Further reading

Optimize IT Project Intake, Approval, and Prioritization

Decide which IT projects to approve and when to start them.

ANALYST PERSPECTIVE

Capacity-constrained intake is the only sustainable path forward.

"For years, the goal of project intake was to select the best projects. It makes sense and most people take it on faith without argument.

But if you end up with too many projects, it’s a bad strategy.

Don’t be afraid to say NO or NOT YET if you don’t have the capacity to deliver. People might give you a hard time in the near term, but you’re not helping by saying YES to things you can’t deliver."

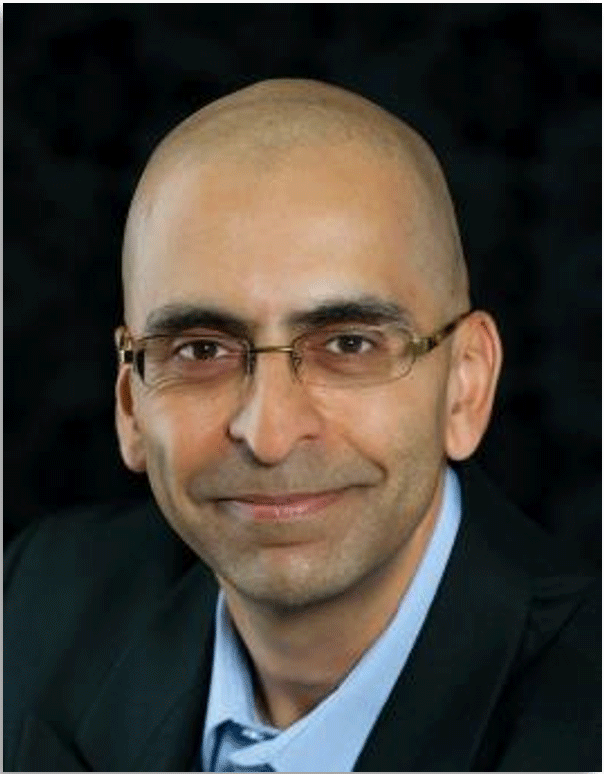

Barry Cousins,

Senior Director, PMO Practice

Info-Tech Research Group

Our understanding of the problem

This Research Is Designed For:

- PMO Directors who have trouble with project throughput

- CIOs who want to improve IT’s responsive-ness to changing needs of the business

- CIOs who want to maximize the overall business value of IT’s project portfolio

This Research Will Help You:

- Align project intake and prioritization with resource capacity and strategic objectives

- Balance proactive and reactive demand

- Reduce portfolio waste on low-value projects

- Manage project delivery expectations and satisfaction of business stakeholders

- Get optimized project intake processes off the ground with low-cost, high-impact tools and templates

This Research Will Also Assist:

- C-suite executives and steering committee members who want to ensure IT’s successful delivery of projects with high business impact

- Project sponsors and product owners who seek visibility and transparency toward proposed projects

This Research Will Help Them:

- Ensure that high-impact projects are approved and delivered in a timely manner

- Gain clarity and visibility in IT’s project approval process

- Improve your understanding of IT’s capacity to set more realistic expectations on what gets done

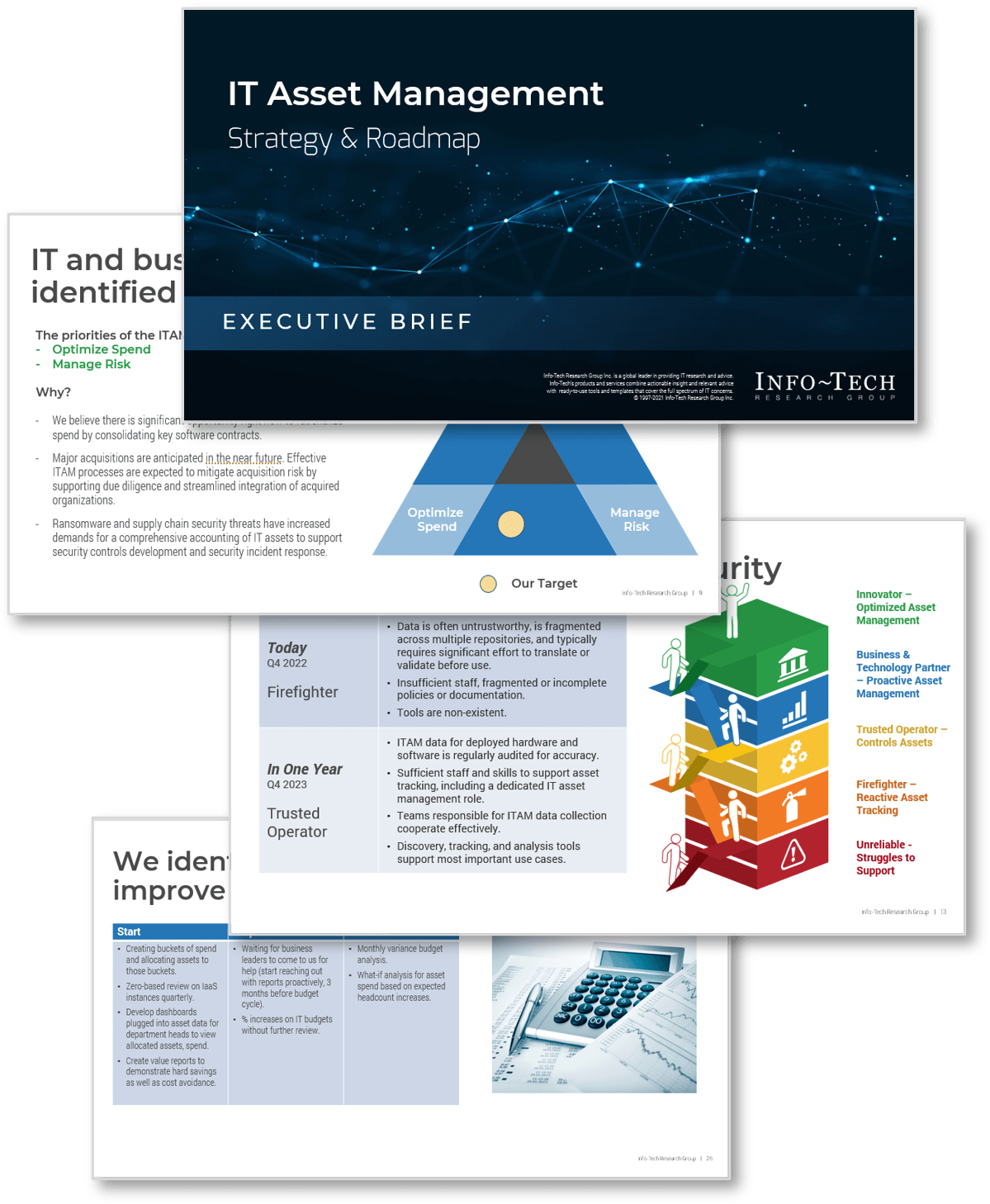

Executive summary

Situation

- As a portfolio manager, you do not have the authority to decline or defer new projects – but you also lack the capacity to realistically say yes to more project work.

- Stakeholders have unrealistic expectations of what IT can deliver. Too many projects are approved, and it may be unclear why their project is delayed or in a state of suspended animation.

Complication

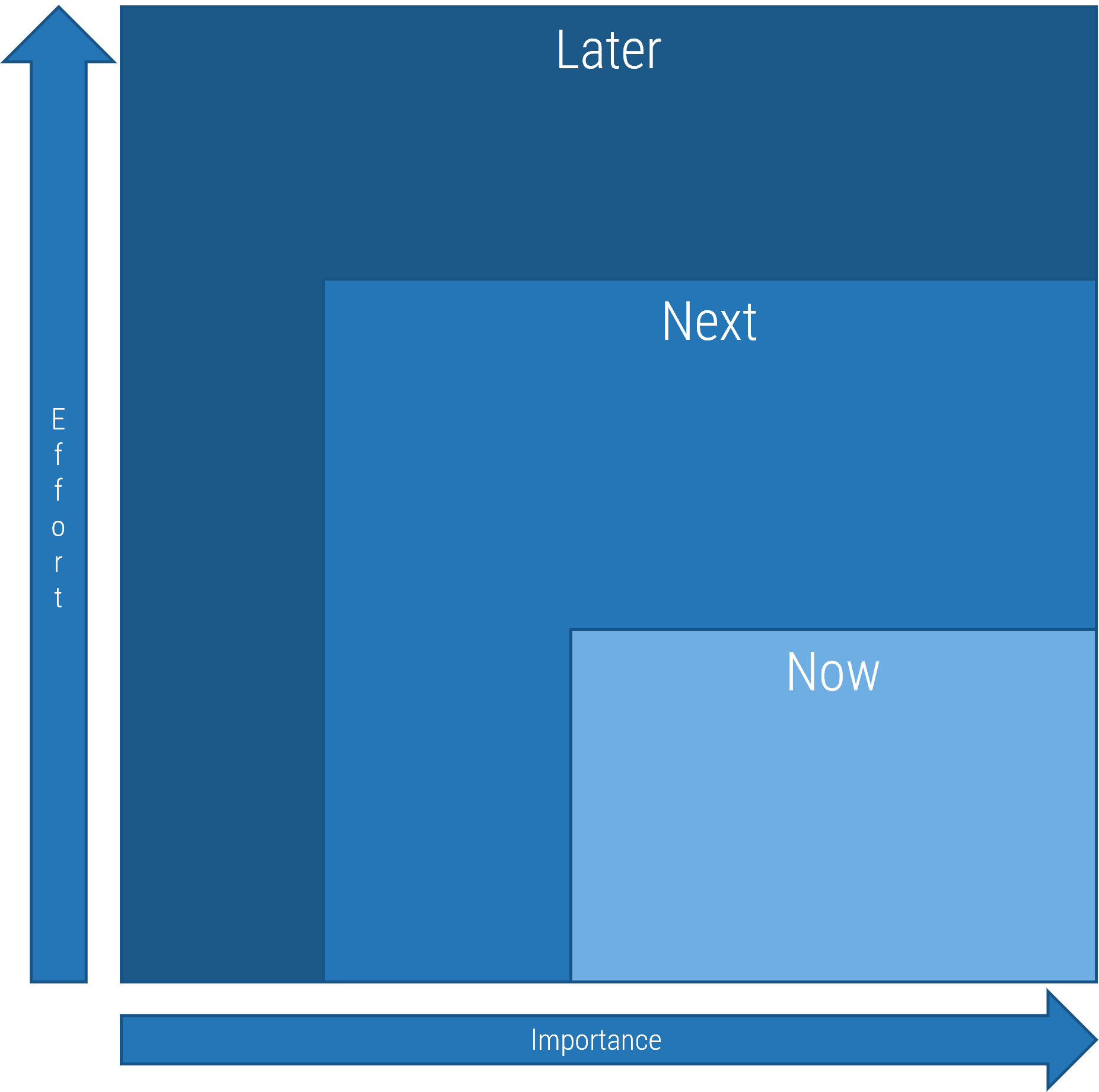

- The cycle of competition is making it increasingly difficult to follow a longer-term strategy during project intake, making it unproductive to approve projects for any horizon longer than one to two years.

- As project portfolios become more aligned to “transformative” projects, resourcing for smaller, department-level projects becomes increasingly opaque.

Resolution

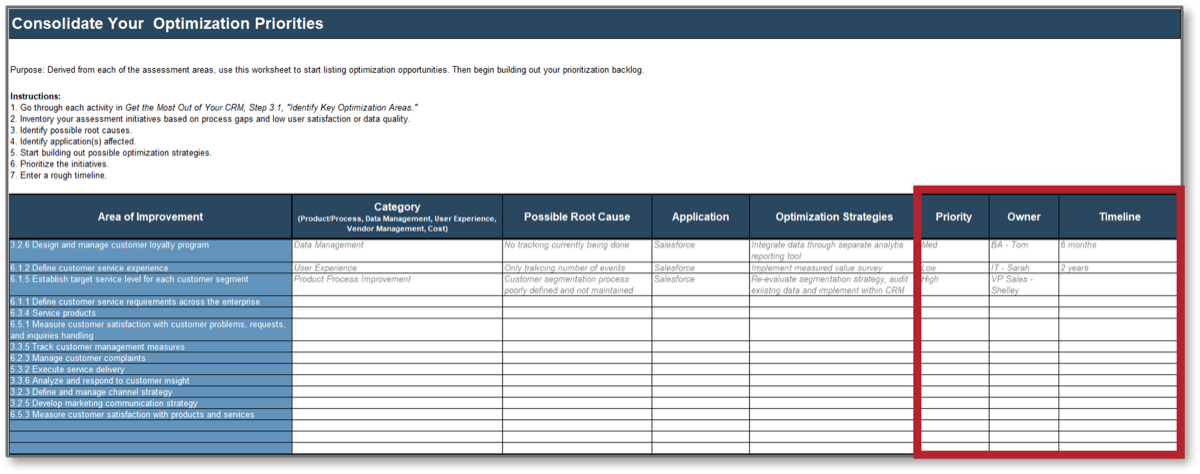

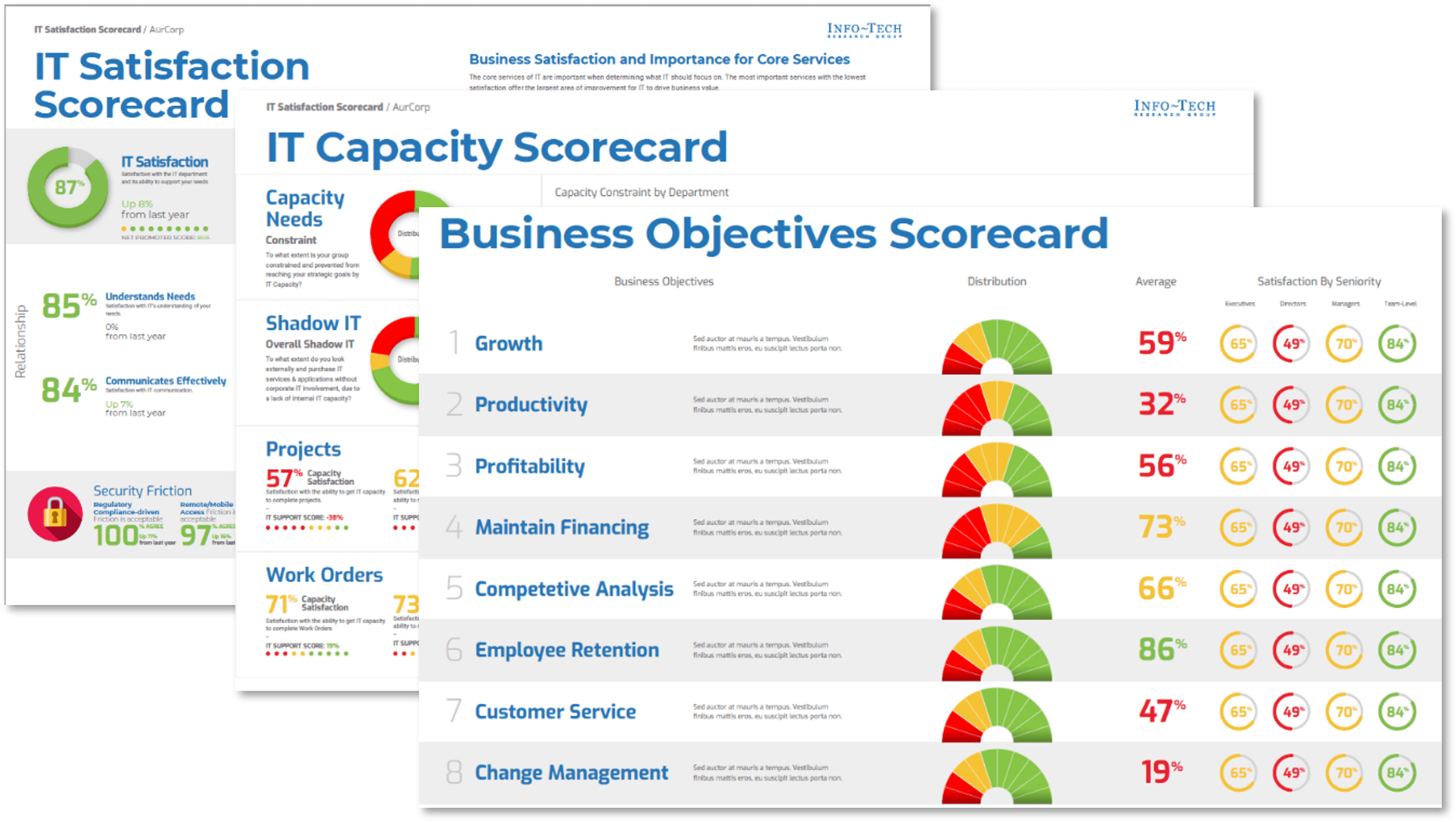

- Establish an effective scorecard to create transparency into IT’s capacity and processes. This will help set realistic expectations for stakeholders, eliminate “squeaky wheel” prioritization, and give primacy to the highest value requests.

- Build a centralized process that funnels requests into a single intake channel to eliminate confusion and doubt for stakeholders and staff while also reducing off-the-grid initiatives.

- Clearly define a series of project approval steps, and communicate requirements for passing them.

- Developing practices that incorporate the constraint of resource capacity to cap the amount of project approvals to that which is realistic will help improve the throughput of projects through the portfolio.

Info-Tech Insight

- Approve only the right projects… Counterbalance stakeholder needs with strategic objectives of the business and that of IT, in order to maintain the value of your project portfolio at a high level.

- …that you have capacity to deliver. Resource capacity-informed project approval process enables you to avoid biting off more than you can chew and, over time, build a track record of fulfilling promises to deliver on projects.

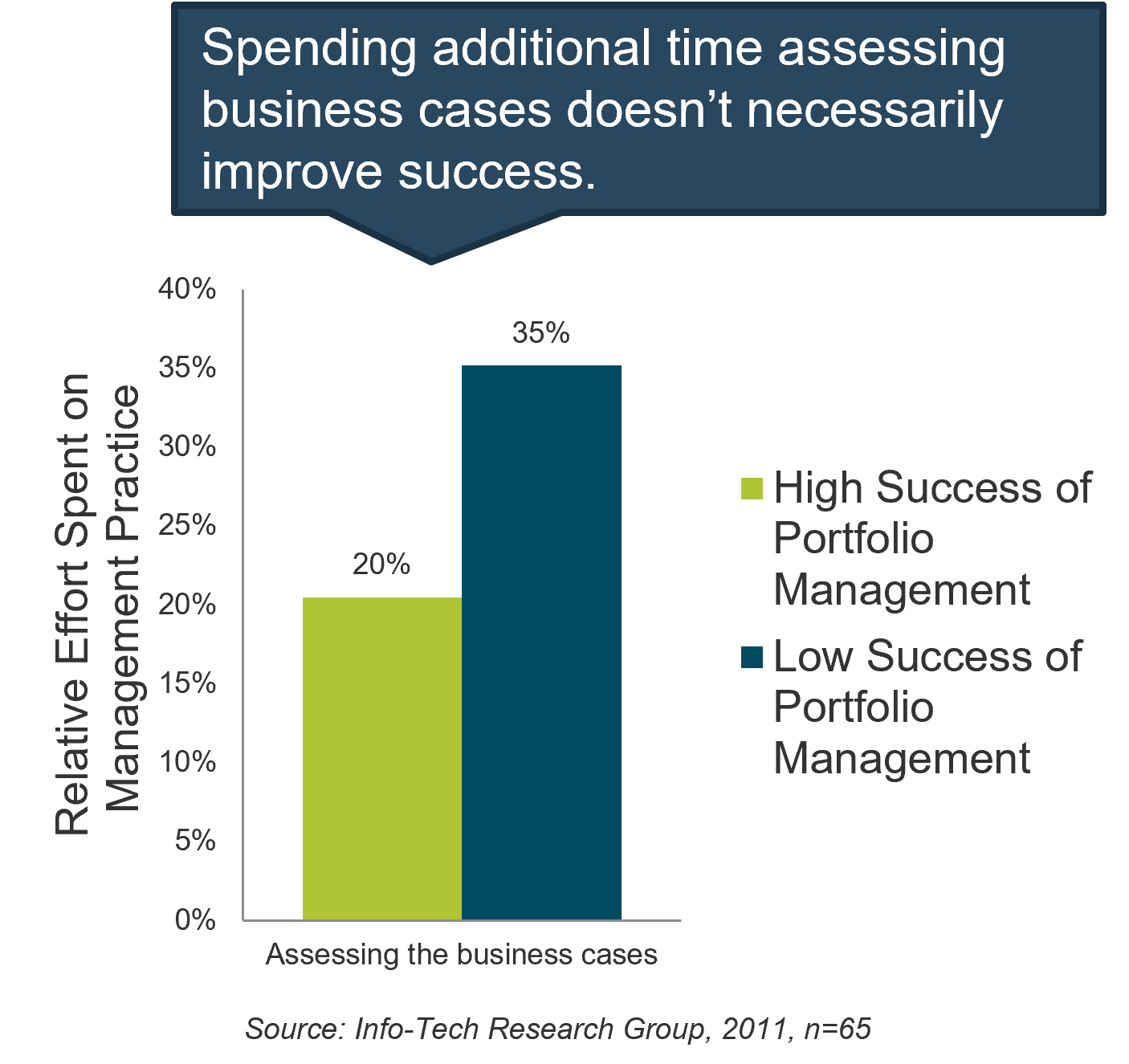

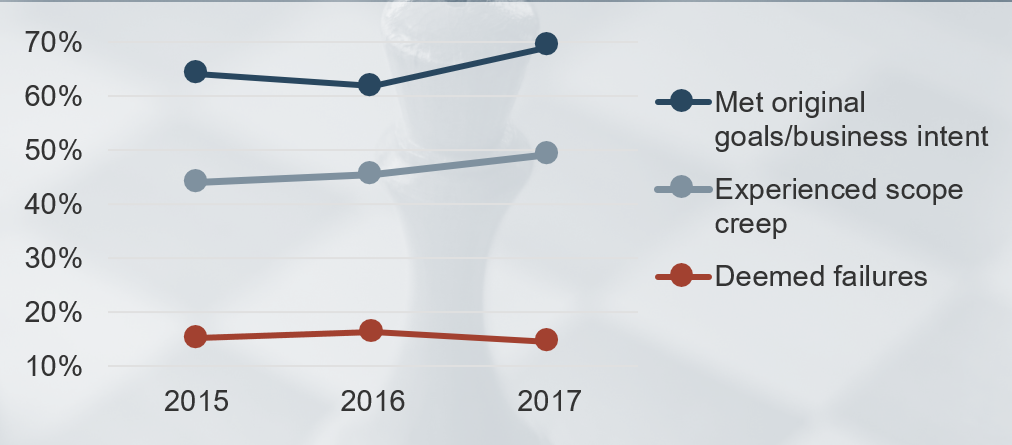

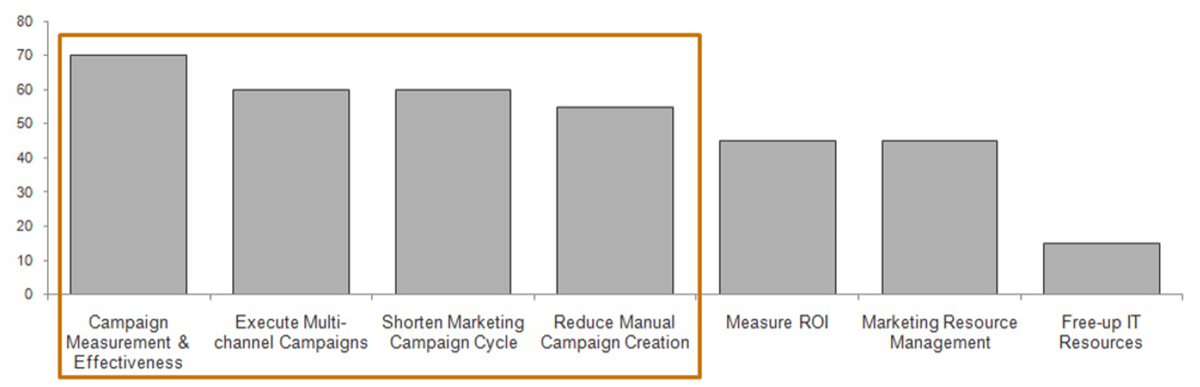

Most organizations are good at approving projects, but bad at starting them – and even worse at finishing them

Establishing project intake discipline should be a top priority from a long-term strategy and near-term tactical perspective.

Most organizations approve more projects than they can finish. In fact, many approve more than they can even start, leading to an ever-growing backlog where project ideas – often good ones – are never heard from again.

The appetite to approve more runs directly counter to the shortage of resources that plagues most IT departments. This tension of wanting more from less suggests that IT departments need to be more disciplined in choosing what to take on.

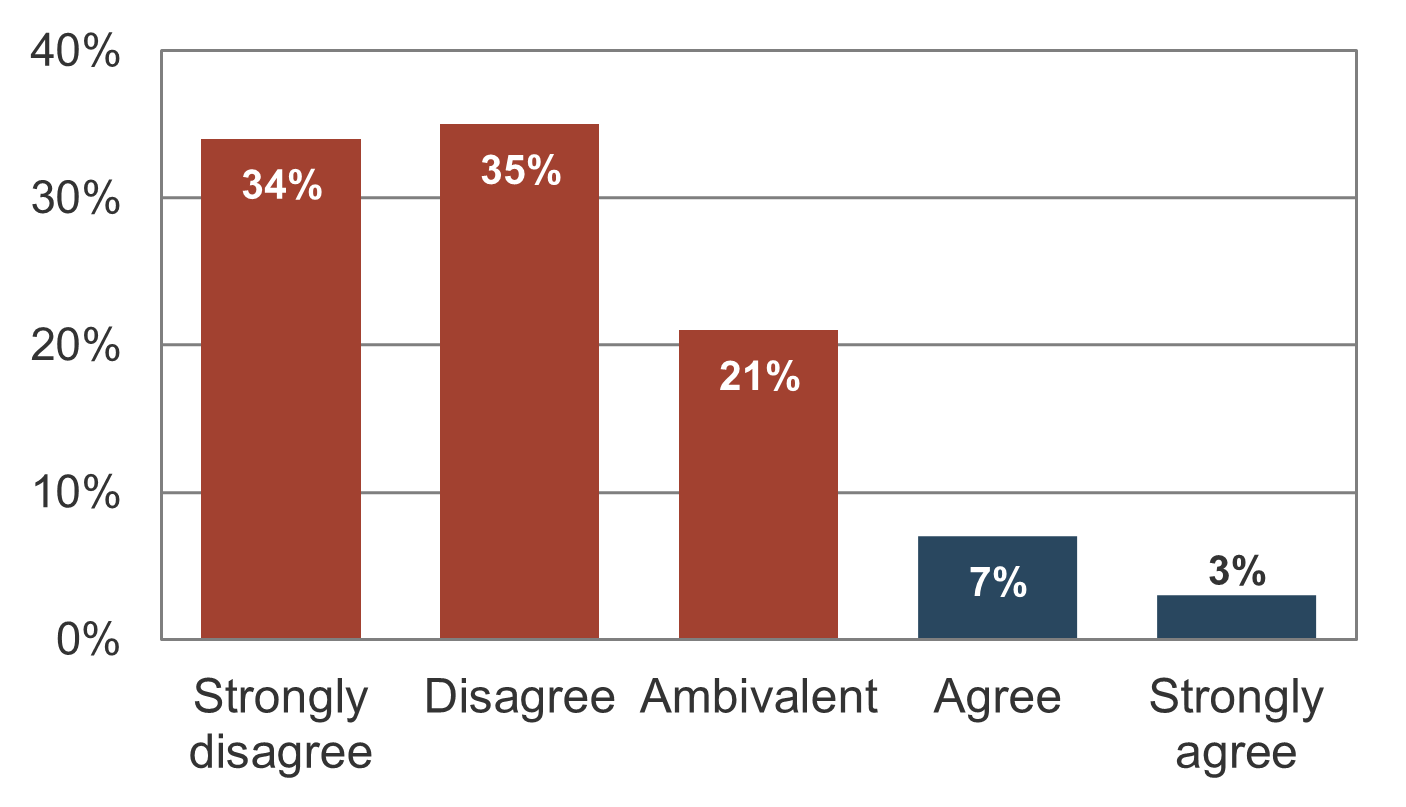

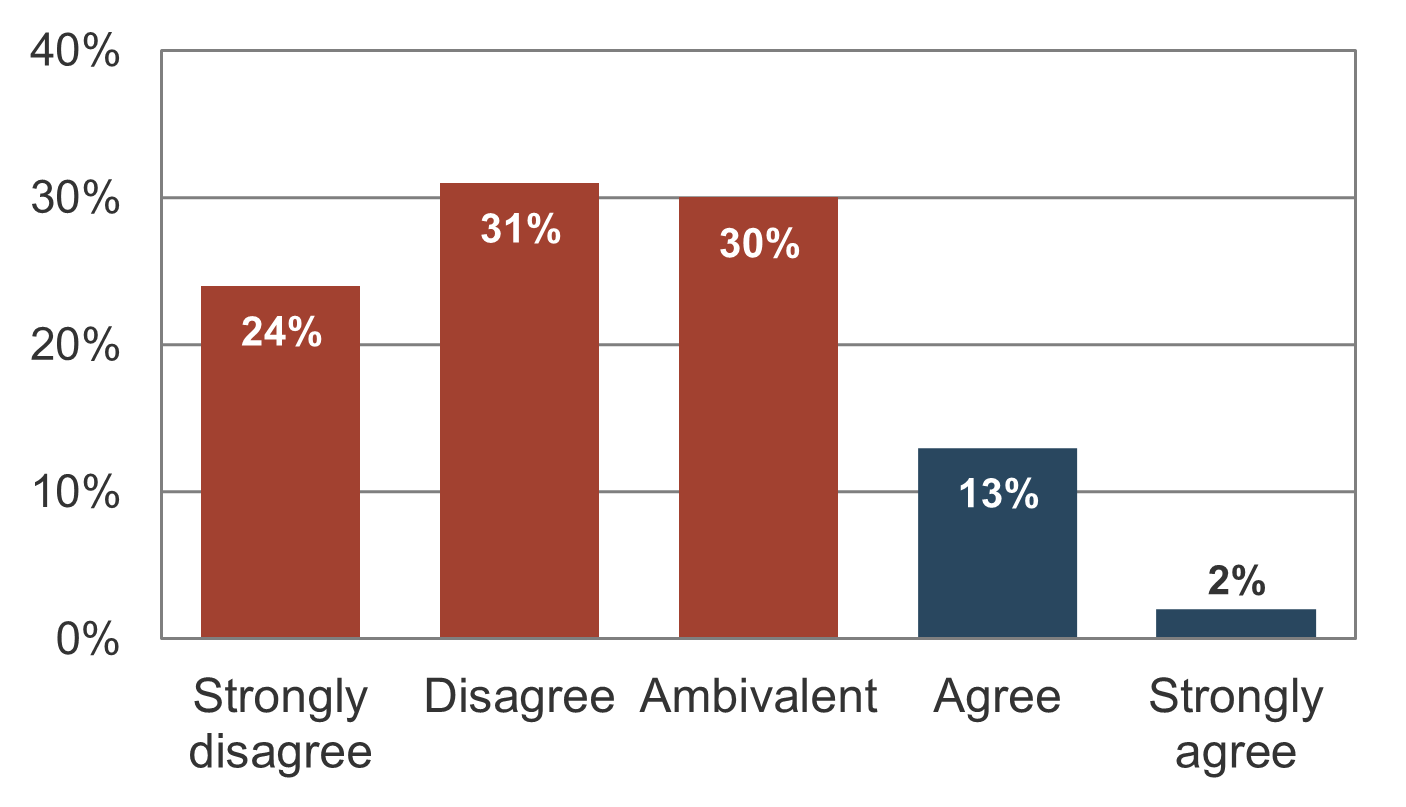

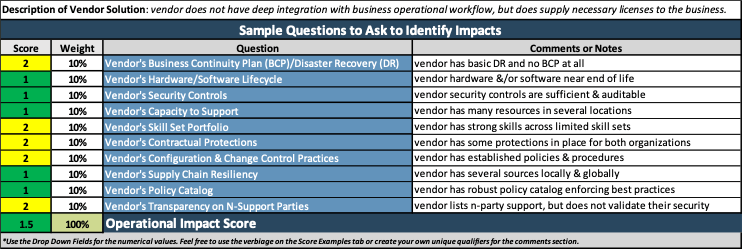

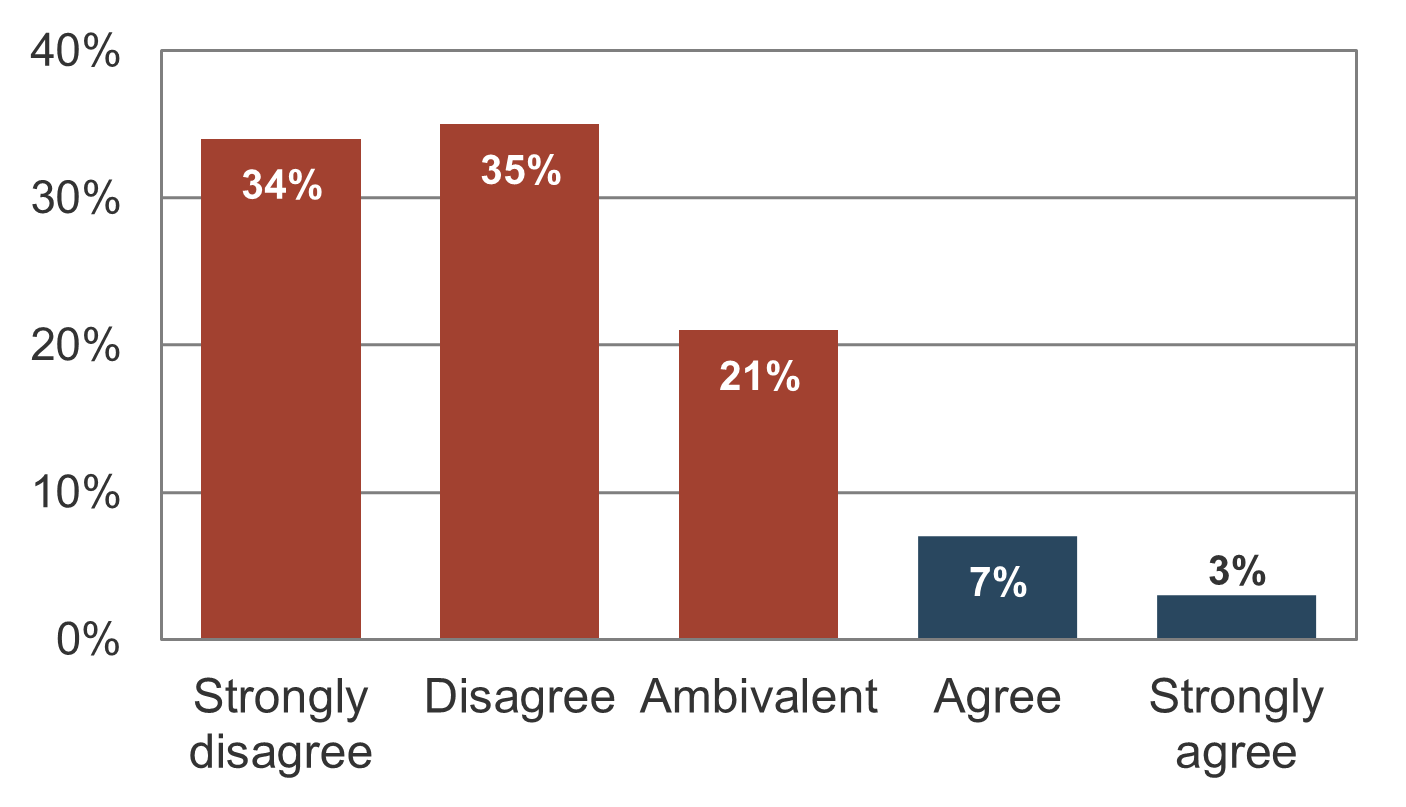

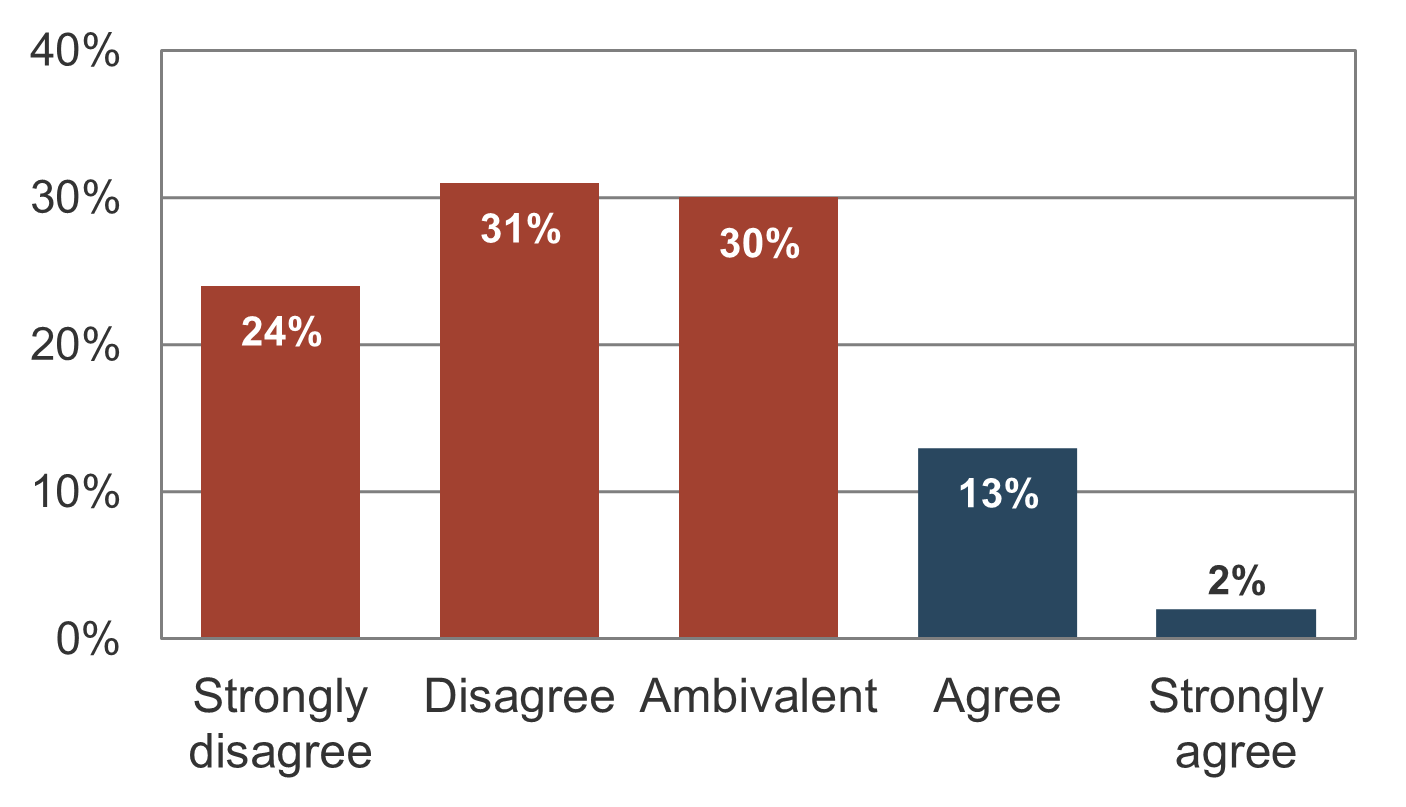

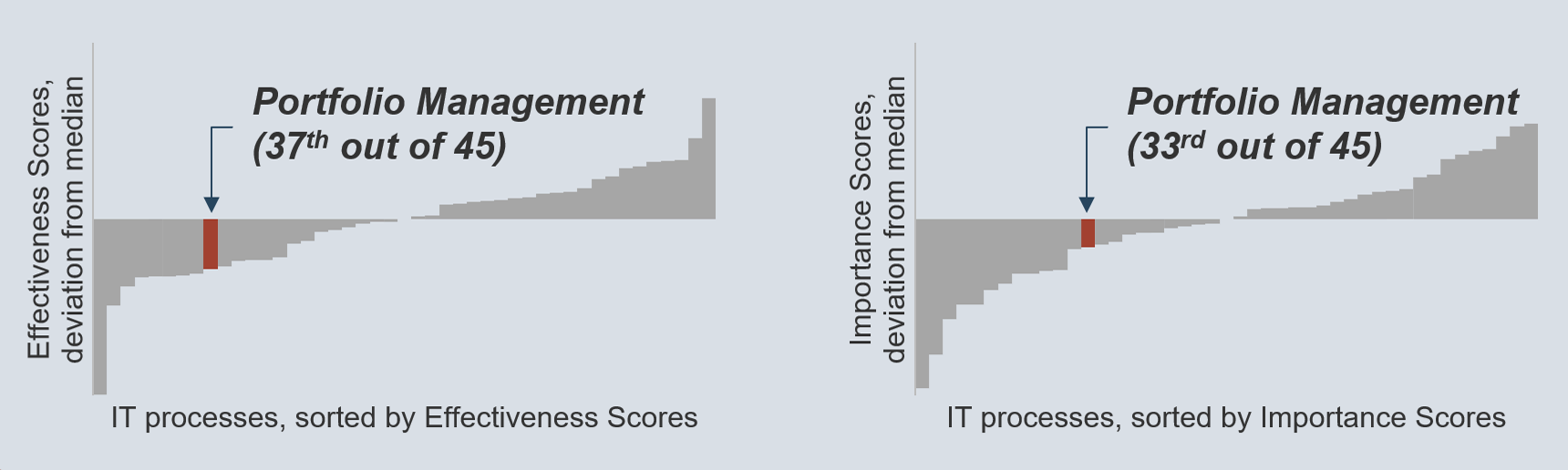

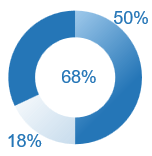

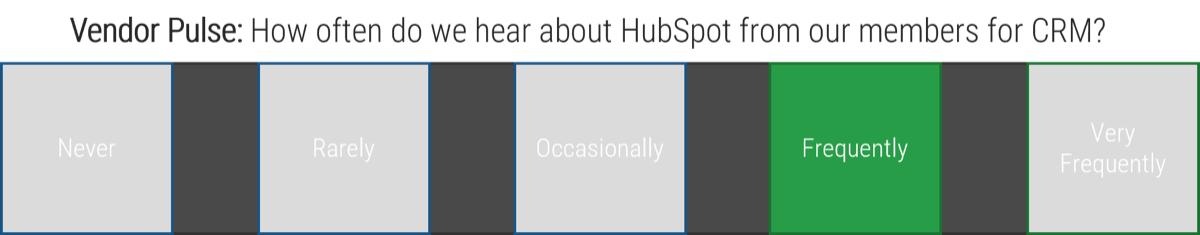

Info-Tech’s data shows that most IT organizations struggle with their project backlog (Source: N=397 organizations, Info-Tech Research Group PPM Current State Scorecard, 2017).

“There is a minimal list of pending projects”

“Last year we delivered the number of projects we anticipated at the start of the year”

The concept of fiduciary duty demonstrates the need for better discipline in choosing what projects to take on

Unless someone is accountable for making the right investment of resource capacity for the right projects, project intake discipline cannot be established effectively.

What is fiduciary duty?

Officers and directors owe their corporation the duty of acting in the corporation’s best interests over their own. They may delegate the responsibility of implementing the actions, but accountability can't be delegated; that is, they have the authority to make choices and are ultimately answerable for them.

No question is more important to the organization’s bottom line. Projects directly impact the bottom line because they require investment of resource time and money for the purposes of realizing benefits. The scarcity of resources requires that choices be made by those who have the right authority.

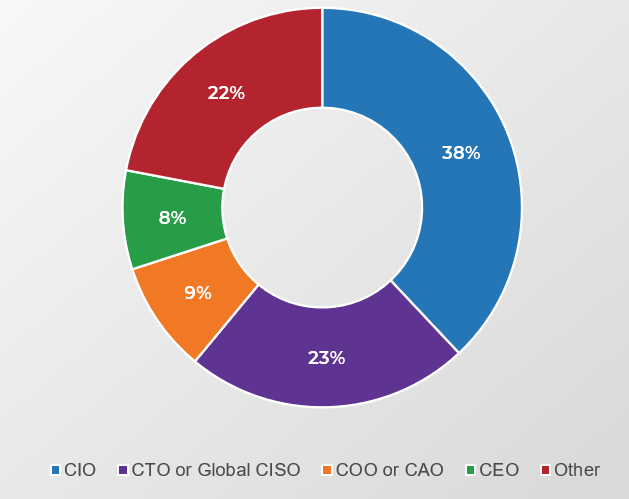

Who approves your projects?

Historically, the answer would have been the executive layer of the organization. However, in the 1990s management largely abdicated its obligation to control resources and expenditures via “employee empowerment.”

Controls on approvals became less rigid, and accountability for choosing what to do (and not do) shifted onto the shoulders of the individual worker. This creates a current paradigm where no one is accountable for the malinvestment…

…of resources that comes from approving too many projects. Instead, it’s up to individual workers to sink or swim as they attempt to reconcile, day after day, seemingly infinite organizational demand with their finite supply of working hours.

Ad hoc project selection schemes do not work

Without active management, reconciling the imbalance between demand with available work hours is a struggle that results largely in one of these two scenarios:

“Squeaky wheel”: Projects with the most vocal stakeholders behind them are worked on first.

- IT is seen to favor certain lines of business, leading to disenfranchisement of other stakeholders.

- Everything becomes the highest priority, which reinforces IT’s image as a firefighter, rather than a business value contributor

- High-value projects without vocal support never get resourced; opportunities are missed.

“First in, first out”: Projects are approved and executed in the order they are requested.

- Urgent or important projects for the business languish in the project backlog; opportunities are missed.

- Low-value projects dominate the project portfolio.

- Stakeholders leave IT out of the loop and resort to “underground economy” for getting their needs addressed.

80% of organizations feel that their portfolios are dominated by low-value initiatives that do not deliver value to the business (Source: Cooper).

Approve the right projects that you have capacity to deliver by actively managing the intake of projects

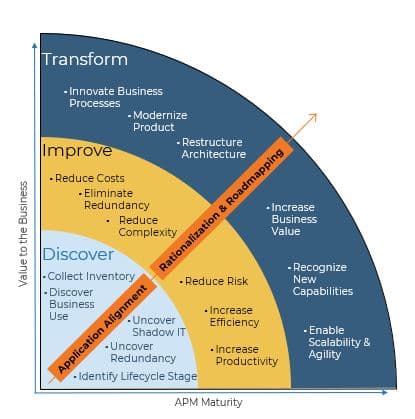

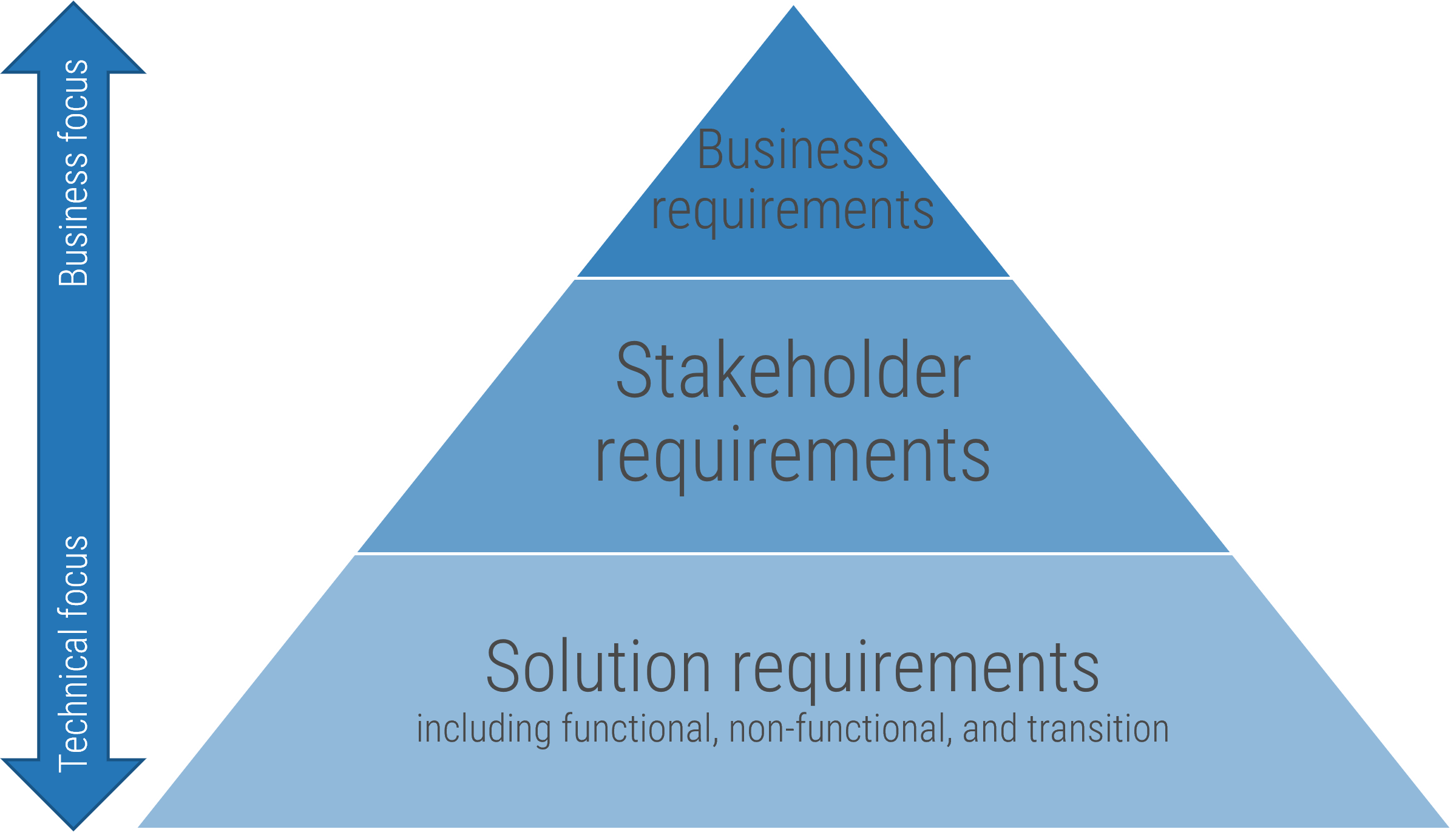

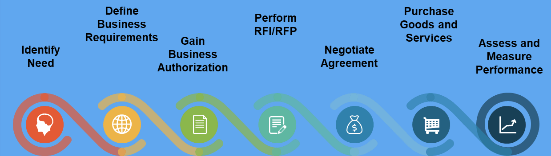

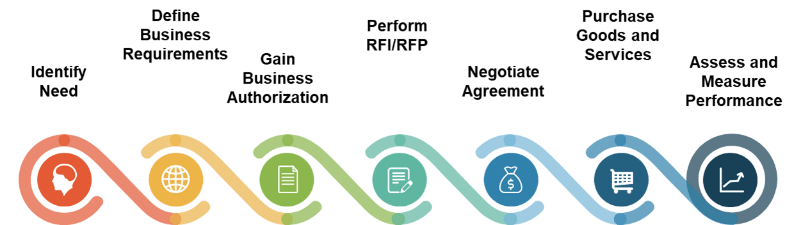

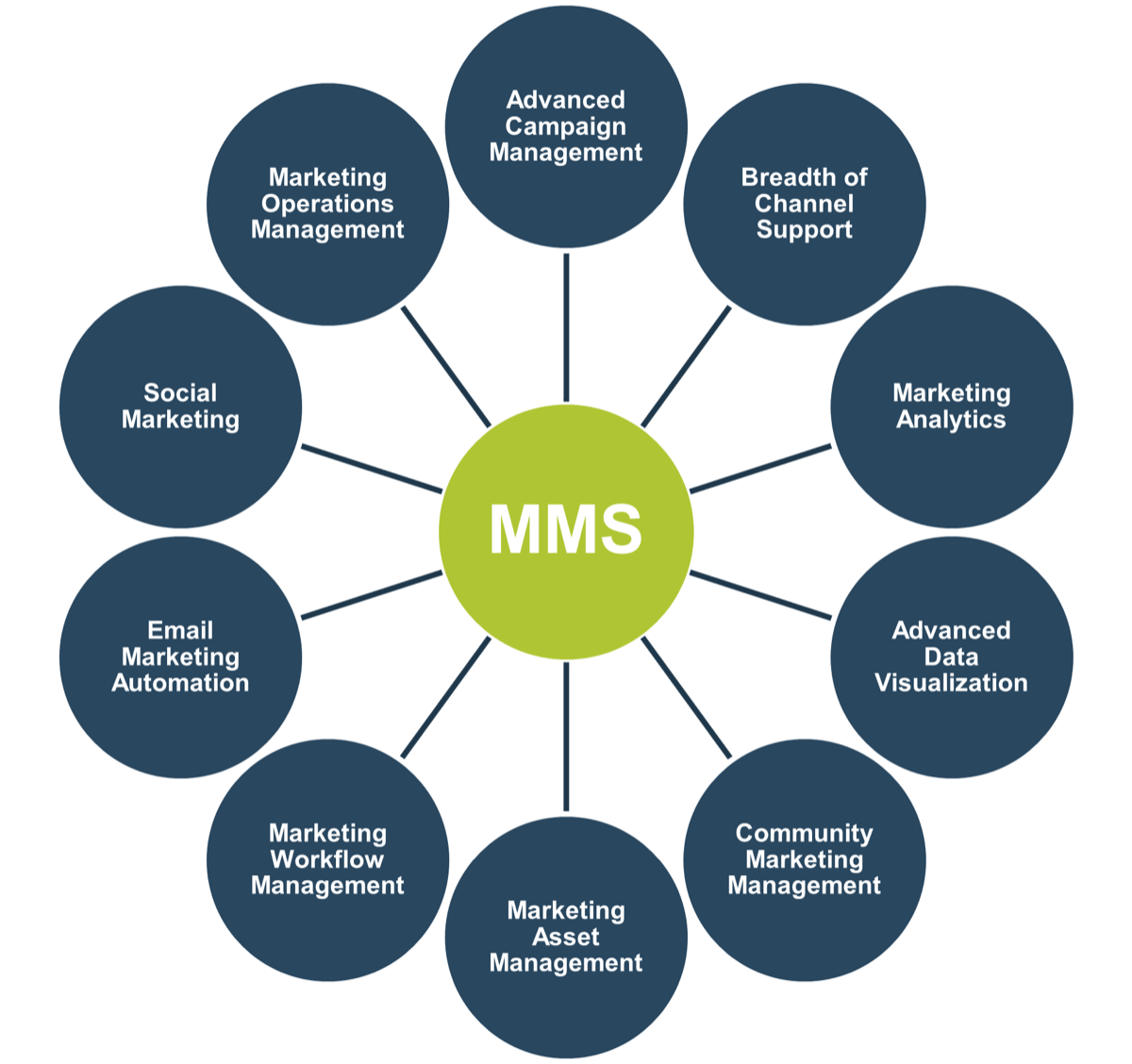

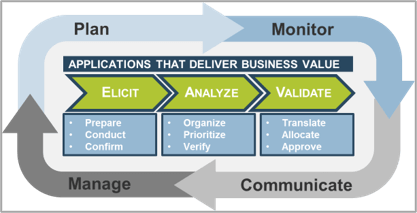

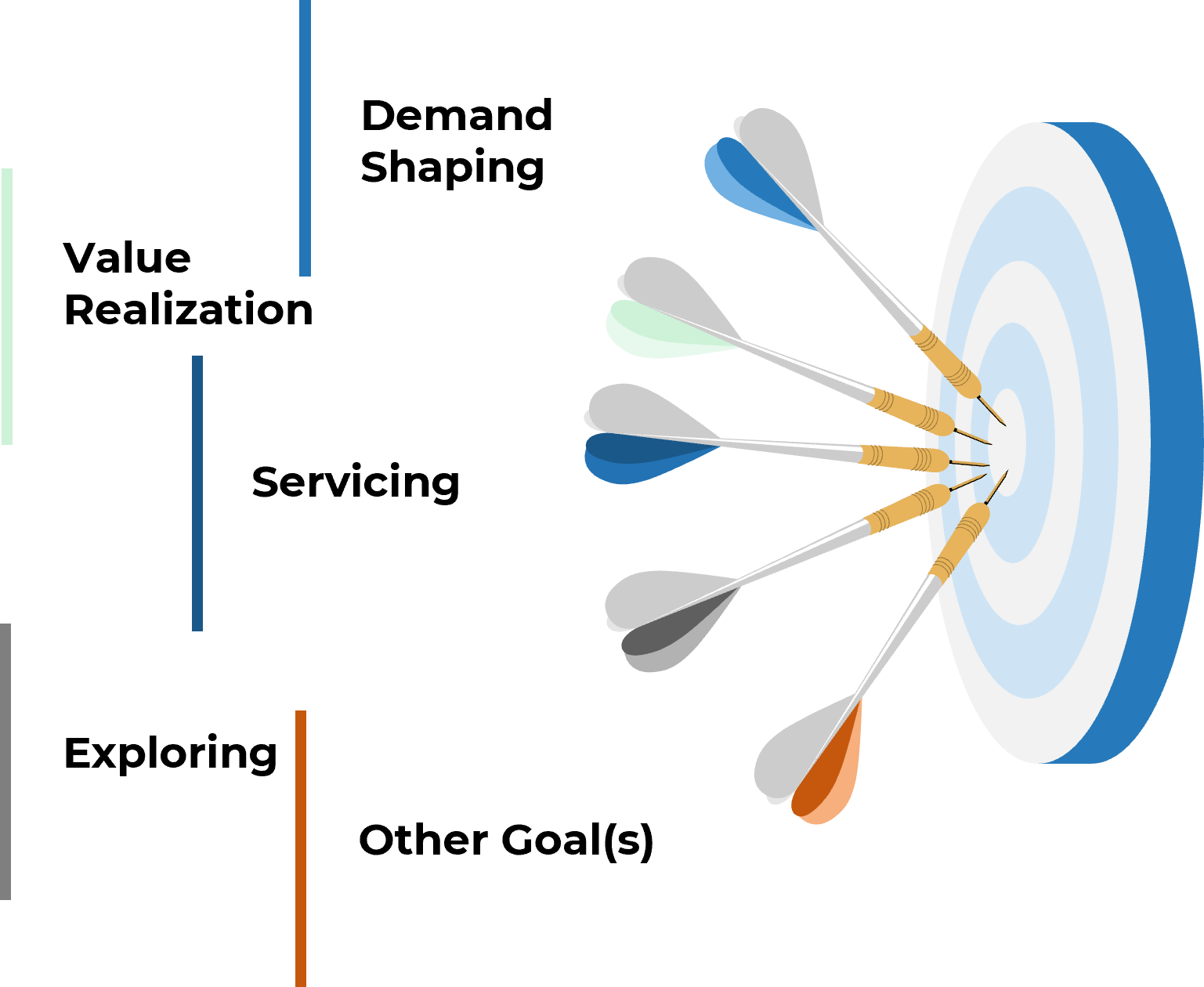

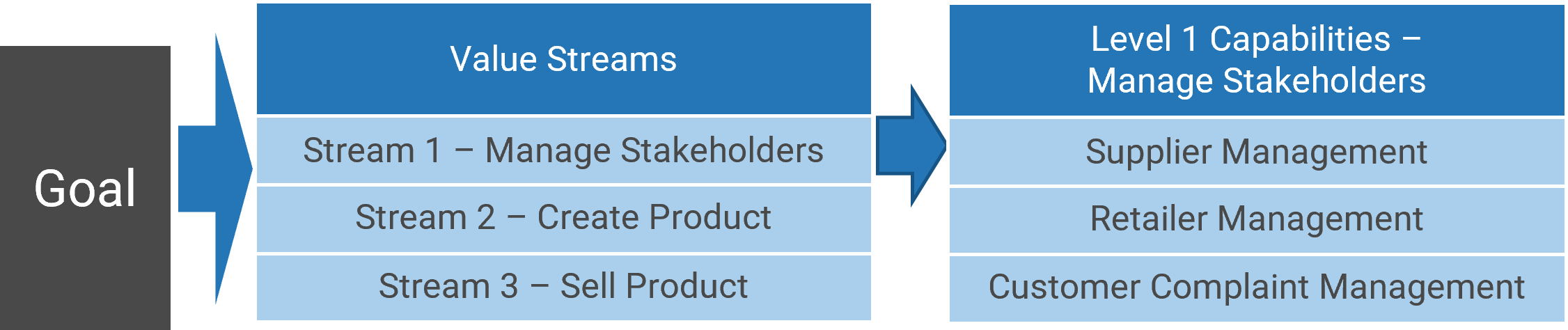

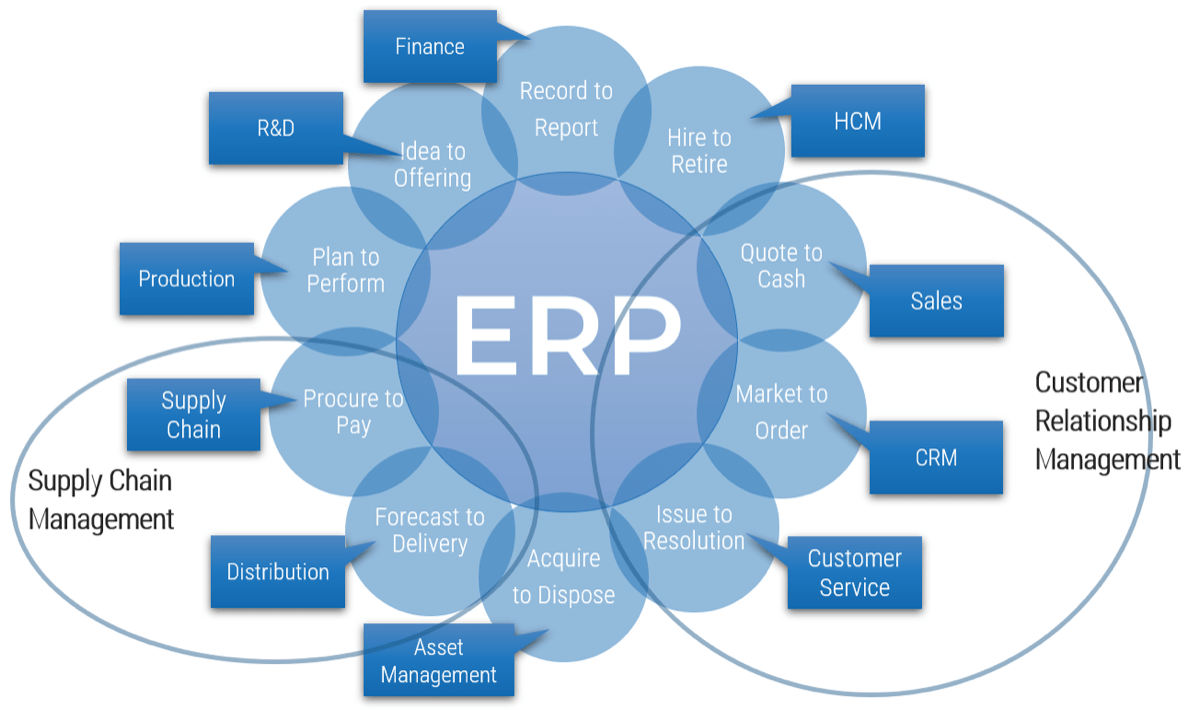

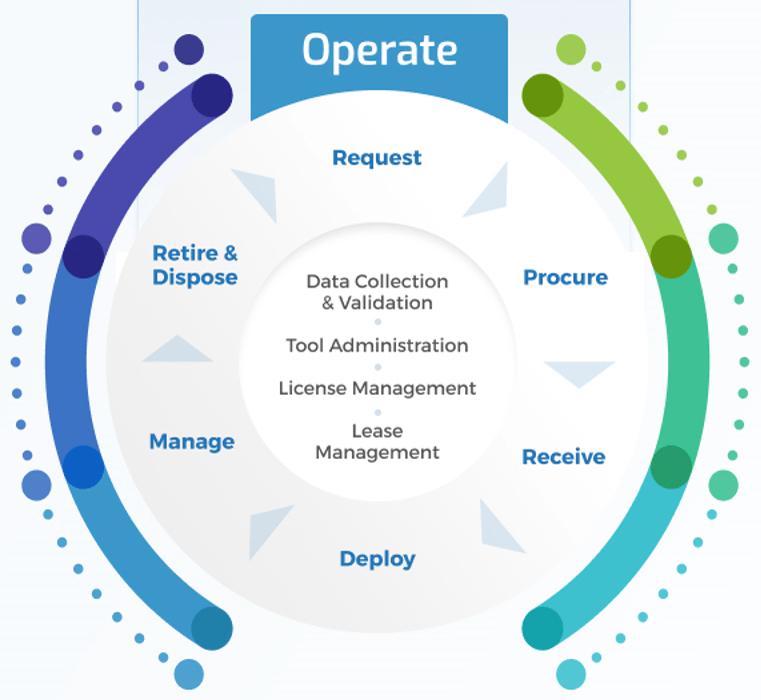

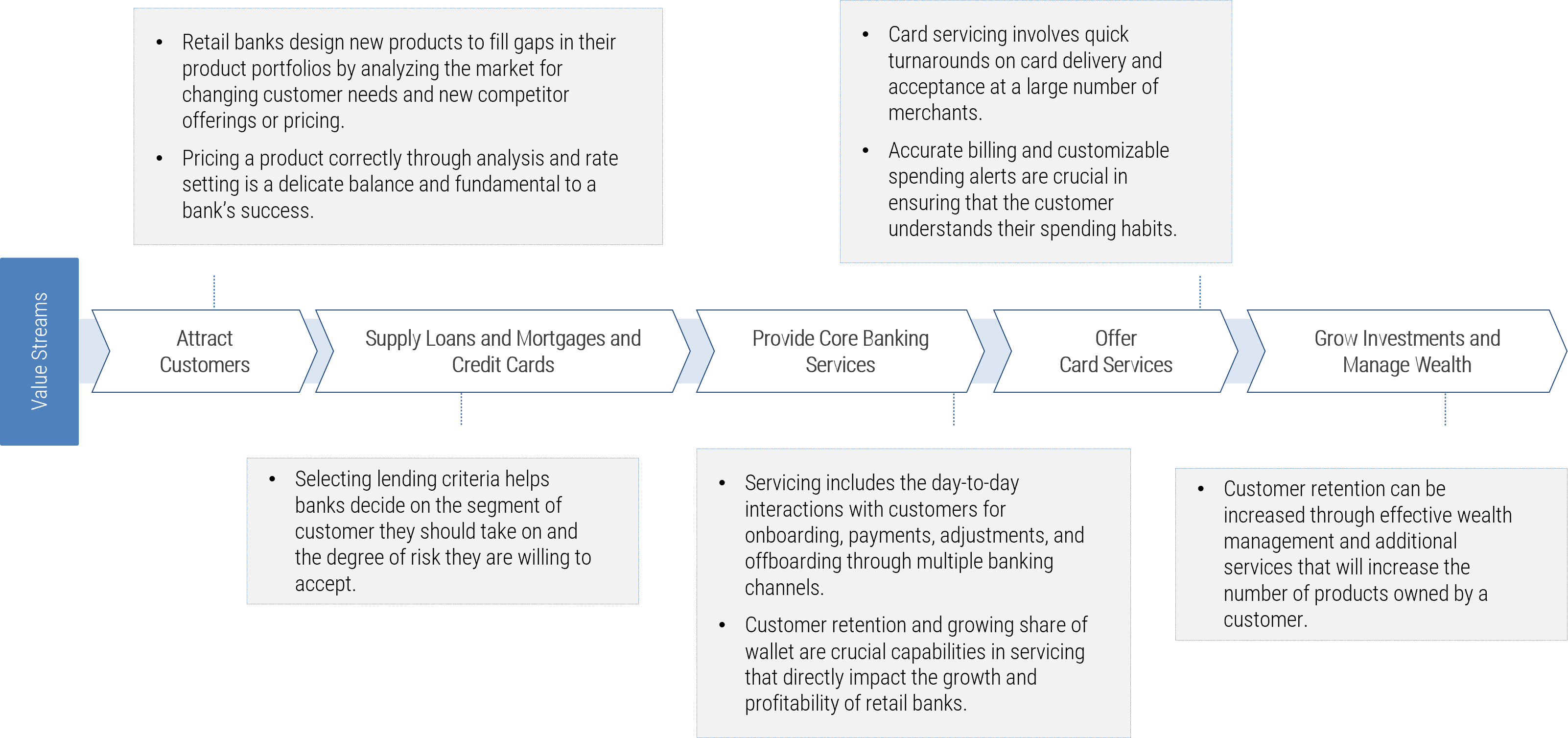

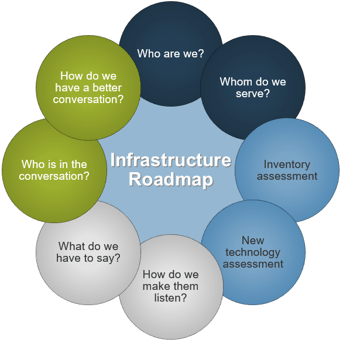

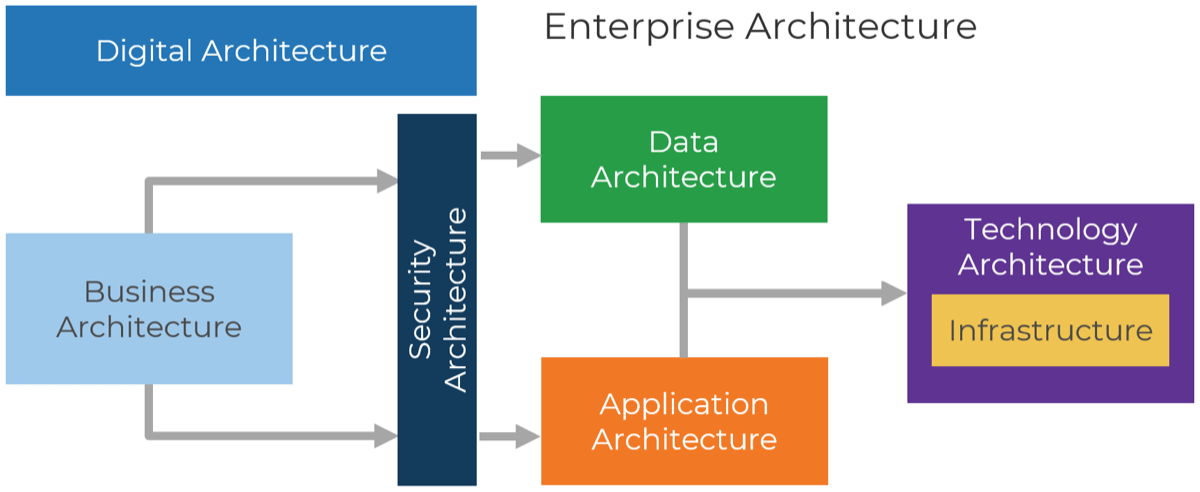

Project intake, approval, and prioritization (collectively “project intake”) reconciles the appetite for new projects with available resource capacity and strategic goals.

Project intake is a key process of project portfolio management (PPM). The Project Management Institute (PMI) describes PPM as:

"Interrelated organizational processes by which an organization evaluates, selects, prioritizes, and allocates its limited internal resources to best accomplish organizational strategies consistent with its vision, mission, and values."

(PMI, Standard for Portfolio Management, 3rd ed.)

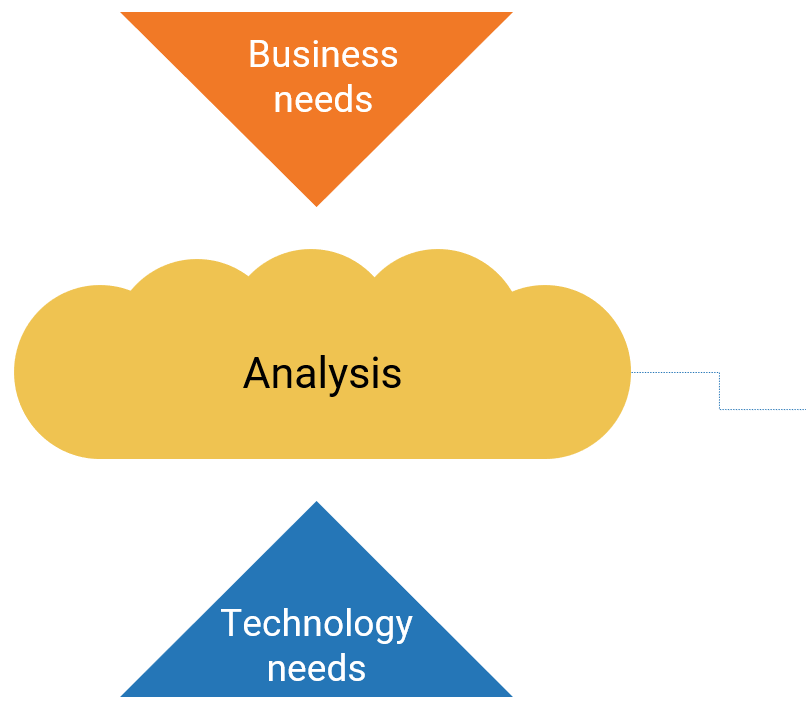

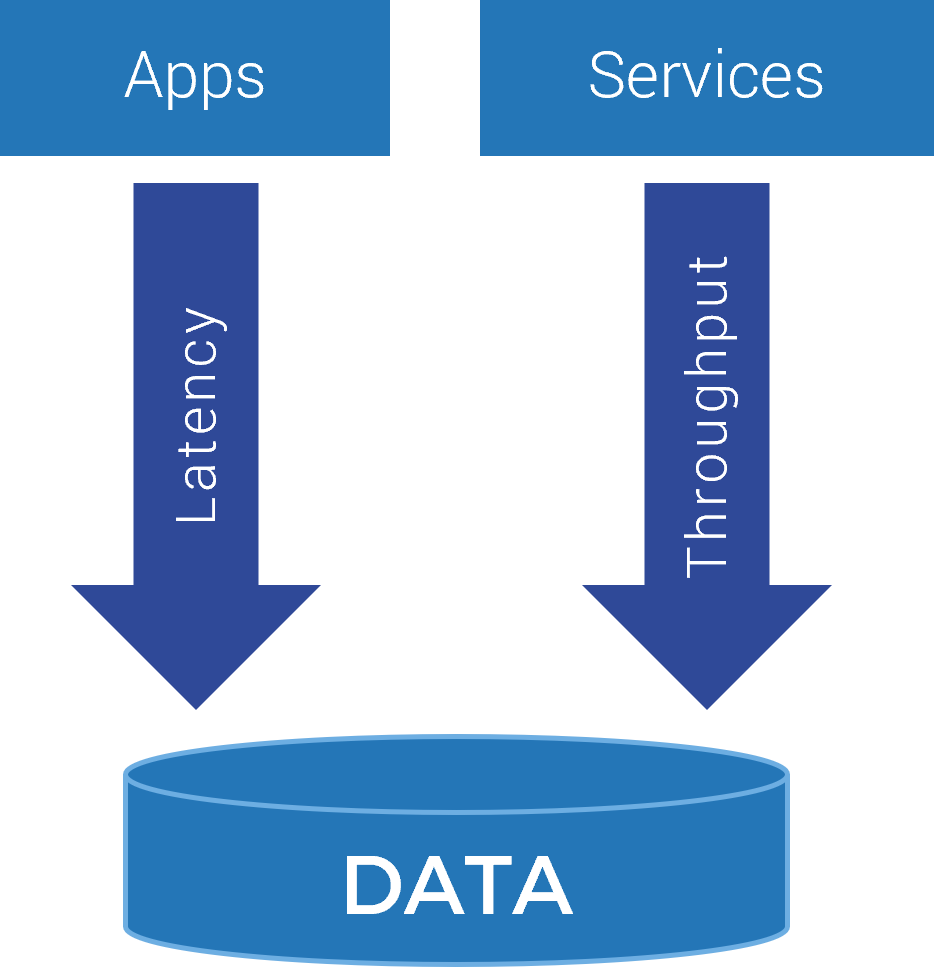

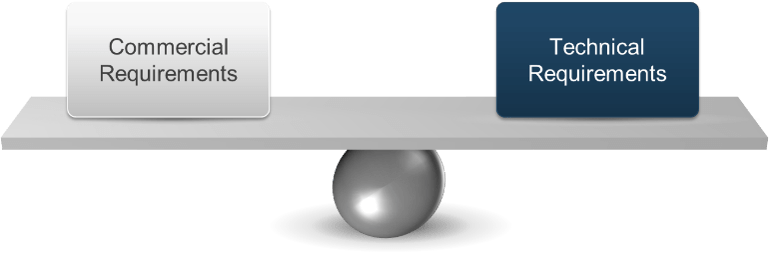

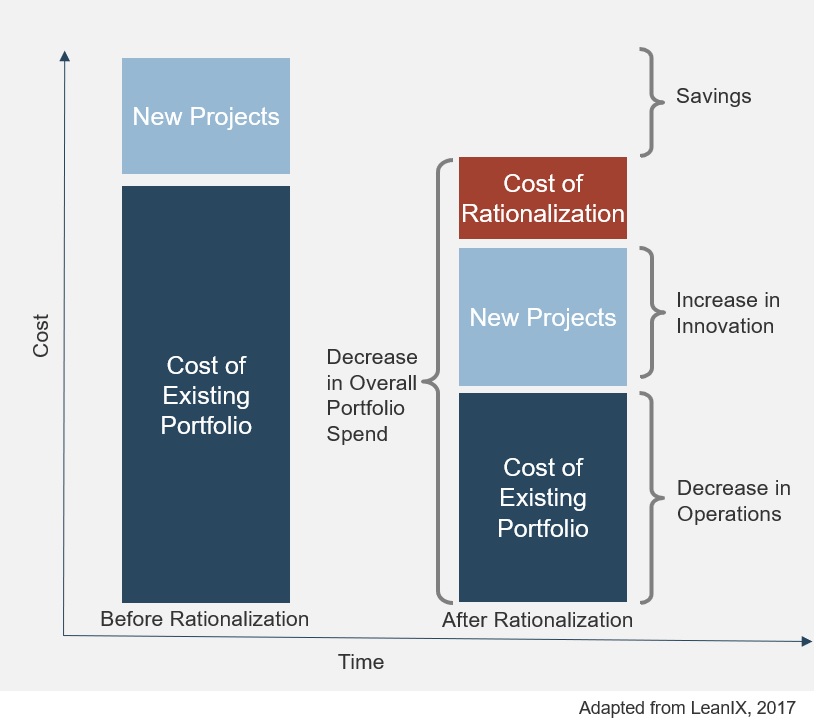

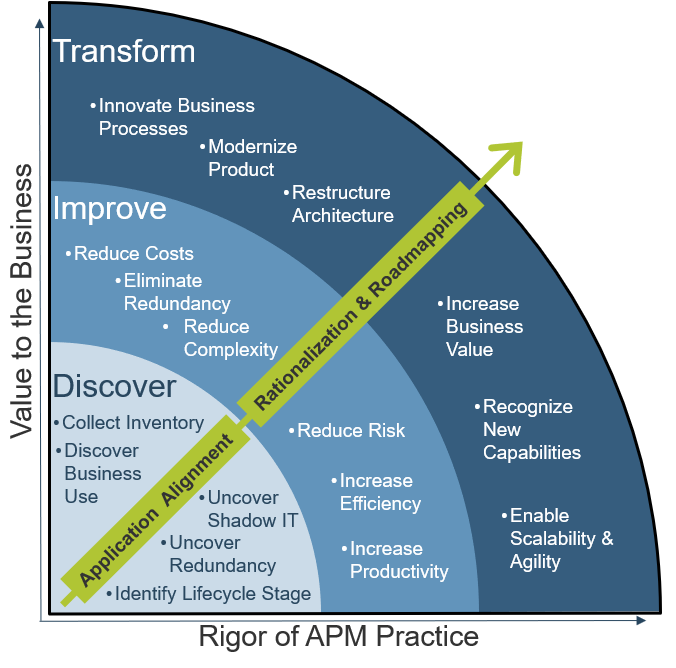

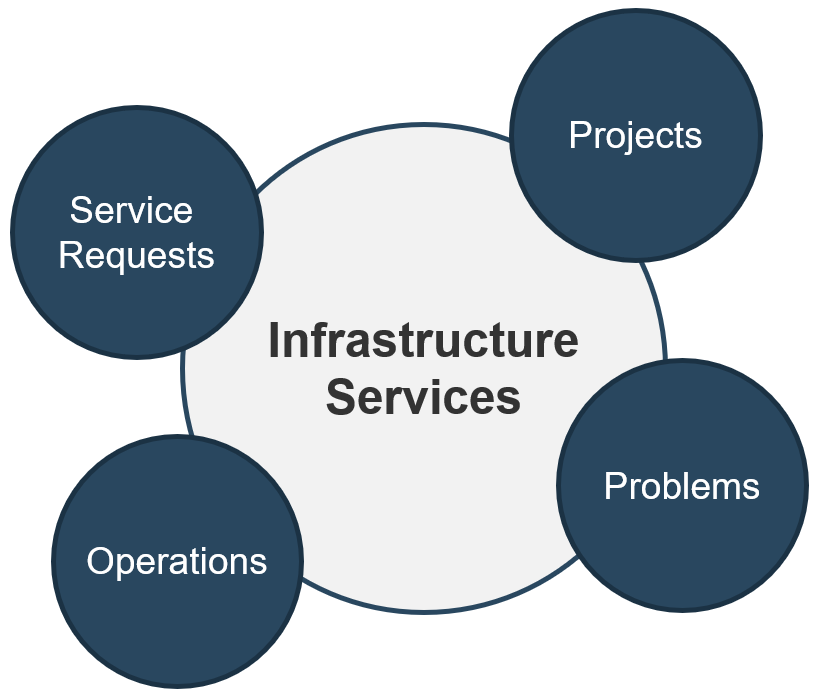

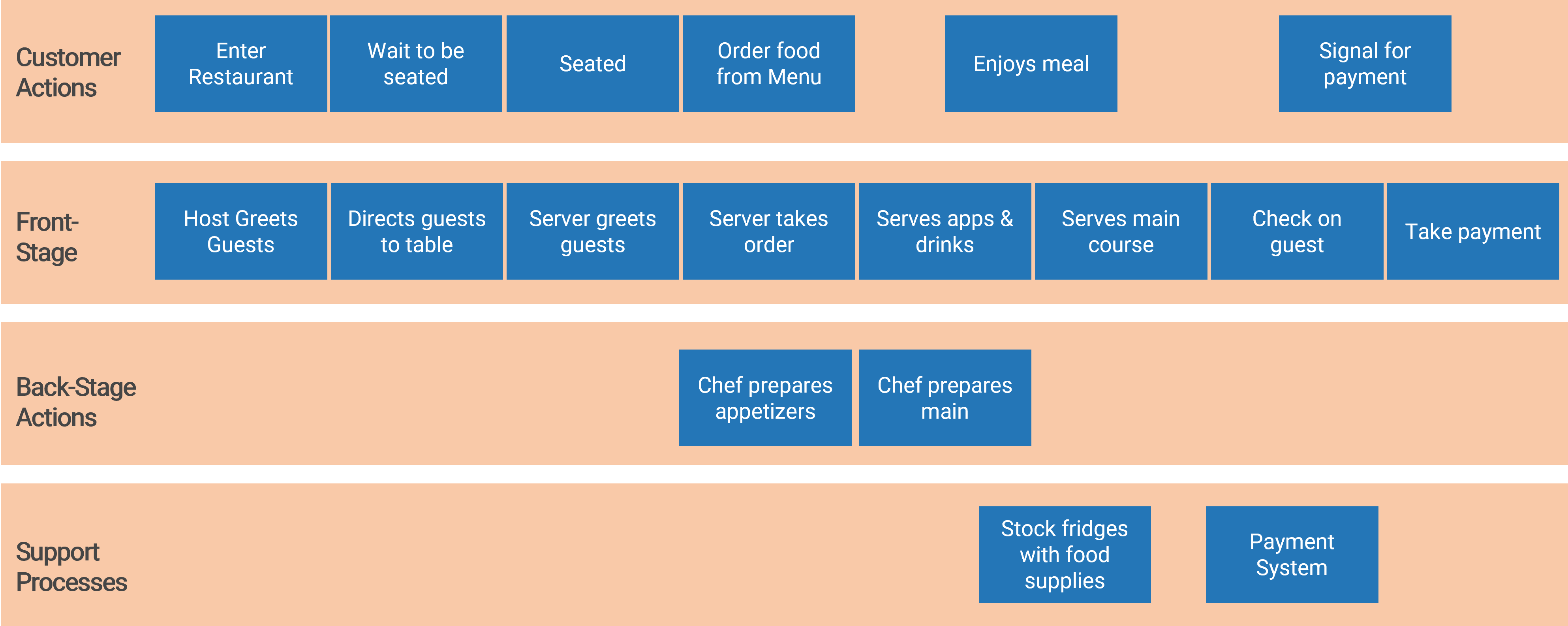

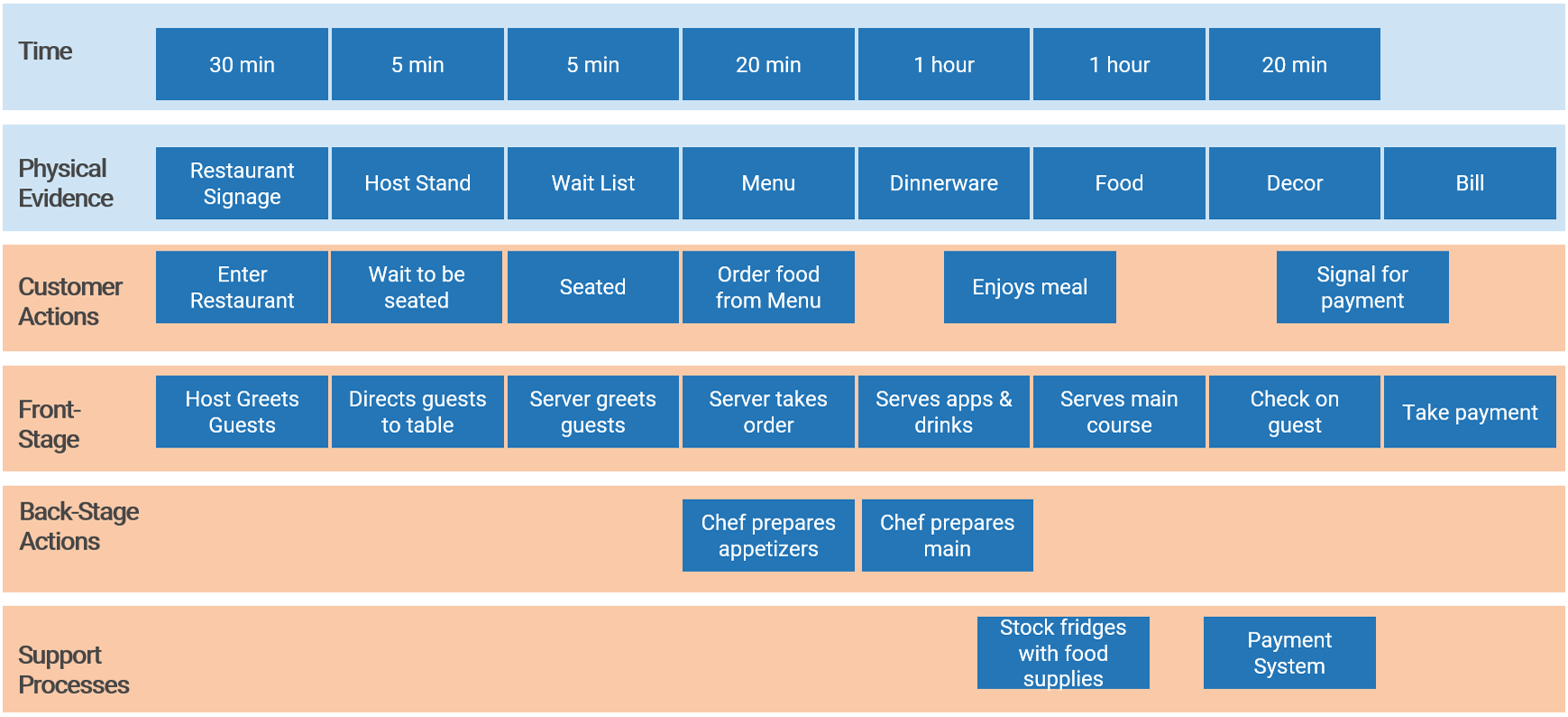

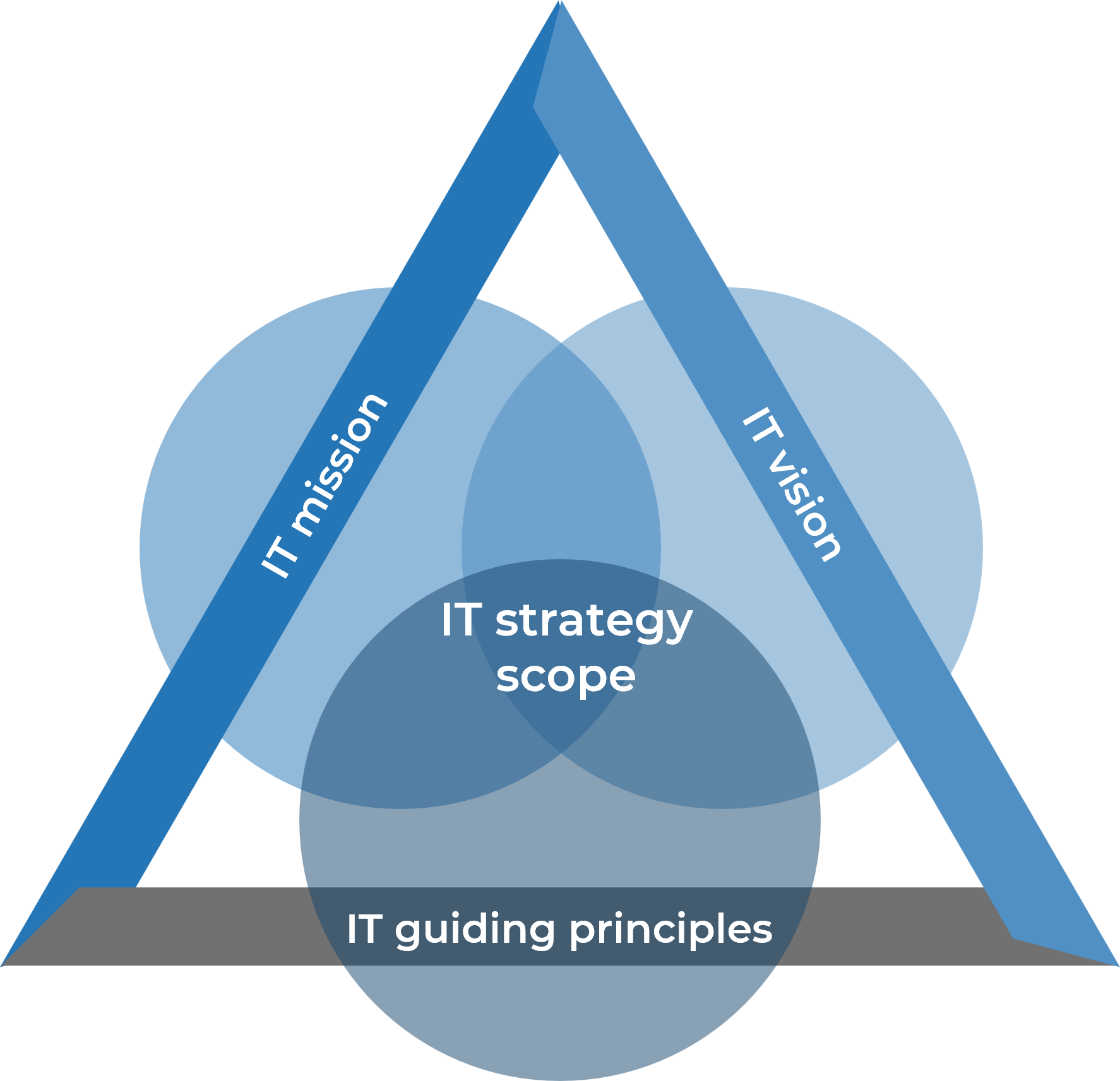

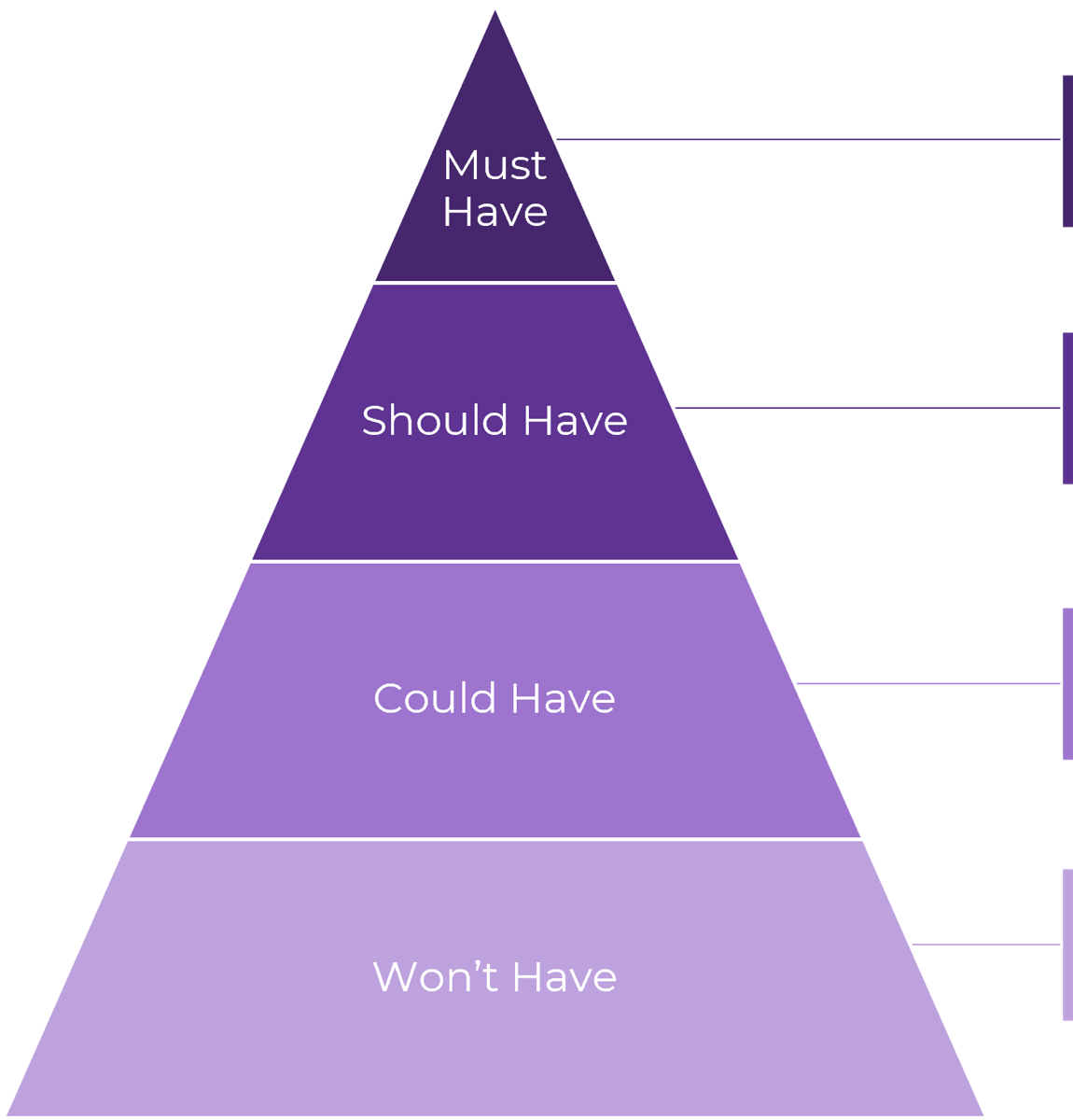

Triple Constraint Model of the Project Portfolio

Project Intake:

- Stakeholder Need

- Strategic Objectives

- Resource Capacity

All three components are required for the Project Portfolio

Organizations practicing PPM recognize available resource capacity as a constraint and aim to select projects – and commit the said capacity – to projects that:

- Best satisfy the stakeholder needs that constantly change with the market

- Best align to the strategic objectives and contribute the most to business

- Have sufficient resource capacity available to best ensure consistent project throughput

92% vs. 74%: 92% of high-performing organizations in PPM report that projects are well aligned to strategic initiatives vs. 74% of low performers (PMI, 2015).

82% vs. 55%: 82% of high-performing organizations in PPM report that resources are effectively reallocated across projects vs. 55% of low performers (PMI, 2015)

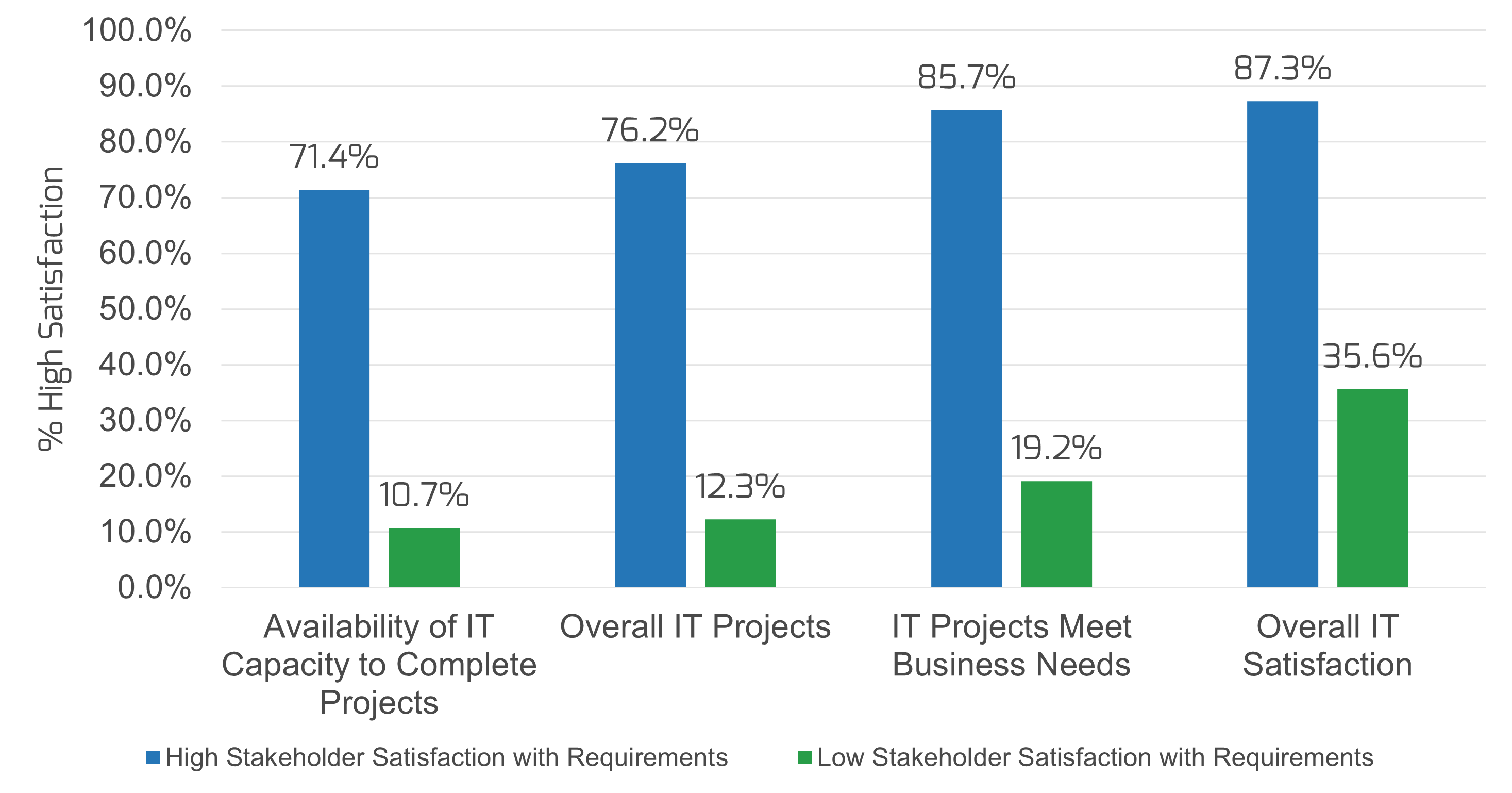

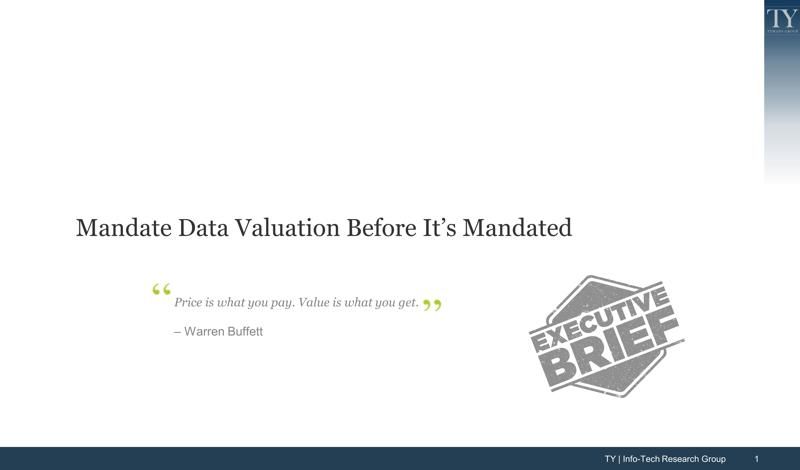

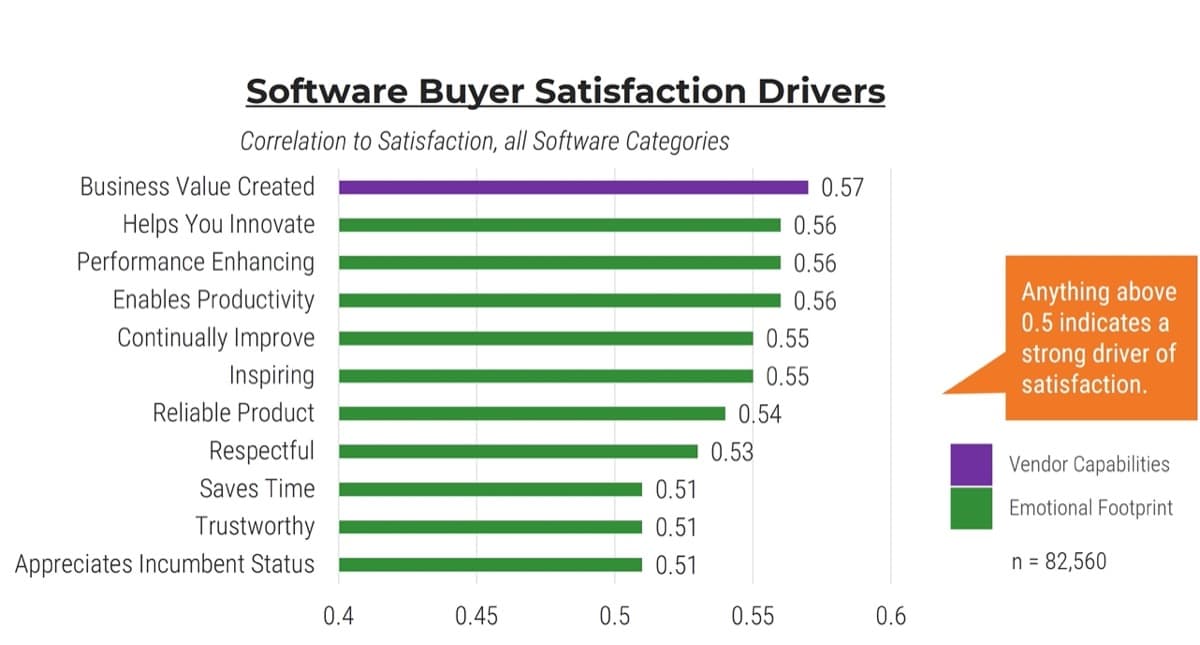

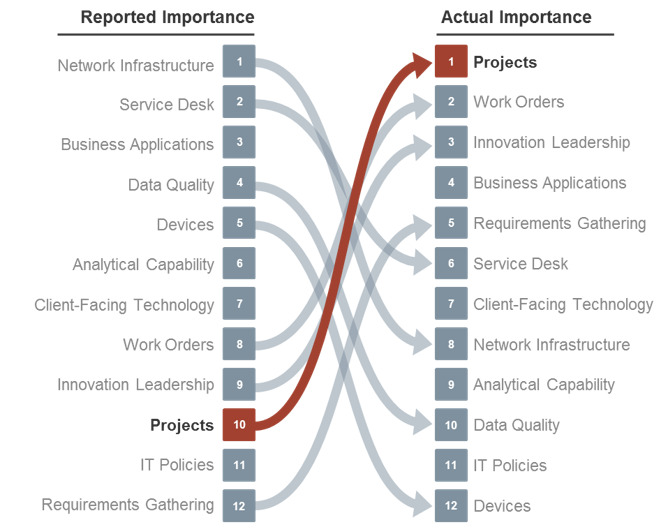

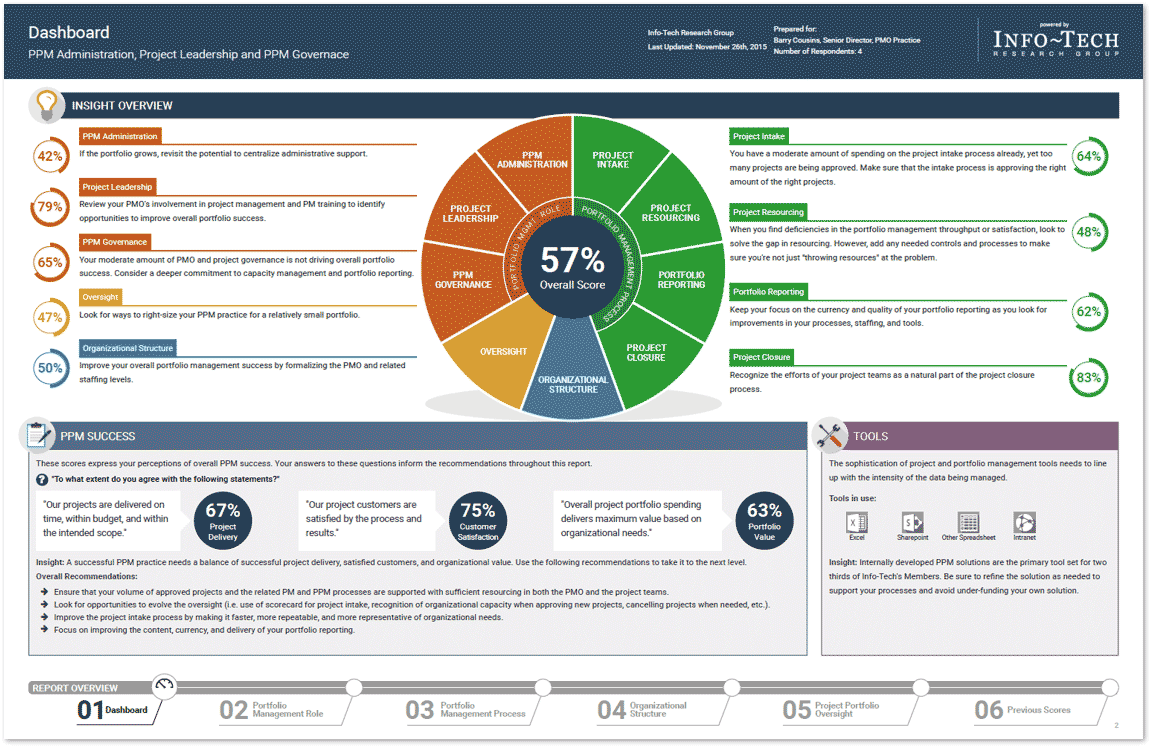

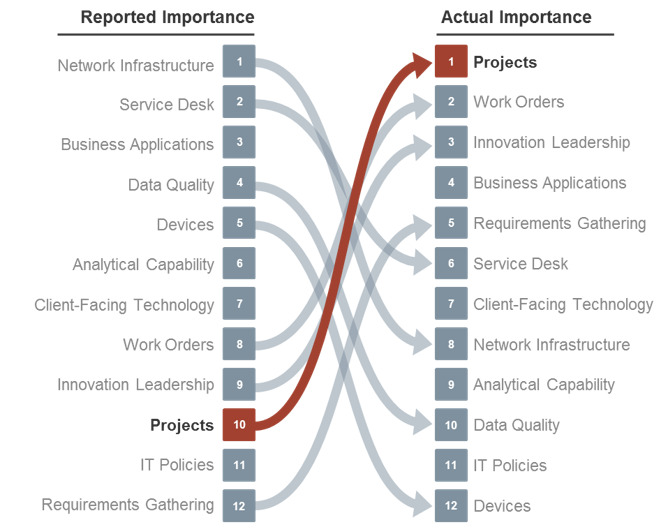

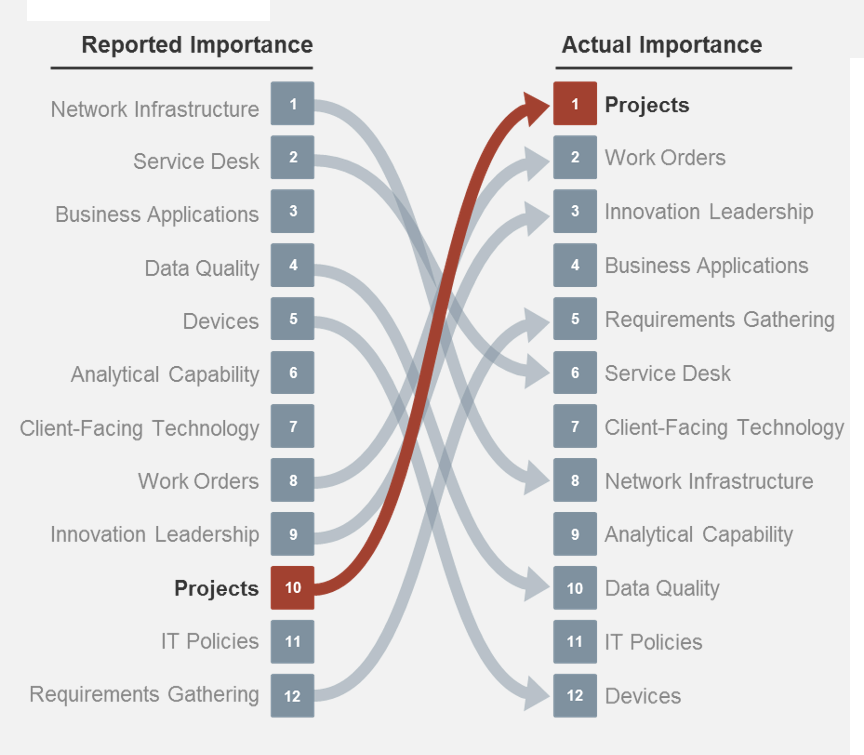

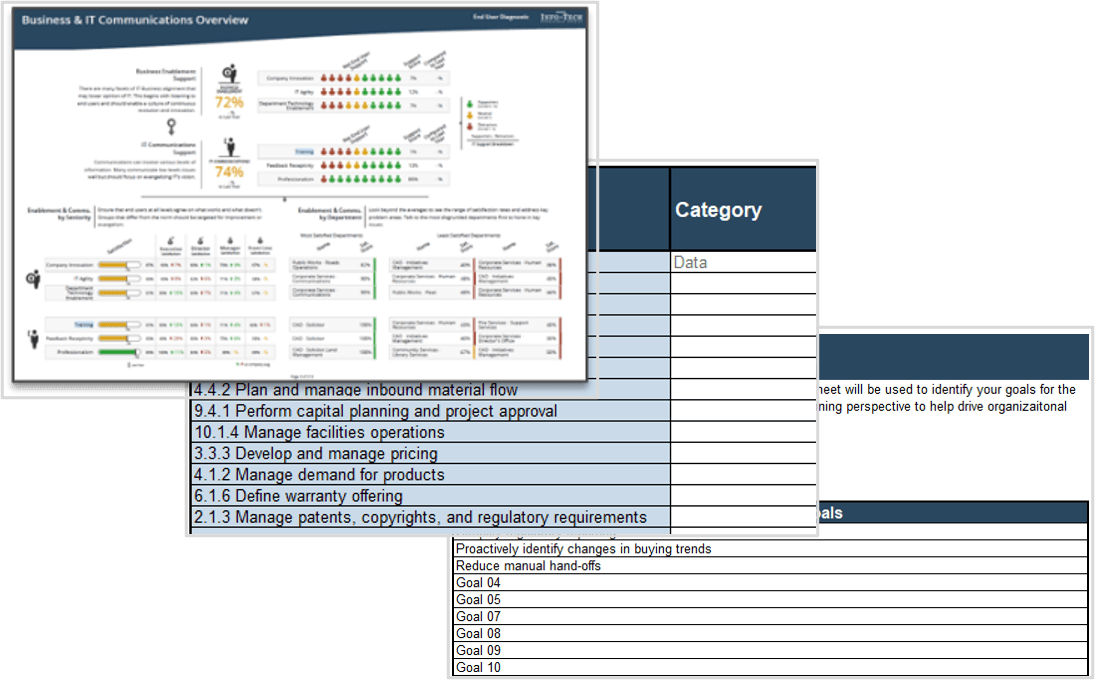

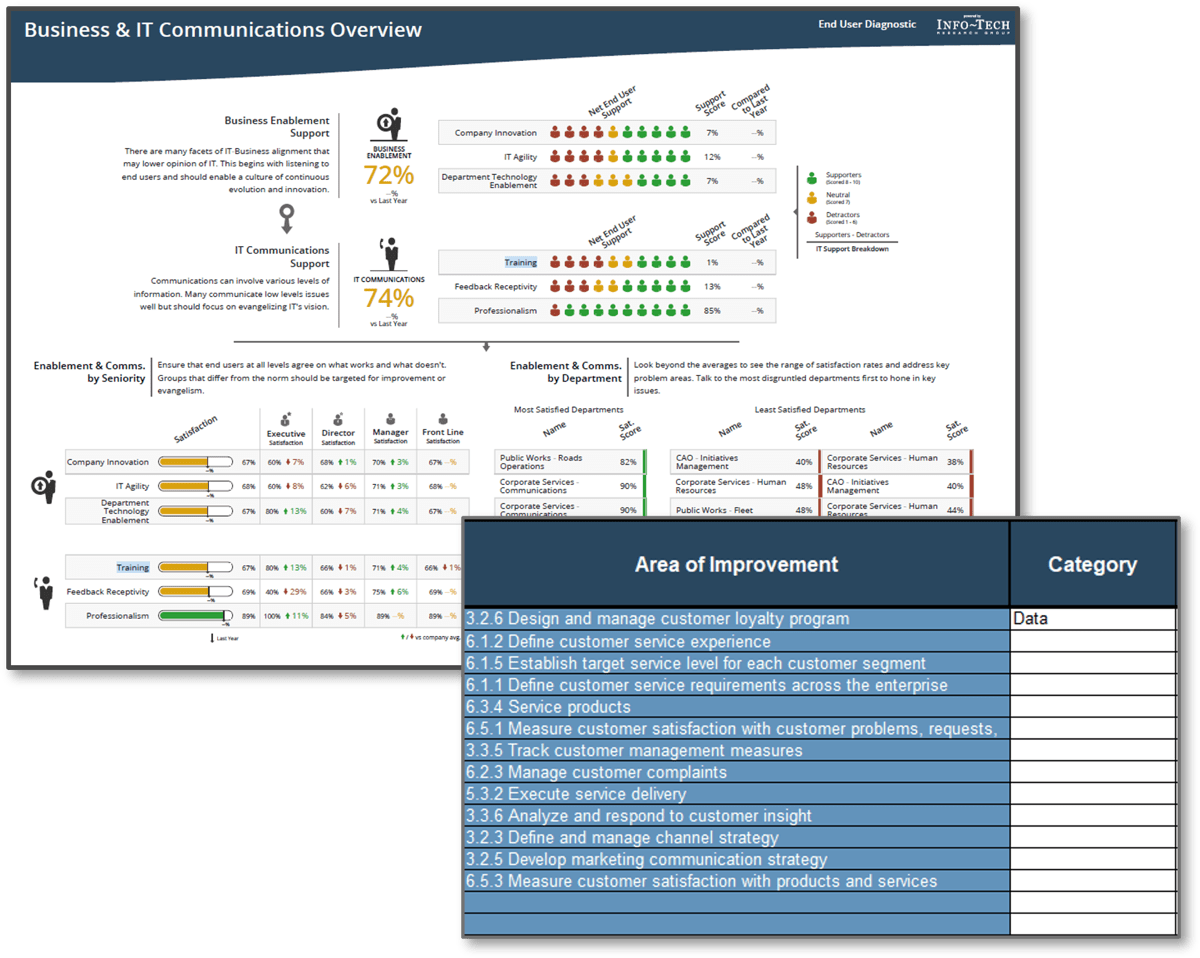

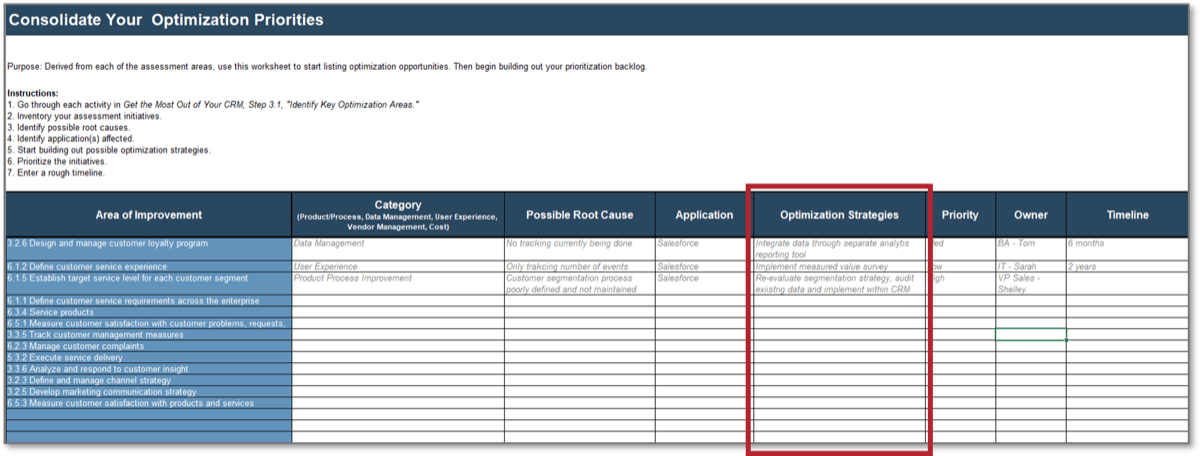

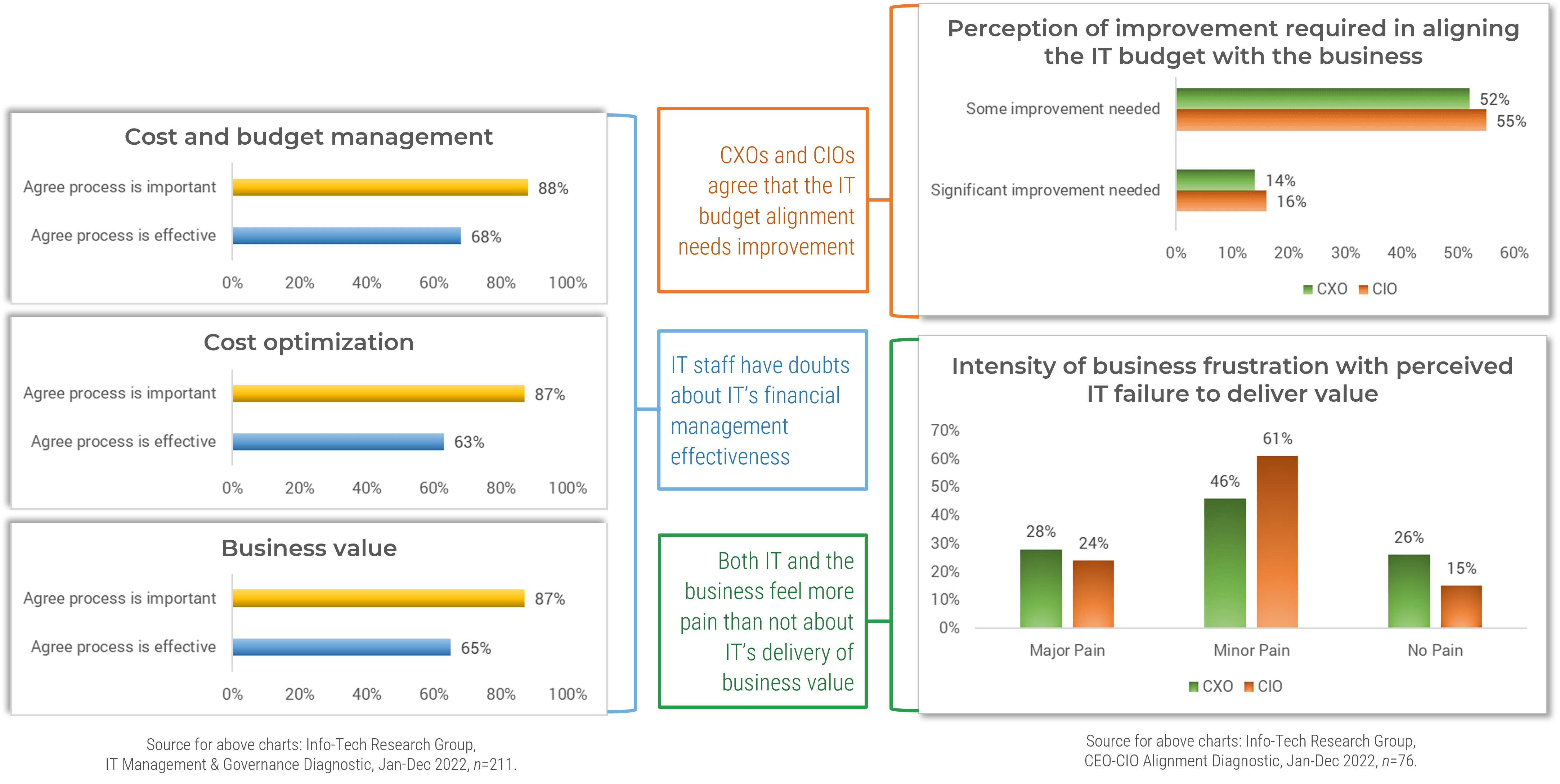

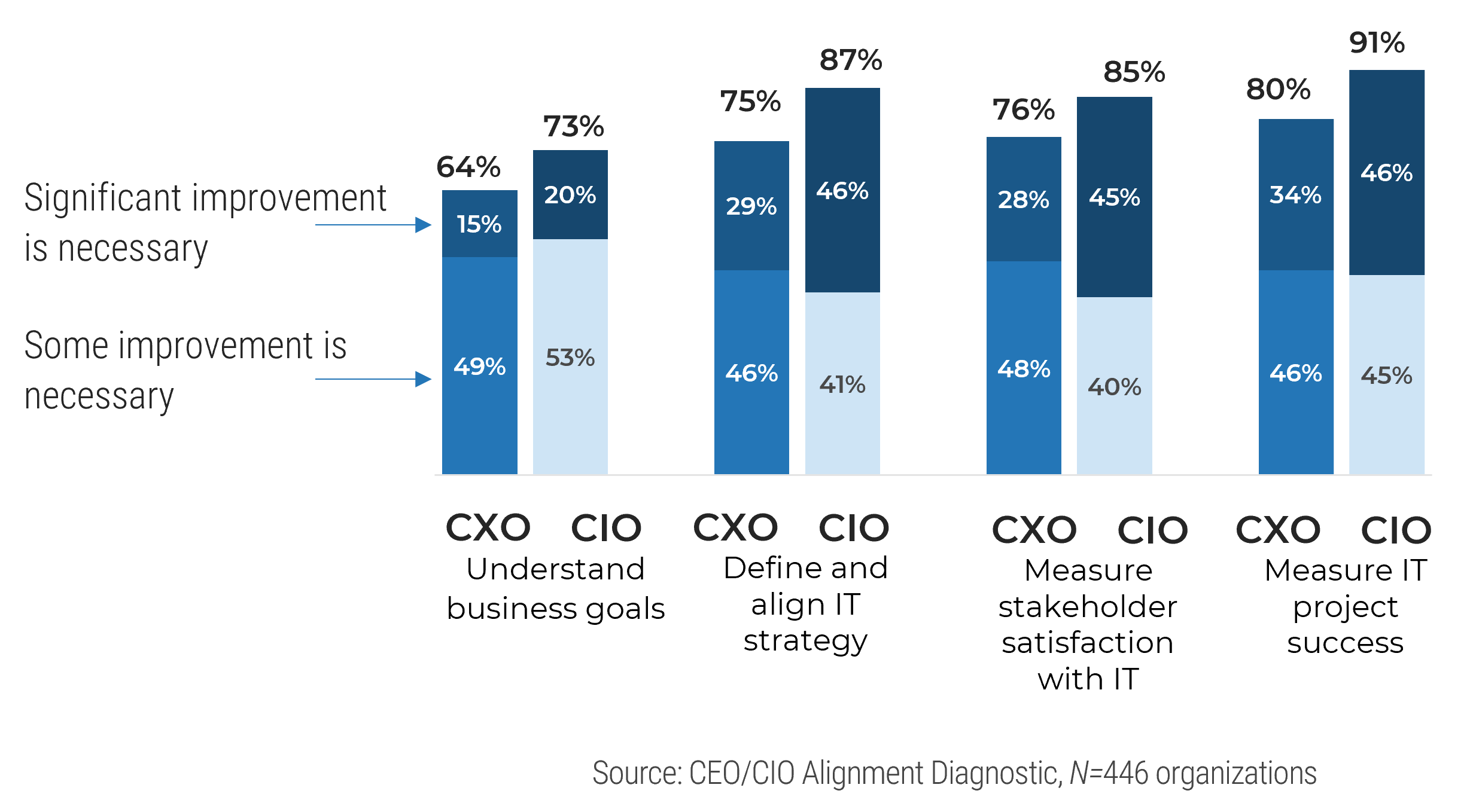

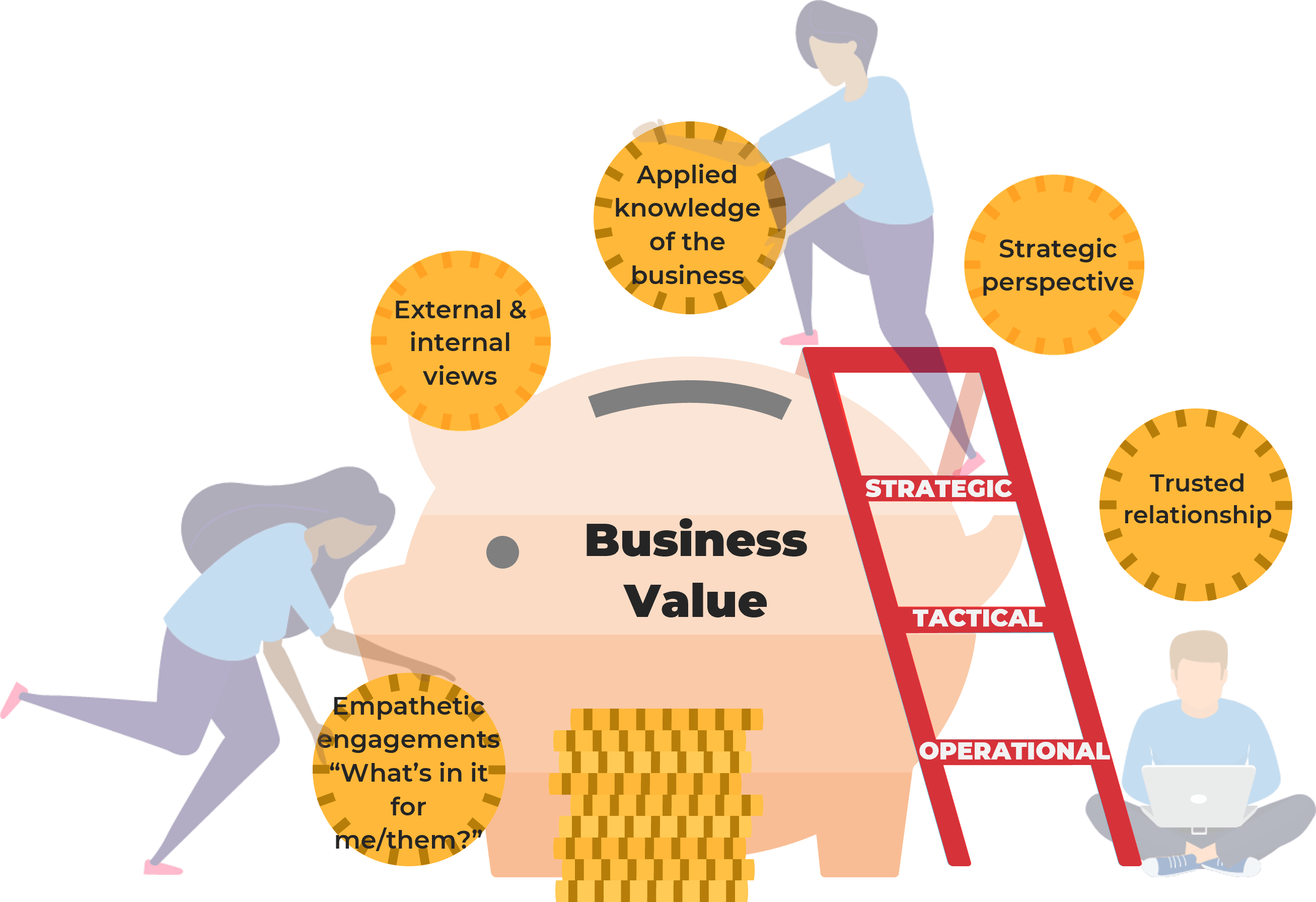

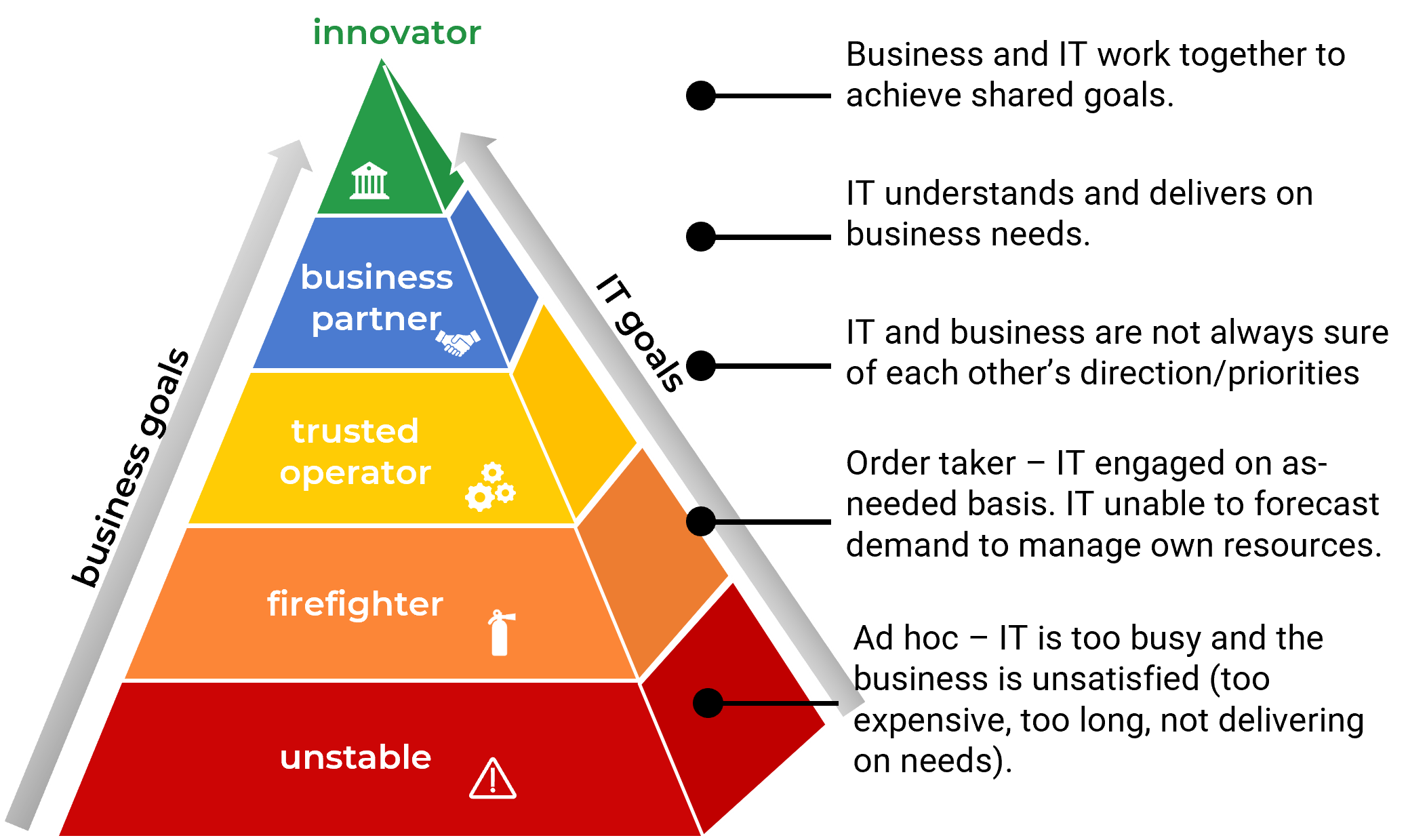

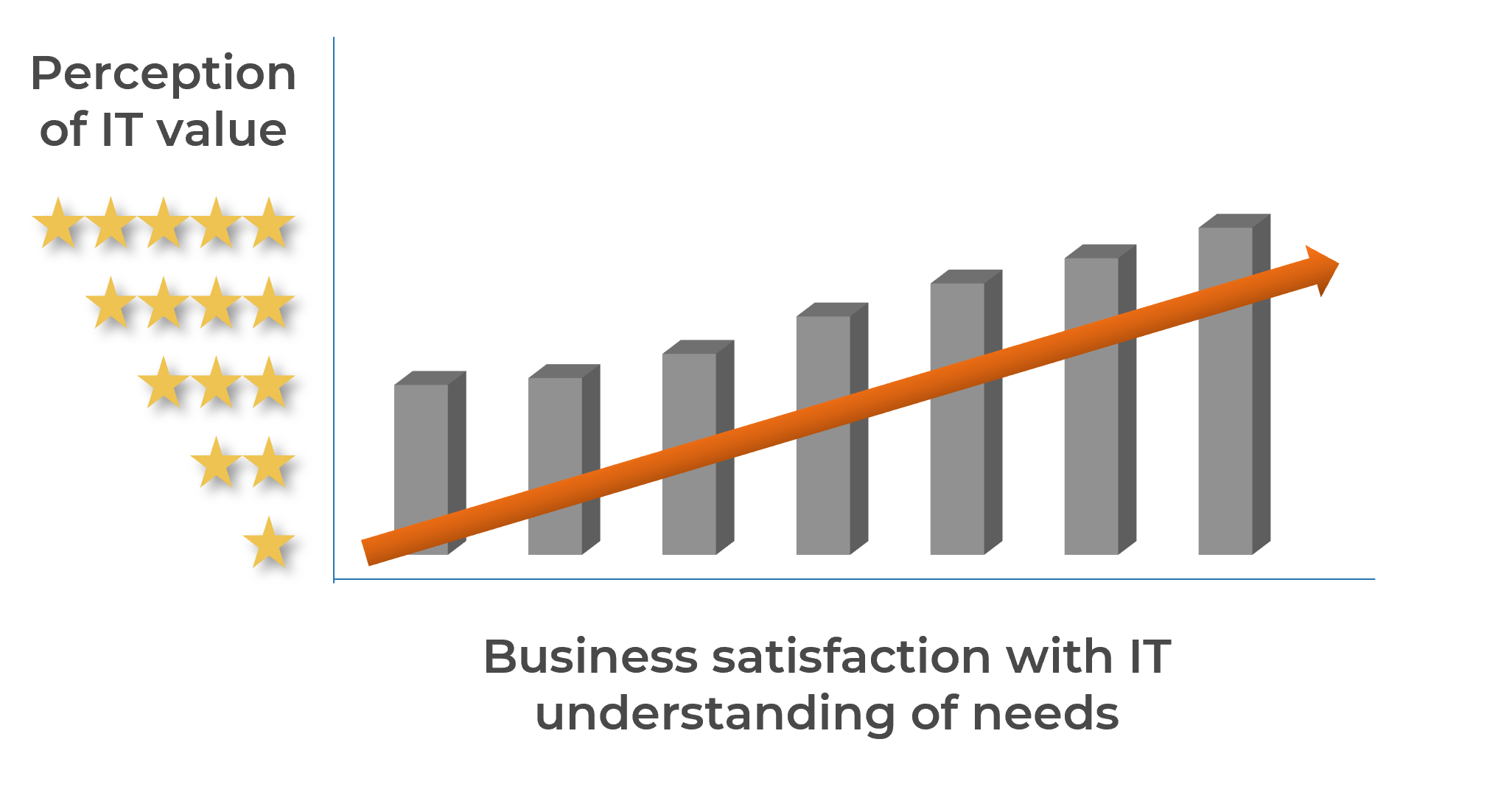

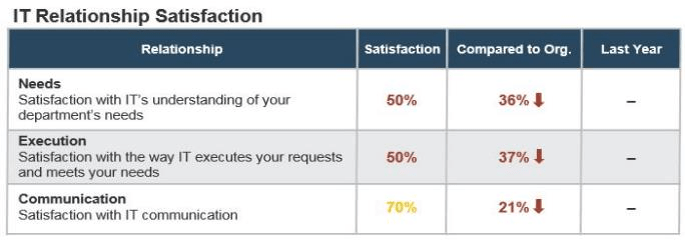

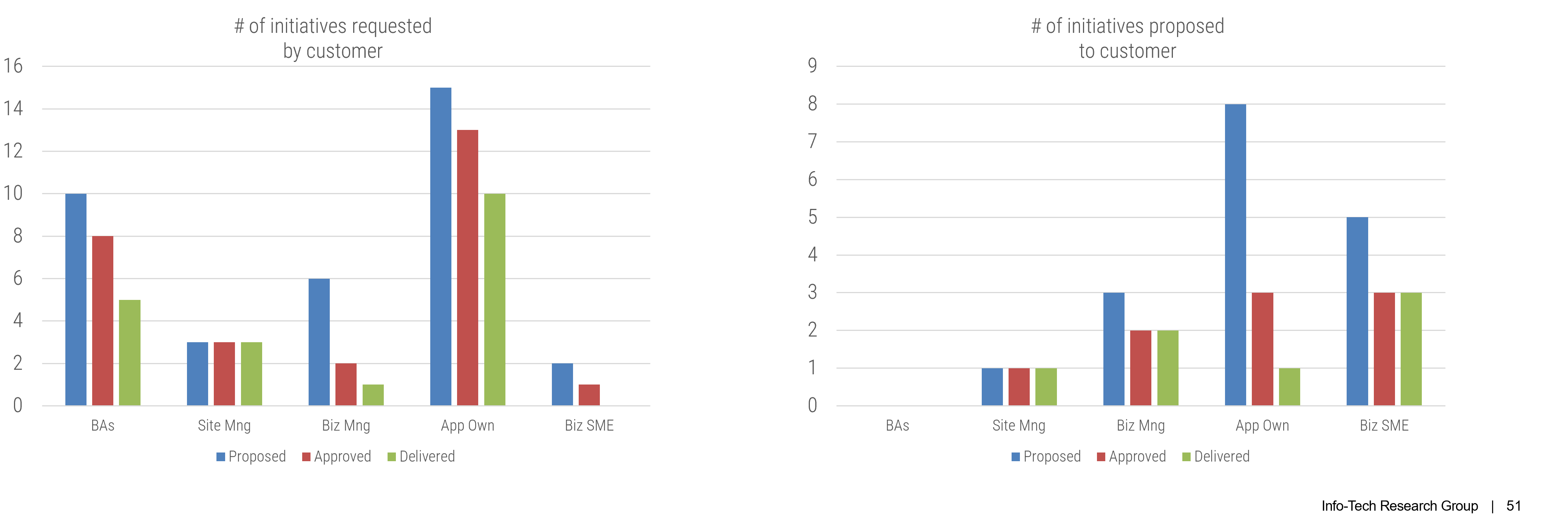

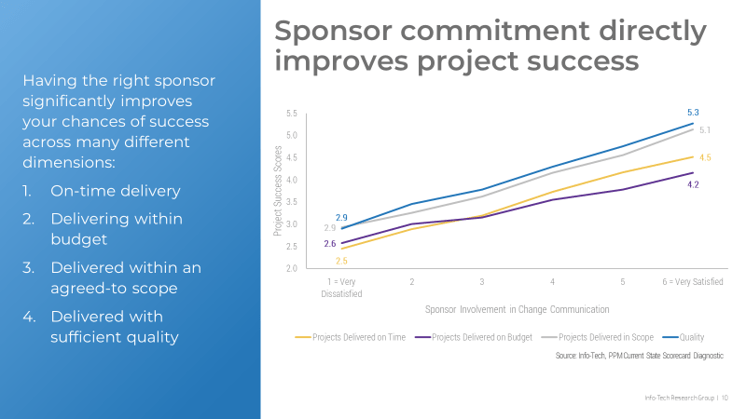

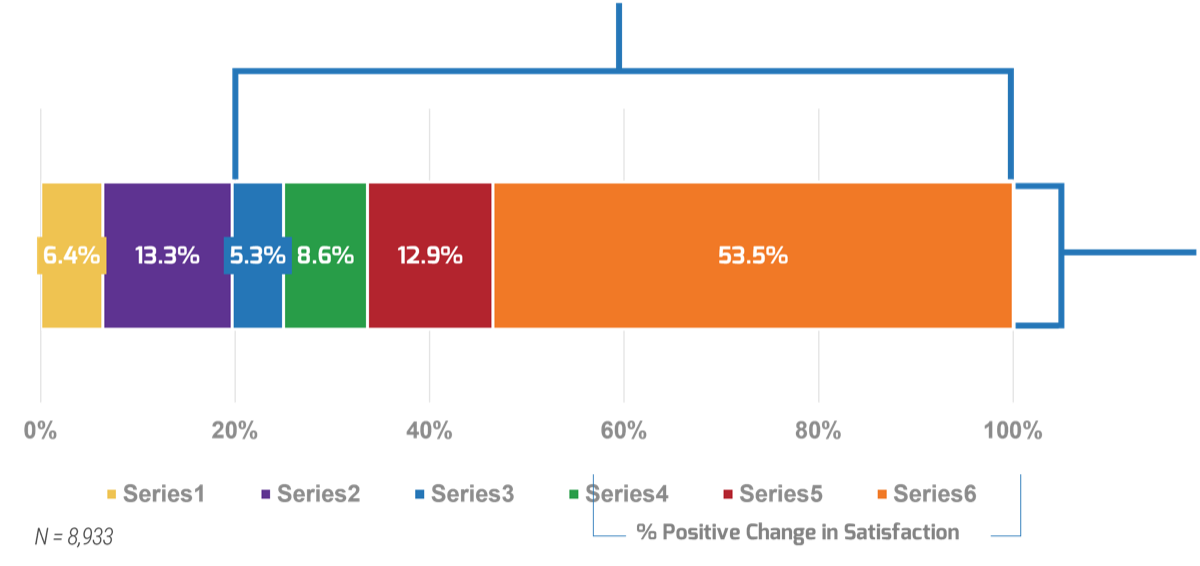

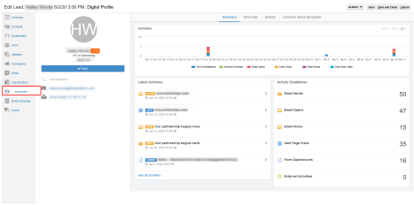

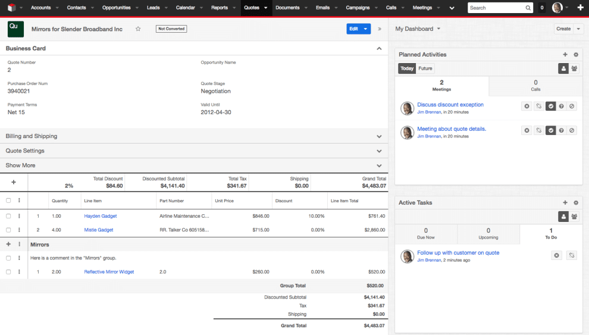

Info-Tech’s data demonstrates that optimizing project intake can also improve business leaders’ satisfaction of IT

CEOs today perceive IT to be poorly aligned to business’ strategic goals:

43% of CEOs believe that business goals are going unsupported by IT (Source: Info-Tech’s CEO-CIO Alignment Survey (N=124)).

60% of CEOs believe that improvement is required around IT’s understanding of business goals (Source: Info-Tech’s CEO-CIO Alignment Survey (N=124)).

Business leaders today are generally dissatisfied with IT:

30% of business stakeholders are supporters of their IT departments (Source: Info-Tech’s CIO Business Vision Survey (N=21,367)).

The key to improving business satisfaction with IT is to deliver on projects that help the business achieve its strategic goals:

Source: Info-Tech’s CIO Business Vision Survey (N=21,367)

Optimized project intake not only improves the project portfolio’s alignment to business goals, but provides the most effective way to improve relationships with IT’s key stakeholders.

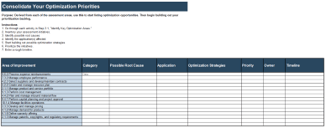

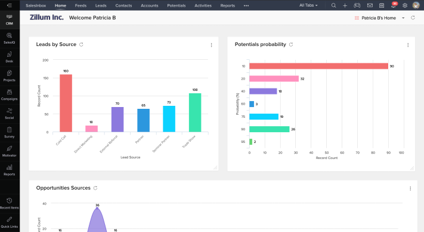

Benchmark your own current state with overall & industry-specific data using Info-Tech’s Diagnostic Program.

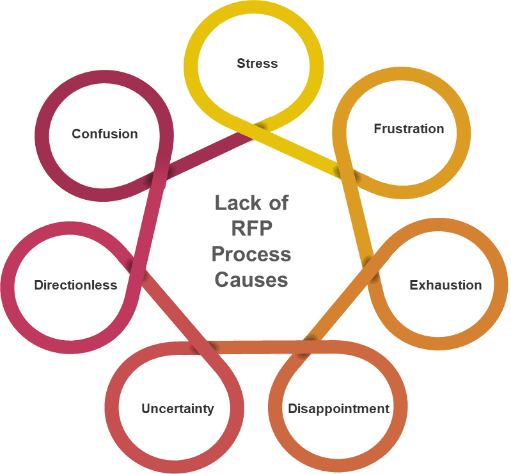

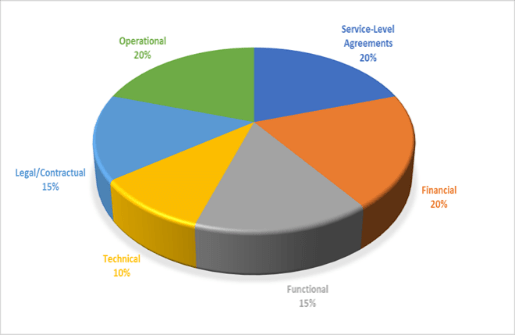

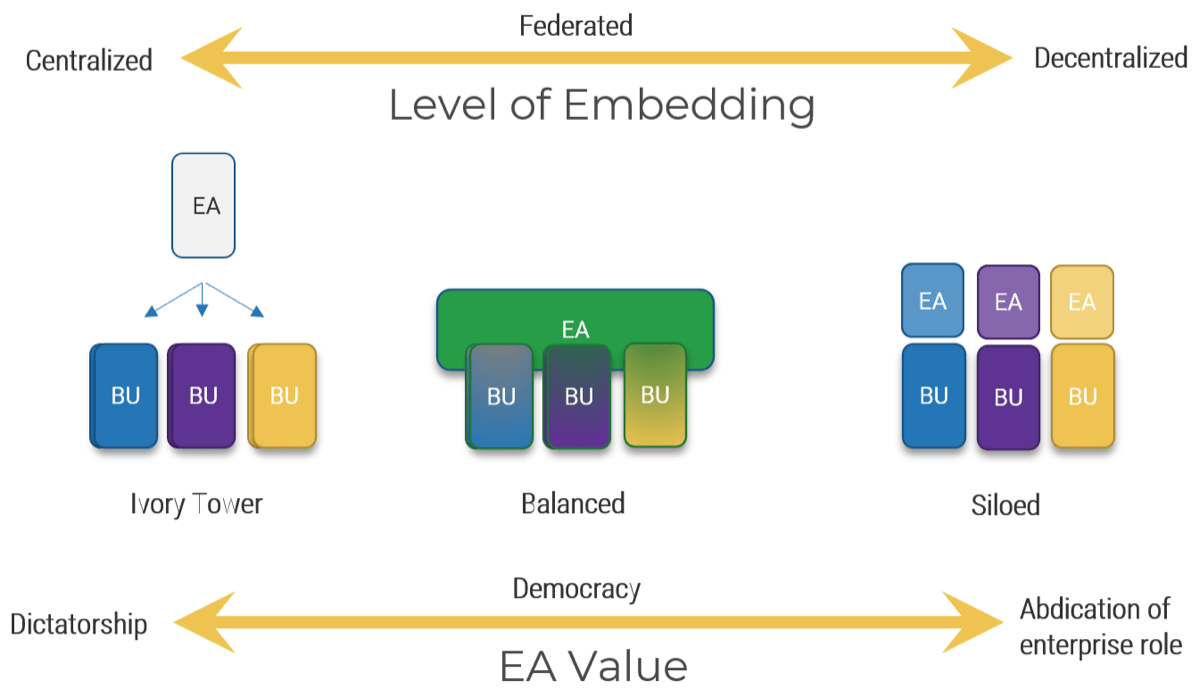

However, establishing organizational discipline for project intake, approval, and prioritization is difficult

Capacity awareness

Many IT departments struggle to realistically estimate available project capacity in a credible way. Stakeholders question the validity of your endeavor to install capacity-constrained intake process, and mistake it for unwillingness to cooperate instead.

Many moving parts

Project intake, approval, and prioritization involve the coordination of various departments. Therefore, they require a great deal of buy-in and compliance from multiple stakeholders and senior executives.

Lack of authority

Many PMOs and IT departments simply lack the ability to decline or defer new projects.

Unclear definition of value

Defining the project value is difficult because there are so many different and conflicting ways that are all valid in their own right. However, without it, it's impossible to fairly compare among projects to select what's "best."

Establishing intake discipline requires a great degree of cooperation and conformity among stakeholders that can be cultivated through strong processes.

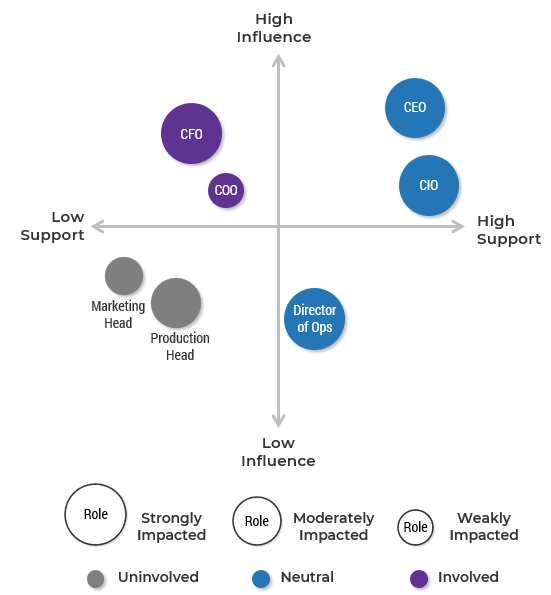

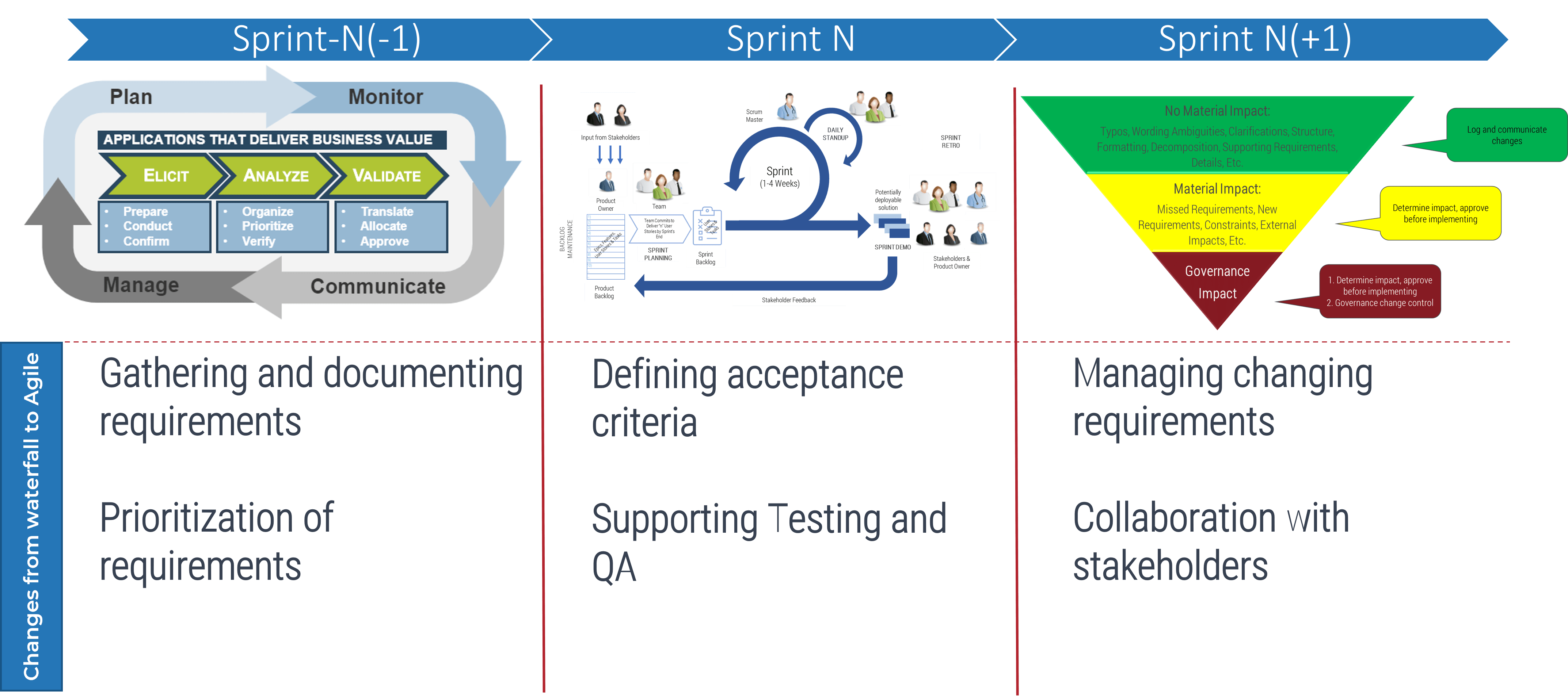

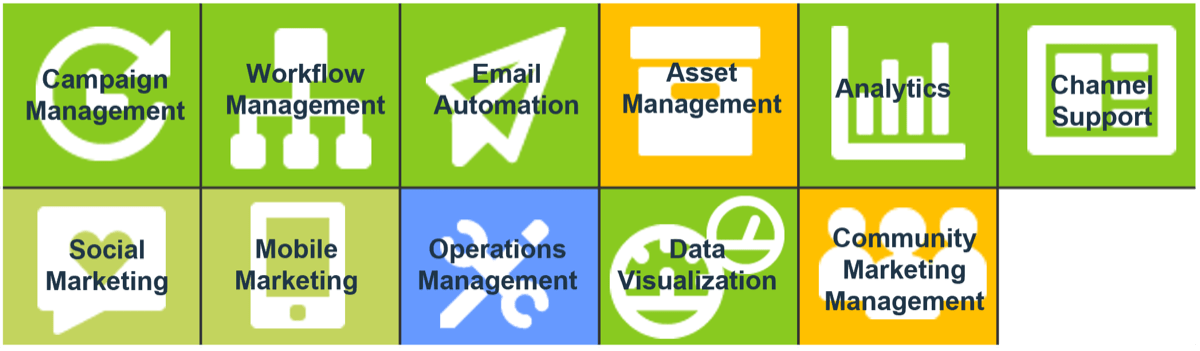

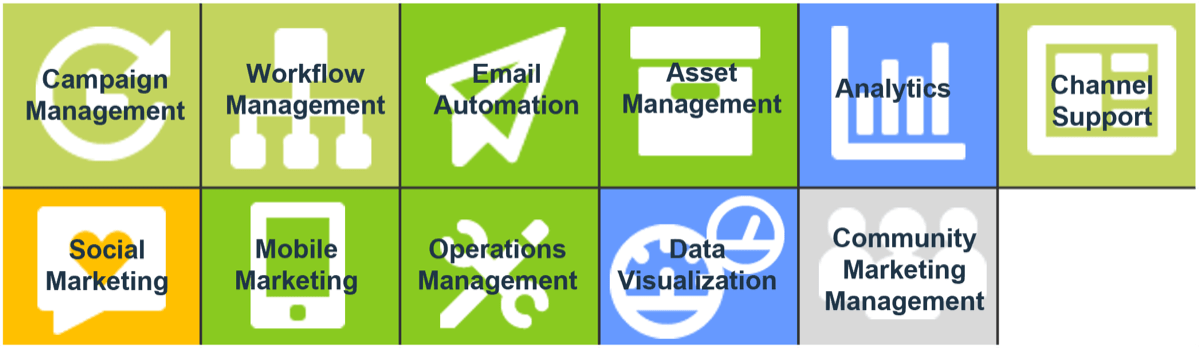

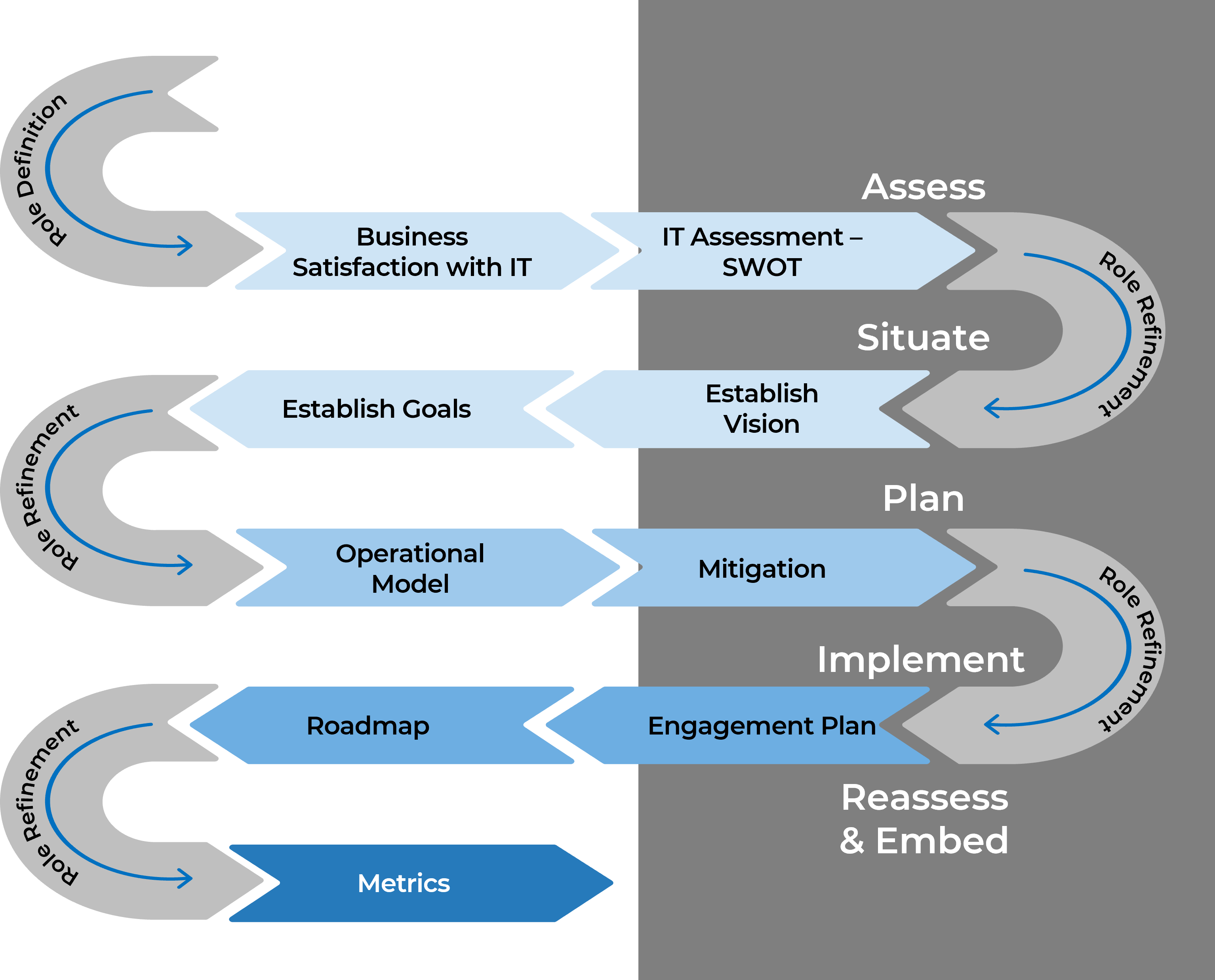

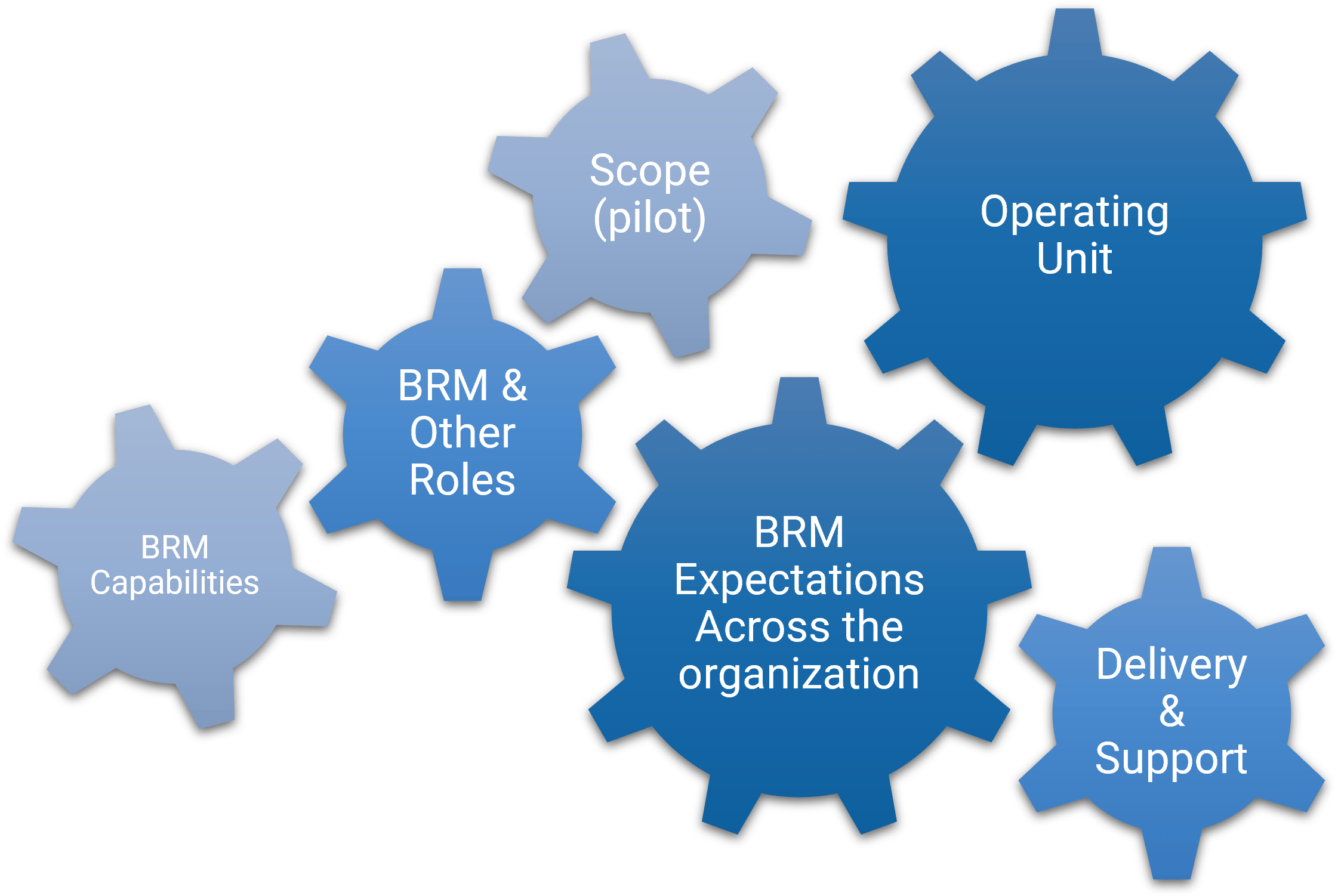

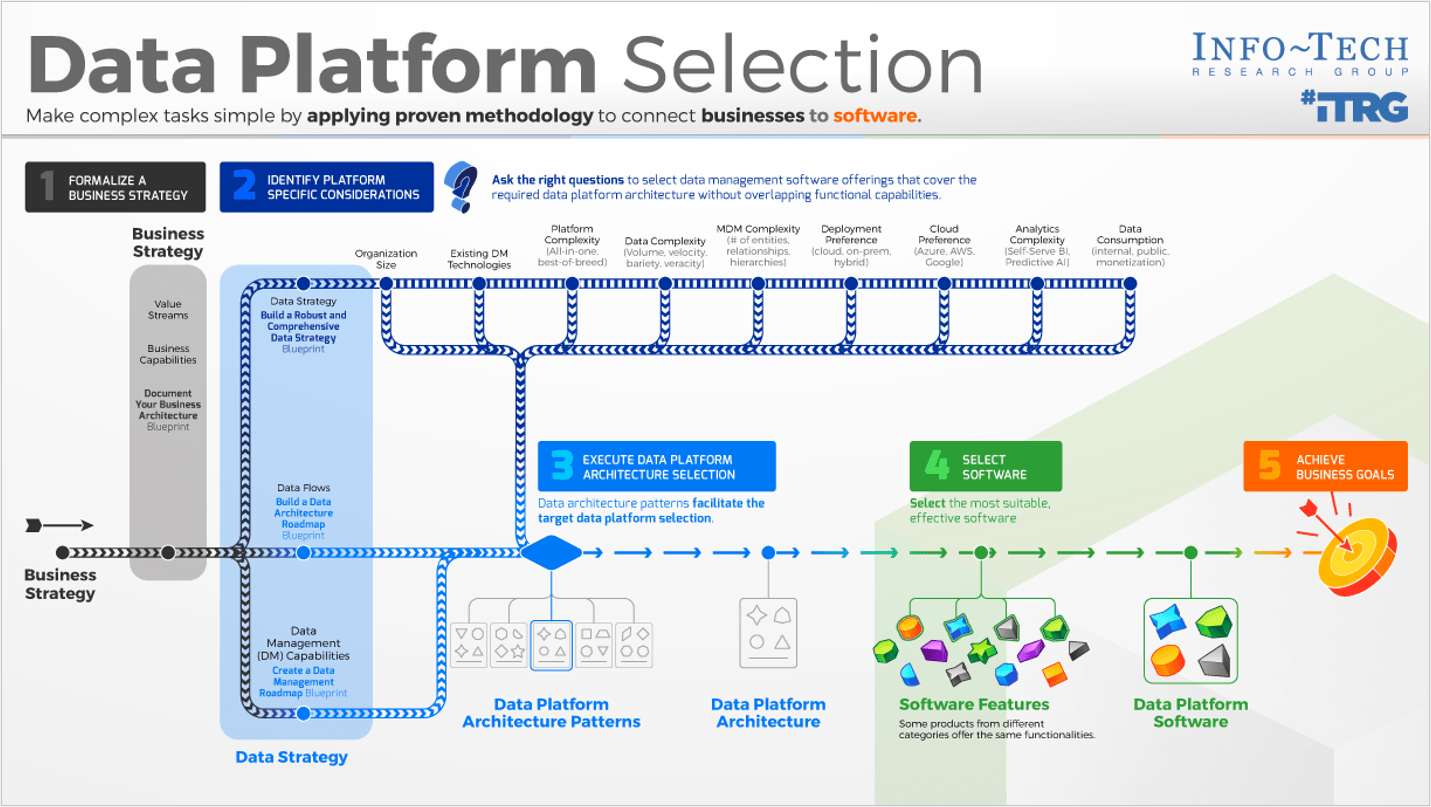

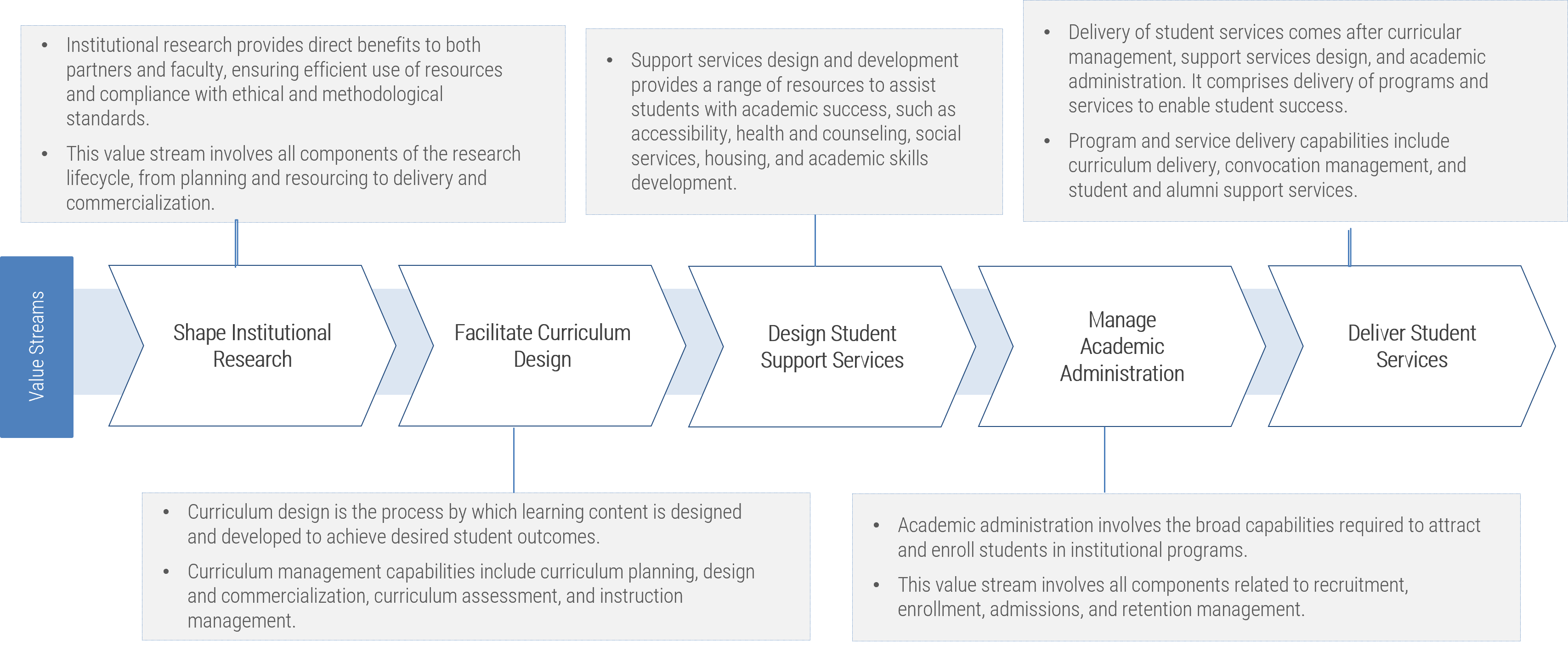

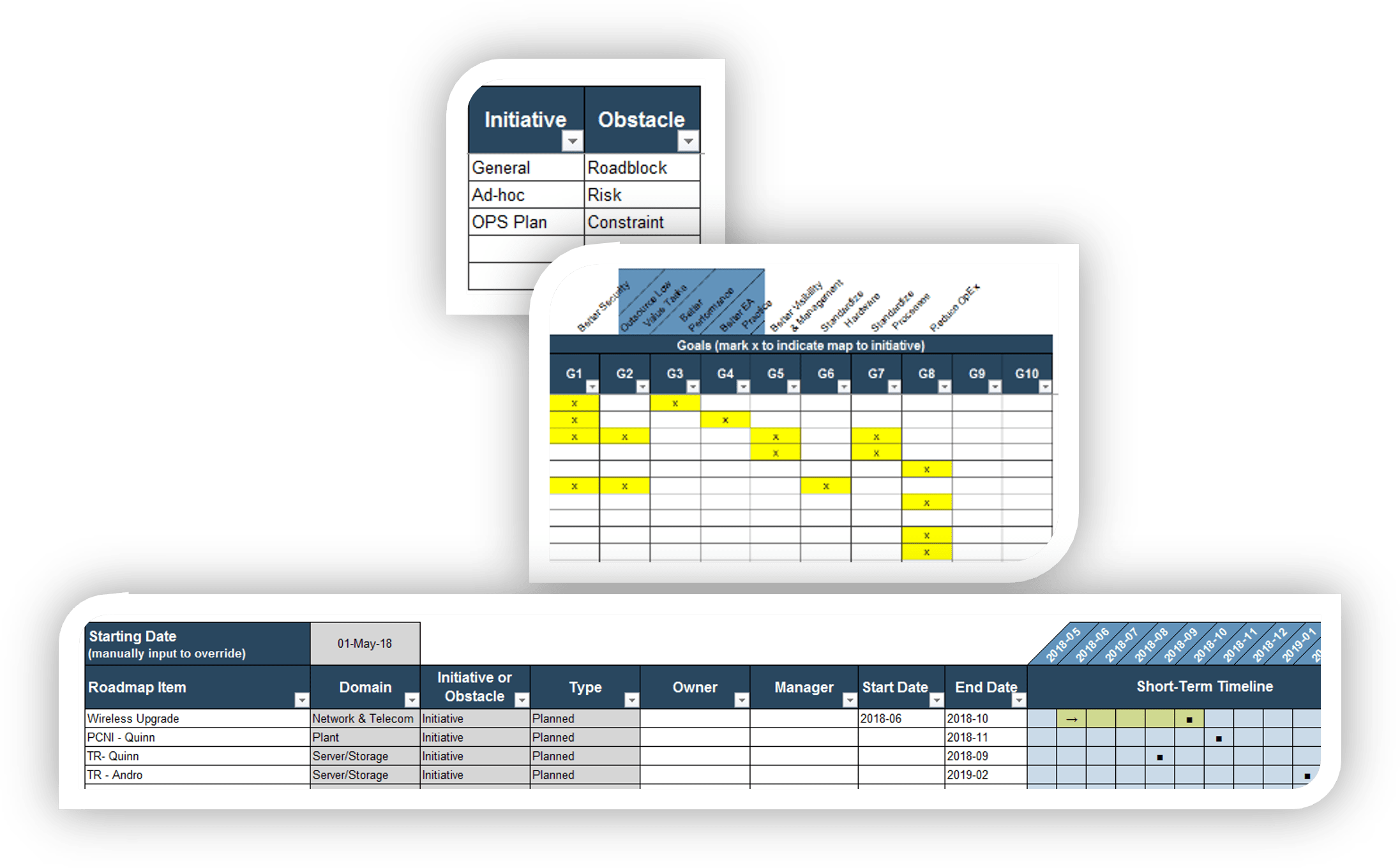

Info-Tech’s intake, approval, and prioritization methodology systemically fits the project portfolio to its triple constraint

Info-Tech’s Methodology

| Info-Tech’s Methodology

|

| Project Intake

|

Project Approval

|

Project Prioritization

|

| Project requests are submitted, received, triaged, and scoped in preparation for approval and prioritization.

|

Business cases are developed, evaluated, and selected (or declined) for investment, based on estimated value and feasibility.

|

Work is scheduled to begin, based on relative value, urgency, and availability of resources.

|

| Stakeholder Needs

|

Strategic Objectives

|

Resource Capacity

|

| Project Portfolio Triple Constraint

|

Info-Tech’s methodology for optimizing project intake delivers extraordinary value, fast

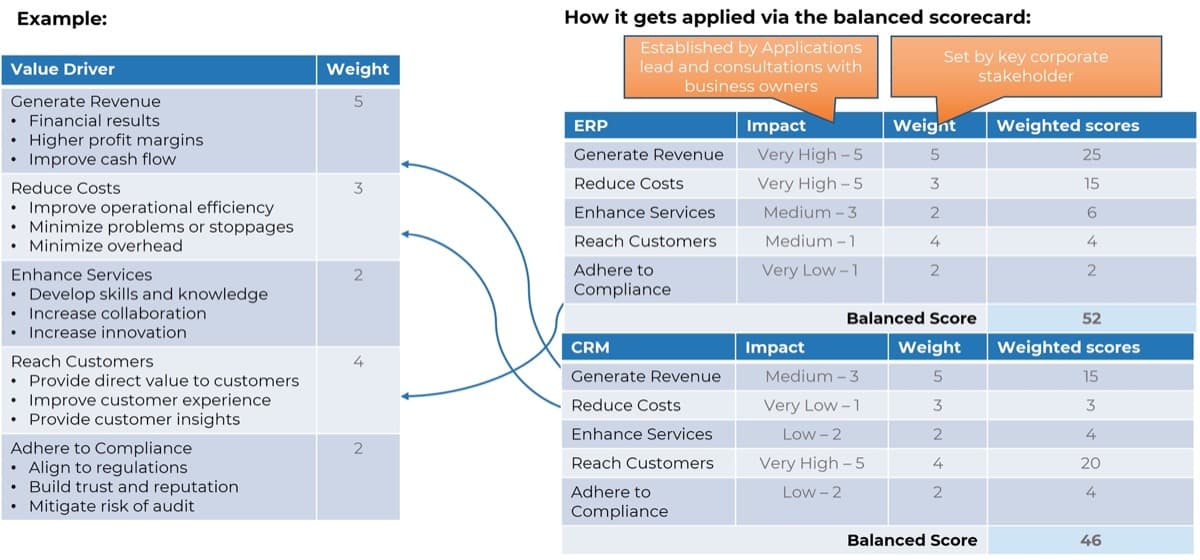

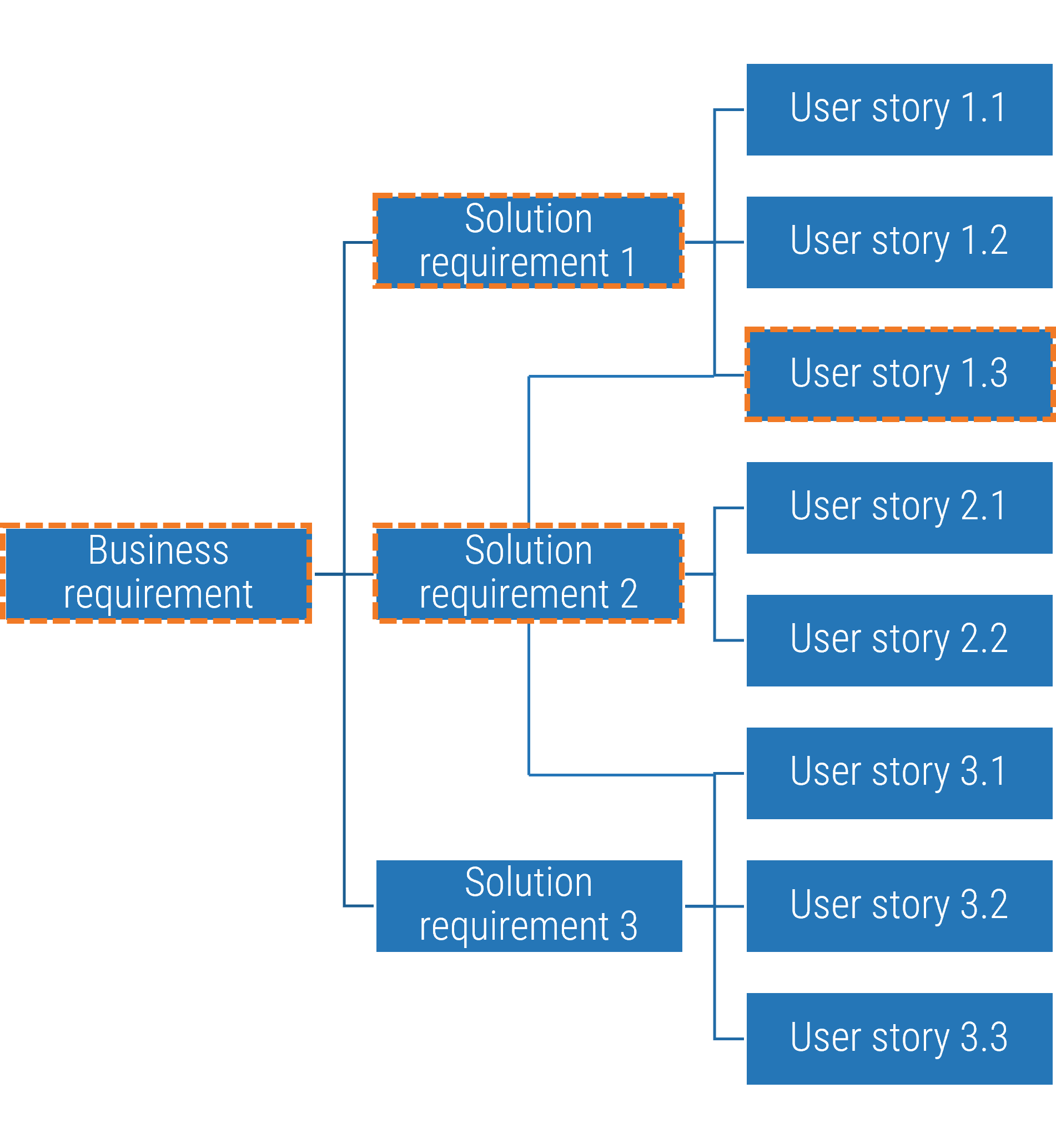

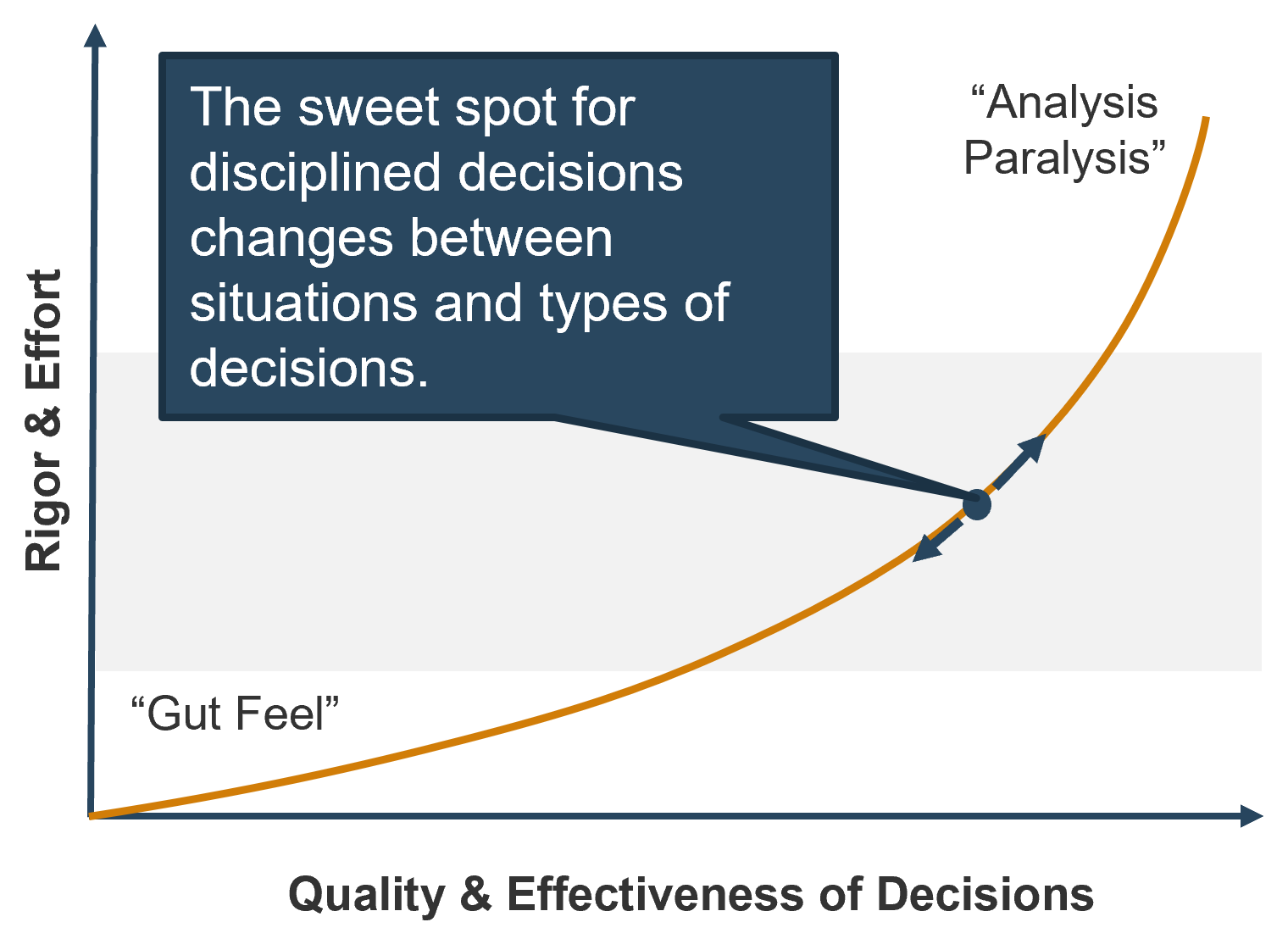

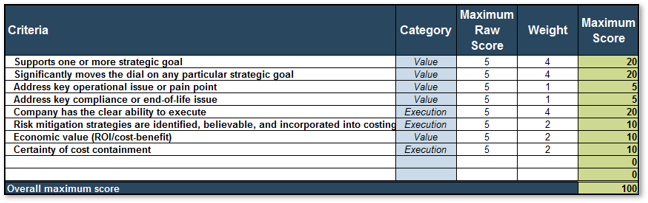

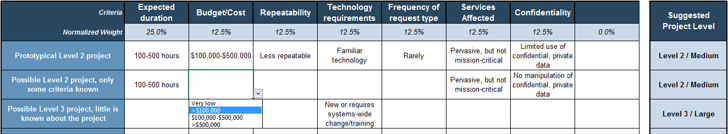

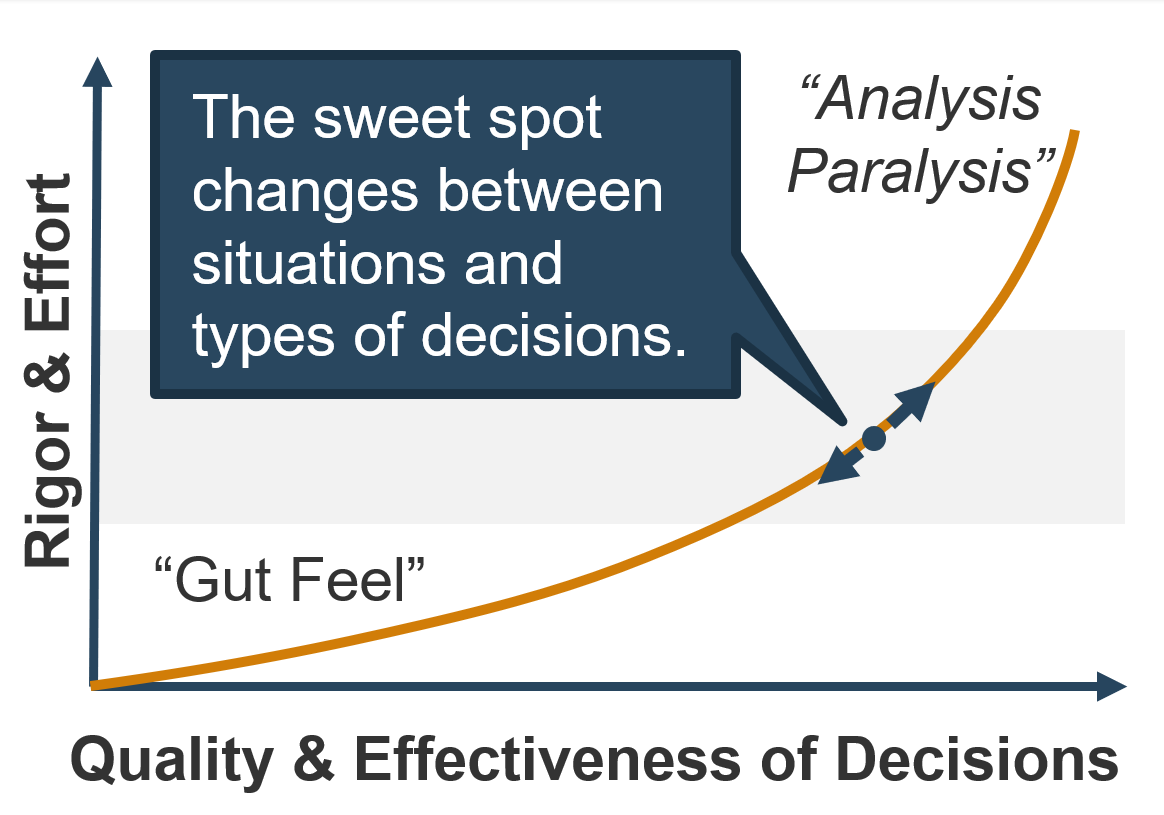

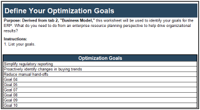

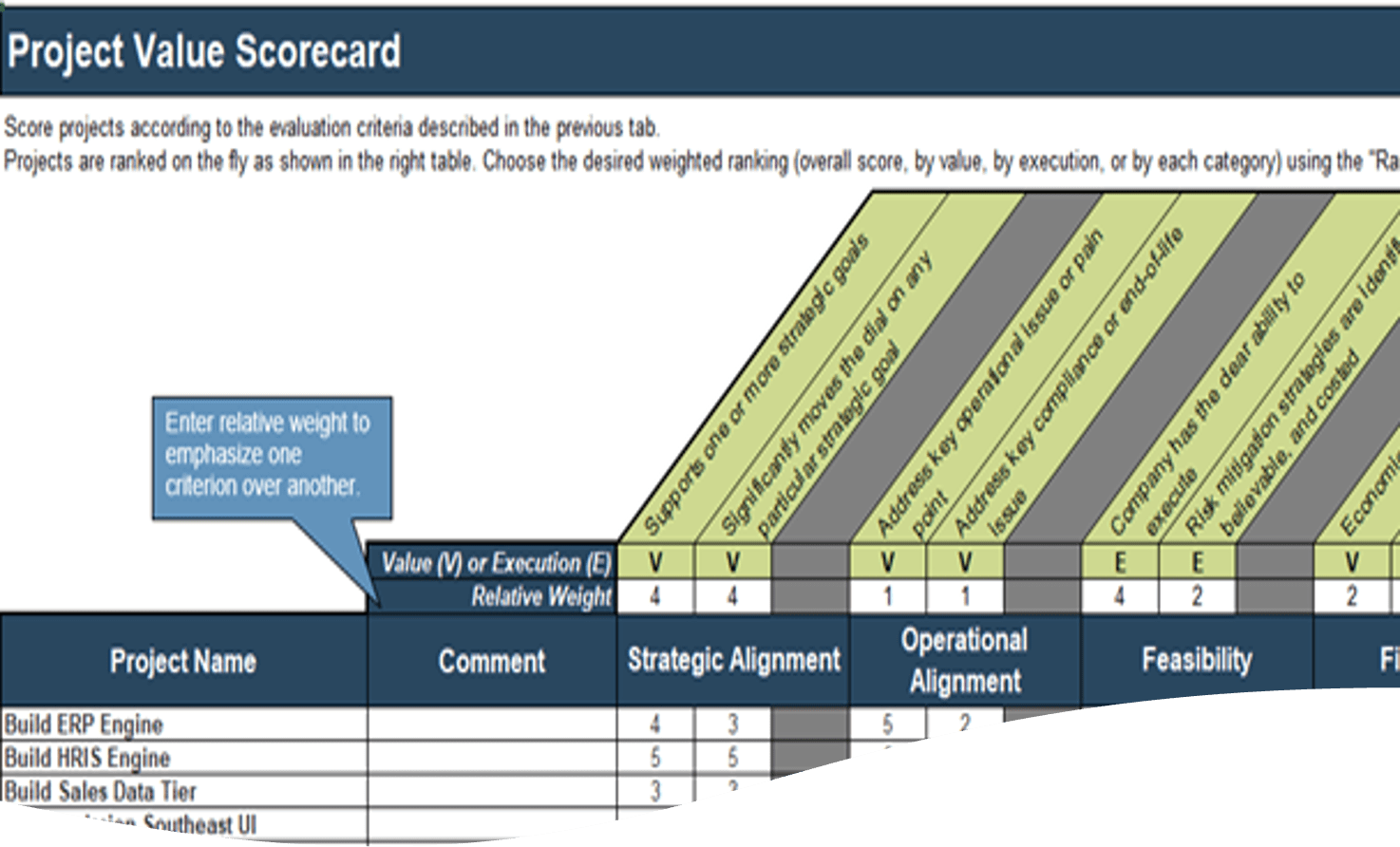

In the first step of the blueprint, you will prototype a set of scorecard criteria for determining project value.

Our methodology is designed to tackle your hardest challenge first to deliver the highest-value part of the deliverable. Since the overarching goal of optimizing project intake, approval, and prioritization process is to maximize the throughput of the best projects, one must define how “the best projects” are determined.

In nearly all instances…a key challenge for the PPM team is reaching agreement over how projects should rank.

– Merkhofer

A Project Value Scorecard will help you:

- Evolve the discussions on project and portfolio value beyond a theoretical concept

- Enable apples-to-apples comparisons amongst many different kinds of projects

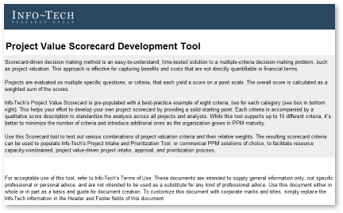

The Project Value Scorecard Development Tool is designed to help you develop the project valuation scheme iteratively. Download the pre-filled tool with content that represents a common case, and then, customize it with your data.

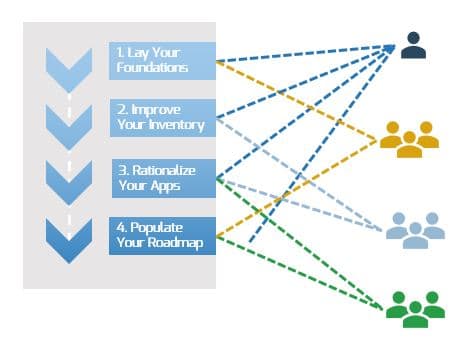

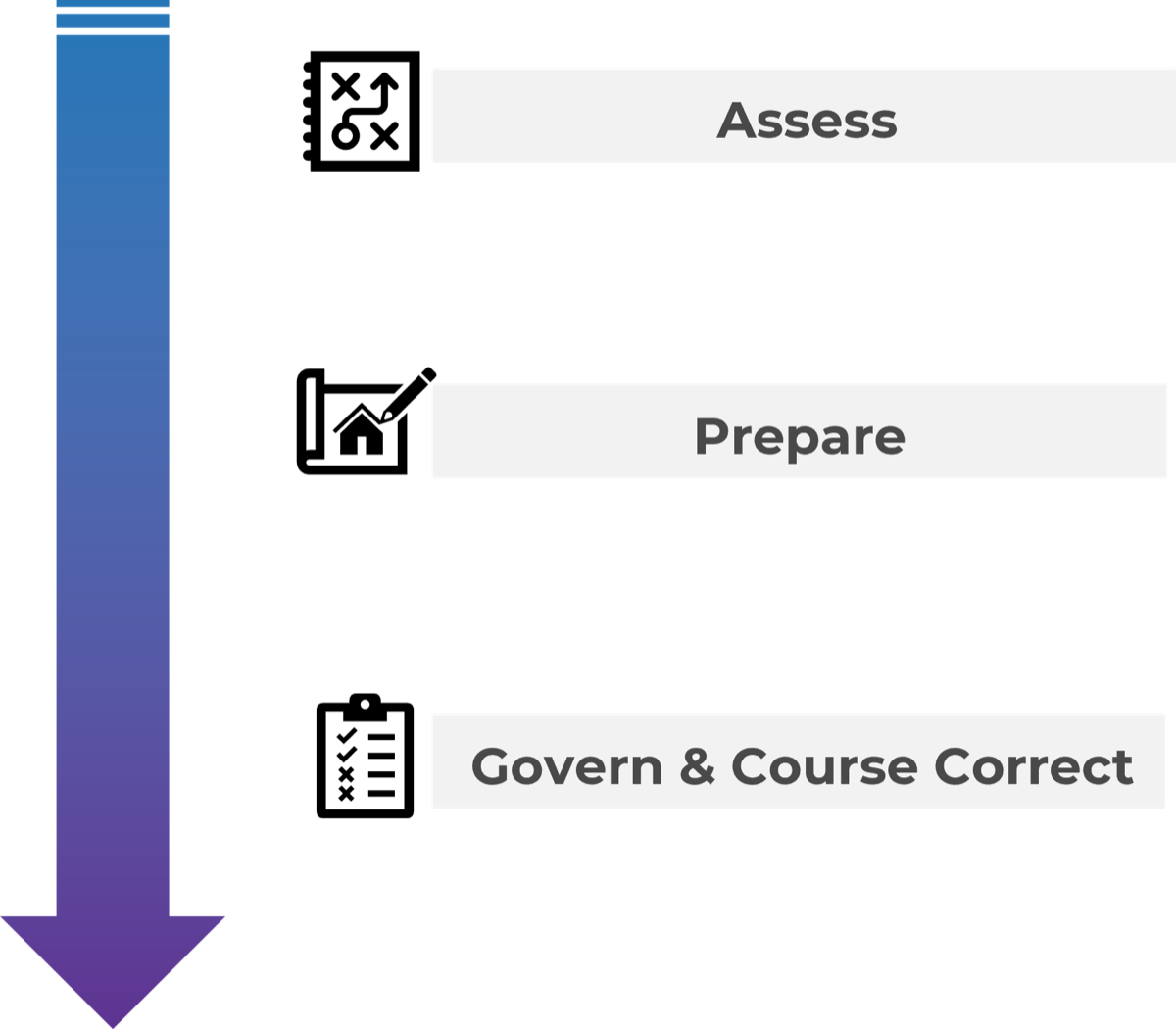

This blueprint provides a clear path to maximizing your chance of success in optimizing project intake

Info-Tech’s practical, tactical research is accompanied by a suite of tools and templates to accelerate your process optimization efforts.

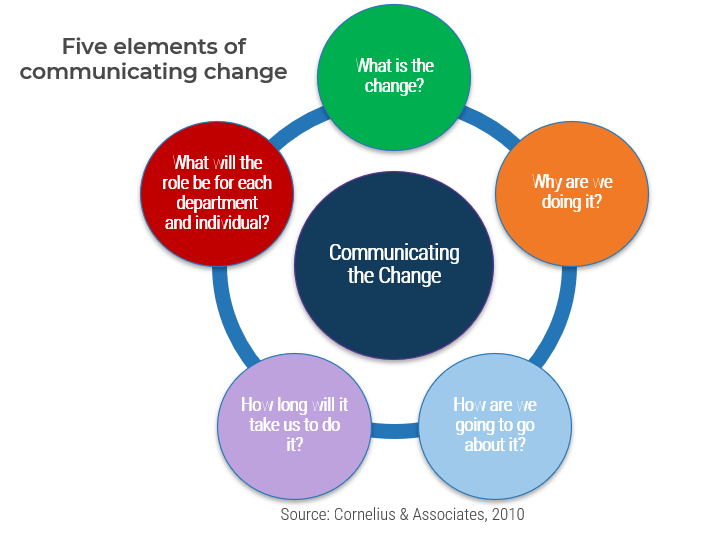

Organizational change and stakeholder management are critical elements of optimizing project intake, approval, and prioritization processes because they require a great degree of cooperation and conformity among stakeholders, and the list of key stakeholders are long and far-reaching.

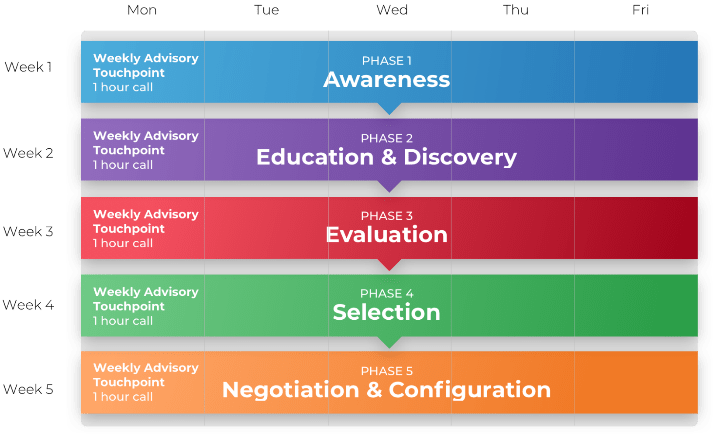

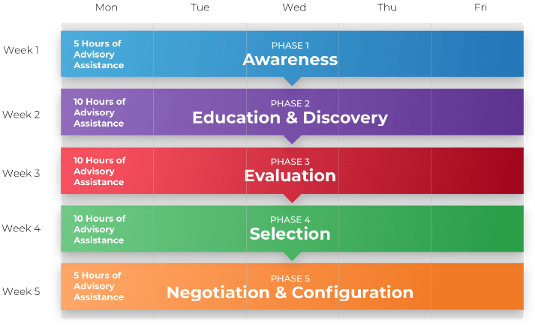

This blueprint will provide a clear path to not only optimize the processes themselves, but also for the optimization effort itself. This research is organized into three phases, each requiring a few weeks of work at your team’s own pace – or all in one week, through a workshop facilitated by Info-Tech analysts.

Set Realistic Goals for Optimizing Project Intake, Approval, and Prioritization

Tools and Templates:

- Project Value Scorecard Development Tool (.xlsx)

- PPM Assessment Report (Info-Tech Diagnostics)

- Standard Operating Procedure Template (.docx)

Build Optimized Project Intake, Approval, and Prioritization Processes

Tools and Templates:

- Project Request Forms (.docx)

- Project Classification Matrix (.xlsx)

- Benefits Commitment Form (.xlsx)

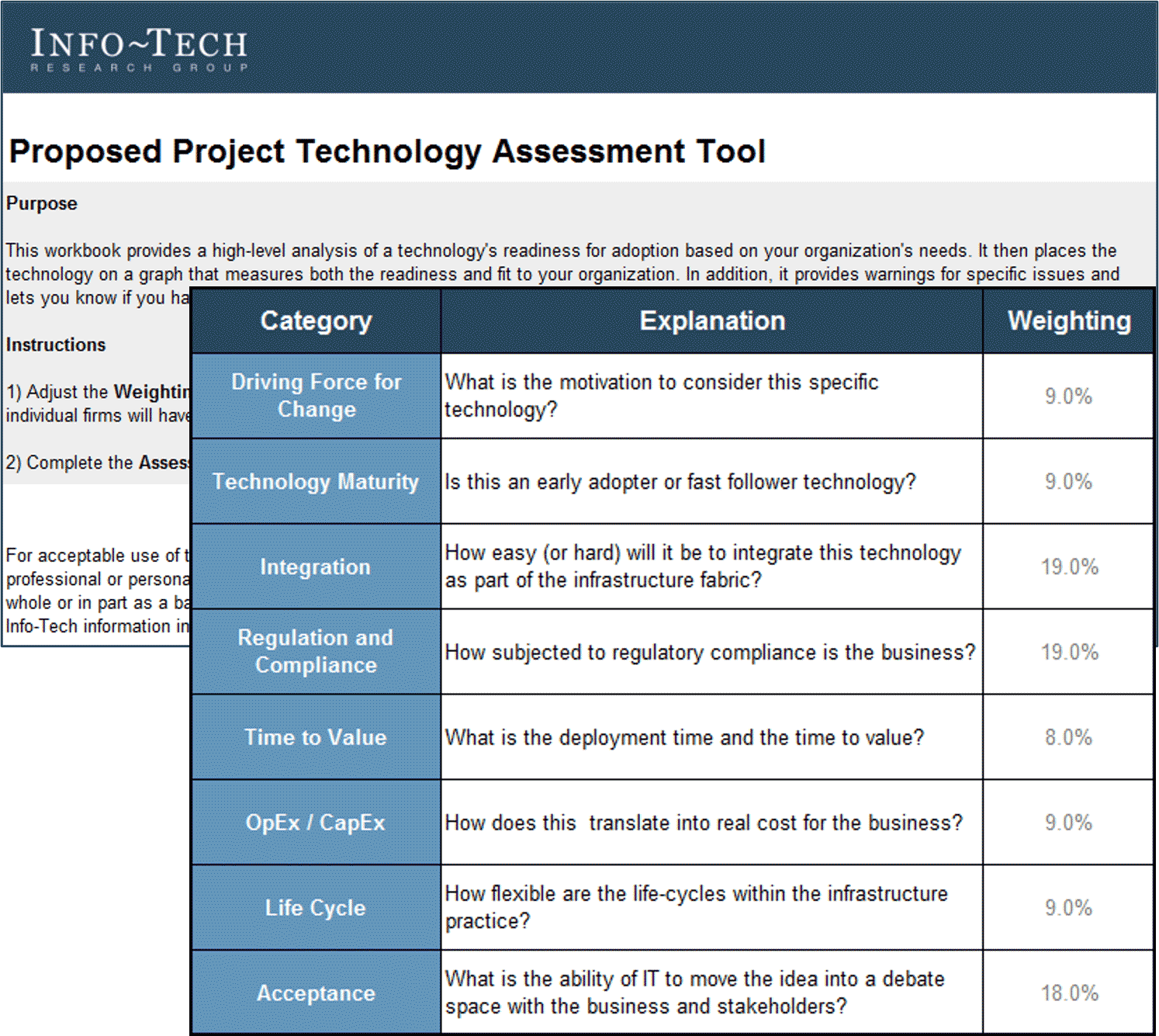

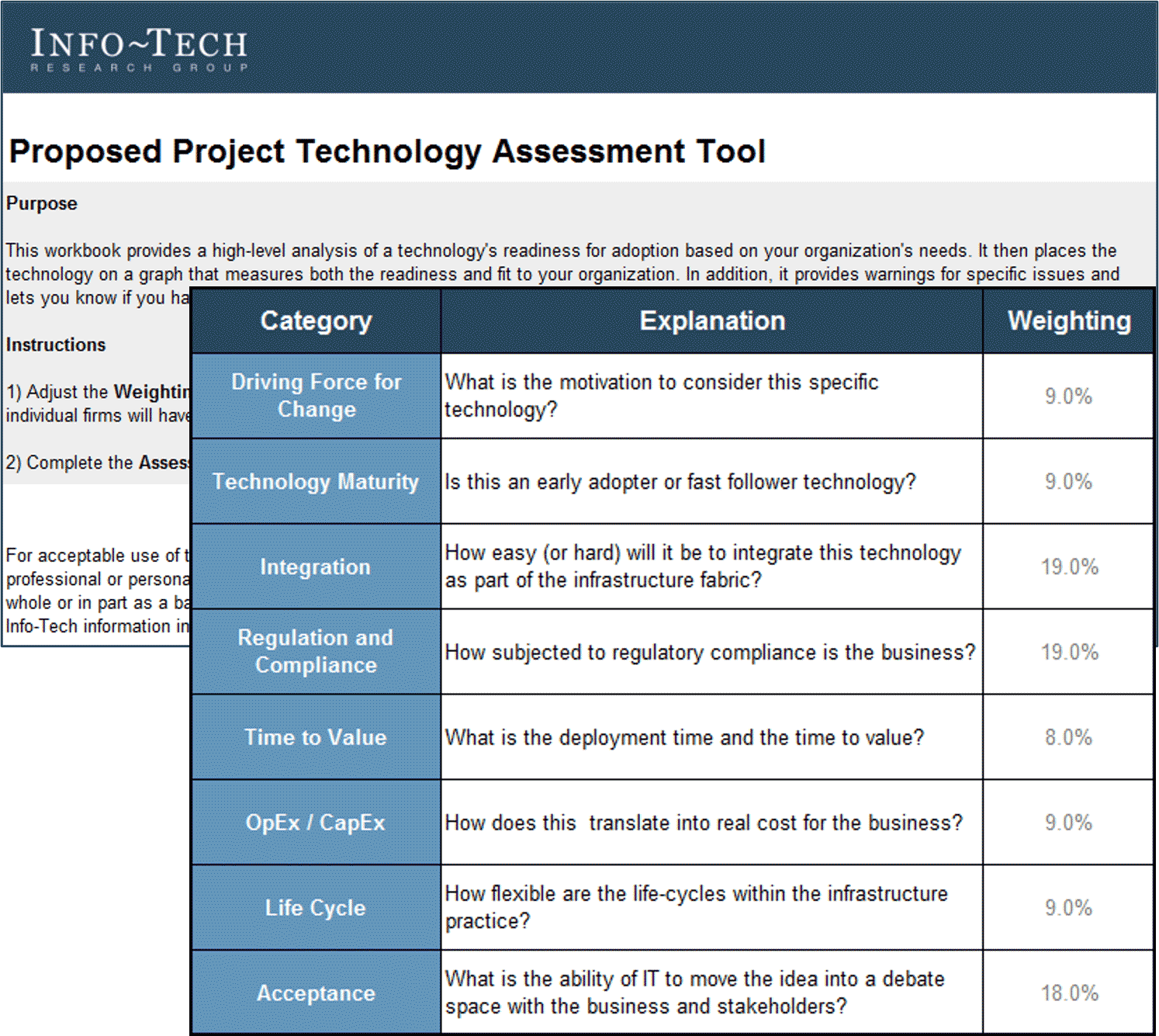

- Proposed Project Technology Assessment Tool (.xlsx)

- Business Case Templates (.docx)

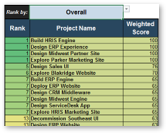

- Intake and Prioritization Tool (.xlsx)

Integrate the Newly Optimized Processes into Practice

Tools and Templates:

- Process Pilot Plan Template (.docx)

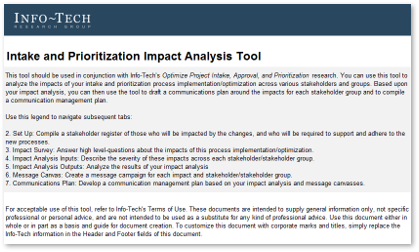

- Impact Assessment and Communication Planning Tool (.xlsx)

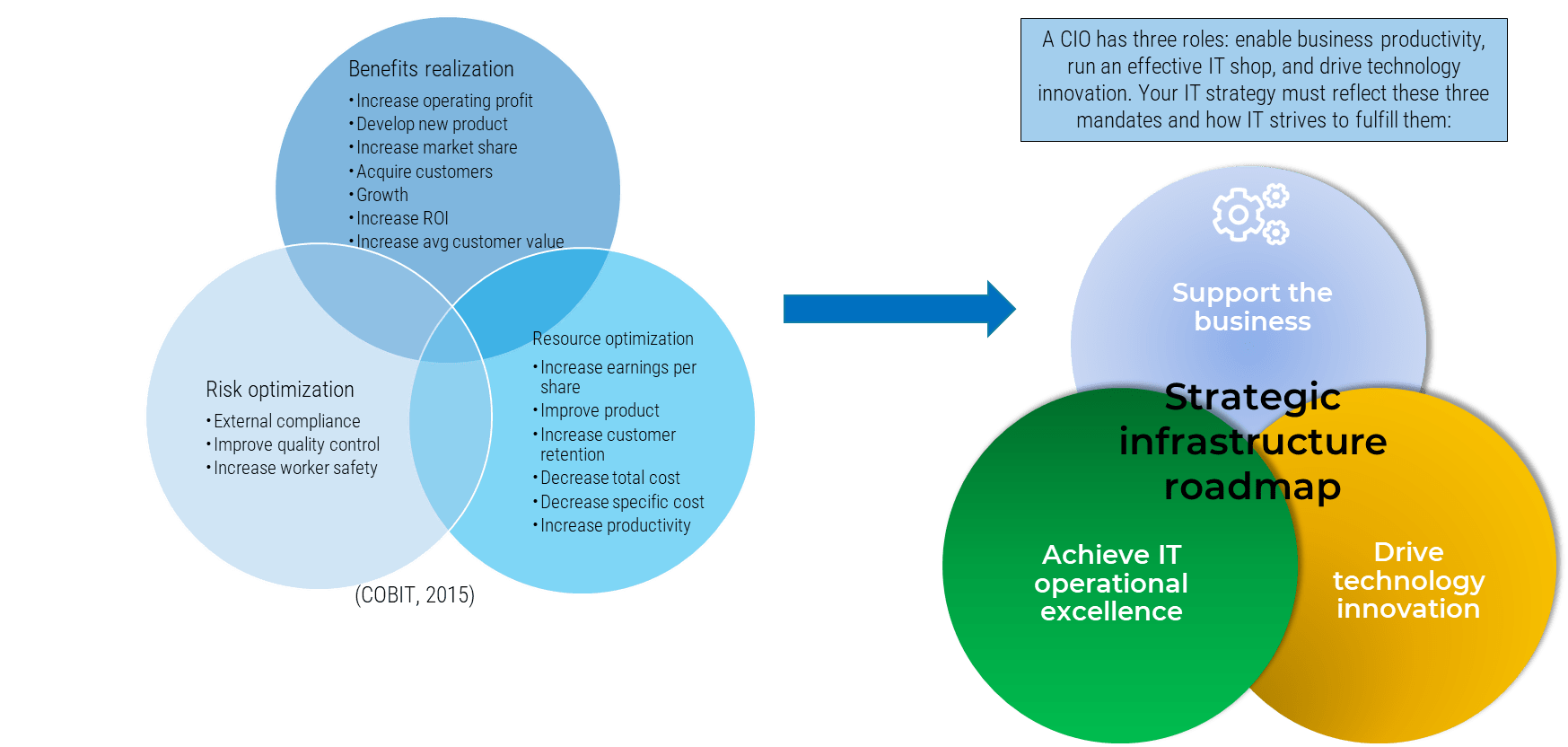

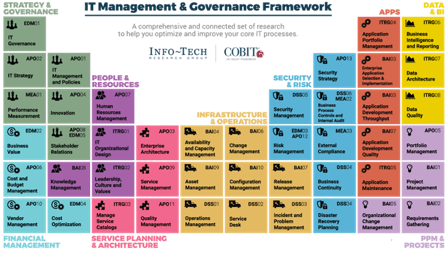

Info-Tech’s approach to PPM is informed by industry best practices and rooted in practical insider research

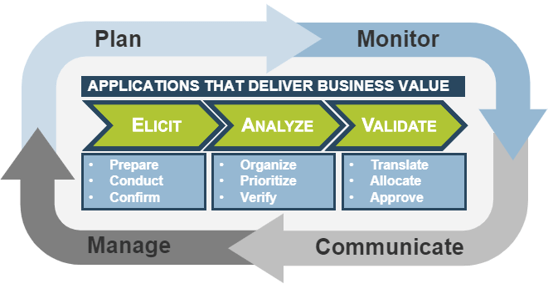

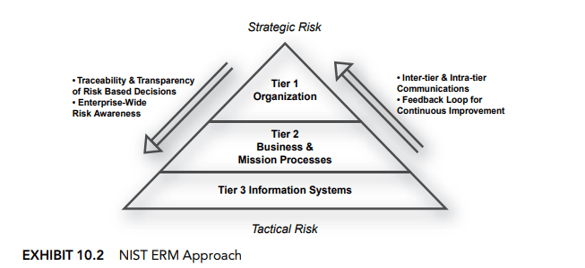

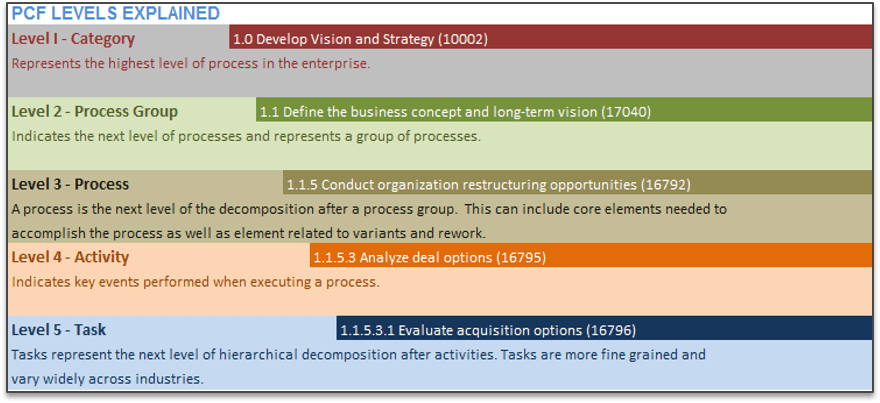

Info-Tech uses PMI and ISACA frameworks for areas of this research.

PMI’s Standard for Portfolio Management, 3rd ed. is the leading industry framework, proving project portfolio management best practices and process guidelines.

COBIT 5 is the leading framework for the governance and management of enterprise IT.

In addition to industry-leading frameworks, our best-practice approach is enhanced by the insights and guidance from our analysts, industry experts, and our clients.

33,000+

Our peer network of over 33,000 happy clients proves the effectiveness of our research.

1,000+

Our team conducts 1,000+ hours of primary and secondary research to ensure that our approach is enhanced by best practices.

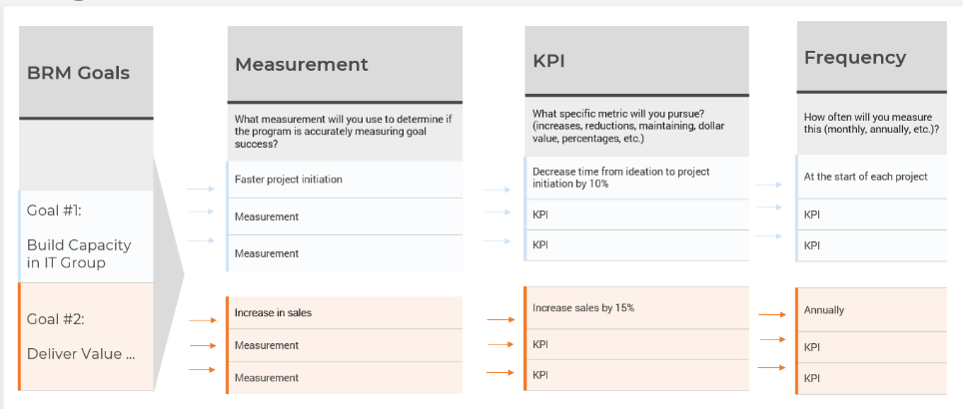

Deliver measurable project intake success for your organization with this blueprint

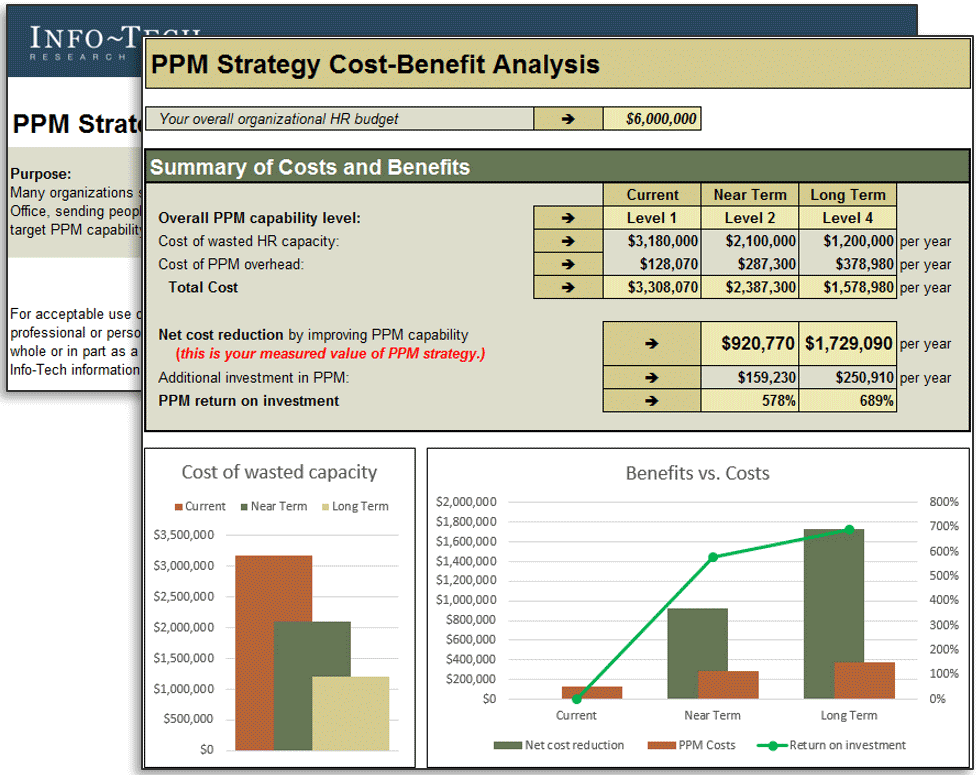

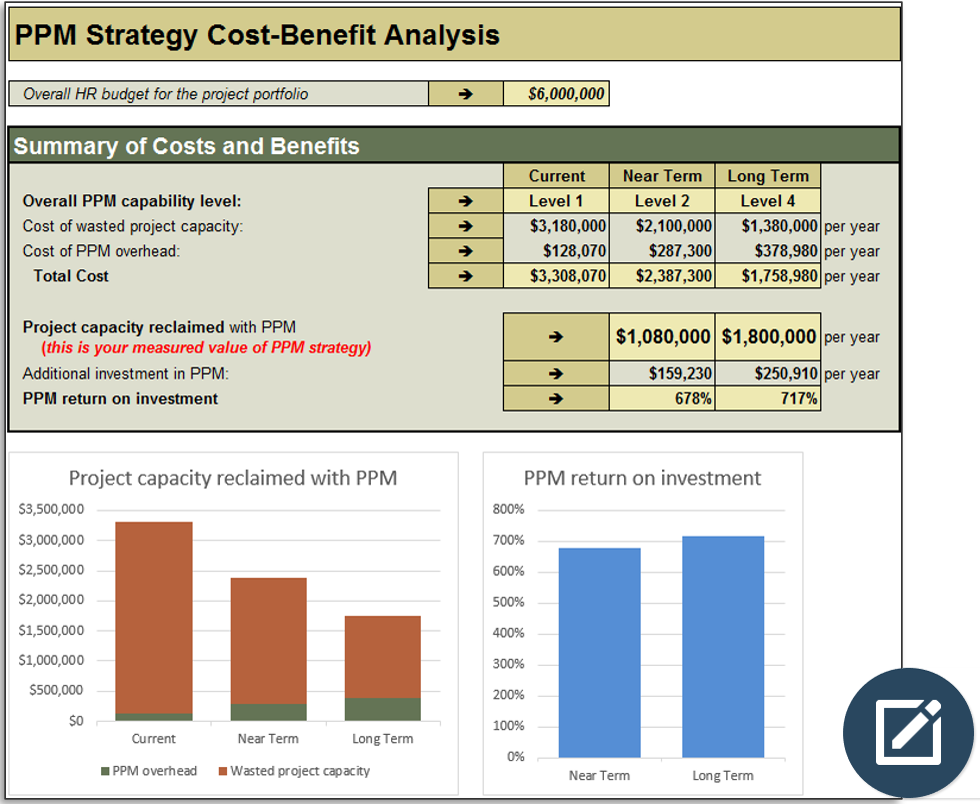

Measure the value of your effort to track your success quantitatively and demonstrate the proposed benefits, as you aim to do so with other projects through improved PPM.

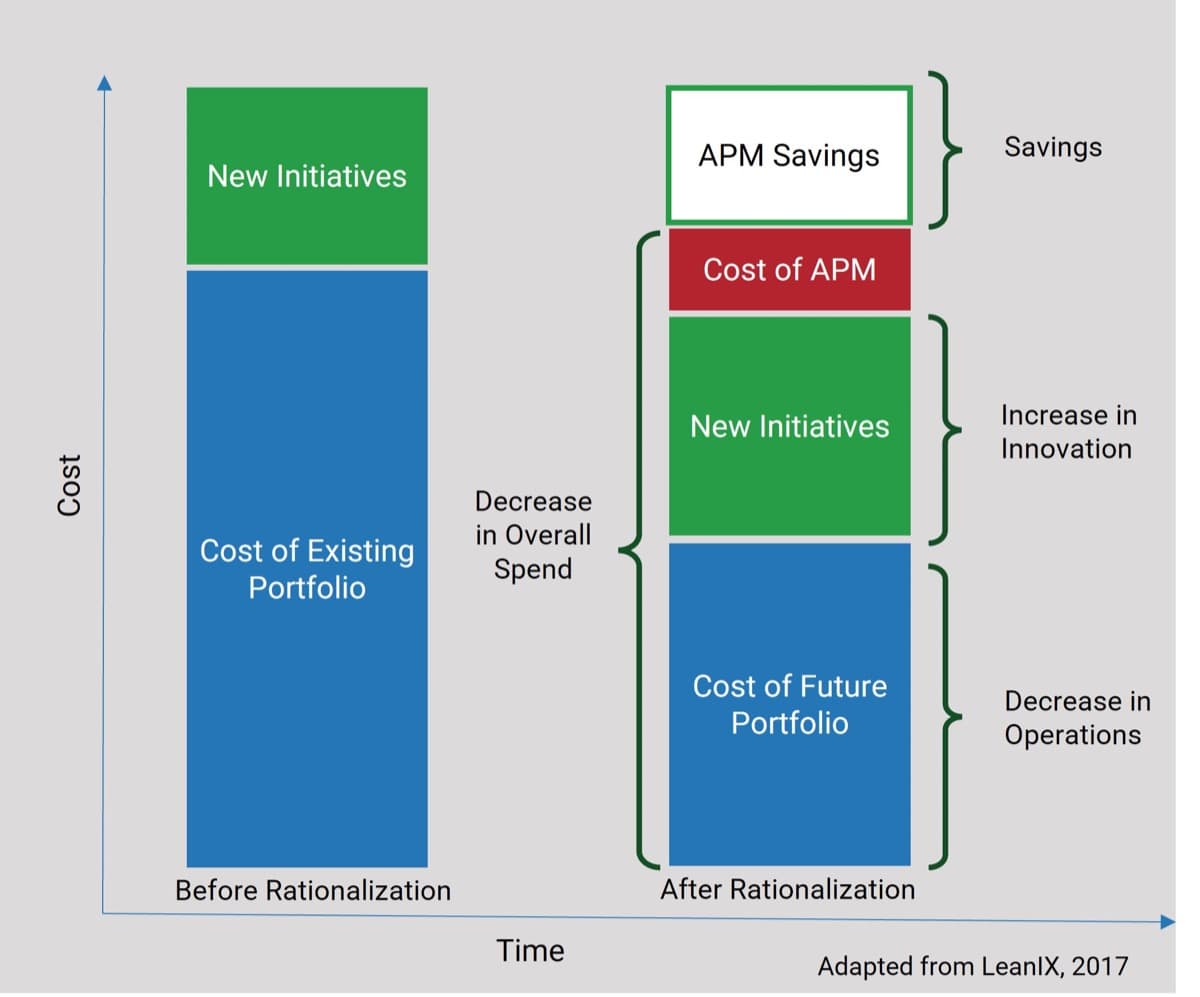

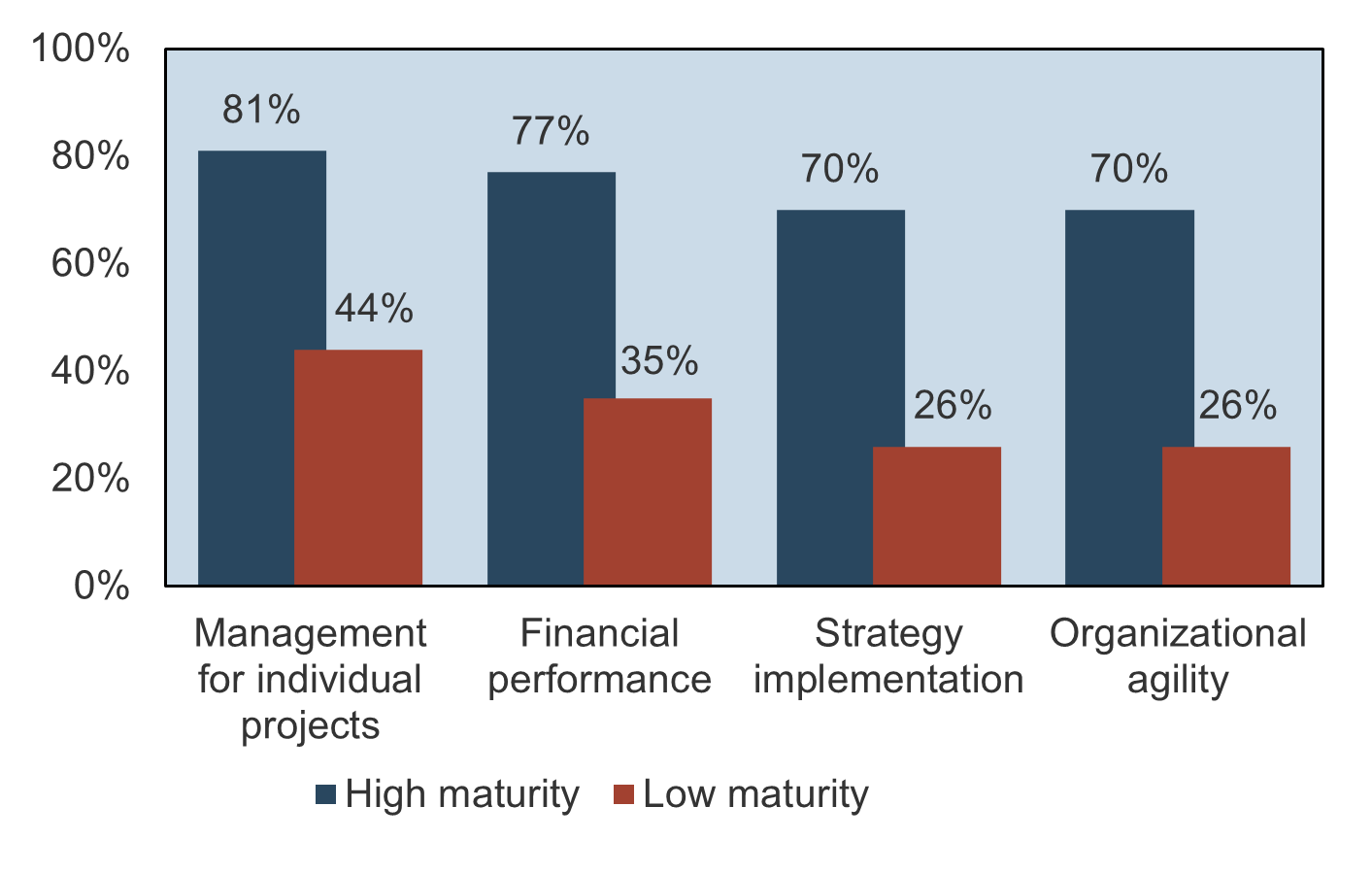

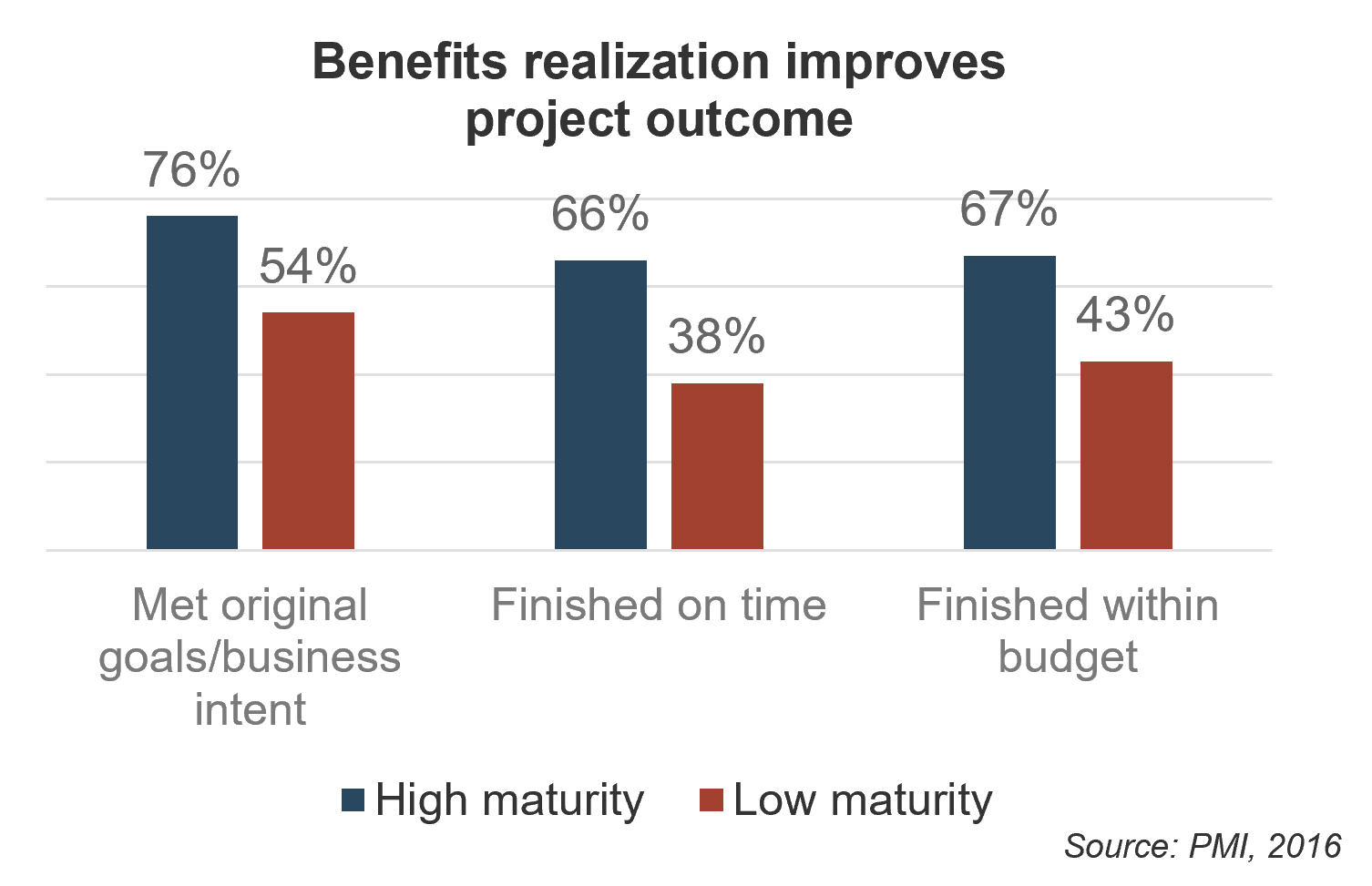

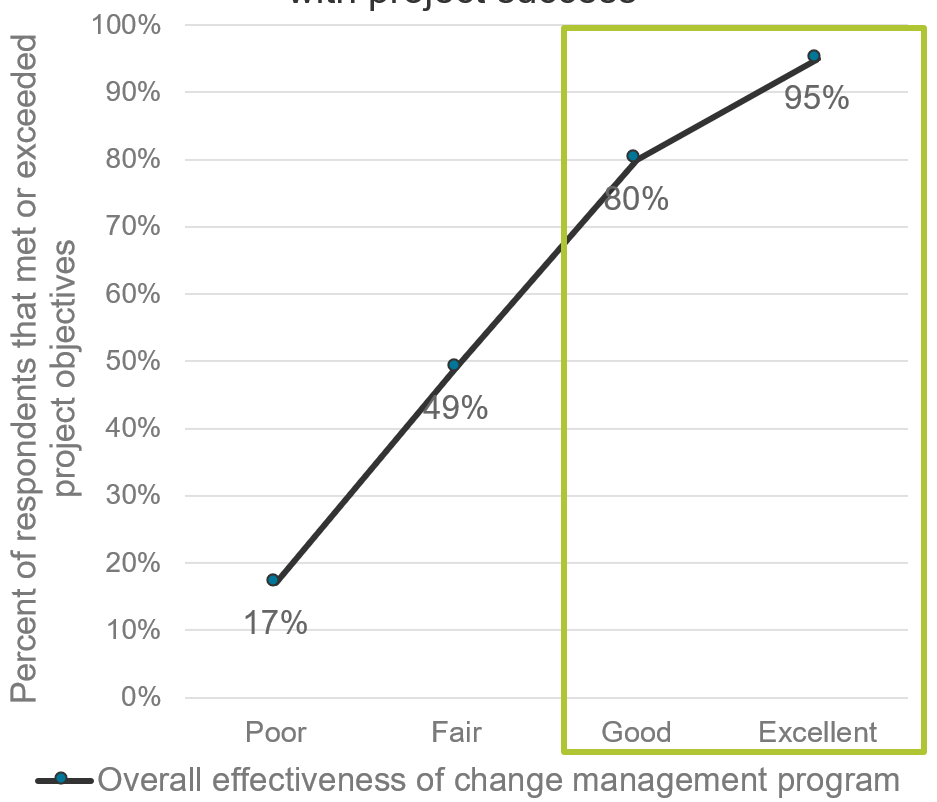

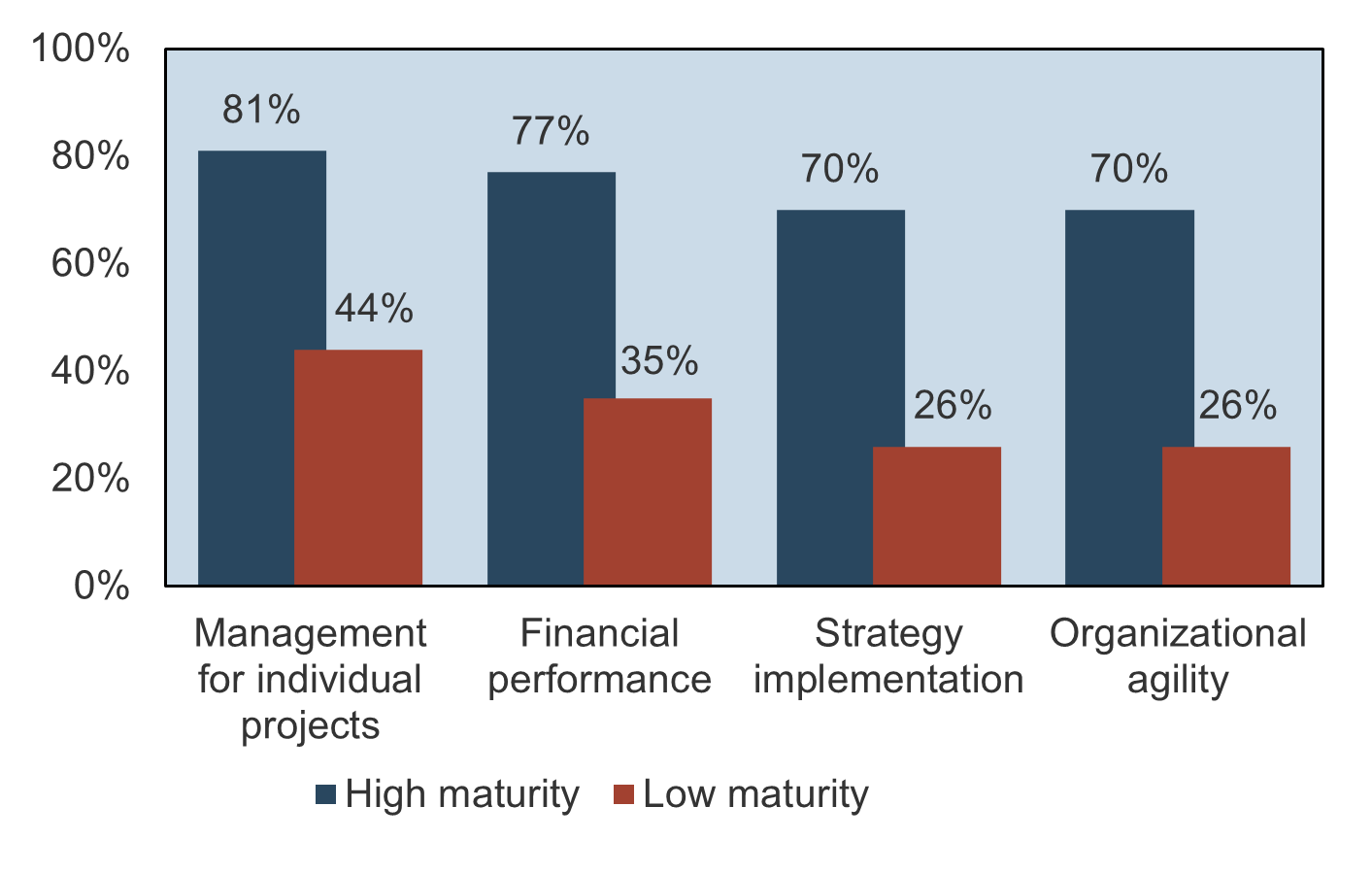

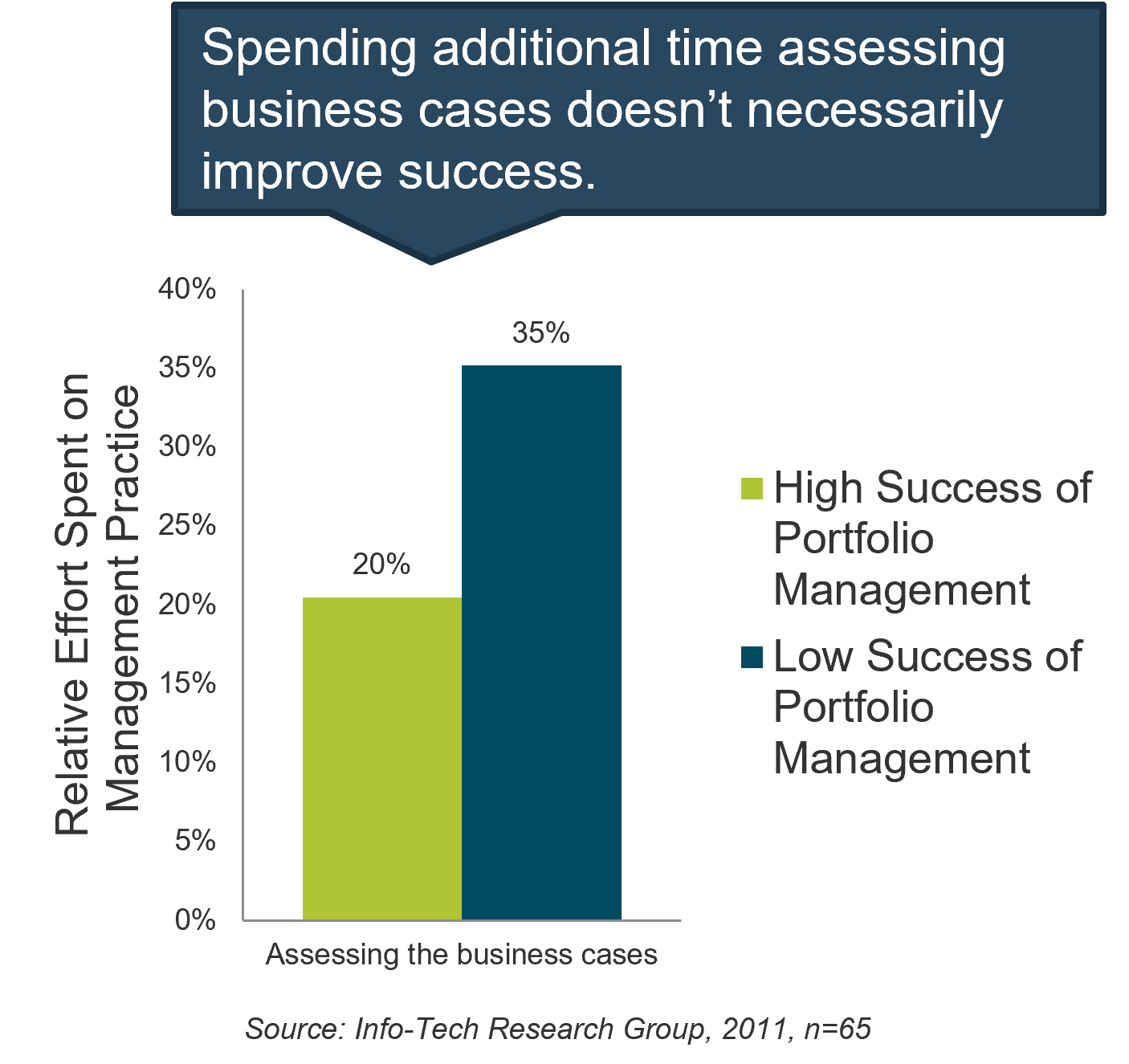

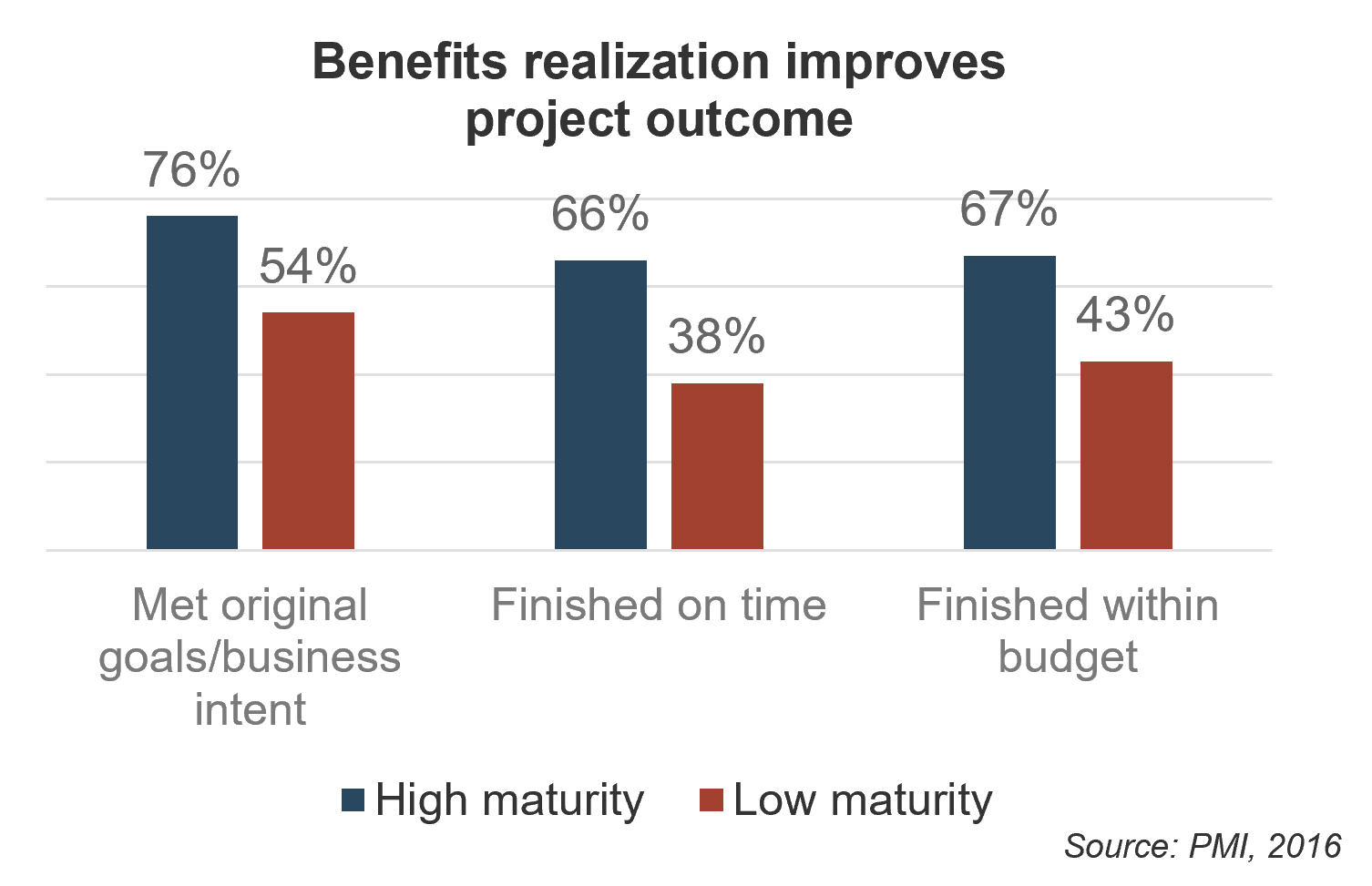

Optimized project intake, approval, and prioritization processes lead to a high PPM maturity, which will improve the successful delivery and throughput of your projects, resource utilization, business alignment, and stakeholder satisfaction ((Source: BCG/PMI).

Measure your success through the following metrics:

- Reduced turnaround time between project requests and initial scoping

- Number of project proposals with articulated benefits

- Reduction in “off-the-grid” projects

- Team satisfaction and workplace engagement

- PPM stakeholder satisfaction score from business stakeholders: see Info-Tech’s PPM Customer Satisfaction Diagnostics

$44,700: In the past 12 months, Info-Tech clients have reported an average measured value of $44,700 from undertaking a guided implementation of this research.

Add your own organization-specific goals, success criteria, and metrics by following the steps in the blueprint.

Case Study: Financial Services PMO prepares annual planning process with Project Value Scorecard Development Tool

CASE STUDY

Industry: Financial Services

Source: Info-Tech Client

Challenge

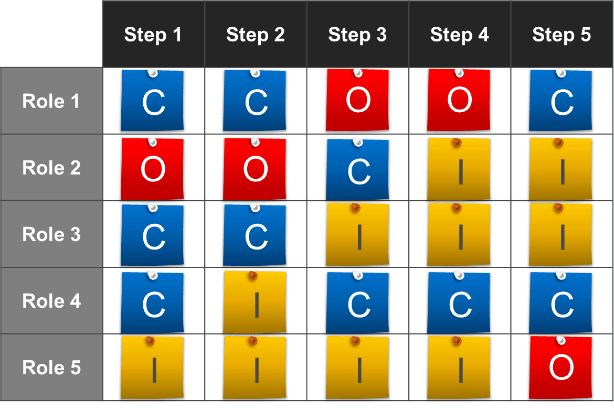

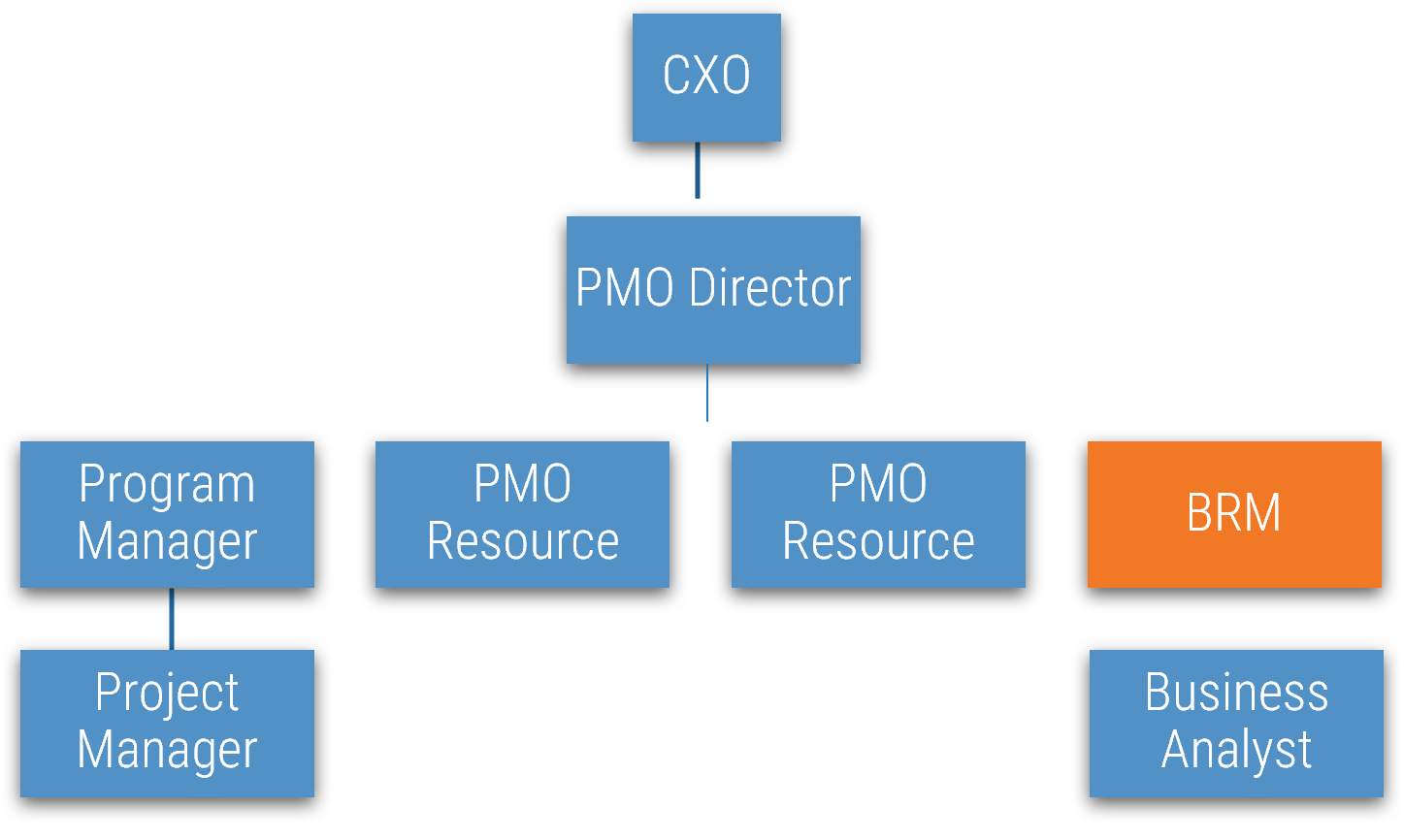

PMO plays a diverse set of roles, including project management for enterprise projects (i.e. PMI’s “Directive” PMO), standards management for department-level projects (i.e. PMI’s “Supportive” PMO), process governance of strategic projects (i.e. PMI’s “Controlling” PMO), and facilitation / planning / reporting for the corporate business strategy efforts (i.e. Enterprise PMO).

To facilitate the annual planning process, the PMO needed to develop a more data-driven and objective project intake process that implicitly aligned with the corporate strategy.

Solution

Info-Tech’s Project Value Scorecard tool was incorporated into the strategic planning process.

Results

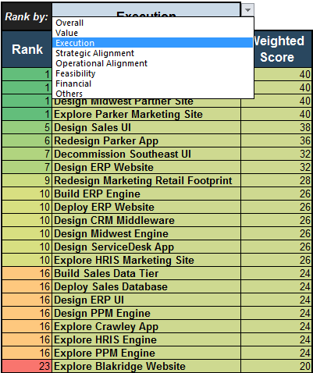

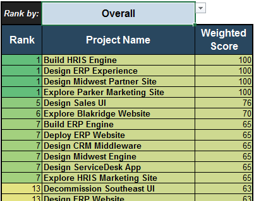

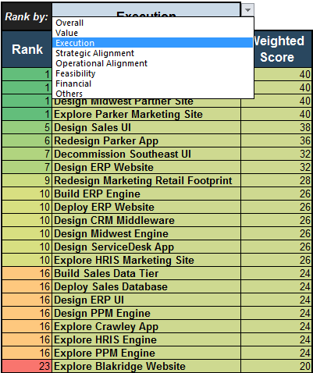

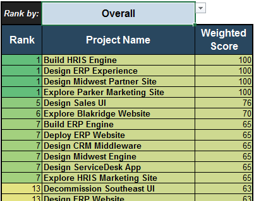

The scorecard provided a simple way to list the competing strategic initiatives, objectively score them, and re-sort the results on demand as the leadership chooses to switch between ranking by overall score, project value, ability to execute, strategic alignment, operational alignment, and feasibility.

The Project Value Scorecard provided early value with multiple options for prioritized rankings.

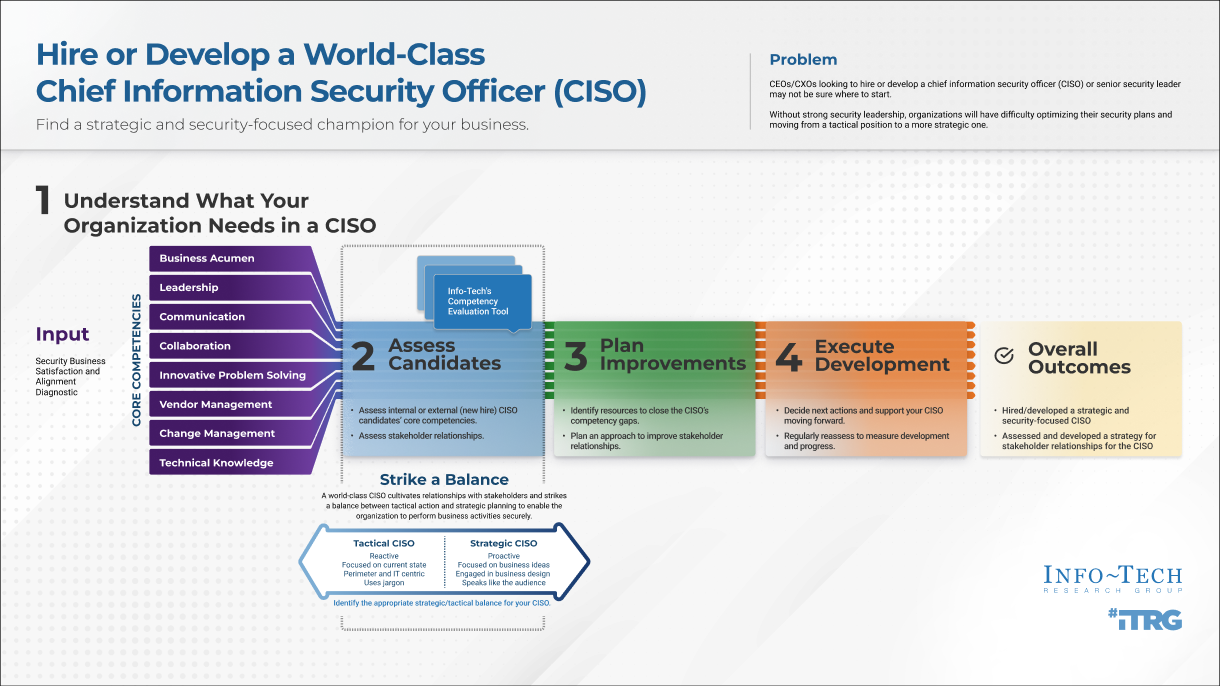

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit

“Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful.”

Guided Implementation

“Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track.”

Workshop

“We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place.”

Consulting

“Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project.”

Diagnostics and consistent frameworks used throughout all four options

Optimize Project Intake, Approval, and Prioritization – project overview

|

|

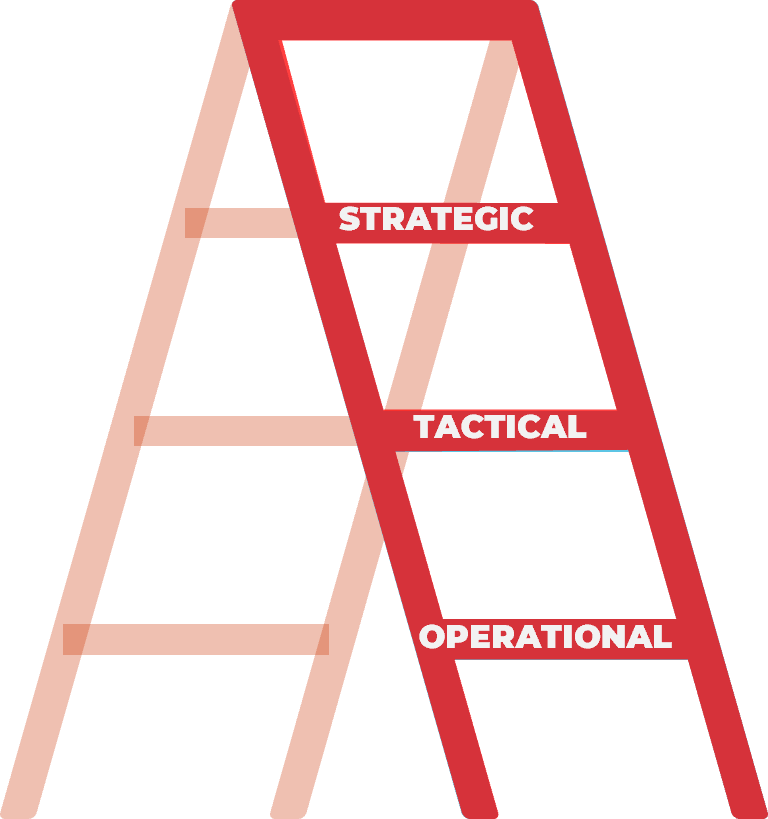

1. Set Realistic Goals for Optimizing Process

|

2. Build New Optimized Processes

|

3. Integrate the New Processes into Practice

|

| Best-Practice Toolkit

|

1.1 Define the criteria with which to determine project value.

|

2.1 Streamline intake to manage stakeholder expectations.

2.2 Set up steps of project approval to maximize strategic alignment while right-sizing the required effort.

2.3 Prioritize projects to maximize the value of the project portfolio within the constraint of resource capacity.

|

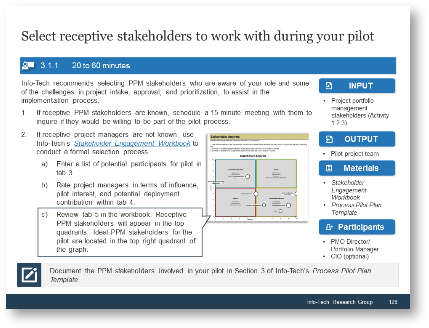

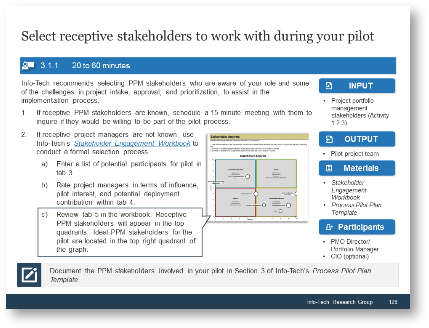

3.1 Pilot your intake, approval, and prioritization process to refine it before rollout.

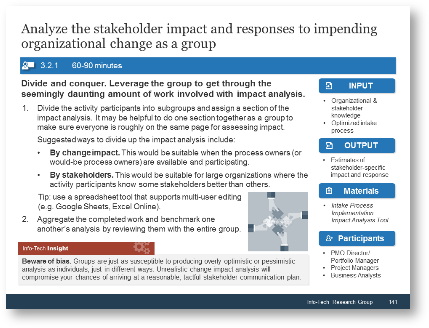

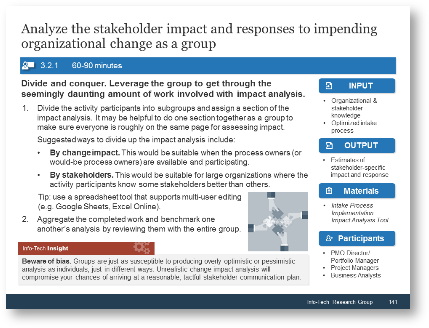

3.2 Analyze the impact of organizational change through the eyes of PPM stakeholders to gain their buy-in.

|

| Guided Implementations

|

- Introduce Project Value Scorecard Development Tool and pilot Info-Tech’s example scorecard on your own backlog.

- Map current project intake, approval, and prioritization process and key stakeholders.

- Set realistic goals for process optimization.

|

- Improve the management of stakeholder expectations with an optimized intake process.

- Improve the alignment of the project portfolio to strategic objectives with an optimized approval process.

- Enable resource capacity-constrained greenlighting of projects with an optimized prioritization process.

|

- Create a process pilot strategy with supportive stakeholders.

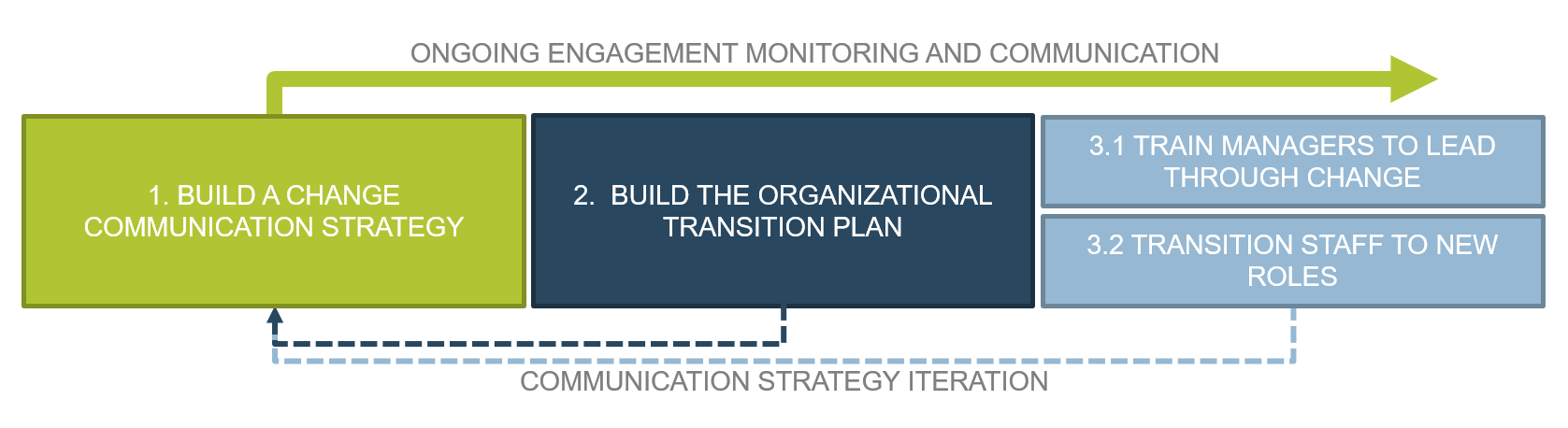

- Conduct a change impact analysis for your PPM stakeholders to create an effective communication strategy.

- Roll out the new process and measure success.

|

| Onsite Workshop

|

Module 1:

Refocus on Project Value to Set Realistic Goals for Optimizing Project Intake, Approval, and Prioritization Process

|

Module 2:

Examine, Optimize, and Document the New Project Intake, Approval, and Prioritization Process

|

Module 3:

Pilot, Plan, and Communicate the New Process and Its Required Organizational Changes

|

|

|

Phase 1 Outcome:

- Draft project valuation criteria

- Examination of current process

- Definition of process success criteria

|

Phase 2 Outcome:

- Documentation of new project intake, approval, and prioritization process

- Tools and templates to aid the process

|

Phase 3 Outcome:

- Process pilot plan

- Organizational change communication plan

|

Workshop overview

Contact your account representative or email Workshops@InfoTech.com for more information.

|

|

Workshop Day 1

|

Workshop Day 2

|

Workshop Day 3

|

Workshop Day 4

|

Workshop Day 5

|

| Activities

|

Benefits of optimizing project intake and project value definition

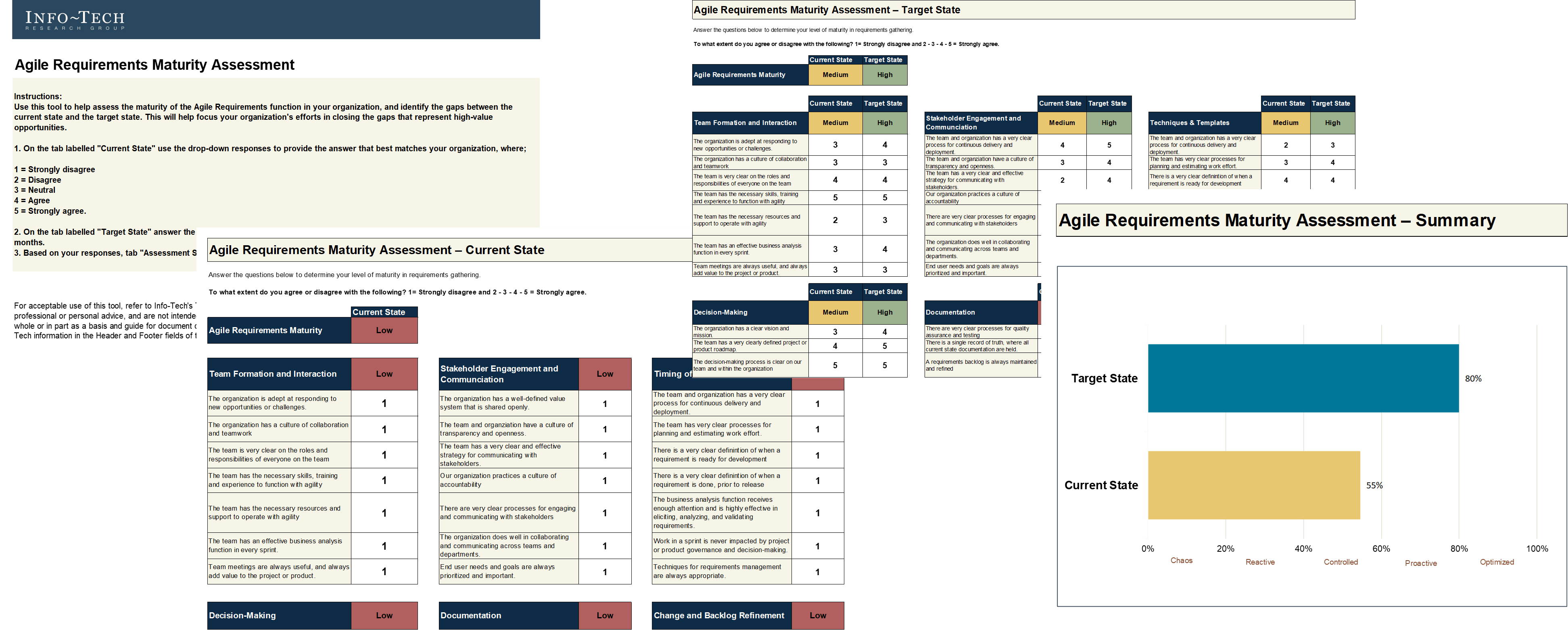

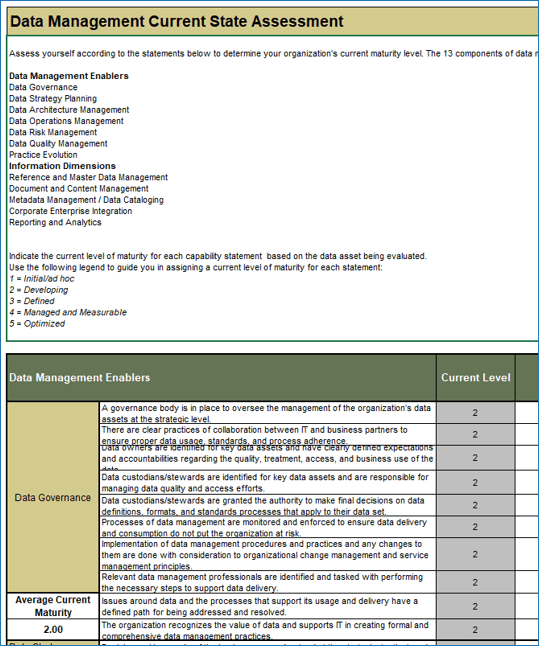

1.1 Complete and review PPM Current State Scorecard Assessment

1.2 Define project value for the organization

1.3 Engage key PPM stakeholders to iterate on the scorecard prototype

|

Set realistic goals for process optimization

2.1 Map current intake, approval, and prioritization workflow

2.2 Enumerate and prioritize process stakeholders

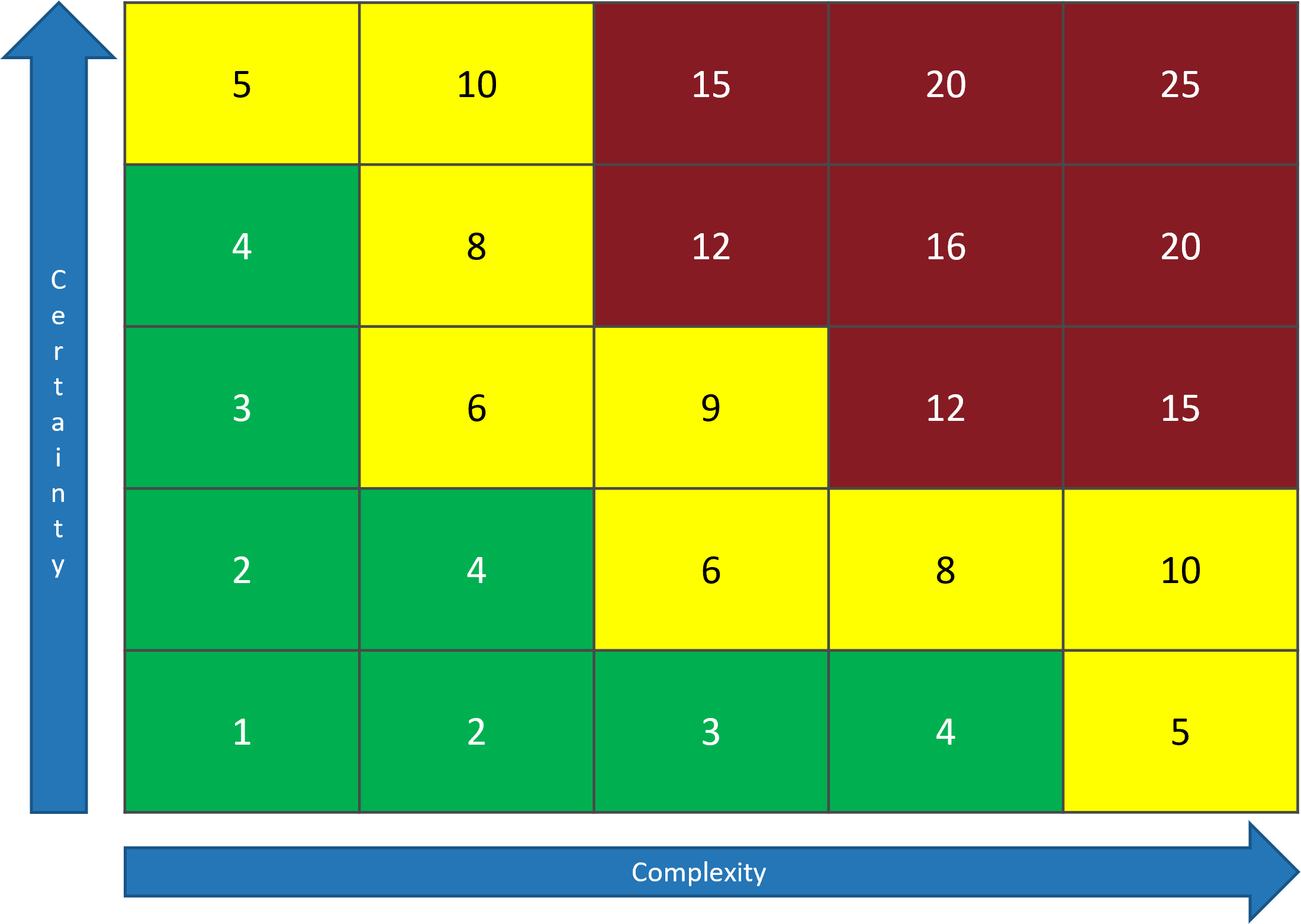

2.3 Determine the current and target capability levels

2.4 Define the process success criteria and KPIs

|

Optimize project intake and approval processes

3.1 Conduct focused retrospectives for project intake and approval

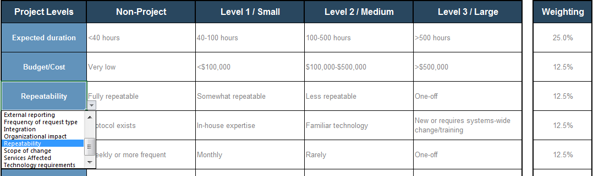

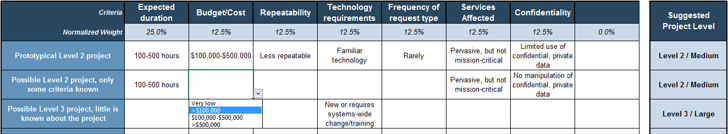

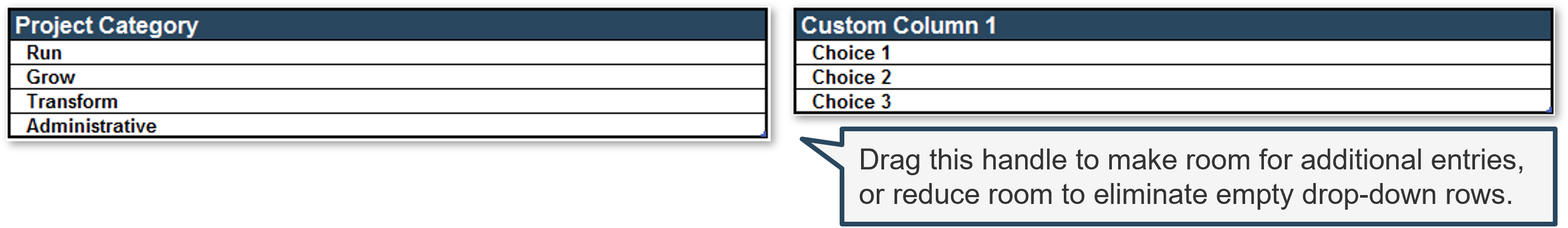

3.2 Define project levels

3.3 Optimize project intake processes

3.4 Optimize project approval processes

3.5 Compose SOP for intake and approval

3.6 Document the new intake and approval workflow

|

Optimize project prioritization process plan for a process pilot

4.1 Conduct focused retrospective for project prioritization

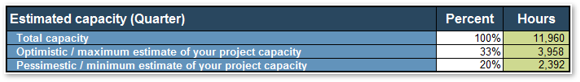

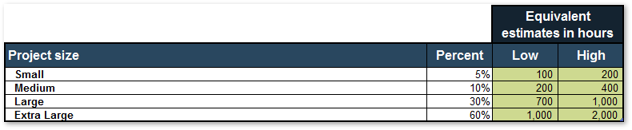

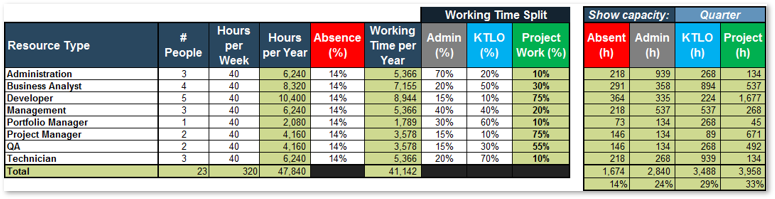

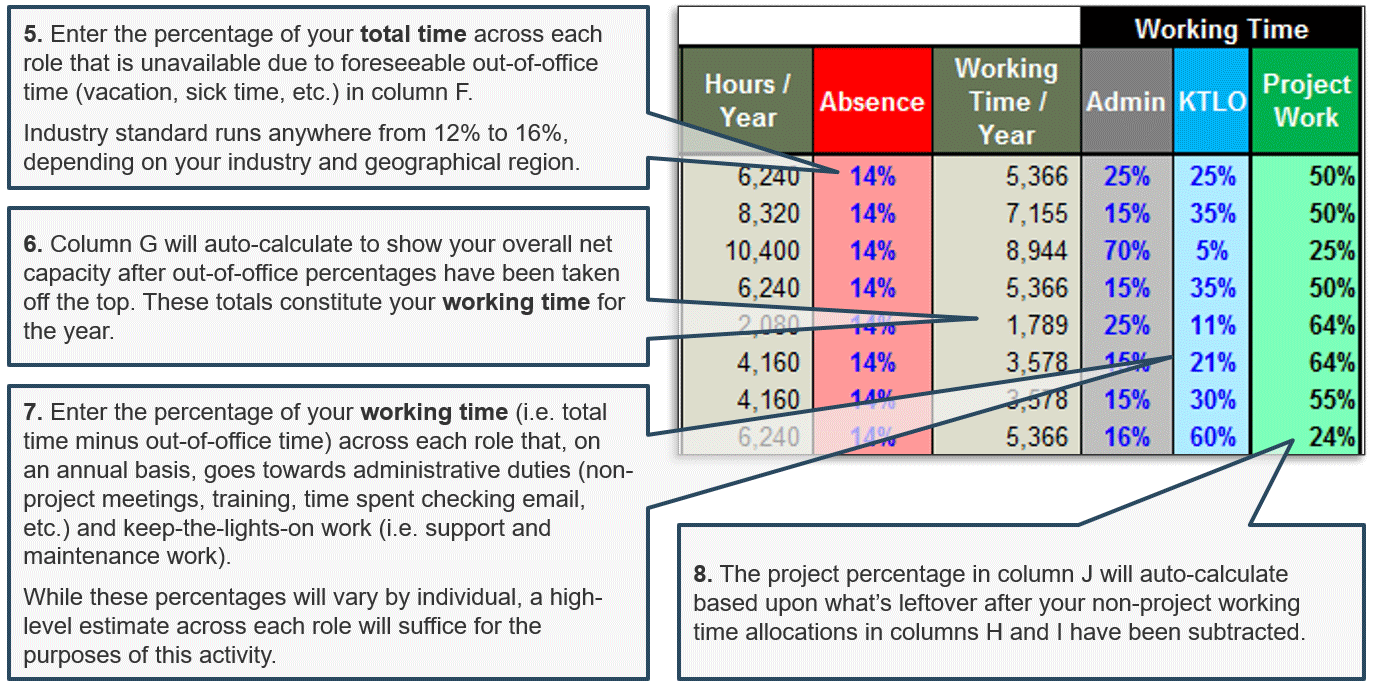

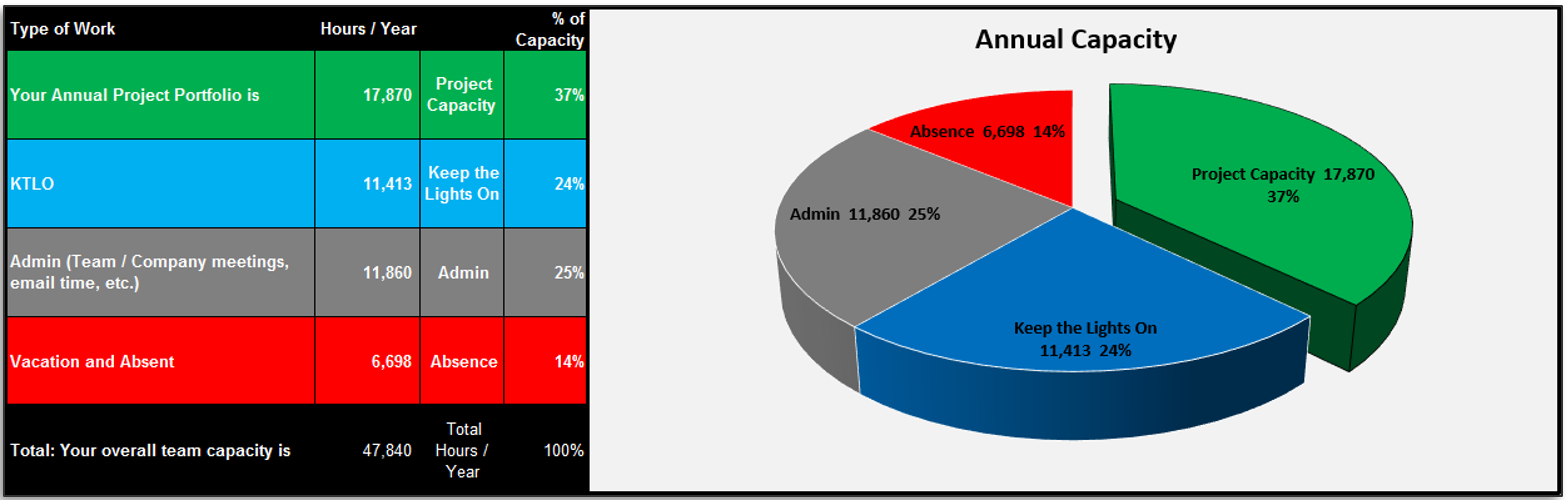

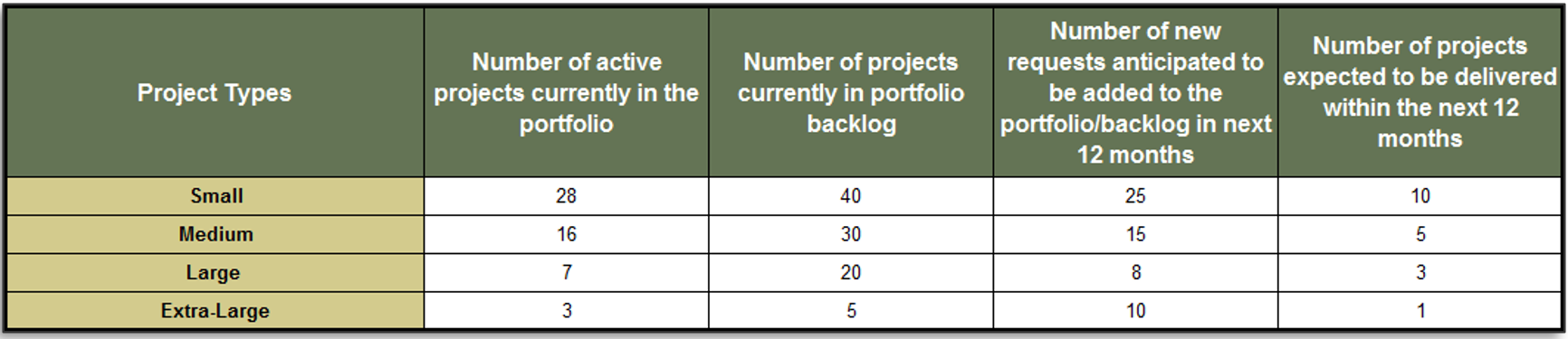

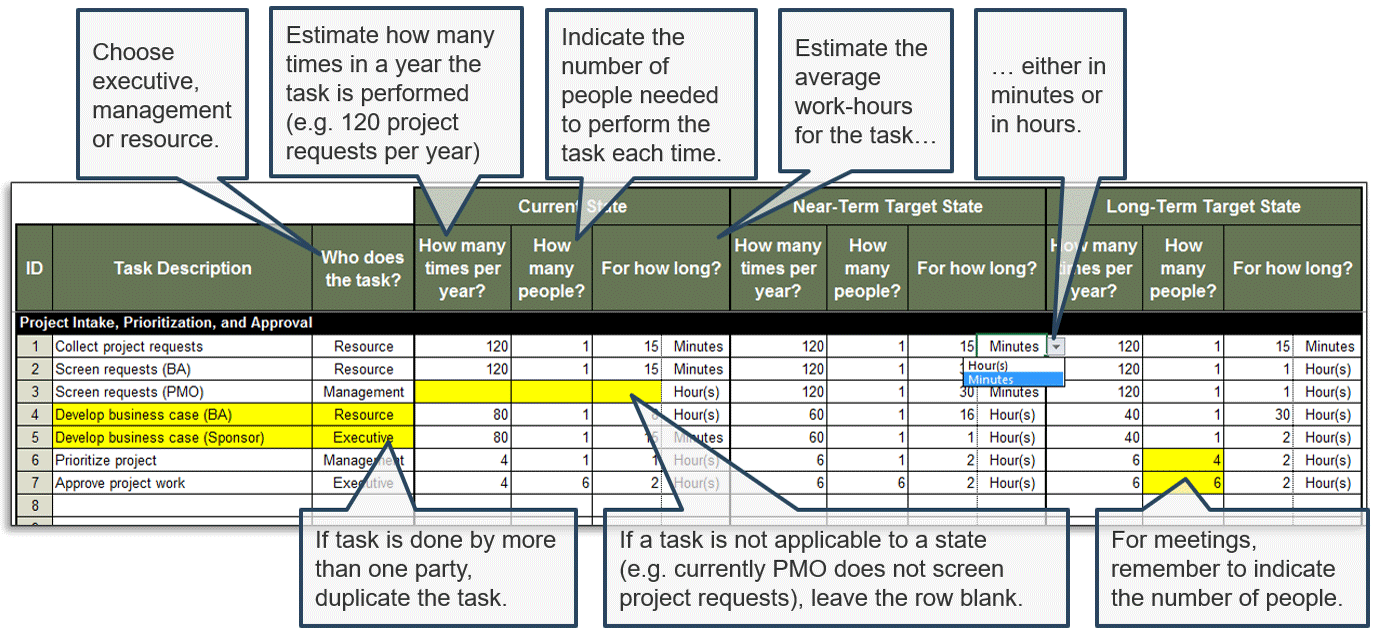

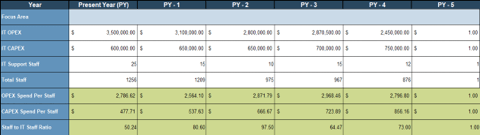

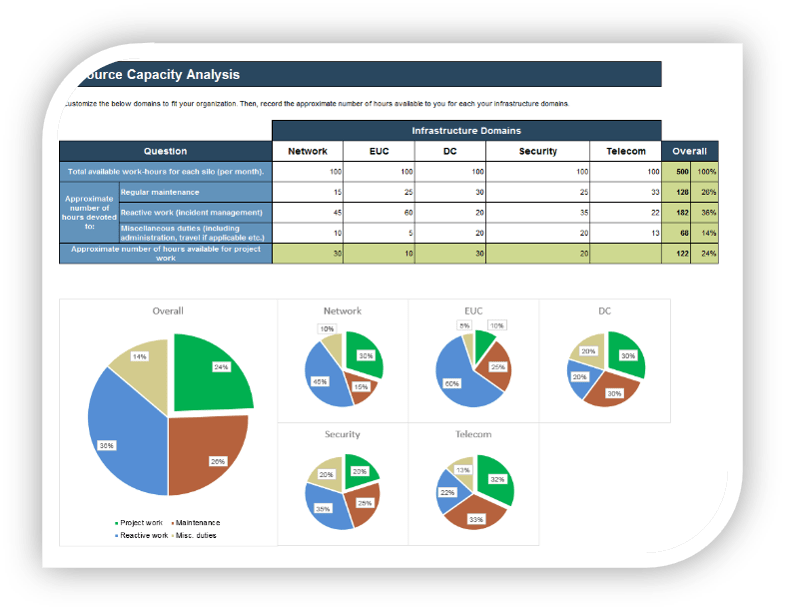

4.2 Estimate available resource capacity

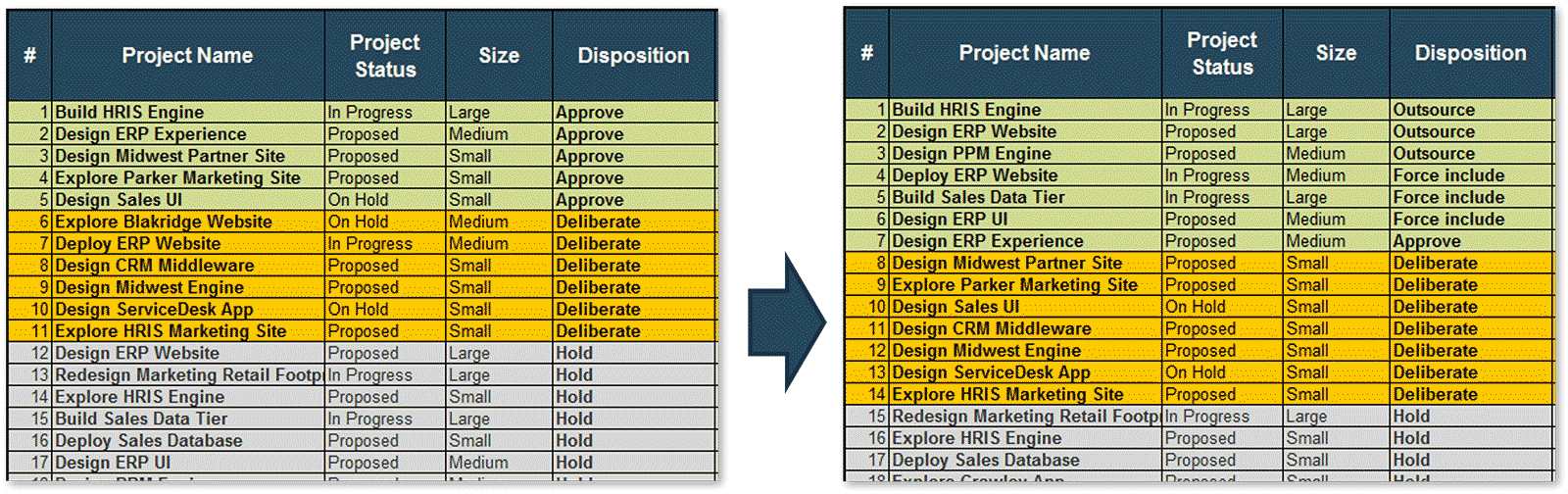

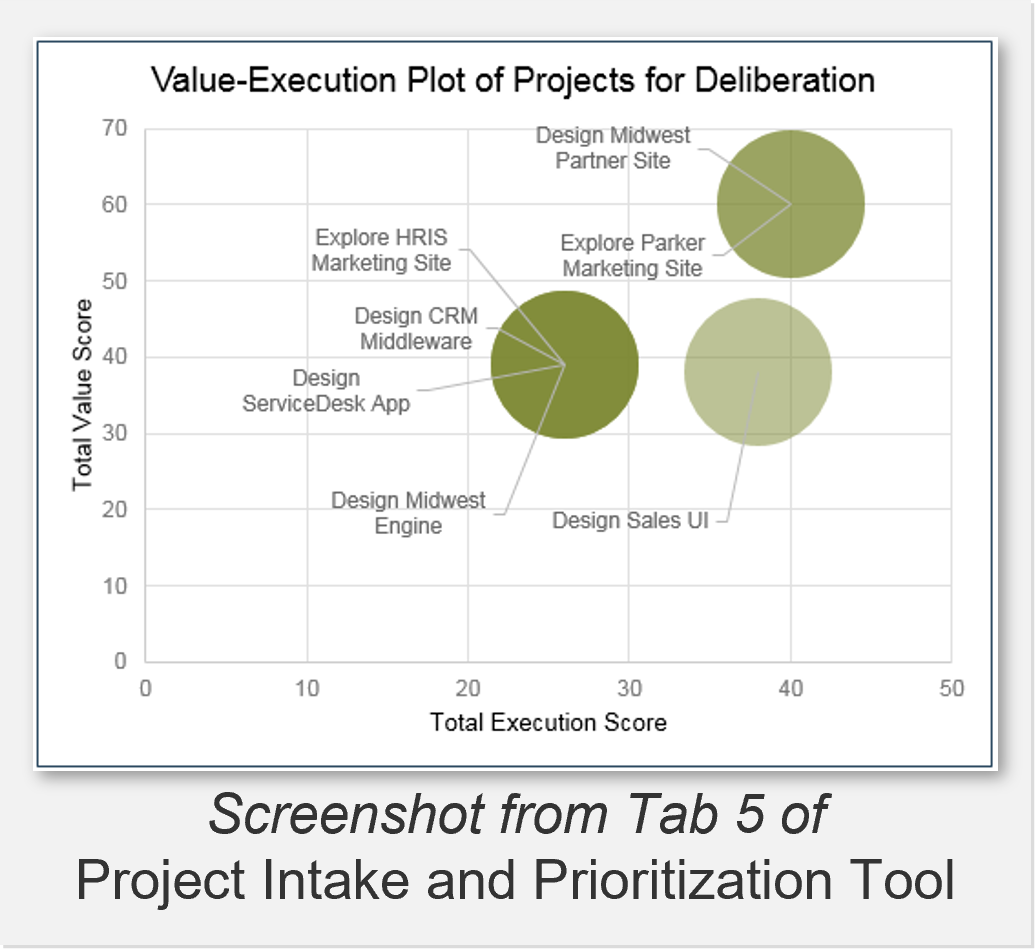

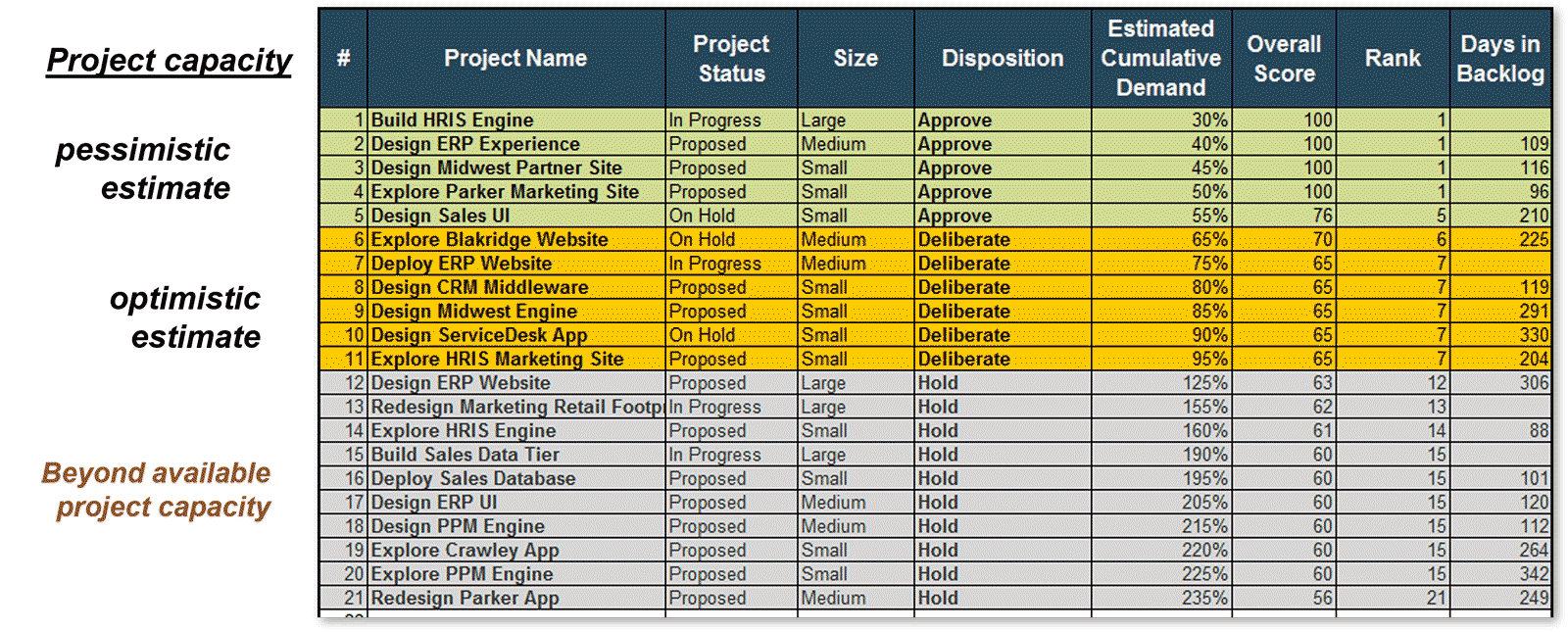

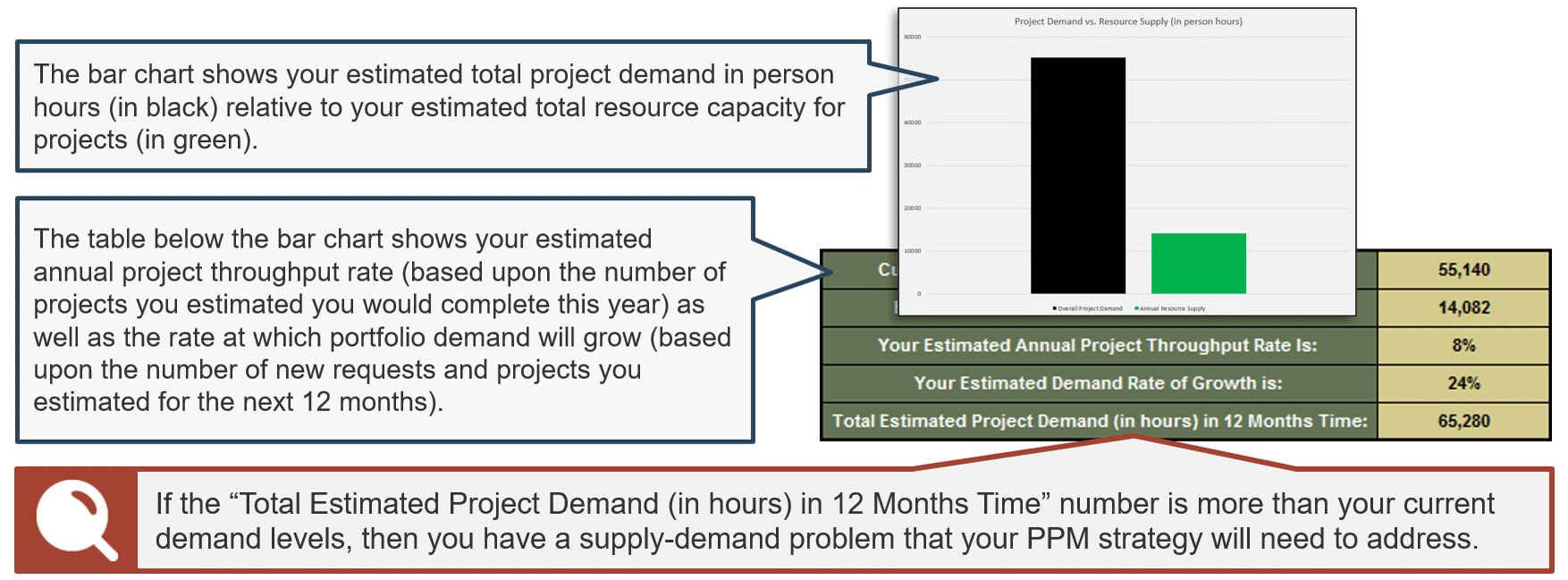

4.3 Pilot Project Intake and Prioritization Tool with your project backlog

4.4 Compose SOP for prioritization

4.5 Document the new prioritization workflow

4.6 Discuss process pilot

|

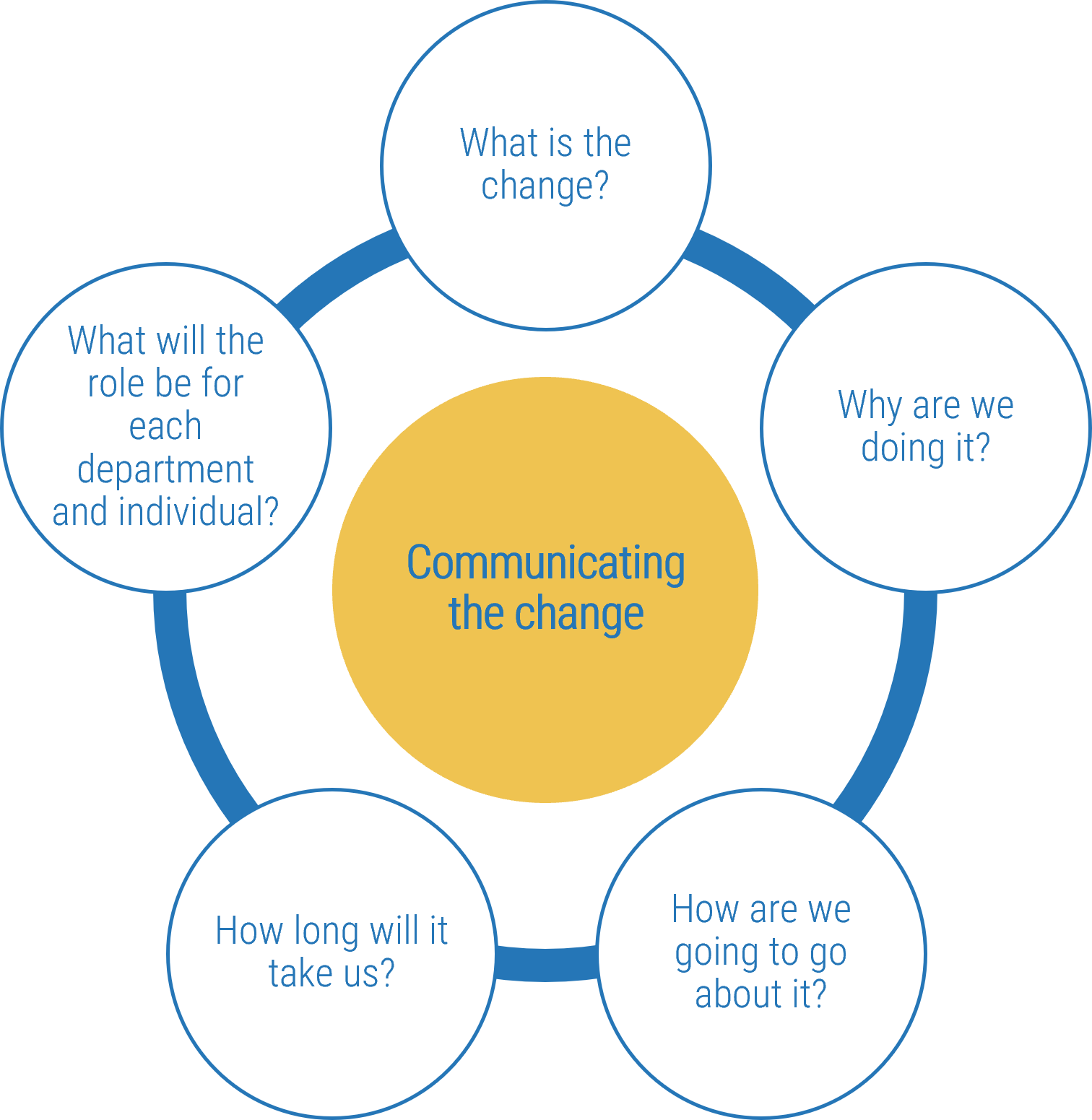

Analyze stakeholder impact and create communication strategy

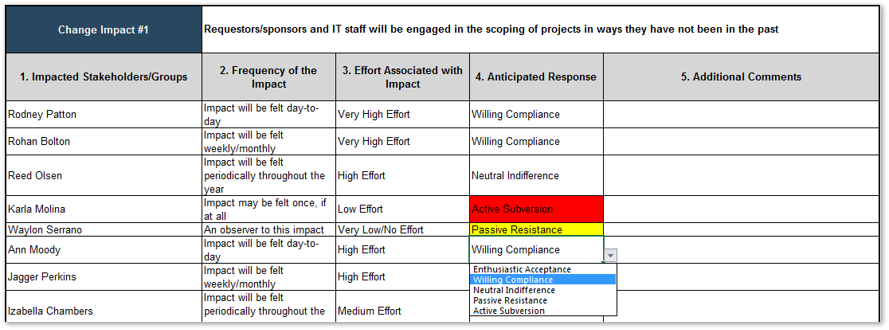

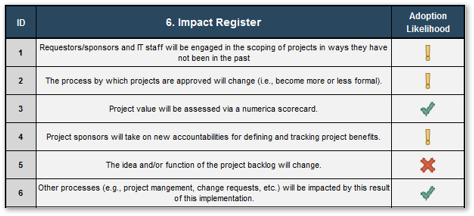

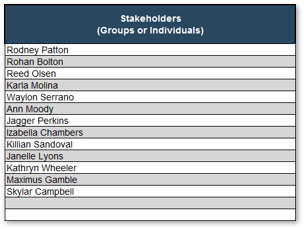

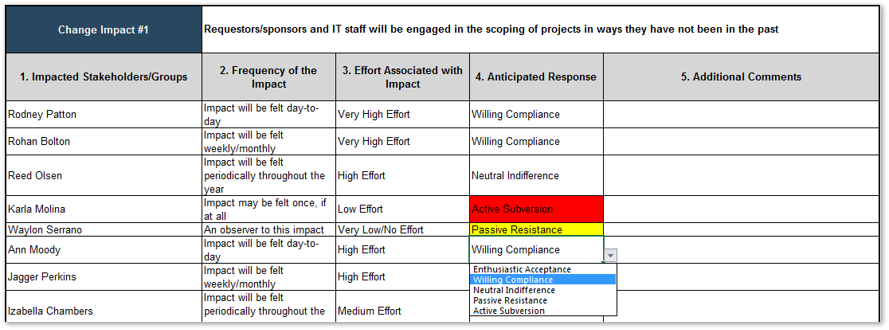

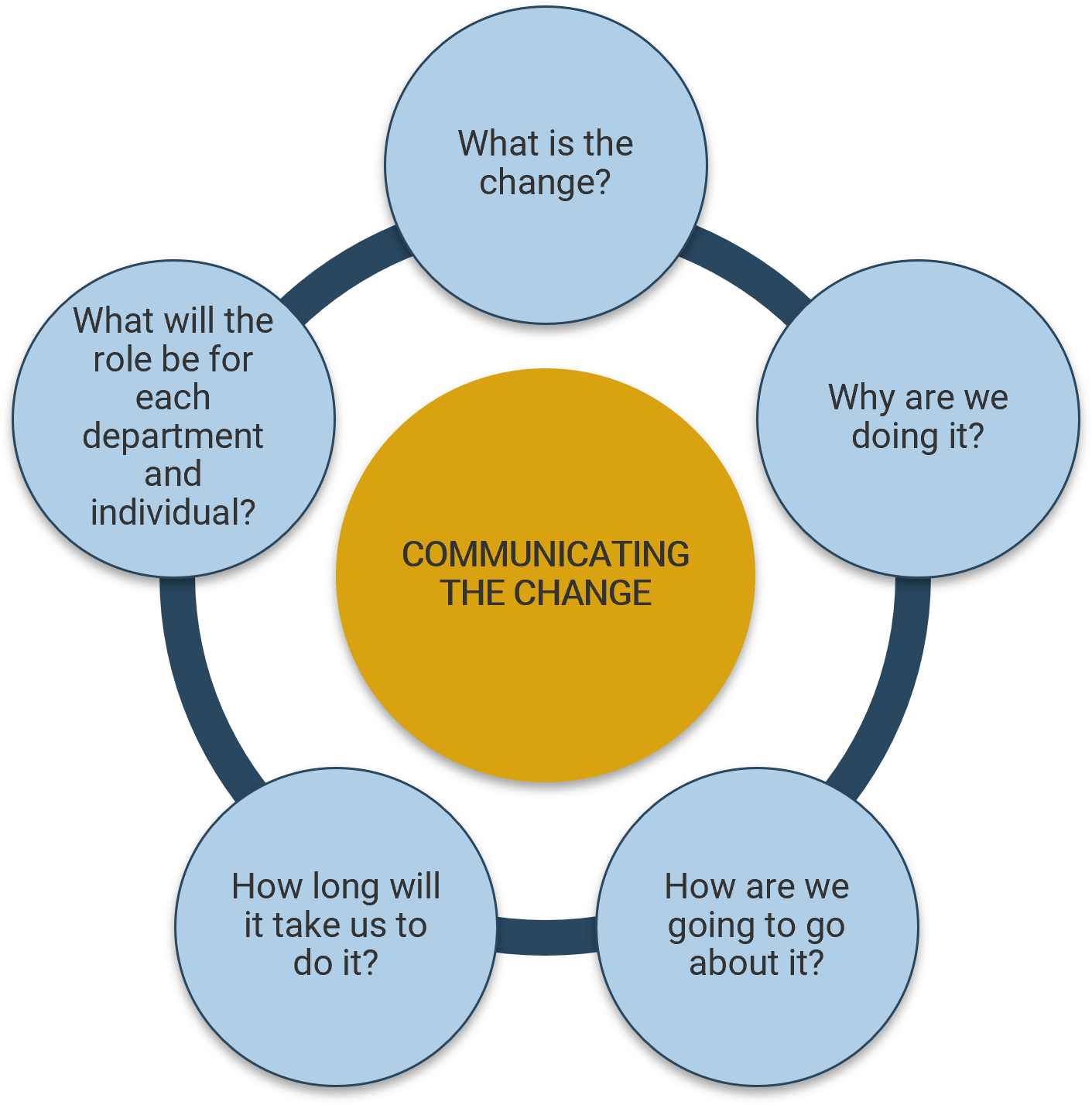

5.1 Analyze stakeholder impact and responses to impending organization change

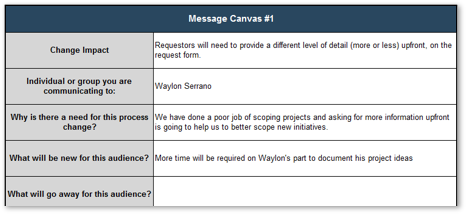

5.2 Create message canvas for at-risk change impacts and stakeholders

5.3 Set course of action for communicating change

|

| Deliverables

|

- PPM Current State Scorecard

- Project Value Scorecard prototype

|

- Current intake, approval, and prioritization workflow

- Stakeholder register

- Intake process success criteria

|

- Project request form

- Project level classification matrix

- Proposed project deliverables toolkit

- Customized intake and approval SOP

- Flowchart for the new intake and approval workflow

|

- Estimated resource capacity for projects

- Customized Project Intake and Prioritization Tool

- Customized prioritization SOP

- Flowchart for the new prioritization workflow

- Process pilot plan

|

- Completed Intake and Prioritization Impact Analysis Tool

- Communication strategy and plan

|

Phase 1

Set Realistic Goals for Optimizing Project Intake, Approval, and Prioritization Process

Phase 1 outline

Call 1-888-670-8889 or email GuidedImplementations@InfoTech.com for more information.

Complete these steps on your own, or call us to complete a guided implementation. A guided implementation is a series of 2-3 advisory calls that help you execute each phase of a project. They are included in most advisory memberships.

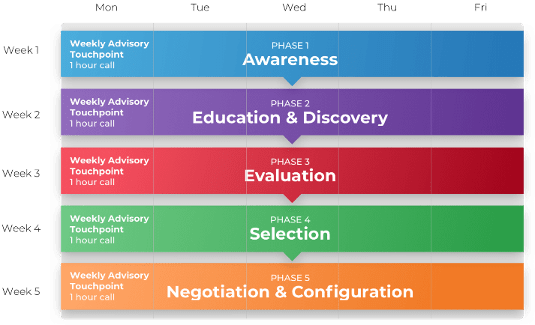

| Guided Implementation 1: Set Realistic Goals for Project Intake, Approval, and Prioritization Process Proposed Time to Completion: 1-2 weeks

|

|

Step 1.1: Define the project valuation criteria

Start with an analyst kick-off call:

- Discuss how a project value is currently determined

- Introduce Info-Tech’s scorecard-driven project valuation approach

Then complete these activities…

- Create a first-draft version of a project value-driven prioritized list of projects

- Review and iterate on the scorecard criteria

With these tools & templates:

Project Value Scorecard Development Tool

|

Step 1.2: Envision your process target state

Start with an analyst kick-off call:

- Introduce Info-Tech’s project intake process maturity model

- Discuss the use of Info-Tech’s Diagnostic Program for an initial assessment of your current PPM processes

Then complete these activities…

- Map your current process workflow

- Enumerate and prioritize your key stakeholders

- Define process success criteria

With these tools & templates:

Project Intake Workflow Template

Project Intake, Approval, and Prioritization SOP Template

|

Phase 1 Results & Insights:

- The overarching goal of optimizing project intake, approval, and prioritization process is to maximize the throughput of the best projects. To achieve this goal, one must have a clear way to determine what are “the best” projects.

|

Get to value early with Step 1.1 of this blueprint

Define how to determine a project’s value and set the stage for maximizing the value of your project portfolio using Info-Tech’s Project Value Scorecard Development Tool.

Where traditional models of consulting can take considerable amounts of time before delivering value to clients, Info-Tech’s methodology for optimizing project intake, approval, and prioritization process gets you to value fast.

The overarching goal of optimizing project intake, approval, and prioritization process is to maximize the throughput of the best projects. To achieve this goal, one must have a clear way to determine what are “the best” projects.

In the first step of this blueprint, you will pilot a multiple-criteria scorecard for determining project value that will help answer that question. Info-Tech’s Project Value Scorecard Development Tool is pre-populated with a ready-to-use, real-life example that you can leverage as a starting point for tailoring it to your organization – or adopt as is.

Introduce objectivity and clarity to your discussion of maximizing the value of your project portfolio with Info-Tech’s practical IT research that drives measurable results.

Download Info-Tech’s Project Value Scorecard Development Tool.

Step 1.1: Define the criteria with which to determine project value

| PHASE 1

|

PHASE 2

|

PHASE 3

|

|

1.1

Define project valuation criteria

|

1.2

Envision process target state

|

2.1

Streamline intake

|

2.2

Right-size approval steps

|

2.3

Prioritize projects to fit resource capacity

|

3.1

Pilot your optimized process

|

3.2

Communicate organizational change

|

This step will walk you through the following activities:

- Learn how to use the Project Value Scorecard Development Tool

- Create a first-draft version of a project value-driven prioritized list of projects

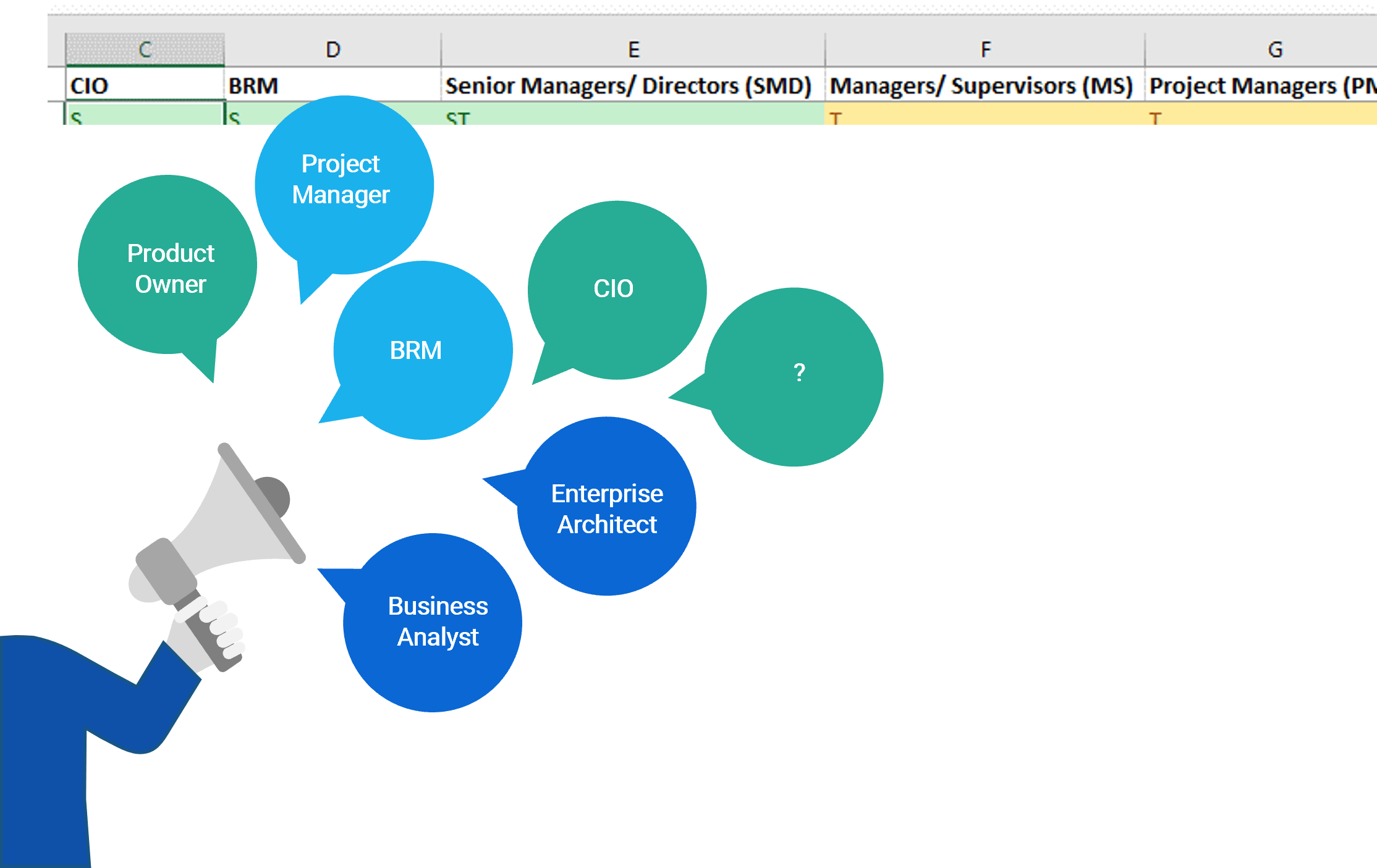

This step involves the following participants:

- PMO Director/ Portfolio Manager

- Project Managers

- Business Analysts

- CIO (optional)

Outcomes of this step

- Understand the importance of devising a consensus criteria for project valuation.

- Try a project value scorecard-driven prioritization process with your currently proposed.

- Set the stage for optimizing project intake, approval, and prioritization processes.

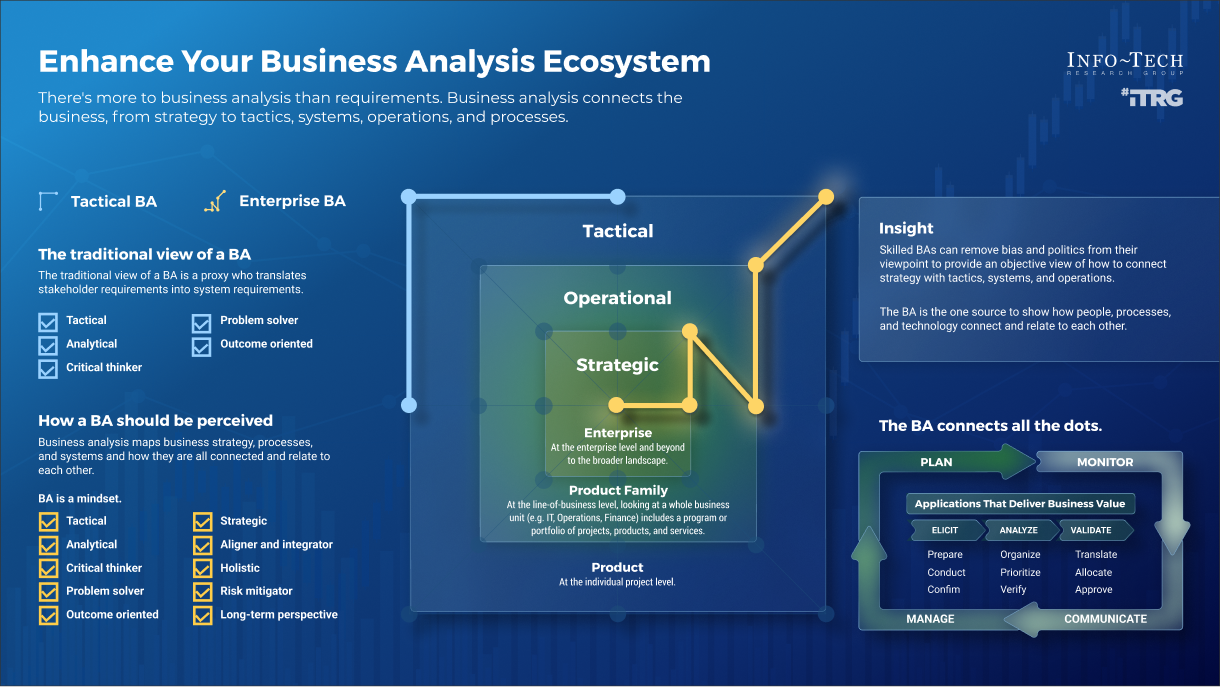

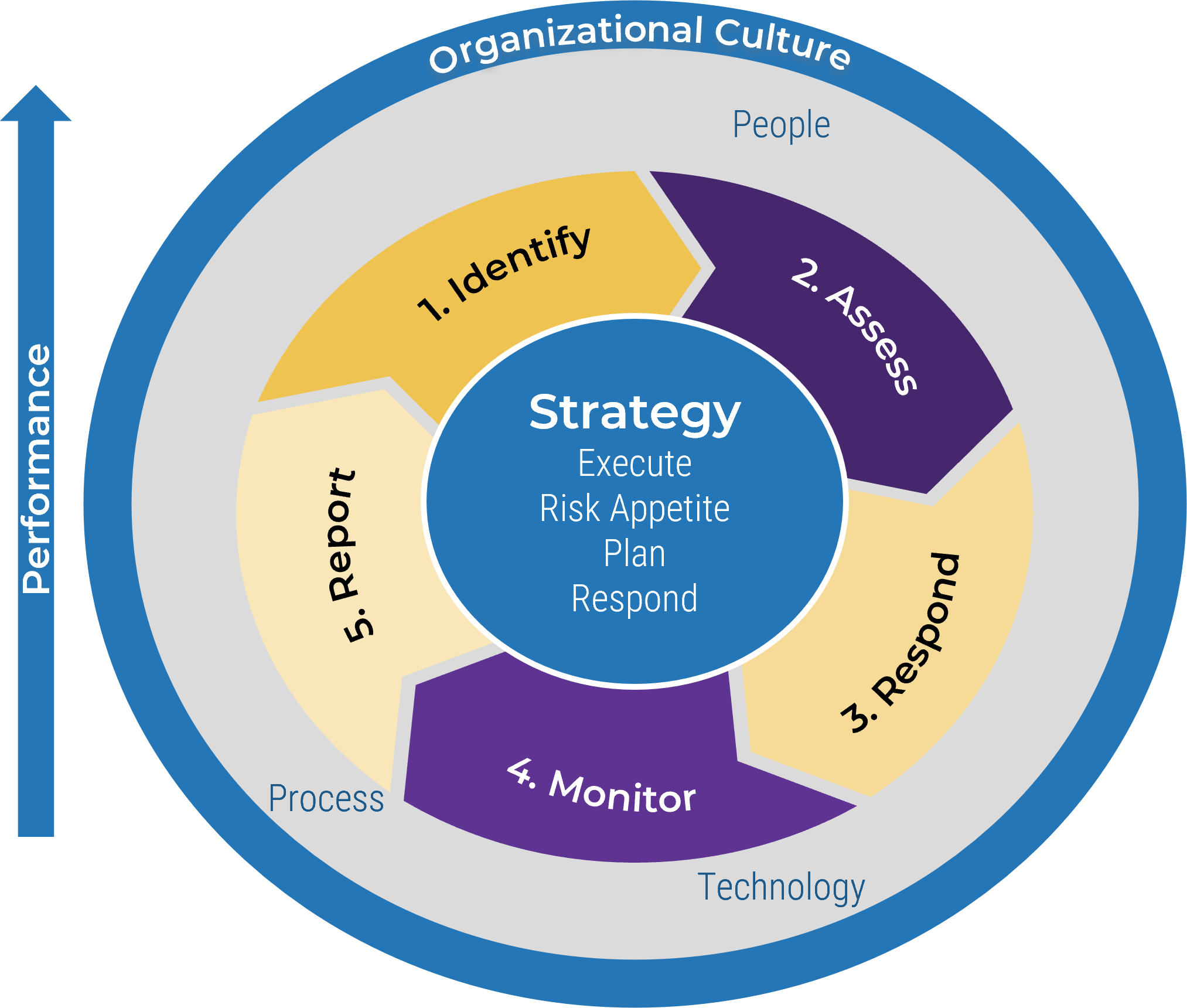

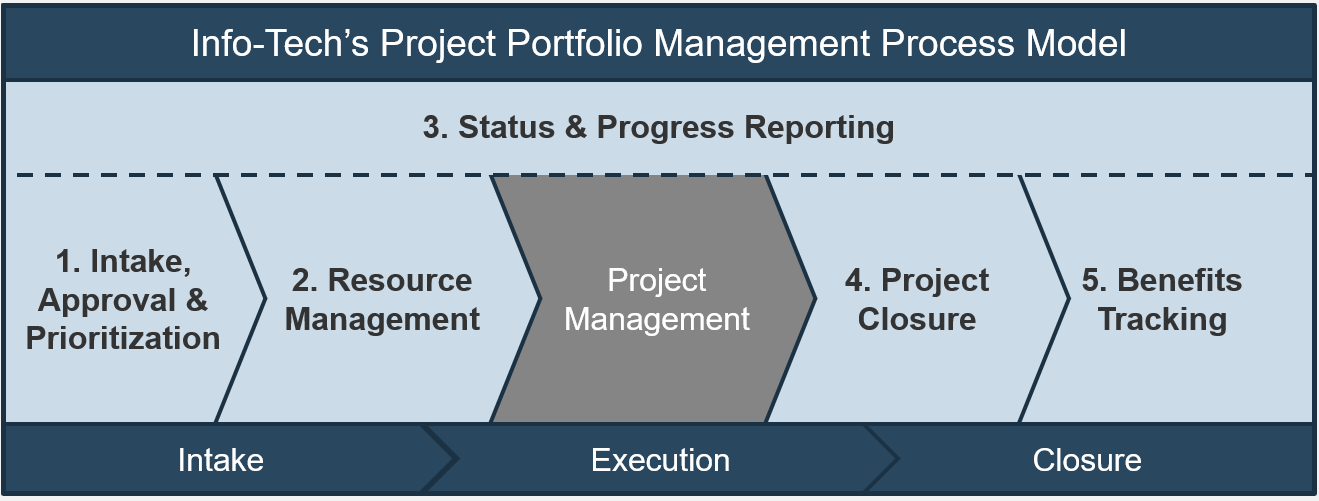

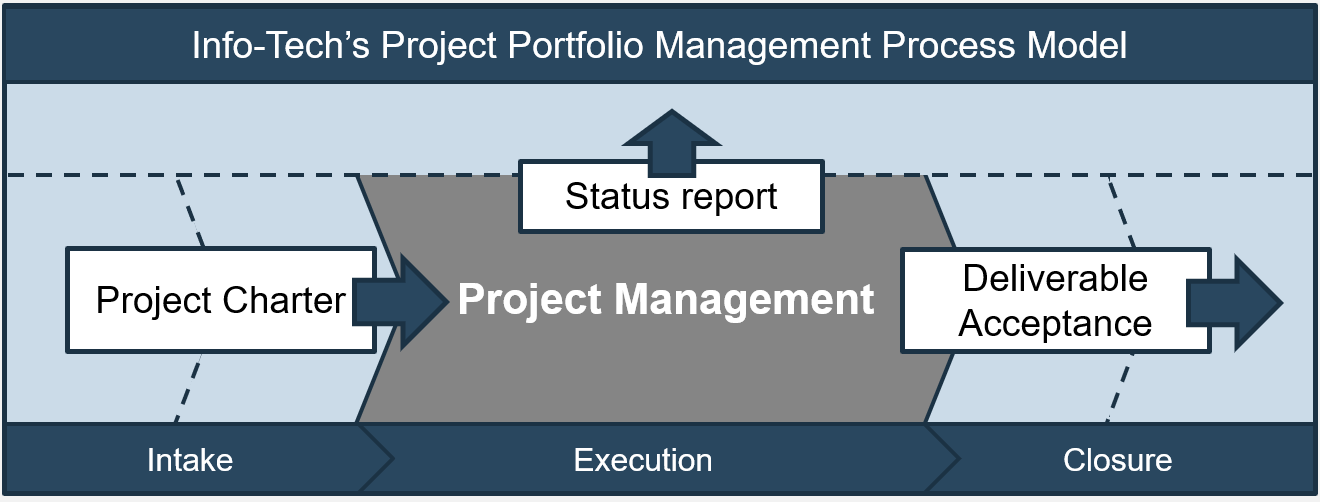

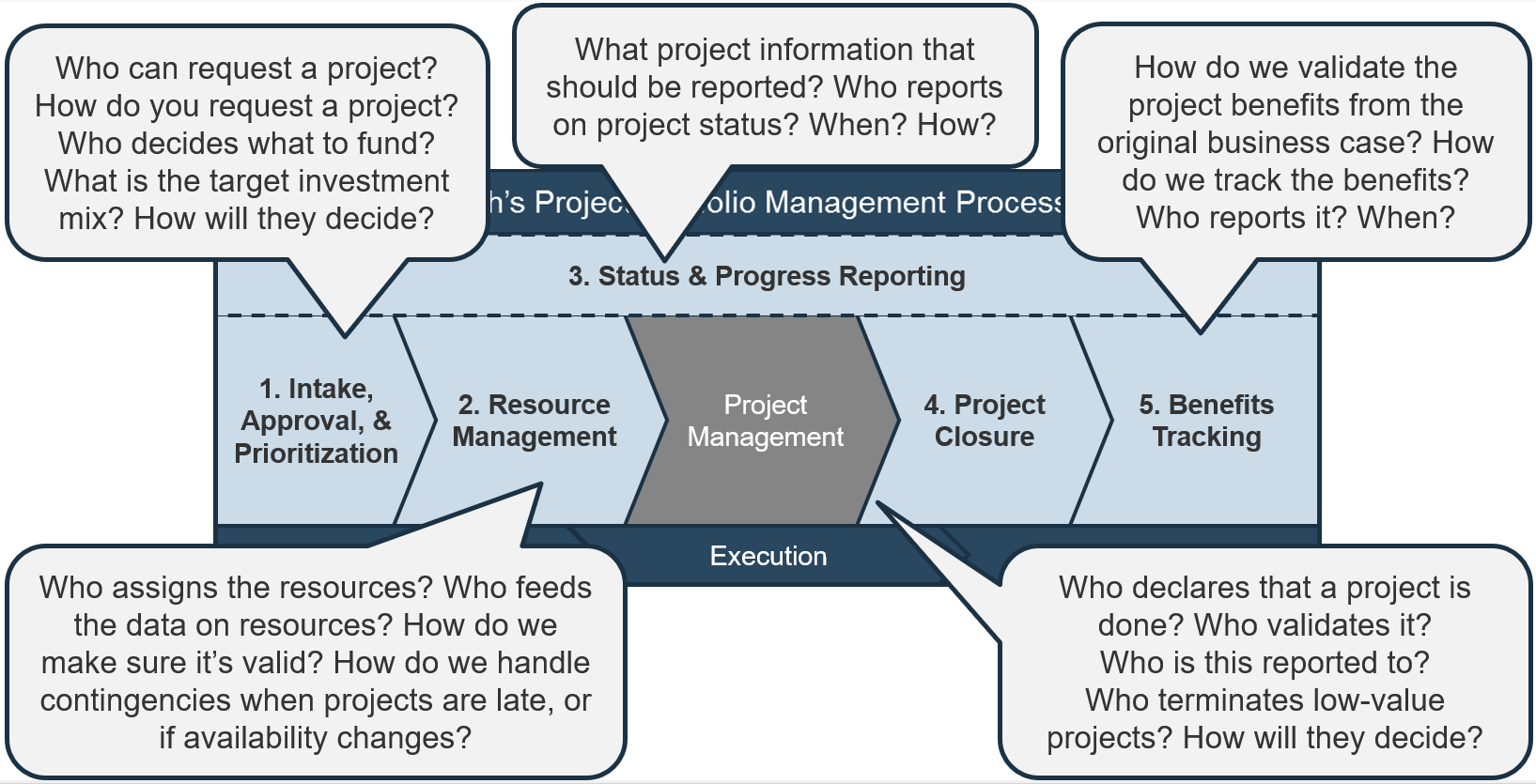

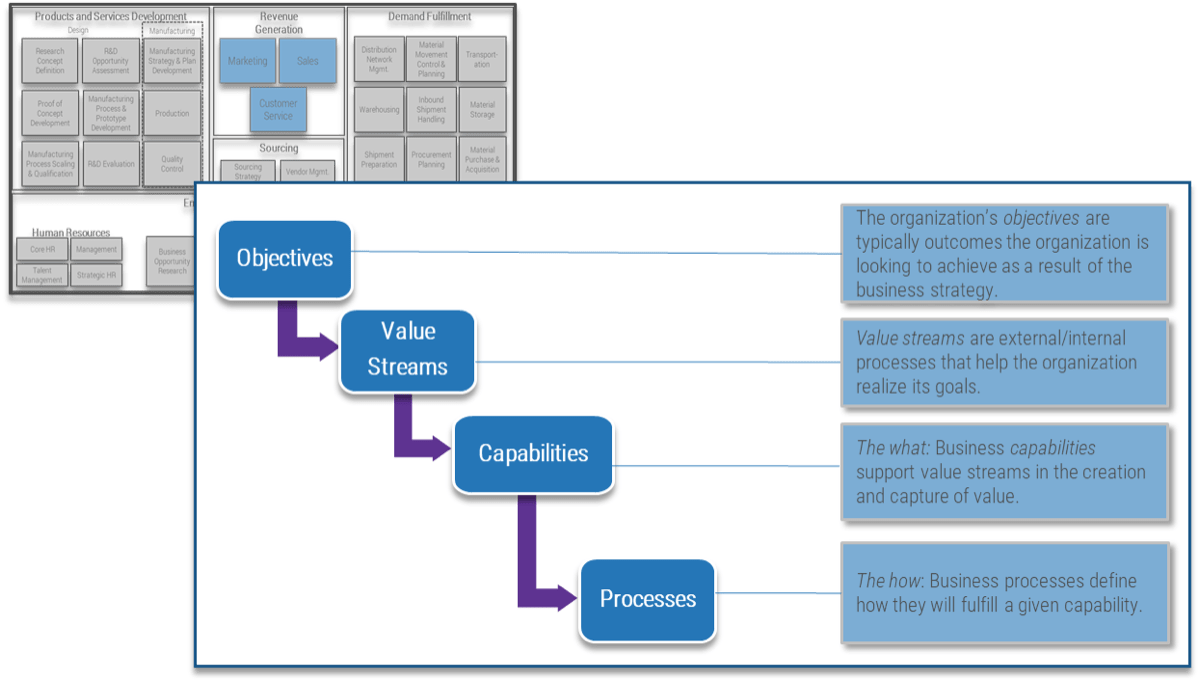

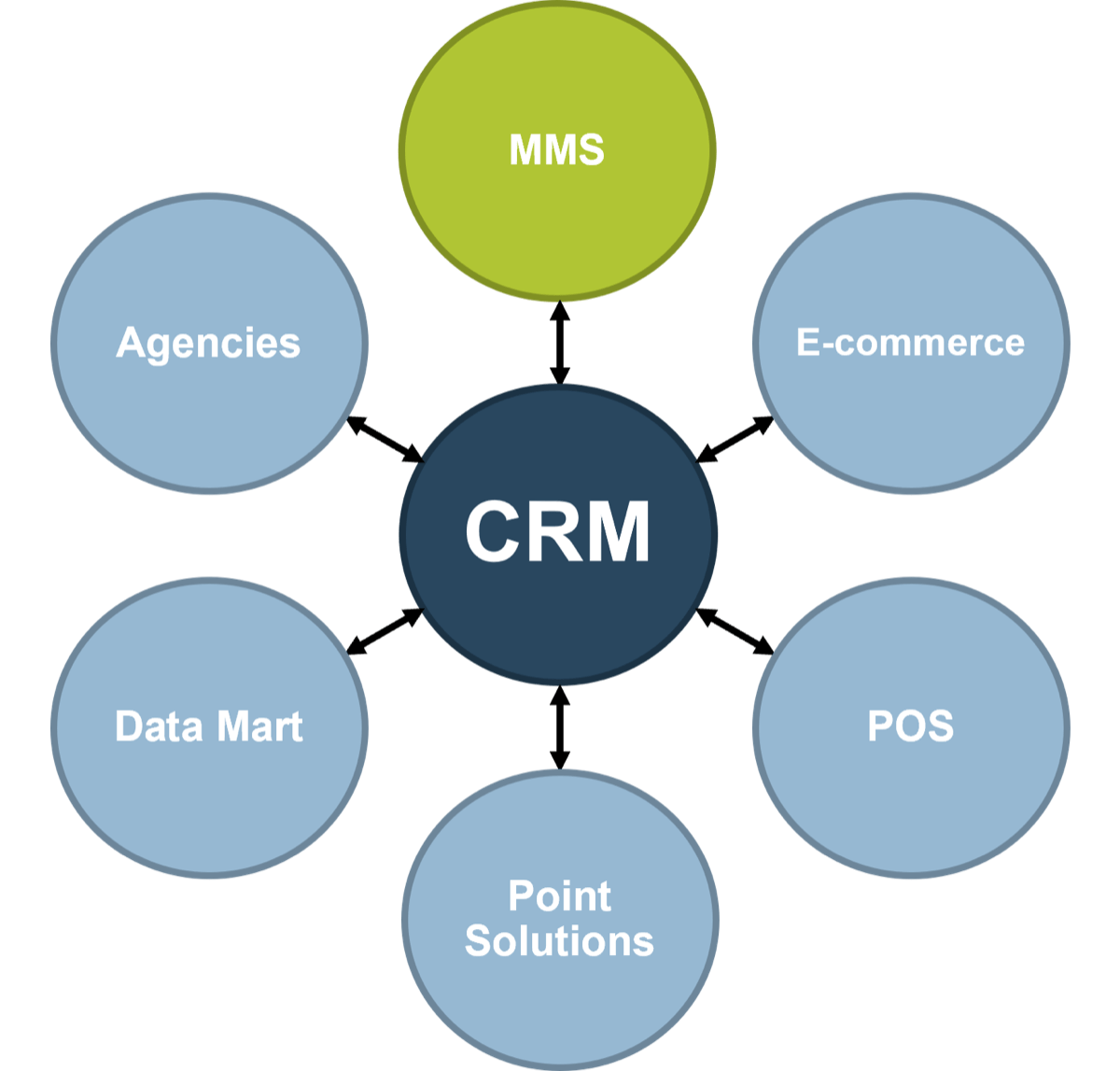

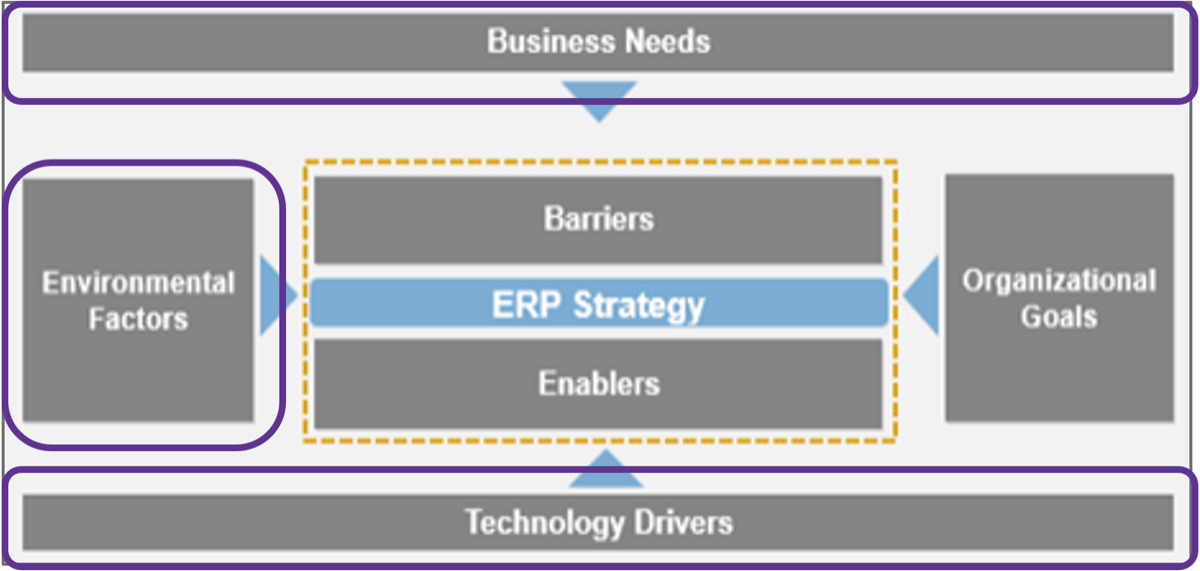

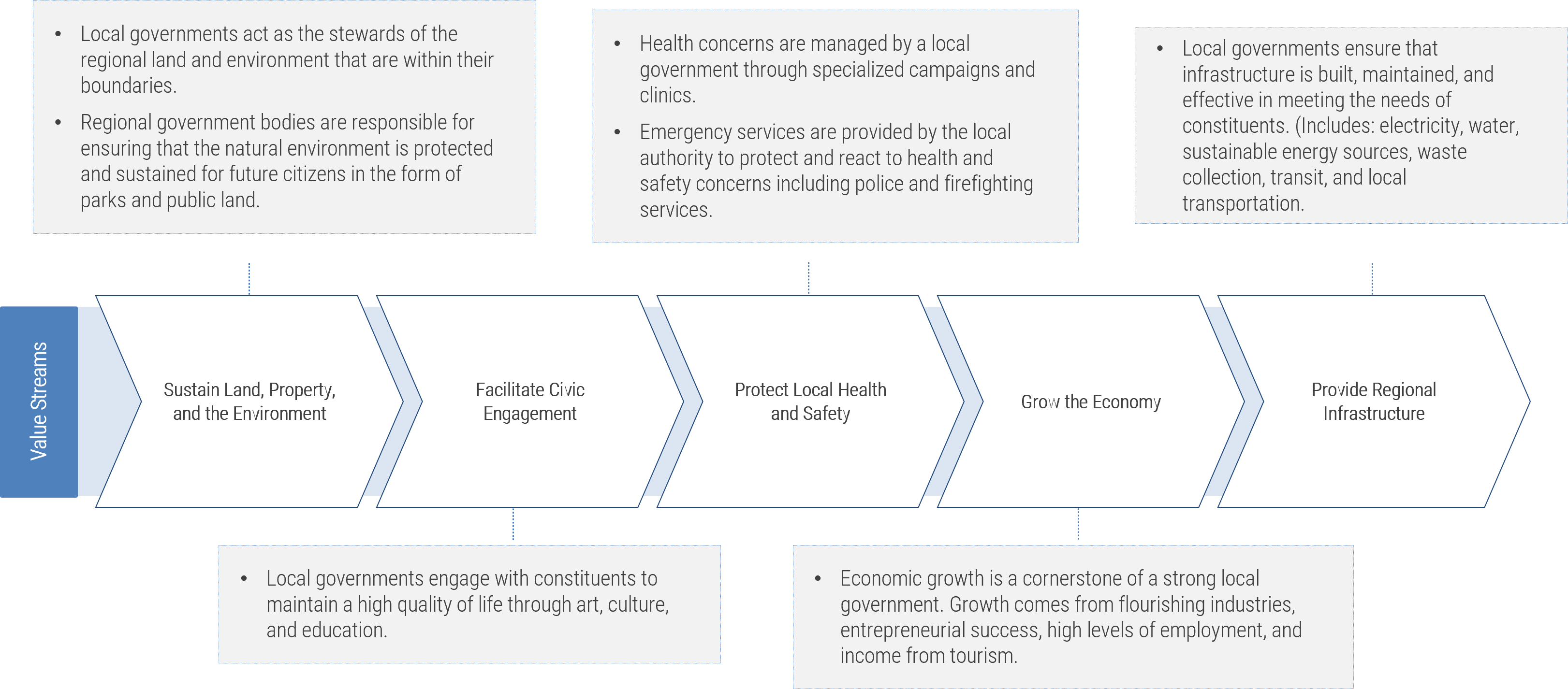

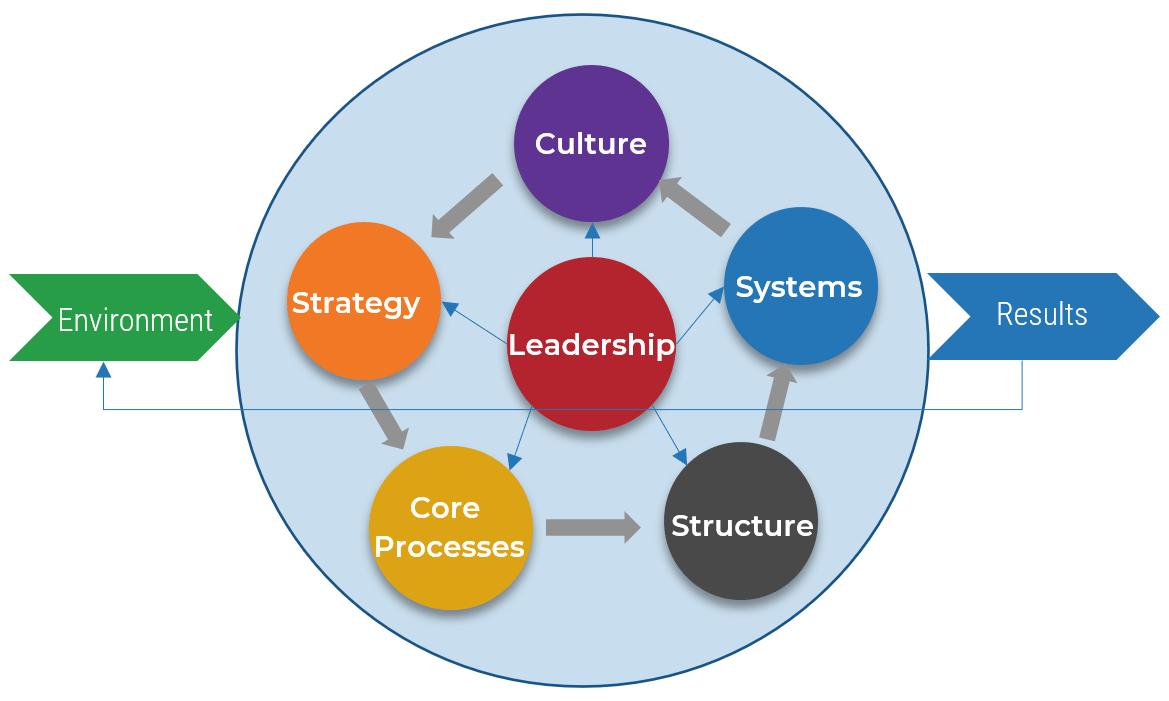

Intake, Approval, and Prioritization is a core process in Info-Tech’s project portfolio management (PPM) framework

PPM is an infrastructure around projects that aims to ensure that the best projects are worked on at the right time with the right people.

PPM’s goal is to maximize the throughput of projects that provide strategic and operational value to the organization. To do this, a PPM strategy must help to:

| Info-Tech's Project Portfolio Management Process Model

|

| 3. Status & Progress Reporting

|

| 1. Intake, Approval & Prioritization

|

2. Resource Management

|

3. Project Management

|

4. Project Closure

|

5. Benefits Tracking

|

- Select the best projects

- Pick the right time and people to execute the projects

- Make sure the projects are okay

- Make sure the projects get done

- Make sure they were worth doing

If you don’t yet have a PPM strategy in place, or would like to revisit your existing PPM strategy before optimizing your project intake, approval, and prioritization practices, see Info-Tech’s blueprint, Develop a Project Portfolio Management Strategy.

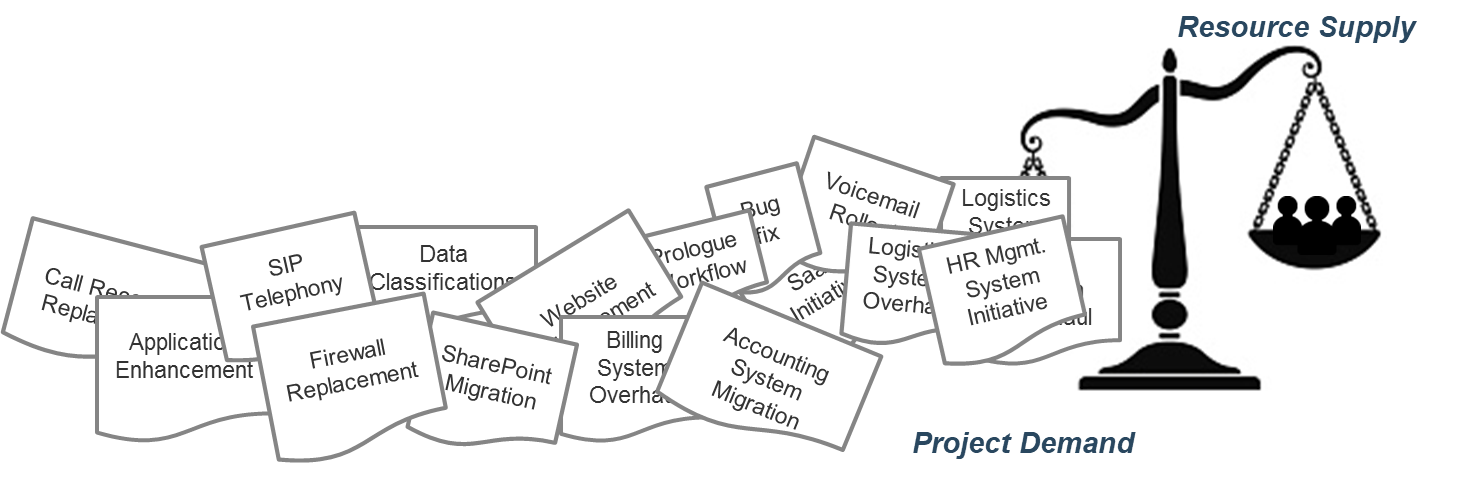

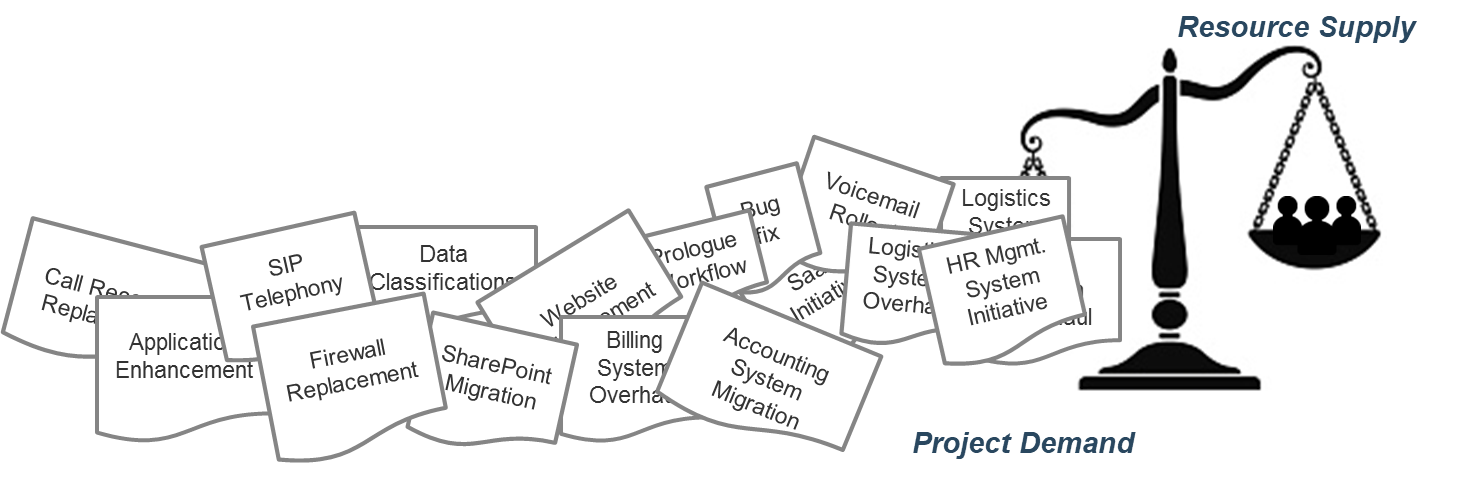

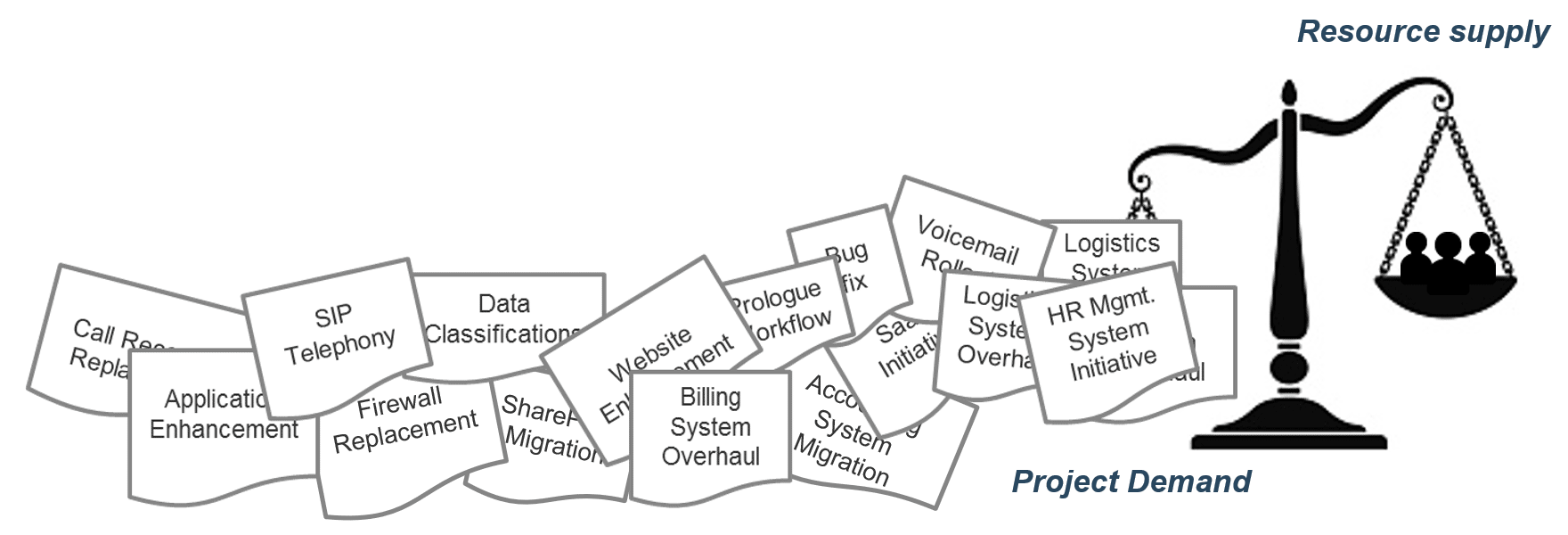

“Too many projects, not enough resources” is the reality of most IT environments

A profound imbalance between demand (i.e. approved project work and service delivery commitments) and supply (i.e. people’s time) is the top challenge IT departments face today.

In today’s organizations, the desires of business units for new products and enhancements, and the appetites of senior leadership to approve more and more projects for those products and services, far outstrip IT’s ability to realistically deliver on everything.

The vast majority of IT departments lack the resourcing to meet project demand – especially given the fact that day-to-day operational demands frequently trump project work.

As a result, project throughput suffers – and with it, IT’s reputation within the organization.

Info-Tech Insight

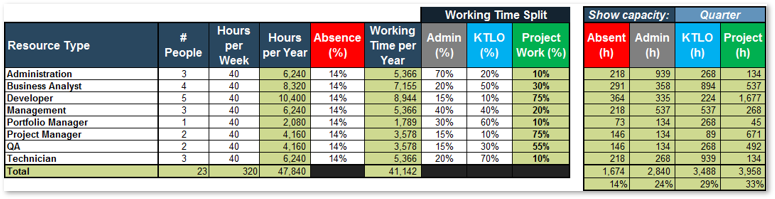

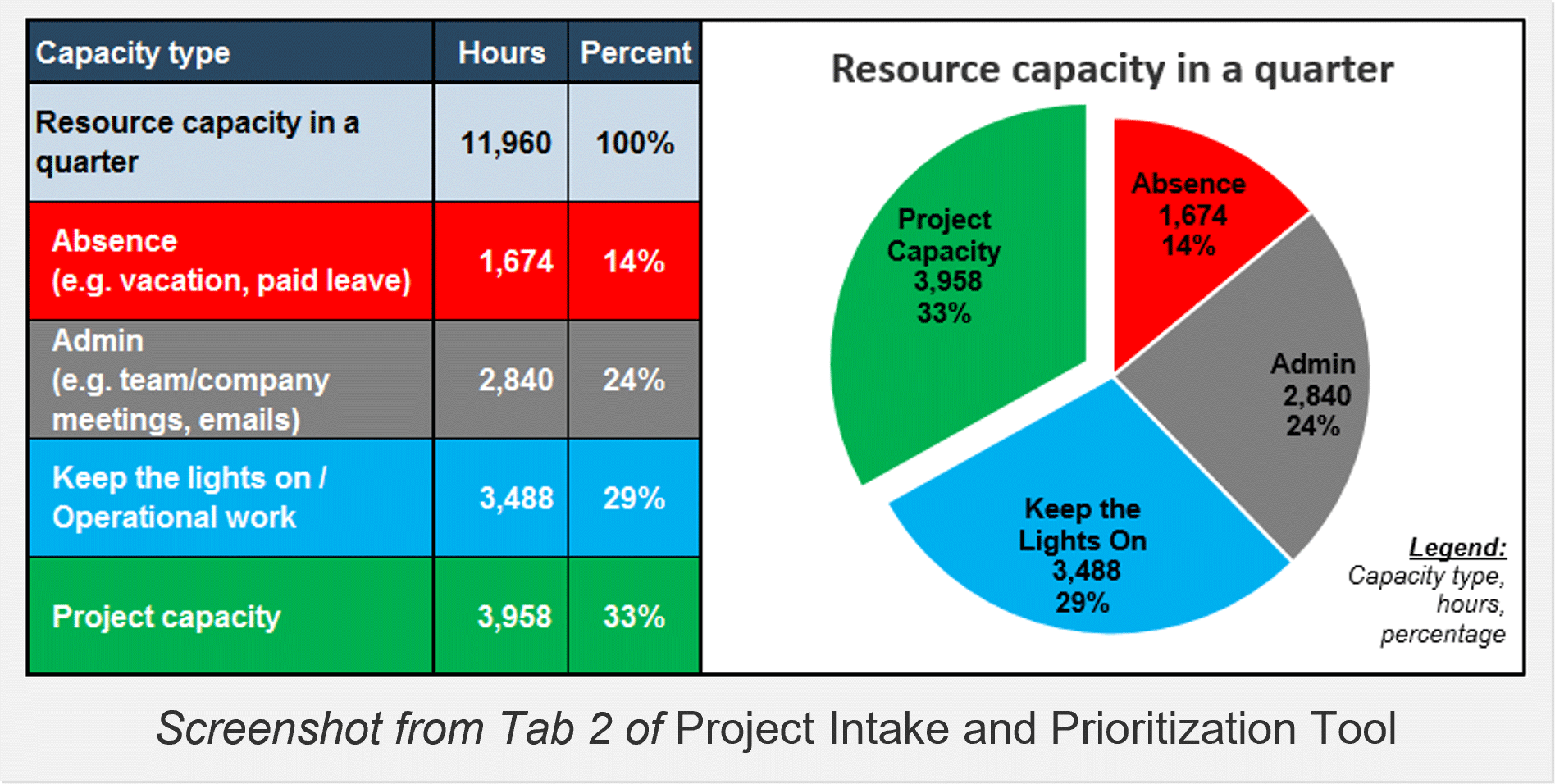

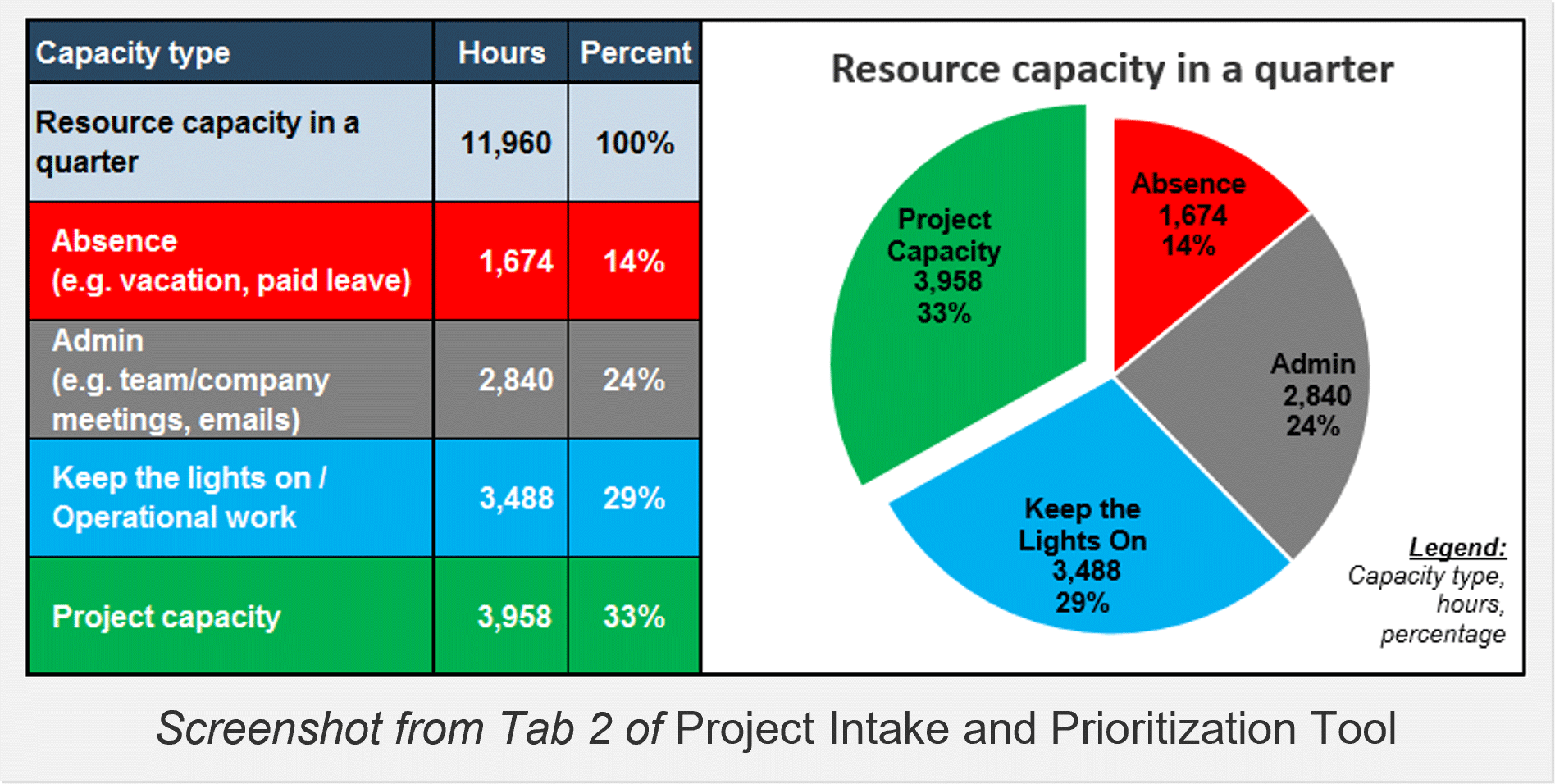

Where does the time go? The portfolio manager (or equivalent) should function as the accounting department for time, showing what’s available in IT’s human resources budget for projects and providing ongoing visibility into how that budget of time is being spent.

Don’t weigh your portfolio down by starting more than you can finish

Focus on what will deliver value to the organization and what you can realistically deliver.

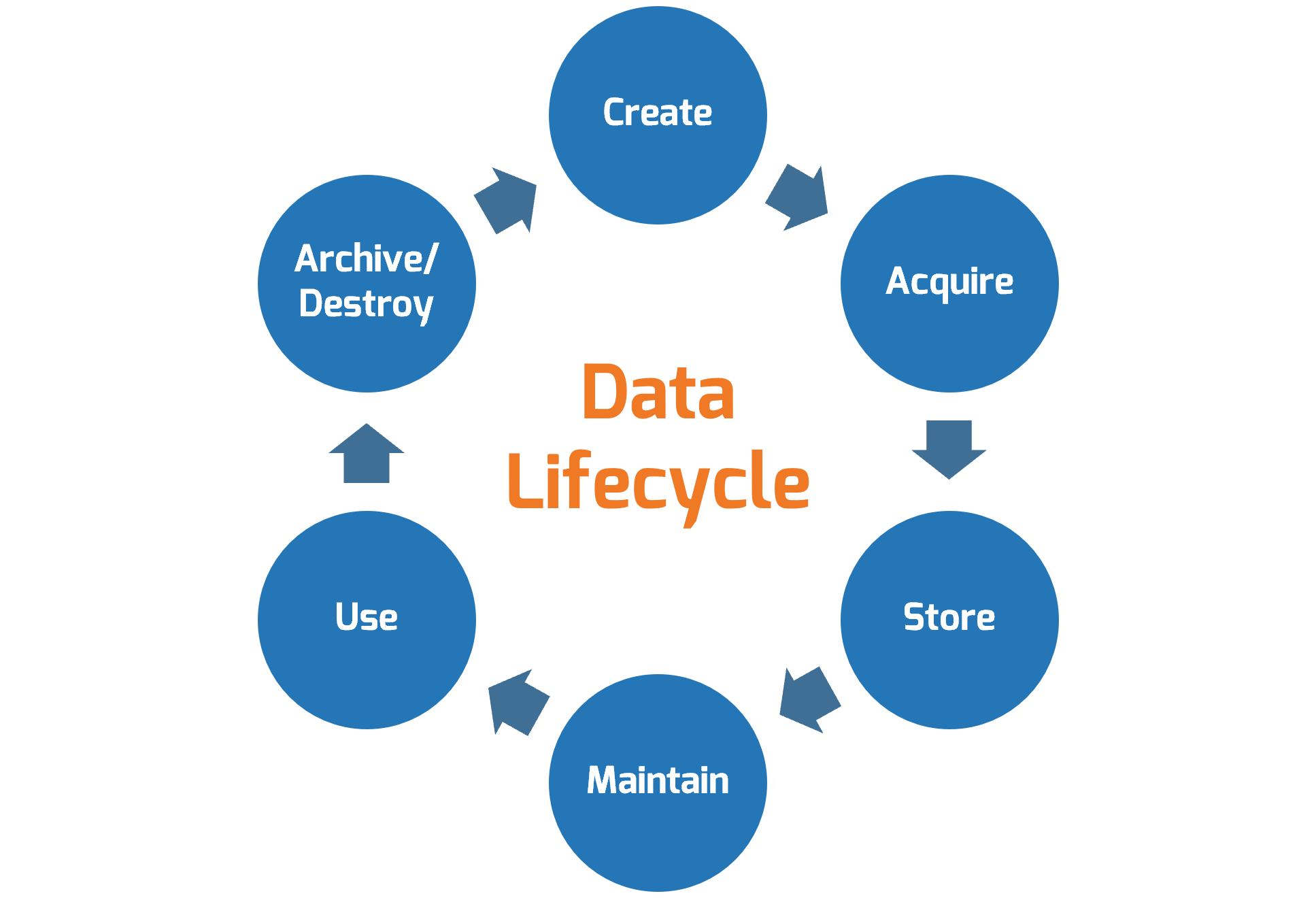

Most of the problems that arise during the lifecycle of a project can be traced back to issues that could have been mitigated during the initiation phase.

More than simply a means of early problem detection at the project level, optimizing your initiation processes is also the best way to ensure the success of your portfolio. With optimized intake processes you can better guarantee:

- The projects you are working on are of high value

- Your project list aligns with available resource capacity

- Stakeholder needs are addressed, but stakeholders do not determine the direction of the portfolio

80% of organizations feel their portfolios are dominated by low-value initiatives that do not deliver value to the business (Source: Cooper).

"(S)uccessful organizations select projects on the basis of desirability and their capability to deliver them, not just desirability" (Source: John Ward, Delivering Value from Information Systems and Technology Investments).

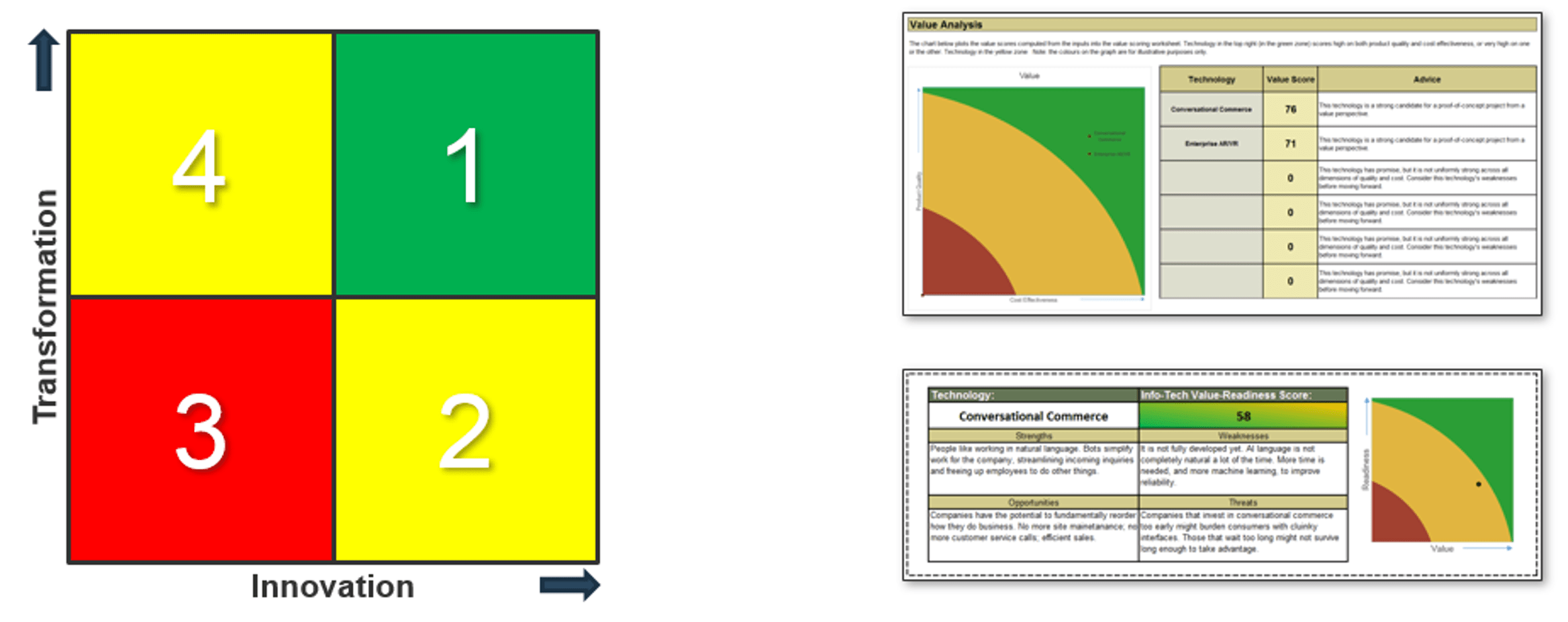

Establishing project value is the first – and difficult – step for optimizing project intake, approval, and prioritization

What is the best way to “deliver value to the organization”?

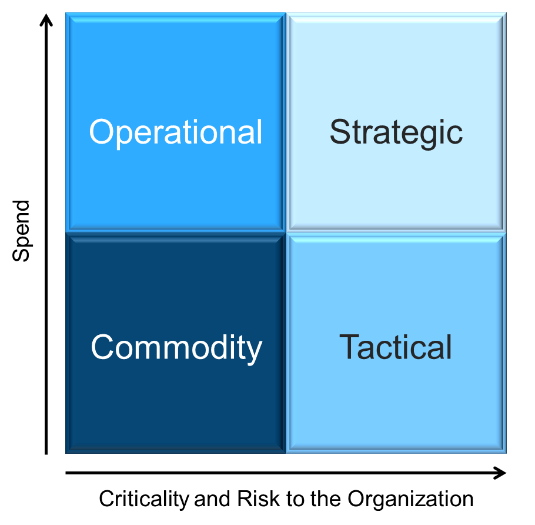

Every organization needs to explicitly define how to determine project value that will fairly represent all projects and provide a basis of comparison among them during approval and prioritization. Without it, any discussions on reducing “low-value initiatives” from the previous slide cannot yield any actionable plan.

However, defining the project value is difficult, because there are so many different and conflicting ways that are all valid in their own right and worth considering. For example:

- Strategic growth vs. operational stability

- Important work vs. urgent work

- Return on investment vs. cost containment

- Needs of a specific line of business vs. business-wide needs

- Financial vs. intangible benefits

This challenge is further complicated by the difficulty of identifying the right criteria for determining project value:

Managers fail to identify around 50% of the important criteria when making decisions (Source: Transparent Choice).

Info-Tech Insight

Sometimes it can be challenging to show the value of IT-centric, operational-type projects that maintain critical infrastructure since they don’t yield net-new benefits. Remember that benefits are only half the equation; you must also consider the costs of not undertaking the said project.

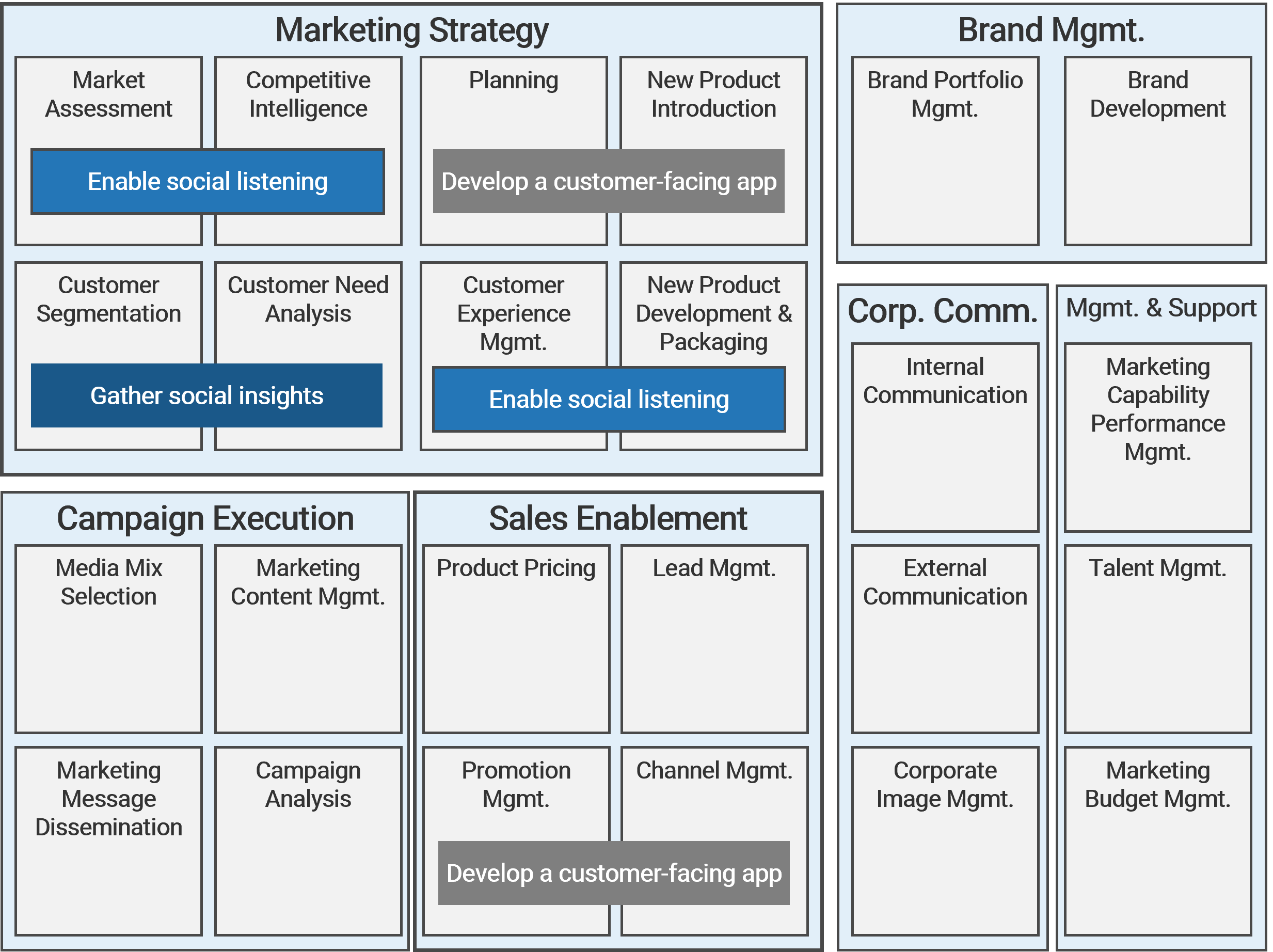

Find the right mix of criteria for project valuation with Info-Tech’s Project Value Scorecard Development Tool

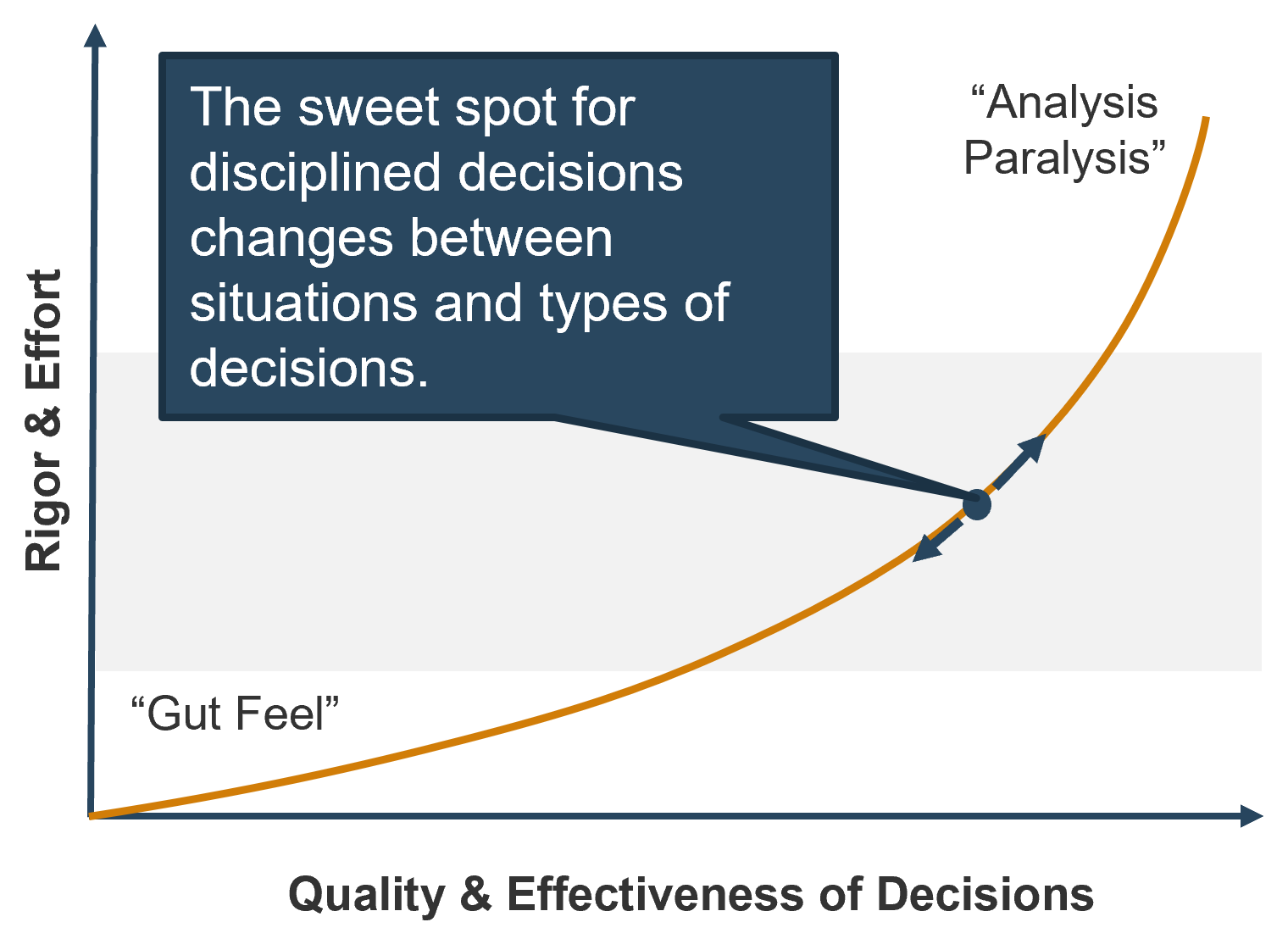

Scorecard-driven approach is an easy-to-understand, time-tested solution to a multiple-criteria decision-making problem, such as project valuation.

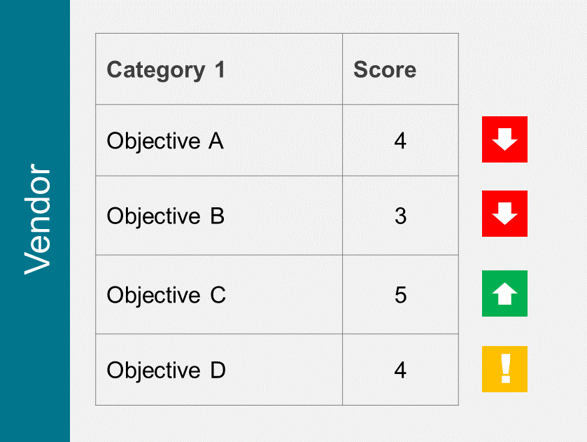

This approach is effective for capturing benefits and costs that are not directly quantifiable in financial terms. Projects are evaluated on multiple specific questions, or criteria, that each yield a score on a point scale. The overall score is calculated as a weighted sum of the scores.

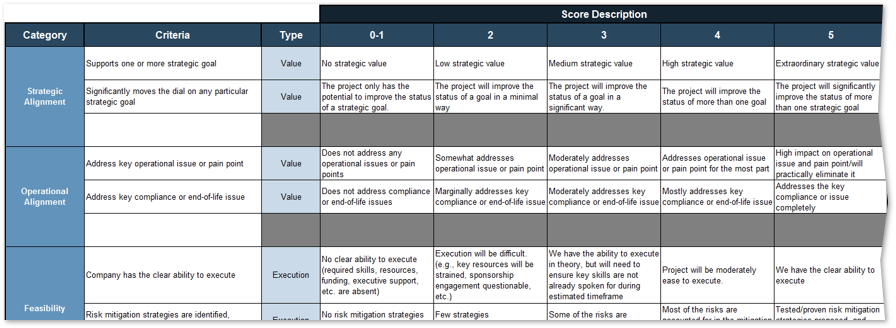

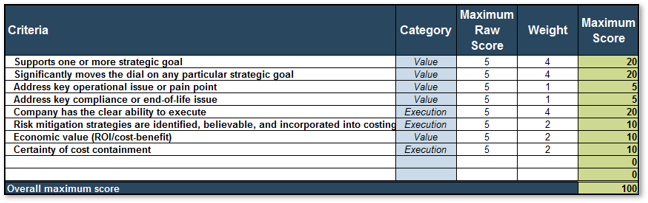

Info-Tech’s Project Value Scorecard is pre-populated with a best-practice example of eight criteria, two for each category (see box at bottom right). This example helps your effort to develop your own project scorecard by providing a solid starting point:

60%: On their own, decision makers could only identify around 6 of their 10 most important criteria for making decisions (Source: Transparent Choice).

Finally, in addition, the overall scores of approved projects can be used as a metric on which success of the process can be measured over time.

Download Info-Tech’s Project Value Scorecard Development Tool.

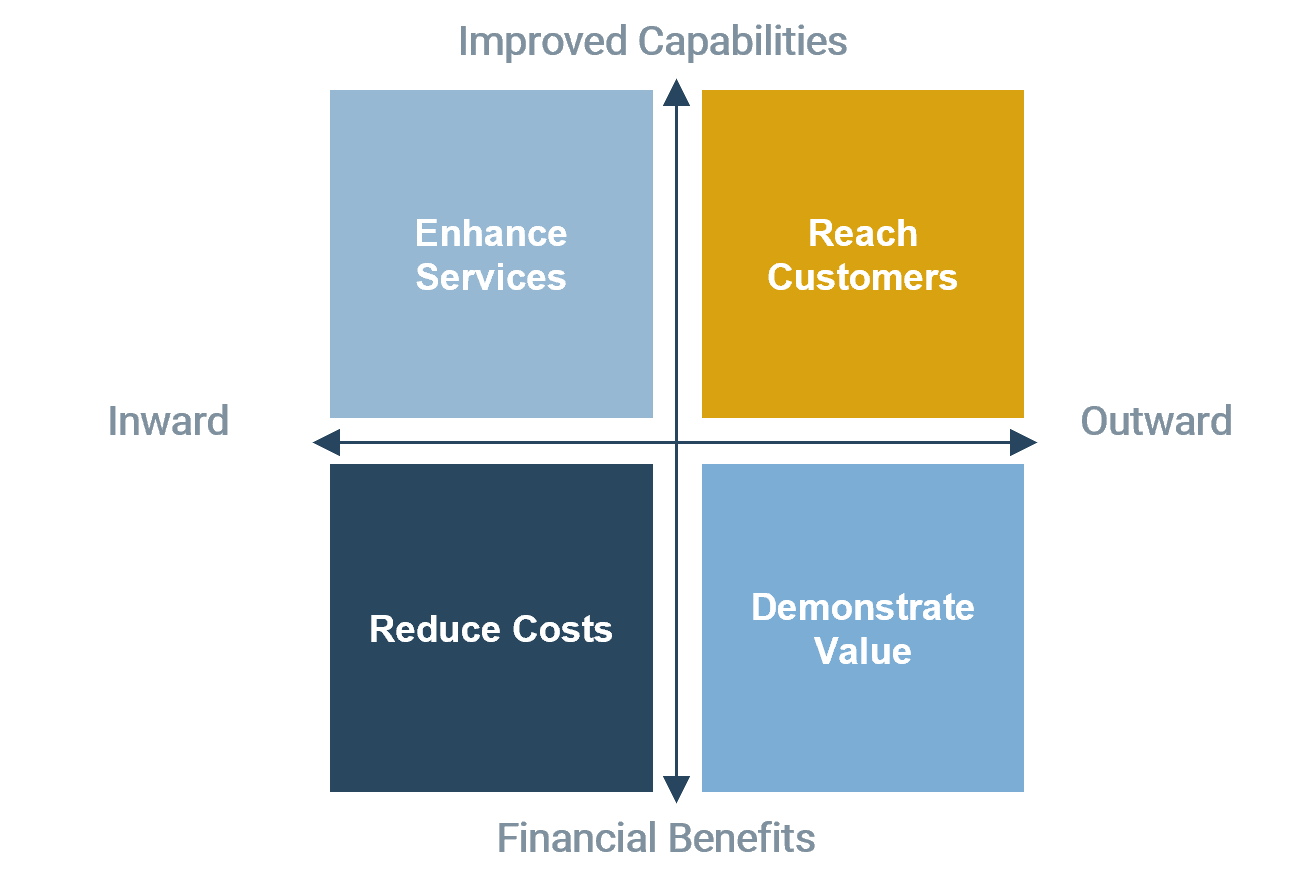

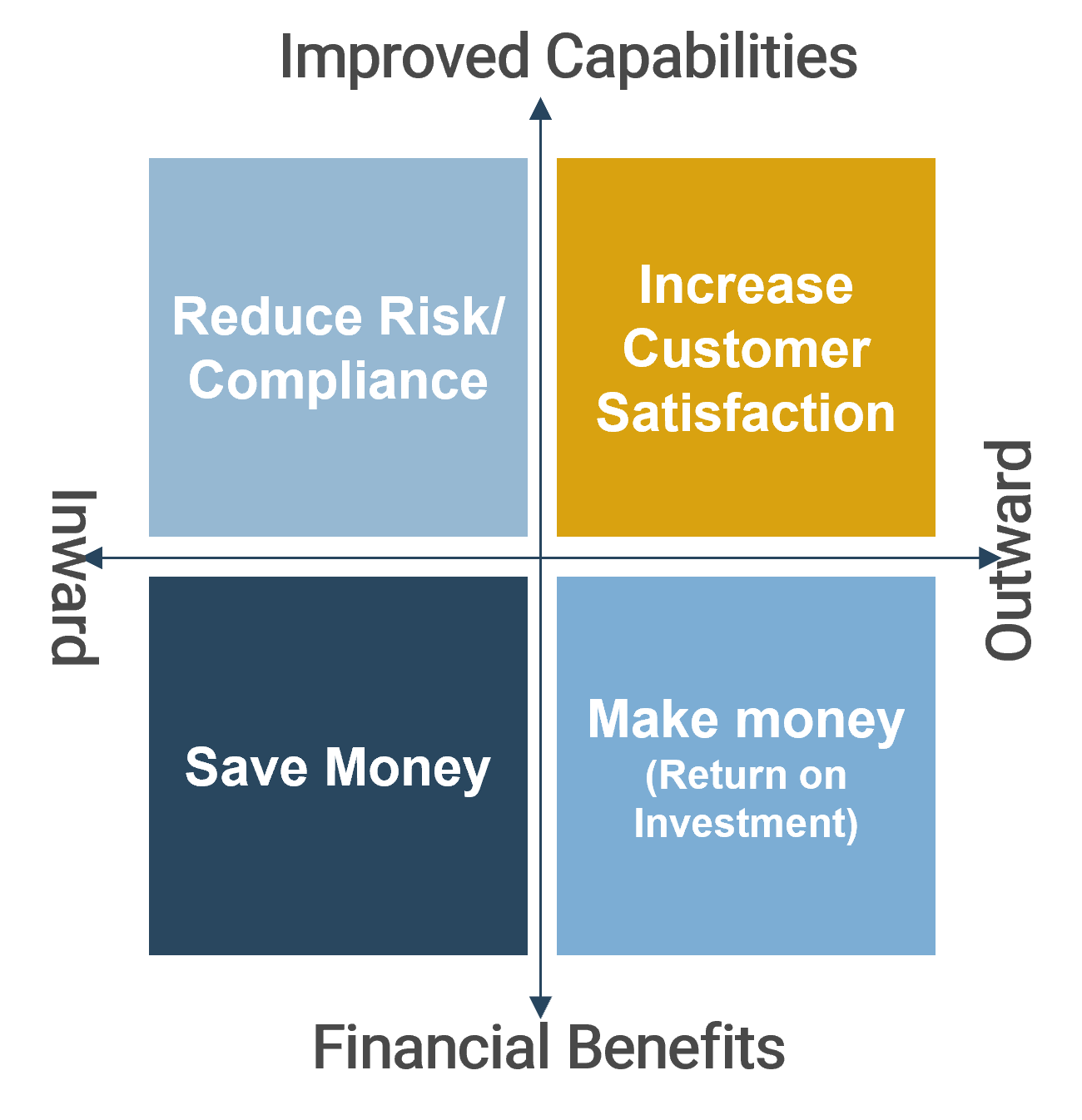

Categories of project valuation criteria

- Strategic alignment: projects must be aligned with the strategic goals of the business and IT.

- Operational alignment: projects must be aligned with the operational goals of the business and IT.

- Feasibility: practical considerations for projects must be taken into account in selecting projects.

- Financial: projects must realize monetary benefits, in increased revenue or decreased costs, while posing as little risk of cost overrun as possible.

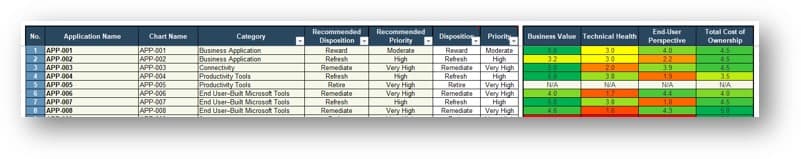

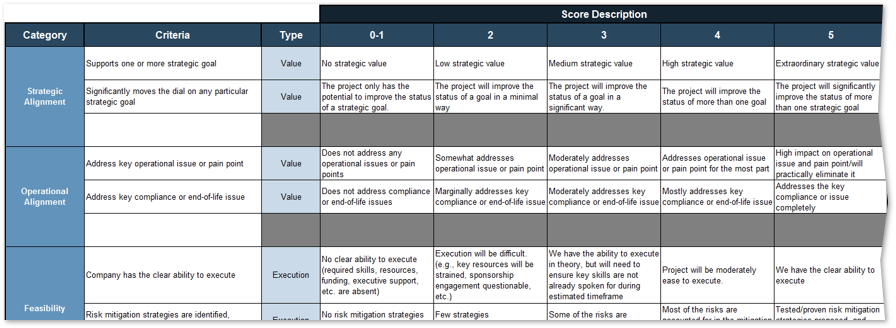

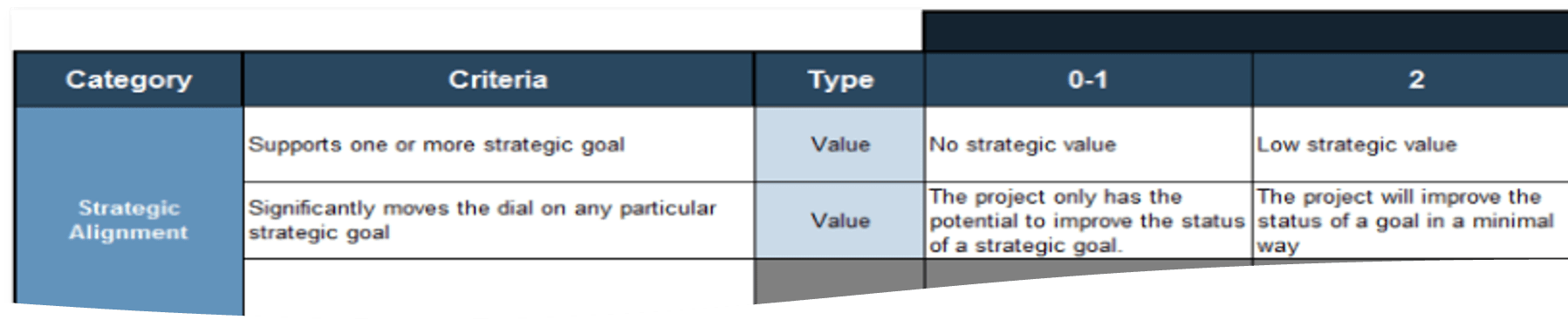

Review the example criteria and score description in the Project Value Scorecard Development Tool

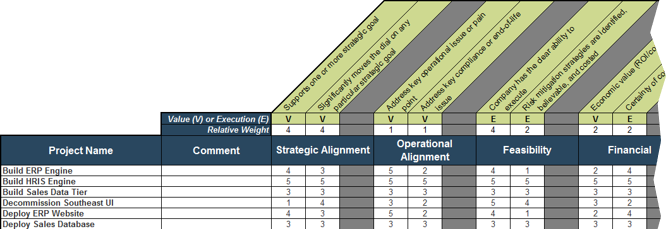

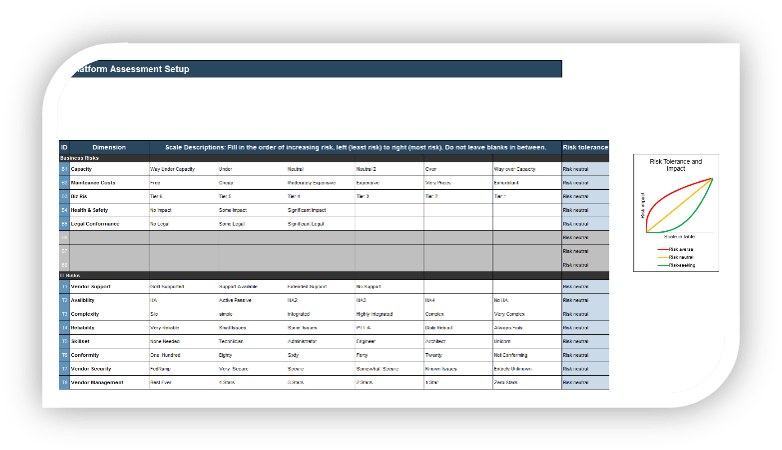

1.1.1 Project Value Scorecard Development Tool, Tab 2: Evaluation Criteria

This tab lists eight criteria that cover strategic alignment, operational alignment, feasibility, and financial benefits/risks. Each criteria is accompanied by a qualitative score description to standardize the analysis across all projects and analysts. While this tool supports up to 15 different criteria, it’s better to minimize the number of criteria and introduce additional ones as the organization grows in PPM maturity.

Type: It is useful to break down projects with similar overall scores by their proposed values versus ease of execution.

Scale: Five-point scale is not required for this tool. Use more or less granularity of description as appropriate for each criteria.

Blank Criteria: Rows with blank criteria are greyed out. Enter a new criteria to turn on the row.

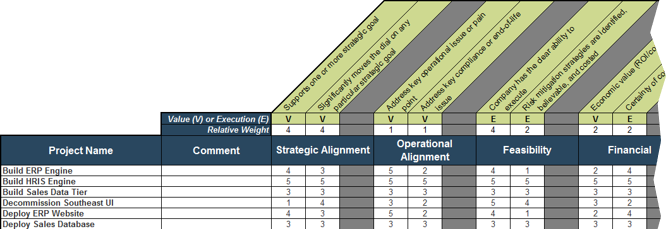

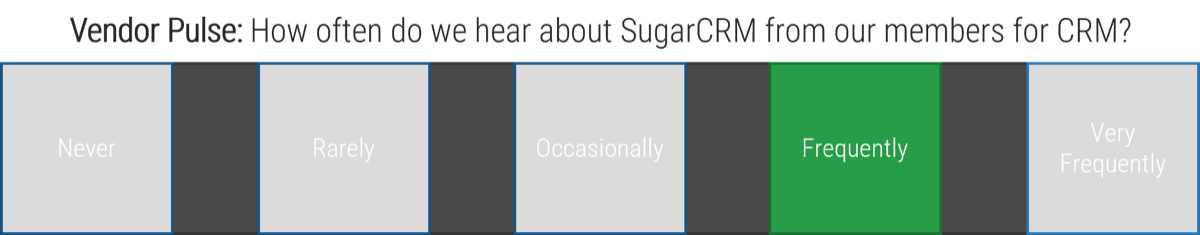

Score projects and search for the right mix of criteria weighting using the scorecard tab

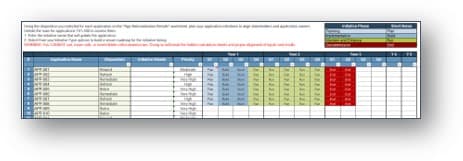

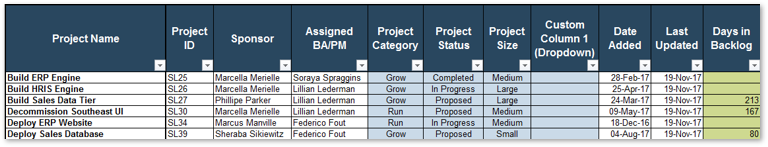

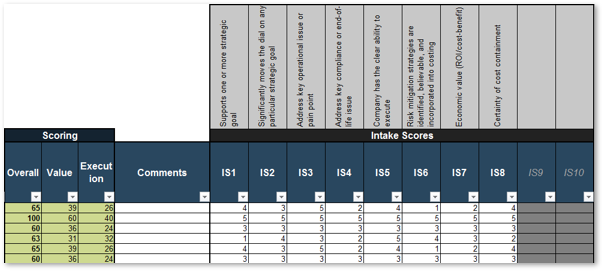

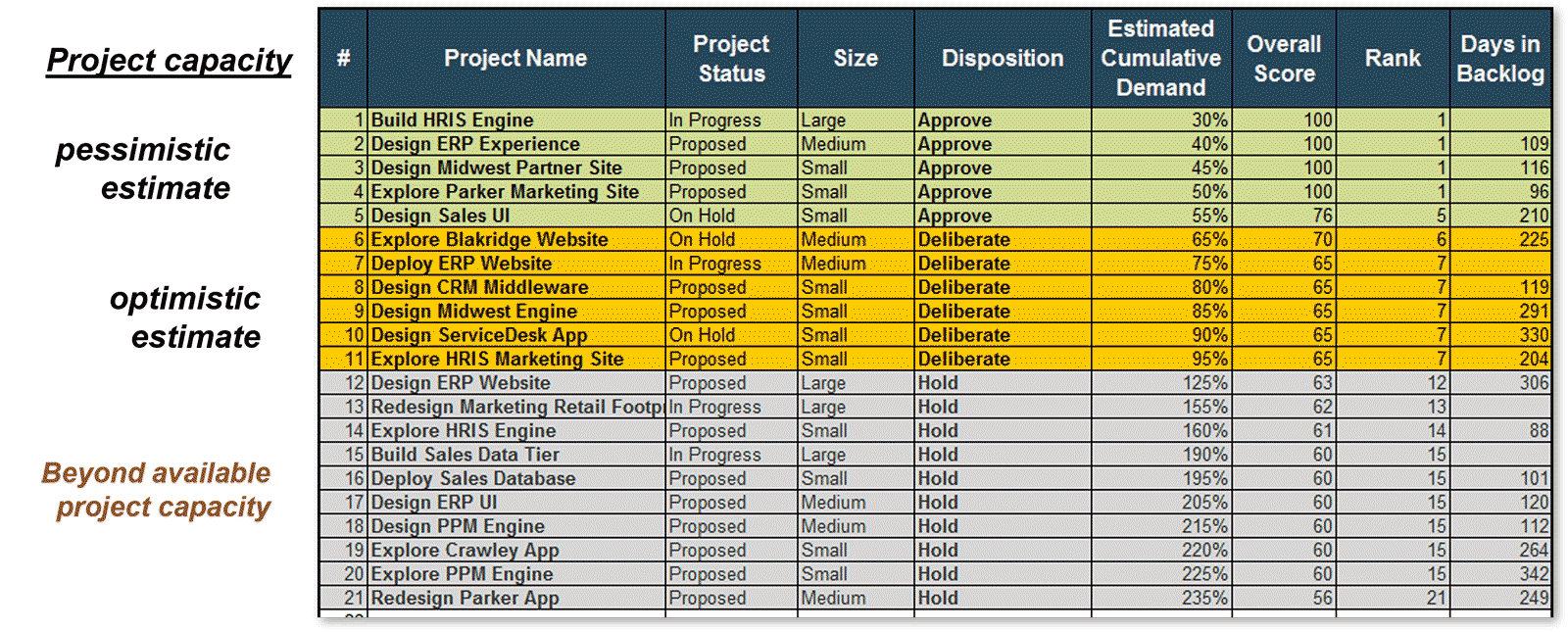

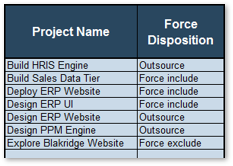

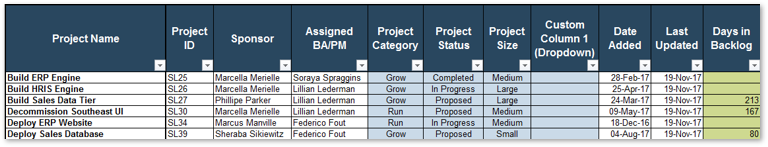

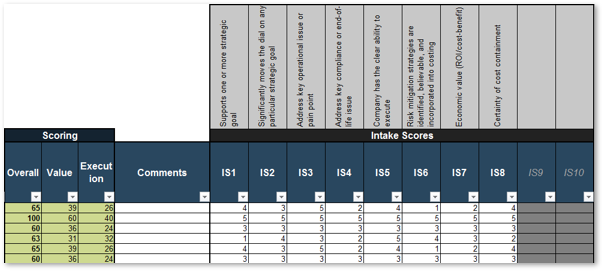

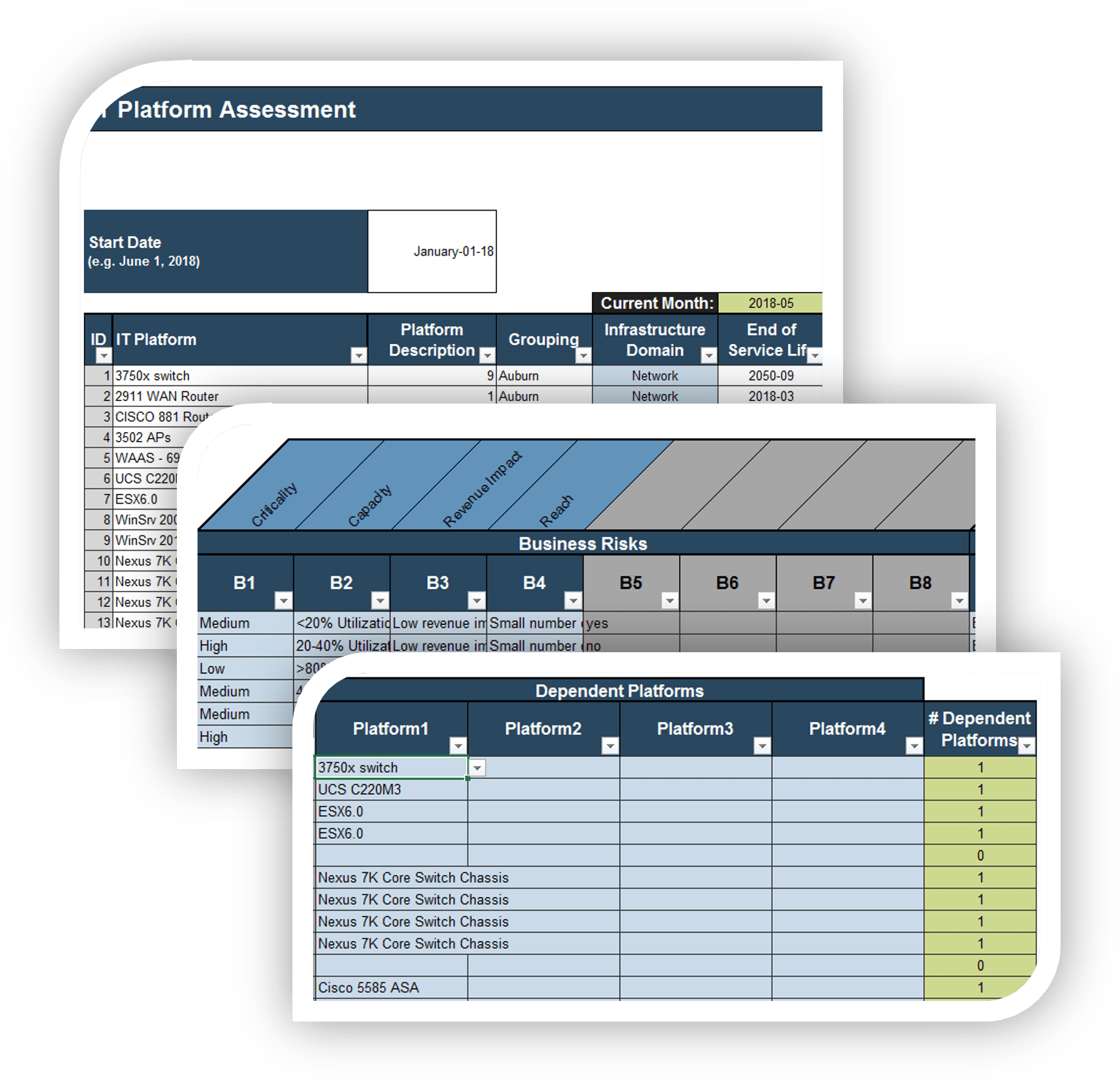

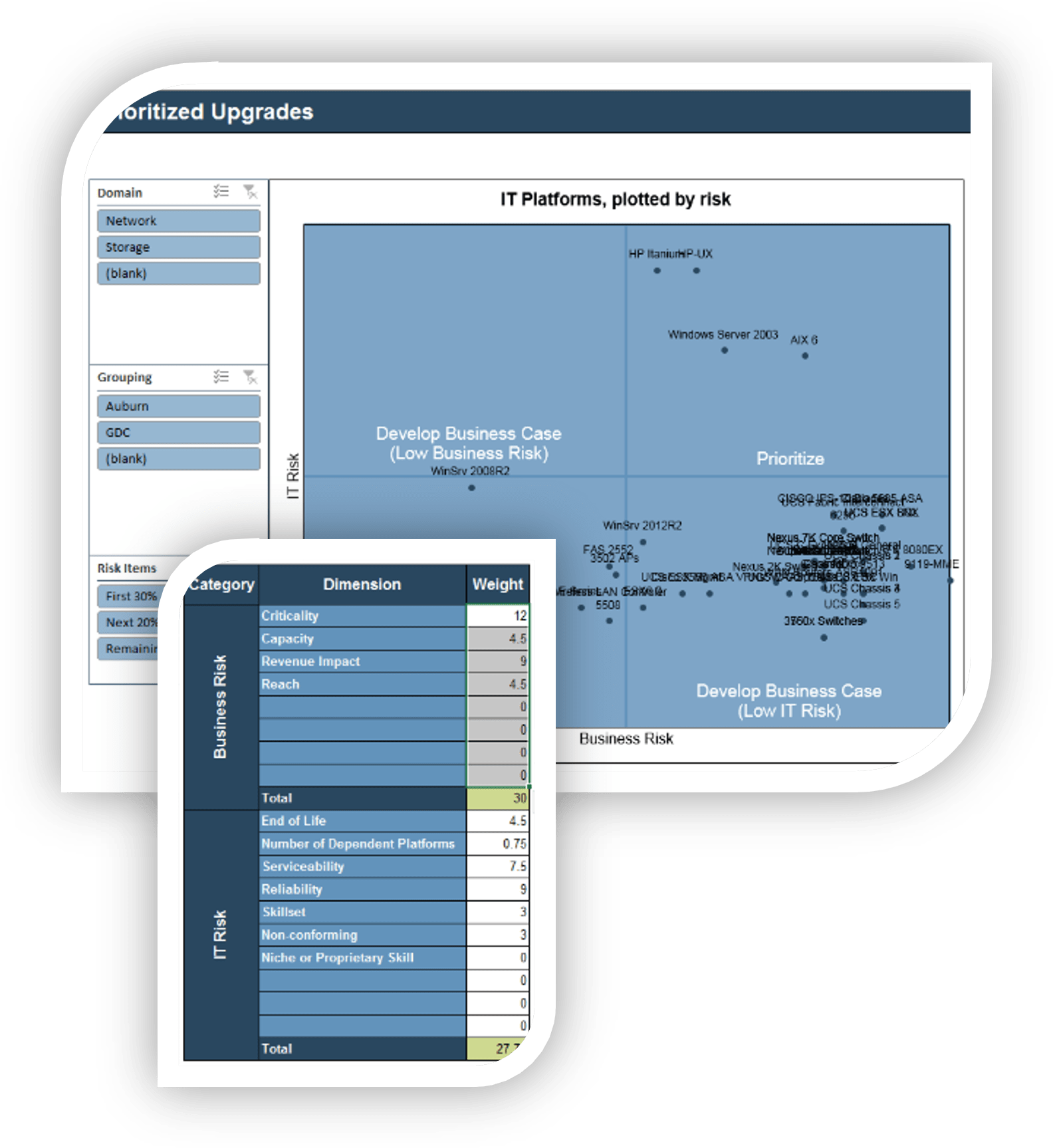

1.1.1 Project Value Scorecard Development Tool, Tab 3: Project Scorecard

In this tab, you can see how projects are prioritized when they are scored according to the criteria from the previous tab. You can enter the scores of up to 30 projects in the scorecard table (see screenshot to the right).

Value (V) or Execution (E) & Relative Weight: Change the relative weights of each criteria and review any changes to the prioritized list of projects change, whose rankings are updated automatically. This helps you iterate on the weights to find the right mix.

Feasibility: Custom criteria category labels will be automatically updated.

Overall: Choose the groupings of criteria by which you want to see the prioritized list. Available groupings are:

- Overall score

- By value or by execution

- By category

Ranks and weighted scores for each project is shown.

For example, click on the drop-down and choose “Execution.”

Project ranks are based only on execution criteria.

Create a first-draft version of a project value-driven prioritized list of projects

1.1.1 Estimated Time: 60 minutes

Follow the steps below to test Info-Tech’s example Project Value Scorecard and examine the prioritized list of projects.

- Using your list of proposed, ongoing, and completed projects, identify a representative sample of projects in your project portfolio, varying in size, scope, and perceived value – about 10-20 of them.

- Arrange these projects in the order of priority using any processes or prioritization paradigm currently in place in your organization.

- In the absence of formal process, use your intuition, as well as knowledge of organizational priorities, and your stakeholders.

Use the example criteria and score description in Tab 2 of Info-Tech’s Project Value Scorecard Development Tool to score the same list of projects:

- Avoid spending too much time at this step. Prioritization criteria will be refined in the subsequent parts of the blueprint.

- If multiple scorers are involved, allow some overlap to benchmark for consistency.

Enter the scores in Tab 3 of the tool to obtain the first-draft version of a project value-driven prioritized project list. Compare it with your list from Step 2.

INPUT

- Knowledge of proposed, ongoing, and completed projects in your project portfolio

OUTPUT

- Prioritized project lists

Materials

- Project Value Scorecard Development Tool

Participants

- PMO Director/ Portfolio Manager

- Project Managers

- Business Analysts

- CIO (optional)

Iterate on the scorecard to set the stage for optimizing project intake, approval, and prioritization

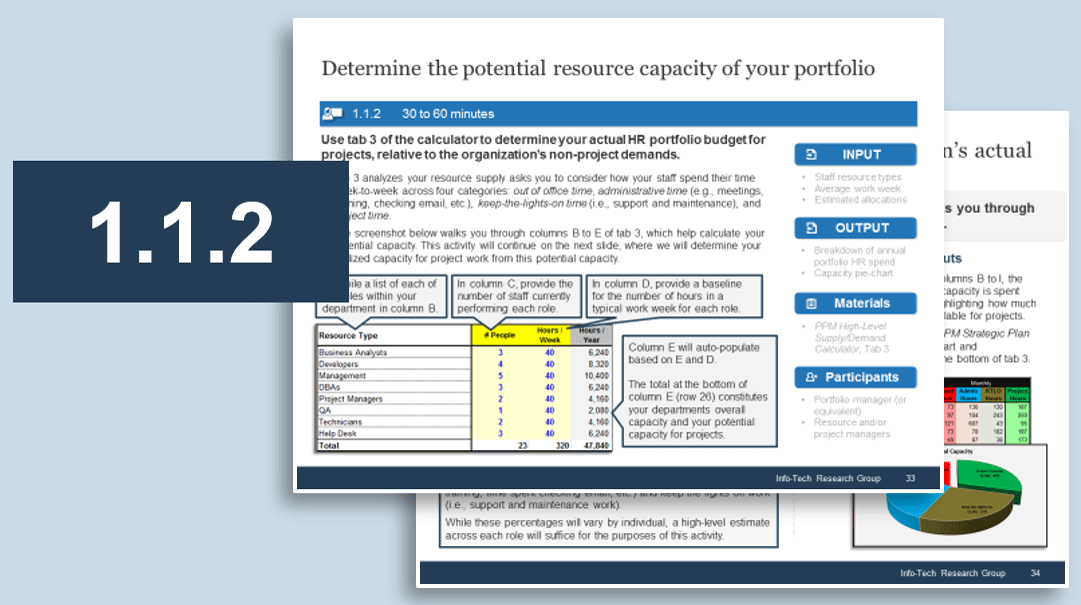

1.1.2 Estimated Time: 60 minutes

Conduct a retrospective of the previous activity by asking these questions:

- How smooth was the overall scoring experience (Step 3 of Activity 1.1.1)?

- Did you experience challenges in interpreting and applying the example project valuation criteria? Why? (e.g. lack of information, absence of formalized business strategic goals, too much room for interpretation in scoring description)

- Did the prioritized project list agree with your intuition?

Iterate on the project valuation criteria:

- Manipulate the relatives weights of valuation criteria to fine-tune them.

- Revise the scoring descriptions to provide clarity or customize them to better fit your organization’s needs, then update the project scores accordingly.

- For projects that did not score well, will this cause concern from any stakeholders? Are the concerns legitimate? If so, this may indicate the need for inclusion of new criteria.

- For projects that score too well, this may indicate a bias toward a specific type of project or group of stakeholders. Try adjusting the relative weights of existing criteria.

INPUT

OUTPUT

- Retrospective on project valuation

- Review of project valuation criteria

Materials

- Project Value Scorecard Development Tool

Participants

- PMO Director/ Portfolio Manager

- Project Managers

- Business Analysts

- CIO (optional)

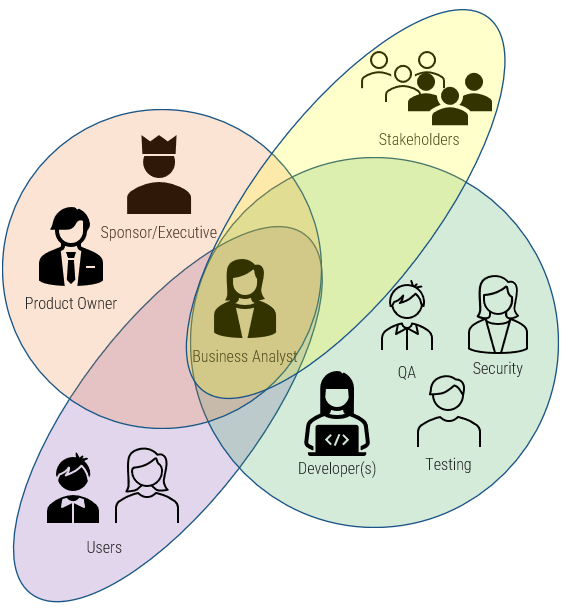

Next steps: engage key PPM stakeholders to reach a consensus when establishing how to determine project value

Engage these key players to create the evaluation criteria that all stakeholders will support:

- Business units: Projects are undertaken to provide value to the business. Senior management from business units must help define how project will be valued.

- IT: IT must ensure that technical/practical considerations are taken into account when determining project value.

- Finance: The CFO or designated representative will ensure that estimated project costs and benefits can be used to manage the budget.

- PMO: PMO is the administrator of the project portfolio. PMO must provide coordination and support to ensure the process operates smoothly and its goals are realized.

- Business analysts: BAs carry out the evaluation of project value. Therefore, their understanding of the evaluation criteria and the process as a whole are critical to the success of the process.

- Project sponsors: Project sponsors are accountable for the realization of benefits for which projects are undertaken.

Optimize the process with the new project value definition to focus your discussion with stakeholders

This blueprint will help you not only optimize the process, but also help you work with your stakeholders to realize the benefits of the optimized process.

In this step, you’ve begun improving the definition of project value. Getting it right will require several more iterations and will require a series of discussions with your key stakeholders.

The optimized intake process built around the new definition of project value will help evolve a conceptual discussion about project value into a more practical one. The new process will paint a picture of what the future state will look like for your stakeholders’ requested projects getting approved and prioritized for execution, so that they can provide feedback that’s concrete and actionable. To help you with that process, you will be taken through a series of activities to analyze the impact of change on your stakeholders and create a communication plan in the last phase of the blueprint.

For now, in the next step of this blueprint, you will undergo a series of activities to assess your current state to identify the specific areas for process optimization.

"To find the right intersection of someone’s personal interest with the company’s interest on projects isn’t always easy. I always try to look for the basic premise that you can get everybody to agree on it and build from there… But it’s sometimes hard to make sure that things stick. You may have to go back three or four times to the core agreement."

-Eric Newcomer

Step 1.2: Envision your target state for your optimized project intake, approval, and prioritization process

| PHASE 1 | PHASE 2 | PHASE 3 |

1.1

Define project valuation criteria

| 1.2

Envision process target state

| 2.1

Streamline intake

| 2.2

Right-size approval steps

| 2.3

Prioritize projects to fit resource capacity

| 3.1

Pilot your optimized process

| 3.2

Communicate organizational change

|

This step will walk you through the following activities:

- Map your current project intake, approval, and prioritization workflow, and document it in a flowchart

- Enumerate and prioritize your key process stakeholders

- Determine your process capability level within Info-Tech’s Framework

- Establish your current and target states for project intake, approval, and prioritization process

This step involves the following participants:

- CIO

- PMO Director/Portfolio Manager

- Project Managers

- Business Analysts

- Other PPM stakeholders

Outcomes of this step

- Current project intake, approval, and prioritization process is mapped out and documented in a flowchart

- Key process stakeholders are enumerated and prioritized to inform future discussion on optimizing processes

- Current and target organizational process capability levels are determined

- Success criteria and key performance indicators for process optimization are defined

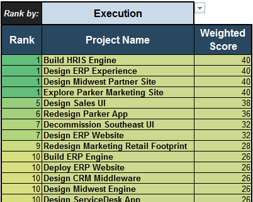

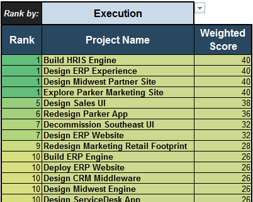

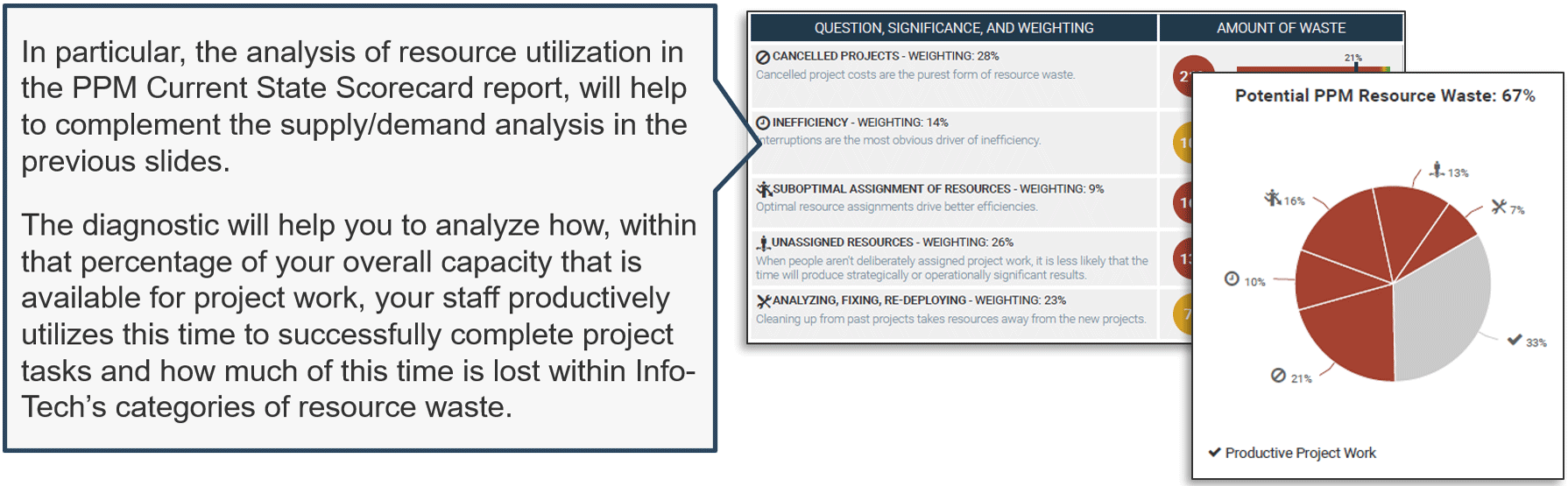

Use Info-Tech’s Diagnostic Program for an initial assessment of your current PPM processes

This step is highly recommended but not required. Call 1-888-670-8889 to inquire about or request the PPM Diagnostics.

Info-Tech's Project Portfolio Management Assessmentprovides you with a data-driven view of the current state of your portfolio, including your intake processes. Our PPM Assessment measures and communicates success in terms of Info-Tech’s best practices for PPM.

Use the diagnostic program to:

- Assess resource utilization across the portfolio.

- Determine project portfolio reporting completeness.

- Solicit feedback from your customers on the clarity of your portfolio’s business goals.

- Rate the overall quality of your project management practices and benchmark your rating over time.

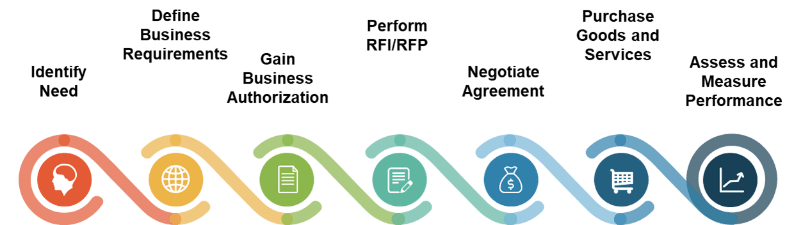

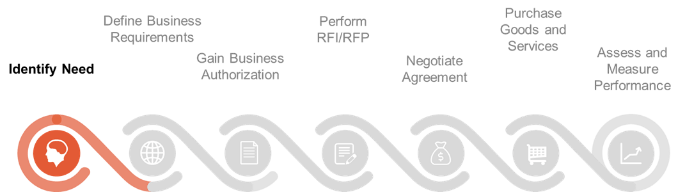

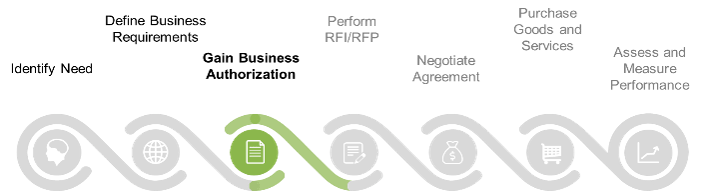

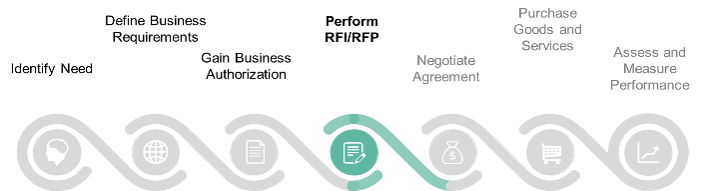

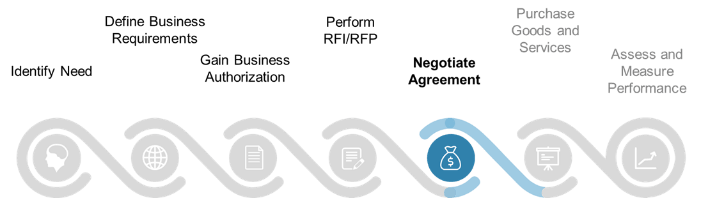

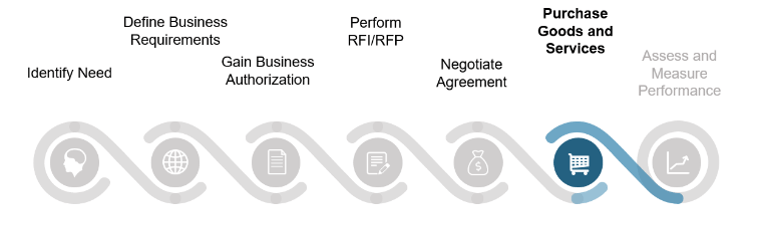

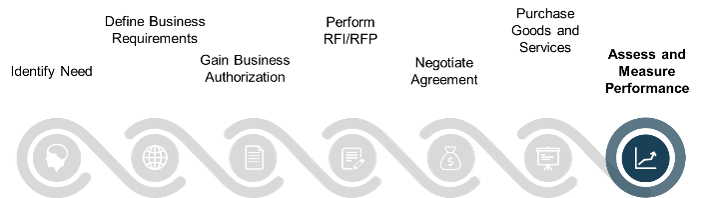

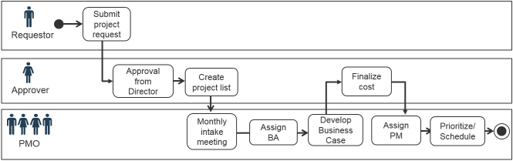

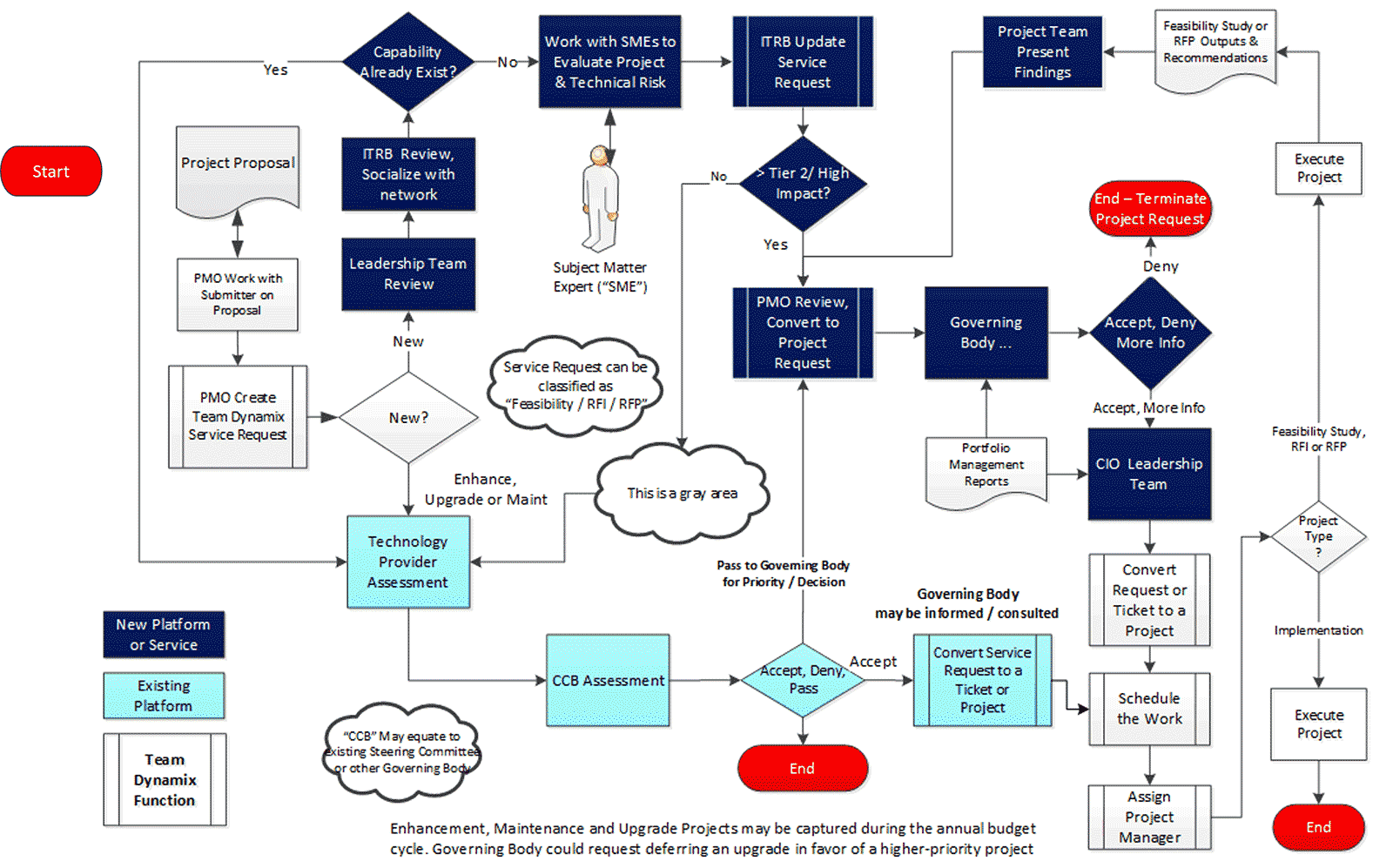

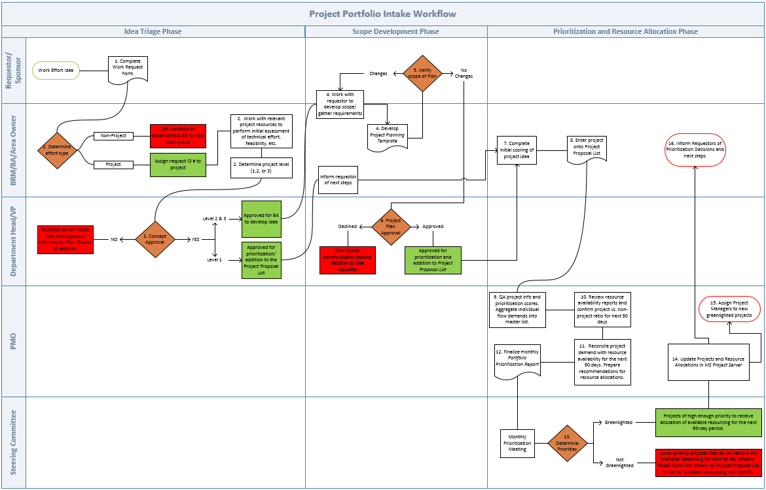

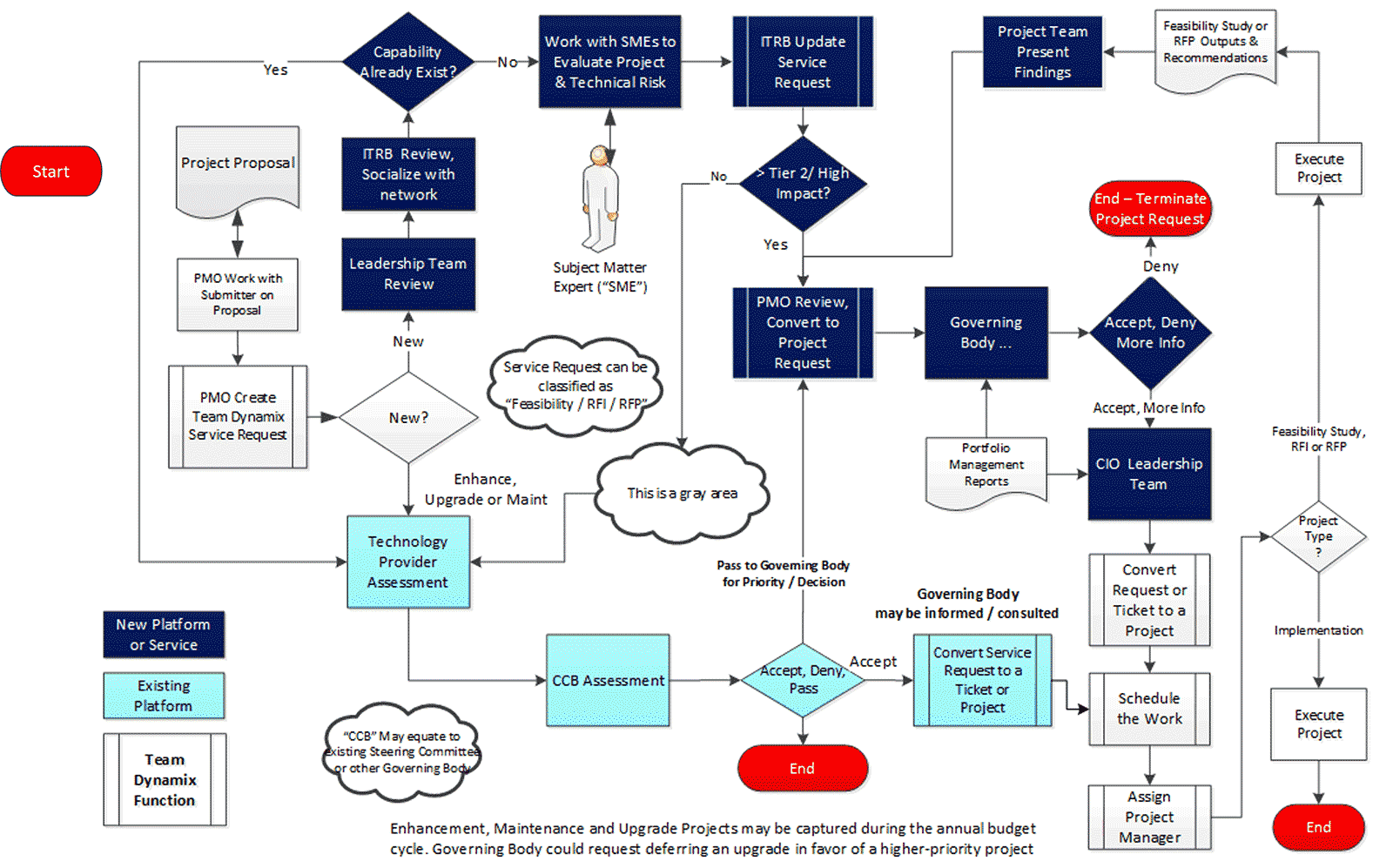

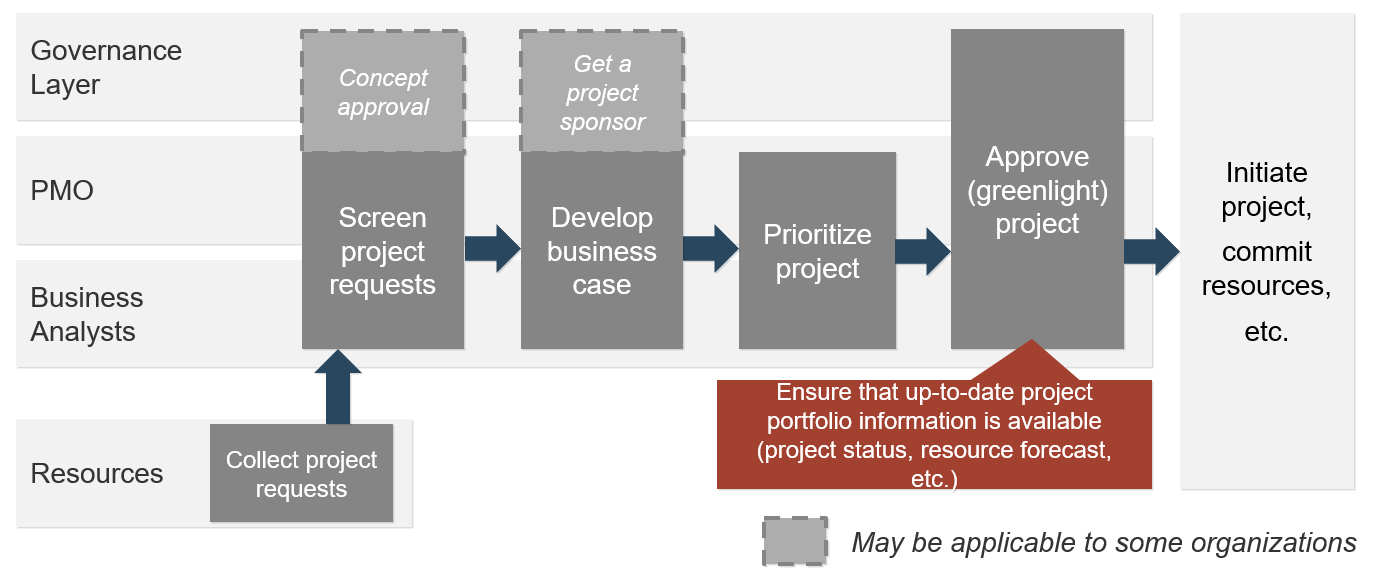

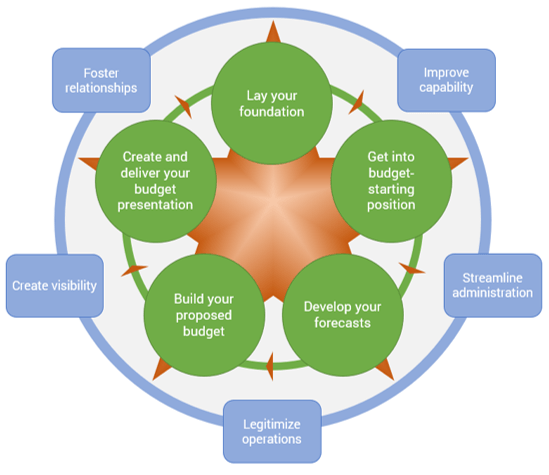

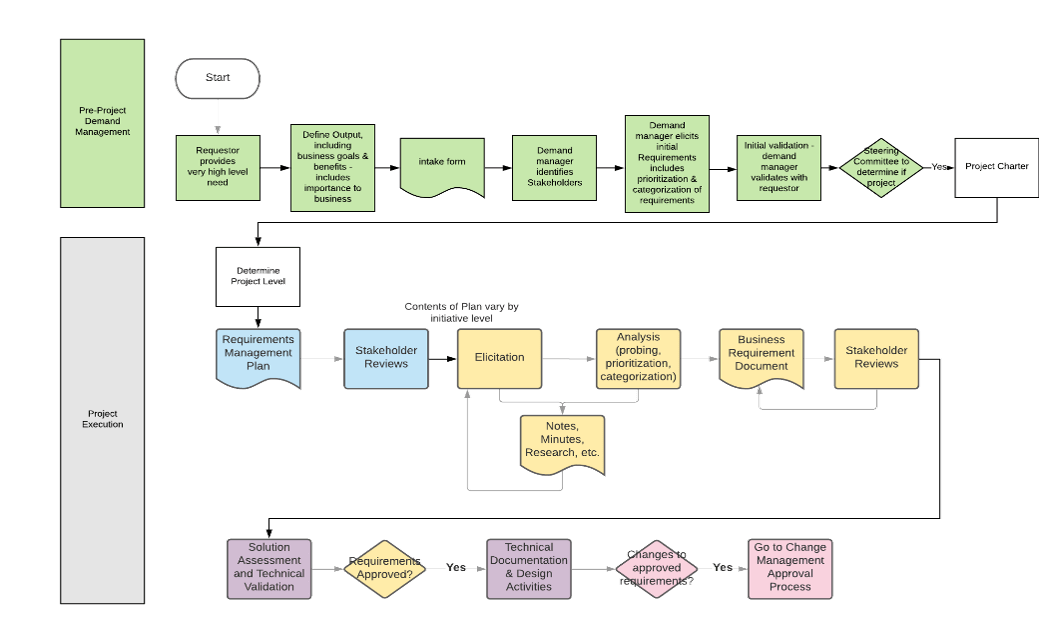

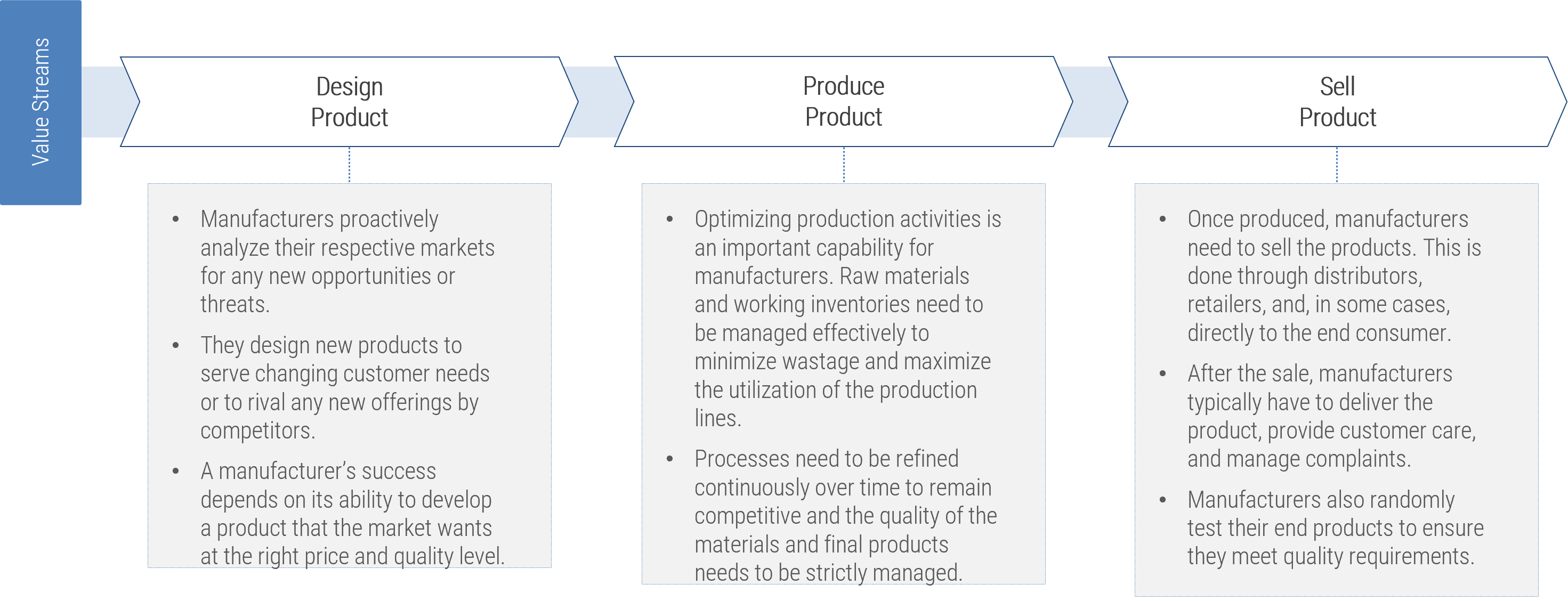

Scope your process optimization efforts with Info-Tech’s high-level intake, approval, and prioritization workflow

Info-Tech recommends the following workflow at a high level for a capacity-constrained intake process that aligns to strategic goals and stakeholder need.

- Intake (Step 2.1)*

- Receive project requests

- Triage project requests and assign a liaison

- High-level scoping & set stakeholder expectations

- Approval (Step 2.2)*

- Concept approval by project sponsor

- High-level technical solution approval by IT

- Business case approval by business

- Resource allocation & greenlight projects

- Prioritization (Step 2.3)*

- Update project priority scores & available project capacity

- Identify high-scoring and “on-the-bubble” projects

- Recommend projects to greenlight or deliberate

* Steps denote the place in the blueprint where the steps are discussed in more detail.

Use this workflow as a baseline to examine your current state of the process in the next slide.

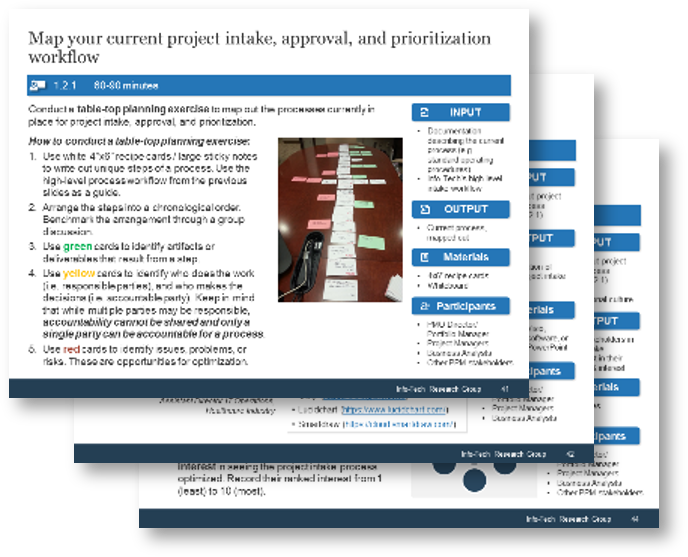

Map your current project intake, approval, and prioritization workflow

1.2.1 Estimated Time: 60-90 minutes

Conduct a table-top planning exercise to map out the processes currently in place for project intake, approval, and prioritization.

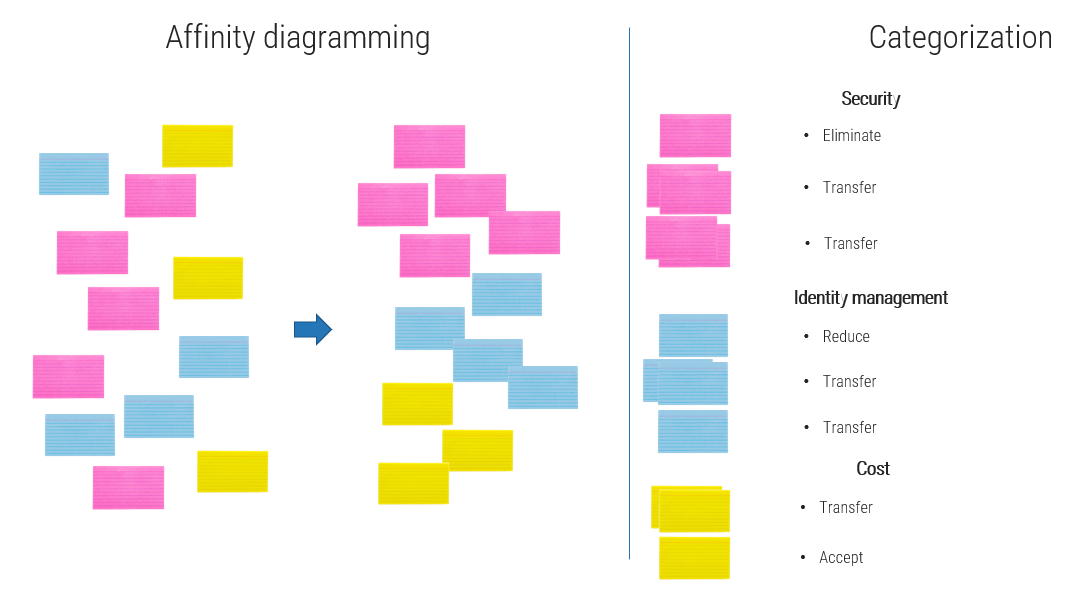

- Use white 4”x6” recipe cards / large sticky notes to write out unique steps of a process. Use the high-level process workflow from the previous slides as a guide.

- Arrange the steps into chronological order. Benchmark the arrangement through a group discussion.

- Use green cards to identify artifacts or deliverables that result from a step.

- Use yellow cards to identify who does the work (i.e. responsible parties), and who makes the decisions (i.e. accountable party). Keep in mind that while multiple parties may be responsible, accountability cannot be shared and only a single party can be accountable for a process.

- Use red cards to identify issues, problems, or risks. These are opportunities for optimization.

INPUT

- Documentation describing the current process (e.g. standard operating procedures)

- Info-Tech’s high-level intake workflow

OUTPUT

- Current process, mapped out

Materials

- 4x6” recipe cards

- Whiteboard

Participants

- PMO Director/ Portfolio Manager

- Project Managers

- Business Analysts

- Other PPM stakeholders

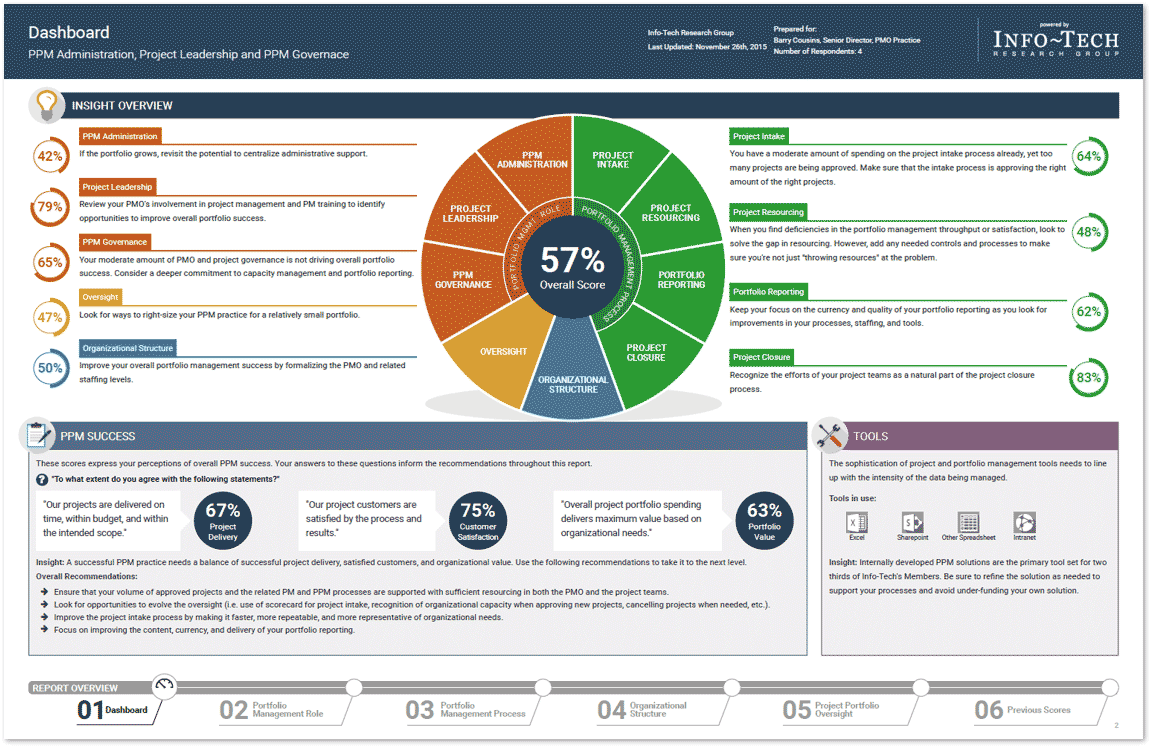

Document the current project intake, approval, and prioritization workflow in a flowchart

1.2.2 Estimated Time: 60 minutes

Document the results of the previous table-top exercise (Activity 1.1.1) into a flow chart. Flowcharts provide a bird’s-eye view of process steps that highlight the decision points and deliverables. In addition, swim lanes can be used to indicate process stages, task ownership, or responsibilities (example below).

Review and customize section 1.2, “Overall Process Workflow” in Info-Tech’s Project Intake, Approval, and Prioritization SOP Template.

"Flowcharts are more effective when you have to explain status and next steps to upper management."

– Assistant Director-IT Operations, Healthcare Industry

Browser-based flowchart tool examples

INPUT

- Mapped-out project intake process (Activity 1.2.1)

OUTPUT

- Flowchart representation of current project intake workflow

Materials

- Microsoft Visio, flowchart software, or Microsoft PowerPoint

Participants

- PMO Director/ Portfolio Manager

- Project Managers

- Business Analysts

Example of a project intake, approval, and prioritization flow chart – without swim lanes

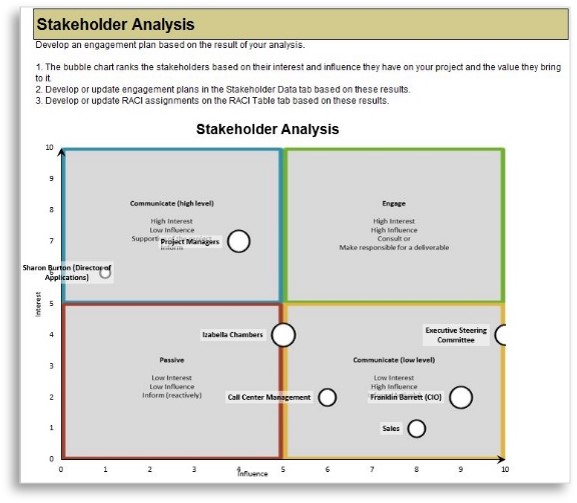

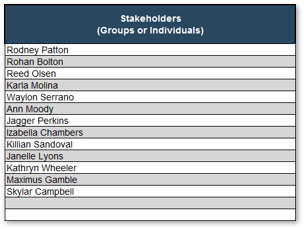

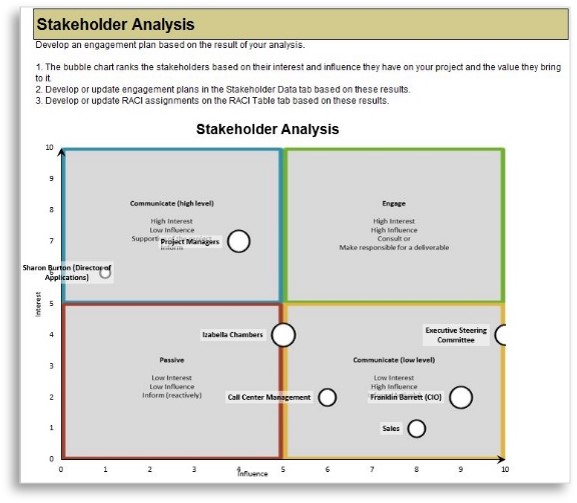

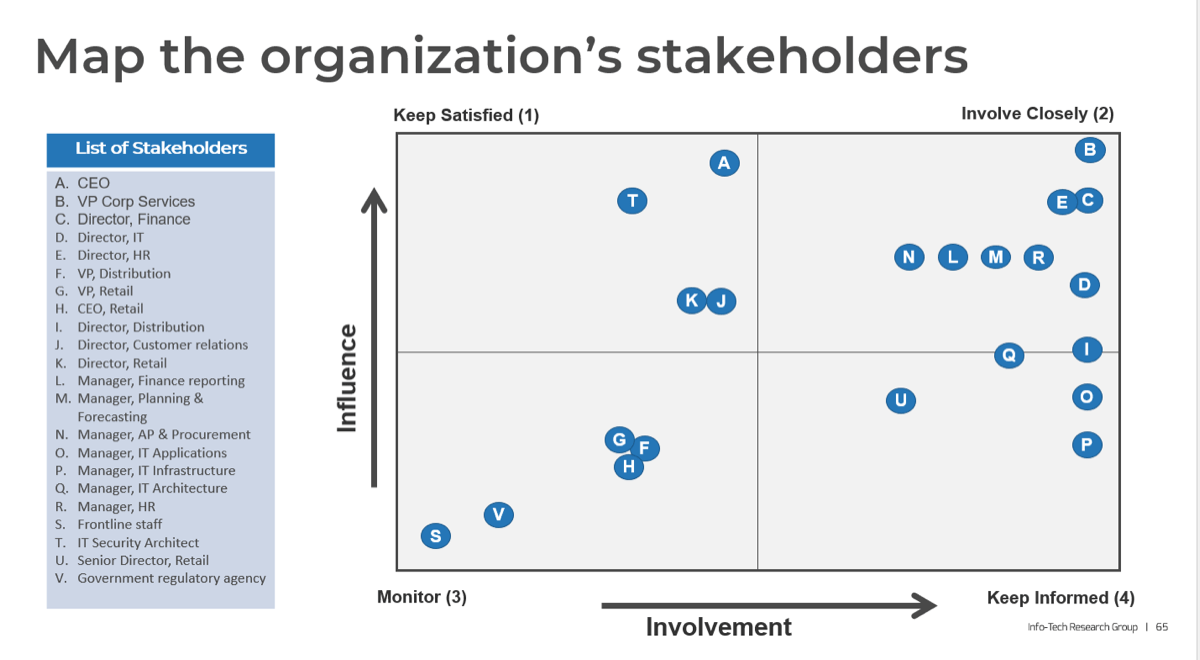

Enumerate your key stakeholders for optimizing intake, approval, and prioritization process

1.2.3 30-45 minutes

In the previous activity, accountable and responsible stakeholders for each of the steps in the current intake, approval, and prioritization process were identified.

- Based on your knowledge and insight of your organization, ensure that all key stakeholders with accountable and responsible stakeholders are accounted for in the mapped-out process. Note any omissions: it may indicate a missing step, or that the stakeholder ought to be, but are not currently, involved.

- For each step, identify any stakeholders that are currently consulted or informed. Then, examine the whole map and identify any other stakeholders that ought to be consulted or informed.

- Compile a list of stakeholders from steps 1-2, and write each of their names in two sticky notes.

- Put both sets of sticky notes on a wall. Use the wisdom-of-the-crowd approach to arrange one set in a descending order of influence. Record their ranked influence from 1 (least) to 10 (most).

- Rearrange the other set in a descending order of interest in seeing the project intake process optimized. Record their ranked interest from 1 (least) to 10 (most).

INPUT

- Mapped-out project intake process (Activity 1.2.1)

- Insight on organizational culture

OUTPUT

- List of stakeholders in project intake

- Ranked list in their influence and interest

Materials

Participants

- PMO Director/ Portfolio Manager

- Project Managers

- Business Analysts

- Other PPM stakeholders

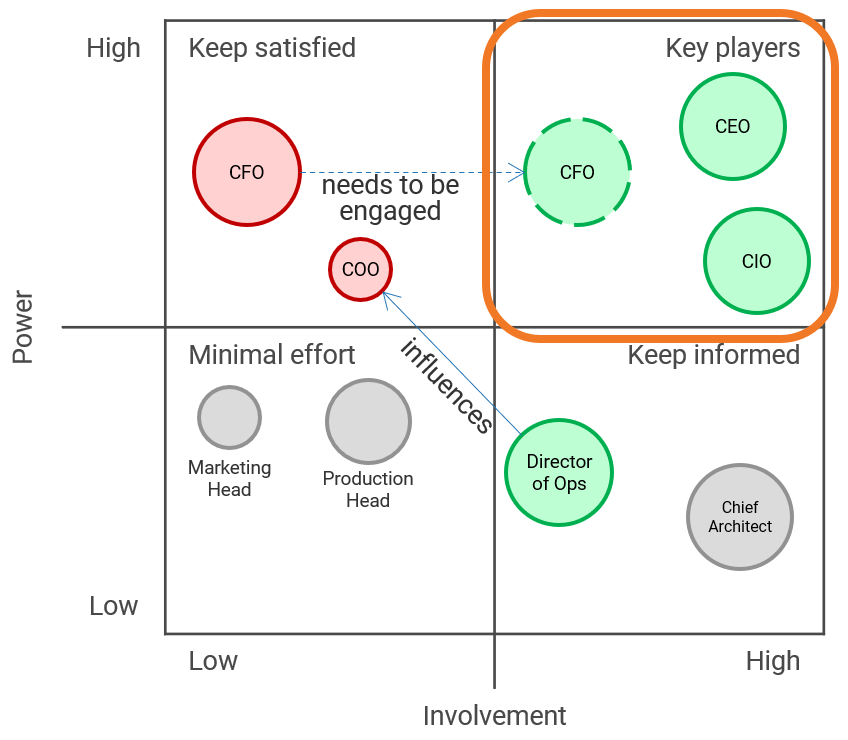

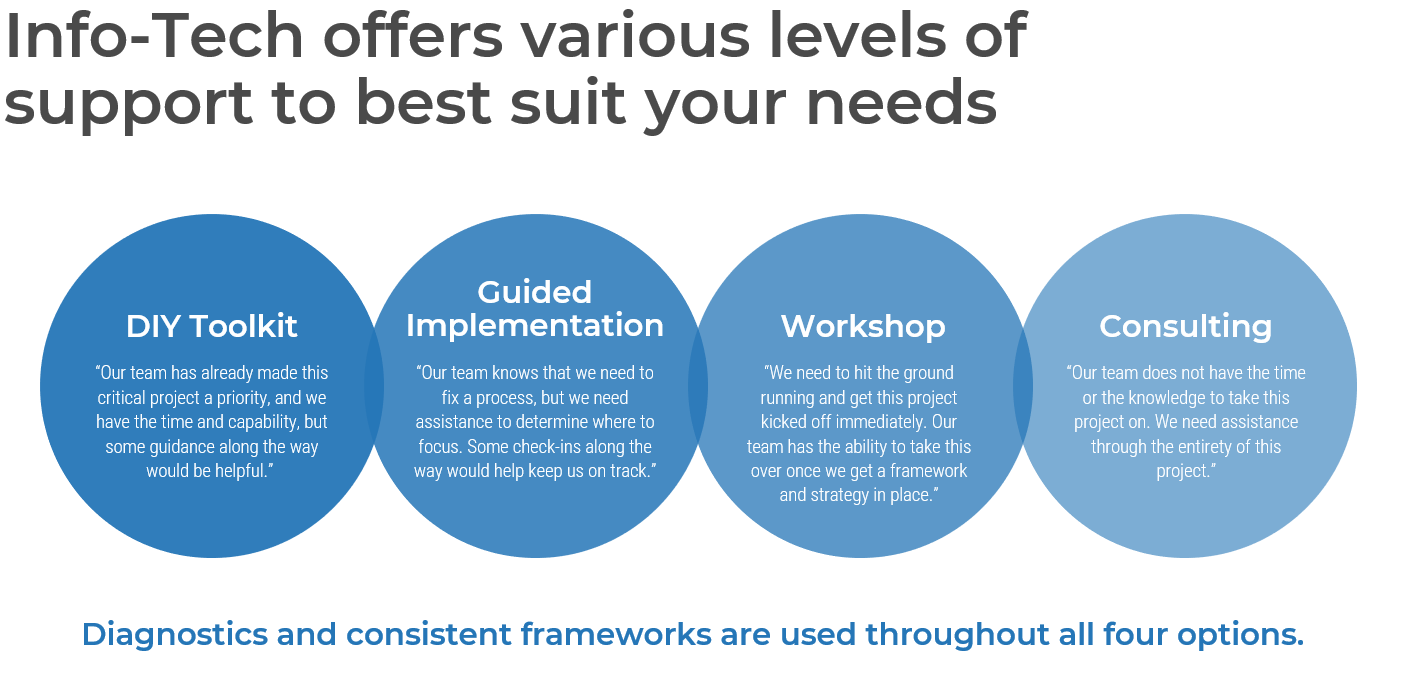

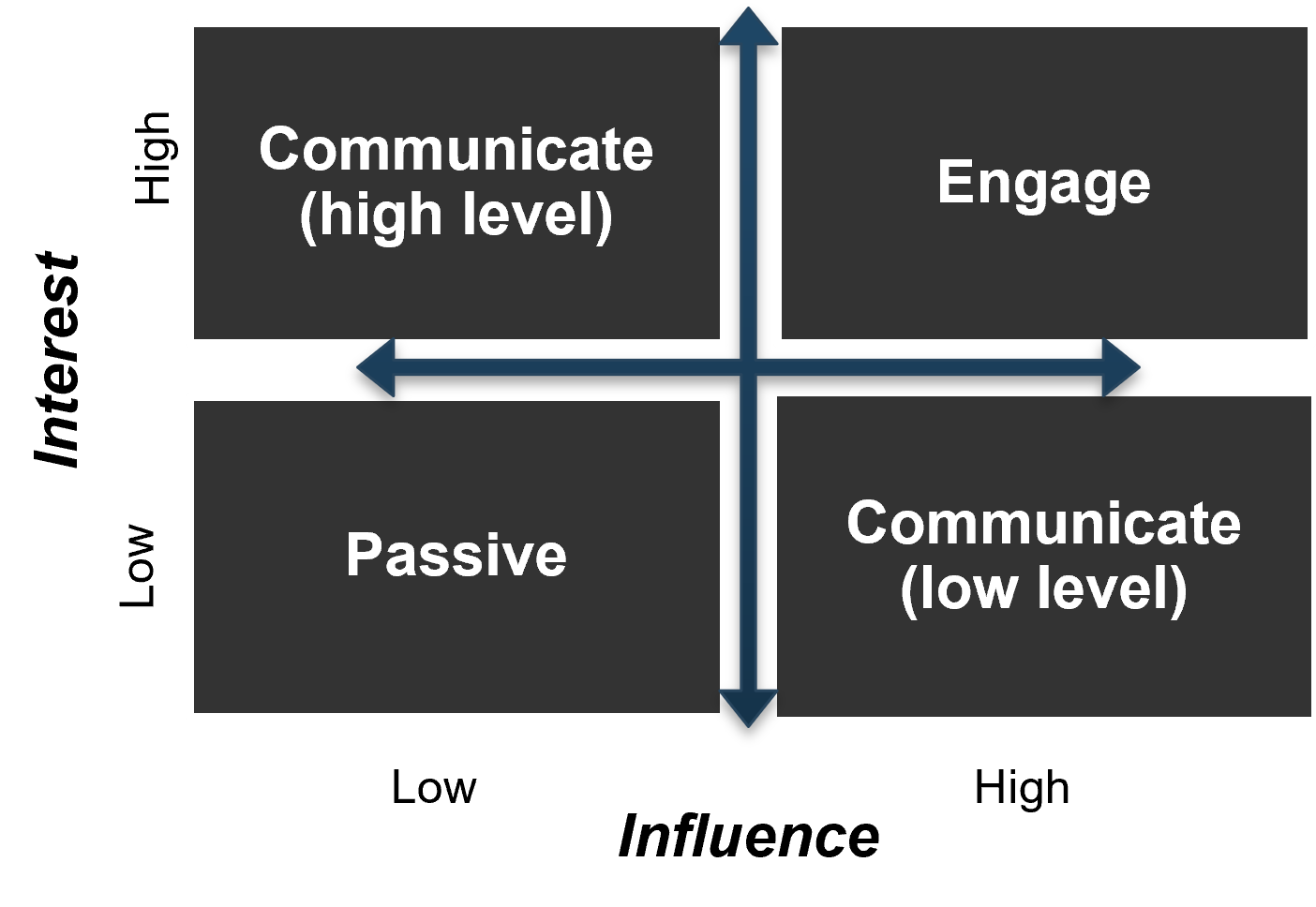

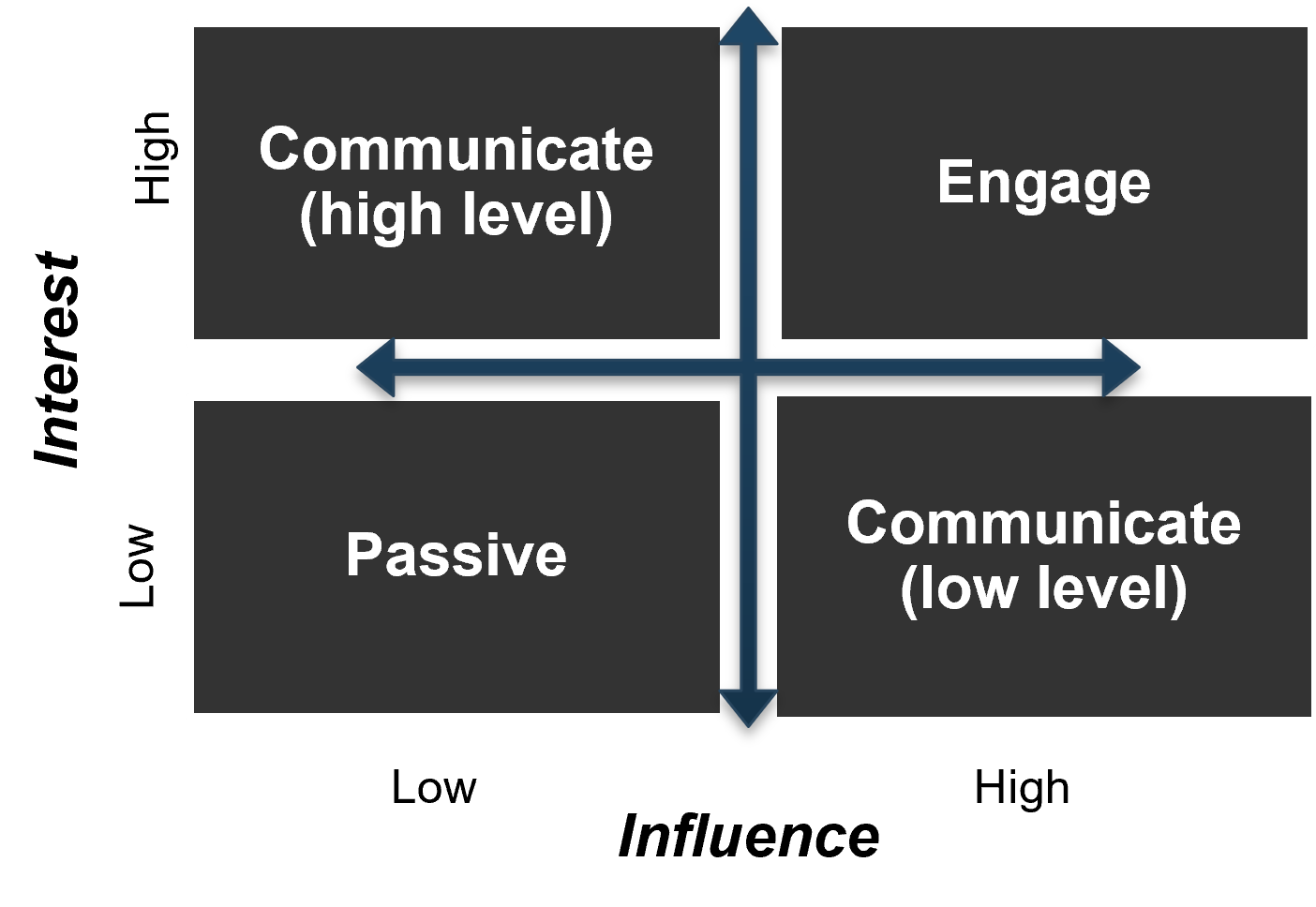

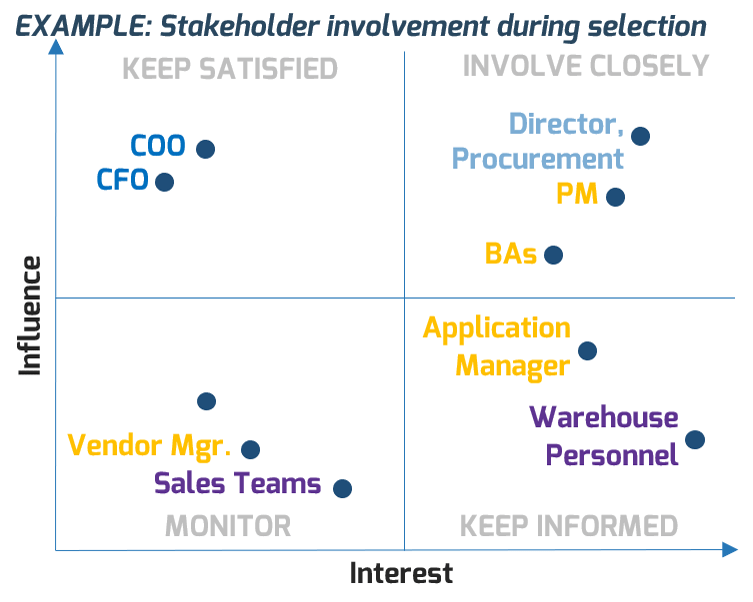

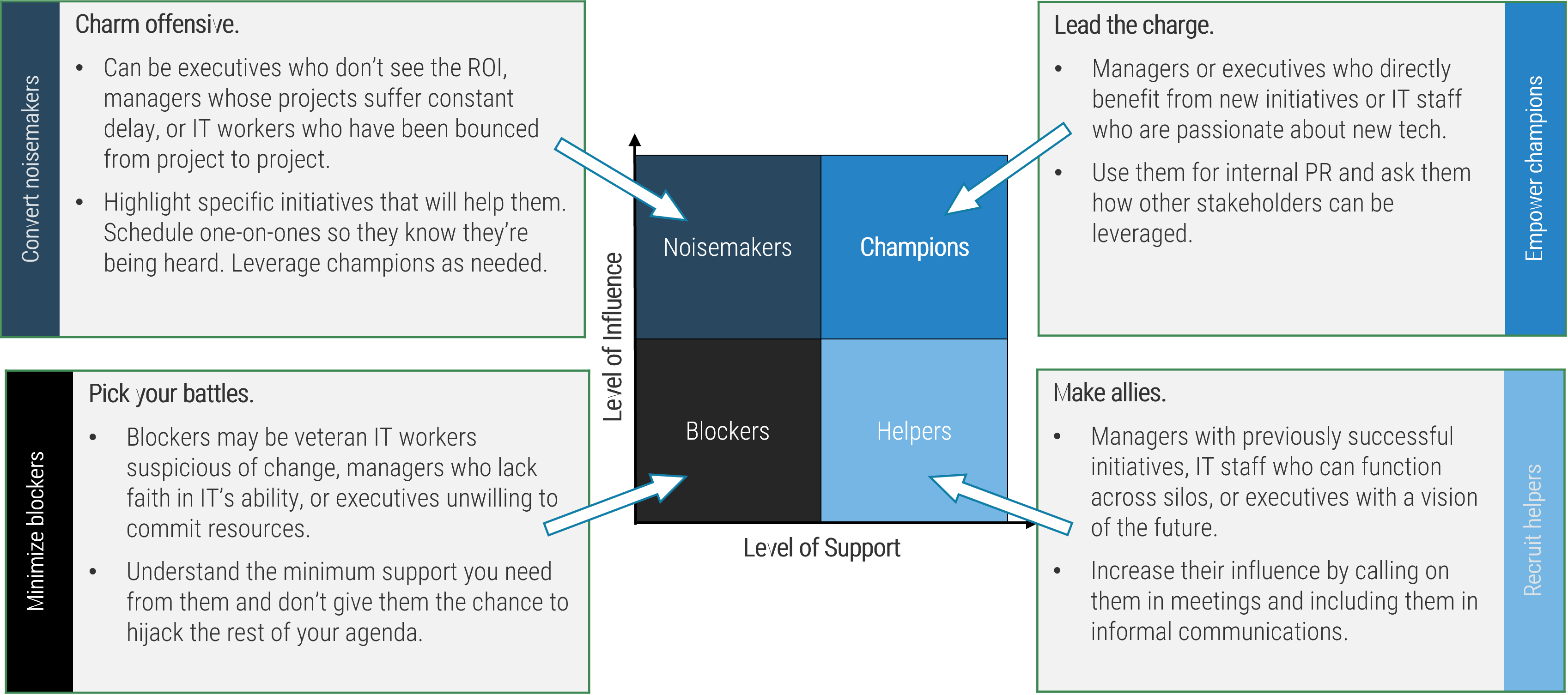

Prioritize your stakeholders for project intake, approval, and prioritization process

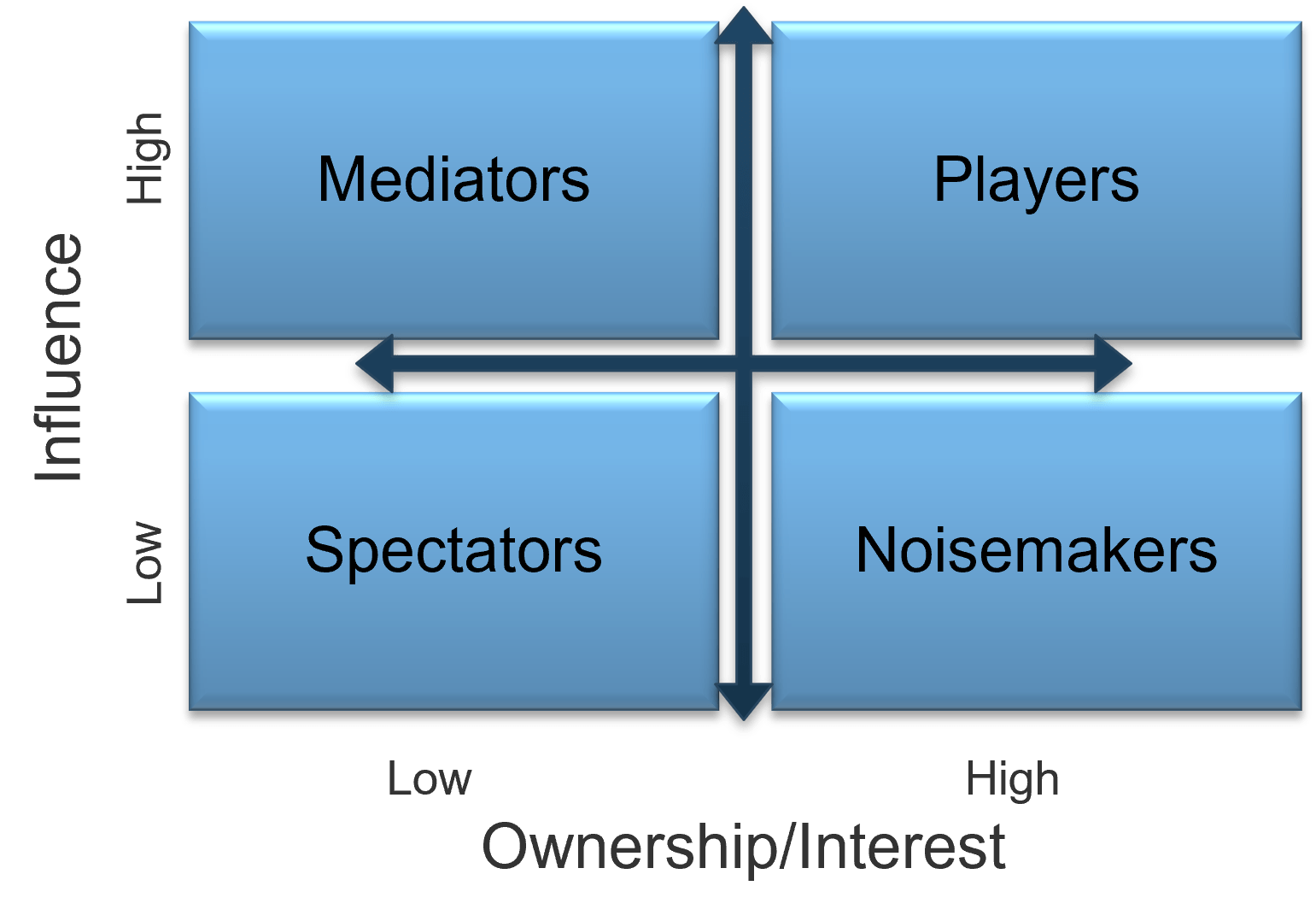

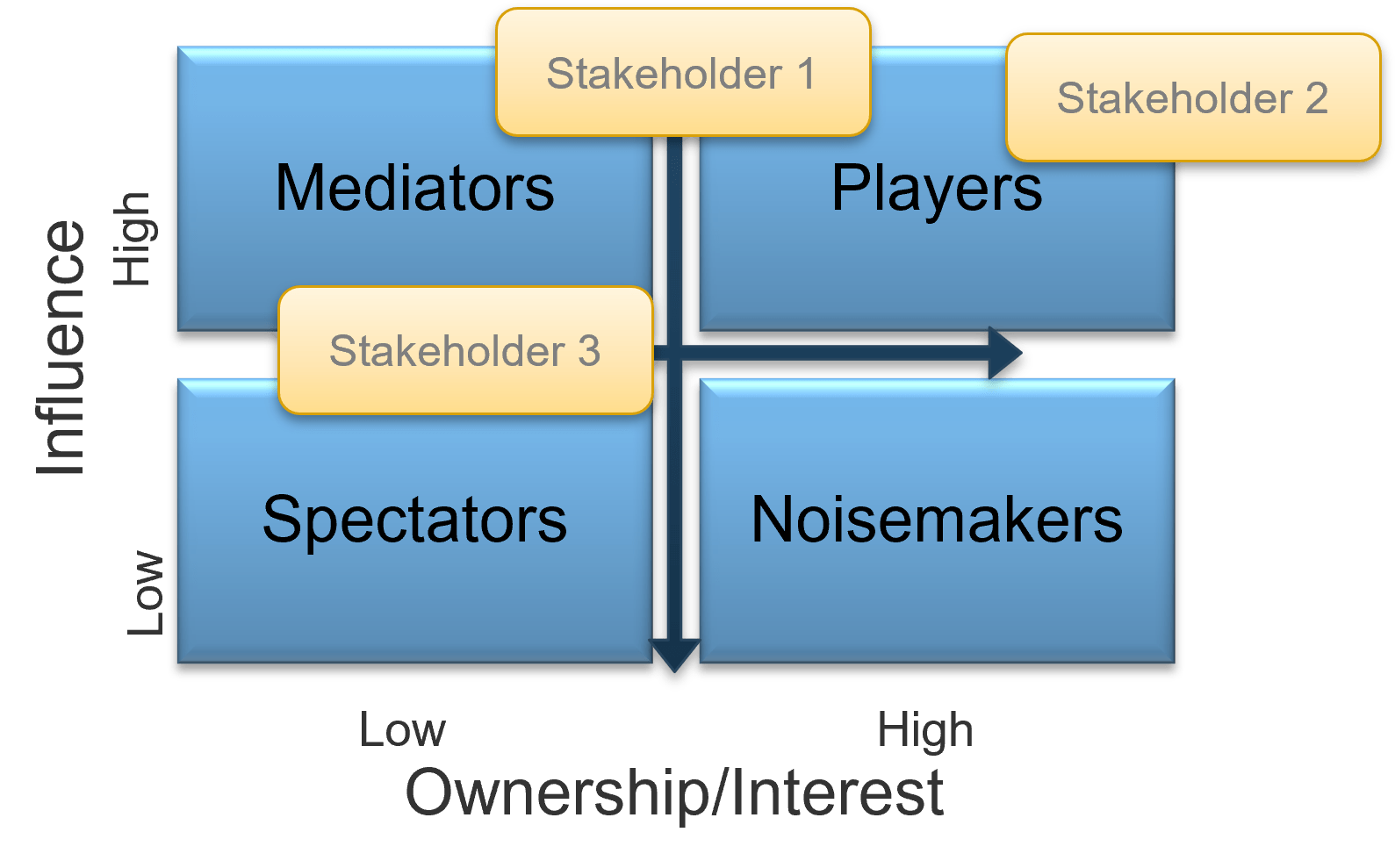

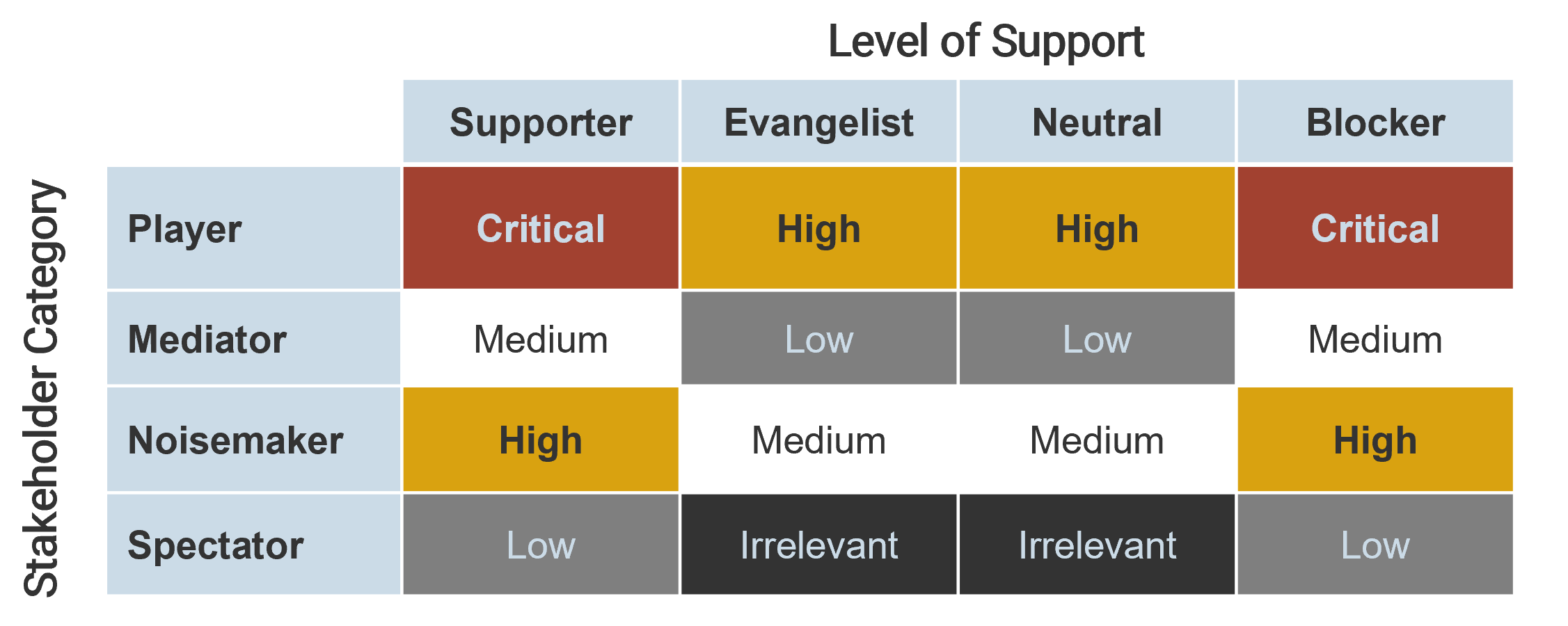

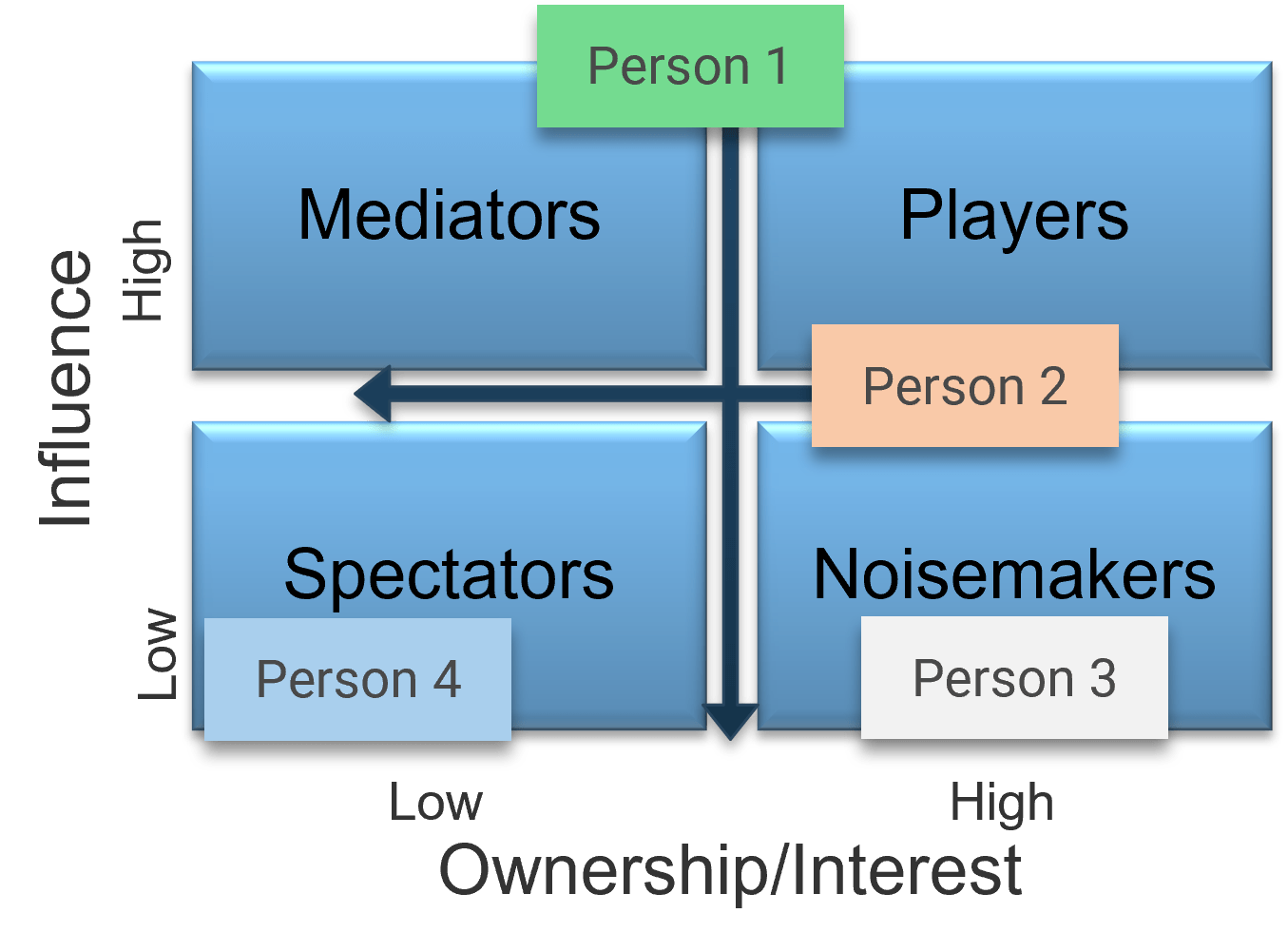

There are three dimensions for stakeholder prioritization: influence, interest, and support.

- Map your stakeholders in a 2D stakeholder power map (top right) according to their relative influence and interest.

- Rate their level of support by asking the following question: how likely is it that your stakeholder would welcome an improved process for project intake?

These parameters will inform how to prioritize your stakeholders according to the stakeholder priority heatmap (bottom right). This priority should inform how to focus your attention during the subsequent optimization efforts.

| Level of Support

|

| Stakeholder Category

|

|

Supporter

|

Evangelist

|

Neutral

|

Blocker

|

| Engage

|

Critical

|

High

|

High

|

Critical

|

| High

|

Medium

|

Low

|

Low

|

Medium

|

| Low

|

High

|

Medium

|

Medium

|

High

|

| Passive

|

Low

|

Irrelevant

|

Irrelevant

|

Low

|

Info-Tech Insight

There may be too many stakeholders to be able to achieve complete satisfaction. Focus your attention on the stakeholders that matter the most.

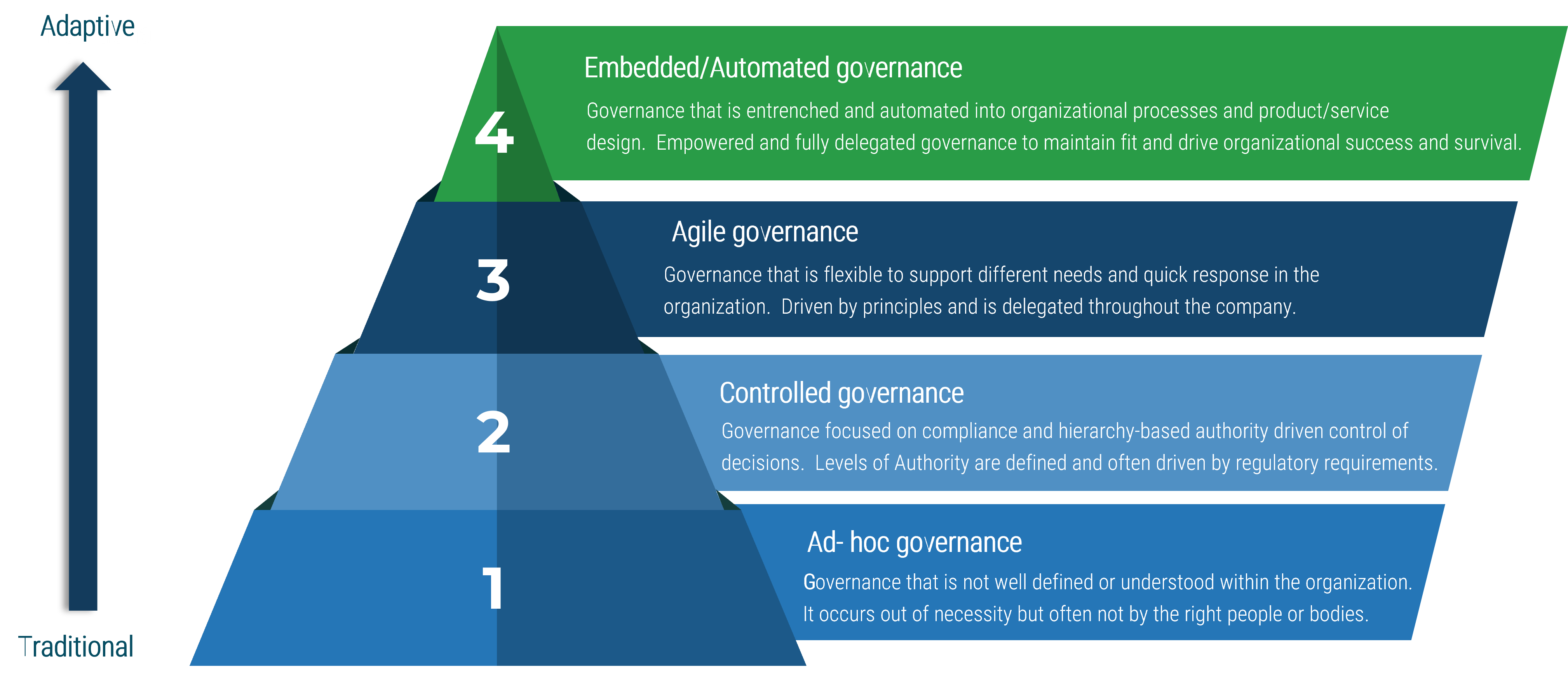

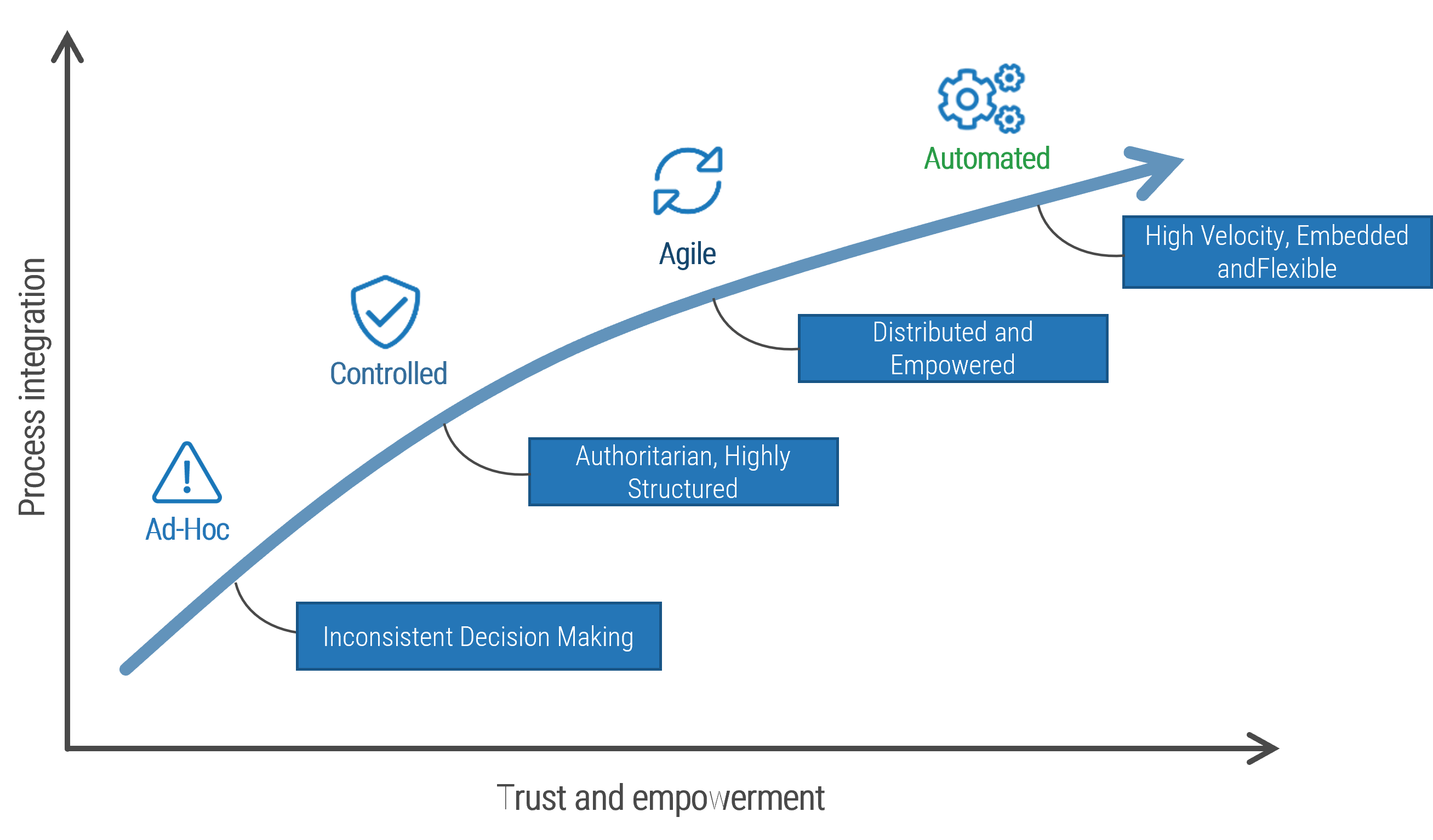

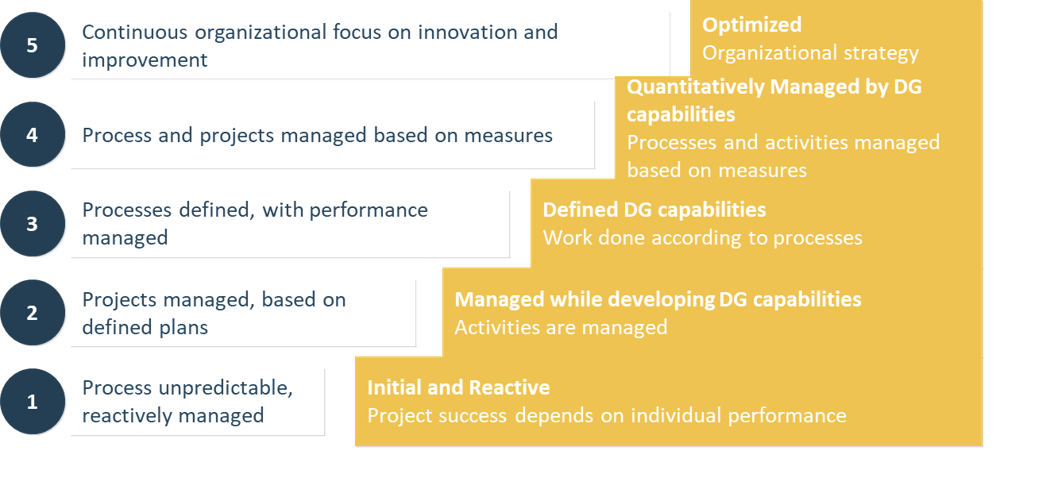

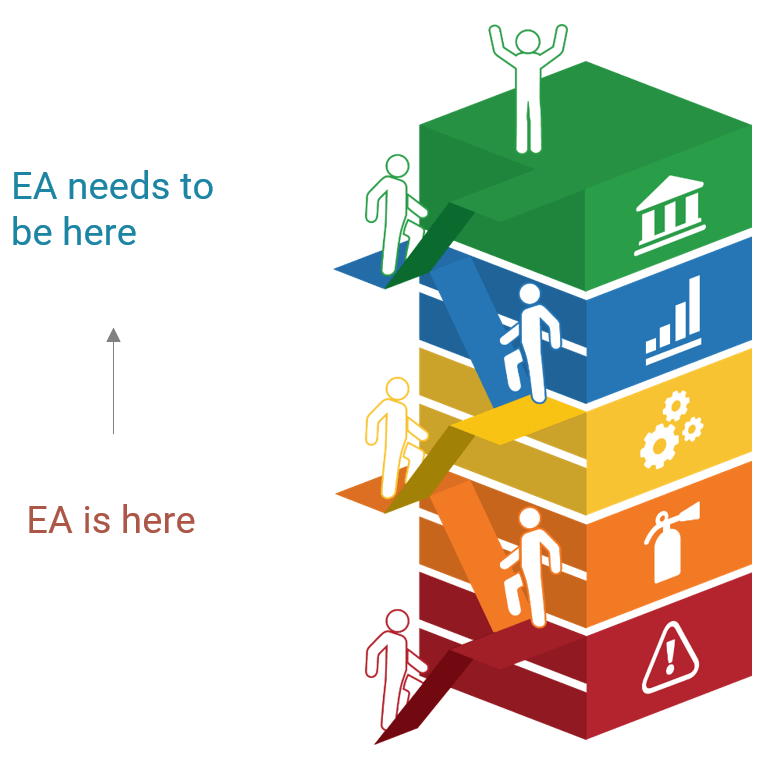

Most organizations have low to medium capabilities around intake, approval, and prioritization

1.2.4 Estimated Time: 15 minutes

Use Info-Tech’s Intake Capability Framework to help define your current and target states for intake, approval, and prioritization.

| Capability Level

|

Capability Level Description

|

| Capability Level 5: Optimized

|

Our department has effective intake processes with right-sized administrative overhead. Work is continuously prioritized to keep up with emerging challenges and opportunities.

|

| Capability Level 4: Aligned

|

Our department has very strong intake processes. Project approvals are based on business cases and aligned with future resource capacity.

|

| Capability Level 3: Engaged

|

Our department has processes in place to track project requests and follow up on them. Priorities are periodically re-evaluated, based largely on the best judgment of one or several executives.

|

| Capability Level 2: Defined

|

Our department has some processes in place but no capacity to say no to new projects. There is a formal backlog, but little or no method for grooming it.

|

| Capability Level 1: Unmanaged

|

Our department has no formal intake processes in place. Most work is done reactively, with little ability to prioritize proactive project work.

|

Refer to the subsequent slides for more detail on these capability levels.

Level 1: Unmanaged

Use these descriptions to place your organization at the appropriate level of intake capability.

| Intake

|

Projects are requested through personal conversations and emails, with minimal documentation and oversight.

|

| Approval

|

Projects are approved by default and rarely (if ever) declined. There is no definitive list of projects in the pipeline or backlog.

|

| Prioritization

|

Most work is done reactively, with little ability to prioritize proactive project work.

|

Symptoms

- Poorly defined – or a complete absence of – PPM processes.

- No formal approval committee.

- No processes in place to balance proactive and reactive demands.

Long Term

PMOs at this level should work to have all requests funneled through a proper request form within six months. Decision rights for approval should be defined, and a scorecard should be in place within the year.

Quick Win

To get a handle on your backlog, start tracking all project requests using the “Project Data” tab in Info-Tech’s Project Intake and Prioritization Tool.

Level 2: Defined

Use these descriptions to place your organization at the appropriate level of intake capability.

| Intake

|

Requests are formally documented in a request form before they’re assigned, elaborated, and executed as projects.

|

| Approval

|

Projects are approved by default and rarely (if ever) declined. There is a formal backlog, but little or no method for grooming it.

|

| Prioritization

|

There is a list of priorities but no process for updating it more than annually or quarterly.

|

Symptoms

- Organization does not have clear concept of project capacity.

- There is a lack of discipline enforced on stakeholders.

- Immature PPM processes in general.

Long Term

PMOs at this level should strive for greater visibility into the portfolio to help make the case for declining (or at least deferring) requests. Within the year, have a formal PPM strategy up and running.

Quick Win

Something PMOs at this level can accomplish quickly without any formal approval is to spend more time with stakeholders during the ideation phase to better define scope and requirements.

Level 3: Engaged

Use these descriptions to place your organization at the appropriate level of intake capability.

| Intake

|

Processes and skills are in place to follow up on requests to clarify project scope before going forward with approval and prioritization.

|

| Approval

|

Projects are occasionally declined based on exceptionally low feasibility or value.

|

| Prioritization

|

Priorities are periodically re-evaluated based largely on the best judgment of one or several executives.

|

Challenges

- Senior executives’ “best judgement” is frequently fallible or influenced. Pet projects still enter the portfolio and deplete resources.

- While approval processes “occasionally” filter out some low-value projects, many still get approved.

Long Term

PMOs at this level should advocate for a more formal cadence for prioritization and, within the year, establish a formal steering committee that will be responsible for prioritizing and re-prioritizing quarterly or monthly.

Quick Win

At the PMO level, employ Info-Tech’s Project Intake and Prioritization Tool to start re-evaluating projects in the backlog. Make this data available to senior executives when prioritization occurs.

Level 4: Aligned

Use these descriptions to place your organization at the appropriate level of intake capability.

| Intake

|

Occurs through a centralized process. Processes and skills are in place for follow-up.

|

| Approval

|

Project approvals are based on business cases and aligned with future resource capacity.

|

| Prioritization

|

Project prioritization is visibly aligned with business goals.

|

Challenges

- The process of developing business cases can be too cumbersome, distracting resources from actual project work.

- “Future” resource capacity predictions are unreliable. Reactive support work and other factors frequently change actual resource availability.

Long Term

PMOs at this level can strive for more accurate and frequent resource forecasting, establishing a more accurate picture of project vs. non-project work within the year.

Quick Win

PMOs at this level can start using Info-Tech’s Business Case Template (Comprehensive or Fast Track) to help simplify the business case process.

Level 5: Optimizing

Use these descriptions to place your organization at the appropriate level of intake capability.

| Intake

|

Occurs through a centralized portal. Processes and skills are in place for thorough follow-up.

|

| Approval

|

Project approvals are based on business cases and aligned with future resource capacity.

|

| Prioritization

|

Work is continuously prioritized to keep up with emerging challenges and opportunities.

|

Challenges

- Establishing a reliable forecast for resource capacity remains a concern at this level as well.

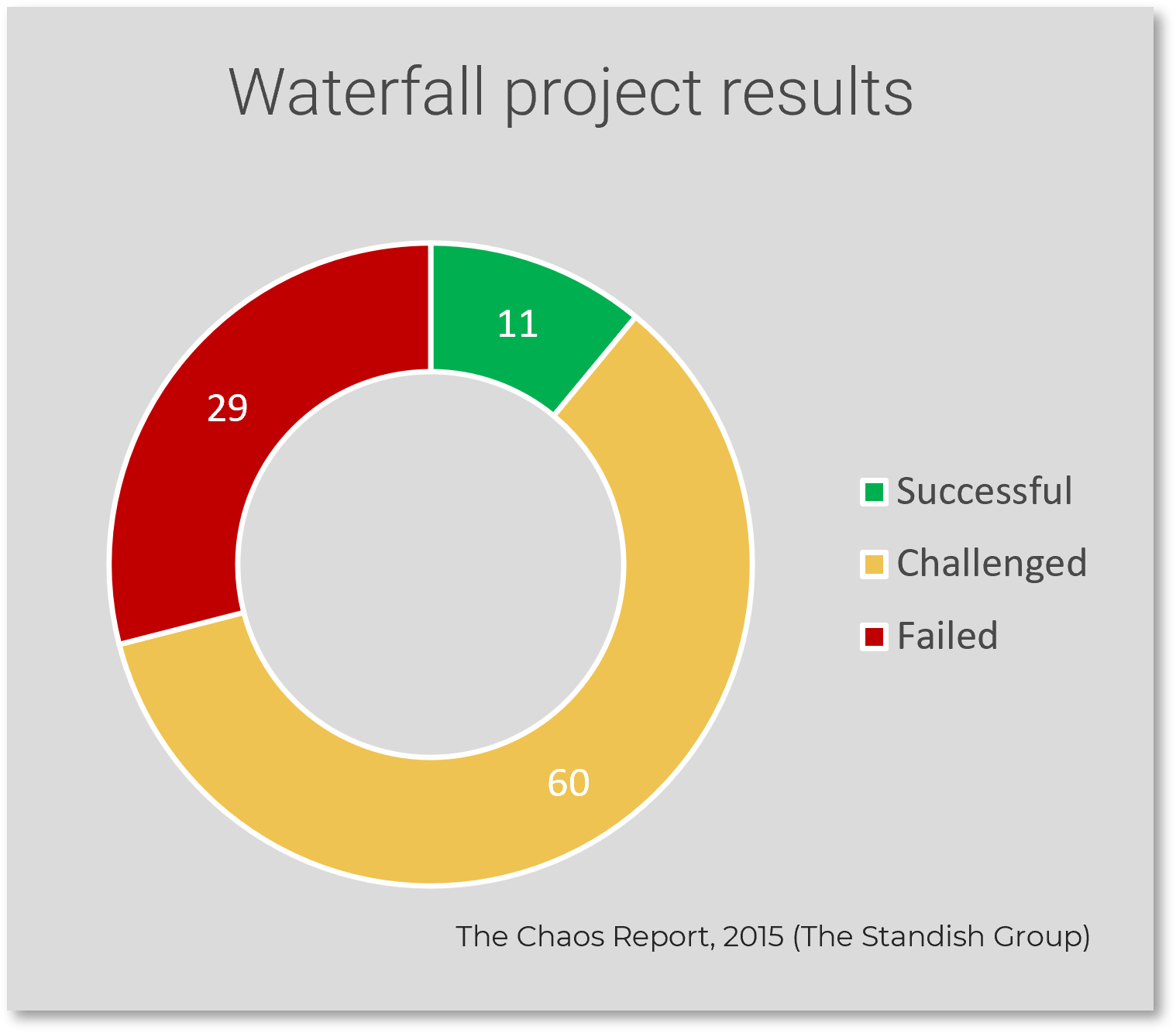

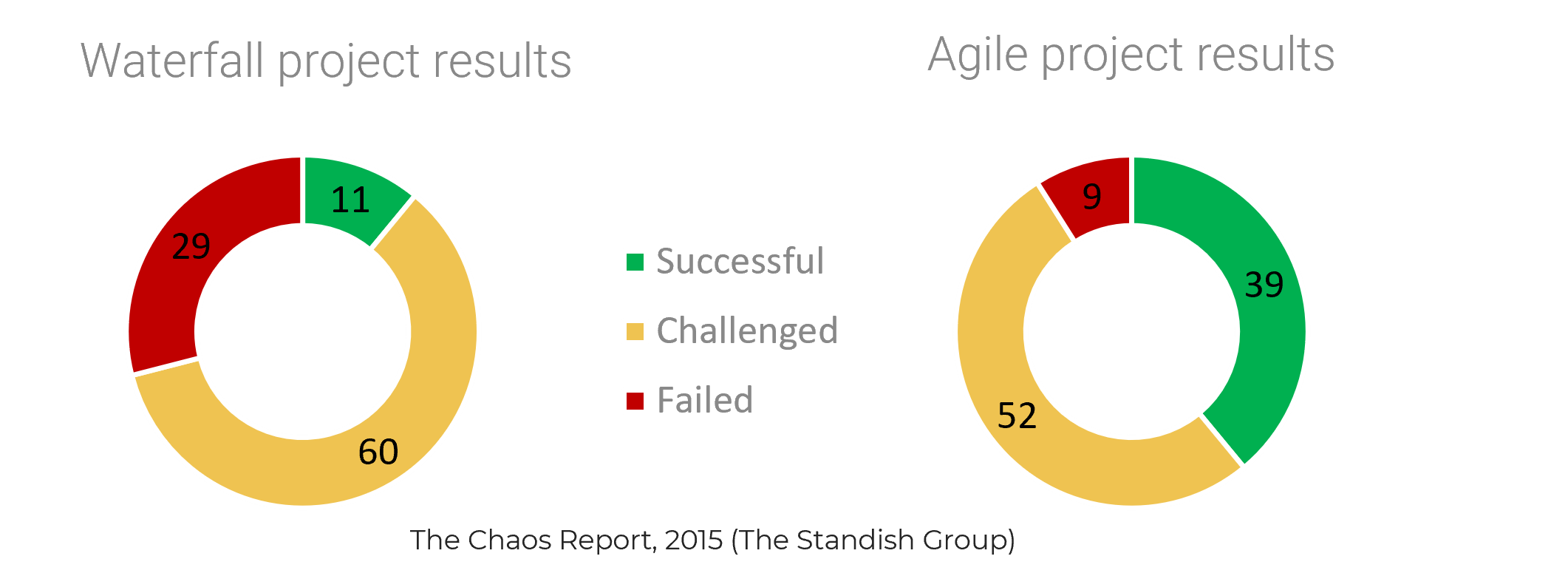

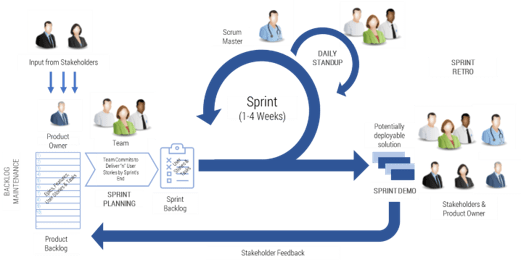

- Organizations at this level may experience an increasing clash between Agile practices and traditional Waterfall methodologies.

PMOs at this level should look at Info-Tech’s Manage an Agile Portfolio for comprehensive tools and guidance on maintaining greater visibility at the portfolio level into work in progress and committed work.

Establish your current and target states for process intake, approval, and prioritization

1.2.5 Estimated Time: 20 minutes

- Having reviewed the intake capability framework, you should be able to quickly identify where you currently reside in the model. Document this in the “Current State” box below.

- Next, spend some time as a group discussing your target state. Make sure to set a realistic target as well as a realistic timeframe for meeting this target. Level 1s will not be able to become Level 5s overnight and certainly not without passing through the other levels on the way.

- A realistic goal for a Level 1 to become a Level 2 is within six to eight months.

| Current State:

|

|

| Target State:

|

|

| Timeline for meeting target

|

|

INPUT

- Intake, approval, and prioritization capability framework (Activity 1.2.4)

OUTPUT

- Current and target state, with stated time goals

Materials

Participants

- CIO

- PMO Director/ Portfolio Manager

- Project Managers

- Business Analysts

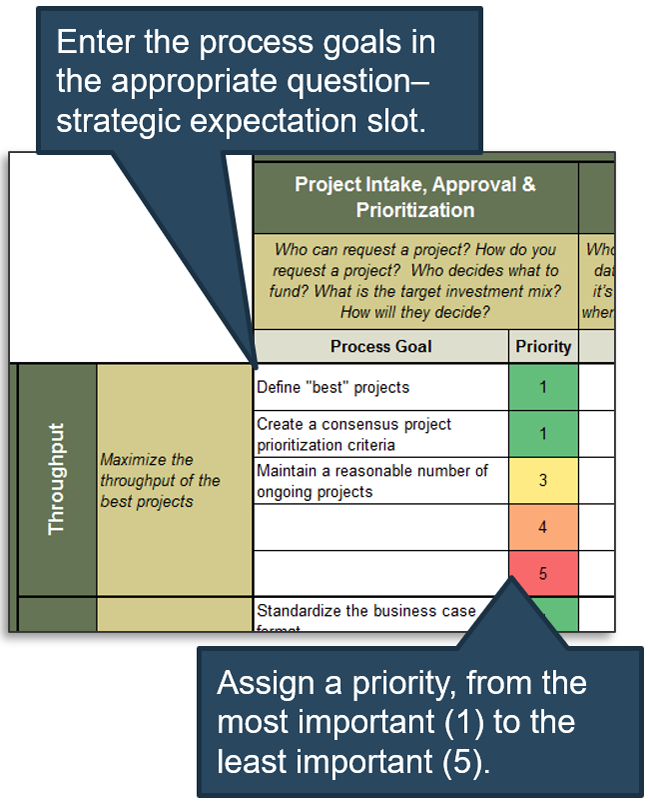

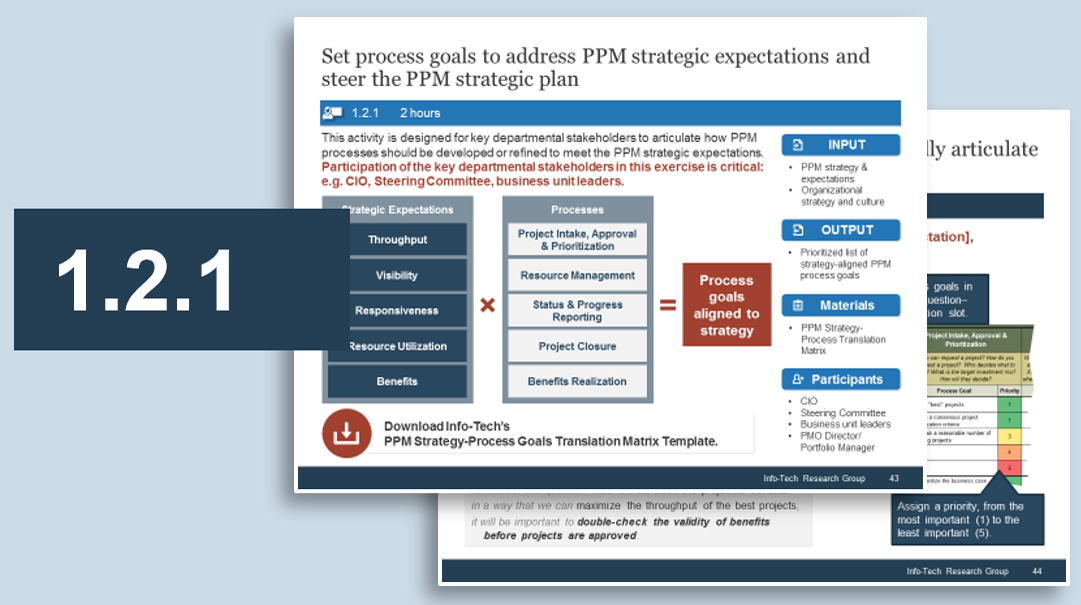

Align your intake success with the strategic expectations of overall project portfolio management

A successful project intake, approval, and prioritization process puts your leadership in a position to best steer the portfolio, like a conductor of an orchestra.

To frame the discussion on deciding what intake success will look like, review Info-Tech’s PPM strategic expectations:

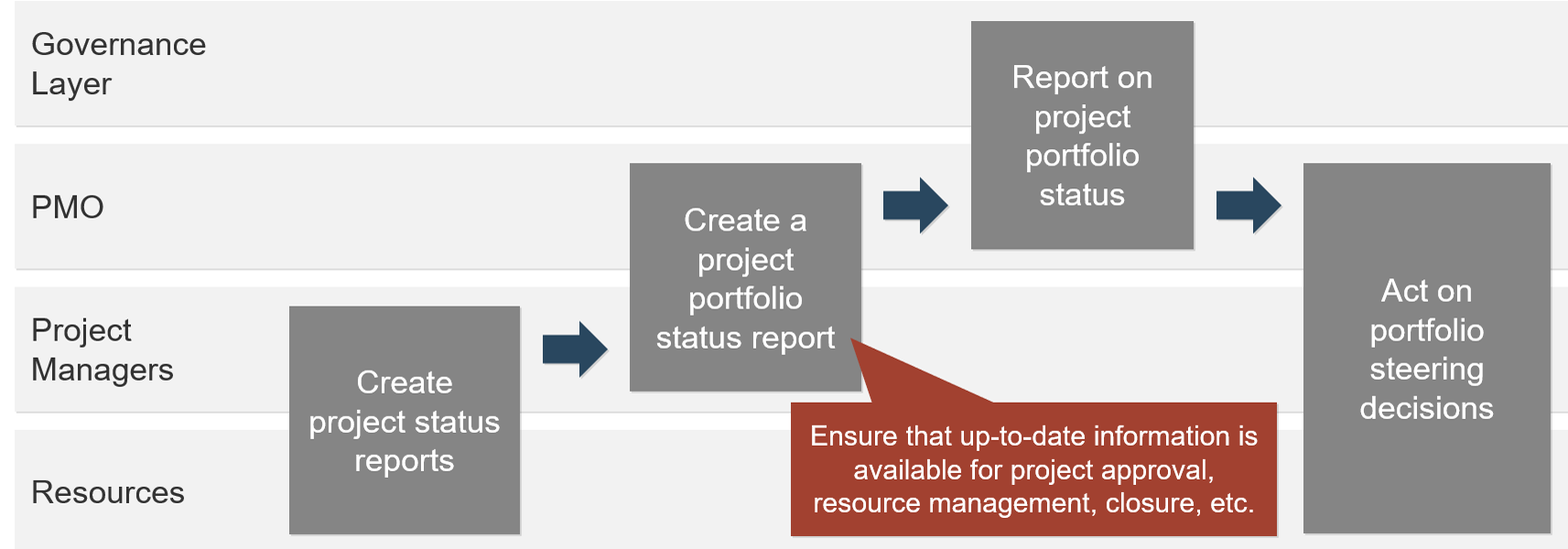

- Project Throughput: Maximize throughput of the best projects.

- Portfolio Visibility: Ensure visibility of current and pending projects.

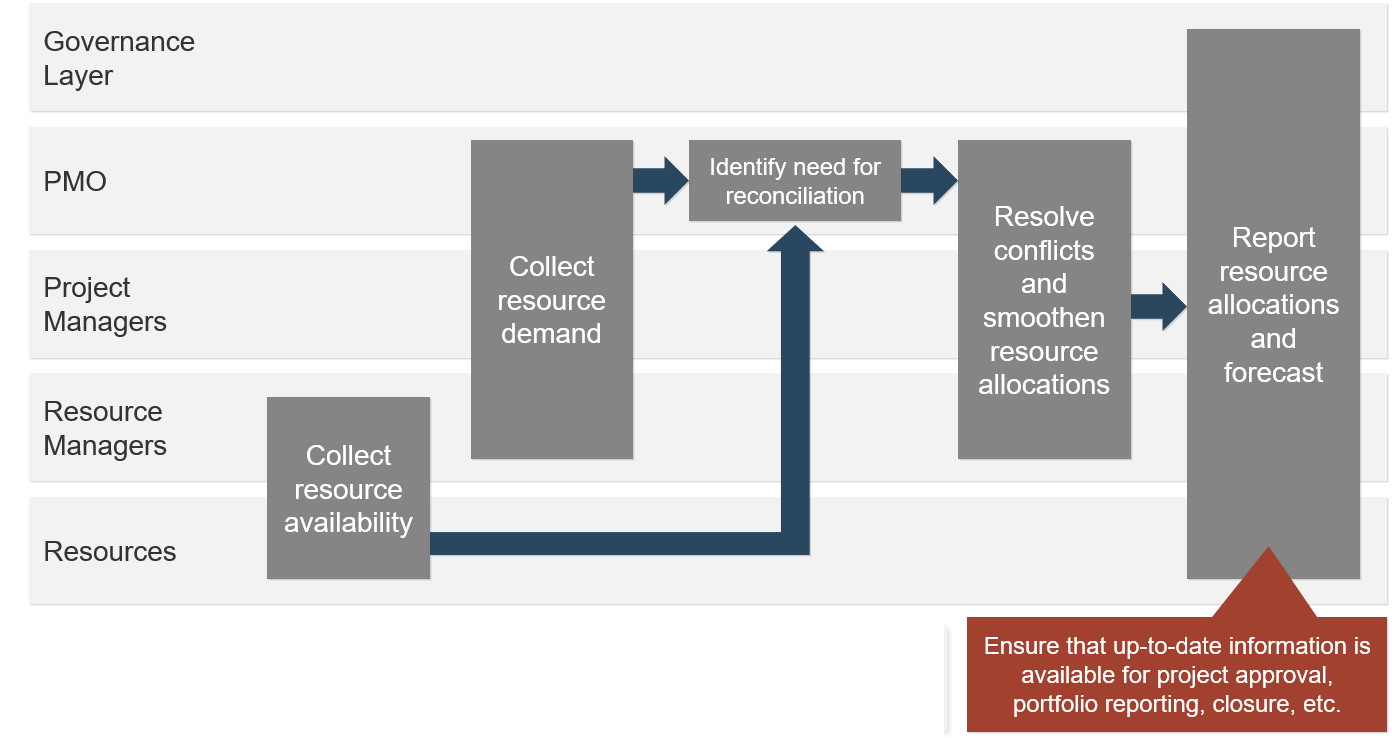

- Portfolio Responsiveness: Make the portfolio responsive to executive steering when new projects and changing priorities need rapid action.

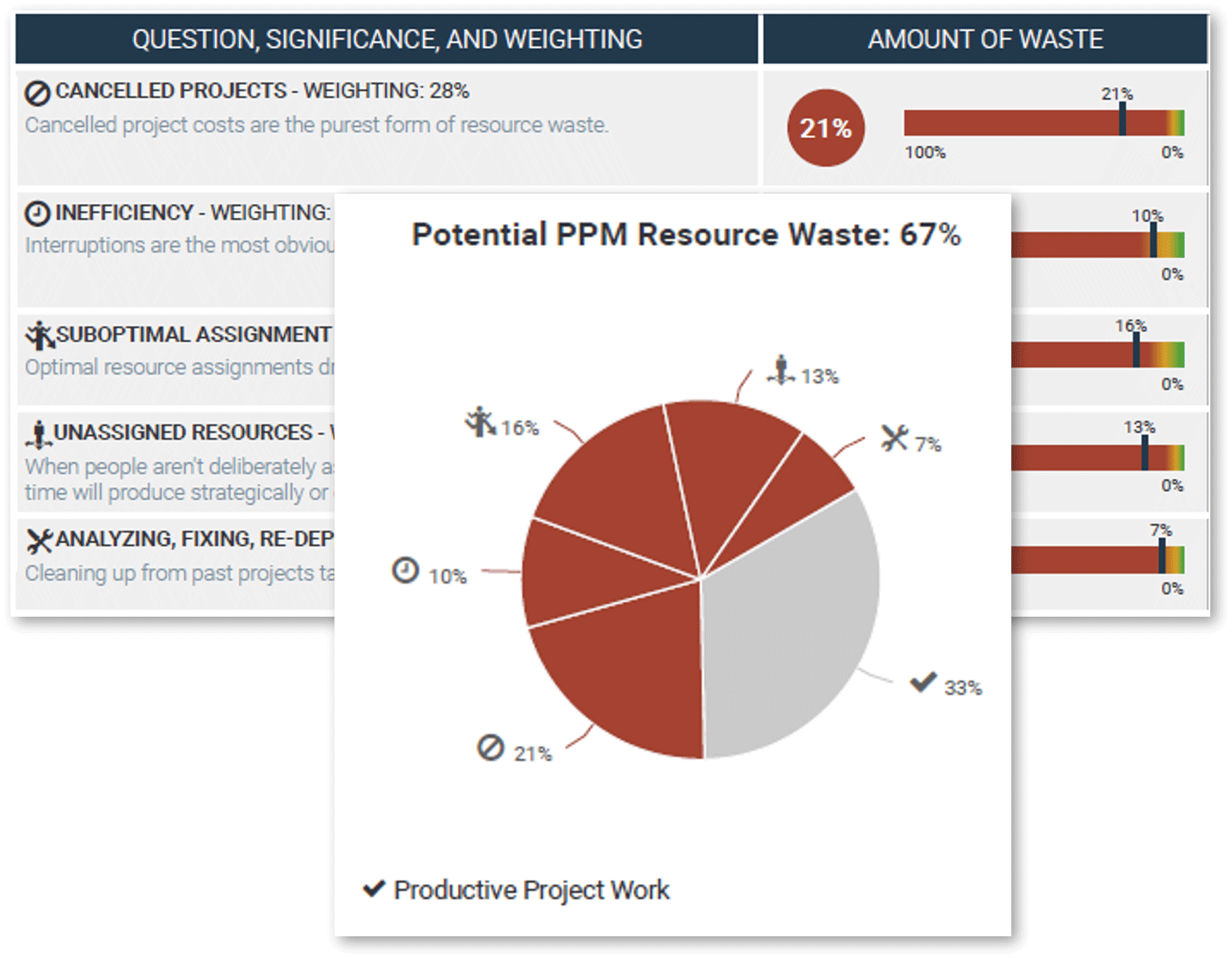

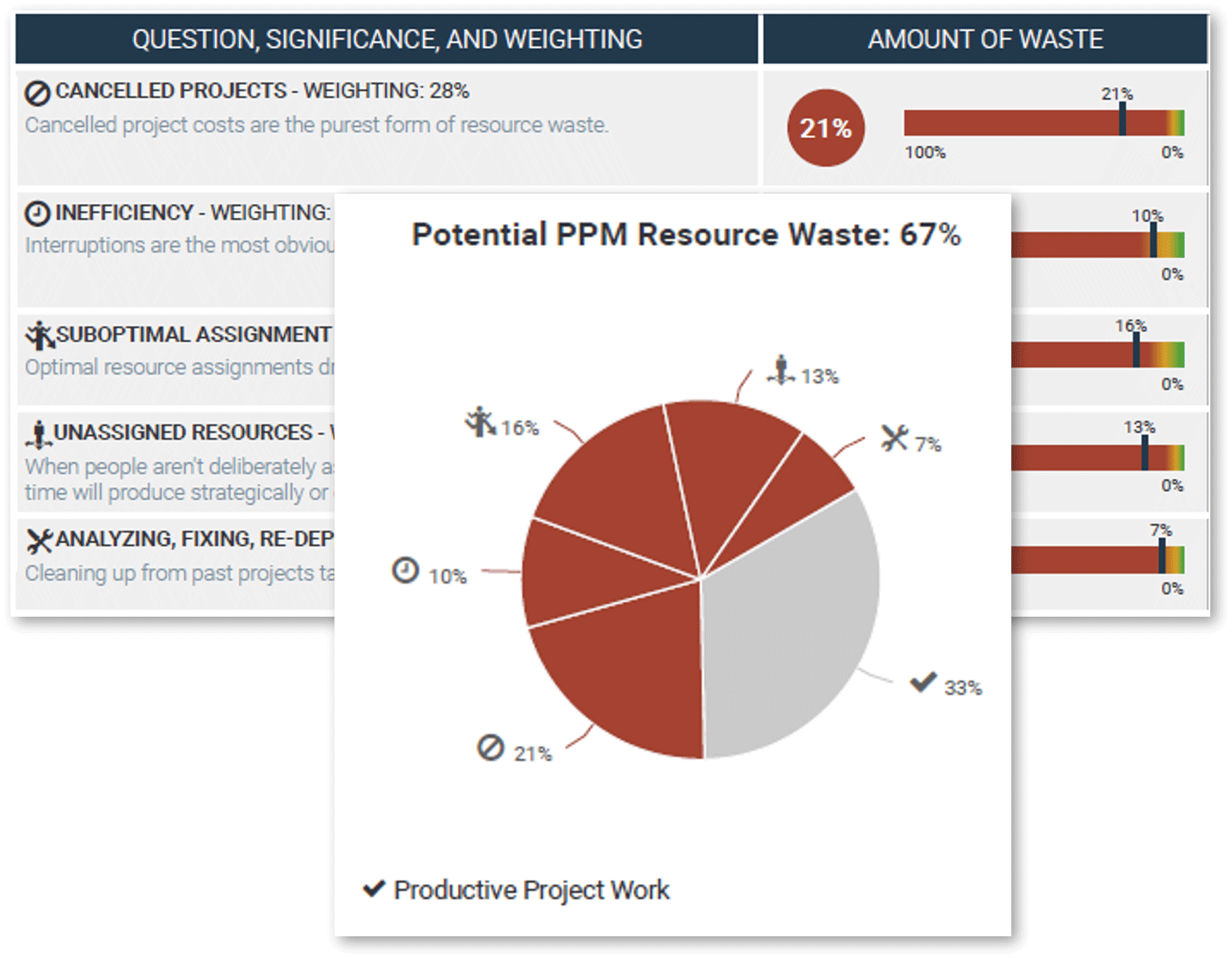

- Resource Utilization: Minimize resource waste and optimize the alignment of skills to assignments.

- Benefits Realization: Clarify accountability for post-project benefits attainment for each project, and facilitate the process of tracking/reporting those benefits.

For a more detailed discussion and insight on PPM strategic expectations see Info-Tech’s blueprint, Develop a Project Portfolio Management Strategy.

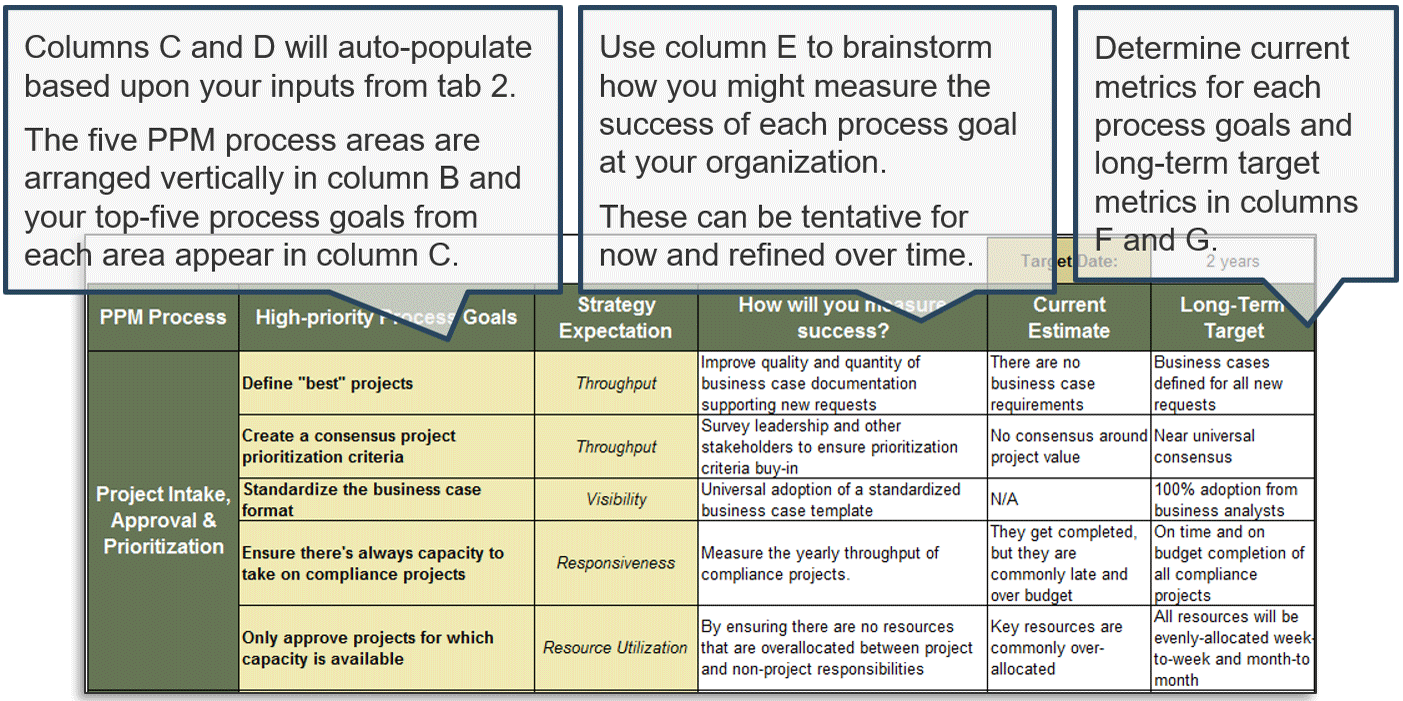

Decide what successful project intake, approval, prioritization process will look like

1.2.6 Estimated Time: 60 minutes

While assessing your current state, it is important to discuss and determine as a team how success will be defined.

- During this process, it is important to consider tentative timelines for success milestones and to ask the question: what will success look like and when should it occur by?

- Use the below table to help document success factors and timeliness. Follow the lead of our example in row 1.

| Optimization Benefit

|

Objective

|

Timeline

|

Success Factor

|

| Facilitate project intake, prioritization, and communication with stakeholders to maximize time spent on the most valuable or critical projects.

|

Look at pipeline as part of project intake approach and adjust priorities as required.

|

July 1st

|

Consistently updated portfolio data. Dashboards to show back capacity to customers. SharePoint development resources.

|

Review and customize section 1.5, “Process Success Criteria” in Info-Tech’s Project Intake, Approval, and Prioritization SOP Template.

Info-Tech Insight

Establish realistic short-term goals. Even with optimized intake procedures, you may not be able to eliminate underground project economies immediately. Make your initial goals realistic, leaving room for those walk-up requests that may still appear via informal channels.

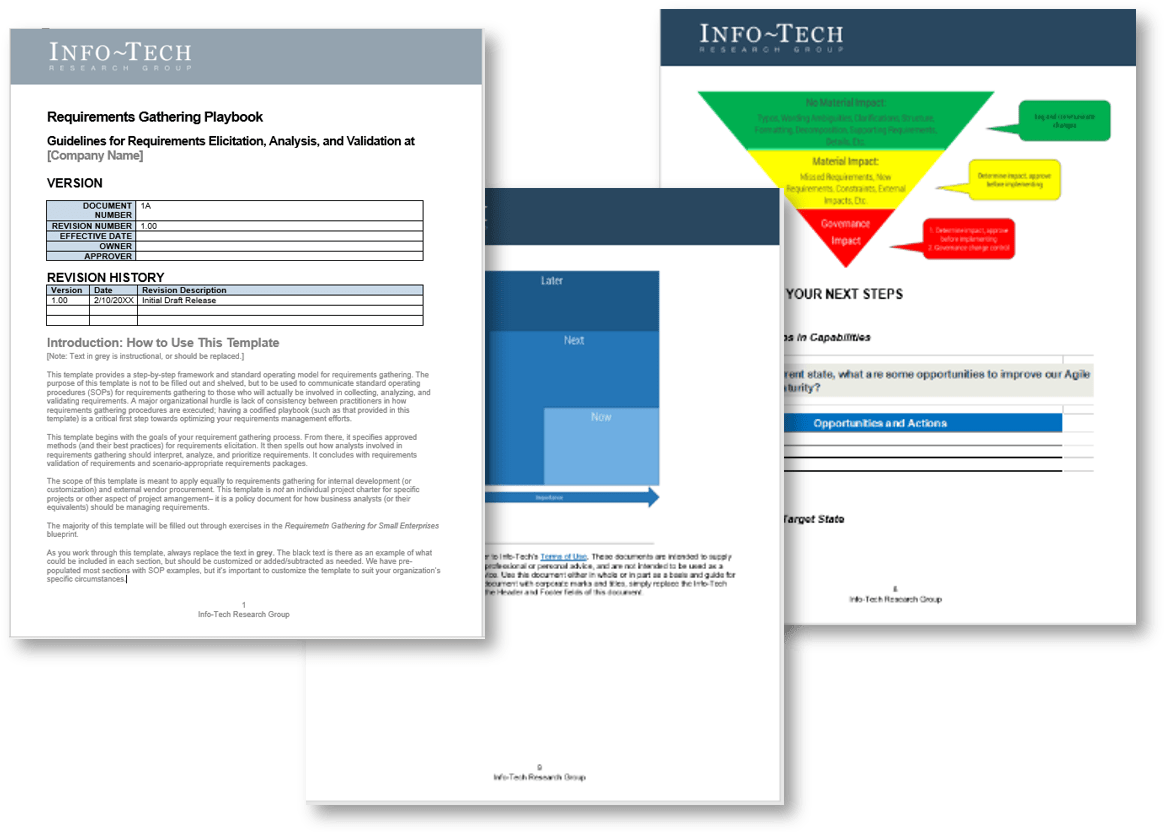

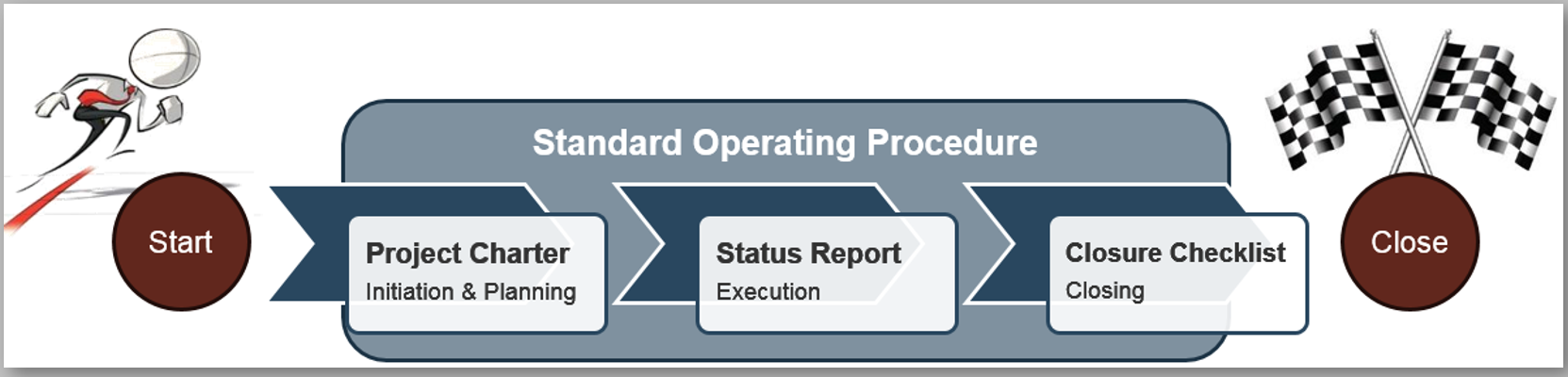

Prepare to optimize project intake and capture the results in the Intake, Approval, and Prioritization SOP

Standard Operating Procedure (SOP) is the reference document to get all PPM stakeholders on the same page with the new optimized process.

The current state explored and documented in this step will serve as a starting point for each step of the next phase of the blueprint. The next phase will take a deeper dive into each of the three components of Info-Tech’s project intake methodology, so that they can achieve the success criteria you’ve defined in the previous activity.

Info-Tech’s Project Intake, Approval, and Prioritization SOP Template is intended to capture the outcome of your process optimization efforts. This blueprint guides you through numerous activities designed for your core project portfolio management team to customize each section.

To maximize the chances of success, it is important that the team makes a concerted effort to participate. Schedule a series of working sessions over the course of several weeks for your team to work through it – or get through it in one week, with onsite Info-Tech analyst-facilitated workshops.

Download Info-Tech’s Project Intake, Approval, and Prioritization SOP.

Contact your account representative or email Workshops@InfoTech.com for more information.

Case study: PMO develops mature intake and prioritization processes by slowly evolving its capability level

CASE STUDY

Industry: Not-for-Profit

Source: Info-Tech Interview

Challenge

- A PMO for a large not-for-profit benefits provider had relatively high project management maturity, but the enterprise had low PPM maturity.

- There were strong intake processes in place for following up on requests. For small projects, project managers would assist as liaisons to help control scope. For corporate initiates, PMs were assigned to work with a sponsor to define scope and write a charter.

Solution

Prioritization was a challenge. Initially, the organization had ad hoc prioritization practices, but they had developed a scoring criteria to give more formality and direction to the portfolio. However, the activity of formally prioritizing proved to be too time consuming.

Off-the-grid projects were a common problem, with initiatives consuming resources with no portfolio oversight.

Results

After trying “heavy” prioritization, the PMO loosened up the process. PMO staff now go through and quickly rank projects, with two senior managers making the final decisions. They re-prioritize quarterly to have discussions around resource availability and to make sure stakeholders are in tune to what IT is doing on a daily basis. IT has a monthly meeting to go over projects consuming resources and to catch anything that has fallen between the cracks.

"Everything isn't a number one, which is what we were dealing with initially. We went through a formal prioritization period, where we painstakingly scored everything. Now we have evolved: a couple of senior managers have stepped up to make decisions, which was a natural evolution from us being able to assign a formal ranking. Now we are able to prioritize more easily and effectively without having to painstakingly score everything."

– PMO Director, Benefits Provider

If you want additional support, have our analysts guide you through this phase as part of an Info-Tech workshop

Book a workshop with our Info-Tech analysts:

- To accelerate this project, engage your IT team in an Info-Tech workshop with an Info-Tech analyst team.

- Info-Tech analysts will join you and your team onsite at your location or welcome you to Info-Tech’s historic Toronto office to participate in an innovative onsite workshop.

- Contact your account manager (www.infotech.com/account), or email Workshops@InfoTech.com for more information.

The following are sample activities that will be conducted by Info-Tech analysts with your team:

1.1.1-2

Pilot Info-Tech’s Project Value Scorecard-driven prioritization method

Use Info-Tech’s example to prioritize your current project backlog to pilot a project value-driven prioritization, which will be used to guide the entire optimization process.

1.2.1-3

Map out and document current project intake, approval, and prioritization process, and the involved key stakeholders

A table-top planning exercise helps you visualize the current process in place and identify opportunities for optimization.

Phase 2

Build an Optimized Project Intake, Approval, and Prioritization Process

Phase 2 outline

Call 1-888-670-8889 or email GuidedImplementations@InfoTech.com for more information.

Complete these steps on your own, or call us to complete a guided implementation. A guided implementation is a series of 2-3 advisory calls that help you execute each phase of a project. They are included in most advisory memberships.

| Guided Implementation 2: Build an Optimized Project Intake, Approval, and Prioritization Process Proposed Time to Completion: 3-6 weeks |

|---|

Step 2.1: Streamline Intake

Start with an analyst kick-off call:

- Challenges of project intake

- Opportunities for improving the management of stakeholder expectations by optimizing intake

Then complete these activities…

- Perform a process retrospective

- Optimize your process to receive, triage, and follow up on project requests

With these tools & templates:

- Project Request Form.

- Project Intake Classification Matrix

| Step 2.2: Right-Size Approval

Start with an analyst call:

- Challenges of project approval

- Opportunities for improving strategic alignment of the project portfolio by optimizing project approval

Then complete these activities…

- Perform a process retrospective

- Clarify accountability at each step

- Decide on deliverables to support decision makers at each step

With these tools & templates:

- Benefits Commitment Form

- Technology Assessment Tool

- Business Case Templates

| Step 3.3: Prioritize Realistically

Start with an analyst call:

- Challenges in project prioritization

Opportunities for installing a resource capacity-constrained intake by optimizing prioritizationThen complete these activities…

- Perform a process retrospective

- Pilot the Intake and Prioritization Tool for prioritization within estimated resource capacity

With these tools & templates:

- Project Intake and Prioritization Tool

|

Phase 2 Results & Insights:

- Info-Tech’s methodology systemically fits the project portfolio into its triple constraint of stakeholder needs, strategic objectives, and resource capacity, to effectively address the challenges of establishing organizational discipline for project intake.

|

Step 2.1: Streamline intake to manage stakeholder expectations

| PHASE 1 | PHASE 2 | PHASE 3 |

1.1

Define project valuation criteria

| 1.2

Envision process target state

| 2.1

Streamline intake

| 2.2

Right-size approval steps

| 2.3

Prioritize projects to fit resource capacity

| 3.1

Pilot your optimized process

| 3.2

Communicate organizational change

|

This step will walk you through the following activities:

- Perform a deeper retrospective on current project intake process

- Optimize your process to receive project requests

- Revisit the definition of a project for triaging requests

- Optimize your process to triage project requests

- Optimize your process to follow up on project requests

This step involves the following participants:

- PMO Director / Portfolio Manager

- Project Managers

- Business Analysts

- PMO Administrative Staff

Outcomes of this Step

- Retrospective of the current project intake process: to continue doing, to start doing, and to stop doing

- A streamlined, single-funnel intake channel with the right procedural friction to receive project requests

- A refined definition of what constitutes a project, and project levels that will determine the necessary standard of rigor with which project requests should be scoped and developed into a proposal throughout the process

- An optimized process for triaging and following up on project requests to prepare them for the steps of project approval

- Documentation of the optimized process in the SOP document

Understand the risks of poor intake practices

Too much red tape could result in your portfolio falling victim to underground economies. Too little intake formality could lead to the Wild West.

Off-the-grid projects, i.e. projects that circumvent formal intake processes, lead to underground economies that can deplete resource capacity and hijack your portfolio.

These underground economies are typically the result of too much intake red tape. When the request process is made too complex or cumbersome, project sponsors may unsurprisingly seek alternative means to get their projects done.

While the most obvious line of defence against the appearance of underground economies is an easy-to-use and access request form, one must be cautious. Too little intake formality could lead to a Wild West of project intake where everyone gets their initiatives approved regardless of their business merit and feasibility.

| Benefits of optimized intake

|

Risks of poor intake

|

| Alignment of portfolio with business goals

|

Portfolio overrun by off-the-grid projects

|

| Resources assigned to high-value projects

|

Resources assigned to low-value projects

|

| Better throughput of projects in the portfolio

|

Ever-growing project backlog

|

| Strong stakeholder relations

|

Stakeholders lose faith in value of PMO

|

Info-Tech Insight

Intake is intimately bound to stakeholder management. Finding the right balance of friction for your team is the key to successfully walking the line between asking for too much and not asking for enough. If your intake process is strong, stakeholders will no longer have any reason to circumvent formal process.

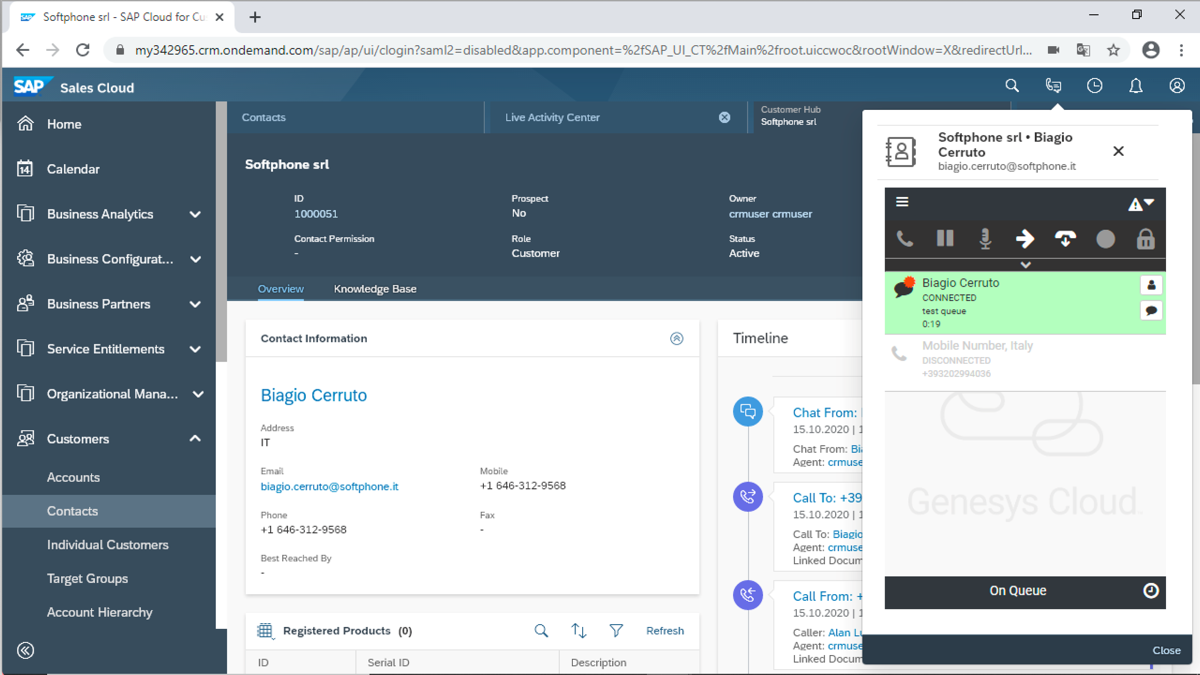

An excess number of intake channels is the telltale sign of a low capability level for intake

Excess intake channels are also a symptom of a portfolio in turmoil.

If you relate to the graphic below in any way, your first priority needs to be limiting the means by which projects get requested. A single, centralized channel with review and approval done in batches is the goal. Otherwise, with IT’s limited capacity, most requests will simply get added to the backlog.

Info-Tech Insight

The PMO needs to have the authority – and needs to exercise the authority – to enforce discipline on stakeholders. Organizations that solicit in verbal requests (by phone, in person, or during scrum) lack the orderliness required for PPM success. In these cases, it needs to be the mission of the PMO to demand proper documentation and accountability from stakeholders before proceeding with requests.

"The golden rule for the project documentation is that if anything during the project life cycle is not documented, it is the same as if it does not exist or never happened…since management or clients will never remember their undocumented requests or their consent to do something."

– Dan Epstein, “Project Initiation Process: Part Two”

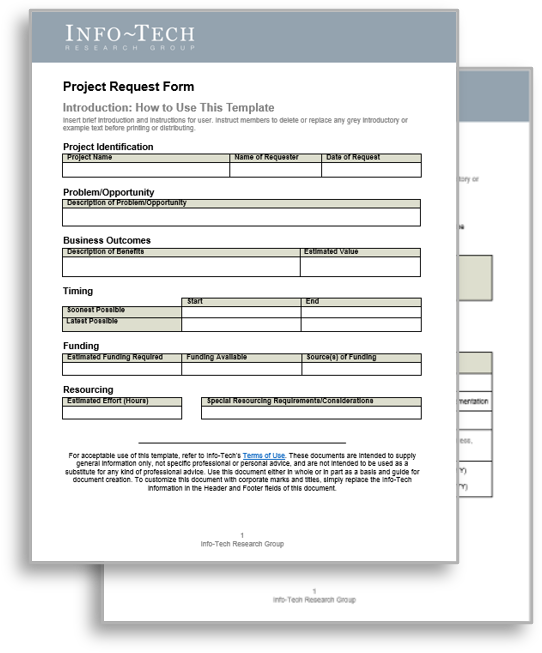

Develop an intake workflow

Info-Tech recommends following a four-step process for managing intake.

1. Requestor fills out form and submits the request.

Project Request Form Templates

2. Requests are triaged into the proper queue.

- Divert non-project request

- Quickly assess value and urgency

- Assign specialist to follow up on request

- Inform the requestor

Project Intake Classification Matrix

3. BA or PM prepares to develop requests into a project proposal.

- Follow up with requestor and SMEs to refine project scope, benefits, and risks

- Estimate size of project and determine the required level of detail for proposal

- Prepare for concept approval

Benefits Commitment Form Template

4. Requestor is given realistic expectations for approval process.

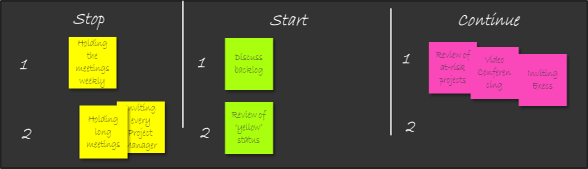

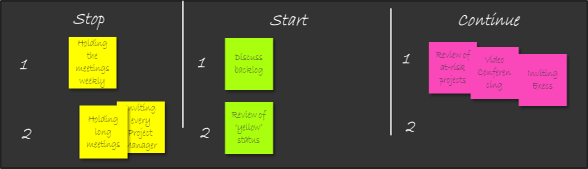

Perform a start-stop-continue exercise to help determine what is working and what is not working

2.1.1 Estimated Time: 45 minutes

Optimizing project intake may not require a complete overhaul of your existing processes. You may only need to tweak certain templates or policies. Perhaps you started out with a strong process and simply lost resolve over time – in which case you will need to focus on establishing motivation and discipline, rather than rework your entire process.

Perform a start-stop-continue exercise with your team to help determine what should be salvaged, what should be abandoned, and what should be introduced:

| 1. On a whiteboard or equivalent, write “Start,” “Stop,” and “Continue” in three separate columns.

|

3. As a group, discuss the responses and come to an agreement as to which are most valid.

|

| 2. Equip your team with sticky notes or markers and have them populate the columns with ideas and suggestions surrounding your current processes.

|

4. Document the responses to help structure your game plan for intake optimization.

|

| Start

|

Stop

|

Continue

|

- Explicitly manage follow-up expectations with project requestor

|

- Receiving informal project requests

- Take too long in proposal development

|

- Quarterly approval meetings

- Approve resources for proposal development

|

INPUT

- Current project intake workflow (Activity 1.2.2)

- Project intake success criteria (Activity 1.2.6)

OUTPUT

- Retrospective review of current intake process

Materials

- Whiteboard

- Sticky notes/markers

Participants

- PMO Director/ Portfolio Manager

- Project Managers

- Business Analysts

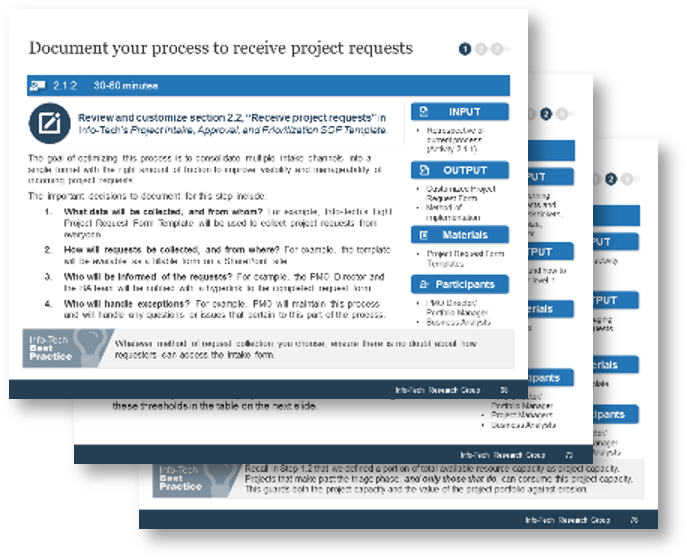

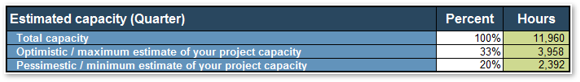

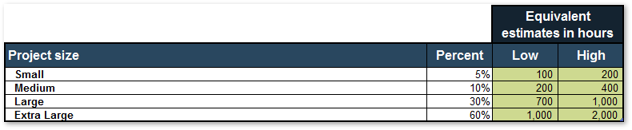

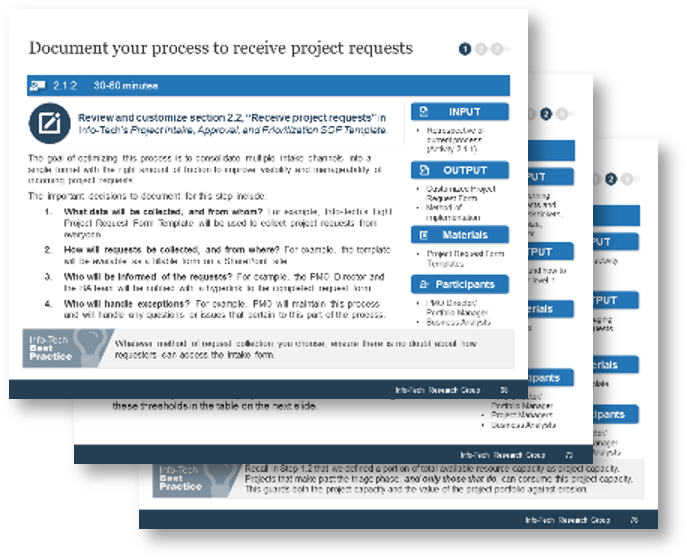

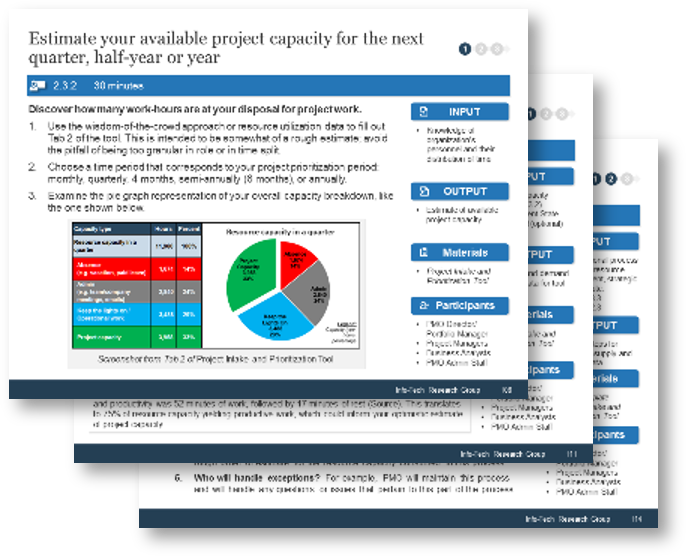

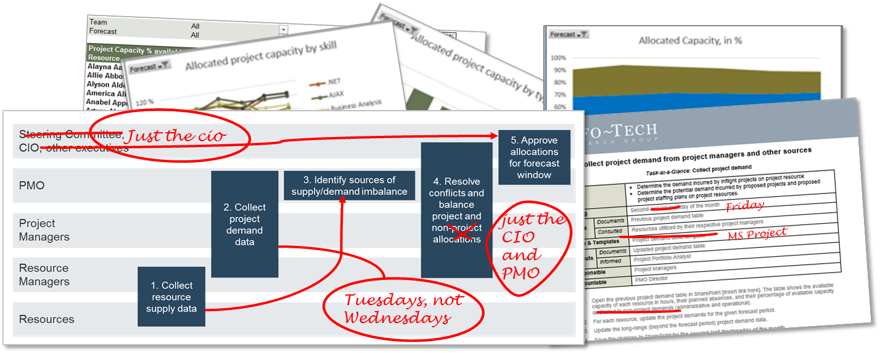

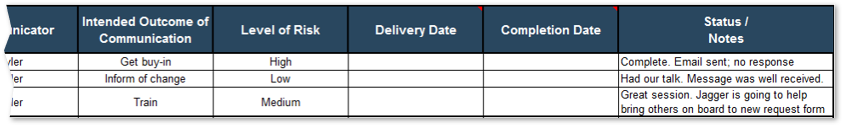

- PMO Admin Staff