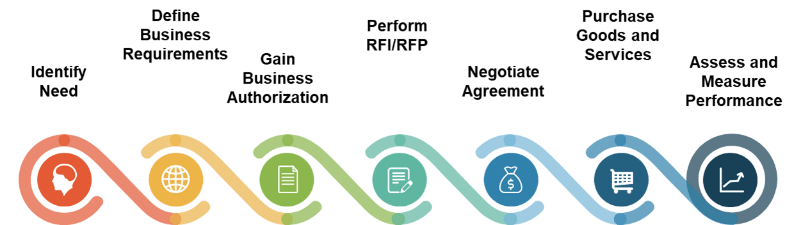

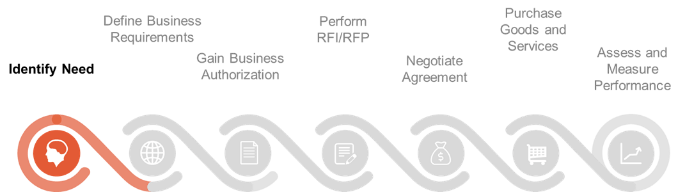

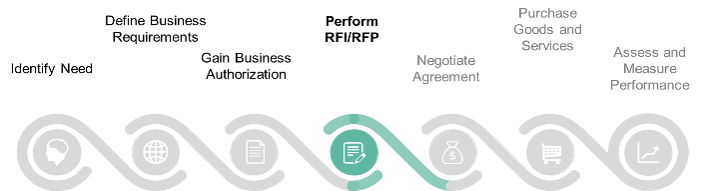

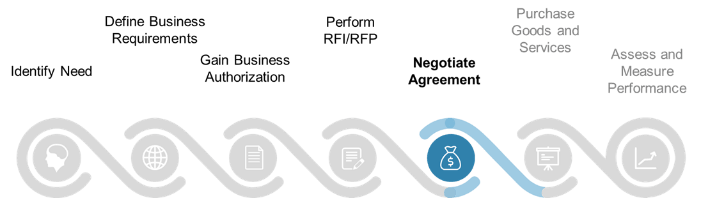

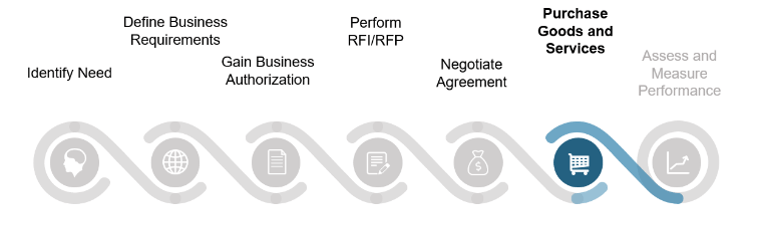

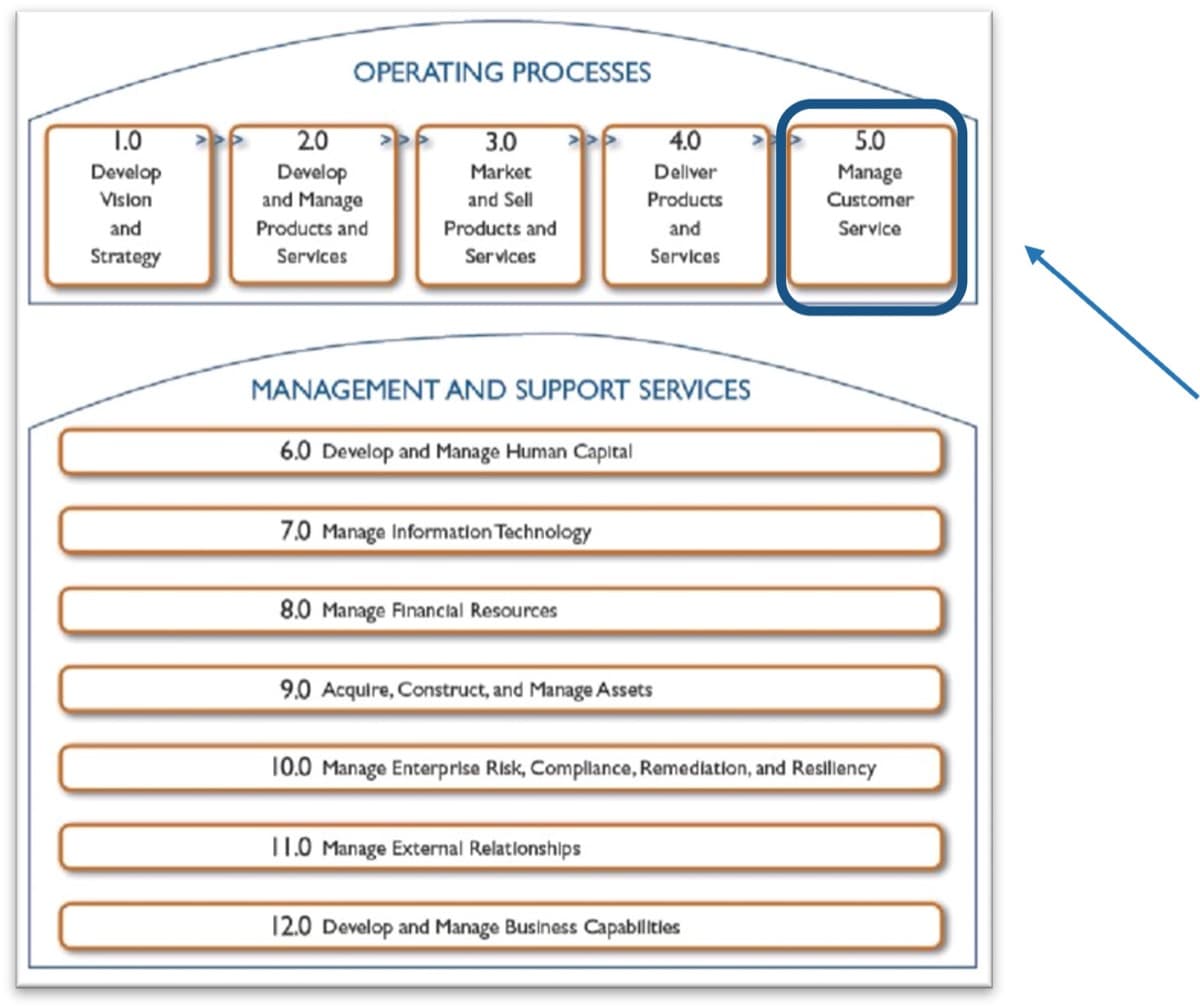

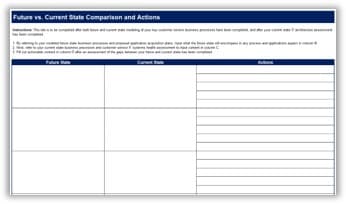

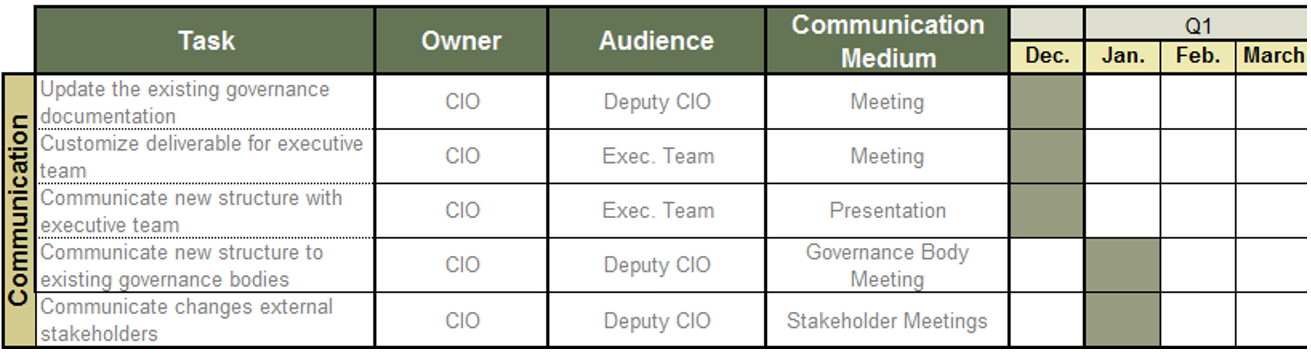

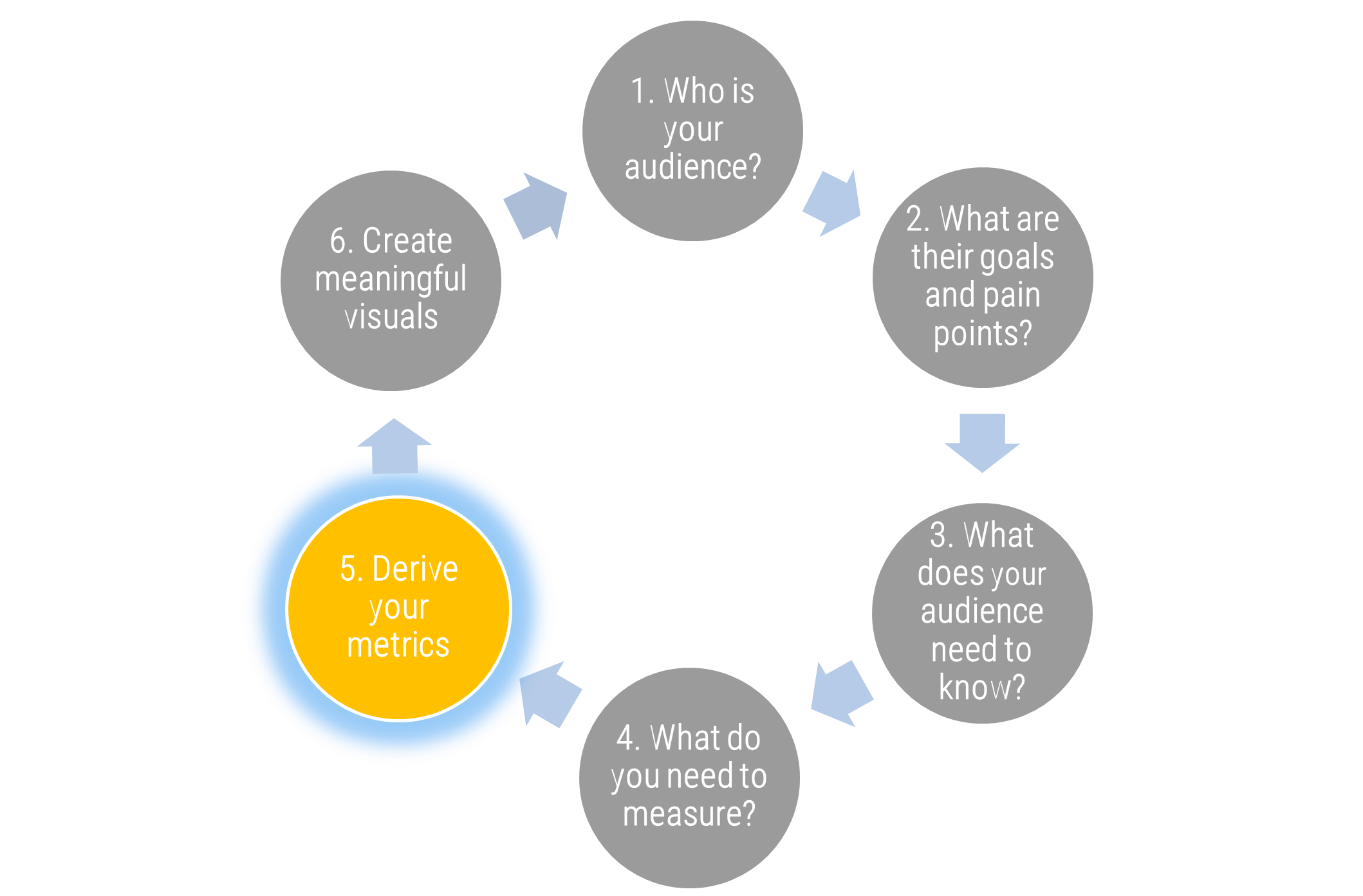

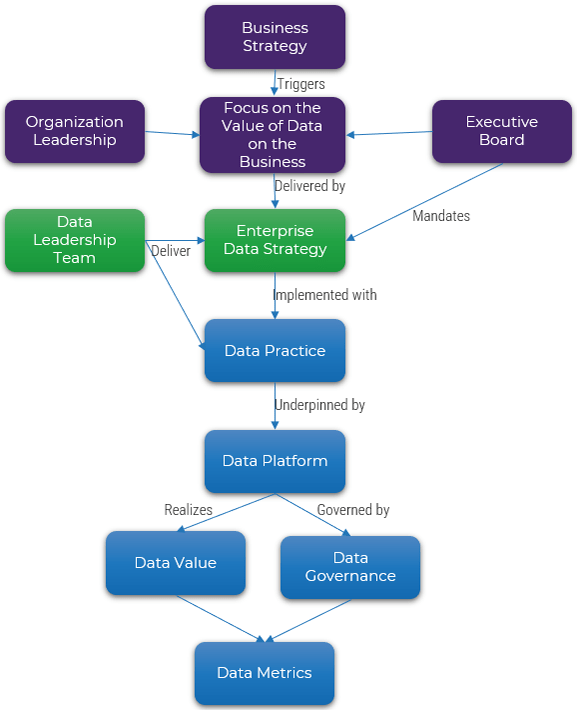

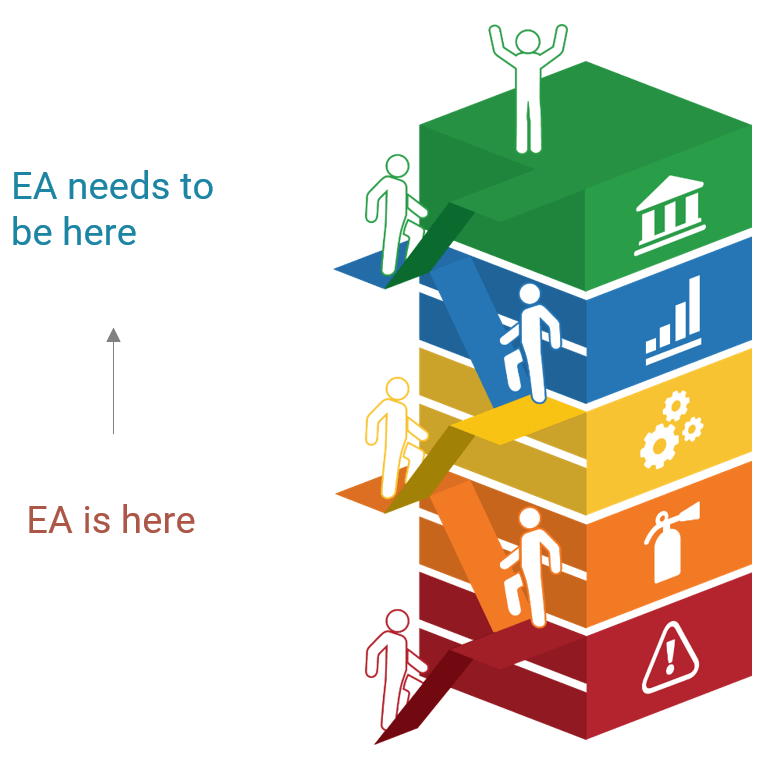

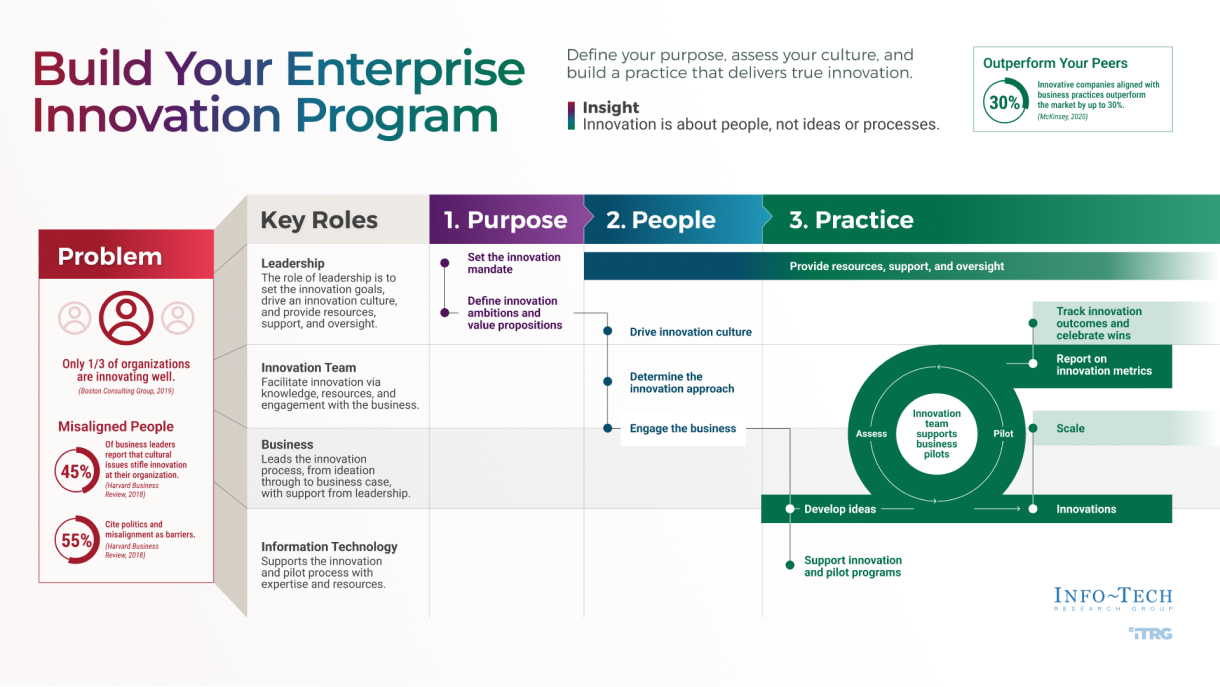

Info-Tech's Approach

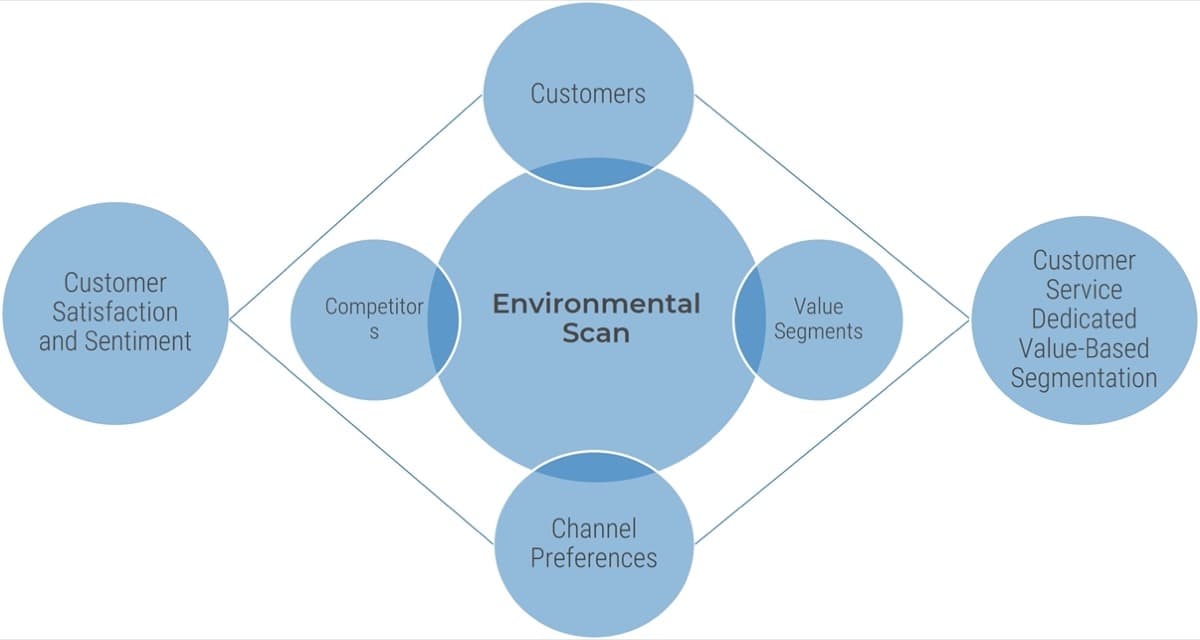

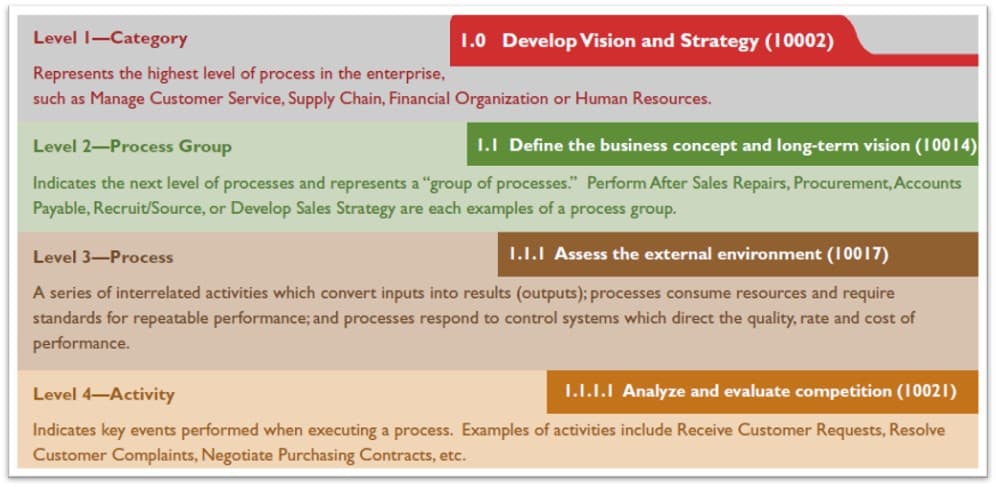

Determine Goals

Conduct activities in the blueprint to pinpoint your current challenges with the service desk and find out objectives to outsource customer service.

Define Requirements

You need to be clear about the processes that will be outsourced. Considering your objectives, we'll help you discover the processes to outsource, to help you achieve your goals.

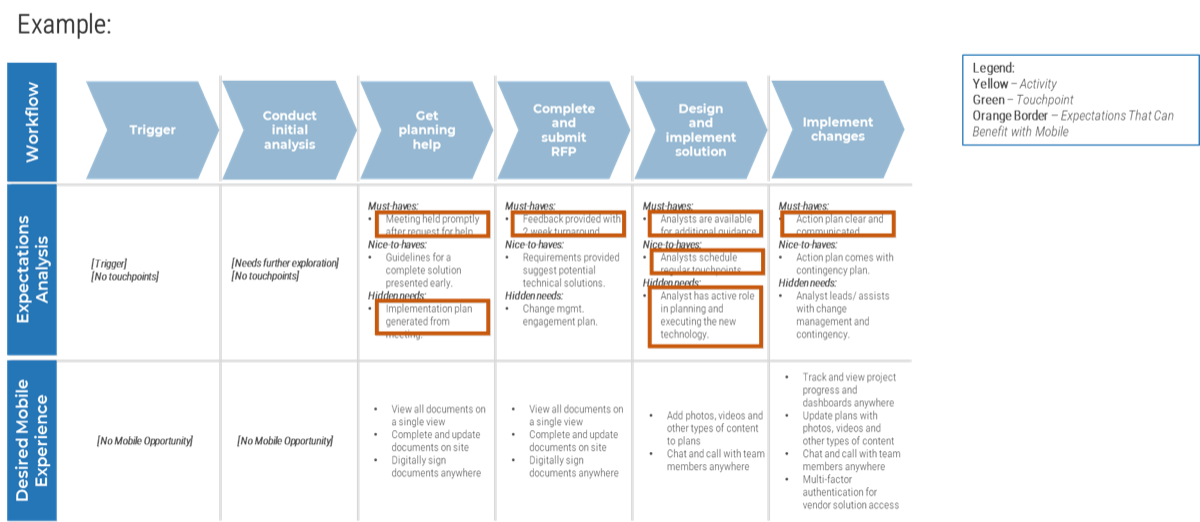

Develop RFP

Your expectations should be documented in a formal proposal to help vendors provide solid information about how they will satisfy your requirements and what their plan is.

Build Long-Term Relationship

Make sure to plan for continual improvement by setting expectations, tracking the services with proper metrics, and using efficient communication with the provider. Think about the rainy day and include exit conditions for ending the relationship if needed.

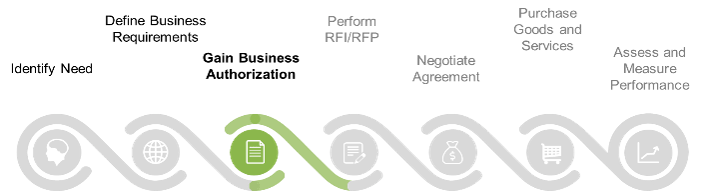

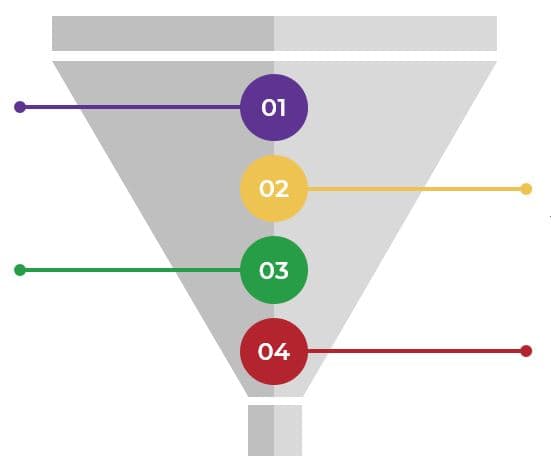

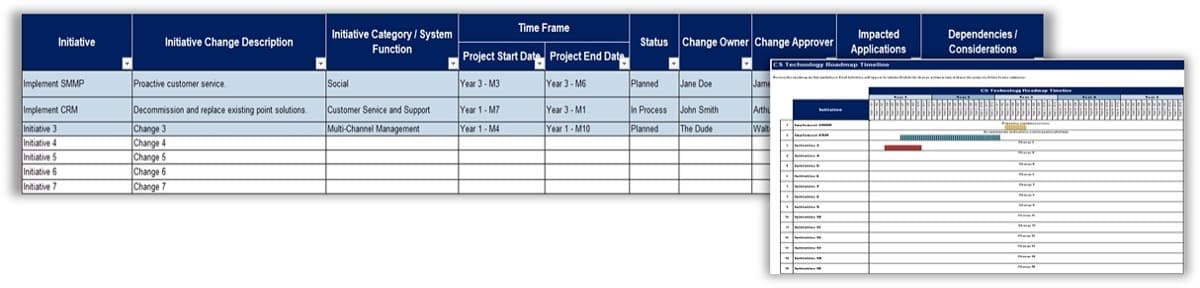

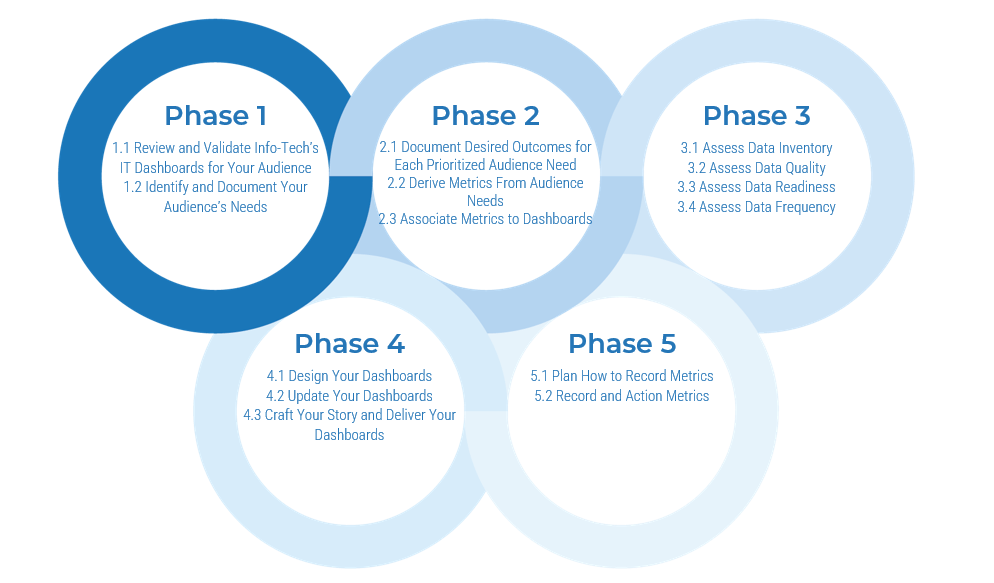

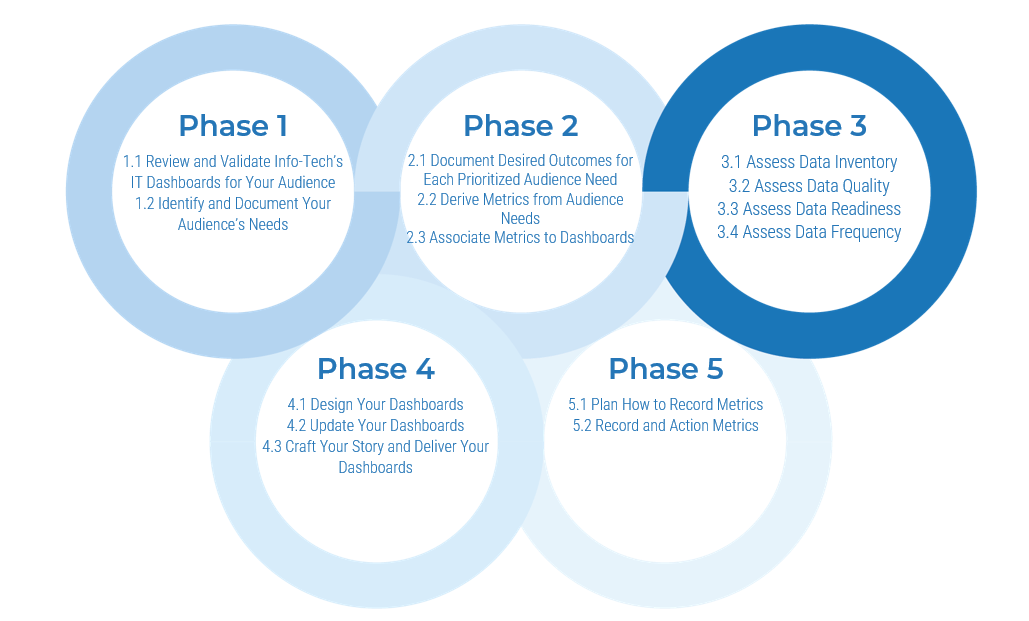

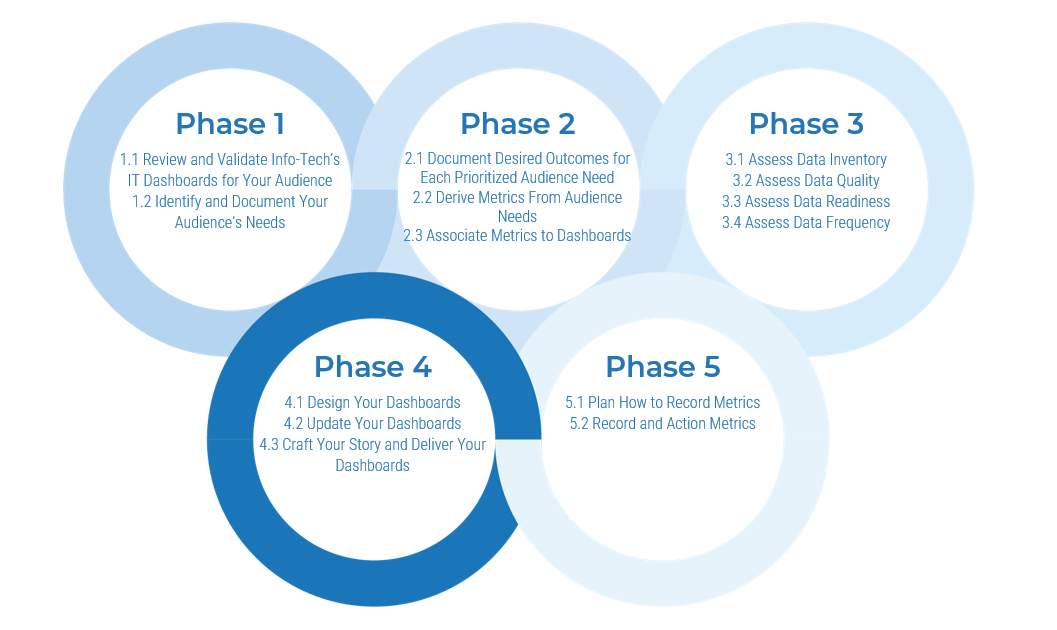

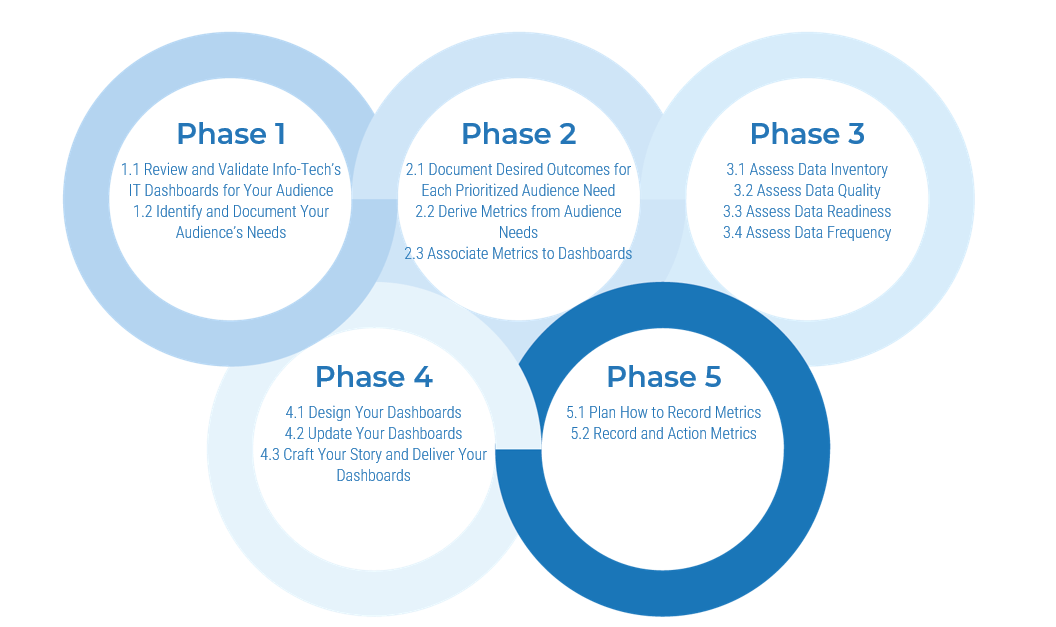

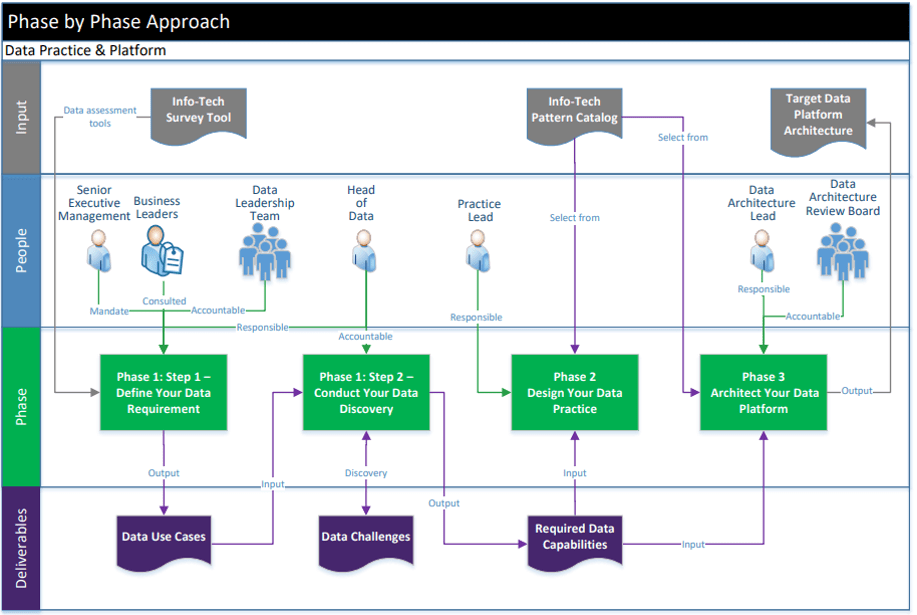

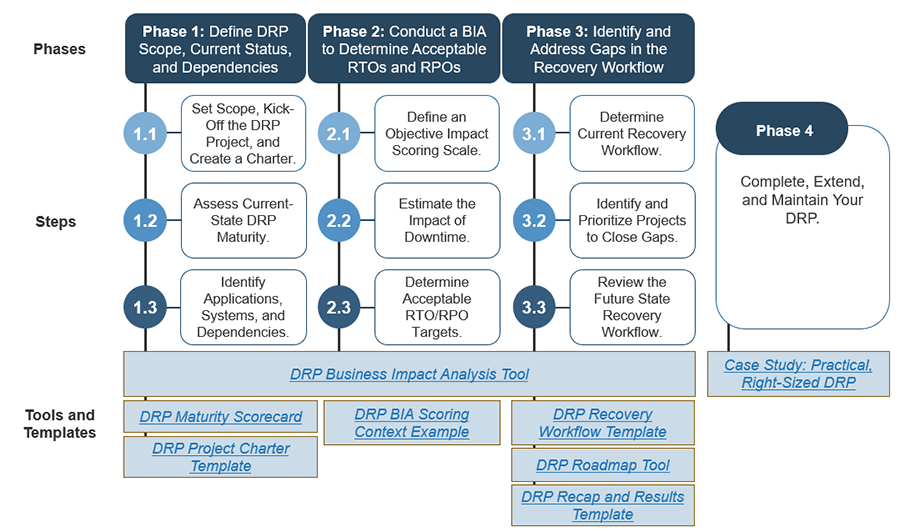

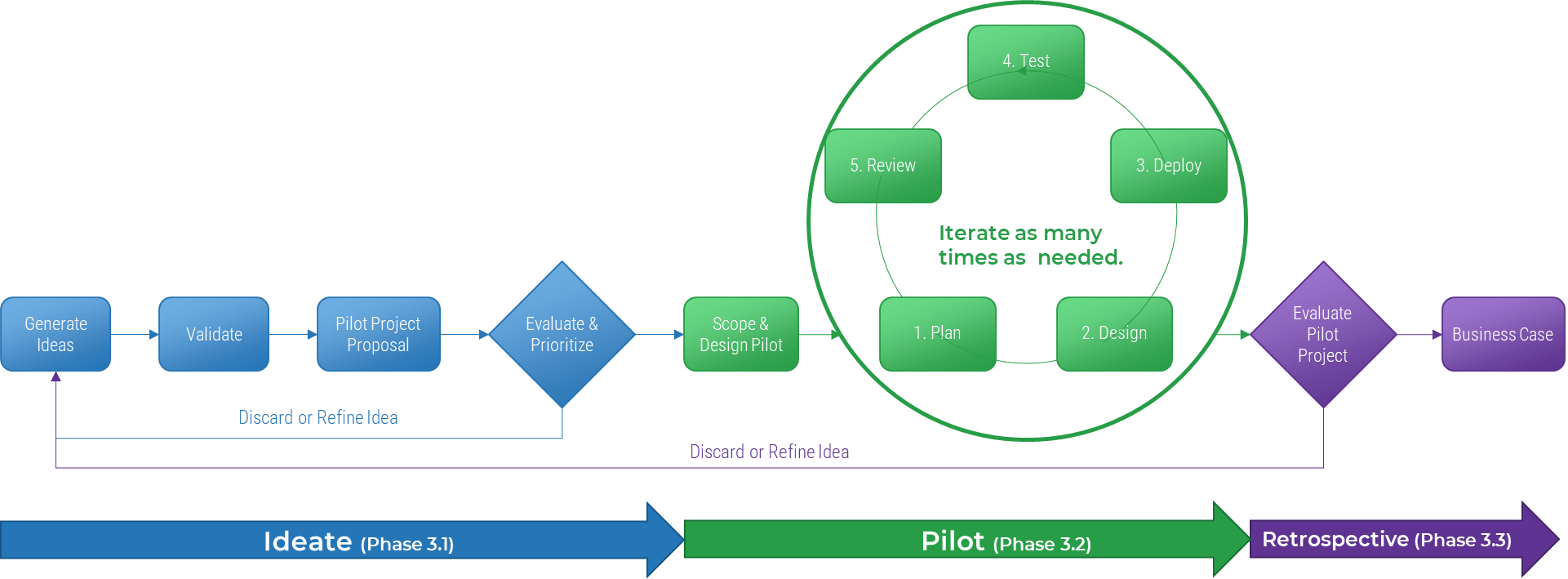

Info-Tech's methodology

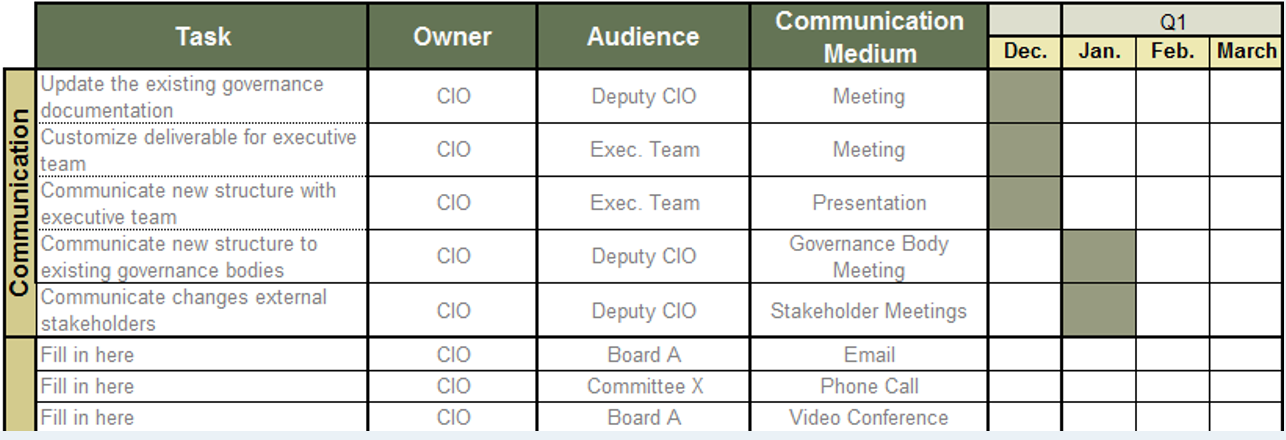

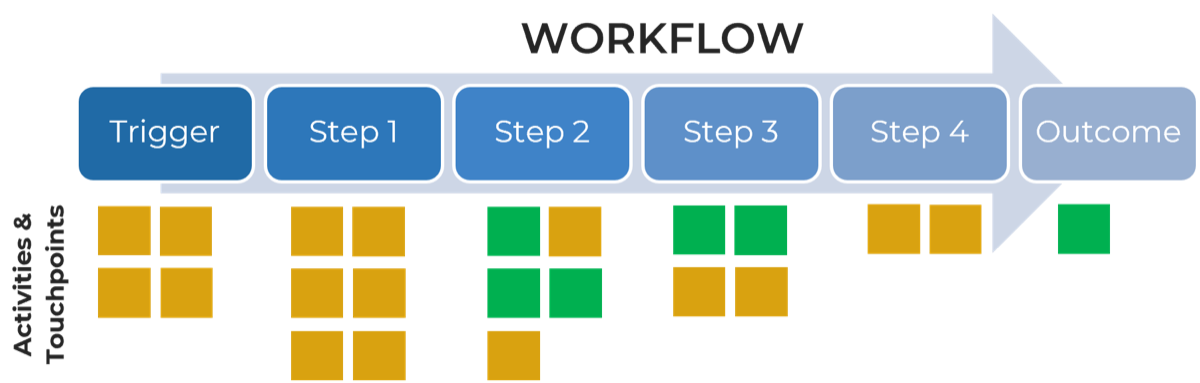

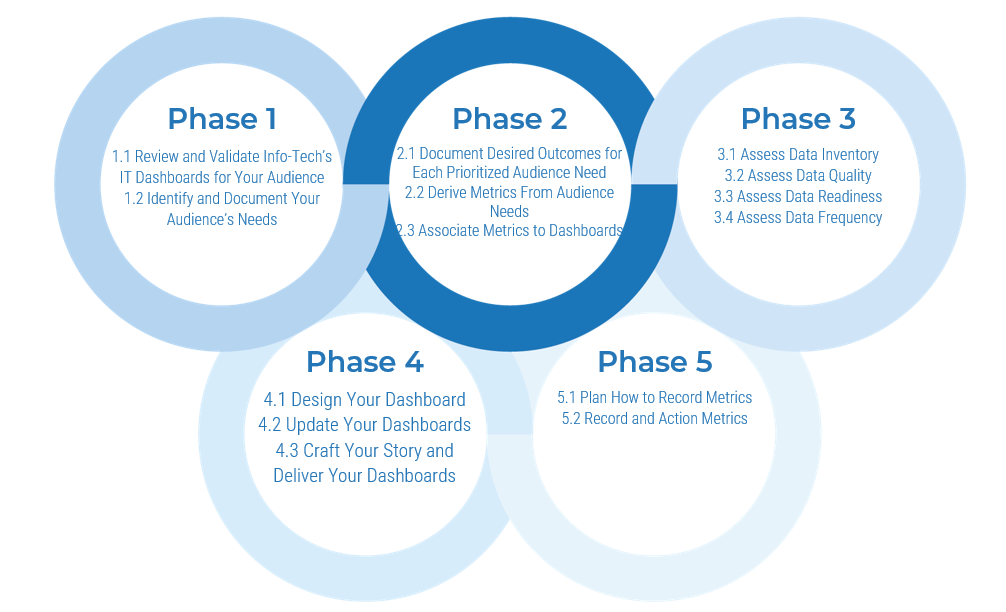

1. Define the Goal | 2. Design an Outsourcing Strategy | 3. Develop an RFP and Make a Long-Term Relationship | |

|---|---|---|---|

Phase Steps | 1.1 Identify goals and objectives 1.2 Assess outsourcing feasibility | 2.1 Identify project stakeholders 2.2 Outline potential risks and constraints | 3.1 Prepare service overview and responsibility matrix 3.2 Define approach to vendor relationship management 3.3 Manage the outsource relationship |

Phase Outcomes | Service Desk Outsourcing Vision and Goals Service Desk Processes to Outsource | Outsourcing Roles and Responsibilities Outsourcing Risks and Constraints Service Desk Outsourcing Project Charter | Service Desk Outsourcing RFP Continual Improvement Plan Exit Strategy |

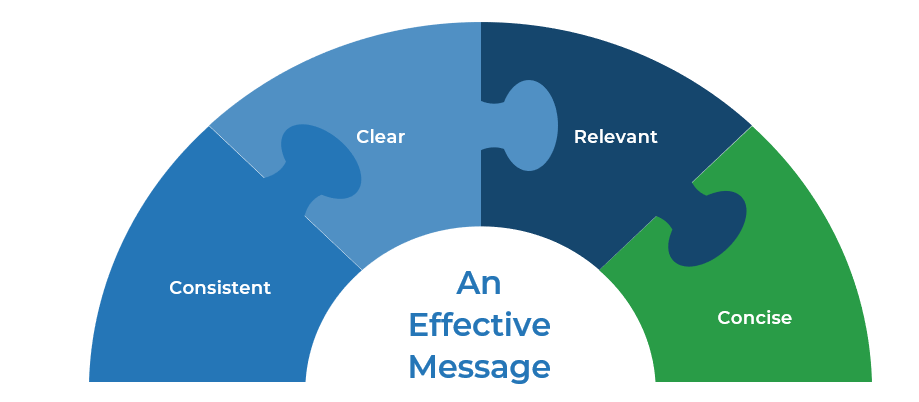

Insight summary

Focus on value

Outsourcing is easy. Realizing all of the expected cost, quality, and focus benefits is hard. Successful outsourcing without being directly involved in service desk management is almost impossible.

Define outsourcing requirements

You don't need to standardize before you outsource, but you still need to conduct your due diligence. If you outsource without thinking about how you want the future to work, you will likely be unsatisfied with the result.

Don't focus on cost

If cost is your only driver for outsourcing, understand that there will be other challenges. Customer service quality will likely be less, and your outsourcer may not add on frills such as Continual Improvement. Be careful that your specialists don't end up spending more time working on incidents and service requests.

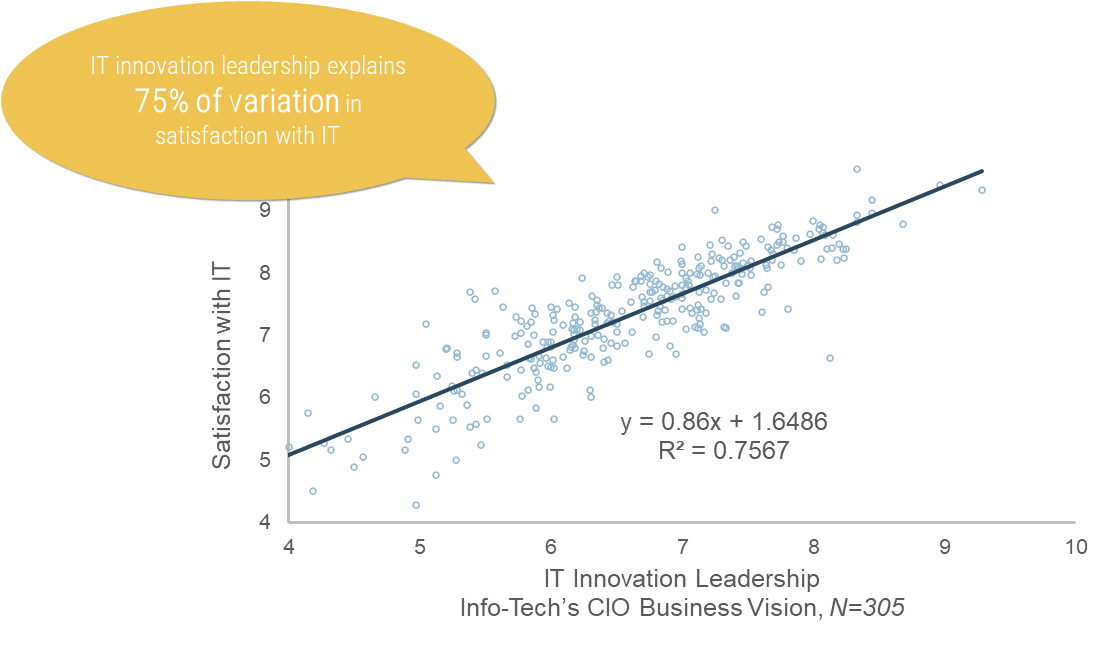

Emphasize on customer service

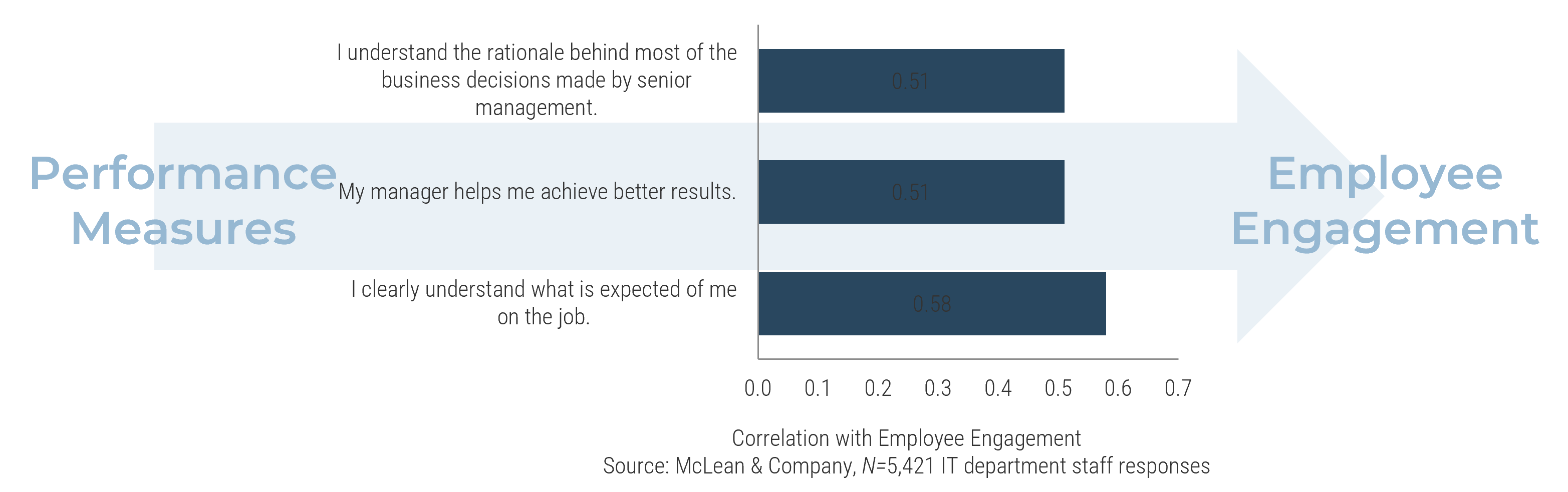

A bad outsourcer relationship will result in low business satisfaction with IT overall. The service desk is the face of IT, and if users are dissatisfied with the service desk, then they are much likelier to be dissatisfied with IT overall.

Vendors are not magicians

They have standards in place to help them succeed. Determine ITSM best practices, define your requirements, and adjust process workflows accordingly. Your staff and end users will have a much easier transition once outsourcing proceeds.

Plan ahead to guarantee success

Identify outsourcing goals, plan for service and system integrations, document standard incidents and requests, and track tension metrics to make sure the vendor does the work efficiently. Aim for building a long-term relationship but contemplate potential exit strategy.

Blueprint deliverables

Each step of this blueprint is accompanied by supporting deliverables to help you accomplish your goals:

| Service Desk Outsourcing Requirements Database LibraryUse this library to guide you through processes to outsource |

| Service Desk Outsourcing RFP TemplateUse this template to craft a proposal for outsourcing your service desk |

| Service Desk Outsourcing Reference Interview TemplateUse this template to verify vendor claims on service delivery with pervious or current customers |

| Service Desk Outsourcing Vendor Proposal Scoring ToolUse this tool to evaluate RFP submissions |

Key deliverable: | |

|---|---|

| Service Desk Outsourcing Project CharterDocument your project scope and outsourcing strategy in this template to organize the project for efficient resource and requirement allocation |

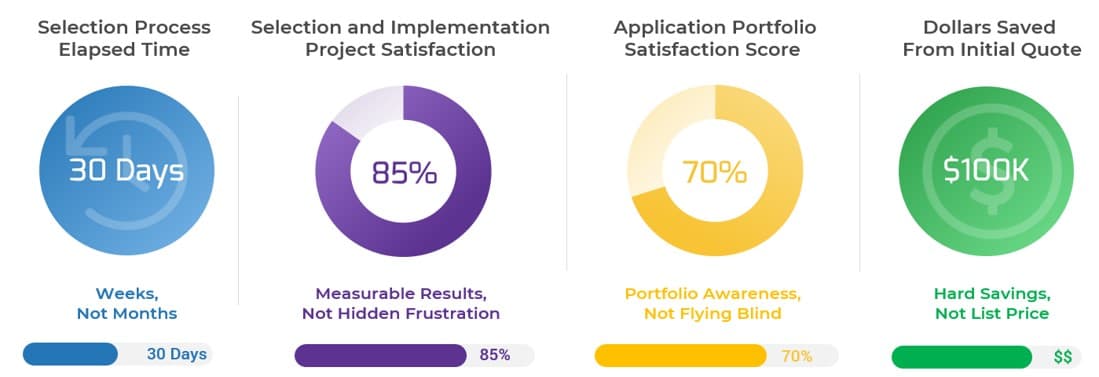

Blueprint benefits

IT Benefits | Business Benefits |

|---|---|

|

|

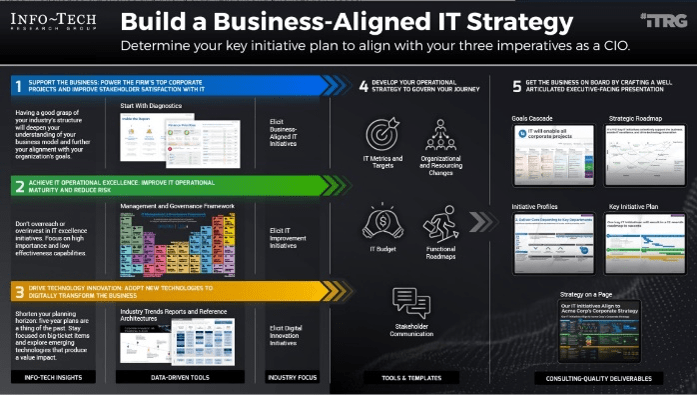

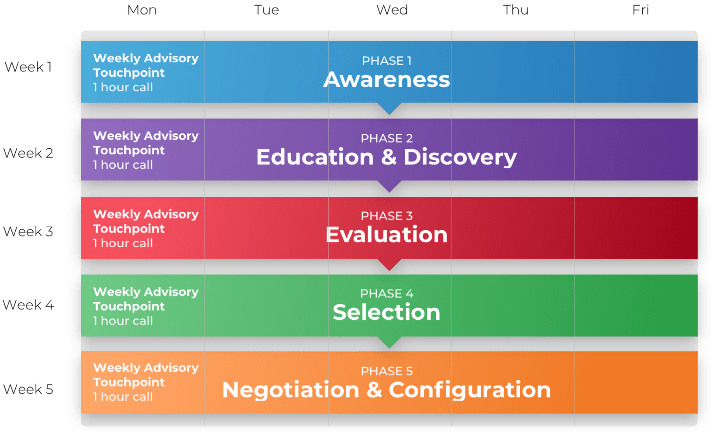

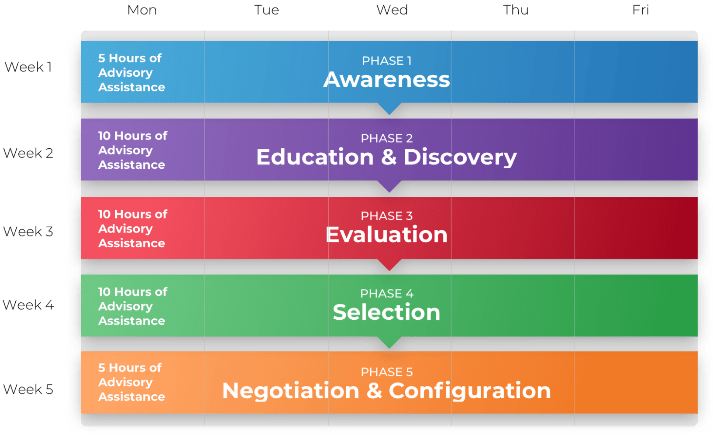

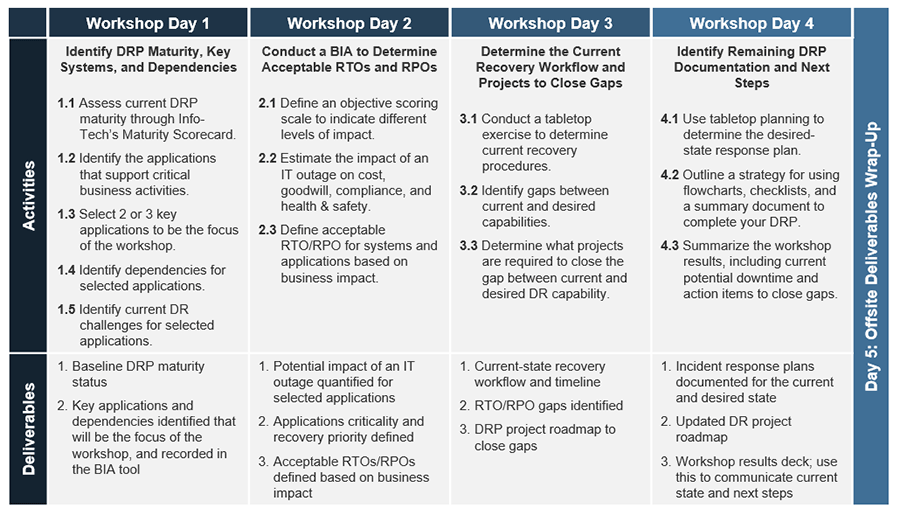

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit

"Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful."

Guided Implementation

"Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track."

Workshop

"We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place."

Consulting

"Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project."

Diagnostics and consistent frameworks used throughout all four options

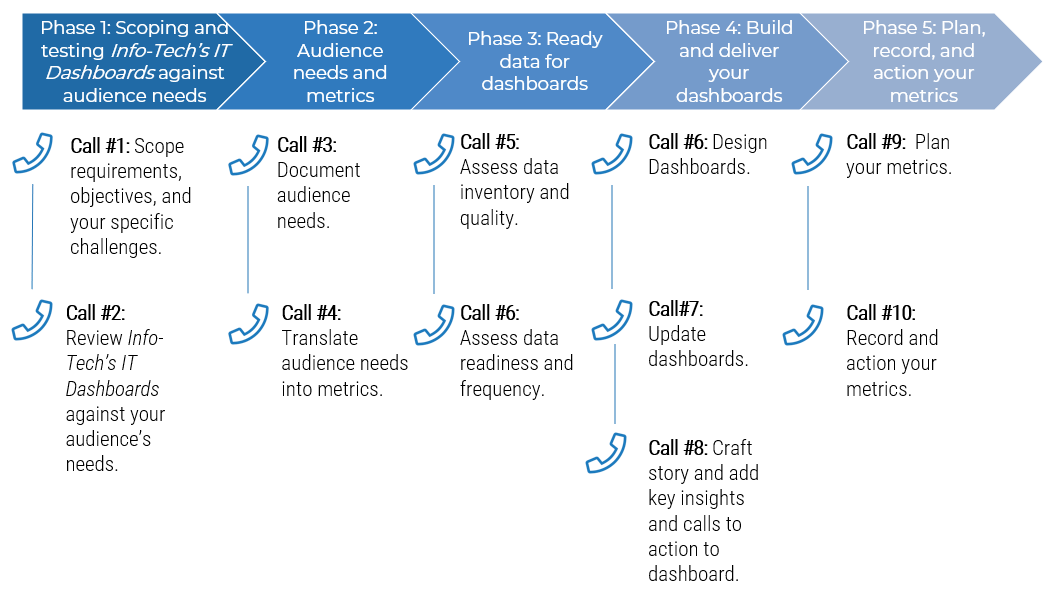

Guided Implementation

What does a typical GI on this topic look like?

| Phase 1 | Phase 2 | Phase 3 |

|---|---|---|

Call #1: Scope your specific challenges and objectives | Call #3: Identify project stakeholders, and potential risks and constraints | Call #5: Create a detailed RFP |

Call #6: Identify strategy risks. | ||

| Call #2: Assess outsourcing feasibility and processes to outsource | Call #4: Create a list of metrics to ensure efficient reporting | Call #7: Prepare for vendor briefing and scoring each vendor |

Call #8: Build a communication plan |

A Guided Implementation (GI) is series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is between 8 to 10 calls over the course of 4 to 6 months.

Phase 1

Define the goal

Define the goal | Design an outsourcing strategy | Develop an RFP and make a long-term relationship |

|---|---|---|

1.1 Identify goals and objectives 1.2 Assess outsourcing feasibility | 2.1 Identify project stakeholders 2.2 Outline potential risks and constraints | 3.1 Prepare a service overview and responsibility matrix 3.2 Define your approach to vendor relationship management 3.3 Manage the outsource relationship |

This phase will walk you through the following activities:

- Analysis outsourcing objectives

- Assess outsourcing feasibility

- Identify services and processes to outsource

This phase involves the following participants:

- Service Desk Team

- IT Leadership

Define requirements for outsourcing service desk support

Step 1.1

Identify goals and objectives

Activities

1.1.1 Find out why you want to outsource your service desk

1.1.2 Document the benefits of outsourcing your service desk

1.1.3 Identify your outsourcing vision and goals

1.1.4 Prioritize service desk outsourcing goals to help structure your mission statement

1.1.5 Craft a mission statement that demonstrates your decision to reach your outsourcing objectives

Define the goal

This step requires the following inputs:

- List of strengths and weaknesses of the service desk

- Challenges with the service desk

This step involves the following participants:

- CIO

- IT Leadership

- Service Desk Manager

- IT Managers

Outcomes of this step

- Service desk outsourcing vision and goals

- Benefits of outsourcing the service desk

- Mission statement

What is your rationale to outsource the service desk?

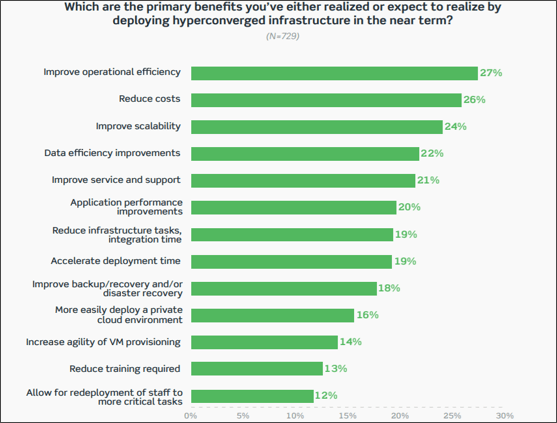

Potential benefits of outsourcing the service desk:

- Bring in the expertise and knowledge to manage tickets according to best-practice guidelines

- Reduce the timeline to response and resolution

- Improve IT productivity

- Enhance IT services and improve performance

- Augment relationship between IT and business through service-level improvement

- Free up the internal team and focus IT on complex projects and higher priority tasks

- Speed up service desk optimization

- Improve end-user satisfaction through efficient IT services

- Reduce impact of incidents through effective incident management

- Increase service consistency via turnover reduction

- Expand coverage hour and access points

- Expand languages to service different geographical areas

1.1.1 Find out why you want to outsource your service desk

1 hour

Service desk is the face of IT. Service desk improvement increases IT efficiency, lowers operation costs, and enhances business satisfaction.

Common challenges that result in deciding to outsource the service desk are:

Participants: IT Director, Service Desk Manager, Service Desk Team

| Challenge | Example |

|---|---|

| Lack of tier 1 support | Startup does not have a dedicated service desk to handle incidents and provide services to end users. |

| Inefficient ticket handling | MTTR is very high and end users are frustrated with their issues not getting solved quickly. Even if they call service desk, they are put on hold for a long time. Due to these inefficiencies, their daily work is greatly impacted. |

| Restricted service hours | Company headquartered in Texas does not have resources to provide 24/7 IT service. When users in the East Asia branch have a laptop issue, they must wait until the next day to get response from IT. This has diminished their satisfaction. |

| Restricted languages | Company X is headquartered in New York. An end user not fluent in English from Madrid calls in for support. It takes five minutes for the agent to understand the issue and log a ticket. |

| Ticket backlog | IT is in firefighting mode, very busy with taking care of critical incidents and requests from upper management. Almost no one is committed to the SLA because of their limited availability. |

Brainstorm your challenges with the service desk. Why have you decided to outsource your service desk? Use the above table as a sample.

1.1.2 Document benefits of outsourcing your service desk

1 hour

- Review the challenges with your current service desk identified in activity 1.1.1.

- Discuss possible ways to tackle these challenges. Be specific and determine ways to resolve these issues if you were to do it internally.

- Determine potential benefits of outsourcing the service desk to IT, business, and end users.

- For each benefit, describe dependencies. For instance, to reduce the number of direct calls (benefit), users should have access to service desk as a single point of contact (dependency).

- Document this activity in the Service Desk Outsourcing Project Charter Template.

Download the Project Charter Template

Input

- List of challenges with the current service desk from activity 1.1.1

Output

- Benefits of outsourcing the service desk

Materials

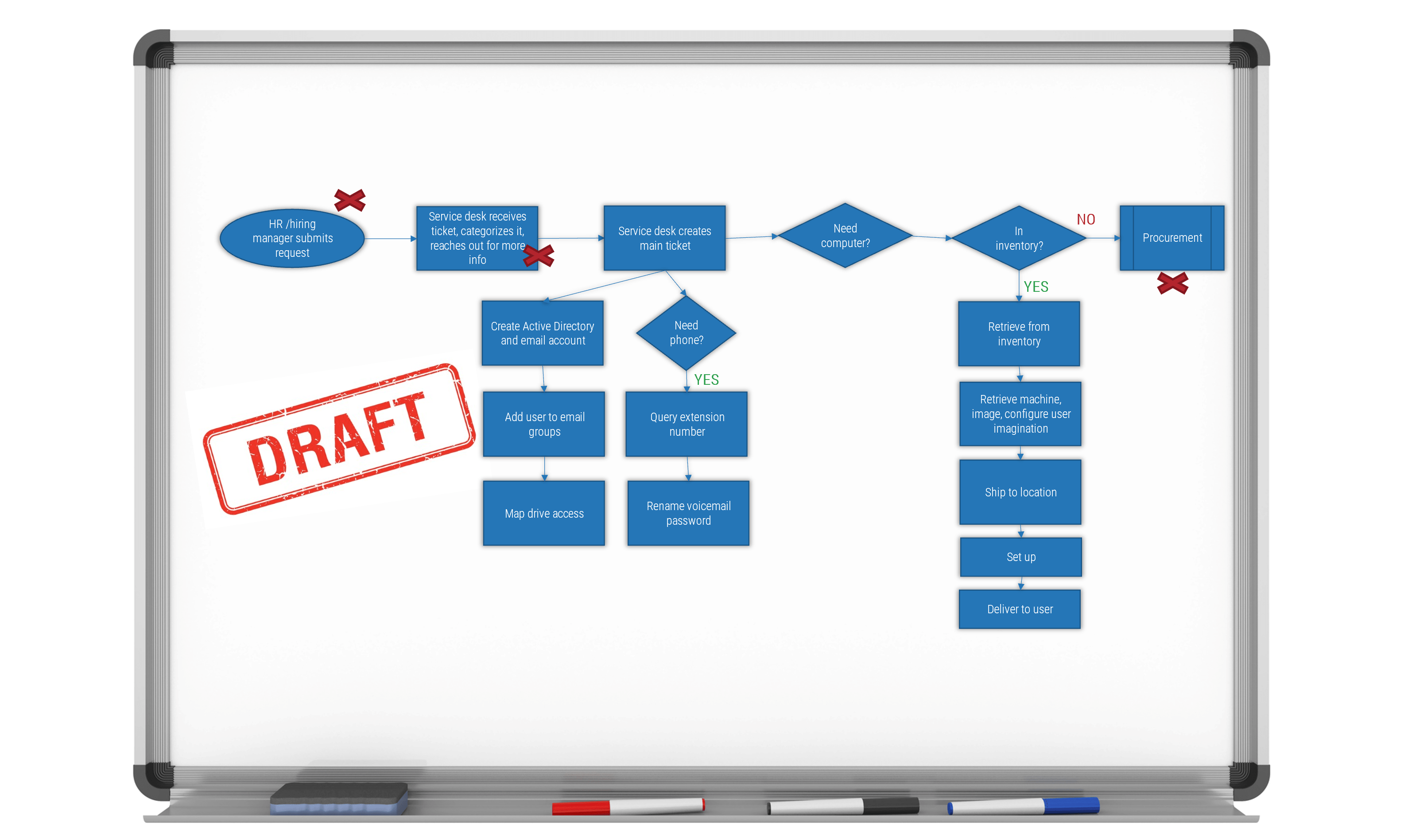

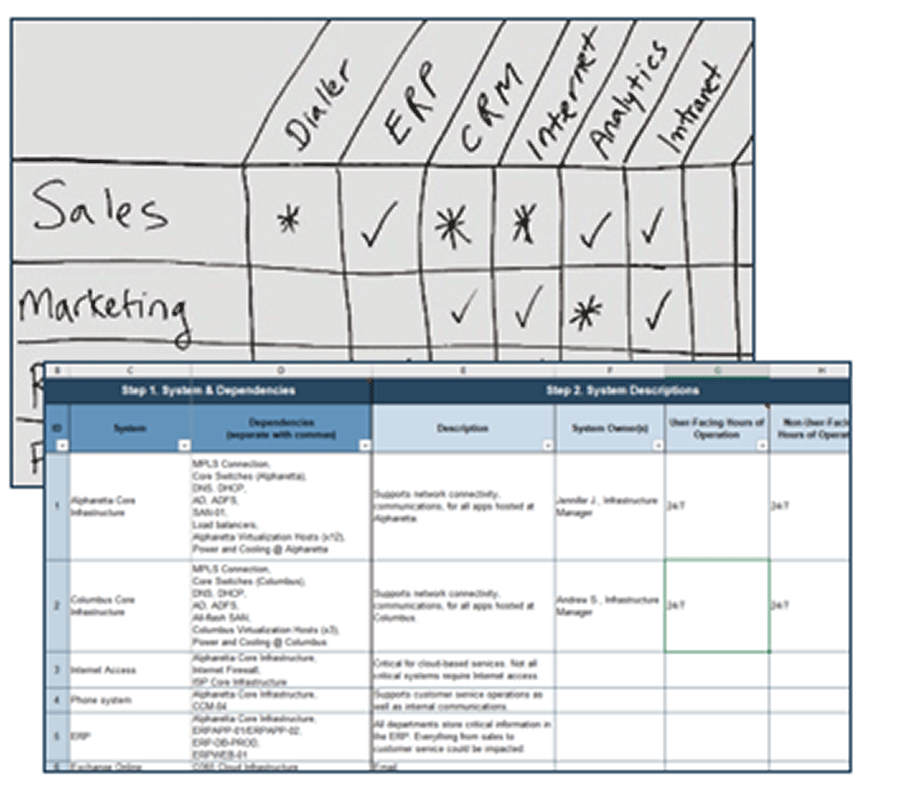

- Whiteboard/flip charts

- Markers

- Sticky notes

- Laptops

Participants

- IT Director/CIO

- Service Desk Manager

- Service Desk Team

- IT Managers

Why should you not consider cost reduction as a primary incentive to outsourcing the service desk?

Assume that some of the costs will not go away with outsourcing

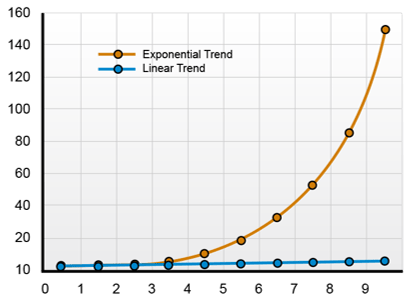

When you outsource, the vendor's staff tend to gradually become less effective as:

- They are managed by metrics to reduce costs by escalating sooner, reducing talk time, and proposing questionable solutions.

- Turnover results in new employees that get insufficient training.

You must actively manage the vendor to identify and resolve these issues. Many organizations find that service desk management takes more time after they outsource.

You need to keep spending on service desk management, and you may not get away from technology infrastructure spending.

Info-Tech Insight

In their first year, almost 42% of Info-Tech's clients do not get the real value of outsourcing services as expected. This iss primarily because of misalignment of organizational goals with outcomes of the outsourced services.

Consider the hidden costs of outsourcing

Expected Costs | Unexpected Costs | Example | |

|---|---|---|---|

| Transition Costs | Severance and staff retention |

|

|

| Fees | Price of the engagement |

|

|

| Management Costs | Time directing account |

|

|

| Rework Costs | Downtime, defect rate, etc. (quality metrics measured in SLAs) |

|

|

Determine strategies to avoid each hidden cost

| Costs related to transitioning into the engagement | Adapting to standards and training costs |

|---|---|

Adapting to standards: Define the process improvements you will need to work with each potential vendor. Training costs for vendor staff: Reduce training costs by keeping the same vendor staff on all of your projects. | |

Fee-related costs | Fees for additional services (that you thought were included) |

Carefully review each proposed statement of work to identify and reduce extra fees. Understand why extra fees occur in the SLA, the contract, and the proposed statement of work, and take steps to protect yourself and the vendor. | |

Management-related costs | Direct management of vendor staff and dispute resolution |

Direct management of vendor staff: Avoid excessive management costs by defining a two-tier management structure on both sides of the engagement. Time spent resolving disputes: Avoid prolonged resolution costs by defining terms of divorce for the engagement up front. | |

Rework costs | Unanticipated requirements and integration with existing systems |

Unanticipated requirements: Use a two-stage process to define requirements, starting with business people and then with review by technical staff. Integration with existing systems: Obtain a commitment from vendors that deliverables will conform to standards at points of integration with your systems. |

Your outsourcing strategy should address the reasons you decided to outsource

A clear vision of strategic objectives prior to entering an outsourcing agreement will allow you to clearly communicate these objectives to the Managed Service Provider (MSP) and use them as a contracted basis for the relationship.

- Define the business' overall approach to outsourcing along with the priorities, rules, and principles that will drive the outsourcing strategy and every subsequent outsourcing decision and activity.

- Define specific business, service, and technical goals for the outsourcing project and relevant measures of success.

"People often don't have a clear direction around what they're trying to accomplish. The strategic goals should be documented. Is this a cost-savings exercise? Is it because you're deficient in one area? Is it because you don't have the tools or expertise to run the service desk yourself? Figure out what problem you're trying to solve by outsourcing, then build your strategy around that.

– Jeremy Gagne, Application Support Delivery Manager, Allegis Group

Most organizations are driven to consider outsourcing their service desk hoping to improve the following:

- Ability to scale (train people and acquire skills)

- Focus on core competencies

- Decrease capital costs

- Access latest technology without large investment

- Resolve labor force constraints

- Gain access to special expertise without paying a full salary

- Save money overall

Info-Tech Insight

Use your goals and objectives as a management tool. Clearly outline your desired project outcomes to both your in-house team and the vendor during implementation and monitoring. It will allow a common ground to unite both parties as the project progresses.

Mitigate pitfalls that lay in the way of desired outcomes of outsourcing

| Desired outcome | Pitfalls to overcome |

|---|---|

| IT can focus on core competencies and strategic initiatives rather than break-fix tasks. | Escalation to second- and third-level support usually increases when the first level has been outsourced. Outsourcers will have less experience with your typical incidents and will give up on trying to solve some issues more quickly than your internal level-one staff. |

| Low outsourcing costs compared to the costs needed to employ internal employees in the same role. | Due to lack of incentive to decrease ticket volume, costs are likely to increase. As a result, organizations often find themselves paying more overall for an outsourced service desk than if they had a few dedicated IT service desk employees in-house. |

| Improved employee morale as a result of being able to focus on more interesting tasks. | Management often expects existing employee morale to increase as a result of shifting their focus to core and strategic tasks, but the fear of diminished job security often spreads to the remaining non-level-one employees. |

1.1.3 Identify outsourcing vision and goals

Identify the goals and objectives of outsourcing to inform your strategy.

Participants: IT Director, Service Desk Manager, Service Desk Team

1-2 hours

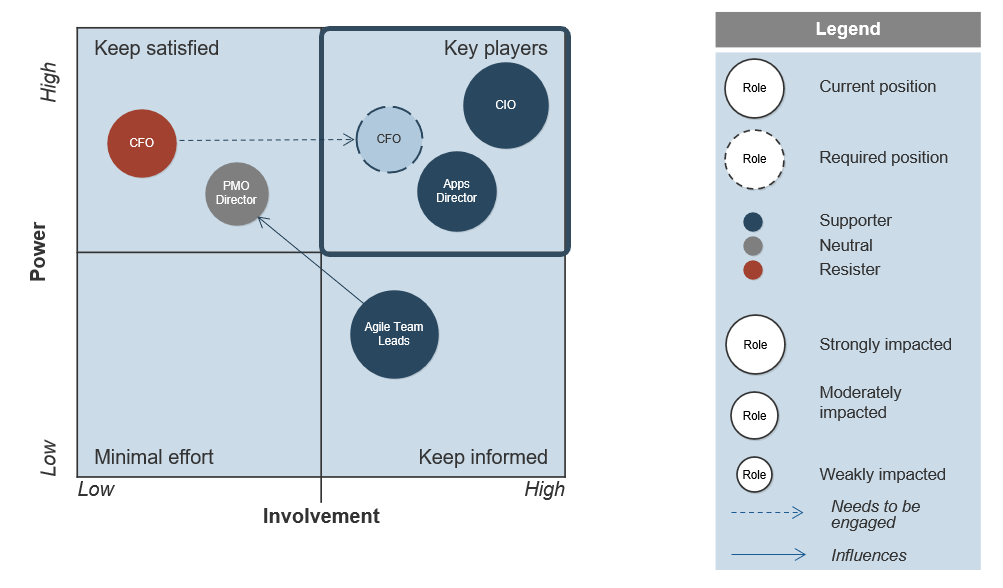

- Meet with key business stakeholders and the service desk staff who were involved in the decision to outsource.

- As a group, review the results from activity 1.1.1 (challenges with current service desk operations) and identify the goals and objectives of the outsourcing initiative.

- Determine the key performance indicator (KPI) for each goal.

- Identify the impacted stakeholder/s for each goal.

- Discuss checkpoint schedule for each goal to make sure the list stays updated.

Use the sample table as a starting point:

- Document your table in the Service Desk Outsourcing Project Charter Template.

| ID | Goal Description | KPI | Impacted Stakeholders | Checkpoint Schedule |

|---|---|---|---|---|

| 1 | Provide capacity to take calls outside of current service desk work hours |

|

|

|

| 2 | Take calls in different languages |

|

|

|

| 3 | Provide field support at remote sites with no IT presence without having to fly out an employee |

|

|

|

| 4 | Improve ease of management by vendor helping with managing and optimizing service desk tasks |

|

|

|

Download the Project Charter Template

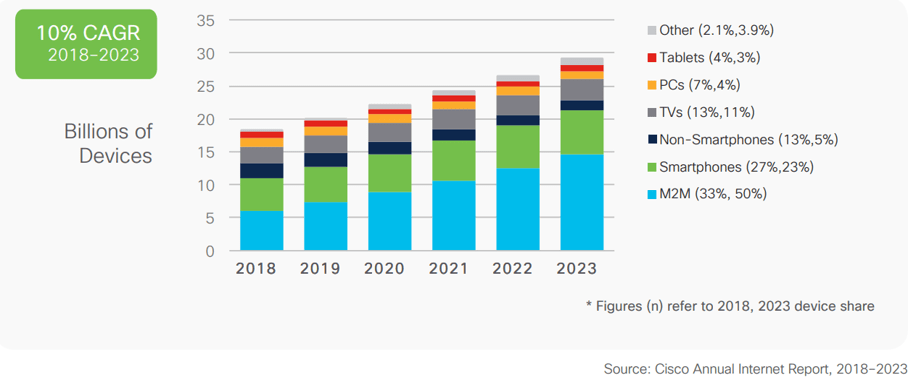

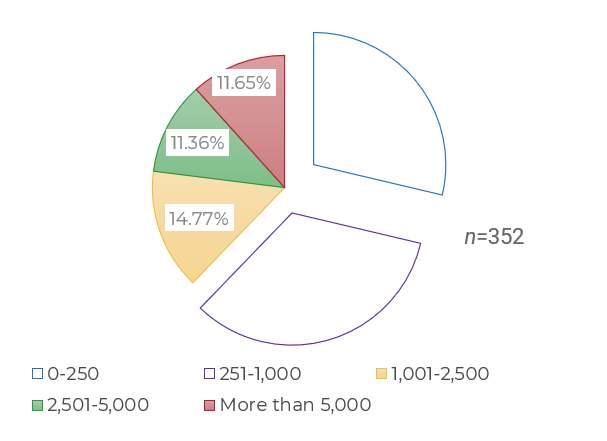

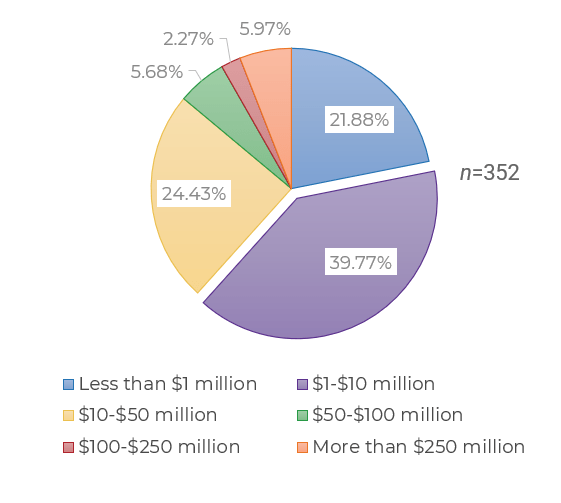

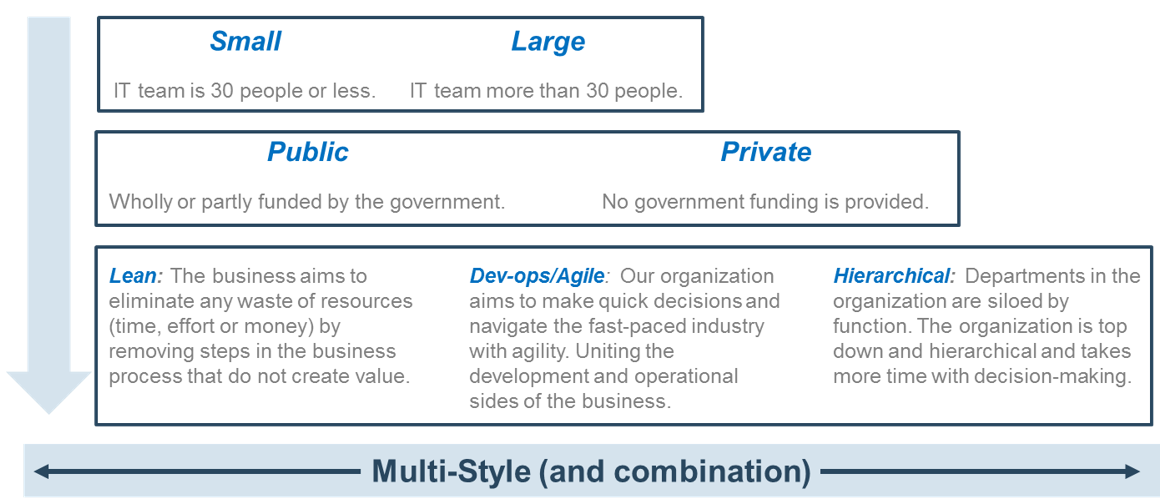

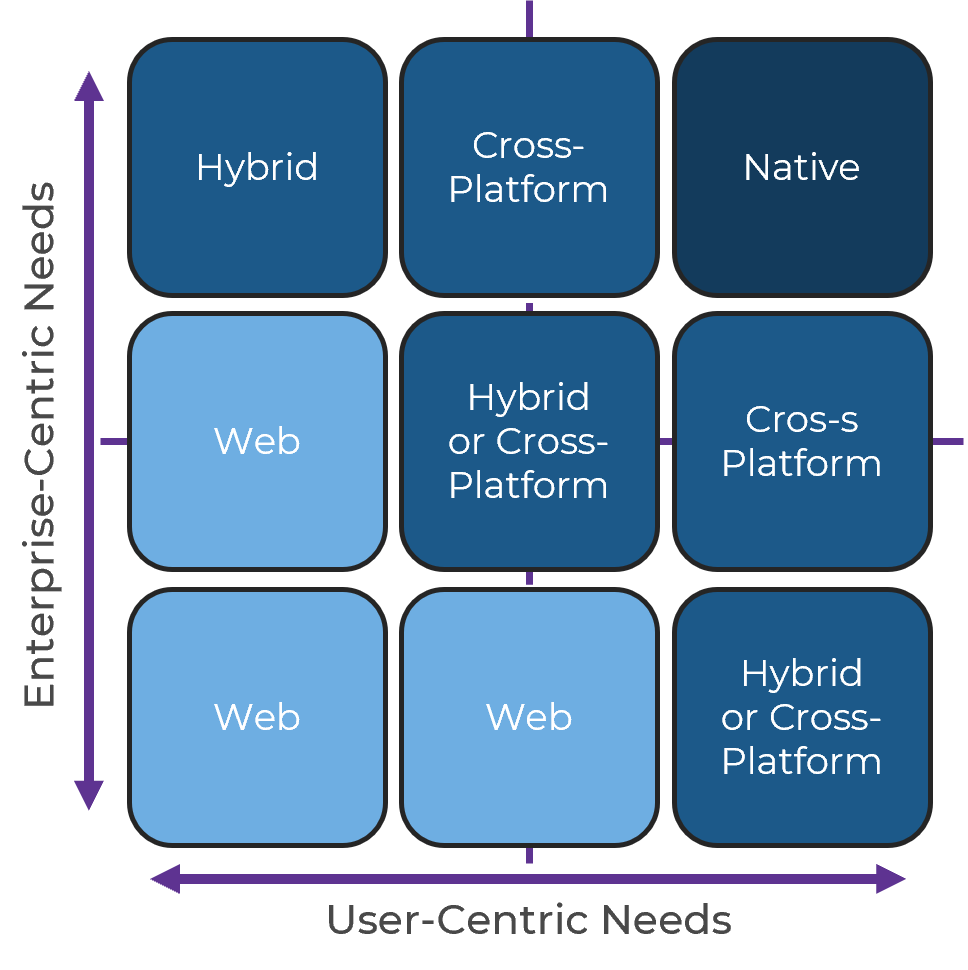

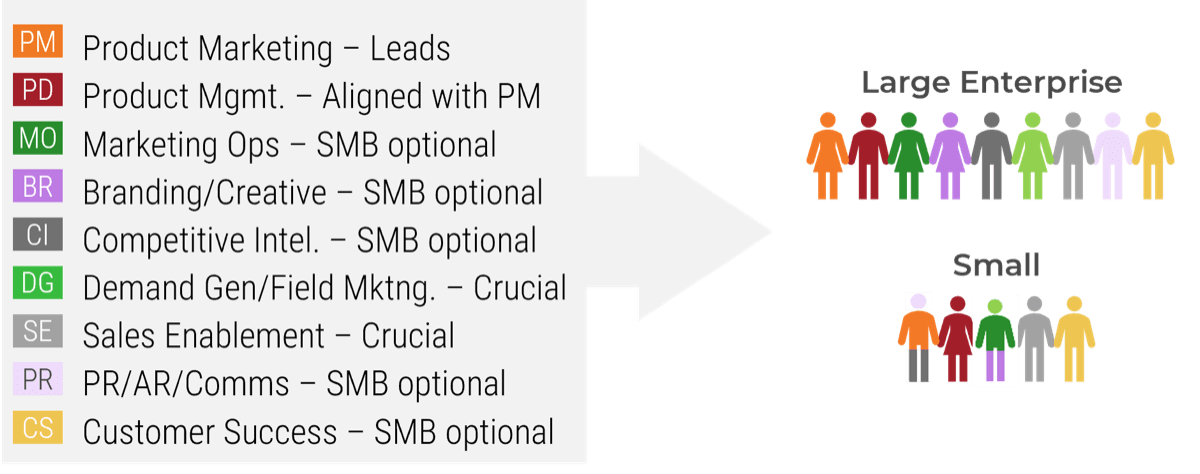

Evaluate organizational demographics to assess outsourcing rationale

The size, complexity, and maturity of your organization are good indicators of service desk direction with regards to outsourcing.

Organization Size

- As more devices, applications, systems, and users are added to the mix, vendor costs will increase but their ability to meet business needs will decrease.

- Small organizations are often either rejected by vendors for being too small or locked into a contract that is overkill for their actual needs (and budget).

Complexity

- Highly customized environments and organizations with specialized applications or stringent regulatory requirements are very difficult to outsource for a reasonable cost and acceptable quality.

- In these cases, the vendor is required to train skilled support or ends up escalating more tickets back to second- and third-level support.

Requirements

- Organizations looking to outsource must have defined outsourcing requirements before looking at vendors.

- Without a requirement assessment, the vendor won't have guidelines to follow and you won't be able to measure their adherence.

Info-Tech Insight

Although less adherence to service desk best practices can be one of the main incentives to outsourcing the service desk, IT should have minimal processes in place to be able to set expectations with targeting vendors.

1.1.4 Prioritize service desk outsourcing goals to help structure mission statement

0.5-1 hour

The evaluation process for outsourcing the service desk should be done very carefully. Project leaders should make sure they won't panic internal resources and impact their performance through the transition period.

If the outsourcing process is rushed, it will result in poor evaluation, inefficient decision making, and project failure.

- Refer to results in activity 1.1.3. Discuss the service desk outsourcing goals once again.

- Brainstorm the most important objectives. Use sticky notes to prioritize the items from the most important to the least important.

- Edit the order accordingly.

Input

- Project goals from activity 1.1.3

Output

- Prioritized list of outsourcing goals

Materials

- Whiteboard/flip charts

- Markers

- Sticky notes

- Laptops

Participants

- IT Director/CIO

- Service Desk Manager

- Service Desk Team

- IT Managers

Download the Project Charter Template

1.1.5 Craft a mission statement that demonstrates your decision to reach outsourcing objectives

Participants: IT Director, Service Desk Manager

0.5-1 hour

The IT mission statement specifies the function's purpose or reason for being. The mission should guide each day's activities and decisions. The mission statement should use simple and concise terminology and speak loudly and clearly, generating enthusiasm for the organization.

Strong IT mission statements:

- Articulate the IT function's purpose and reason for existence

- Describe what the IT function does to achieve its vision

- Define the customers of the IT function

- Can be described as:

- Compelling

- Easy to grasp

- Sharply focused

- Inspirational

- Memorable

- Concise

Sample mission statements:

- To help fulfill organizational goals, IT has decided to empower business stakeholders with outsourcing the service desk.

- To support efficient IT service provision, better collaboration, and effective communication, [Company Name] has decided to outsource the service desk.

- [Company Name] plans to outsource the service desk so it can identify bottlenecks and inefficiencies with current service desk processes and enable [Company Name] to innovate and support business growth.

- Considering the goals and benefits determined in the previous activities, outline a mission statement.

- Document your outsourcing mission statement in the "Project Overview" section of the Project Charter Template.

Download the Project Charter Template

Step 1.2

Assess outsourcing feasibility

Activities

1.2.1 Create a baseline of customer experience

1.2.2 Identify service desk processes to outsource

1.2.3 Design an outsourcing decision matrix for service desk processes and services

1.2.4 Discuss if you need to outsource only service desk or if additional services would benefit from outsourcing too

Define the goal

This step requires the following inputs:

- List of service desk tasks and responsibilities

This step involves the following participants:

- CIO

- IT Leadership

- Service Desk Manager

- Infrastructure Manager

Outcomes of this step

- End-user satisfaction with the service desk

- List of processes and services to outsource

1.2.1 Create a baseline of customer experience

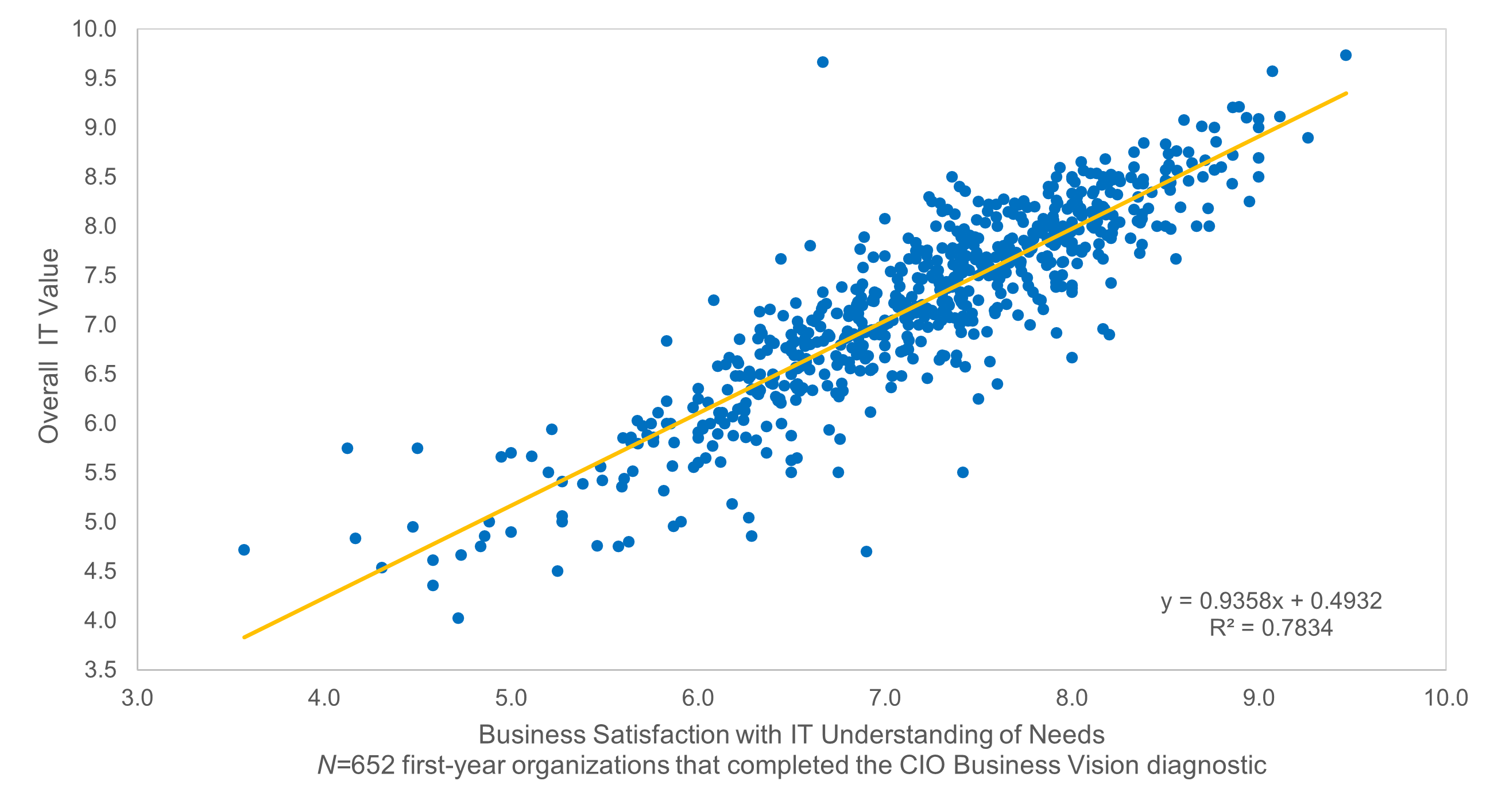

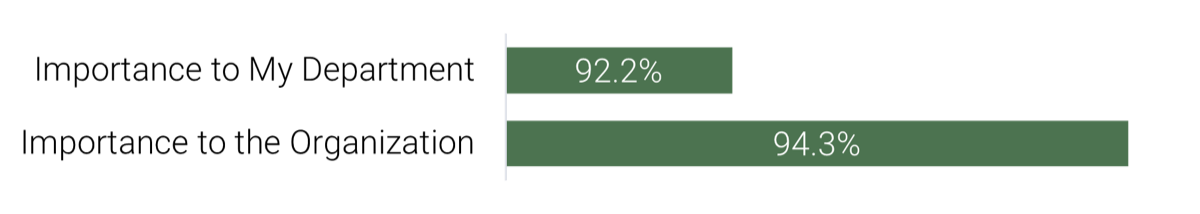

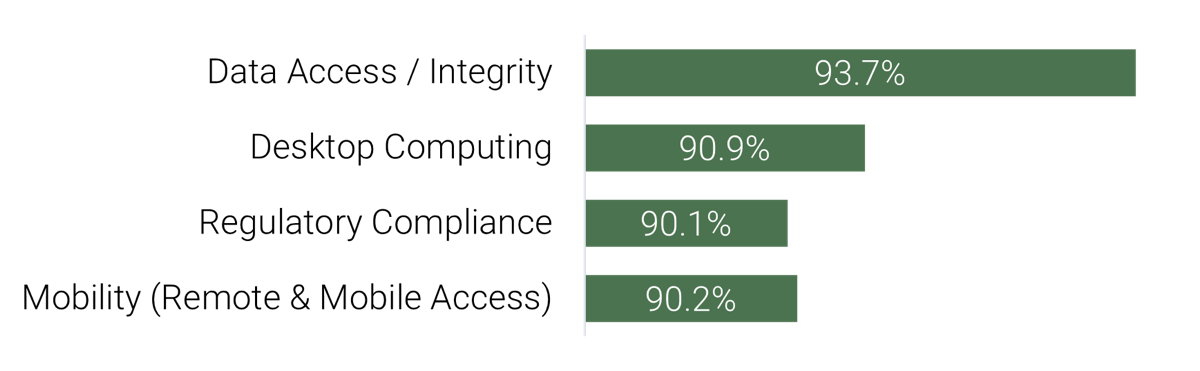

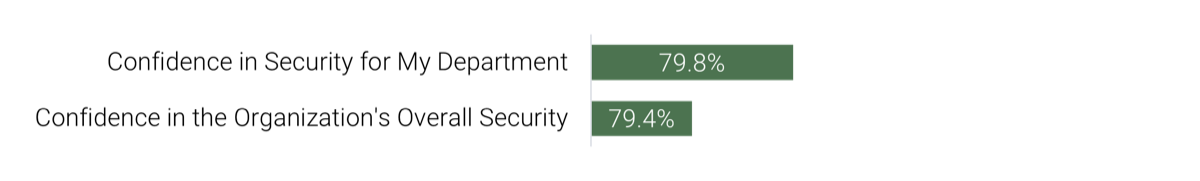

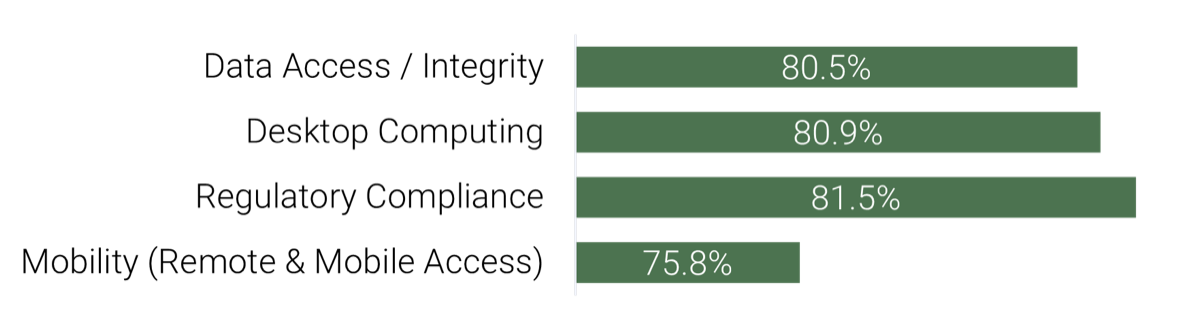

Solicit targeted department feedback on IT's core service capabilities, communications, and business enablement from end users. Use this feedback to assess end-user satisfaction with each service, broken down by department and seniority level.

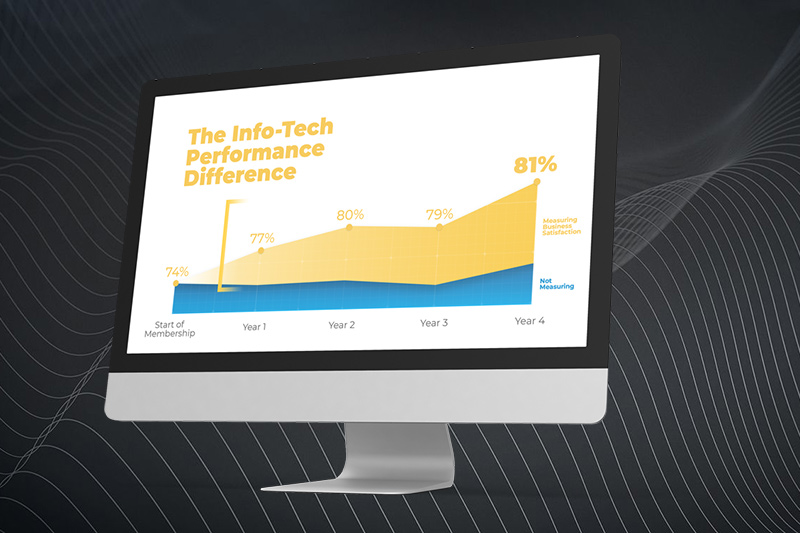

- Complete an end-user satisfaction survey to define the current state of your IT services, including service desk (timeliness and effectiveness). With Info-Tech's end-user satisfaction program, an analyst will help you set up the diagnostic and will go through the report with you.

- Evaluate survey results.

- Communicate survey results with team leads and discuss the satisfaction rates and comments of the end users.

- Schedule to launch another survey one year after outsourcing the service desk.

- Your results will be compared to the following year's results to analyze the overall success/failure of your outsourcing project.

A decrease of business and end-user satisfaction is a big drive to outsourcing the service desk. Conduct a customer service survey to discover your end-user experience prior to and after outsourcing the service desk.

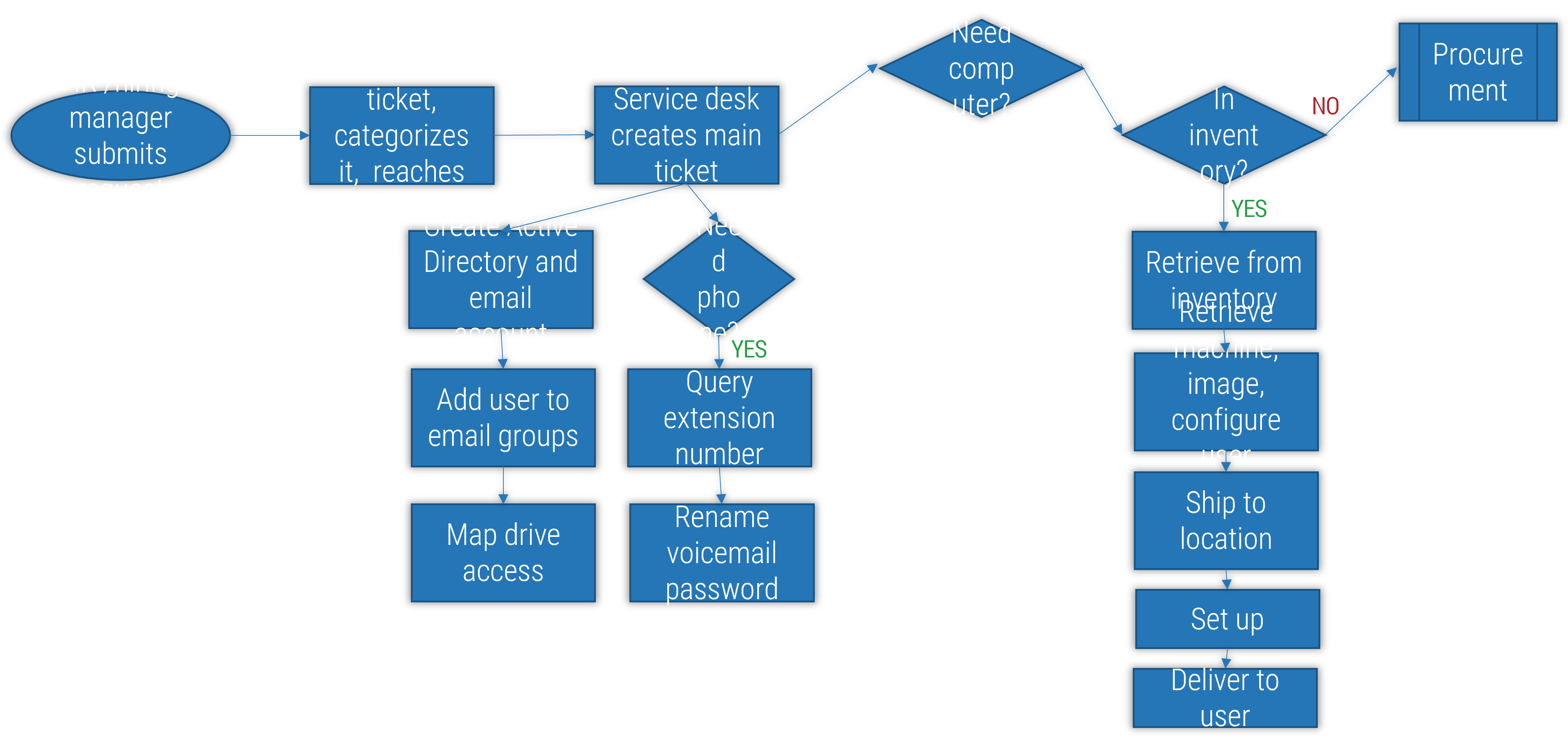

Don't get caught believing common misconceptions: outsourcing doesn't mean sending away all the work

First-time outsourcers often assume they are transferring most of the operations over to the vendor, but this is often not the case.

- Management of performance, SLAs, and customer satisfaction remain the responsibility of your organization.

- Service desk outsource vendors provide first-line response. This includes answering the phones, troubleshooting simple problems, and redirecting requests that are more complex.

- The vendor is often able to provide specialized support for standard applications (and for customized applications if you'll pay for it). However, the desktop support still needs someone onsite, and that service is very expensive to outsource.

- Tickets that are focused on custom applications and require specialized or advanced support are escalated back to your organization's second- and third-level support teams.

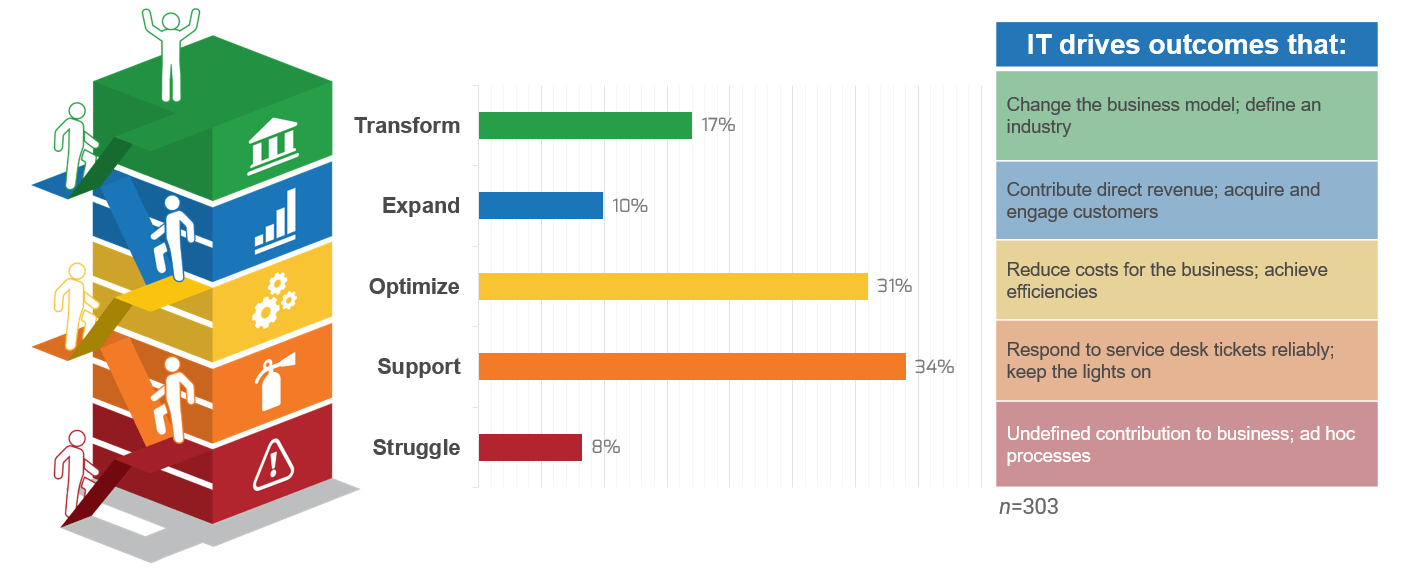

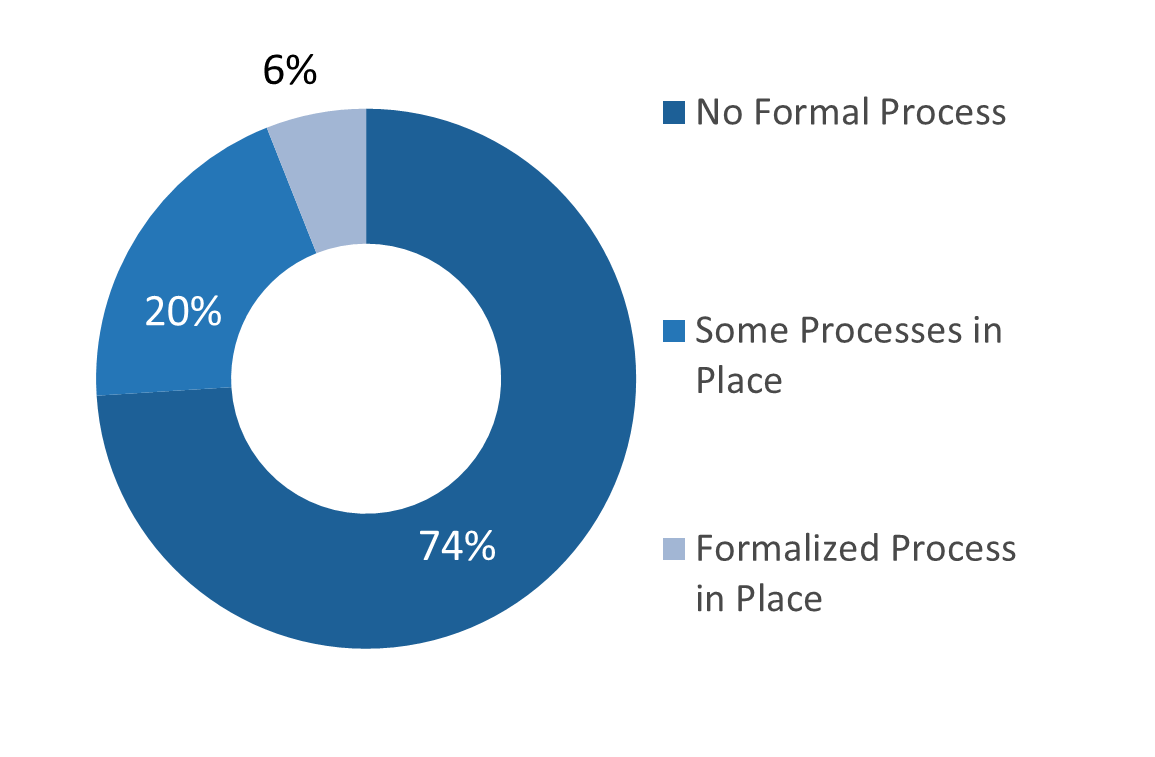

Switching to a vendor won't necessarily improve your service desk maturity

You should have minimal requirements before moving.

Whether managing in-house or outsourcing, it is your job to ensure core issues have been clarified, processes defined, and standards maintained. If your processes are ad-hoc or non-existent right now, outsourcing won't fix them.

You must have the following in place before looking to outsource:

- Defined reporting needs and plans

- Formalized skill-set requirements

- Problem management and escalation guidelines

- Ticket templates and classification rules

- Workflow details

- Knowledge base standards

Info-Tech Insight

If you expect your problems to disappear with outsourcing, they might just get worse.

Define long-term requirements

Anticipate growth throughout the lifecycle of your outsourcing contract and build that into the RFP

- Most outsourcing agreements typically last three to five years. In that time, you risk outgrowing your service provider by neglecting to define your long-term service desk requirements.

- Outgrowing your vendor before your contract ends can be expensive due to high switching costs. Managing multiple vendors can also be problematic.

- It is crucial to define your service desk requirements before developing a request for proposal to make sure the service you select can meet your organization's needs.

- Make sure that the business is involved in this planning stage, as the goals of IT need to scale with the growth strategy of the business. You may select a vendor with no additional capacity despite the fact that your organization has a major expansion planned to begin two years from now. Assessing future requirements also allows you to culture match with the vendor. If your outlooks and practices are similar, the match will likely click.

Info-Tech Insight

Don't select a vendor for what your company is today – select a vendor for what your company will be years from now. Define your future service desk requirements in addition to your current requirements and leave room for growth and development.

You can't outsource everything

Manage the things that stay in-house well or suffer the consequences.

"You can't outsource management; you can only outsource supervision." Barry Cousins, Practice Lead, Info-Tech Research Group | |

|---|---|

What can be the vendor in charge of? | What stays in-house? |

|

|

Info-Tech Insight

The need for a Service Desk Manager does not go away when you outsource. In fact, the need becomes even stronger and never diminishes.

Assess current service desk processes before outsourcing

Process standards with areas such as documentation, workflow, and ticket escalation should be in place before the decision to outsource has been made.

Every effective service desk has a clear definition of the services that they are performing for the end user. You can't provide a service without knowing what the services are.

MSPs typically have their own set of standards and processes in play. If your service desk is not at a similar level of maturity, outsourcing will not be pleasant.

Make sure that your metrics are reported consistently and that they tell a story.

"Establish baseline before outsourcing. Those organizations that don't have enough service desk maturity before outsourcing should work with the outsourcer to establish the baseline."

– Yev Khobrenkov, Enterprise Consultant, Solvera Solutions

Info-Tech Insight

Outsourcing vendors are not service desk builders; they're service desk refiners. Switching to a vendor won't improve your maturity; you must have a certain degree of process maturity and standardization before moving.

Case Study

INDUSTRY: Cleaning Supplies

SOURCE: PicNet

Challenge

- Reckitt Benckiser of Australia determined that its core service desk needed to be outsourced.

- It would retain its higher level service desk staff to work on strategic projects.

- The MSP needed to fulfill key requirements outlined by Reckitt Benckiser.

Solution

- Reckitt Benckiser recognized that its rapidly evolving IT needs required a service desk that could fulfill the following tasks:

- Free up internal IT staff.

- Provide in-depth understanding of business apps.

- Offer efficient, cost-effective support onsite.

- Focus on continual service improvement (CSI).

Results

- An RFP was developed to support the outsourcing strategy.

- With the project structure outlined and the requirements of the vendor for the business identified, Reckitt Benckiser could now focus on selecting a vendor that met its needs.

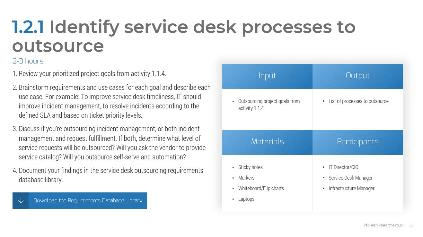

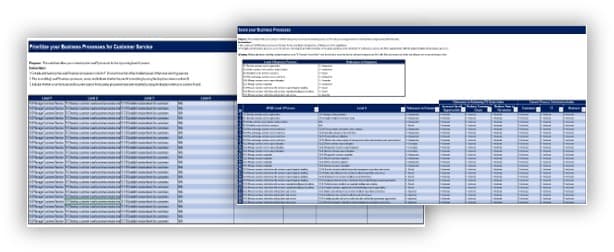

1.2.1 Identify service desk processes to outsource

2-3 hours

Review your prioritized project goals from activity 1.1.4.

Brainstorm requirements and use cases for each goal and describe each use case. For example: To improve service desk timeliness, IT should improve incident management, to resolve incidents according to the defined SLA and based on ticket priority levels.

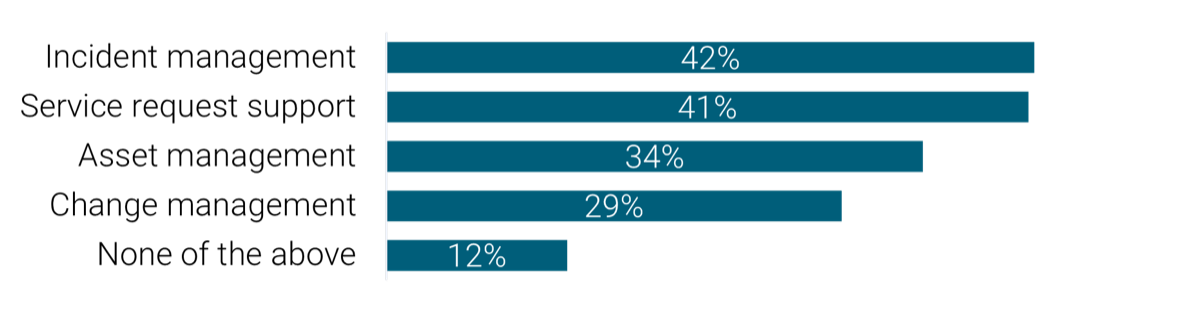

Discuss if you're outsourcing just incident management or both incident management and request fulfillment. If both, determine what level of service requests will be outsourced? Will you ask the vendor to provide a service catalog? Will you outsource self-serve and automation?

Document your findings in the service desk outsourcing requirements database library.

Input

- Outsourcing project goals from activity 1.1.4

Output

- List of processes to outsource

Materials

- Sticky notes

- Markers

- Whiteboard/flip charts

- Laptops

Participants

- IT Director/CIO

- Service Desk Manager

- Service Desk Team

Download the Requirements Database Library

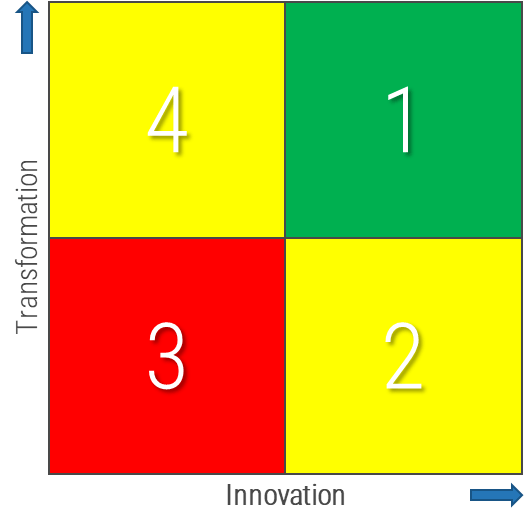

1.2.2 Design an outsourcing decision matrix for service desk processes and services

Participants: IT Director, Service Desk Manager, Infrastructure manager

2-3 hours

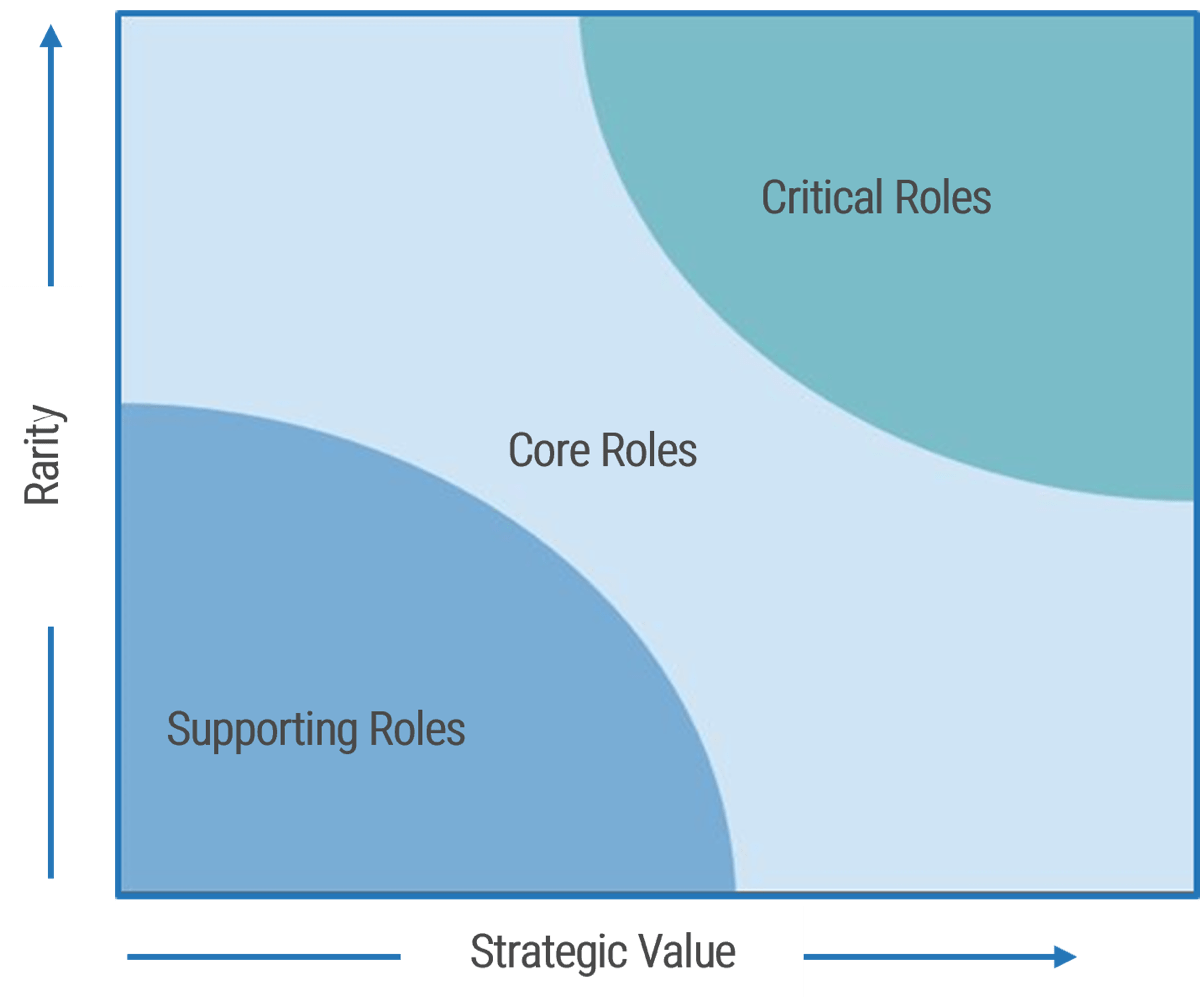

Most successful service desk outsourcing engagements have a primary goal of freeing up their internal resources to work on complex tasks and projects. The key outsourcing success factor is to find out internal services and processes that are standardized or should be standardized, and then determine if they can be outsourced.

- Review the list of identified service desk processes from activity 1.2.1.

- Discuss the maturity level of each process (low, medium, high) and document under the maturity column of the Outsource the Service Desk Requirements Database Library.

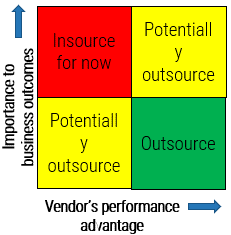

- Use the following decision matrix for each process. Discuss which tasks are important to strategic objectives, which ones provide competitive advantage, and which ones require specialized in-house knowledge.

- Identify processes that receive high vendor's performance advantage. For instance, access to talent, lower cost at scale, and access to technology.

- In your outsourcing assessment, consider a narrow scope of engagement and a broad view of what is important to business outcome.

- Based on your findings, determine the priority of each process to be outsourced. Document results in the service desk outsourcing requirements database library, and section 4.1 of the service desk outsourcing project charter.

|

|

|

Download the Requirements Database Library

Download the Project Charter Template

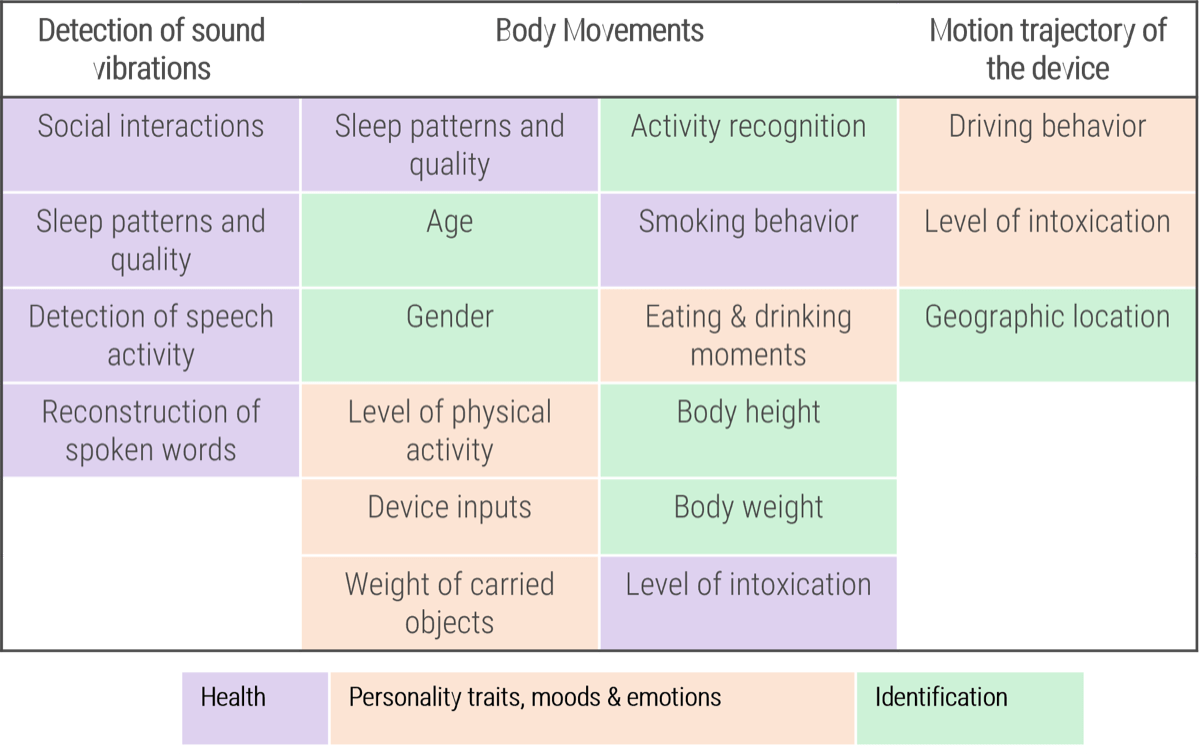

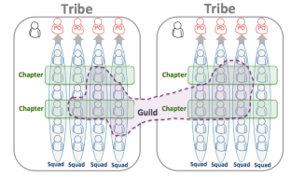

Maintain staff and training: you need to know who is being hired, how, and why

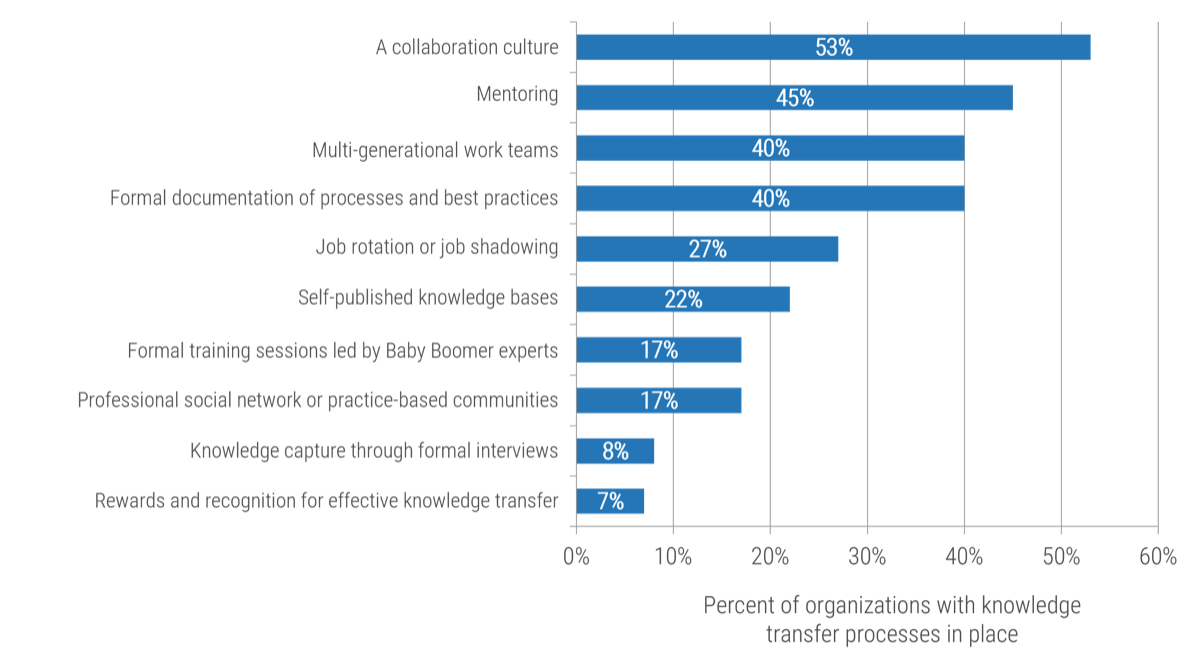

Define documentation rules to retain knowledge

- Establish a standard knowledge article template and list of required information.

- Train staff on the requirements of knowledge base creation and management. Help them understand the value of the time spent recording their work.

- It is your responsibility to assure the quality of each knowledge article. Outline accountabilities for internal staff and track for performance evaluations.

For information on better knowledge management, refer to Info-Tech's blueprint Optimize the Service Desk With a Shift-Left Strategy.

Expect to manage stringent skills and training standards

- Plan on being more formal about a Service Manager position and spending more time than you allocated previously.

- Complete a thorough assessment of the skills you need to keep the service desk running smoothly.

- Don't forget to account for any customized or proprietary systems. How will you train vendor staff to accommodate your needs? What does their turnaround look like: would it be more likely that you acquire a dependable employee in-house?

- Staffing requirements need to be actively monitored to ensure the outsourcer doesn't have degradation of quality or hiring standards. Don't assume that things run well – complete regular checks and ask for access to audit results.

- Are the systems and data being accessed by the vendor highly sensitive or subject to regulatory requirements? If so, it is your job to ensure that vendor staff are being screened appropriately.

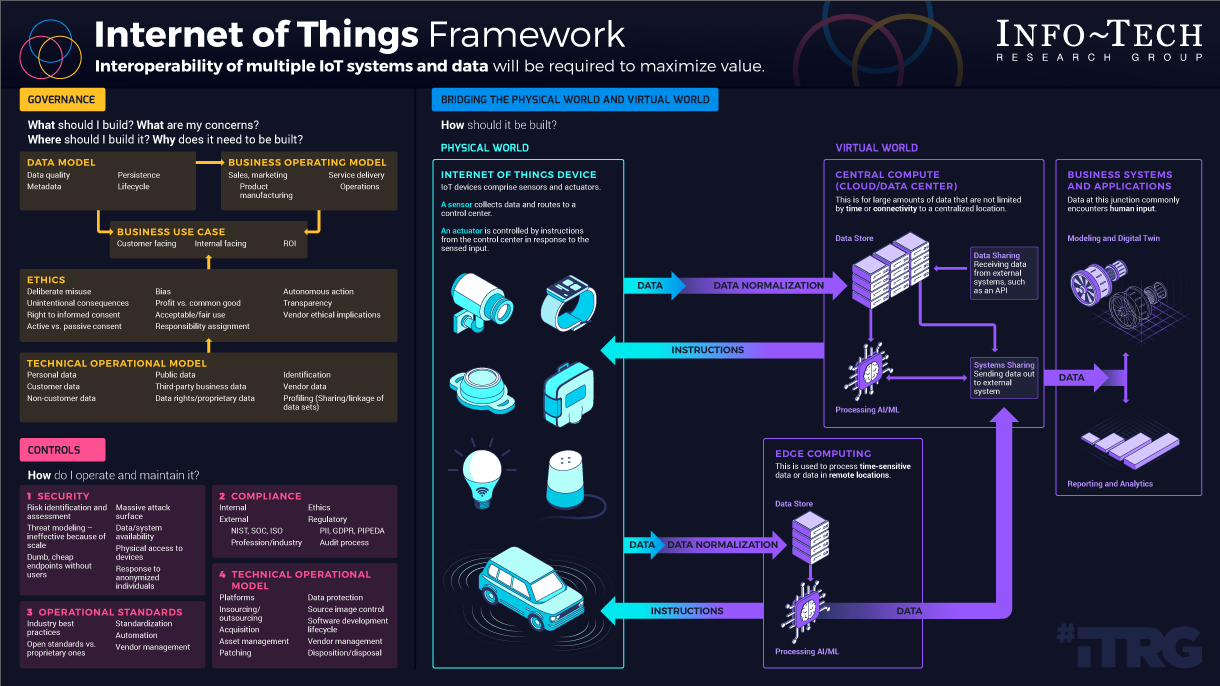

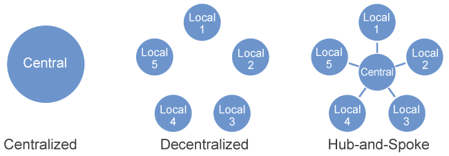

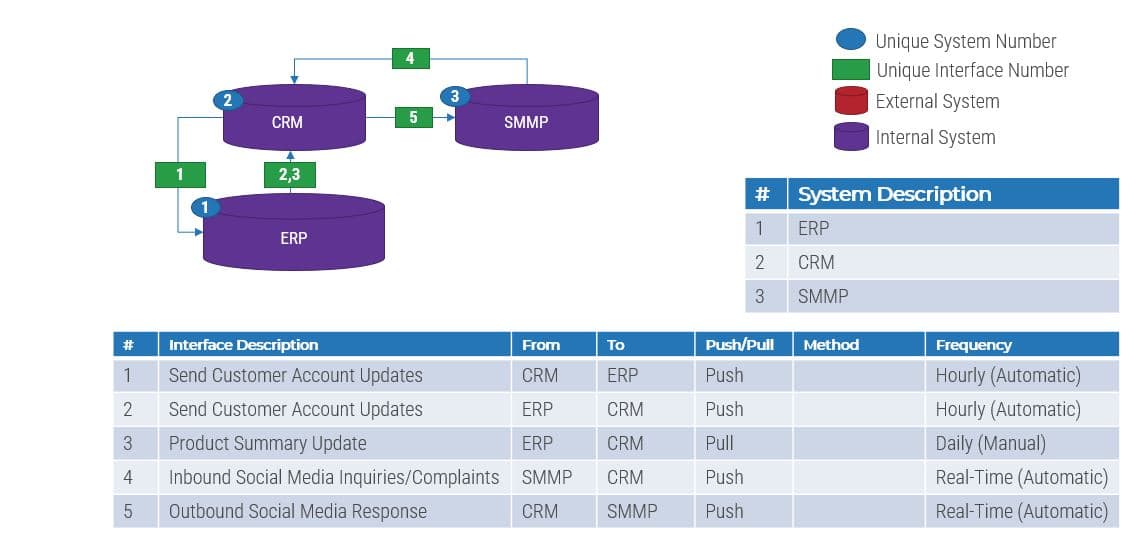

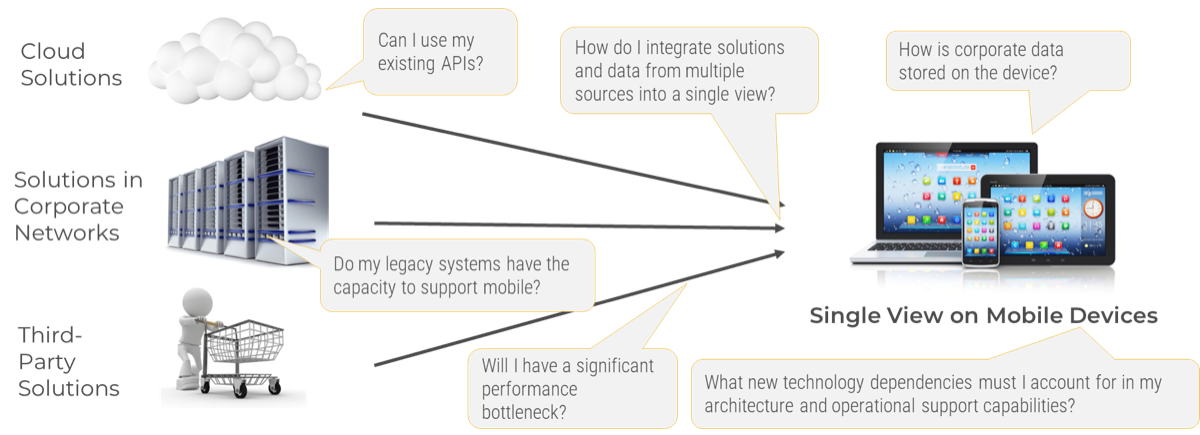

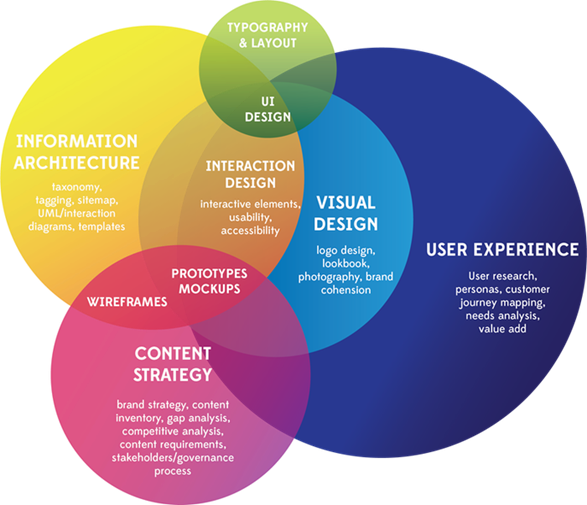

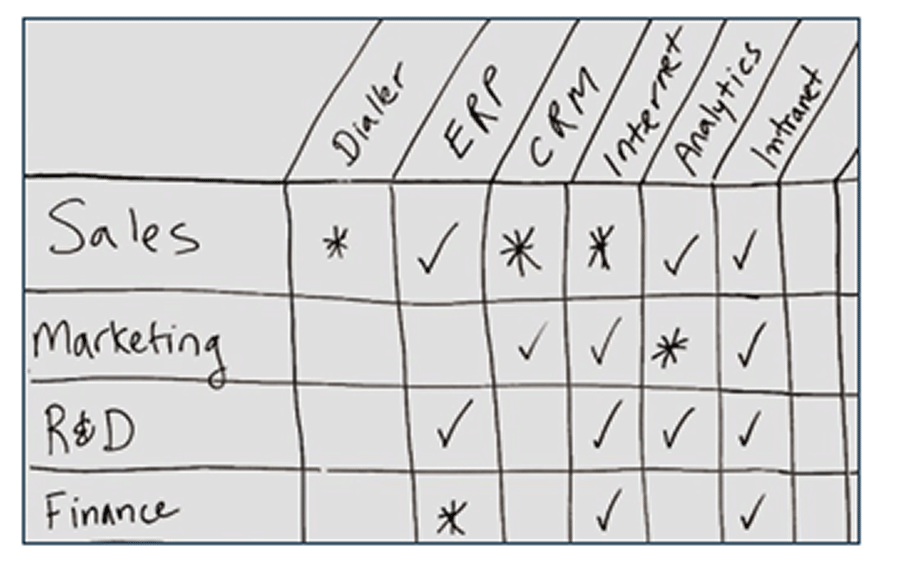

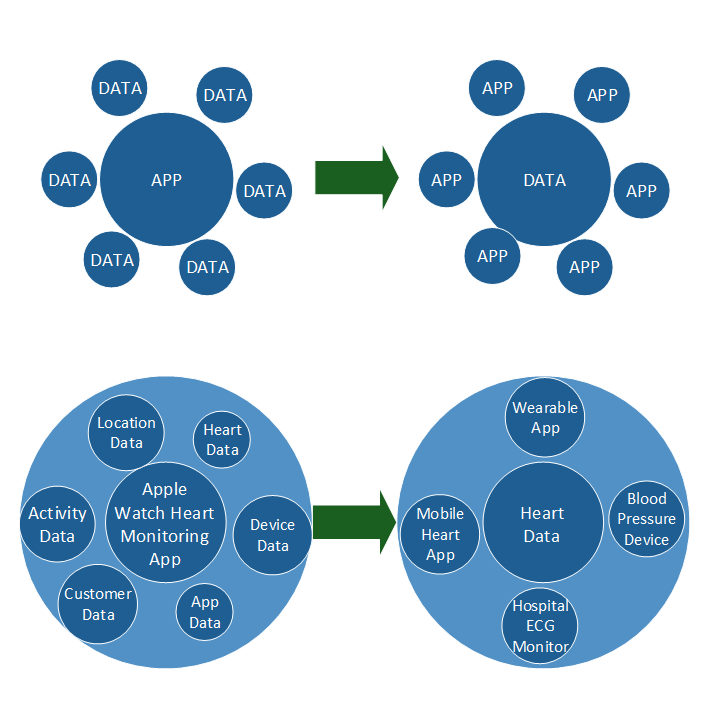

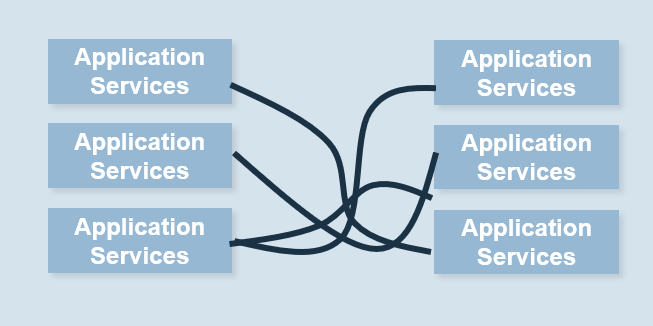

Does your service desk need to integrate to other IT services?

A common challenge when outsourcing multiple services to more than one vendor is a lack of collaboration and communication between vendors.

- Leverage SIAM capabilities to integrate service desk tasks to other IT services, if needed.

- "Service Integration and Management (SIAM) is a management methodology that can be applied in an environment that includes services sourced from a number of service providers" (Scopism Limited, 2020).

- SIAM supports cross-functional integrations. Organizations that look for a single provider will be less likely to get maximum benefits from SIAM.

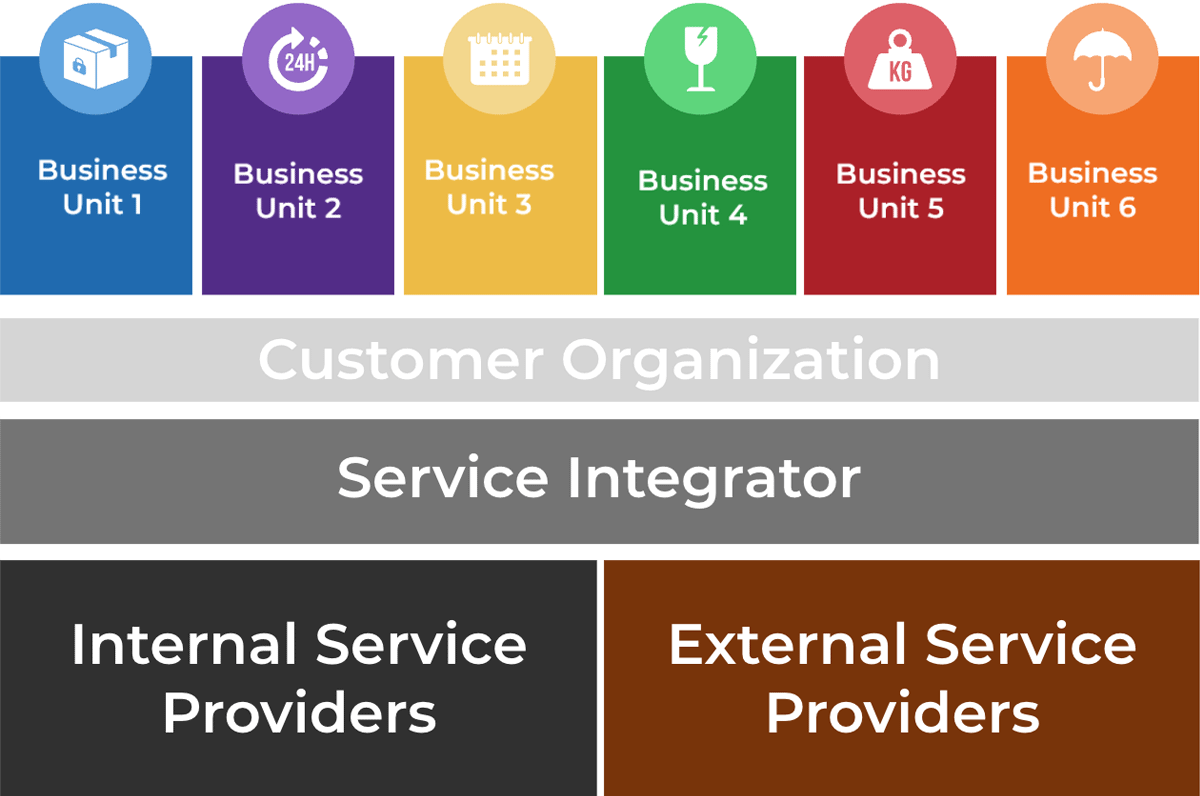

There are three layers of entities in SIAM:

- Customer Organization: The customer who receives services, who defines the relationship with service providers.

- Service Integrator: End-to-end service governance and integration is done at this layer, making sure all service providers are committed to their services.

- Service Provider: Responsible party for service delivery according to contract. It can be combination of internal provider, managed by internal agreements, and external provider, managed by SLAs between providers and customer organization.

Use SIAM to obtain better results from multiple service providers

In the SIAM model, the customer organization keeps strategic, governance, and business activities, while integrating other services (either internally or externally).

SIAM Layers. Source: SIAM Foundation BoK

Utilize SIAM to obtain better results from multiple service providers

SIAM reduces service duplication and improves service delivery via managing internal and external service providers.

To utilize the SIAM model, determine the following components:

- Service providers

- Service consumers

- Service outcomes

- Service obstacles and boundaries

- Service dependencies

- Technical requirements and interactions for each service

- Service data and information including service levels

To learn more about adopting SIAM, visit Scopism.

1.2.3 Discuss if you need to outsource only service desk or if additional services would benefit from outsourcing too

1-2 hours

- Discuss principles and goals of SIAM and how integrating other services can apply within your processes.

- Review the list of service desk processes and tasks to be outsourced from activities 1.2.1 and 1.2.2.

- Brainstorm a list of other services that are outsourced/need to be outsourced.

- Determine providers of each service (both internal and external). Document the other services to be integrated in the project charter template and requirements database library.

Input

- SIAM objectives

- List of service desk processes to outsource

Output

- List of other services to outsource and integrate in the project

Materials

- Sticky notes

- Markers

- Whiteboard/flip charts

- Laptops

Participants

- IT Director/CIO

- Service Desk Manager

- Service Desk Team

Download the Requirements Database Library

Download the Project Charter Template

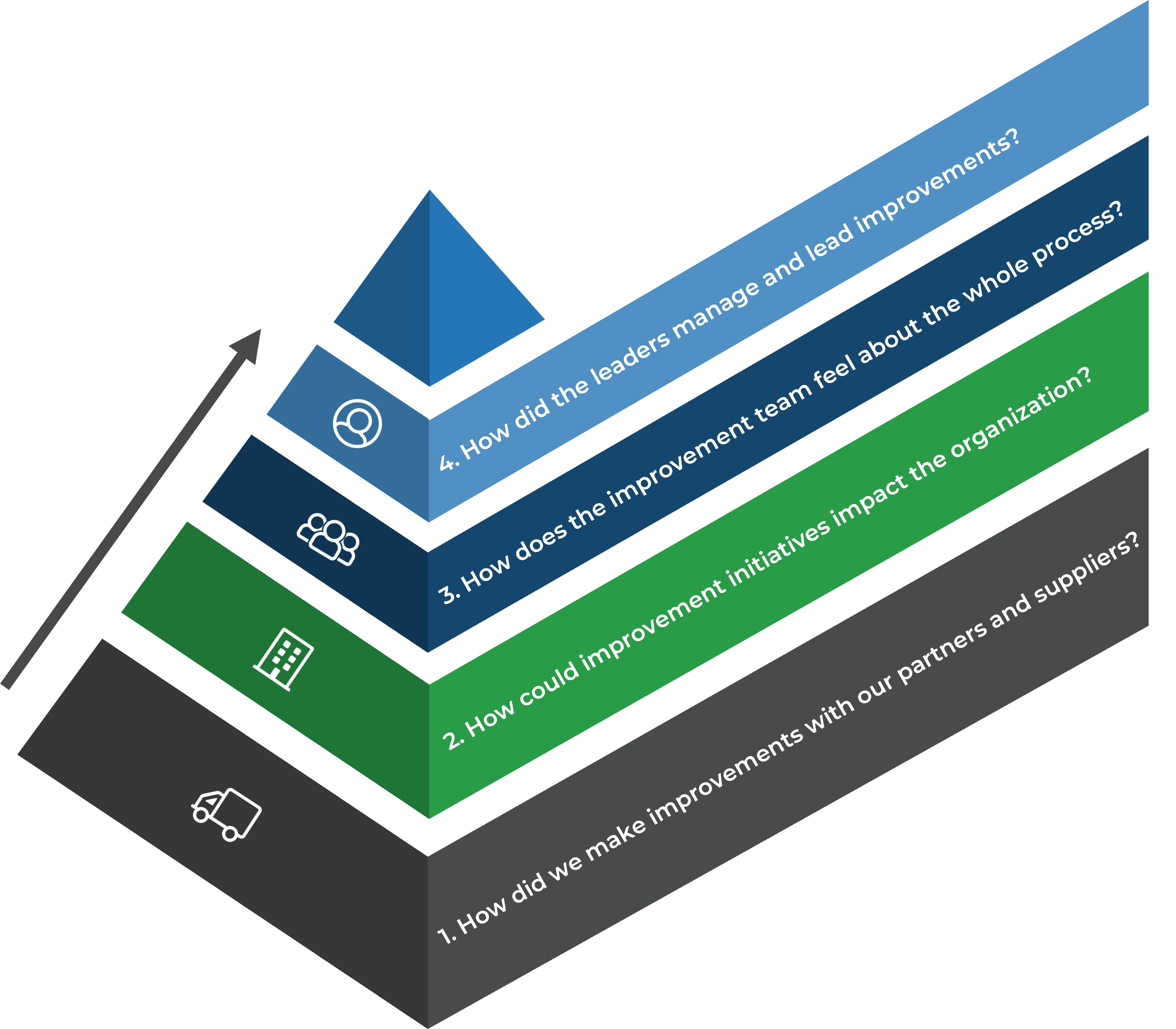

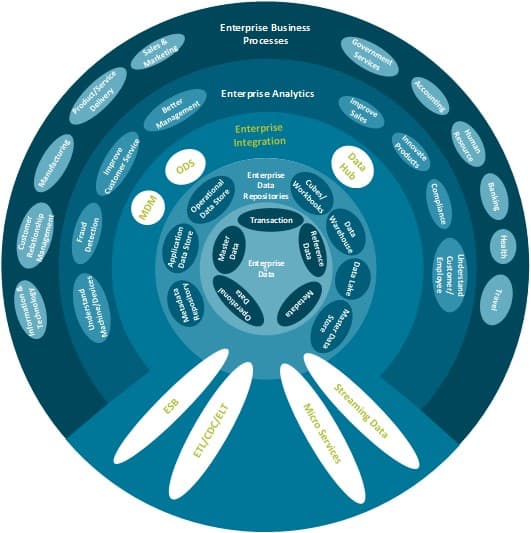

Establish requirements for problem management in the outsourcing plan

Your MSP should not just fulfill SLAs – they should be a proactive source of value.

Problem management is a group effort. Make sure your internal team is assisted with sufficient and efficient data by the outsourcer to conduct a better problem management.

Clearly state your organization's expectations for enabling problem management. MSPs may not necessarily need, and cannot do, problem management; however, they should provide metrics to help you discover trends, define recurring issues, and enable root cause analysis.

For more information on problem management, refer to Info-Tech's blueprint Improve Incident and Problem Management.

PROBLEM MANAGEMENT

INCIDENT MANAGEMENT

INTAKE: Ticket data from incident management is needed for incident matching to identify problems. Critical Incidents are also a main input to problem management.

EVENT MANAGEMENT

INTAKE: SMEs and operations teams monitoring system health events can identify indicators of potential future issues before they become incidents.

APPLICATION, INFRASTRUCTURE, and SECURITY TEAMS

ACTION: Problem tickets require investigation from relevant SMEs across different IT teams to identify potential solutions or workarounds.

CHANGE MANAGEMENT

OUTPUT: Problem resolution may need to go through Change Management for proper authorization and risk management.

Outline problem management protocols to gain value from your service provider

- For example, with a deep dive into ticket trend analysis, your MSP should be able to tell you that you've had a large number of tickets on a particular issue in the past month, allowing you to look into means to resolve the issue and prevent it from reoccurring.

- A proactive MSP should be able to help your service levels improve over time. This should be built into the KPIs and metrics you ask for from the outsourcer.

Sample Scenario

Your MSP tracks ticket volume by platform.

There are 100 network tickets/month, 200 systems tickets/month, and 5,000 end-user tickets/month.

Tracking these numbers is a good start, but the real value is in the analysis. Why are there 5,000 end-user tickets? What are the trends?

Your MSP should be providing a monthly root-cause analysis to help improve service quality.

Outcomes:

- Meeting basic SLAs tells a small part of the story. The MSP is performing well in a functional sense, but this doesn't shed any insight on what kind of knowledge or value is being added.

- The MSP should provide routine updates on ticket trends and other insights gained through data analysis.

- A commitment to continual improvement will provide your organization with value throughout the duration of the outsourcing agreement.

Phase 2

Design an Outsourcing Strategy

Define the goal | Design an outsourcing strategy | Develop an RFP and make a long-term relationship |

|---|---|---|

1.1 Identify goals and objectives 1.2 Assess outsourcing feasibility | 2.1 Identify project stakeholders 2.2 Outline potential risks and constraints | 3.1 Prepare a service overview and responsibility matrix 3.2 Define your approach to vendor relationship management 3.3 Manage the outsource relationship |

This phase will walk you through the following activities:

- Identify roles and responsibilities

- Determine potential risks of outsourcing the service desk

- Build a list of metrics

This phase involves the following participants:

- Service Desk Team

- IT Leadership

Define requirements for outsourcing service desk support

Step 2.1

Identify project stakeholders

Activity

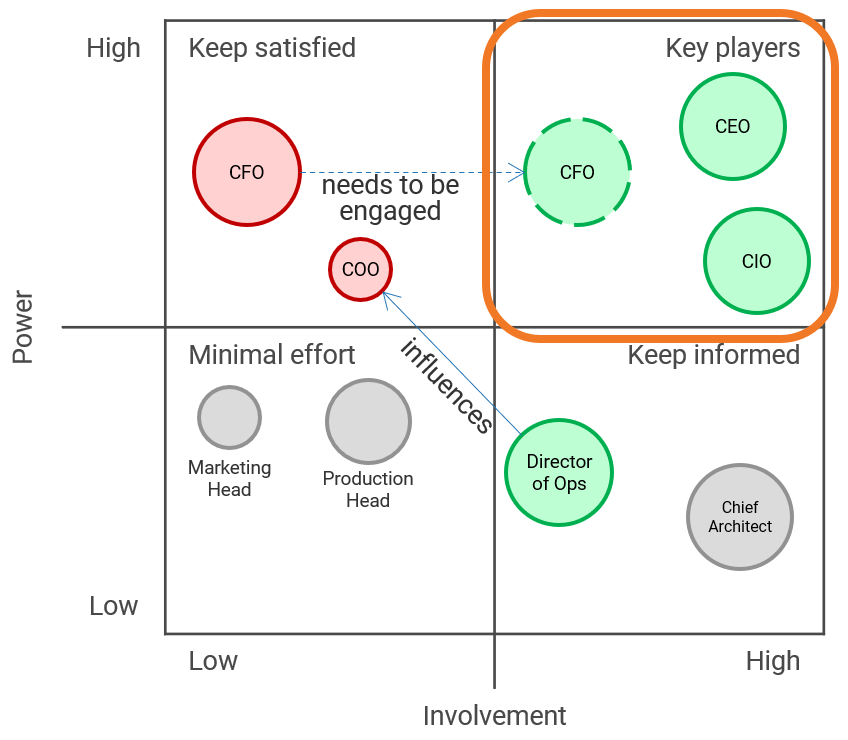

2.1.1 Identify internal outsourcing roles and responsibilities

Design an Outsourcing Strategy

This step requires the following inputs:

- List of service desk roles

- Service desk outsourcing goals

This step involves the following participants:

- IT Managers

- Project Team

- Service Desk Manager

Outcome of this step

- Outsourcing roles and responsibilities

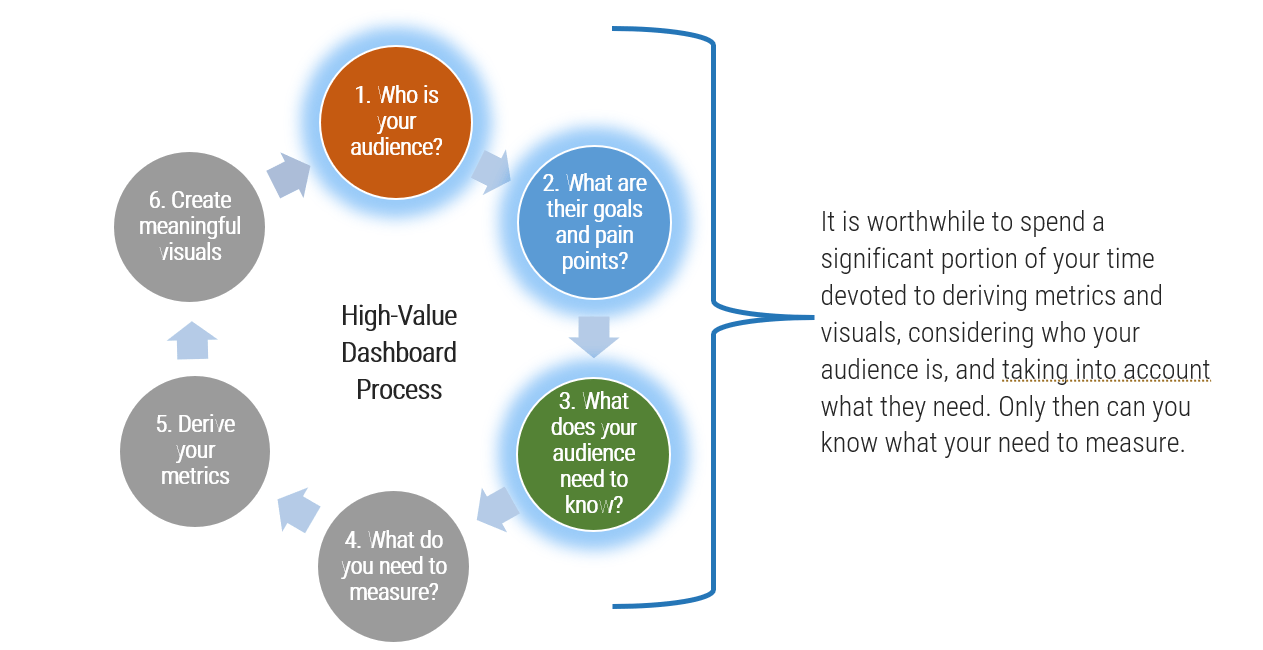

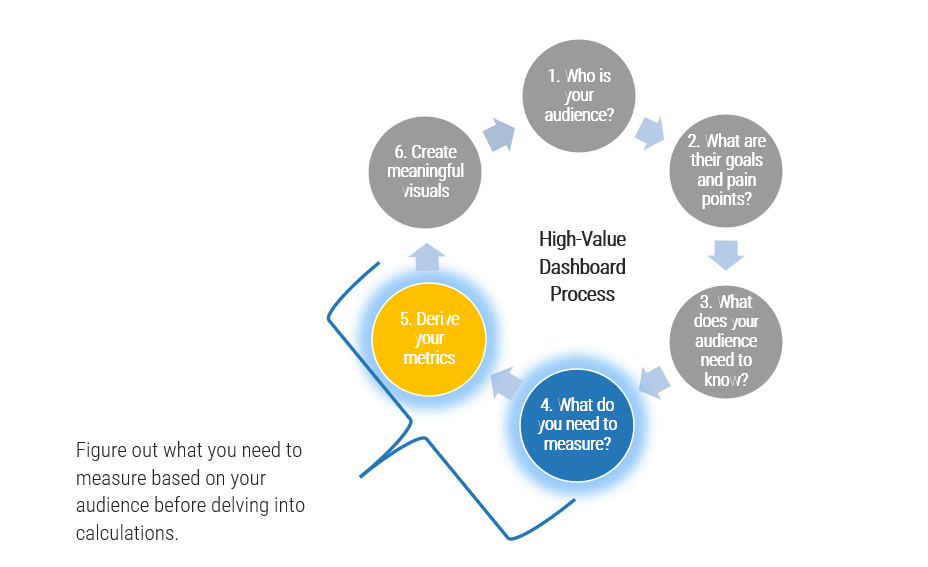

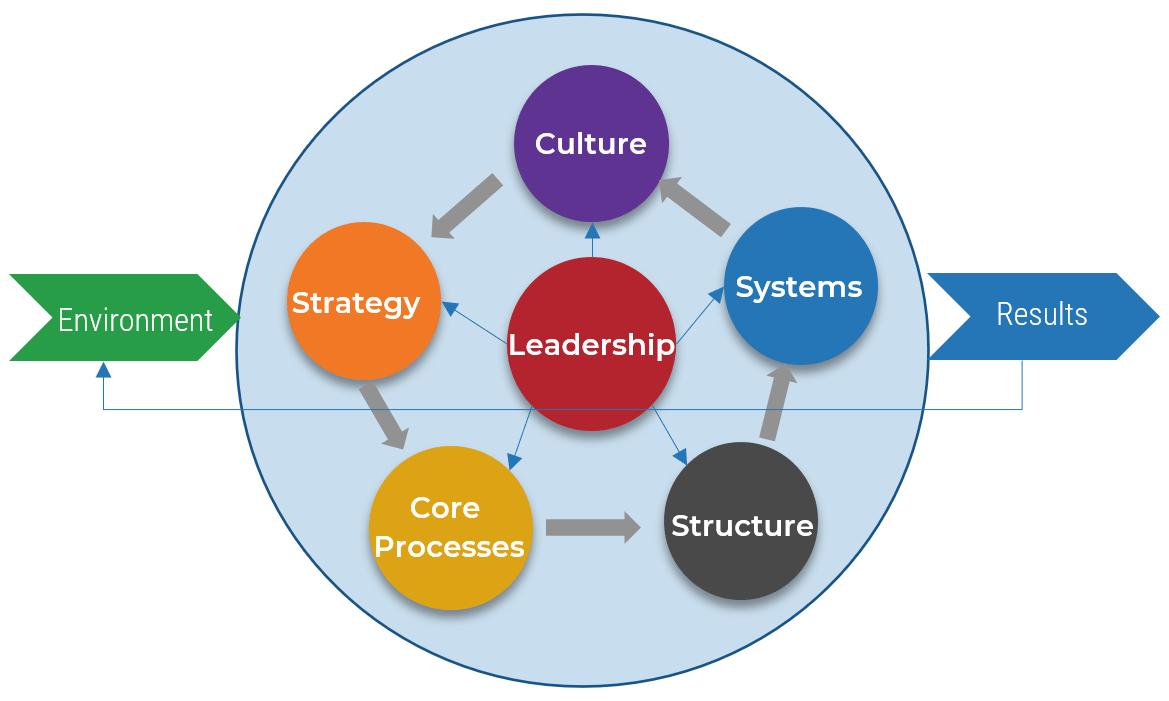

Design an outsourcing strategy to capture the vision of your service desk

An outsourcing strategy is crucial to the proper accomplishment of an outsourcing project. By taking the time to think through your strategy beforehand, you will have a clear idea of your desired outcomes. This will make your RFP of higher quality and will result in a much easier negotiation process.

Most MSPs are prepared to offer a standard proposal to clients who do not know what they want. These are agreements that are doomed to fail. A clearly defined set of goals (discussed in Phase 1), risks, and KPIs and metrics (covered in this phase) makes the agreement more beneficial for both parties in the long run.

- Identify goals and objectives

- Determine mission statement

- Define roles and responsibilities

- Identify risks and constraints

- Define KPIs and metrics

- Complete outsourcing strategy

A successful outsourcing initiative depends on rigorous preparation

Outsourcing is a garbage in, garbage out initiative. You need to give your service provider the information they need to provide an effective product.

- Data quality is critical to your outsourcing initiative's success.

- Your vendor will be much better equipped to help you and to better price its services if it has a thorough understanding of your IT environment.

- This means more than just building a catalog of your hardware and software. You will need to make available documented policies and processes so you and your vendor can understand where they fit in.

- Failure to completely document your environment can lead to a much longer time to value as your provider will have to spend much more time (and thus much more money) getting their service up and running.

"You should fill the gap before outsourcing. You should make sure how to measure tickets, how to categorize, and what the cost of outsourcing will be. Then you'll be able to outsource the execution of the service. Start your own processes and then outsource their execution."

– Kris Krishan, Head of IT and business systems, Waymo

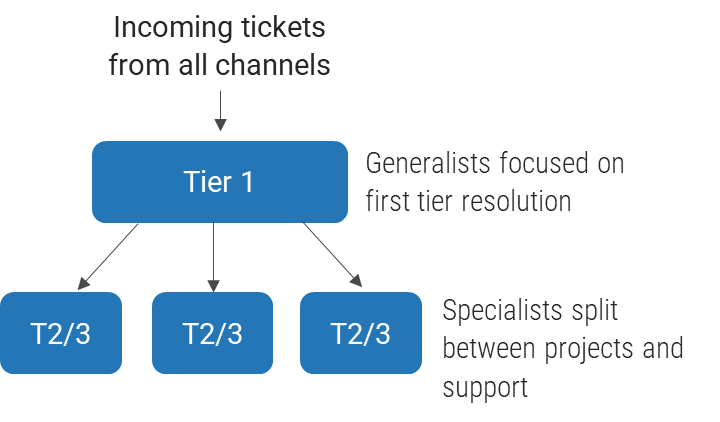

Case Study

Digital media company built an outsourcing strategy to improve customer satisfaction

INDUSTRY: Digital Media

SOURCE: Auxis

Challenge

A Canadian multi-business company with over 13,000 employees would like to maintain a growing volume of digital content with their endpoint management.

The client operated a tiered model service desk. Tier 1 was outsourced, and tier 2 tasks were done internally, for more complex tasks and projects.

As a result of poor planning and defining goals, the company had issues with:

- Low-quality ticket handling

- High volume of tickets escalated to tier 2, restraining them from working on complex tickets

- High turn over and a challenge with talent retention

- Insufficient documentation to train external tier 1 team

- Long resolution time and low end-user satisfaction

Solution

The company structured a strategy for outsourcing service desk and defined their expectations and requirements.

They engaged with another outsourcer that would fulfill their requirements as planned.

With the help of the outsourcer's consulting team, the client was able to define the gaps in their existing processes and system to:

- Implement a better ticketing system that could follow best-practices guidelines

- Restructure the team so they would be able to handle processes efficiently

Results

The proactive planning led to:

- Significant improvement in first call resolution (82%).

- MTTR improvement freed tier 2 to focus on business strategic objectives and allowed them to work on higher-value activities.

- With a better strategy around outsourcing planning, the company saved 20% of cost compared to the previous outsourcer.

- As a result of this partnership, the company is providing a 24/7 structure in multiple languages, which is aligned with the company's growth.

- Due to having a clear strategy built for the project, the client now has better visibility into metrics that support long-term continual improvement plans.

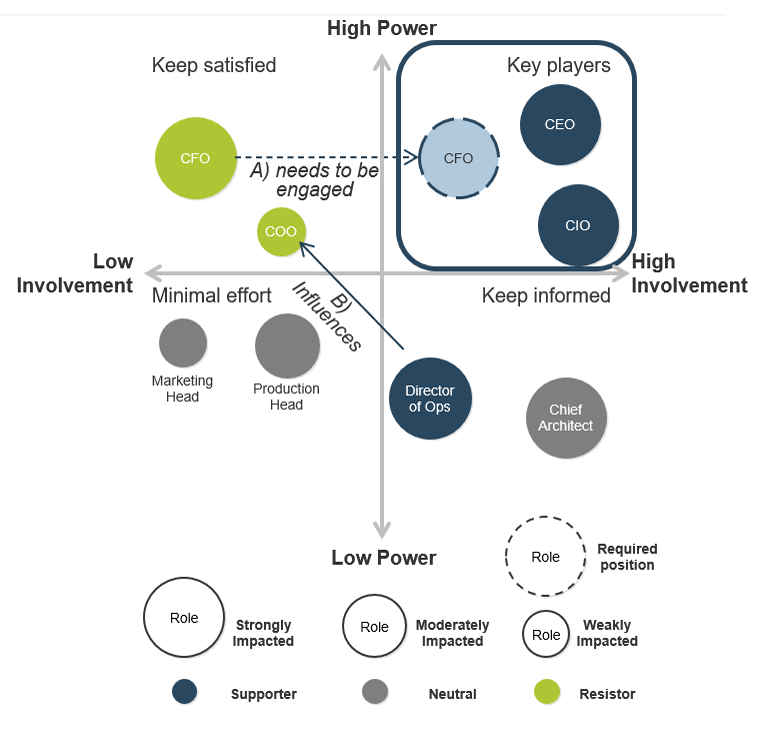

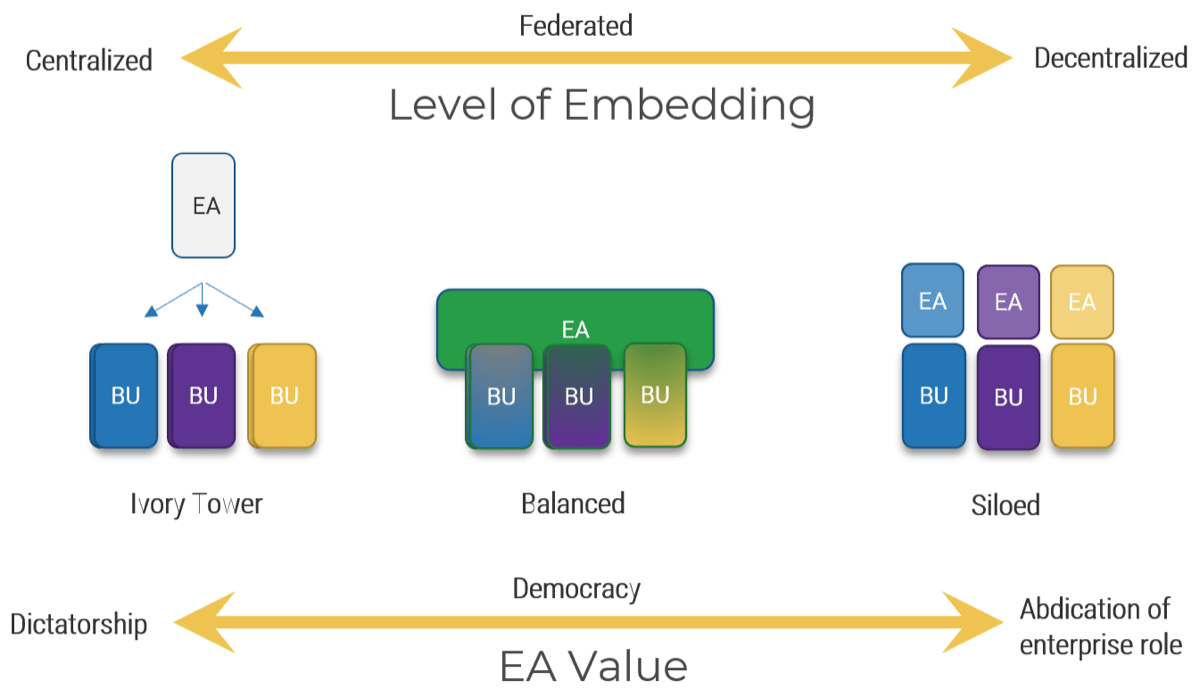

Define roles and responsibilities for the outsourcing transition to form the base of your outsourcing strategy

There is no "I" in outsource; make sure the whole team is involved

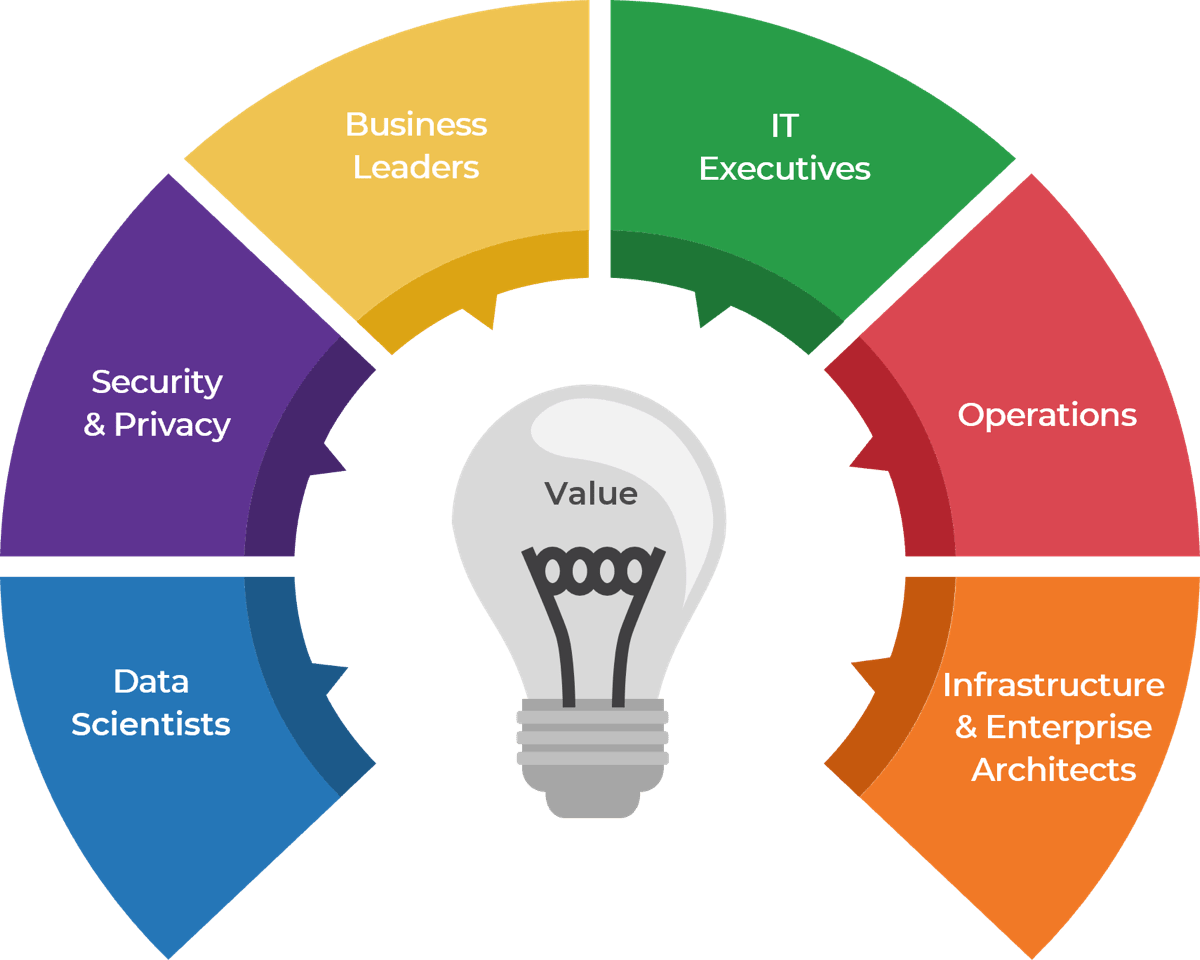

Outsourcing is a complete top-to-bottom process that involves multiple levels of engagement:

- Management must make high-level decisions about staffing and negotiate contract details with the vendor.

- Service desk employees must execute on the documentation and standardization of processes in an effort to increase maturity.

- Roles and responsibilities need to be clearly defined to ensure that all aspects of the transition are completed on time.

- Implement a full-scale effort that involves all relevant staff. The most common mistake is to have the project design follow the same top-down pattern as the decision-making process.

Info-Tech Insight

The service desk doesn't operate in isolation. The service desk interfaces with many other parts of the organization (such as finance, purchasing, field support, etc.), so it's important to ensure you engage stakeholders from other departments as well. If you only engage the service desk staff in your discussions around outsourcing strategy and RFP development, you may miss requirements that will come up when it's too late.

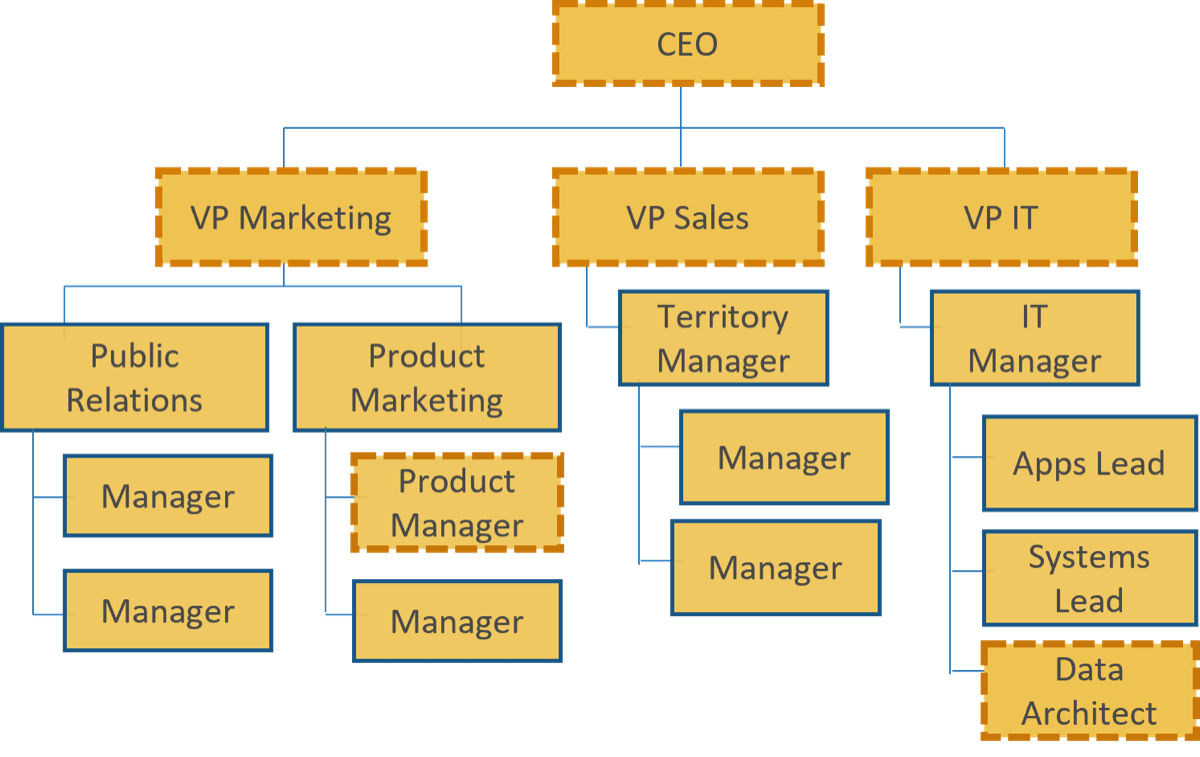

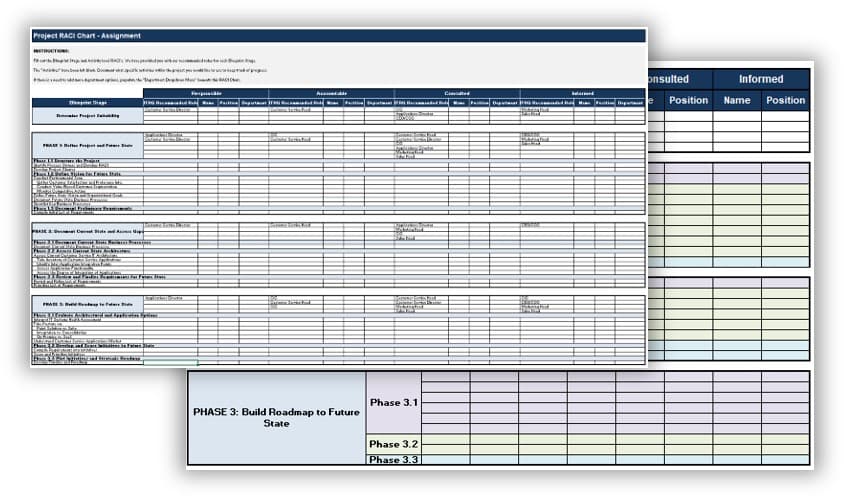

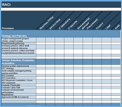

2.1.1 Identify internal outsourcing roles and responsibilities

2 hours

- The sample RACI chart in section 5 of the Project Charter Template outlines which positions are responsible, accountable, consulted, and informed for each major task within the outsourcing project.

- Responsible, is the group that is responsible for the execution and oversight of activities for the project. Accountable is the owner of the task/process, who is accountable for the results and outcomes. Consulted is the subject matter expert (SME) who is actively involved in the task/process and consulted on decisions. Informed is not actively involved with the task/process and is updated about decisions around the task/process.

- Make sure that you assign only one person as accountable per process. There can be multiple people responsible for each task. Consulted and Informed are optional for each task.

- Complete the RACI chart with recommended participants, and document in your service desk outsourcing project charter, under section 5.

Input

- RACI template

- Org chart

Output

- List of roles and responsibilities for outsource project

Materials

- Whiteboard/flip charts

- Markers

- Laptops

Participants

- IT Director/CIO

- Service Desk Manager

- Service Desk Team

Download the Project Charter Template

Step 2.2

Outline potential risks and constraints

Activities

2.2.1 Identify potential risks and constraints that may impact achievement of objectives

2.2.2 Arrange groups of tension metrics to balance your reporting

Design an Outsourcing Strategy

This step will walk you through the following activities:

- Outsourcing objectives

- Potential risks

This step involves the following participants:

- IT Managers

- Project Team

- Service Desk Manager

Outcomes of this step

- Mitigation strategy for each risk

- Service desk metrics

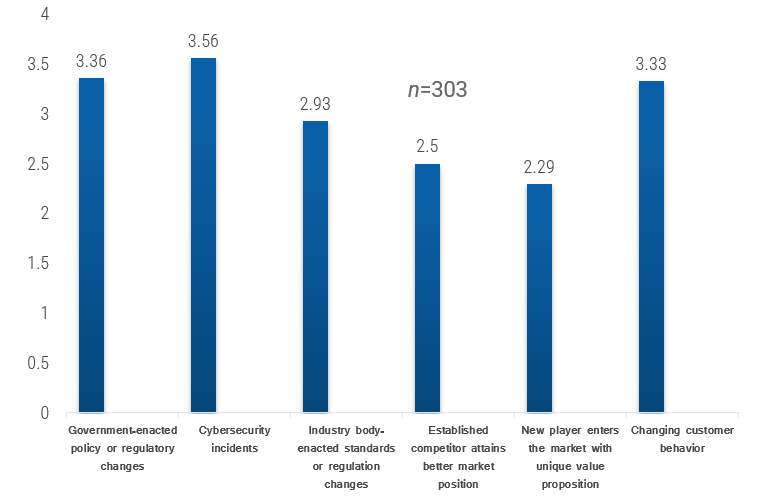

Know your constraints to reduce surprises during project implementation

No service desk is perfect; know your limits and plan accordingly

Define your constraints to outsourcing the service desk.

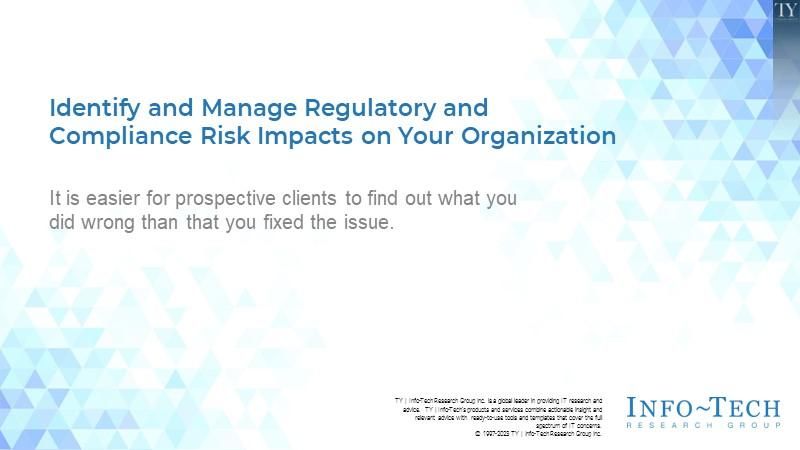

Consider all types of constraints and opportunities, including:

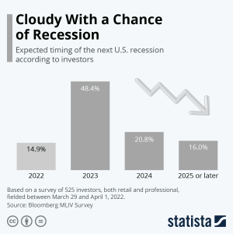

- Business forces

- Economic cycles

- Disruptive tech

- Regulation and compliance issues

- Internal organizational issues

Within the scope of a scouring decision, define your needs and objectives, measure those as much as possible, and compare them with the "as-is" situation.

Start determining what alternative approaches/scenarios the organization could use to fill the gaps. Start a comparison of scenarios against drivers, goals, and risks.

Constraints | Goals and objectives |

|---|---|

|

|

Plan ahead for potential risks that may impede your strategy

Risk assessment must go hand-in-hand with goal and objective planning

Risk is inherent with any outsourcing project. Common outsourcing risks include:

- Lack of commitment to the customer's goals from the vendor.

- The distraction of managing the relationship with the vendor.

- A perceived loss of control and a feeling of over-dependence on your vendor.

- Managers may feel they have less influence on the development of strategy.

- Retained staff may feel they have become less skilled in their specialist field.

- Unanticipated expenses that were assumed to be offered by the vendor.

- Savings only result from high capital investment in new projects on the part of the customer.

Analyze the risks associated with a specific scenario. This analysis should identify and understand the most common sourcing and vendor risks using a risk-reward analysis for selected scenarios. Use tools and guidelines to assess and manage vendor risk and tailor risk evaluation criteria to the types of vendors and products.

Info-Tech Insight

Plan for the worst to prevent it from happening. Evaluating risk should cover a wide variety of scenarios including the worst possible cases. This type of thinking will be crucial when developing your exit strategy in a later exercise.

2.2.1 Identify potential risks and constraints that may impact achievement of objectives

1-3 hours

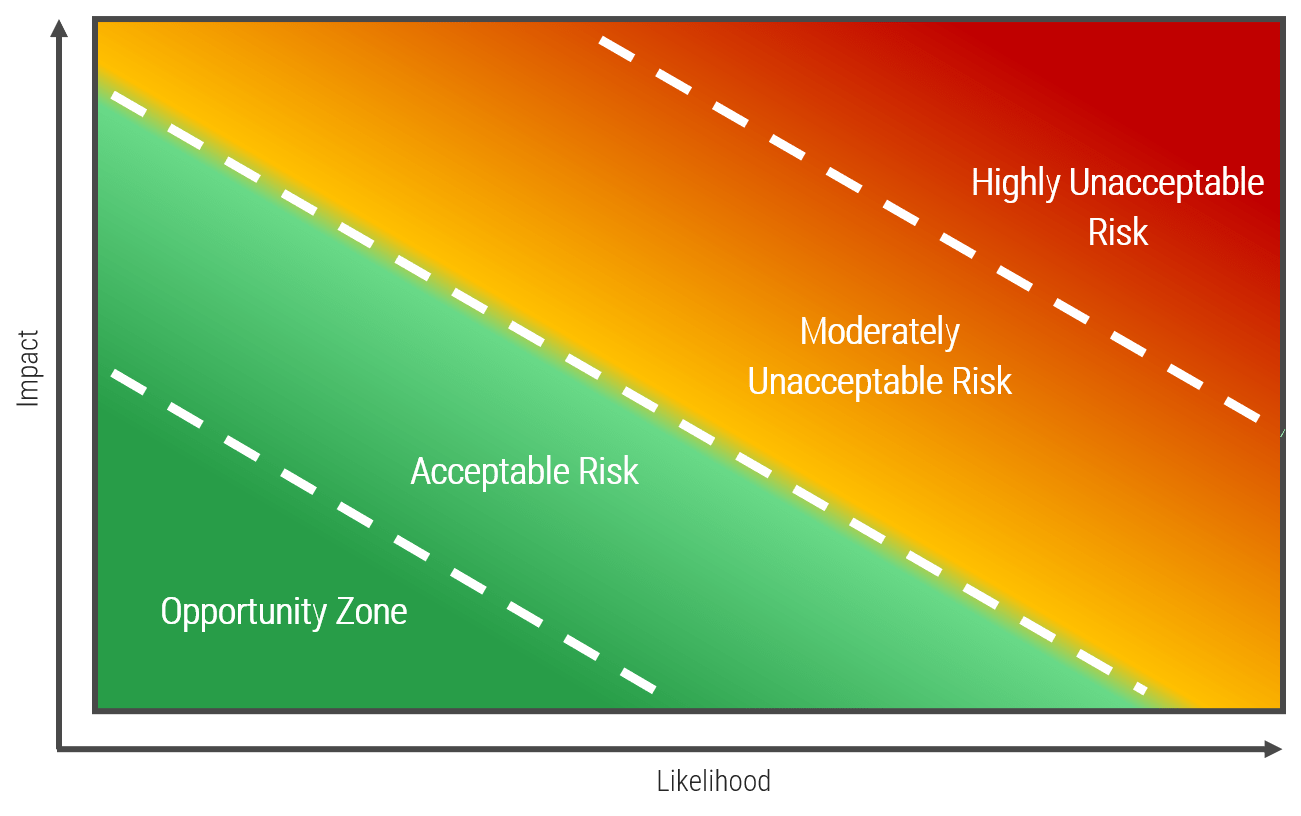

- Brainstorm any potential risks that may arise through the outsourcing project. Describe each risk and categorize both its probability of occurring and impact on the organization as high (H), medium (M), or low (L), using the table below:

| Risk Description | Probability(H/M/L) | Impact(H/M/L) | Planned Mitigation |

| Lack of documentation | M | M | Use cloud-based solution to share documents. |

| Knowledge transfer | L | M | Detailed knowledge-sharing agreement in place in the RFP. |

| Processes not followed | L | H | Clear outline and definition of current processes. |

- Identify any constraints for your outsourcing strategy that may restrict, limit, or place certain conditions on the outsourcing project.

- This may include budget restrictions or staffing limitations.

- Identifying constraints will help you be prepared for risks and will lessen their impact.

- Document risks and constraints in section 6 of the Service Desk Outsourcing Project Charter Template.

Input

- RACI template

- Org chart

Output

- List of roles and responsibilities for outsource project

Materials

- Whiteboard/flip charts

- Markers

Participants

- IT Director/CIO

- Service Desk Manager

- Service Desk Team

Download the Project Charter Template

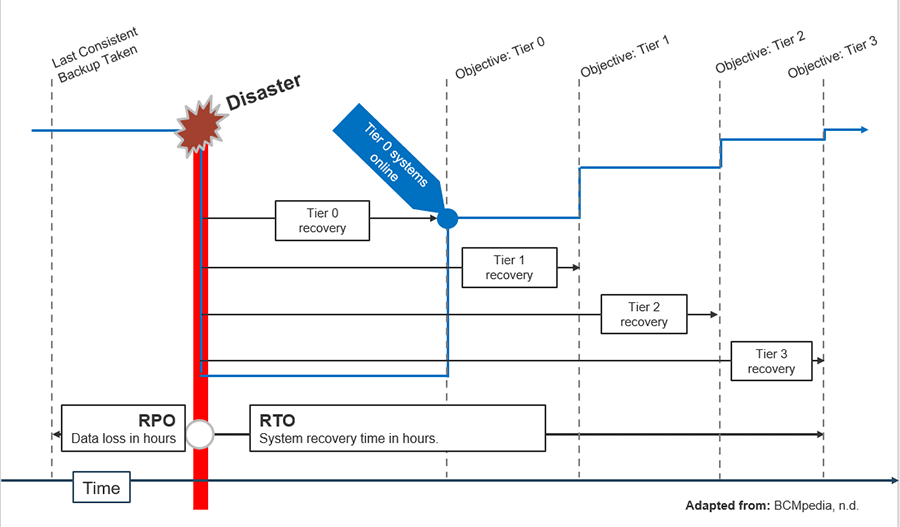

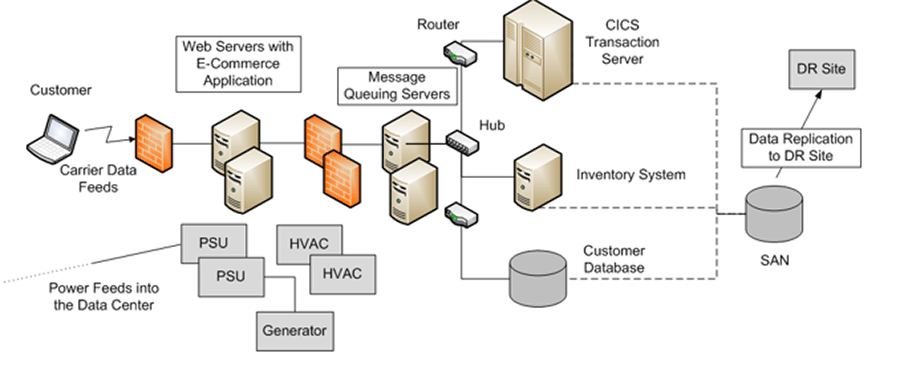

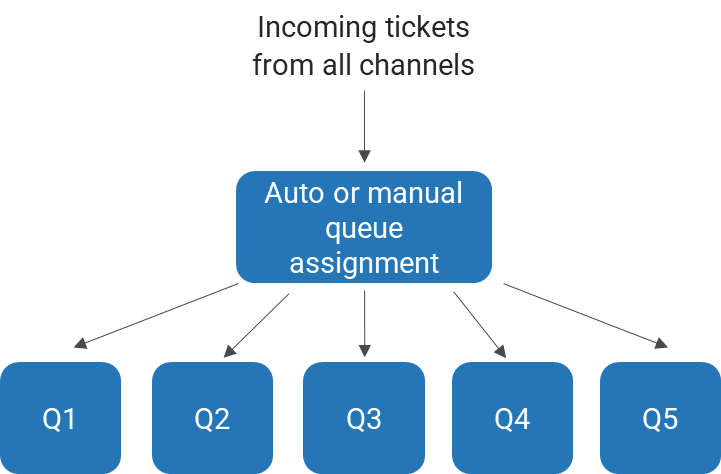

Define service tiers and roles to develop clear vendor SLAs

Management of performance, SLAs, and customer satisfaction remain the responsibility of your organization.

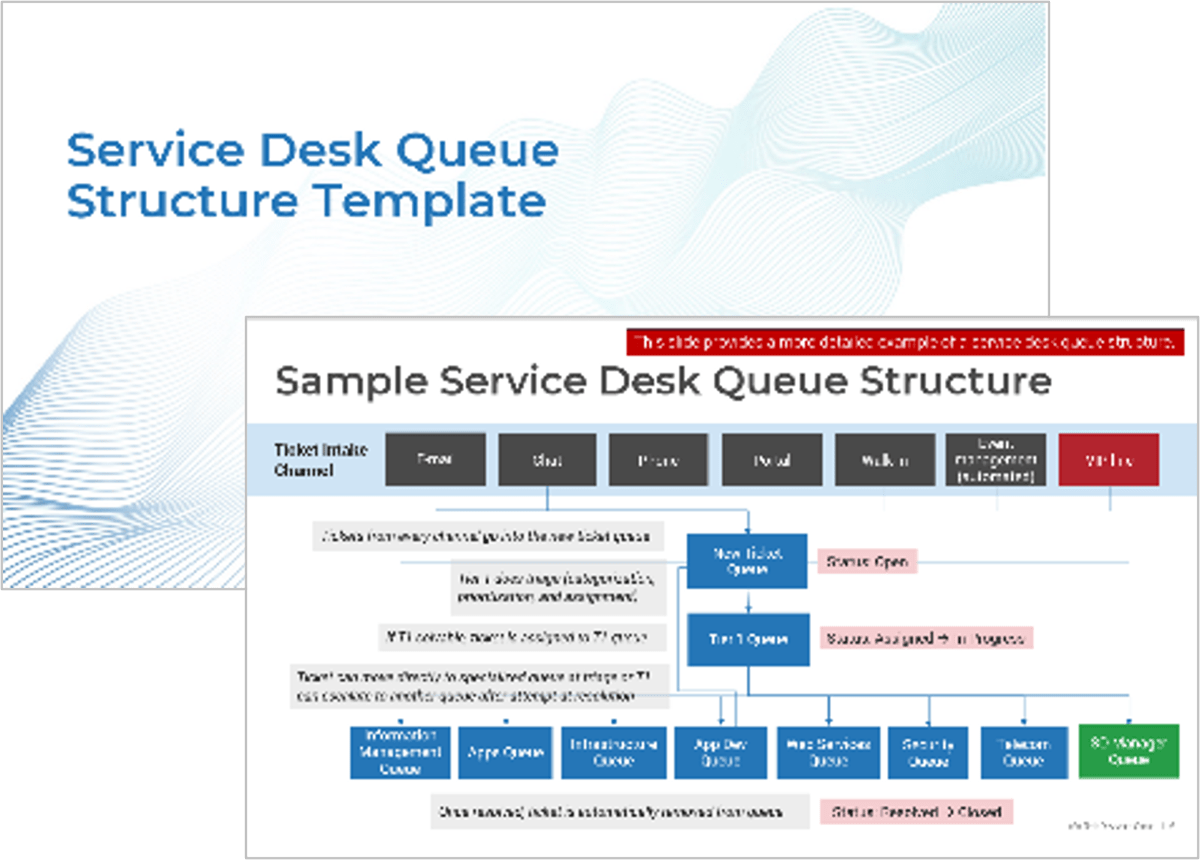

Define the tiers and/or services that will be the responsibility of the MSP, as well as escalations and workflows across tiers. A sample outsourced structure is displayed here:

| External Vendor | Tickets beyond the scope of the service desk staff need to be escalated back to the vendor responsible for the affected system. |

|---|---|

| Tier 3 | Tickets that are focused on custom applications and require specialized or advanced support are escalated back to your organization's second- and third-level support teams. |

| Tier 2 | The vendor is often able to provide specialized support for standard applications. However, the desktop support still needs someone onsite as that service is very expensive to outsource. |

| Tier 1 | Service desk outsource vendors provide first-line response. This includes answering the phones, troubleshooting simple problems, and redirecting requests that are more complex. |

Info-Tech Insight

If you outsource everything, you'll be at the mercy of consultancy or professional services shops later on. You won't have anyone in-house to help you deploy anything; you're at the mercy of a consultant to come in and tell you what to do and how much to spend. Keep your highly skilled people in-house to offset what you'd have to pay for consultancy. If you need to repatriate your service desk later on, you will need skills in-house to do so.

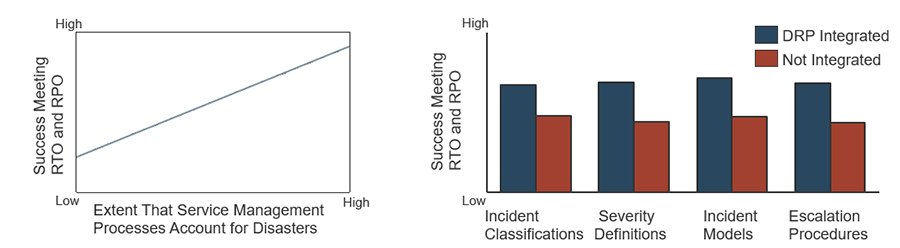

Don't become obsessed with managing by short-term metrics – look at the big picture

"Good" metric results may simply indicate proficient reactive fixing; long-term thinking involves implementing proactive, balanced solutions.

KPIs demonstrate that you are running an effective service desk because:

- You close an average of 300 tickets per week

- Your first call resolution is above 90%

- Your talk time is less than five minutes

- Surveys reveal clients are satisfied

While these results may appear great on the surface, metrics don't tell the whole story.

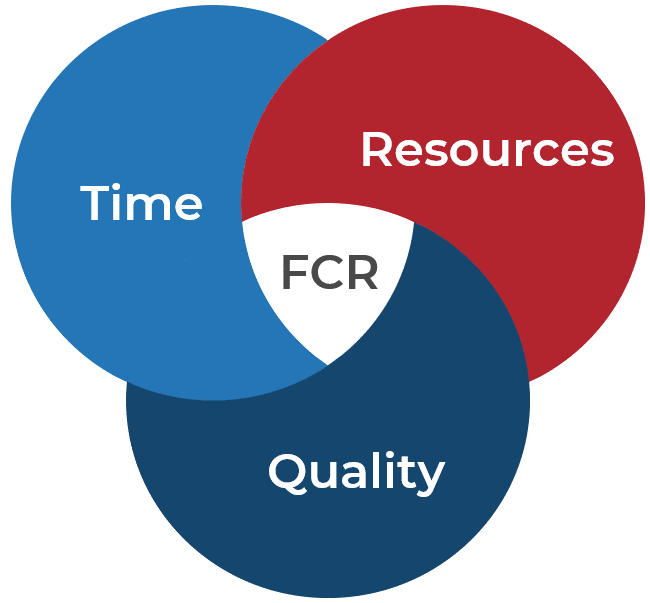

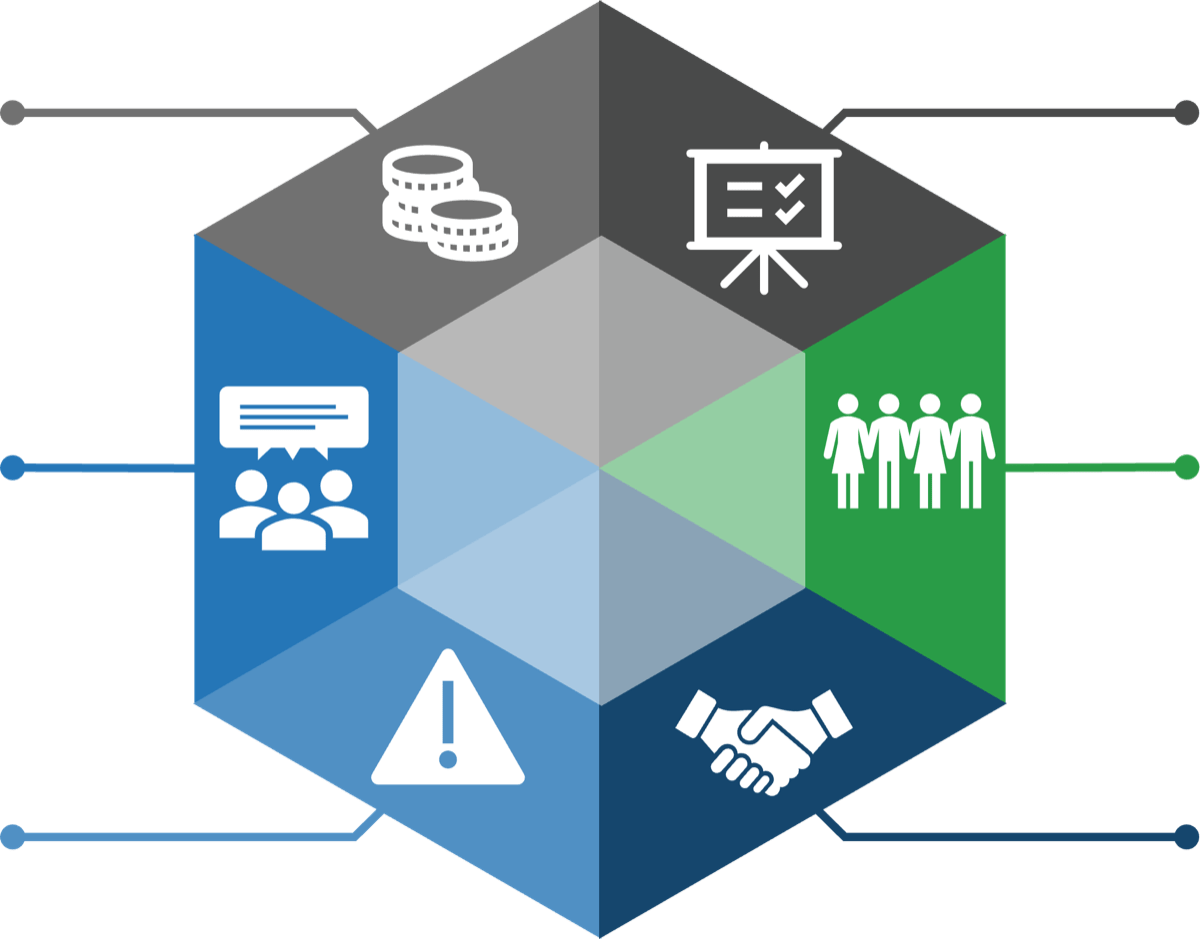

The effort from any support team seeks to balance three elements:

| First-Contact Resolution (FCR) Rate | Percentage of tickets resolved during first contact with user (e.g. before they hang up or within an hour of submitting ticket). Could be measured as first-contact, first-tier, or first-day resolution. |

|---|---|---|

End-User Satisfaction | Perceived value of the service desk measured by a robust annual satisfaction survey of end users and/or transactional satisfaction surveys sent with a percentage of tickets. | |

| Ticket Volume and Cost Per Ticket | Monthly operating expenses divided by average ticket volume per month. Report ticket volume by department or ticket category, and look at trends for context. | |

Average Time to Resolve (incidents) or Fulfill (service requests) | Time elapsed from when a ticket is "open" to "resolved." Distinguish between ticket resolution vs. closure, and measure time for incidents and service requests separately. |

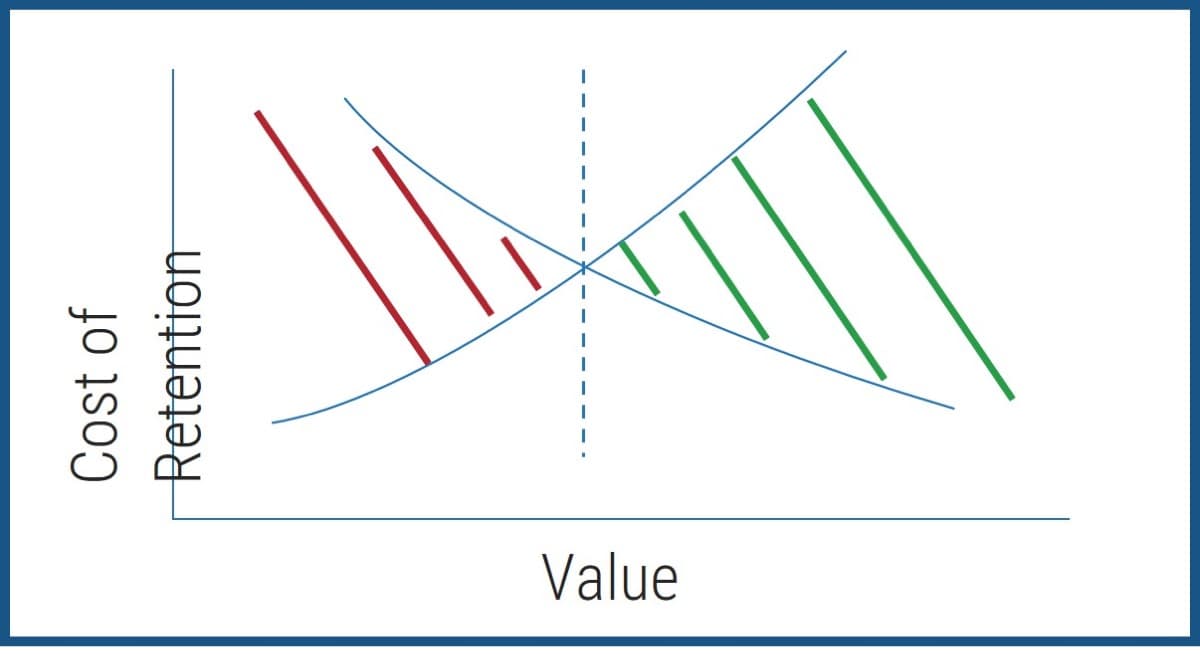

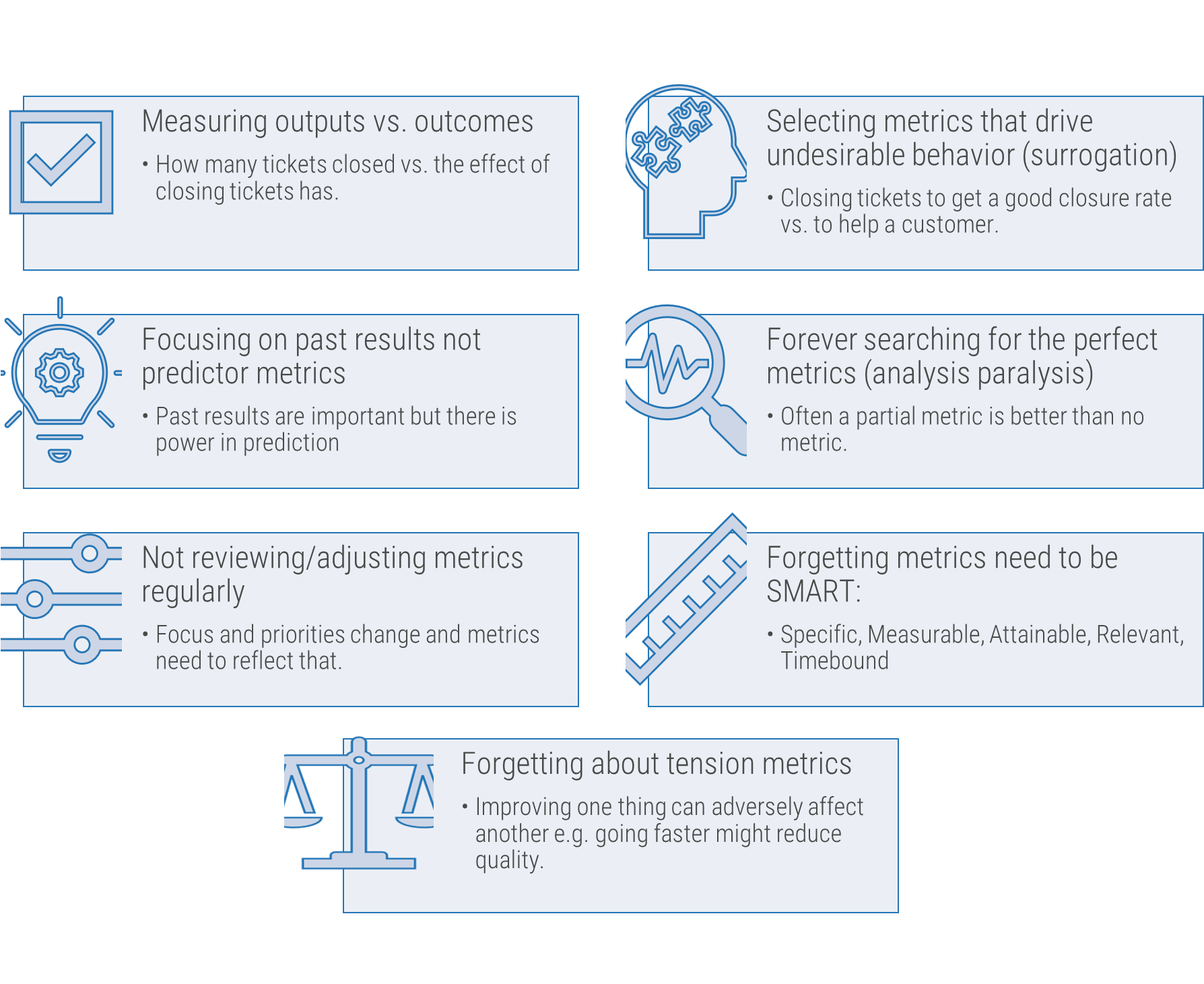

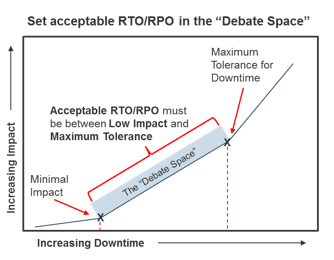

Focus on tension metrics to achieve long-term success

Tension metrics help create a balance by preventing teams from focusing on a single element.

For example, an MSP built incentives around ticket volume for their staff, but not the quality of tickets. As a result, the MSP staff rushed through tickets and gamed the system while service quality suffered.

Use metrics to establish baselines and benchmarking data:

- If you know when spikes in ticket volumes occur, you can prepare to resource more appropriately for these time periods

- Create KB articles to tackle recurring issues and assist tier 1 technicians and end users.

- Employ a root cause analysis to eliminate recurring tickets.

"We had an average talk time of 15 minutes per call and I wanted to ensure they could handle those calls in 15 minutes. But the behavior was opposite, [the vendor] would wrap up the call, transfer prematurely, or tell the client they'd call them back. Service levels drive behavior so make sure they are aligned with your strategic goals with no unintended consequences."

– IT Services Manager, Banking

Info-Tech Insight

Make sure your metrics work cooperatively. Metrics should be chosen that cause tension on one another. It's not enough to rely on a fast service desk that doesn't have a high end-user satisfaction rate or runs at too high a cost; there needs to be balance.

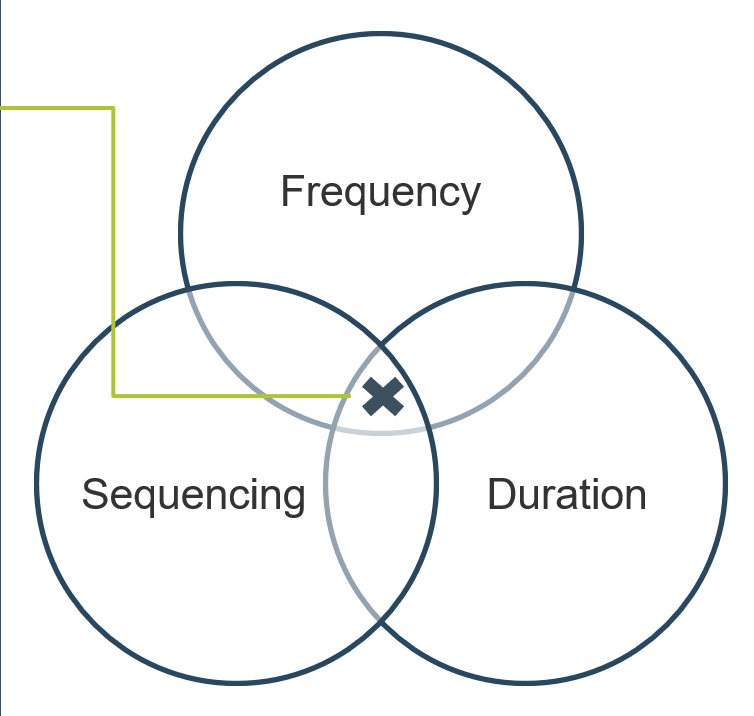

2.2.2 Arrange groups of tension metrics to balance your reporting

1-3 hours

- Define KPIs and metrics that will be critical to service desk success.

- Distribute sticky notes of different colors to participants around the table.

- Select a space to place the sticky notes – a table, whiteboard, flip chart, etc. – and divide it into three zones.

- Refer to your defined list of goals and KPIs from activity 1.1.3 and discuss metrics to fulfill each KPI. Note that each goal (critical success factor, CSF) may have more than one KPI. For instance:

- Goal 1: Increase end-user satisfaction; KPI 1: Improve average transactional survey score. KPI 2: Improve annual relationship survey score.

- Goal 2: Improve service delivery; KPI 1: Reduce time to resolve incidents. KPI 2: Reduce time to fulfill service requests.

- Recall that tension metrics must form a balance between:

- Time

- Resources

- Quality

- Record the results in section 7 of the Service Desk Outsourcing Project Charter Template.

Input

- Service desk outsourcing goals

- Service desk outsourcing KPIs

Output

- List of service desk metrics

Materials

- Whiteboard/flip charts

- Sticky notes

- Markers

- Laptops

Participants

- Project Team

- Service Desk Manager

Download the Project Charter Template

Phase 3

Develop an RFP and make a long-term relationship

Define the goal | Design an outsourcing strategy | Develop an RFP and make a long-term relationship |

|---|---|---|

1.1 Identify goals and objectives 1.2 Assess outsourcing feasibility | 2.1 Identify project stakeholders 2.2 Outline potential risks and constraints | 3.1 Prepare a service overview and responsibility matrix 3.2 Define your approach to vendor relationship management 3.3 Manage the outsource relationship |

This phase will walk you through the following activities:

- Build your outsourcing RFP

- Set expectations with candidate vendors

- Score and select your vendor

- Manage your relationship with the vendor

This phase involves the following participants:

- CIO

- Service Desk Manager

- IT Managers

- Project Managers

Define requirements for outsourcing service desk support

Step 3.1

Prepare a service overview and responsibility matrix

Activities

3.1.1 Evaluate your technology, people, and process requirements

3.1.2 Outline which party will be responsible for which service desk processes

This step requires the following inputs:

- Service desk processes and requirements

This step involves the following participants:

- CIO

- Service Desk Manager

- IT Managers

- Project Managers

Outcomes of this step

- Knowledge management and technology requirements

- Self-service requirements

Develop an RFP and make a long-term relationship

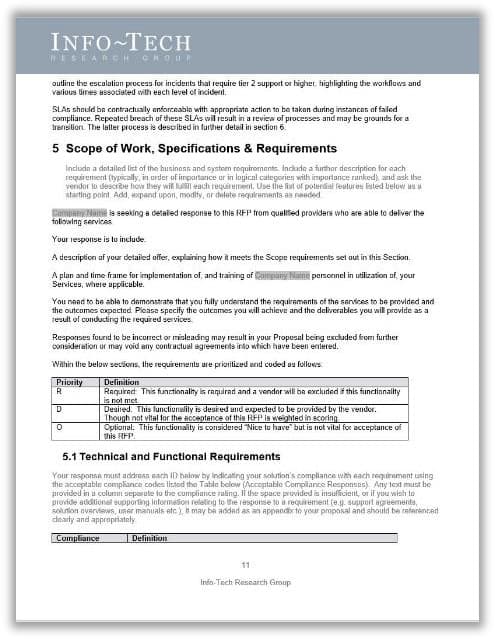

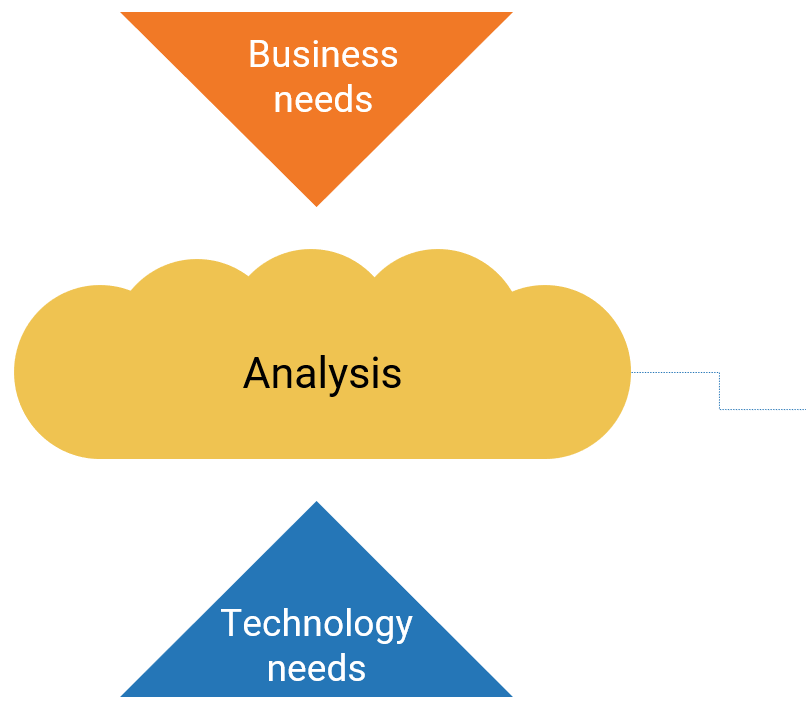

Create a detailed RFP to ensure your candidate vendor will fulfill all your requirements

At its core, your RFP should detail the outcomes of your outsourcing strategy and communicate your needs to the vendor.

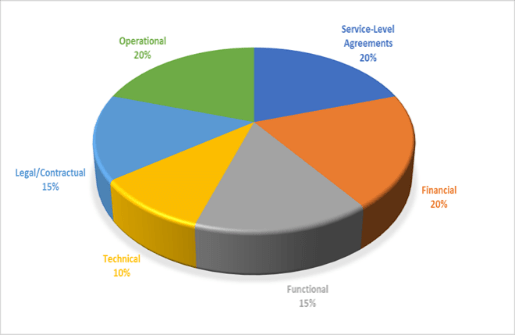

The RFP must cover business needs and the more detailed service desk functions required. Many enterprises only consider the functionality they need, while ignoring operational and selection requirements.

Negotiate a supply agreement with the preferred outsourcer for delivery of the required services. Ensure your RFP covers:

- Service specification

- Service levels

- Roles and responsibilities

- Transition period and acceptance

- Prices, payment, and duration

- Agreement administration

- Outsourcing issues

In addition to defining your standard requirements, don't forget to take into consideration the following factors when developing your RFP:

- Employee onboarding and hardware imaging for new users

- Applications you need current and future support for

- Reporting requirements

- Self-service options

- Remote support needs and locations

Although it may be tempting, don't throw everything over the wall at your vendor in the RFP. Evaluate your service desk functions in terms of quality, cost effectiveness, and the value provided from the vendor. Organizations should only outsource functions that the vendor can operate better, faster, or cheaper.

Info-Tech Insight

Involve the right stakeholders in developing your RFP, not just service desk. If only service desk is involved in RFP discussion, the connection between tier 1 and specialists will be broken, as some processes are not considered from IT's point of view.

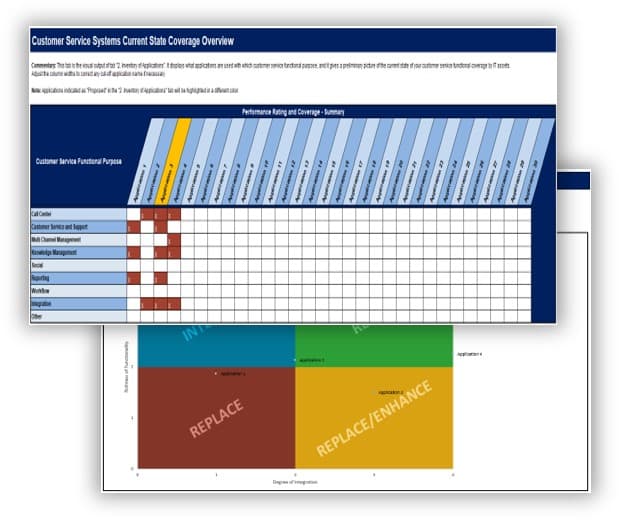

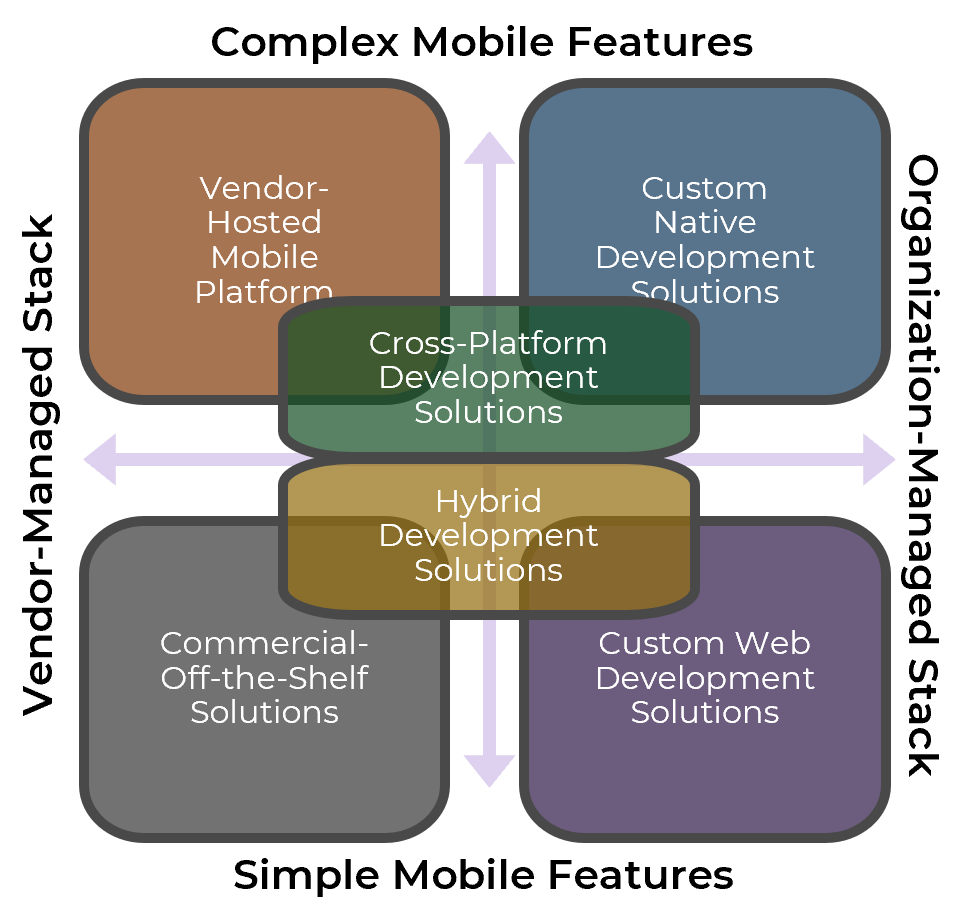

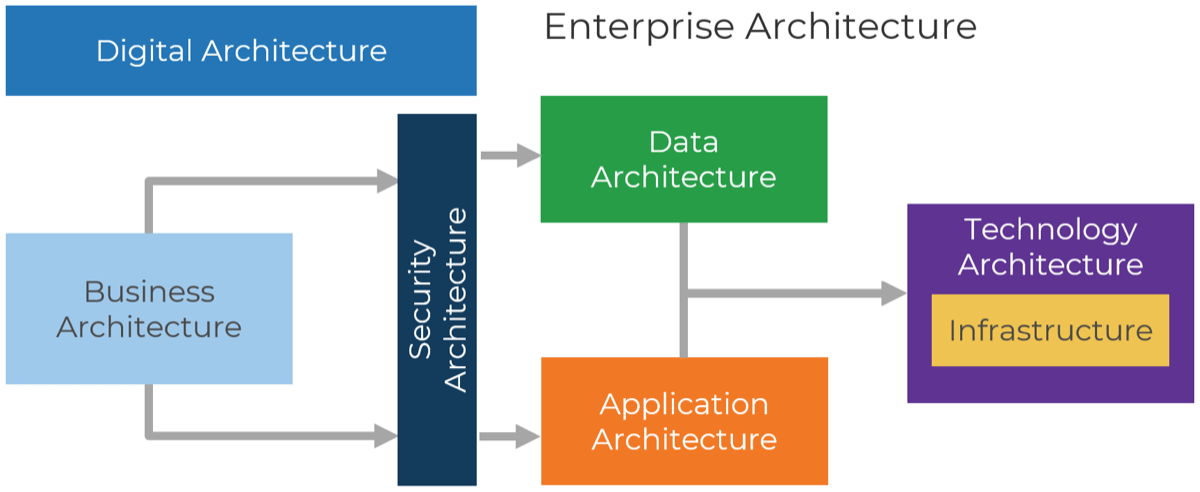

Identify ITSM solution requirements

Your vendor probably uses a different tool to manage their processes; make sure its capabilities align with the vision of your service desk.

Your service desk and outsourcing strategy were both designed with your current ITSM solution in mind. Before you hand the reins to an MSP, it is crucial that you outline how your current ITSM solution is being used in terms of functionality.

Find out if it's better to have the MSP use their own ITSM tools or your ITSM solution.

Benefits of operating within your own ITSM while outsourcing the service desk: | Disadvantages of using your own ITSM while outsourcing the service desk: |

|---|---|

|

|

Info-Tech Insight

Defining your tool requirements can be a great opportunity to get the tool functionality you always wanted. Many MSPs offer enterprise-level ITSM tools and highly mature processes that may tempt you to operate within their ITSM environment. However, first define your goals for such a move, as well as pros and cons of operating in their service management tool to weigh if its benefits overweigh its downfalls.

Case Study

Lone Star College learned that it's important to select a vendor whose tool will work with your service desk

INDUSTRY: Education

SOURCE: ServiceNow

Challenge

Lone Star College has an end-user base of over 100,000 staff and students.

The college has six campuses across the state of Texas, and each campus was using its own service desk and ITSM solution.

Initially, the decision was to implement a single ITSM solution, but organizational complexity prevented that initiative from succeeding.

A decision was made to outsource and consolidate the service desks of each of the campuses to provide more uniform service to end users.

Solution

Lone Star College selected a vendor that implemented FrontRange.

Unfortunately, the tool was not the right fit for Lone Star's service and reporting needs.

After some discussion, the outsourcing vendor made the switch to ServiceNow.

Some time later, a hybrid outsourced model was implemented, with Lone Star and the vendor combining to provide 24/7 support.

Results

The consolidated, standardized approach used by Lone Star College and its vendor has created numerous benefits:

- Standardized reporting

- High end-user satisfaction

- All SLAs are being met

- Improved ticket resolution times

- Automated change management.

Lone Star outsourced in order to consolidate its service desks quickly, but the tools didn't quite match.

It's important to choose a tool that works well with your vendor's, otherwise the same standardization issues can persist.

Design your RFP to help you understand what the vendor's standard offerings are and what it is capable of delivering

Your RFP should be worded in a way that helps you understand what your vendor's standard offerings are because that's what they're most capable of delivering. Rather than laying out all your requirements in a high level of detail, carefully craft your questions in a probing way. Then, understand what your current baseline is, what your target requirements are, and assess the gap.

Design the RFP so that responses can easily be compared against one another.

It is common to receive responses that are very different – RFPs don't provide a response framework. Comparing vastly different responses can be like comparing apples to oranges. Not only are they immensely time consuming to score, their scores also don't end up accurately reflecting the provider's capabilities or suitability as a vendor.

If your RFP is causing a ten minute printer backlog, you're doing something wrong.

Your RFP should not be hundreds of pages long. If it is, there is too much detail.

Providing too much detail can box your responses in and be overly limiting on your responses. It can deter potentially suitable provider candidates from sending a proposal.

Request

For

Proposal