Further reading

Spread Best Practices With an Agile Center of Excellence

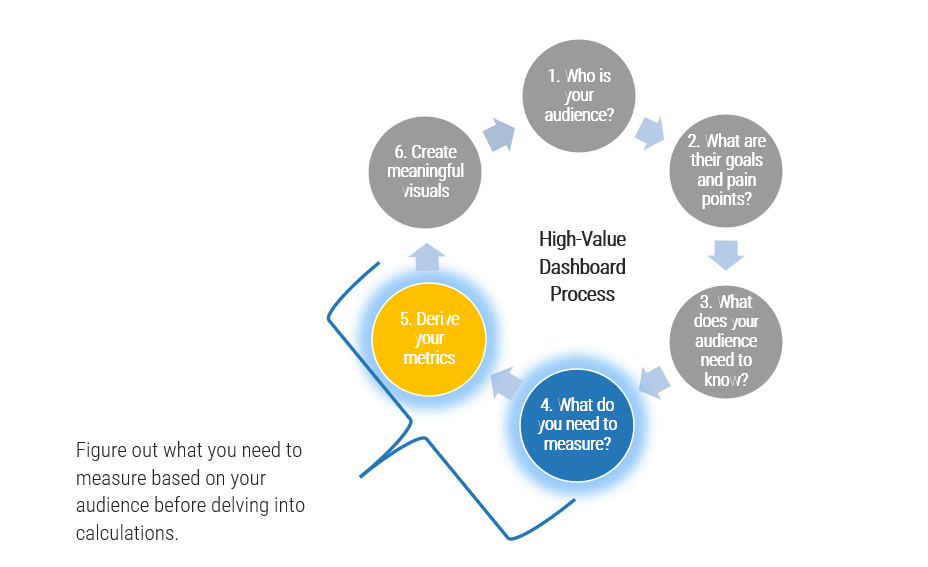

Achieve ongoing alignment between Agile teams and the business with a set of targeted service offerings.

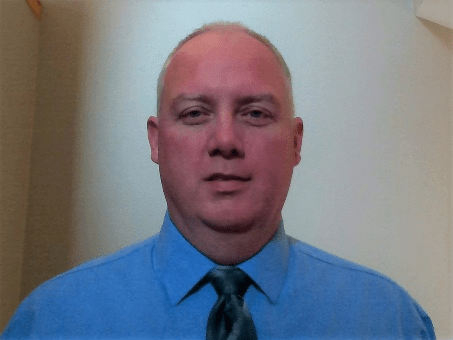

ANALYST PERSPECTIVE

"Inconsistent processes and practices used across Agile teams is frequently cited as a challenge to adopting and scaling Agile within organizations. (VersionOne’s 13th Annual State of Agile Report [N=1,319]) Creating an Agile Center of Excellence (ACE) is a popular way to try to impose structure and improve performance. However, simply establishing an ACE does not guarantee you will be successful with Agile. When setting up an ACE you must: Define ACE services based on identified stakeholder needs. Staff the ACE with respected, “hands on” people, who deliver identifiable value to your Agile teams. Continuously evolve ACE service offerings to maximize stakeholder satisfaction and value delivered."

Alex Ciraco, Research Director, Applications Practice Info-Tech Research Group

Our understanding of the problem

This Research Is Designed For:

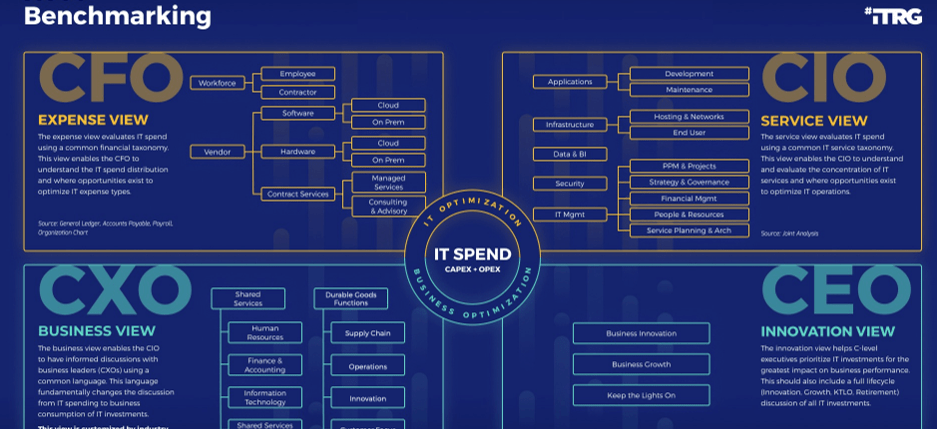

- A CIO who is looking for a way to optimize their Agile capabilities and ensure ongoing alignment with business objectives.

- An applications director who is looking for mechanisms to inject continuous improvement into organization-wide Agile practices.

This Research Will Help You:

- Align your Agile support structure with business objectives and the functional expectations of its users.

- Standardize the ways in which Agile teams develop and learn to create consistency in purpose and execution.

- Track and communicate successes to ensure the long-term viability of an Agile Center of Excellence (ACE).

This Research Will Also Assist

- Project managers who are tasked with managing Agile projects.

- Application development managers who are struggling with establishing consistency, transparency, and collaboration across their teams.

This Research Will Help Them:

- Provide service offerings to their team members that will help them personally and collectively to develop desired skills.

- Provide oversight and transparency into Agile projects and outcomes through ongoing monitoring.

Executive summary

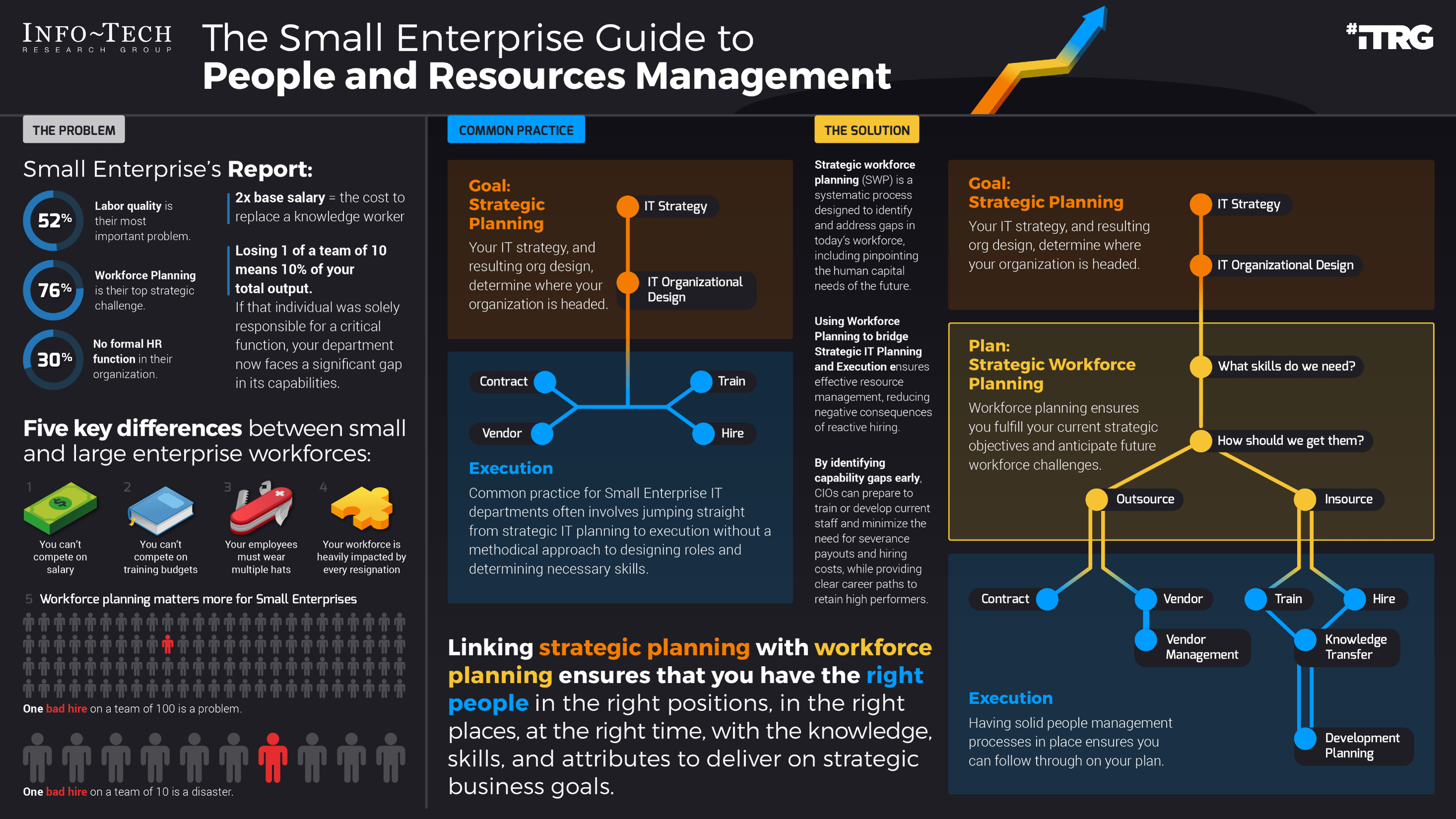

Situation

- Your organization has had some success with Agile, but needs to drive consistency across Agile teams for better business results and alignment.

- You are seeking to organically grow Agile capabilities within the organization through a set of support services and facilitated through shared learning and capabilities.

Complication

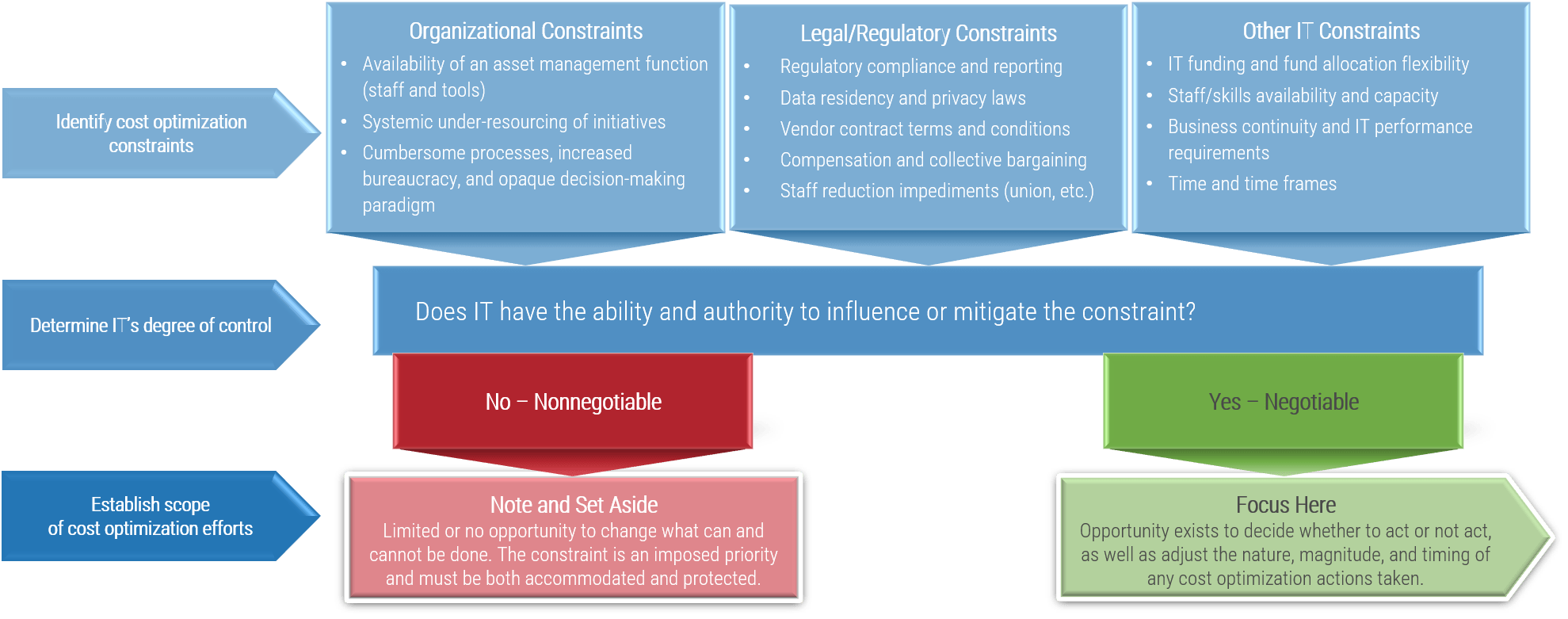

- Organizational constraints, culture clash, and lack of continuous top-down support are hampering your Agile growth and maturity.

- Attempts to create consistency across Agile teams and processes fail to account for the expectations of users and stakeholders, leaving them detached from projects and creating resistance.

Resolution

- Align the service offerings of your ACE with both corporate objectives and the functional expectations of its stakeholders to ensure broad support and utilization of the invested resources.

- Understand some of the culture and process challenges you will face when forming an ACE, and address them using Info-Tech’s Agile adoption journey model.

- Track the progress of the ACE and your Agile teams. Use this data to find root causes for issues, and ideate to implement solutions for challenges as they arise over time.

- Effectively define and propagate improvements to your Agile teams in order to drive business-valued results.

- Communicate progress to interested stakeholders to ensure long-term viability of the Center of Excellence (CoE).

Info-Tech Insight

- Define ACE services based on stakeholder needs.Don’t assume you know what your stakeholders need without talking to them.

- Staff the ACE strategically. Choose those who are thought leaders and proven change agents.

- Continuously improve based on metrics and feedback.Constantly monitor how your ACE is performing and adjust to feedback.

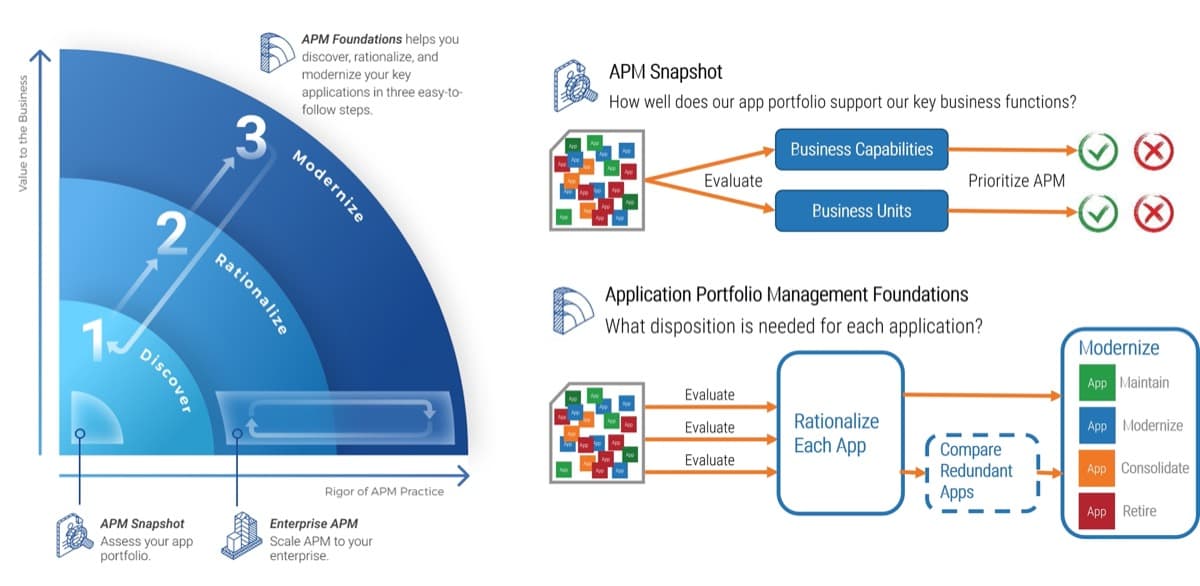

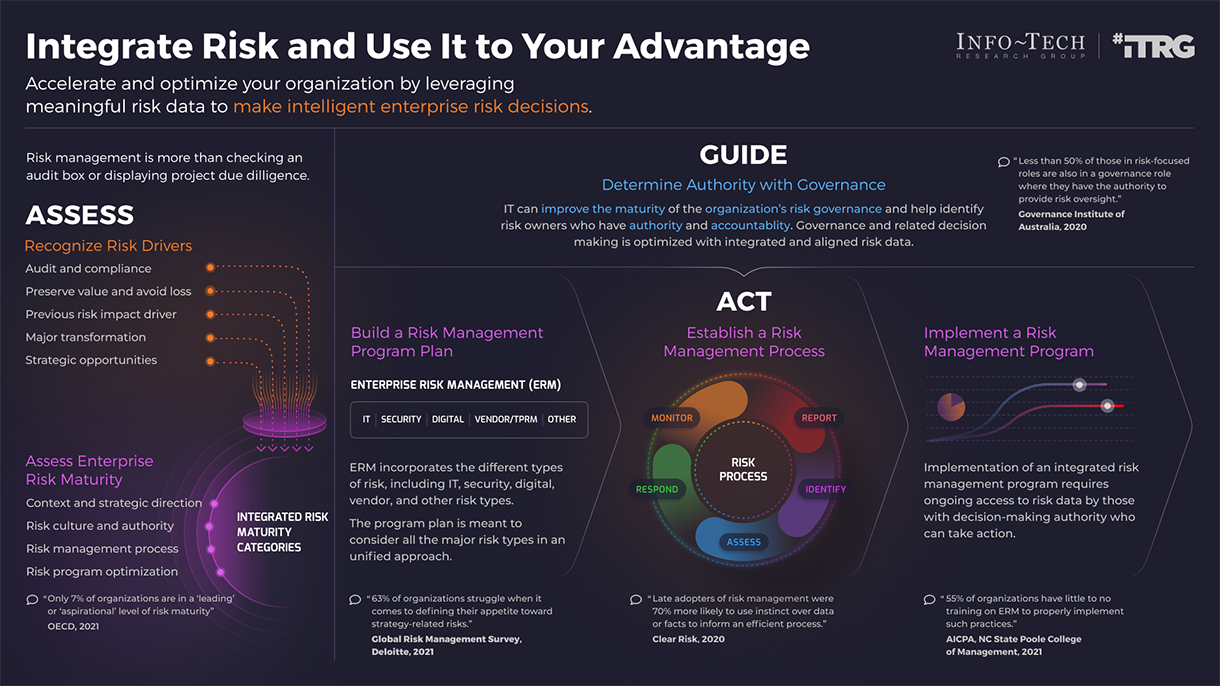

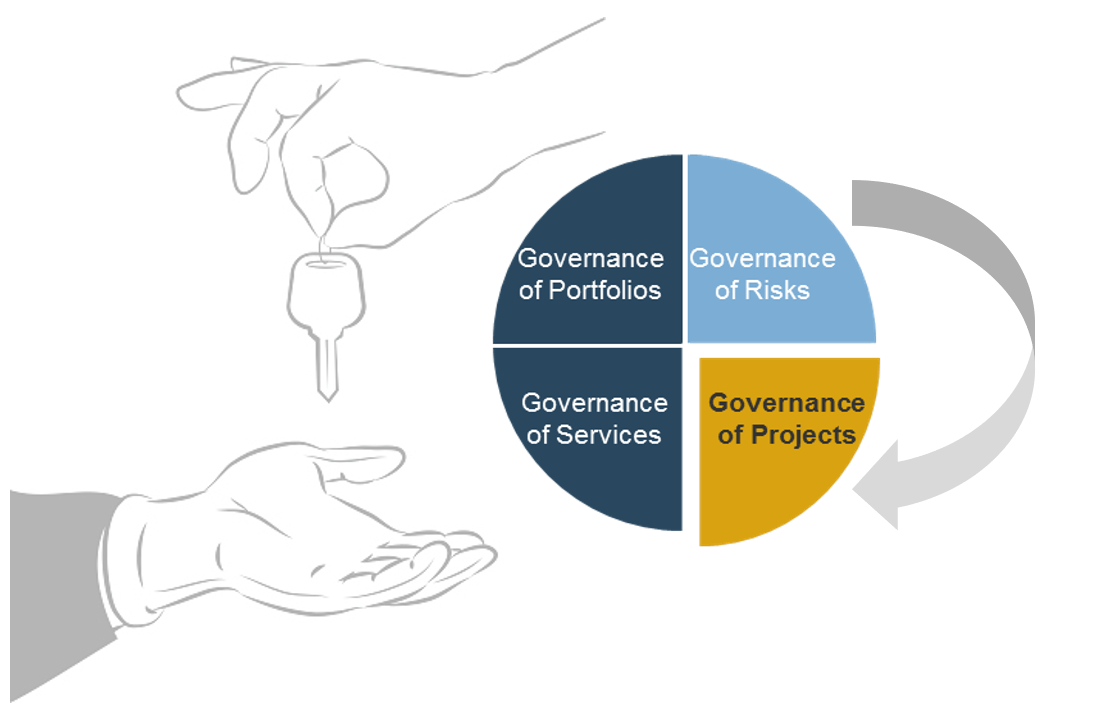

Info-Tech’s Agile Journey related Blueprints

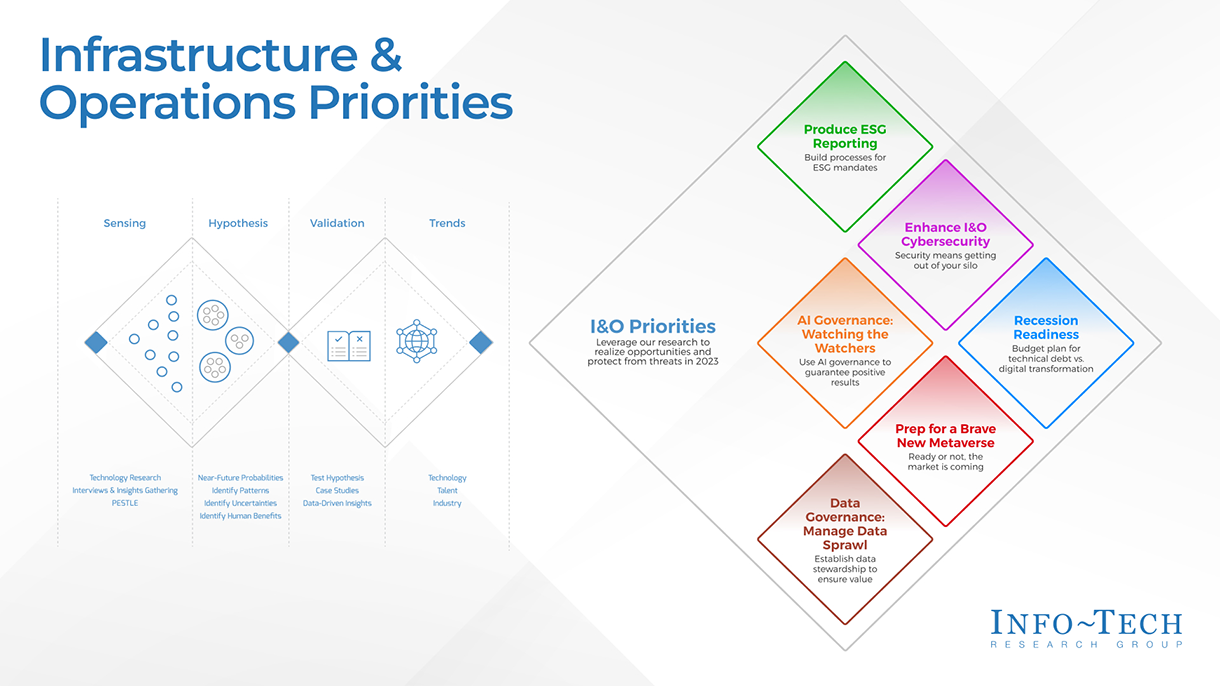

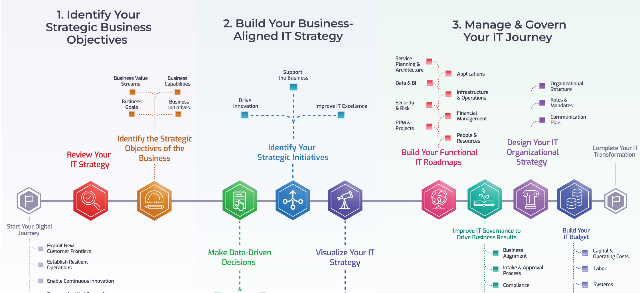

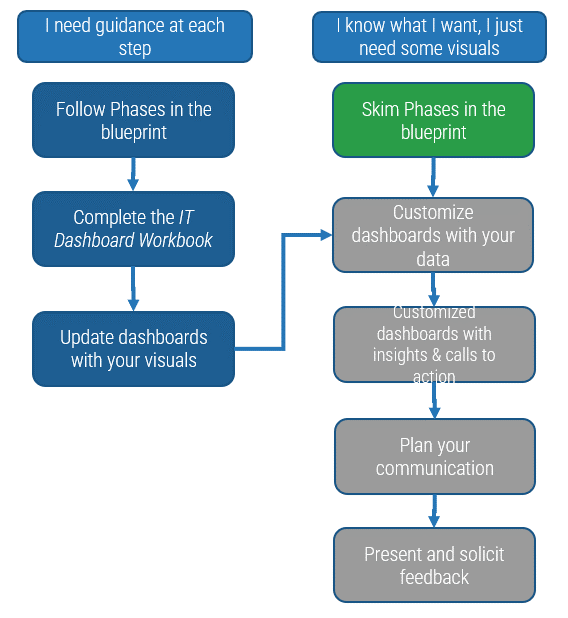

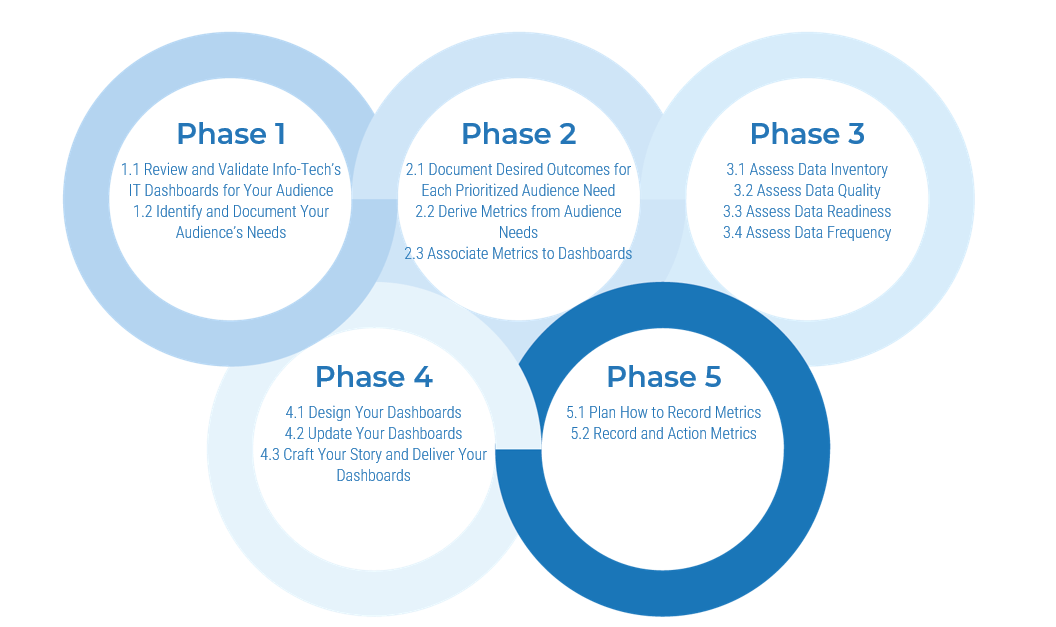

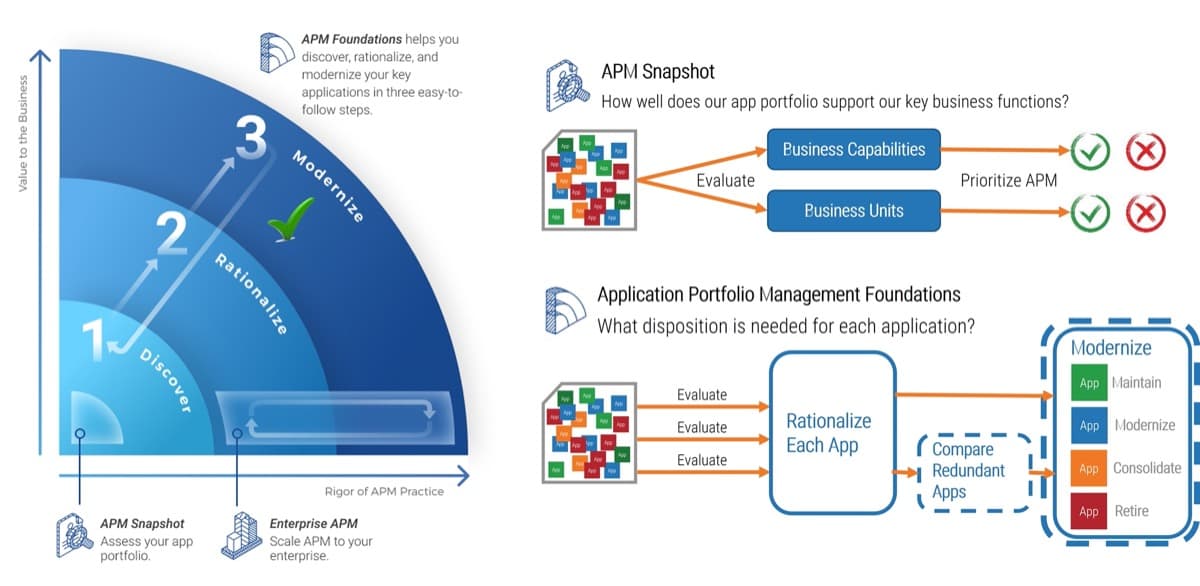

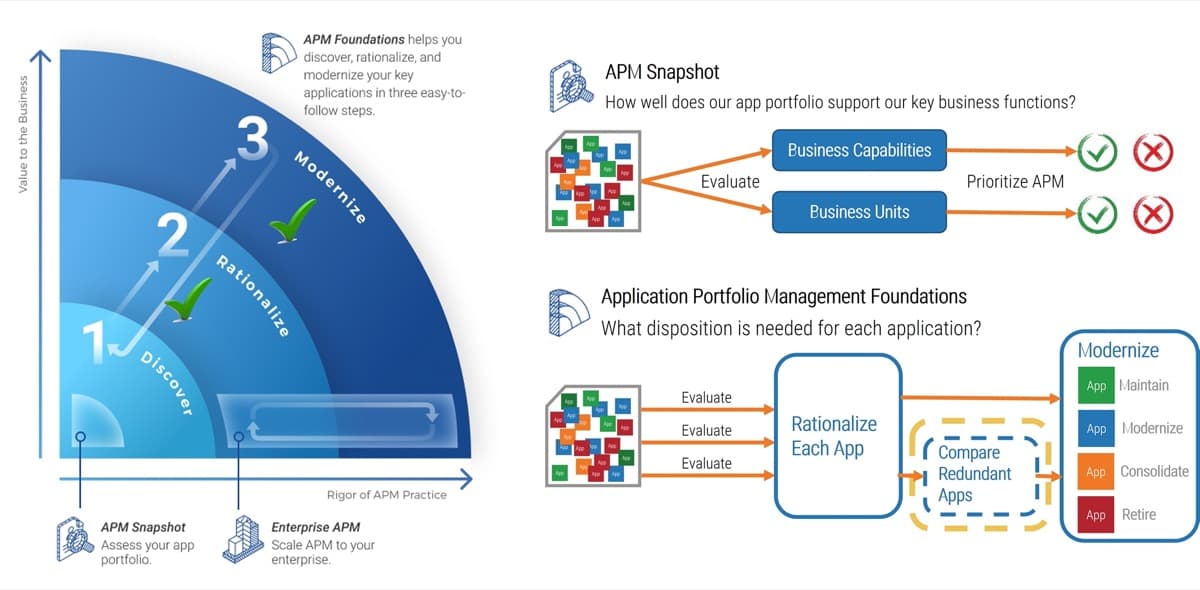

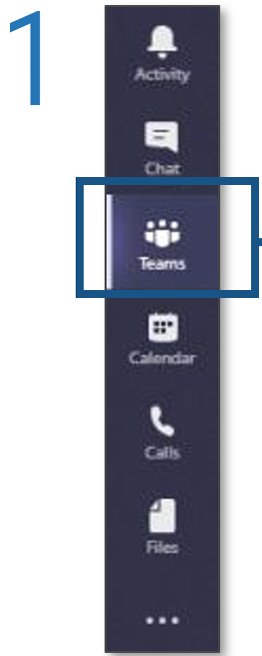

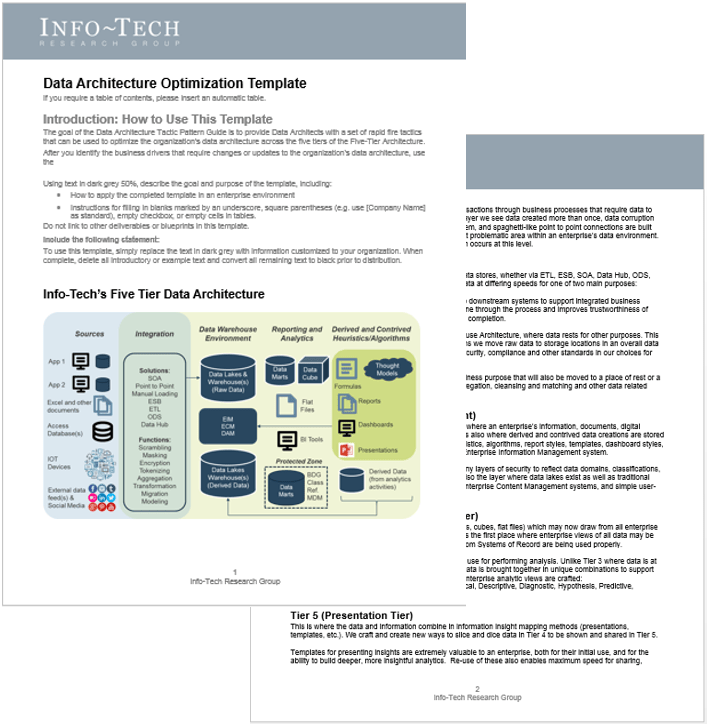

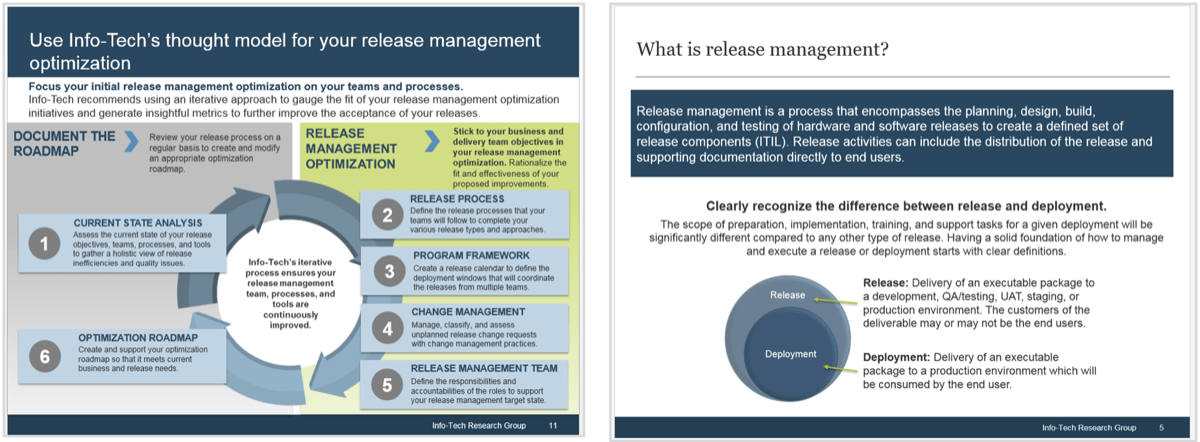

1. Stabilize

Implement Agile Practices That Work

Begin your Agile transformation with a comprehensive readiness assessment and a pilot project to adopt Agile development practices and behaviors that fit.

2. Sustain

YOU ARE HERE

Spread Best Practices with an Agile Center of Excellence

Form an ACE to support Agile development at all levels of the organization with thought leadership, strategic development support & process innovation.

3. Scale

Enable Organization-Wide Collaboration by Scaling Agile

Extend the benefits of your Agile pilot project into your organization by strategically scaling Agile initiatives that will meet stakeholders’ needs.

4. Satisfy

Transition to Product Delivery Introduce product-centric delivery practices to drive greater benefits and better delivery outcomes.

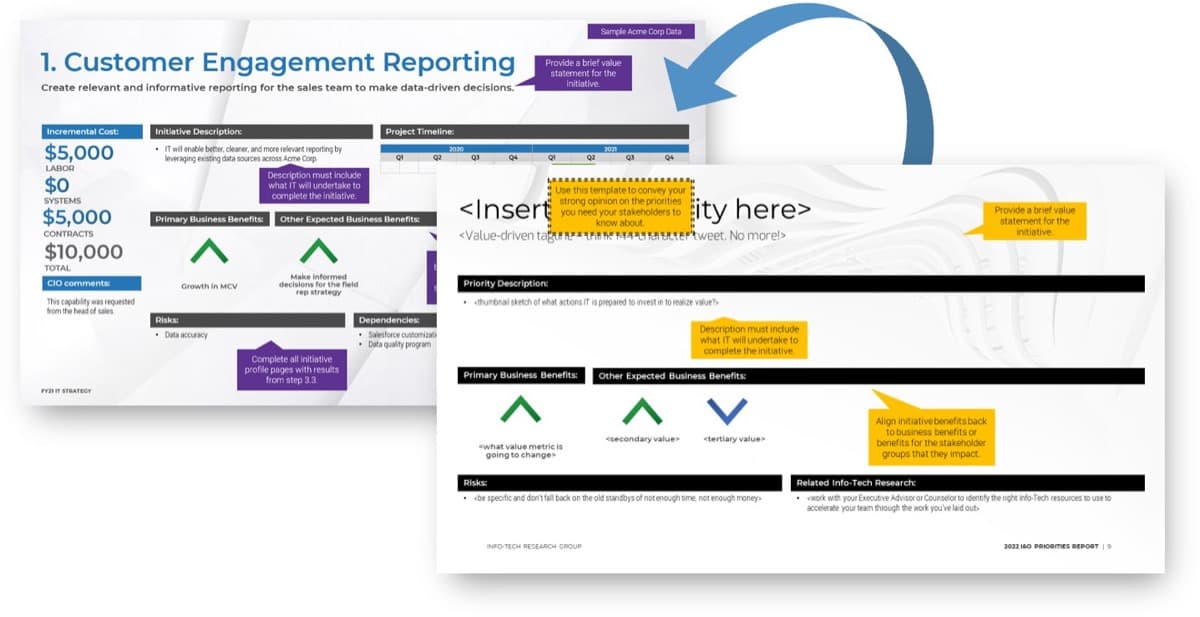

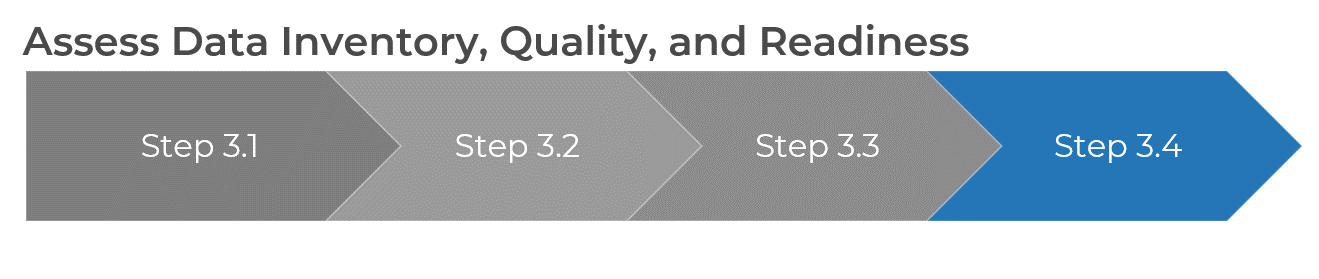

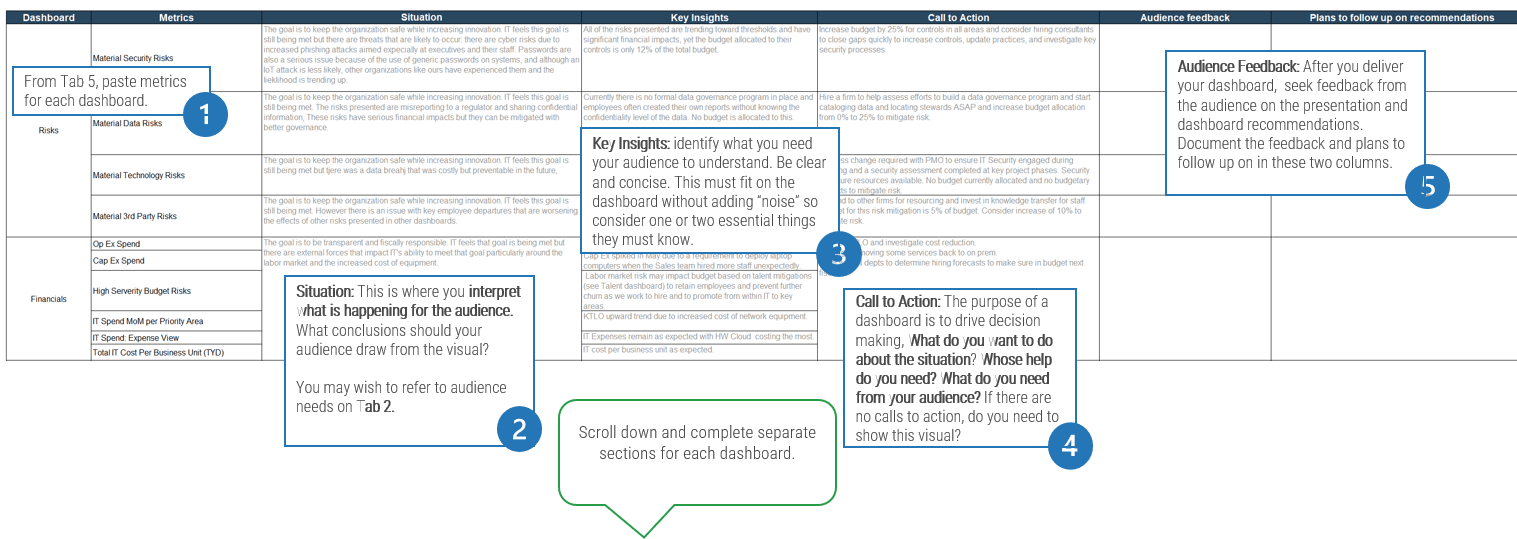

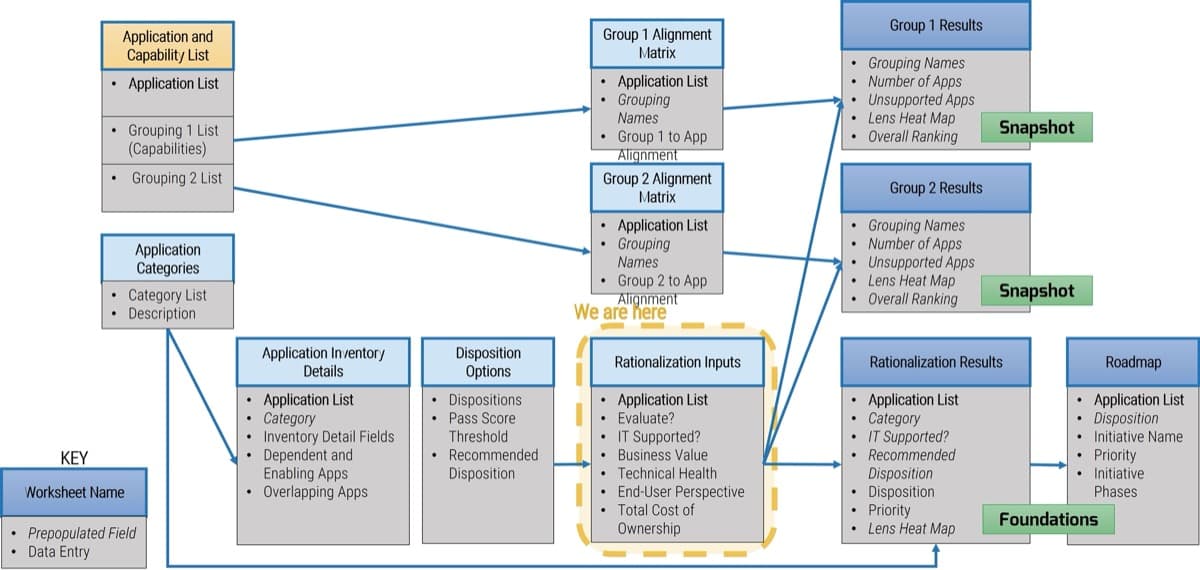

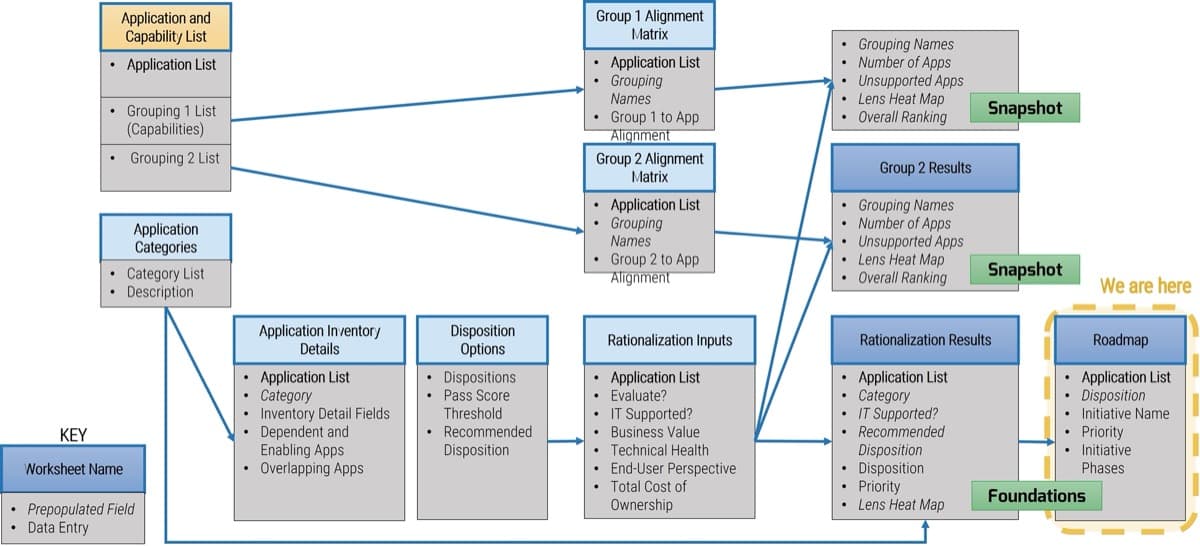

1.1 Determine the vision of your ACE

1.2 Define the service offerings of your ACE

2.1 Define an adoption plan for Agile teams

2.2 Create an ACE engagement plan

2.3 Define metrics to measure success

3.1 Optimize the success of your ACE

3.2 Plan change to enhance your Agile initiatives

3.3 Conduct ongoing retrospectives

Supporting Capabilities and Practices

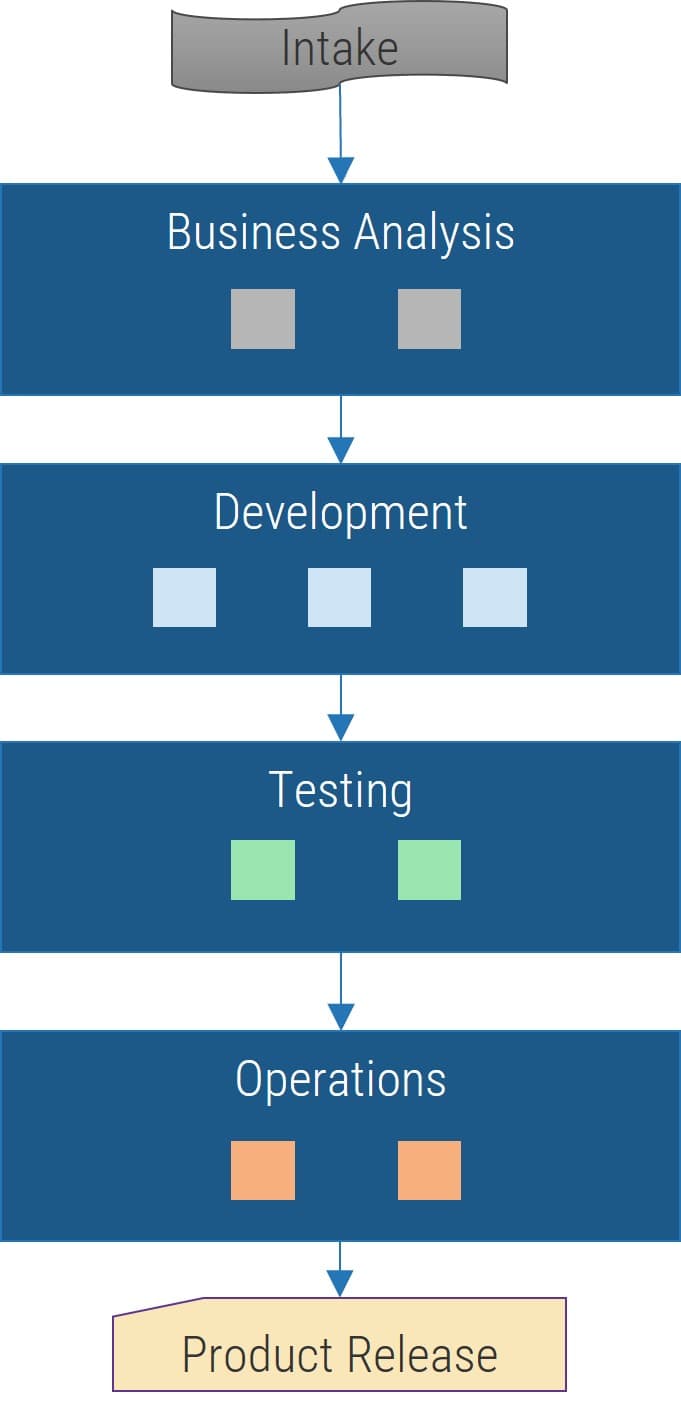

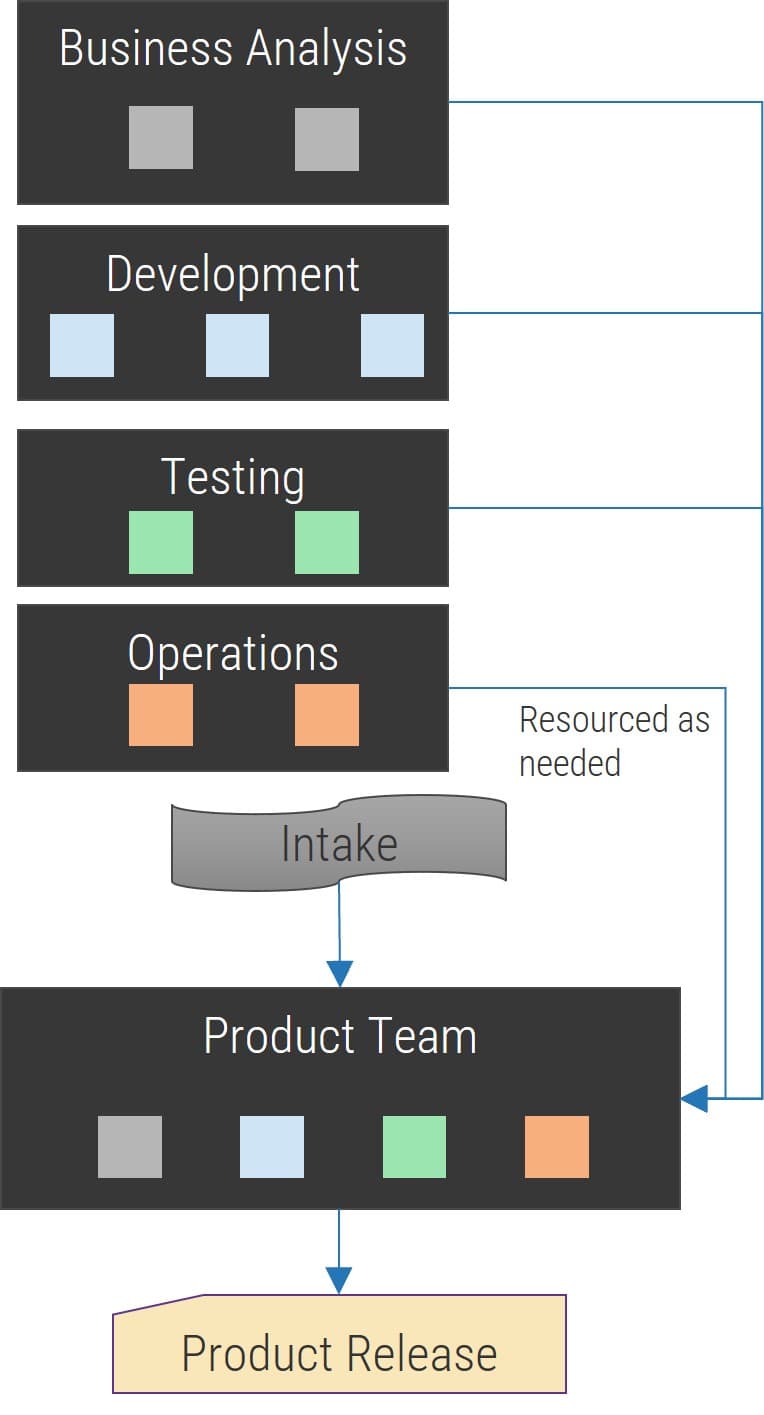

Modernize Your SDLC

Remodel the stages of your lifecycle to standardize your definition of a successful product.

Build a Strong Foundation for Quality

Instill quality assurance practices and principles in each stage of your software development lifecycle.

Implement DevOps Practices That Work

Fix, deploy, and support applications quicker though development and operations collaboration.

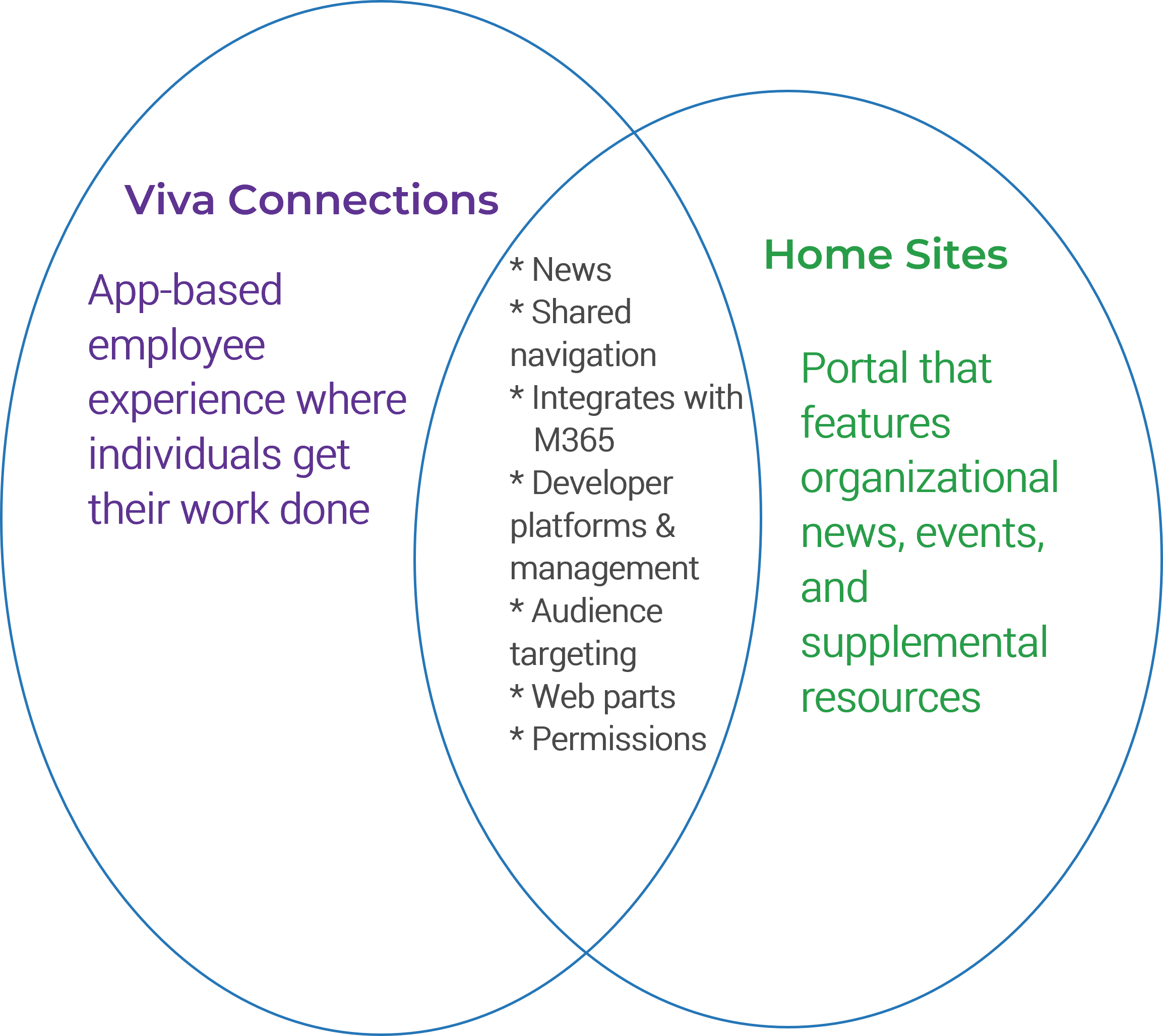

What is an Agile Center of Excellence?

NOTE: Organizational change is hard and prone to failure. Determine your organization’s level of readiness for Agile transformation (and recommended actions) by completing Info-Tech’s Agile Transformation Readiness Tool.

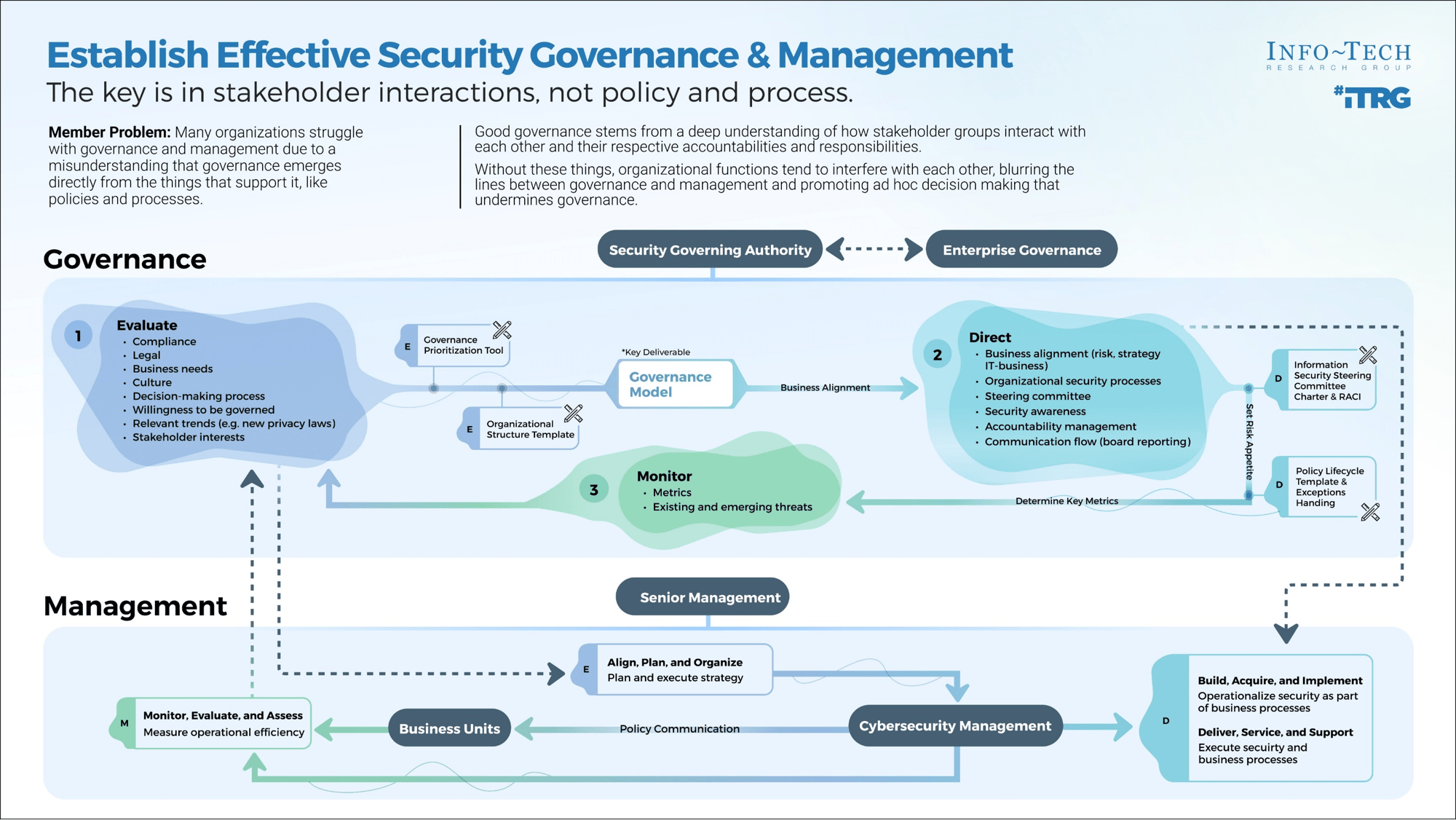

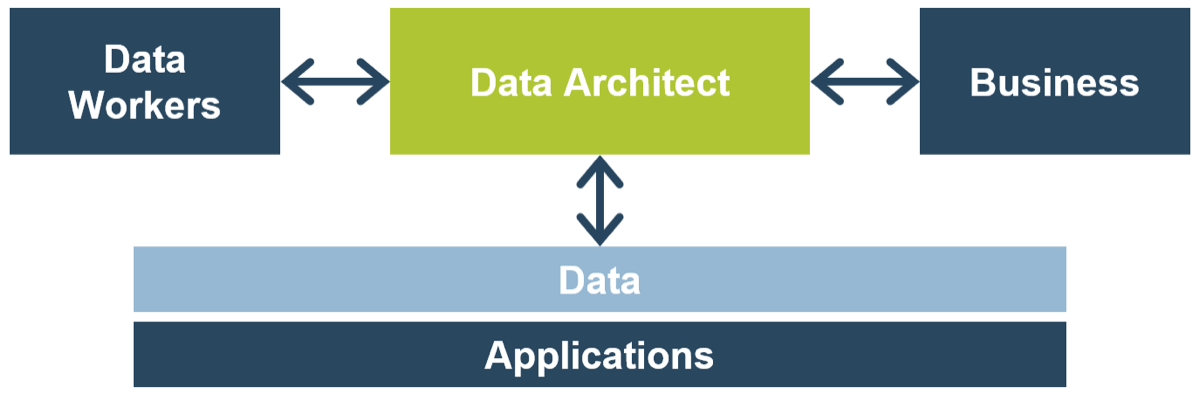

An ACE amplifies good practices that have been successfully employed within your organization, effectively allowing you to extend the benefits obtained from your Agile pilot(s) to a wider audience.

From the viewpoint of the business, members of the ACE provide expertise and insights to the entire organization in order to facilitate Agile transformation and ensure standard application of Agile good practices.

From the viewpoint of your Agile teams, it provides a community of individuals that share experiences and lessons learned, propagate new ideas, and raise questions or concerns so that delivering business value is always top of mind.

An ACE provides the following:

- A mechanism to gather thought leadership to maximize the accessibility and reach of your Agile investment.

- A mechanism to share innovations and ideas to facilitate knowledge transfer and ensure broadly applicable innovations do not go to waste.

- Strategic alignment to ensure that Agile practices are driving value towards business objectives.

- Purposeful good practices to ensure that the service offerings provided align with expectations of both your Agile practitioners and stakeholders.

SIDEBAR: What is a Community of Practice?

(And how does it differ from a CoE?)

Some organizations prefer Communities of Practice (CoP) to Centers of Excellence (CoE). CoPs are different from CoEs:

“A CoP is an affiliation of people who share a common practice and who have a desire to further the practice itself … and of course to share knowledge, refine best practices, and introduce standards. CoPs are defined by their domain of interest, but the membership is a social structure comprised of volunteer practitioners”

– Wenger, E., R. A. McDermott, et al. (2002) Cultivating communities of practice: A guide to managing knowledge, Harvard Business Press.

“CoPs differ from a CoE mainly in that they tend to have no geographical boundaries, they hold no hierarchical power within a firm, and they definitely can never have structure determined by the company. However, one of the most obvious and telling differences lies in the stated motive of members – CoPs exist because they have active practitioner members who are passionate about a specific practice, and the goals of a CoP are to refine and improve their chosen domain of practice – and the members provide discretionary effort that is not paid for by the employer”

– Matthew Loxton (June 1, 2011) CoP vs CoE – What’s the difference, and Why Should You Care?, Wordpress.com

What to know about CoPs:

- Less formal than a CoE

- Loosely organized by volunteer practitioners who are interested in advancing the practice.

- Not the Authoritative Voice

- Stakeholders engage the CoP voluntarily, and are not bound by them.

- Not funded by Organization

- CoP members are typically volunteers who provide support in addition to their daily responsibilities.

- Not covered in this Blueprint

- In depth analysis on CoPs is outside the scope of this Blueprint.

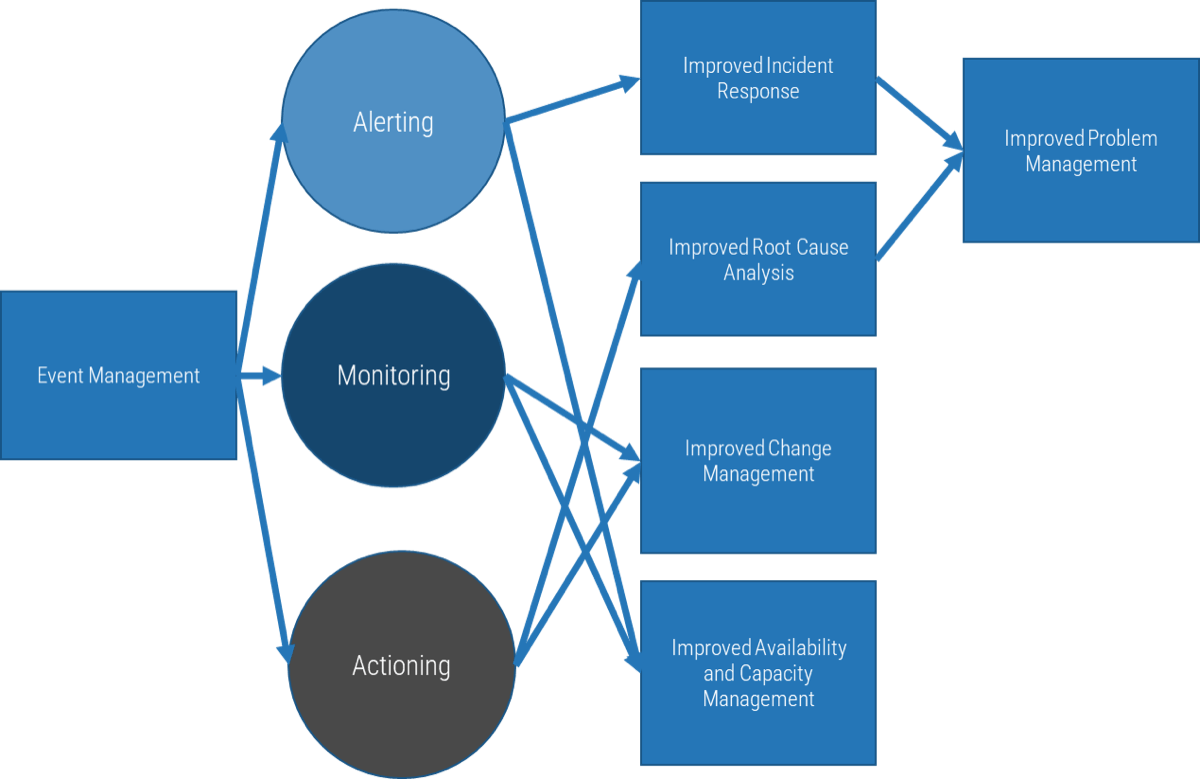

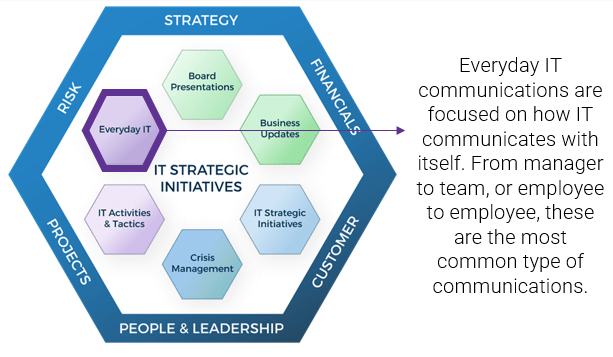

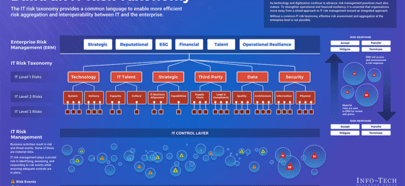

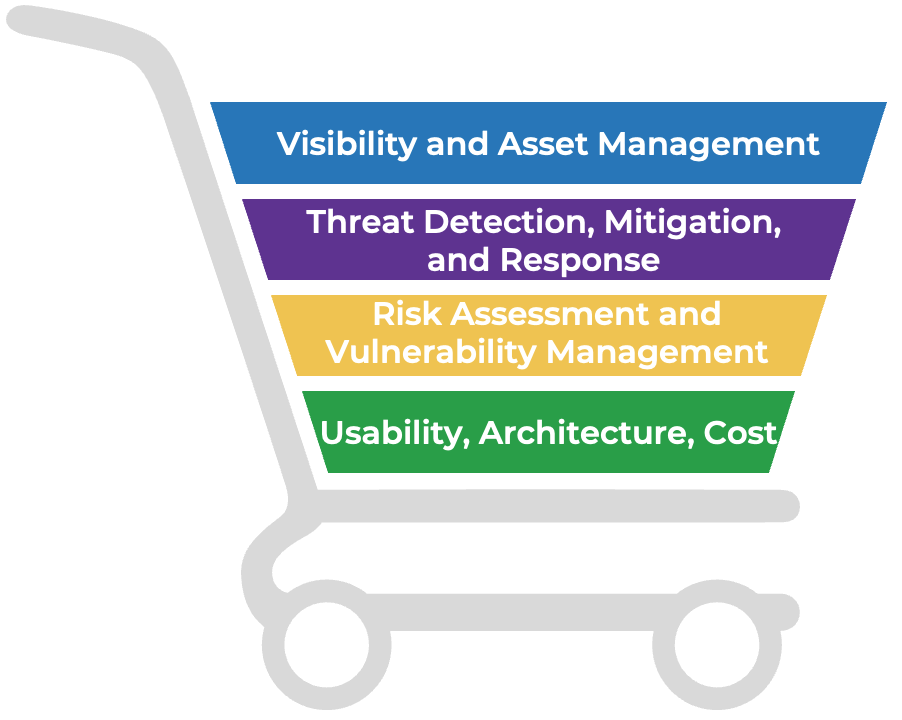

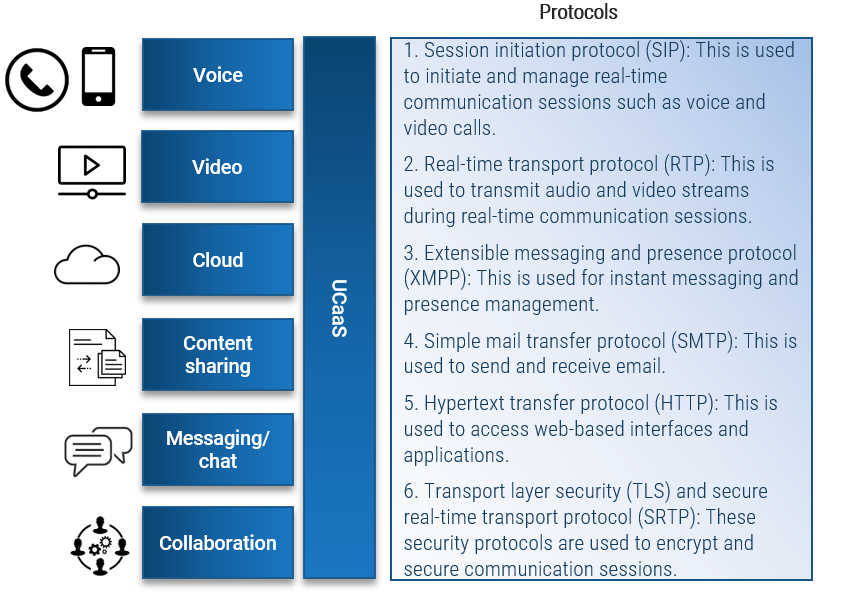

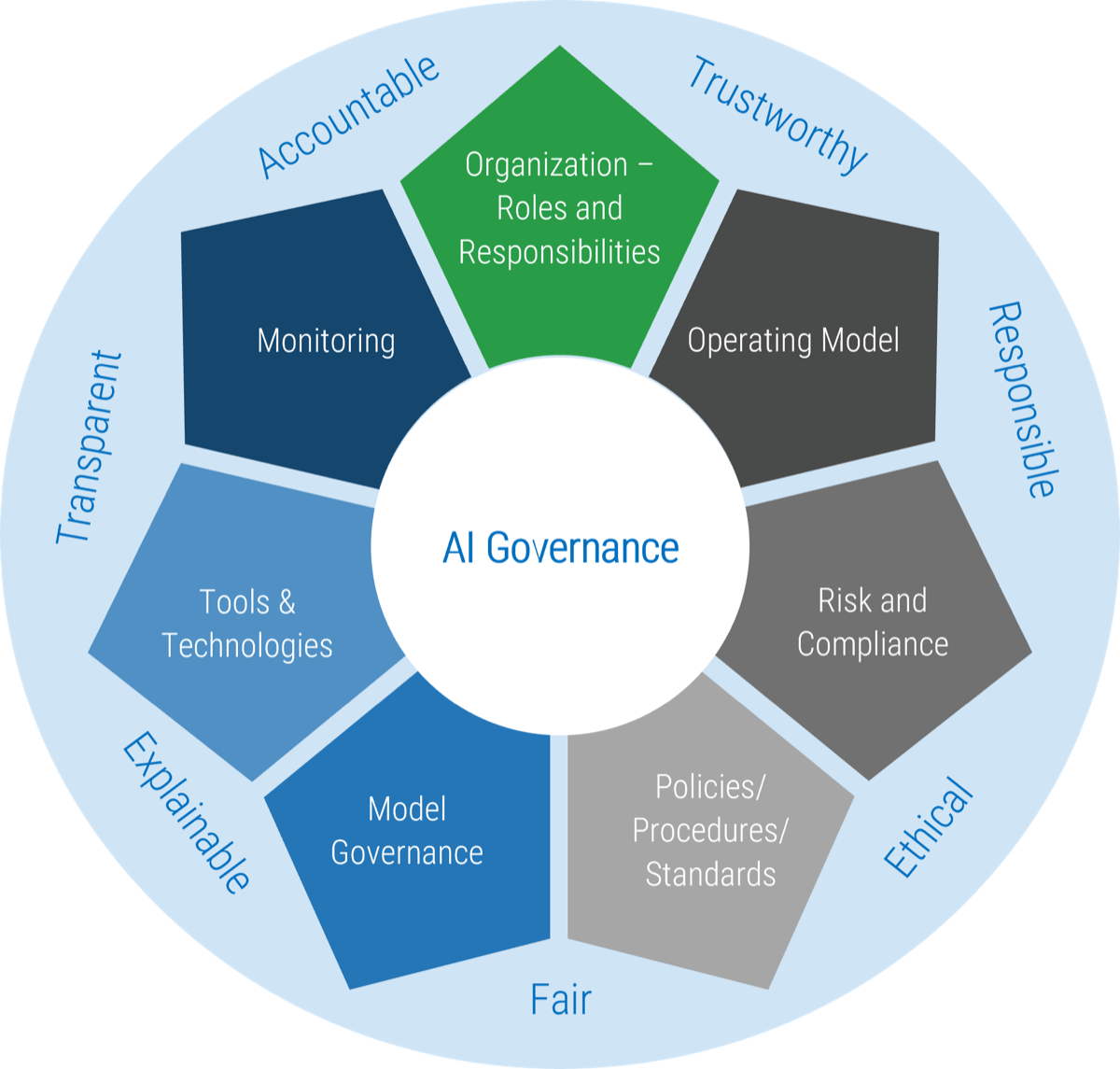

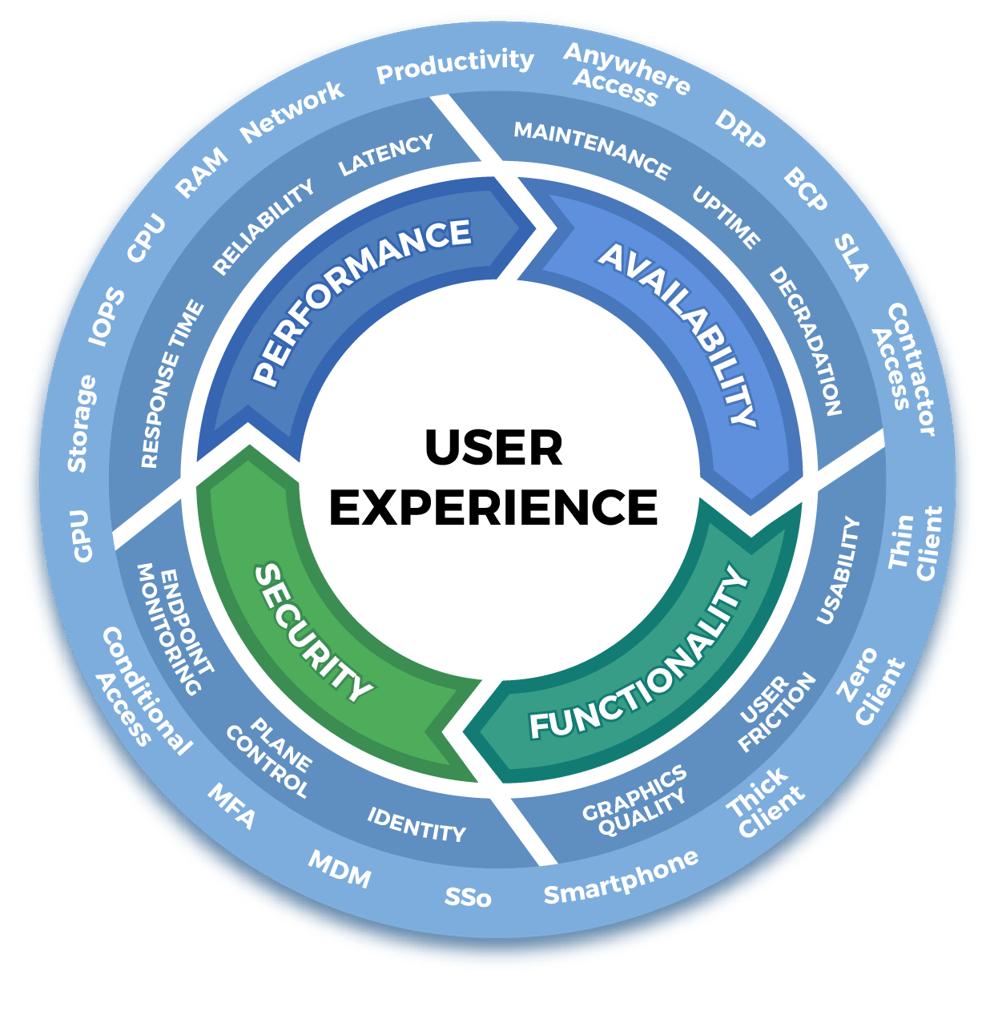

What does an ACE do?

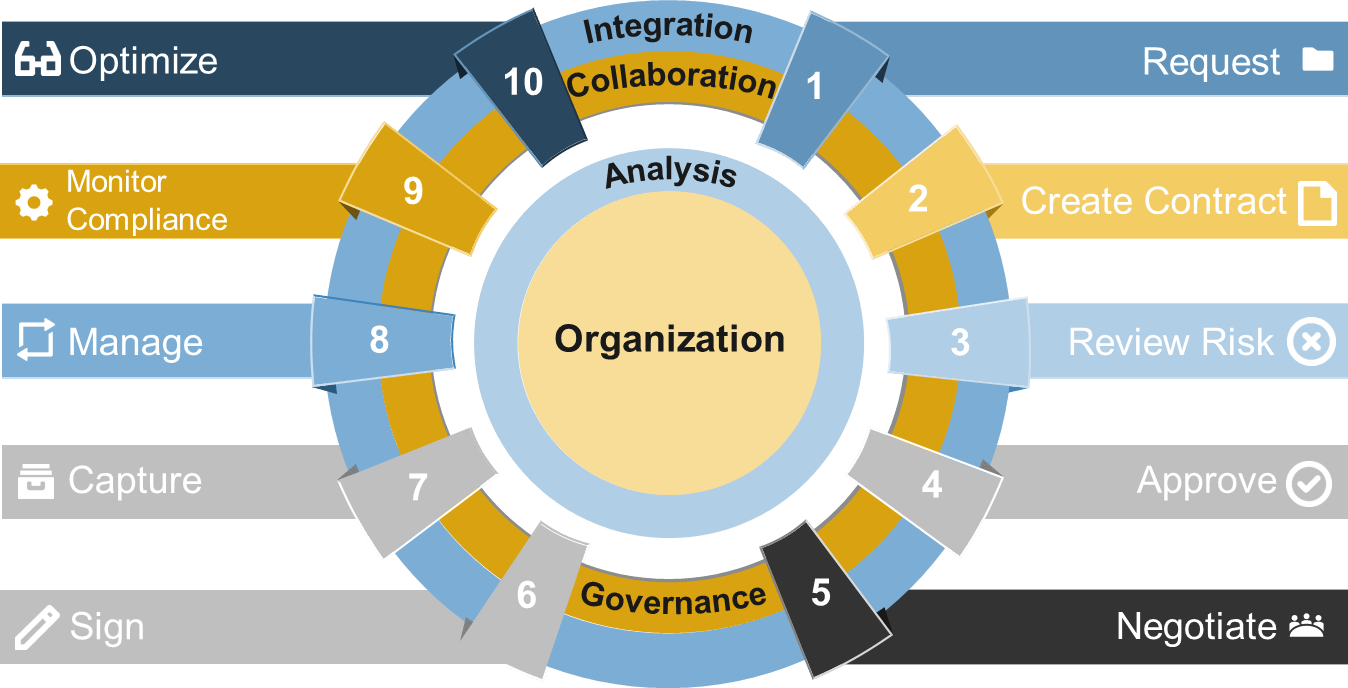

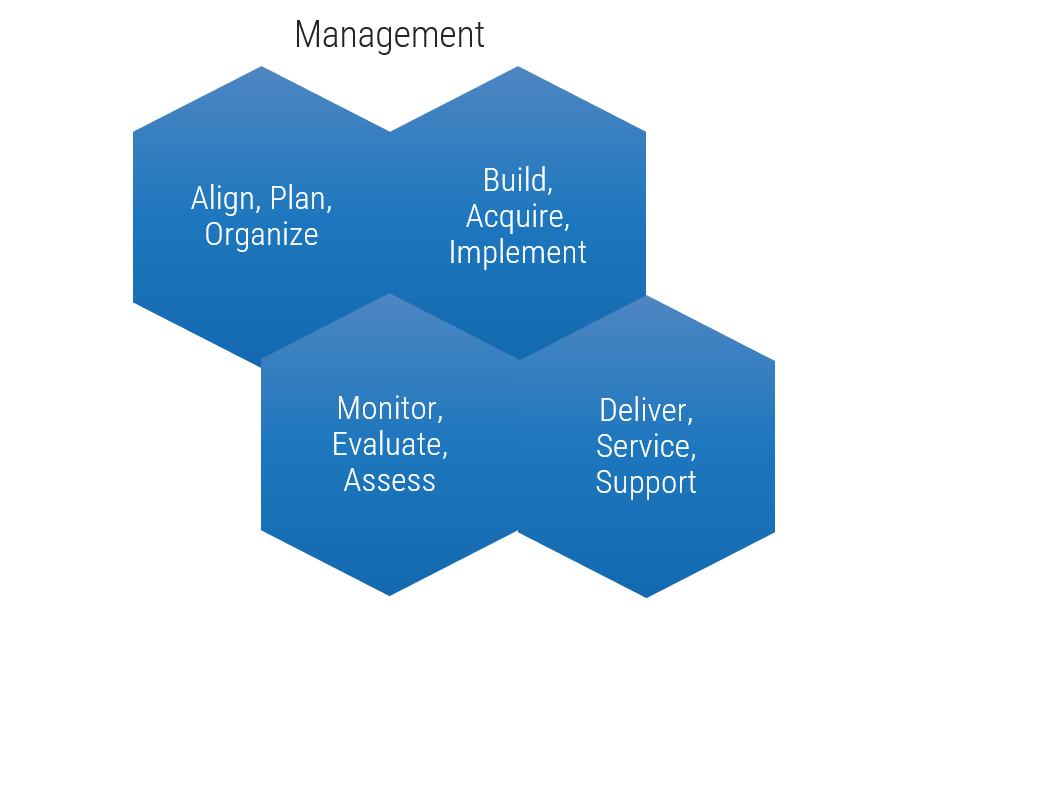

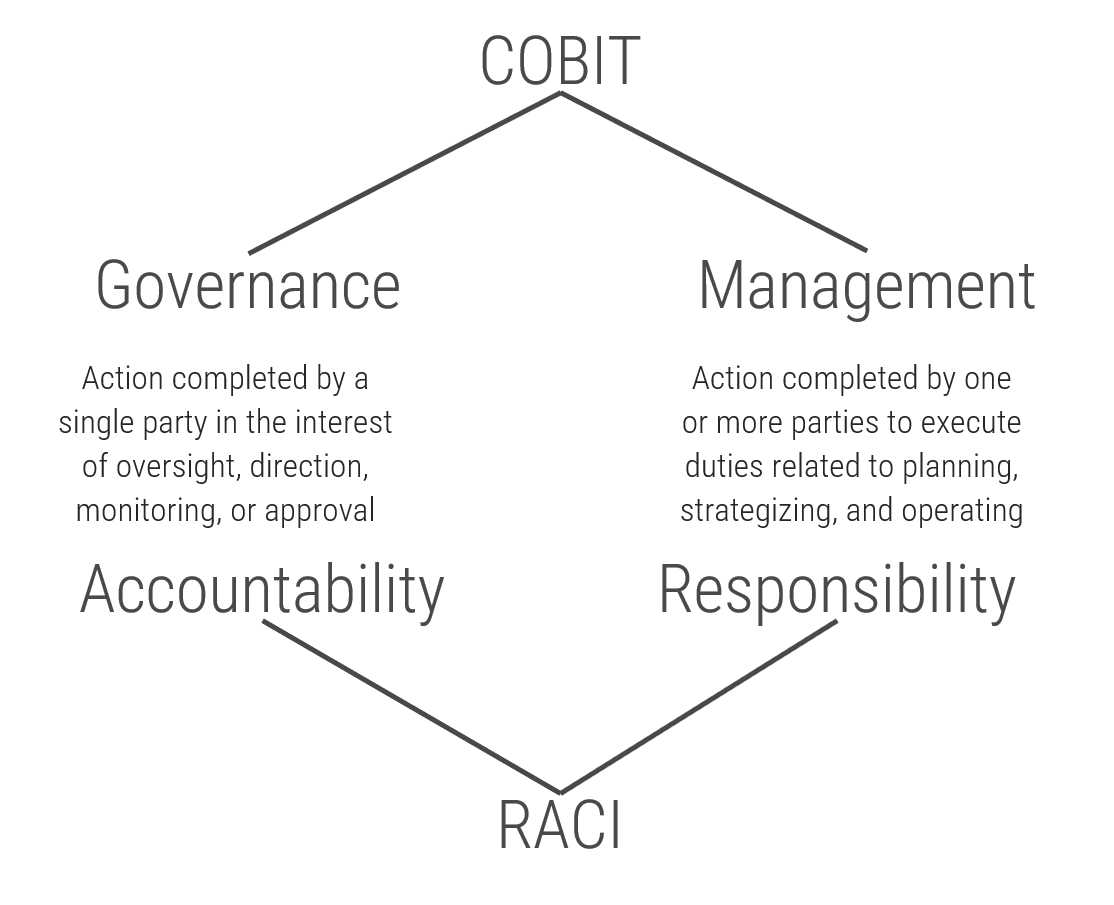

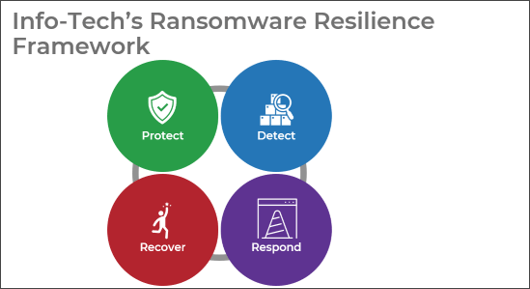

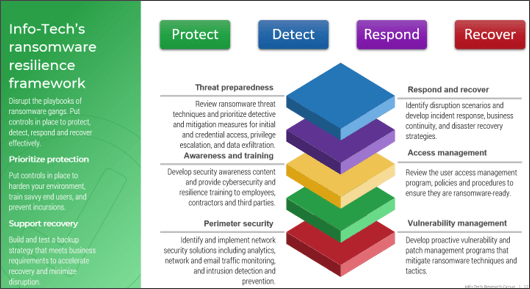

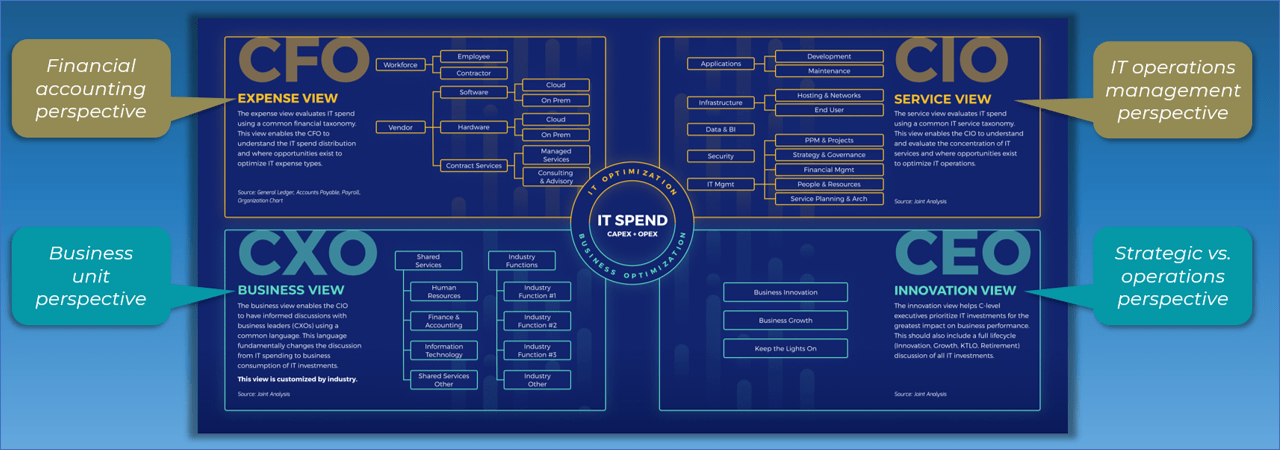

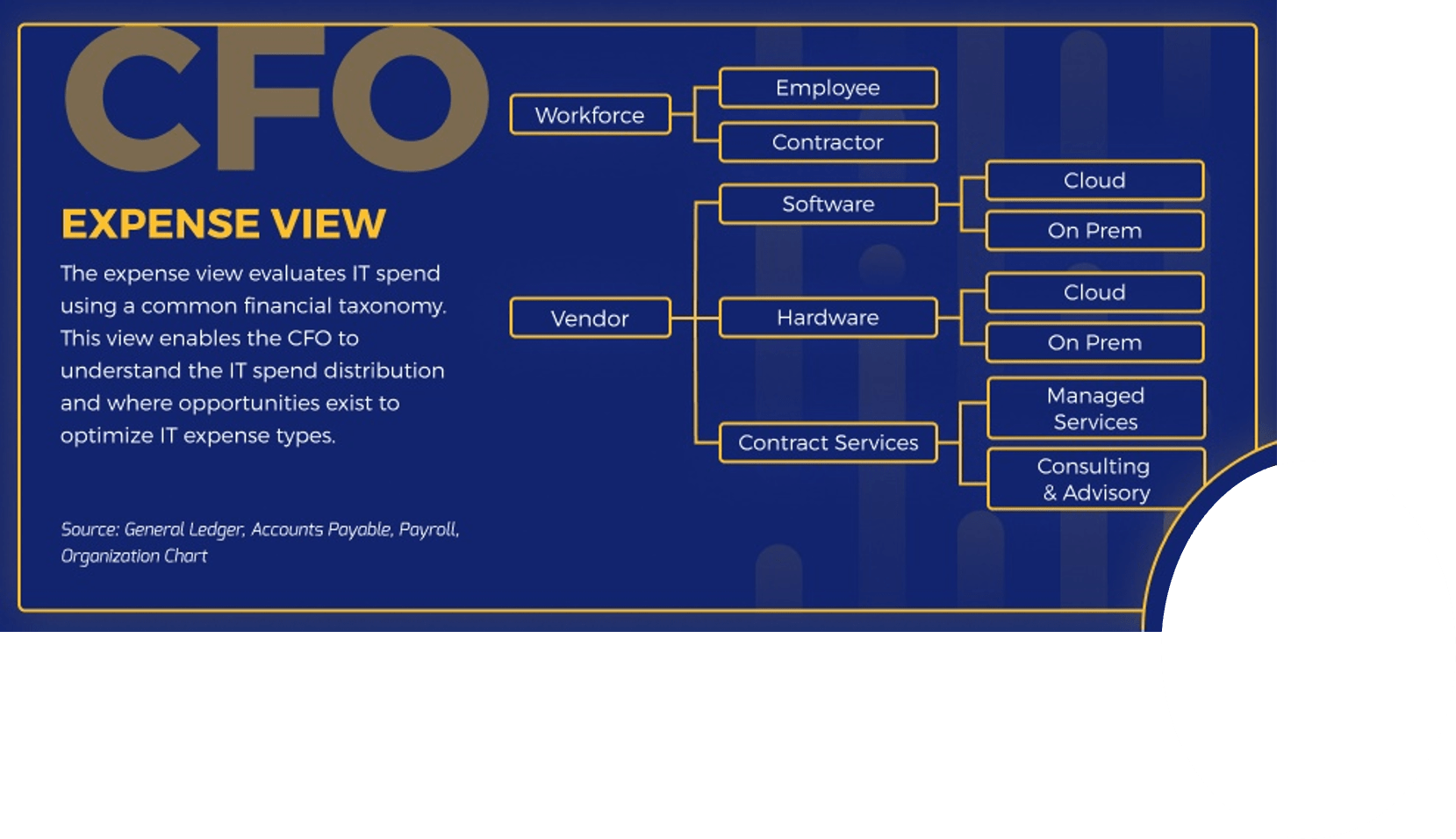

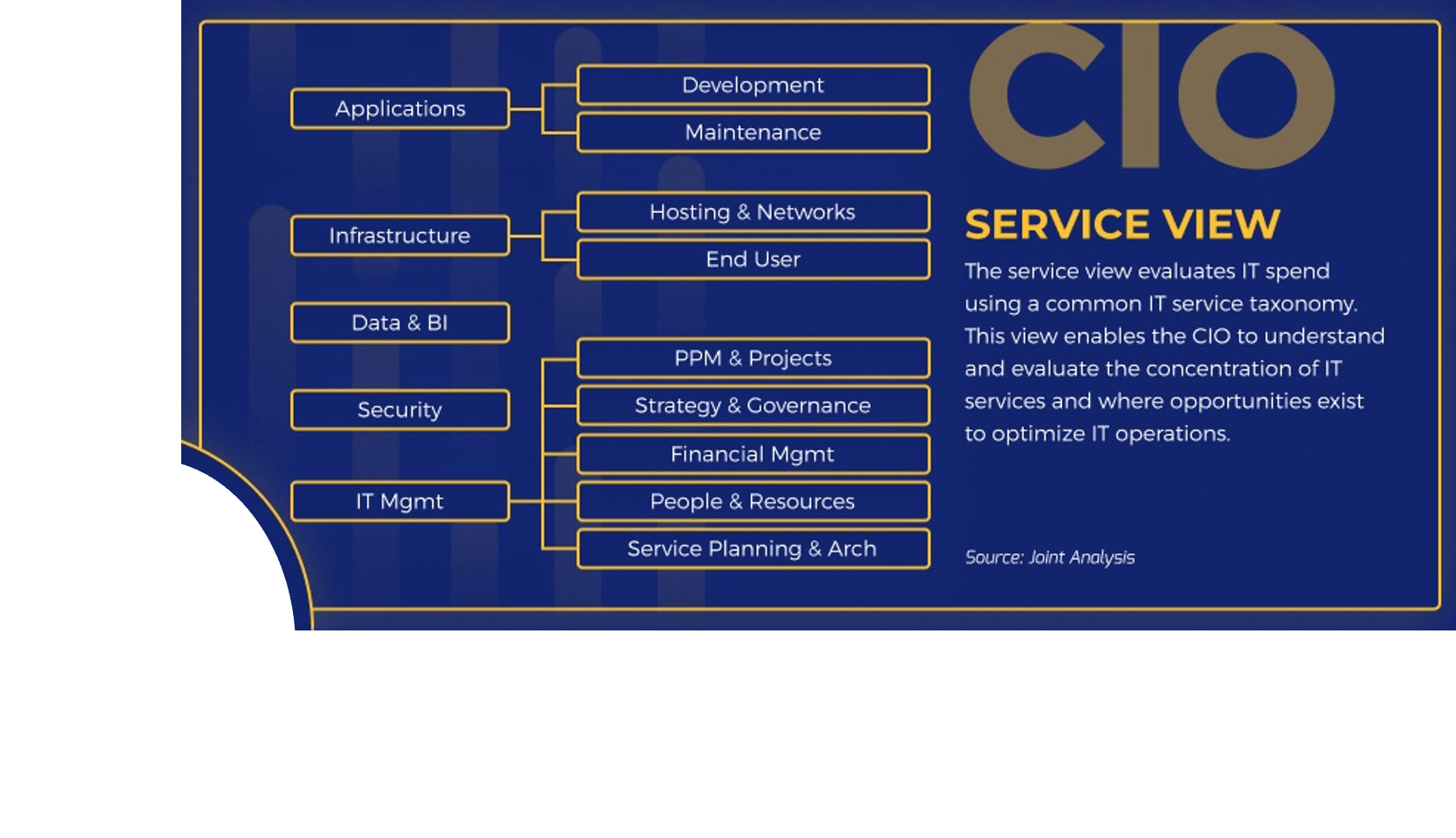

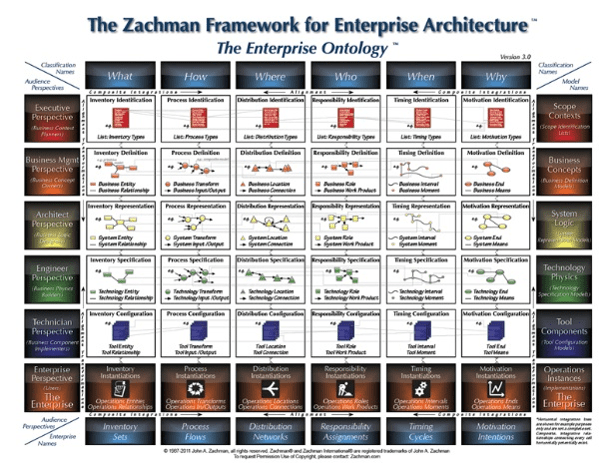

Six main functions derived from Info-Tech’s CLAIM+G Framework

- Learning

- Provide training and development and enable engagement based on identified interaction points to foster organizational growth.

Tooling

- Promote the use of standardized tooling to improve efficiency and consistency throughout the organization.

Supporting

- Enable your Agile teams to access subject-matter expertise by facilitating knowledge transfer and documenting good practices.

Governing

- Create operational boundaries for Agile teams, and monitor their progress and ability to meet business objectives within these boundaries.

Monitoring

- Demonstrate the value the CoE is providing through effective metric setting and ongoing monitoring of Agile’s effectiveness.

Guiding

- Provide guidance, methodology, and knowledge for teams to leverage to effectively meet organizational business objectives.

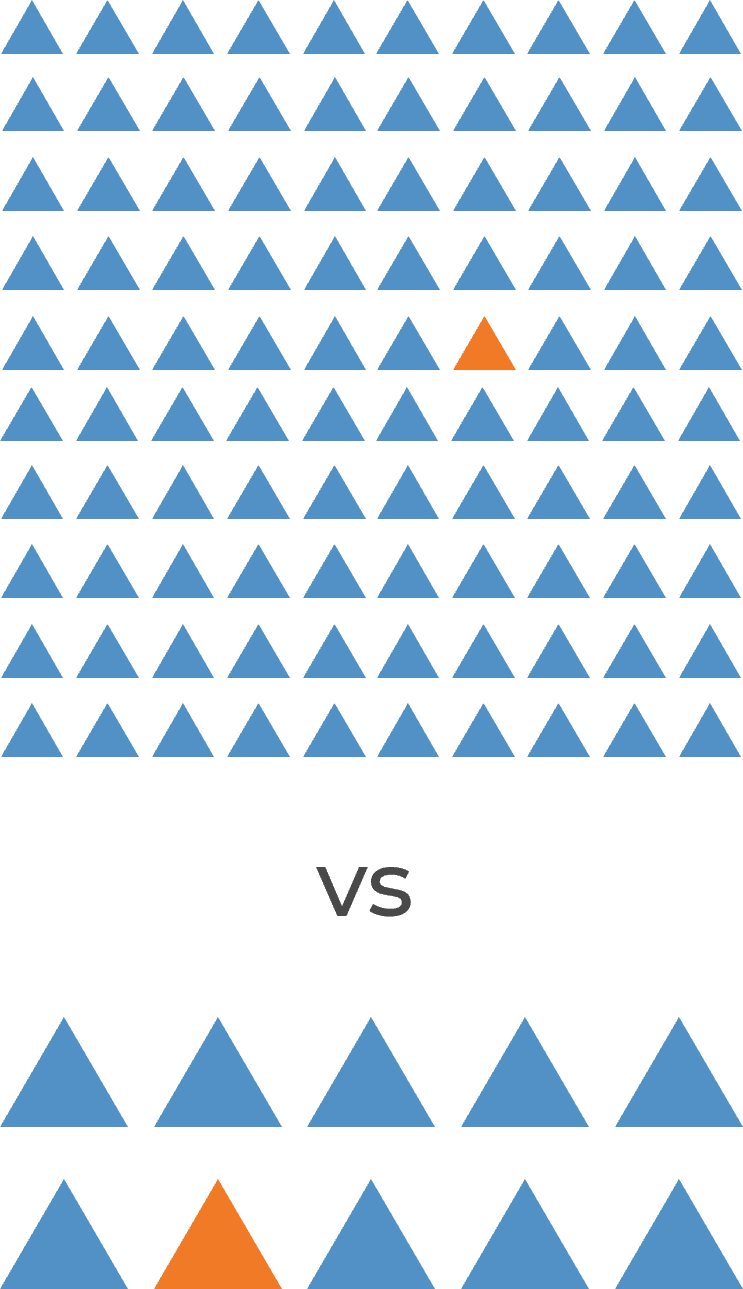

Many organizations encounter challenges to scaling Agile

Tackle the following barriers to Agile adoption with a business-aligned ACE.

List based on reported impediments from VersionOne’s 13th Annual State of Agile Report (N=1,319)

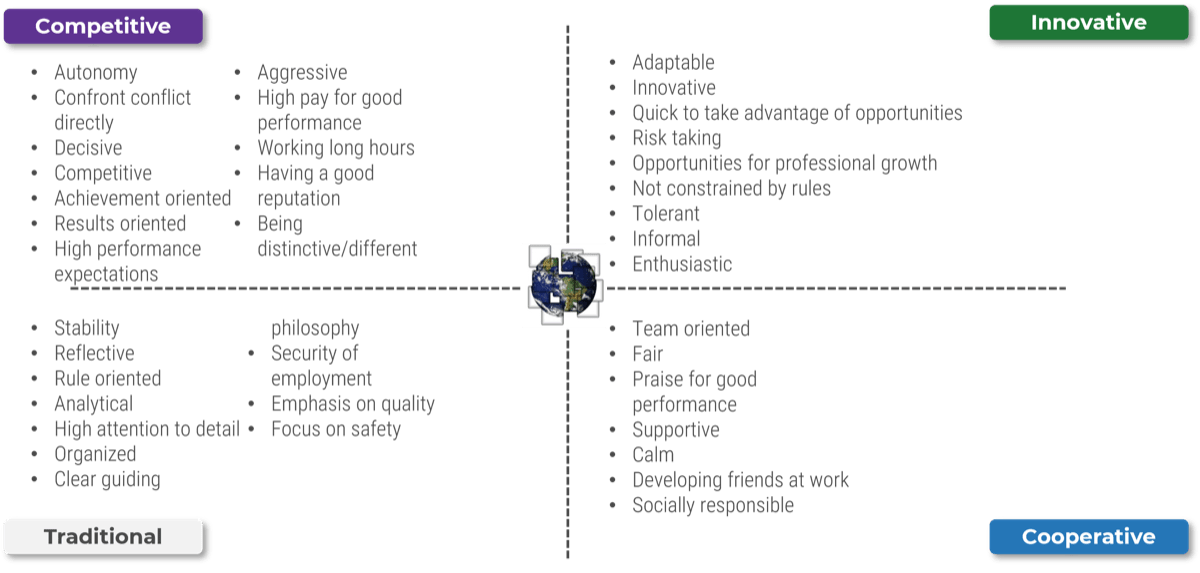

- Organizational culture at odds with Agile values

- The ACE identifies and measures the value of Agile to build support from senior business leaders for shifting the organizational culture and achieving tangible business benefits.

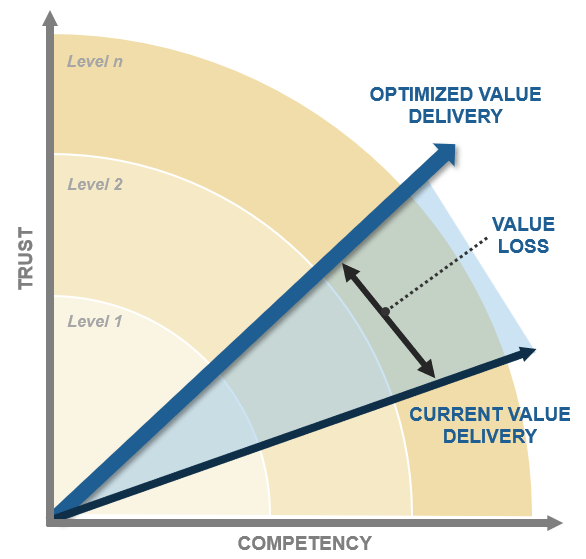

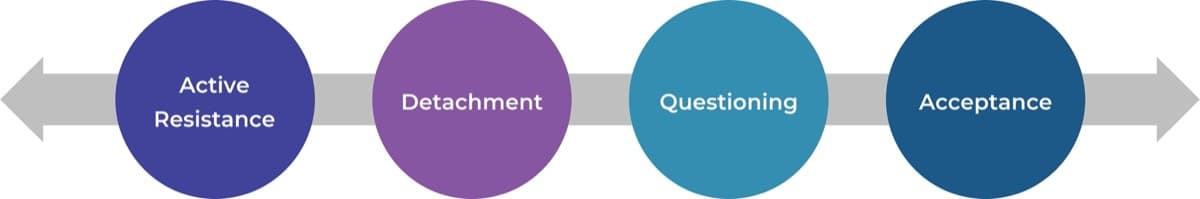

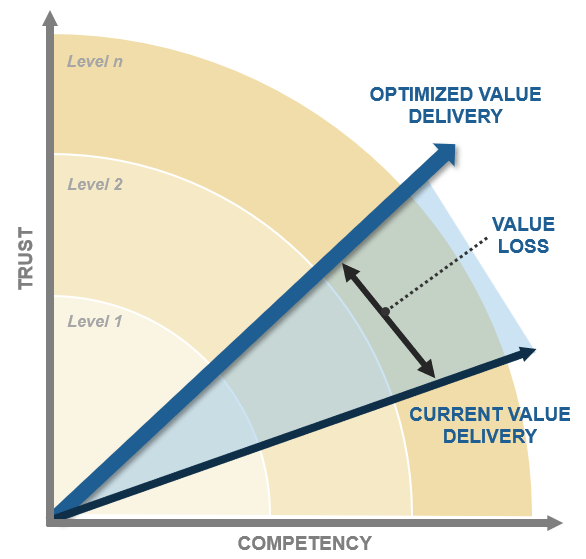

General organizational resistance to change

- Resistance comes from a lack of trust. Optimized value delivery from Info-Tech’s Agile adoption model will build the necessary social capital to drive cultural change.

Inadequate management support and sponsorship

- Establishing an ACE will require senior management support and sponsorship. Its formation sends a strong signal to the organizational leadership that Agile is here to stay.

Lack of skills/experience with Agile methods

- The ACE provides a vehicle to absorb external training into an internal development program so that Agile capabilities can be grown organically within the organization.

Inconsistent processes and practices across teams

- The ACE provides support to individual Agile teams and will guide them to adopt consistent processes and practices which have a proven track record in the organization.

Insufficient training and education

- The ACE will assist teams with obtaining the Agile skills training they need to be effective in the organization, and support a culture of continuous learning.

Overcome your Agile scaling challenges with a business aligned ACE

An ACE drives consistency and transparency without sacrificing the ability to innovate. It can build on the success of your Agile pilot(s) by encouraging practices known to work in your organization.

Support Agile Teams

Provide services designed to inject evolving good practices into workflows and remove impediments or roadblocks from your Agile team’s ability to deliver value.

Maintain Business Alignment

Maintain alignment with corporate objectives without impeding business agility in the long term. The ACE functions as an interface layer so that changing expectations can be adapted without negatively impacting Agile teams.

Facilitate Learning Events

Avoid the risk of innovation and subject-matter expertise being lost or siloed by facilitating knowledge transfer and fostering a continuous learning environment.

Govern Improvements

Set baselines, monitor metrics, and run retrospectives to help govern process improvements and ensure that Agile teams are delivering expected benefits.

Shift Culture

Instill Agile thinking and behavior into the organization. The ACE must encourage innovation and be an effective agent for change.

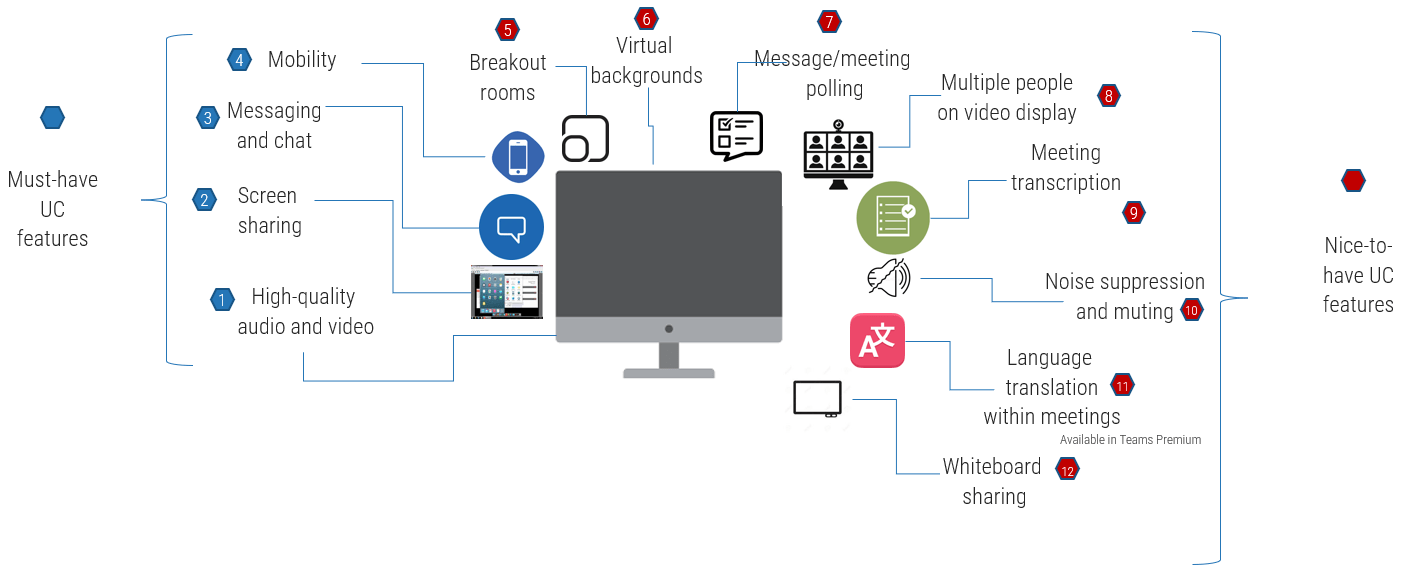

Use your ACE to go from “doing” Agile to “being” Agile

Organizations that do Agile without embracing the changes in behavior will not reap the benefits.

Doing what was done before

- Processes and Tools

- Comprehensive Documentation

- Contract Negotiation

- Following a Plan

Being Prescriptive

Going through the motions

- Uses SCRUM and tools such as Jira

- Plans multiple sprints in detail

- Talks to stakeholders once in a release

- Works off a fixed scope BRD

Doing Agile

Living the principles

- Individuals and Interactions

- Working Software

- Customer Collaboration

- Responding to Change

Being Agile

“(‘Doing Agile’ is) just some rituals but without significant change to support the real Agile approach as end-to-end, business integration, value focus, and team empowerment.” - Arie van Bennekum

Establishing a CoE does not guarantee success

Simply establishing a Center of Excellence for any discipline does not guarantee its success:

The 2019 State of DevOps Report found that organizations which had established DevOps CoEs underperformed compared to organizations which adopted other approaches for driving DevOps transformation. (Accelerate State of DevOps Report 2019 [N=~1,000])

Still, Agile Centers of Excellence can and do successfully drive Agile adoption in organizations. So what sets the successful examples apart from the others? Here’s what some have to say:

“The ACE must be staffed with qualified people with delivery experience! … [It is] effectively a consulting practice, that can evolve and continuously improve its services … These services are collectively about ‘enablement’ as an output, more than pure training … and above all, the ability to empirically measure the progress” – Paul Blaney, TD Bank

“When leaders haven’t themselves understood and adopted Agile approaches, they may try to scale up Agile the way they have attacked other change initiatives: through top-down plans and directives. The track record is better when they behave like an Agile team. That means viewing various parts of the organization as their customers.” – HBR, “Agile at Scale”

“the Agile CoE… is truly meant to be measured by the success of all the other groups, not their own…[it] is meant to be serving the teams and helping them improve, not by telling them what to do, but rather by listening, understanding and helping them adapt.” - Bart Gerardi, PMI

“The CoE must also avoid becoming static, as it’s crucial the team can adjust as quickly as business and customer needs change, and evolve the technology as necessary to remain competitive.” – Forbes, “RPA CoE (what you need to know)”

"The best CoEs are formed from thought leaders and change agents within the CoE domain. They are the process and team innovators who will influence your CoE roadmap and success. Select individuals who feel passionate about Agile." – Hans Eckman, InfoTech

To be successful with your ACE, do the following…

Info-Tech Insight

Simply establishing an Agile Center of Excellence does not guarantee its success. When setting up your ACE, optimize its impact on the organization by doing the following 3 things:

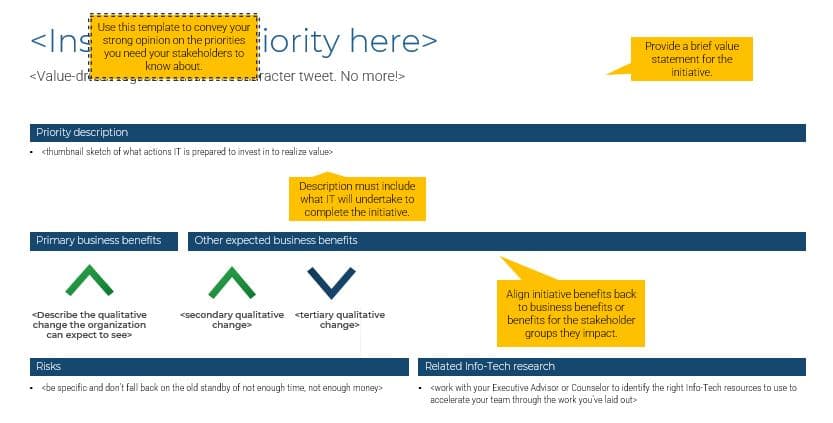

- Define ACE services based on stakeholder needs. Be sure to broadly survey your stakeholders and identify the ACE functions and services which will best meet their needs. ACE services must clearly deliver business value to the organization and the Agile teams it supports.

- Staff the ACE strategically. Select ACE team members who have real world, hands-on delivery experience, and are well respected by the Agile teams they will serve. Where possible, select internal thought leaders in your organization who have the credibility needed to effect positive change.

- Continuously improve ACE services based on metrics and feedback. The value your ACE brings to the organization must be clear and measurable, and do not assume that your functions and services will remain static. You must regularly monitor both your metrics and feedback from your Agile teams, and adjust ACE behavior to improve/maximize these over time.

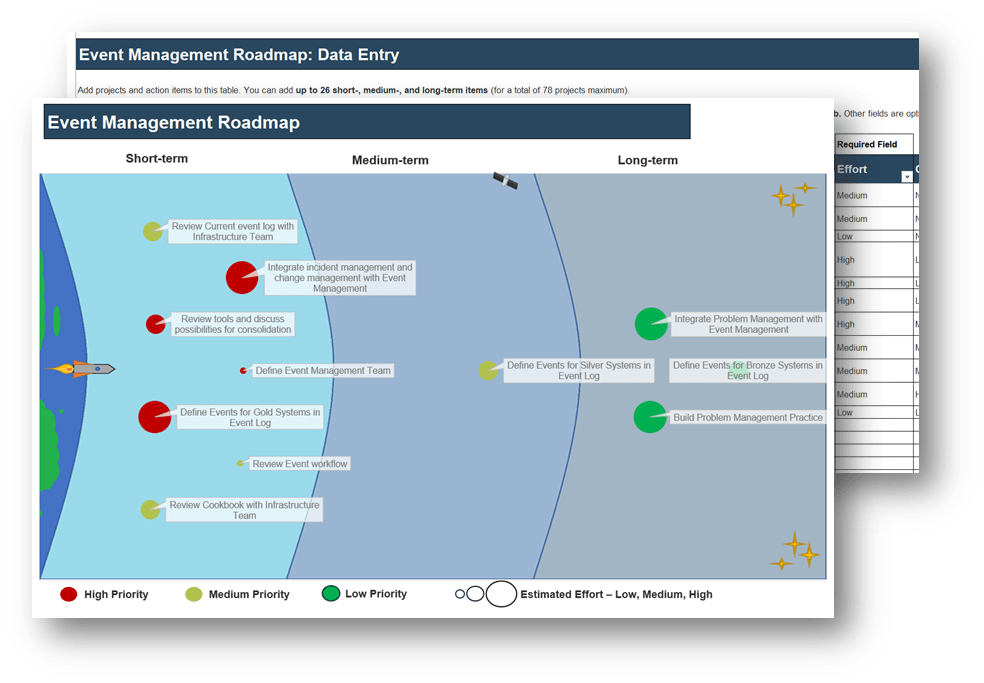

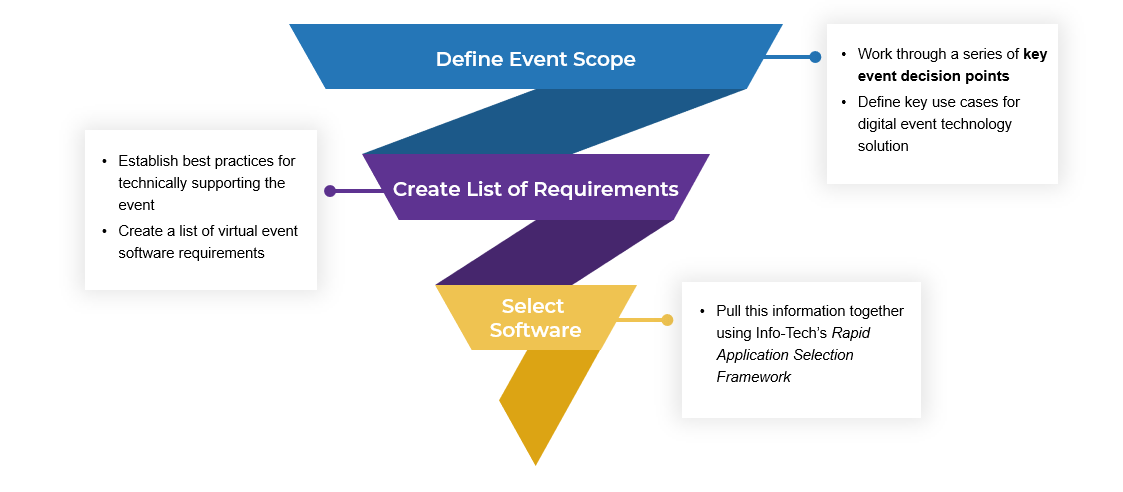

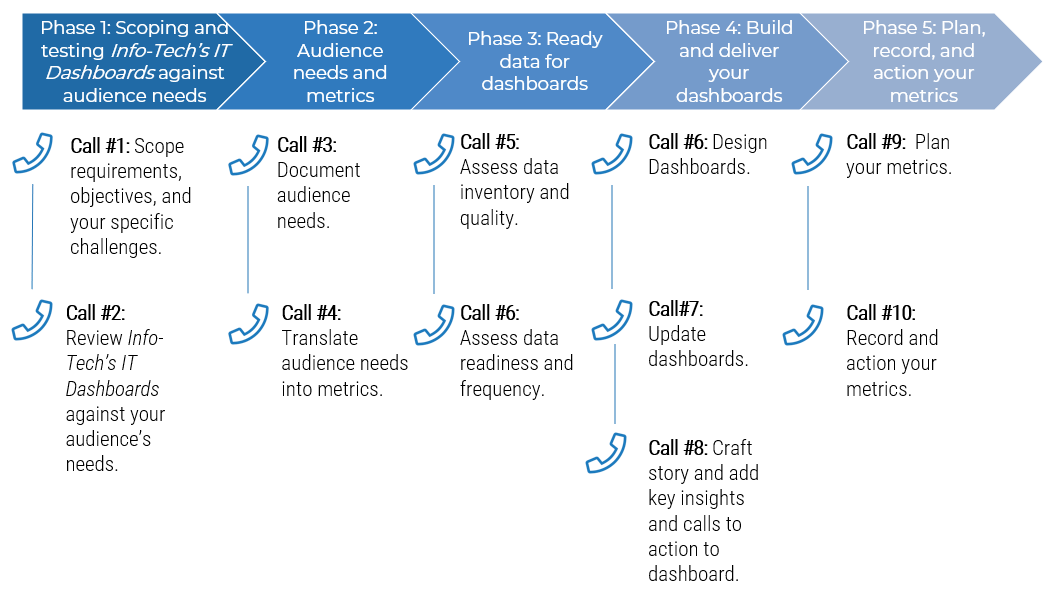

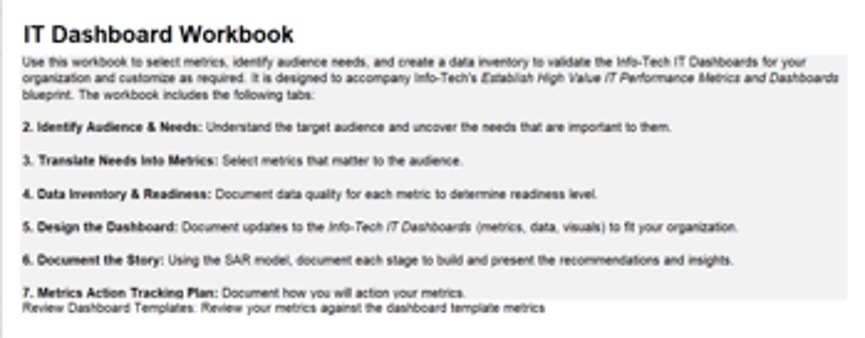

Spread Best Practices With an Agile Center of Excellence

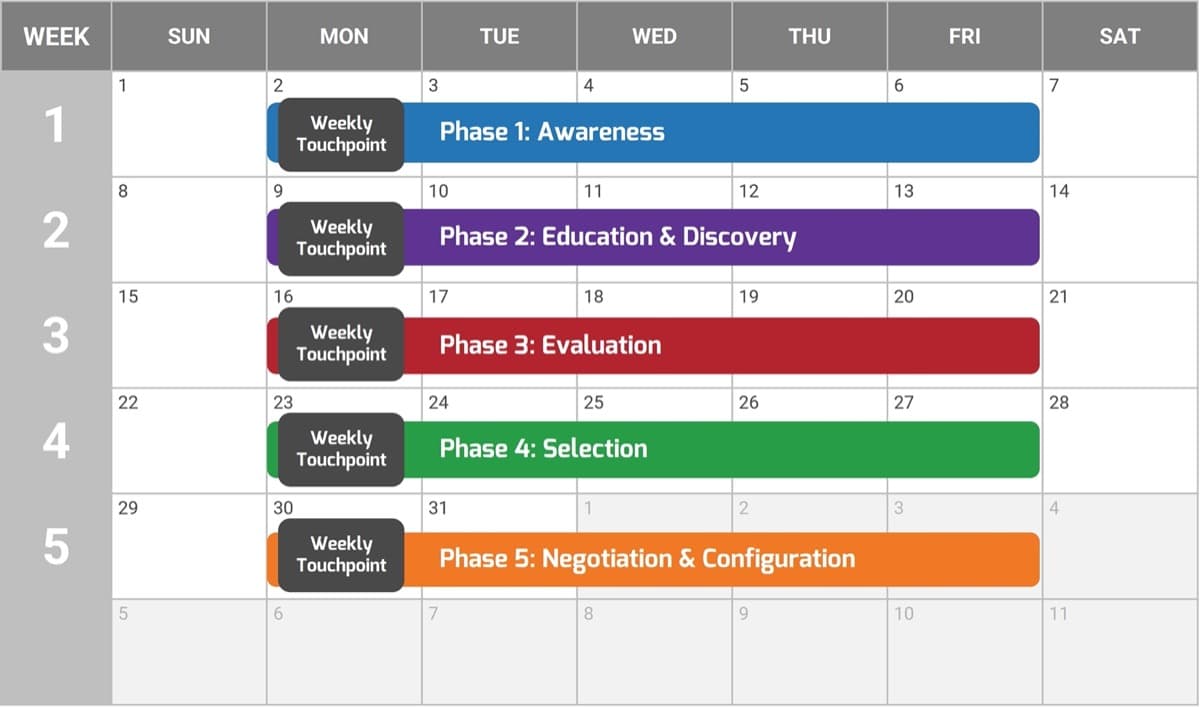

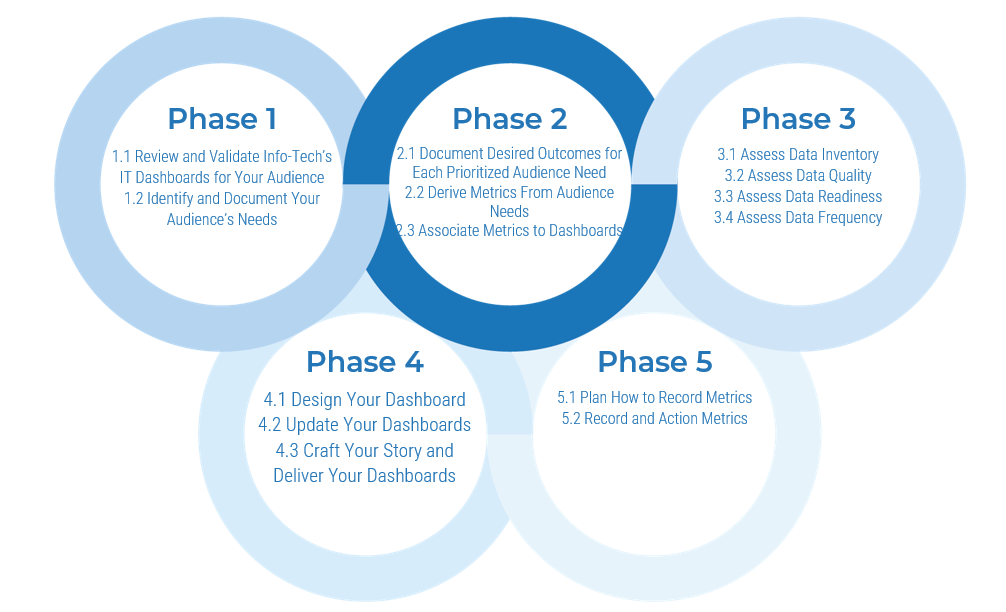

This blueprint will walk you through the steps needed to build the foundations for operational excellence within an Agile Center of Excellence.

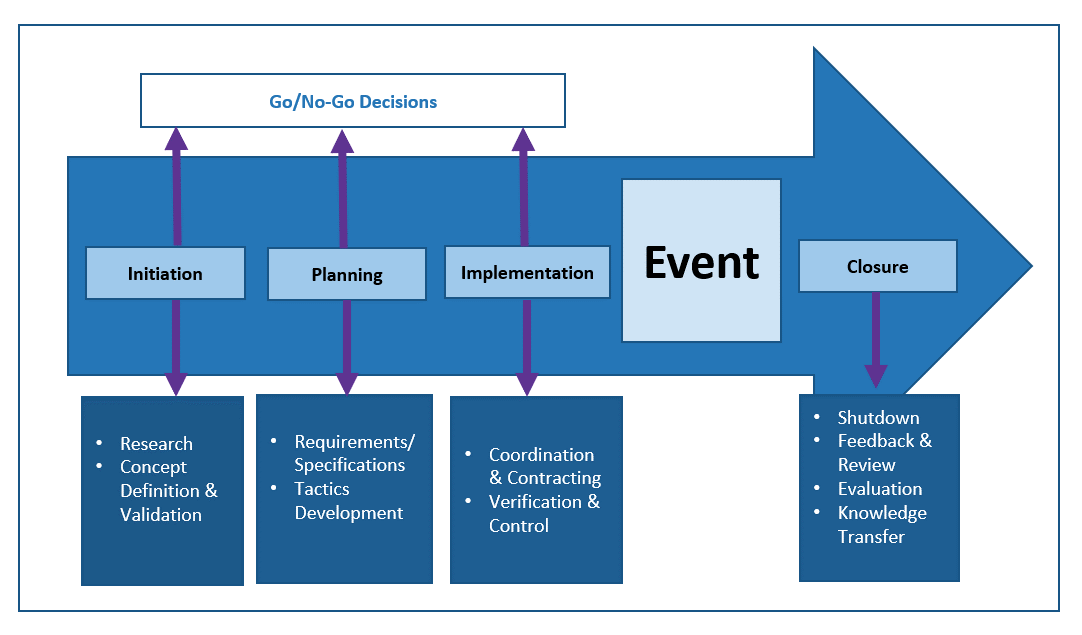

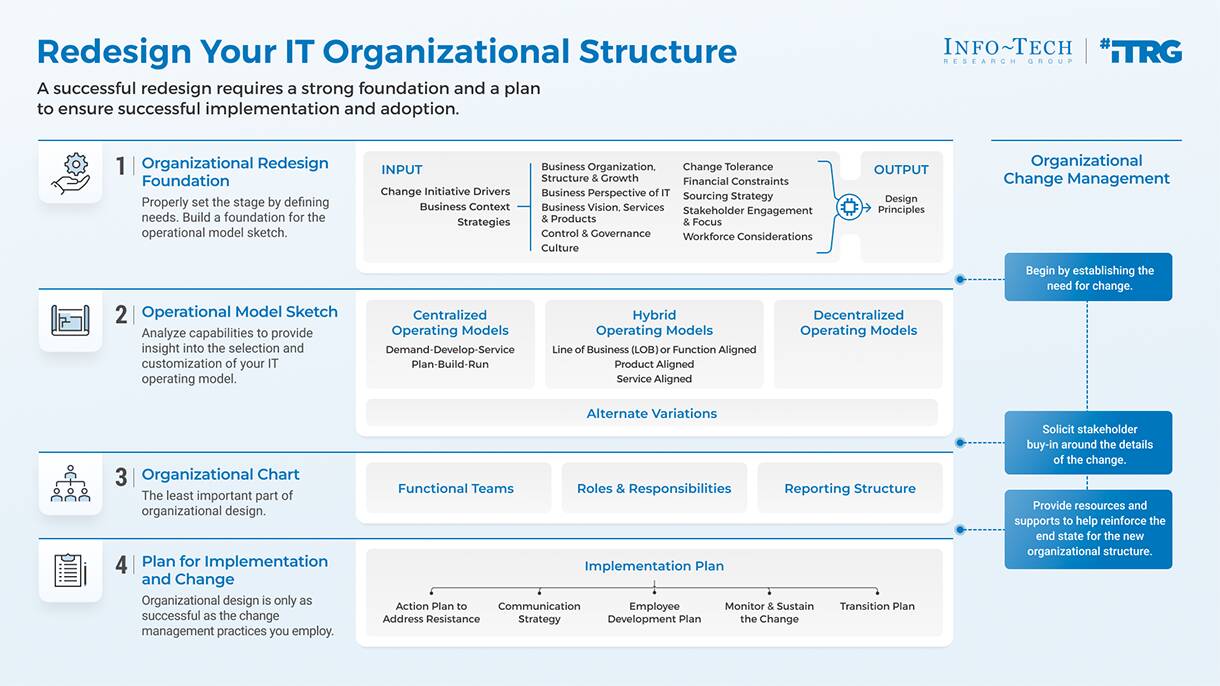

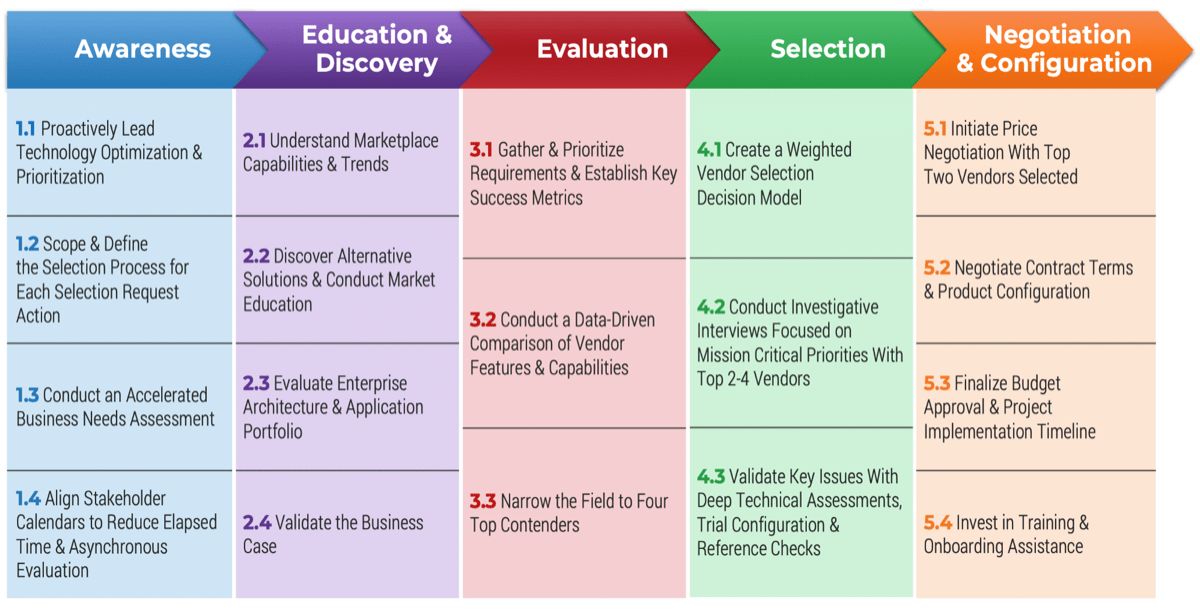

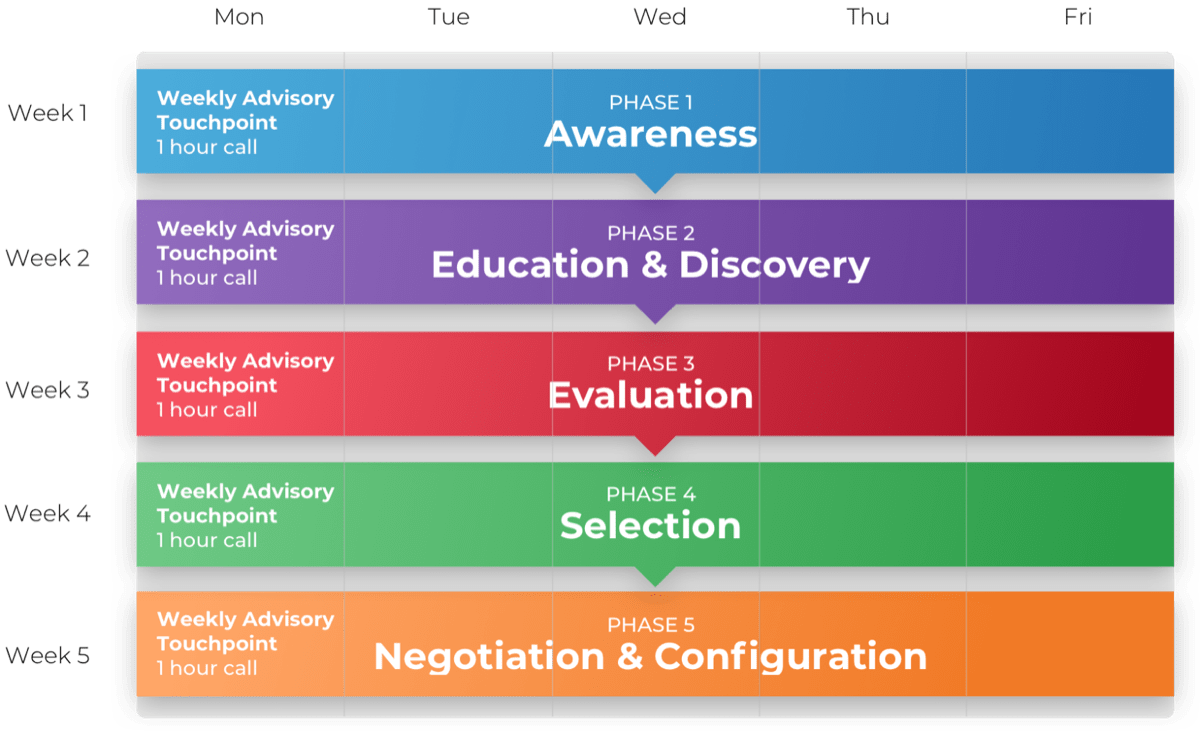

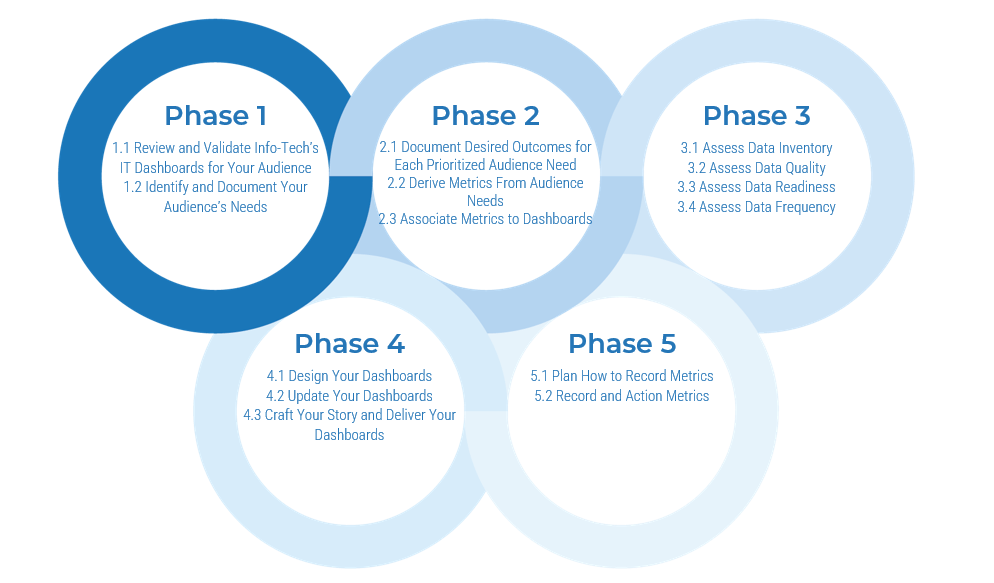

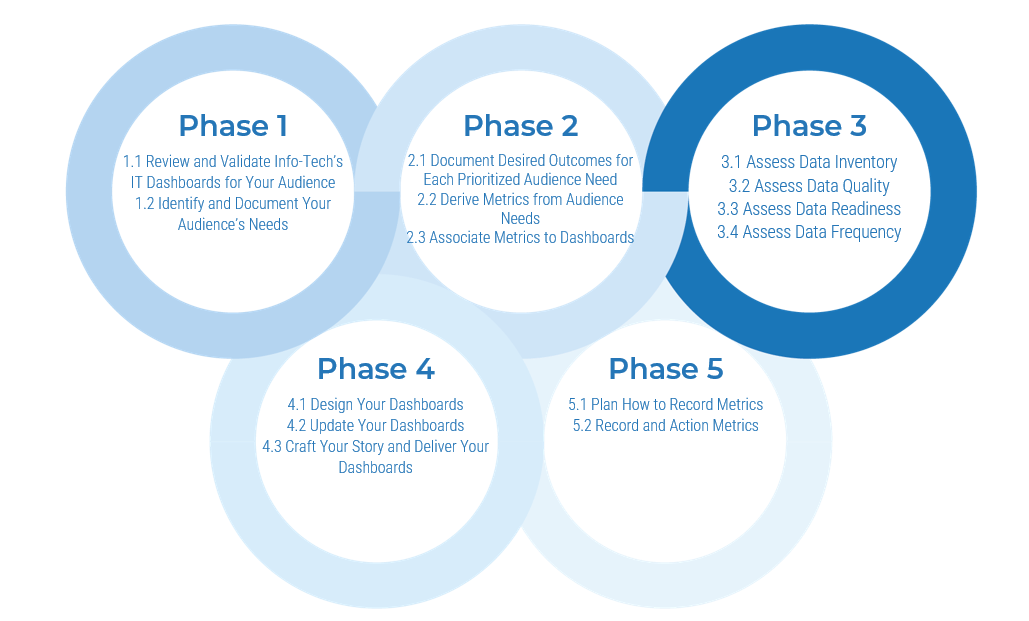

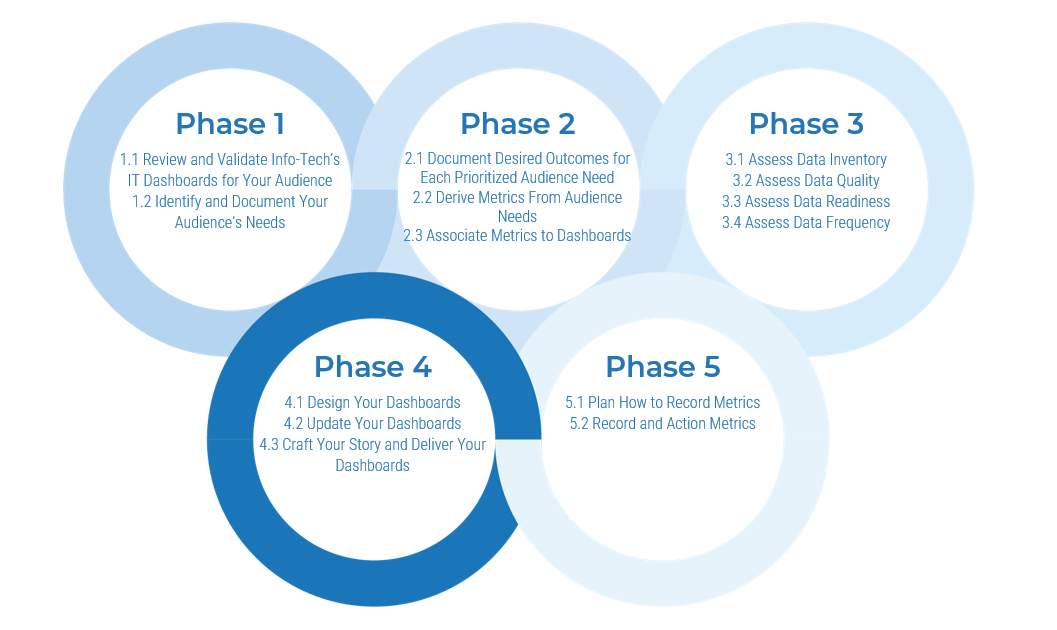

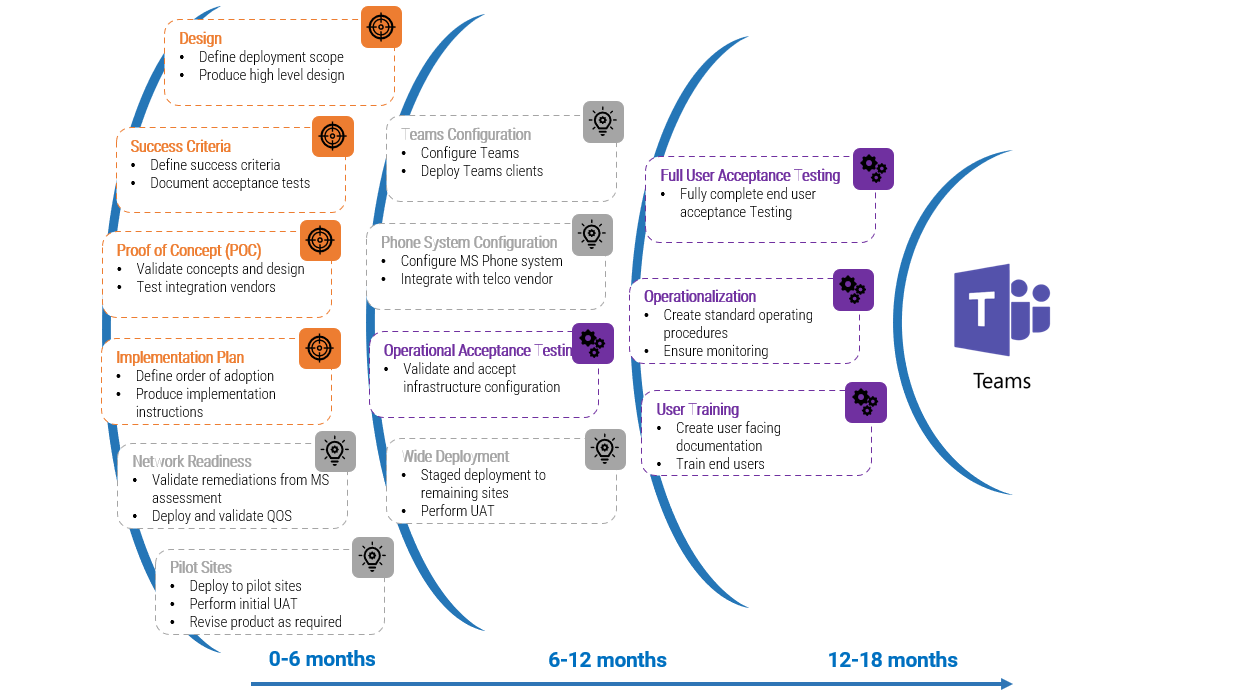

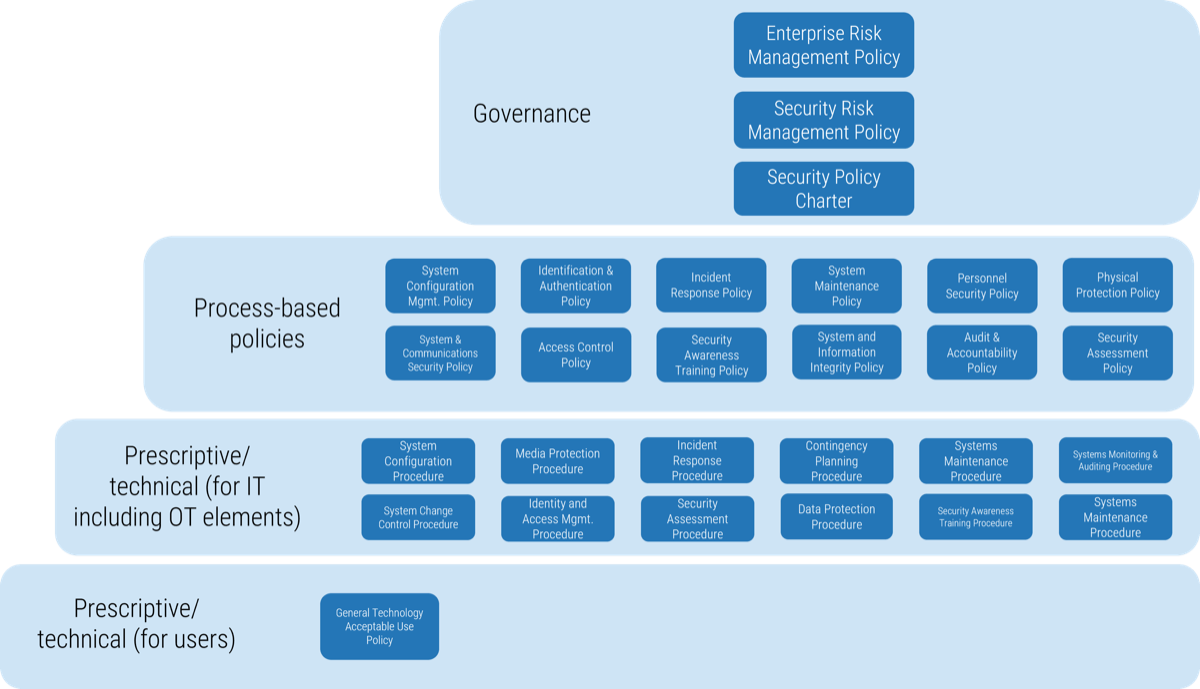

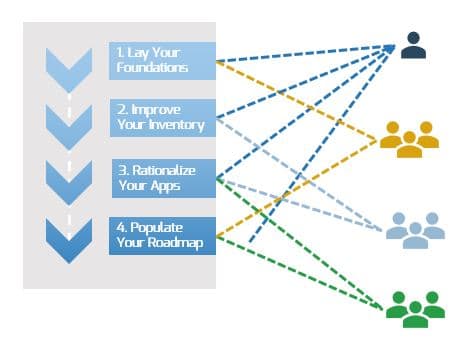

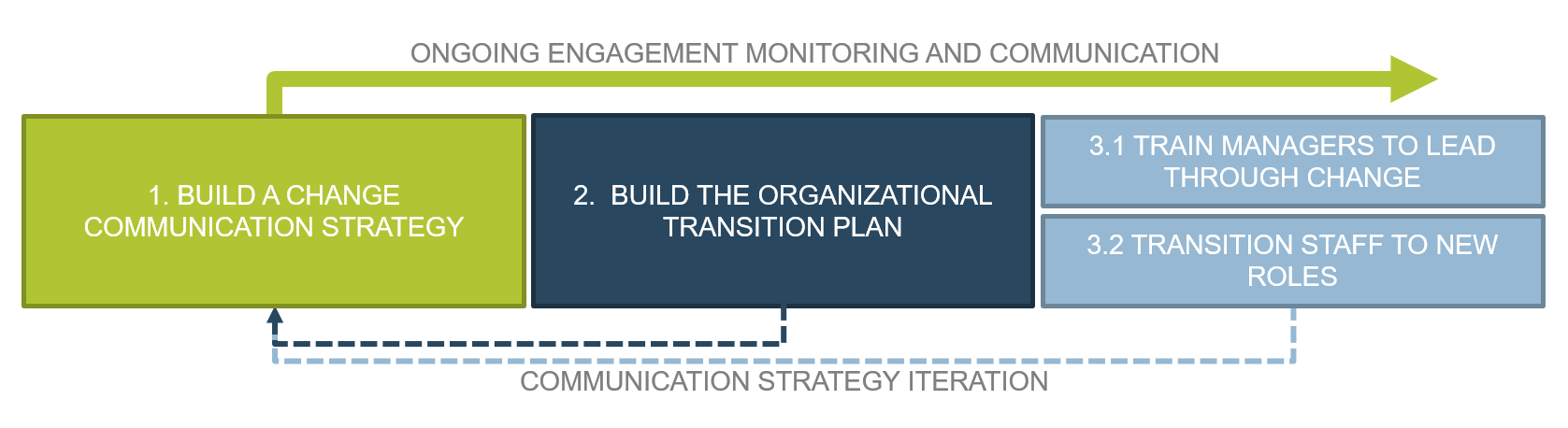

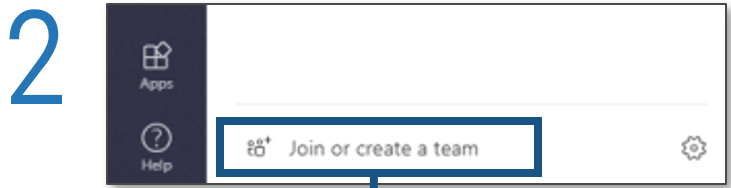

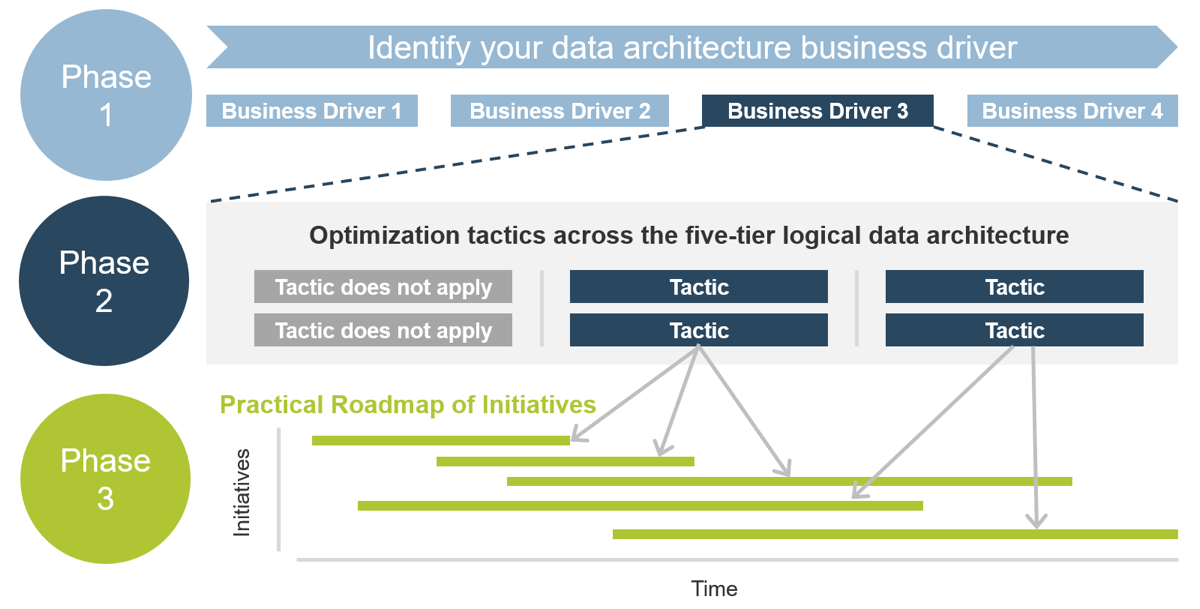

Phase 1 - Strategically Align the CoE

Create strategic alignment between the CoE and the organization’s goals, objectives, and vision. This alignment translates into the CoE mandate intended to enhance the way Agile will enable teams to meet business objectives.

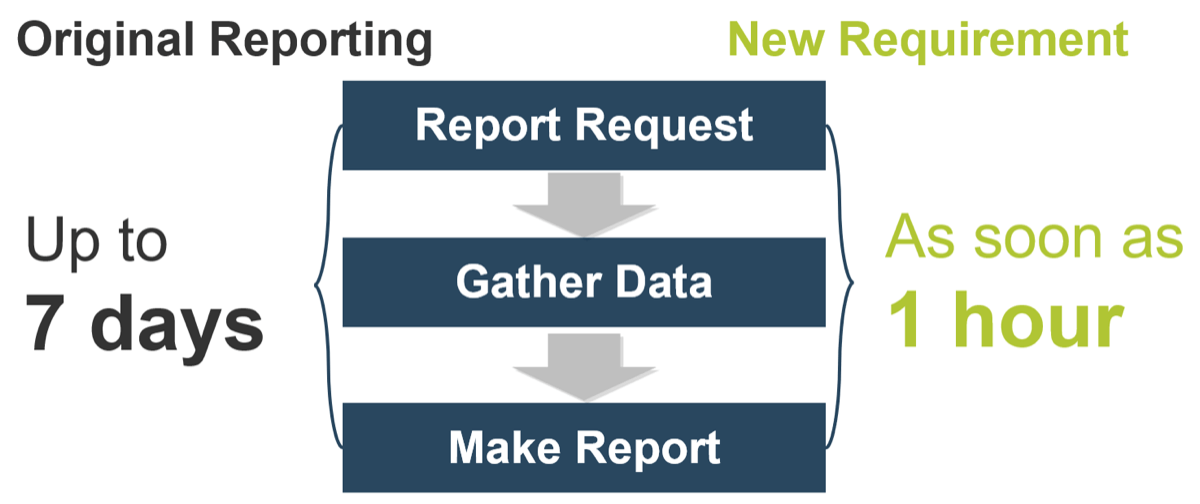

Phase 2 - Standardize the CoEs Service Offerings

Build an engagement plan based on a standardized adoption model to ensure your CoE service offerings are accessible and consistent across the organization. Create and consolidate key performance indicators to measure the CoEs utility and whether or not the expected value is being translated to tangible results.

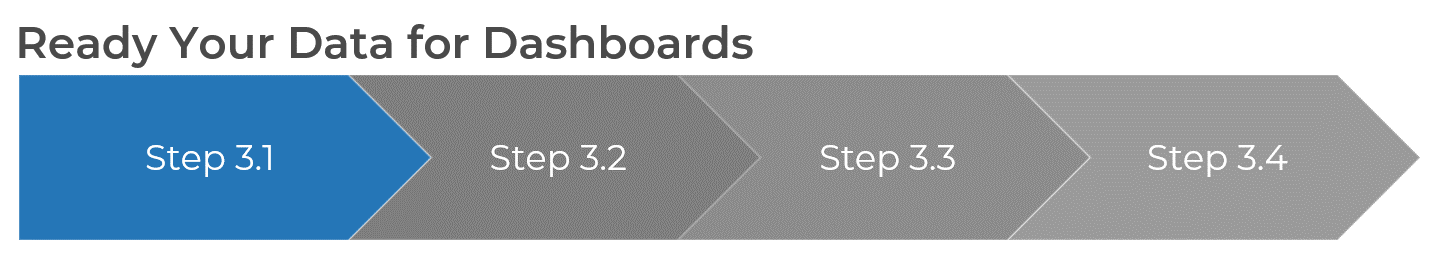

Phase 3 - Operate the CoE

Operate the CoE to provide service offerings to Agile teams, identify improvements to optimize the function of your Agile teams, and effectively manage and communicate change so that teams can grow within the Agile adoption model and optimize value delivery both within your Agile environment and across functions.

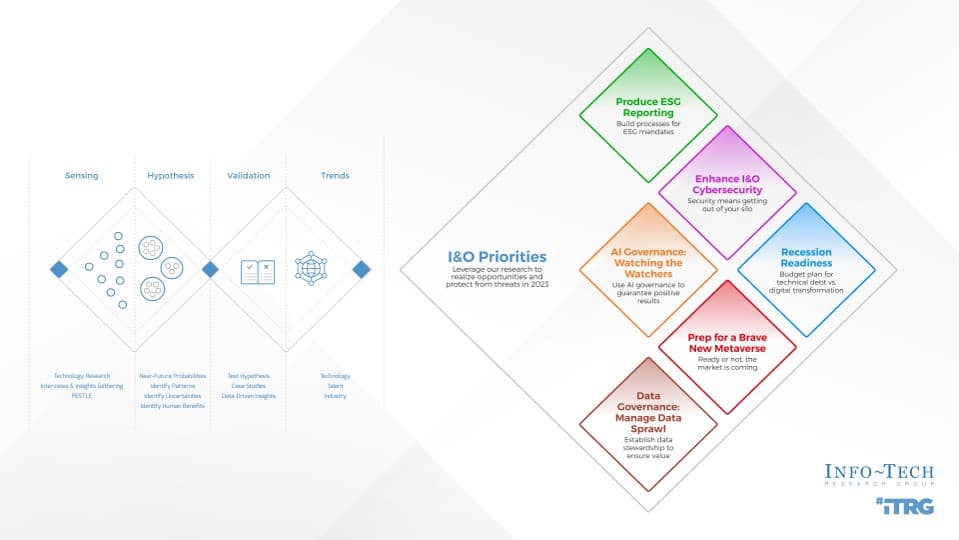

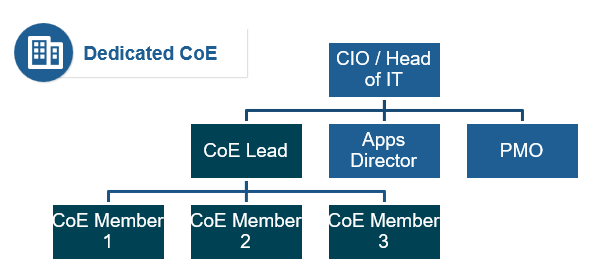

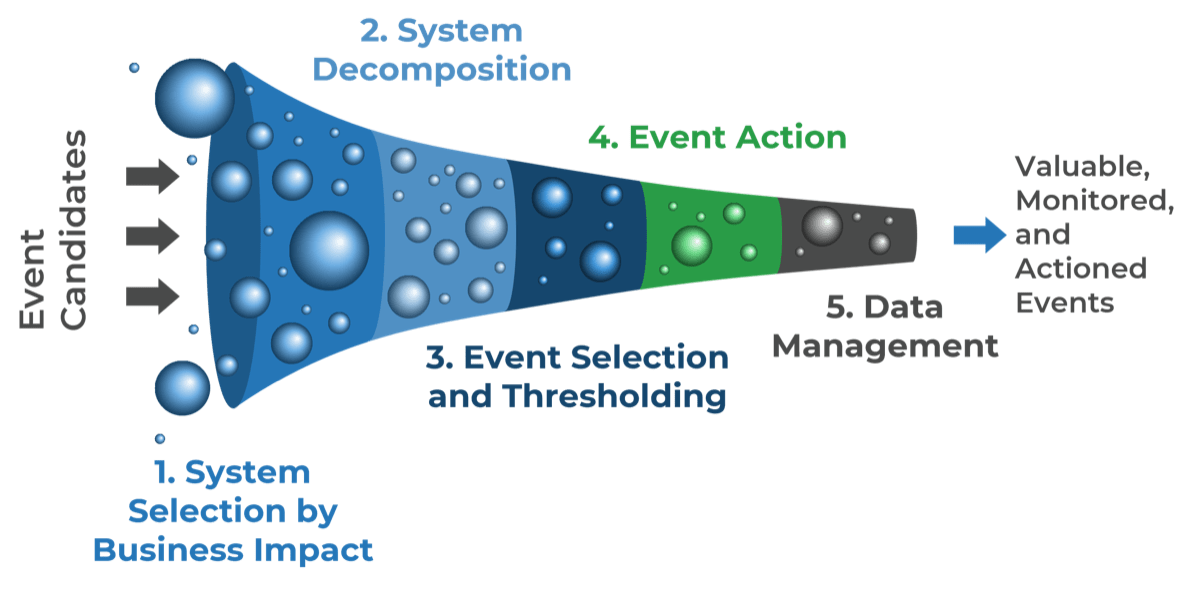

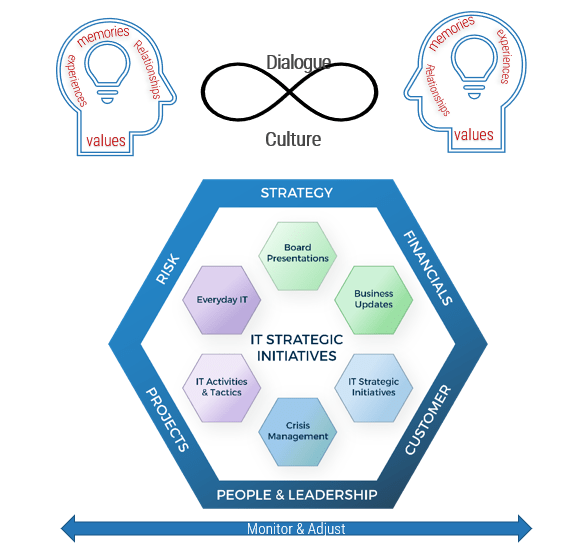

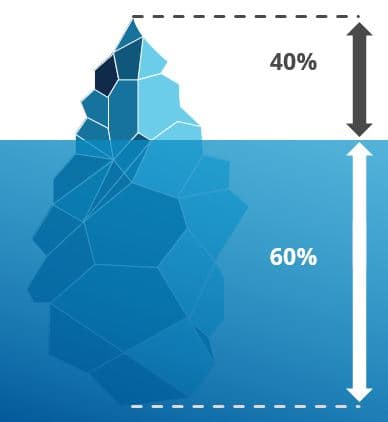

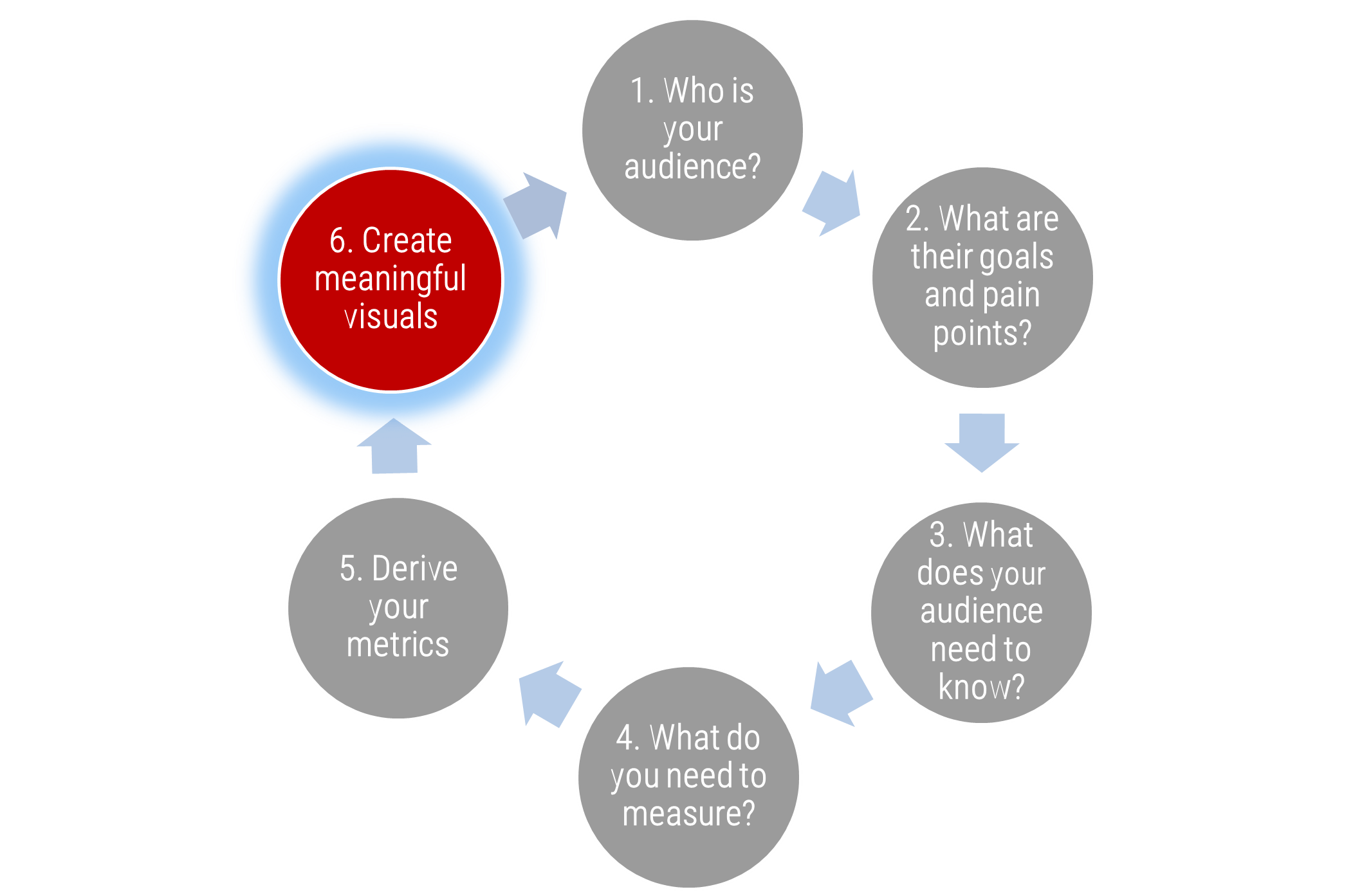

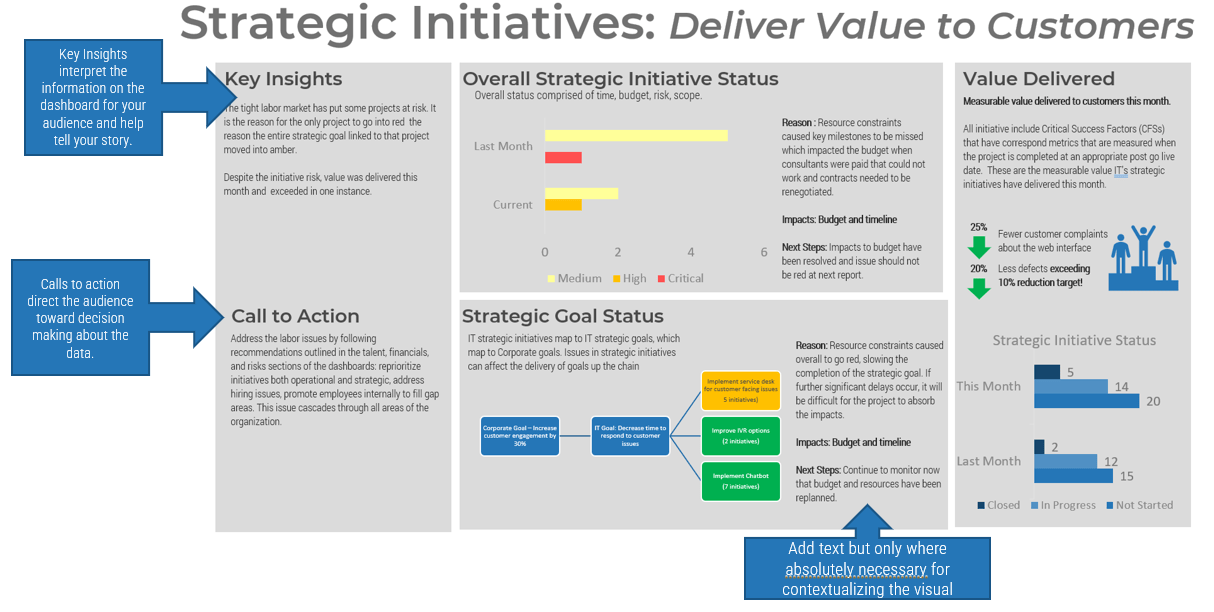

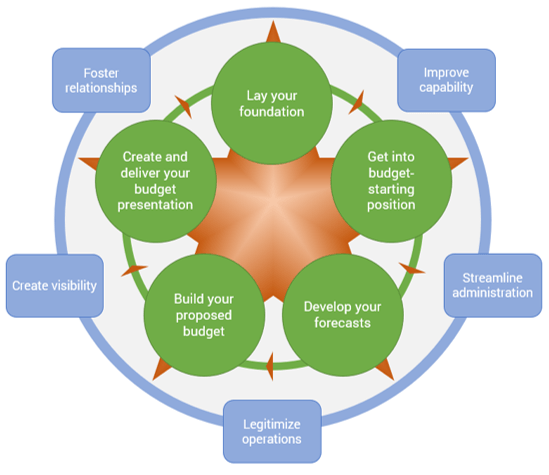

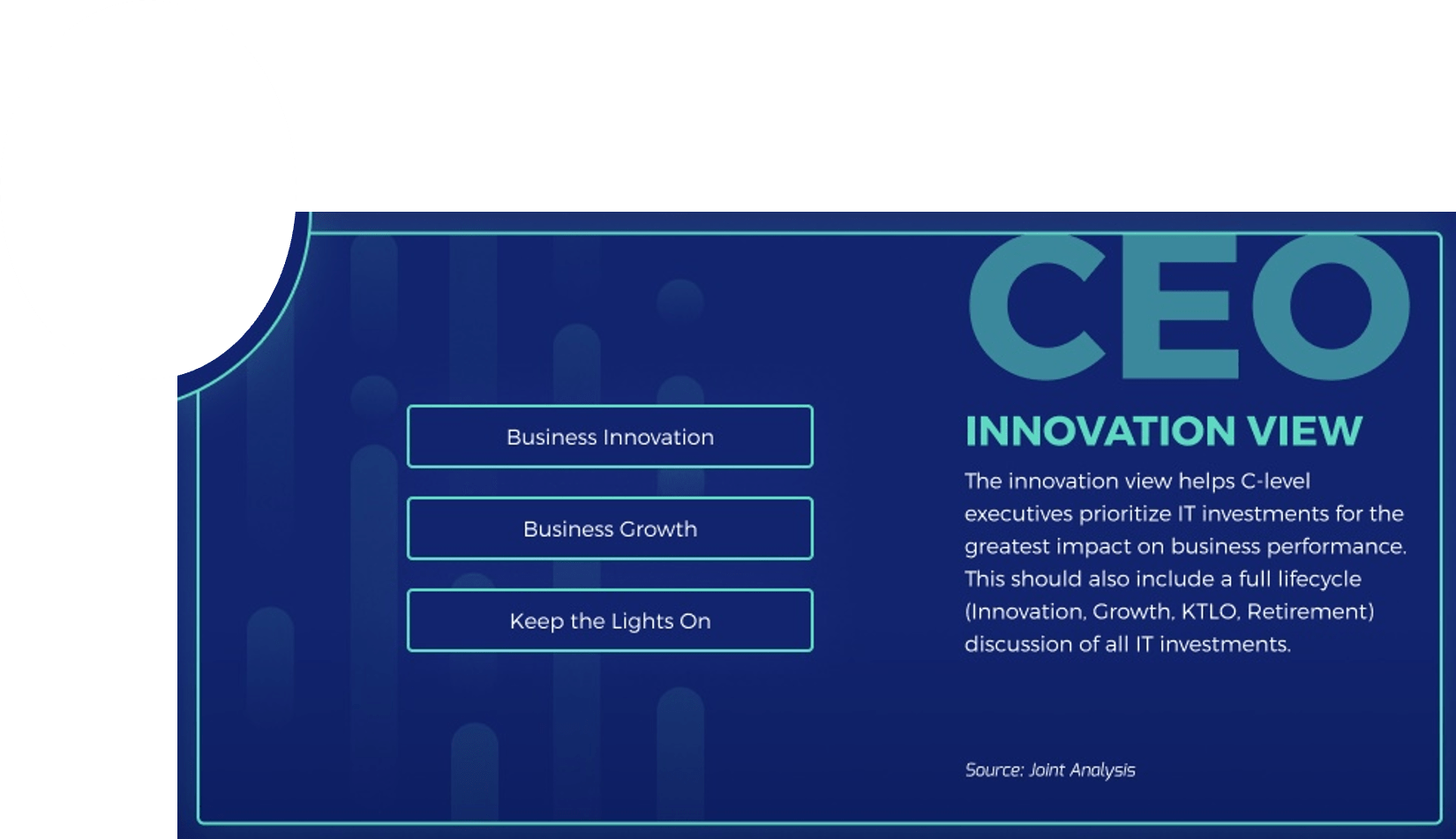

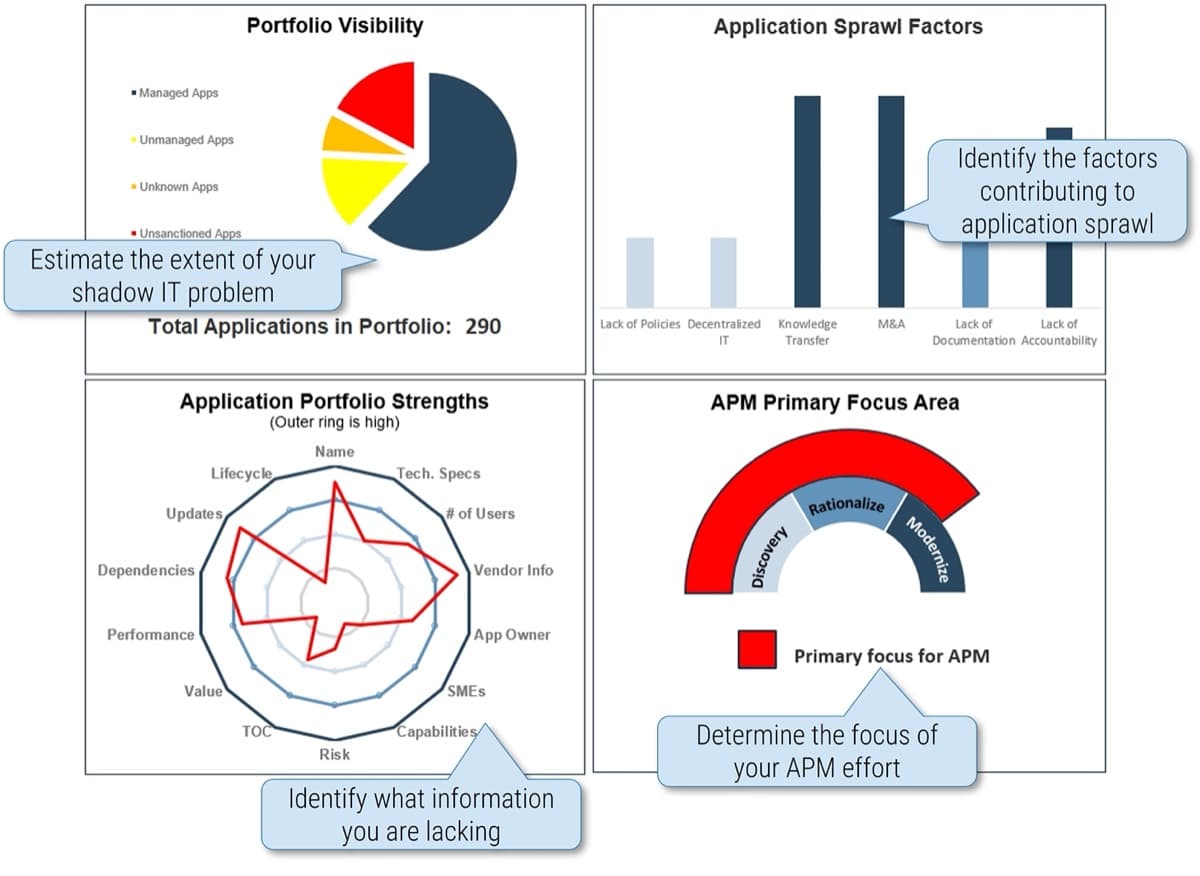

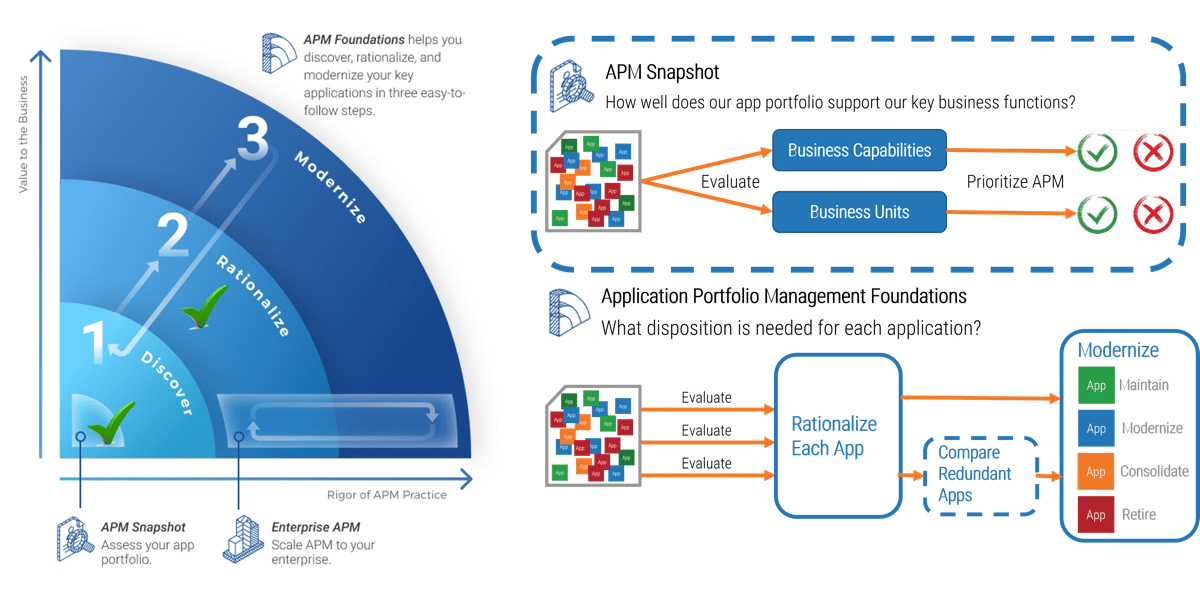

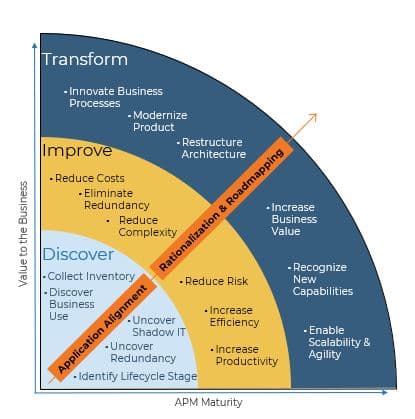

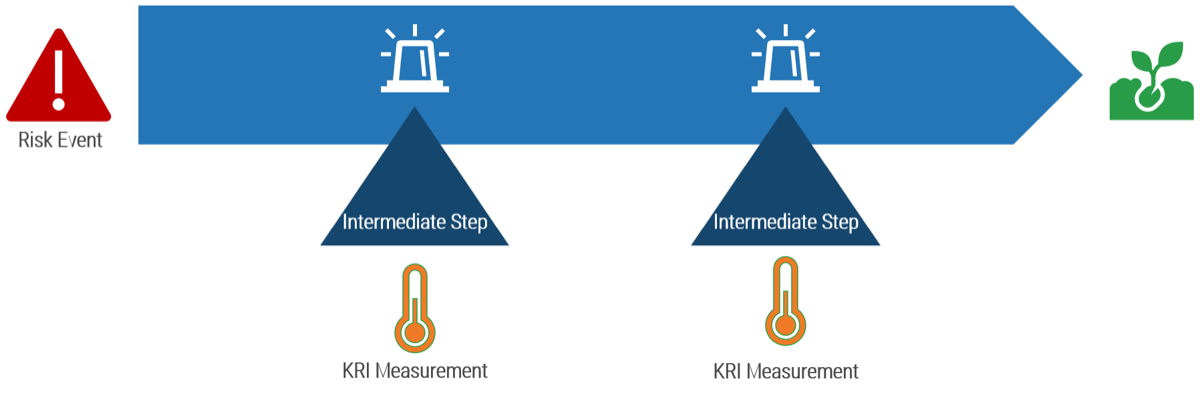

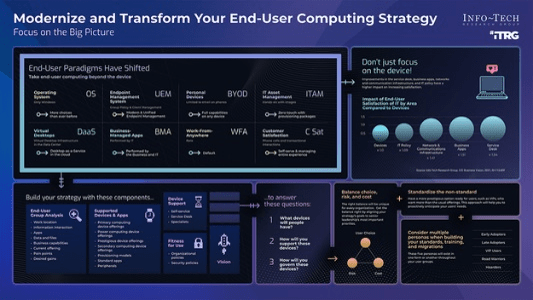

Info-Tech’s Practice Adoption Journey

Use Info-Tech’s Practice Adoption Journey model to establish your ACE. Building social capital (stakeholders’ trust in your ability to deliver positive outcomes) incrementally is vital to ensure that everyone is aligned to new mindsets and culture as your Agile practices scale.

Trust & Competency ↓

DEFINE

Begin to document your development workflow or value chain, implement a tracking system for KPIs, and start gathering metrics and reporting them transparently to the appropriate stakeholders.

ITERATE

Use collected metrics and retrospectives to stabilize team performance by reducing areas of variability in your workflow and increasing the consistency at which targets are met.

COLLABORATE

Use information to support changes and adopt appropriate practices to make incremental improvements to the existing environment.

EMPOWER

Drive behavioral and cultural changes that will empower teams to be accountable for their own success and learning.

INNOVATE

Use your built-up trust and support practice innovation, driving the definition and adoption of new practices.

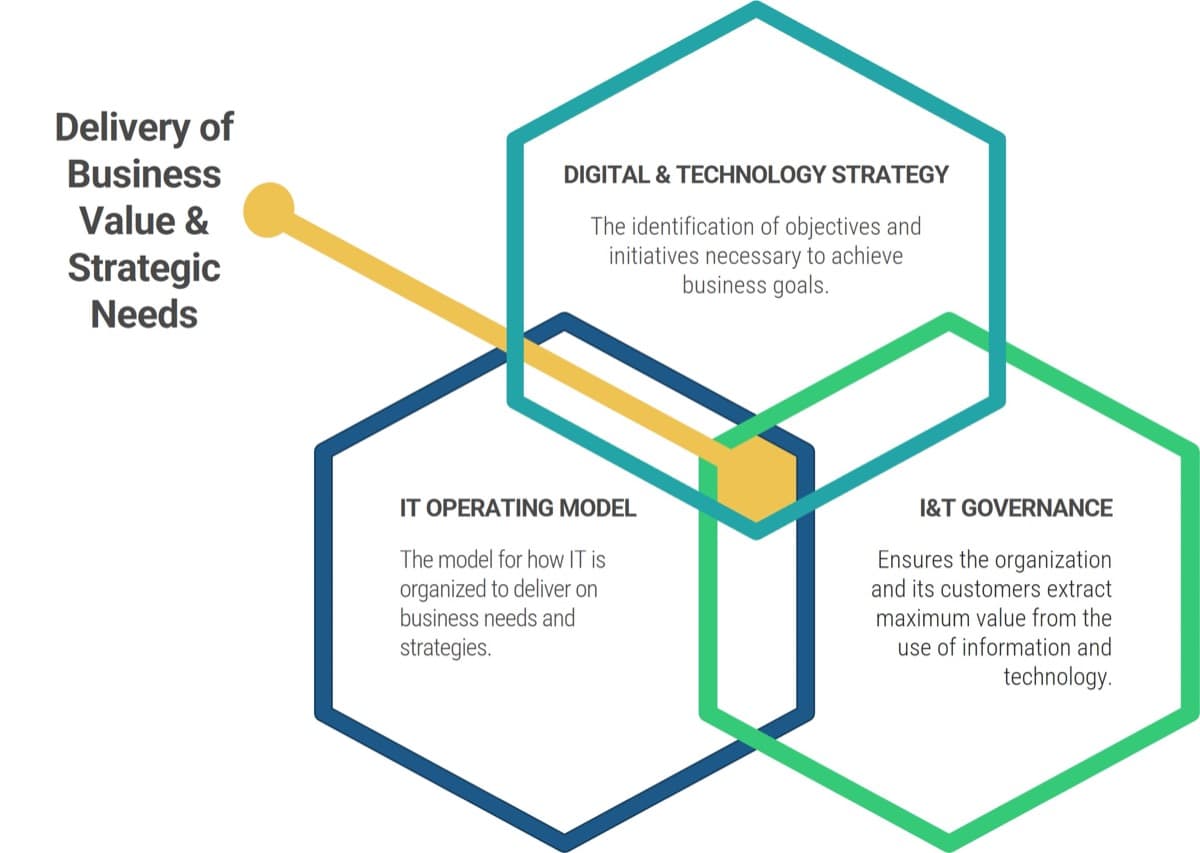

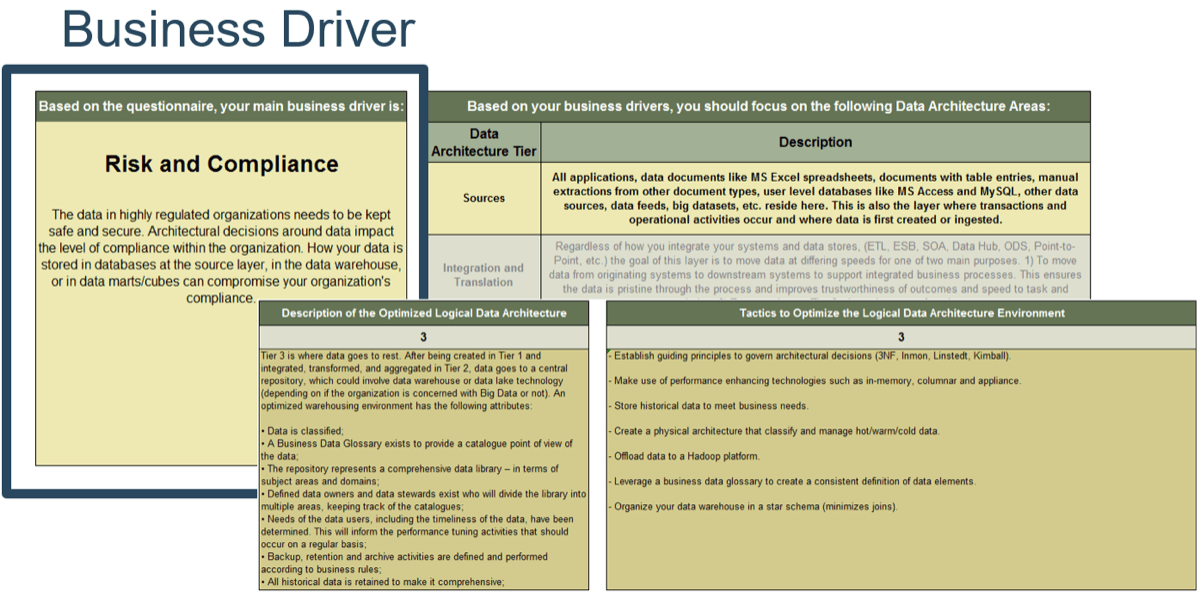

Align your ACE with your organization’s strategy

This research set will assist you with aligning your ACEs services to the objectives of the business in order to justify the resources and funding required by your Agile program.

Business Objectives → Alignment ←ACE Functions

Business justification to continue to fund a Center of Excellence can be a challenge, especially with traditional thinking and rigid stakeholders. Hit the ground running and show value to your key influencers through business alignment and metrics that will ensure that the ACE is worth continuous investment.

Alignment leads to competitive advantage

The pace of change in customer expectations, competitive landscapes, and business strategy is continuously increasing. It is critical to develop a method to facilitate ongoing alignment to shifting business and development expectations seamlessly and ensure that your Agile teams are able to deliver expected business value.

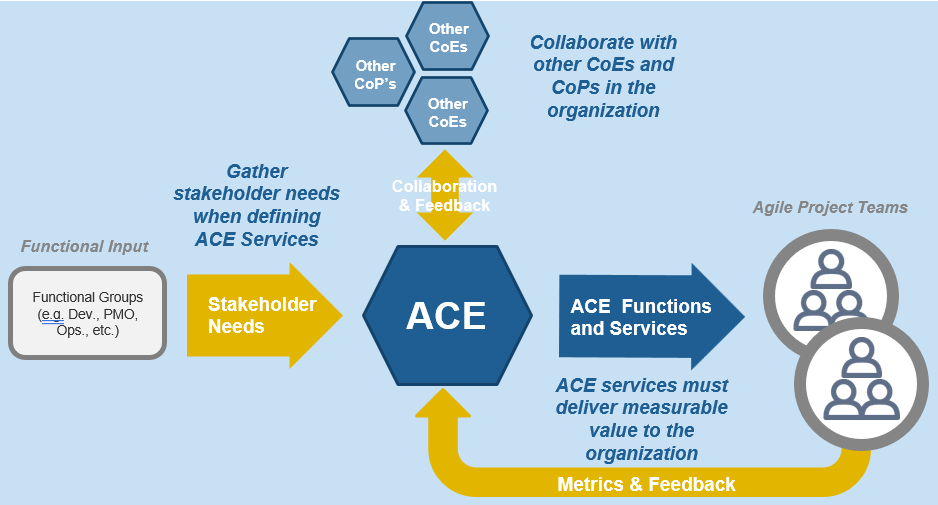

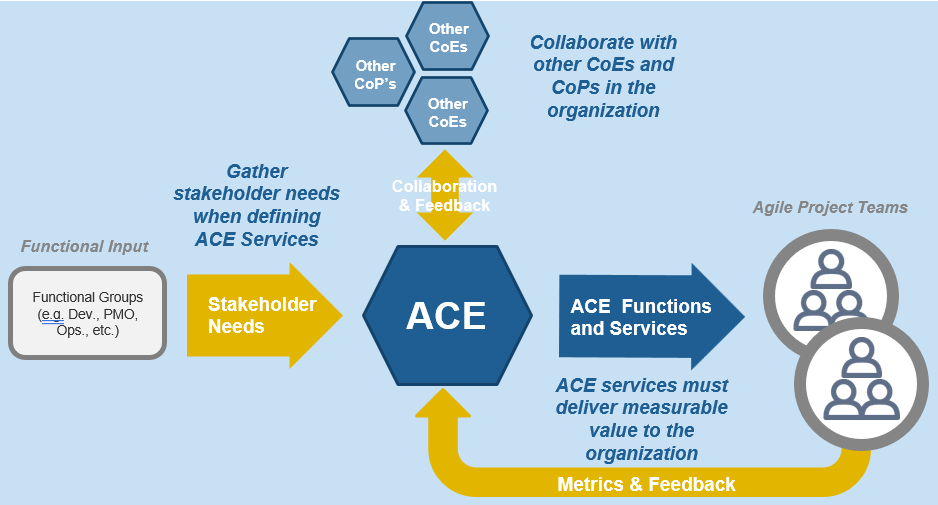

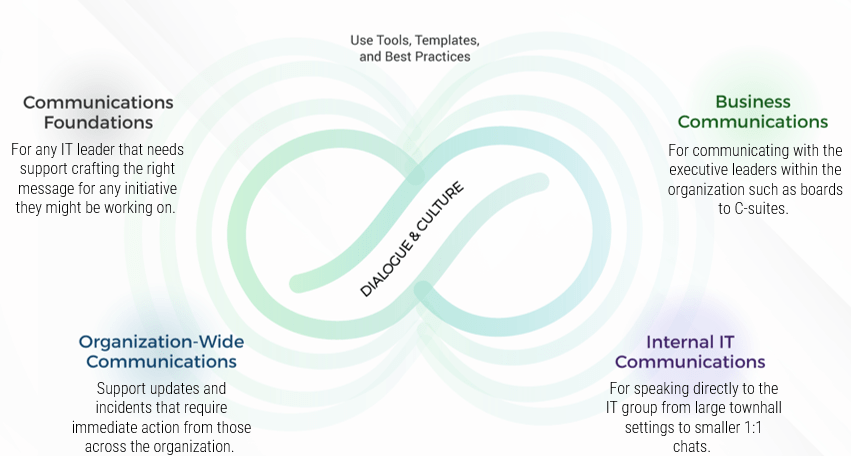

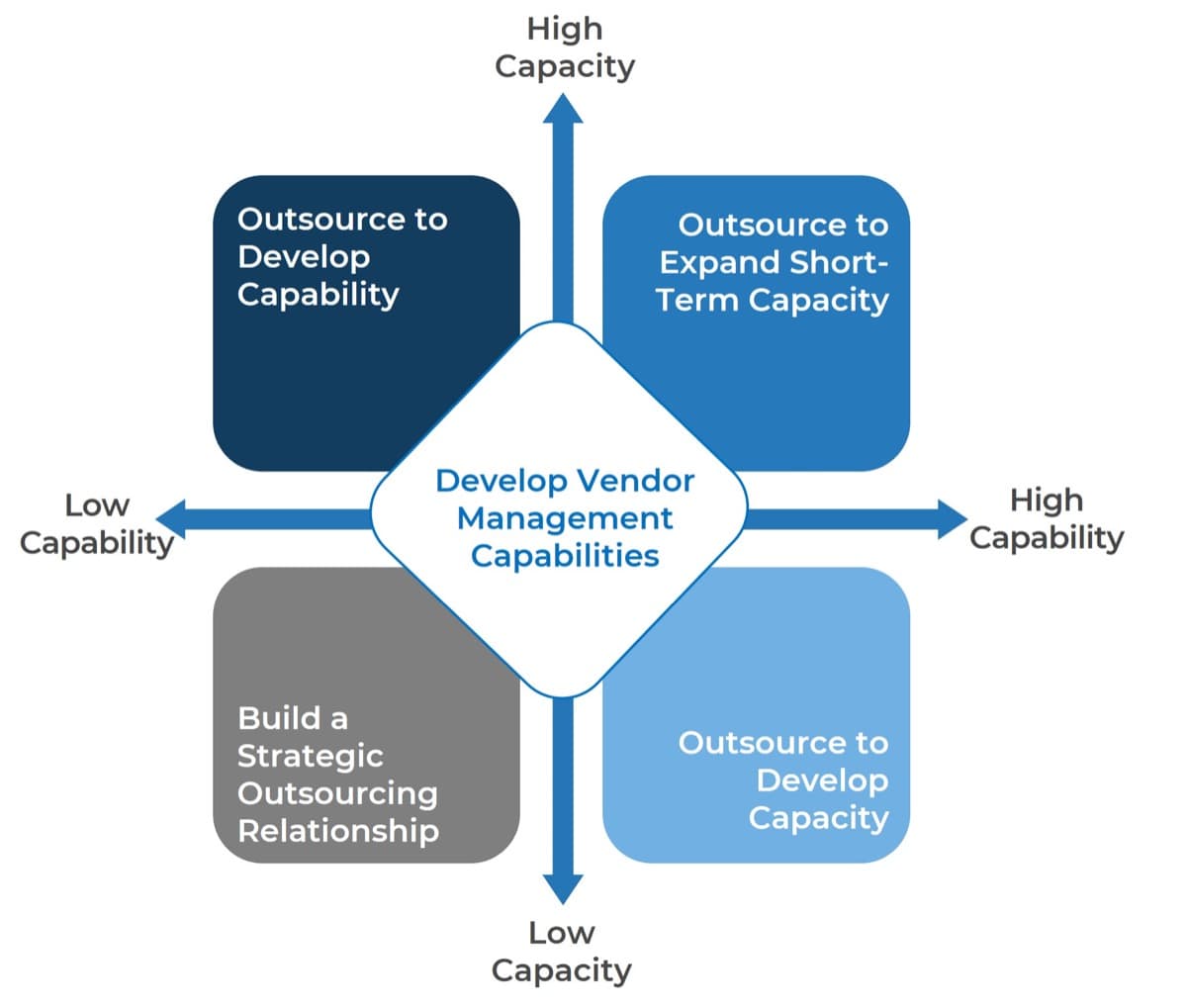

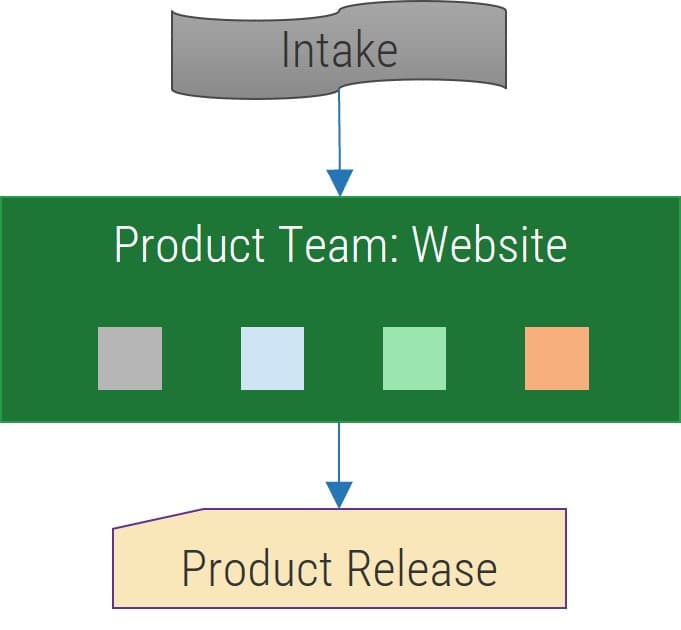

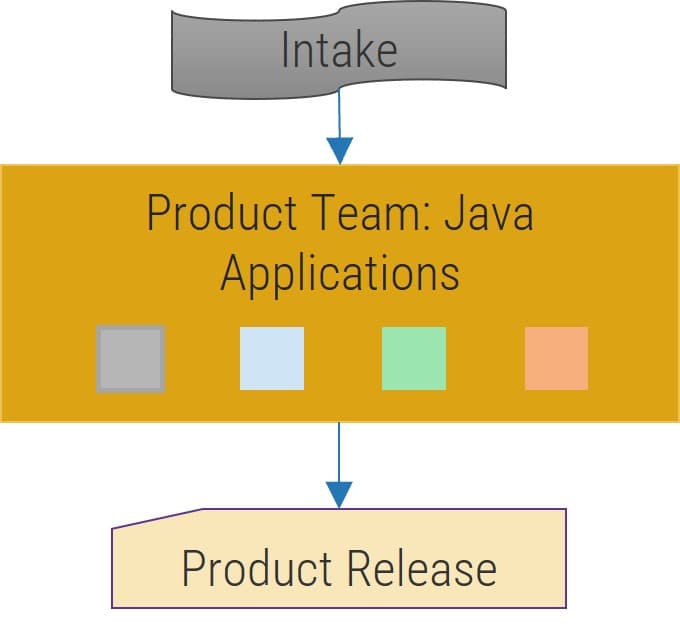

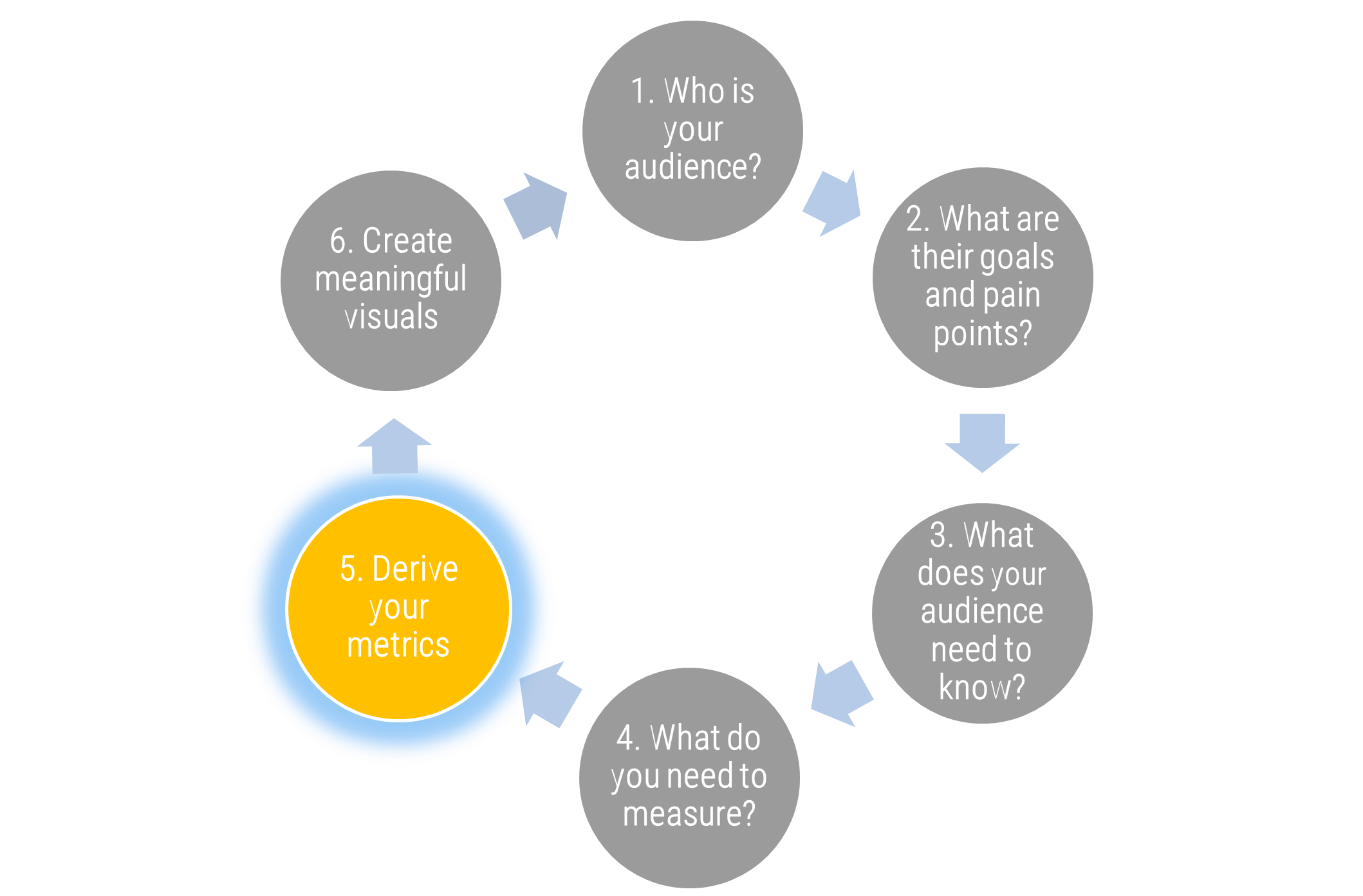

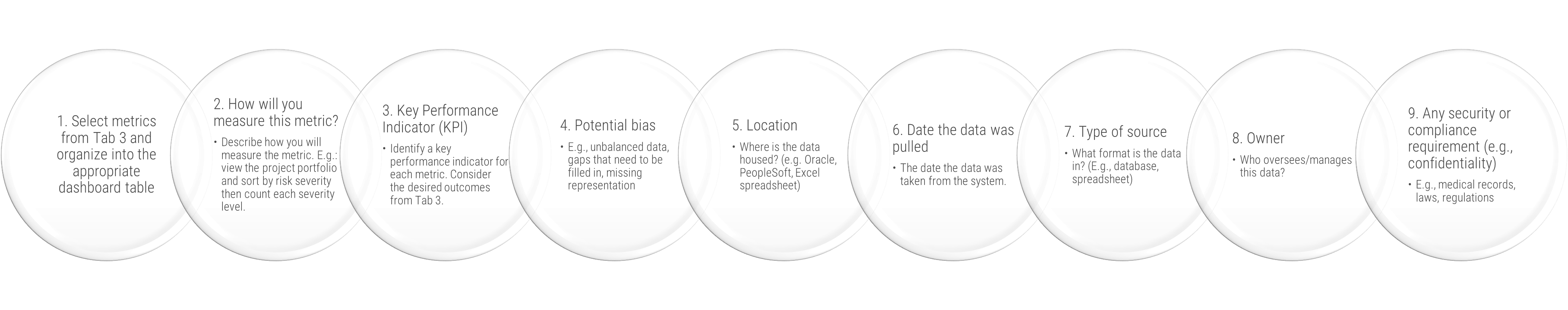

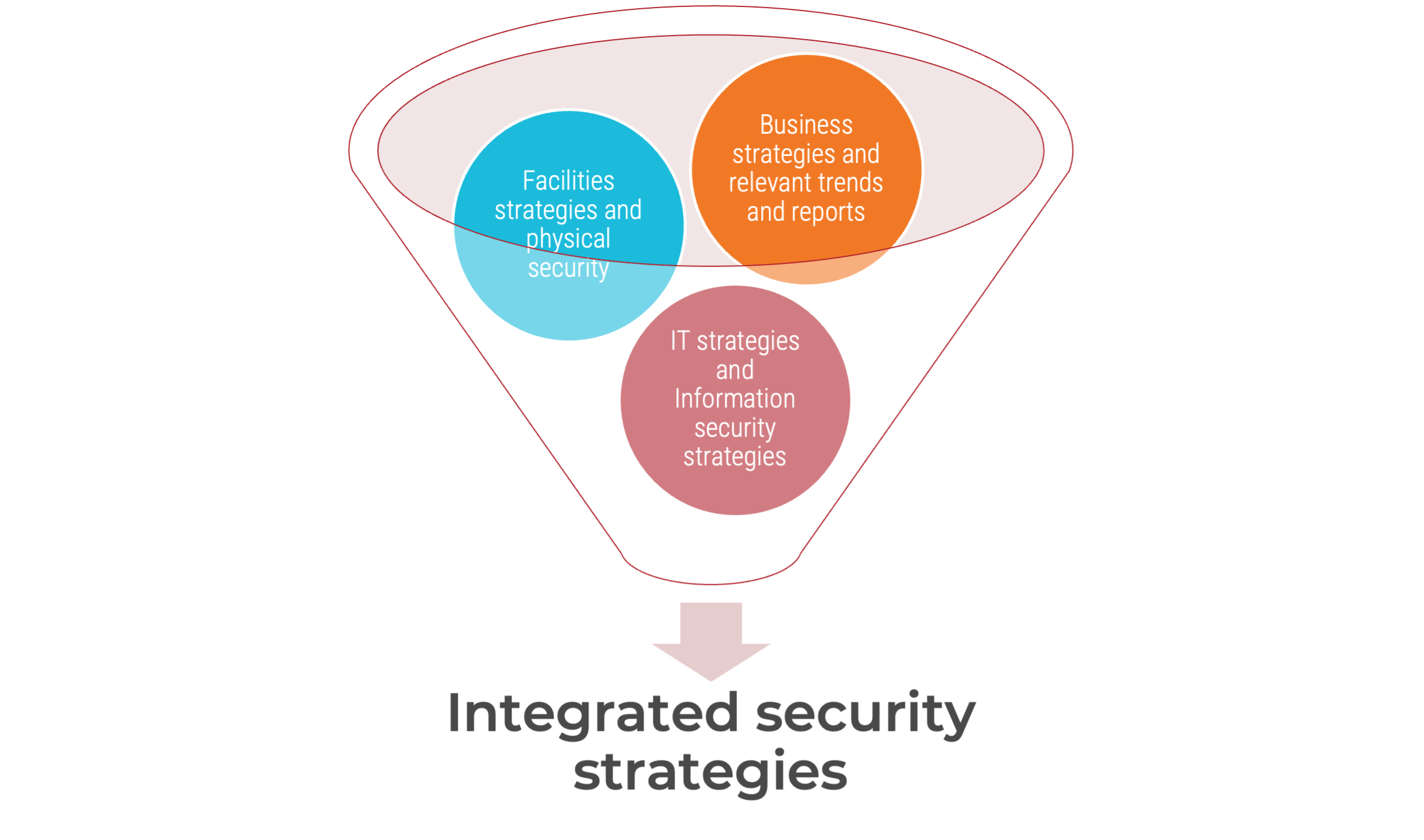

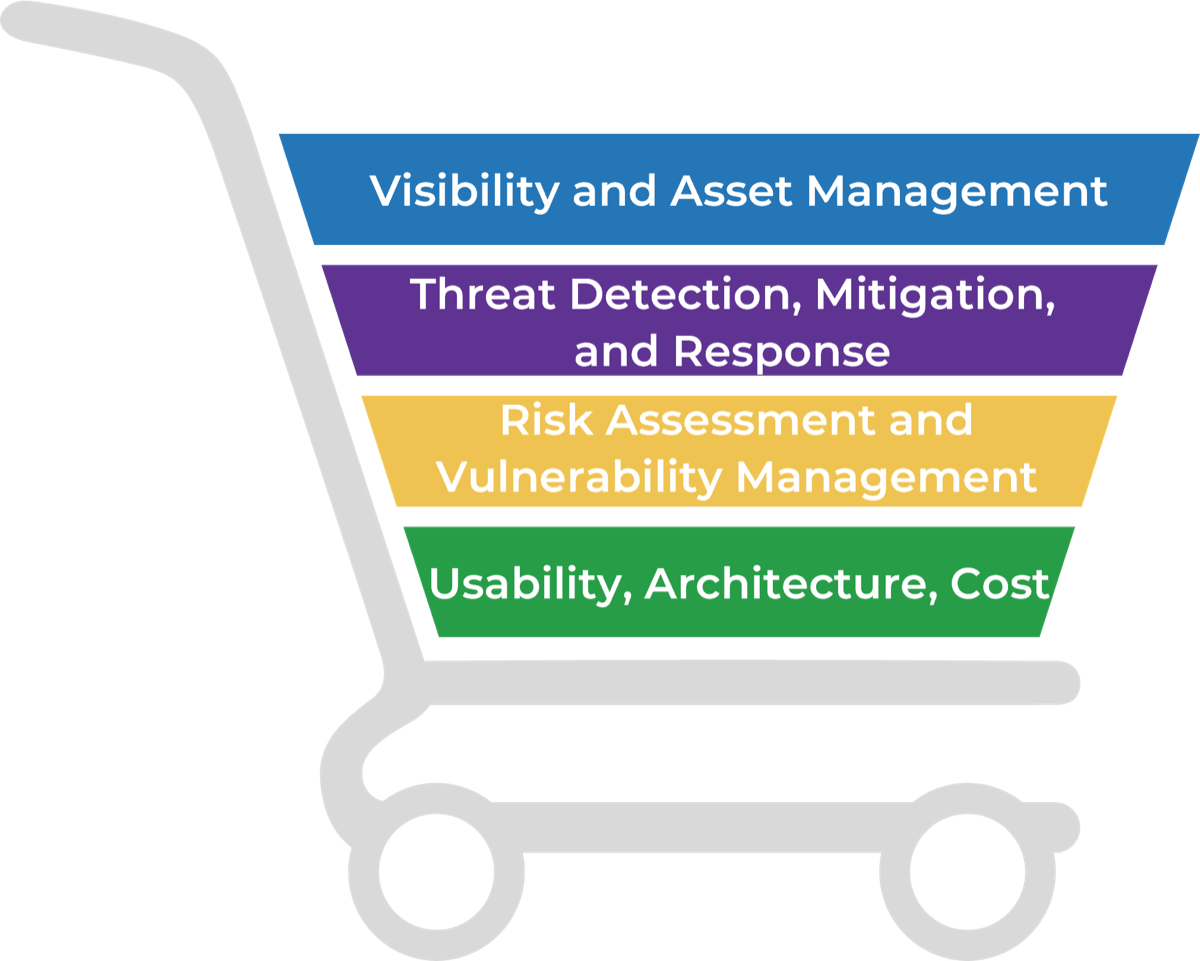

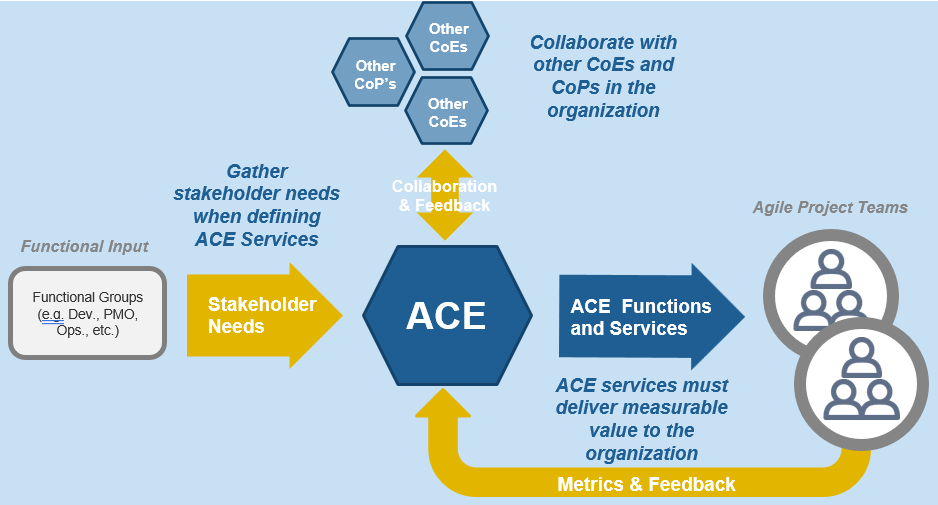

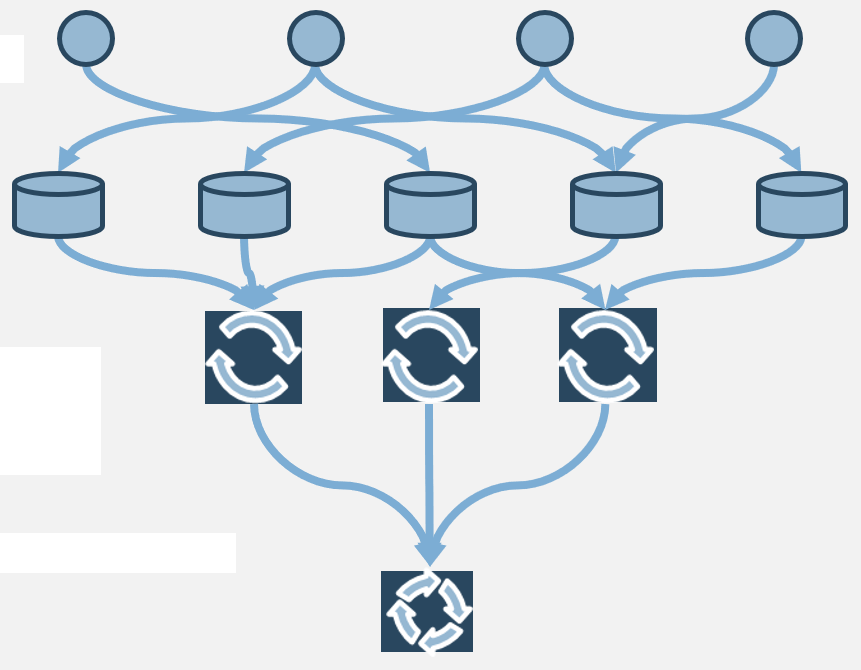

Use Info-Tech’s CoE Operating Model to define the service offerings of your ACE

Understand where your inputs and outputs lie to create an accessible set of service offerings for your Agile teams.

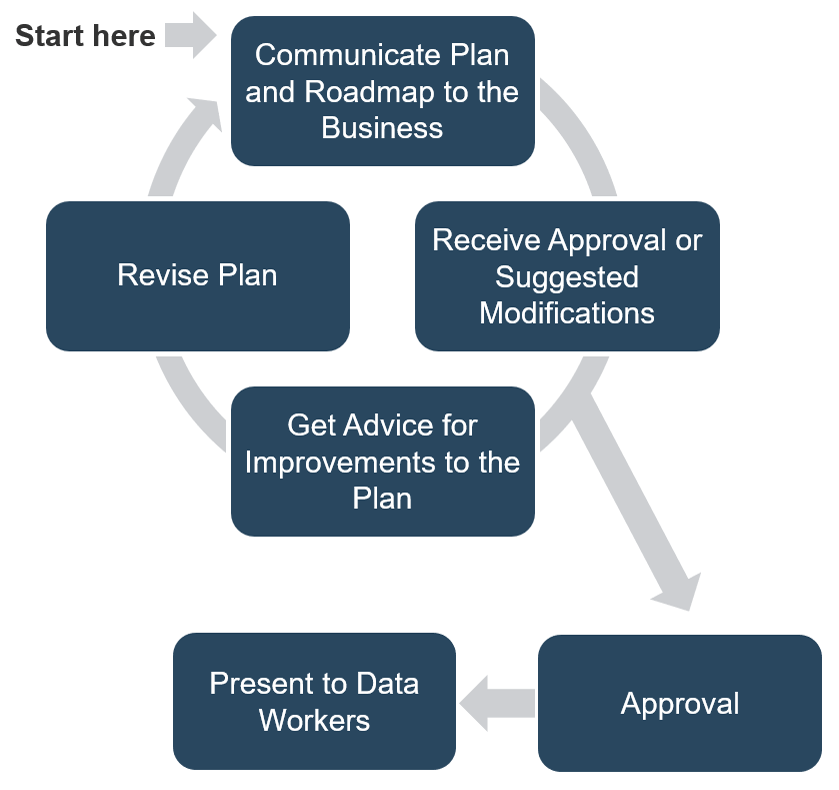

Continuously improve the ACE to ensure long-term viability

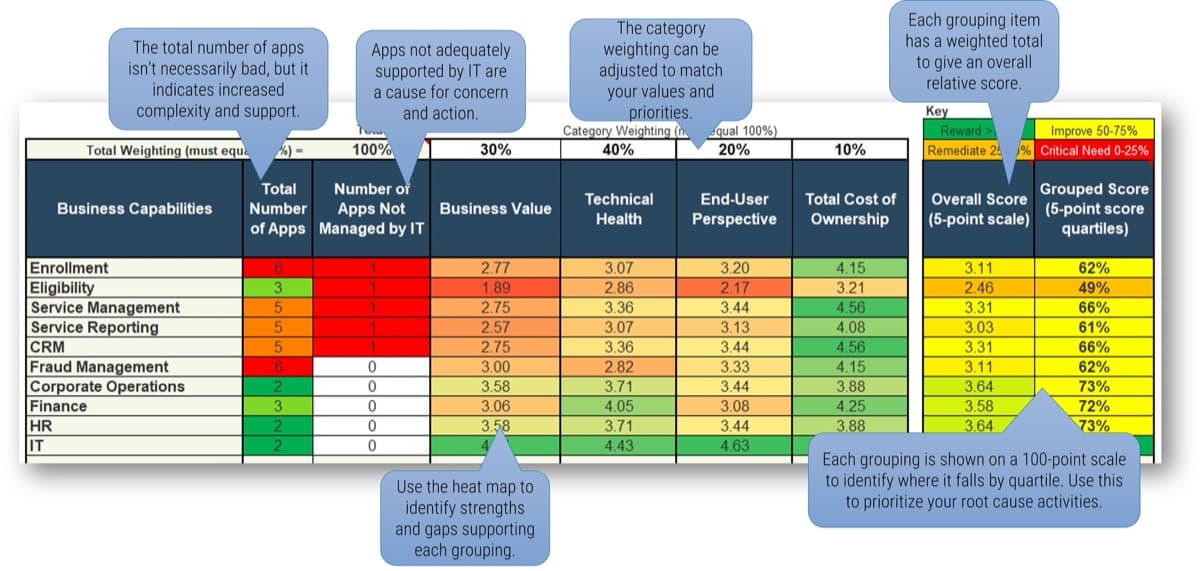

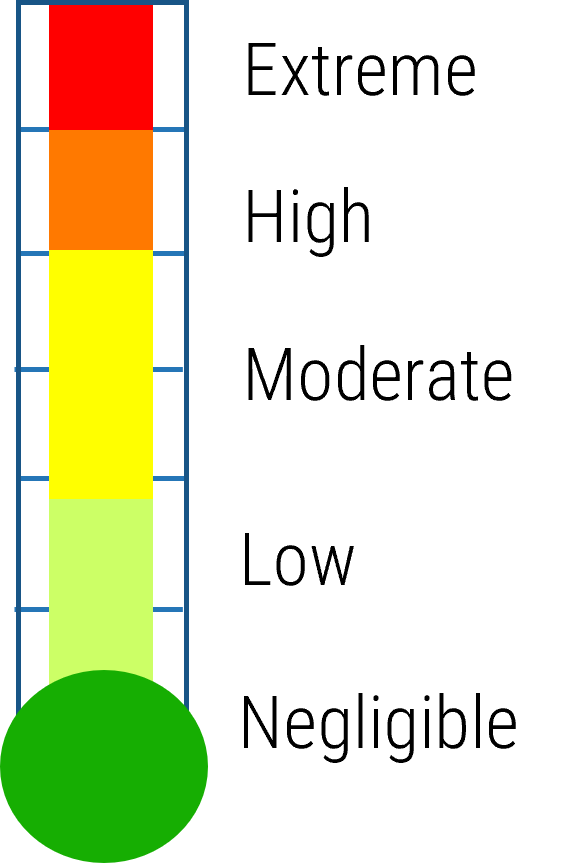

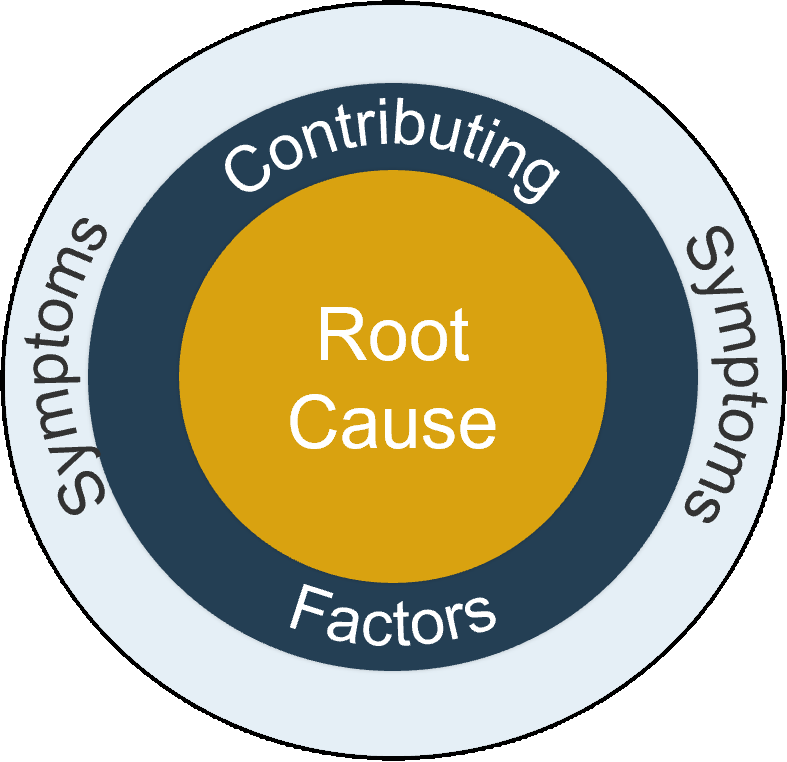

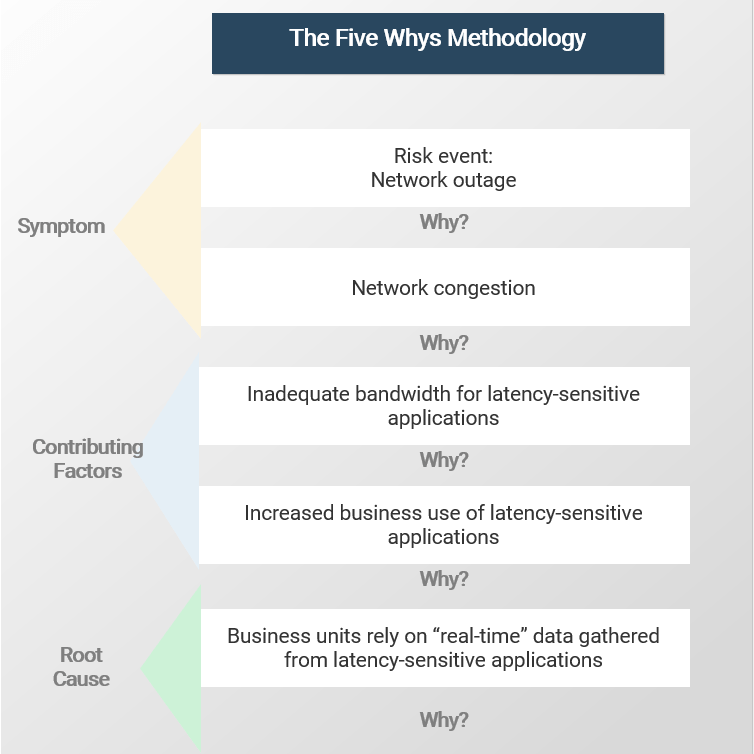

Improvement involves the continuous evaluation of the performance of your teams, using well-defined metrics and reasonable benchmarks that are supplemented by analogies and root-cause analysis in retrospectives.

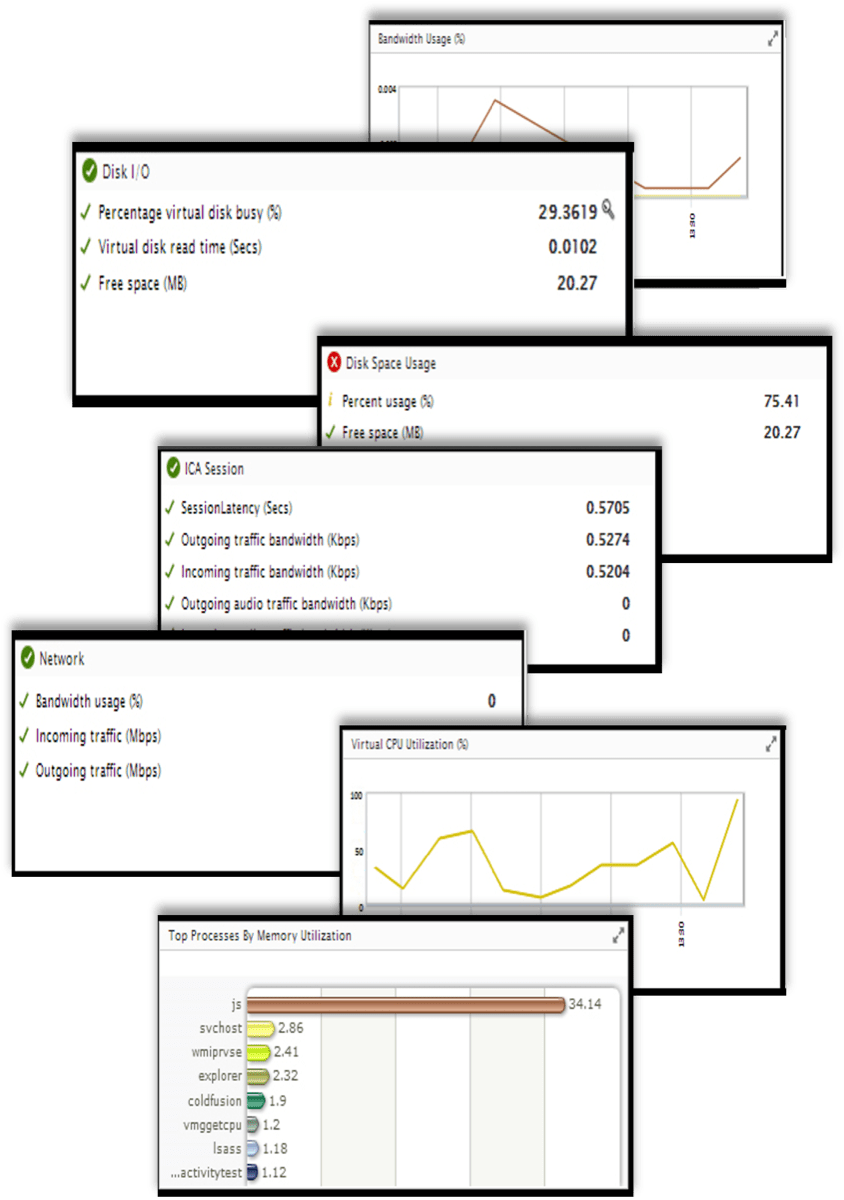

Monitor

Monitor your metrics to ensure desired benefits are being realized. The ACE is responsible for ensuring that expected Agile benefits are achievable and on track. Monitor against your defined baselines to create transparency and accountability for desired outcomes.

Iterate

Run retrospectives to drive improvements and fixes into Agile projects and processes. Metrics falling short of expectations must be diagnosed and their root causes found, and fixes need to be communicated and injected back into the larger organization.

Define

Define metrics and set targets that align with the goals of the ACE. These metrics represent the ACEs expected value to the organization and must be measured against on a regular basis to demonstrate value to your key stakeholders.

Beware the common risks of implementing your ACE

Culture clash between Agile teams and larger organization

Agile leverages empowered teams, meritocracy, and broad collaboration for success, but typical organizations are siloed and hierarchical with top down decision making. There needs to be a plan to enable a smooth transition from the current state towards the Agile target state.

Persistence of tribal knowledge

Agile relies on easy and open knowledge sharing, but organizational knowledge can sit in siloes. Employees may also try to protect their expertise for job security. It is important to foster knowledge sharing to ensure that critical know-how is accessible and doesn’t leave the organization with the individual.

Rigid management structures

Rigidity in how managers operate (performance reviews, human resource management, etc.) can result in cultural rejection of Agile. People need to be assessed on how they enable their teams rather than as individual contributors. This can help ensure that they are given sufficient opportunities to succeed. More support and less strict governance is key.

Breakdown due to distributed teams

When face-to-face interactions are challenging, ensure that you invest in the right communication technologies and remove cultural and process impediments to facilitate organization-wide collaboration. Alternative approaches like using documentation or email will not provide the same experience and value as a face-to-face conversation.

The State of Maine used an ACE to foster positive cultural change

CASE STUDY

Industry - Government

Source - Cathy Novak, Agile Government Leadership

The State of Maine’s Agile Center of Excellence

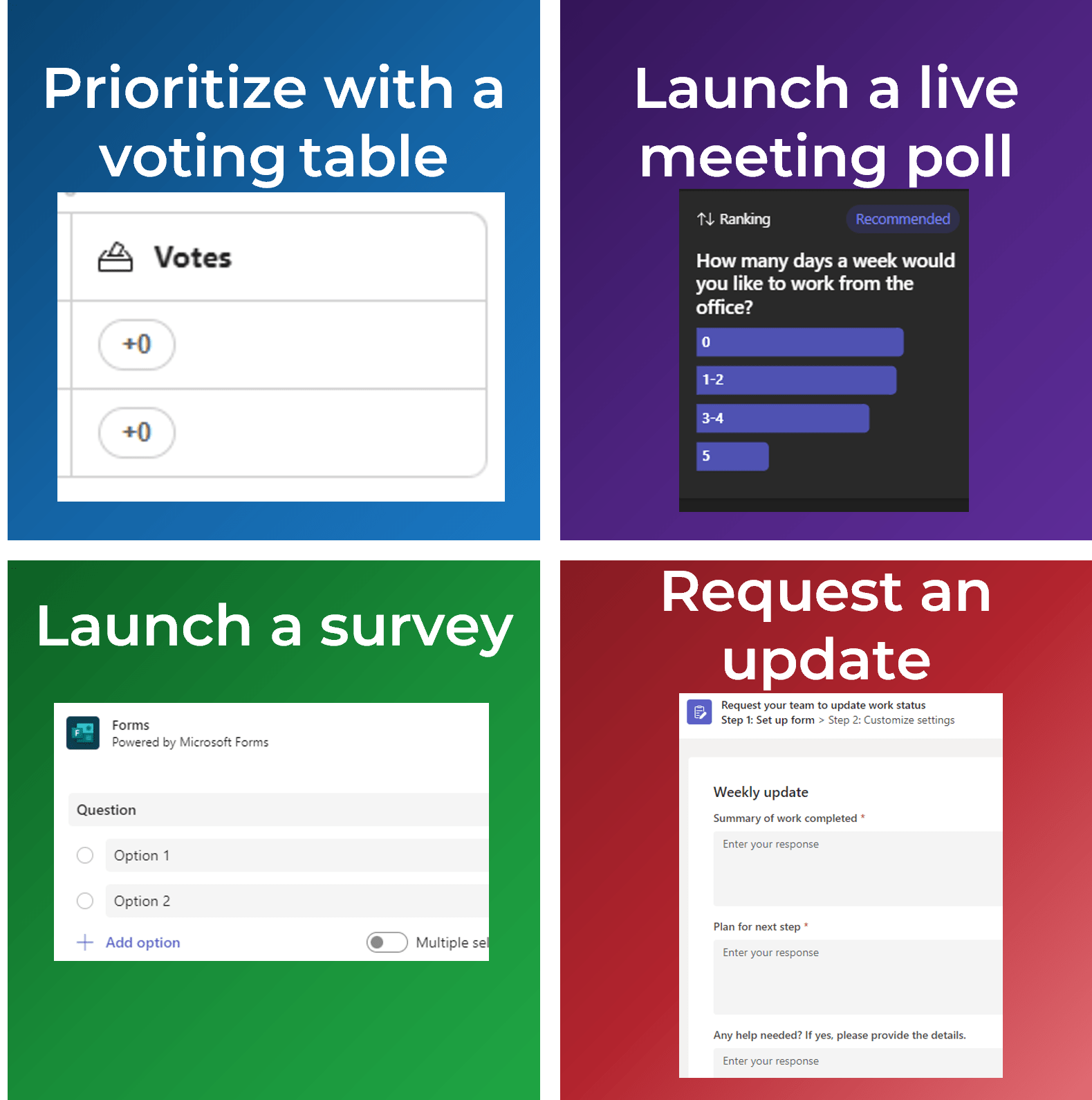

“The Agile CoE in the State of Maine is completely focused on the discipline of the methodology. Every person who works with Agile, or wants to work with Agile, belongs to the CoE. Every member of the CoE tells the same story, approaches the methodology the same way, and uses the same tools. The CoE also functions as an Agile research lab, experimenting with different standards and tools.

The usual tools of project management – mission, goals, roles, and a high-level definition of done – can be found in Maine’s Agile CoE. For story mapping, teams use sticky notes on a large wall or whiteboard. Demonstrating progress this way provides for positive team dynamics and a psychological bang. The State of Maine uses a project management framework that serves as its single source of truth. Everyone knows what’s going on at all times and understands the purpose of what they are doing. The Agile team is continually looking for components that can be reused across other agencies and programs.”

Results:

- Realized positive culture change, leading to more collaborative and supportive teams.

- Increased visibility of Agile benefits across functional groups.

- Standardized methodology across Agile teams and increased innovation and experimentation with new standards and tools.

- Improved traceability of projects.

- Increased visibility and ability to determine root causes of problems and right the course when outcomes are not meeting expectations.

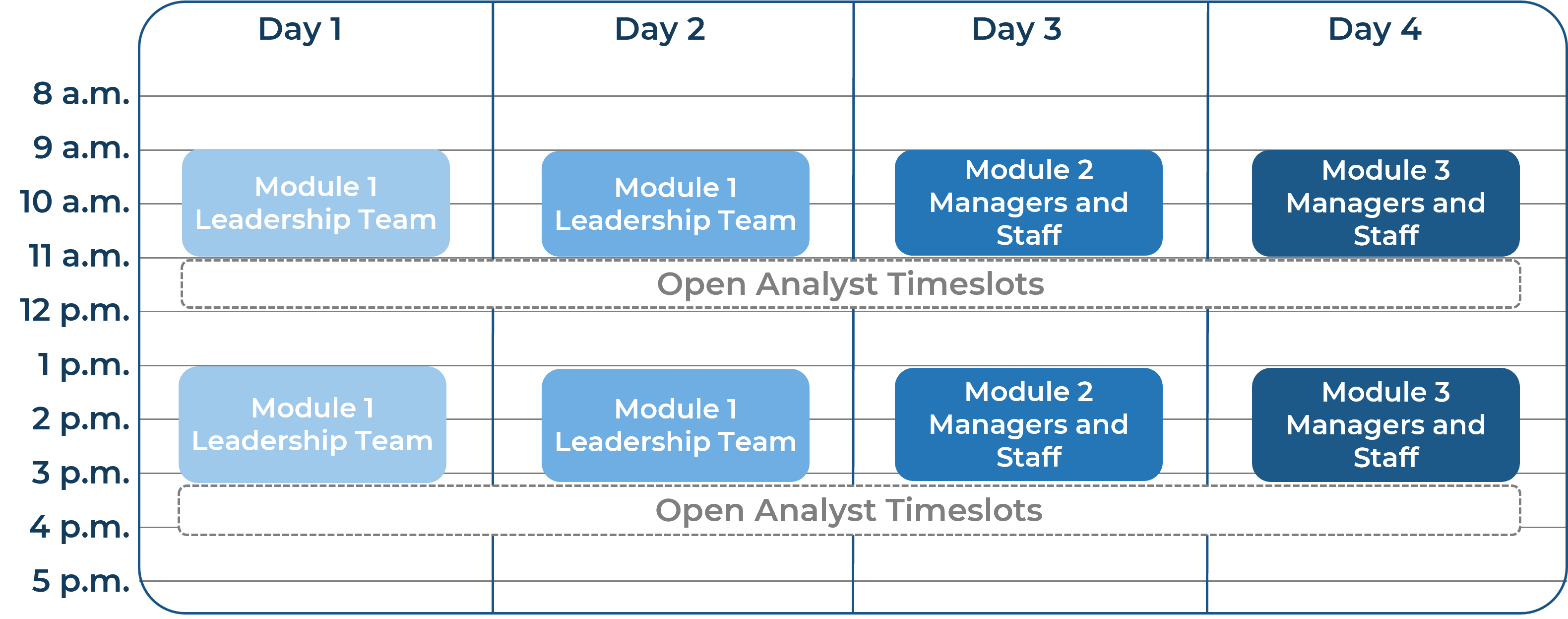

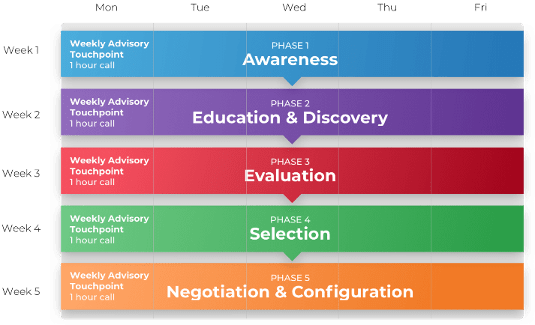

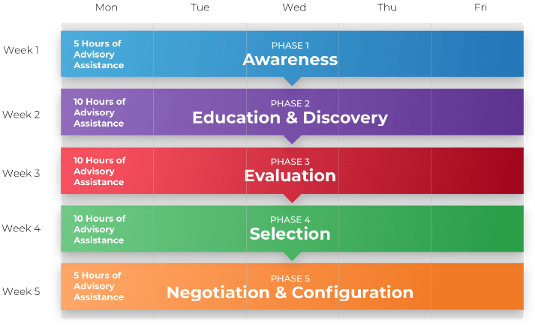

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit

“Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful.”

Guided Implementation

“Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track.”

Workshop

“We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place.”

Consulting

“Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project.”

Diagnostics and consistent frameworks used throughout all four options

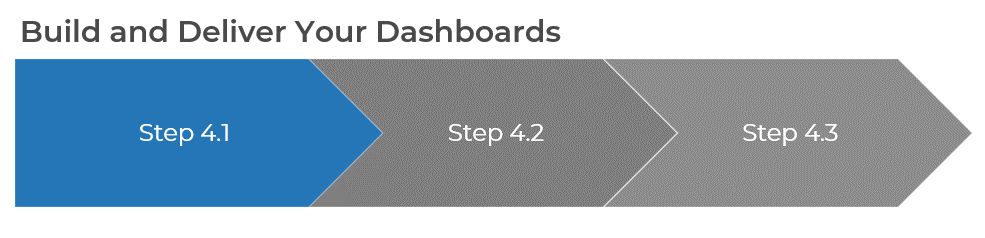

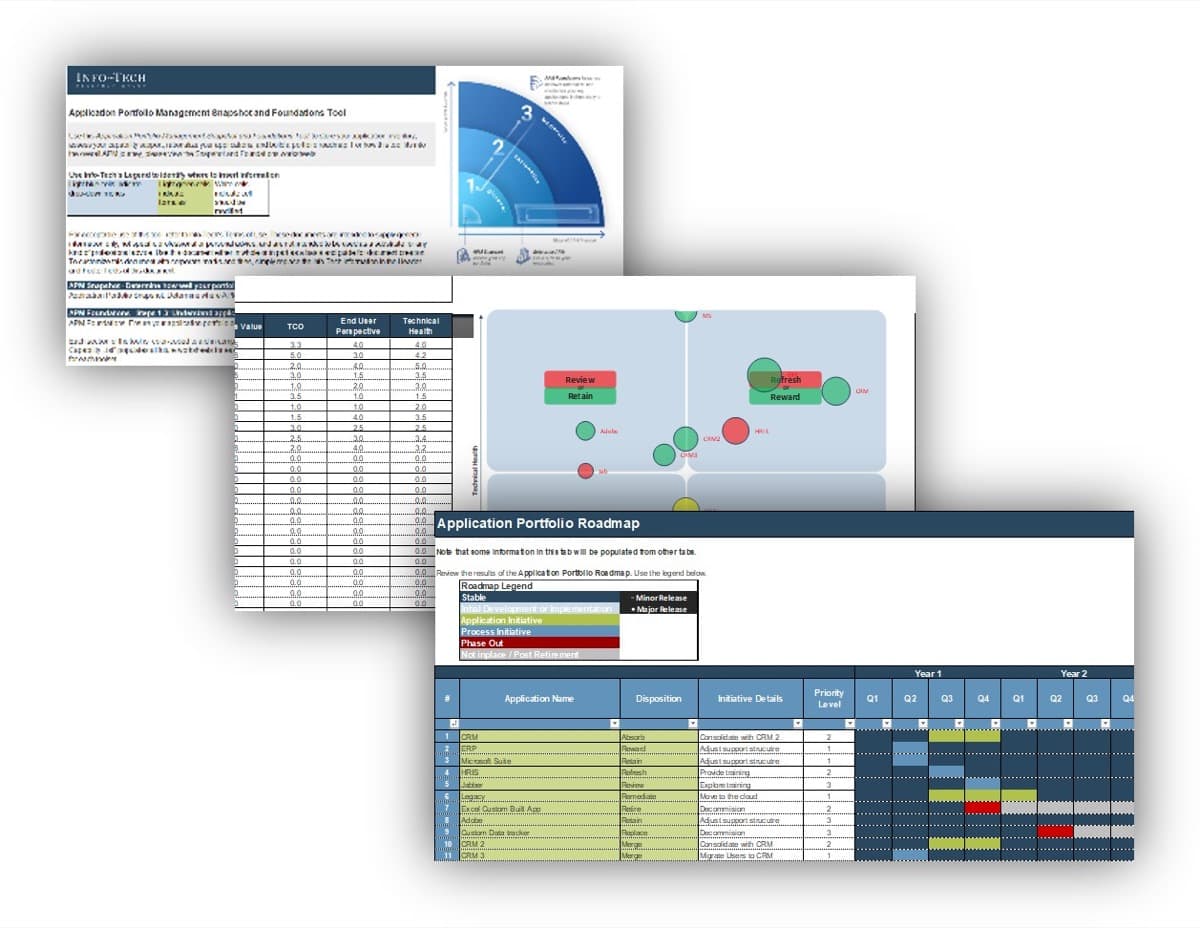

Spread Best Practices With an Agile Center of Excellence – project overview

| |

1. Strategically align the Center of Excellence |

2. Standardize the CoEs service offerings |

3. Operate the Center of Excellence |

| Best-Practice Toolkit |

1.1 Determine the vision of your ACE.

1.2 Define the service offerings of your ACE. |

2.1 Define an adoption plan for your Agile teams.

2.2 Create an ACE engagement plan.

2.3 Define metrics to measure success. |

3.1 Optimize the success of your ACE.

3.2 Plan change to enhance your Agile initiatives.

3.3 Conduct ongoing retrospectives of your ACE. |

| Guided Implementations |

- Align your ACE with the business.

- Align your ACE with its users.

|

- Dissect the key attributes of Agile adoption.

- Form engagement plans for your Agile teams.

- Discuss effective ACE metrics.

|

- Conduct a baseline assessment of your Agile environment.

- Interface ACE with your change management function.

- Build a communications deck for key stakeholders.

|

| Onsite Workshop |

Module 1: Strategically align the ACE |

Module 2: Standardize the offerings of the ACE |

Module 3: Prepare for organizational change |

| |

Phase 1 Outcome: Create strategic alignment between the CoE and organizational goals. |

Phase 2 Outcome: Build engagement plans and key performance indicators based on a standardized Agile adoption plan. |

Phase 3 Outcome: Operate the CoEs monitoring function, identify improvements, and manage the change needed to continuously improve. |

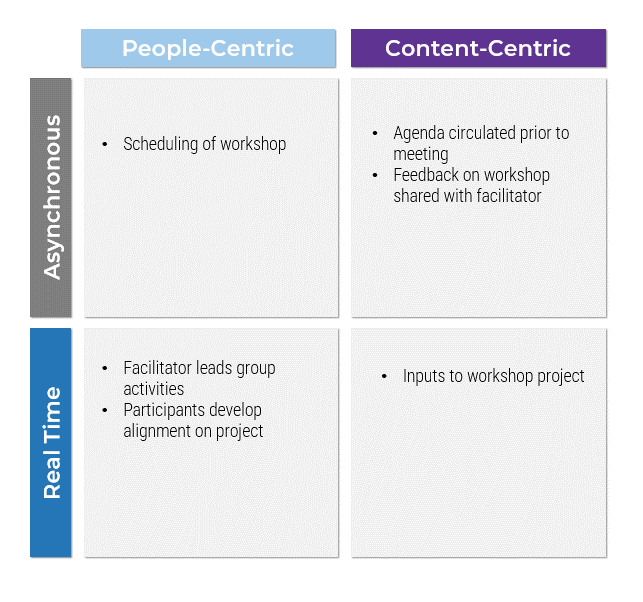

Workshop overview

Contact your account representative or email Workshops@InfoTech.com for more information.

| |

Workshop Module 1 |

Workshop Module 2 |

Workshop Module 3 |

Workshop Module 4 |

| Activities |

Determine vision of CoE

1.1 Identify and prioritize organizational business objectives.

1.2 Form use cases for the points of alignment between your ACE and business objectives.

1.3 Prioritize your ACE stakeholders. |

Define service offerings of CoE

2.1 Form a solution matrix to organize your pain points and opportunities.

2.2 Refine your use cases to identify your ACE functions and services.

2.3 Visualize your ACE functions and service offerings with a capability map. |

Define engagement plans

3.1 Further categorize your use cases within the Agile adoption model.

3.2 Create an engagement plan for each level of adoption. |

Define metrics and plan communications

4.1 Define metrics that align with your Agile business objectives.

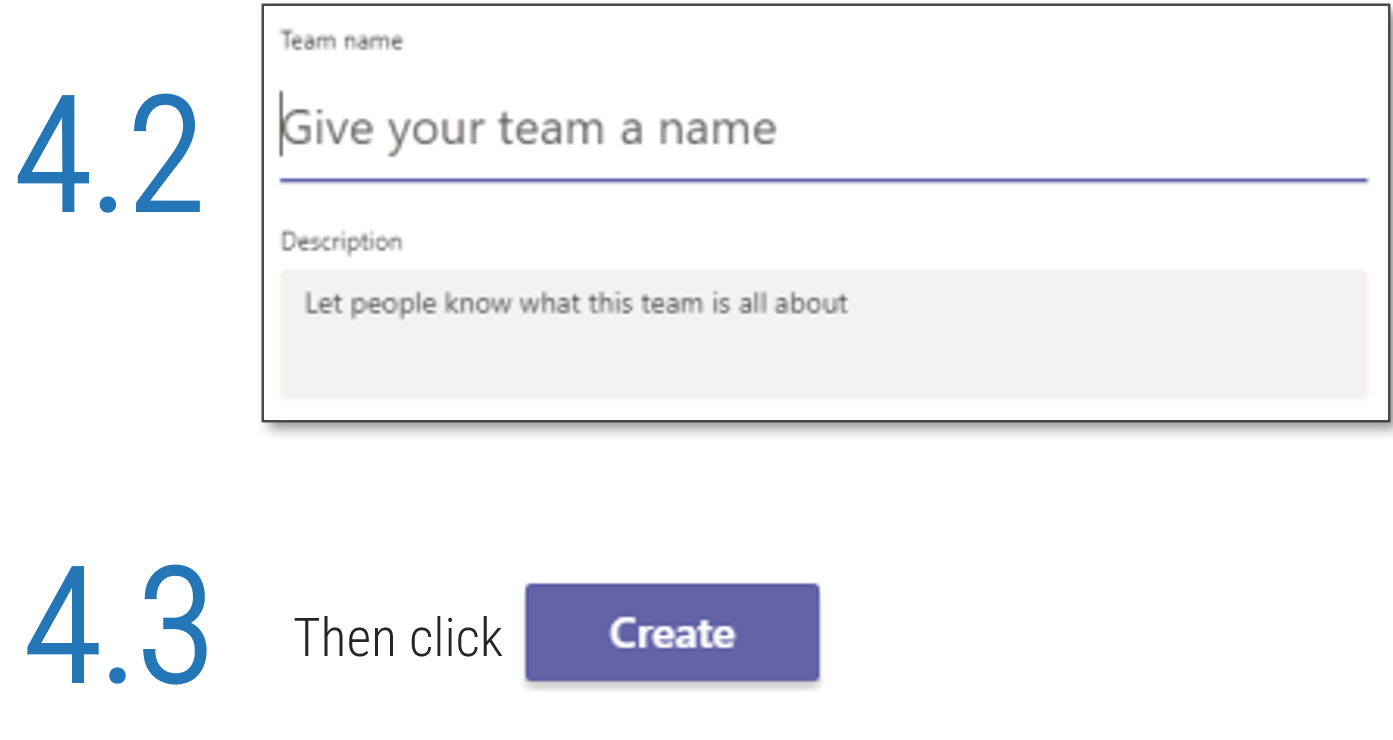

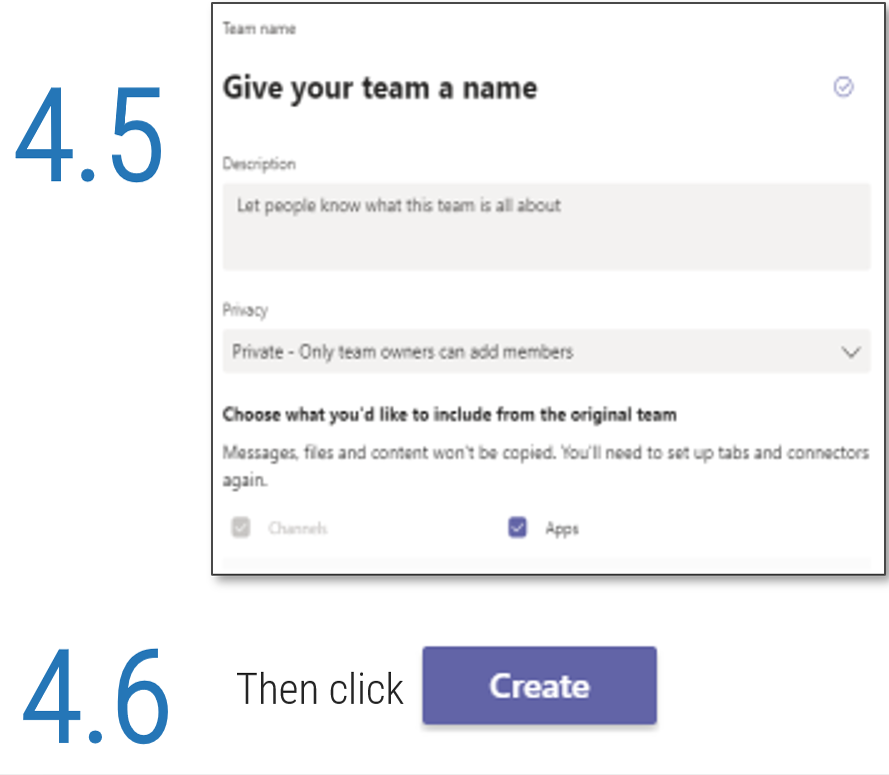

4.2 Define target ACE performance metrics.

4.3 Define Agile adoption metrics.

4.4 Assess the interaction and communication points of your Agile team.

4.5 Create a communication plan for change. |

| Deliverables |

- Prioritized business objectives

- Business-aligned use cases to form CoEs service offerings

- Prioritized list of stakeholders

|

- Classified pains and opportunities

- Refined use cases based on pains and opportunities identified during ACE requirements gathering

- ACE capability map

|

- Adoption-aligned service offerings

- Role-specific engagement plans

|

- Business objective-aligned metrics

- ACE performance metrics

- Agile adoption metrics

- Assessment of organization design

- ACE Communication Plan

|

Phase 1

Strategically Align the Center of Excellence

Spread Best Practices With an Agile Center of Excellence

Begin by strategically aligning your Center of Excellence

The first step to creating a high-functioning ACE is to create alignment and consensus amongst your key stakeholders regarding its purpose. Engage in a set of activities to drill down into the organization’s goals and objectives in order to create a set of high-level use cases that will evolve into the service offerings of the ACE.

Phase 1 - Strategically Align the CoE

Create strategic alignment between the CoE and the organization’s goals, objectives, and vision. This alignment translates into the CoE mandate intended to enhance the way Agile will enable teams to meet business objectives.

Phase 2 - Standardize the CoEs Service Offerings

Build an engagement plan based on a standardized adoption model to ensure your CoE service offerings are accessible and consistent across the organization. Create and consolidate key performance indicators to measure the CoEs utility and whether or not the expected value is being translated to tangible results.

Phase 3 - Operate the CoE

Operate the CoE to provide service offerings to Agile teams, identify improvements to optimize the function of your Agile teams, and effectively manage and communicate change so that teams can grow within the Agile adoption model and optimize value delivery both within your Agile environment and across functions.

Phase 1 outline

Call 1-888-670-8889 or email GuidedImplementations@InfoTech.com for more information.

Complete these steps on your own, or call us to complete a guided implementation. A guided implementation is a series of

2-3 advisory calls that help you execute each phase of a project. They are included in most advisory memberships.

Guided Implementation 1: Strategically align the ACE

Proposed Time to Completion (in weeks): 1

Step 1.1: Determine the vision of your ACE

Start with an analyst kick off call:

- Align your ACE with the business.

Then complete these activities…

1.1.1 Optional: Baseline your ACE maturity.

1.1.2 Identify and prioritize organizational business objectives.

1.1.3 Form use cases for the points of alignment between your ACE and business objectives.

1.1.4 Prioritize your ACE stakeholders.

1.1.5 Select a centralized or decentralized model for your ACE.

1.1.6 Staff your ACE strategically.

Step 1.2: Define the service offerings of your ACE

Start with an analyst kick off call:

- Align your ACE with its users.

Then complete these activities…

1.2.1 Form the Center of Excellence.

1.2.2 Gather and document your existing Agile practices for the CoE.

1.2.3 Interview stakeholders to align ACE requirements with functional expectations.

1.2.4 Form a solution matrix to organize your pain points and opportunities.

1.2.5 Refine your use cases to identify your ACE functions and services.

1.2.6 Visualize your ACE functions and service offerings with a capability map.

Phase 1 Results & Insights:

- Aligning your ACE with the functional expectations of its users is just as critical as aligning with the business. Invest the time to understand how the ACE fits at all levels of the organization to ensure its highest effectiveness.

Phase 1, Step 1: Determine the vision of your ACE

Phase 1

1.1 Determine the vision of your ACE

1.2 Define the service offerings of your ACE

Phase 2

2.1 Define an adoption plan for your Agile teams

2.2 Create an ACE engagement plan

2.3 Define metrics to measure success

Phase 3

3.1 Optimize the success of your ACE

3.2 Plan change to enhance your Agile initiatives

3.3 Conduct ongoing retrospectives of your ACE

Activities:

1.1.1 Optional: Baseline your ACE maturity.

1.1.2 Identify and prioritize organizational business objectives.

1.1.3 Form use cases for the points of alignment between your ACE and business objectives.

1.1.4 Prioritize your ACE stakeholders.

1.1.5 Select a centralized or decentralized model for your ACE.

1.1.6 Staff your ACE strategically.

Outcomes:

- Gather your leadership to position the ACE and align it with business priorities.

- Form a set of high-level use cases for services that will support the enablement of business priorities.

- Map the stakeholders of the ACE to visualize expected influence and current support levels for your initiative.

What does an ACE do?

Six main functions derived from Info-Tech’s CLAIM+G Framework

- Learning

- Provide training and development and enable engagement based on identified interaction points to foster organizational growth.

Tooling

- Promote the use of standardized tooling to improve efficiency and consistency throughout the organization.

Supporting

- Enable your Agile teams to access subject-matter expertise by facilitating knowledge transfer and documenting good practices.

Governing

- Create operational boundaries for Agile teams, and monitor their progress and ability to meet business objectives within these boundaries.

Monitoring

- Demonstrate the value the CoE is providing through effective metric setting and ongoing monitoring of Agile’s effectiveness.

Guiding

- Provide guidance, methodology, and knowledge for teams to leverage to effectively meet organizational business objectives.

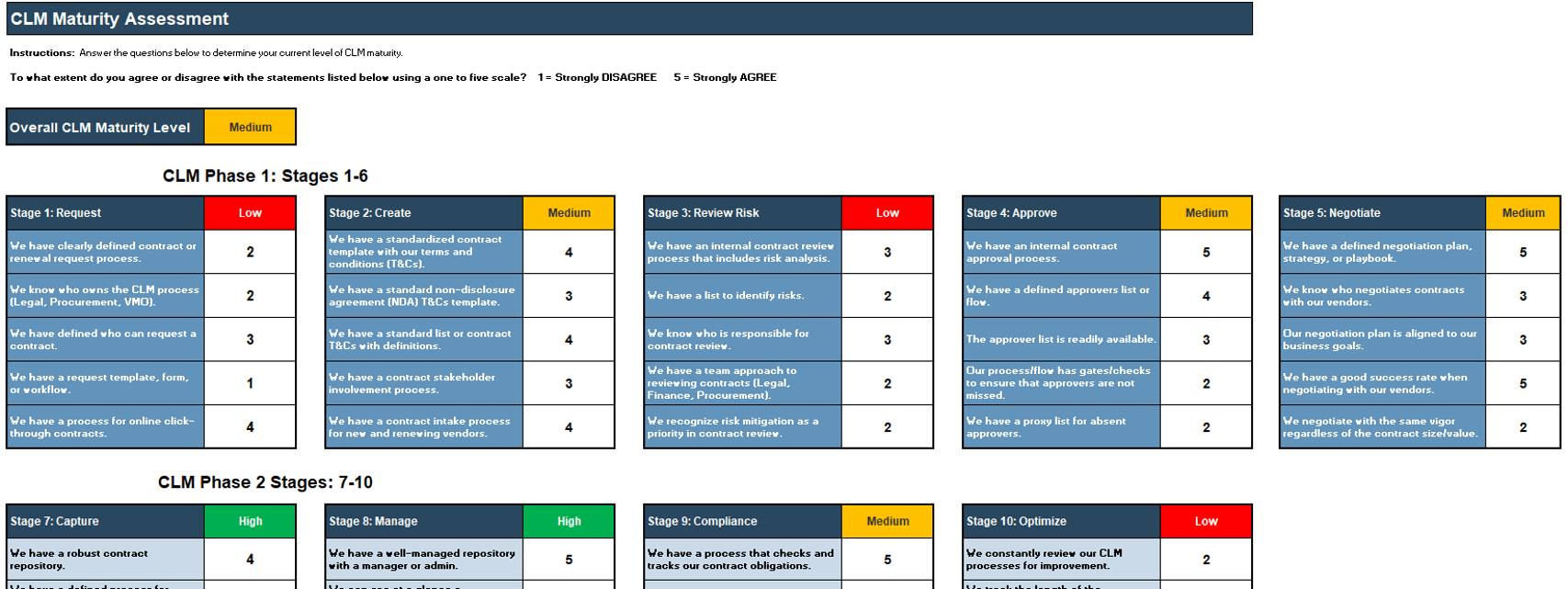

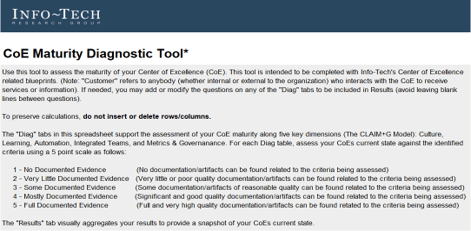

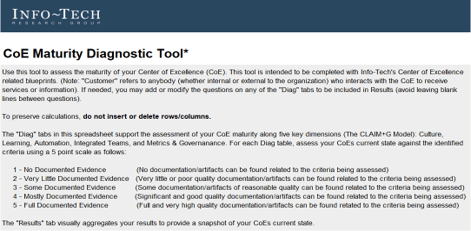

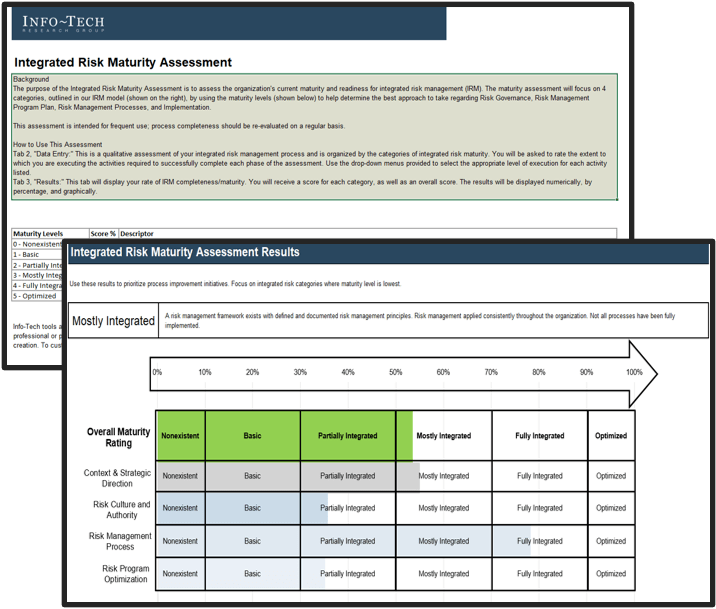

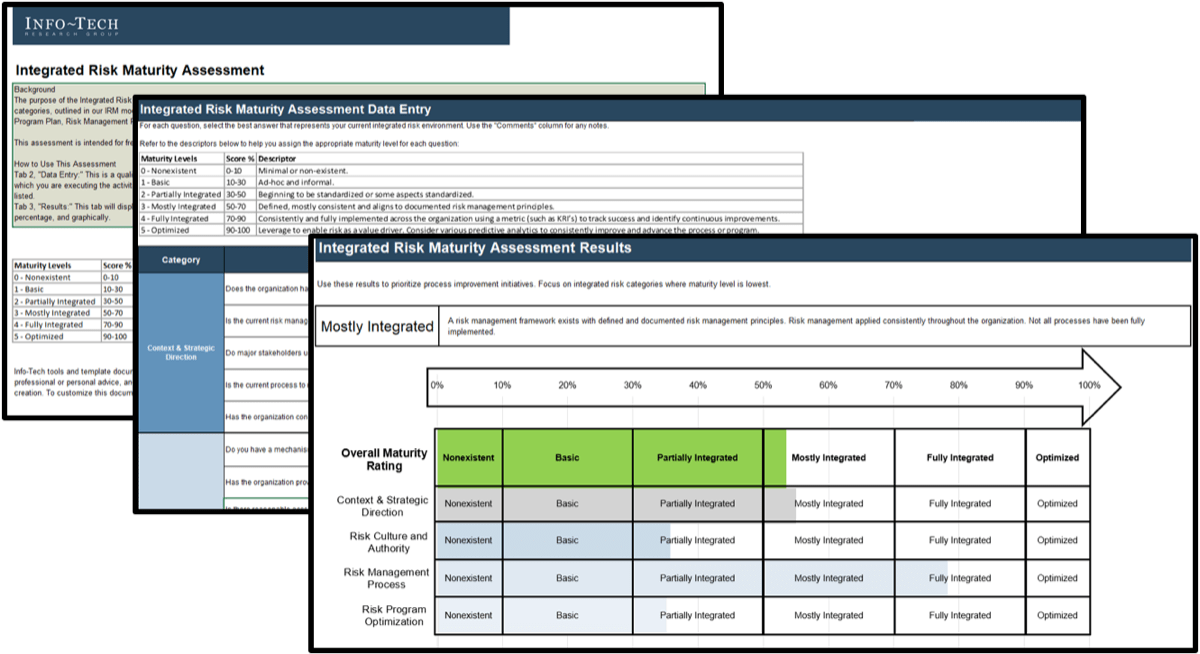

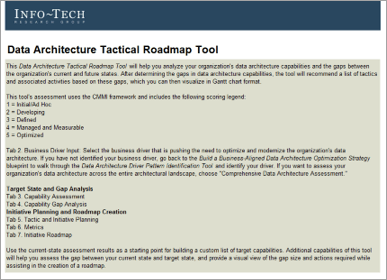

OPTIONAL: If you have an existing ACE, use Info-Tech’s CoE Maturity Diagnostic Tool to baseline current practices

1.1.1 Existing CoE Maturity Assessment

Purpose

If you already have established an ACE, use Info-Tech’s CoE Maturity Diagnostic Tool to baseline its current maturity level (this will act as a baseline for comparison after you complete this Blueprint). Assessing your ACEs maturity lets you know where you currently are, and where to look for improvements.

Steps

- Download the CoE Maturity Diagnostic Tool to assess the maturity of your ACE.

- Complete the assessment tool with all members of your ACE team to determine your current Maturity score.

- Document the results in the ACE Communications Deck.

Document results in the ACE Communications Deck.

INFO-TECH DELIVERABLE

Download the CoE Maturity Diagnostic Tool.

Get your Agile leadership together and position the ACE

| Stakeholder |

Role |

Why they are essential players |

| CIO/ Head of IT |

Program sponsor: Champion and set the tone for the Agile program. Critical in gaining and maintaining buy-in and momentum for the spread of Agile service offerings. |

The head of IT has insight and influence to drive buy-in from executive stakeholders and ensure the long-term viability of the ACE. |

| Applications Director |

Program executor: Responsible for the formation of the CoE and will ensure the viability of the initial CoE objectives, use cases, and service offerings. |

Having a coordinator who is responsible for collating performance data, tracking results, and building data-driven action plans is essential to ensuring continuous success. |

| Agile Subject-Matter Experts |

Program contributor: Provide information on the viability of Agile practices and help build capabilities on existing best practices. |

Agile’s success relies on adoption. Leverage the insights of people who have implemented and evangelized Agile within your organization to build on top of a working foundation. |

| Functional Group Experts |

Program contributor: Provide information on the functional group’s typical processes and how Agile can achieve expected benefits. |

Agile’s primary function is to drive value to the business – it needs to align with the expected capabilities of existing functional groups in order to enhance them for the better. |

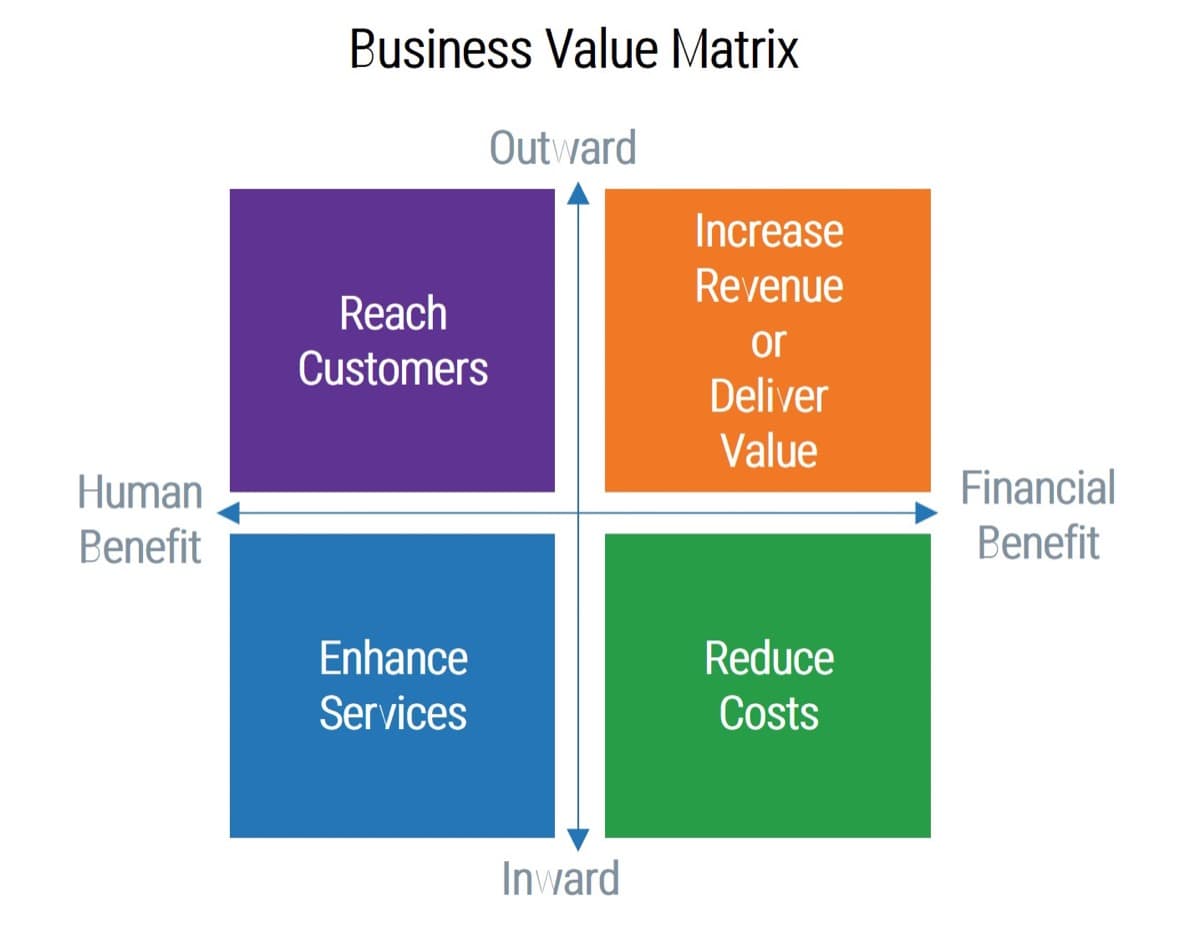

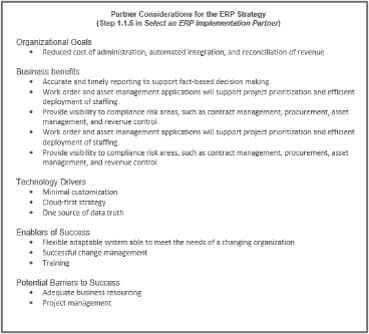

Align your ACE with your organization’s strategy

This research set will assist you with aligning your ACEs services to the objectives of the business in order to justify the resources and funding required by your Agile program.

Business Objectives → Alignment ←ACE Functions

Business justification to continue to fund a Center of Excellence can be a challenge, especially with traditional thinking and rigid stakeholders. Hit the ground running and show value to your key influencers through business alignment and metrics that will ensure that the ACE is worth continuous investment.

Alignment leads to competitive advantage

The pace of change in customer expectations, competitive landscapes, and business strategy is continuously increasing. It is critical to develop a method to facilitate ongoing alignment to shifting business and development expectations seamlessly and ensure that your Agile teams are able to deliver expected business value.

Activity: Identify and prioritize organizational business objectives

1.1.2 2 Hours

Input

- Organizational business objectives

Output

- Prioritized business objectives

Materials

Participants

- List the primary high-level business objectives that your organization aims to achieve over the course of the following year (focusing on those that ACE can impact/support).

- Prioritize these business objectives while considering the following:

- Criticality of completion: How critical is the initiative in enabling the business to achieve its goals?

- Transformational impact: To what degree is the foundational structure of the business affected by the initiative (rationale: Agile can support impact on transformational issues)?

Document the hypothesized role of Agile in supporting these business objectives. Take the top three prioritized objectives forward for the establishment of your ACE. While in future years or iterations you can inject more offerings, it is important to target your service offerings to specific critical business objectives to gain buy-in for long-term viability of the CoE.

Sample Business Objectives:

- Increase customer satisfaction.

- Reduce time-to-market of product releases.

- Foster a strong organizational culture.

- Innovate new feature sets to differentiate product. Increase utilization rates of services.

- Reduce product delivery costs.

- Effectively integrate teams from a merger.

- Offer more training programs for personal development.

- Undergo a digital transformation.

Understand potential hurdles when attempting to align with business objectives

While there is tremendous pressure to align IT functions and the business due to the accelerating pace of change and technology innovation, you need to be aware that there are limitations in achieving this goal. Keep these challenges at the top of mind as you bring together your stakeholders to position the service offerings of your ACE. It is beneficial to make your stakeholders self-aware of these biases as well, so they come to the table with an open mind and are willing to find common ground.

The search for total alignment

There are a plethora of moving pieces within an organization and total alignment is not a plausible outcome.

The aim of a group should not be to achieve total alignment, but rather reframe and consider ways to ensure that stakeholders are content with the ways they interact and that misalignment does not occur due to transparency or communication issues.

“The business” implies unity

While it may seem like the business is one unified body, the reality is that the business can include individuals or groups (CEO, CFO, IT, etc.) with conflicting priorities. While there are shared business goals, these entities may all have competing visions of how to achieve them. Alignment means compromise and agreement more than it means accommodating all competing views.

Cost vs. reputation

There is a political component to alignment, and sometimes individual aspirations can impede collective gain.

While the business side may be concerned with cost, those on the IT side of things can be concerned with taking on career-defining projects to bolster their own credentials. This conflict can lead to serious breakdowns in alignment.

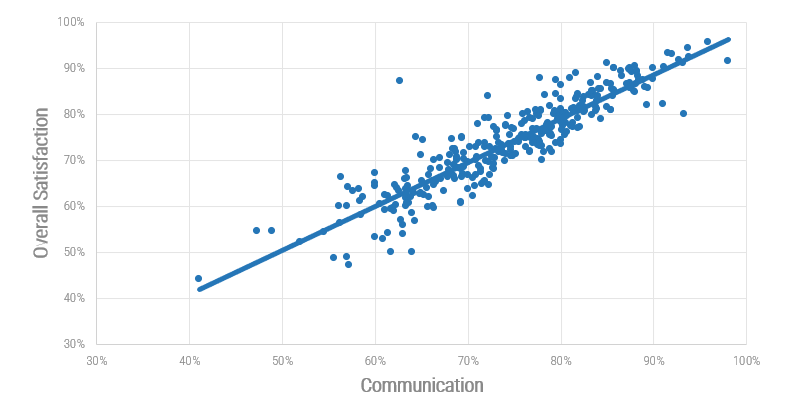

Panera Bread used Agile to adapt to changing business needs

CASE STUDY

Industry Food Services

Source Scott Ambler and Associates, Case Study

Challenge

Being in an industry with high competition, Panera Bread needed to improve its ability to quickly deliver desired features to end customers and adapt to changing business demands from high internal growth.

Solution

Panera Bread engaged in an Agile transformation through a mixture of Agile coaching and workshops, absorbing best practices from these engagements to drive Agile delivery frameworks across the enterprise.

Results

Adopting Agile delivery practices resulted in increased frequency of solution delivery, improving the relationship between IT and the business. Business satisfaction increased both with the development process and the outcomes from delivery.

The transparency that was needed to achieve alignment to rapidly changing business needs resulted in improved communication and broad-scale reduced risk for the organization.

"Agile delivery changed perception entirely by building a level of transparency and accountability into not just our software development projects, but also in our everyday working relationships with our business stakeholders. The credibility gains this has provided our IT team has been immeasurable and immediate."

– Mike Nettles, VP IT Process and Architecture, Panera Bread

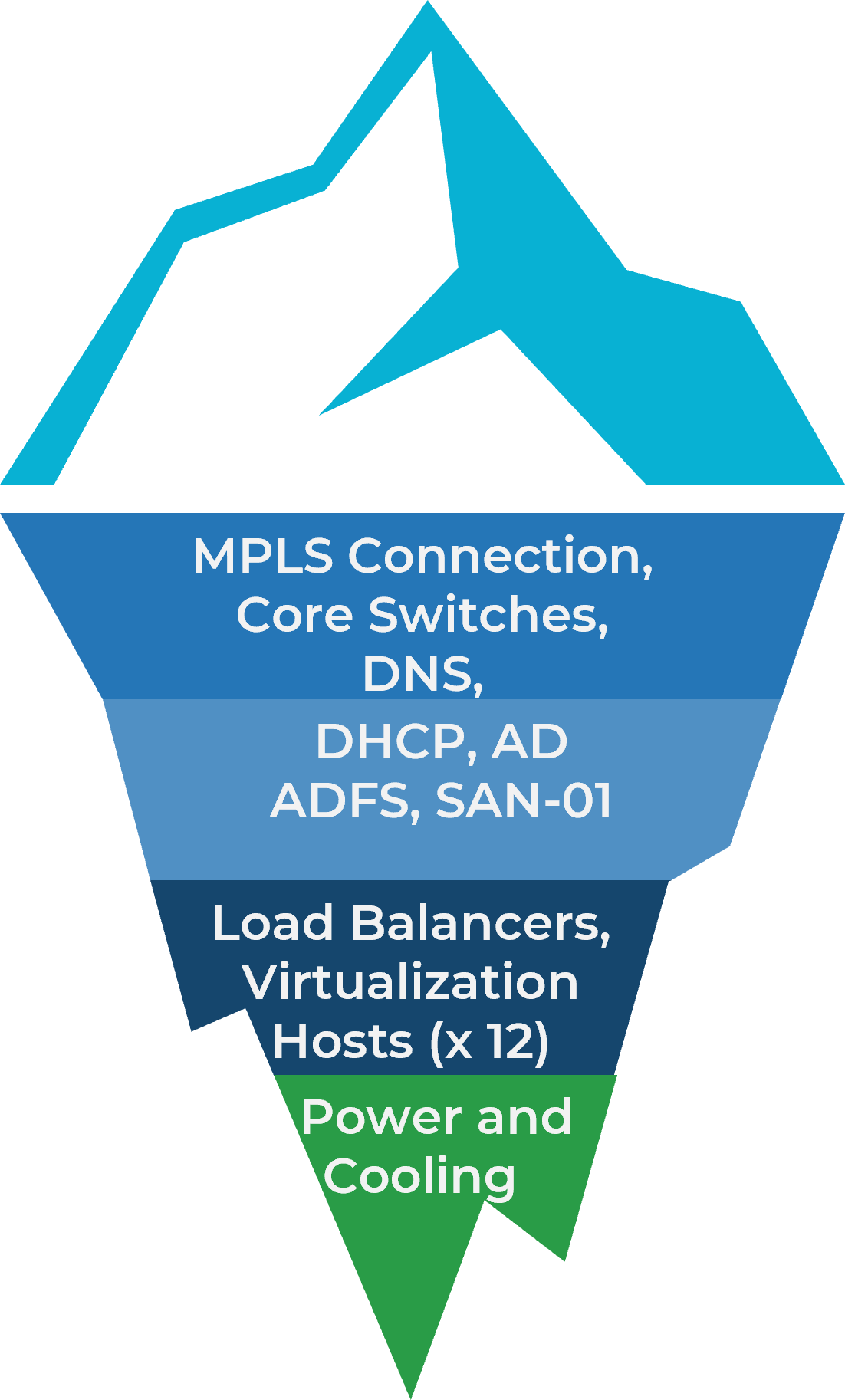

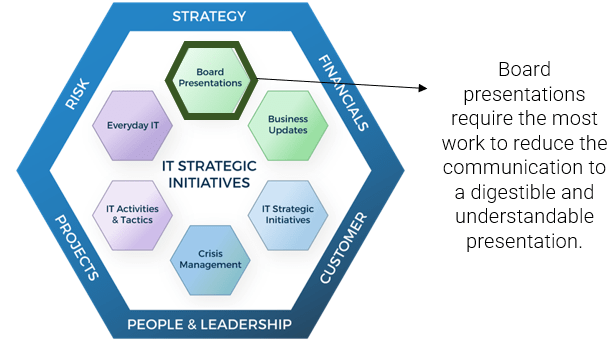

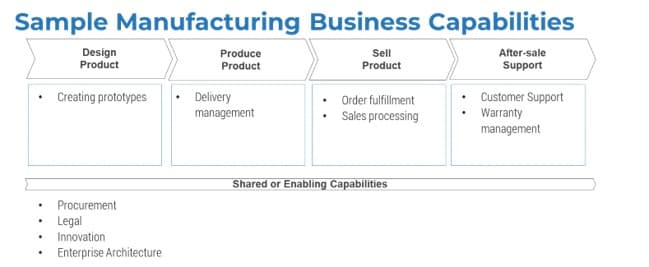

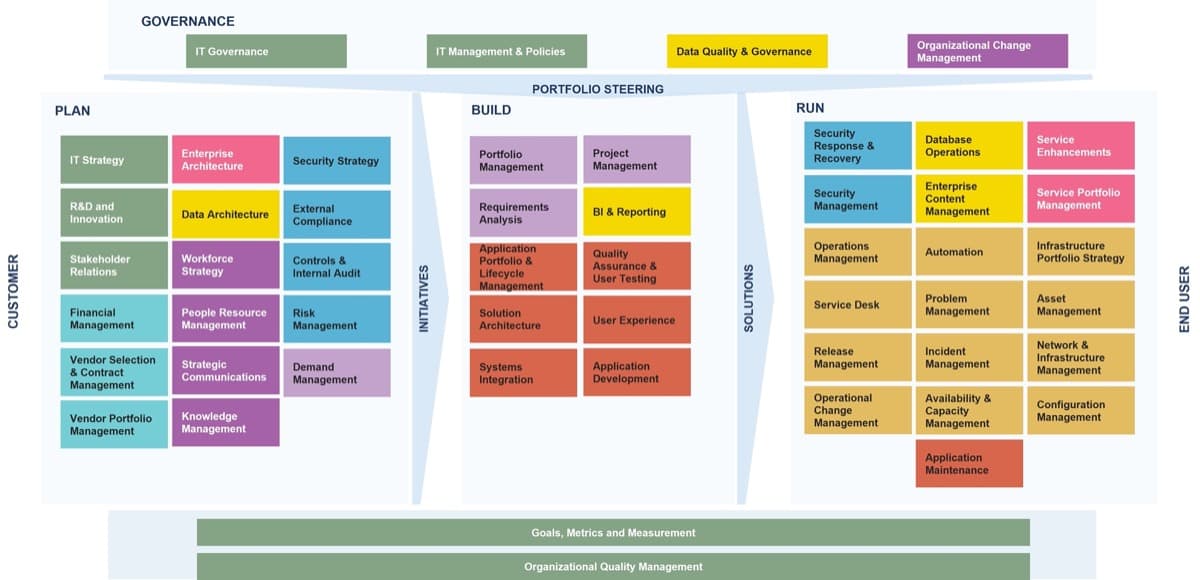

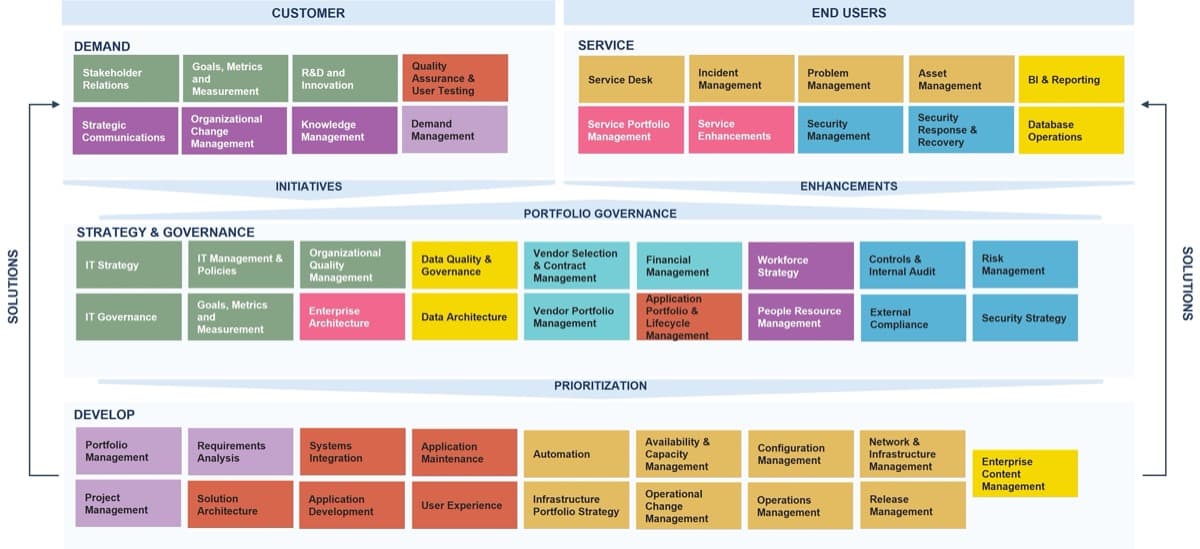

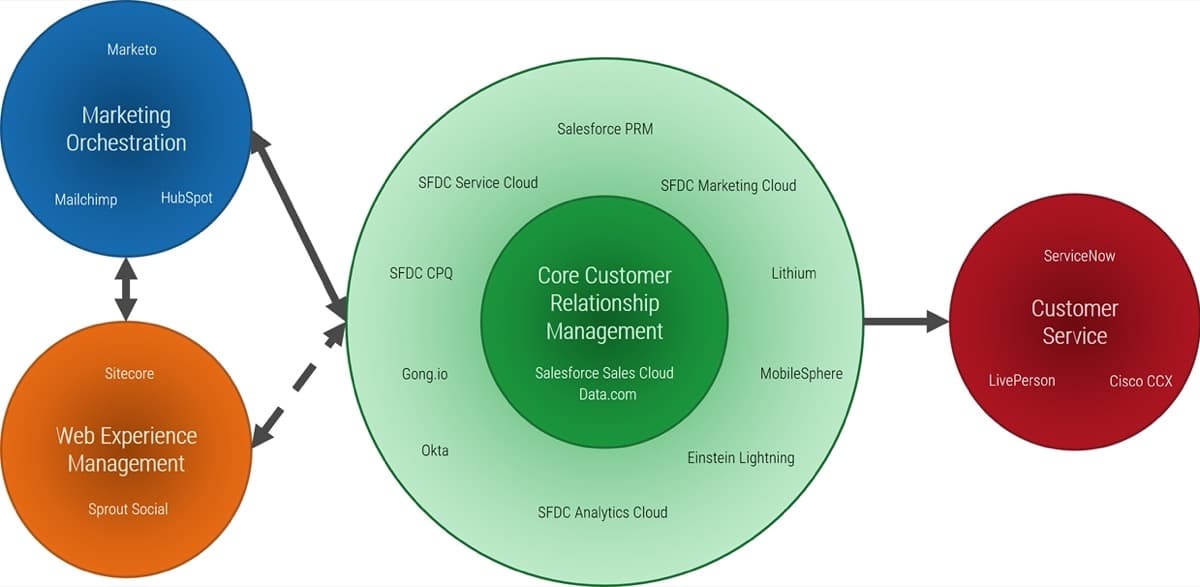

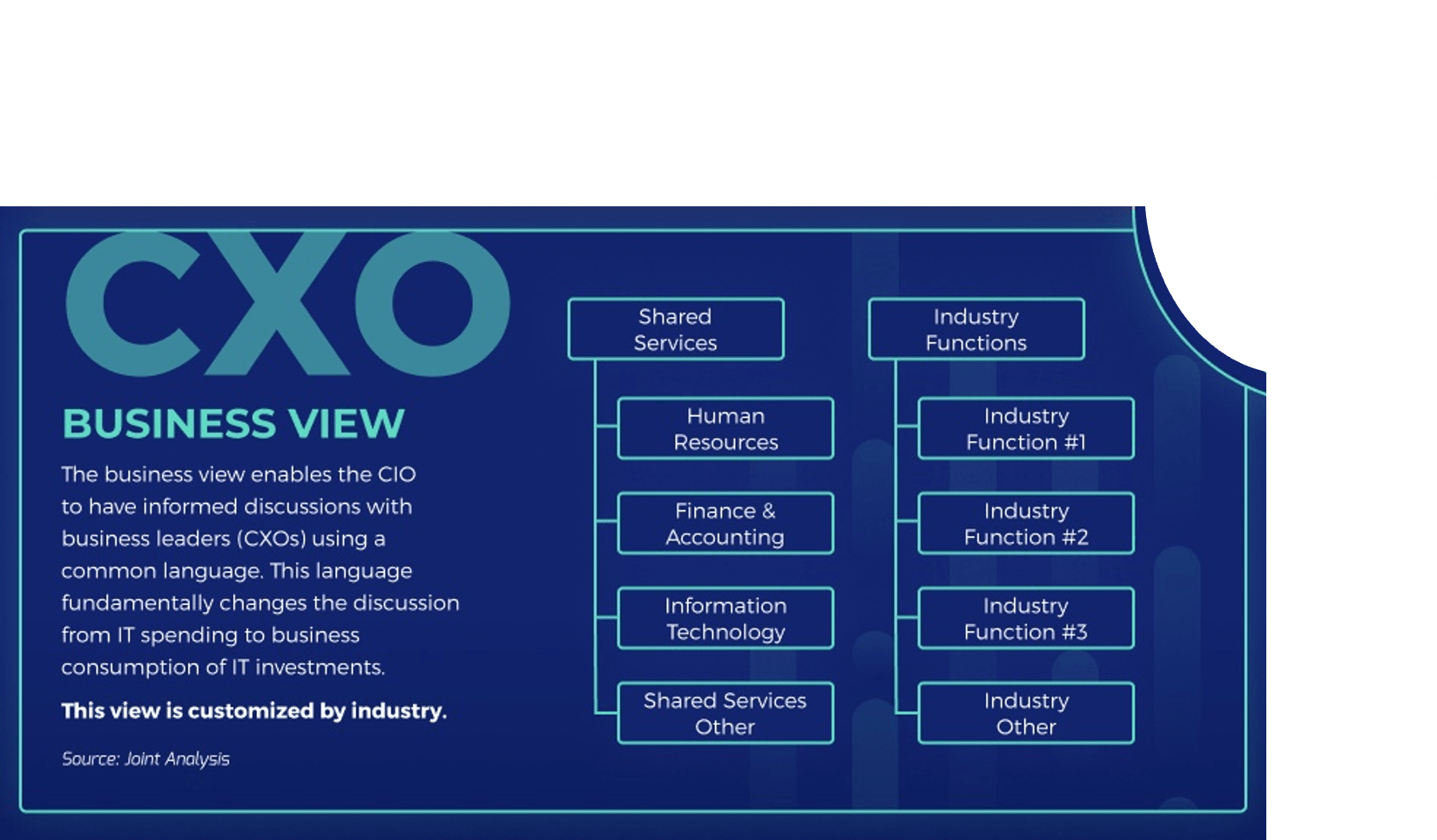

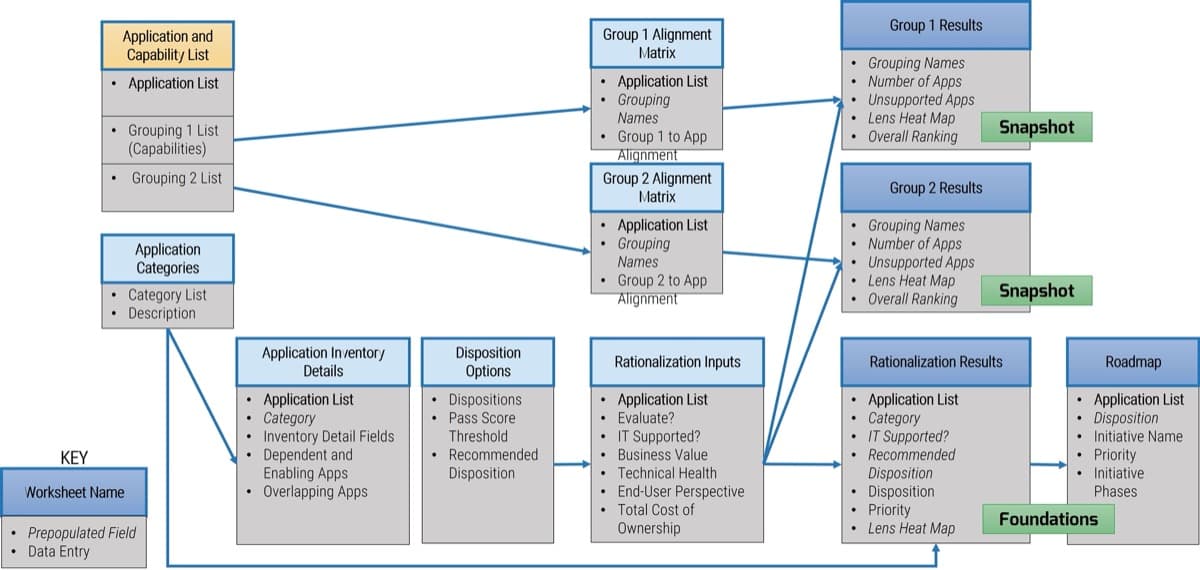

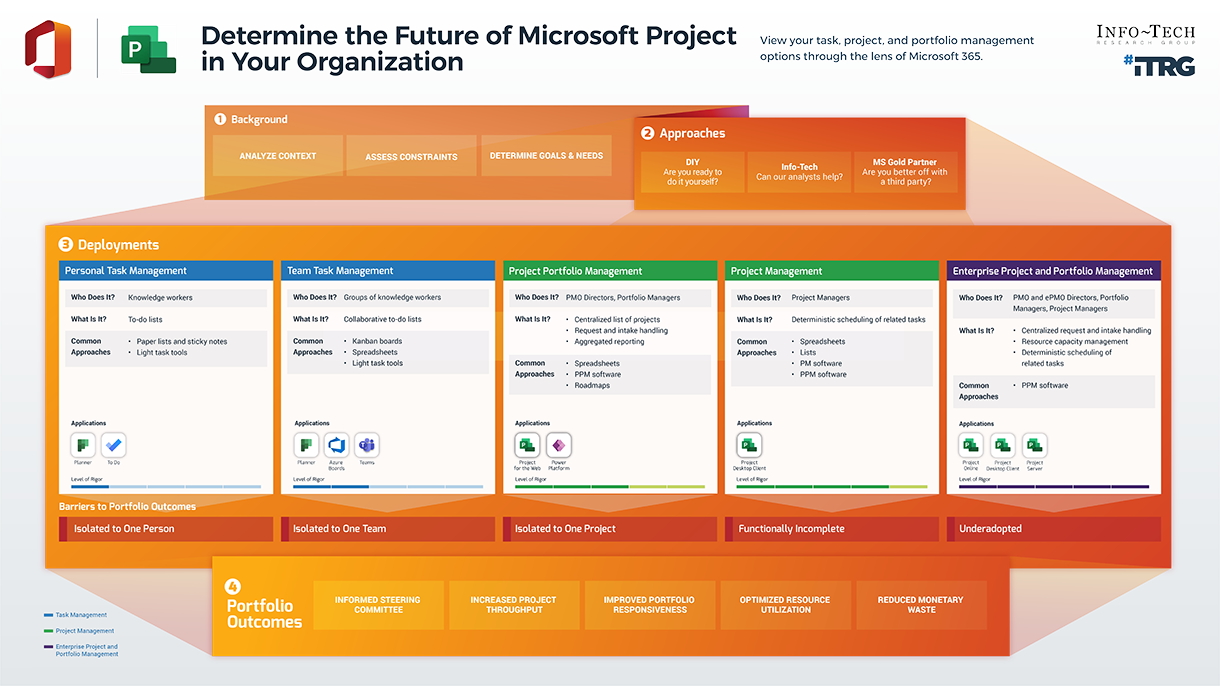

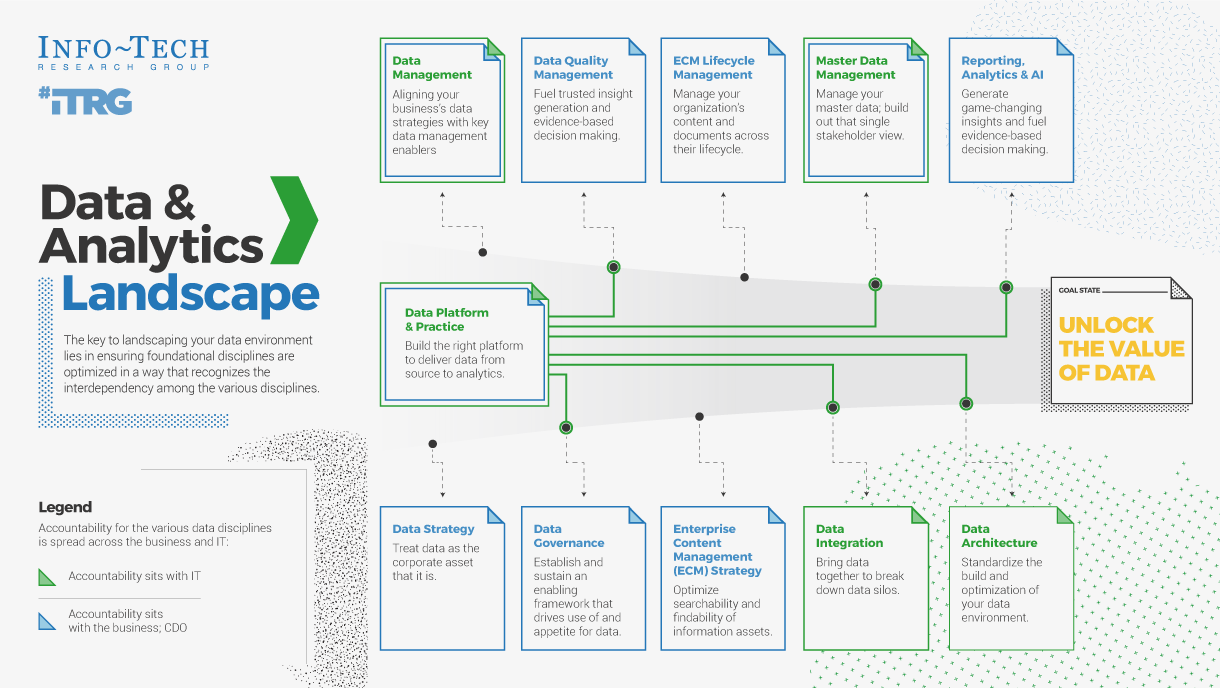

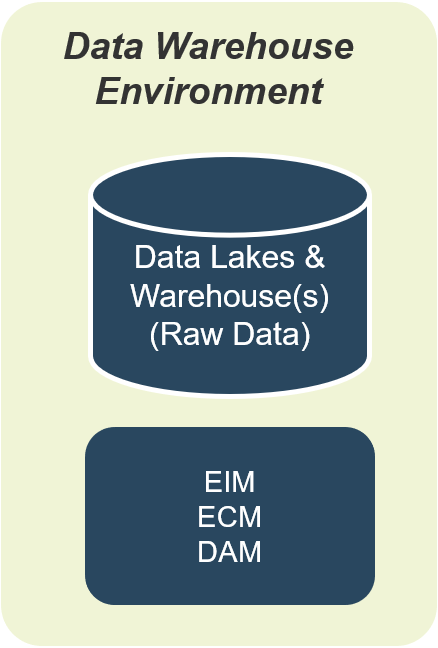

Use Info-Tech’s CoE Operating Model to define the service offerings of your ACE

Understand where your inputs and outputs lie to create an accessible set of service offerings for your Agile teams.

Functional Input

- Application Development

- Project Management

- CIO

- Enterprise Architecture

- Data Management

- Security

- Infrastructure & Operations

- Who else?

Input arrows represent functional group needs, feedback from Agile teams, and collaboration with other CoEs and CoPs

Output arrows represent the services the CoE delivers and the benefits realized across the organization.

ACE Operating Model: Governance & Metrics

Governance & Metrics involves enabling success through the management of the ACEs resources and services, and ensuring that organizational structures evolve in concert with Agile growth and maturity. Your focus should be on governing, measuring, implementing, and empowering improvements.

Effective governance will function to ensure the long-term effectiveness and viability of your ACE. Changes and improvements will happen continuously and you need a way to decide which to adopt as best practices.

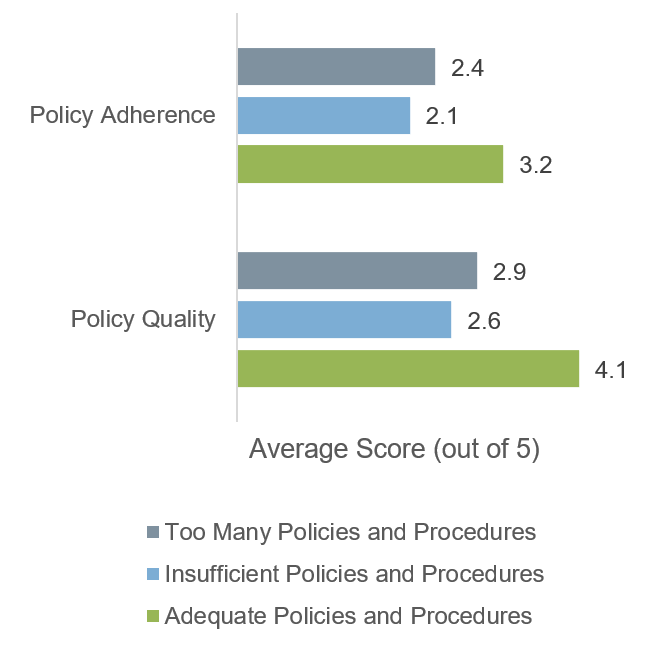

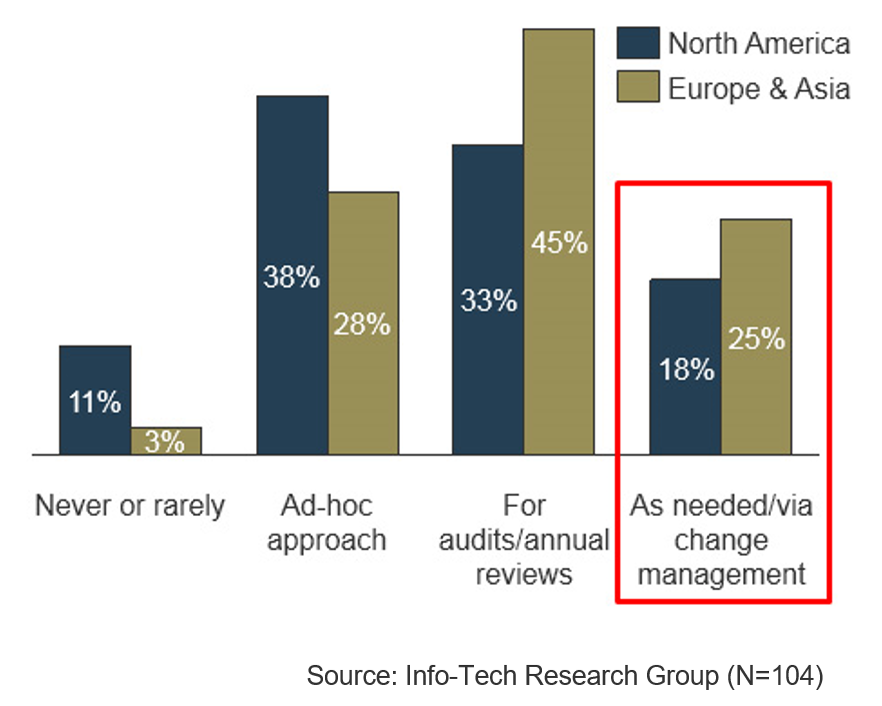

"Organizations have lengthy policies and procedures (e.g. code deployment, systems design, how requirements are gathered in a traditional setting) that need to be addressed when starting to implement an Agile Center of Excellence. Legacy ideas that end up having legacy policy are the ones that are going to create bottlenecks, waste resources, and disrupt your progress." – Doug Birgfeld, Senior Partner, Agile Wave

Governance & Metrics

- Manage organizational Agile standards, policies, and procedures.

- Define organizational boundaries based on regulatory, compliance, and cultural requirements.

- Ensure ongoing alignment of service offerings with business objectives.

- Adapt organizational change management policies to reflect Agile practices.

- CoE governance functions include:

- Policy Management

- Change Management

- Risk Management

- Stakeholder Management

- Metrics/Feedback Monitoring

ACE Operating Model: Services

Services refers to the ability to deliver resourcing, guidance, and assistance across all Agile teams. By creating a set of shared services, you enable broad access to specialized resources, knowledge, and insights that will effectively scale to more teams and departments as Agile matures in your organization.

A Services model:

- Supports the organization by standardizing and centralizing service offerings, ensuring consistency of service delivery and accessibility across functional groups.

- Provides a mechanism for efficient knowledge transfer and on-demand support.

- Helps to drive productivity and project efficiencies through the organization by disseminating best practices.

Services

- Provide reference, support, and re-assurance to implement and adapt organizational best practices.

- Interface relevant parties and facilitate knowledge transfer through shared learning and communities of practice.

- Enable agreed-upon service levels through standardized support structures.

- Shared services functions include:

- Engagement Planning

- Knowledge Management

- Subject-Matter Expertise

- Agile Team Evaluation

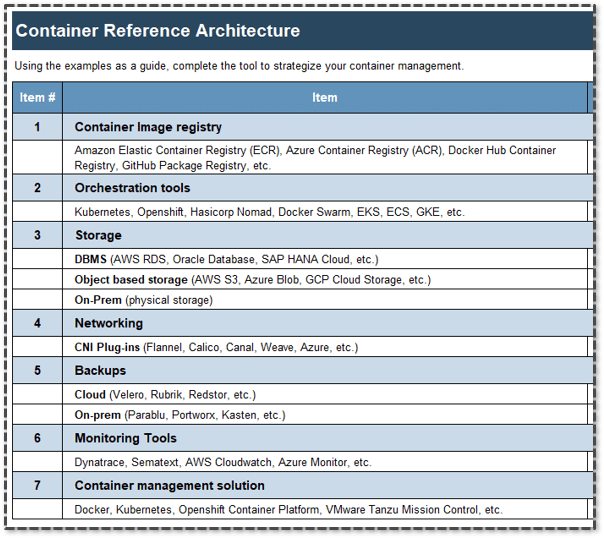

ACE Operating Model: Technology

Technology refers to a broad range of supporting tools to enable employees to complete their day-to-day tasks and effectively report on their outcomes. The key to technological support is to strike the right balance between flexibility and control based on your organization's internal and external constraints (policy, equipment, people, regulatory, etc.).

"We sometimes forget the obvious truth that technology provides no value of its own; it is the application of technology to business opportunities that produces return on investment." – Robert McDowell, Author, In Search of Business Value

Technology

- Provide common software tools to enable alignment to organizational best practices.

- Enable access to locally desired tools while considering organizational, technical, and scaling constraints.

- Enable communication with a technical subject matter expert (SME).

- Enable reporting consistency through training and maintenance of reporting mechanisms.

- Technology functions can include:

- Vendor Management

- Application Support

- Tooling Standards

- Tooling Use Cases

ACE Operating Model: Staff

Staff is all about empowerment. The ACE should support and facilitate the sharing of ideas and knowledge sharing. Create processes and spaces where people are encouraged to come together, learn from, and share with each other. This setting will bring up new ideas to enhance productivity and efficiency in day-to-day activities while maintaining alignment with business objectives.

"An Agile CoE is legitimized by its ability to create a space where people can come together, share, and learn from one another. By empowering teams to grow by themselves and then re-connect with each other you allow the creativity of your employees to flow back into the CoE." – Anonymous, Founder, Agile consultancy group

Staff

- Develop and provide training and day-to-day coaching that are aligned with organizational engagement and growth plans.

- Include workflow change management to assist traditional roles with accommodating Agile practices.

- Support the facilitation of knowledge transfer from localized Agile teams into other areas of the organization.

- Achieve team buy-in and engagement with ACE services and capabilities. Provide a forum for collaboration and innovation.

- People functions can include:

- Onboarding

- Coaching

- Learning Facilitation

Form use cases to align your ACE with business objectives

What is a use case?

A use case tells a story about how a system will be used to achieve a goal from the perspective of a user of that system. The people or other systems that interact with the use case are called “actors.” Use cases describe what a system must be able to do, not how it will do it.

How does a use case play a role in building your ACE?

Use cases are used to guide design by allowing you to highlight the intended function of a service provided by the Center of Excellence while maintaining a business focus. Jumping too quickly to a solution without fully understanding user and business needs leads to the loss of stakeholder buy-in and the Centers of Excellence rejection by teams.

Hypothesized ACE user needs →Use Case←Business objective

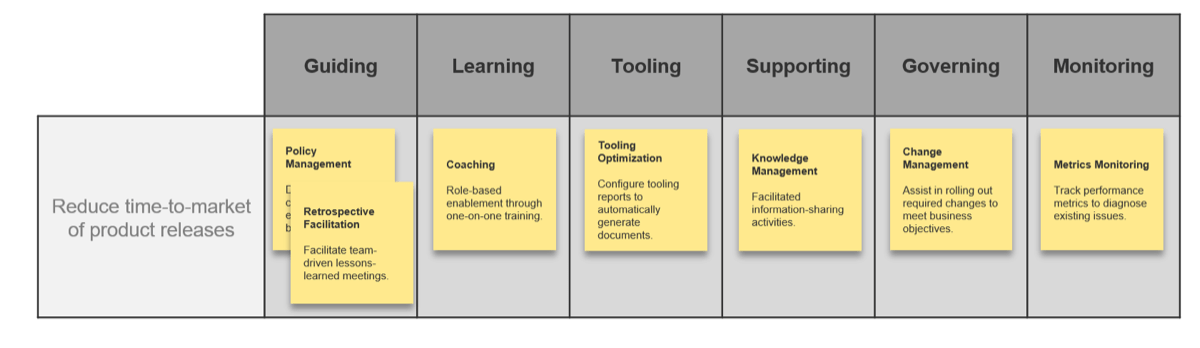

Activity: Form use cases for the points of alignment between your ACE and business objectives

1.1.3 2 Hours

Input

- Prioritized business objectives

- ACE functions

Output

Materials

Participants

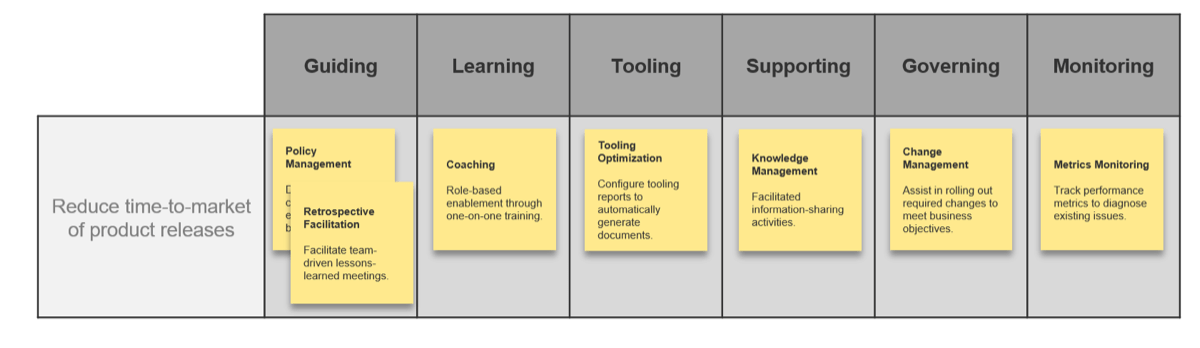

- Using your prioritized business objectives and the six functions of a CoE, create high-level use cases for each point of alignment that describe how the Center of Excellence will better facilitate the realization of that business objective.

- For each use case, define the following:

- Name: Generalized title for the use case.

- Description: A high-level description of the expected CoE action.

| |

|

AGILE CENTER OF EXCELLENCE FUNCTIONS: |

| |

|

Guiding |

Learning |

Tooling |

Supporting |

Governing |

Monitoring |

| BUSINESS OBJECTIVES |

Reduce time-to-market of product releases |

|

|

|

|

|

|

| Reduce product delivery costs |

|

|

|

|

|

|

| Effectively integrate teams from a merger |

|

|

|

|

|

|

Activity: Form use cases for the points of alignment between your ACE and business objectives (continued)

1.1.3 2 Hours

Your goal should be to keep these as high level and generally applicable as possible as they provide an initial framework to further develop your service offerings. Begin to talk about the ways in which the ACE can support the realization of your business objectives and what those interactions may look like to customers of the ACE.

Involve all relevant stakeholders to discuss the organizational goals and objectives of your ACE

Avoid the rifts in stakeholder representation by ensuring you involve the relevant parties. Without representation and buy-in from all interested parties, your ACE may omit and fail to meet long-term organizational goals.

By ensuring every group receives representation, your service offerings will speak for the broad organization and in turn meet the needs of the organization as a whole.

- Business Units: Any functional groups that will be expected to engage with the ACE in order to achieve their business objectives.

- Team Leads: Representation from the internal Agile community who is aware of the backgrounds, capabilities, and environments of their respective Agile teams.

- Executive Sponsors: Those expected to evangelize and set the tone and direction for the ACE within the executive ranks of the organization. These roles are critical in gaining buy-in and maintaining momentum for ACE initiatives.

Organization

- ACE

- Executive Sponsors

- Team Leads

- Business Units

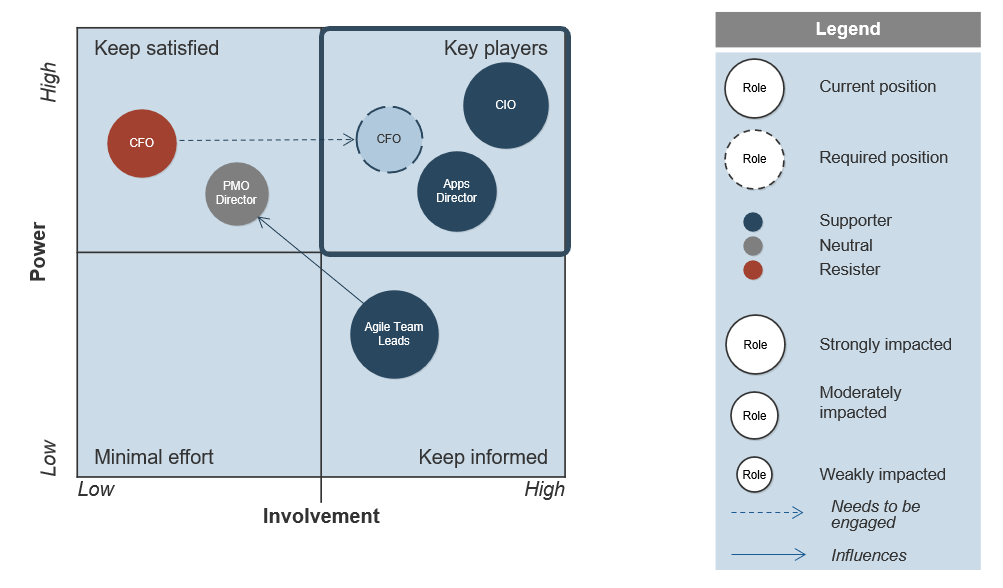

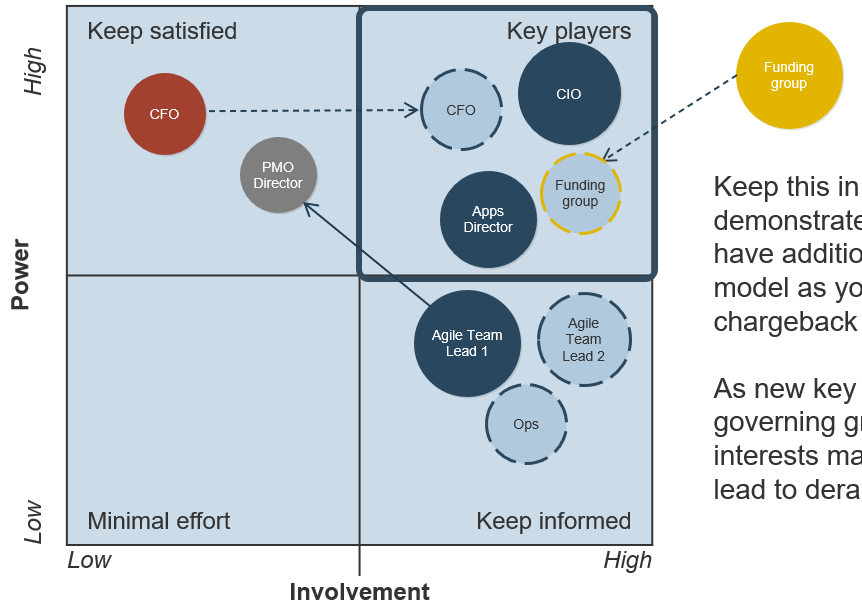

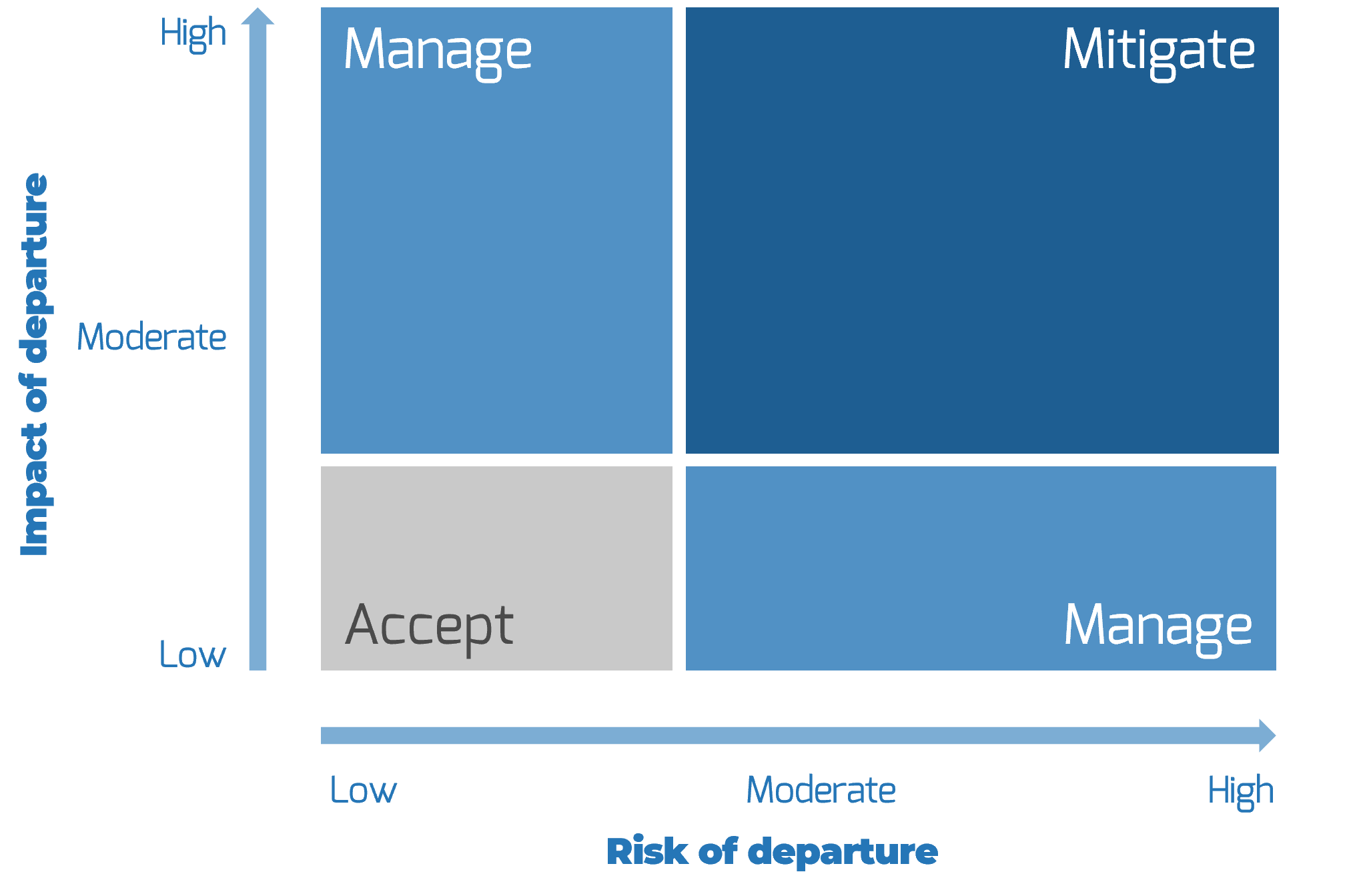

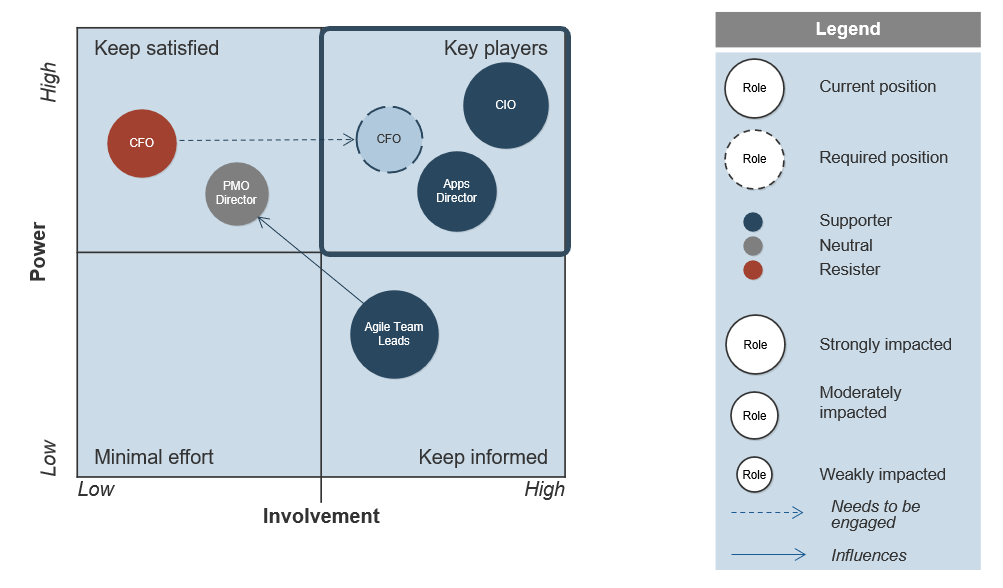

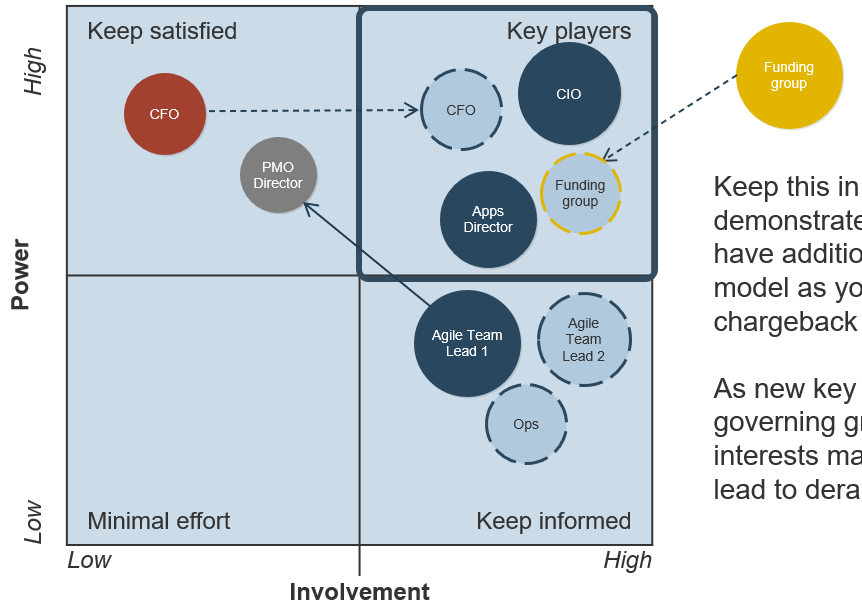

Activity: Prioritize your ACE stakeholders

1.1.4 1 Hour

Input

- Prioritized business objectives

Output

- Prioritized list of stakeholders

Materials

Participants

- Using your prioritized business objectives, brainstorm, as a group, the potential list of stakeholders (representatives from business units, team leads, and executive sponsors) that would need to be involved in setting the tone and direction of your ACE.

- Evaluate each stakeholder in terms of power, involvement, impact, and support.

- Power: How much influence does the stakeholder have? Enough to drive the CoE forward or into the ground?

- Involvement: How interested is the stakeholder? How involved is the stakeholder in the project already?

- Impact: To what degree will the stakeholder be impacted? Will this significantly change how they do their job?

- Support: Is the stakeholder a supporter of the project? Neutral? A resister?

Map each stakeholder to an area on the power map on the next slide based on his or her level of power and involvement.

Vary the size of the circle to distinguish stakeholders that are highly impacted by the ACE from those who are not. Color each circle to show each stakeholder’s estimated or gauged level of support for the project.

Prioritize your ACE stakeholders (continued)

1.1.4 1 Hour

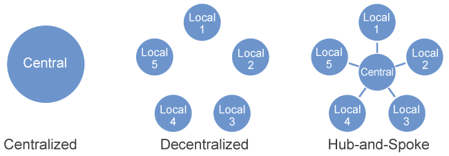

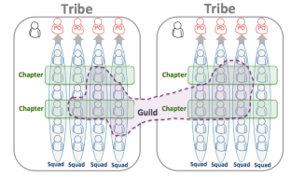

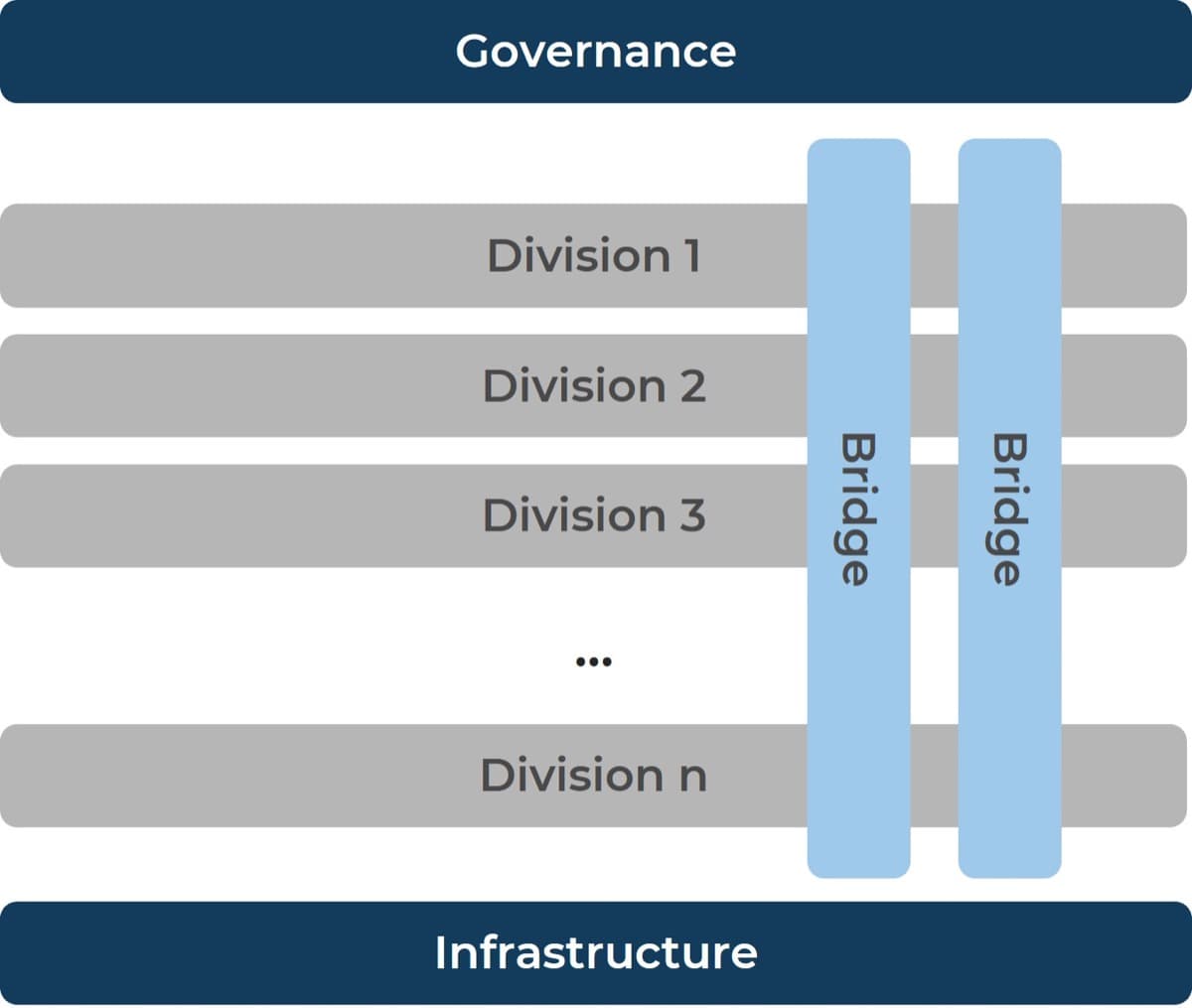

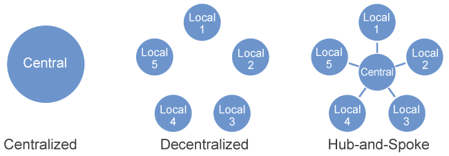

Should your ACE be Centralized or Decentralized?

An ACE can be organized differently depending on your organization’s specific needs and culture.

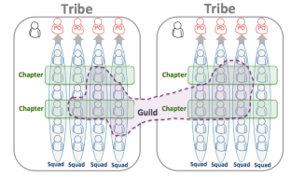

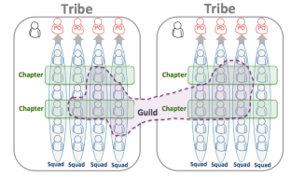

The SAFe Model:©

“For smaller enterprises, a single centralized [ACE] can balance speed with economies of scale. However, in larger enterprises—typically those with more than 500 – 1,000 practitioners—it’s useful to consider employing either a decentralized model or a hub-and-spoke model.”

© Scaled Agile, Inc.

The Spotify Model:

Spotify avoids using an ACE and instead spreads agile practices using Squads, Tribes, Chapters, Guilds, etc.

It can be a challenging model to adopt because it is constantly changing, and must be fundamentally supported by your organization’s culture. (Linders, Ben. “Don't Copy the Spotify Model.” InfoQ.com. 6 Oct. 2016.)

Detailed analysis of The Spotify Model is out of scope for this Blueprint.

Activity: Select a Centralized or Decentralized ACE Model

1.1.5 30 minutes

Input

- Prioritized business objectives

- Use Cases

- Organization qualities

Output

- Centralized or decentralized ACE model

Materials

Participants

- Using your prioritized business objectives, your ACE use cases, your organization size, structure, and culture, brainstorm the relative pros and cons of a centralized vs decentralized ACE model.

- Consider this: to improve understanding and acceptance, ask participants who prefer a centralized model to brainstorm the pros and cons of a decentralized model, and vice-versa.

- Collectively decide whether your ACE should be centralized, decentralized or hub-and-spoke and document it.

| |

|

Centralized ACE |

Decentralized ACE |

| |

|

Pros |

Cons |

Pros |

Cons |

| Centralize Vs De-centralize Considerations |

Prioritized Business Objectives |

- Neutral (objectives don’t favor either model)

|

|

- Neutral (objectives don’t favor either model)

|

|

| ACE Use Cases |

- Neutral (use cases don’t favor either model)

|

|

- Neutral (use cases don’t favor either model)

|

|

| Organization Size |

- Org. is small enough for centralized ACE

|

|

|

- Overkill for a small org. like ours

|

| Organization Structure |

- All development done in one location

|

|

|

- Not all locations do development

|

| Organization Culture |

|

- All development done in one location

|

- Decentralized ACE may have yield more buy-in

|

|

SELECTED MODEL: Centralized ACE

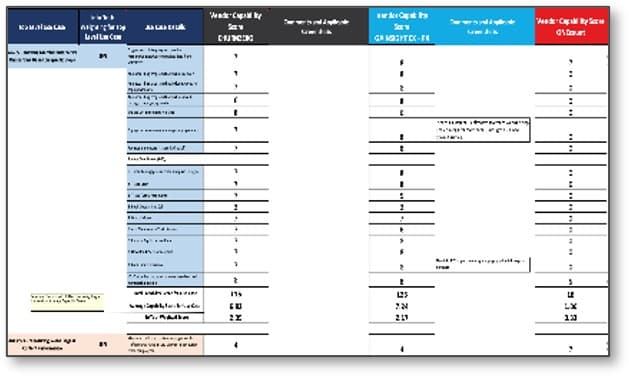

Activity: Staff your ACE strategically

1.1.6 1 Hour

Input

- List of potential ACE staff

Output

Materials

Participants

- Identify your list of potential ACE staff (this may be a combination of full time and contract staff).

- Add/modify/delete the rating criteria to meet your specific needs.

- Discuss and adjust the relative weightings of the rating criteria to best suit your organization’s needs.

- Rate each potential staff member and compare results to determine the best suited staff for your ACE.

| Candidate: Jane Doe |

| Rating Criteria |

Criteria Weighting |

Candidate's Score (1-5) |

| Candidate has strong theoretical knowledge of Agile. |

8% |

4 |

| Candidate has strong hands on experience with Agile. |

18% |

5 |

| Candidate has strong hands on experience with Agile. |

10% |

4 |

| Candidate is highly respected by the Agile teams. |

18% |

5 |

| Candidate is seen as a thought leader in the organization. |

18% |

5 |

| Candidate is seen as a change agent in the organization. |

18% |

5 |

| Candidate has strong desire to be member of ACE staff. |

10% |

3 |

| Total Weighted Score |

4.6 |

Phase 1, Step 2: Define the service offerings of your ACE

Phase 1

1.1 Determine the vision of your ACE

1.2 Define the service offerings of your ACE

Phase 2

2.1 Define an adoption plan for your Agile teams

2.2 Create an ACE engagement plan

2.3 Define metrics to measure success

Phase 3

3.1 Optimize the success of your ACE

3.2 Plan change to enhance your Agile initiatives

3.3 Conduct ongoing retrospectives of your ACE

Activities:

1.2.1 Form the Center of Excellence.

1.2.2 Gather and document your existing Agile practices for the CoE.

1.2.3 Interview stakeholders to align ACE requirements with functional expectations.

1.2.4 Form a solution matrix to organize your pain points and opportunities.

1.2.5 Refine your use cases to identify your ACE functions and services.

1.2.6 Visualize your ACE functions and service offerings with a capability map.

Outcomes:

- Collect data regarding the functional expectations of the Agile teams.

- Refine your business-aligned use cases with your collected data to achieve both business and functional alignment.

- Create a capability map that visualizes and prioritizes your key service offerings.

Structure your ACE with representation from all of your key stakeholders

Now that you have a prioritized list of stakeholders, use their influence to position the ACE to ensure maximum representation with minimal bottlenecks.

By operating within a group of your key players, you can legitimize your Center of Excellence by propagating the needs and interests of those who interface and evangelize the CoE within the larger organization.

The group of key stakeholders will extend the business alignment you achieved earlier by refining your service offerings to meet the needs of the ACEs customers. Multiple representations at the table will generate a wide arrangement of valuable insights and perspectives.

Info-Tech Insight

While holistic representation is necessary, ensure that the list is not too comprehensive and will not lead to progress roadblocks. The goal is to ensure that all factors relevant to the organization are represented; too many conflicting opinions may create an obstruction moving forward.

ACE

- Executive Sponsors

- Team Leads

- Business Units

Determine how you will fund your ACE

Choose the ACE funding model which is most aligned to your current system based on the scenarios provided below. Both models will offer the necessary support to ensure the success of your Agile program going forward.

| Funding Model |

Funding Scenario I |

Funding Scenario II |

| Funded by the CIO |

Funded by the CIO office and a stated item within the general IT budget. |

Charged back to supported functional groups with all costs allocated to each functional group’s budget. |

| Funded by the PMO |

Charged back to supported functional groups with all costs allocated to each functional group’s budget. |

Charged back to supported functional groups with all costs allocated to each functional group’s budget. |

Info-Tech Insight

Your funding model may add additional key influencers into the mix. After you choose your funding model, ensure that you review your stakeholder map and add anyone who will have a direct impact in the viability and stability of your ACE.

Determine how you will govern your ACE

An Agile Center of Excellence is unique in the way you must govern the actions of its customers. Enable “flexible governance” to ensure that Agile teams have the ability to locally optimize and innovate while still operating within expected boundaries.

ACE Governing Body

↑ Agile Team → ACE ← Agile Team ↑

Who should take on the governance role?

The governing body can be the existing executive or standing committees, or a newly formed committee involving your key ACE influencers and stakeholders.

Flexible governance means that your ACE set boundaries based on your cultural, regulatory, and compliance requirements, and your governance group monitors your Agile teams’ adherence to these boundaries.

Governing Body Responsibilities

- Review and approve ACE strategy annually and ensure that it is aligned with current business strategy.

- Provide detailed quality information for board members.

- Ensure that the ACE is adequately resourced and that the organization has the capacity to deliver the service offerings.

- Assure that the ACE is delivering benefits and achieving targets.

- Assure that the record keeping and reporting systems are capable of providing the information needed to properly assess the quality of service.

Modify your resourcing strategy based on organizational need

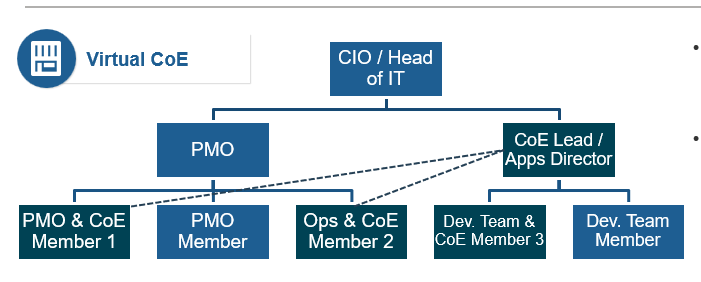

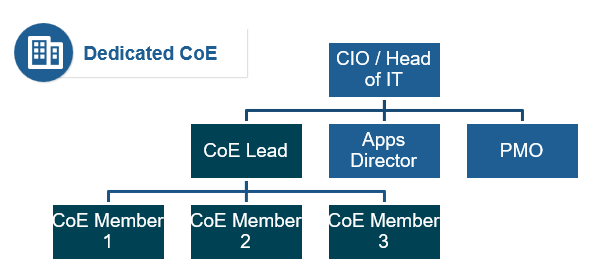

Your Agile Center of Excellence can be organized either in a dedicated or a virtual configuration, depending on your company’s organizational structure and complexity.

There is no right answer to how your Center of Excellence should be resourced. Consider your existing organizational structure and culture, the quality of relationships between functional groups, and the typical budgetary factors that would weigh on choosing between a virtual and dedicated CoE structure.

| COE |

Advantages |

Disadvantages |

| Virtual |

- No change in organization structure required, just additional task delegation to your Agile manager or program manager.

- Less effort and cost to implement.

- Investment in quality is proportional to return.

|

- Resources are shared between practice areas, and initiatives will take longer to implement.

- Development and enhancement of best practices can become difficult without a centralized knowledge repository.

|

| Dedicated |

- Demonstrates a commitment to the ACEs long-term existence.

- Allows for dedicated maintenance of best practices.

- Clear lines of accountability for Agile processes.

- Ability to develop highly skilled employees as their responsibilities are not shared.

|

- Requires dedicated resources that can in turn be more costly.

- Requires strong relationships with the functional groups that interface with the ACE.

|

Staffing the ACE: Understand virtual versus dedicated ACE organizational models

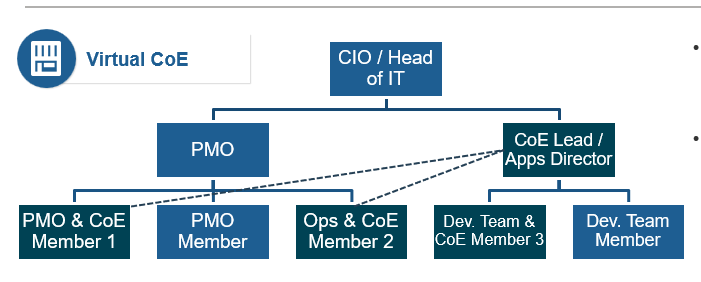

Virtual CoE

- Responsibilities for CoE are split and distributed throughout departments on a part-time basis.

- CoE members from the PMO report to apps director who also functions as the CoE lead on a part-time basis.

- Requires re-organization and dedicated full-time staff to run the CoE with clear lines of responsibility and accountability.

- Hiring or developing highly skilled employees who have a sole function to facilitate and monitor quality best practices within the IT department may be necessary.

Activity: Form the Center of Excellence

1.2.1 1 Hour

Input

Output

- ACE governance and resourcing plan

Materials

Participants

- As a group, discuss if there is an existing body that would be able to govern the Center of Excellence. This body will monitor progress on an ongoing basis and assess any change requests that would impact the CoEs operation or goals.

- List current governing bodies that are closely aligned with your current Agile environment and determine if the group could take on additional responsibilities.

- Alternatively, identify individuals who could form a new ACE governing body.

Using the results of Exercise 1.1.6 in Step 1, select the individuals who will participate in the Center of Excellence. As a rough rule of thumb for sizing, an ACE staffed with 3-5 people can support 8-12 Agile Teams.

Document results in the ACE Communications Deck.

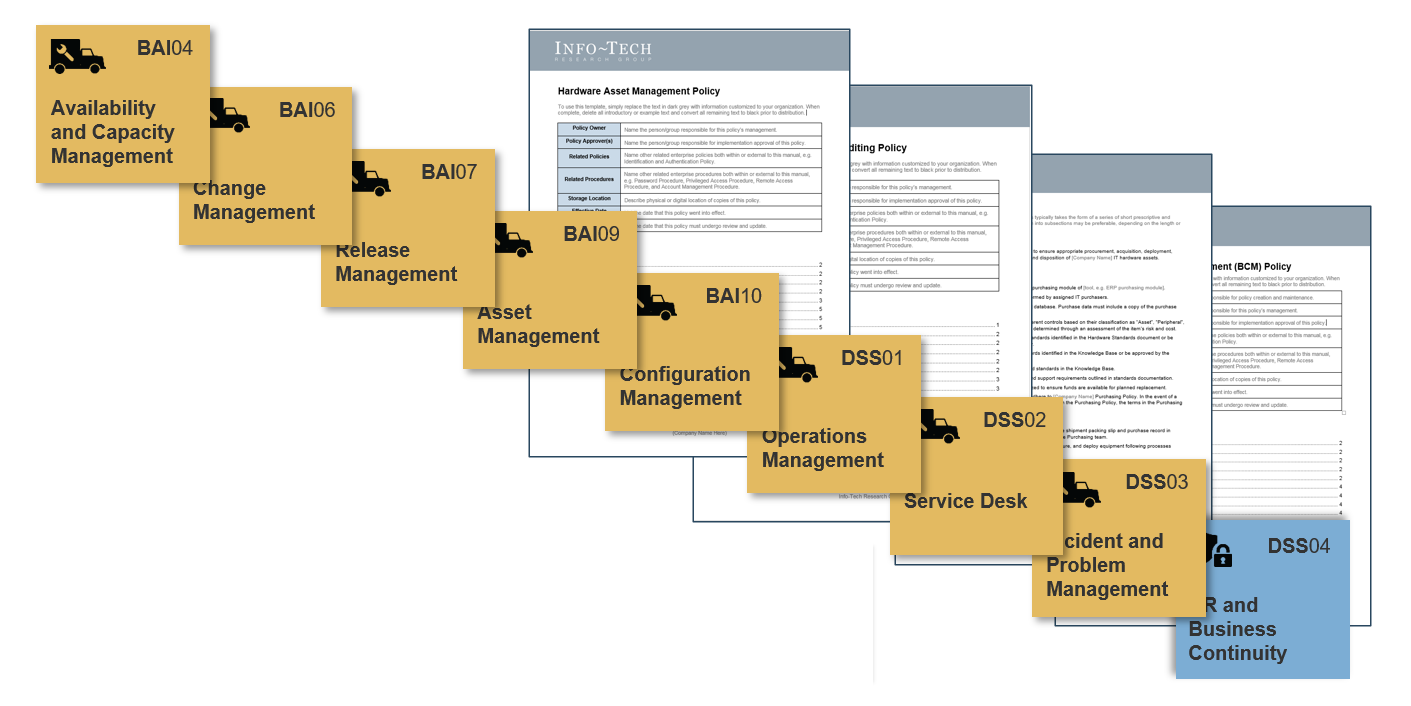

Leverage your existing Agile practices and SMEs when establishing the ACE

The synergy between Agile and CoE relies on its ability to build on existing best practices. Agile cannot grow without a solid foundation. ACE gives you the way to disseminate these practices and facilitate knowledge transfer from a centralized sharing environment. As part of defining your service offerings, engage with stakeholders across the organization to evaluate what is already documented so that it can be accommodated in the ACE.

Documentation

- Are there any existing templates that can be leveraged (e.g. resource planning, sprint planning)?

- Are there any existing process documents that can be leveraged (e.g. SIPOC, program frameworks)?

- Are there any existing standards documents the CoE can incorporate (e.g. policies, procedures, guidelines)?

SMEs

- Interview existing subject-matter experts that can give you an idea of your current pains and opportunities.

- You already have feedback from those in your workshop group, so think about the rest of the organization:

- Agile practitioners

- Business stakeholders

- Operations

- Any other parties not represented in the workshop group

Metrics

- What are the current metrics being used to measure the success of Agile teams?

- What metrics are currently being used to measure the completion of business objectives?

- What tools or mediums are currently used for recording and communicating metrics?

Info-Tech Insight

When considering existing practices, it is important to evaluate the level of adherence to these practices. If they have been efficiently utilized, injecting them into ACE becomes an obvious decision. If they have been underutilized, however, it is important to understand why this occurred and discuss how you can drive higher adherence.

Examples of existing documents to leverage

People

- Agile onboarding planning documents

- Agile training documents

- Organizational Agile manifesto

- Team performance metrics dashboard

- Stakeholder engagement and communication plan

- Development team engagement plan

- Organizational design and structure

- Roles and responsibilities chart (i.e. RACI)

- Compensation plan Resourcing plan

Process

- Tailored Scrum process

- Requirements gathering process

- Quality stage-gate checklist (including definitions of ready and done)

- Business requirements document

- Use case document

- Business process diagrams

- Entity relationship diagrams

- Data flow diagrams

- Solution or system architecture

- Application documentation for deployment

- Organizational and user change management plan

- Disaster recovery and rollback process

- Test case templates

Technology

- Code review policies and procedures

- Systems design policies

- Build, test, deploy, and rollback scripts

- Coding guidelines

- Data governance and management policies

- Data definition and glossary

- Request for proposals (RFPs)

- Development tool standards and licensing agreements

- Permission to development, testing, staging, and production environments

- Application, system, and data integration policies

Build upon the lessons learned from your Agile pilots

The success of your Center of Excellence relies on the ability to build sound best practices within your organization’s context. Use your previous lessons learned and growing pains as shared knowledge of past Agile implementations within the ACE.

Implement Agile Practices That Work

Draw on the experiences of your initial pilot where you learned how to adapt the Agile manifesto and practices to your specific context. These lessons will help onboard new teams to Agile since they will likely experience some of the same challenges.

Download

Documents for review include:

- Tailored Scrum Process

- Agile Pilot Metrics

- Info-Tech’s Agile Pilot Playbook

Enable Organization-Wide Collaboration by Scaling Agile

Draw on previous scaling Agile experiences to help understand how to interface, facilitate, and orchestrate cross-functional teams and stakeholders for large and complex projects. These lessons will help your ACE teams develop collaboration and problem-solving techniques involving roles with different priorities and lines of thinking.

Download

Documents for review include:

- Agile Program Framework

- Agile Pilot Program Metrics

- Scaled Agile Development Process

- Info-Tech’s Scaling Agile Playbook

Activity: Gather and document your existing Agile practices for the CoE

1.2.2 Variable time commitment based on current documentation state

Input

Output

- Practices categorized within operating model

Materials

- Whiteboard

- Markers

- Sticky notes

Participants

- Compile a list of existing practices that will be shared by the Center of Excellence. Consider any documents, templates, or tools that are used regularly by Agile teams.

- Evaluate the level of adherence to use of the practices (whether the practice is complied with regularly or not) with a high, medium, or low. Low compliance will need a root-cause analysis to understand why and how to remedy the situation.

- Determine the best fit for each practice under the ACE operational model.

| |

Name |

Type |

Adherence Level |

CoE Best Fit |

Source |

| 1 |

Tailored Scrum process |

Process |

High |

Shared Services |

Internal Wiki |

| 2 |

|

|

|

|

|

| 3 |

|

|

|

|

|

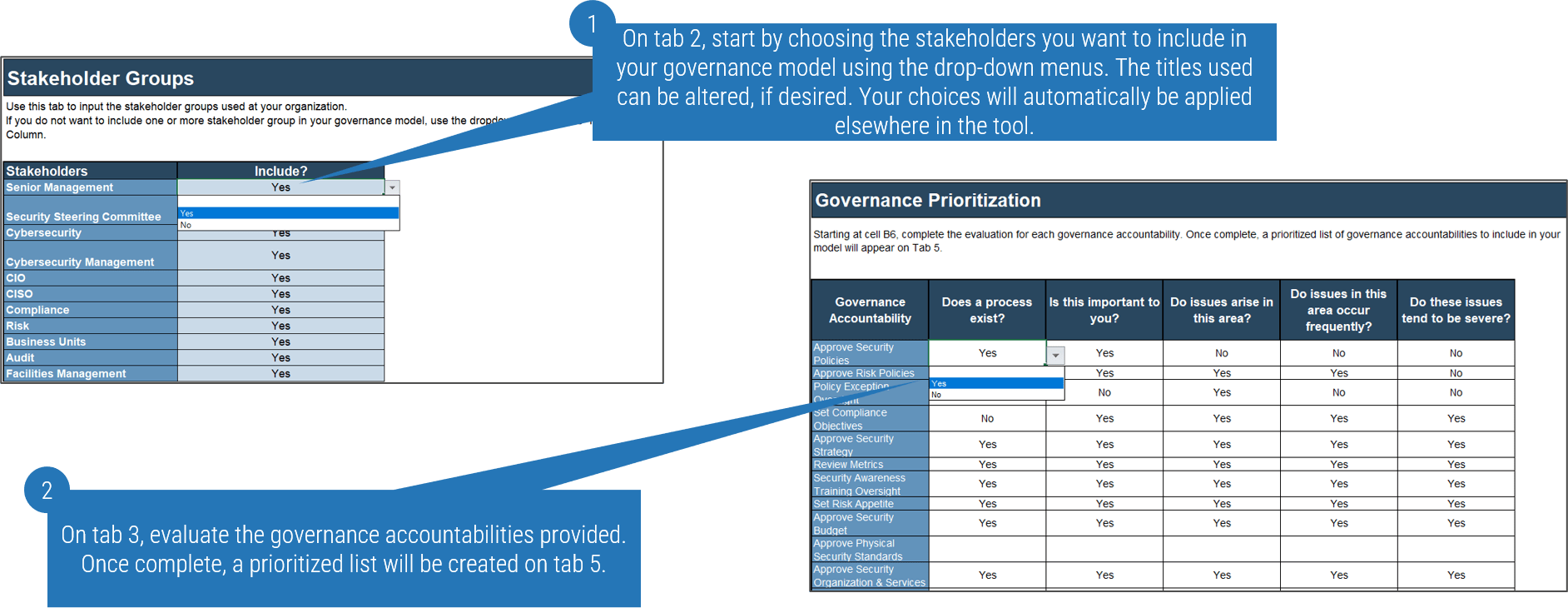

Activity: Interview stakeholders to understand the ACE functional expectations

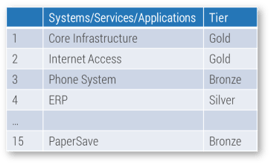

1.2.3 30-60 Minutes per interview

Interview Stakeholders (from both Agile teams and functional areas) on their needs from the ACE. Ensure you capture both pain points and opportunities. Capture these as either Common Agile needs or Functional needs. Document using the tables below:

| Common Agile Needs |

| Common Agile Needs |

- Each Agile Team interprets Agile differently

- Need common approach to Agile with a proven track record within the organization

- Making sure all Team members have a good understanding of Agile

- Common set of tool(s) with a proven track record, along with a strong understanding of how to use the tool(s) efficiently and effectively

- Help troubleshooting process related questions

- Assistance with addressing the individual short comings of each Agile Team

- Determining what sort of help each Agile Team needs most

- Better understanding of the role played by Scrum Master and associated good practices

- When and how do security/privacy/regulatory requirements get incorporated into Agile projects

|

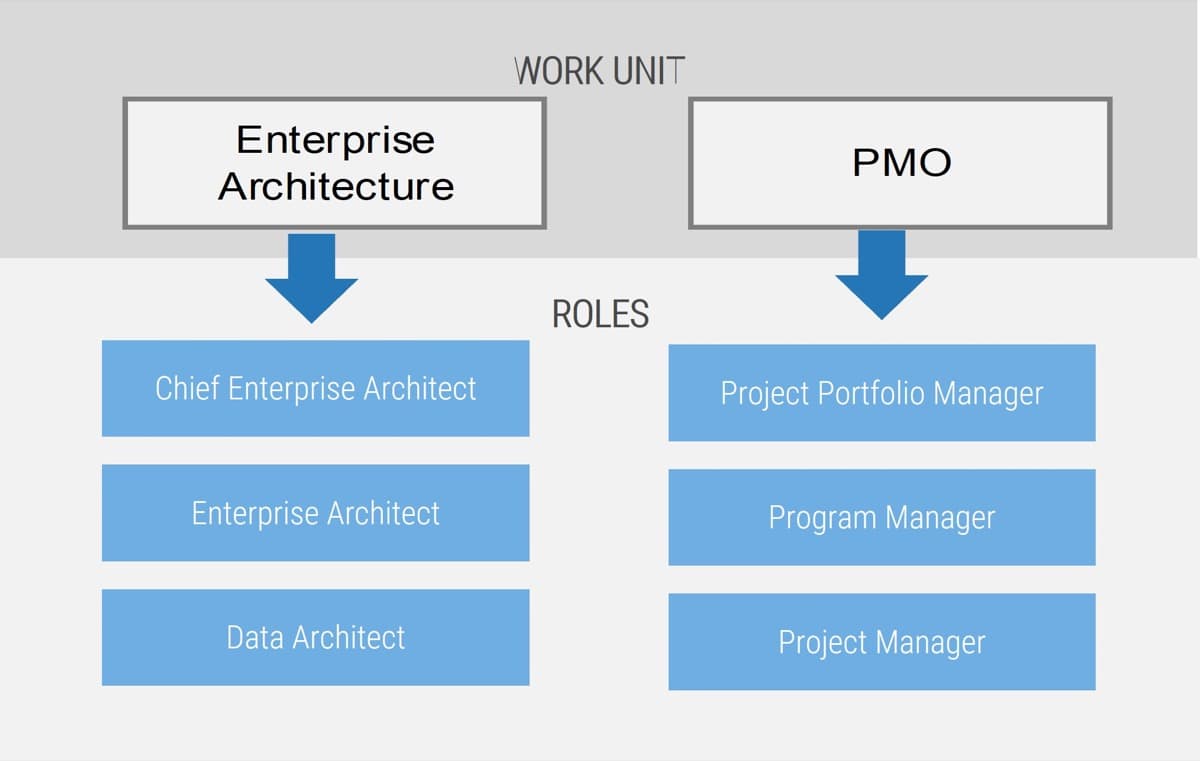

| Functional Needs |

Ent Arch Needs |

- How do we ensure Ent Arch has insight and influence on Agile software design

- Better understanding of Agile process

- How to measure compliance with reference architectures

|

PMO Needs

- Better understanding of Agile process

- Understanding role of PM in Agile

- Project status reports that determine current level of project risk

- How does project governance apply on Agile projects

- What deliverables/artifacts are produced by Agile projects and when are they completed

Operations Needs

- Alignment on approaches for doing releases

- Impact of Agile on change management and support desk processes

- How and when will installation and operation instructions be available in Agile

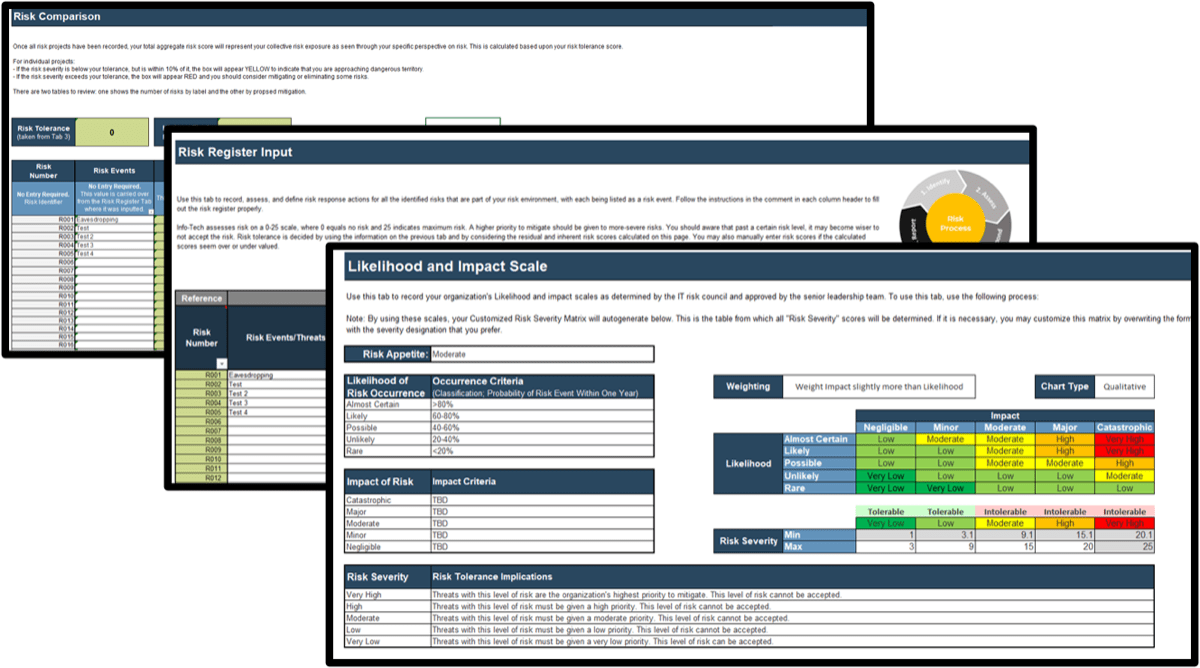

Activity: Form a solution matrix to organize your pain points and opportunities

1.2.4 Half day

Input

Output

- Classified pains and opportunities

Materials

- Whiteboard

- Markers

- Sticky notes

Participants

- Review the listed pain points from the data gathering process. Sort the pain points on sticky notes into technology, governance, people, and shared services.

- Consider opportunities under each defining element based on the identified business requirements.

- Document your findings.

- Discuss the results with the project team and prioritize the opportunities.

- Where do the most pains occur?

- What opportunities exist to alleviate pains?

| |

Governance |

Shared Services |

Technology |

People |

| Pain Points |

|

|

|

|

| Opportunities |

|

|

|

|

Document results in the ACE Communications Deck.

Activity: Refine your use cases to identify your ACE functions and services

1.2.5 1 Hour

Input

- Use cases from activity 1.1.2

Output

- Refined use cases based on data collection

Materials

- Whiteboard

- Markers

- Sticky notes

Participants

- Refine your initial use cases for the points of alignment between your ACE and business objectives using your classified pain points and opportunities.

- Add use cases to address newly realized pain points.

- Determine the functions and services the CoE can offer to address the identified requirements.

- Evaluate the outputs in the form of realized benefits and extracted inefficiencies.

Possible ACE use cases:

- Policy Management

- Change Management

- Risk Management

- Stakeholder Management

- Engagement Planning

- Knowledge Management

- Subject-Matter Expertise

- Agile Team Evaluation

- Operations Support

- Onboarding

- Coaching

- Learning Facilitation

- Communications Training

- Vendor Management

- Application Support

- Tooling Standards

Document results in the ACE Communications Deck.

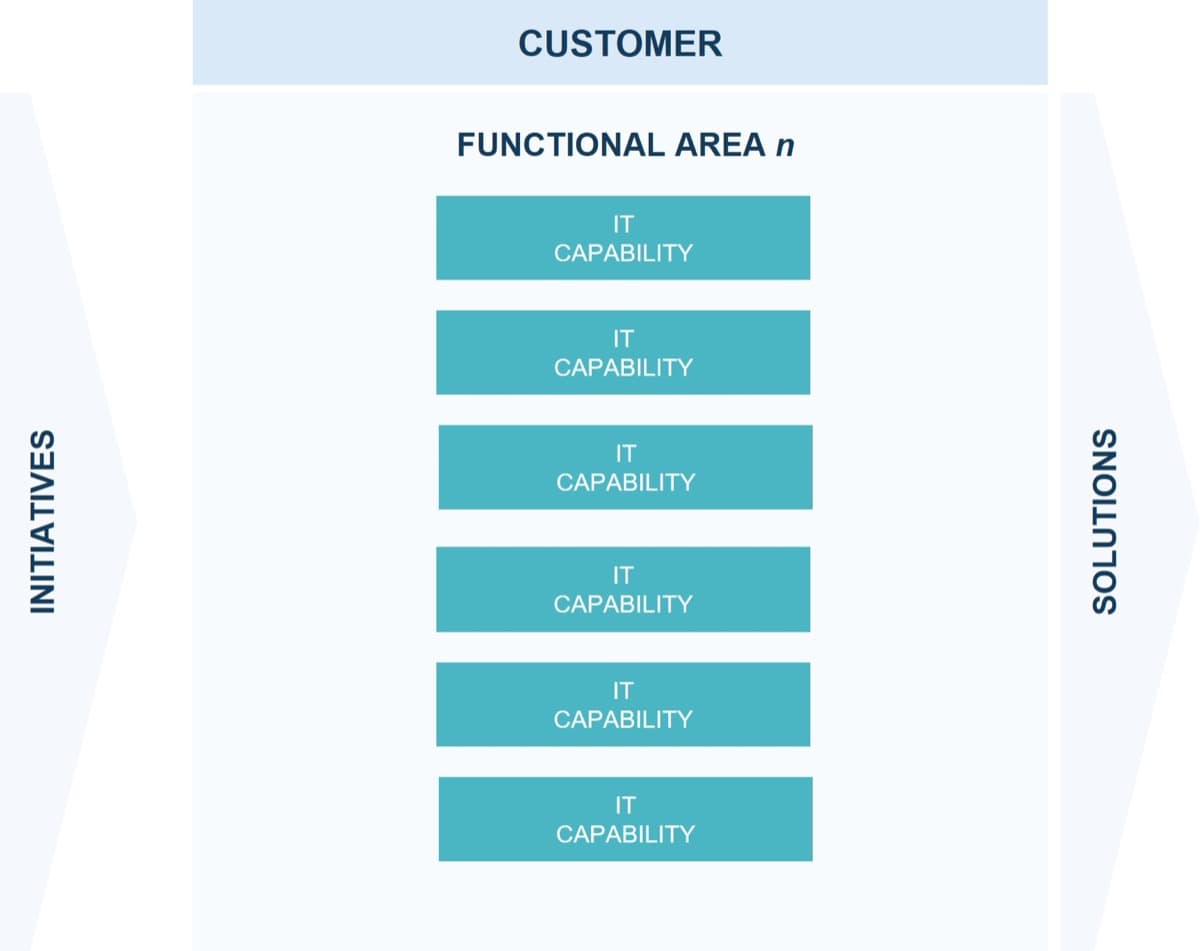

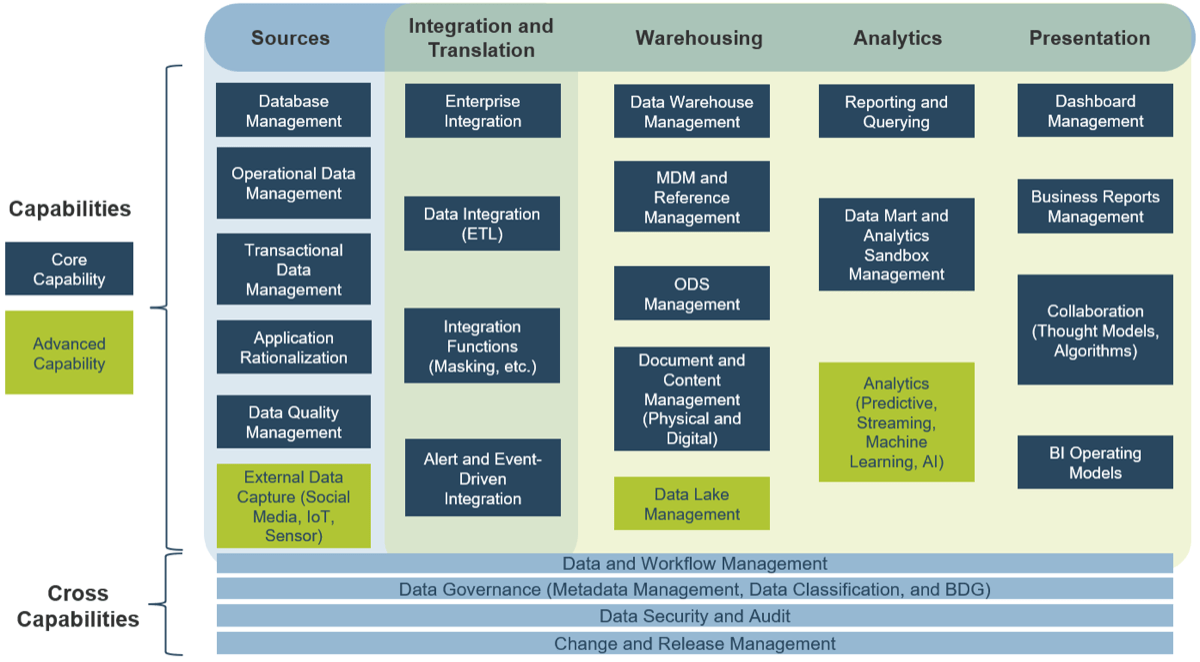

Activity: Visualize your ACE functions and service offerings with a capability map

1.2.6 1 Hour

Input

- Use cases from activity 1.2.4

Output

Materials

- Whiteboard

- Markers

- Sticky notes

Participants

- Review the refined and categorized list of service offerings.

- Determine how these new capabilities will add, remove, or enhance your existing service and capabilities.

- Categorize the capabilities into the following groups:

- Governance and Metrics

- Services

- Staff

- Technology

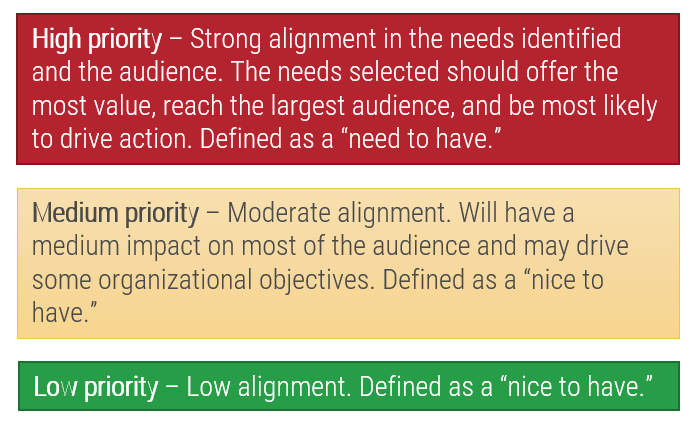

Label the estimated impact of the service offering based on your business priorities for the year. This will guide your strategy for implementing your Agile Center of Excellence moving forward.

Document results in the ACE Communications Deck.

Activity: Visualize your ACE functions and service offerings with a capability map (continued)

Governance

Policy Management (Medium Potential)

Change Management (High Potential)

Risk Management (High Potential)

Stakeholder Management (High Potential)

Metrics/Feedback Monitoring (High Potential)

Shared Services

Engagement Planning (High Potential)

Knowledge Management (High Potential)

Subject-Matter Expertise (High Potential)

Agile Team Evaluation (High Potential)

Operations Support (High Potential)

People

Onboarding (Medium Potential)

Coaching (High Potential)

Learning Facilitation (High Potential)

Internal Certification Program (Low Potential)

Communications Training (Medium Potential)

Technology

Vendor Management (Medium Potential)

Application Support (Low Potential)

Tooling Standards (High Potential)

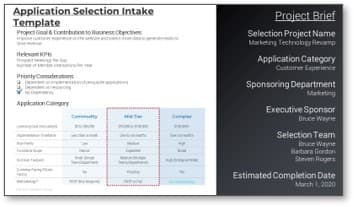

Checkpoint: Are you ready to standardize your CoEs service offerings?

Phase 1

1.1 Determine the vision of your ACE

1.2 Define the service offerings of your ACE

Phase 2

2.1 Define an adoption plan for your Agile teams

2.2 Create an ACE engagement plan

2.3 Define metrics to measure success

Self-Auditing Guidelines

- Have you identified and prioritized the key business objectives for the upcoming year that the ACE will align with?

- Do you have a high-level set of use cases for points of alignment between your ACE and business objectives?

- Have you mapped your stakeholders and identified the key players that will have an influence over the future success of your ACE?

- Have you identified how your organization will fund, resource, and govern the ACE?

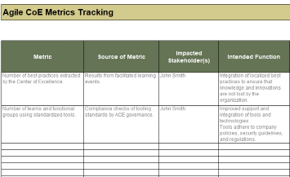

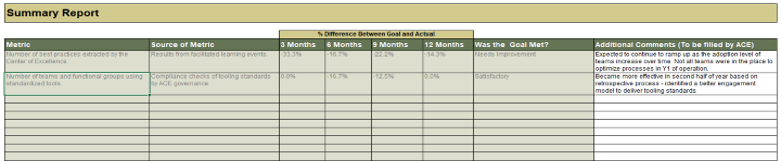

- Have you collected data to understand the functional expectations of the users the ACE is intended to serve?