Further reading

Mature and Scale Product Ownership

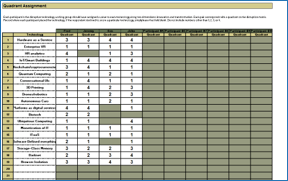

Strengthen the product owner’s role in your organization by focusing on core capabilities and proper alignment.

Executive Brief

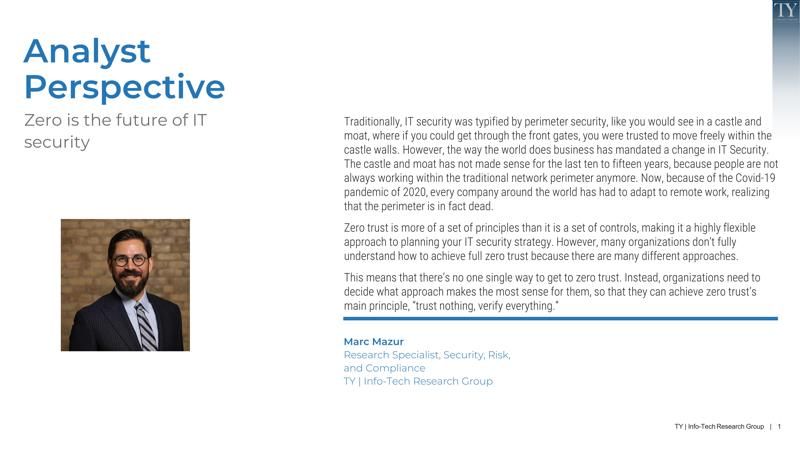

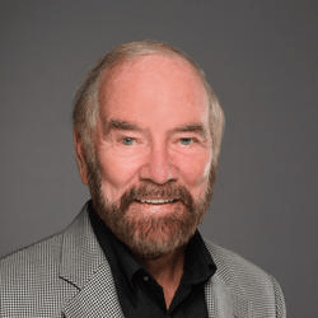

Analyst Perspective

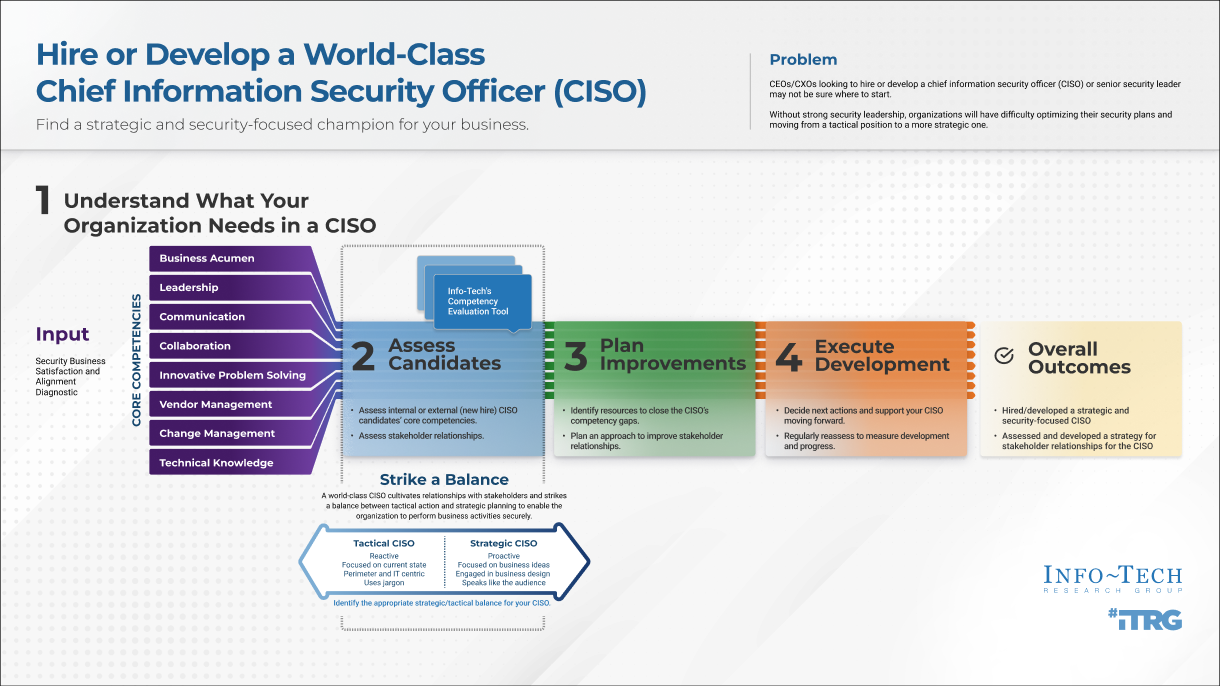

Empower product owners throughout your organization.

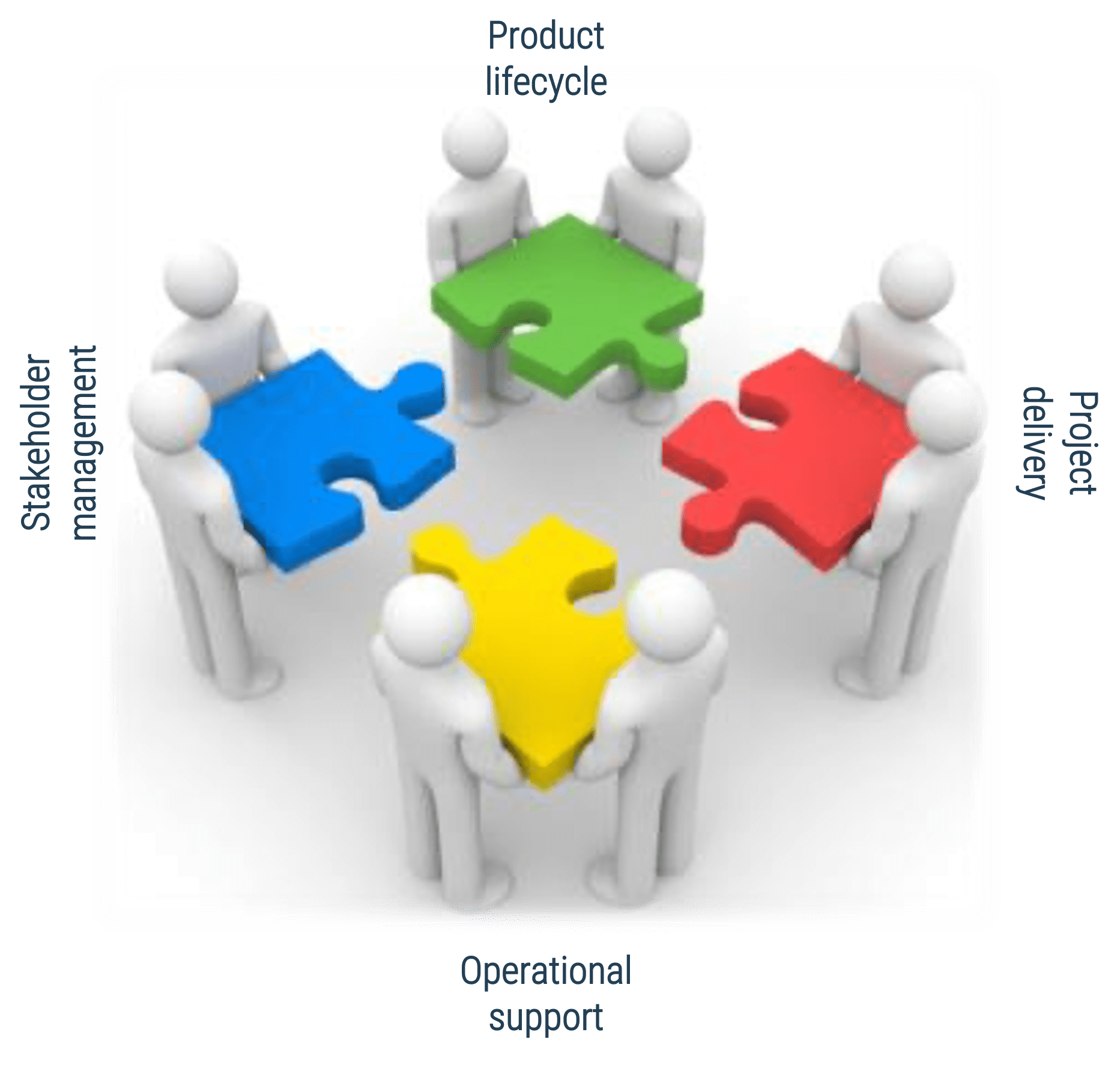

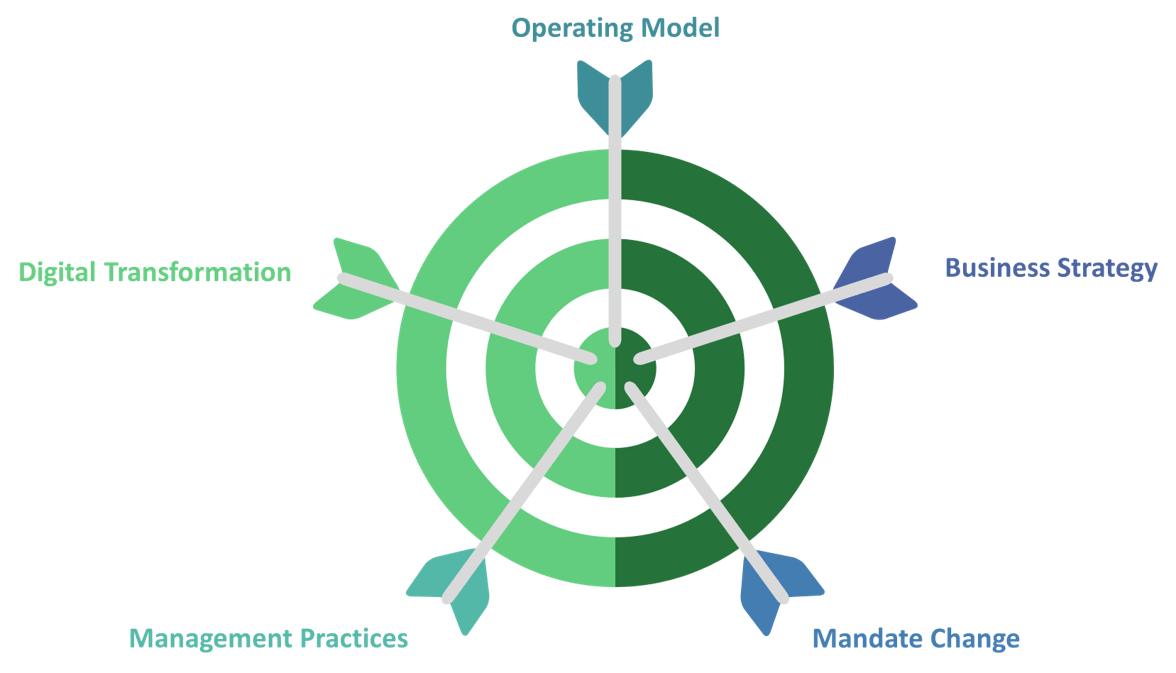

Whether you manage a product or service, the fundamentals of good product ownership are the same. Organizations need to focus on three key elements of product ownership in order to be successful.

-

Create an environment of empowerment and service leadership to reinforce product owners and product family managers as the true owners of the vision, improvement, and realized the value of their products.

-

Align product and product family owner roles based on operational alignment and the groups defined when scaling product management.

-

Develop your product owners to improve the quality of roadmaps, alignment to enterprise goals, and profit and loss (P&L) for each product or service.

By focusing the attention of the teammates serving in product owner or service owner roles, your organization will deliver value sooner and respond to change more effectively.

Hans Eckman

Principal Research Director – Application Delivery and Management

Info-Tech Research Group

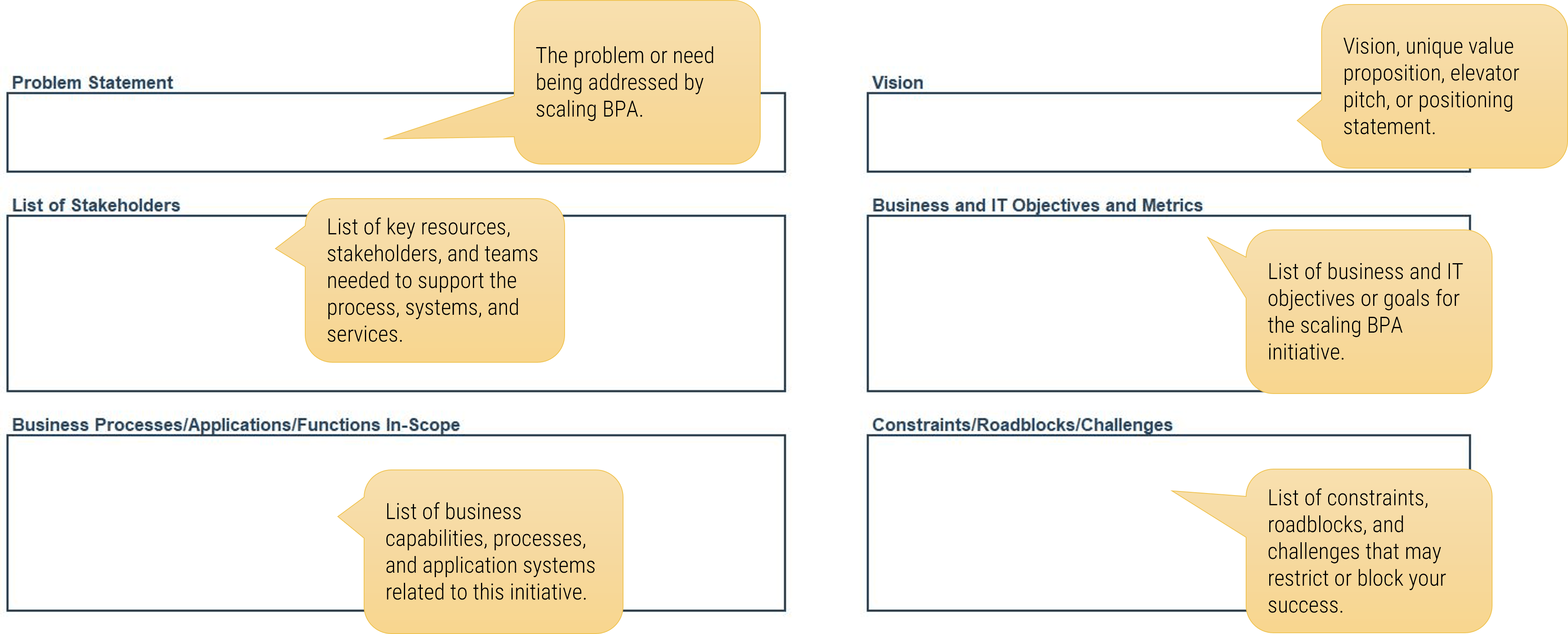

Executive Summary

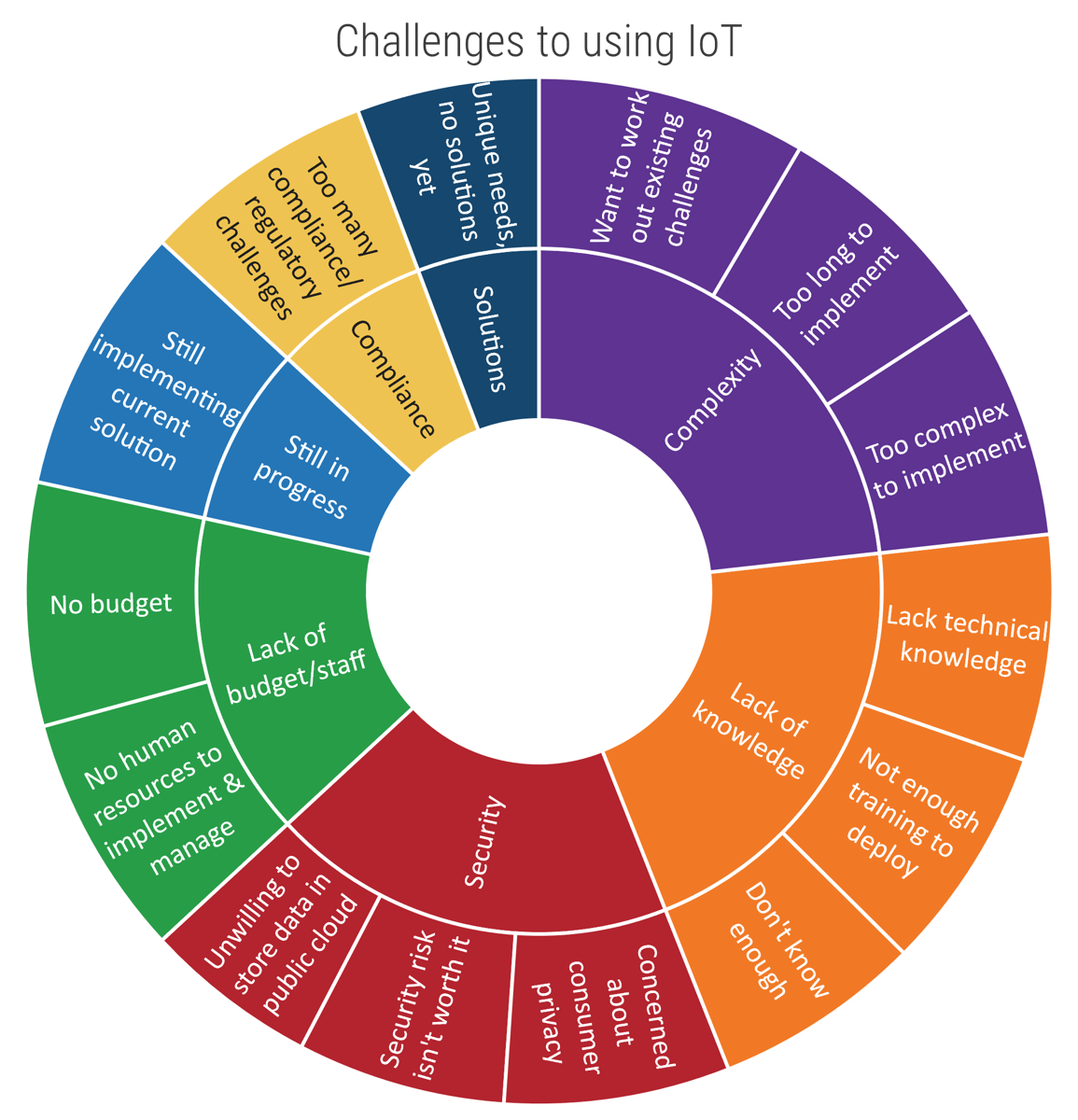

Your Challenge

Product owners must bridge the gap between the customers, operations, and delivery to ensure products continuously

deliver increasing value.

Product owners are often assigned to projects or product delivery without proper support, guidance, or alignment.

In many organizations the product owner role is not well-defined, serves as a proxy for stakeholder ownership, and lacks

reinforcement of the key skills needed to be successful.

|

Common Obstacles

Organizations have poor alignment or missing product owners between lines of business, IT, and operations.

Product owners are aligned to projects and demand management rather than long-term strategic product ownership.

Product families are not properly defined, scaled, and supported within organizations.

Individuals in product owner roles have an incomplete understanding of needed capabilities and lack a development path.

|

Info-Tech's Approach

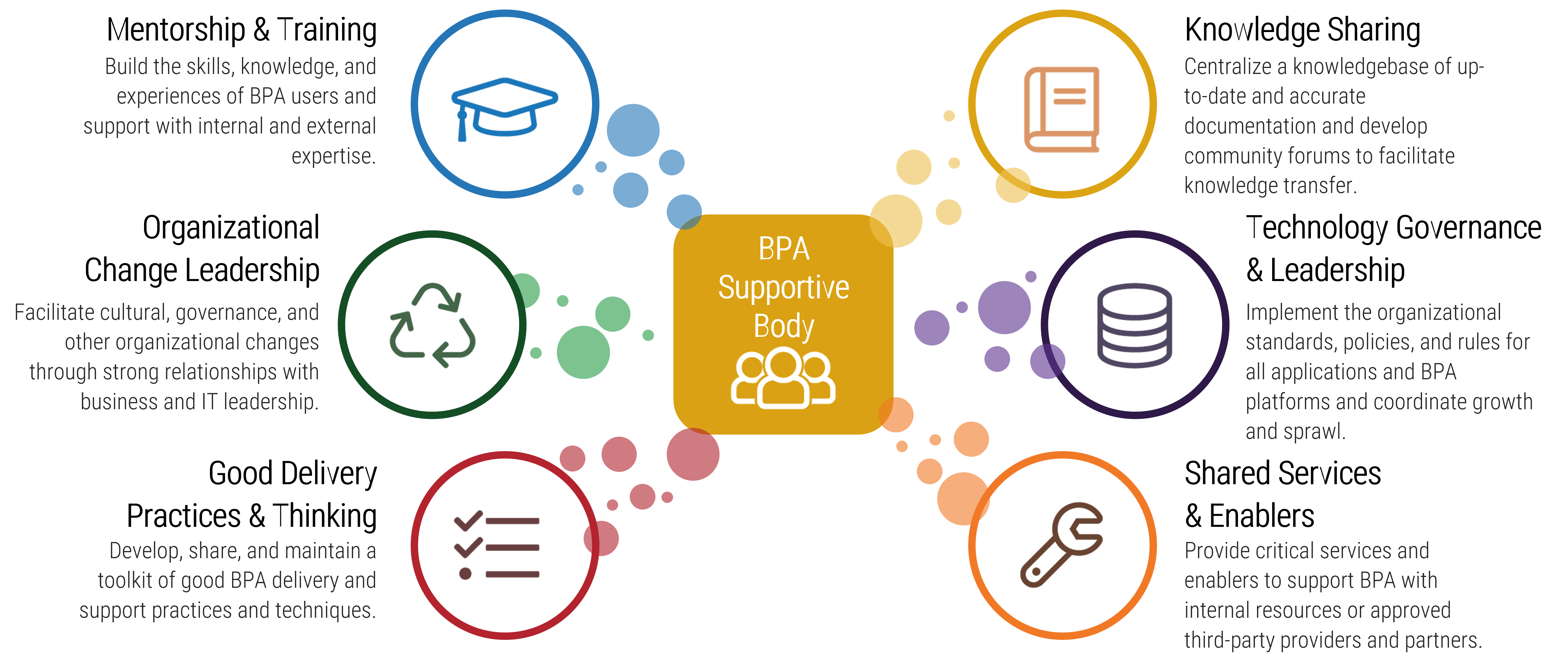

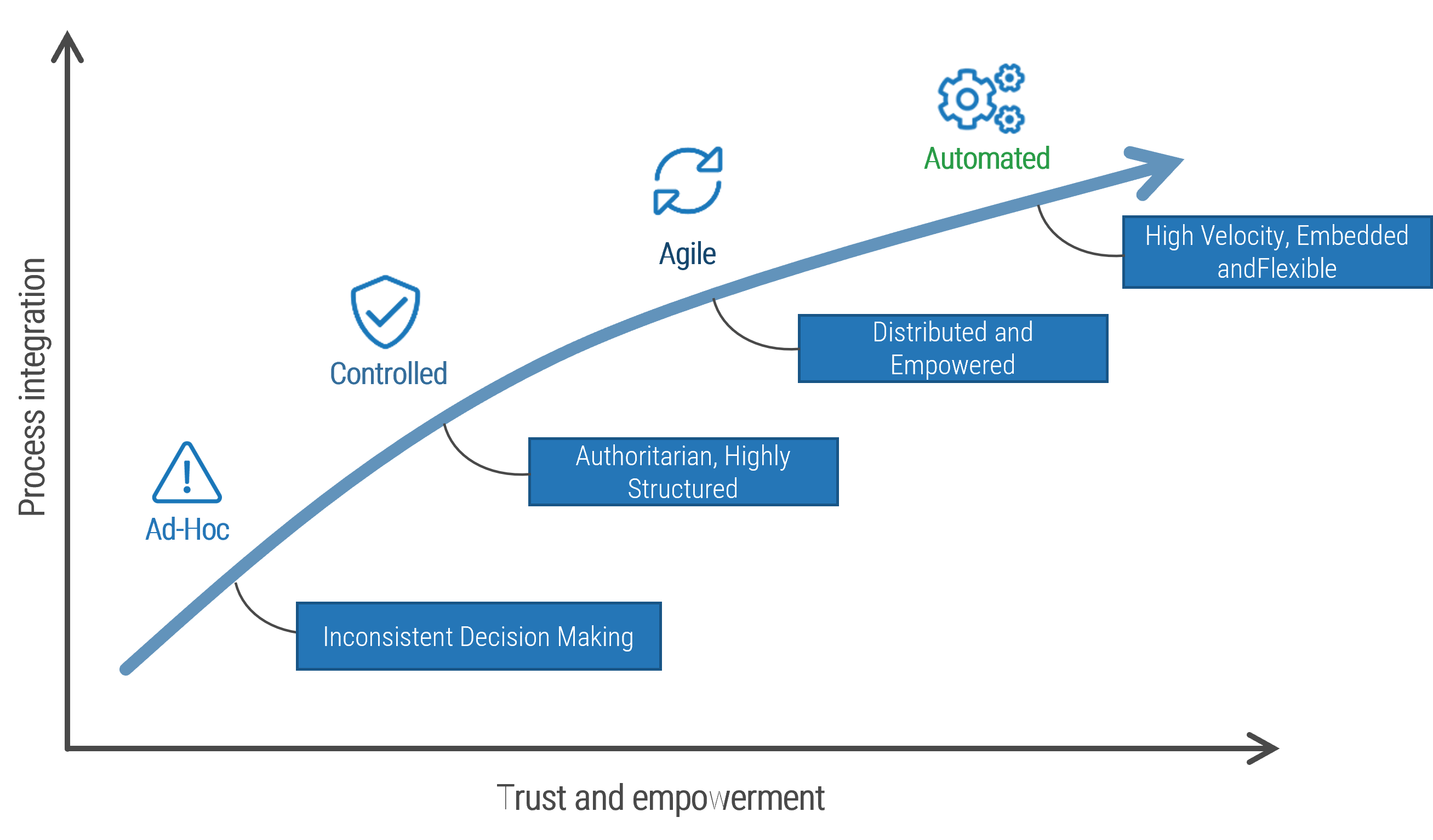

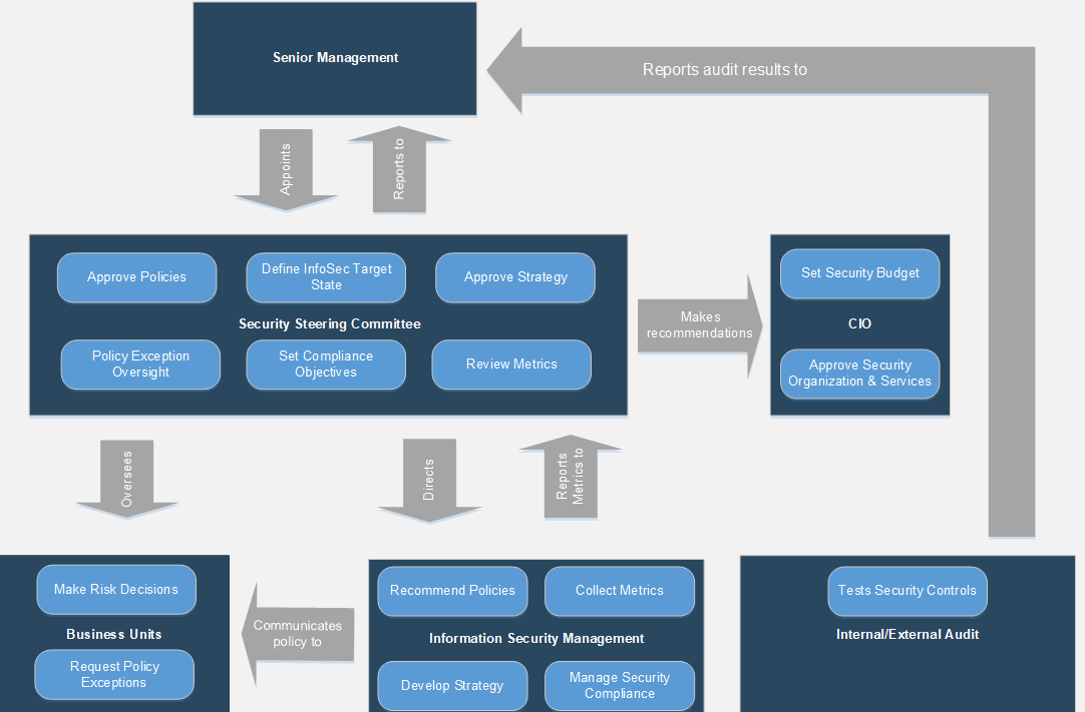

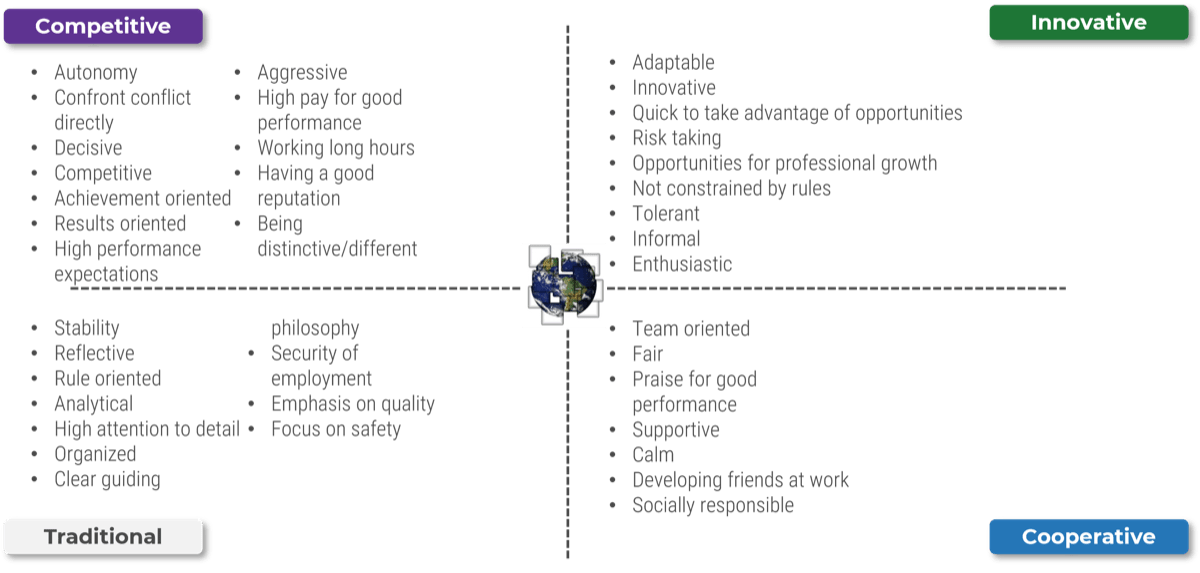

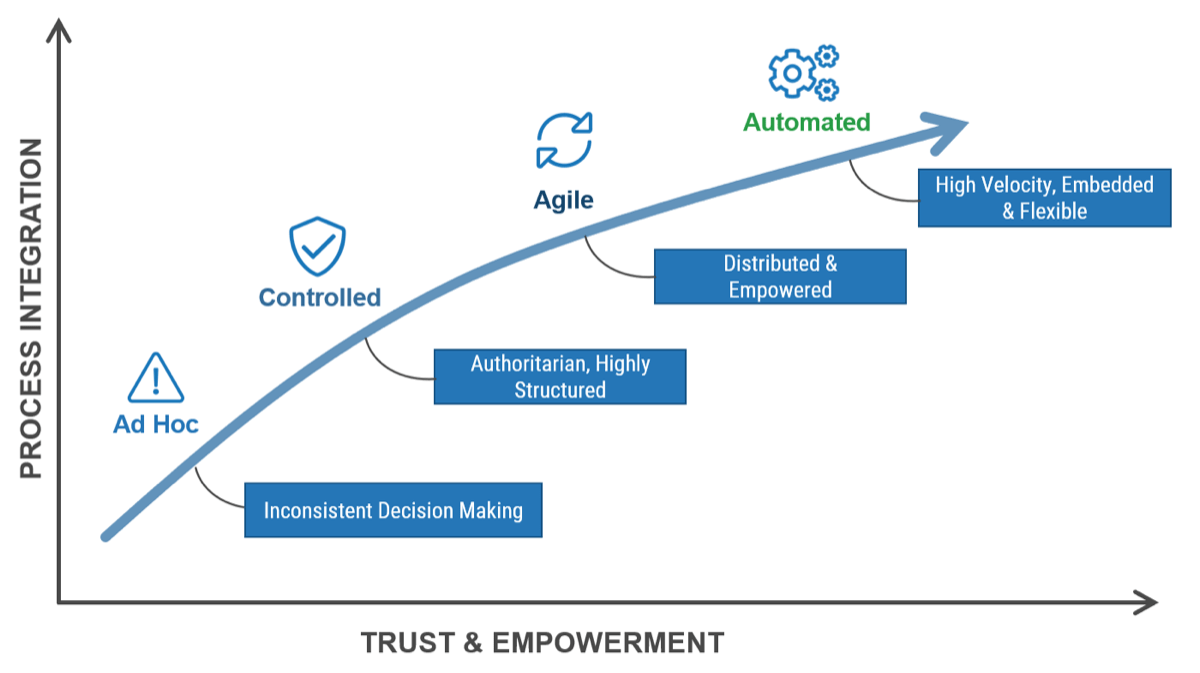

Create a culture of product management trust and empowerment with product owners aligned to your operational structure and product needs.

Promote and develop true Agile skills among your product owners and family managers.

Implement Info-Tech’s product owner capability model to define the role expectations and provide a development path for product owners.

Extend product management success using Deliver on Your Digital Product Vision and Deliver Digital Products at Scale.

|

Info-Tech Insight

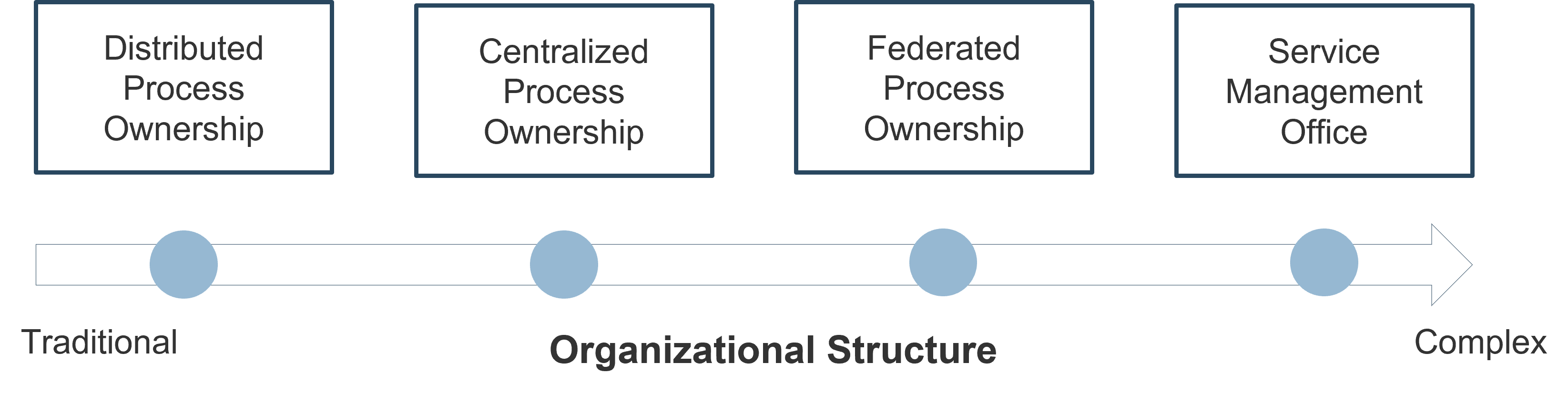

There is no single correct approach to product ownership. Product ownership must be tuned and structured to meet the delivery needs of your organization and the teams it serves.

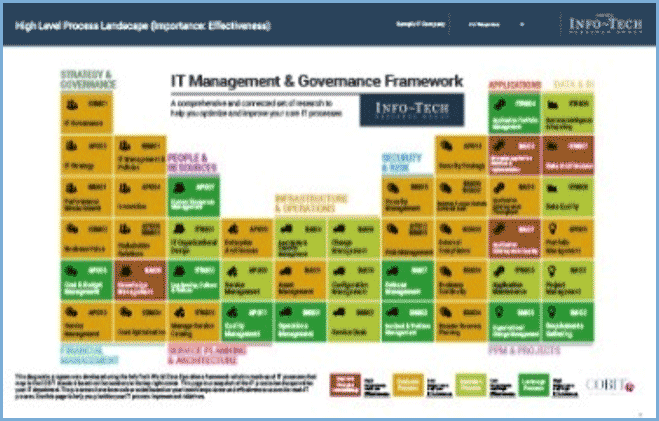

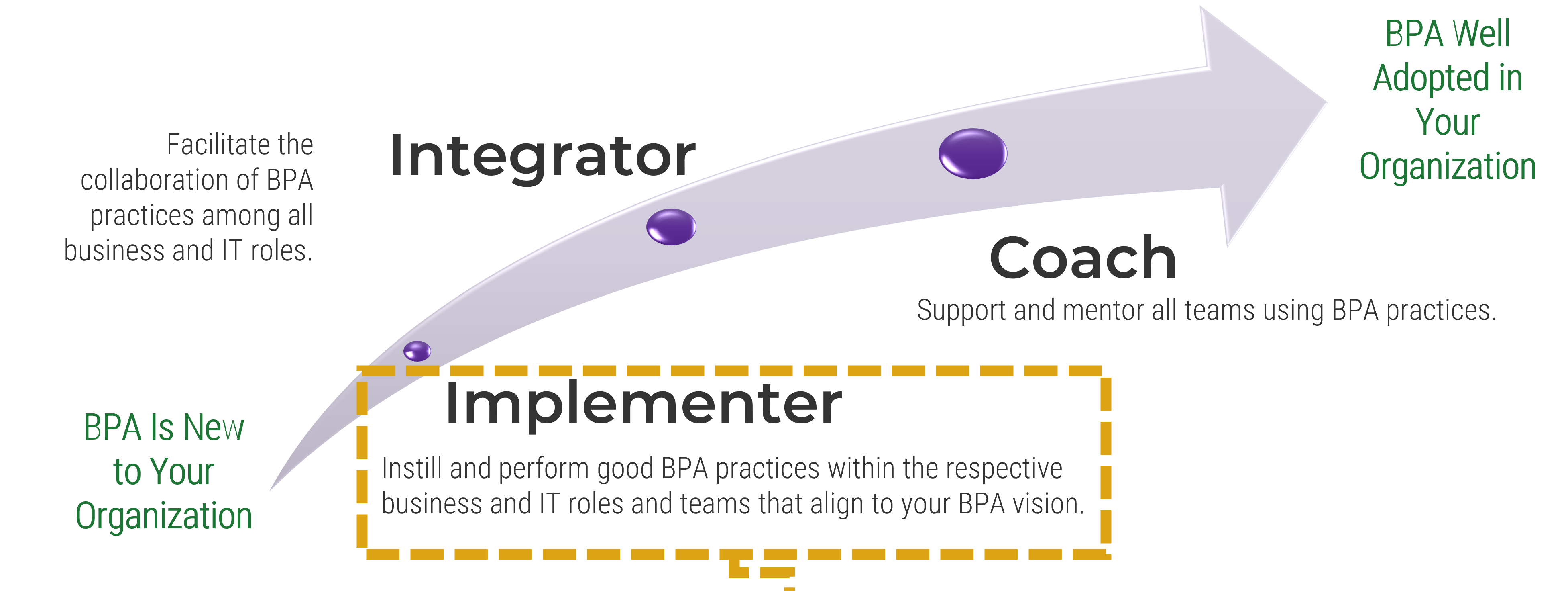

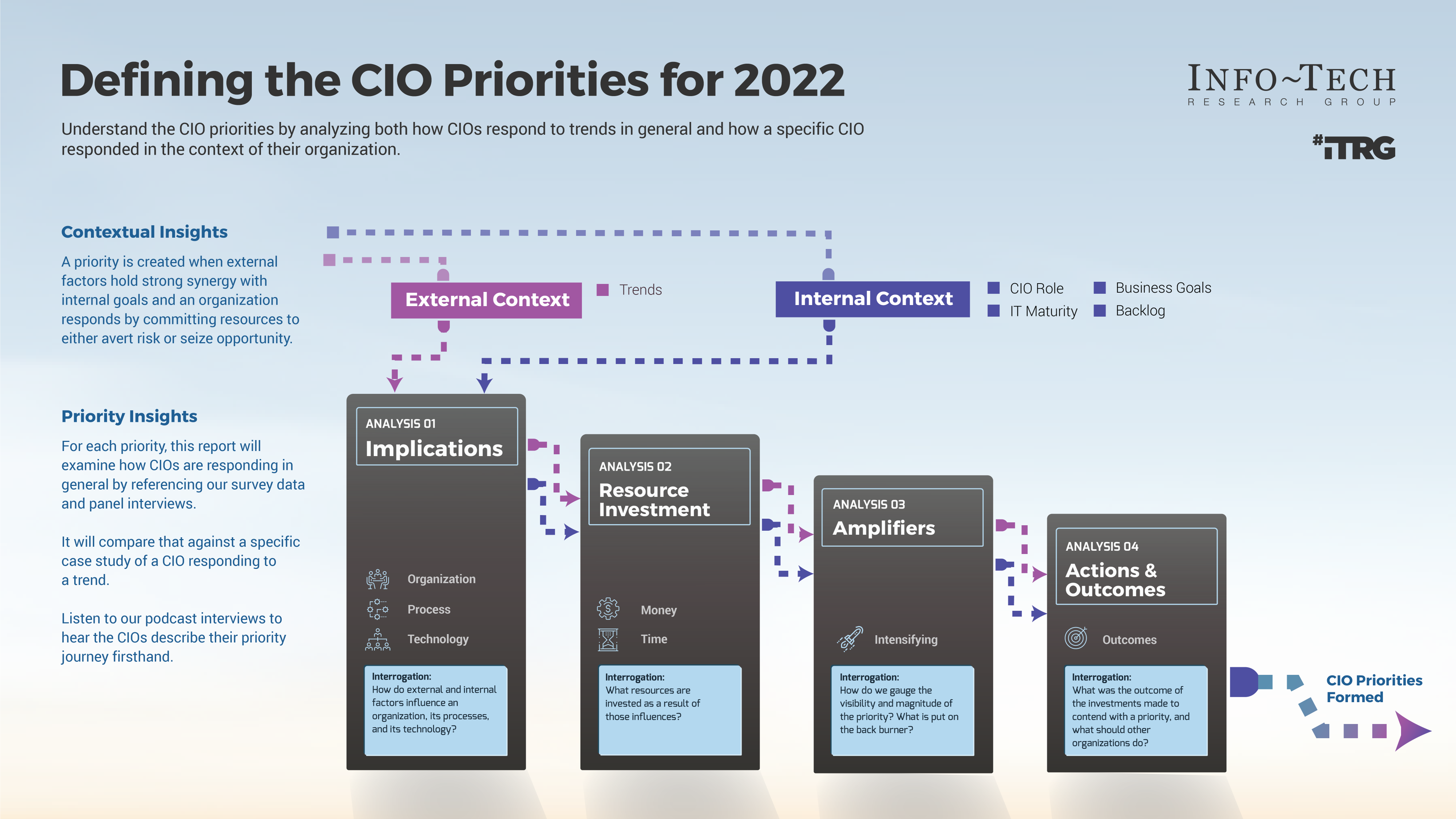

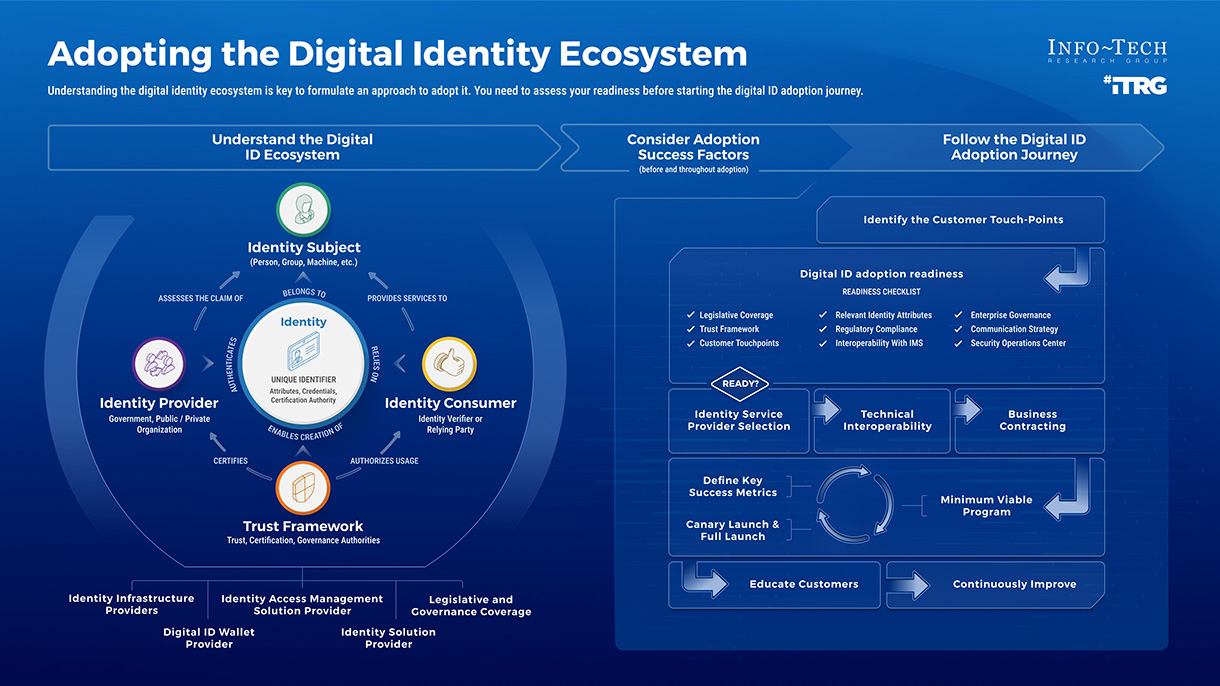

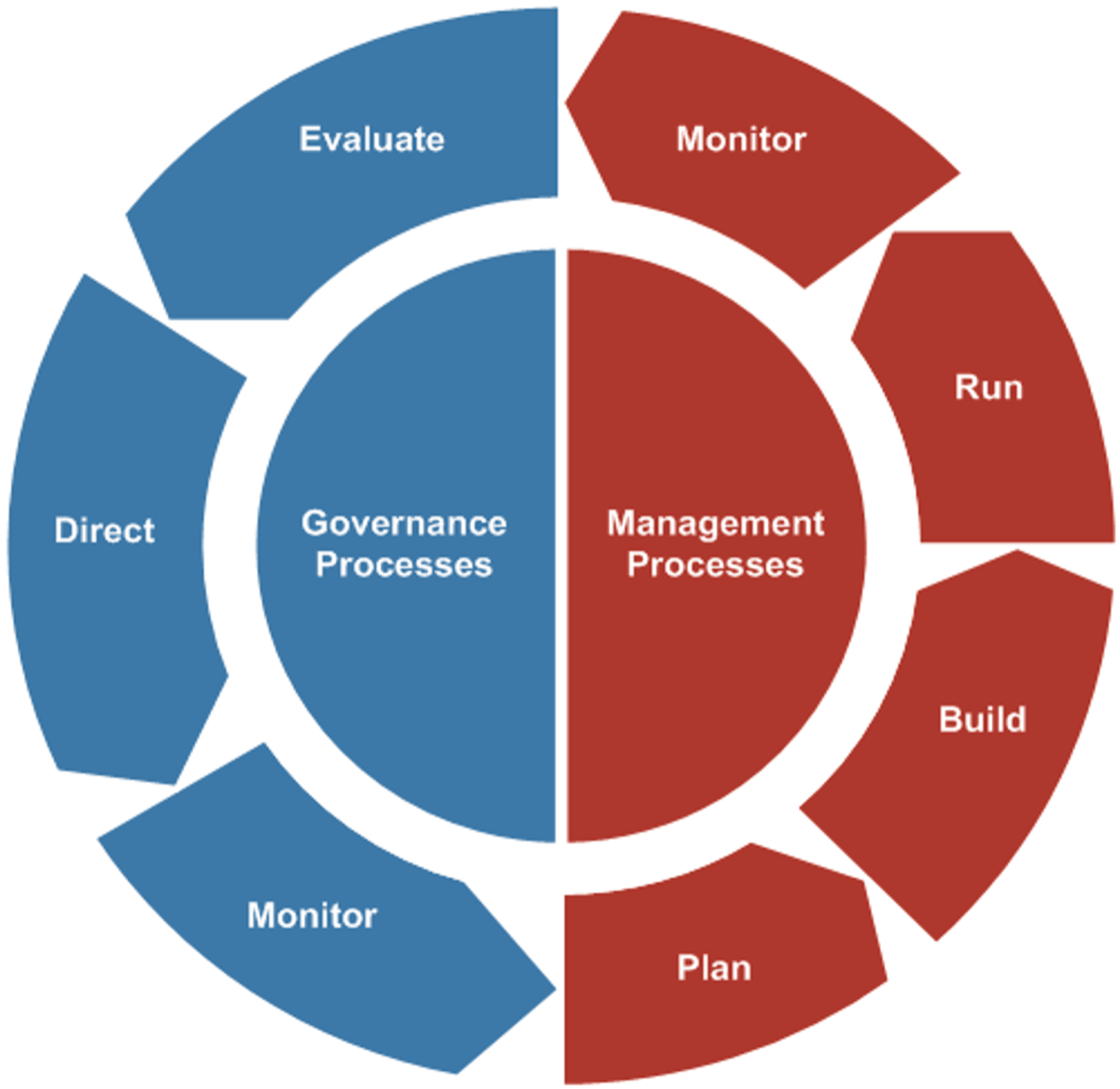

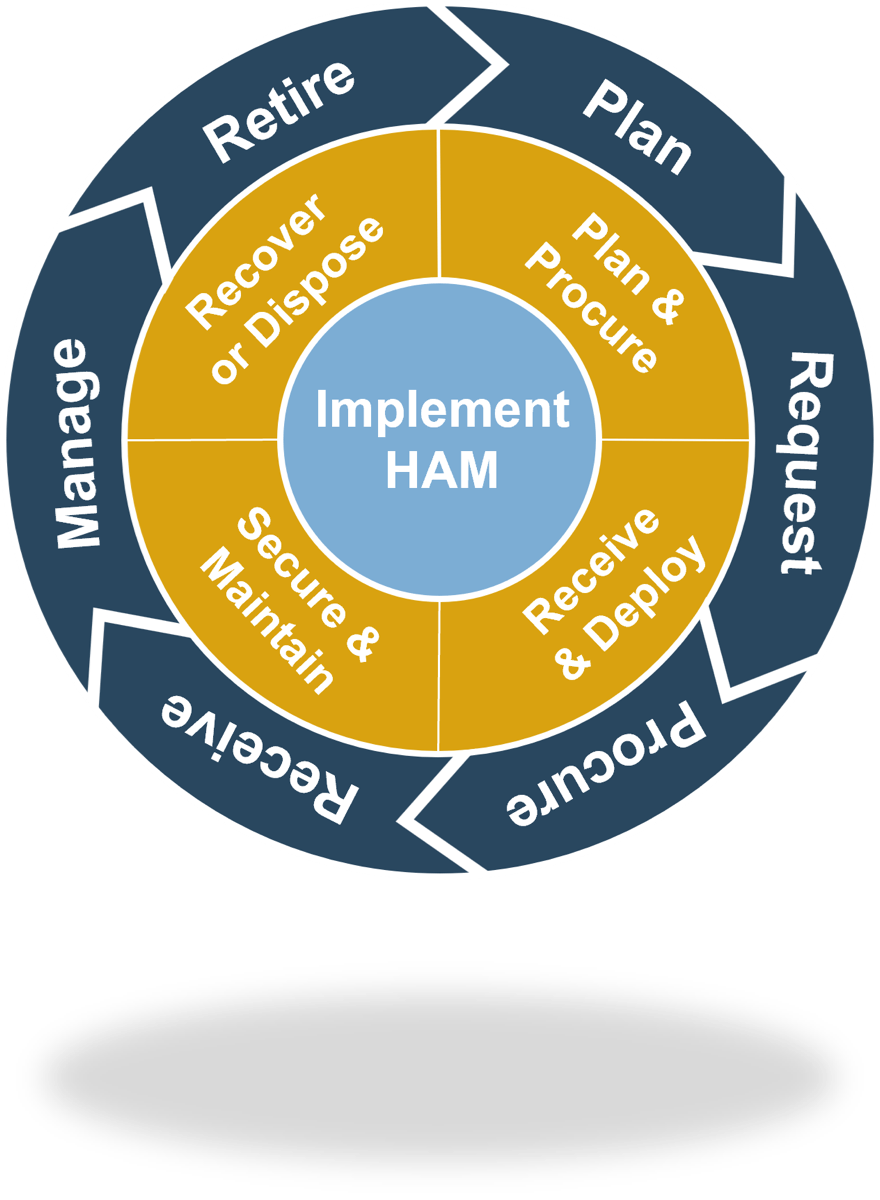

Info-Tech’s Approach

Product owners make the final decision

-

Establish a foundation for empowerment and success

-

Assign product owners and align with products and

stakeholders

-

Mature product owner capabilities and skills

The Info-Tech difference

-

Assign product owners where product decisions are needed, not to match org charts or delivery teams. The product owner

has the final word on product decisions.

-

Organize product owners into related teams to ensure product capabilities delivered are aligned to enterprise strategy

and goals.

-

Shared products and services must support the needs of many product owners with conflicting priorities. Shared service

product owners must map and prioritize demand to align to enterprise priorities and goals.

-

All product owners share the same capability model.

Insight summary

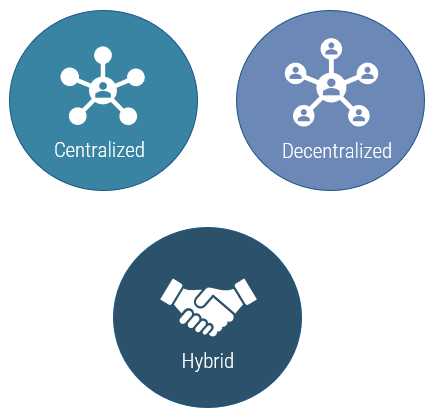

There is no single correct approach to product ownership

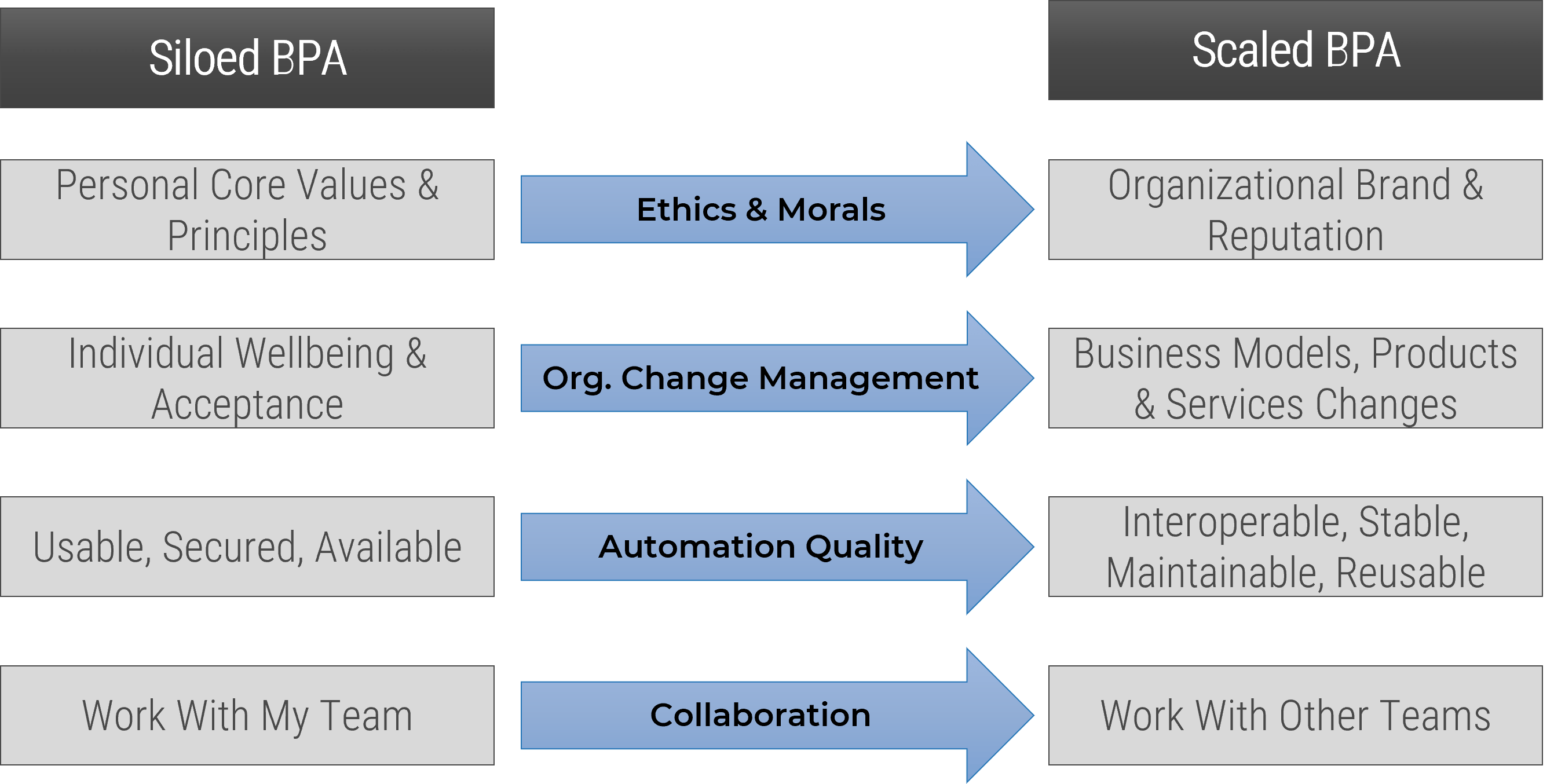

Successful product management starts with empowerment and accountability. Product owners own the vision, roadmap, and

value realization for their product or family aligned to enterprise goals and priorities.

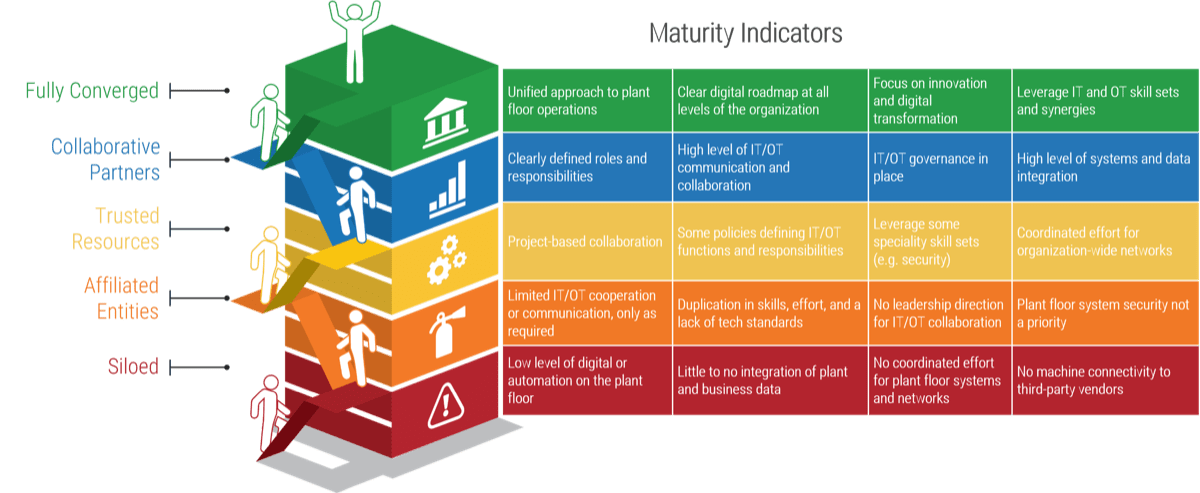

Phase 1 insight

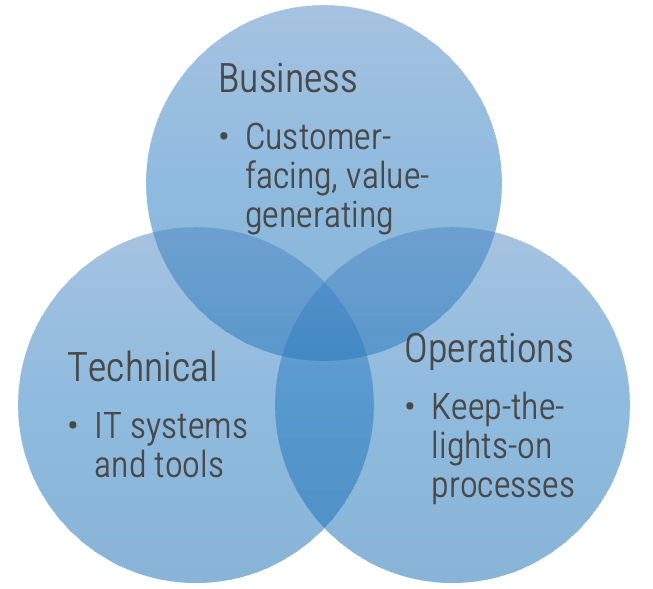

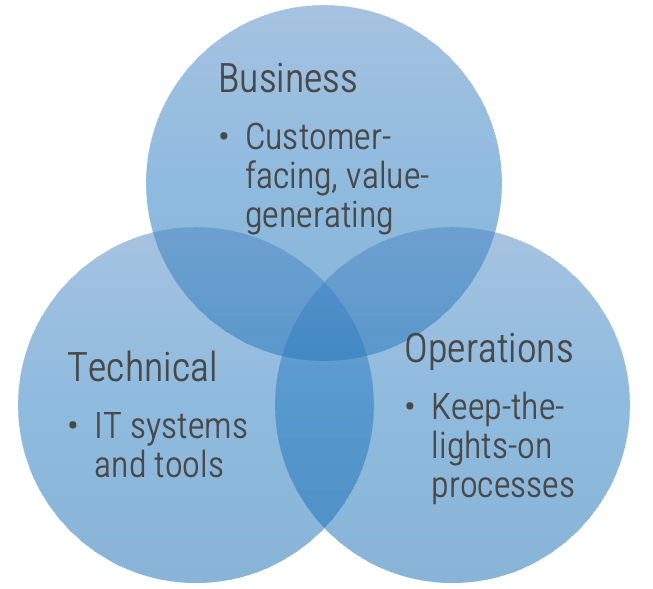

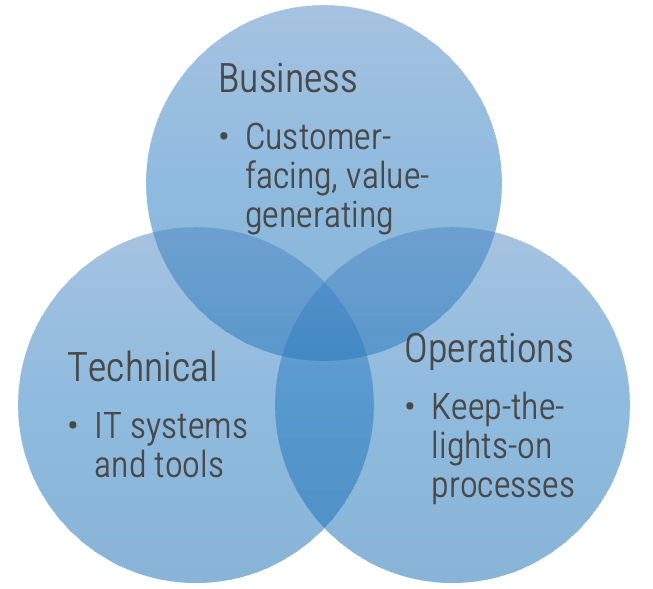

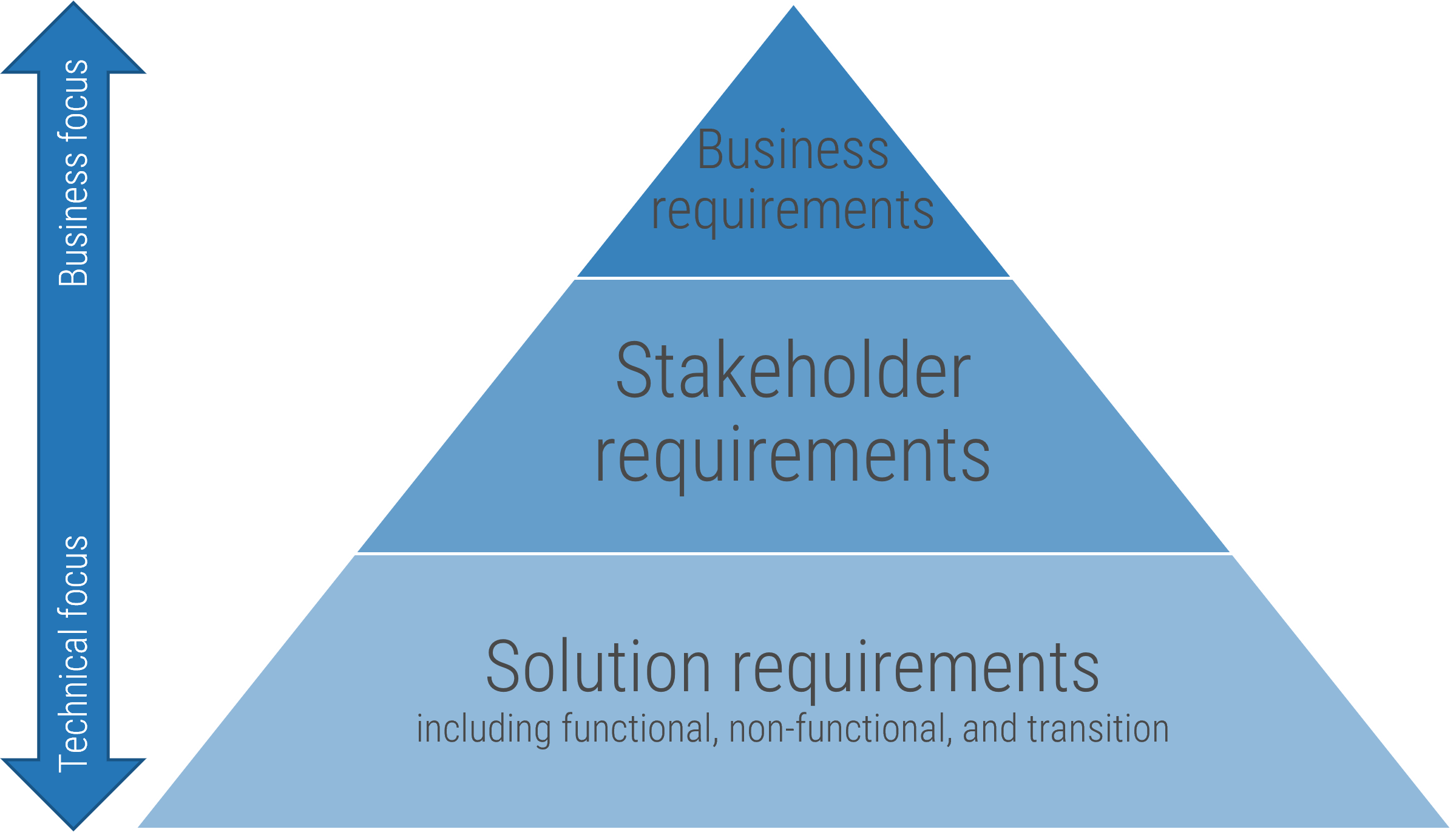

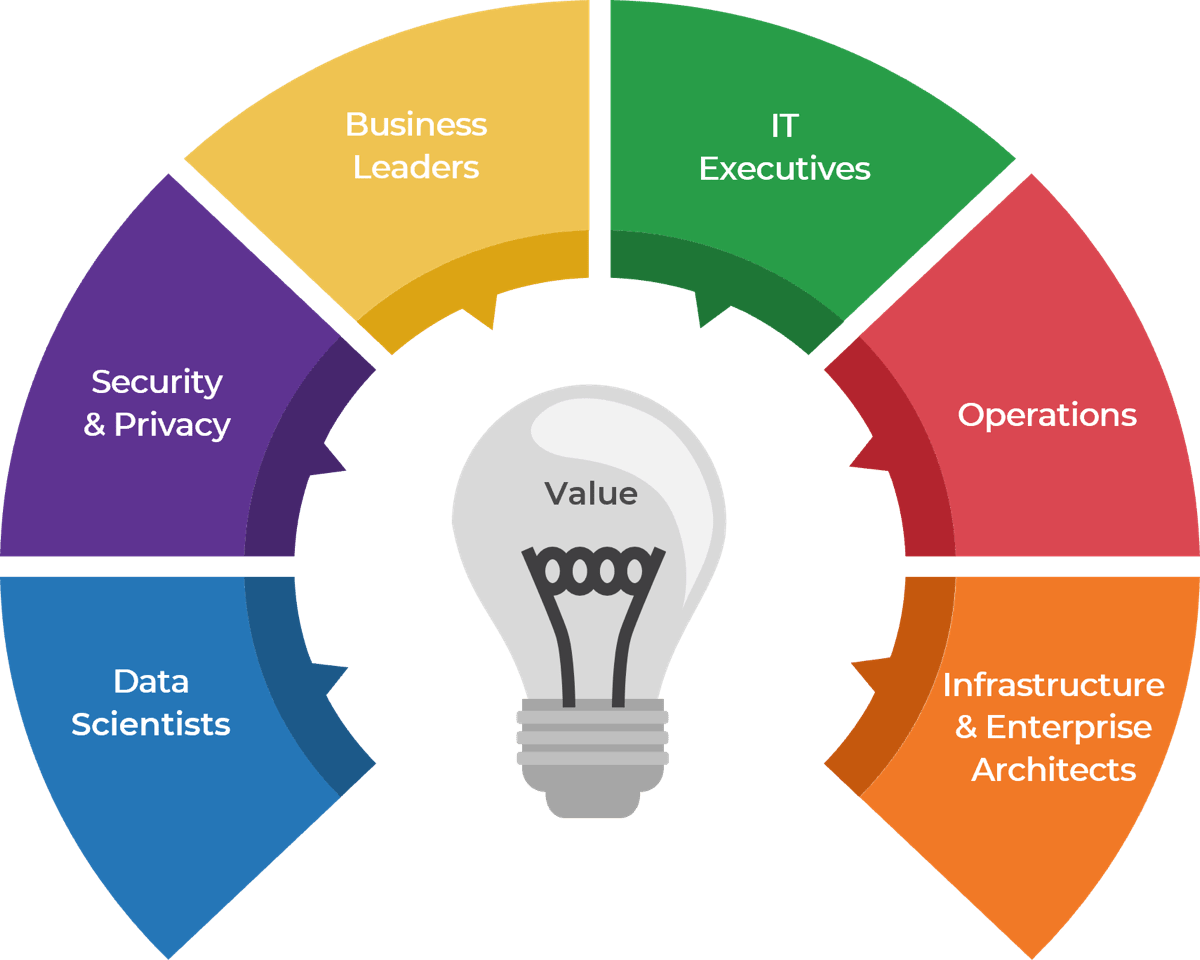

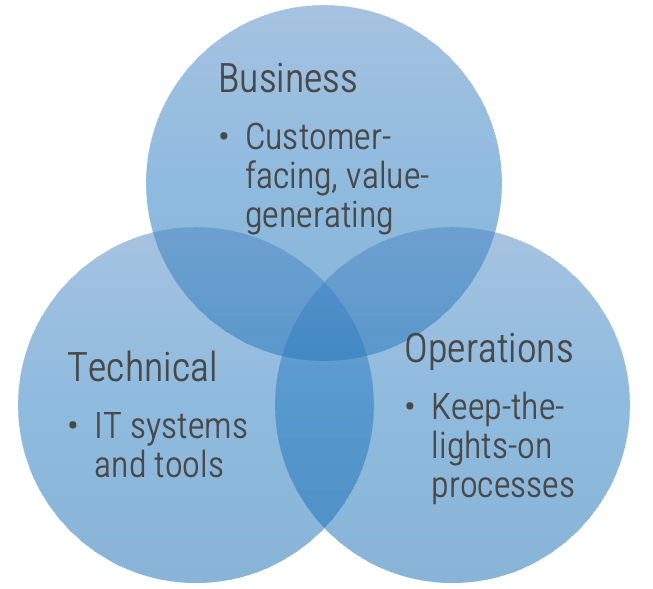

Product owners represent three primary perspectives: business (external-facing), technical (systems and tools), or

operational (manual processes). Although all share the same capabilities, how they approach their responsibilities is

influenced by their primary perspective.

Phase 2 insight

Start with your operational grouping of products and families, identifying where an owner is needed. Then, assign people

to the products and families. The owner does not define the product or family.

Phase 3 insight

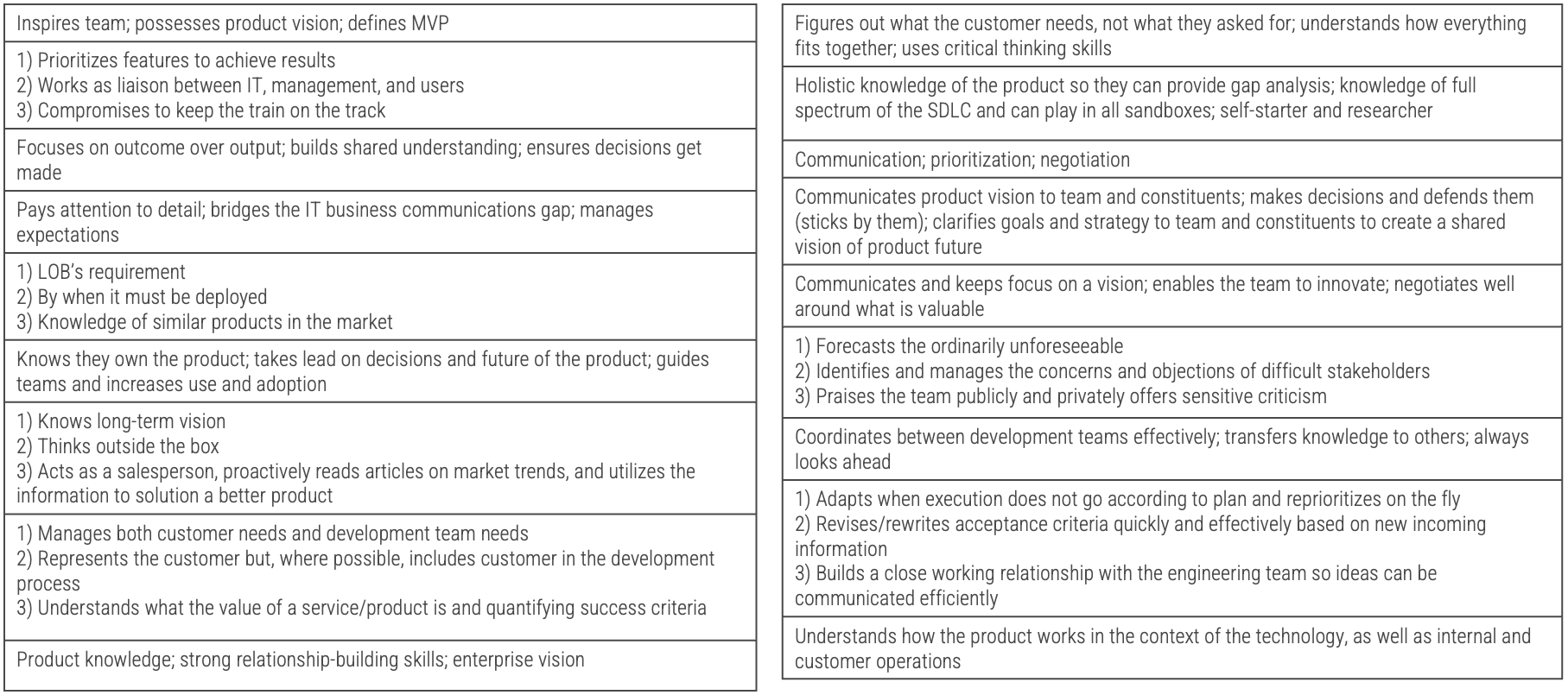

Product owners are operating under an incomplete understanding of the capabilities needed to succeed. Most product/service owners lack a complete picture of the needed capabilities, skills, and activities to successfully perform their roles.

Product and service ownership share the same foundation

The underlying capabilities and best practices to own and improve a product or service are identical for both roles. Use

the terms that make the most sense for your culture.

Map product owner roles to your existing job titles

Identify where product management is needed and align expectations with existing roles. Successful product management

does not require a dedicated job family.

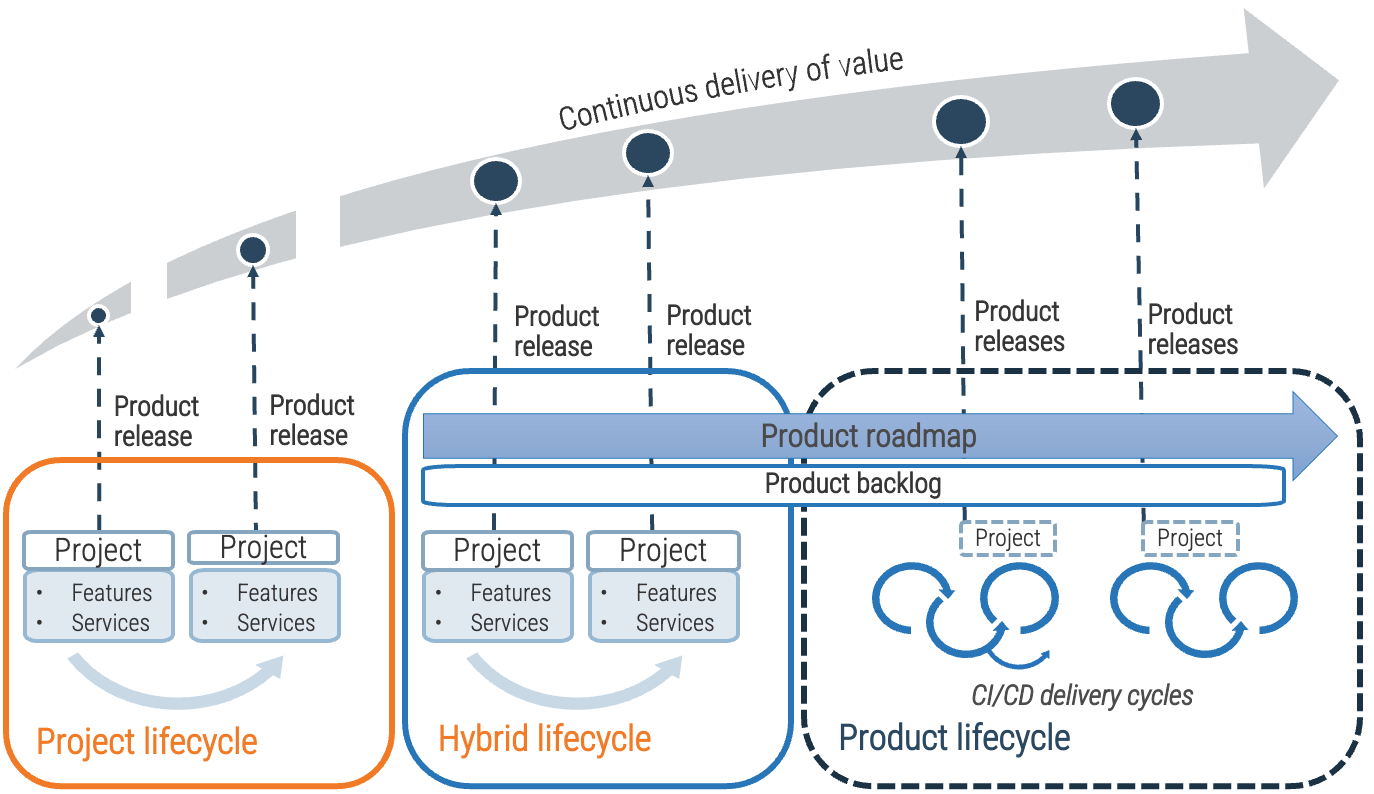

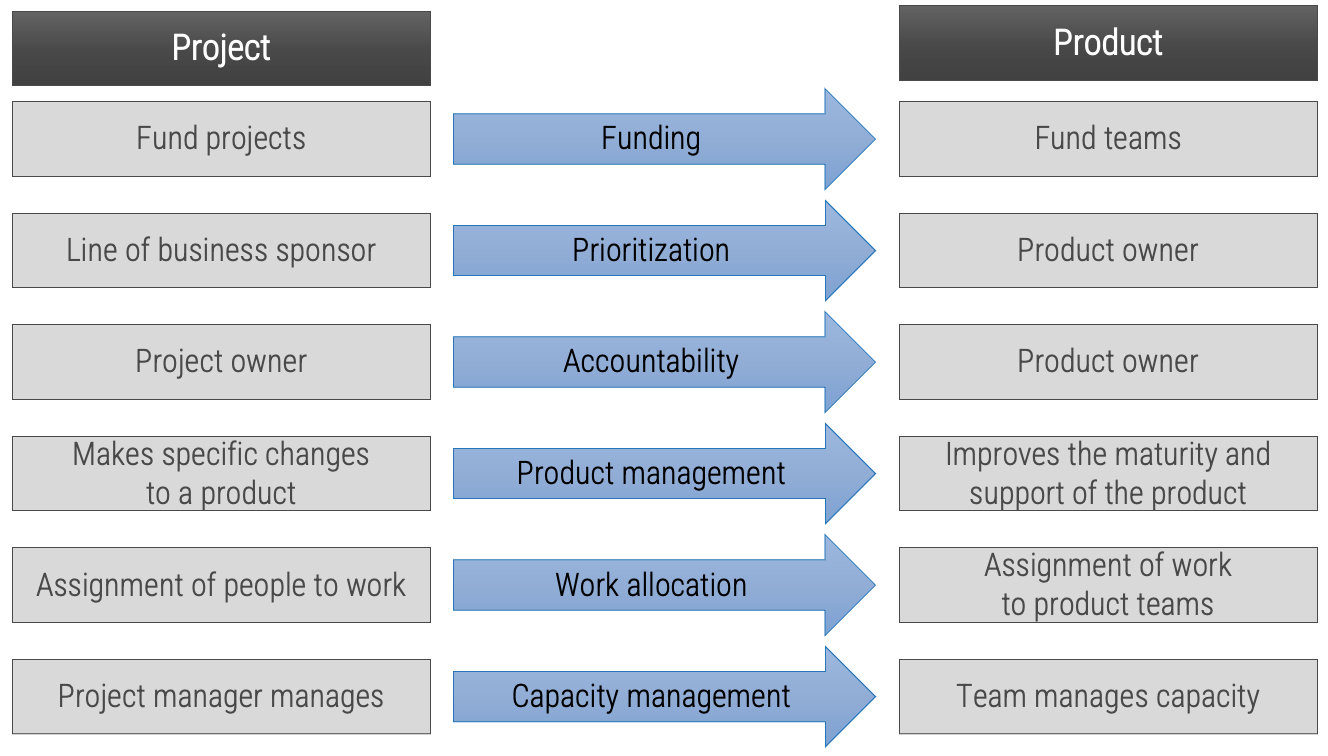

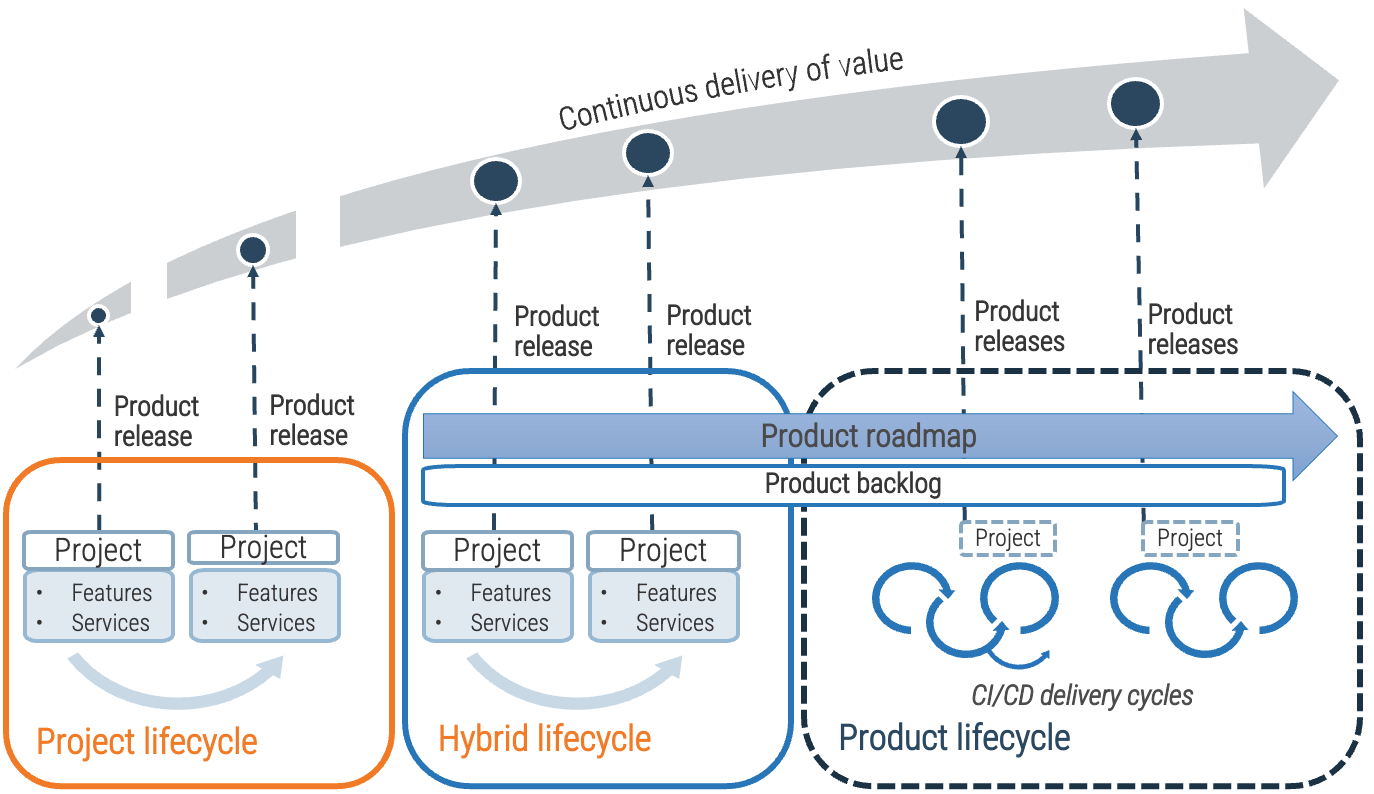

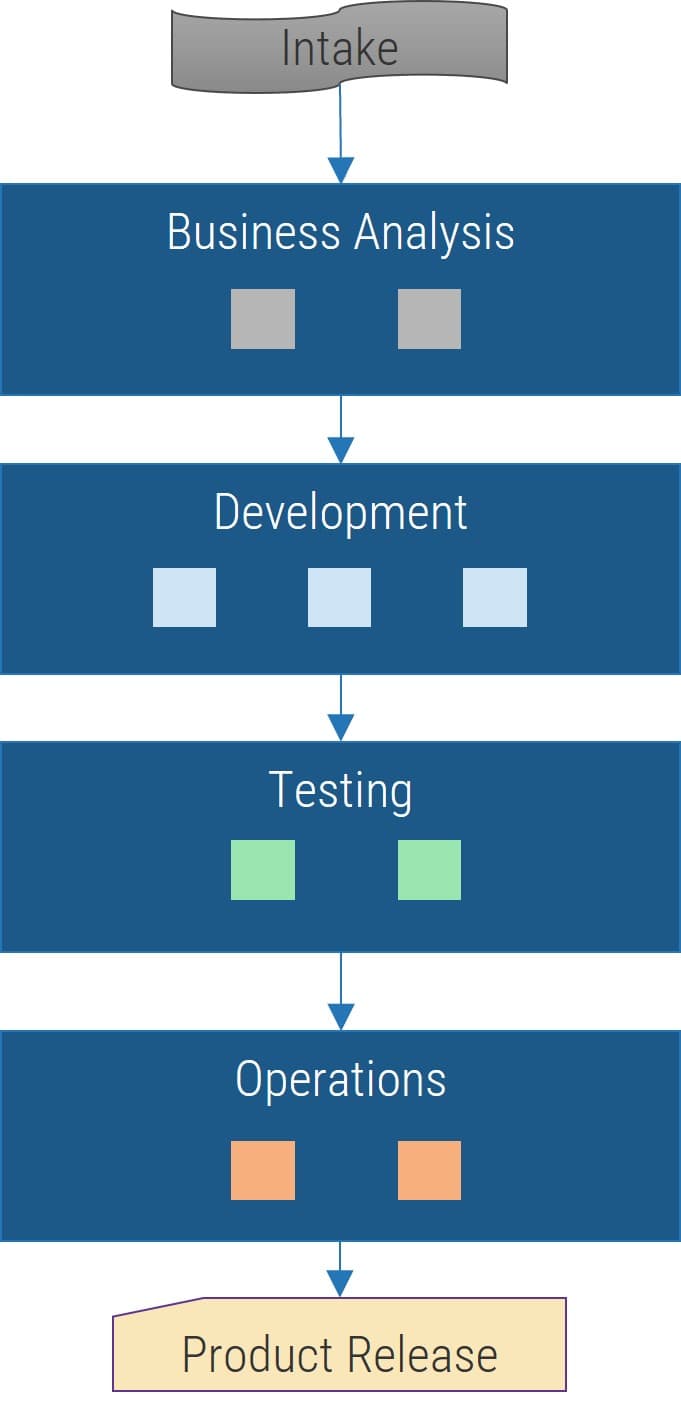

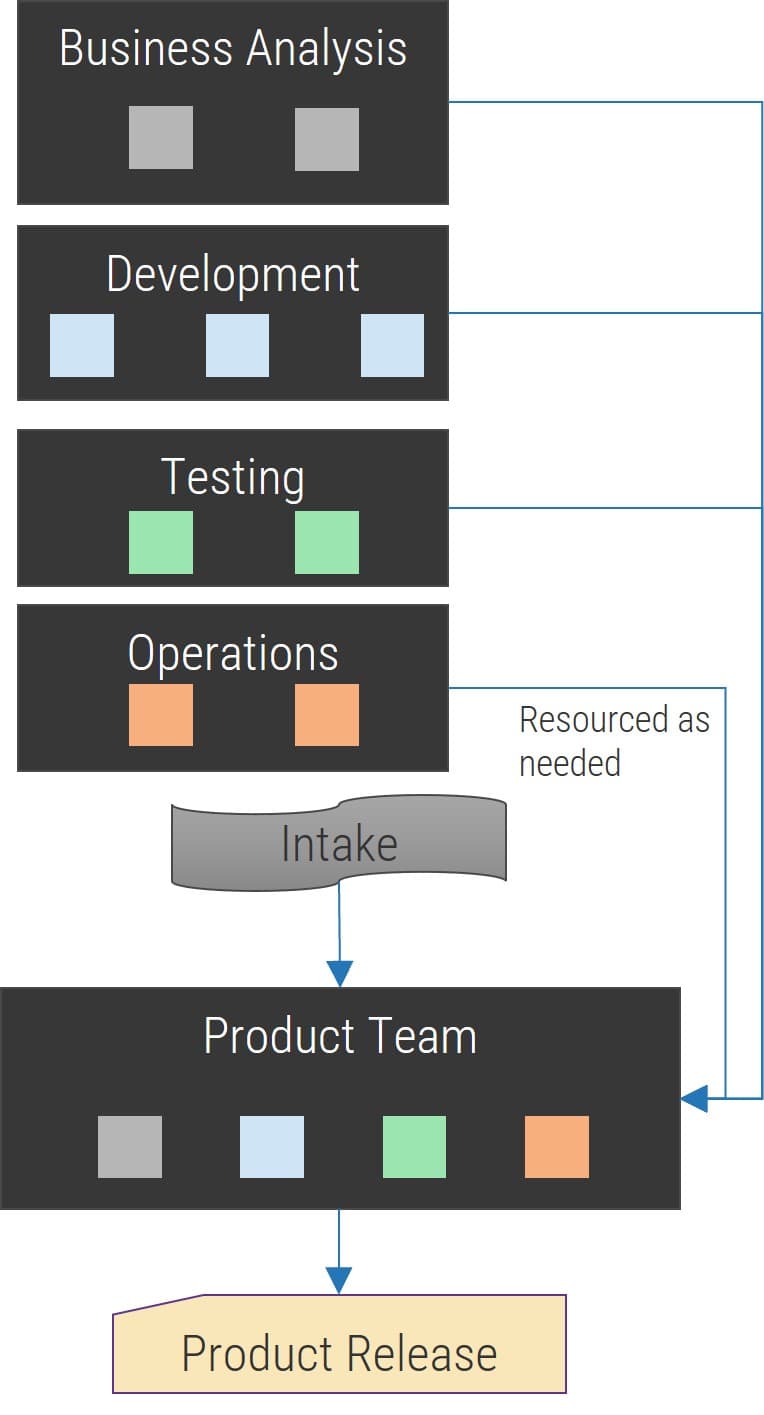

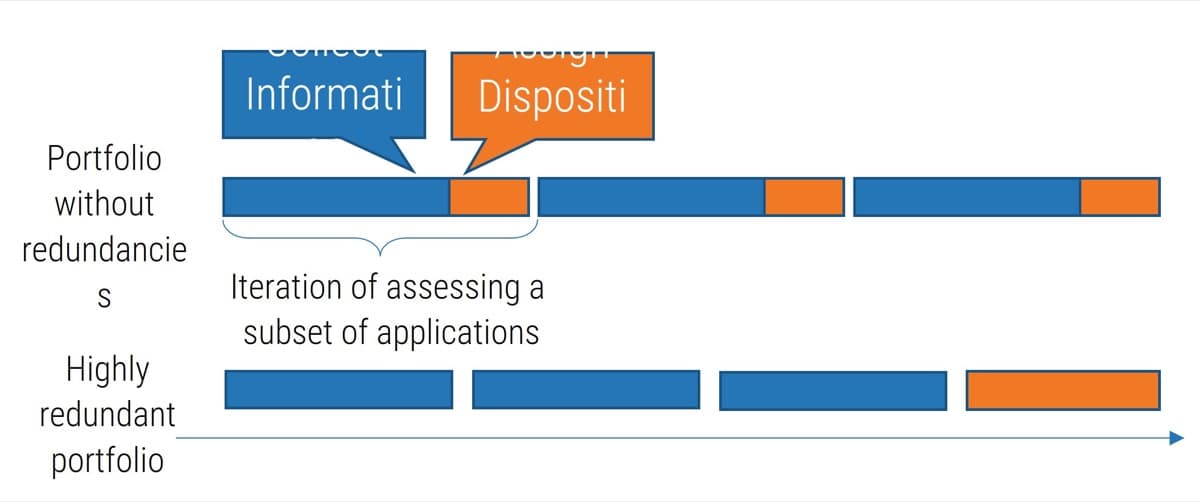

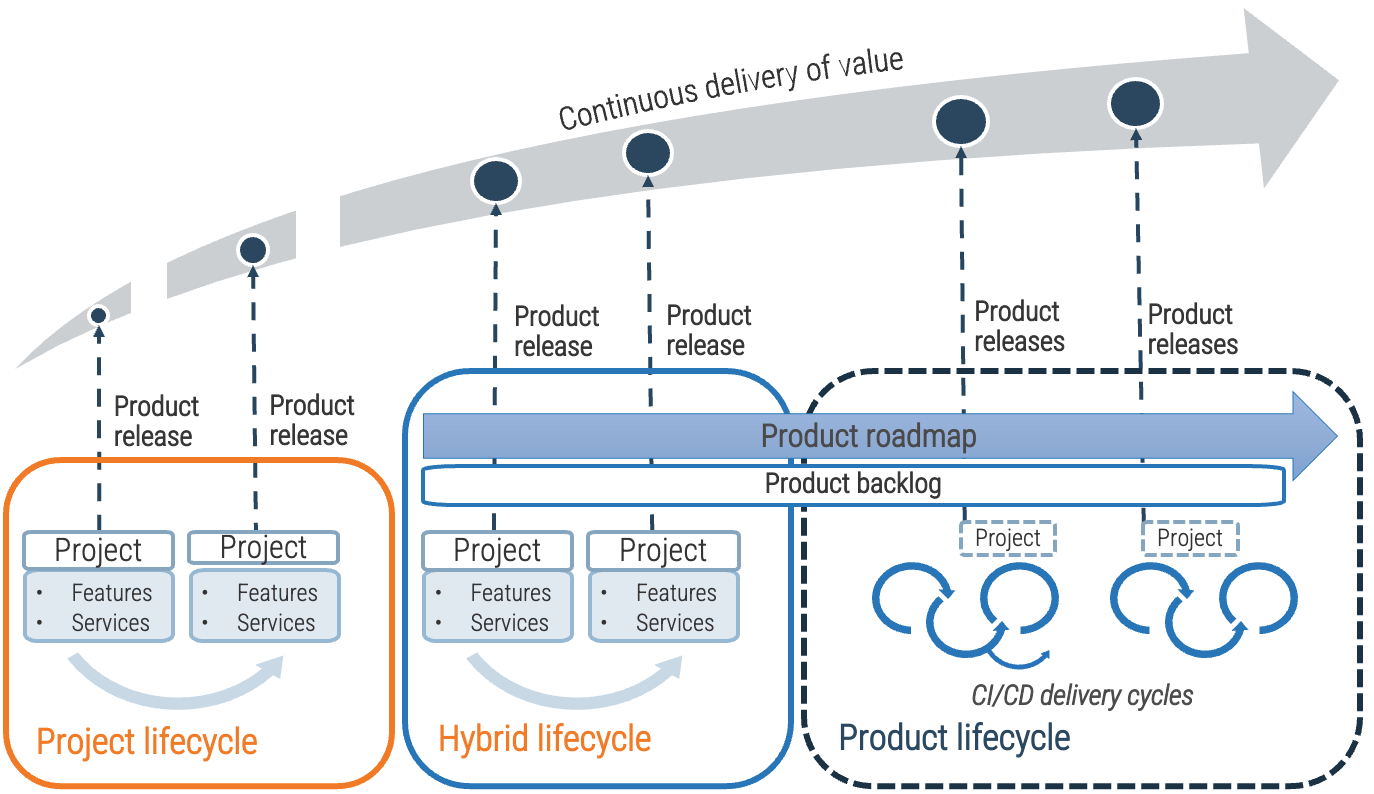

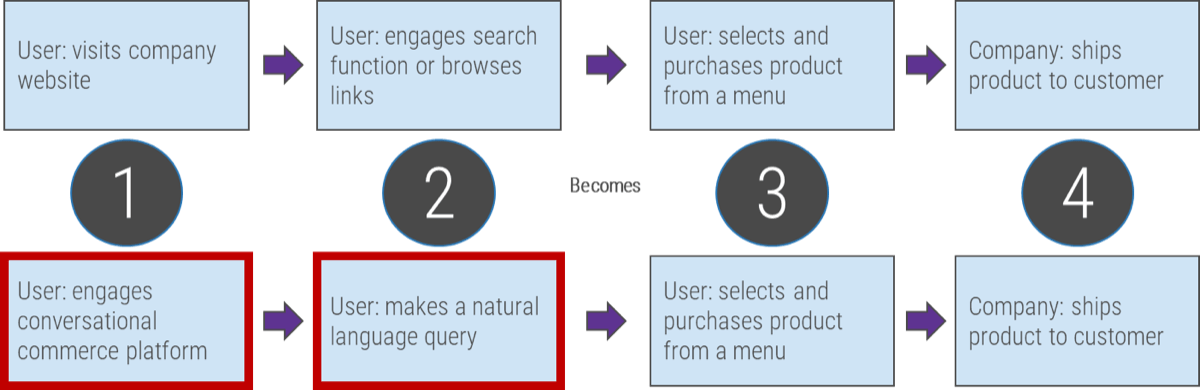

Projects can be a mechanism for funding product changes and improvements

Projects within products

Regardless of whether you recognize yourself as a product-based or project-based shop, the same basic principles should apply.

You go through a period or periods of project-like development to build a version of an application or product.

You also have parallel services along with your project development, which encompass the more product-based view. These may range from basic support and maintenance to full-fledged strategy teams or services like sales and marketing.

Product and services owners share the same foundation and capabilities

For the purpose of this blueprint, product/service and product owner/service owner are used interchangeably. The term

“product” is used for consistency but would apply to services, as well.

Product = Service

Common foundations: Focus on continuous improvement, ROI, and value realization. Clear vision, goals, roadmap, and backlog.

“Product” and “service” are terms that each organization needs to define to fit its culture and customers (internal and

external). The most important aspect is consistent use and understanding of:

-

External products

-

Internal products

-

External services

-

Internal services

-

Products as a service (PaaS)

-

Productizing services (SaaS)

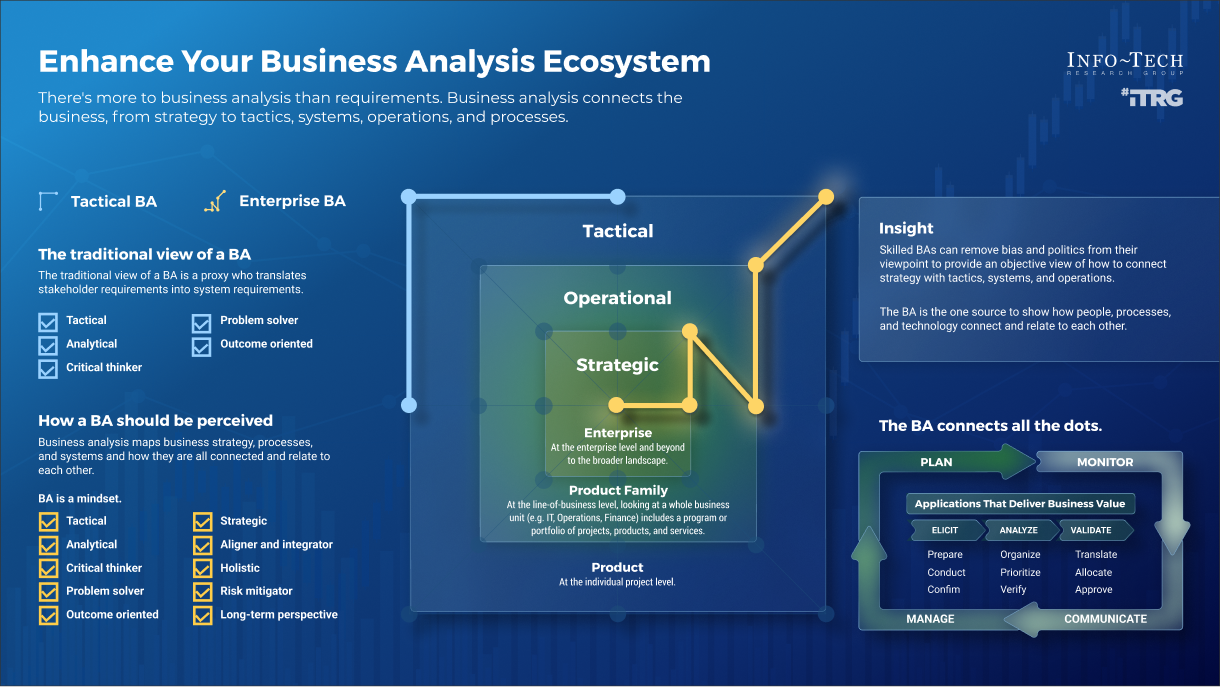

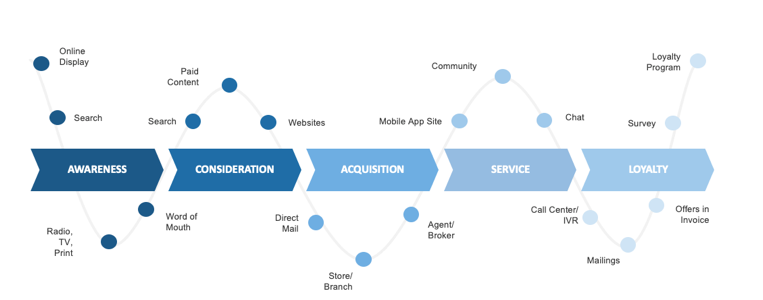

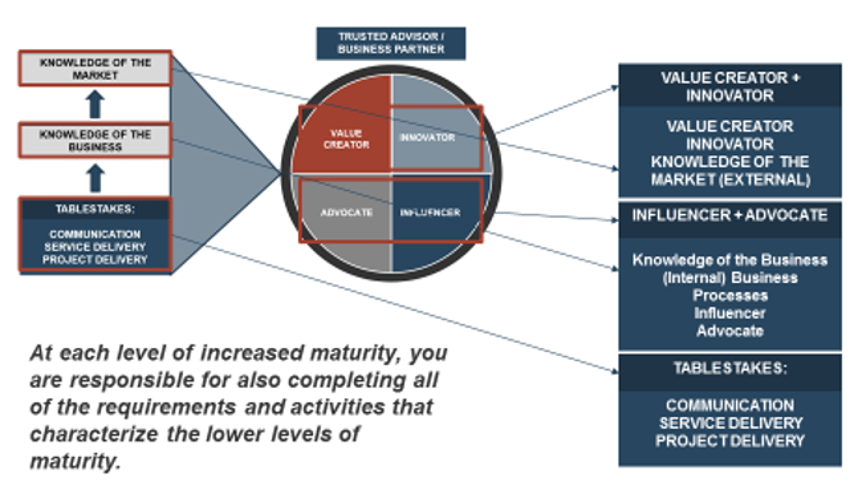

Recognize the product owner perspectives

Product owners represent one of three primary perspectives. Although all share the same capabilities, how they approach their responsibilities is influenced by their primary perspective.

Info-Tech Insight

Product owners must translate needs and constraints from their perspective into the language of their audience. Kathy Borneman, Digital Product Owner at SunTrust Bank, noted the challenges of finding a common language between lines of business and IT (e.g. what is a unit?).

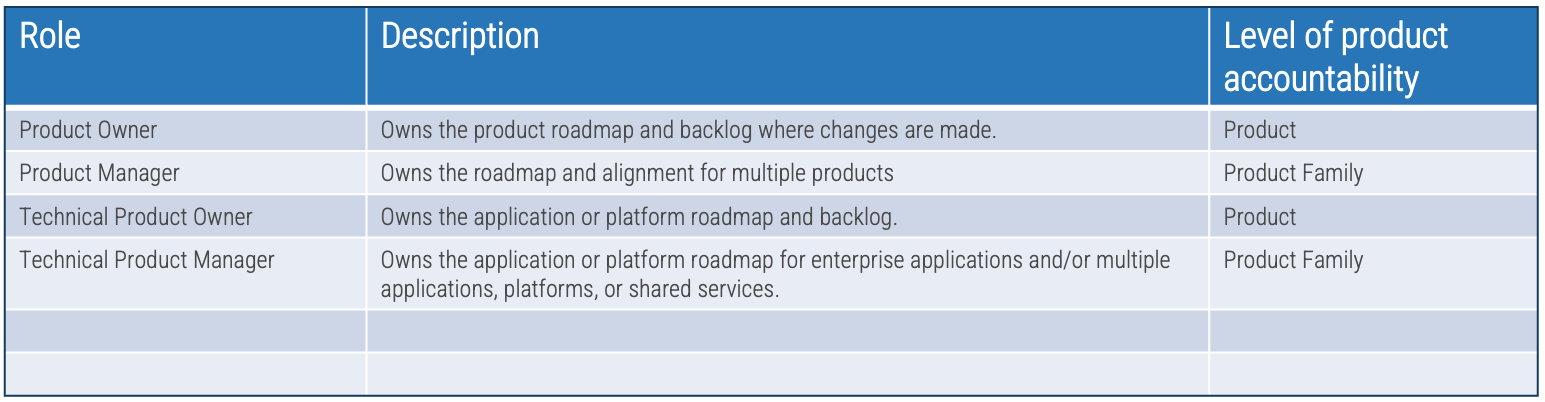

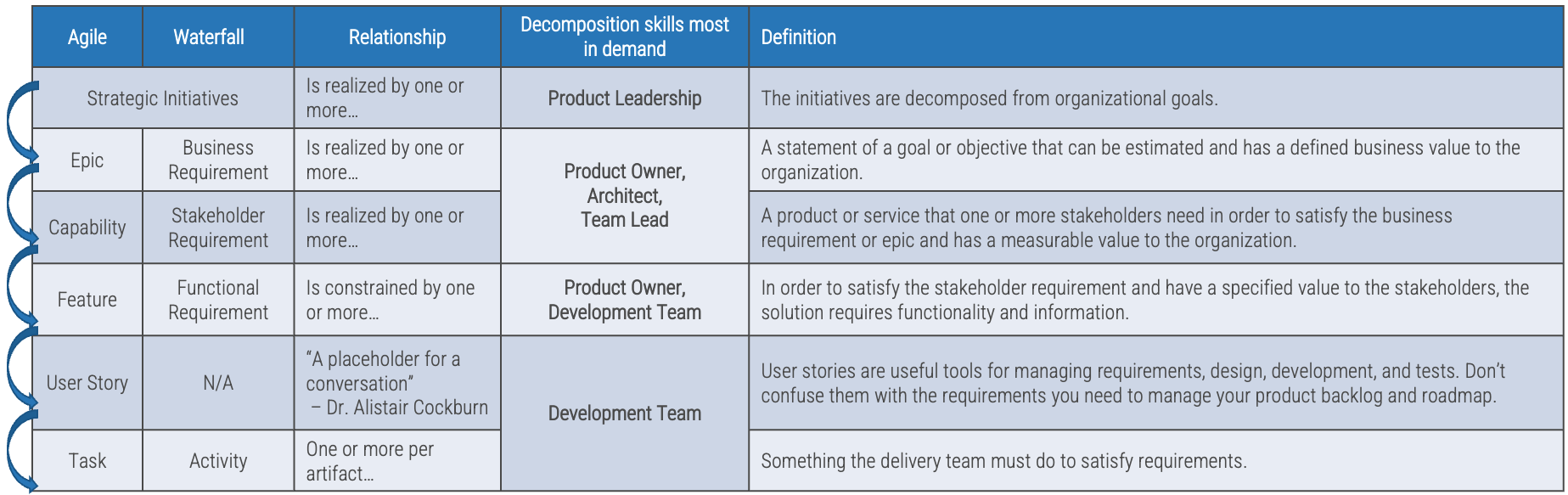

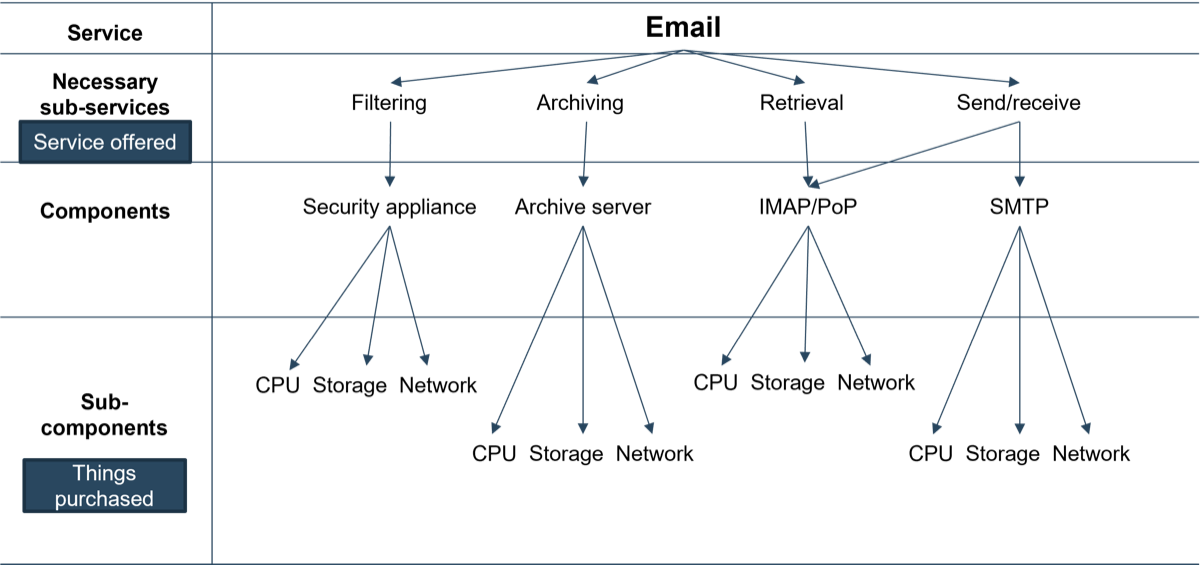

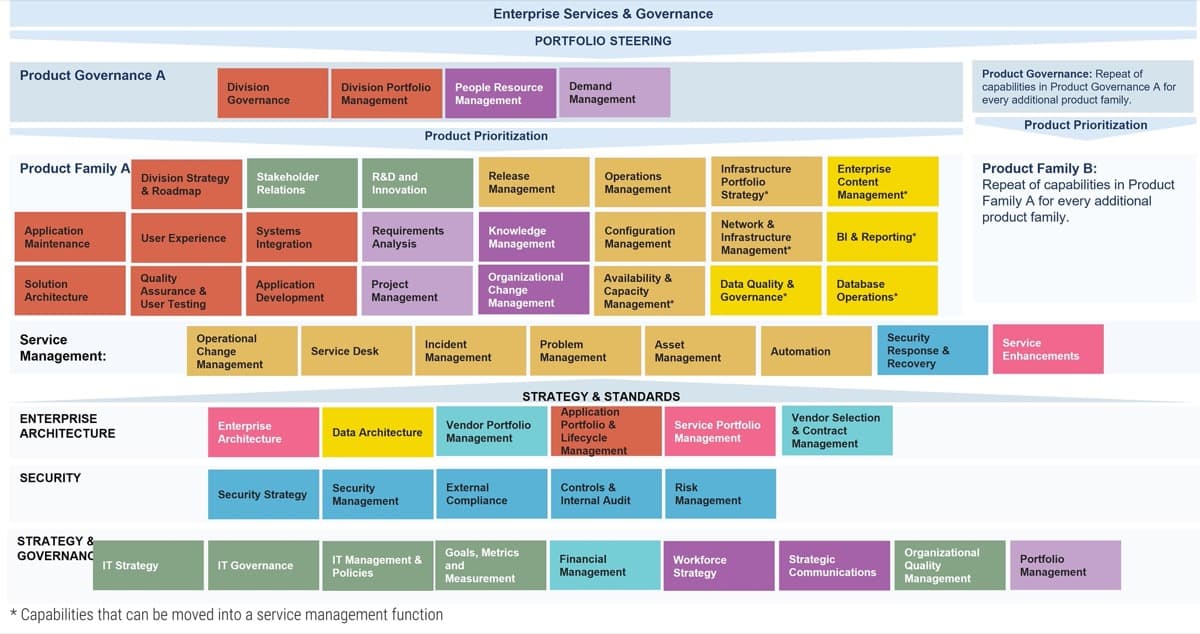

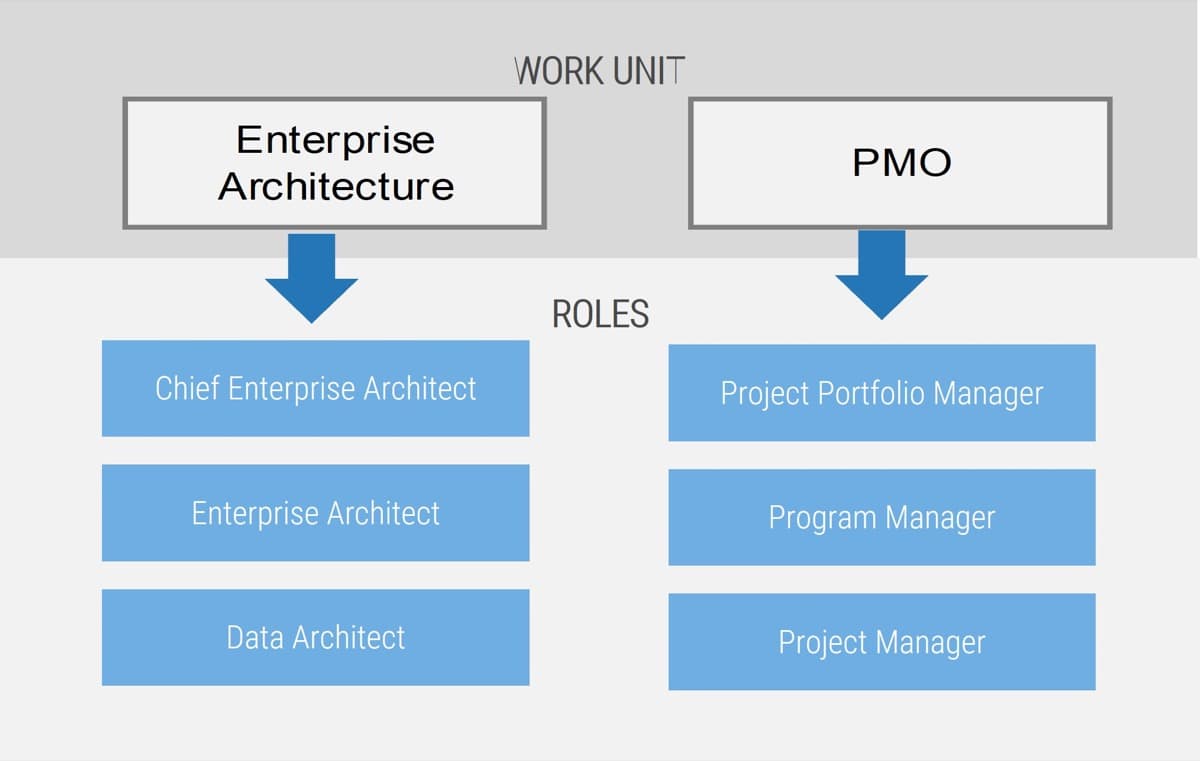

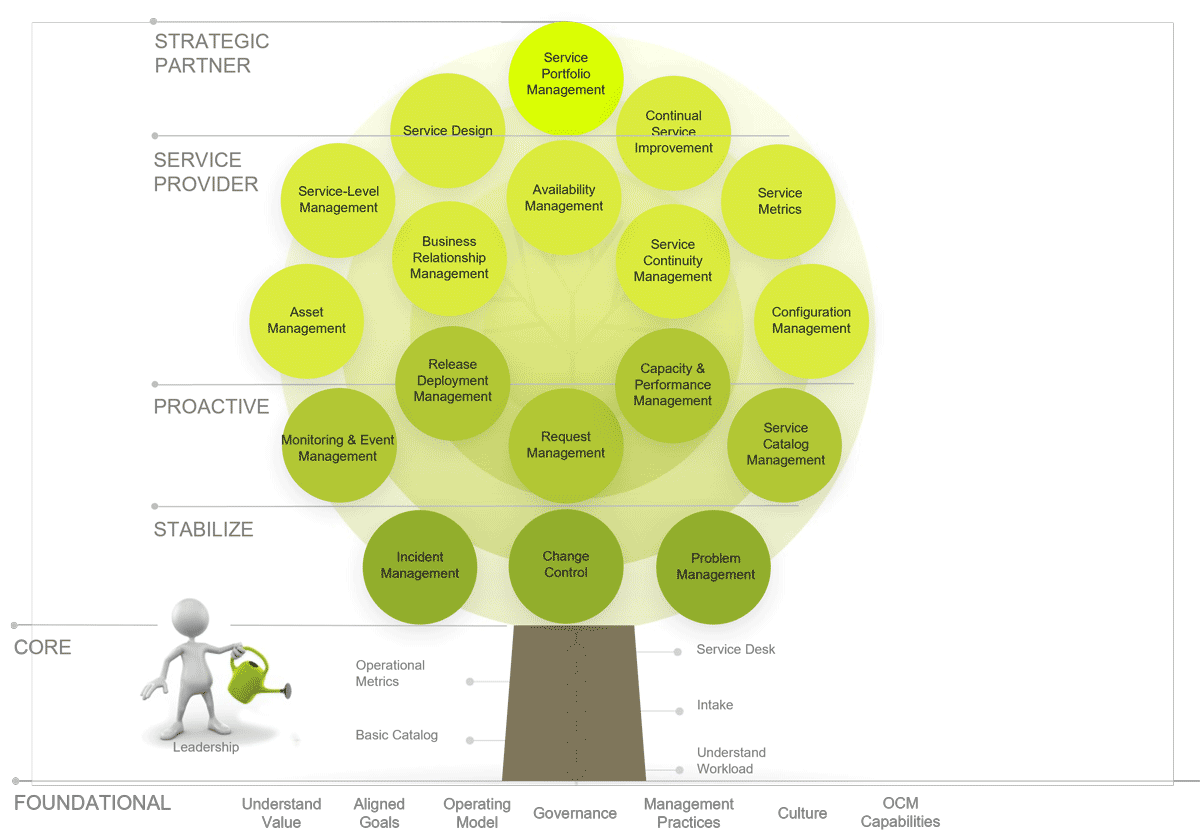

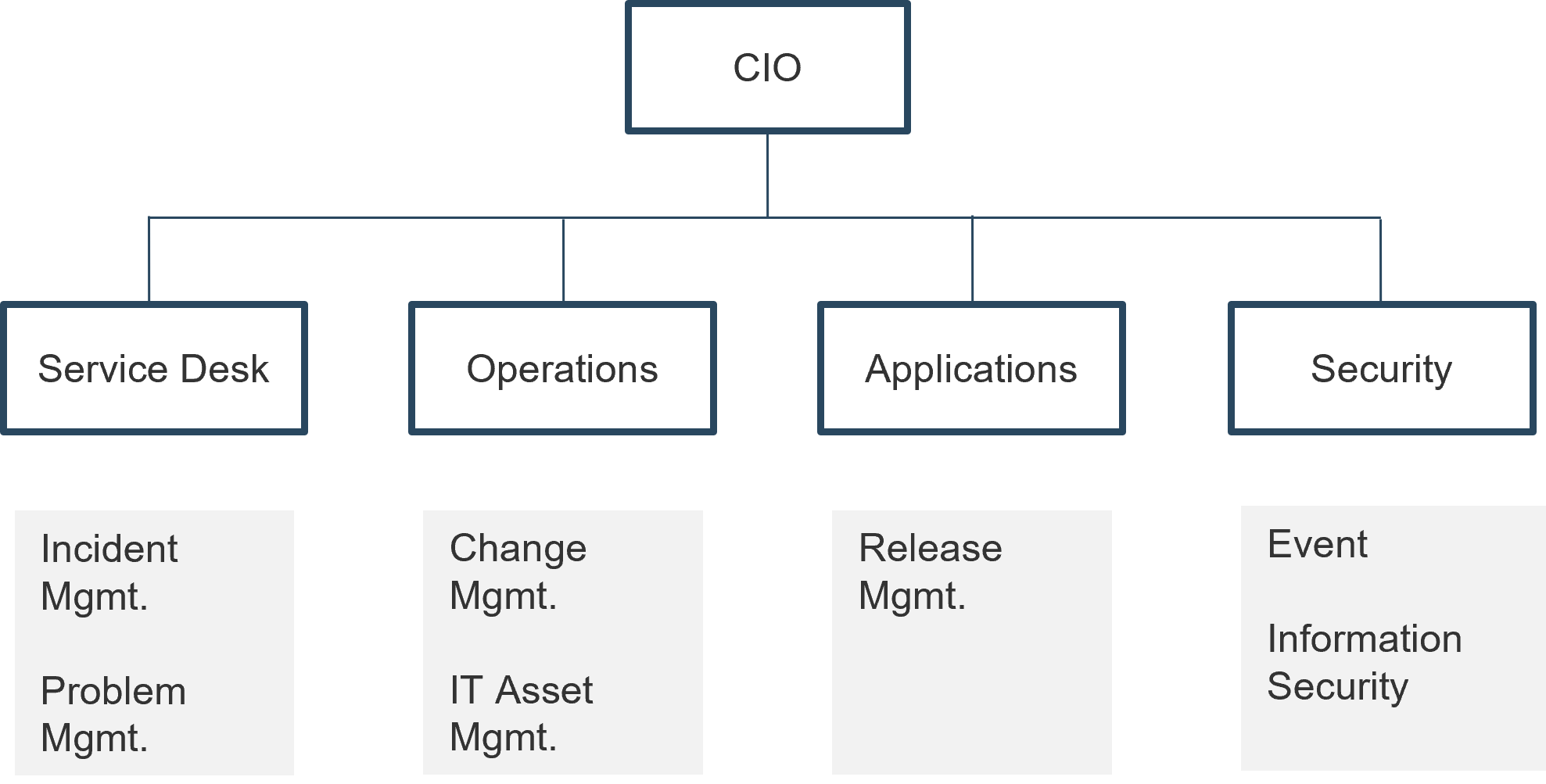

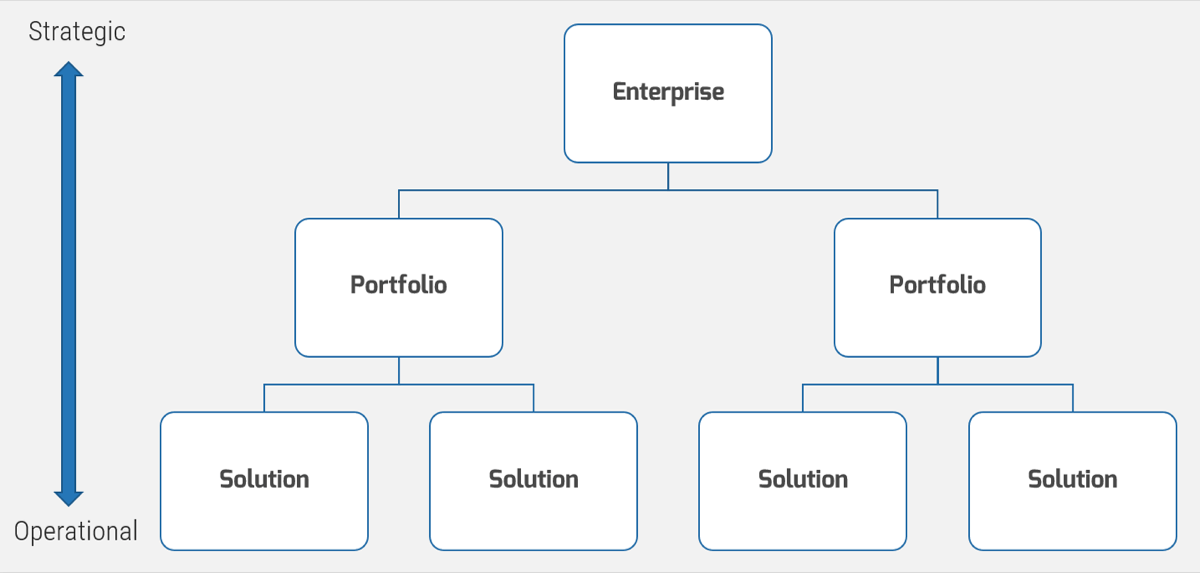

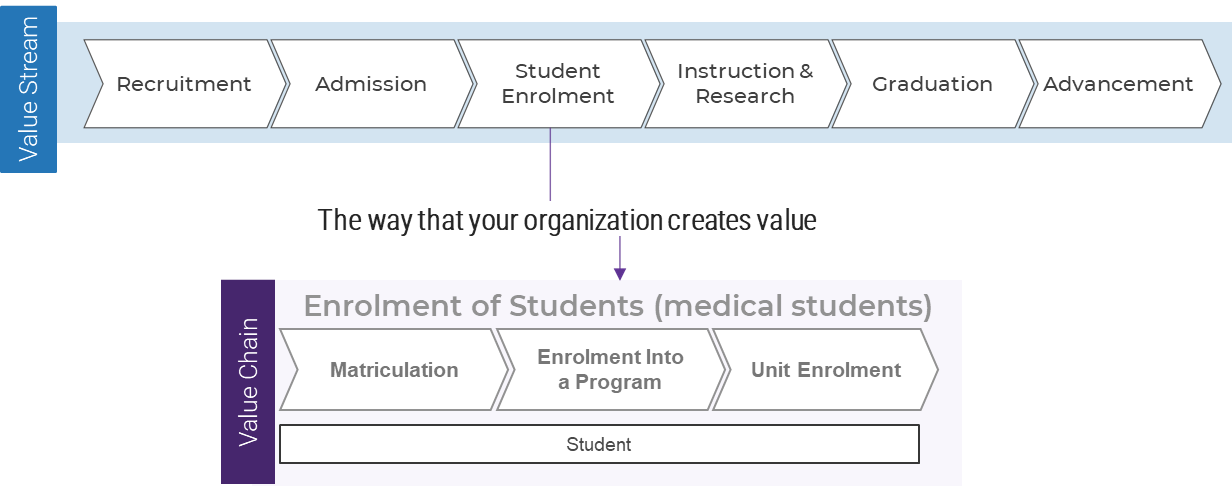

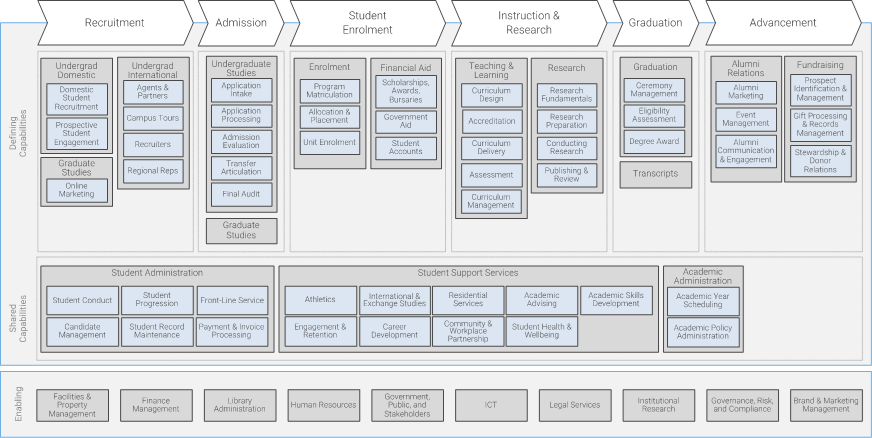

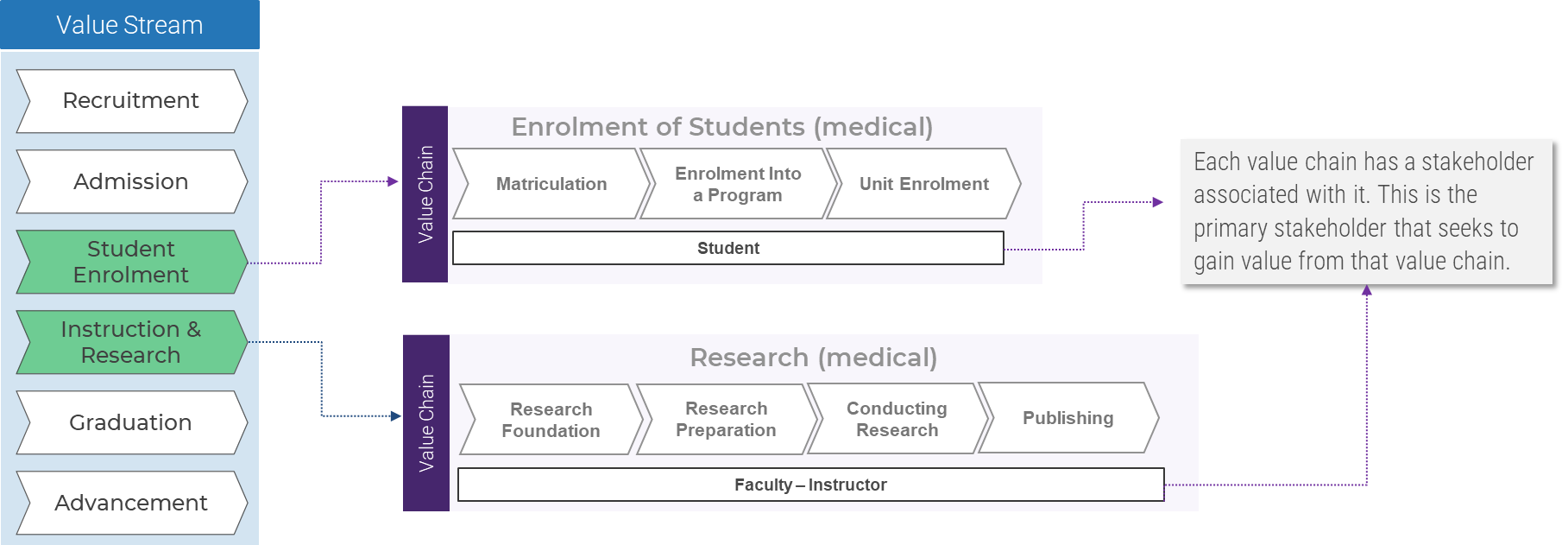

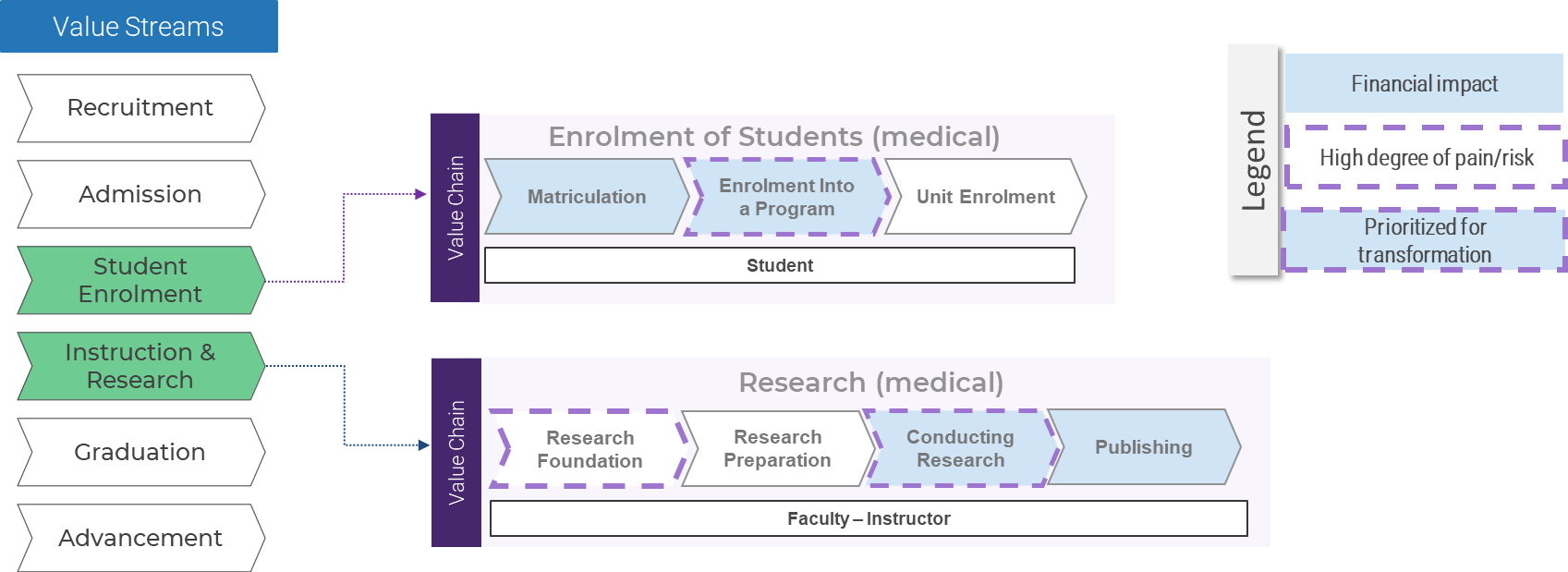

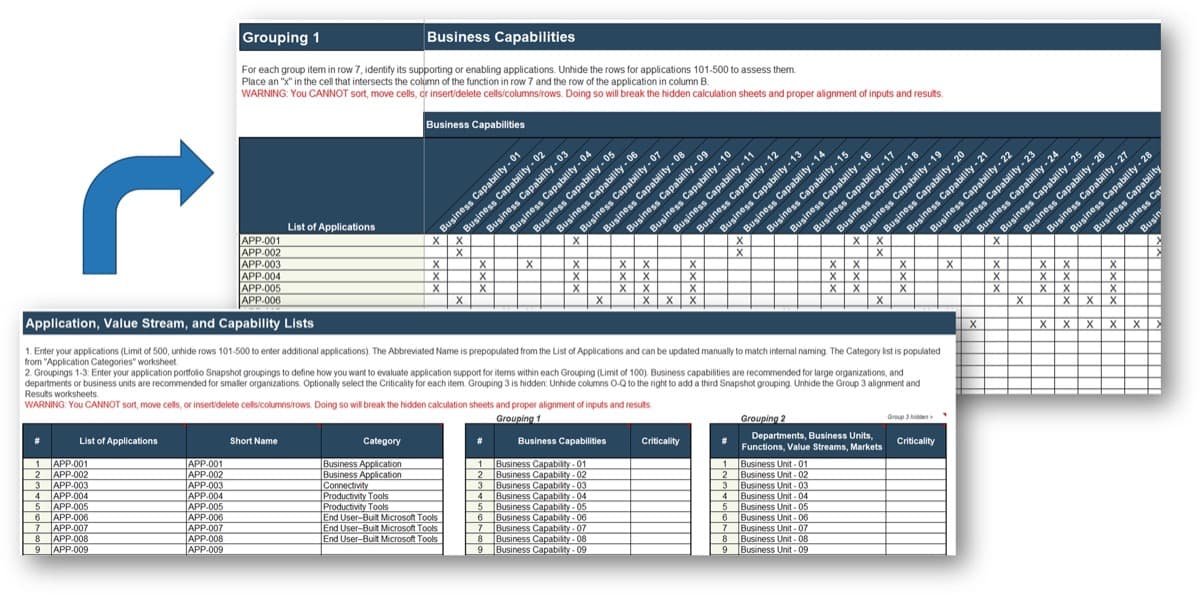

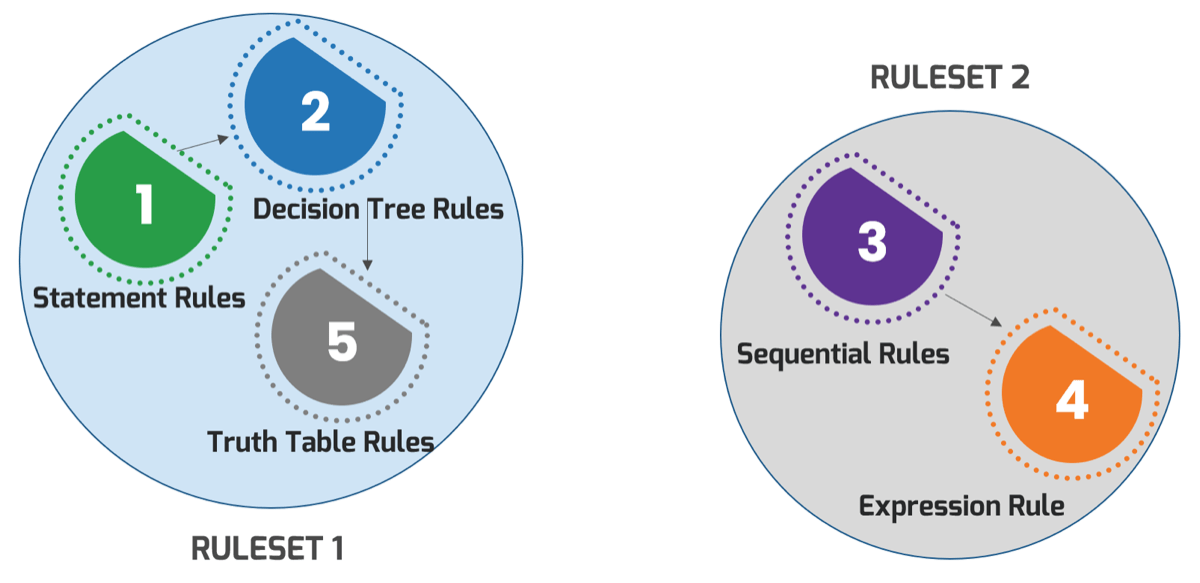

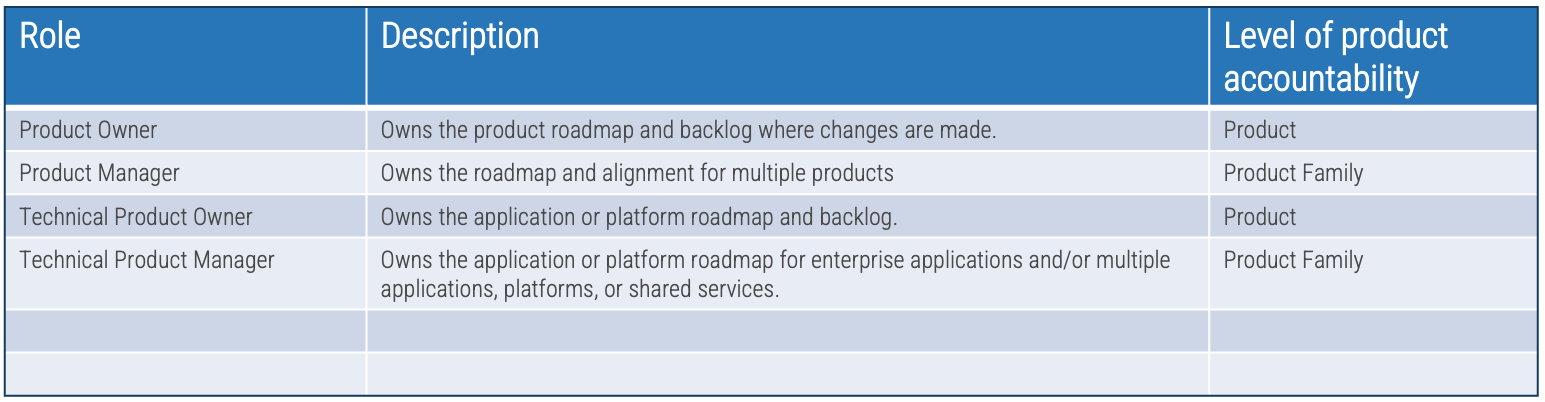

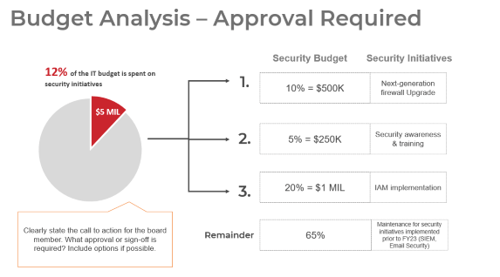

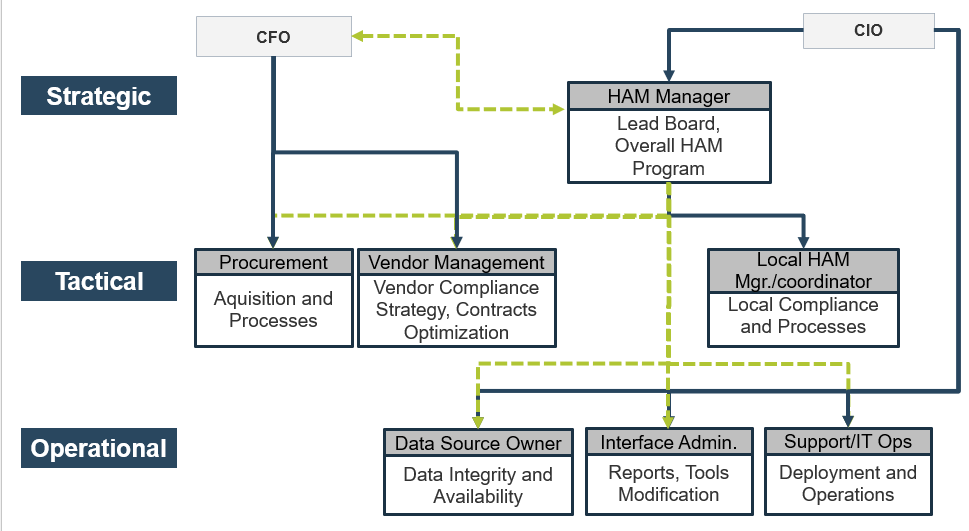

Match your product management role definitions to your product family levels

Product ownership exists at the different operational tiers or levels in your product hierarchy. This does not imply a management relationship.

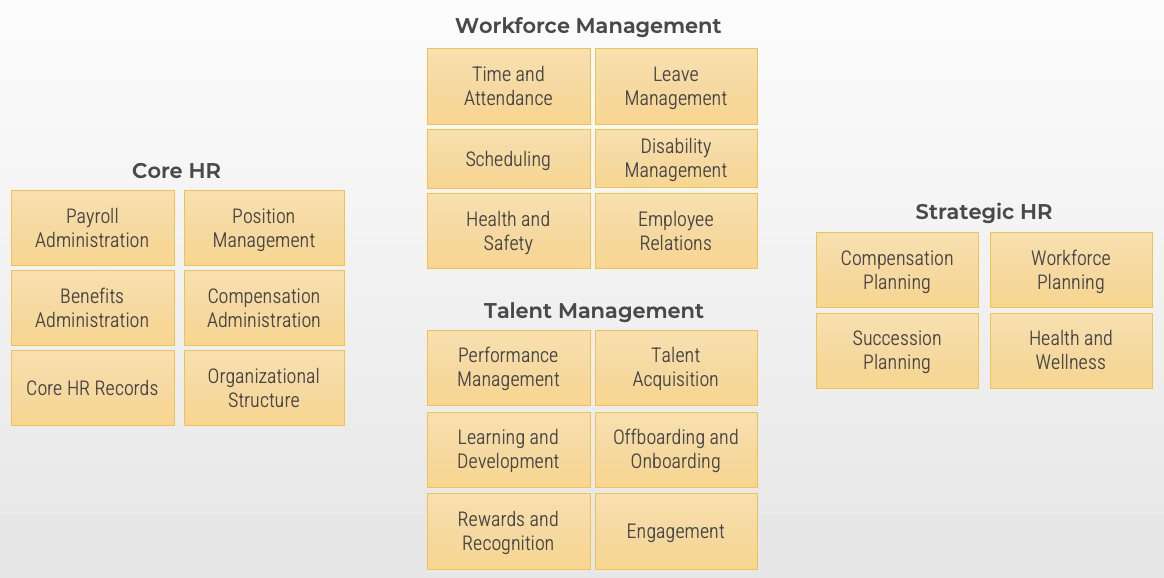

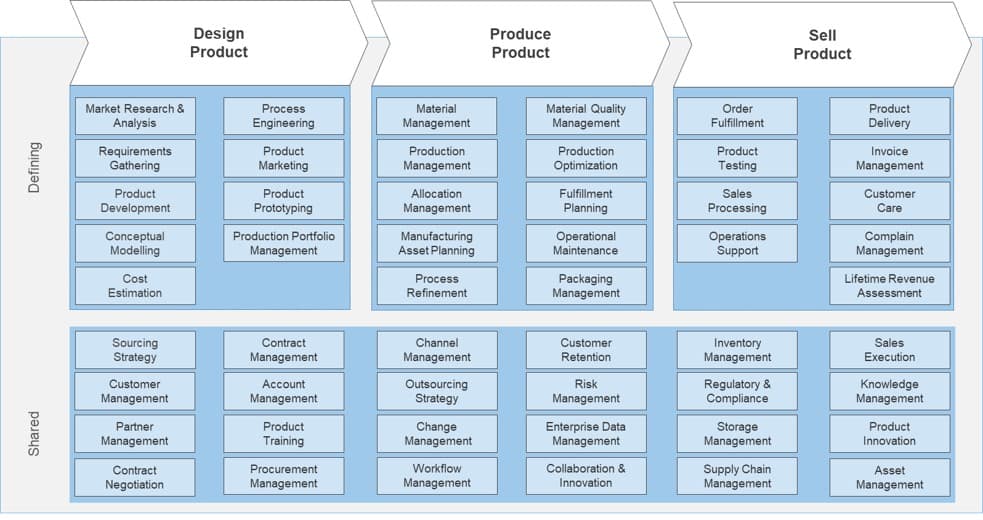

Product portfolio

Groups of product families within an overall value stream or capability grouping.

Project portfolio manager

Product family

A collection of related products. Products can be grouped along architectural, functional, operational, or experiential

patterns.

Product family manager

Product

Single product composed of one or more applications and services.

Product owner

Info-Tech Insight

Define the current roles that will perform the product management function or define consistent role names to product

owners and managers.

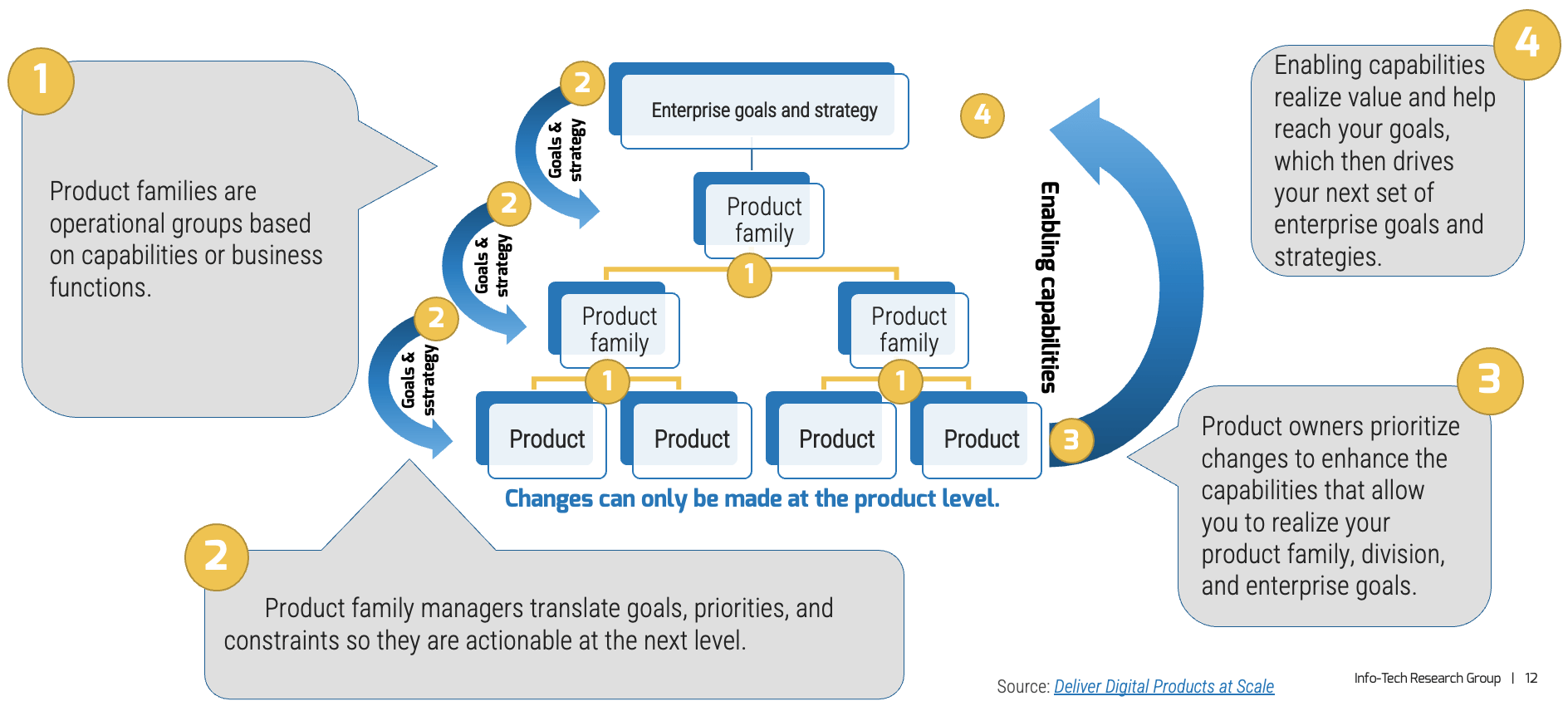

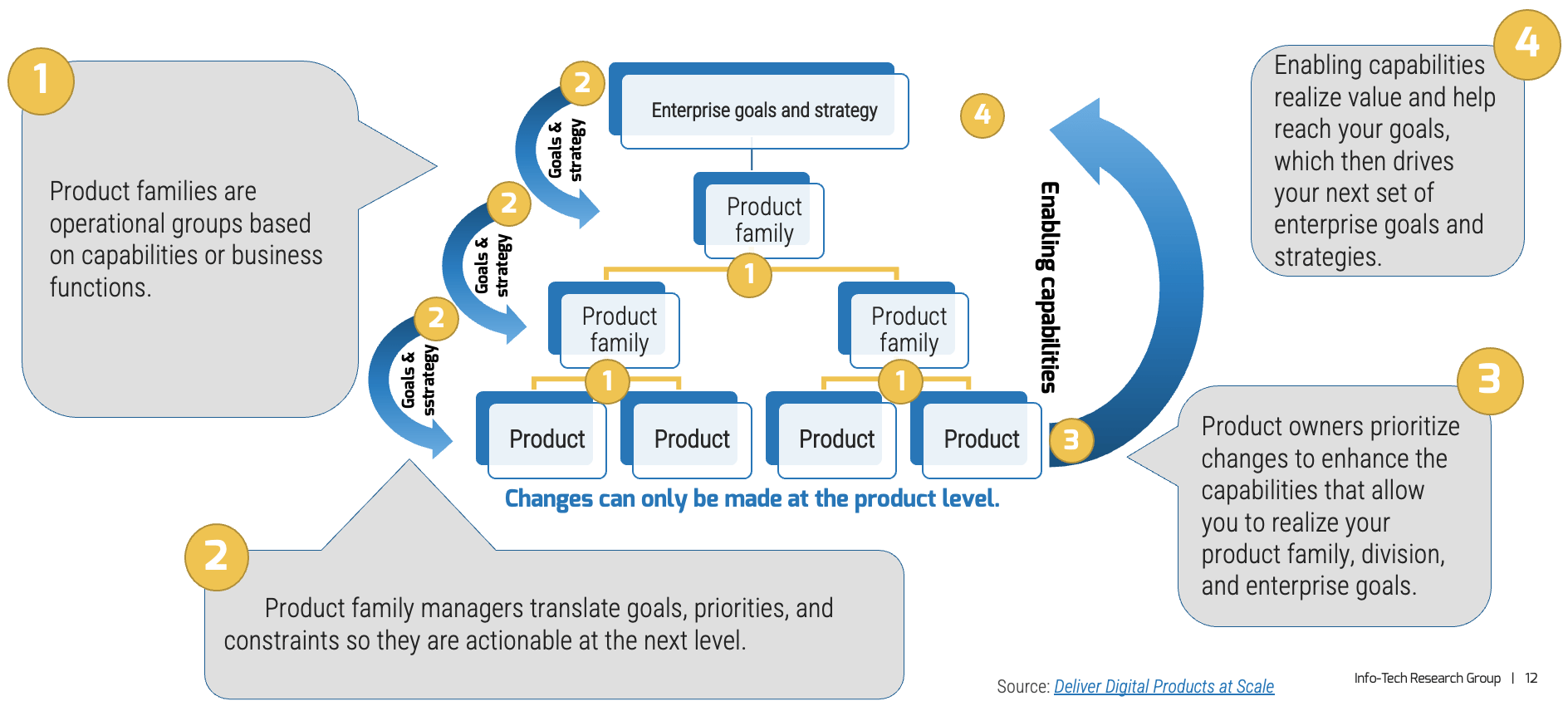

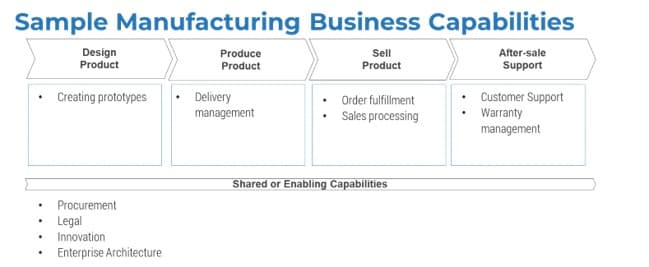

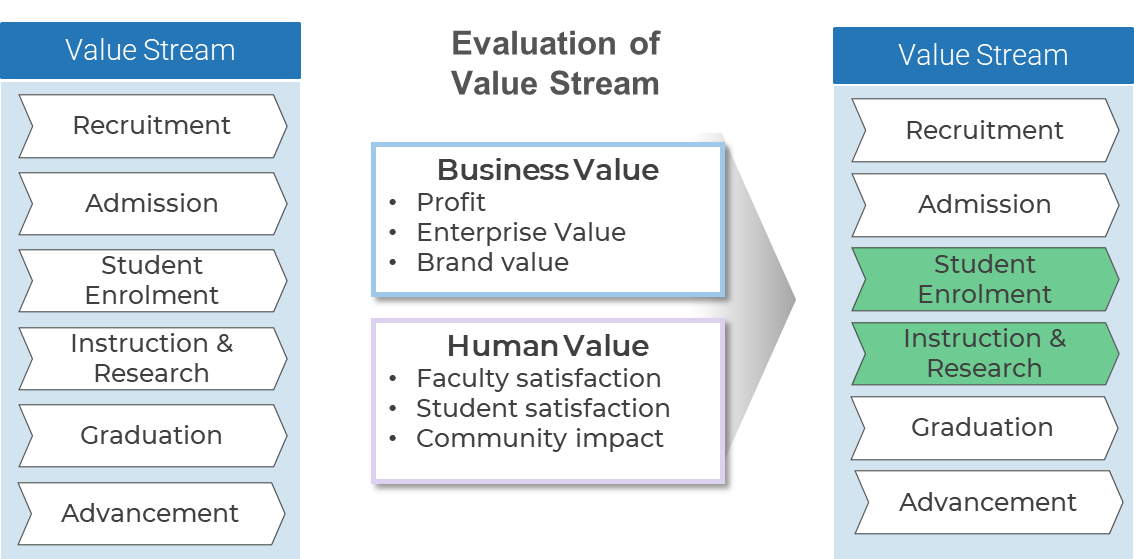

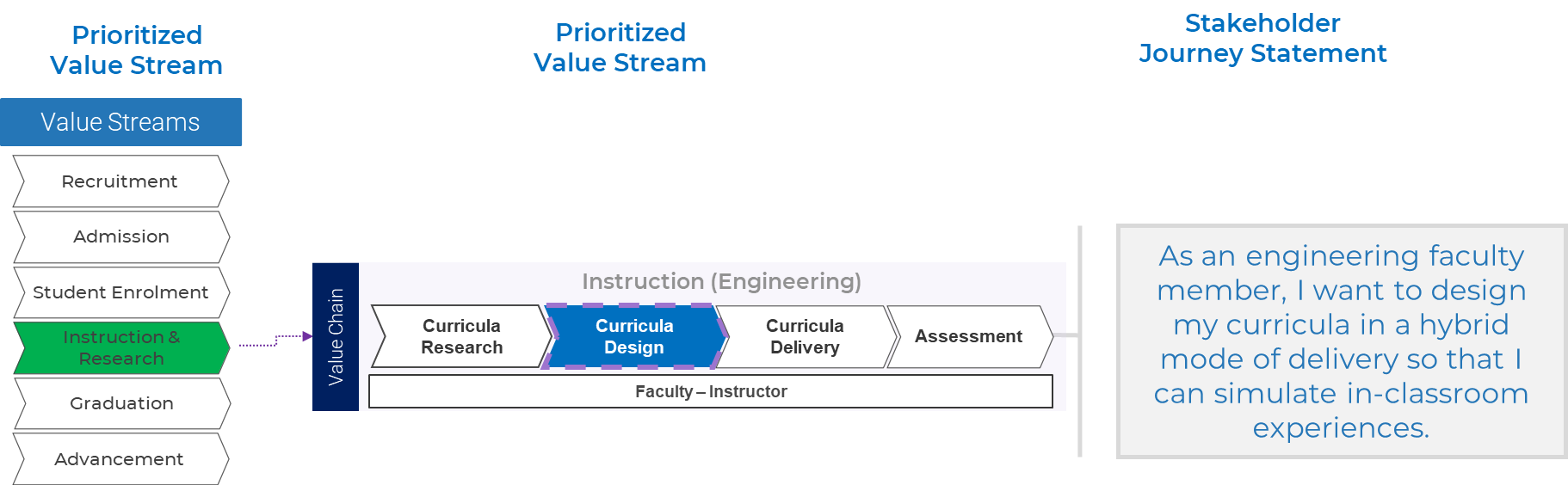

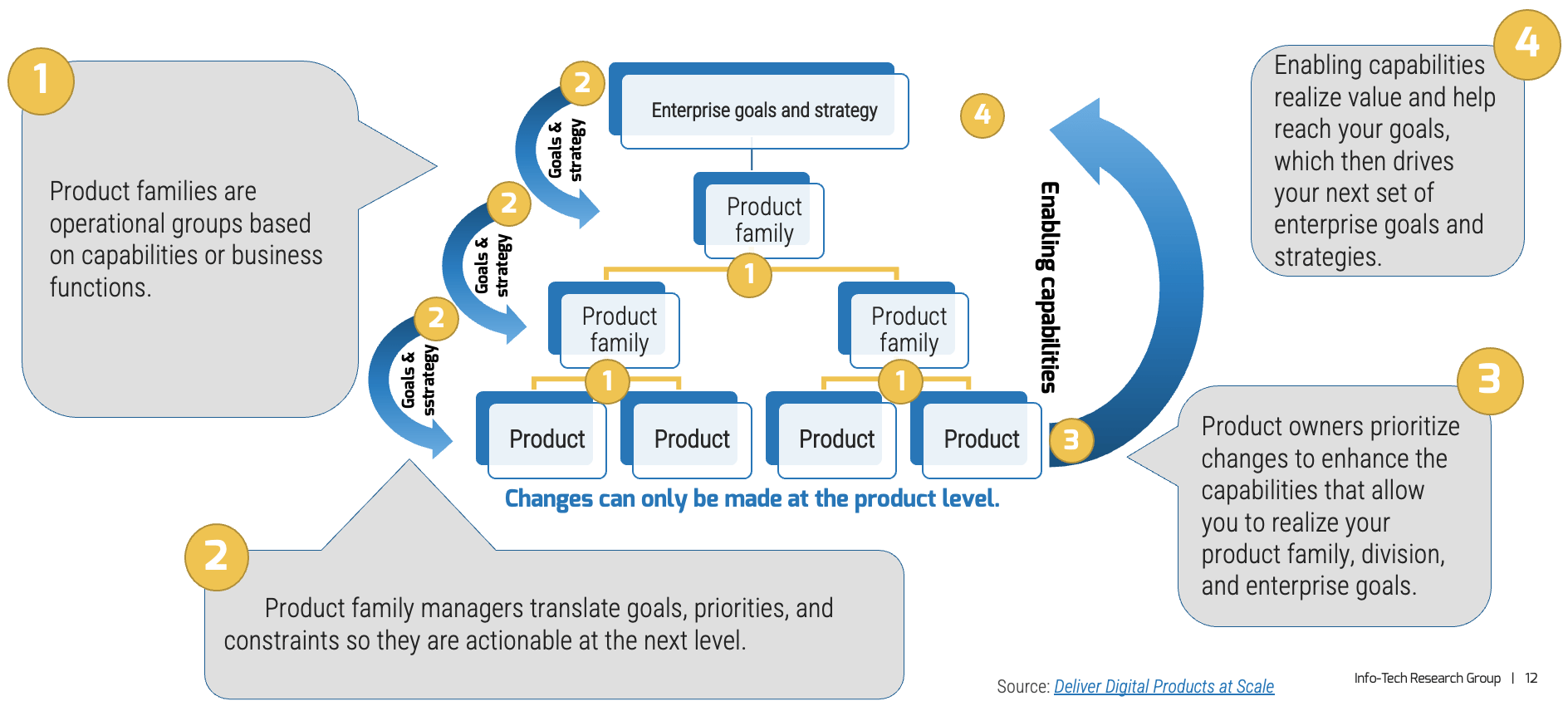

Align enterprise value through product families

Understand special circumstances

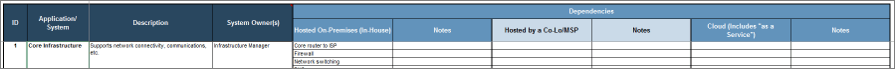

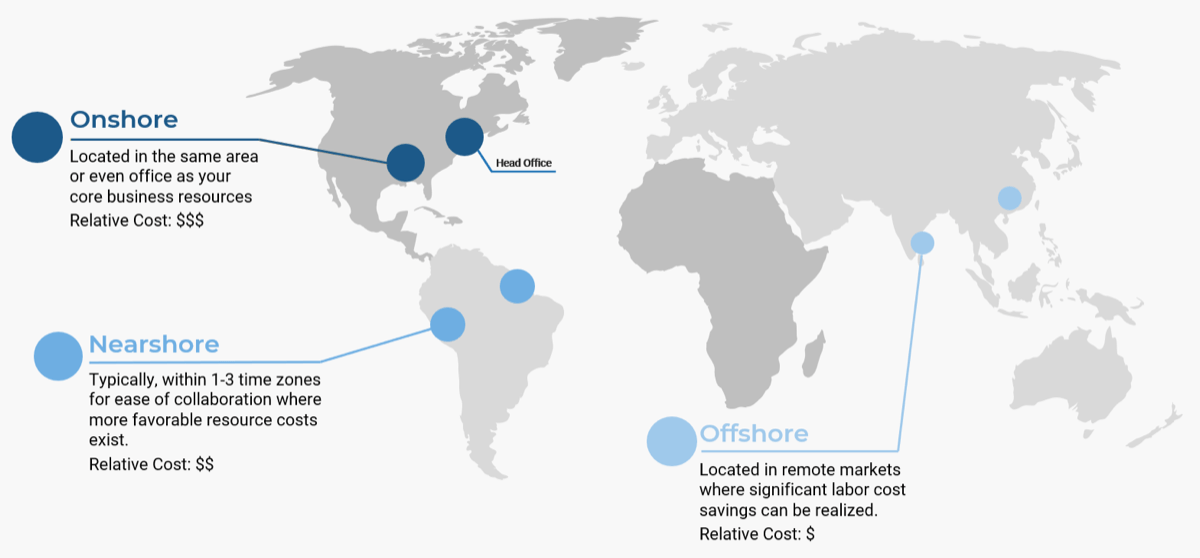

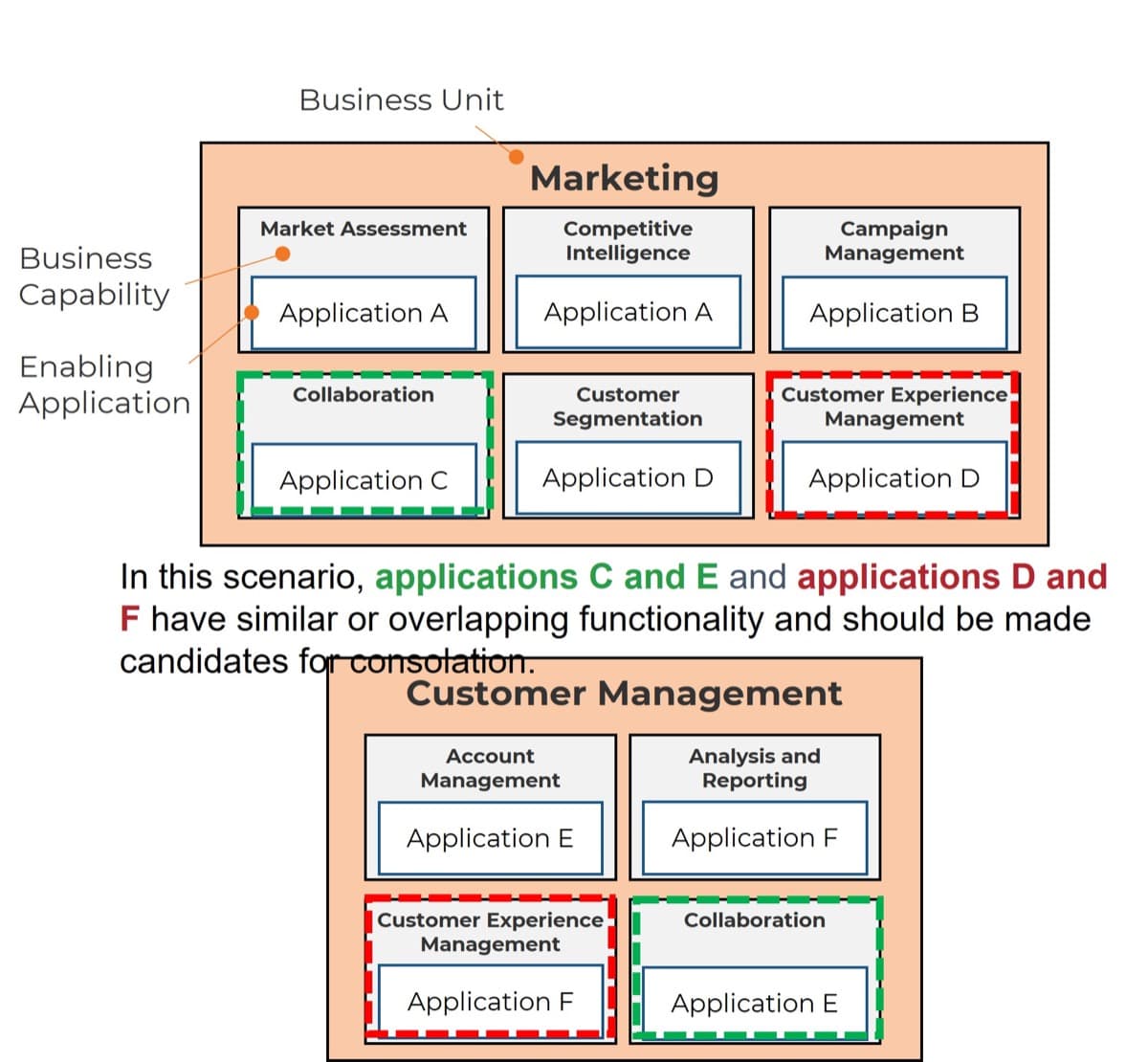

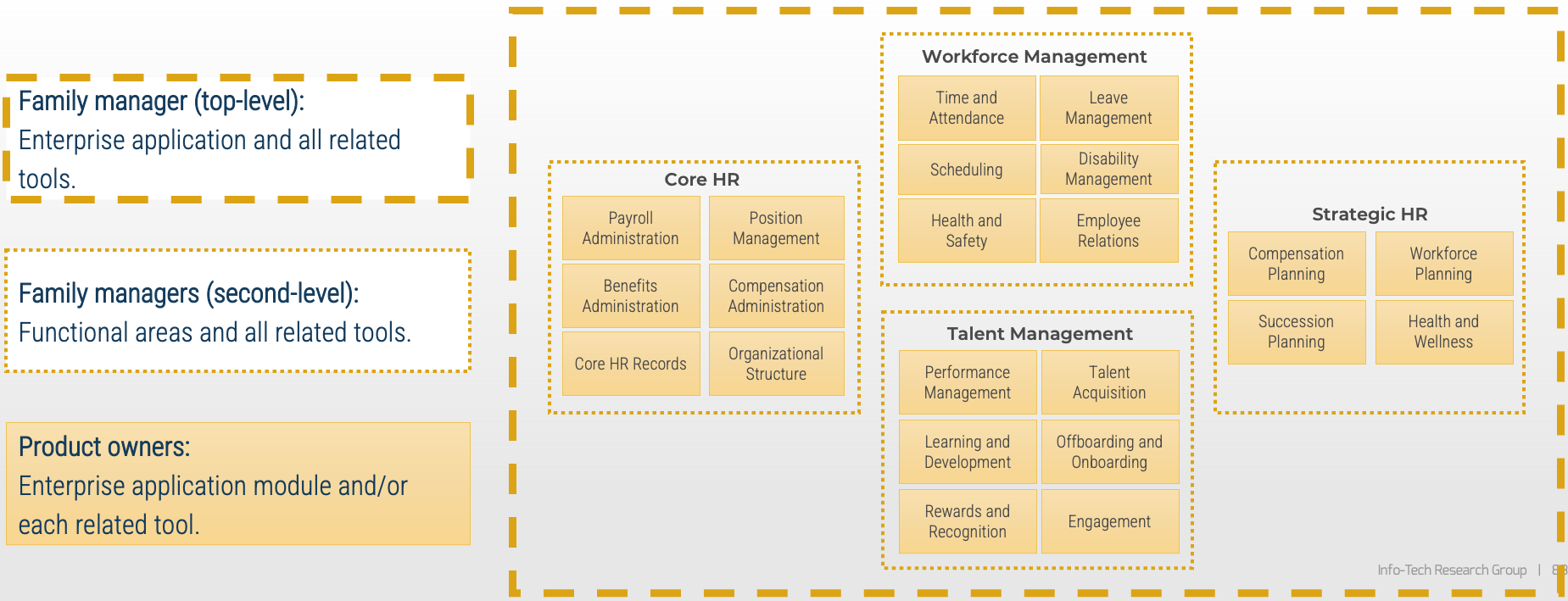

In Deliver Digital Products at Scale, products were grouped into families using Info-Tech’s five scaling patterns. Assigning owners to Enterprise Applications and Shared Services requires special consideration.

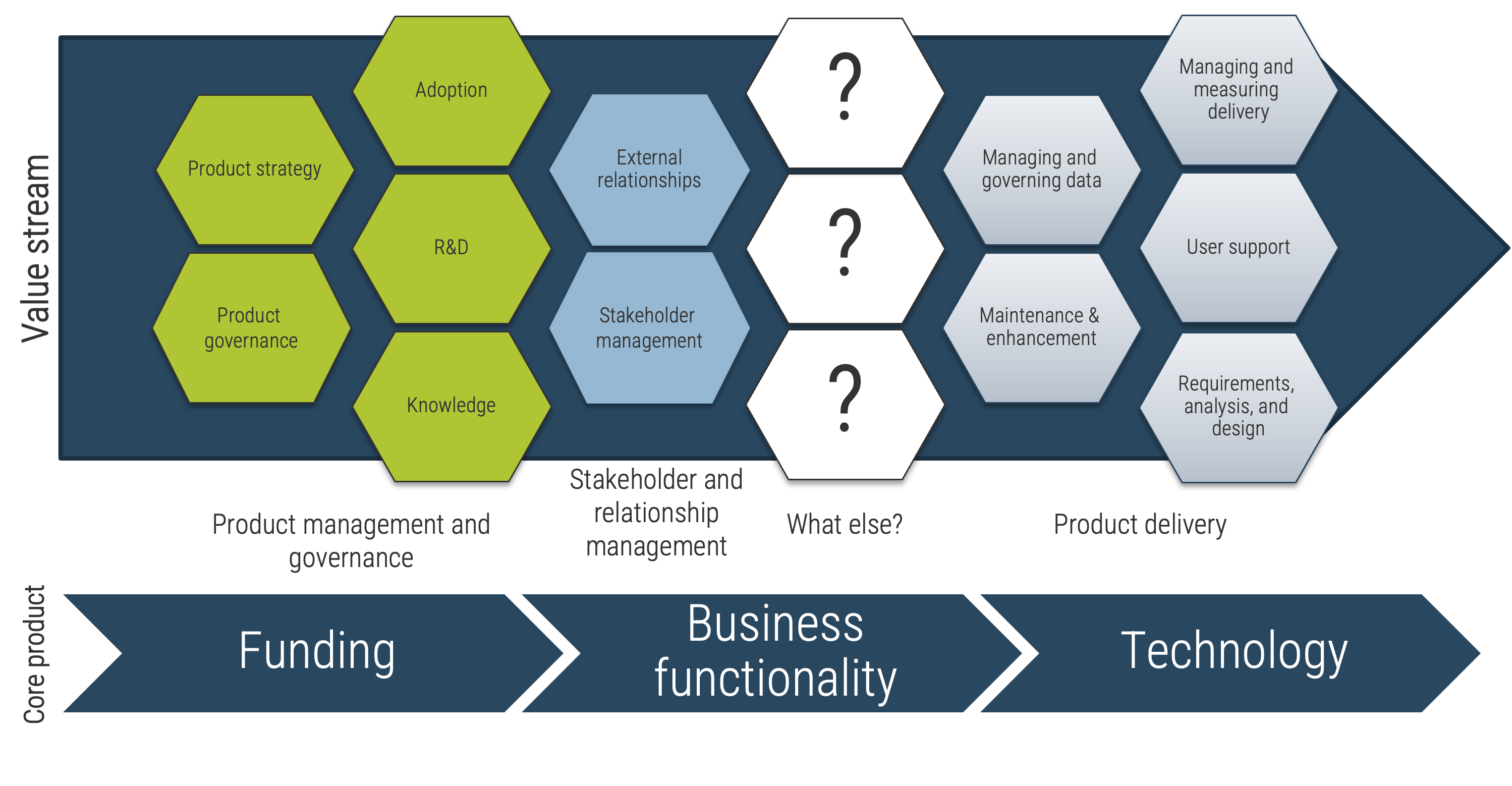

Value stream alignment

-

Business architecture

-

Value stream

-

Capability

-

Function

-

Market/customer segment

-

Line of business (LoB)

-

Example: Customer group > value stream > products

Enterprise applications

-

Enabling capabilities

-

Enterprise platforms

-

Supporting apps

-

Example: HR > Workday/Peoplesoft > Modules

Supporting: Job board, healthcare administrator

Shared Services

-

Organization of related services into service family

-

Direct hierarchy does not necessarily exist within the family

-

Examples: End-user support and ticketing,

workflow and collaboration tools

Technical

-

Domain grouping of IT infrastructure, platforms, apps, skills, or languages

-

Often used in combination with Shared Services grouping or LoB-specific apps

-

Examples: Java, .NET, low-code, database, network

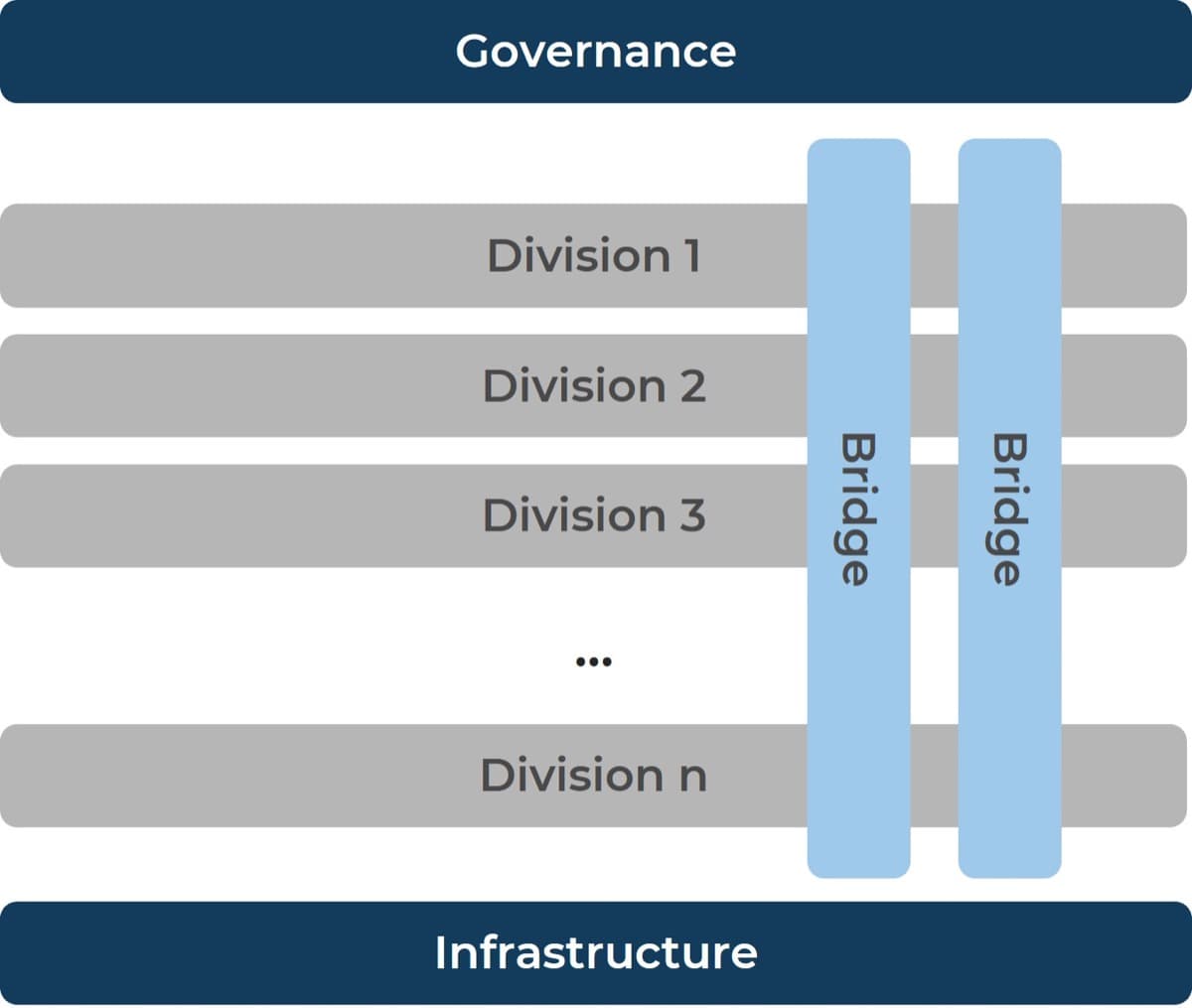

Organizational alignment

-

Used at higher levels of the organization where products are aligned under divisions

-

Separation of product managers from organizational structure is no longer needed because the management team owns the

product management role

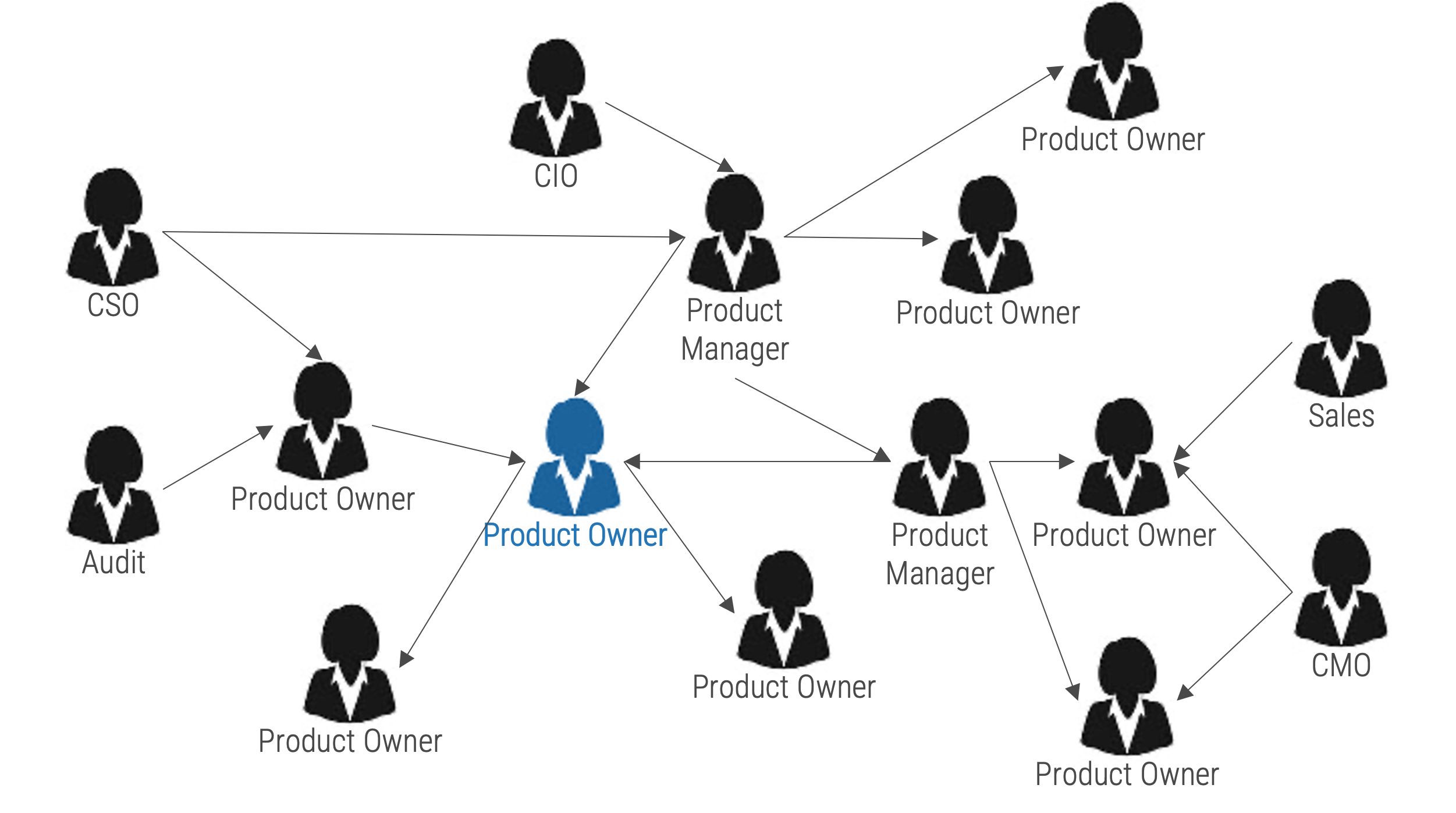

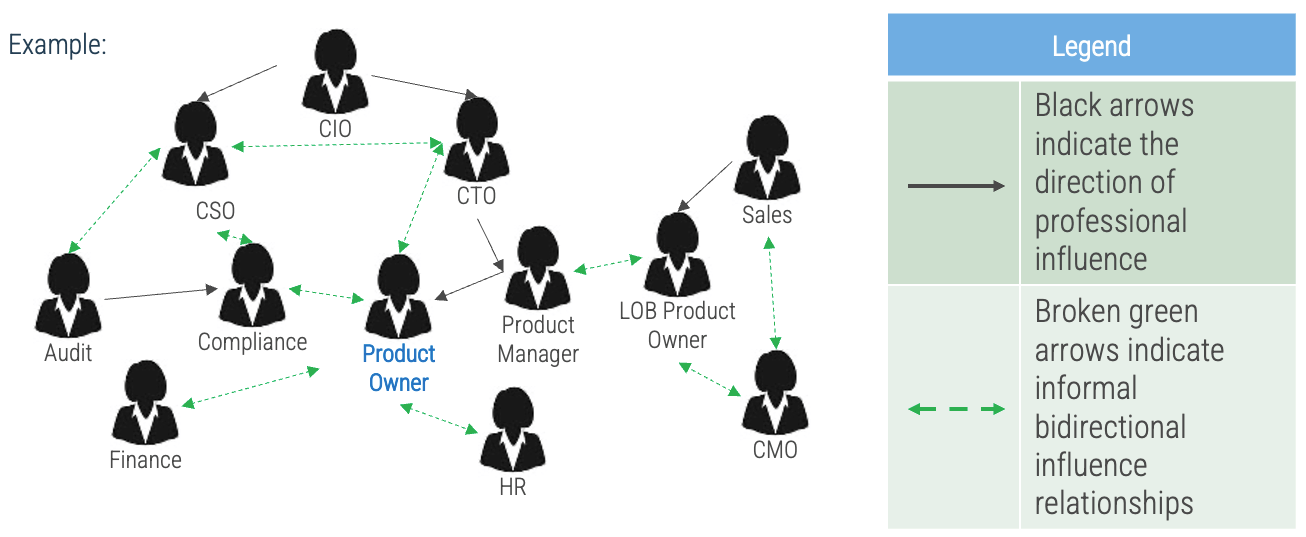

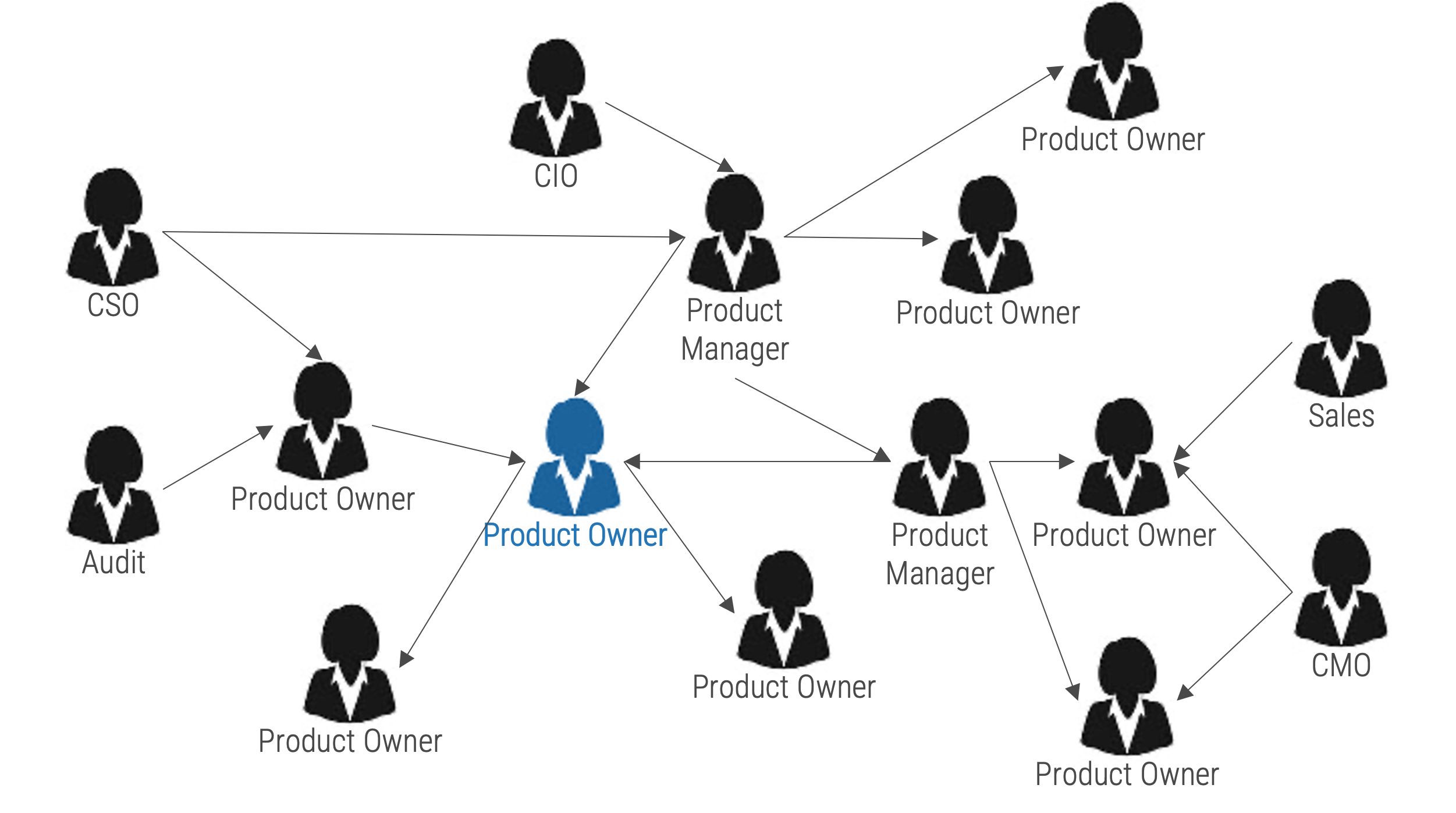

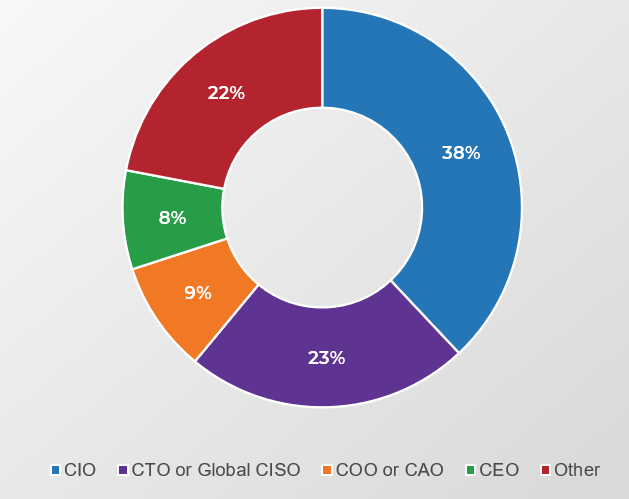

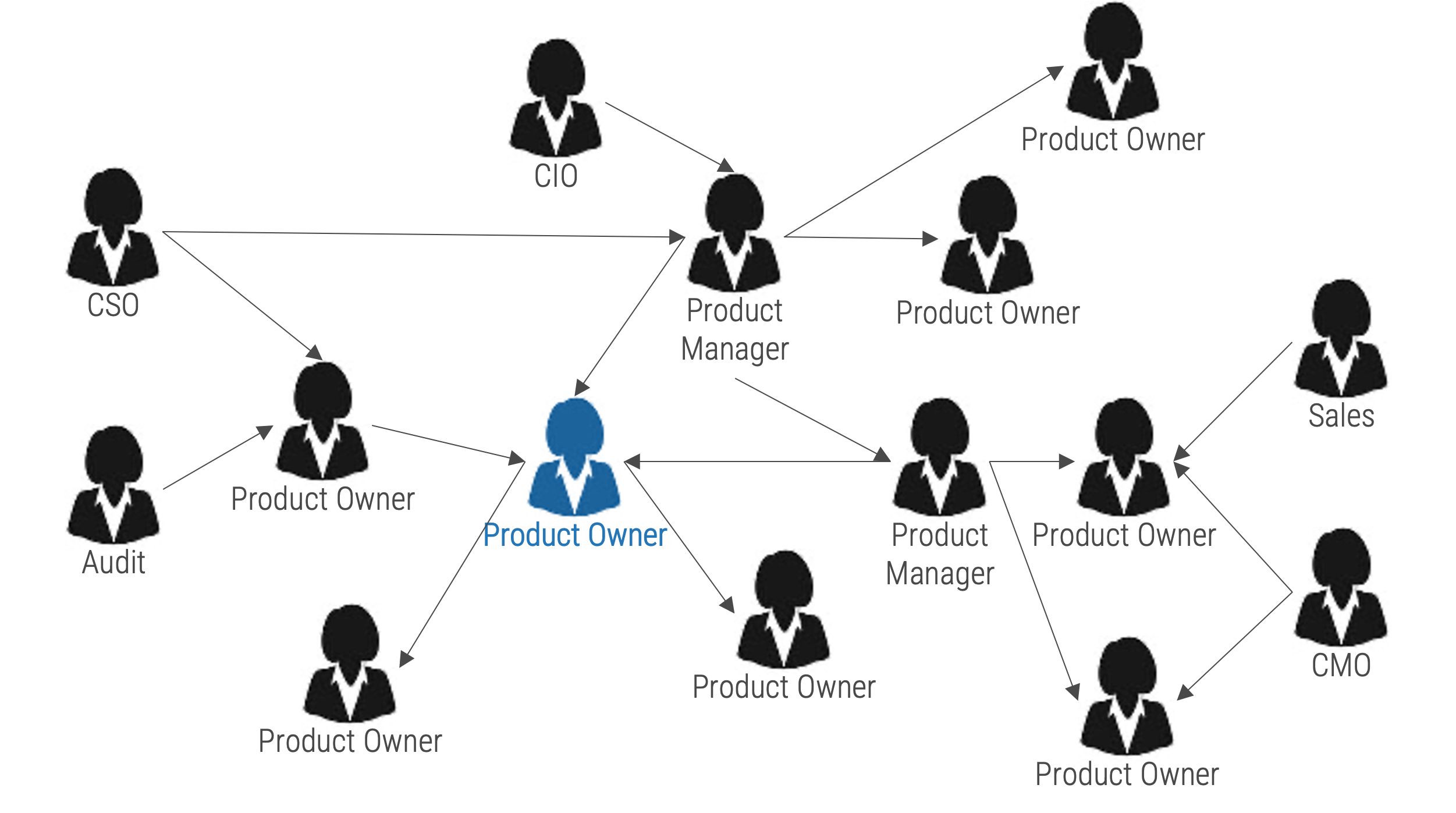

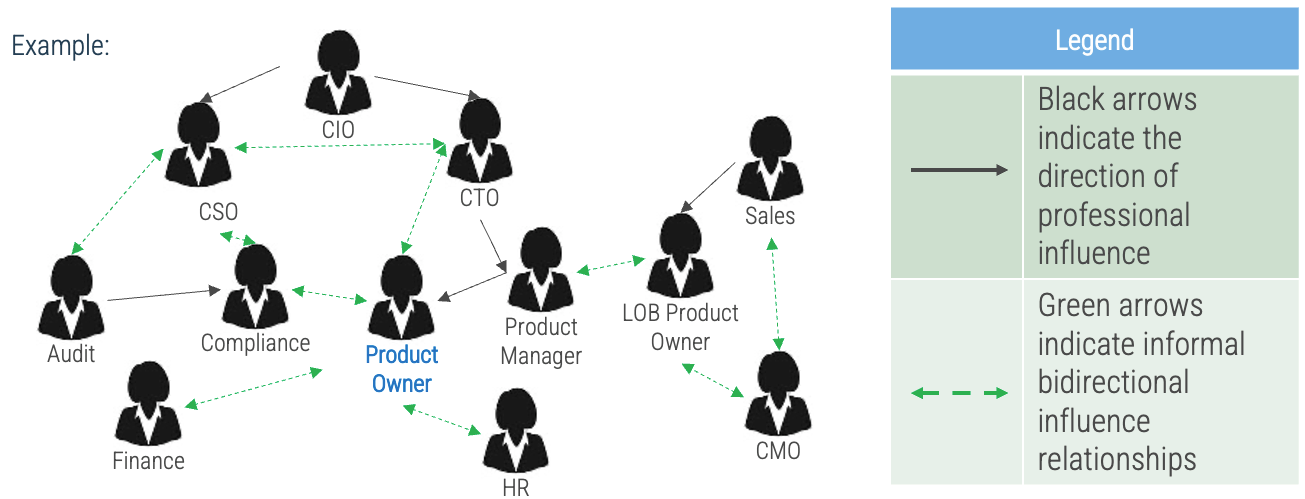

Map sources of demand and influencers

Use the stakeholder analysis to define the key stakeholders and sources of demand for enterprise applications and shared

services. Extend your mapping to include their stakeholders and influencers to uncover additional sources of demand and

prioritization.

Info-Tech Insight

Your product owner map defines the influence landscape your product operates. It is every bit as important as the teams

who enhance, support and operate your product directly.

Combine your product owner map with your stakeholder map to create a comprehensive view of influencers.

The primary value of the product owner is to fill the backlog with the highest ROI opportunities aligned with enterprise

goals.

Info-Tech Insight

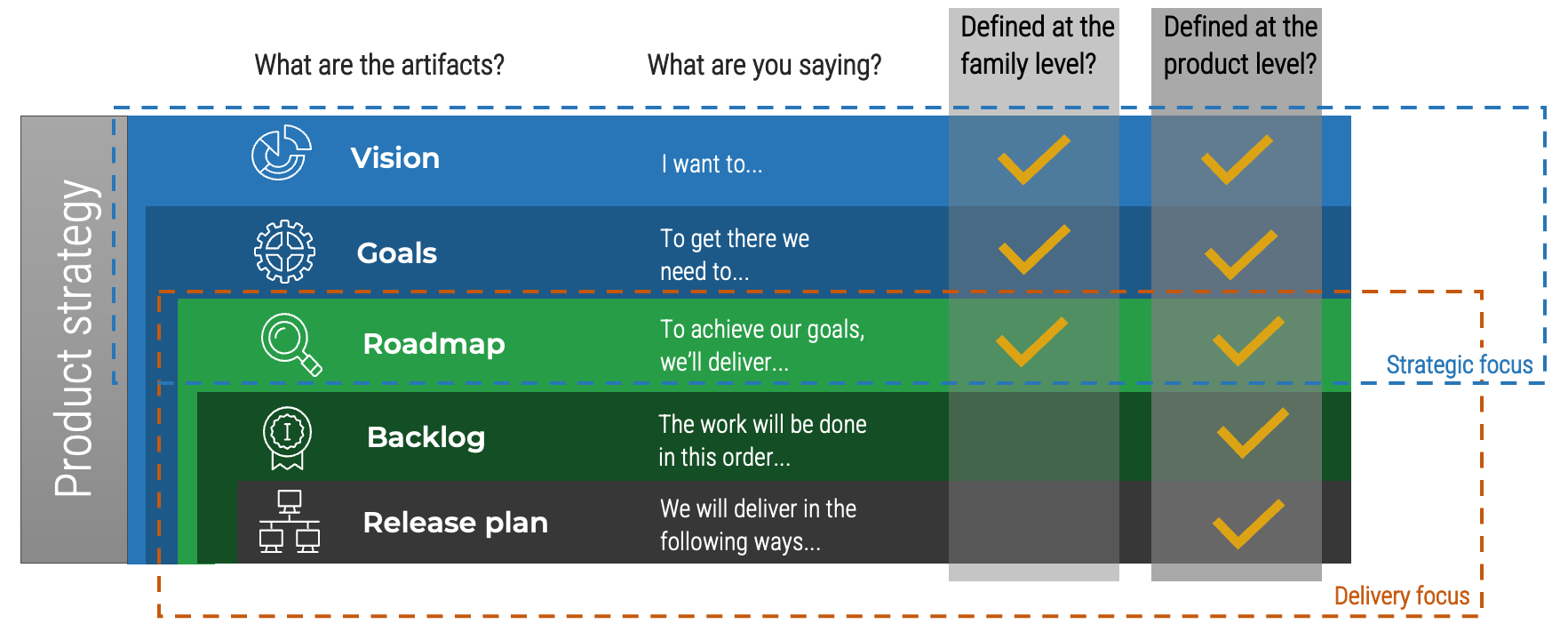

The product owner owns the direction of the product.

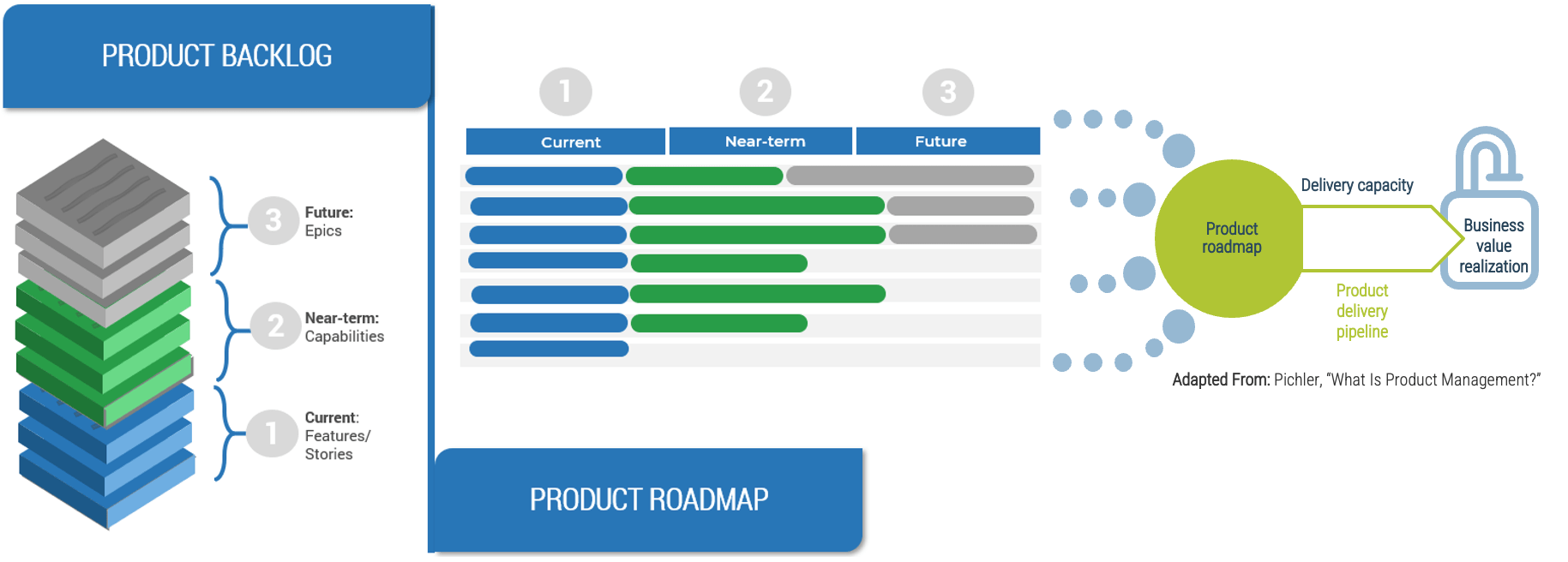

-

Roadmap - Where are we going?

-

Backlog - What changes are needed to get there?

-

Product review - Did we get close enough?

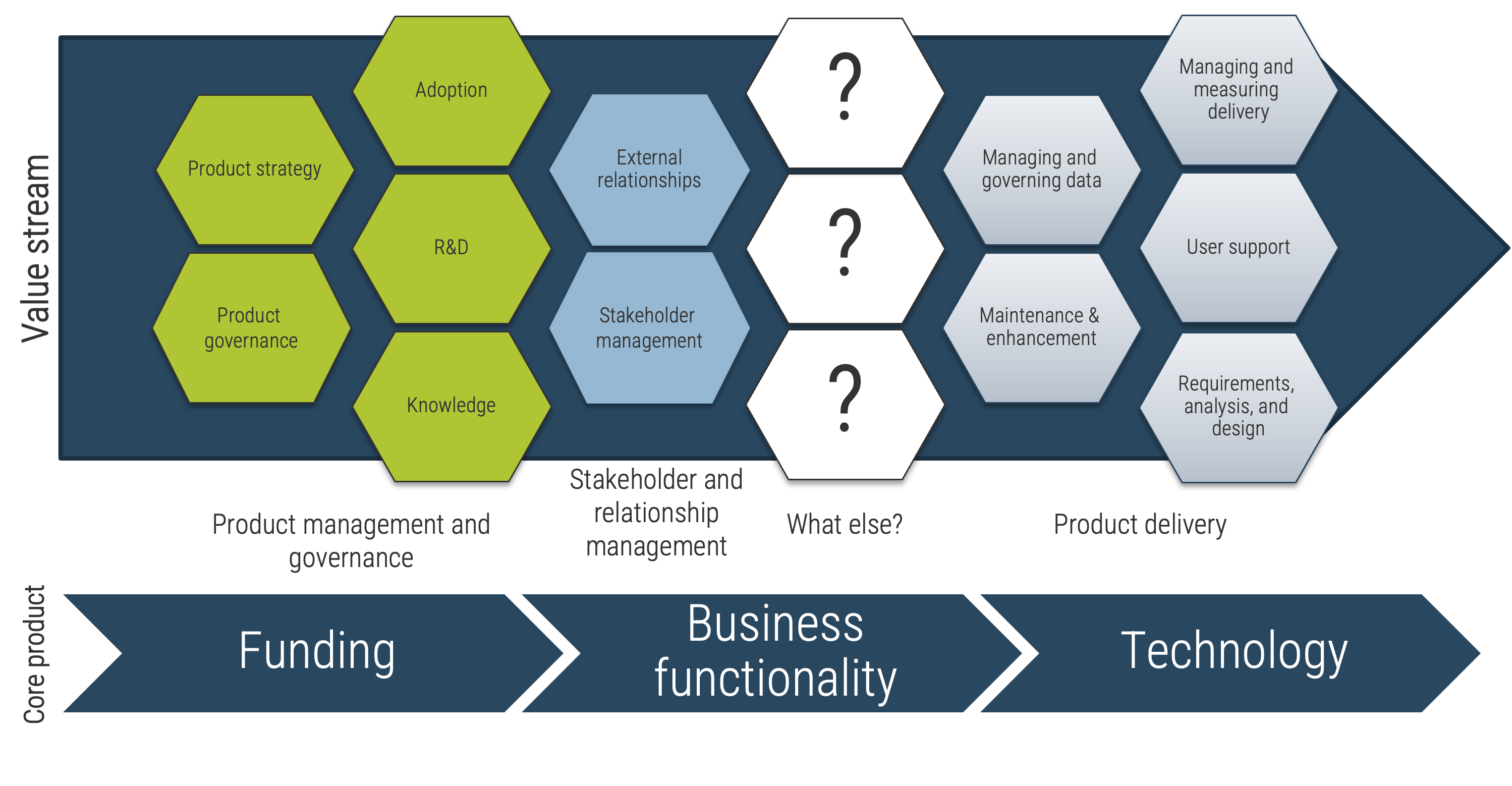

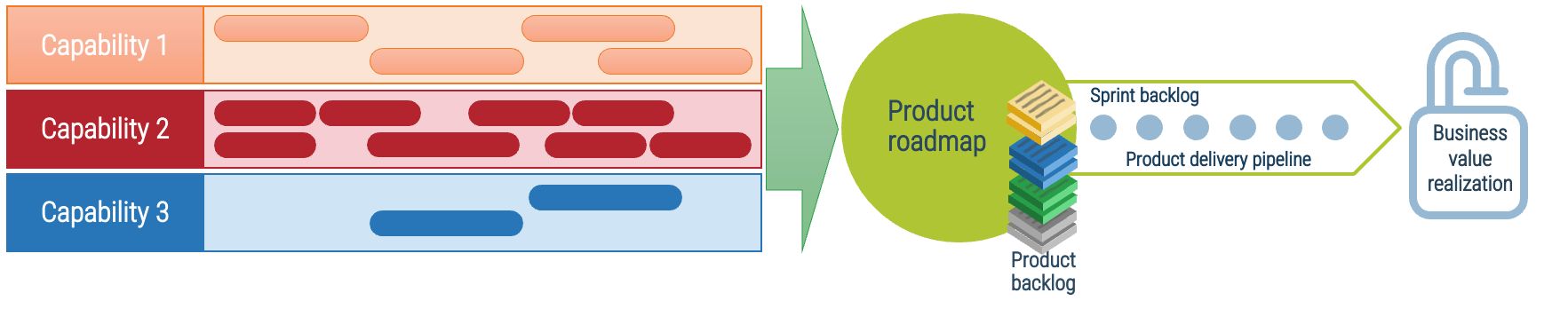

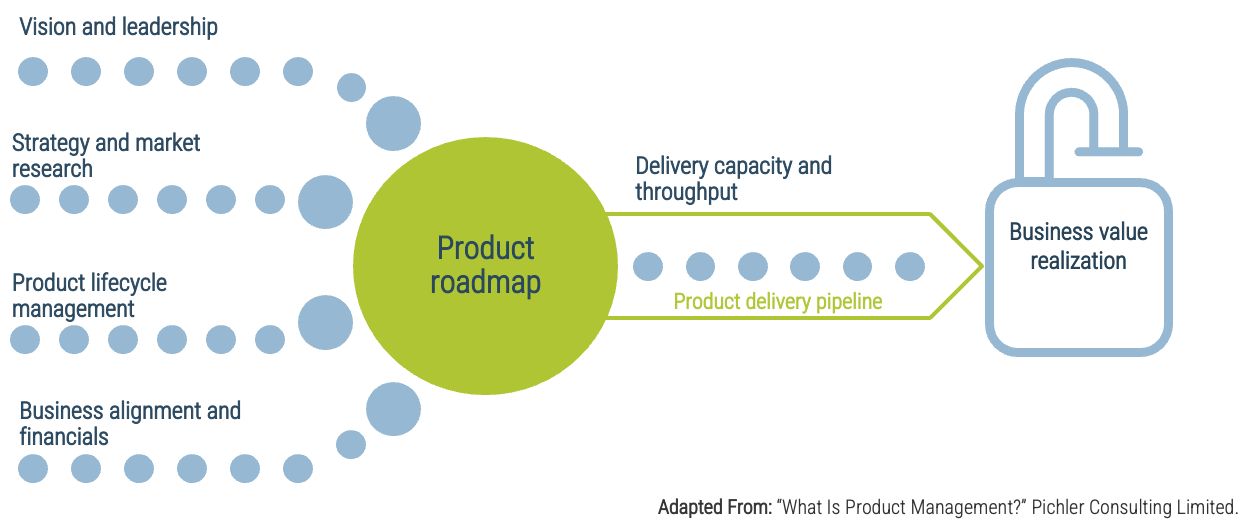

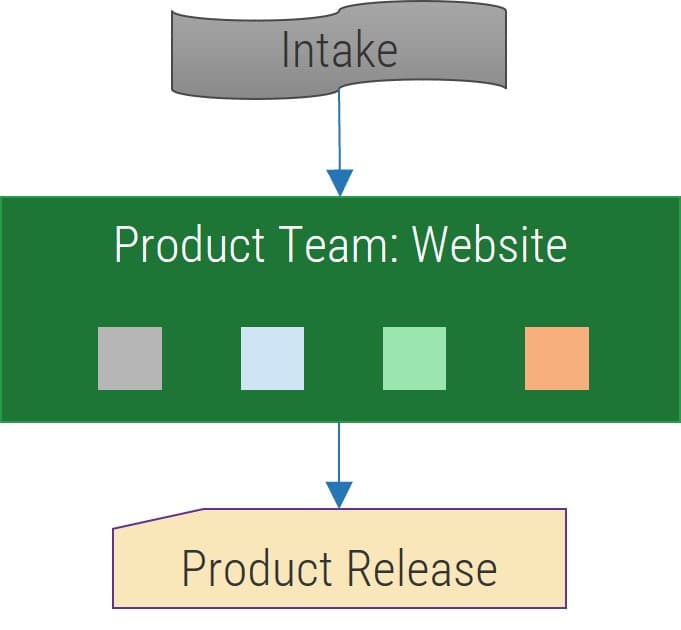

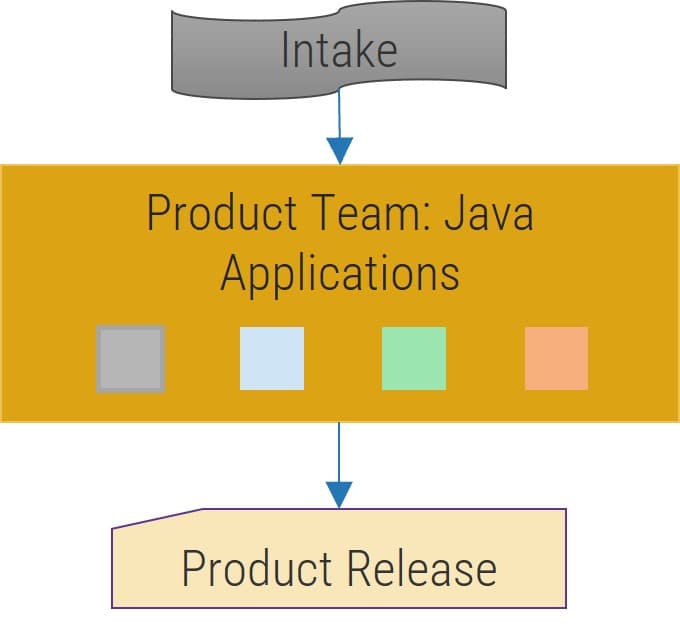

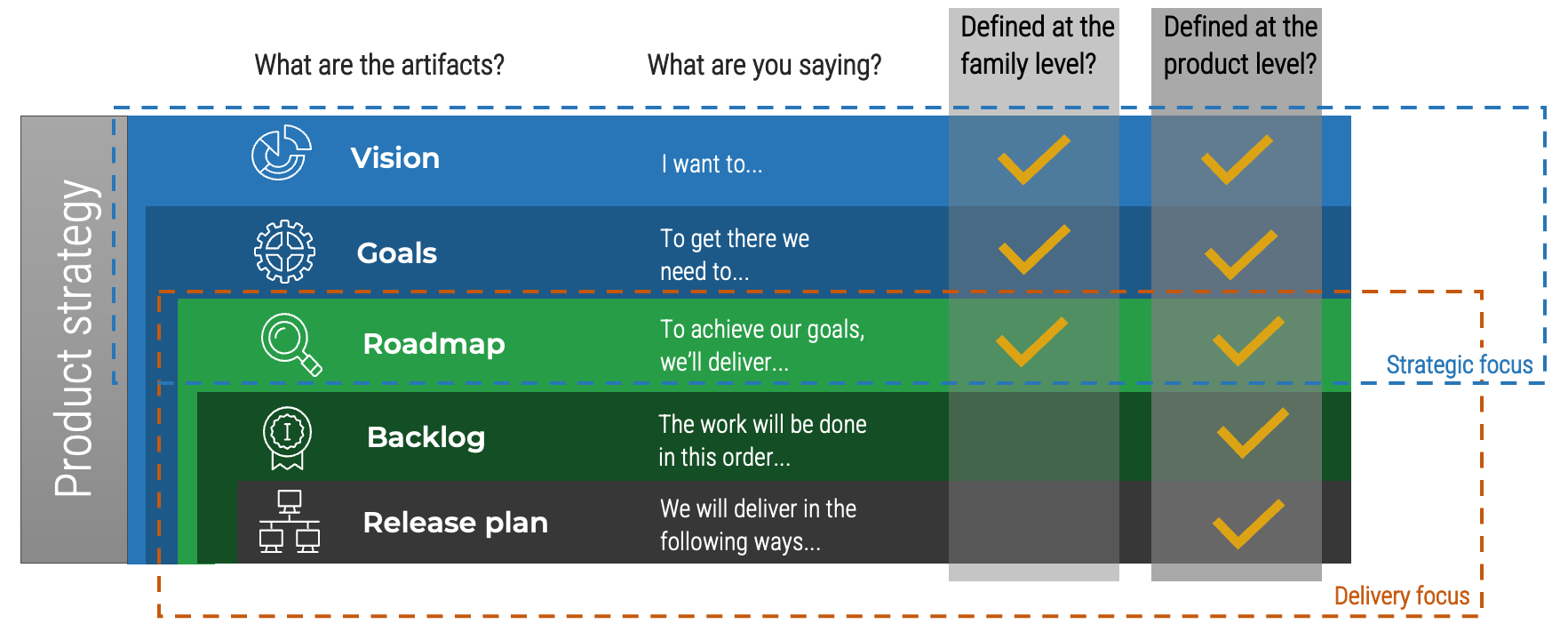

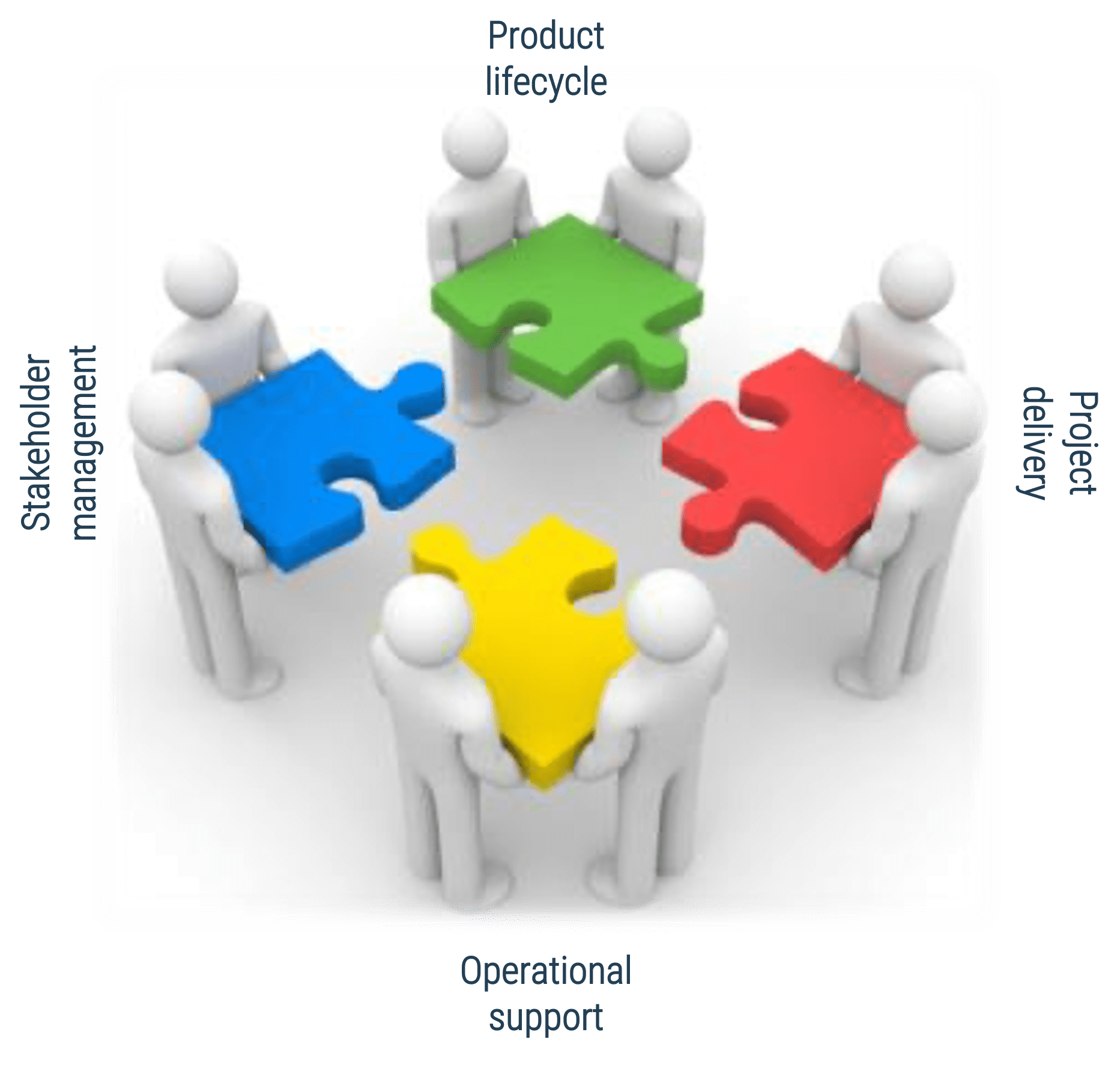

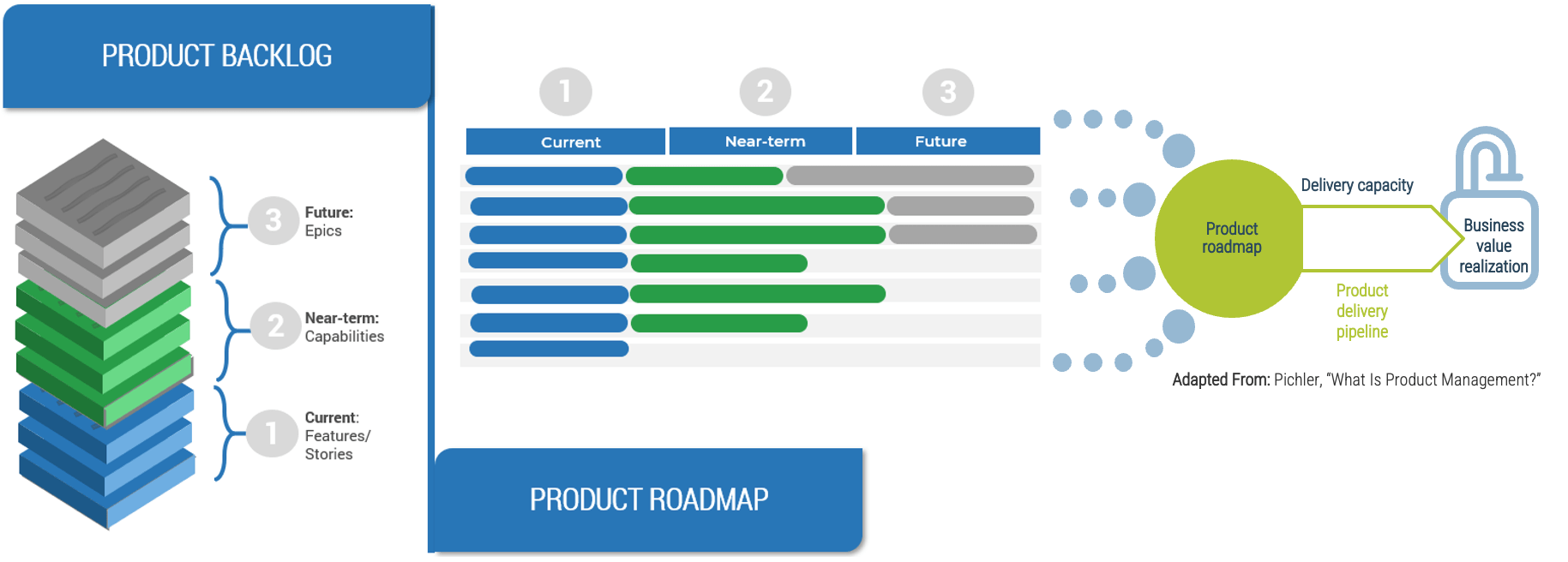

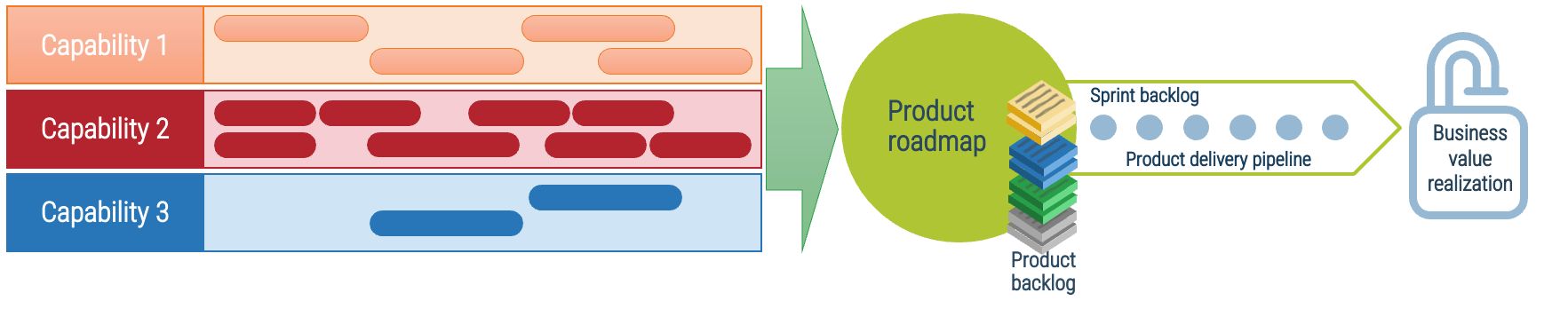

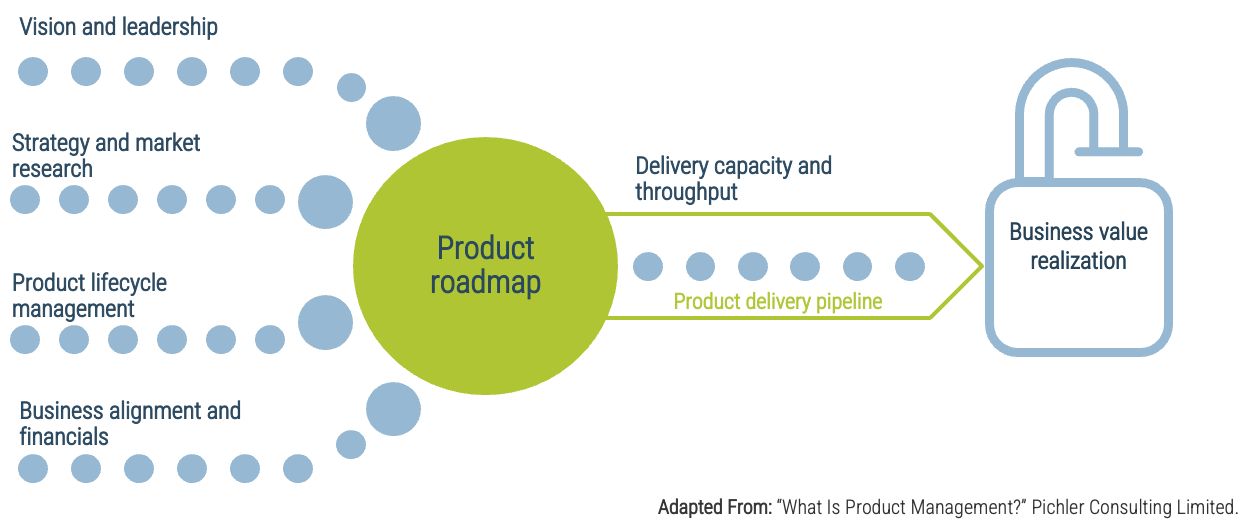

Product delivery realizes value for your product family

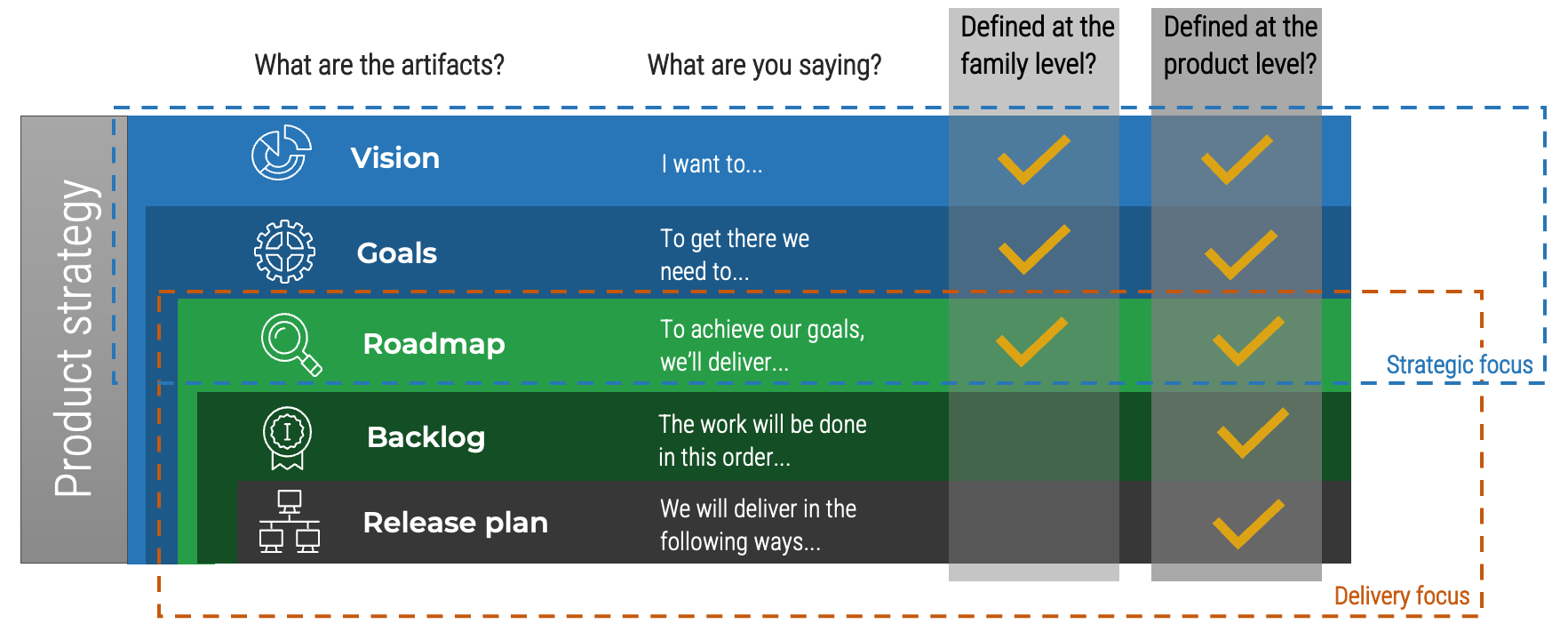

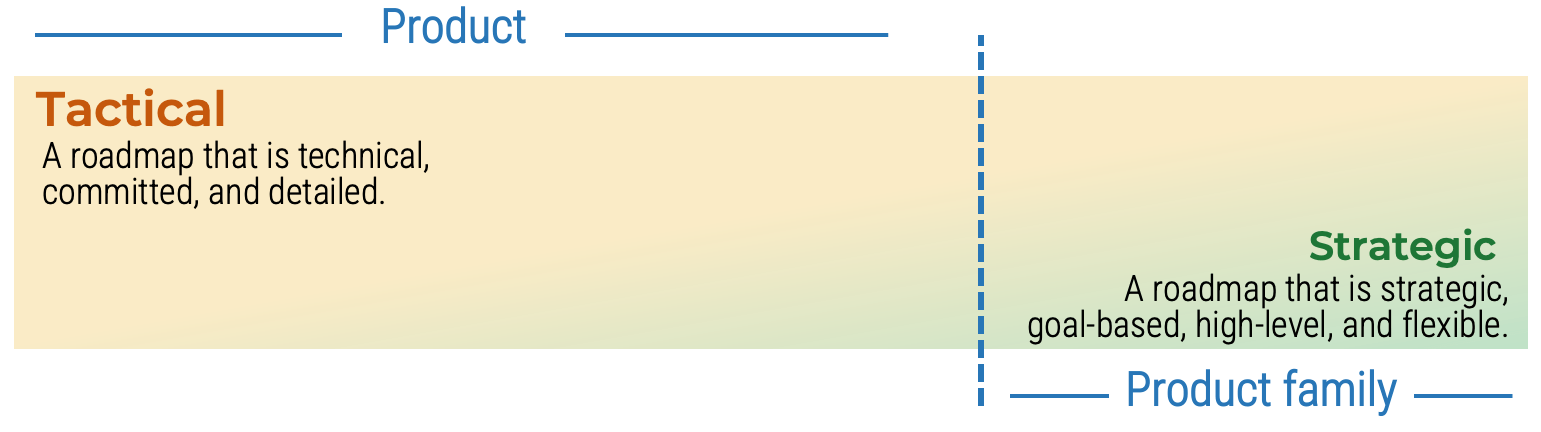

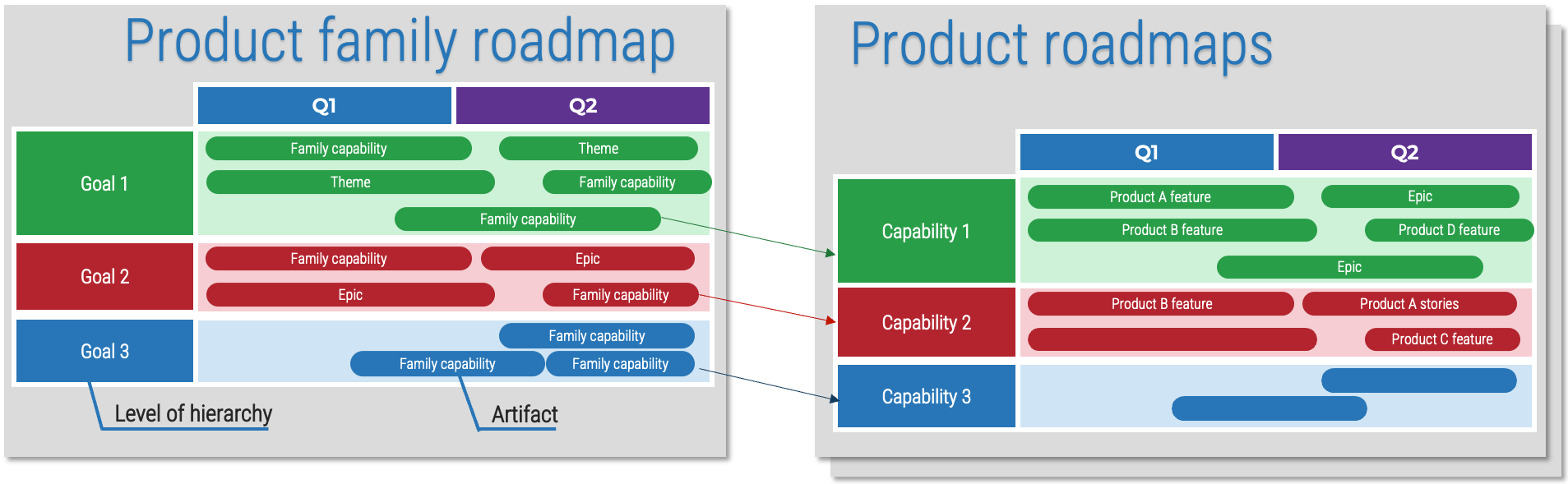

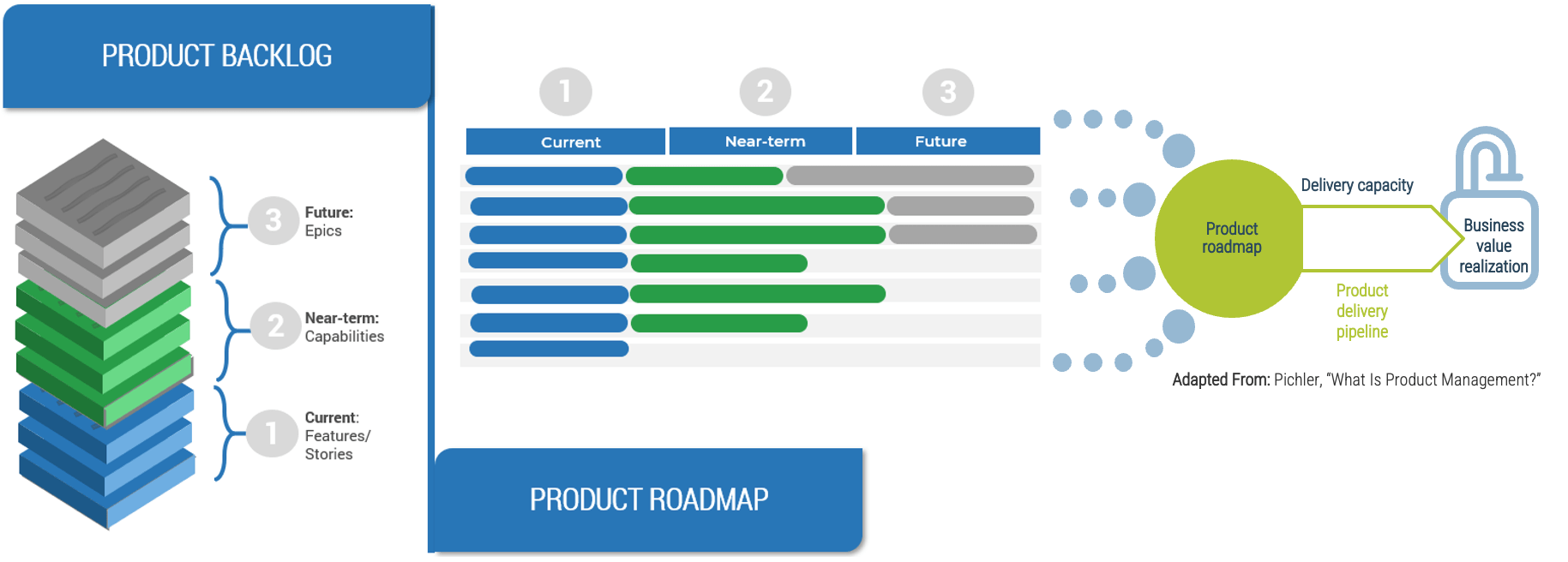

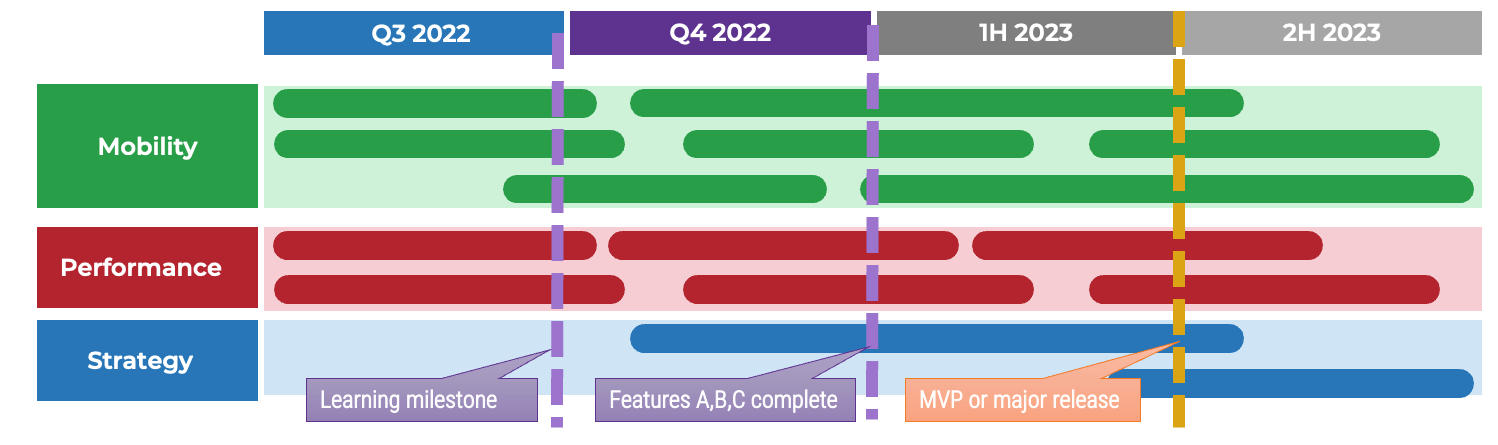

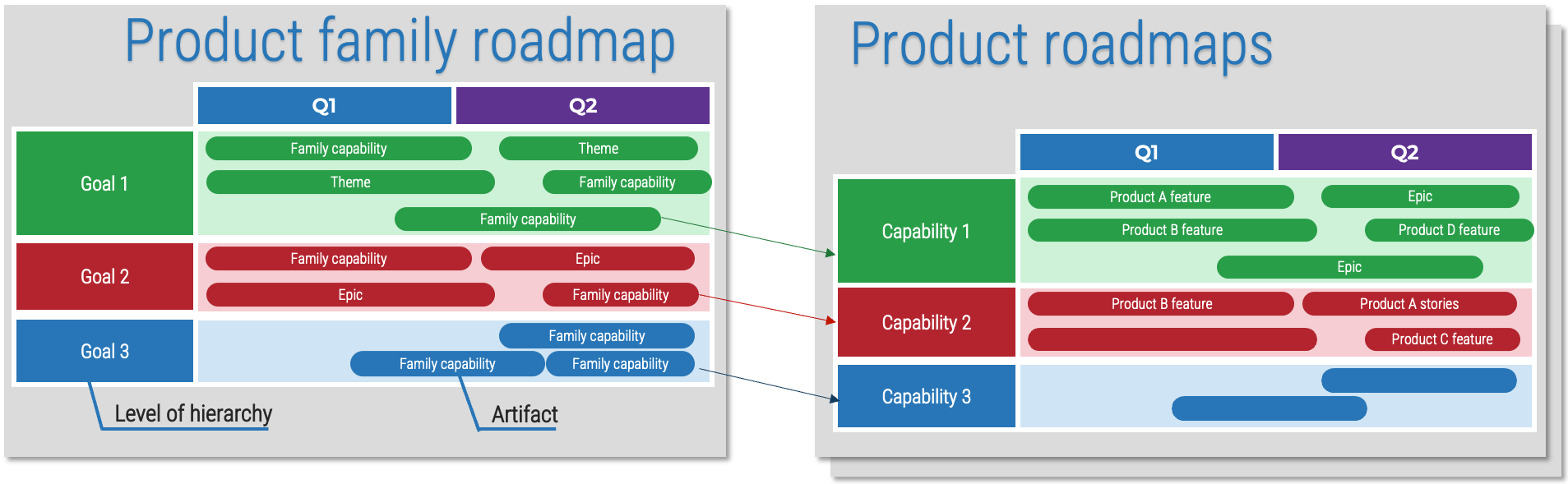

While planning and analysis are done at the family level, work and delivery are done at the individual product level.

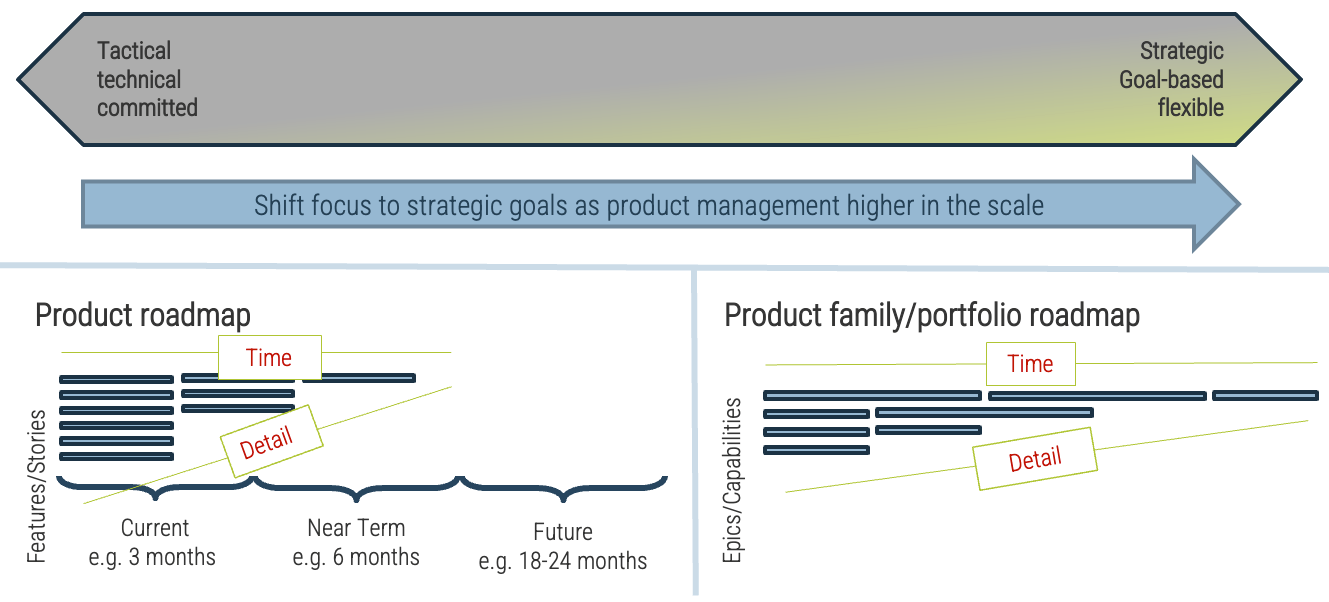

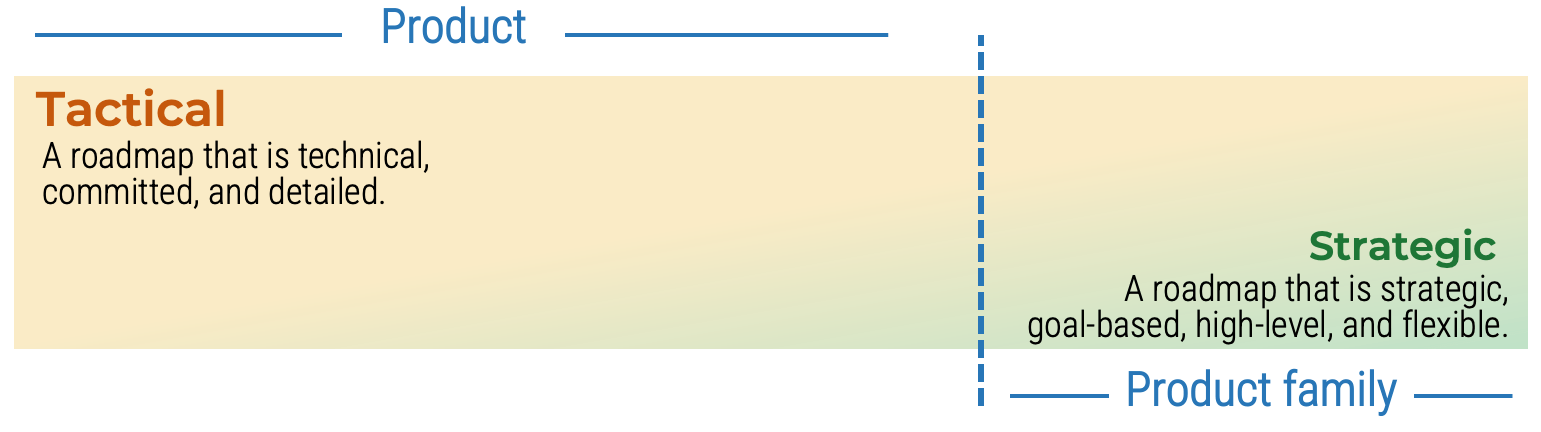

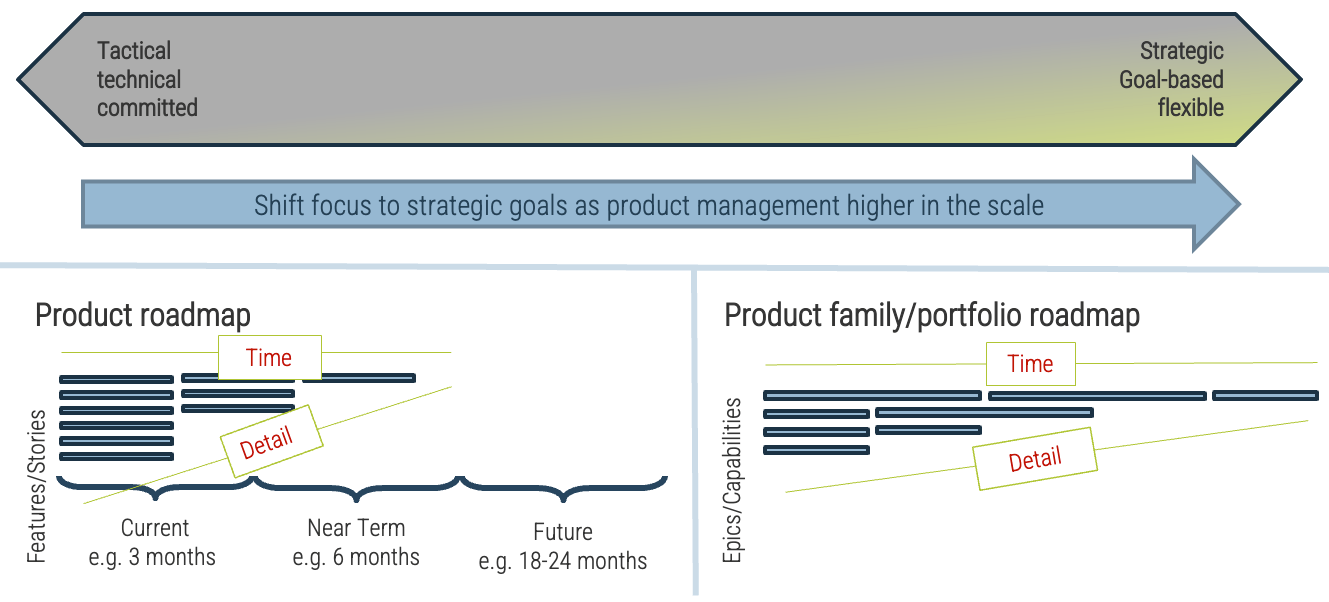

Product family owners are more strategic

When assigning resources, recognize that product family owners will need to be more strategic with their planning and alignment of child families and products.

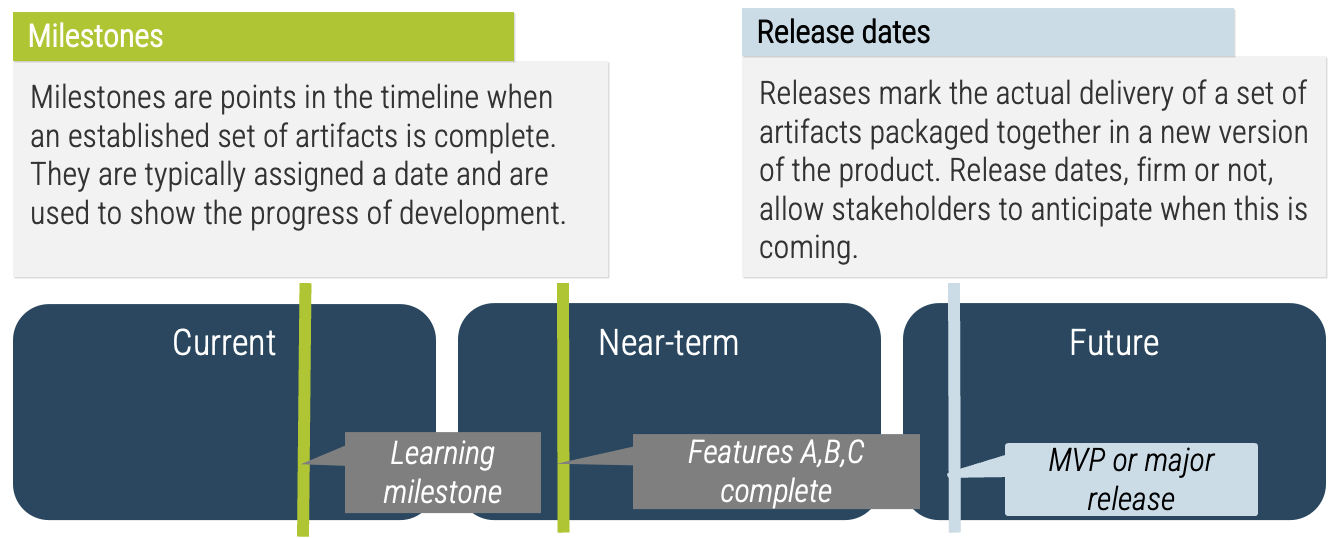

Info-Tech Insight

Roadmaps for your product family are, by design, less detailed. This does not mean they aren’t actionable! Your product family roadmap should be able to communicate clear intentions around the future delivery of value in both the near and long term.

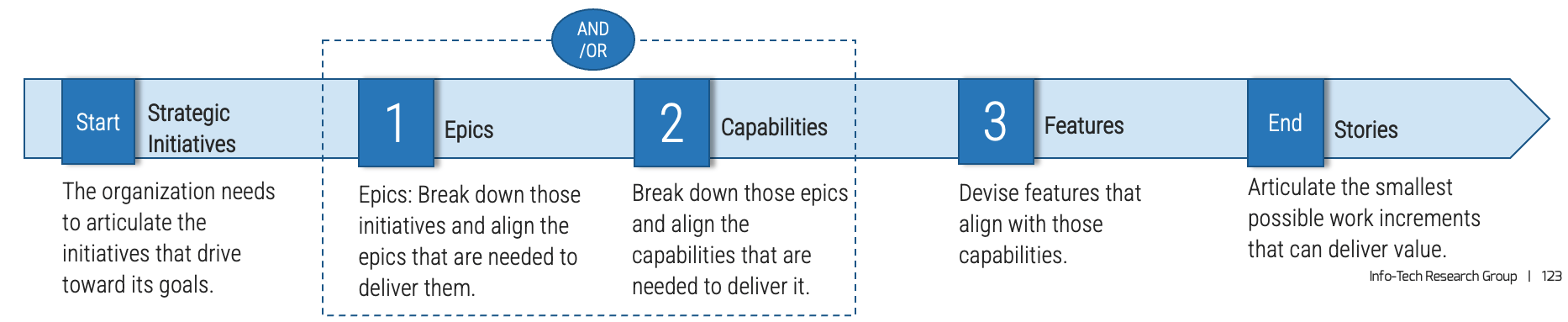

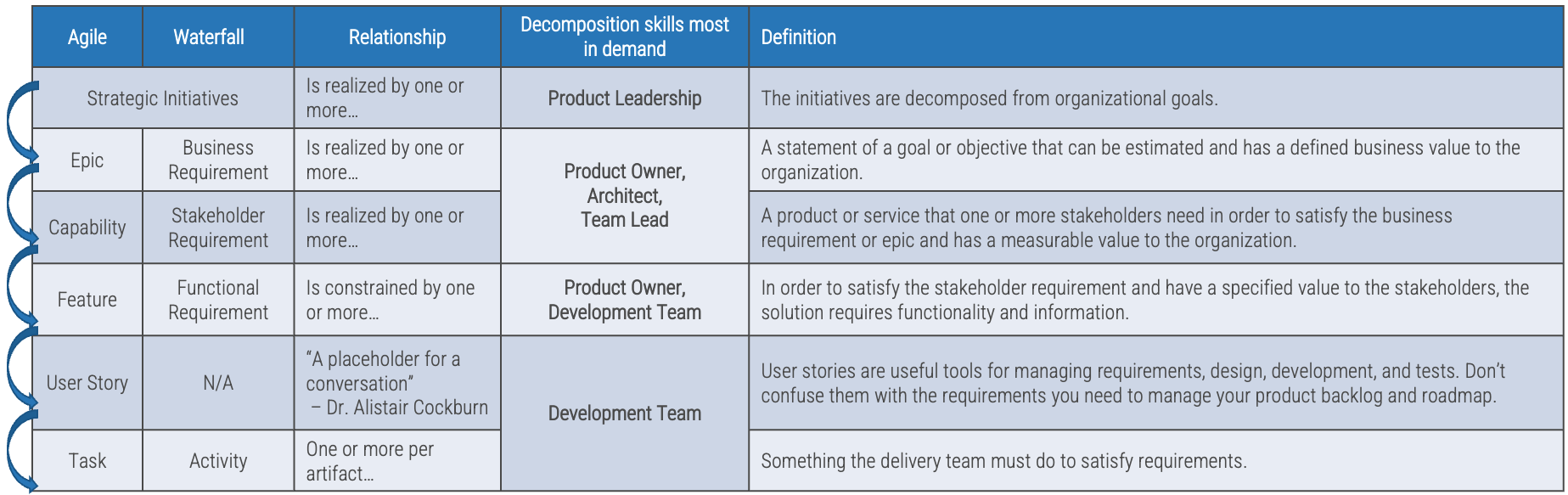

Connecting your product family roadmaps to product roadmaps

Your product and product family roadmaps should be connected at an artifact level that is common between both. Typically, this is done with capabilities, but it can be done at a more granular level if an understanding of capabilities isn’t available.

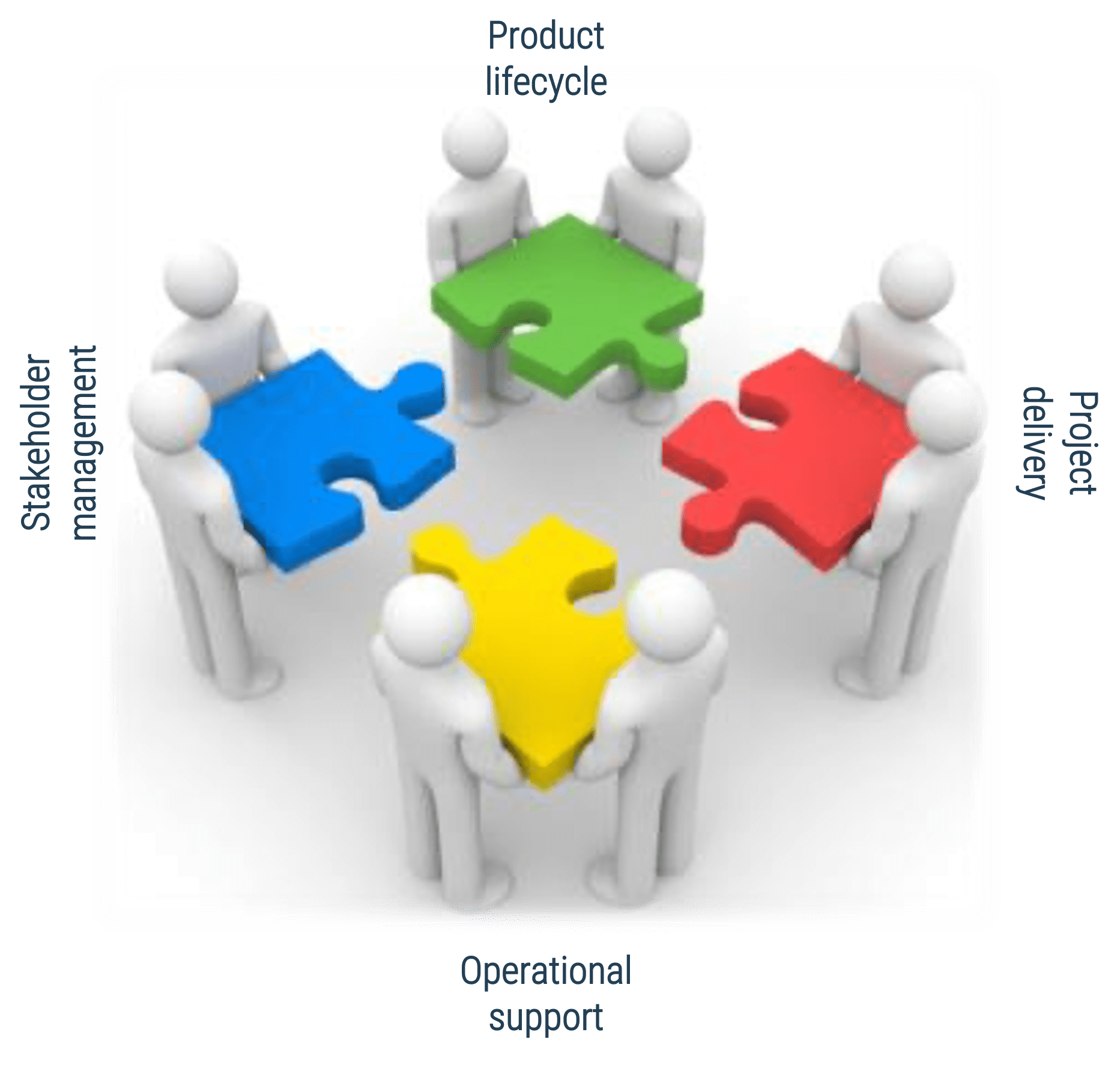

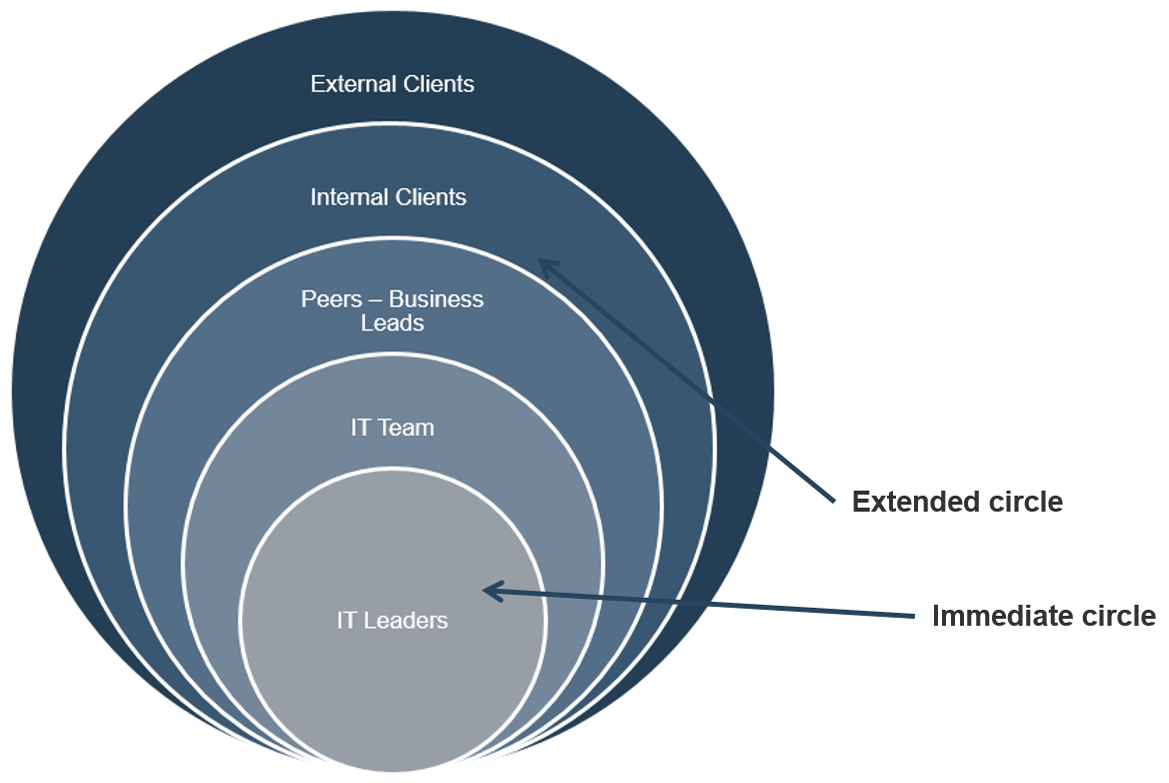

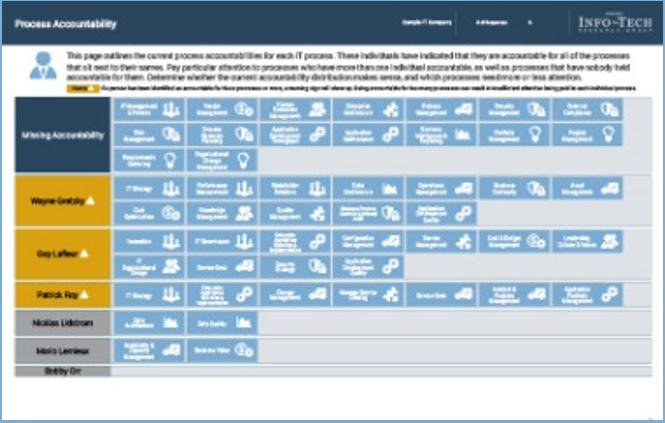

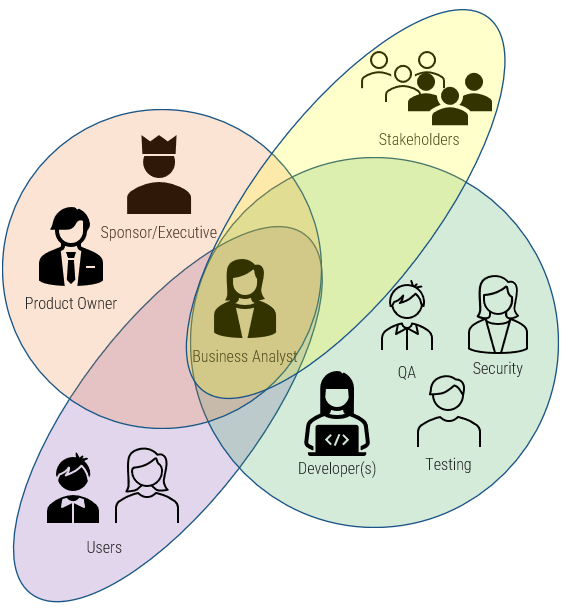

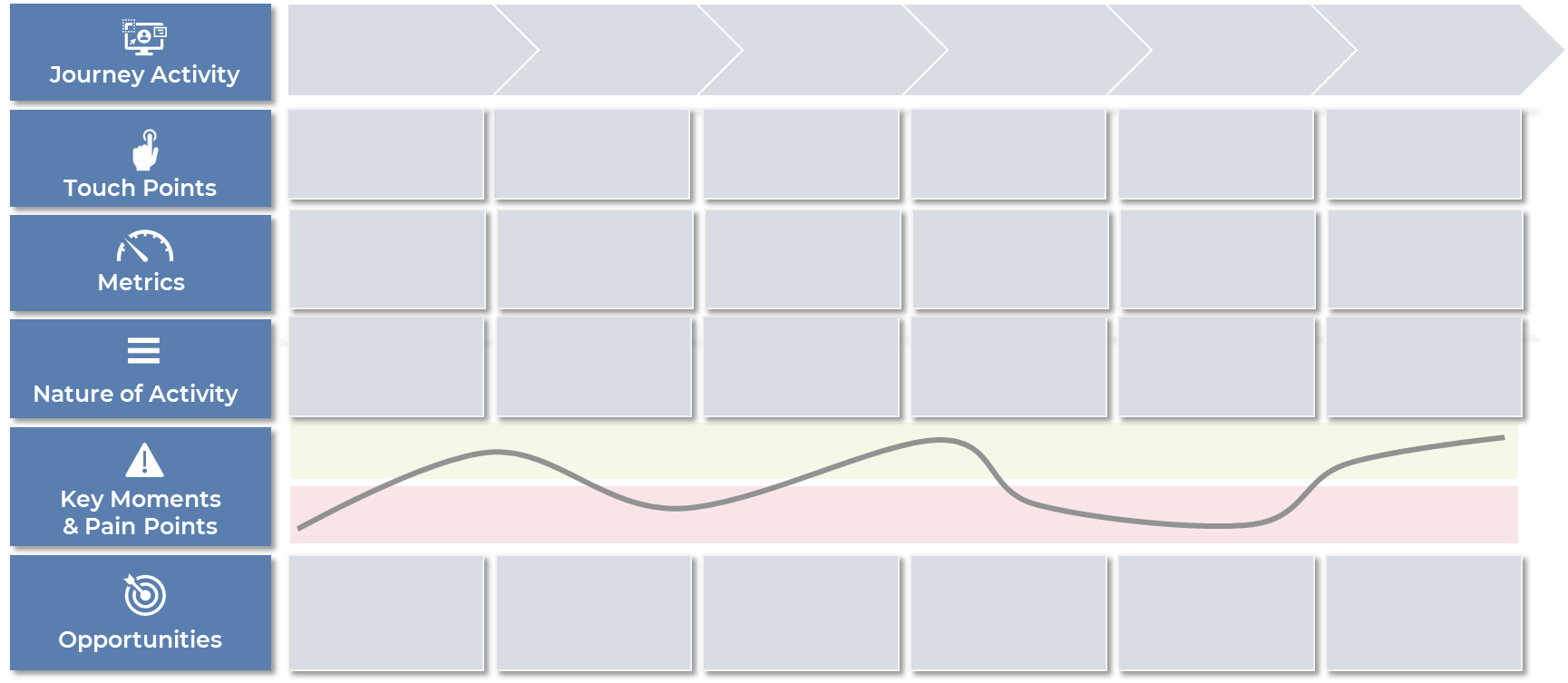

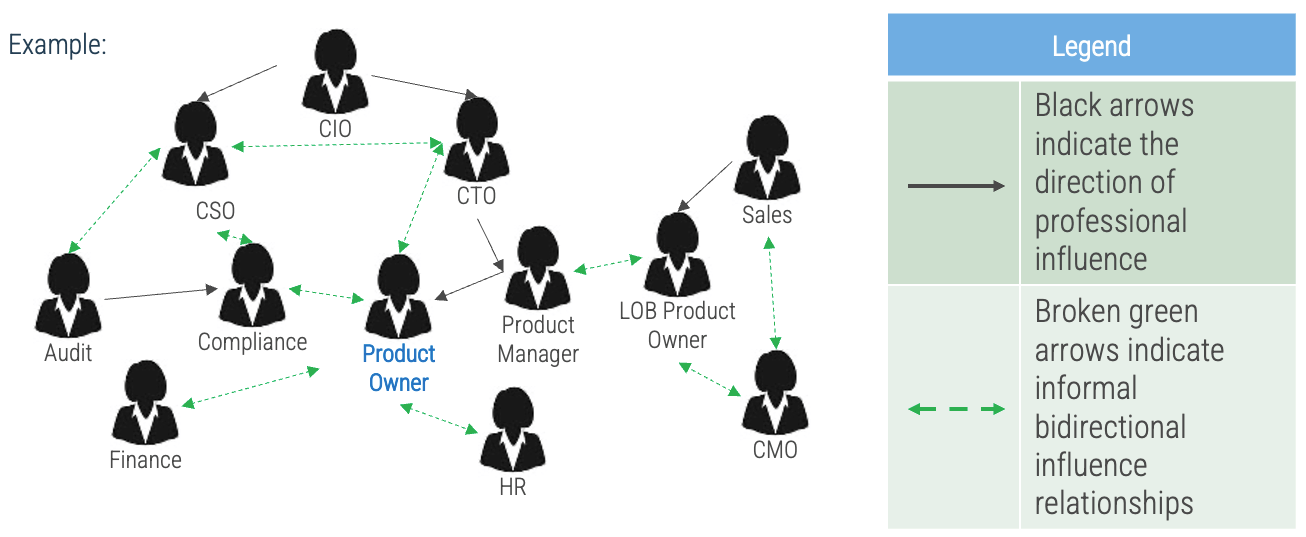

Develop a product owner stakeholder strategy

Stakeholders are a critical cornerstone to product ownership. They provide the context, alignment, and constraints that

influence or control what a product owner can accomplish.

Product owners operate within a network of stakeholders who represent different perspectives within the organization.

First, product owners must identify members of their stakeholder network. Next, they should devise a strategy for managing stakeholders.

Without a stakeholder strategy, product owners will encounter obstacles, resistance, or unexpected changes.

Create a stakeholder network map to product roadmaps and prioritization

Follow the trail of breadcrumbs from your direct stakeholders to their influencers, to uncover hidden stakeholders.

Info-Tech Insight

Your stakeholder map defines the influence landscape your product operates. It is every bit as important as the teams who enhance, support and operate your product directly.

Use “connectors” to determine who may be influencing your direct stakeholders. They may not have any formal authority within the organization, but they may have informal yet substantive relationships with your stakeholders.

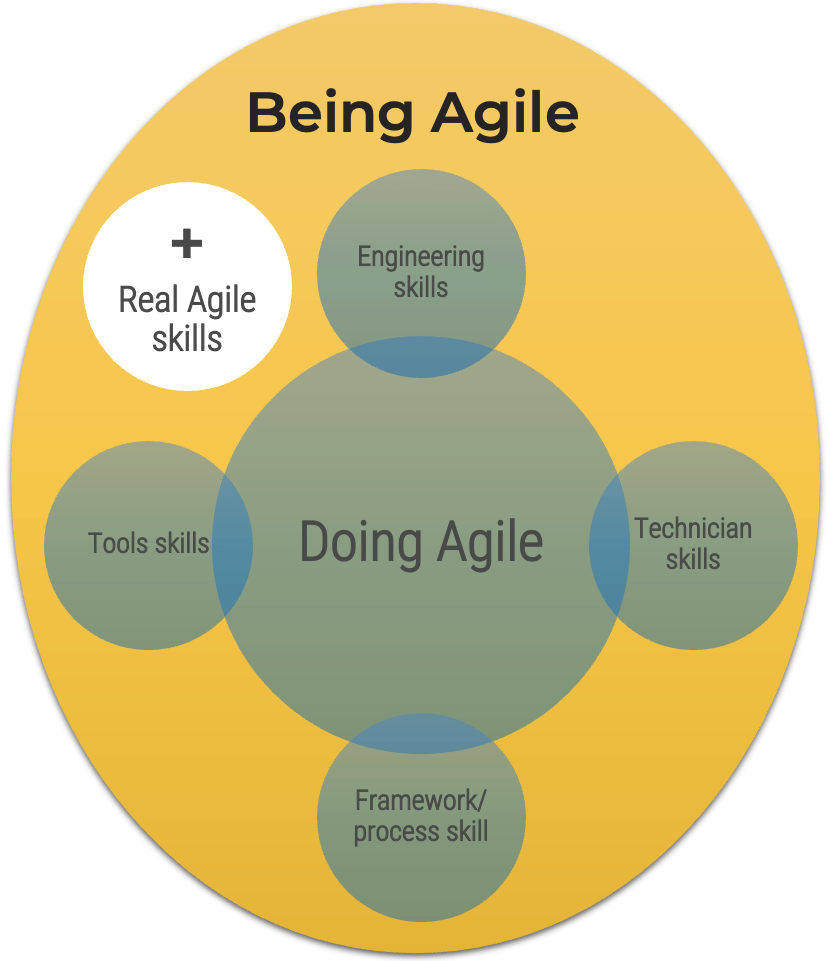

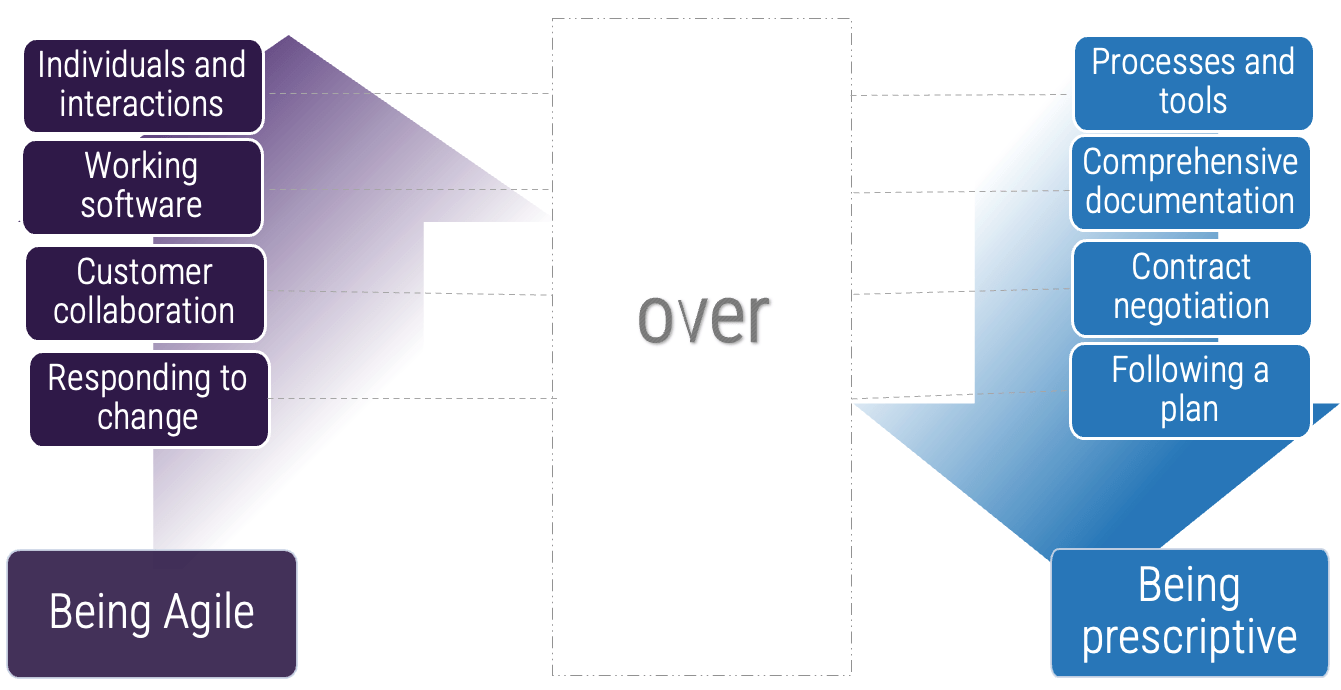

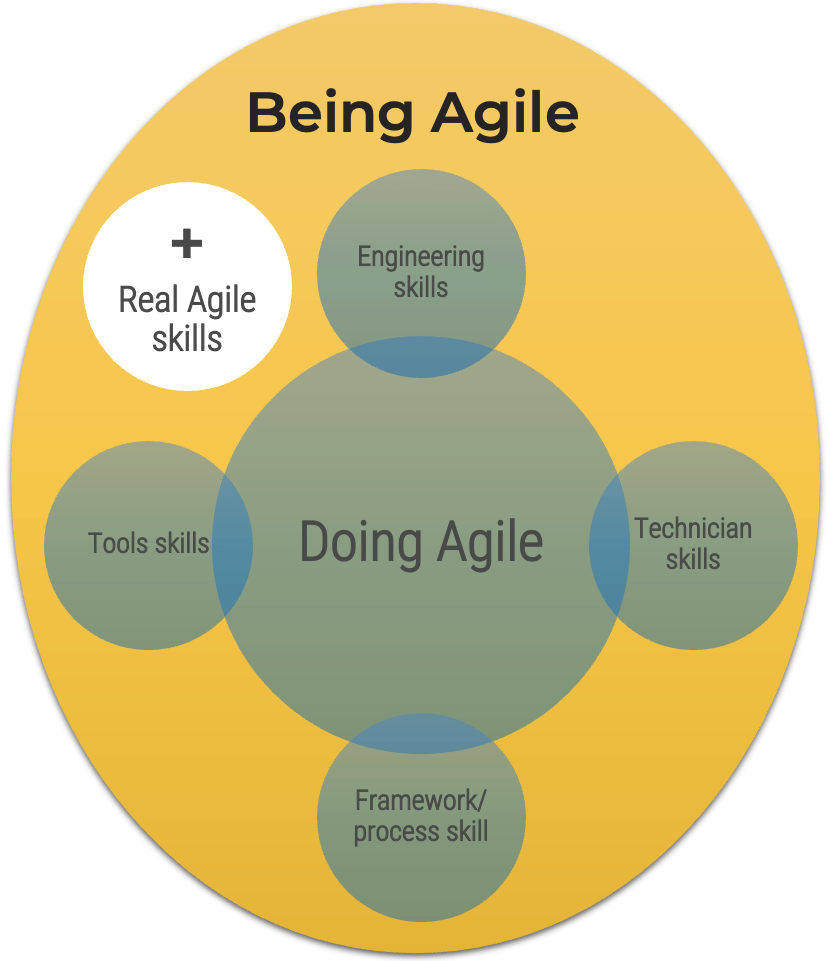

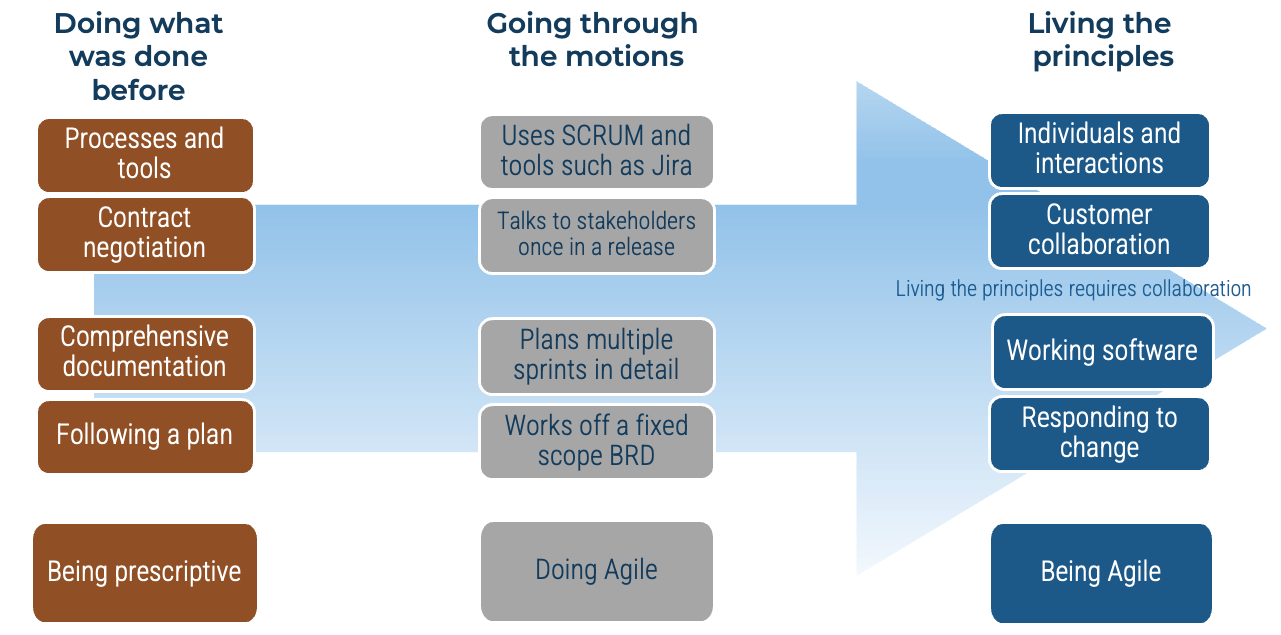

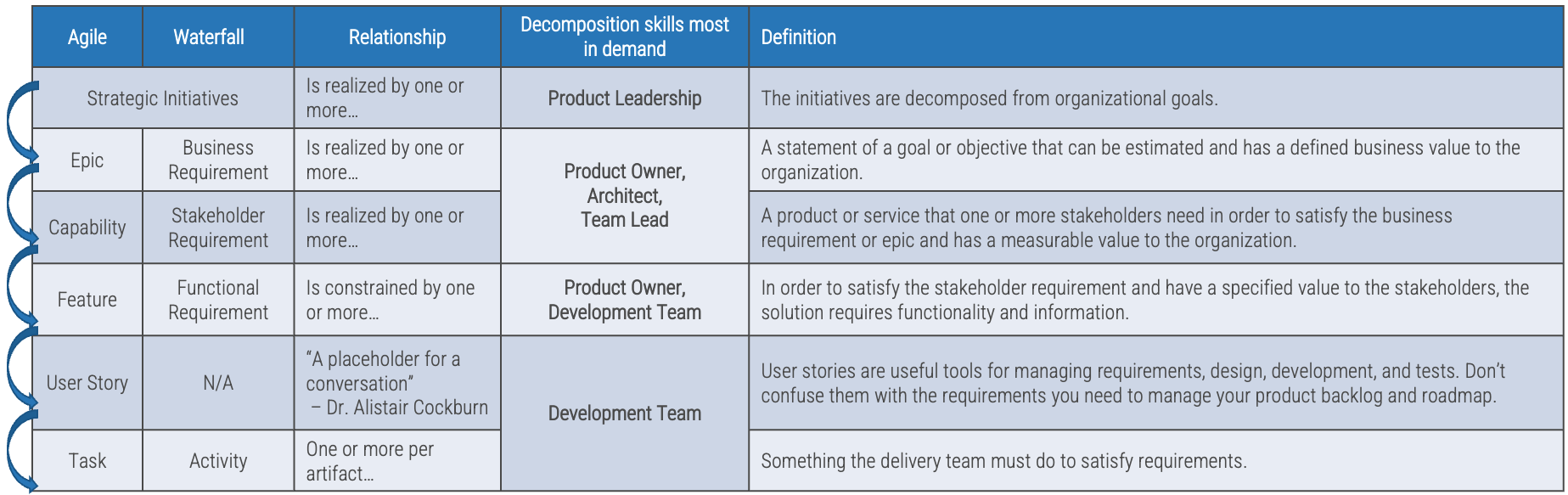

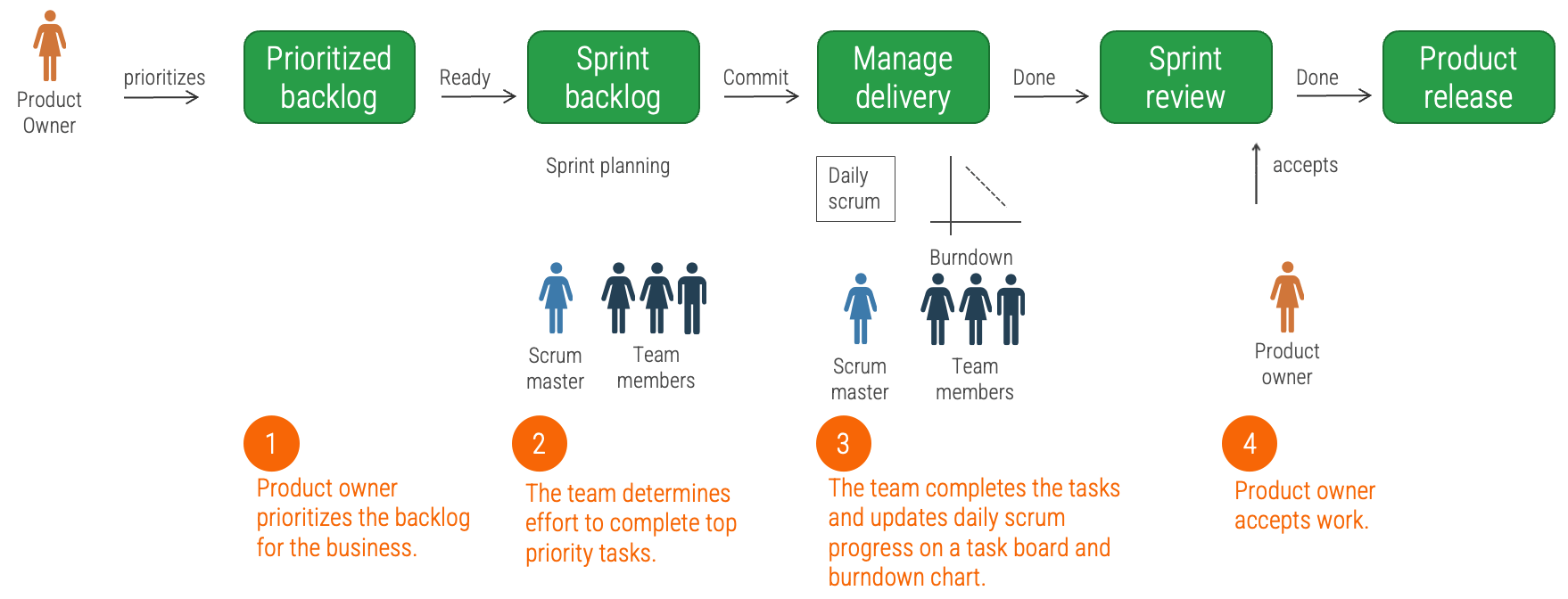

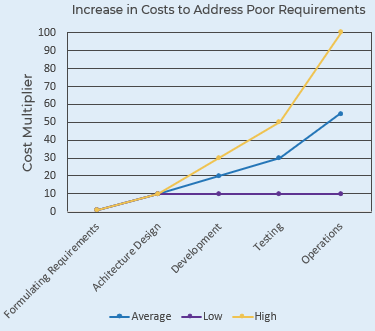

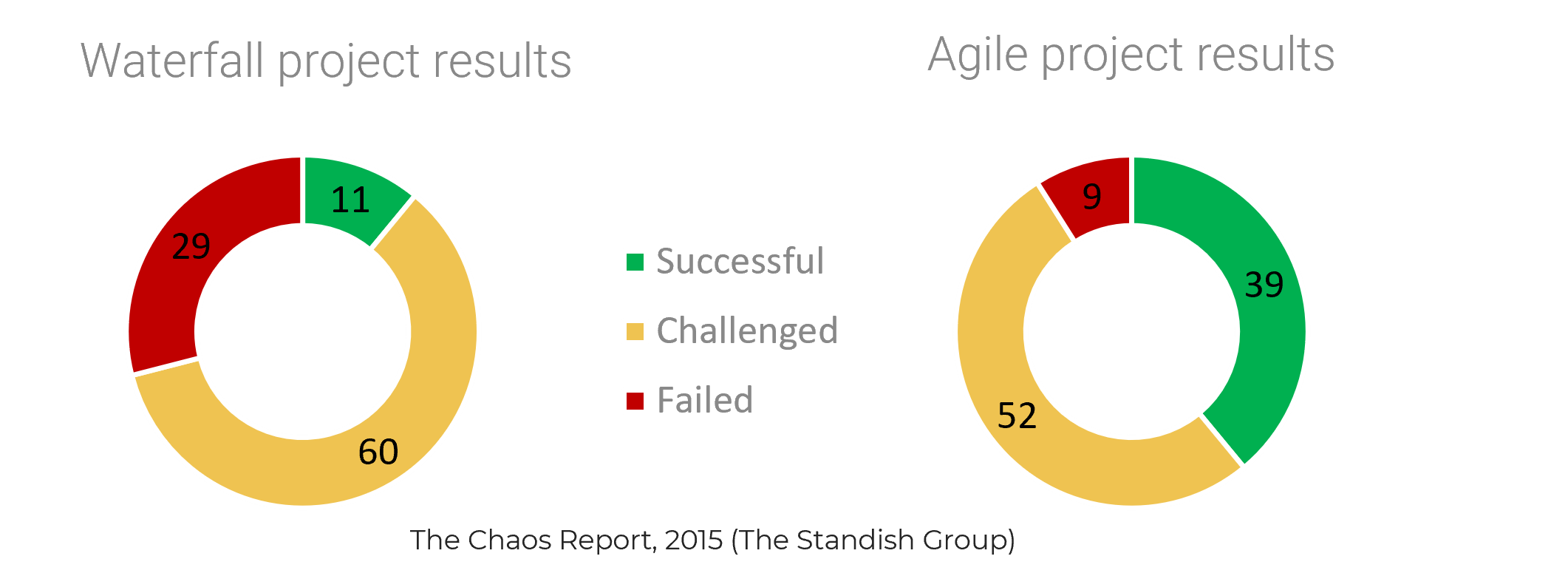

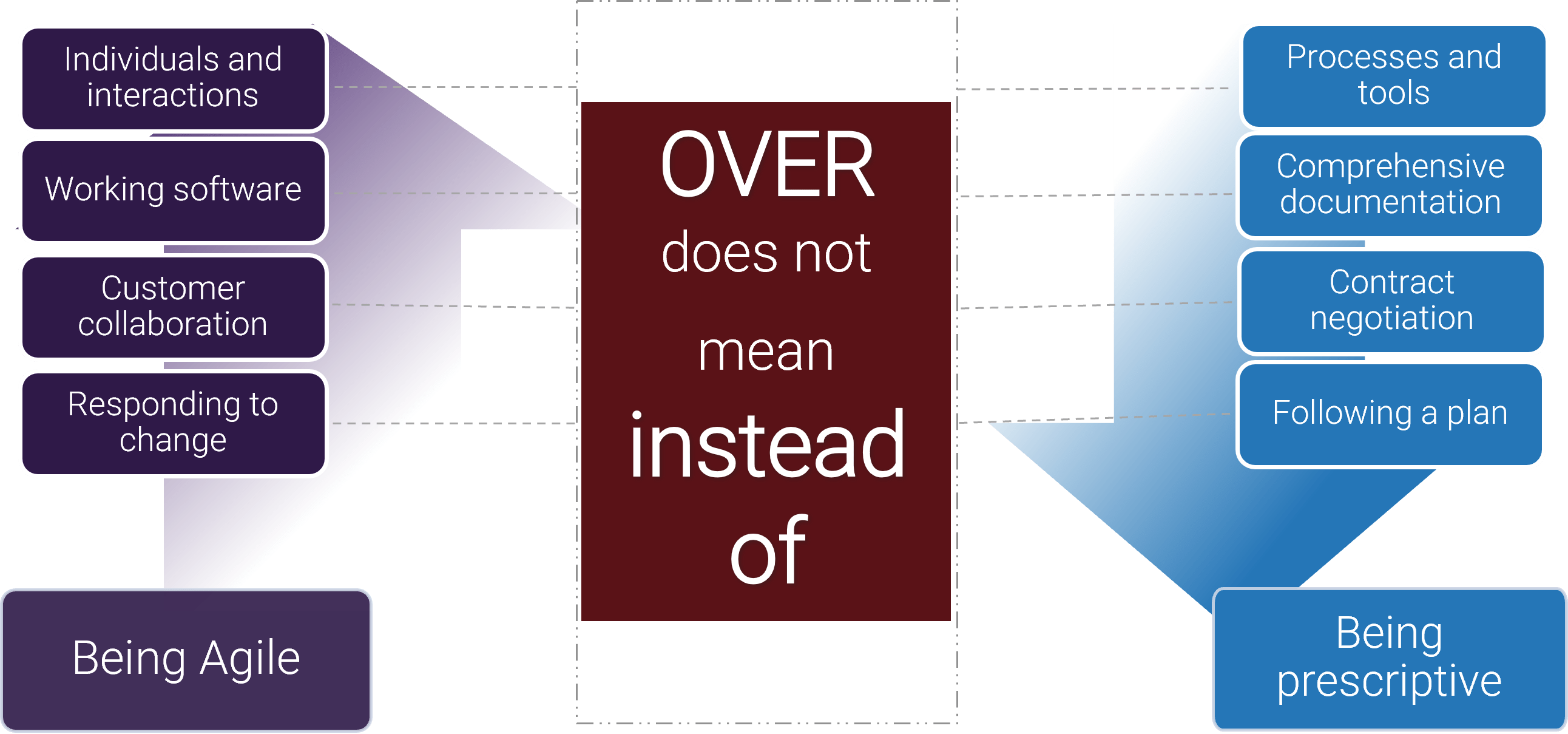

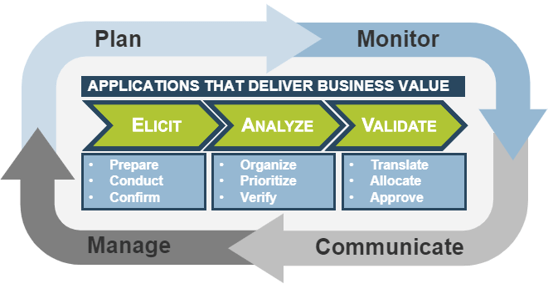

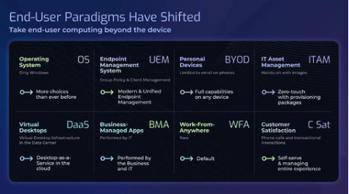

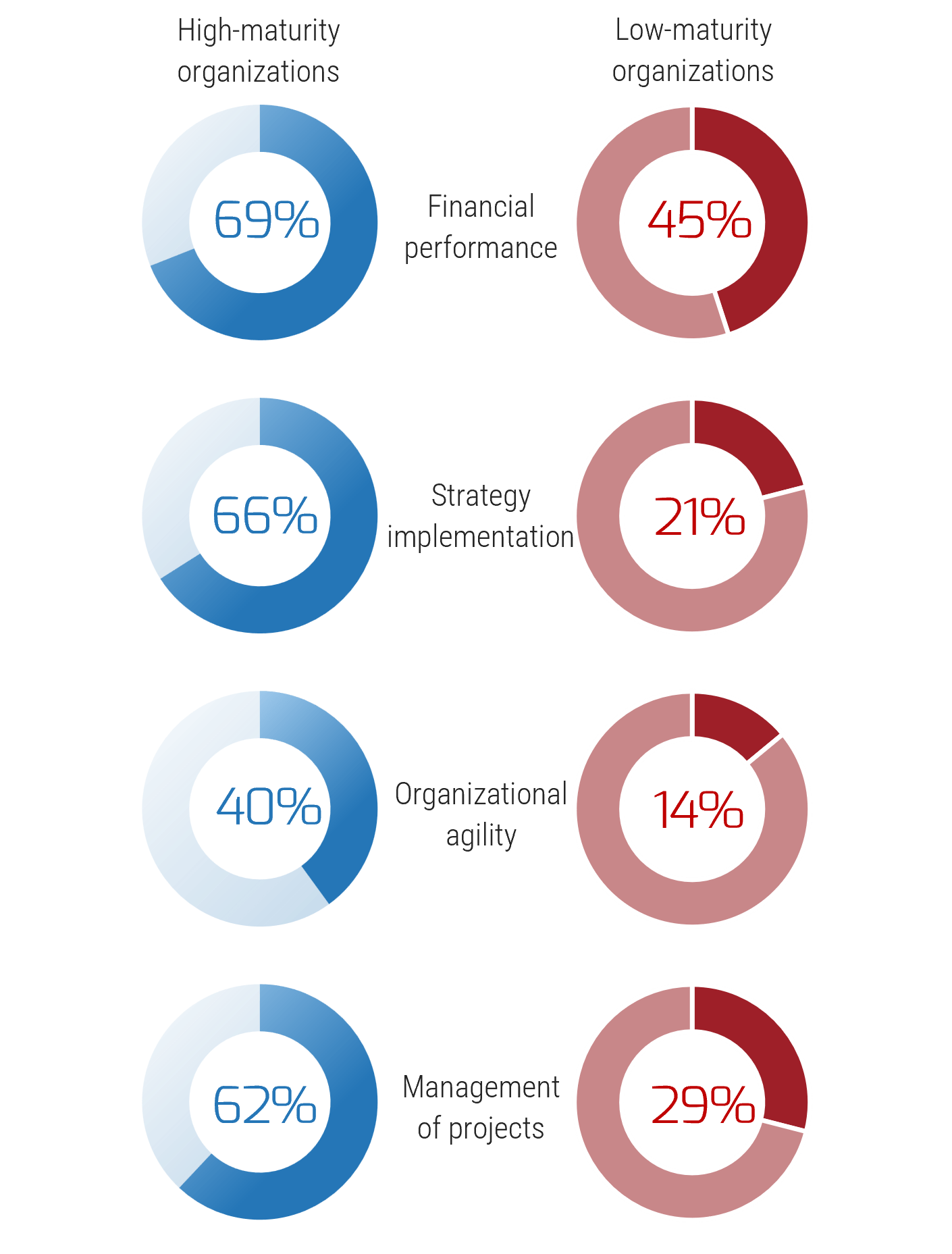

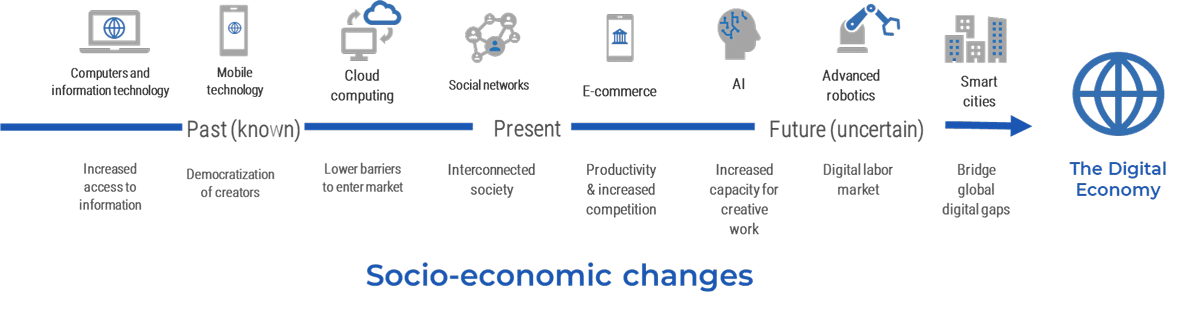

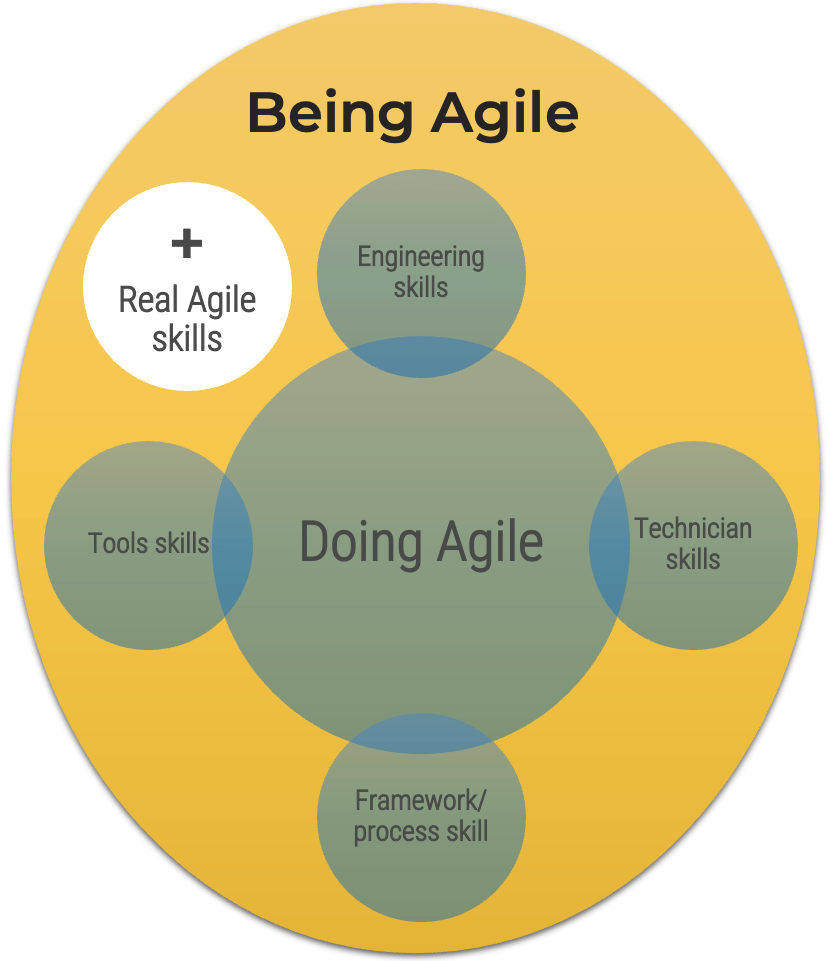

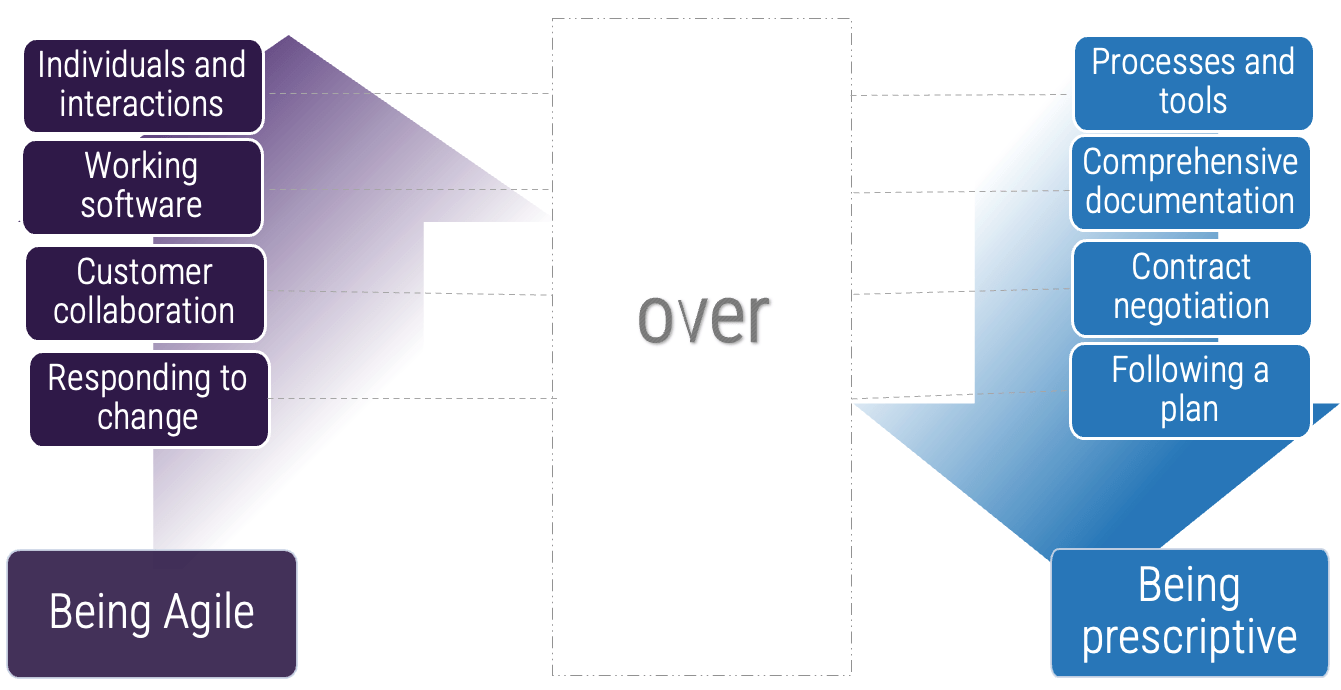

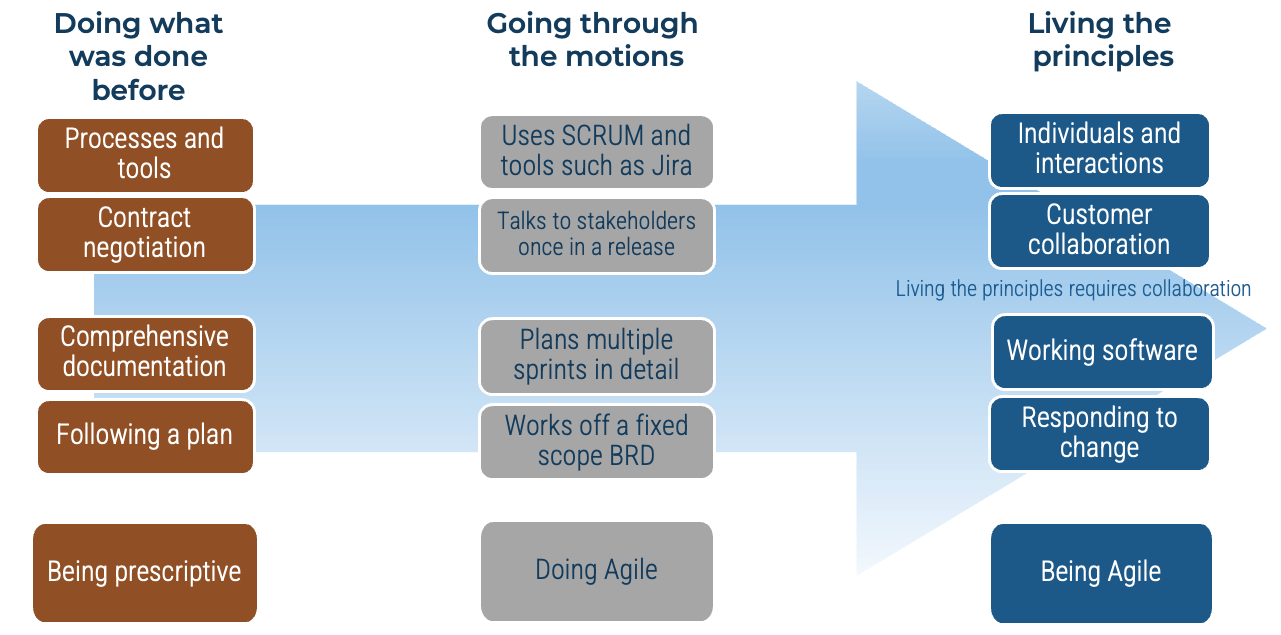

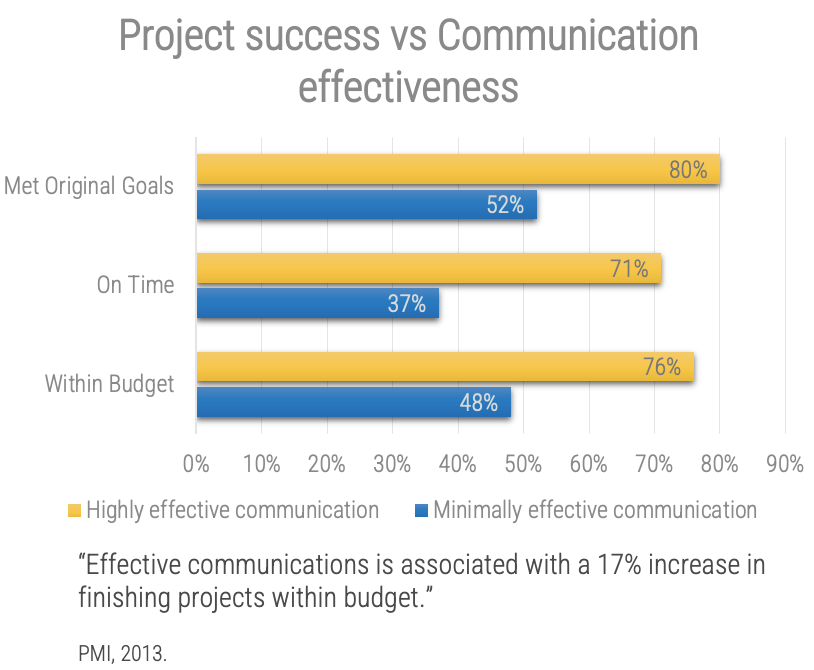

Being successful at Agile is more than about just doing Agile

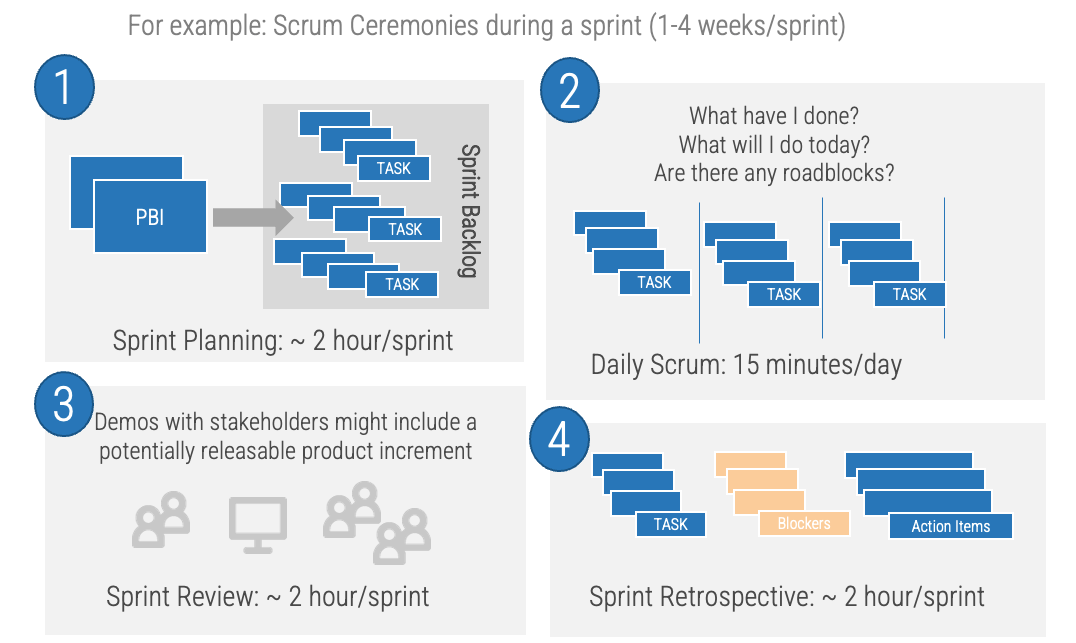

The following represents the hard skills needed to “Do Agile”:

-

Engineering skills. These are the skills and competencies required for building brand-new valuable software.

-

Technician skills. These are the skills and competencies required for maintaining and operating the software delivered to stakeholders.

-

Framework/Process skills. These are the specific knowledge skills required to support engineering or technician skills.

-

Tools skills. This represents the software that helps you deliver other software.

While these are important, they are not the whole story. To effectively deliver software, we believe in the importance of being Agile over simply doing Agile.

Adapted from: “Doing Agile” Is Only Part of the Software Delivery Pie

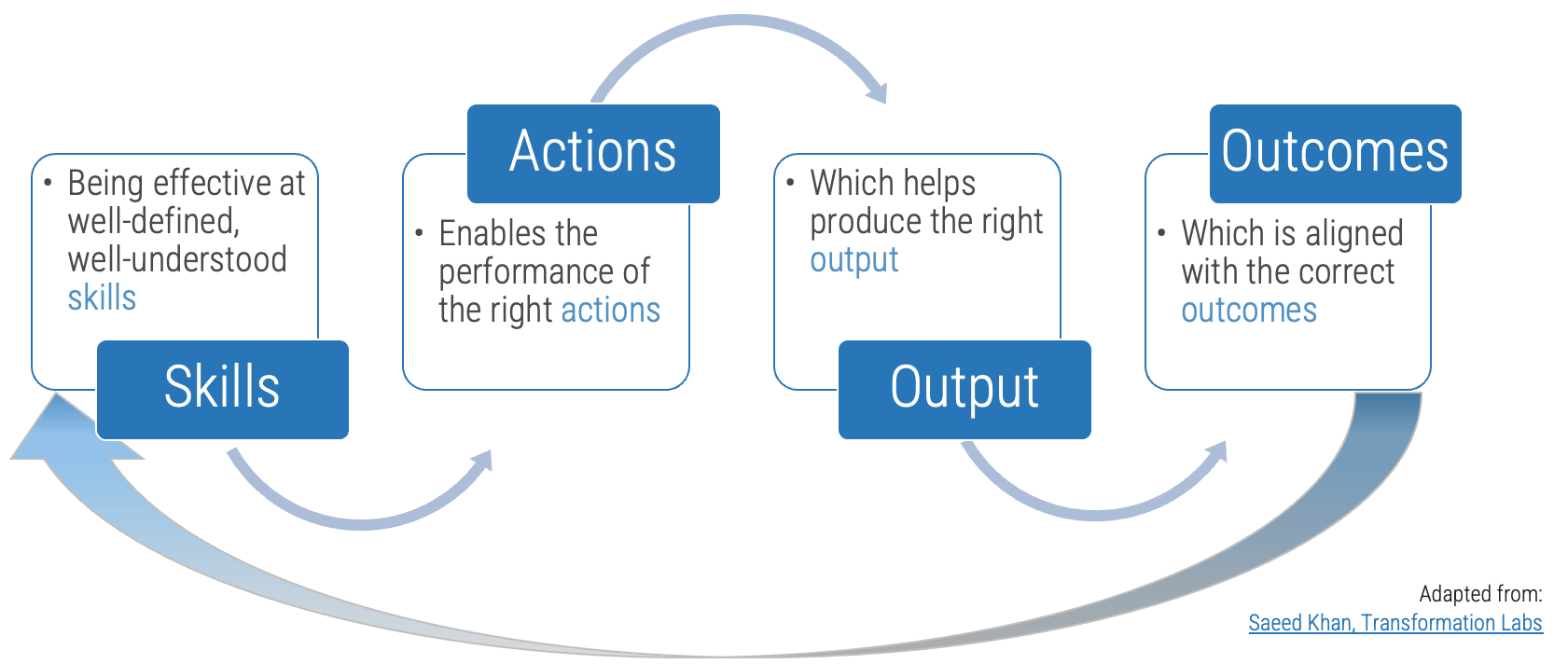

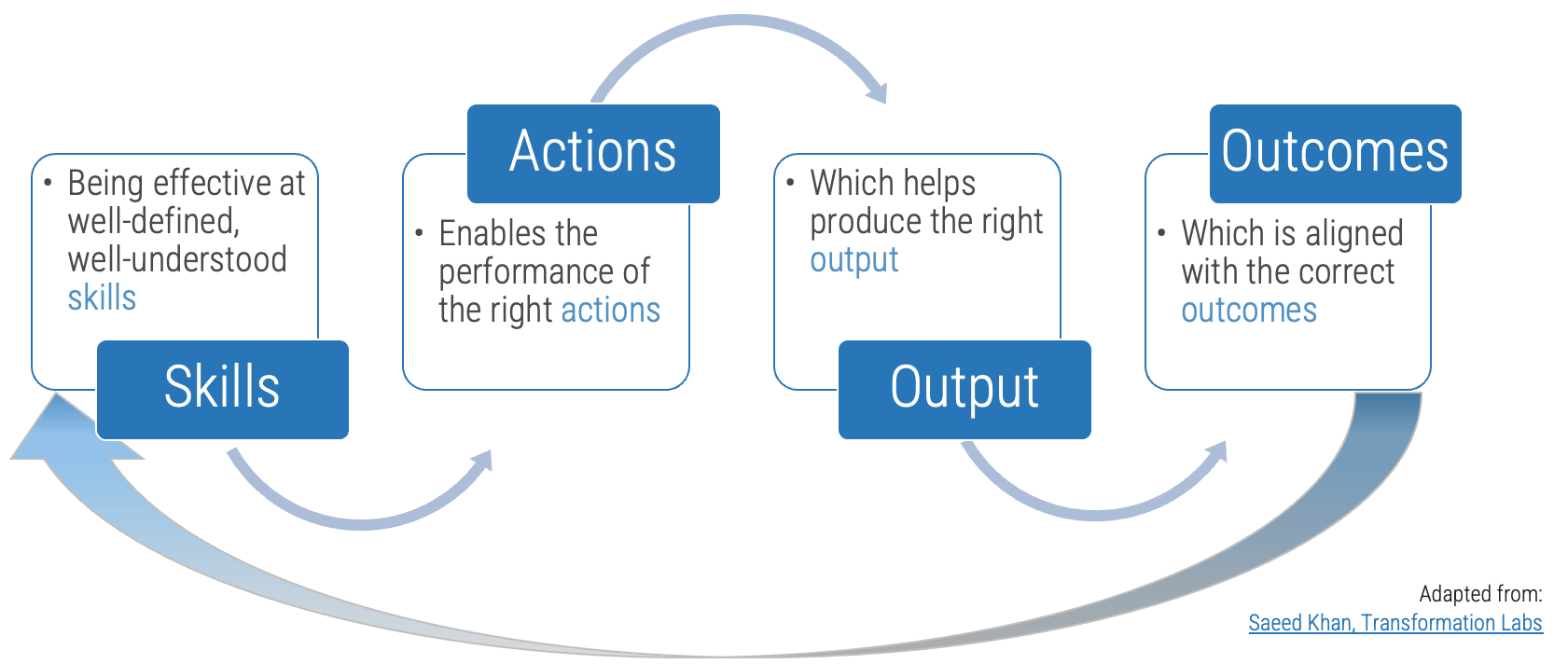

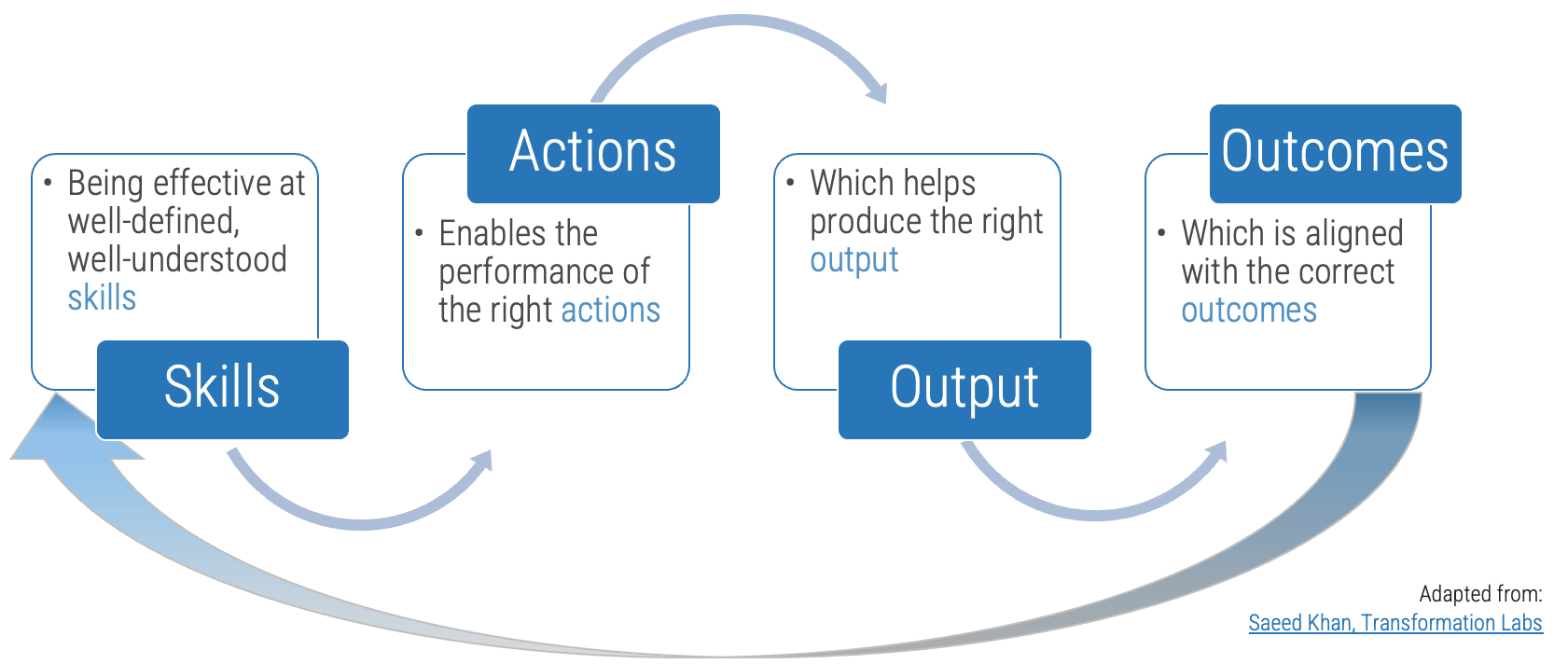

Why focus on core skills?

They are the foundation to achieve business outcomes

The right skills development is only possible with proper assessment and alignment against outcomes.

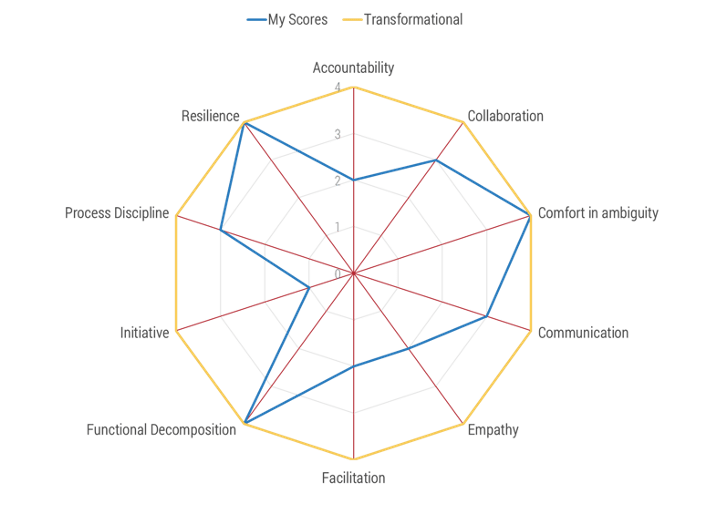

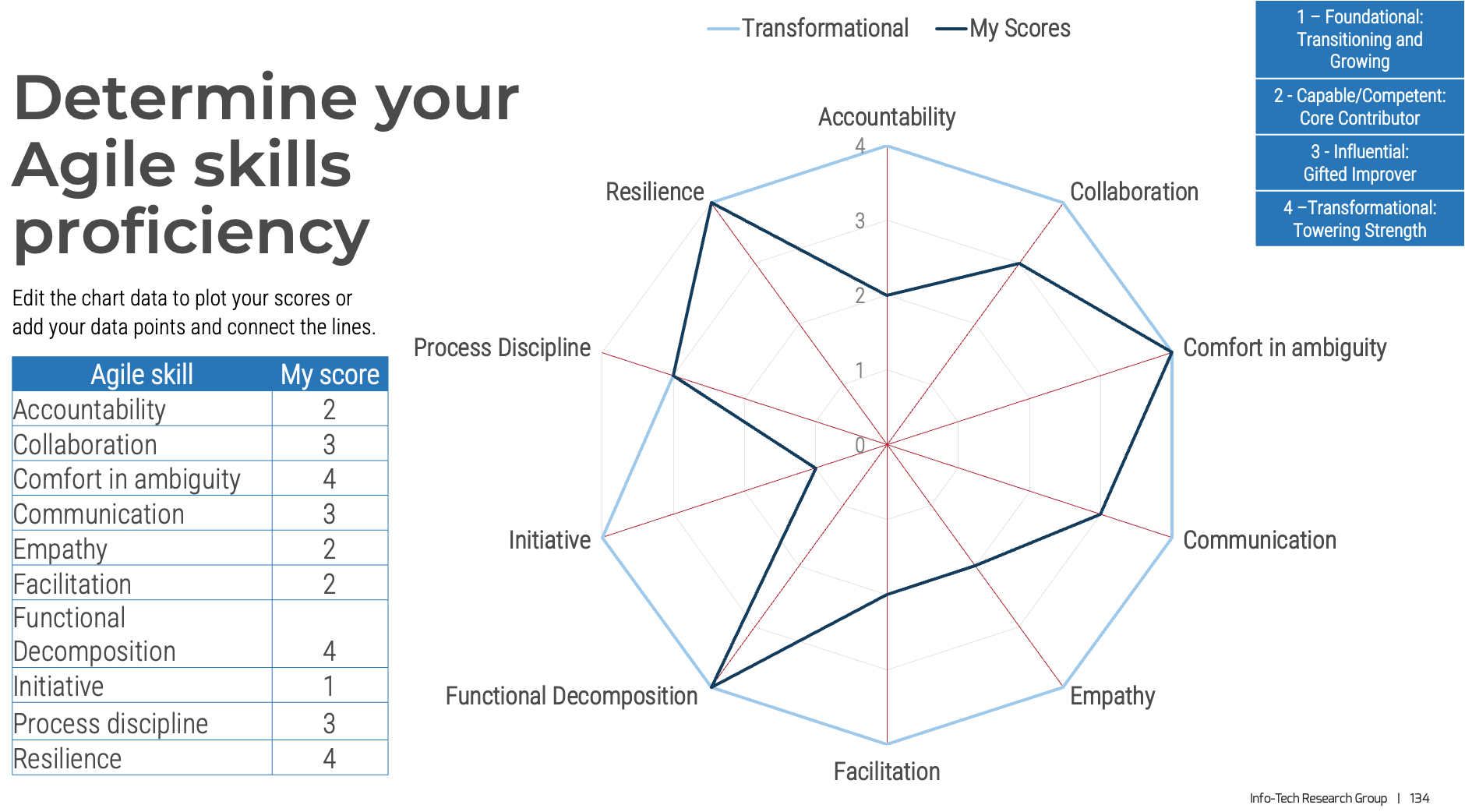

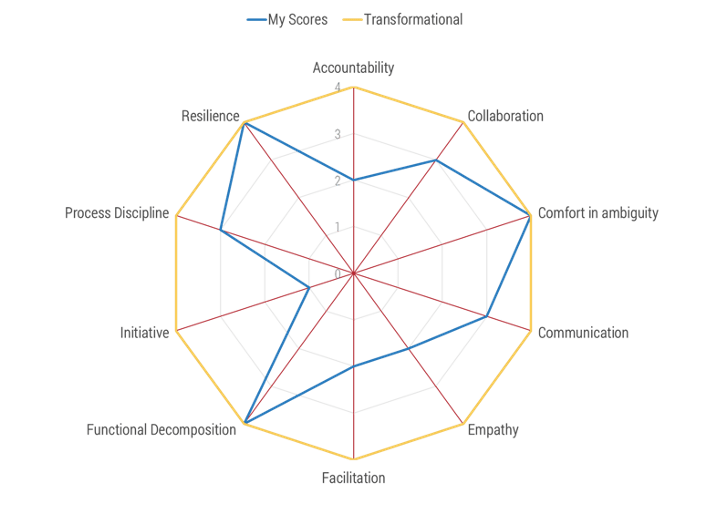

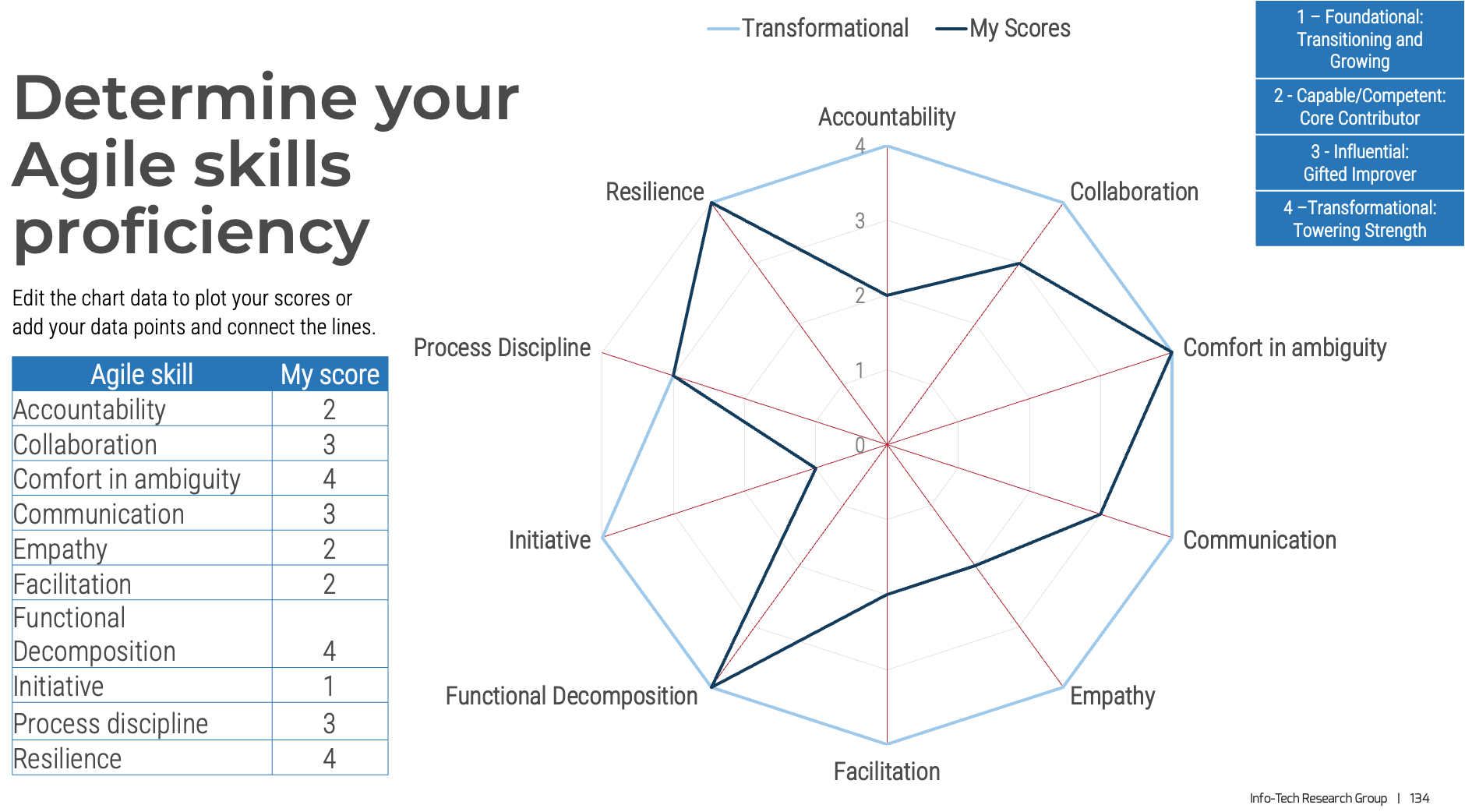

Focus on these real Agile skills

Agile skills

- Accountability

- Collaboration

- Comfort with ambiguity

- Communication

- Empathy

- Facilitation

- Functional decomposition

- Initiative

- Process discipline

- Resilience

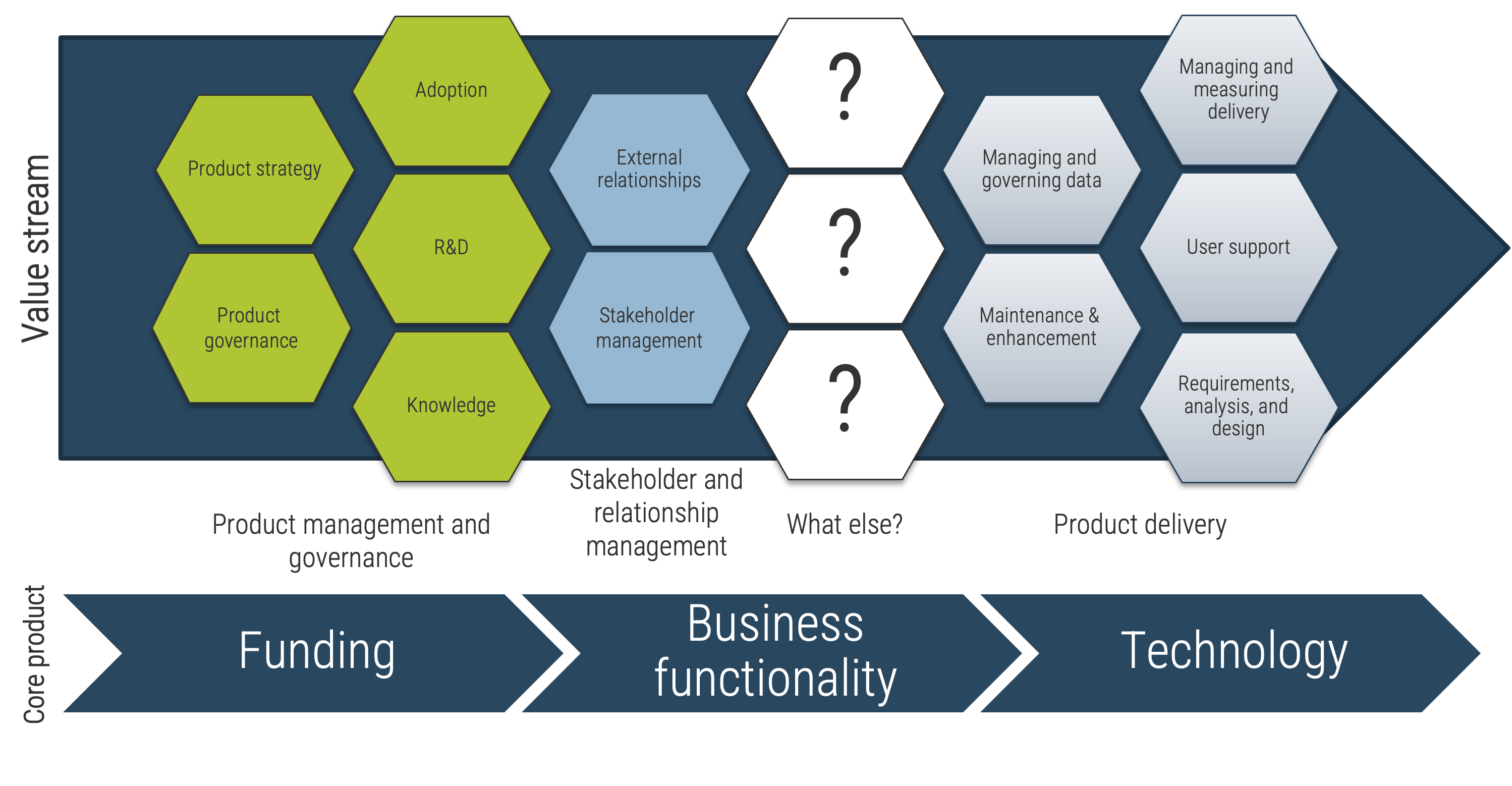

Product capabilities deliver value

As a product owner, you are responsible for managing these facets through your capabilities and activities.

Info-Tech Best Practice

It is easy to lose sight of what matters when we look at a product from a single point of view. Despite what "The Agile Manifesto" says, working software is not valuable without the knowledge and support that people need in order to adopt, use, and maintain it. If you build it, they will not come. Product owners must consider the needs of all stakeholders when designing and building products.

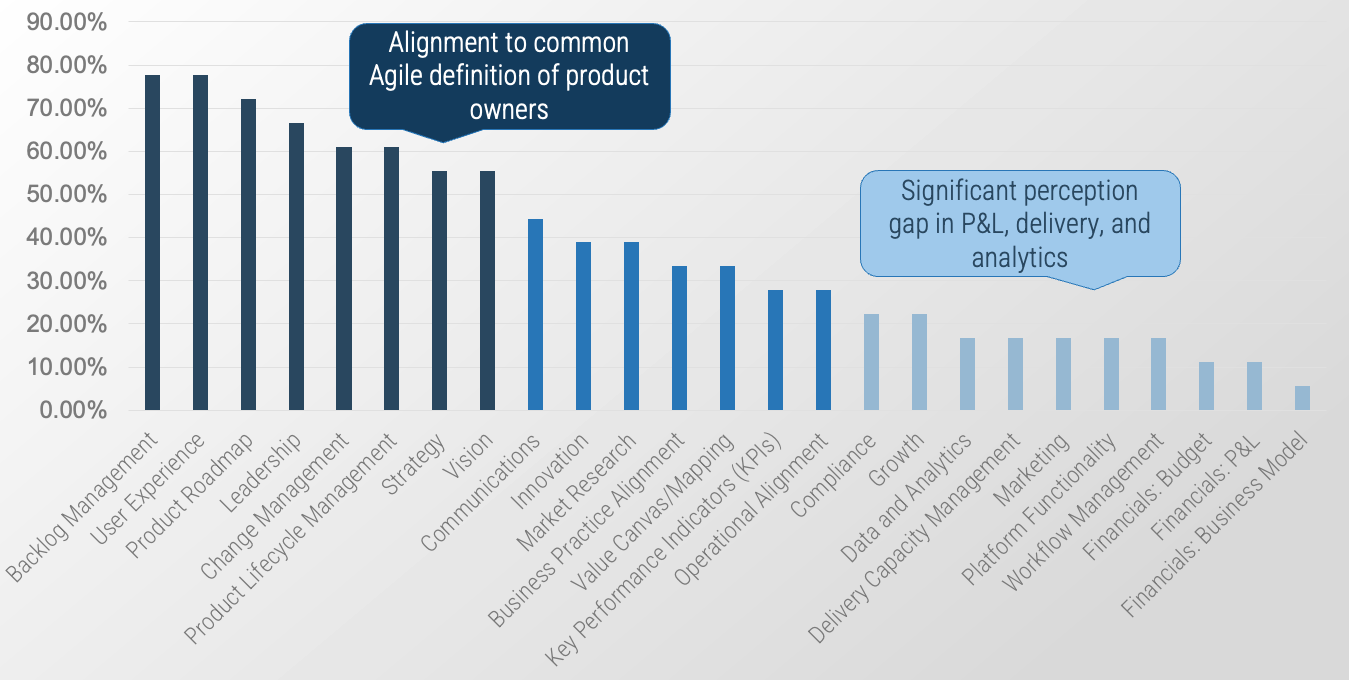

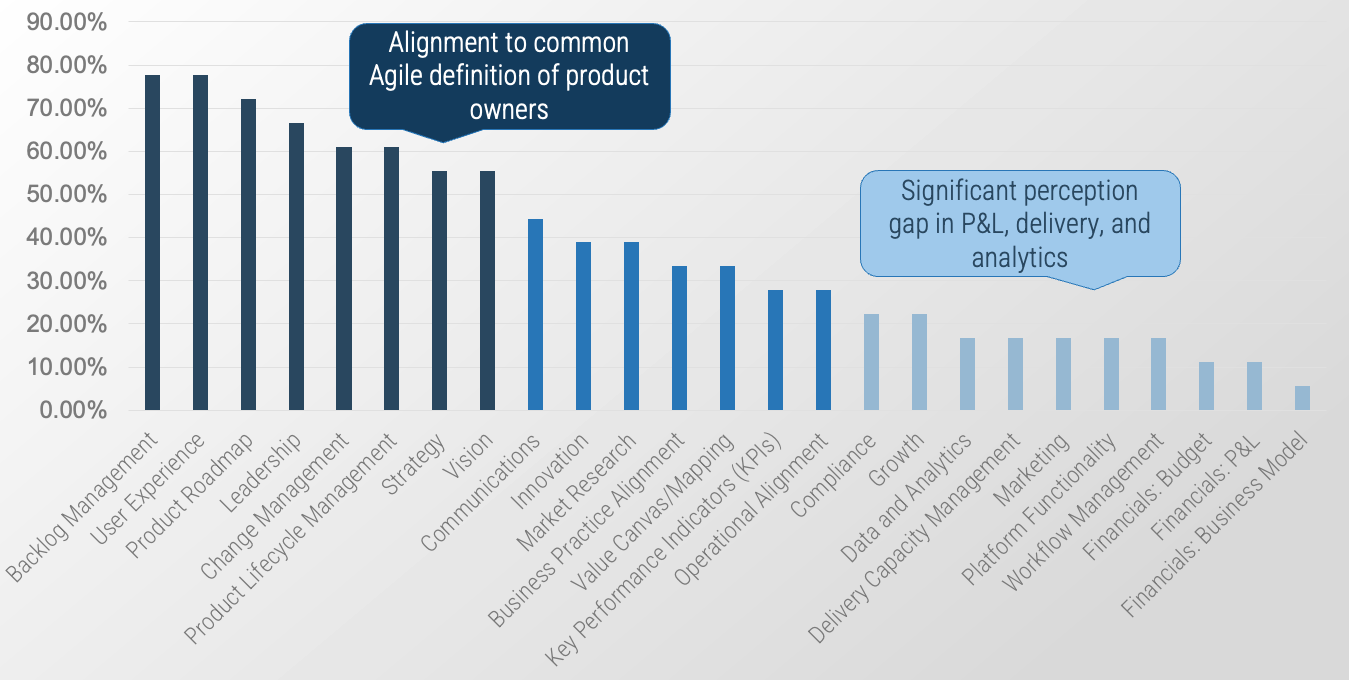

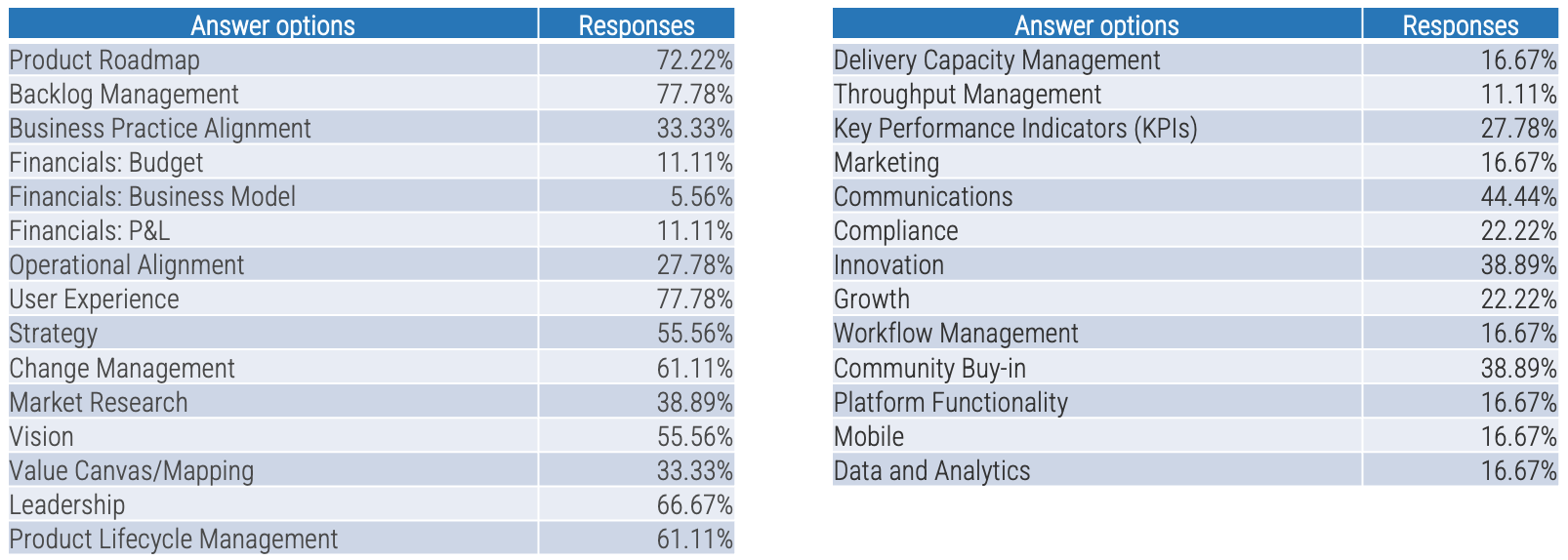

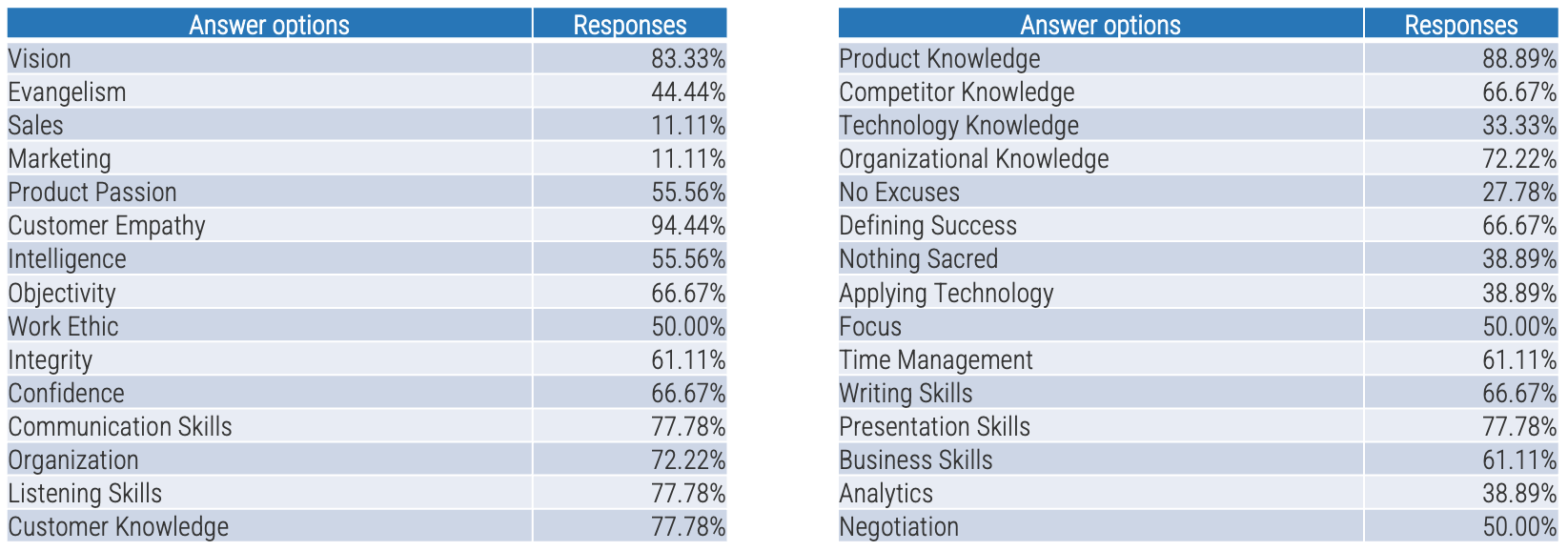

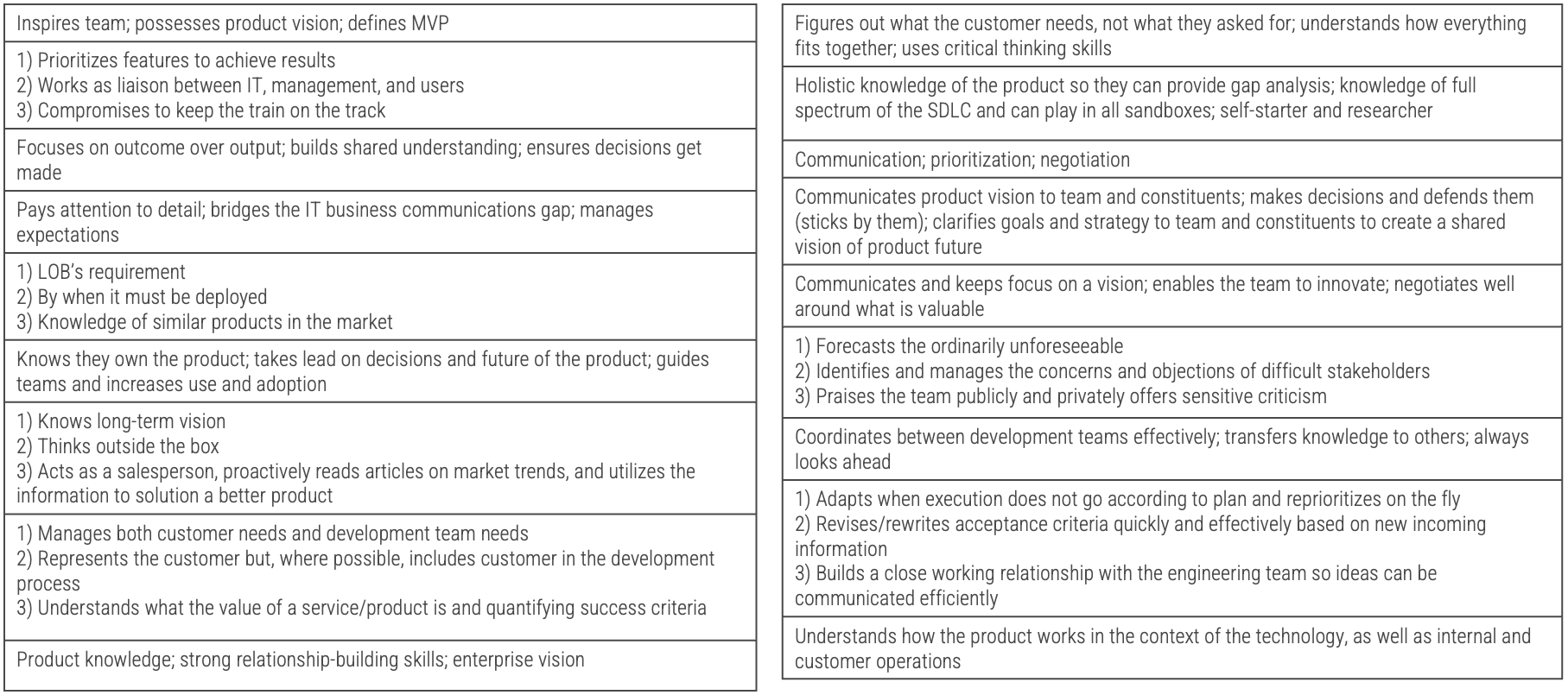

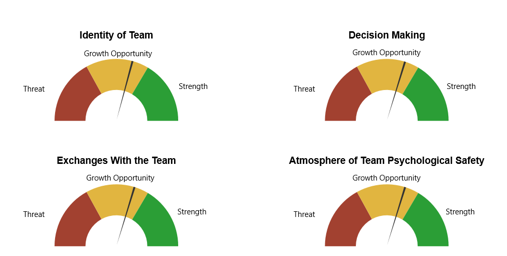

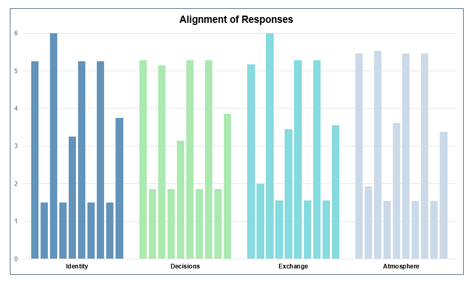

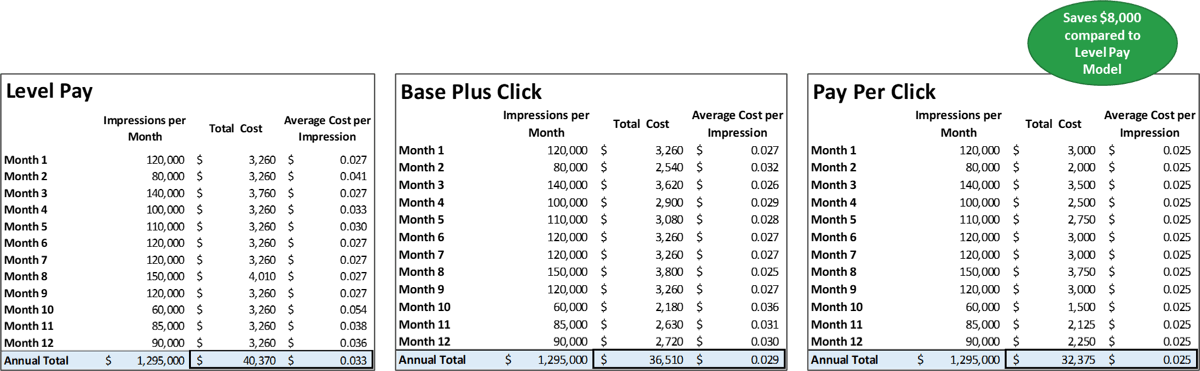

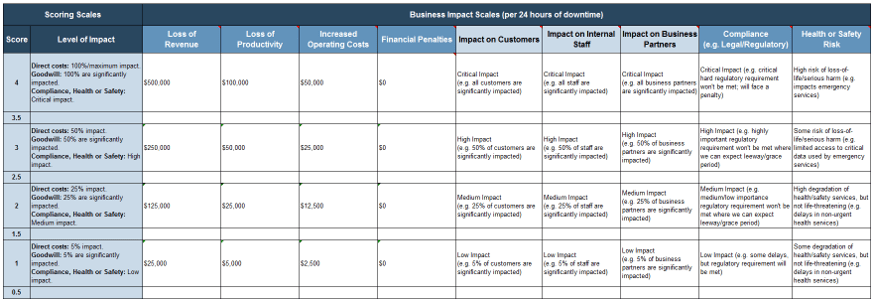

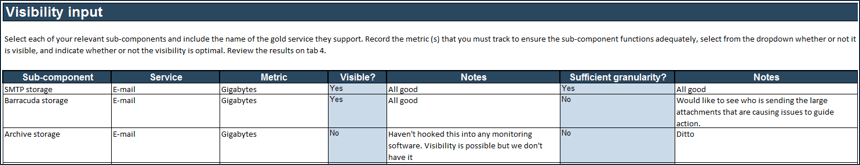

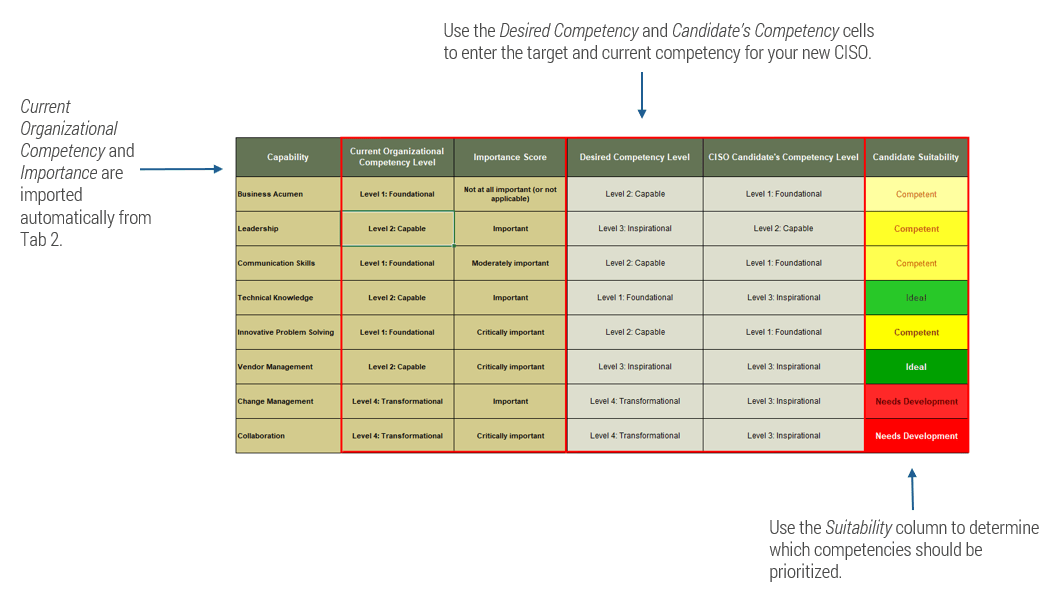

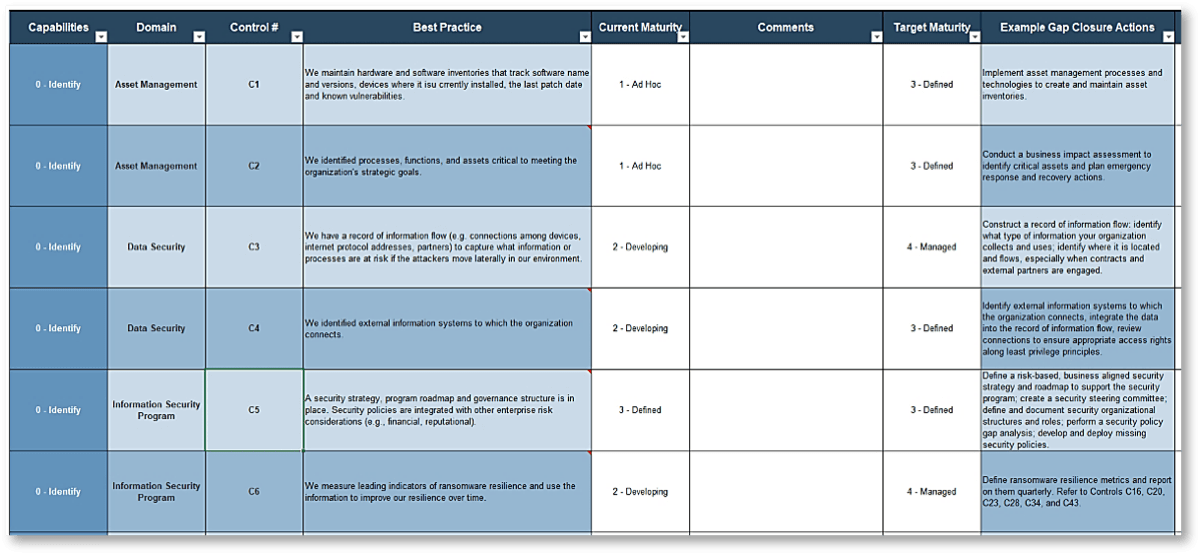

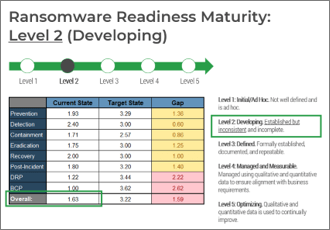

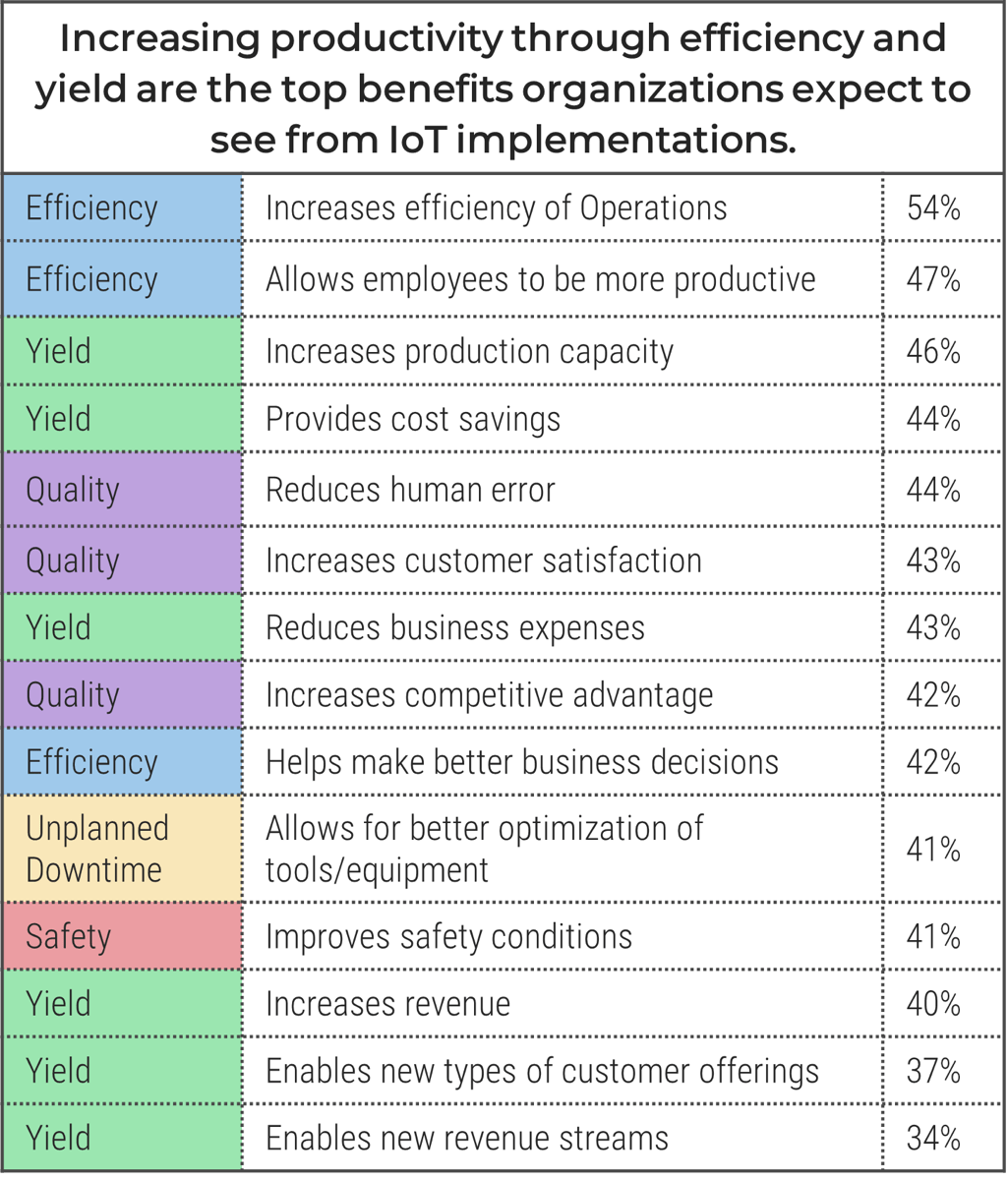

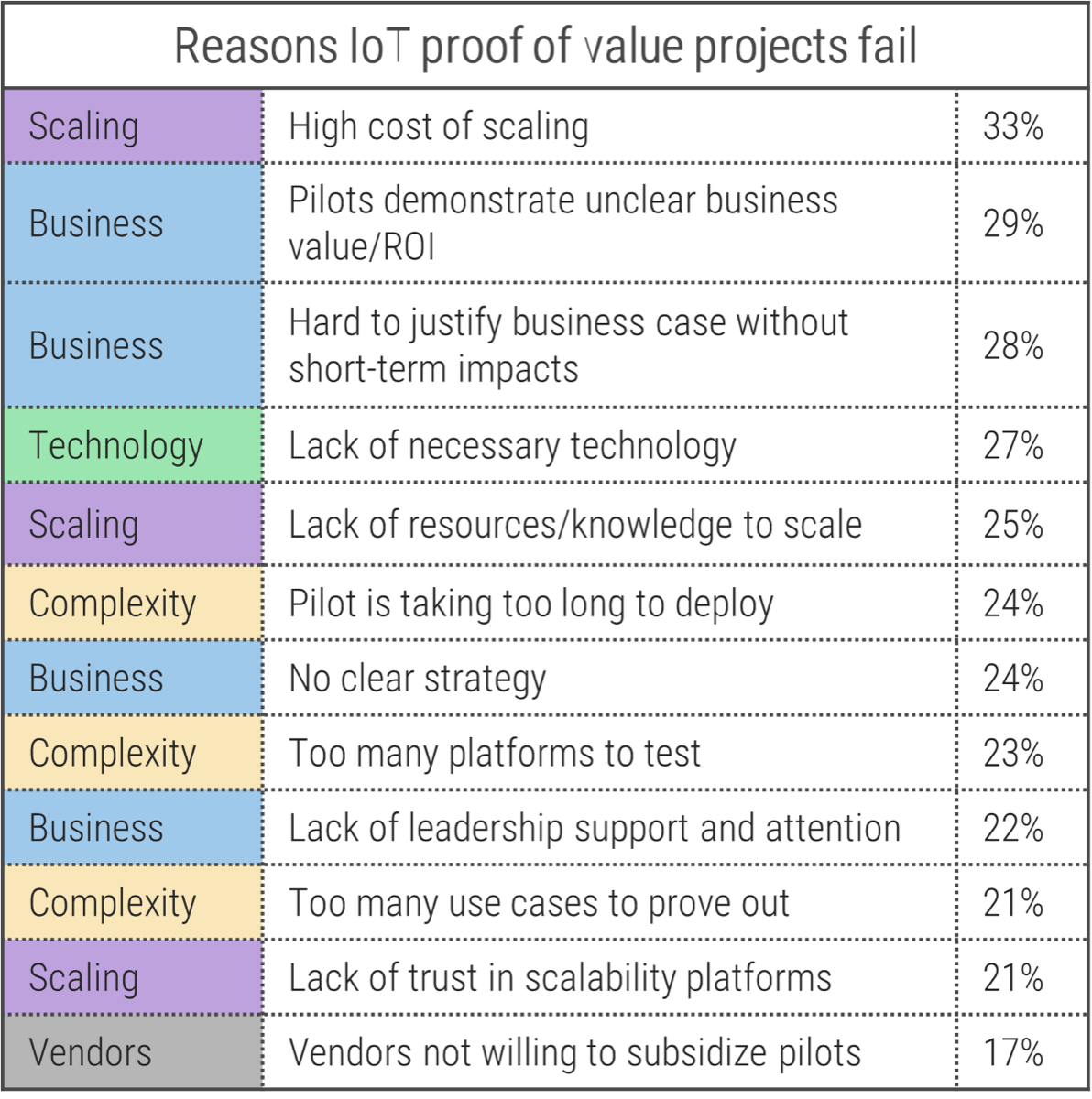

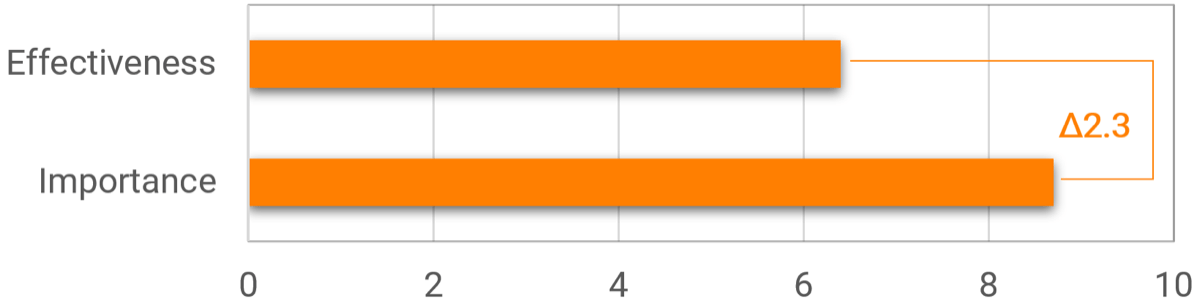

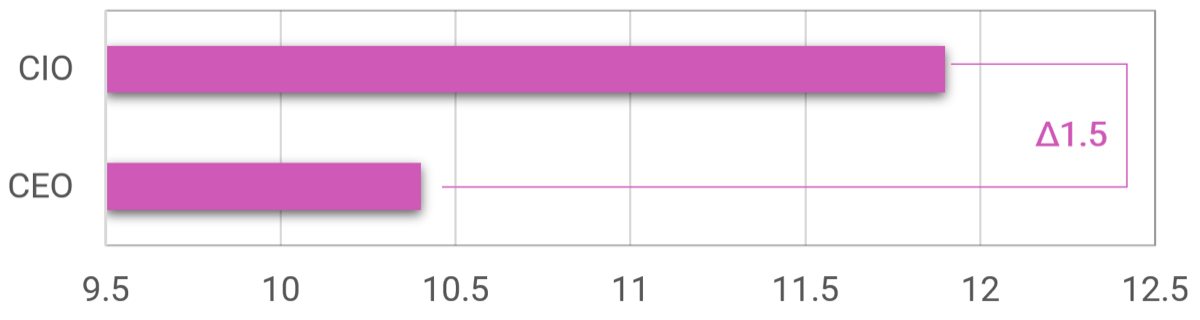

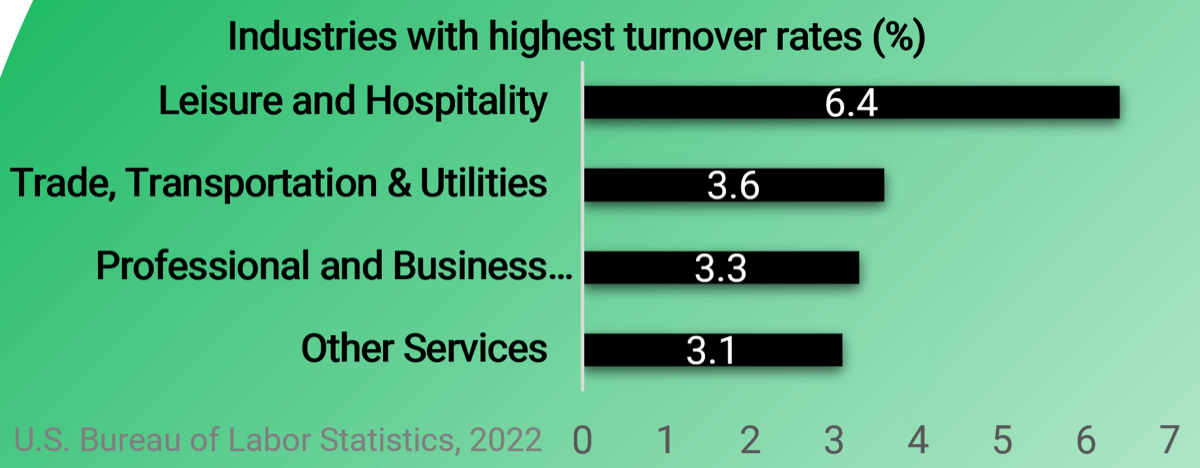

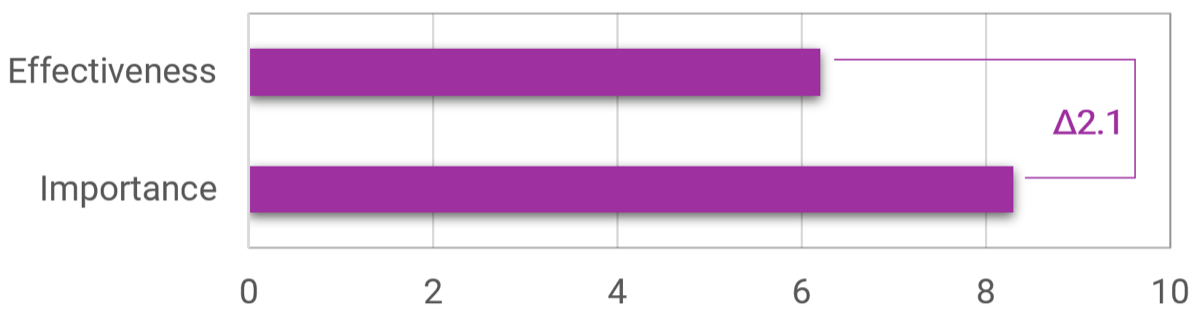

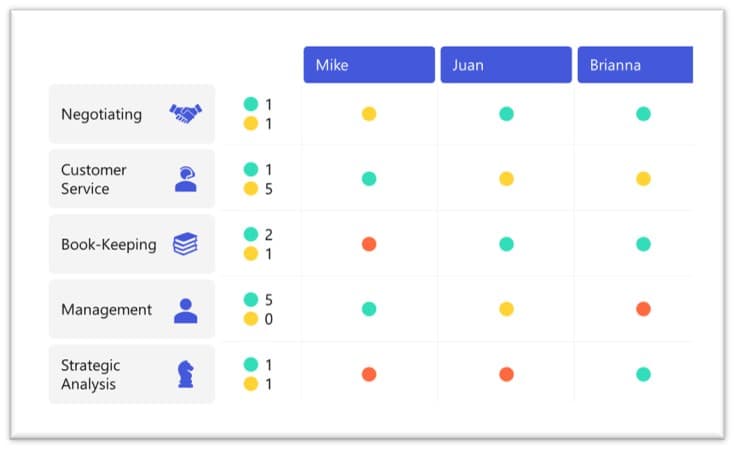

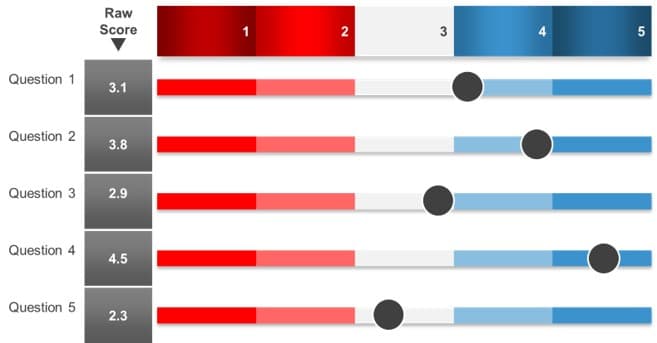

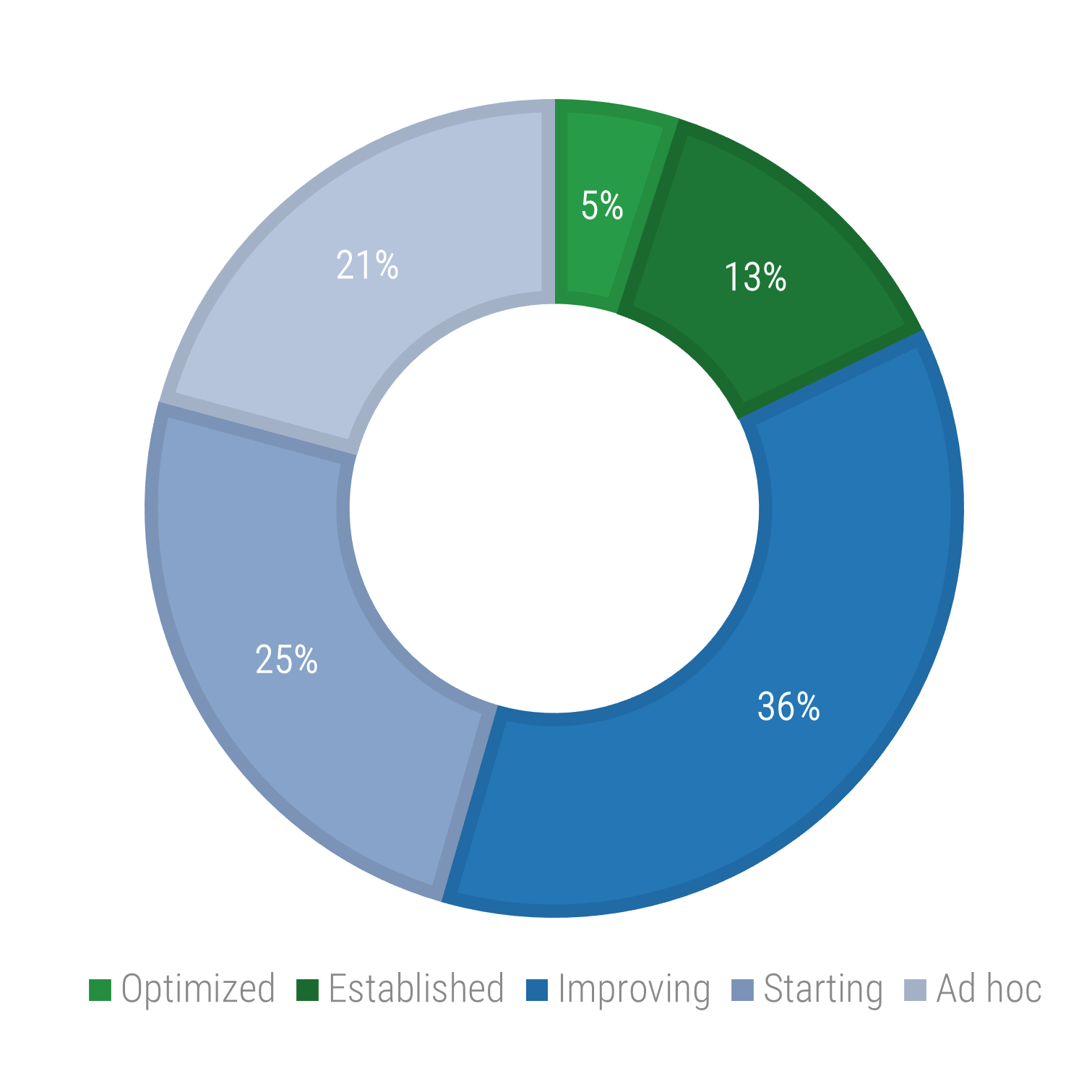

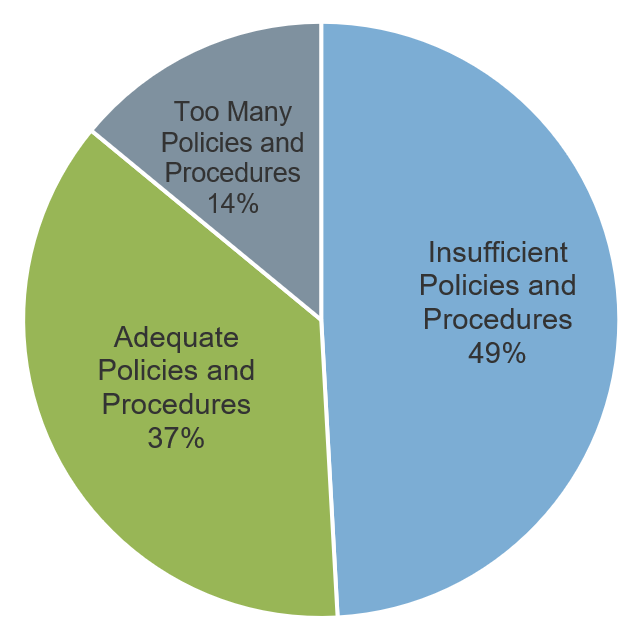

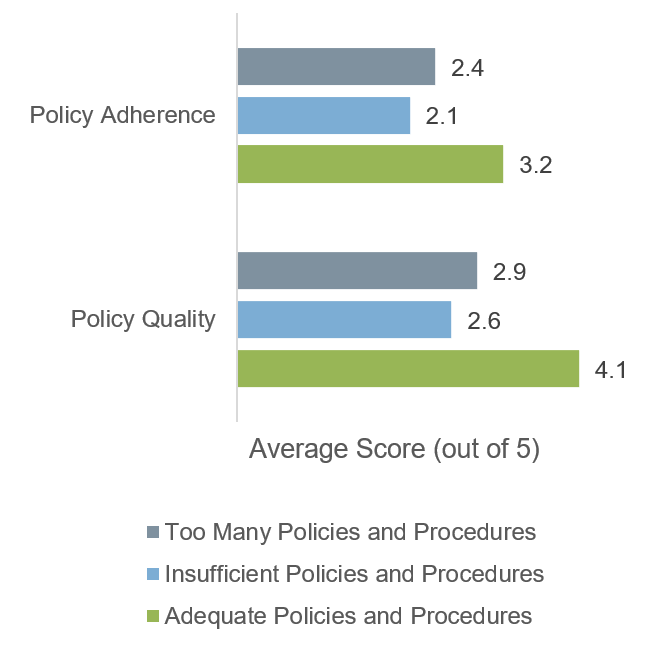

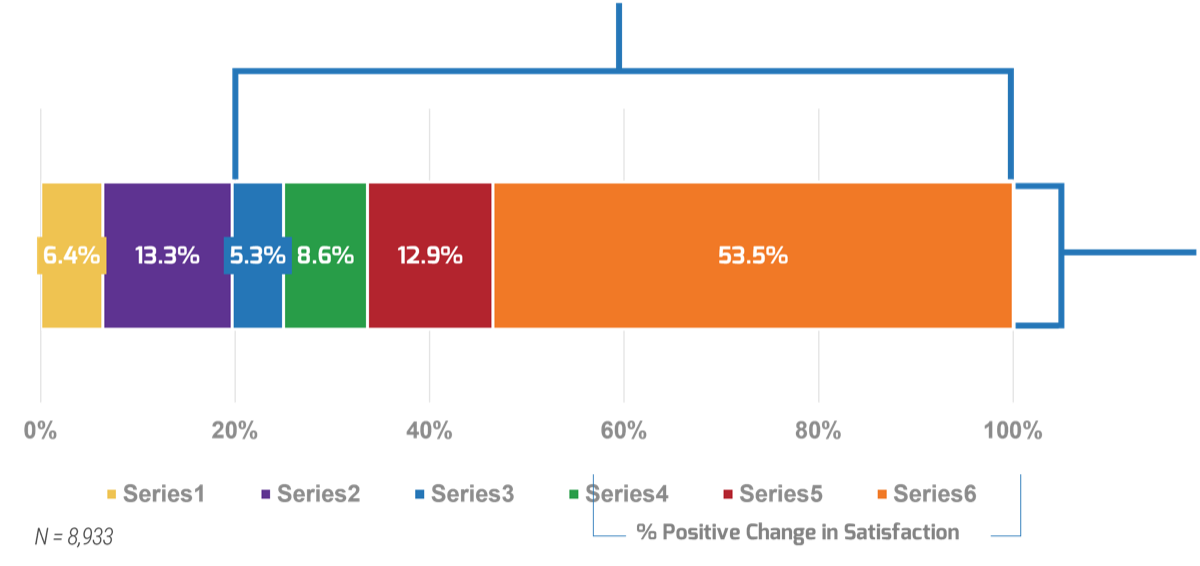

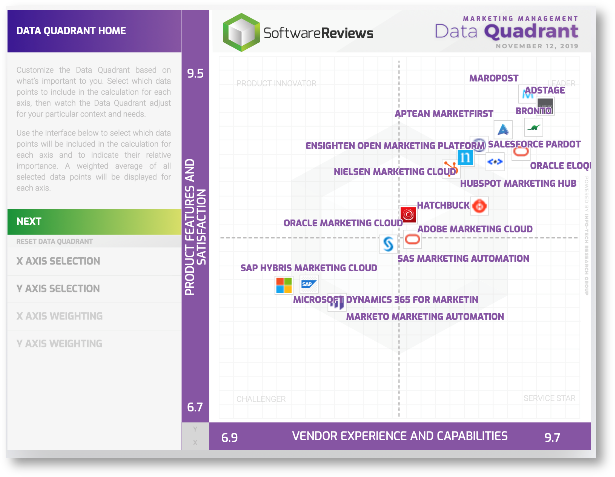

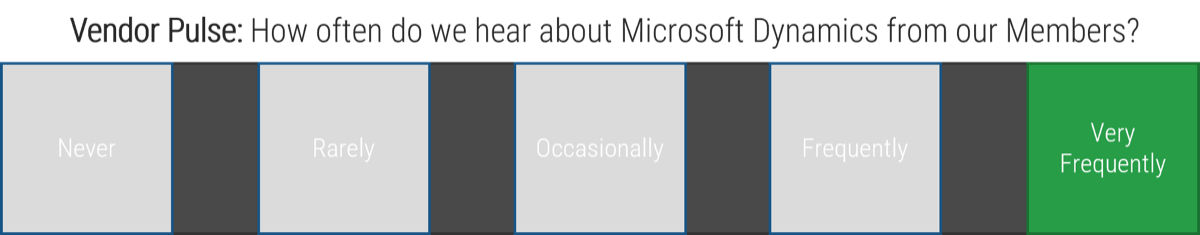

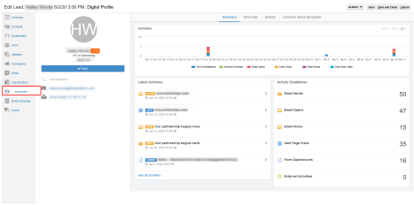

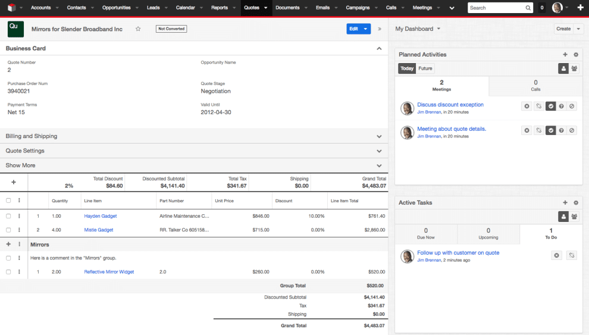

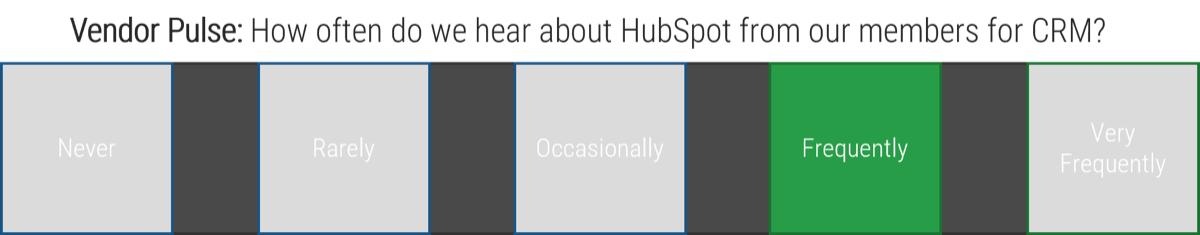

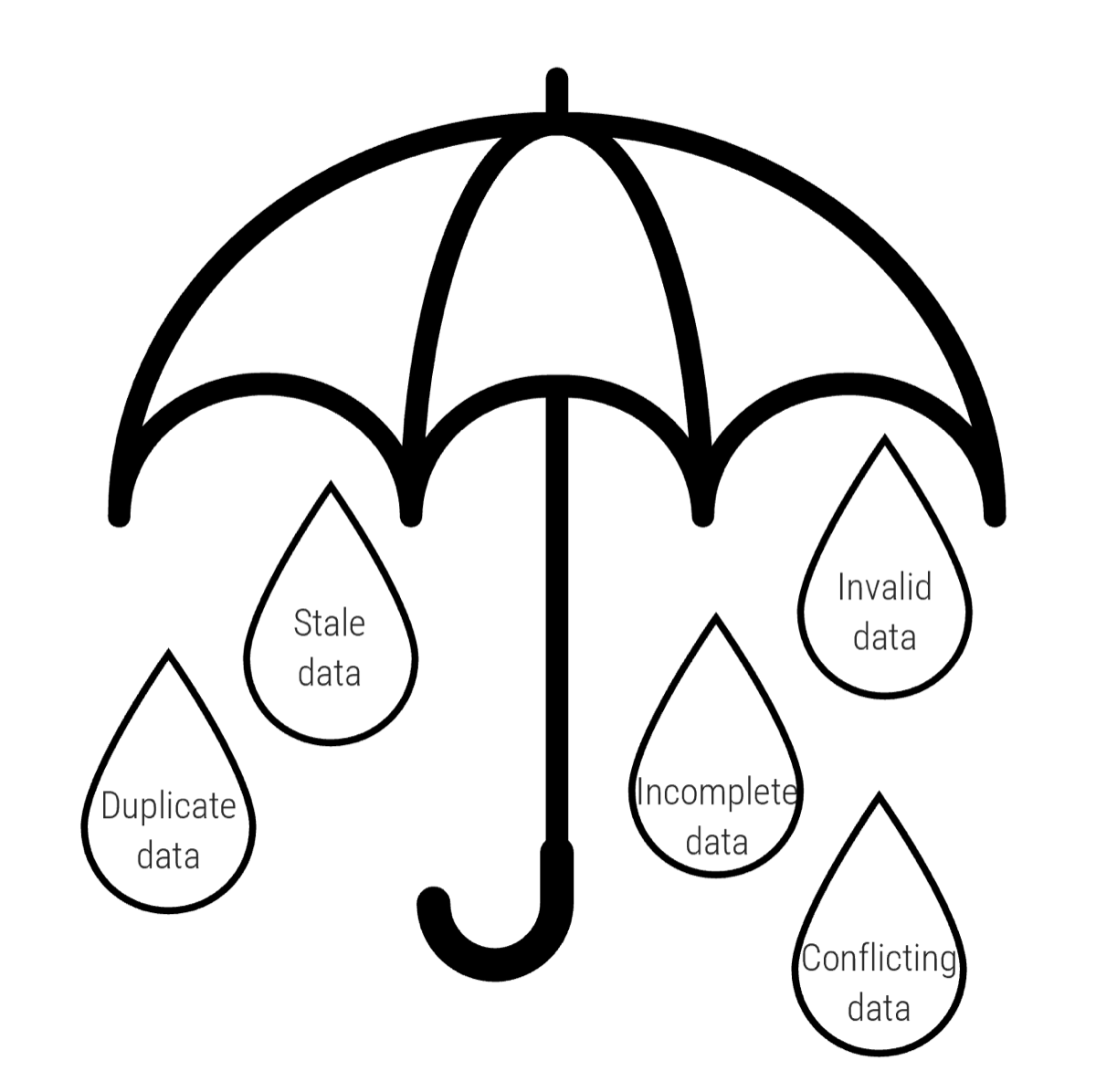

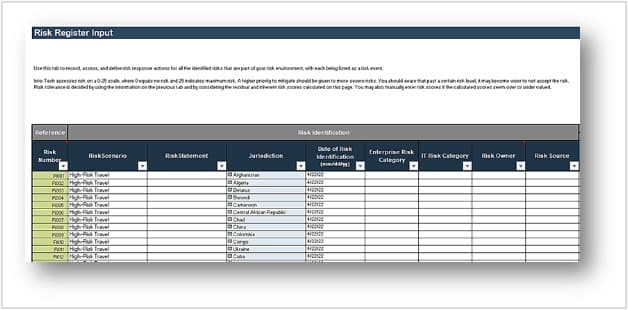

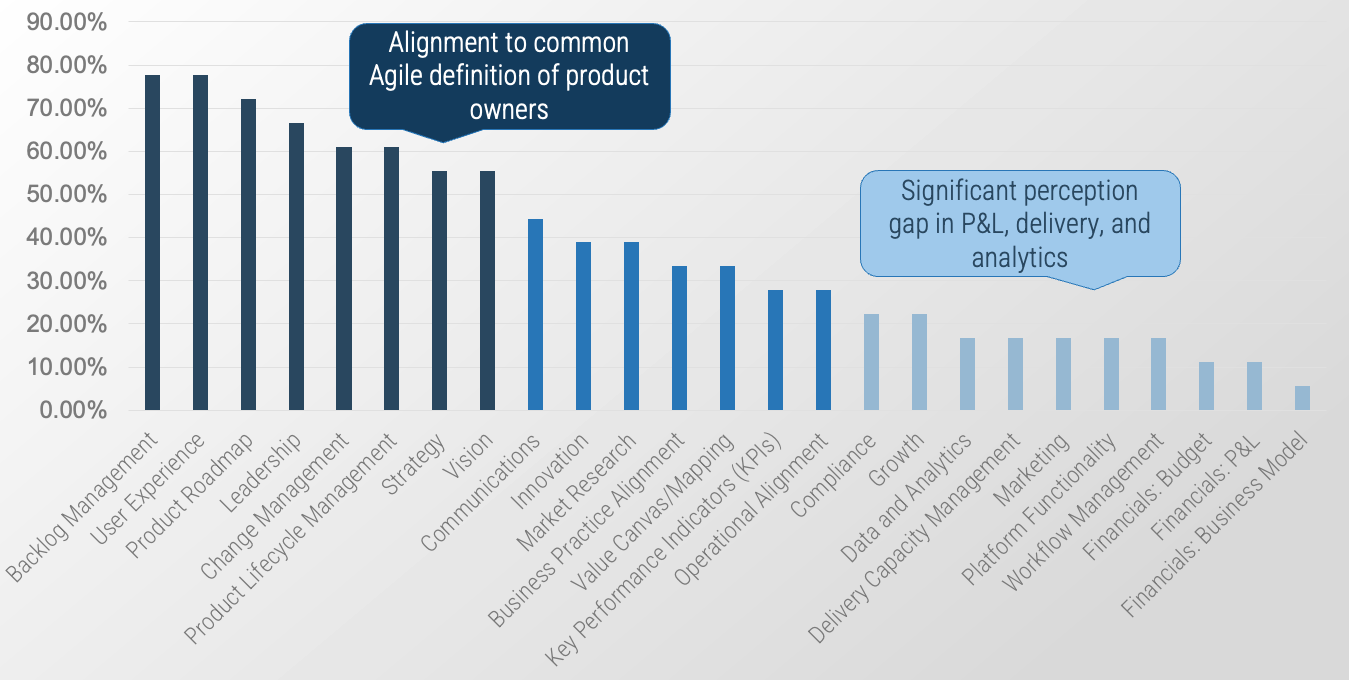

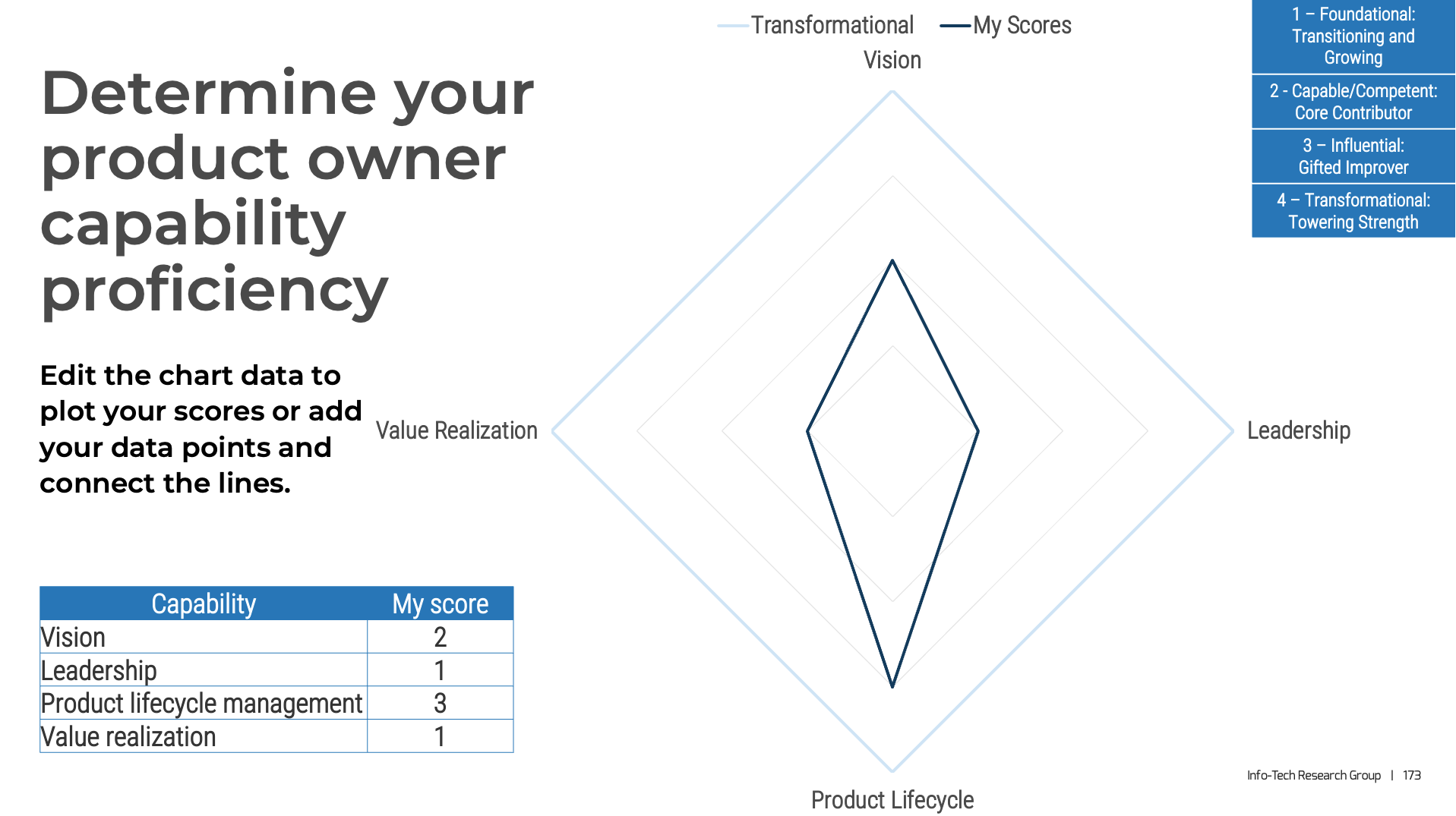

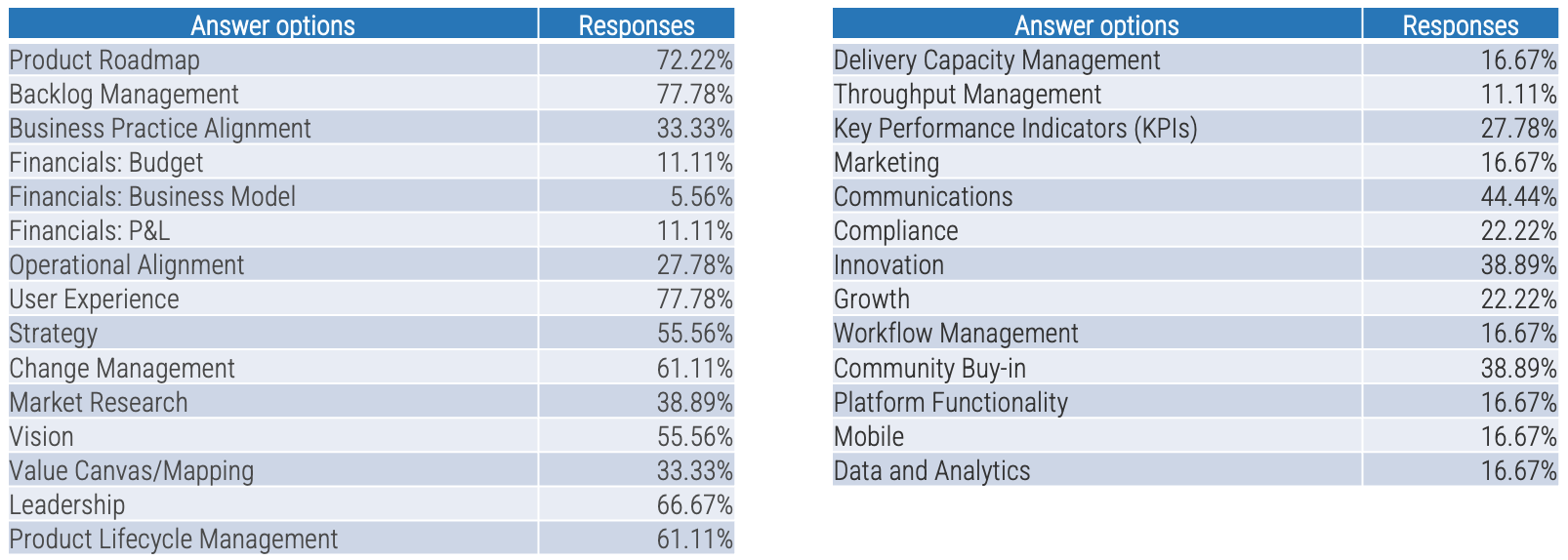

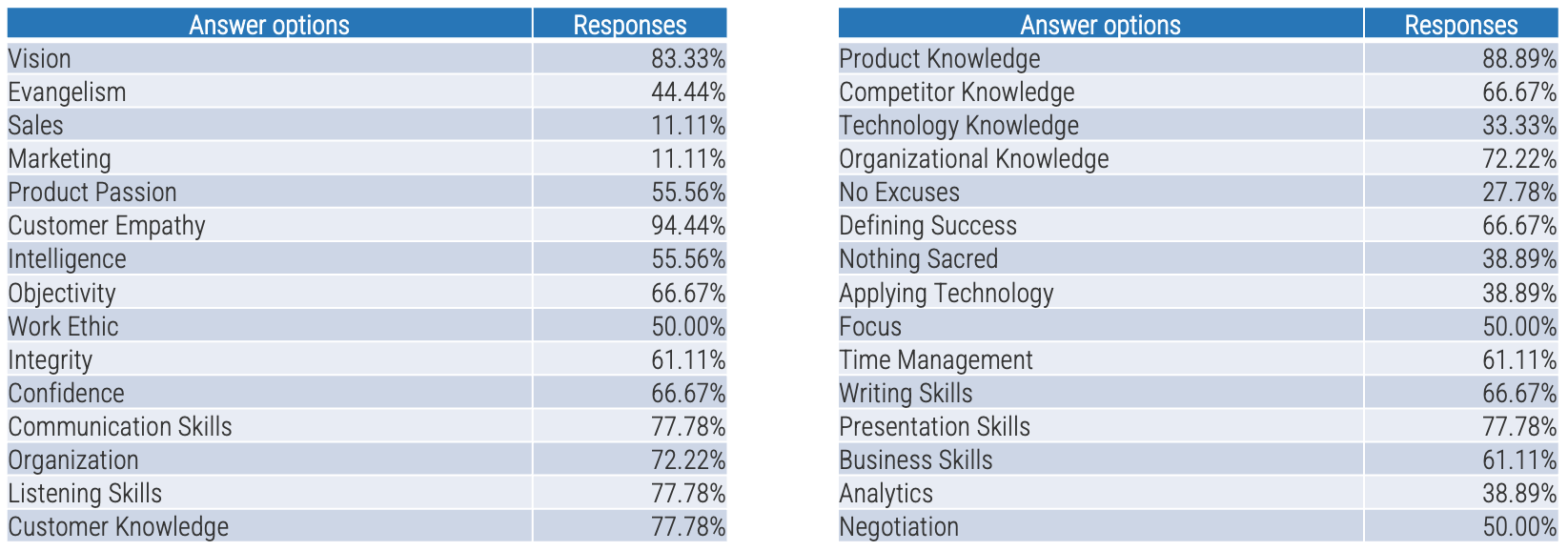

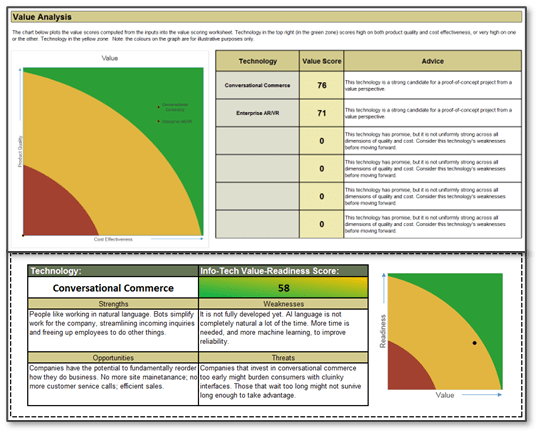

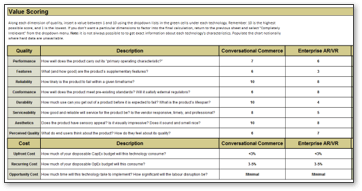

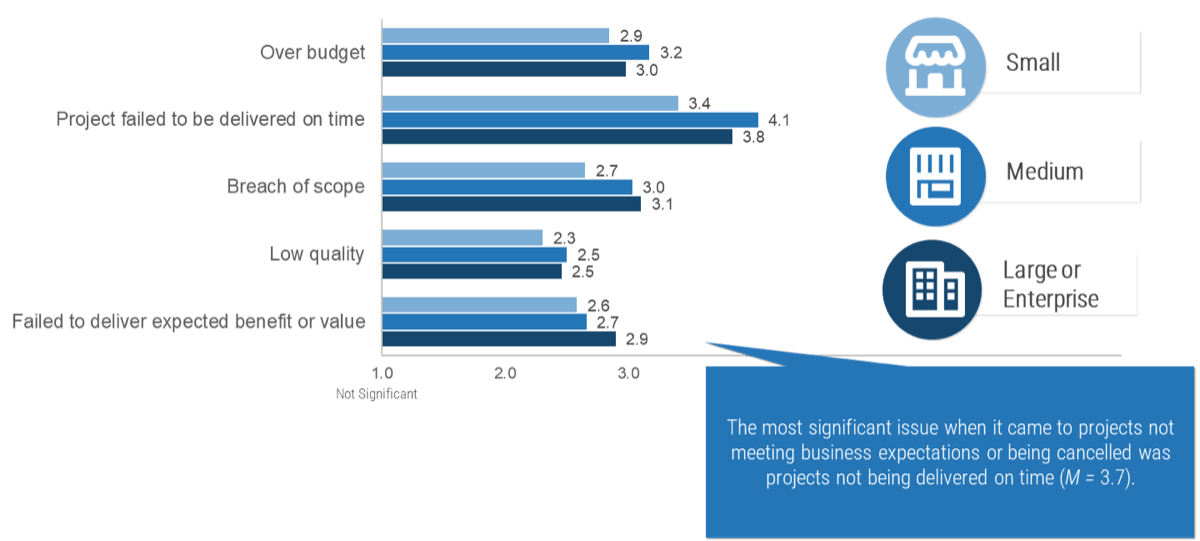

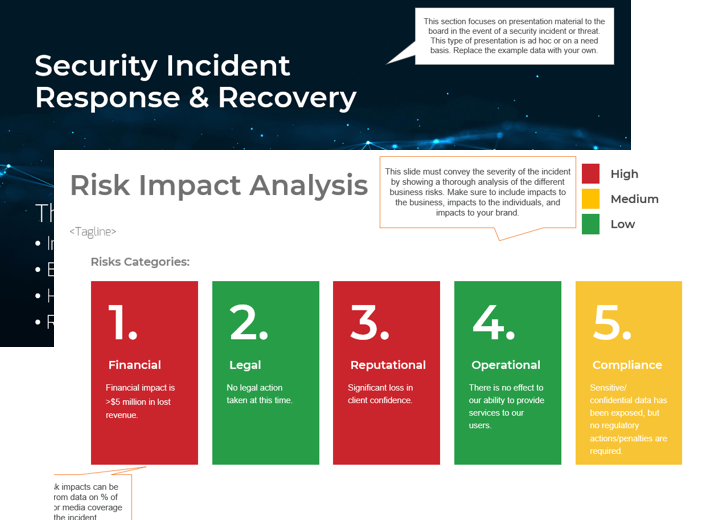

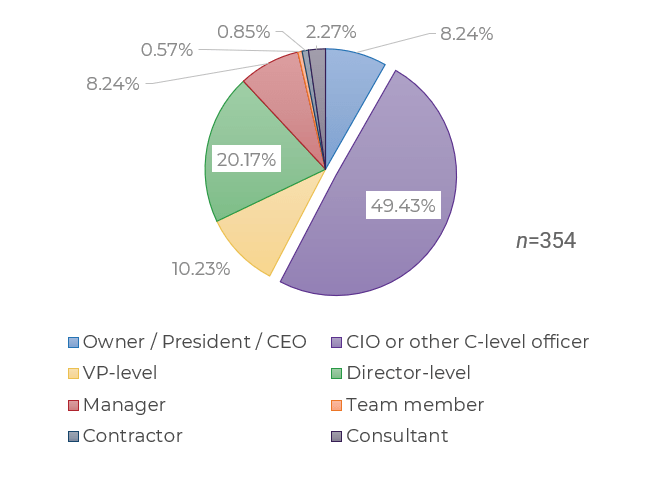

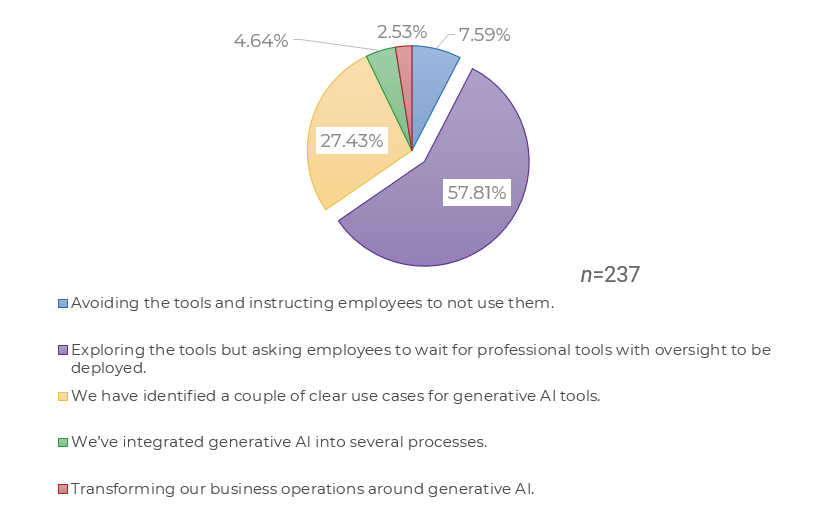

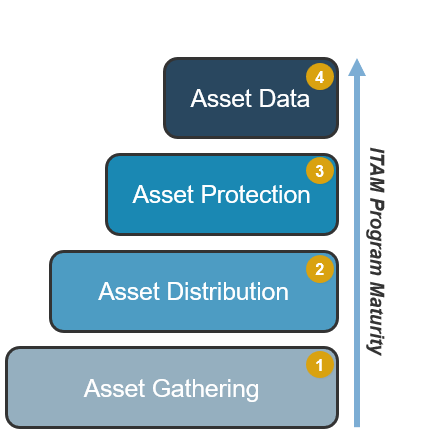

Recognize product owner knowledge gaps

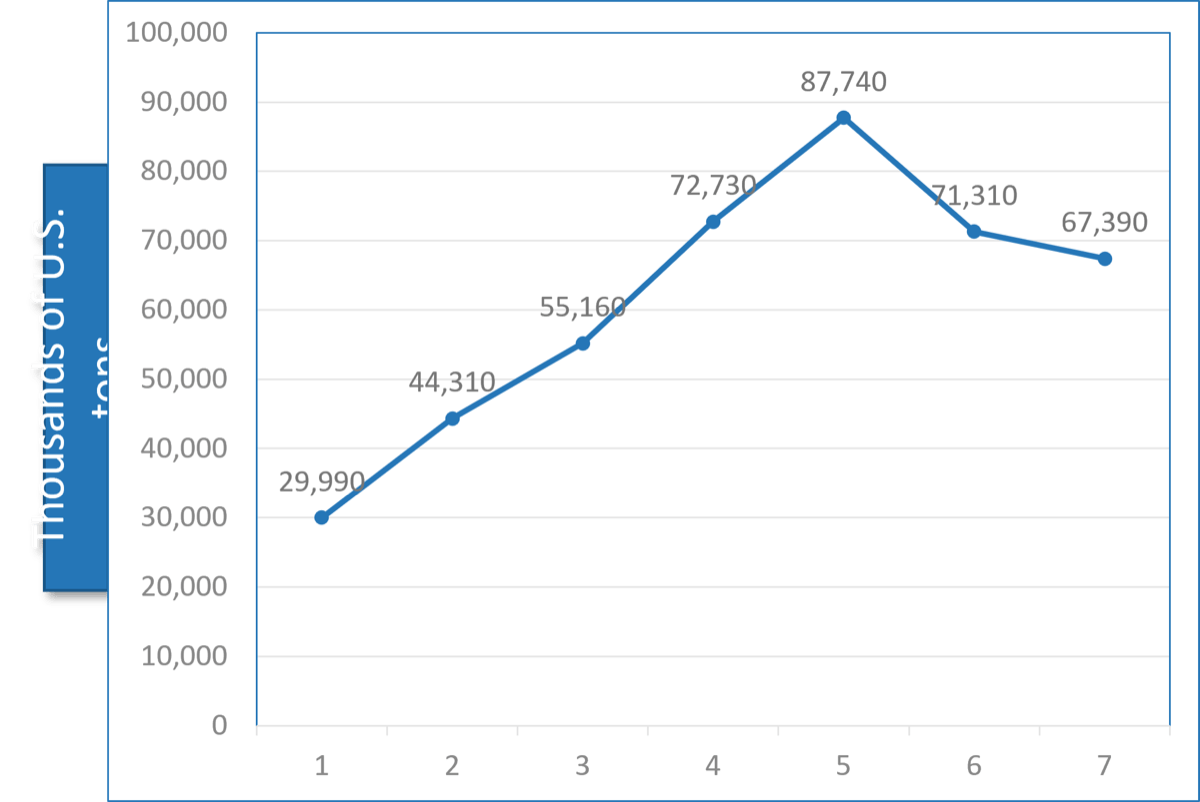

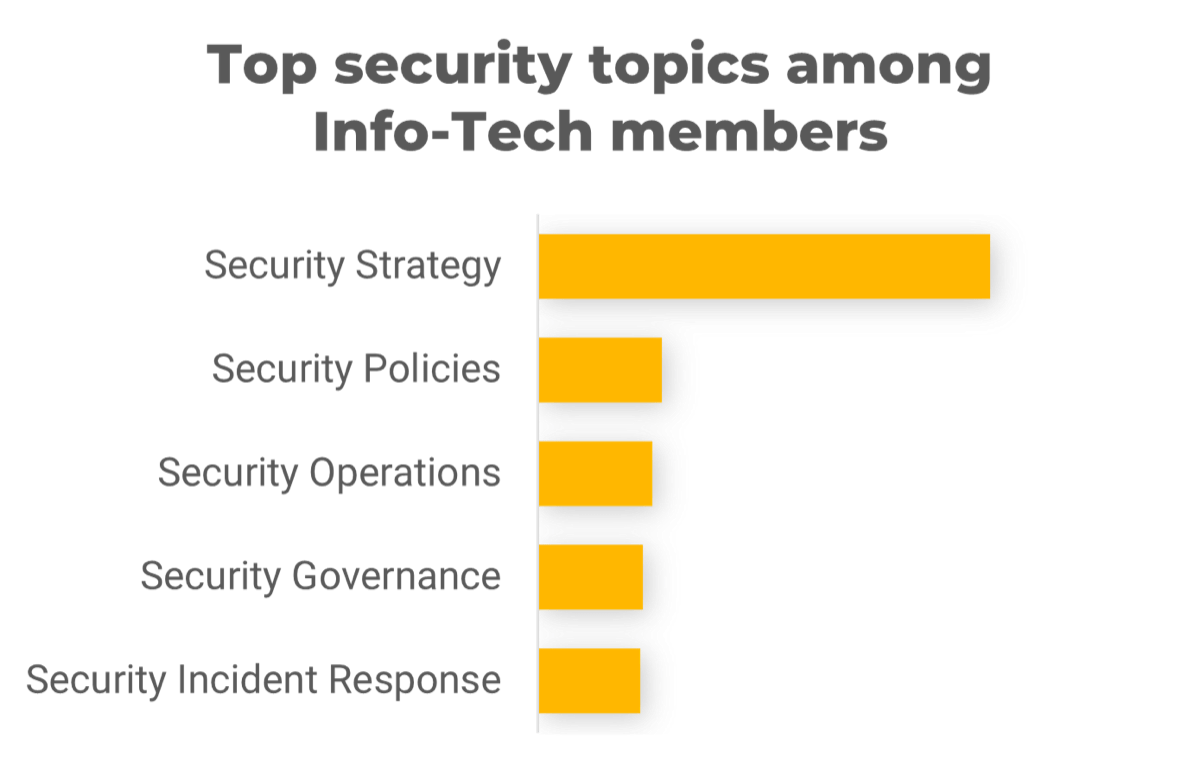

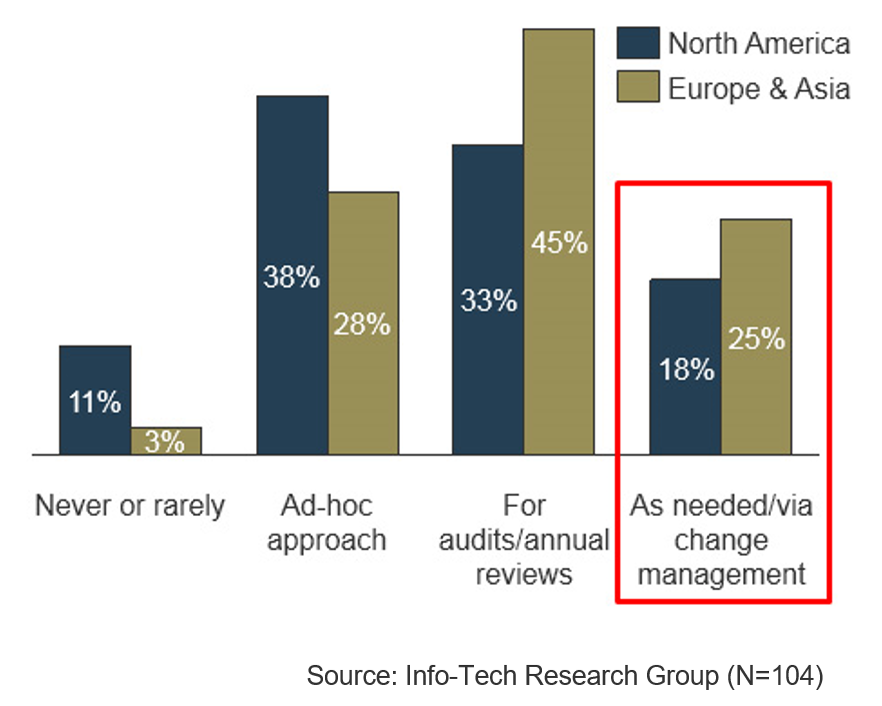

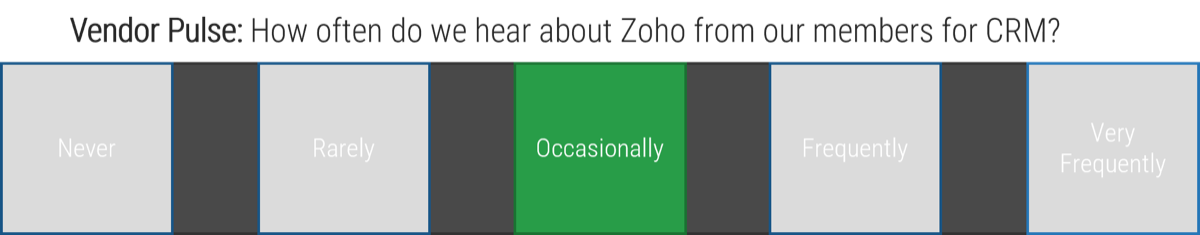

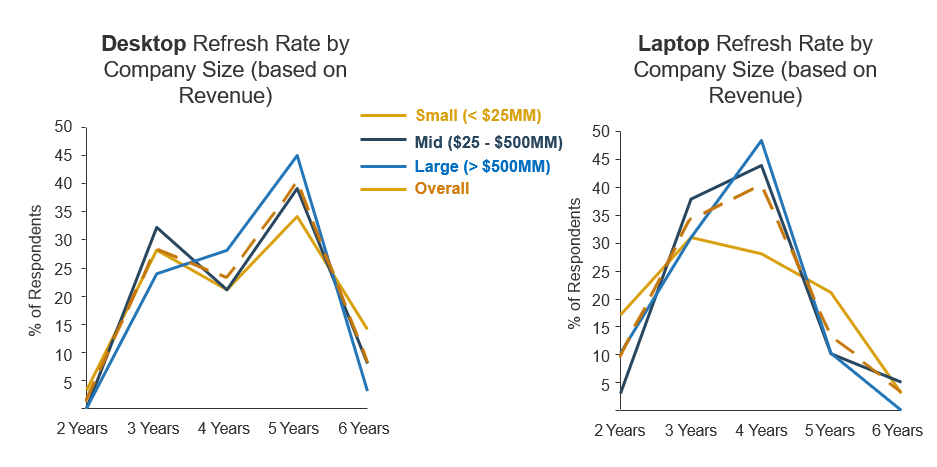

Pulse survey of product owners

Info-Tech Insight

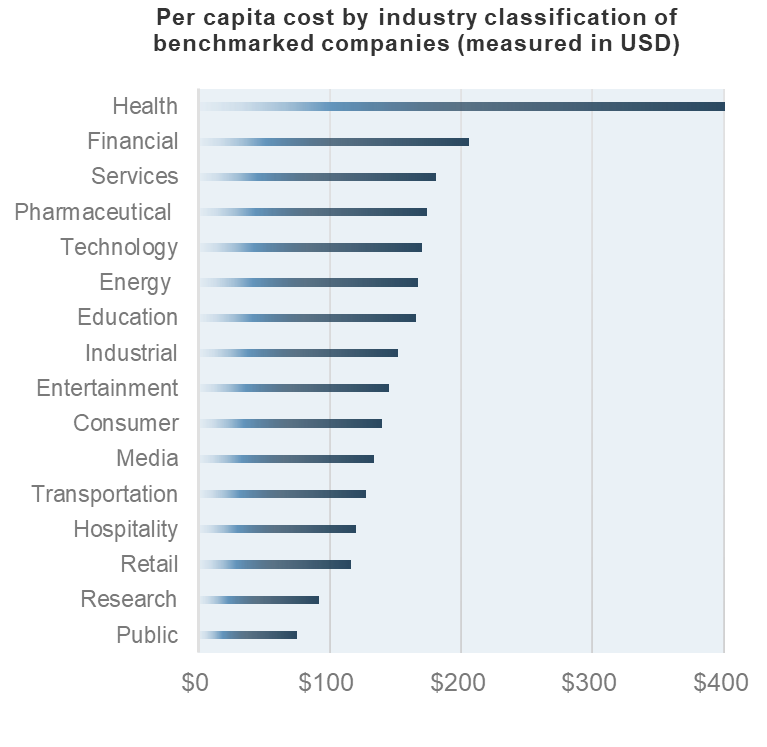

-

Less than 15% of respondents identified analytics or financial management as a key component of product ownership.

-

Assess your product owner’s capabilities and understanding to develop a maturity plan.

Source: Pulse Survey (N=18)

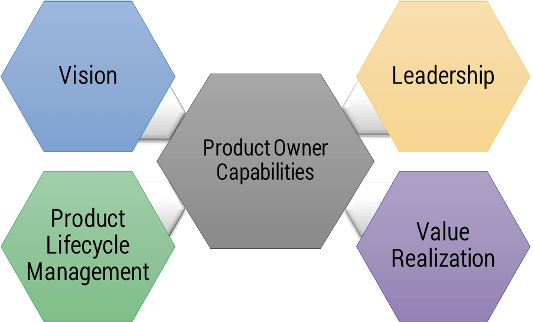

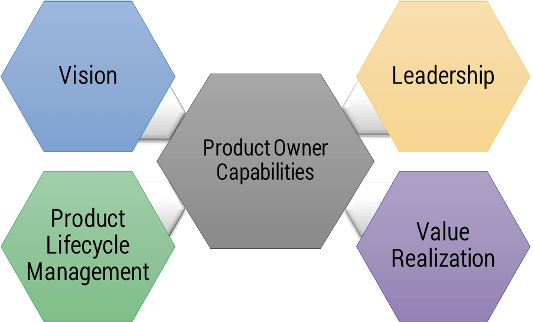

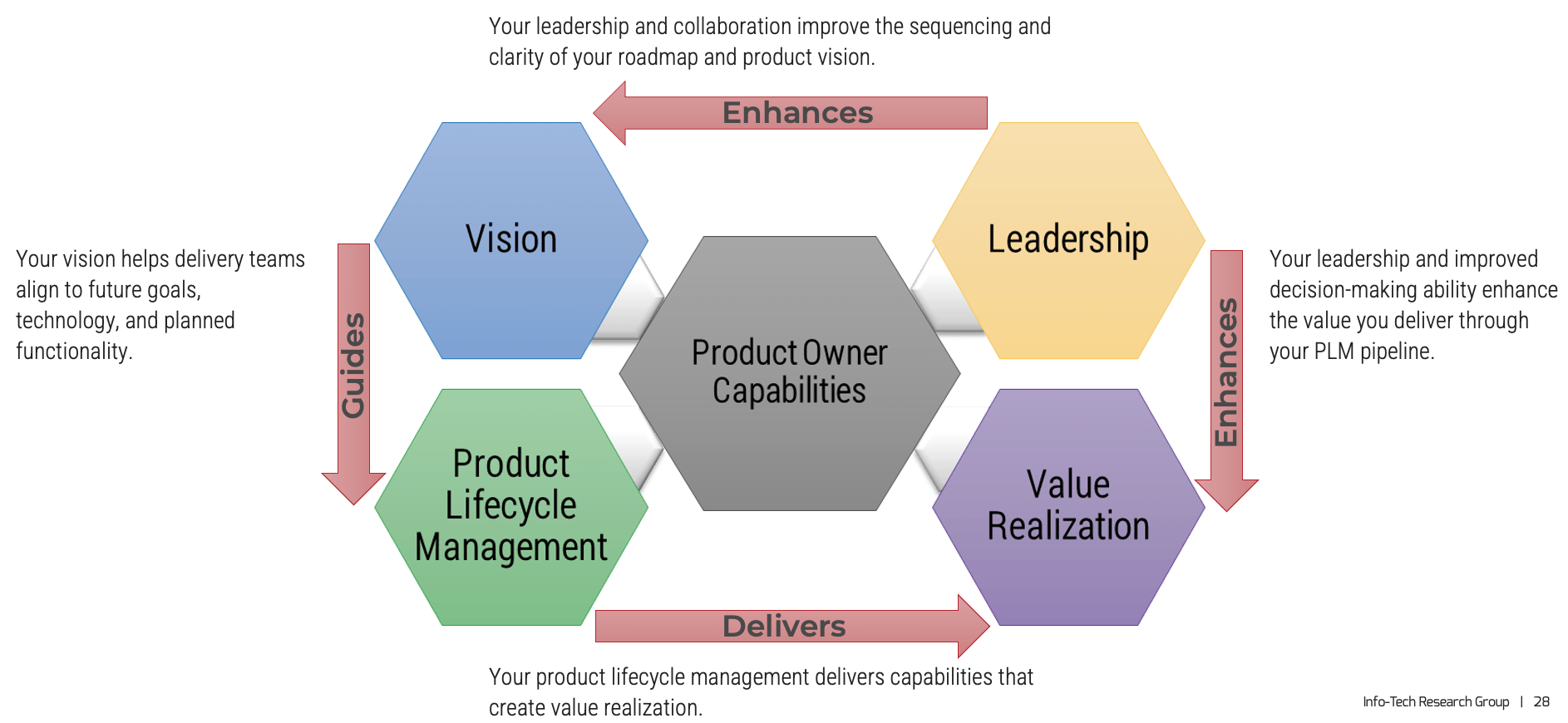

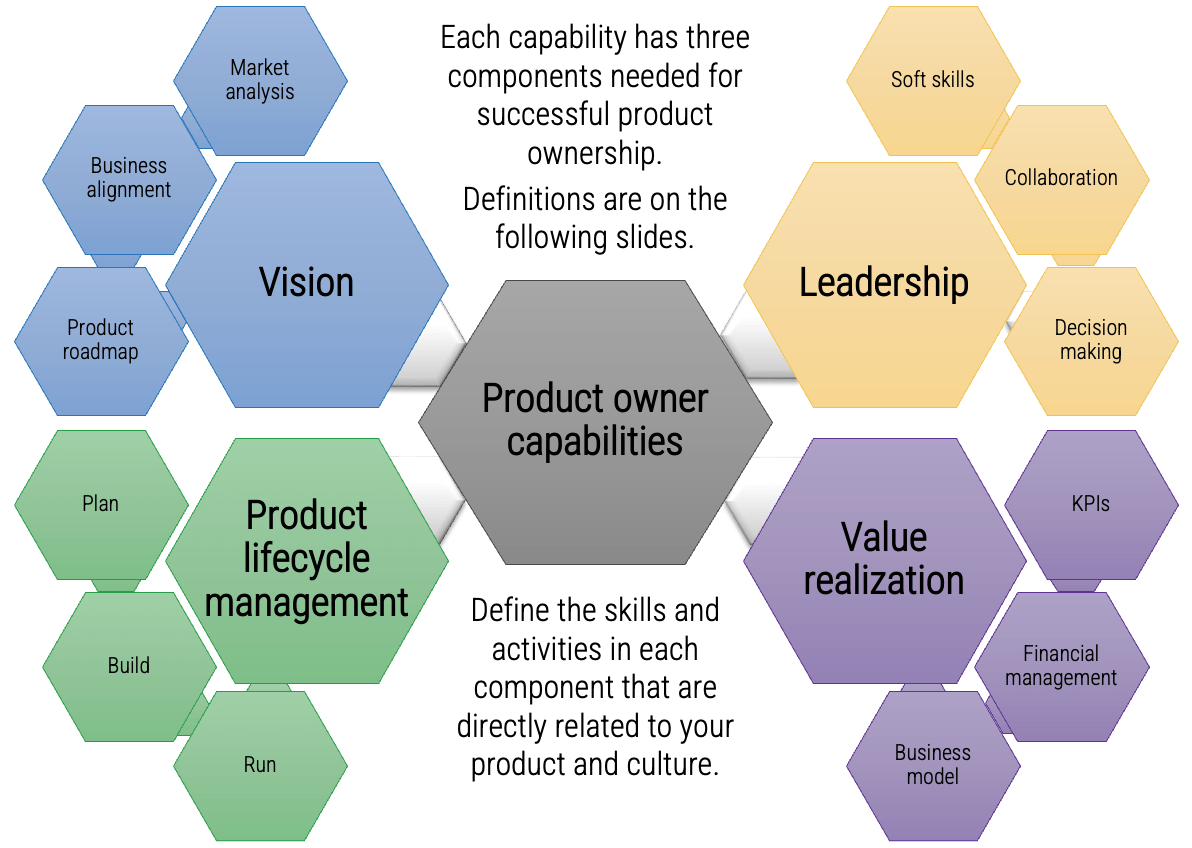

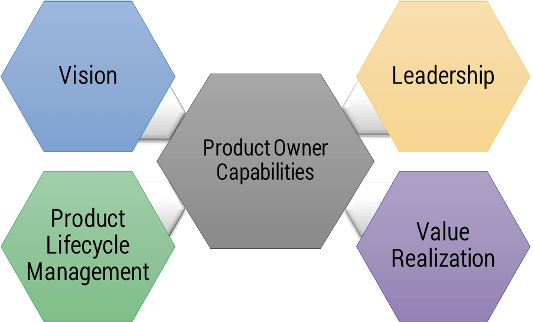

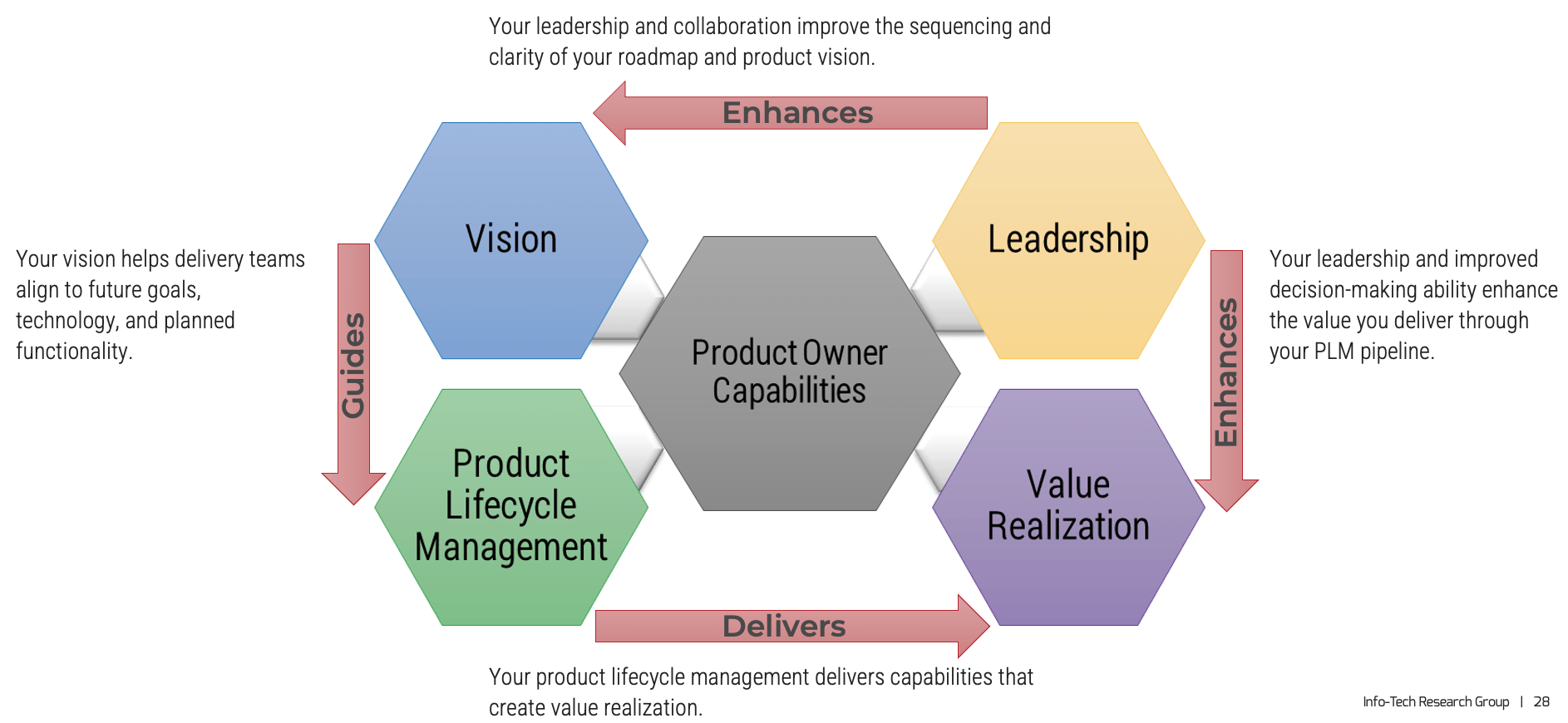

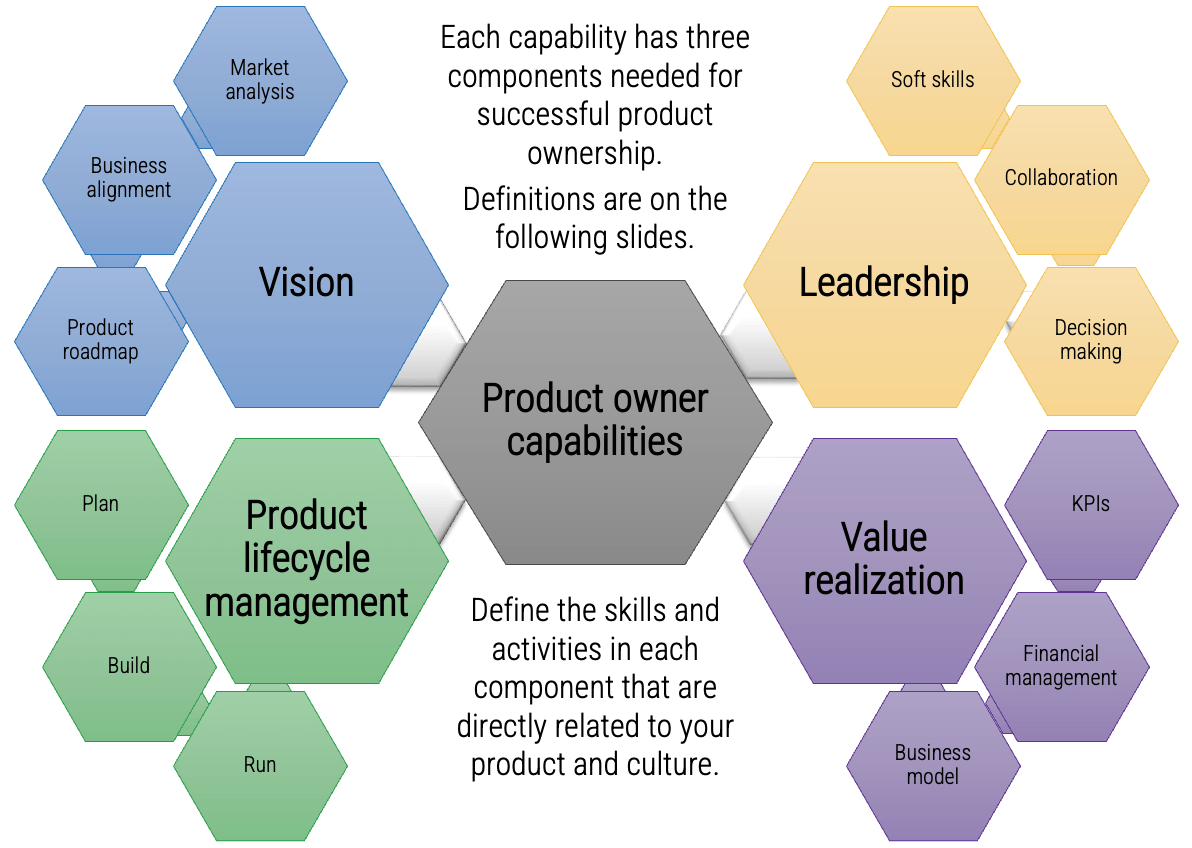

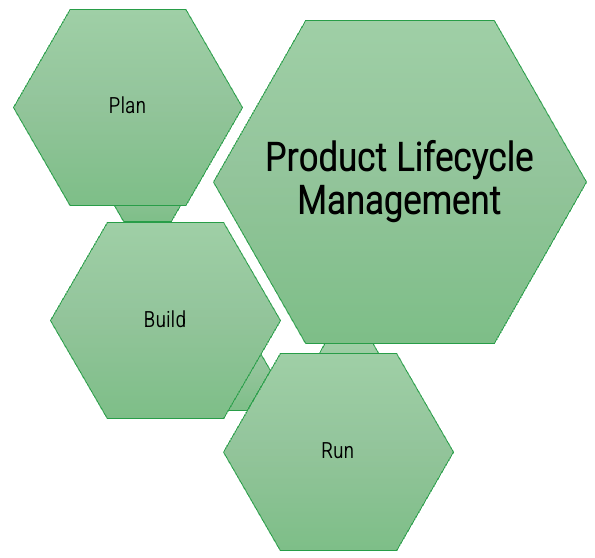

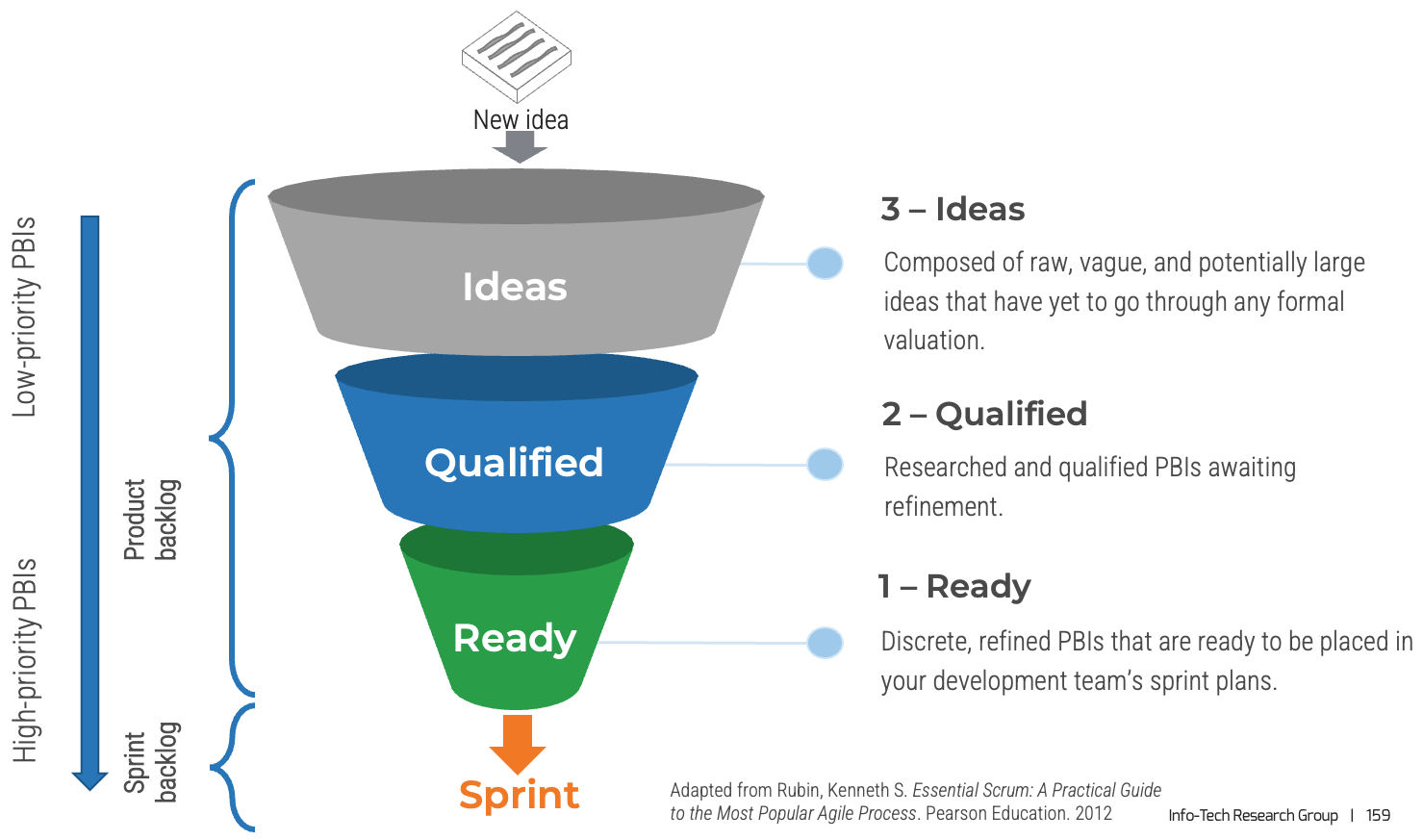

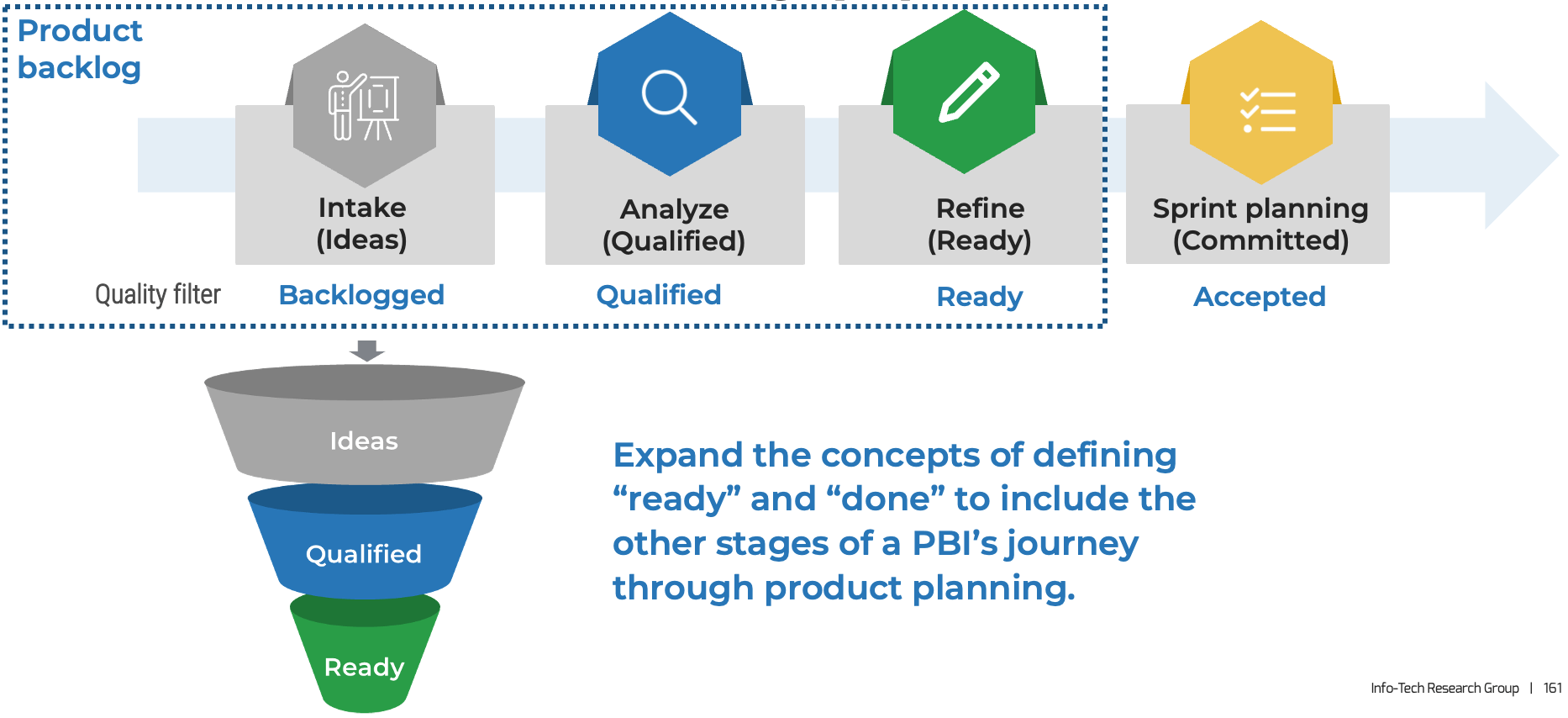

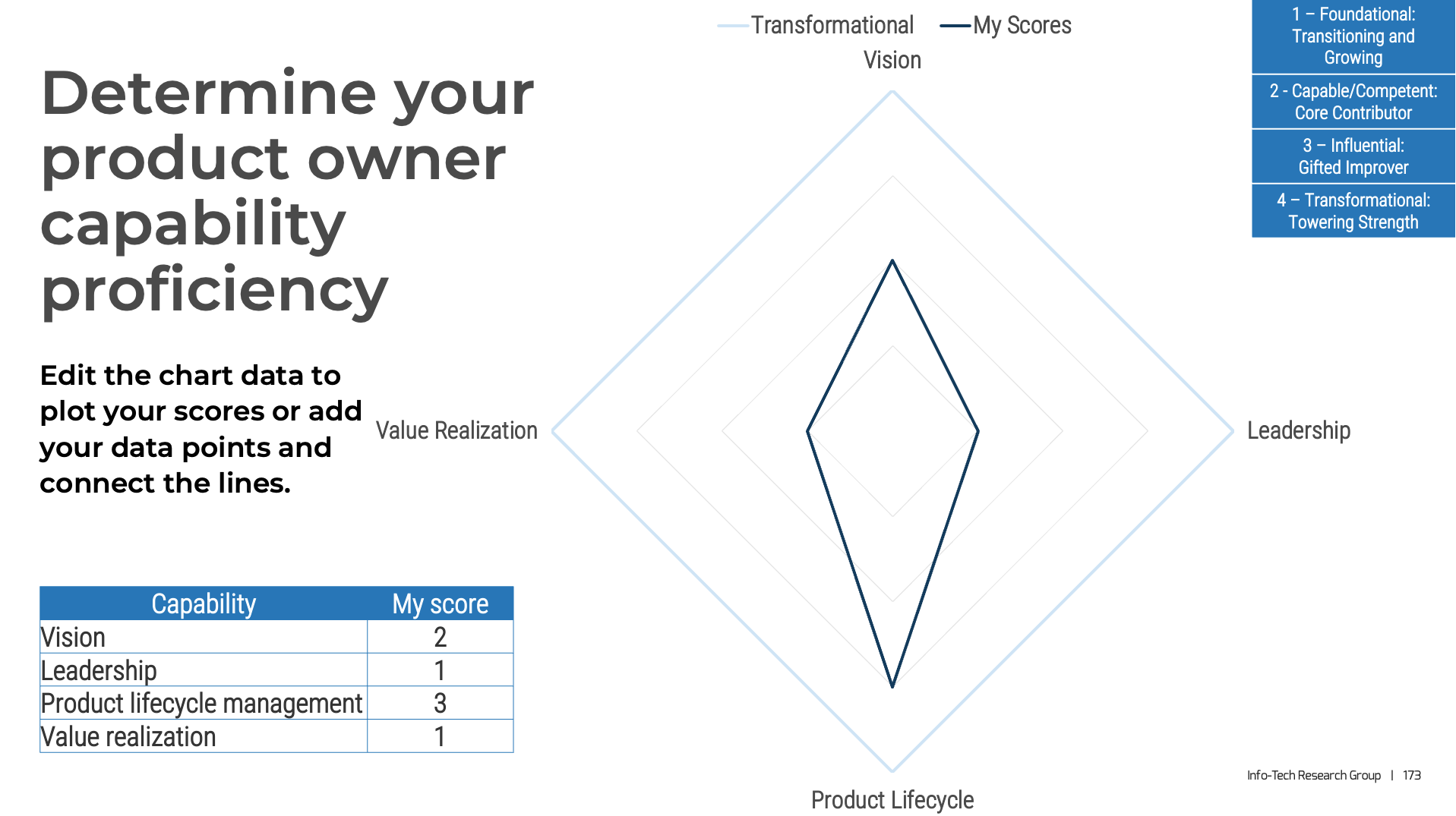

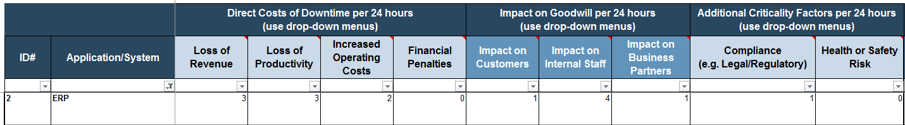

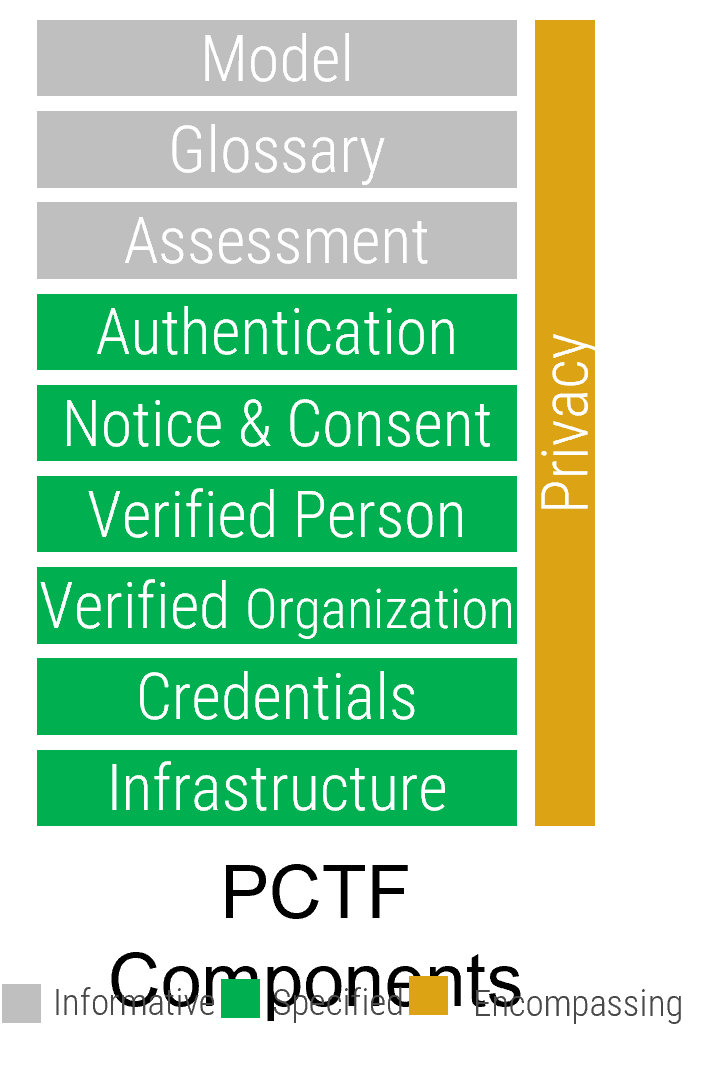

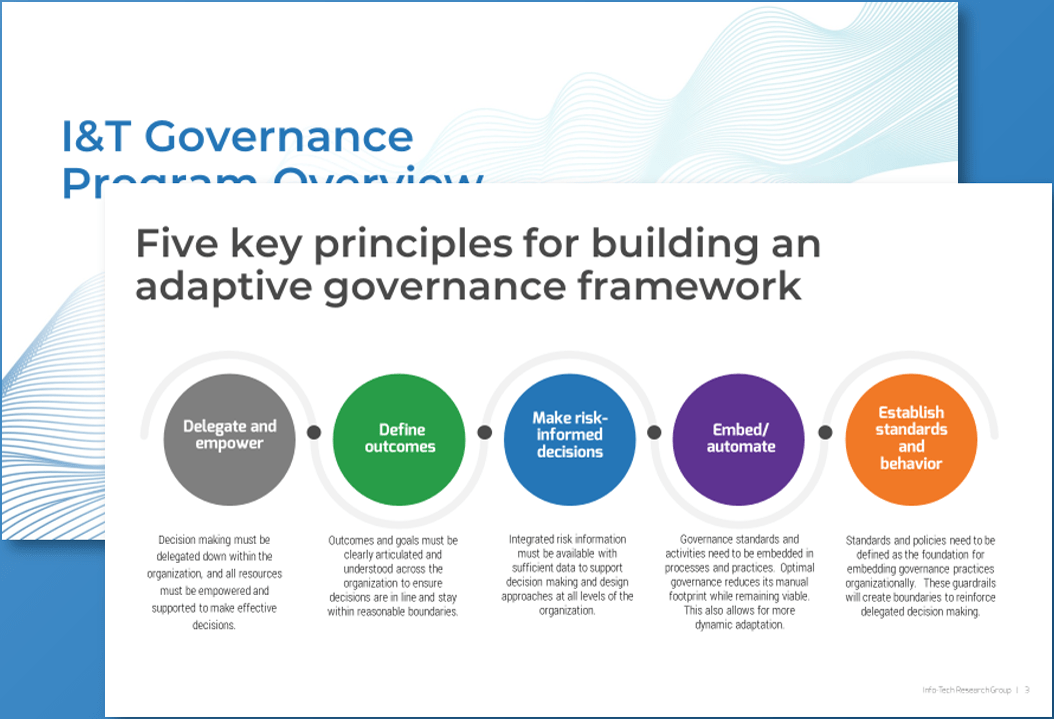

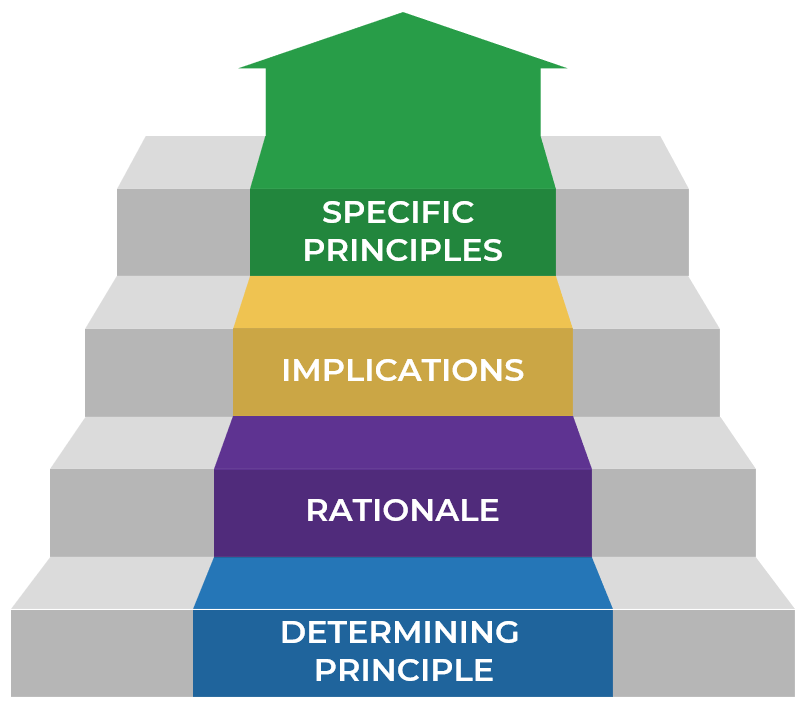

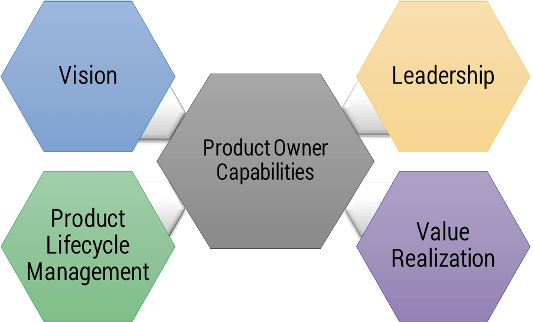

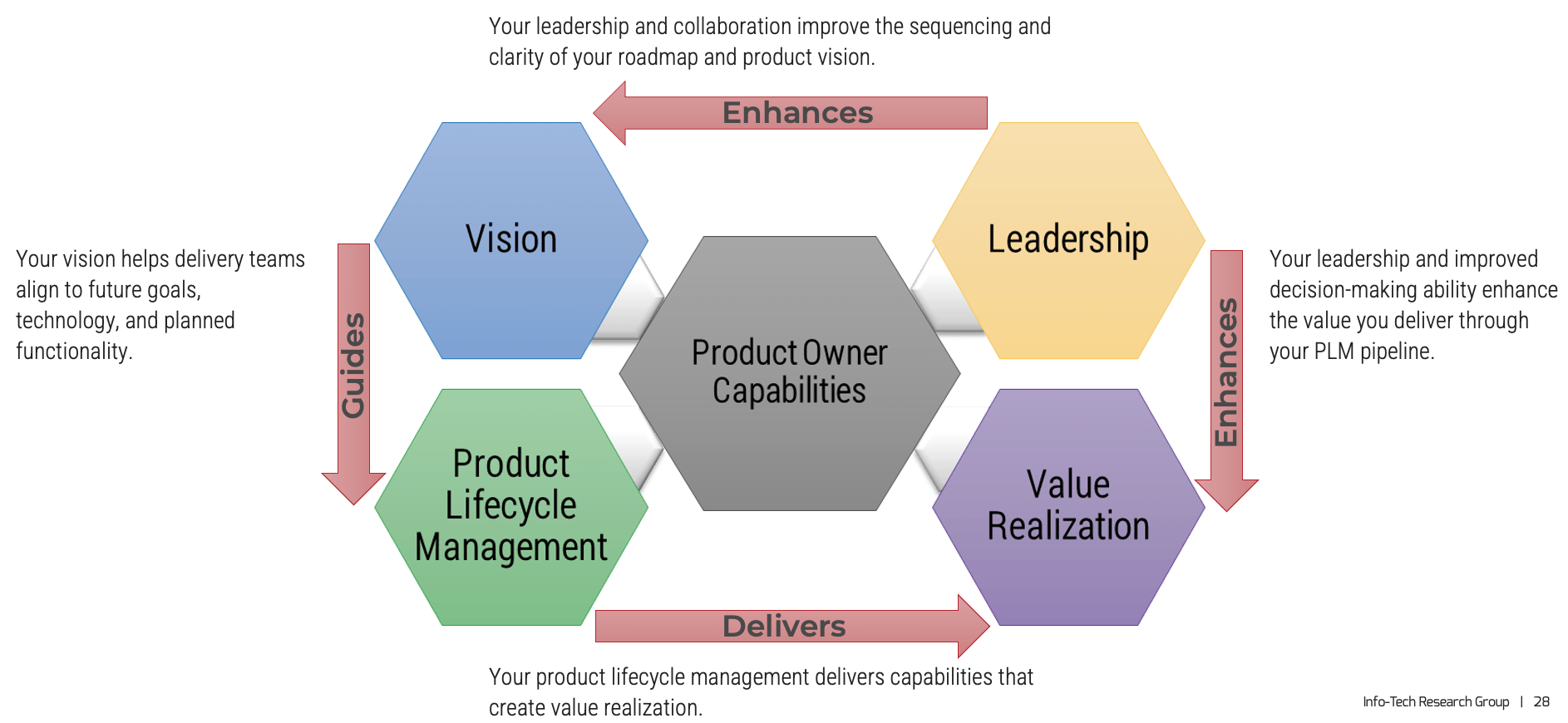

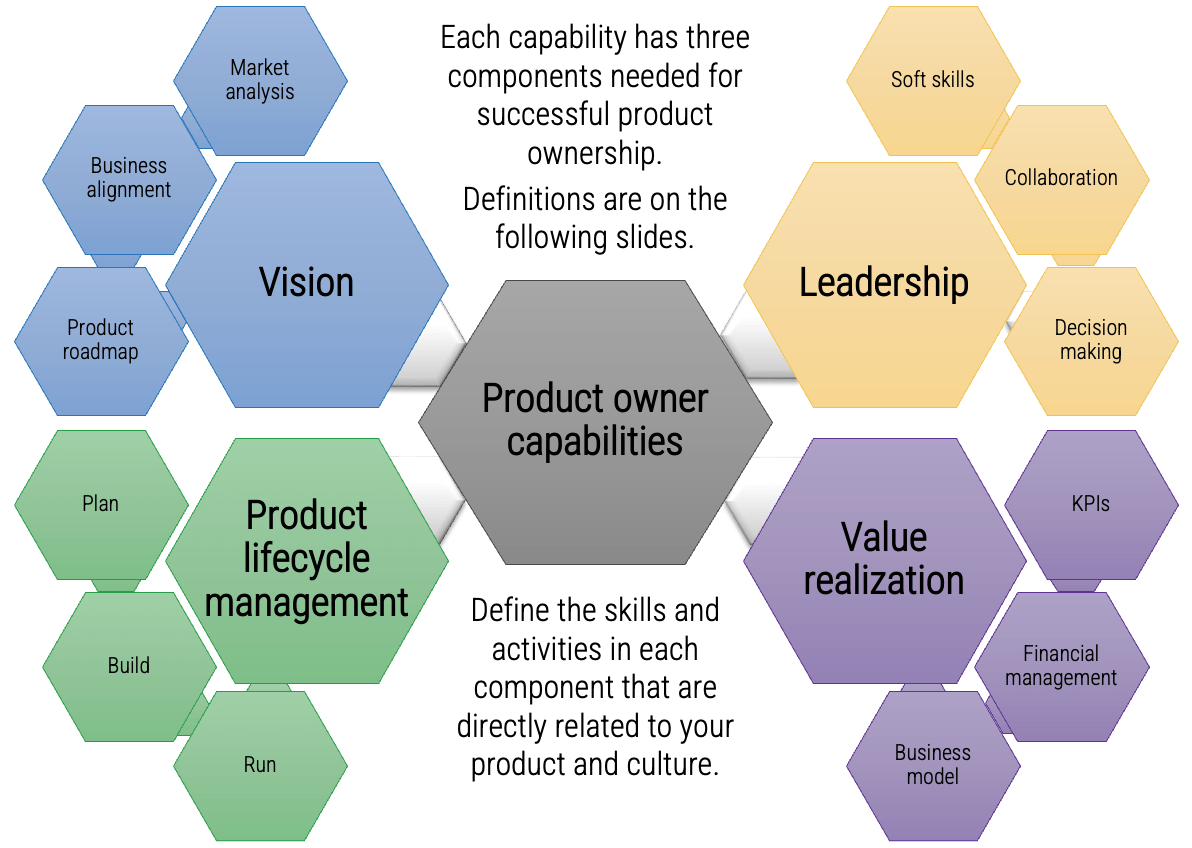

Implement the Info-Tech product owner capability model

Unfortunately, most product owners operate with incomplete knowledge of the skills and capabilities needed to perform

the role. Common gaps include focusing only on product backlogs, acting as a proxy for product decisions, and ignoring

the need for key performance indicators (KPIs) and analytics in both planning and value realization.

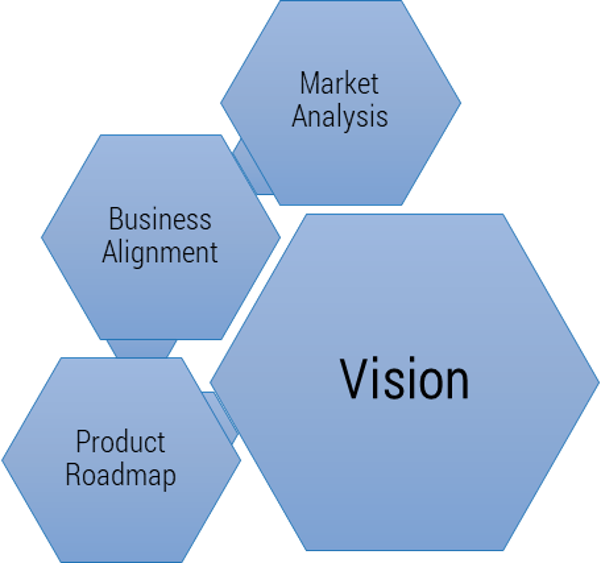

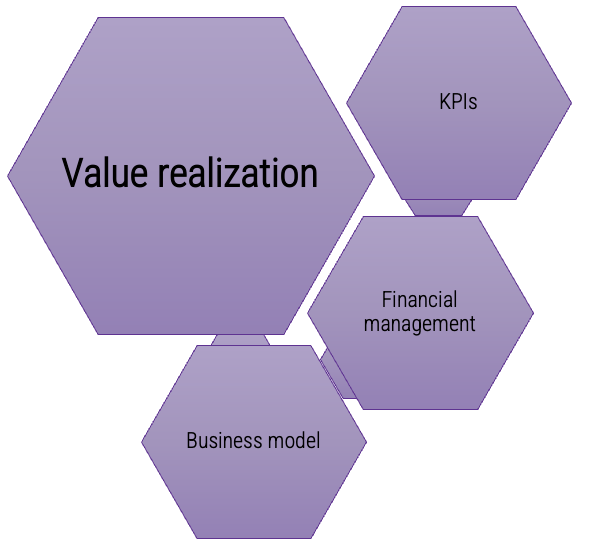

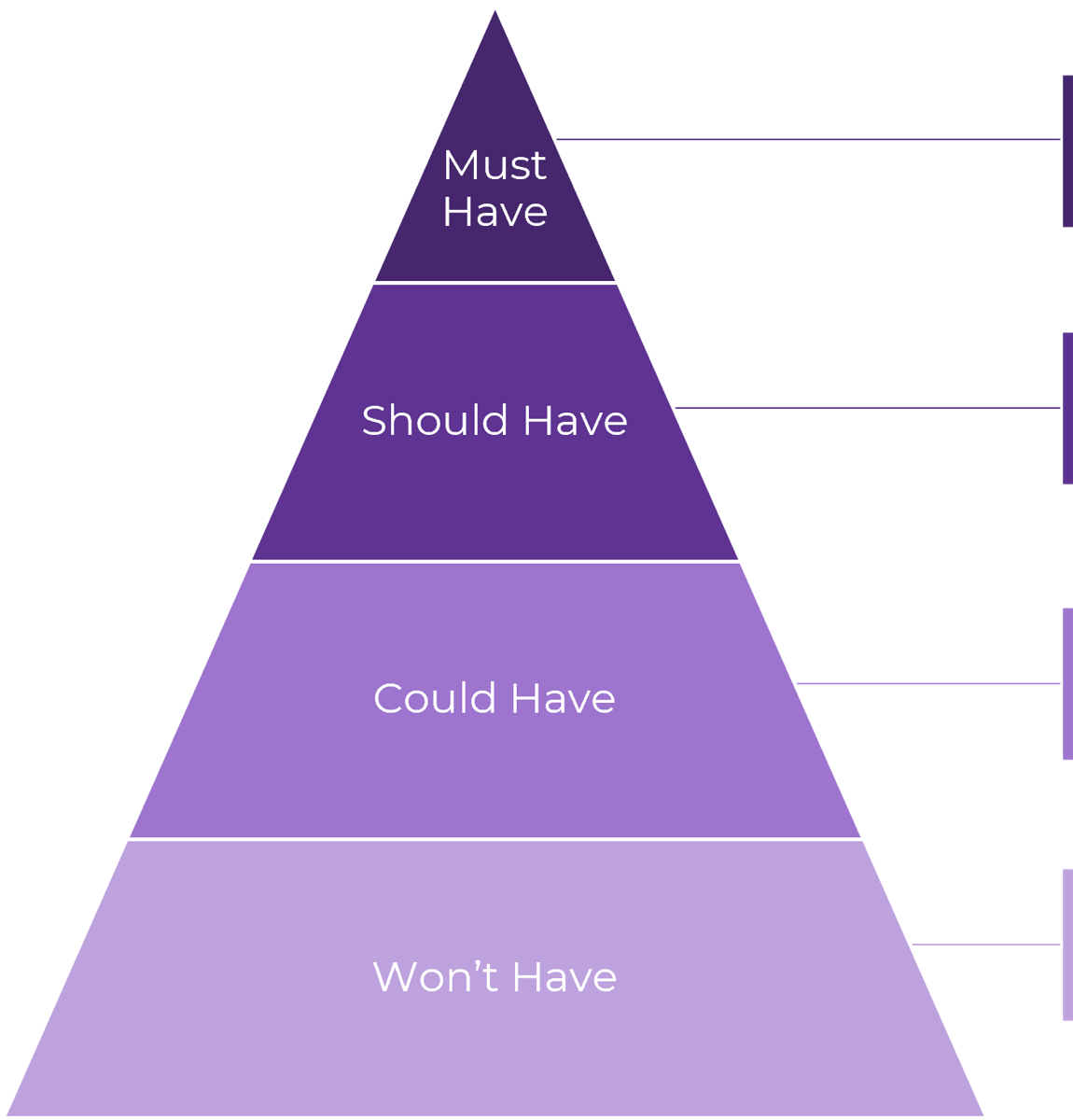

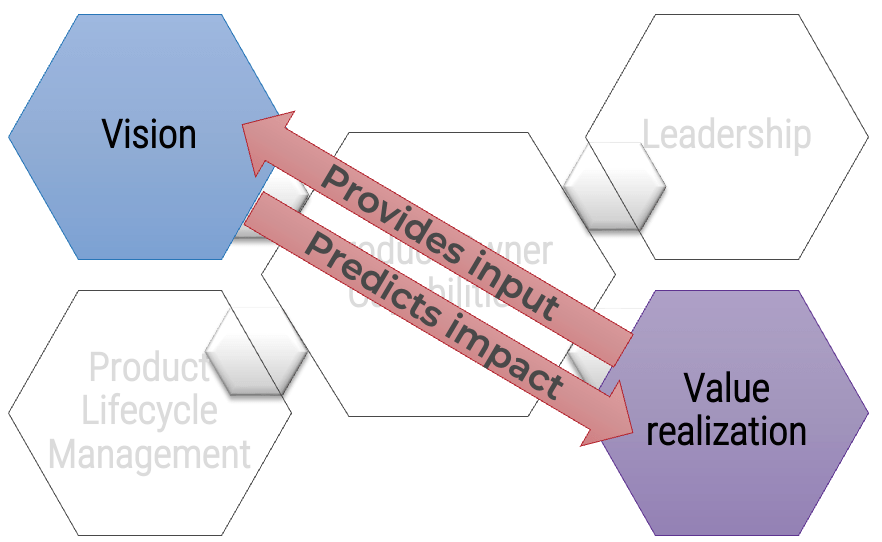

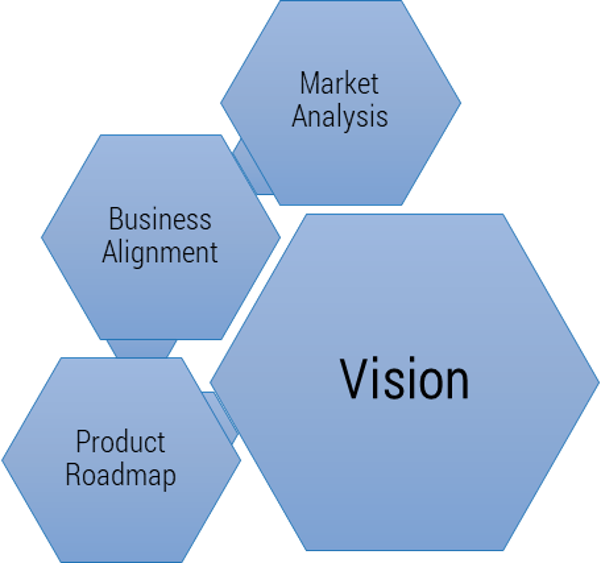

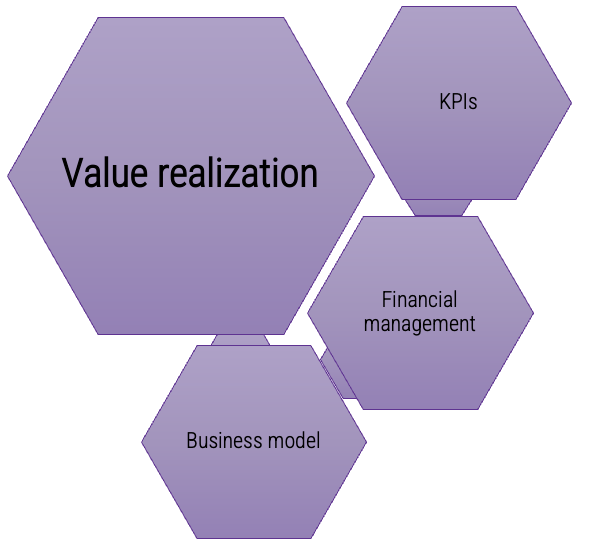

Vision

- Market Analysis

- Business Alignment

- Product Roadmap

Leadership

- Soft Skills

- Collaboration

- Decision Making

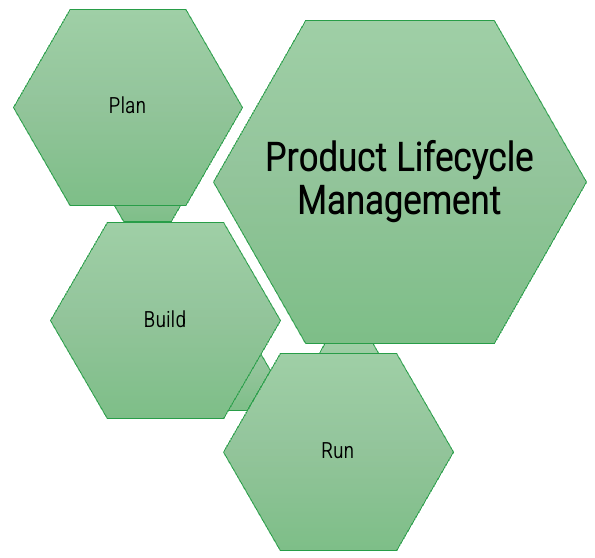

Product Lifecycle Management

Value Realization

- KPIs

- Financial Management

- Business Model

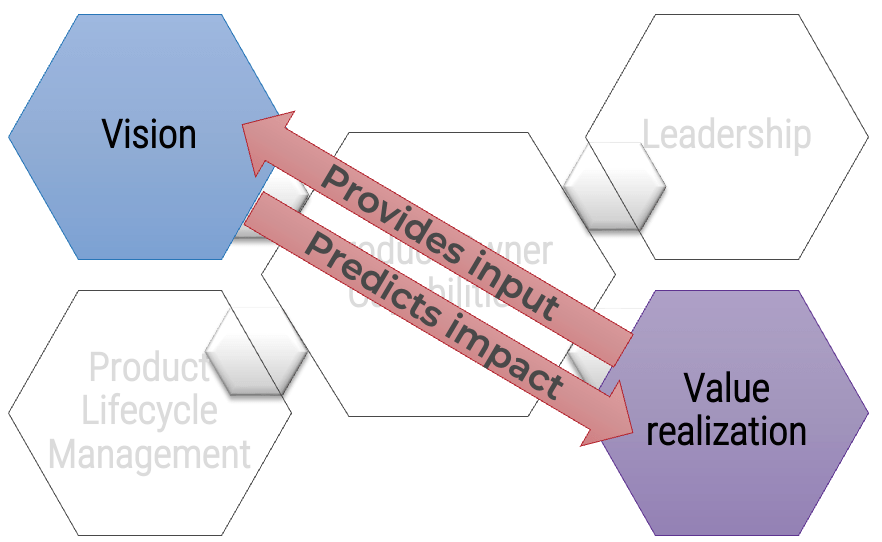

Product owner capabilities provide support

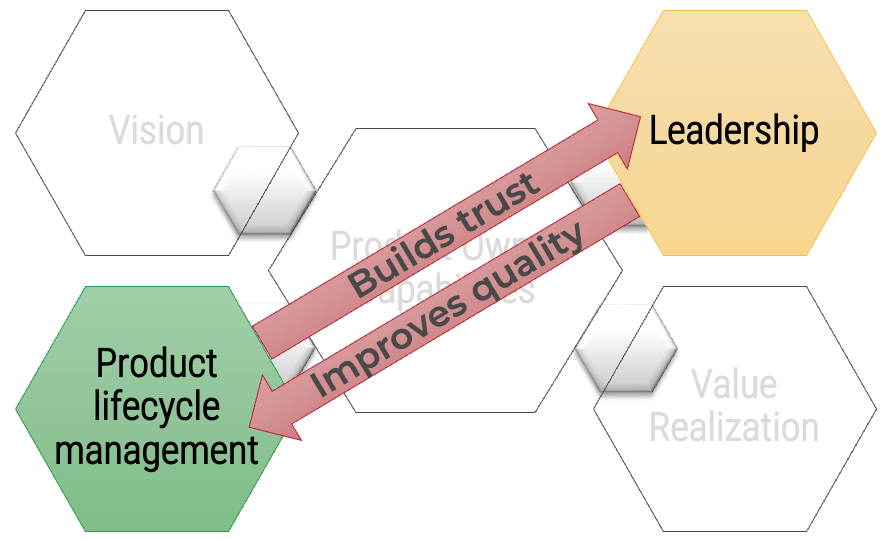

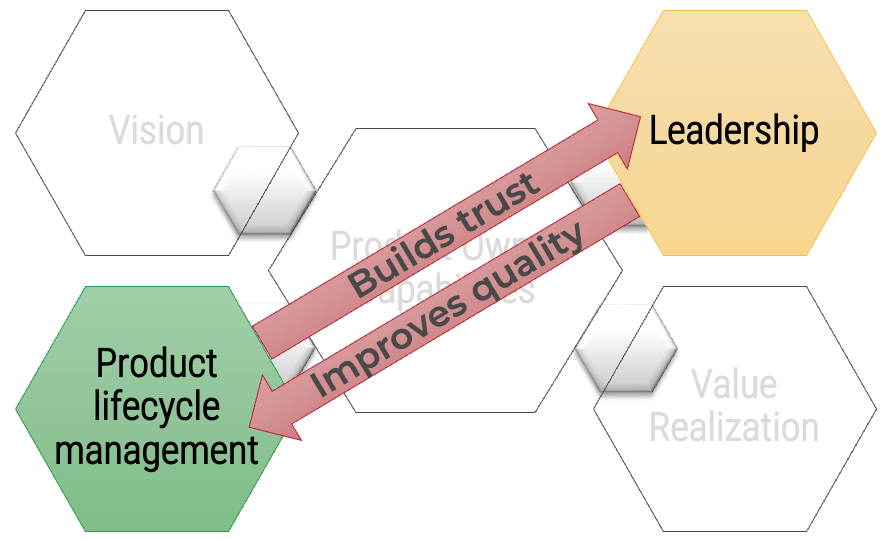

Your vision informs and aligns what goals and capabilities are needed to fulfill your product or product family vision and align with enterprise goals and priorities. Each item on your roadmap should have corresponding KPIs or OKRs to know how far you moved the value needle. Value realization measures how well you met your target, as well as the impacts on your business value canvas and cost model.

Your leadership skills improve collaborations and decisions when working with your stakeholders and product delivery teams. This builds trust and improves continued improvements to the entire product lifecycle. A product owner’s focus should always be on finding ways to improve value delivery.

Product owner capabilities provide support

Develop product owner capabilities

Avoid common capability gaps

Vision

-

Focusing solely on backlog grooming (tactical only)

-

Ignoring or failing to align product roadmap to enterprise goals

-

Operational support and execution

-

Basing decisions on opinion rather than market data

-

Ignoring or missing internal and external threats to your product

Leadership

-

Failing to include feedback from all teams who interact with your product

-

Using a command-and-control approach

-

Viewing product owner as only a delivery role

-

Acting as a proxy for stakeholder decisions

-

Avoiding tough strategic decisions in favor of easier tactical choices

Product lifecycle management

-

Focusing on delivery and not the full product lifecycle

-

Ignoring support, operations, and technical debt

-

Failing to build knowledge management into the lifecycle

-

Underestimating delivery capacity, capabilities, or commitment

-

Assuming delivery stops at implementation

Value realization

-

Focusing exclusively on “on time/on budget” metrics

-

Failing to measure a 360-degree end-user view of the product

-

Skipping business plans and financial models

-

Limiting financial management to project/change budgets

-

Ignoring market analysis for growth, penetration, and threats

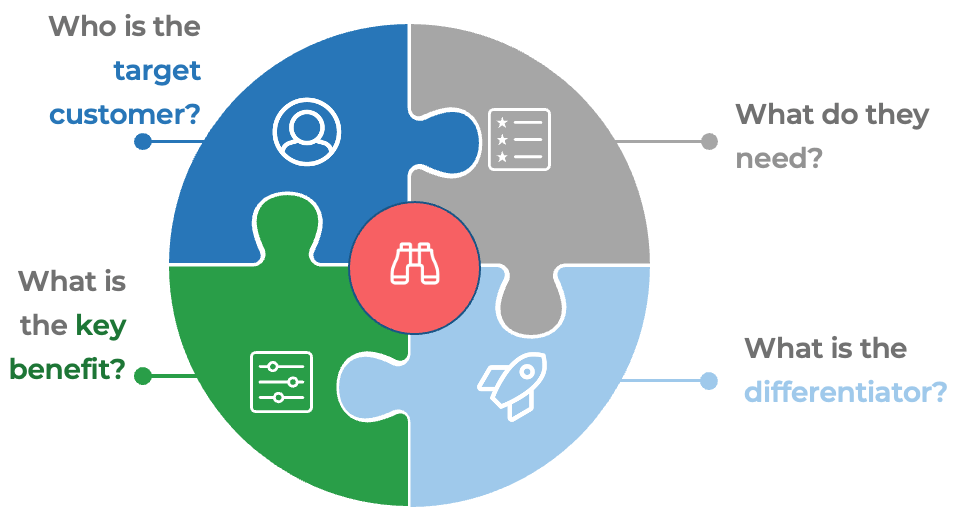

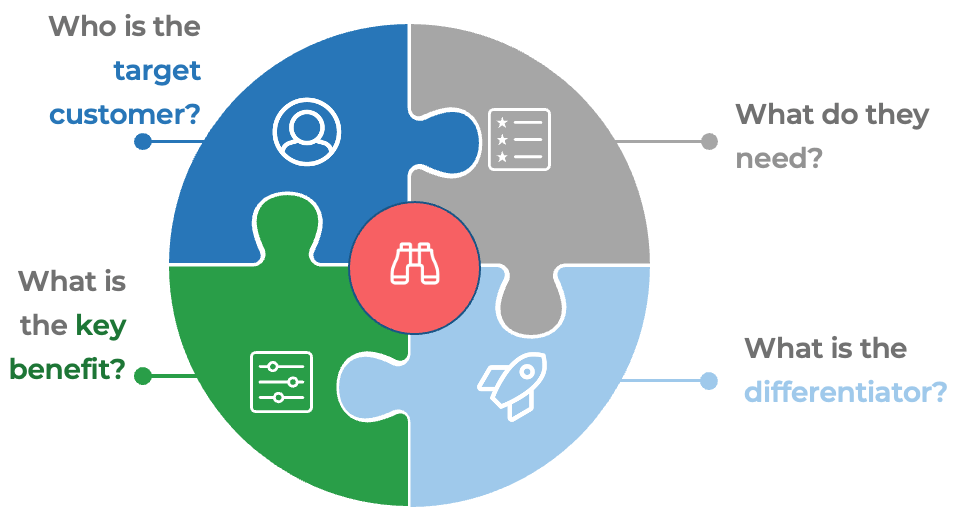

Your product vision is your North Star

It's ok to dream a little!

Adapted from: Crossing the Chasm

Info-Tech Best Practice

A product vision shouldn’t be so far out that it doesn’t feel real or so short-term that it gets bogged down in minutiae and implementation details. Finding the right balance will take some trial and error and will be different for each organization.

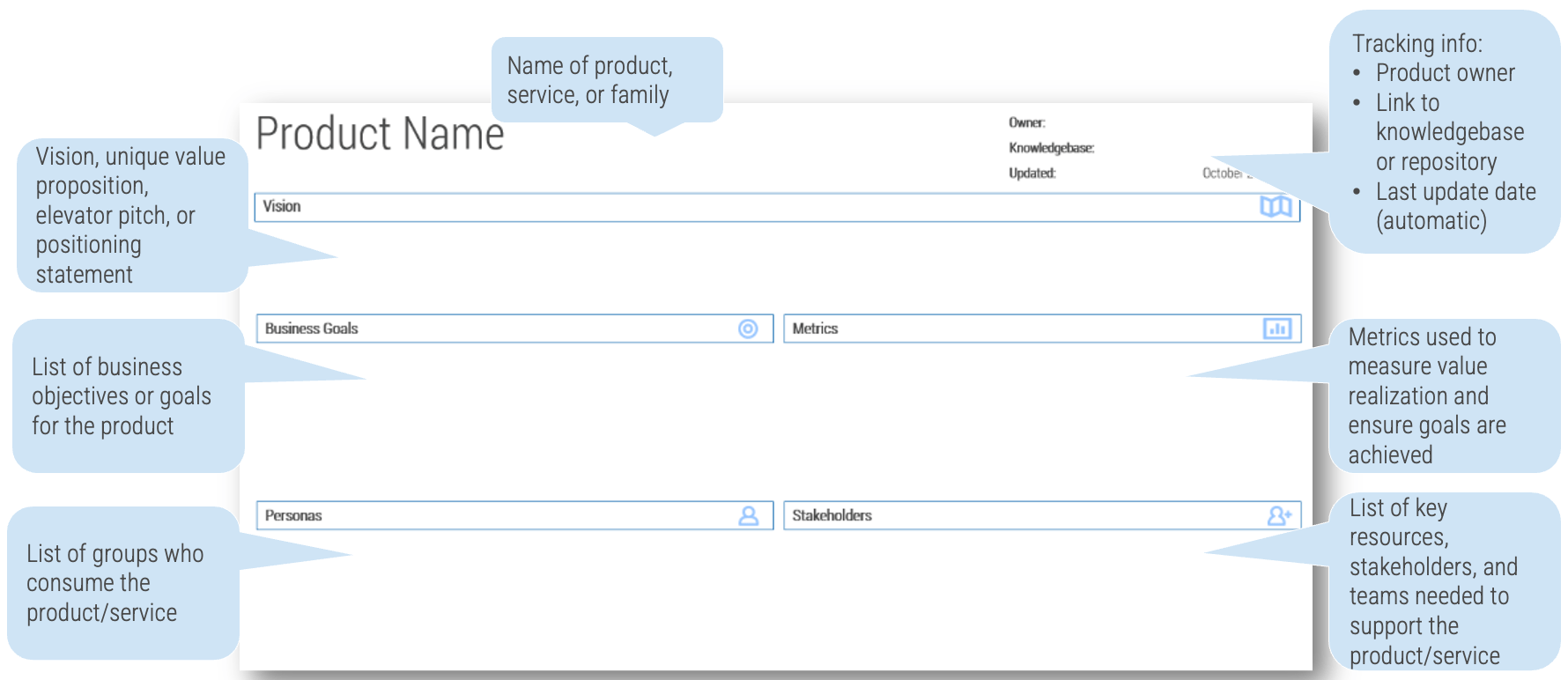

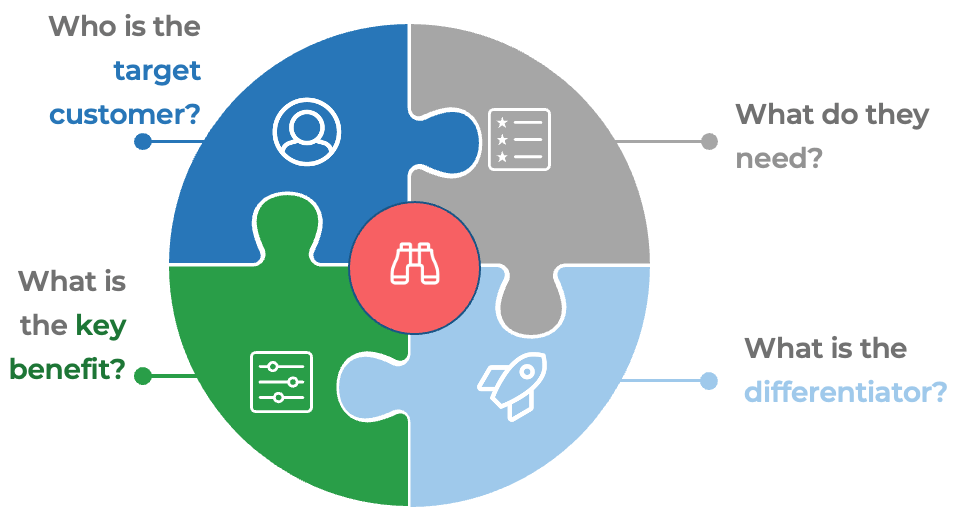

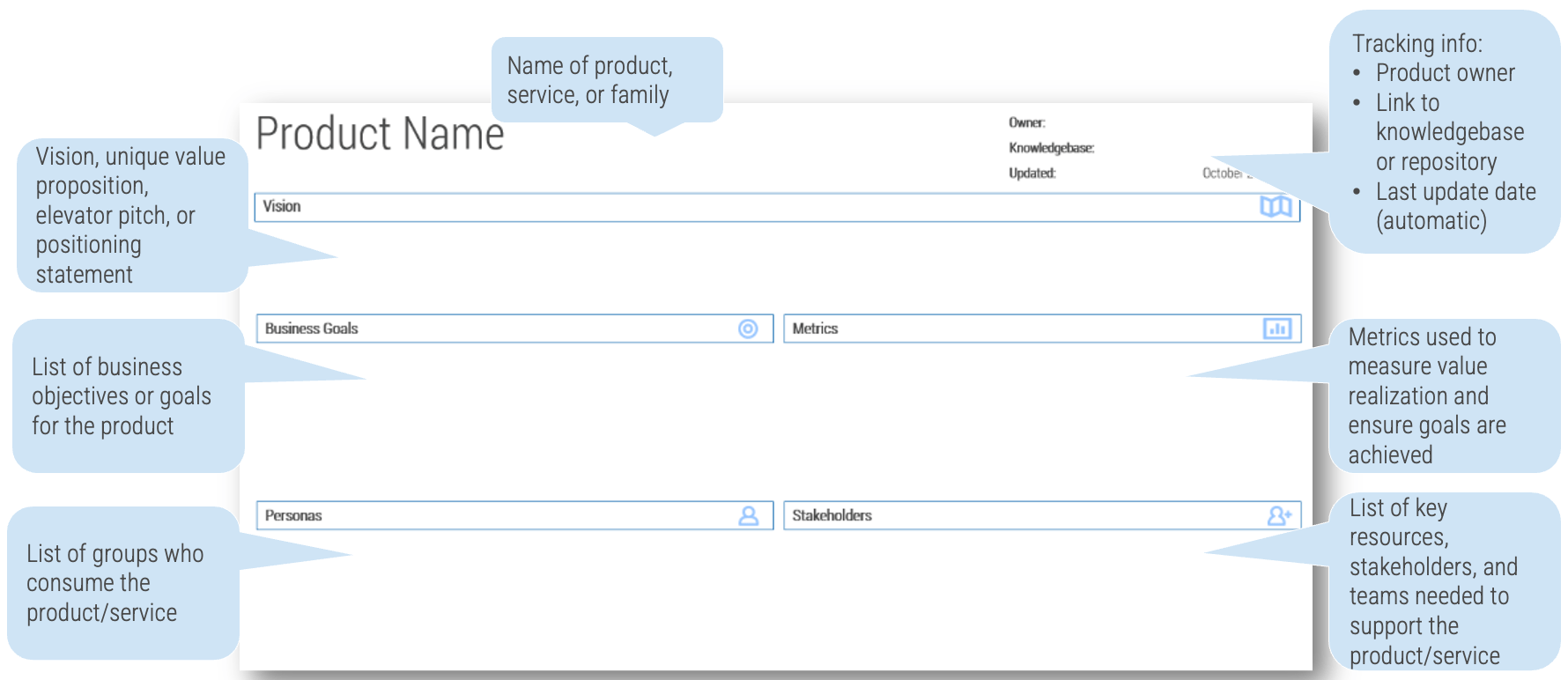

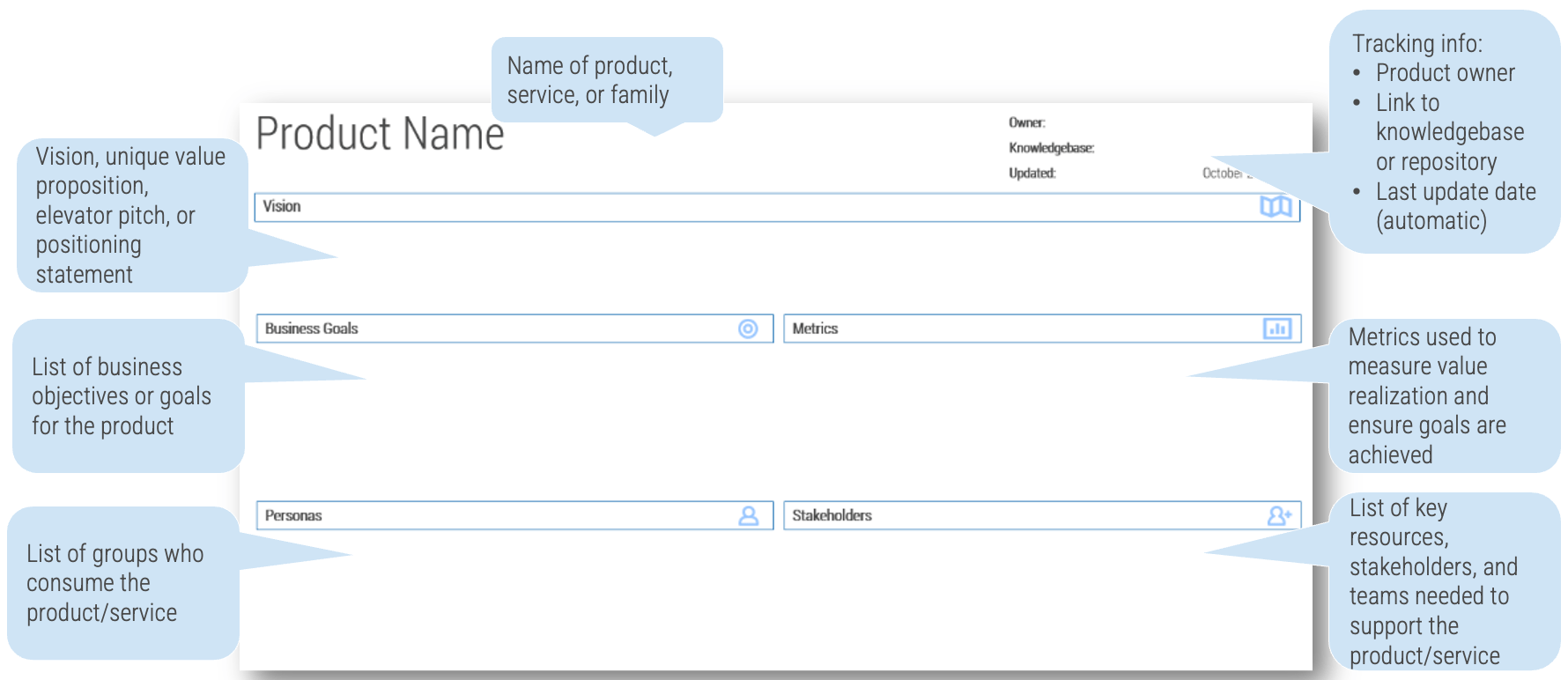

Leverage the product canvas to state and inform your product vision

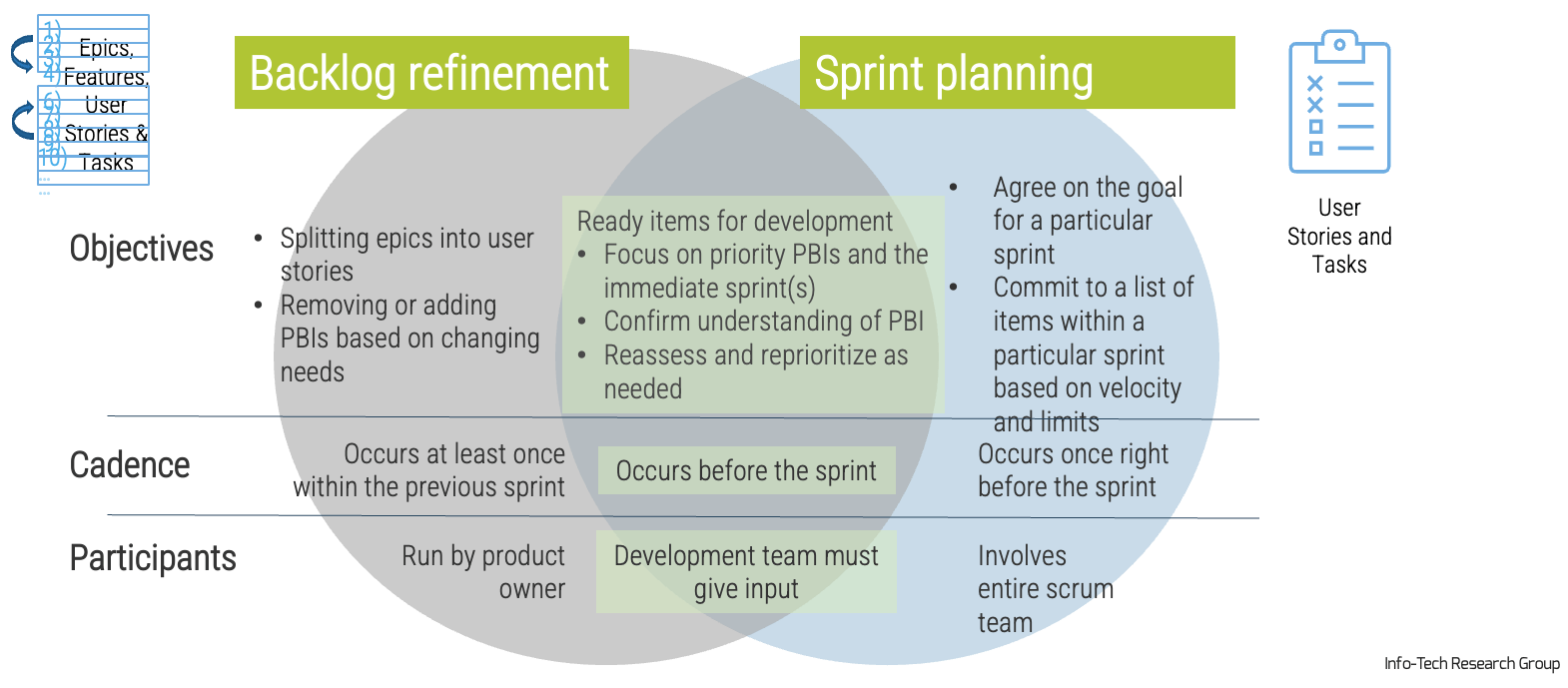

Define product value by aligning backlog delivery with roadmap goals

In each product plan, the backlogs show what you will deliver. Roadmaps identify when and in what order you will deliver value, capabilities, and goals.

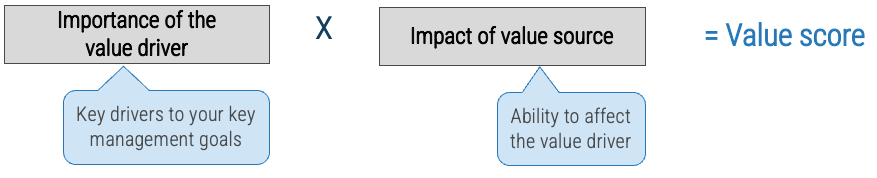

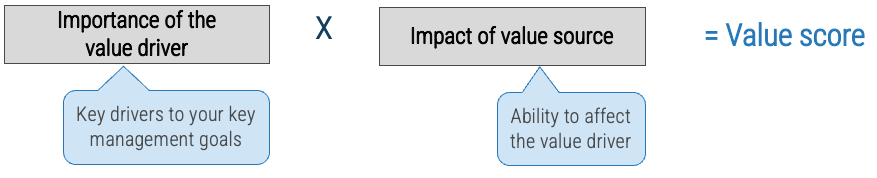

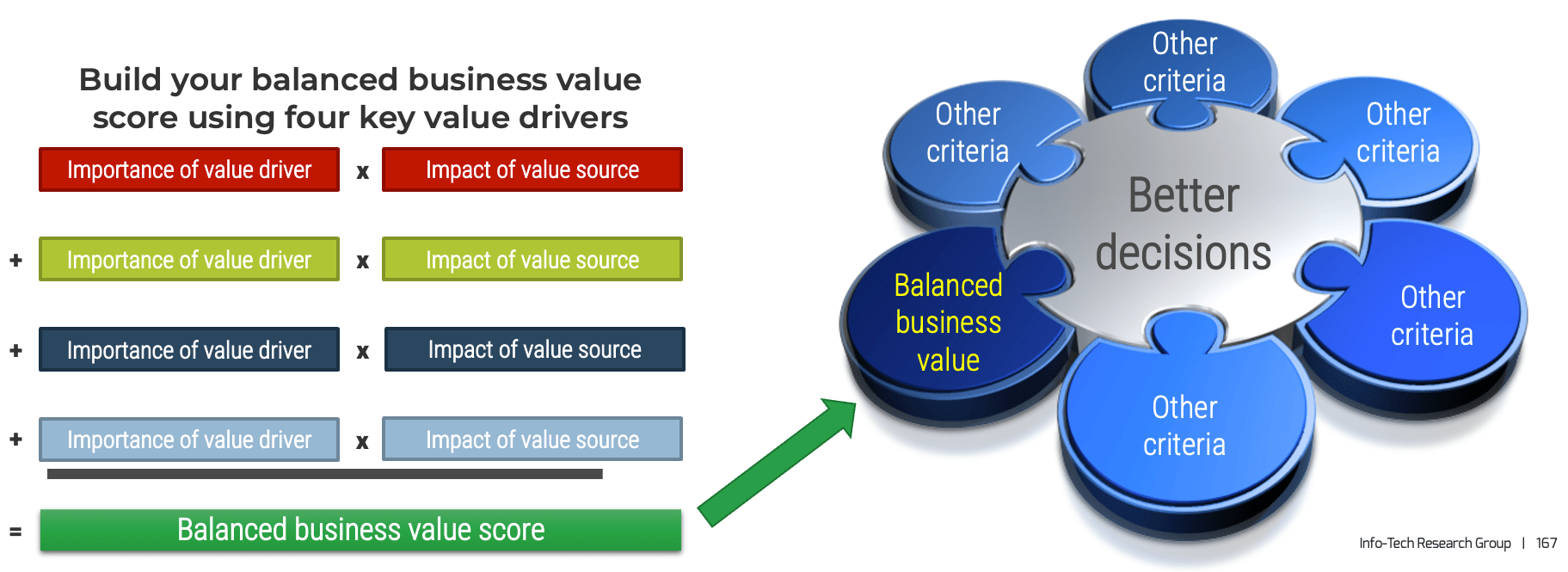

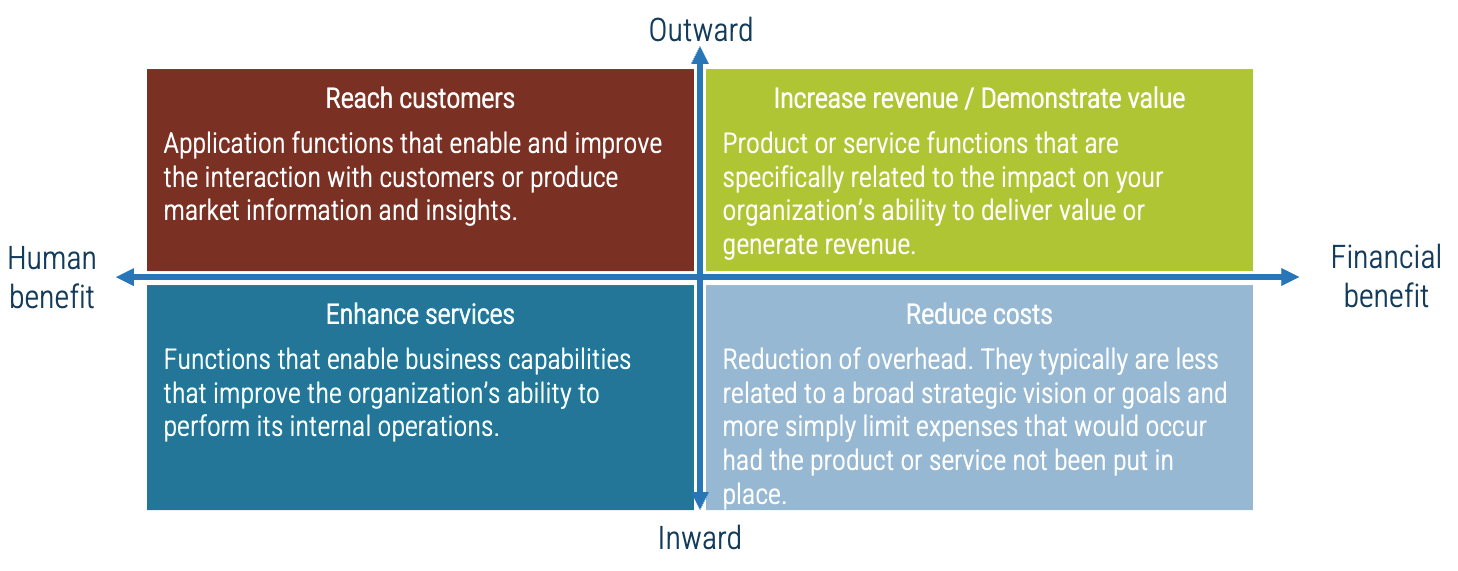

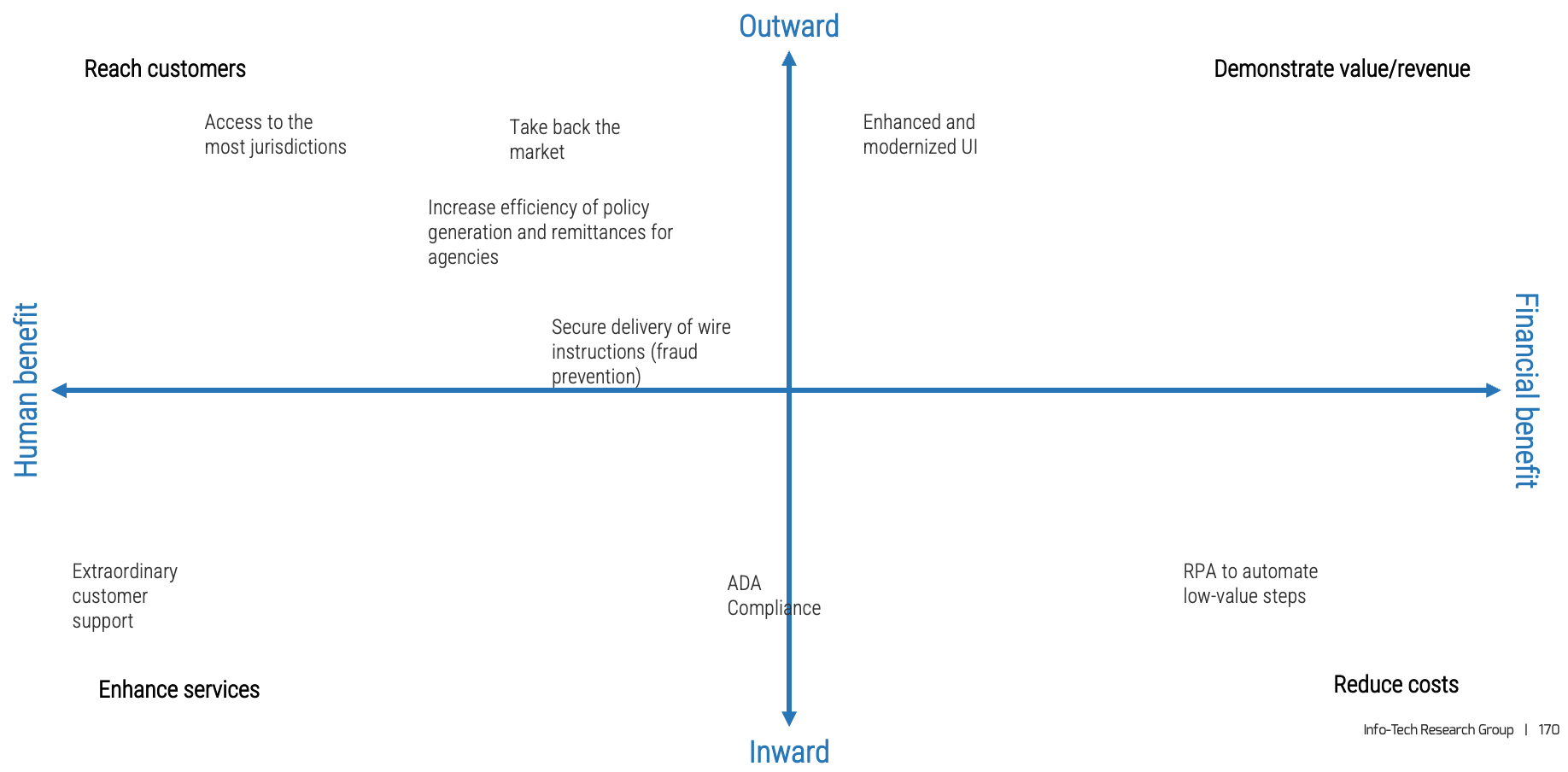

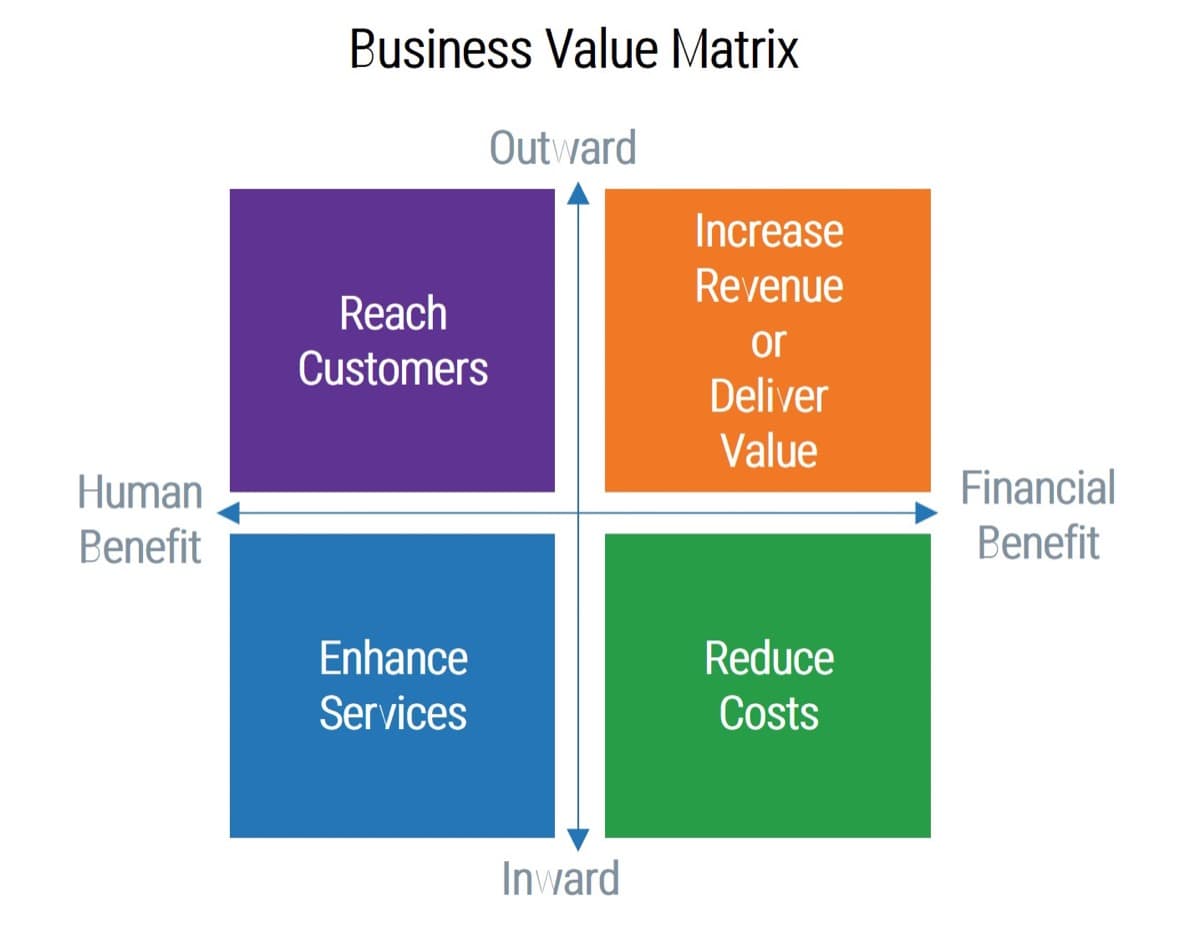

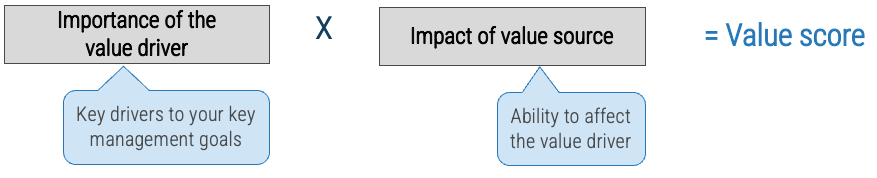

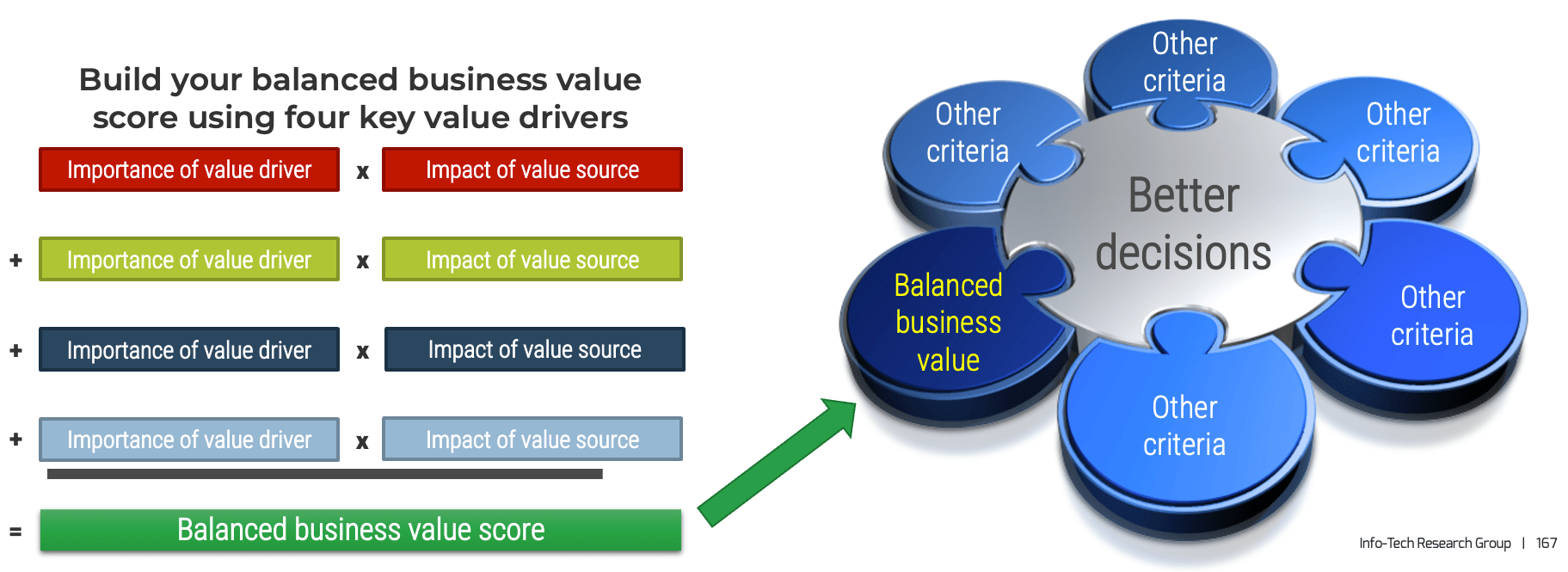

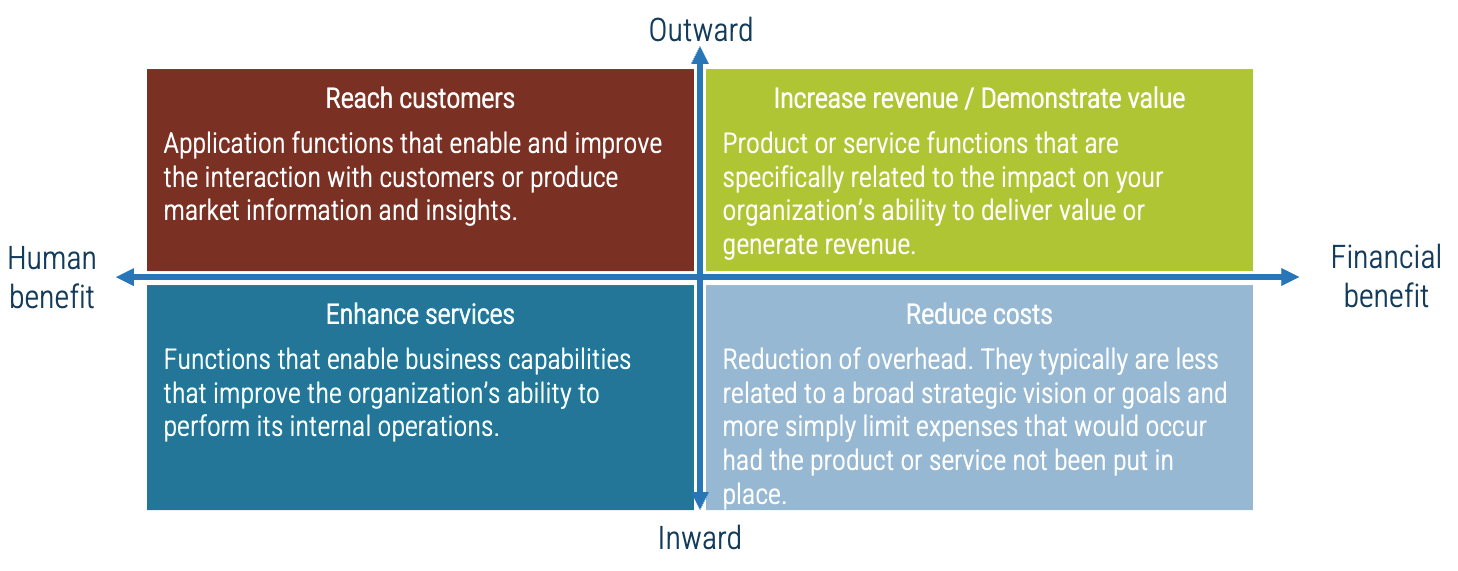

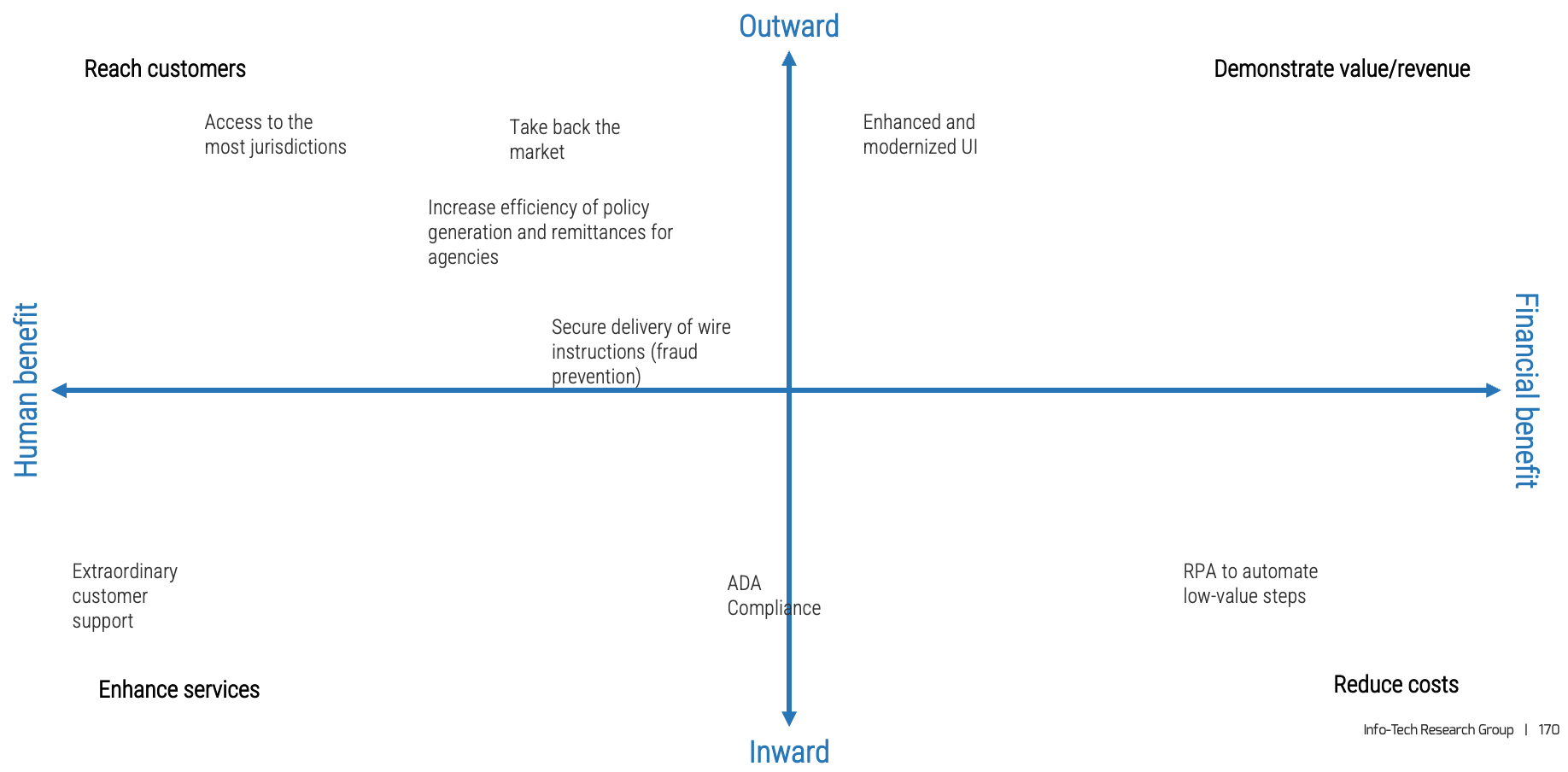

Use a balanced value to establish a common definition of goals and value

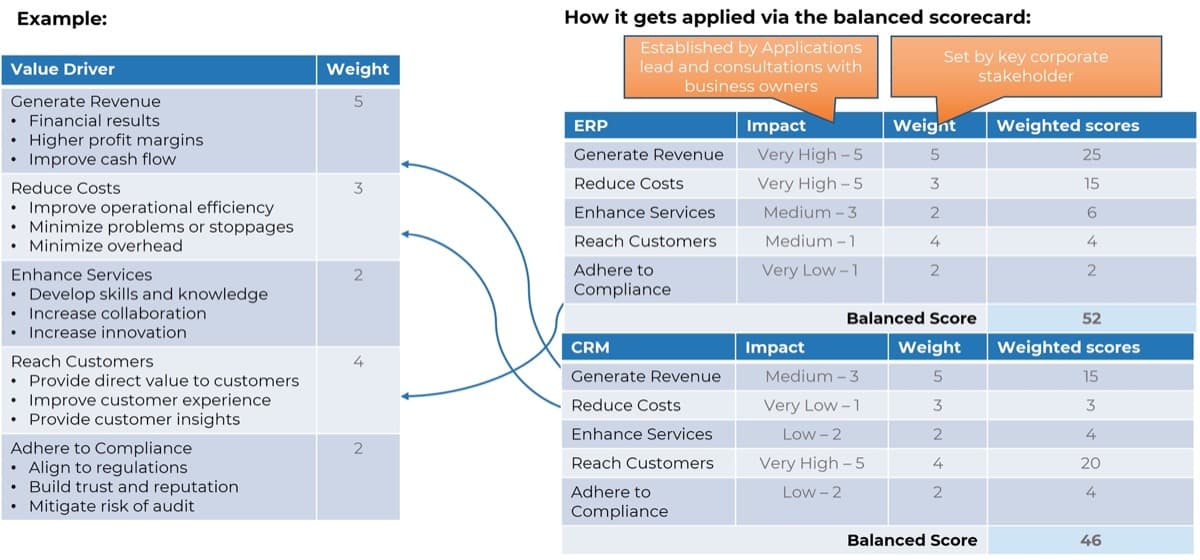

Value drivers are strategic priorities aligned to our enterprise strategy and translated through our product families. Each product and change has an impact on the value driver helping us reach our enterprise goals.

Info-Tech Insight

Your value drivers and impact helps estimate the expected value of roadmap items, prioritize roadmap and backlog items, and identify KPIs and OKRs to measure value realization and actual impact.

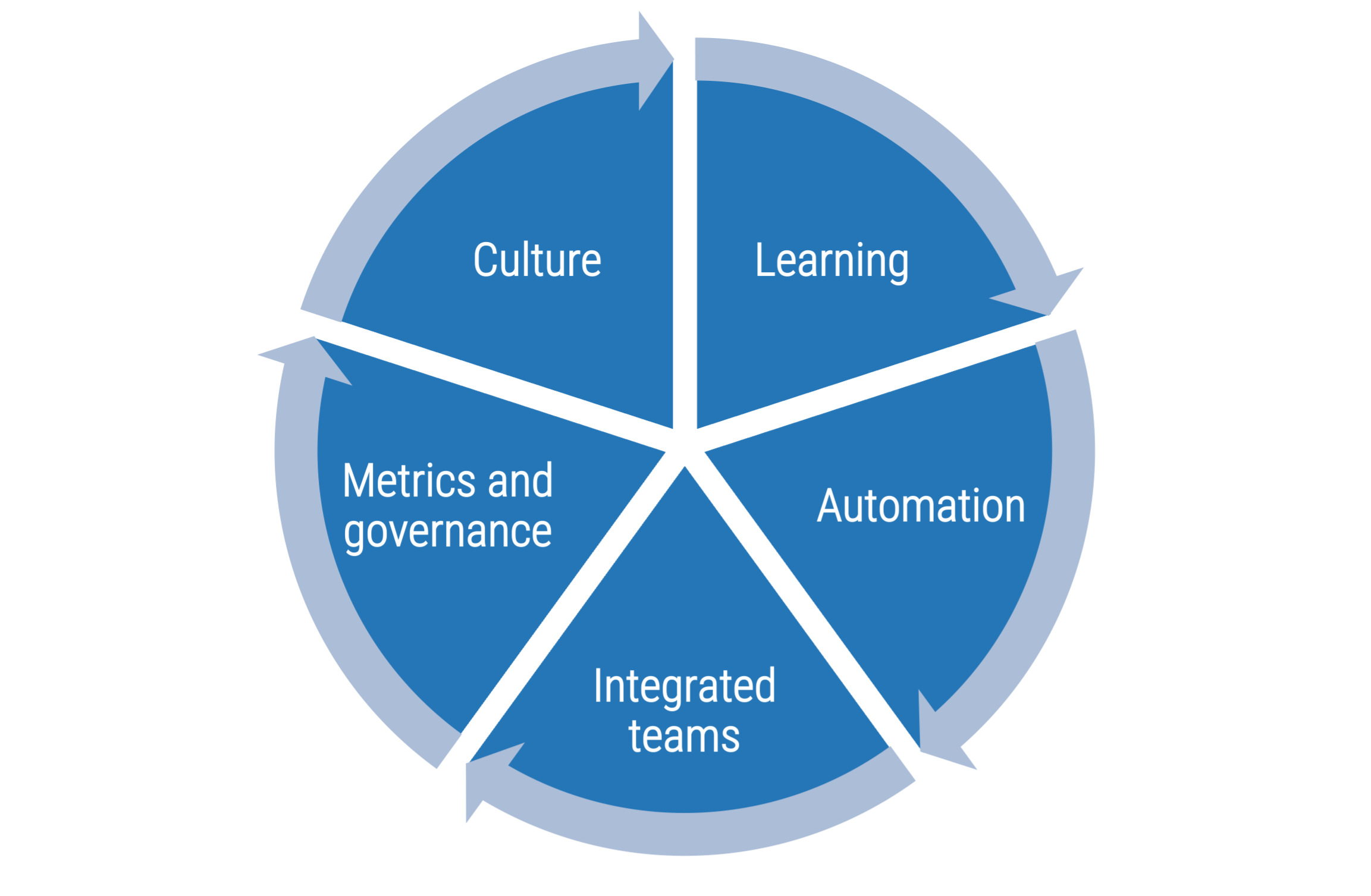

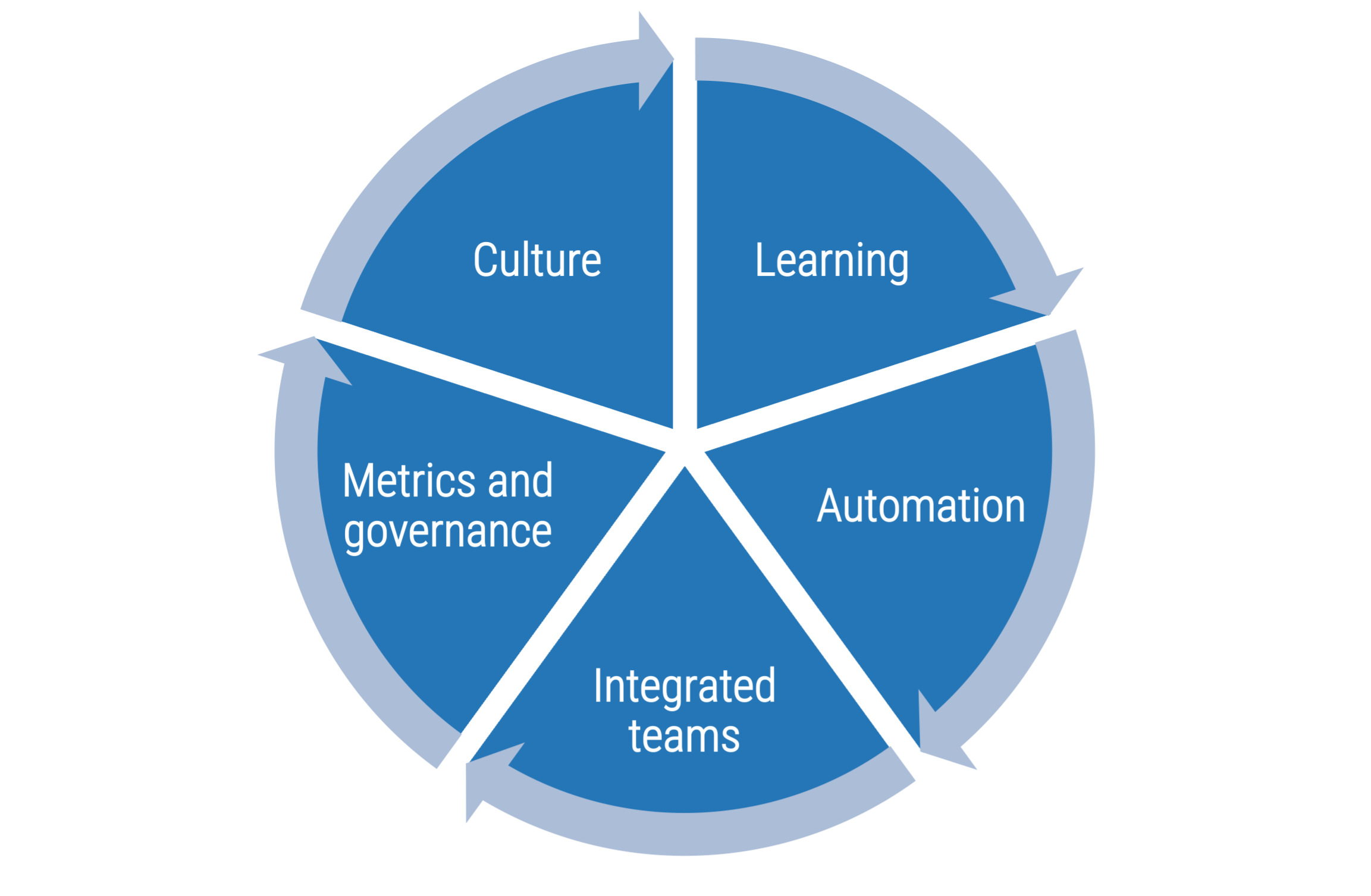

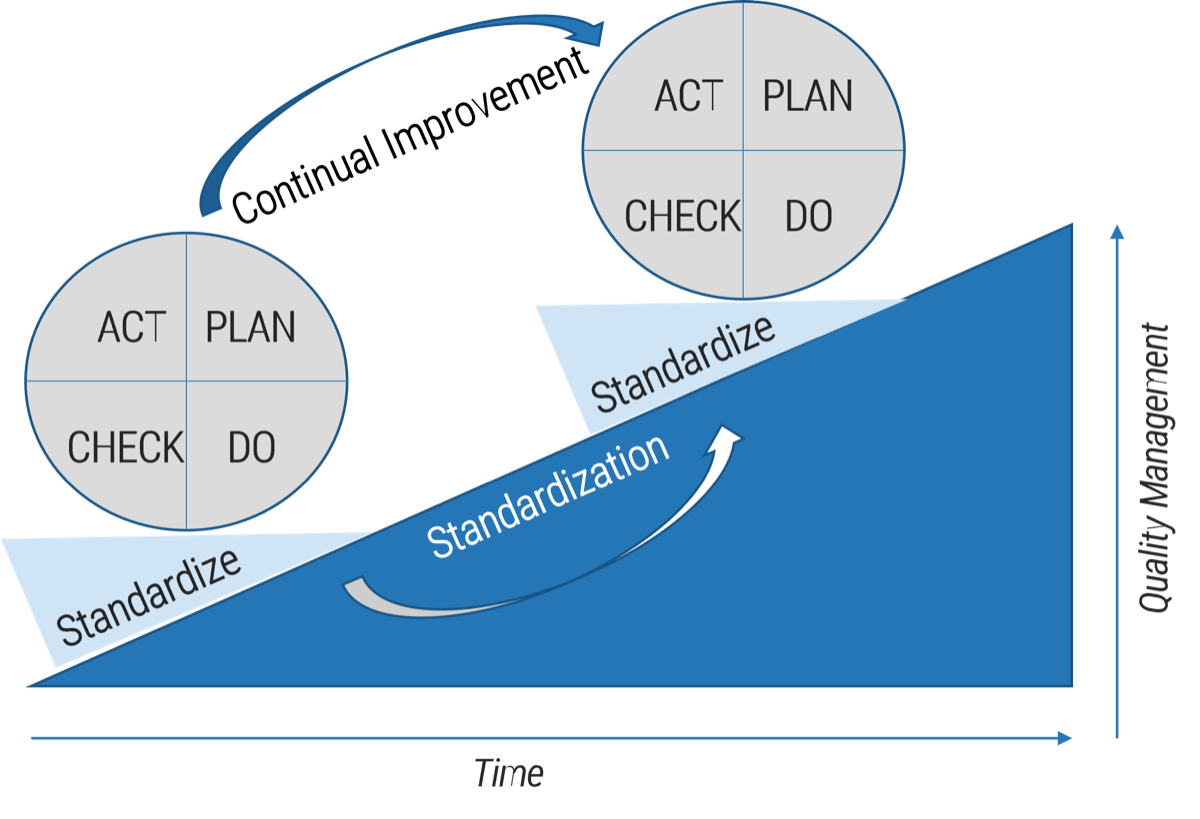

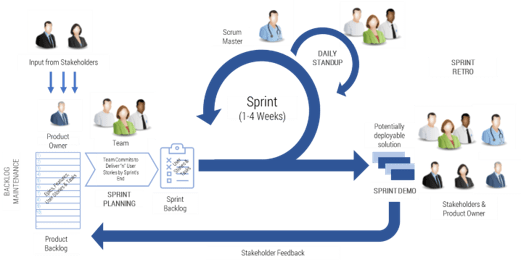

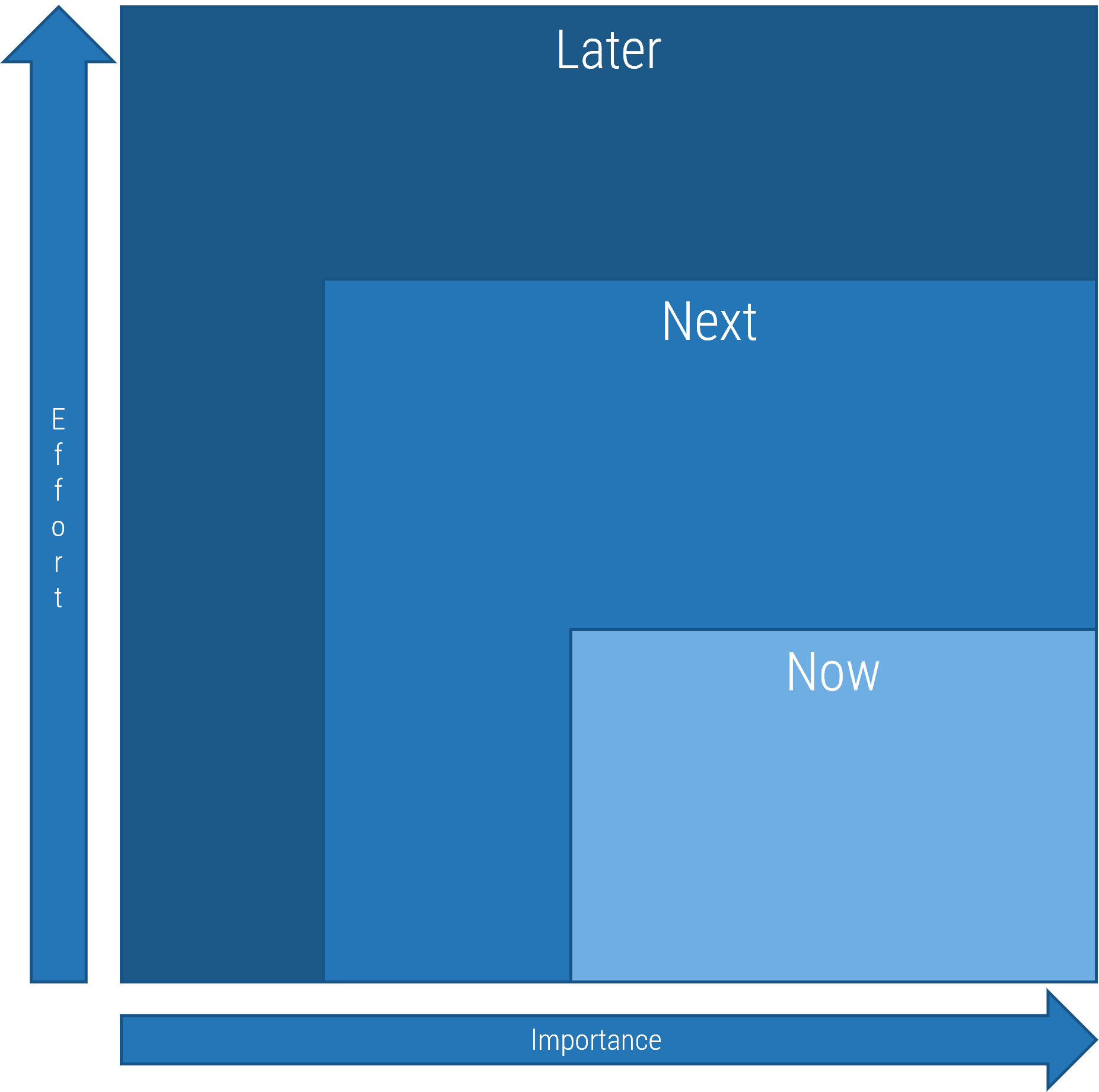

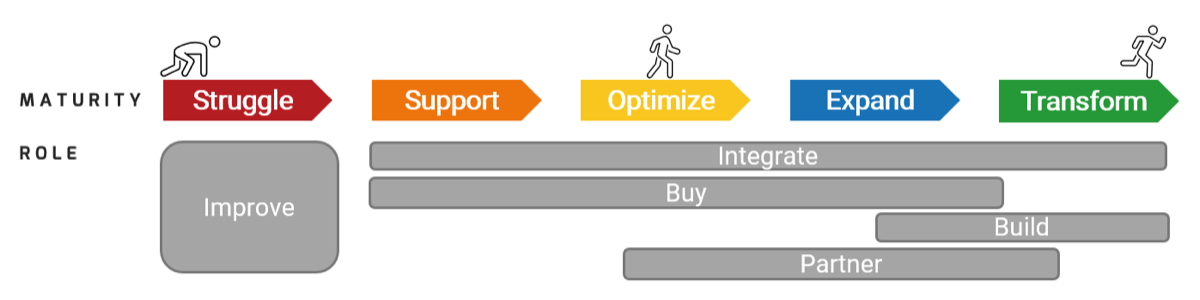

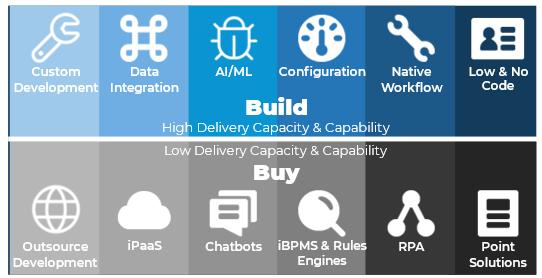

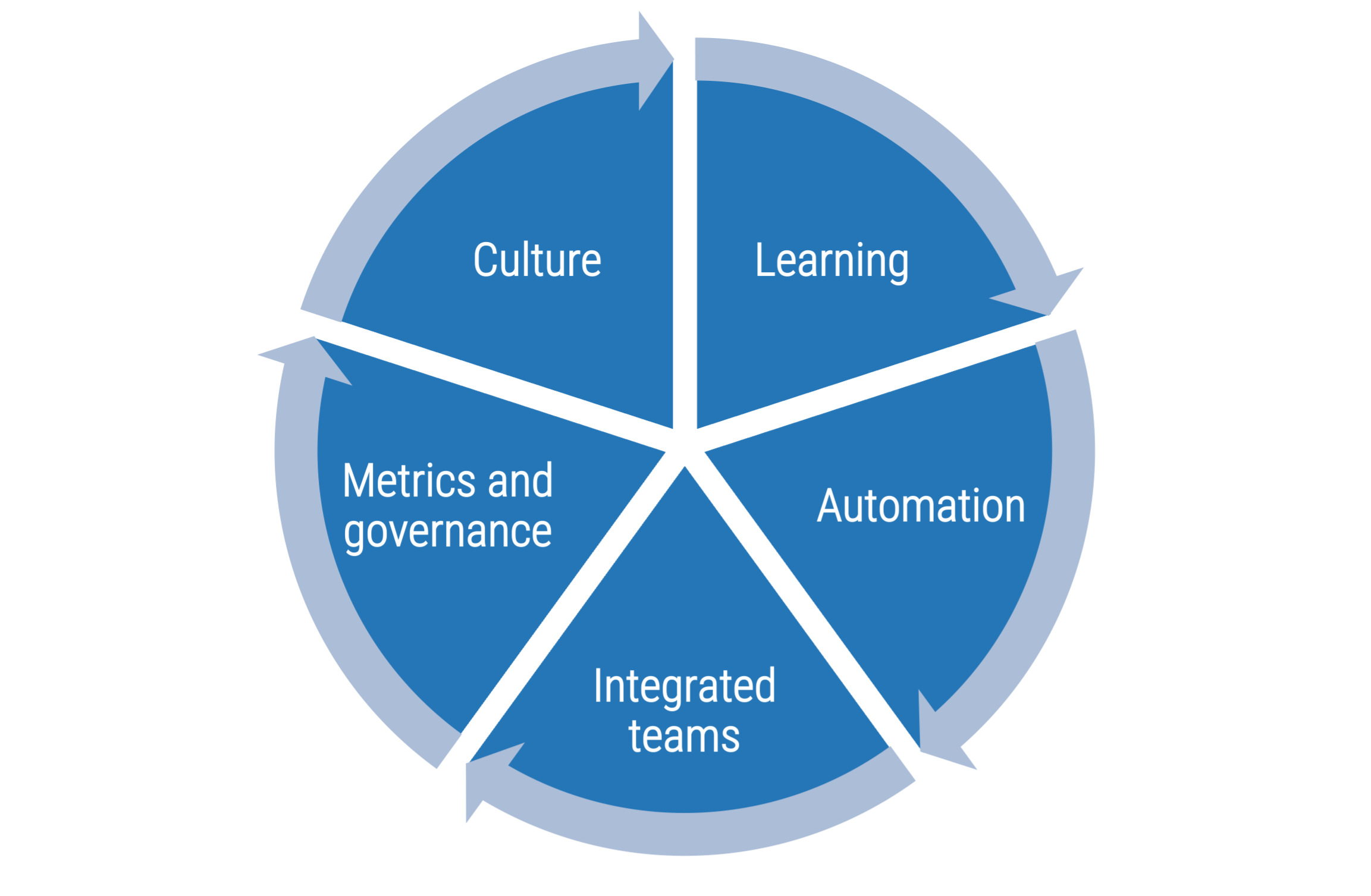

Use CLAIM to guide your journey

Value is best created by self-managing teams who deliver in frequent, short increments supported by leaders who coach them through challenges.

Product-centric delivery and Agile are a radical change in how people work and think. Structured, facilitated learning is required throughout the transformation to help leaders and practitioners make the shift.

Product management, Agile, and DevOps have inspired SDLC tools that have become a key part of delivery practices and work management.

Self-organizing teams that cross business, delivery, and operations are essential to gain the full benefits of product-centric delivery.

Successful implementations require the disciplined use of metrics that support developing better teams

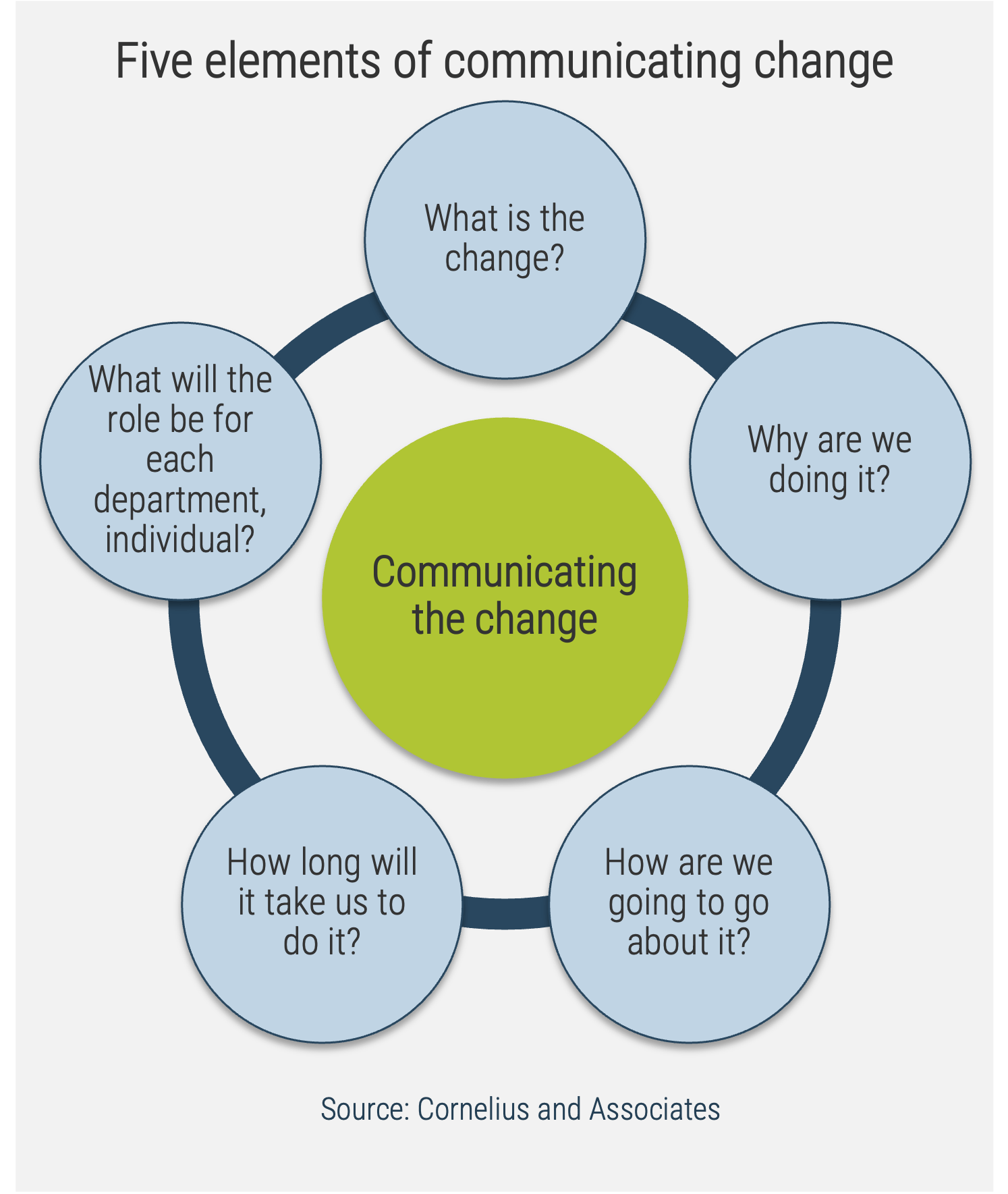

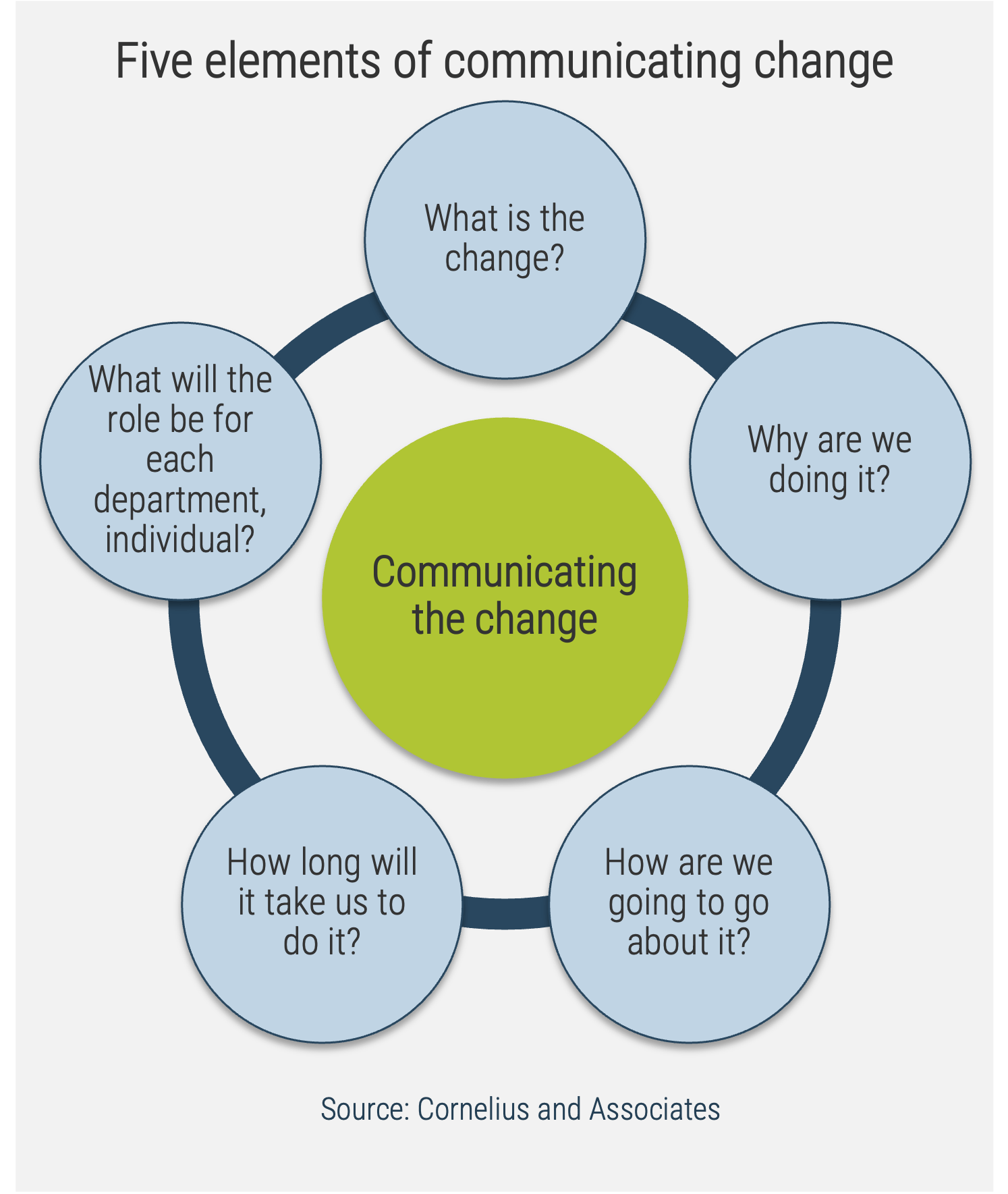

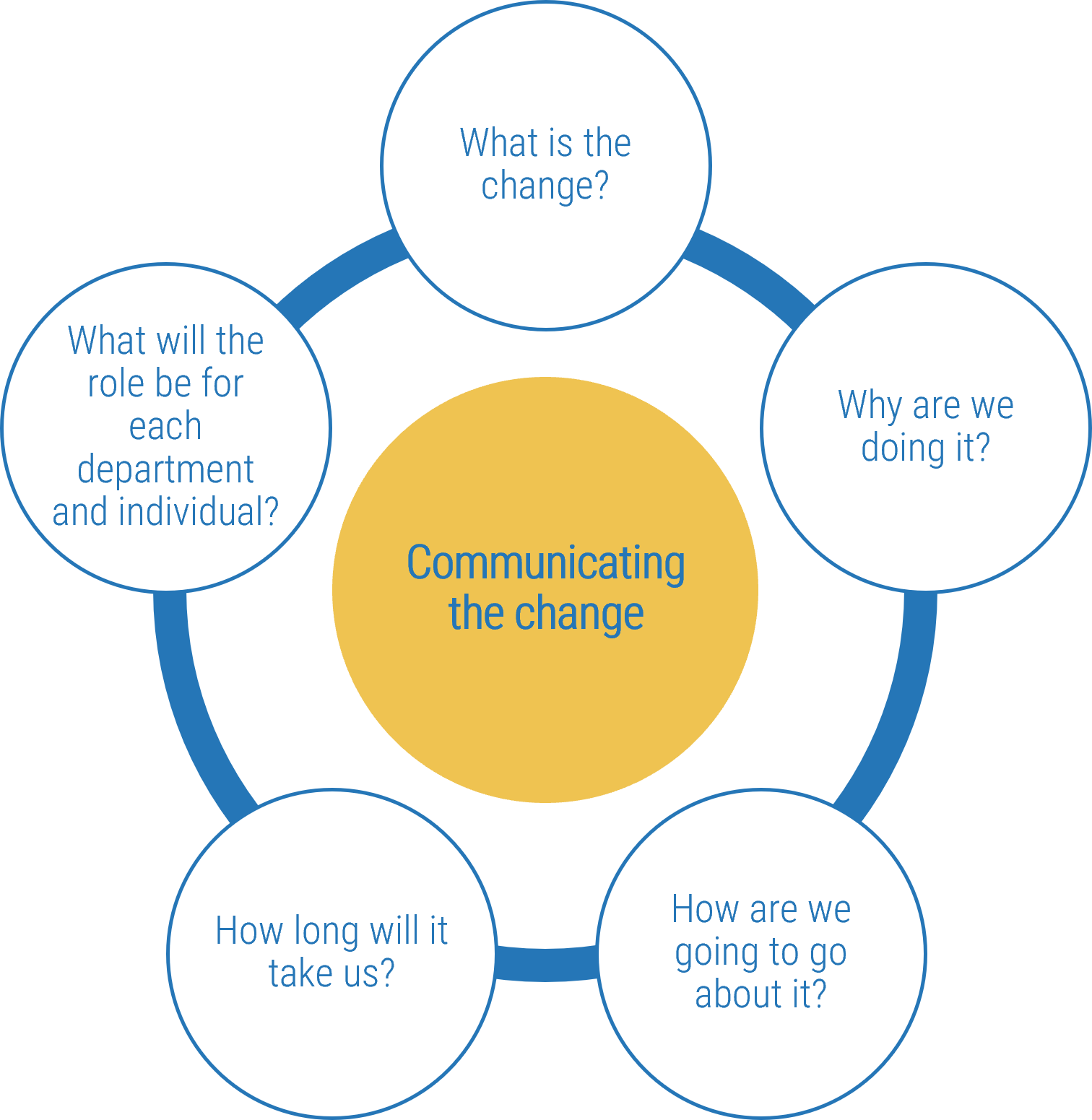

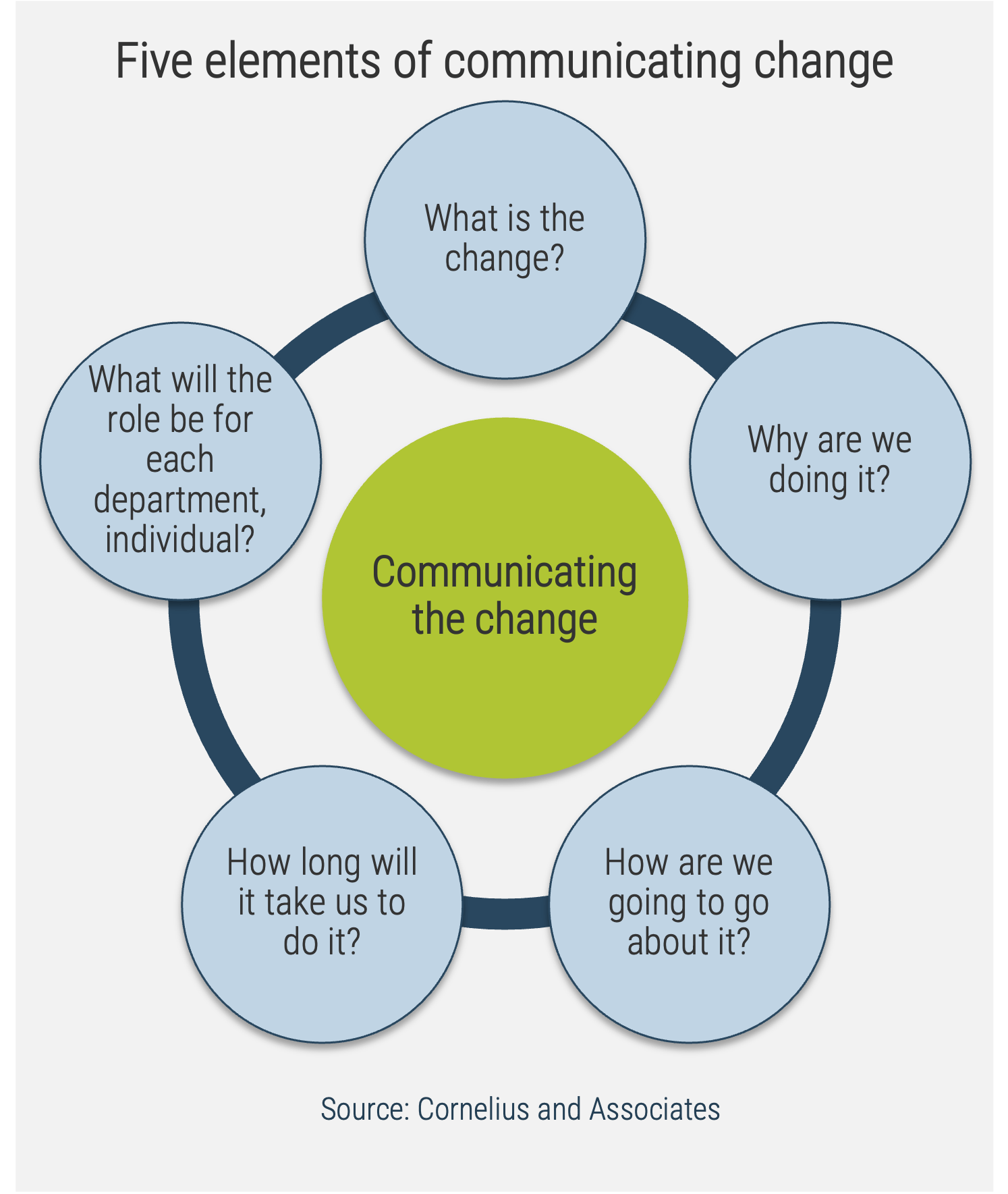

Communicate reasons for changes and how they will be implemented

Leaders of successful change spend considerable time developing a powerful change message; that is, a compelling narrative that articulates the desired end state, and that makes the change concrete and meaningful to staff.

The organizational change message should:

-

Explain why the change is needed.

-

Summarize what will stay the same.

-

Highlight what will be left behind.

-

Emphasize what is being changed.

-

Explain how the change will be implemented.

-

Address how change will affect various roles in the organization.

-

Discuss the staff’s role in making the change successful.

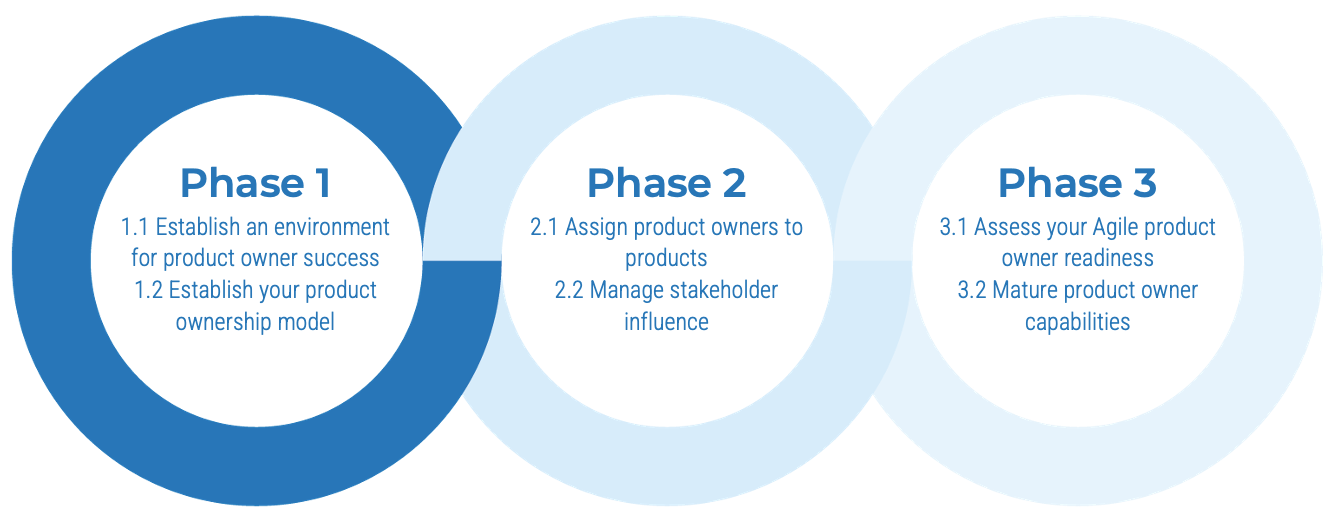

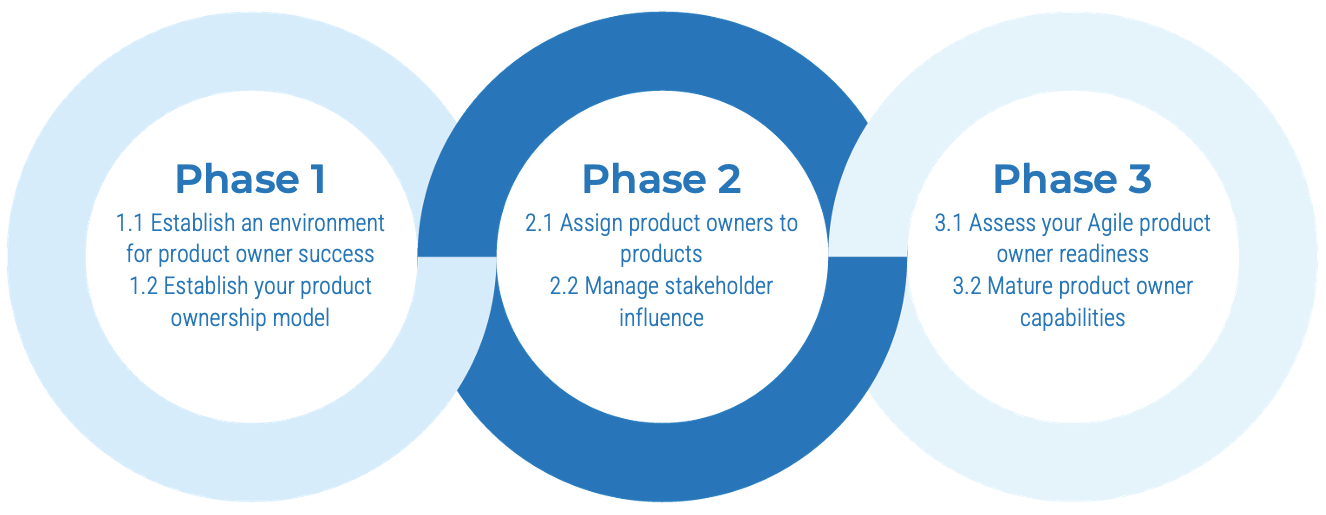

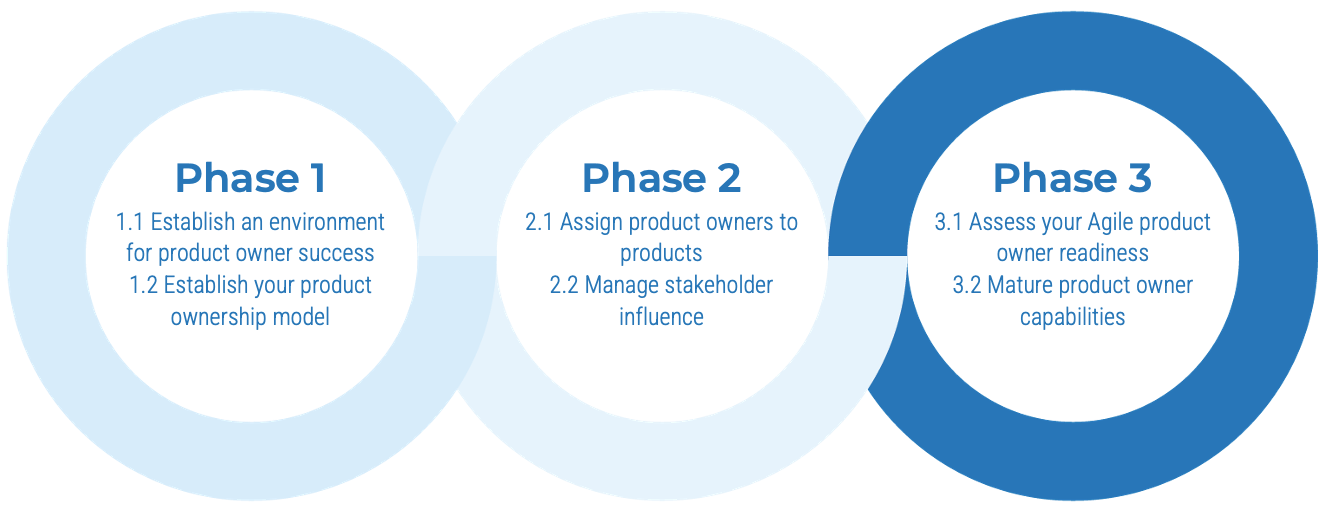

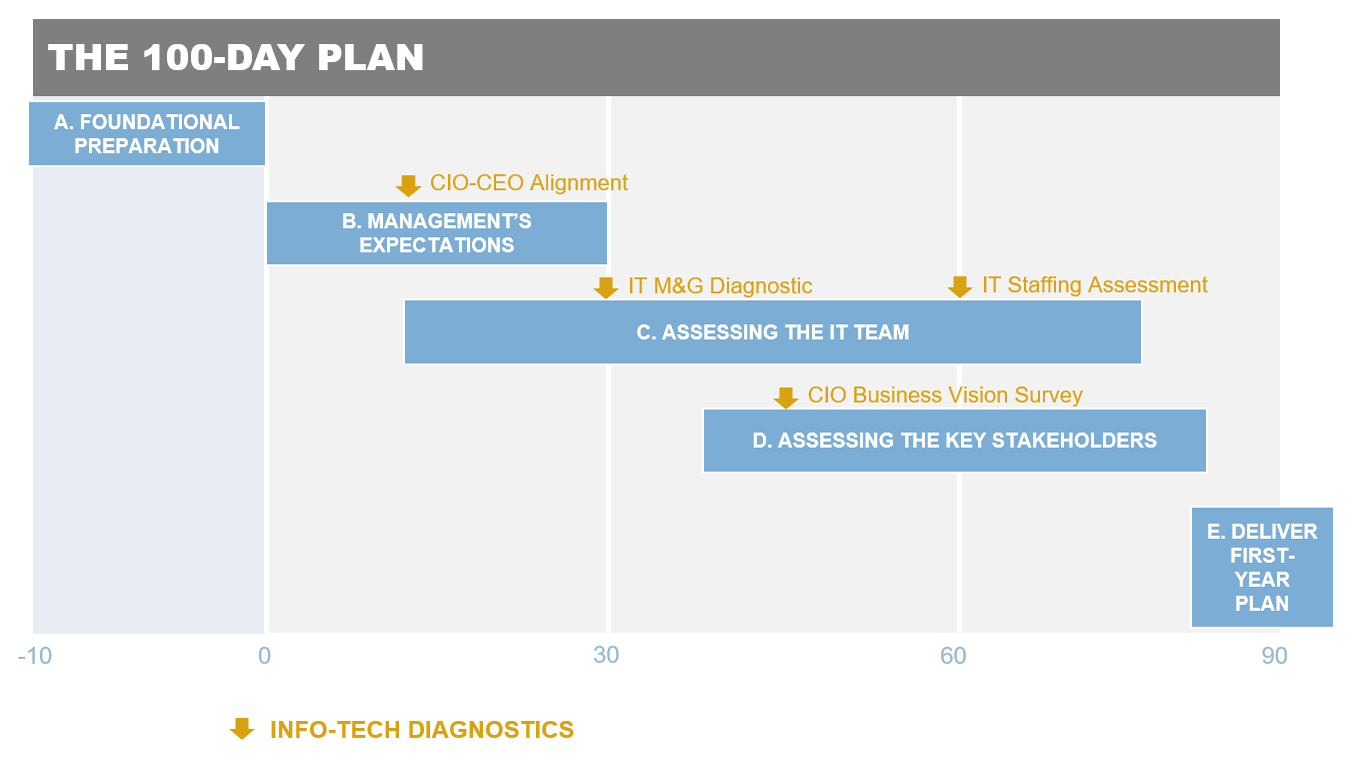

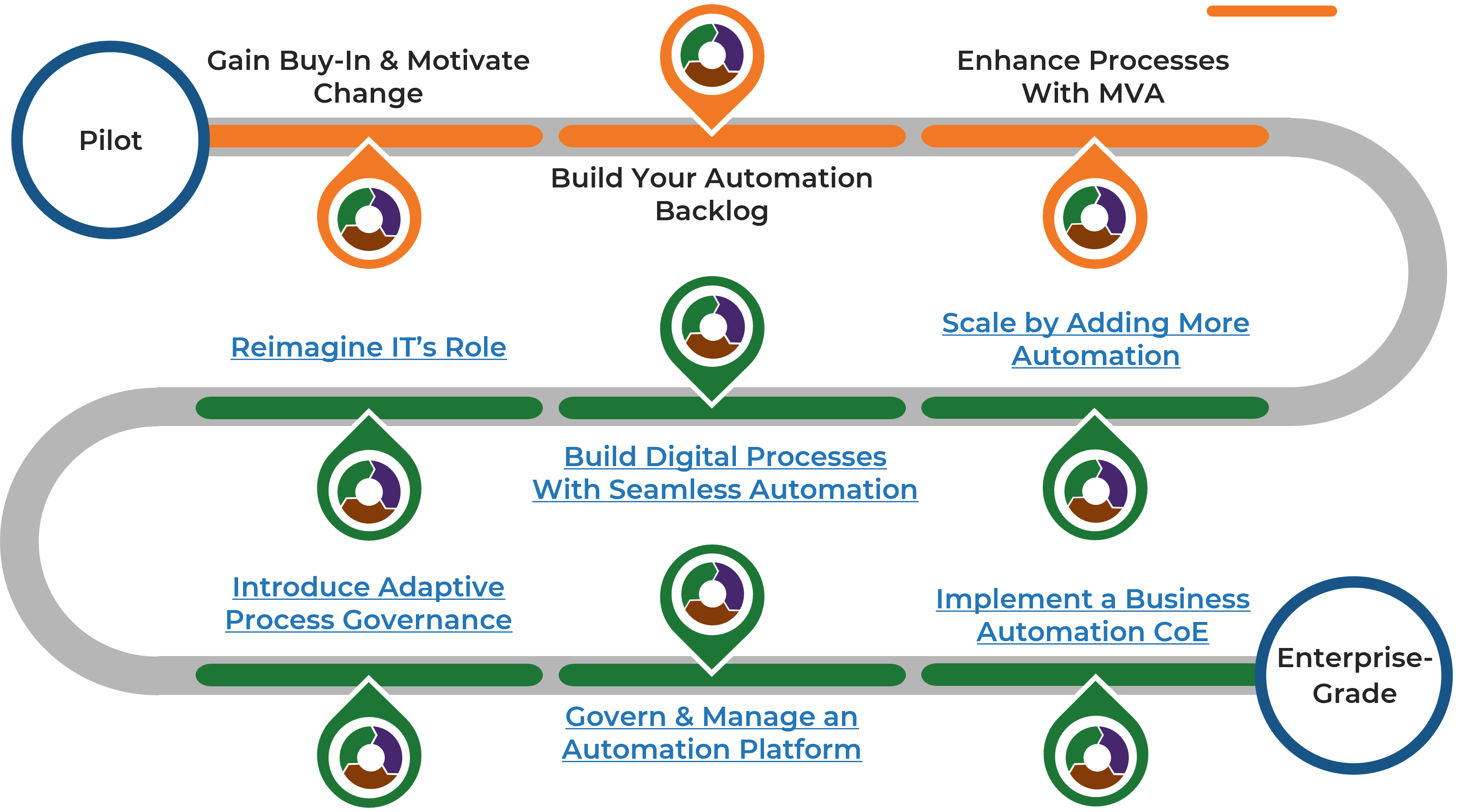

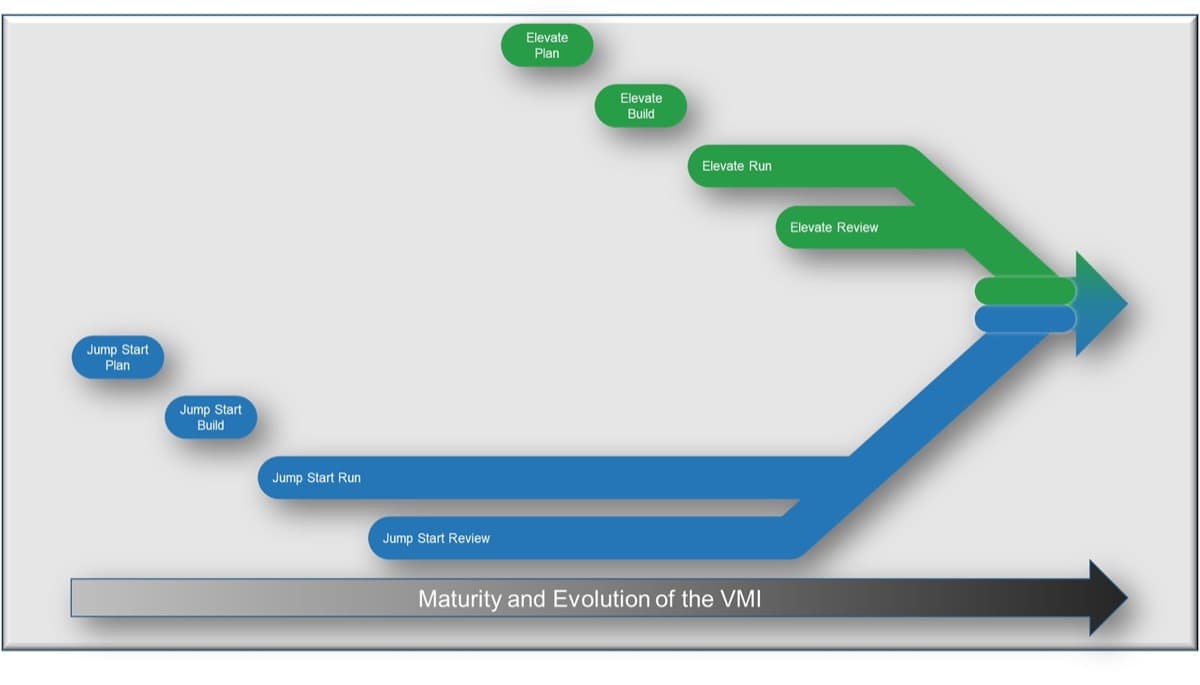

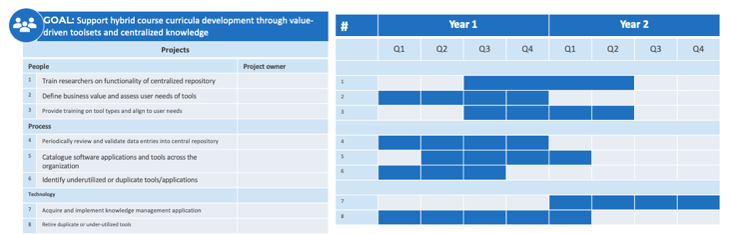

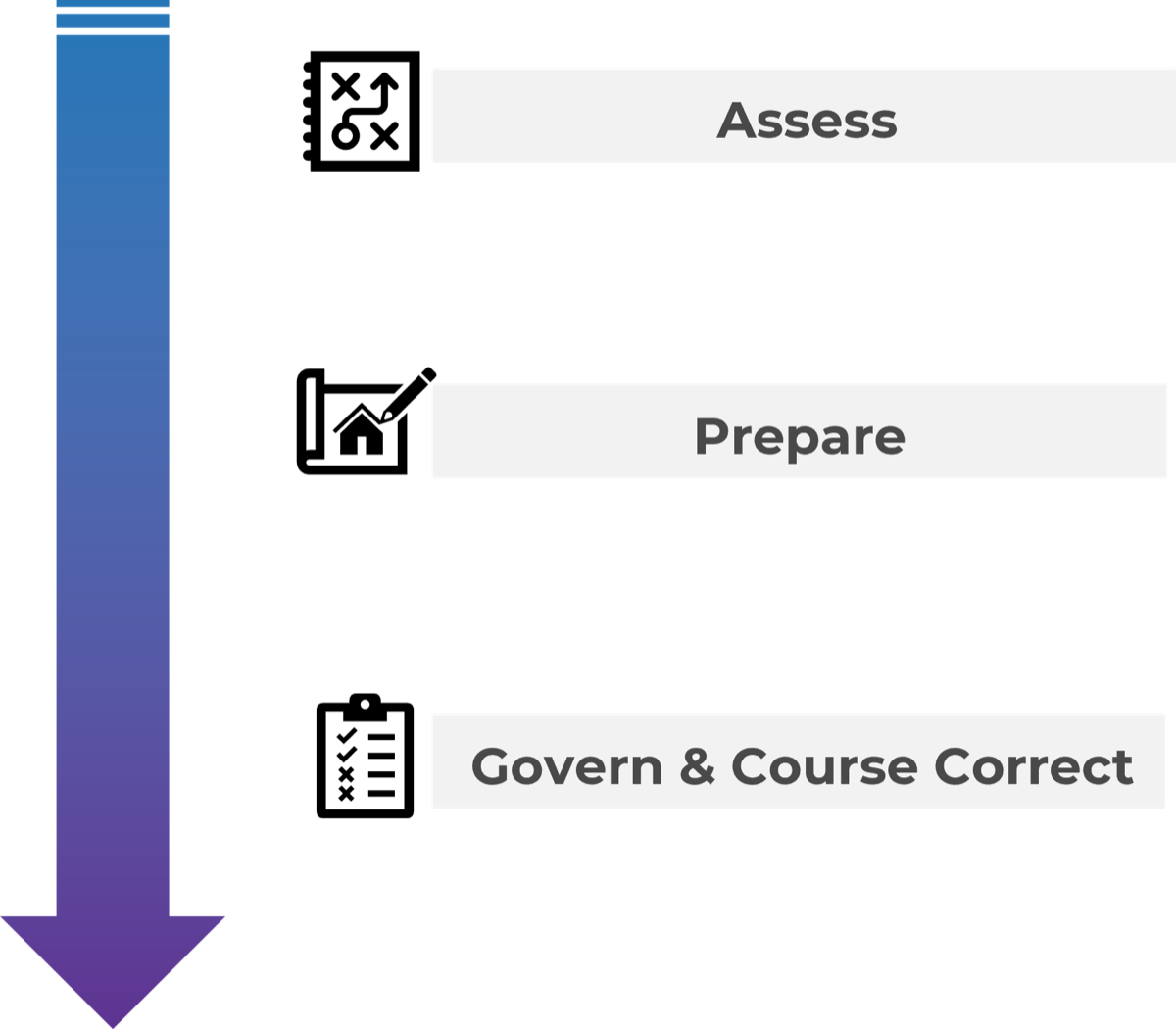

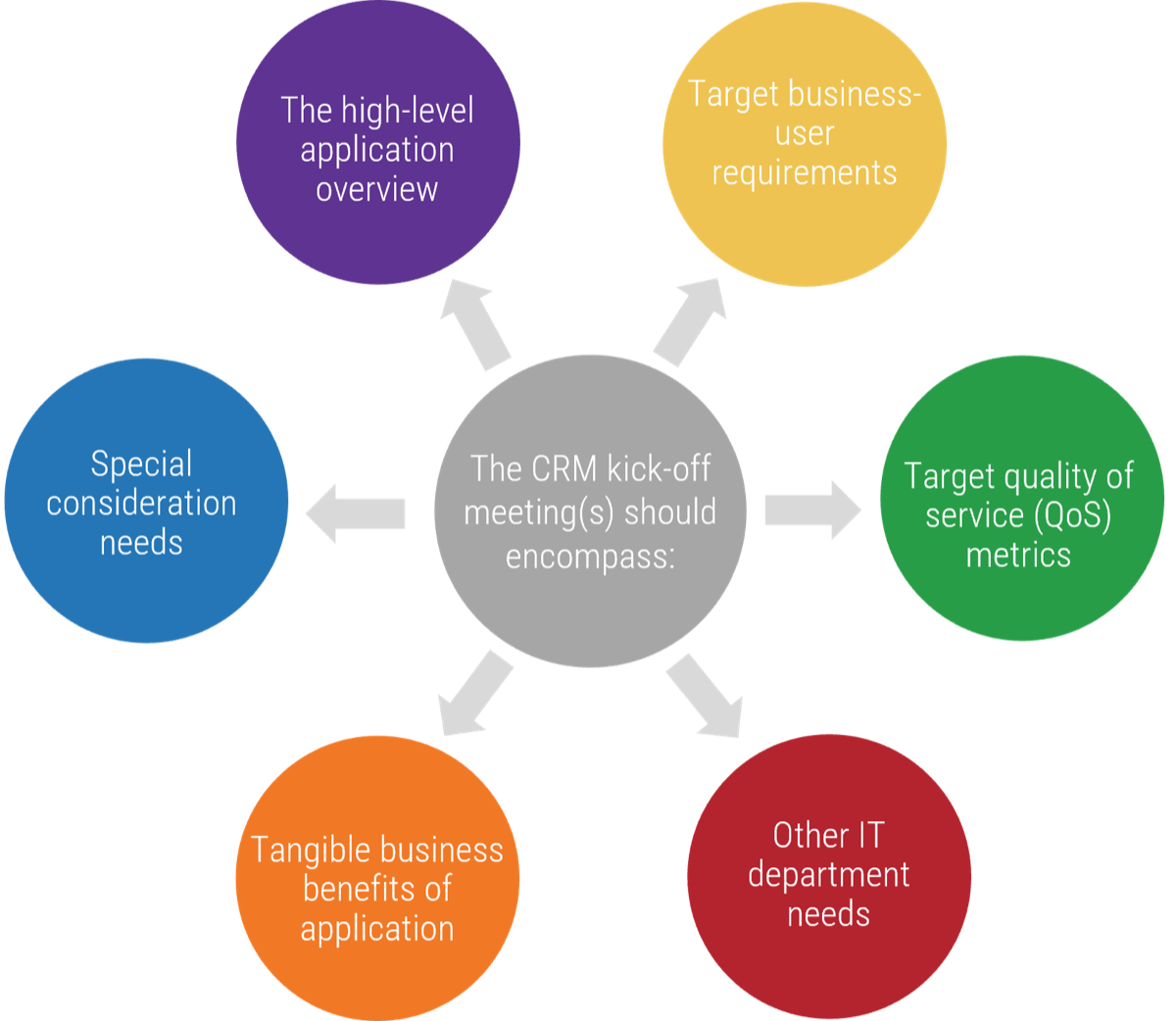

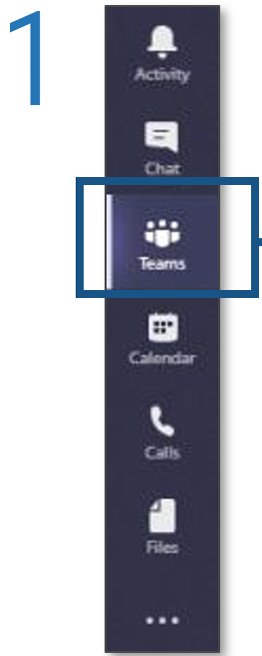

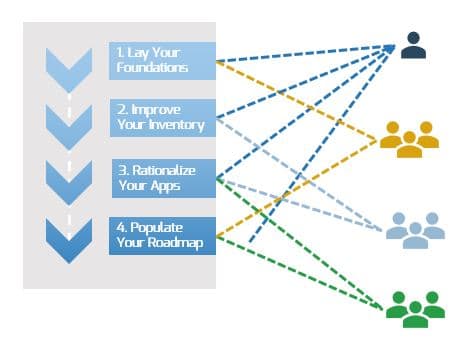

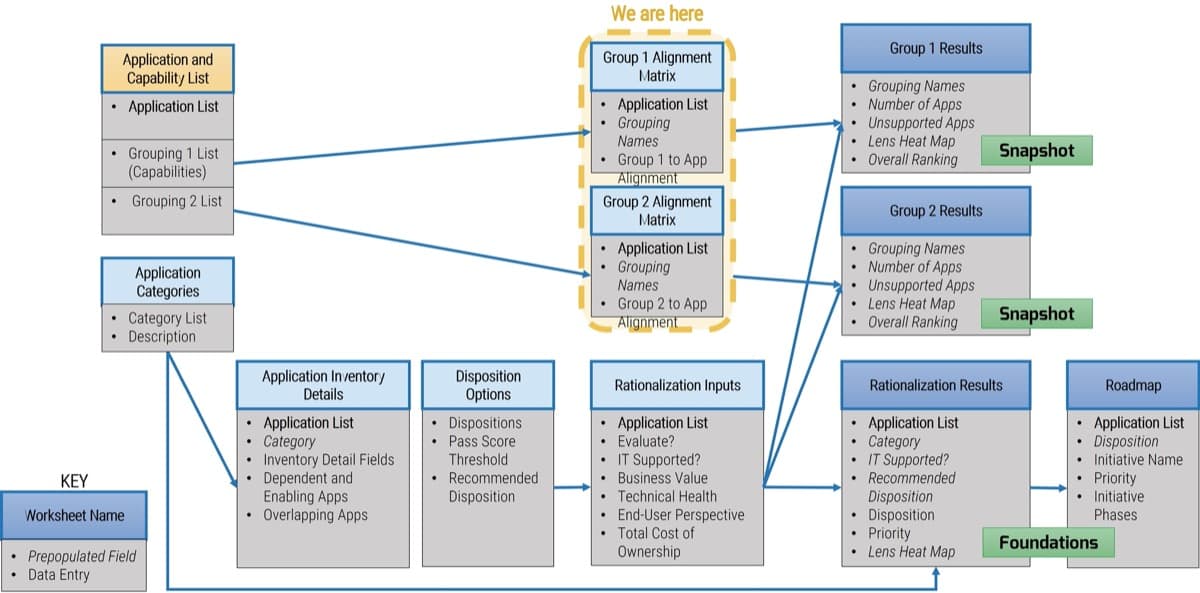

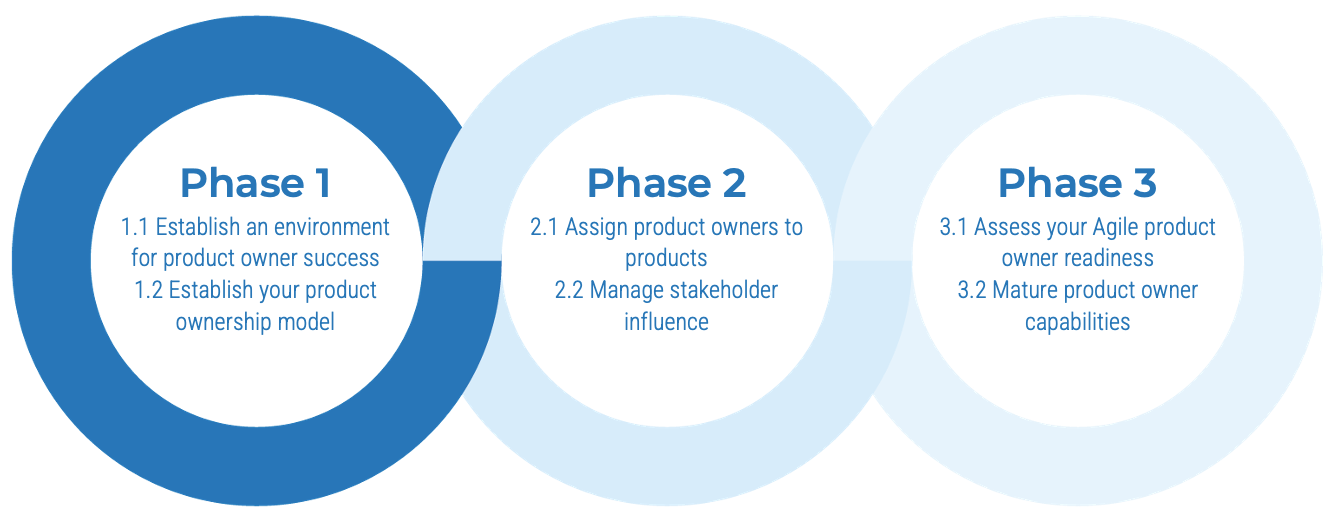

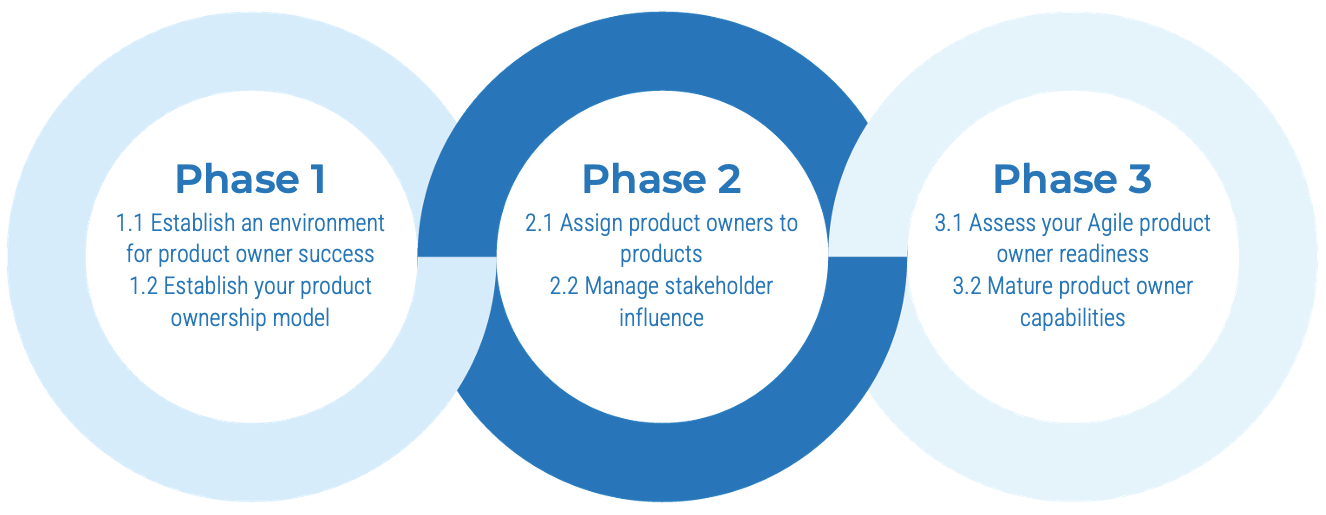

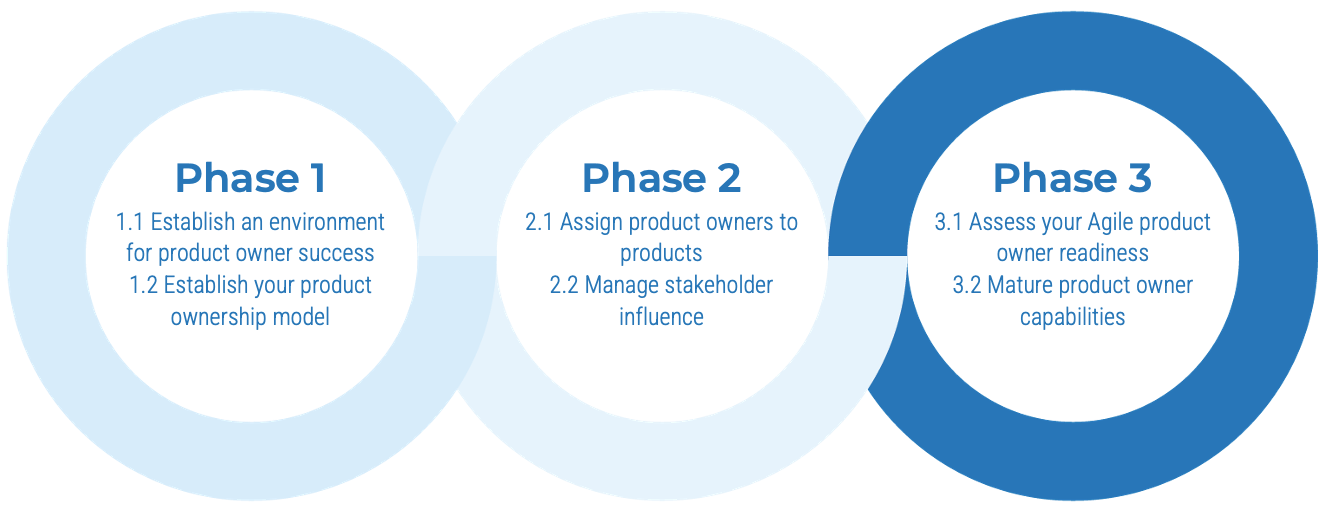

Info-Tech’s methodology for mature and scale product ownership

Phase steps

|

1. Establish the foundation for product ownership

Step 1.1 Establish an environment for product owner success

Step 1.2 Establish your product ownership model

|

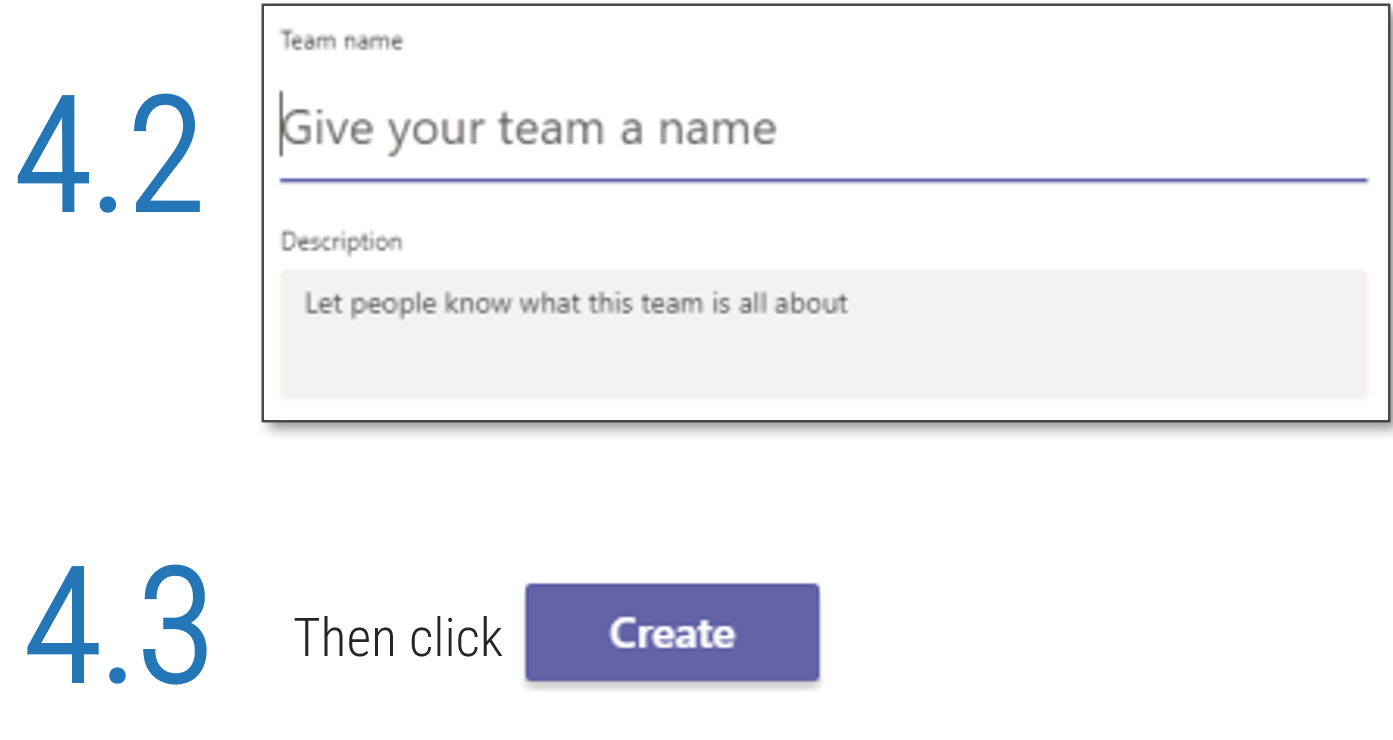

2. Align product owners to products

Step 2.1 Assign product owners to products

Step 2.2 Manage stakeholder influence

|

3. Mature product owner capabilities

Step 3.1 Assess your Agile product owner readiness

Step 3.2 Mature product owner capabilities

|

Phase outcomes

|

1.1.1 Define enablers and blockers of product management

1.1.2 Define your product management roles and names

1.2.1 Identify your primary product owner perspective

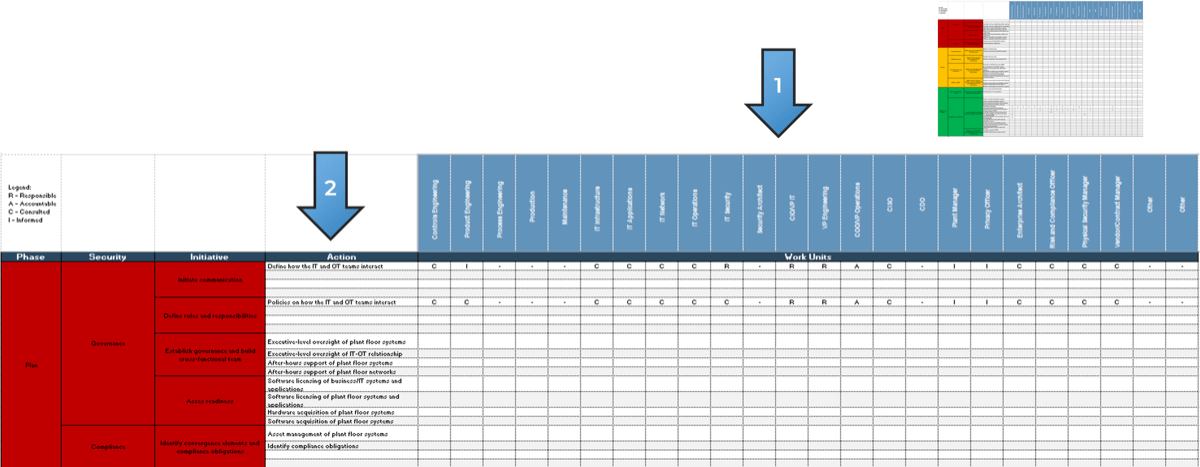

1.2.2 Define your product owner RACI

|

2.1.1 Assign resources to your products and families

2.2.1 Visualize relationships to identify key influencers

2.2.2 Group stakeholders into categories

2.2.3 Prioritize your stakeholders

|

3.1.1 Assess your real Agile skill proficiency

3.2 Mature product owner capabilities

3.2.1 Assess your vision capability proficiency

3.2.2 Assess your leadership capability proficiency

3.2.3 Assess your PLM capability proficiency

3.2.4 Identify your business value drivers and sources of value

3.2.5 Assess your value realization capability proficiency

|

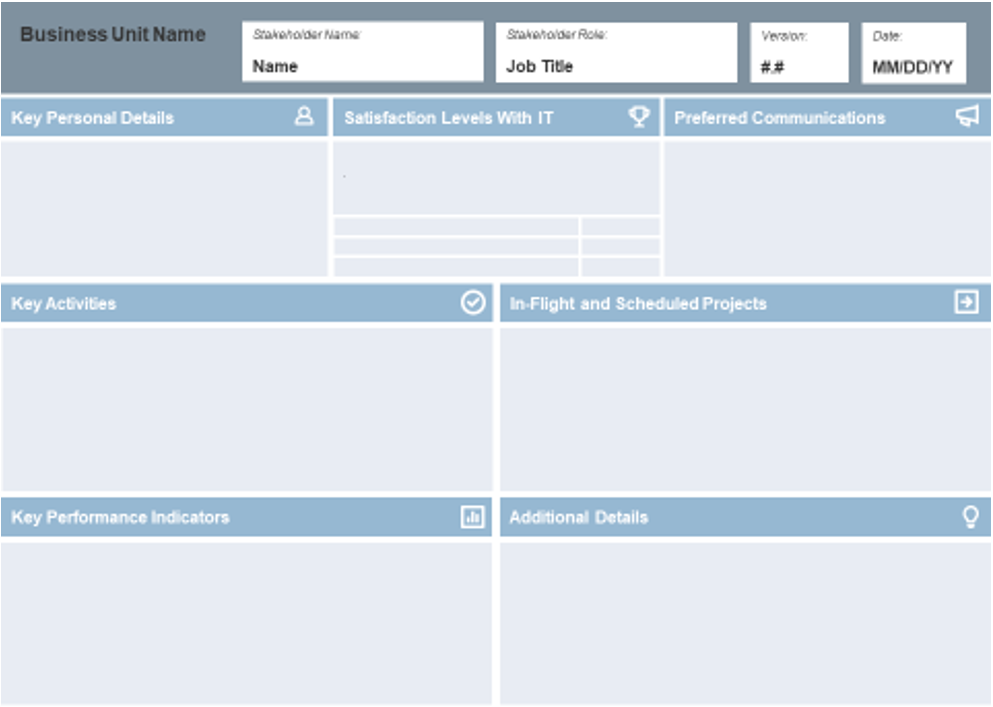

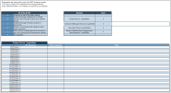

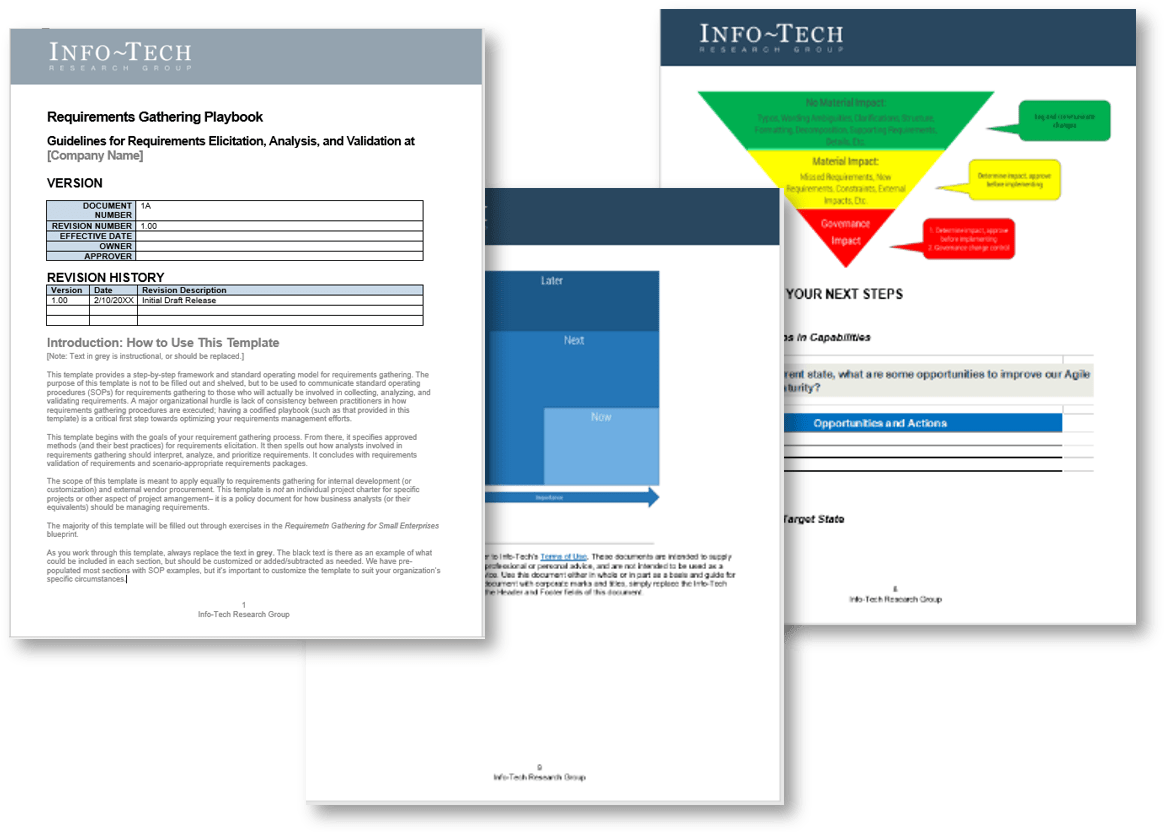

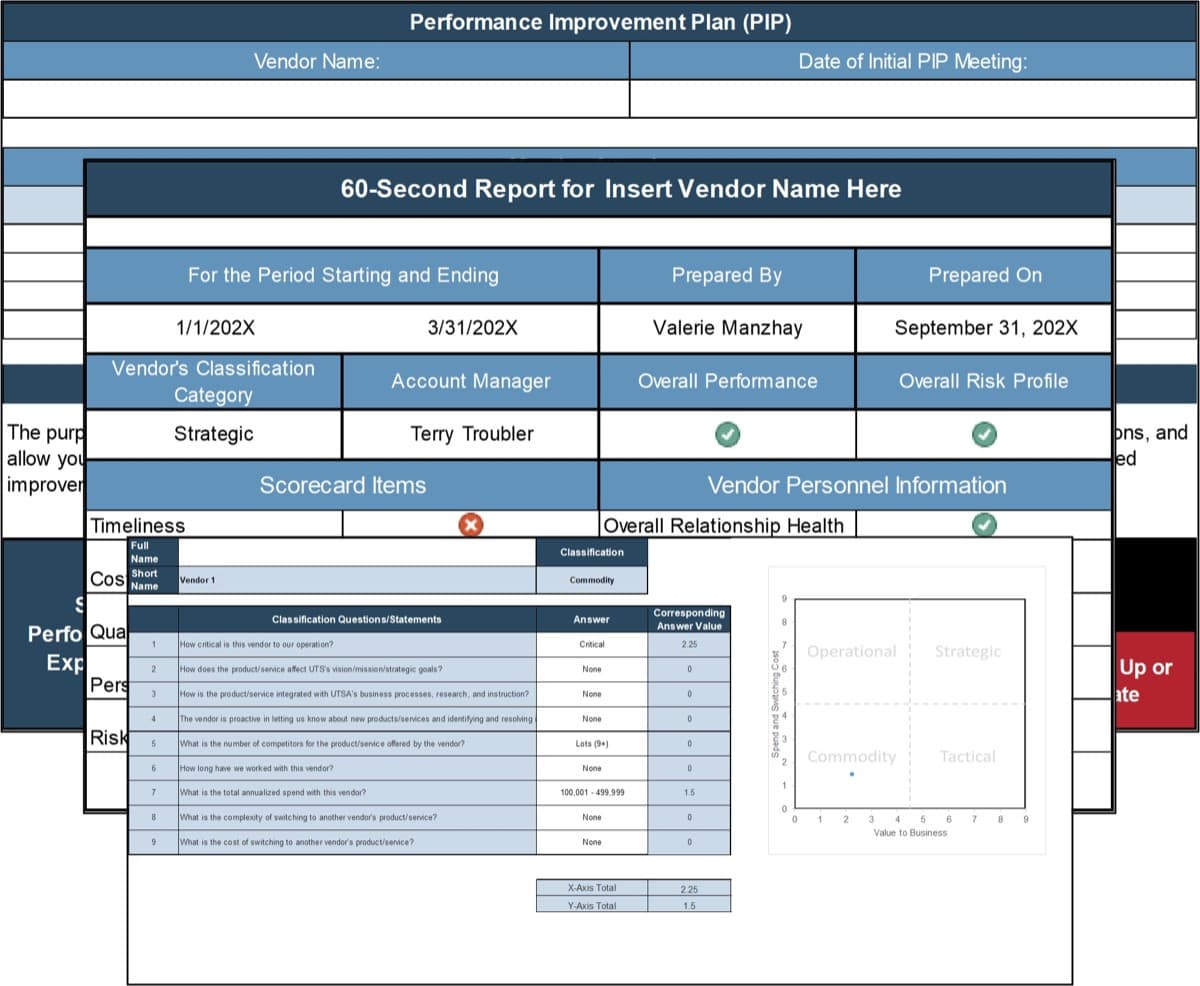

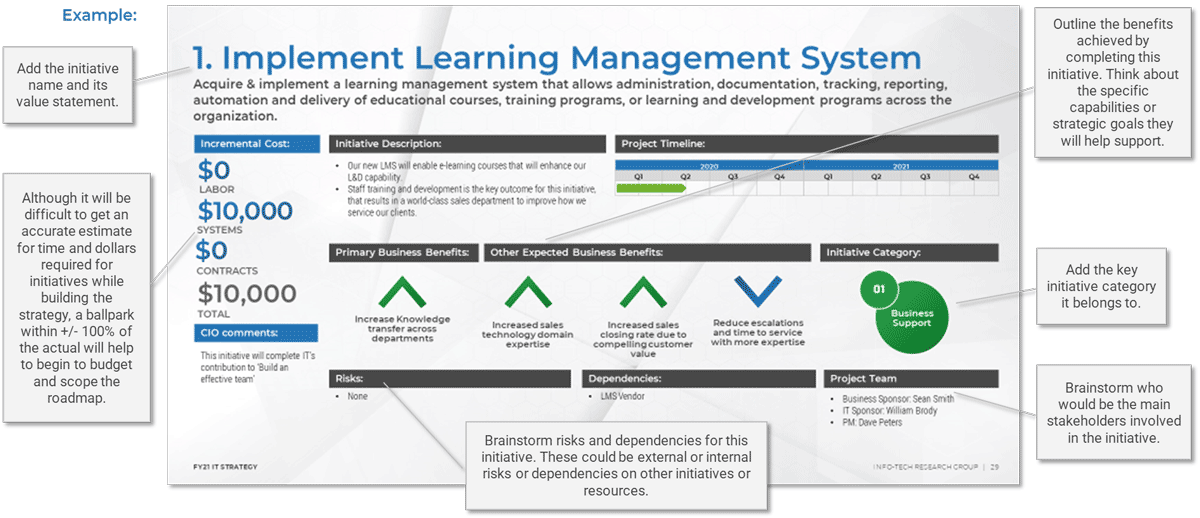

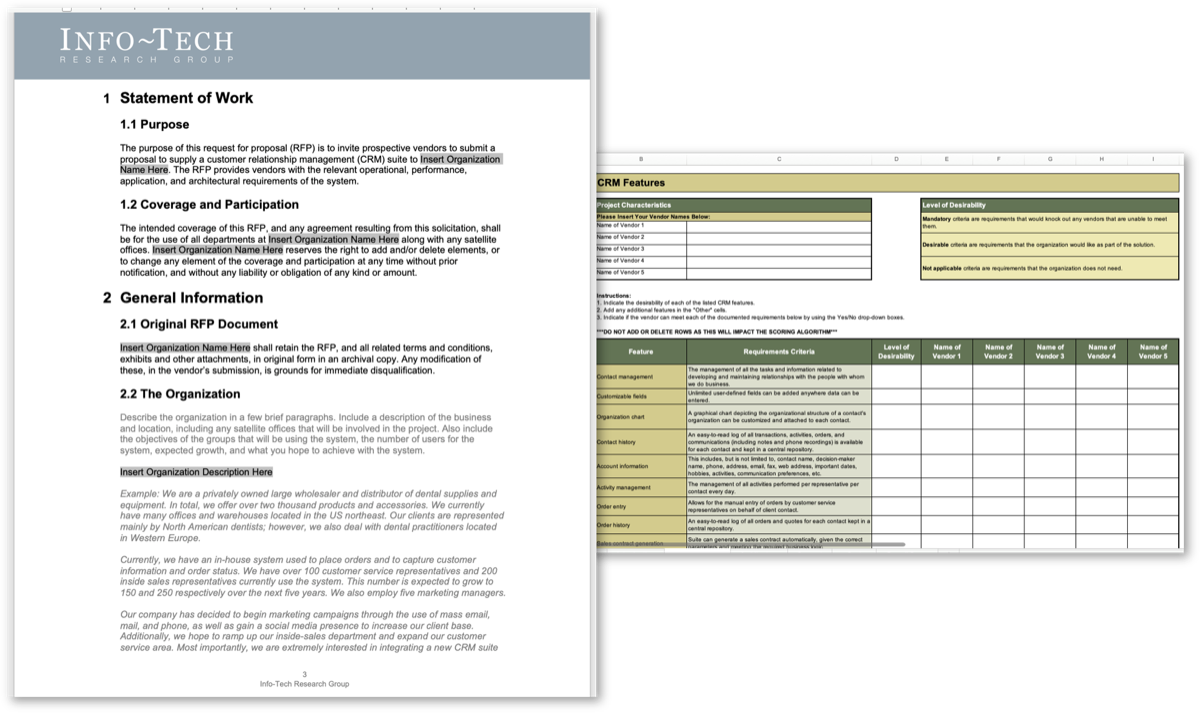

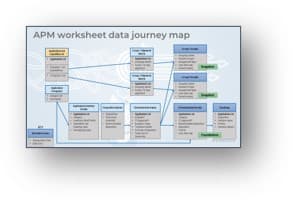

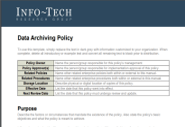

Blueprint deliverables

Each step of this blueprint is accompanied by supporting deliverables to help you accomplish your goals.

Key deliverable

Mature and Scale Product Ownership Playbook

Capture and organize the outcomes of the activities in the workbook.

Mature and Scale Product Ownership Workbook

The workbook helps organize and communicate the outcomes of each activity.

Mature and Scale Product Ownership Readiness Assessment

Determine your level of mastery of real Agile skills and product owner capabilities.

Blueprint benefits

IT benefits

-

Competent product owner who can support teams operating in any delivery methodology.

-

Representative viewpoint and input from the technical and operational product owner perspectives.

-

Products aligned to business needs and committed work are achievable.

-

Single point of contact with a business representative.

-

Acceptance of product owner role outside the Scrum teams.

Business benefits

-

Better alignment to enterprise goals, vision, and outcomes.

-

Improved coordination with stakeholders.

-

Quantifiable value realization tied to vision.

-

Product decisions made at the right time and with the right input.

-

Product owner who has the appropriate business, operations, and technical knowledge.

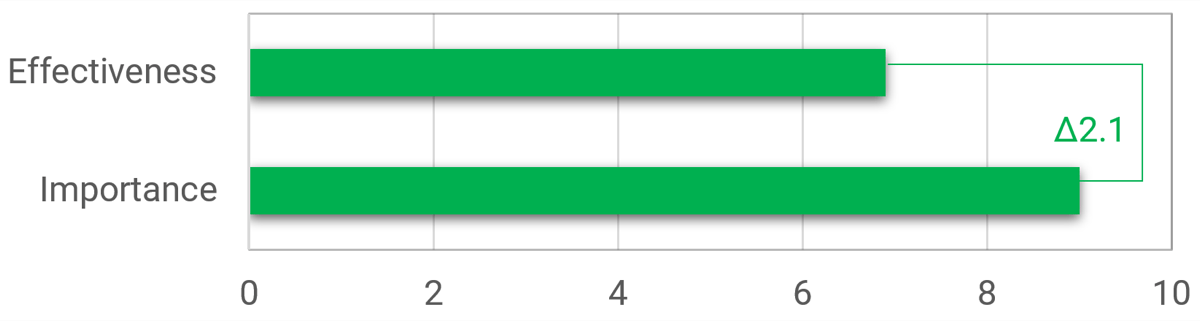

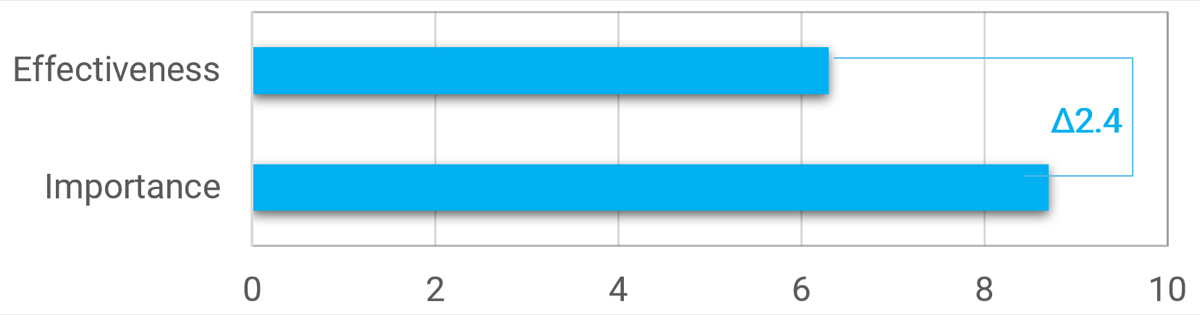

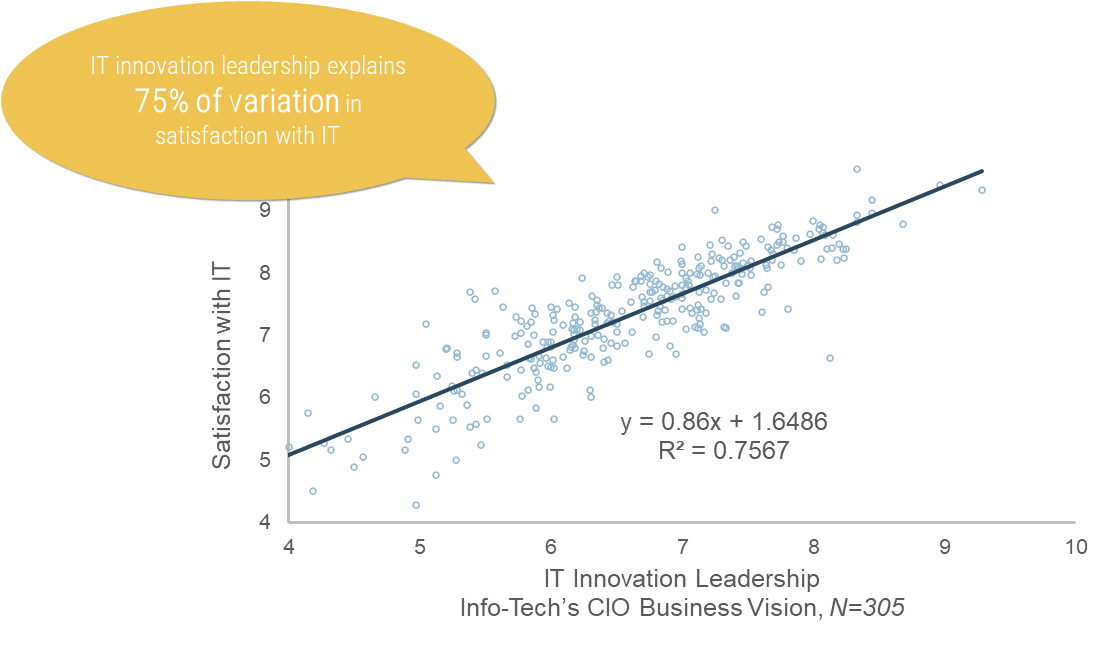

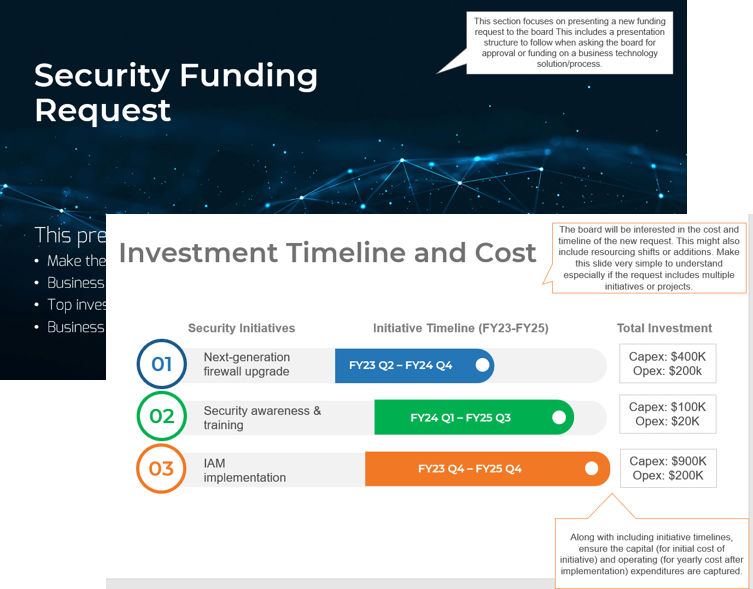

Measure the value of this blueprint

Align product owner metrics to product delivery and value realization.

Member outcome

|

Suggested Metric

|

Estimated impact

|

|

Increase business application satisfaction

|

Satisfaction of business applications

(CIO BV Diagnostic)

|

20% increase within one year after implementation

|

|

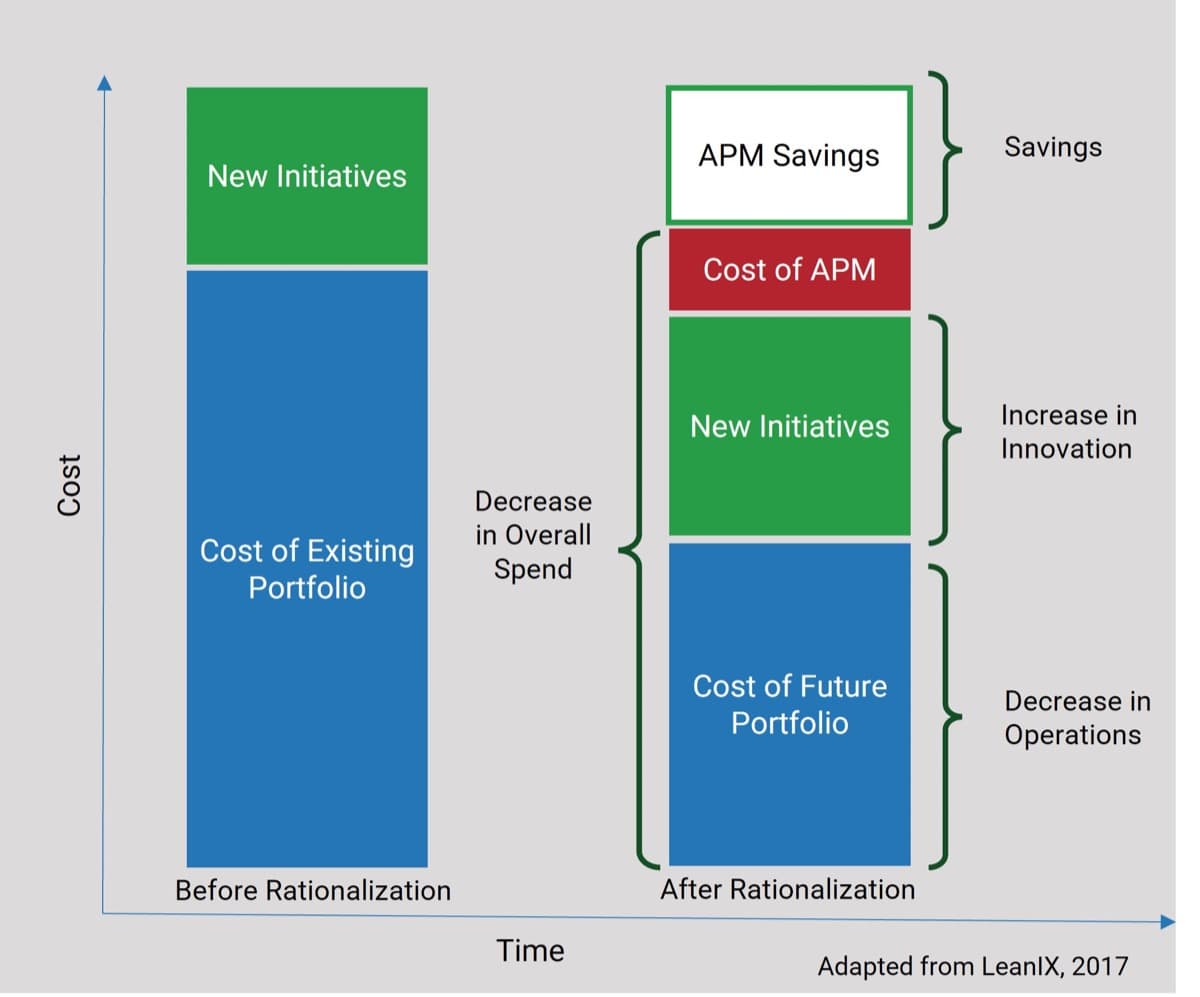

Increase effectiveness of application portfolio management

|

Effectiveness of application portfolio management (M&G Diagnostic)

|

20% increase within one year after implementation

|

|

Increase importance and effectiveness of application portfolio

|

Importance and effectiveness to business (APA Diagnostic)

|

20% increase within one year after implementation

|

|

Increase satisfaction of support of business operations

|

Support to business (CIO BV Diagnostic)

|

20% increase within one year after implementation

|

|

Successfully deliver committed work (productivity)

|

Number of successful deliveries; burndown

|

Reduction in project implementation overrun by 20%

|

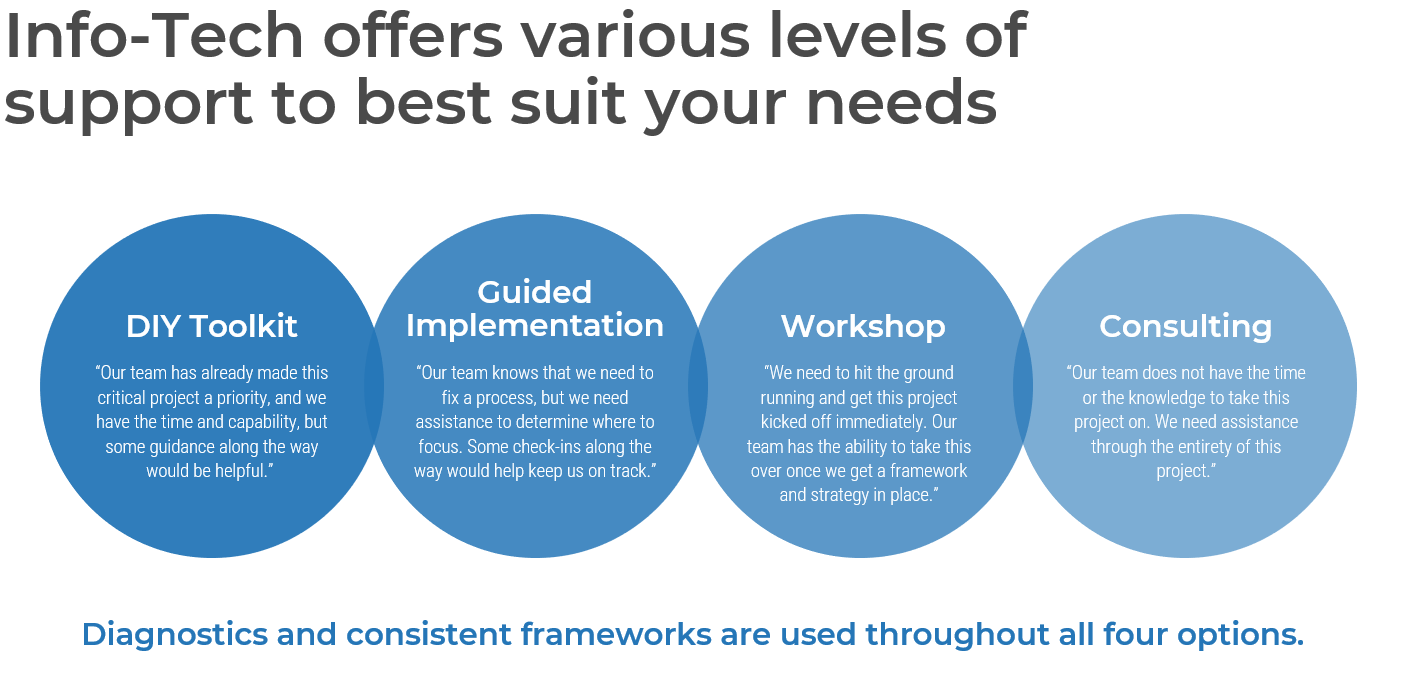

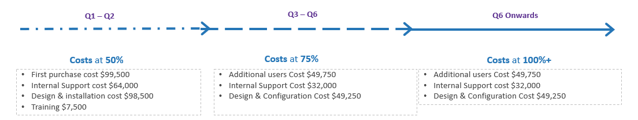

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit

"Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful."

Guided Implementation

"Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along

the way would help keep us on track."

Workshop

"We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place."

Consulting

"Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project"

Diagnostics and consistent frameworks are used throughout all four options.

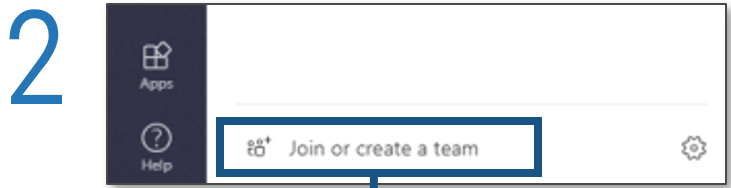

Guided Implementation

What does a typical GI on this topic look like?

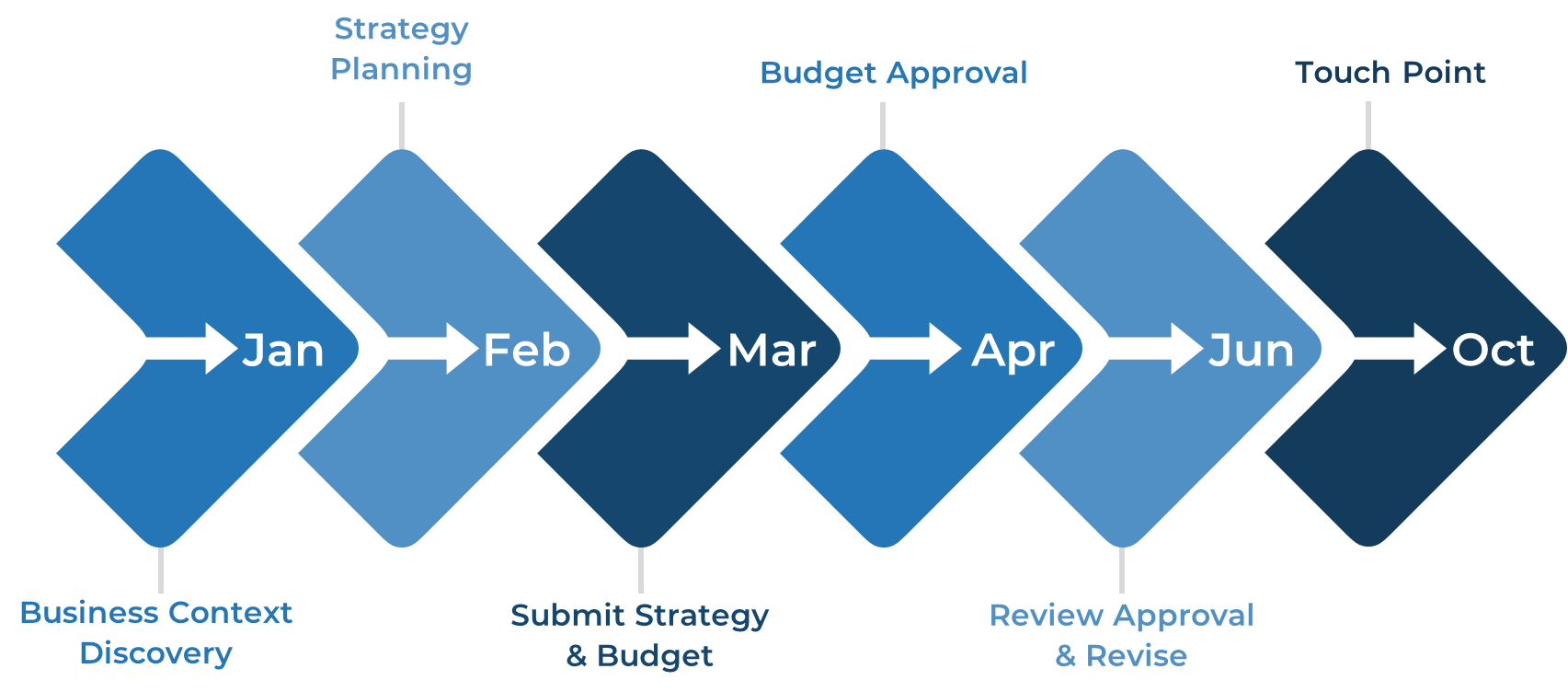

Phase 1 Establish the Foundation for Product Ownership

|

Phase 2 Align Product Owners to Products

|

Phase 3 Mature Product Owner Capabilities

|

-

Call #1:

Scope objectives and your specific challenges

-

Call #2:

Step 1.1 Establish an environment for product owner success

Step 1.2 Establish your product ownership model

|

-

Call #3:

Step 2.1 Assign product owners to products

-

Call #4:

Step 2.2 Manage stakeholder influence

|

-

Call #5:

Step 3.1 Assess your Agile product owner readiness

-

Call #6:

Step 3.2 Mature product owner capabilities

|

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is between 8 and 12 calls over the course of 4 to 6 months.

Workshop Overview

Contact your account representative for more information.

workshops@infotech.com 1-888-670-8889

| Phase 1 | Phase 2 | Phase 3 |

Activities |

Establish the Foundation for Product Ownership

Step 1.1 Establish an environment for product owner success

1.1.1 Define enablers and blockers of product management

1.1.2 Define your product management roles and names

1.1.3 Assess your product management readiness

Step 1.2 Establish your product ownership model

1.2.1 Identify your primary product owner perspective

1.2.2 Define your product owner RACI

| Align Product Owners to Products

Step 2.1 Assign product owners to products

2.1.1 Assign resources to your products and families

Step 2.2 Manage stakeholder influence

2.2.1 Visualize relationships to identify key influencers

2.2.2 Group stakeholders into categories

2.2.3 Prioritize your stakeholders

| Mature Product Owner Capabilities

Step 3.1 Assess your Agile product owner readiness

3.1.1 Assess your real Agile skill proficiency

Step 3.2 Mature product owner capabilities=

3.2.1 Assess your Vision capability proficiency

3.2.2 Assess your Leadership capability proficiency

3.2.3 Assess your PLM capability proficiency

3.2.4 Identify your business value drivers and sources of value

3.2.5 Assess your Value Realization capability proficiency

|

Deliverables |

-

Enablers and blockers

-

Role definitions

-

Product culture readiness

-

Product owner perspective mapping

-

Product owner RACI

|

-

Product resource assignment

-

Stakeholder management strategy

|

-

Real Agile skill proficiency assessment

-

Info-Tech’s product owner capability model proficiency assessment

-

Business value drivers and sources of value

|

Related Info-Tech Research

Product delivery

Build a product vision your organization can take from strategy through execution.

Deliver value at the scale of your organization through defining enterprise product families.

Quickly assess the state of your Agile readiness and plan your path forward to higher value realization.

Understand Agile fundamentals, principles, and practices so you can apply them effectively in your organization.

Streamline business value delivery through the strategic adoption of DevOps practices.

Further the benefits of Agile by extending a scaled Agile framework to the business.

Embrace a team sport culture built around continuous business-IT collaboration to deliver great products.

Shift security left to get into DevSecOps.

Facilitate ongoing alignment between Agile teams and the business with a set of targeted service offerings.

Execute a disciplined approach to rolling out Agile methods in the organization.

Related Info-Tech Research

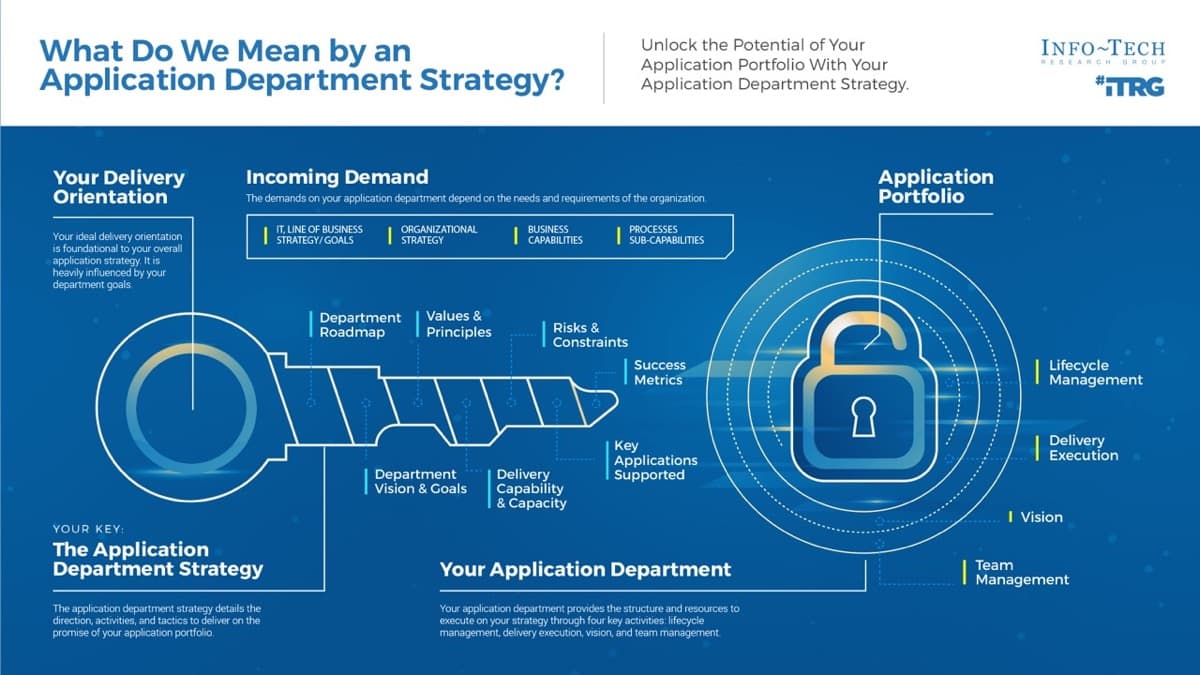

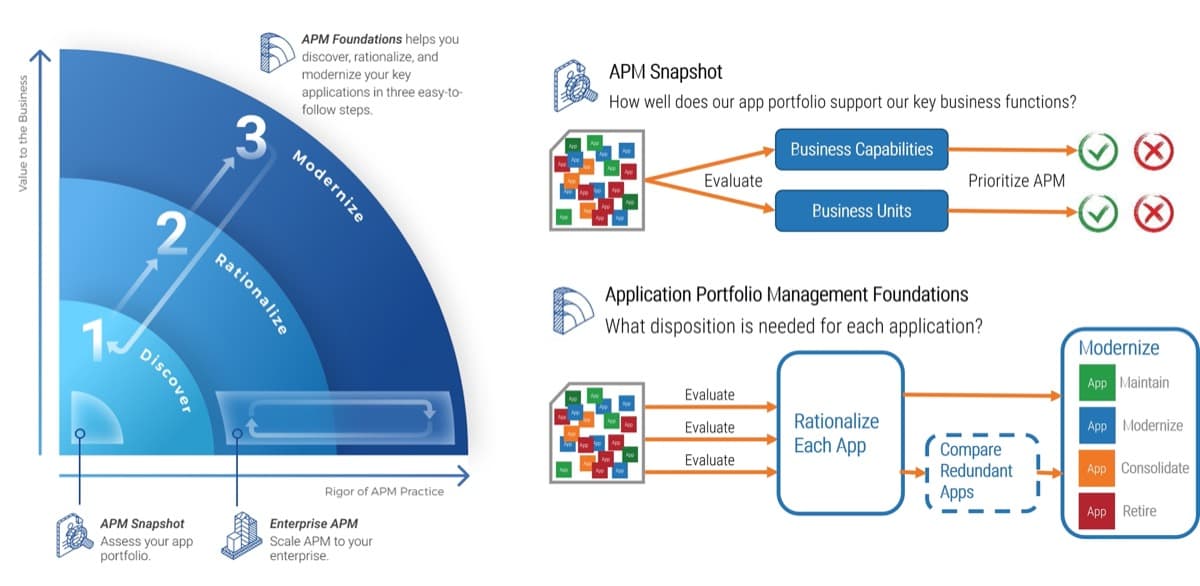

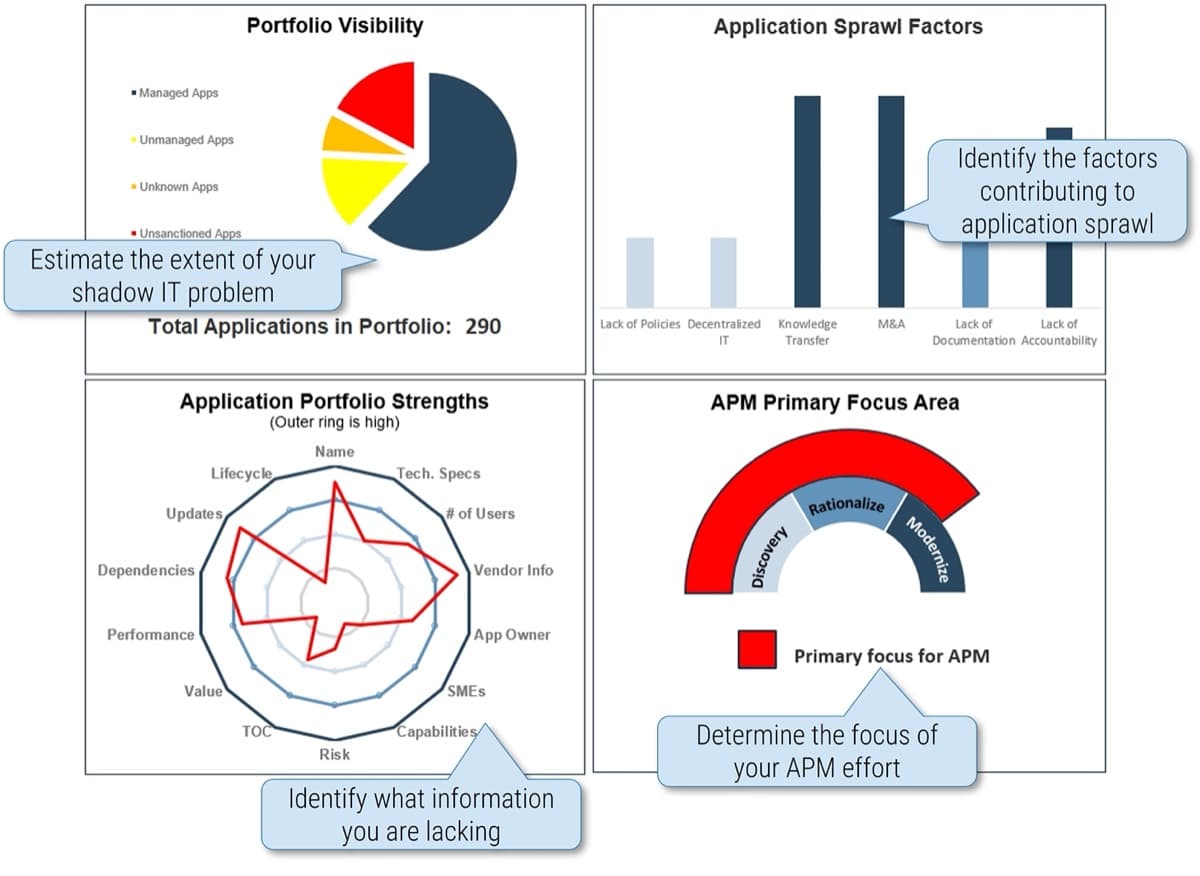

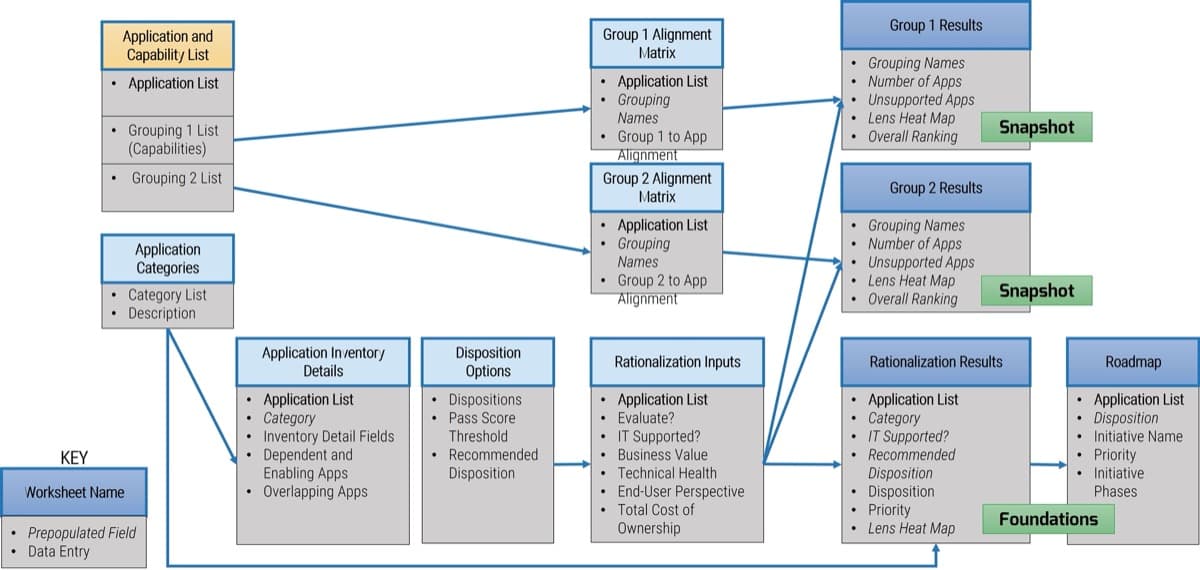

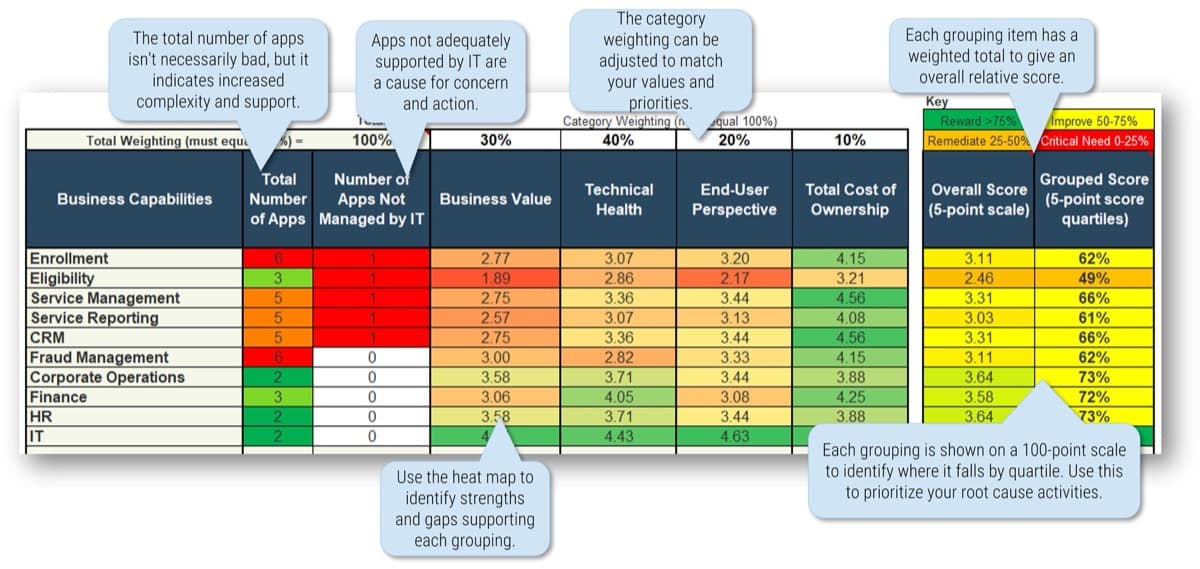

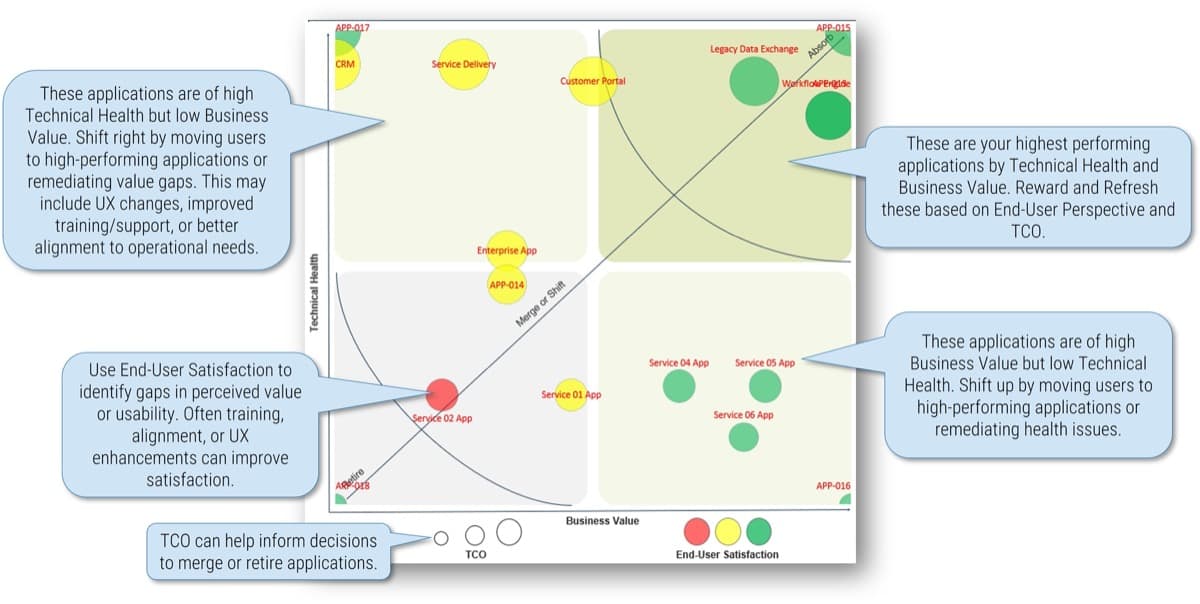

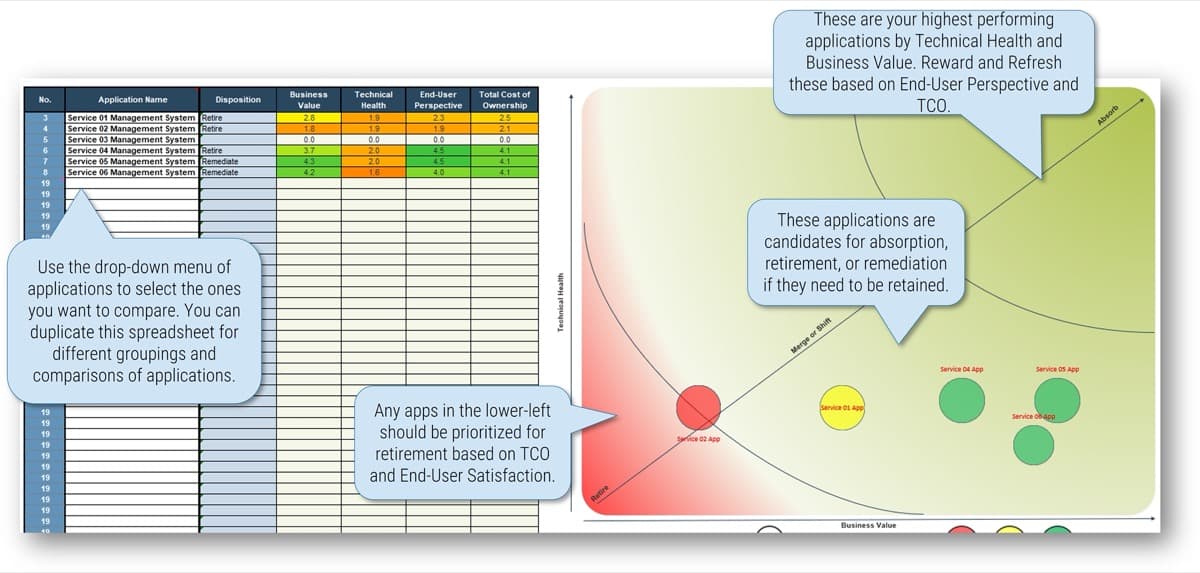

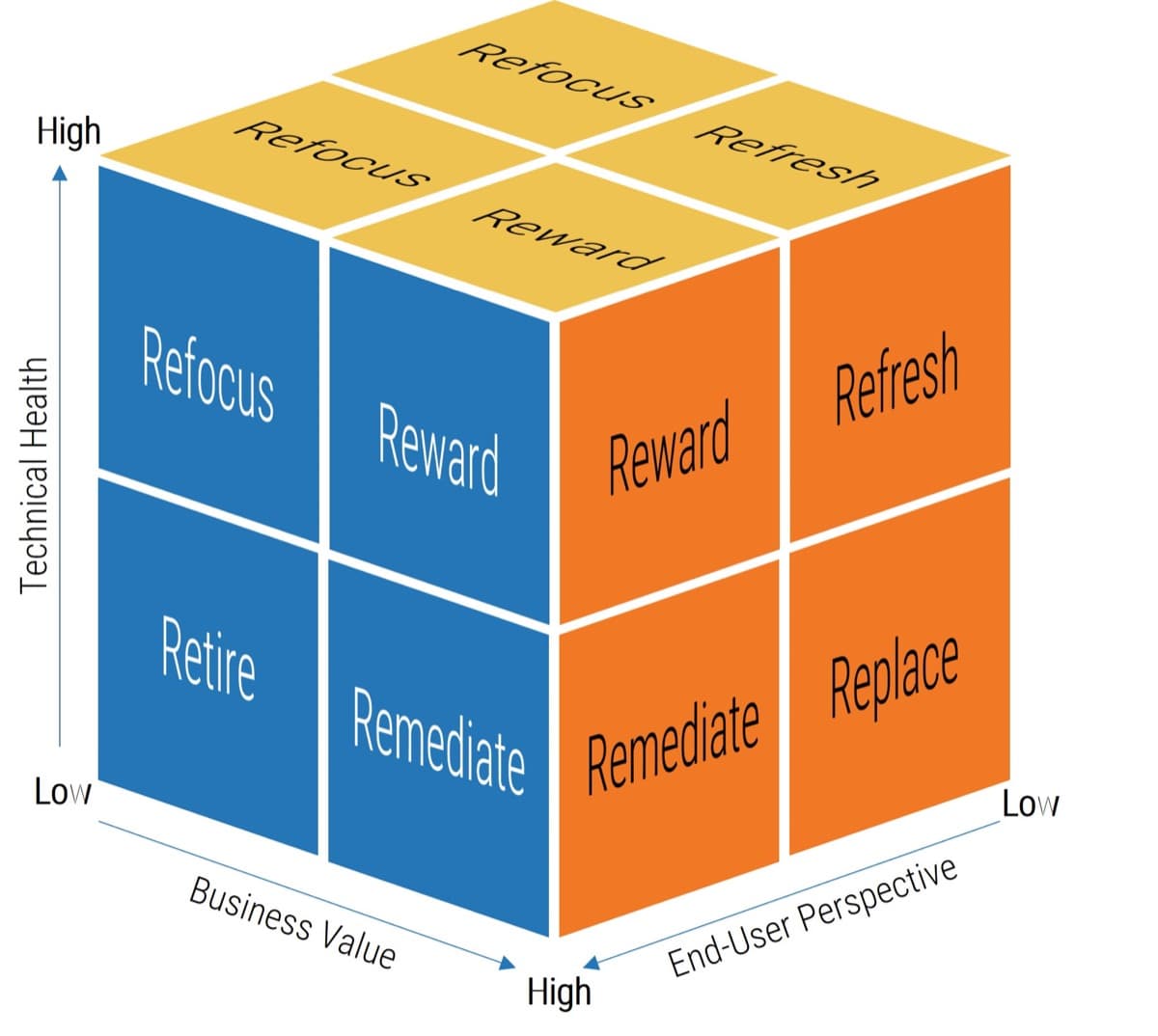

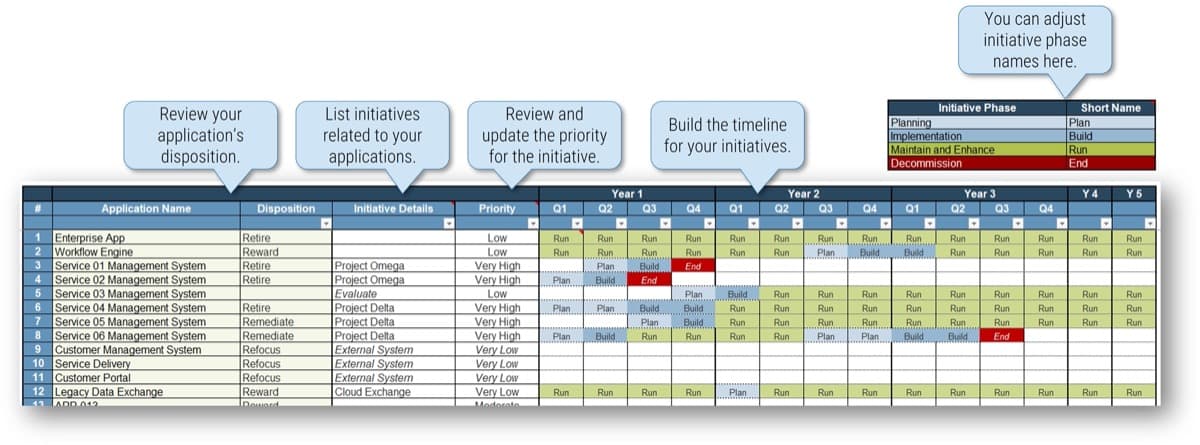

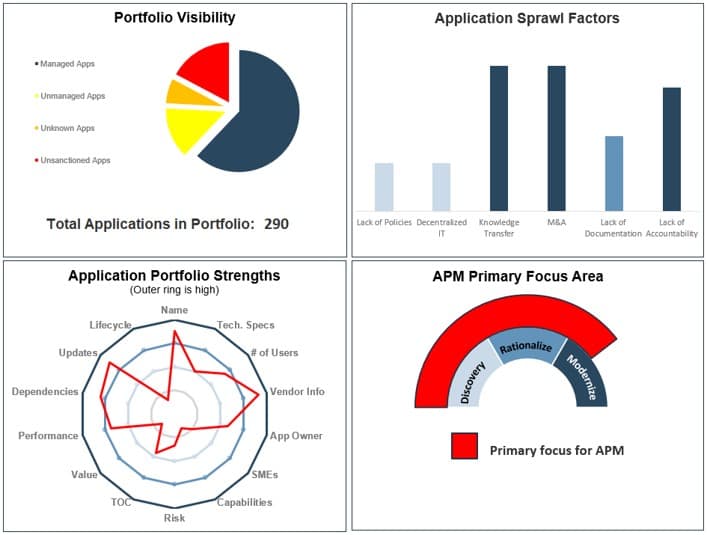

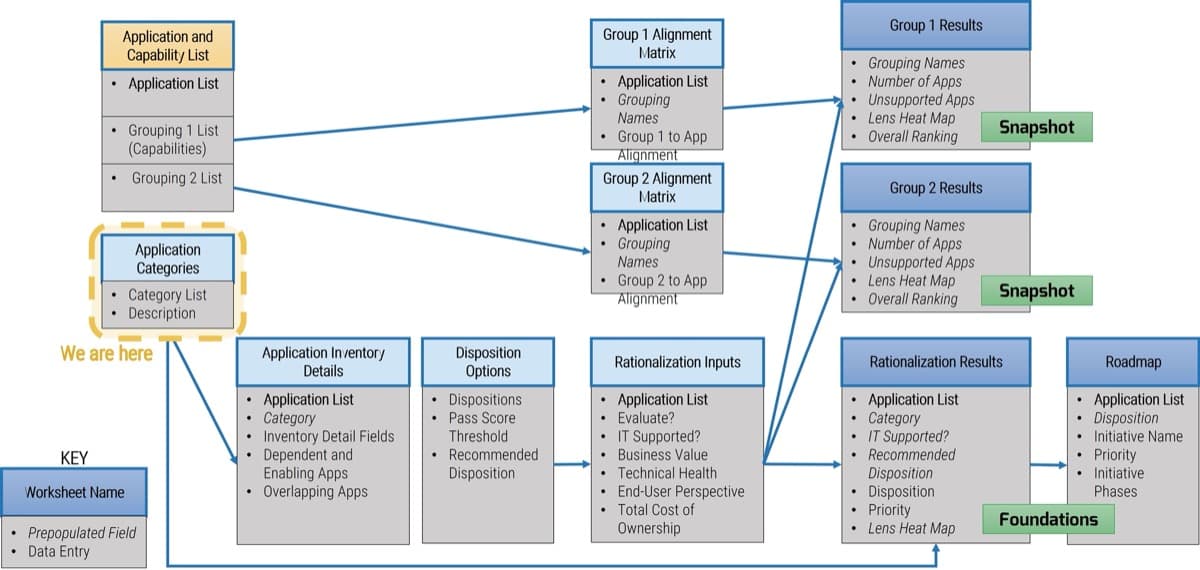

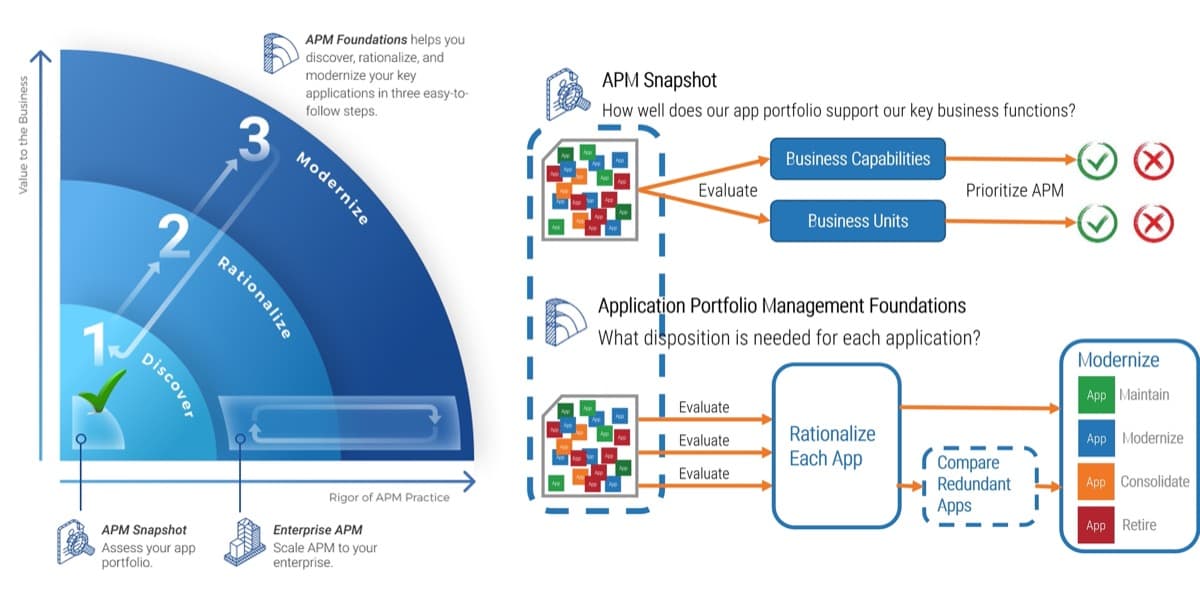

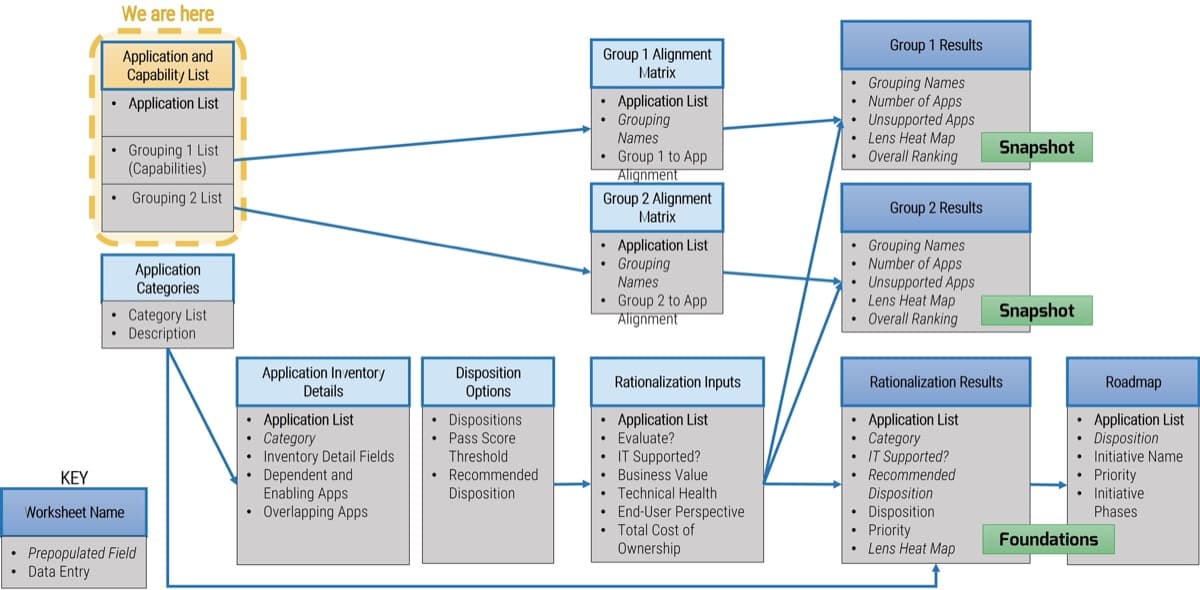

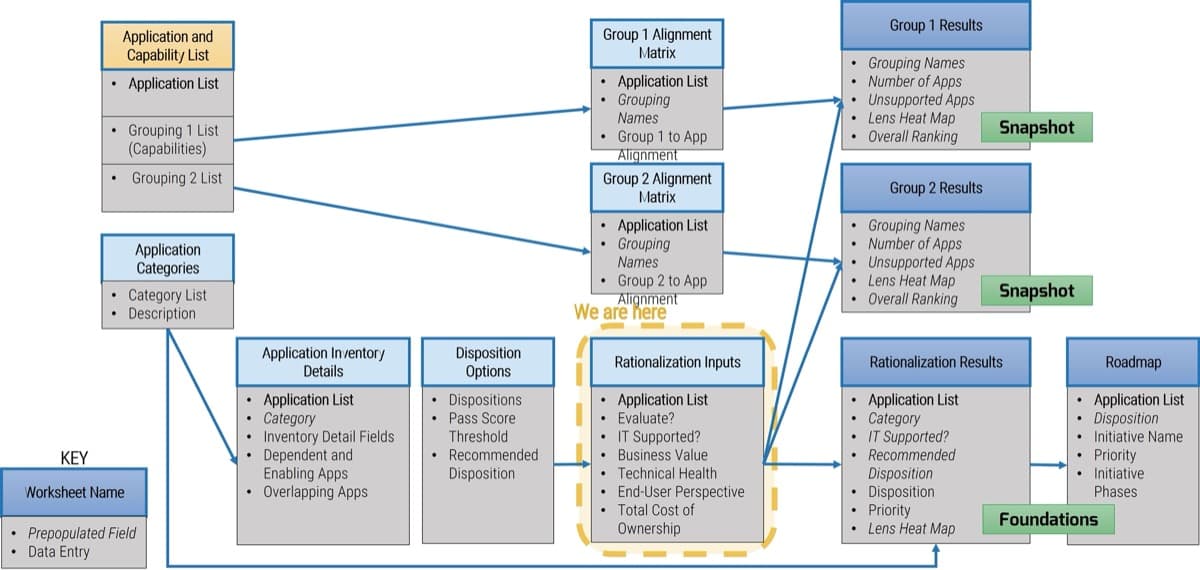

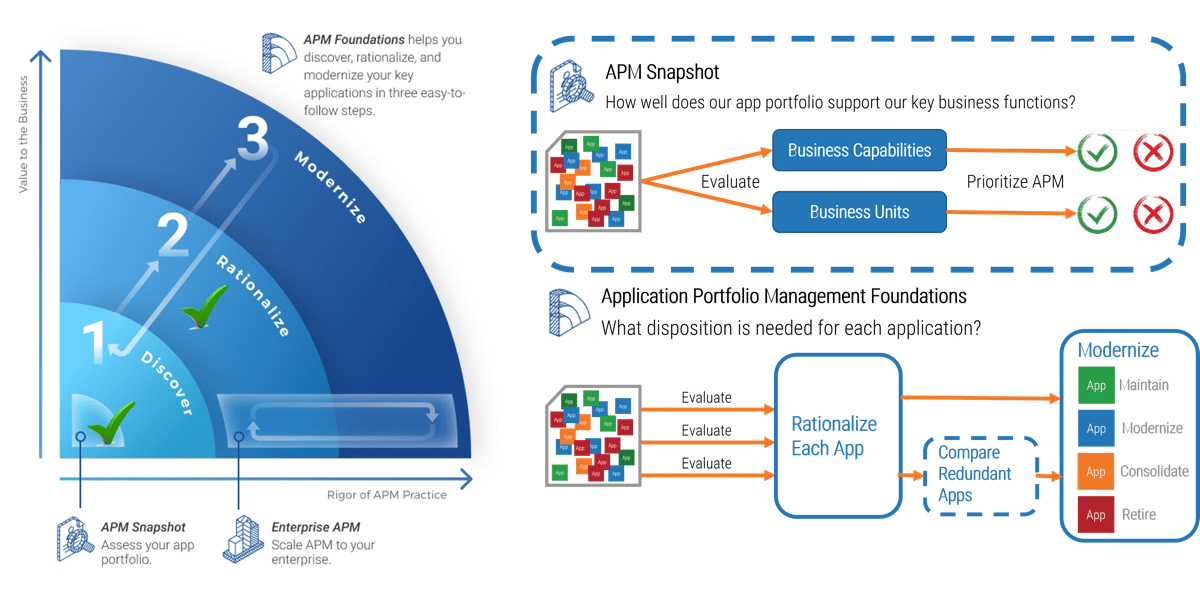

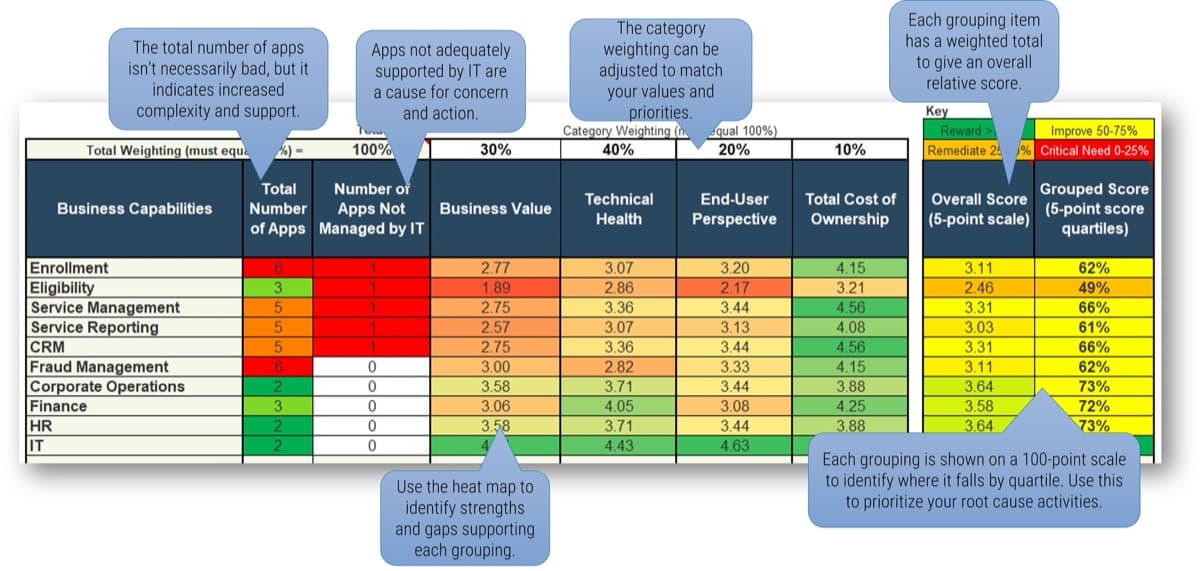

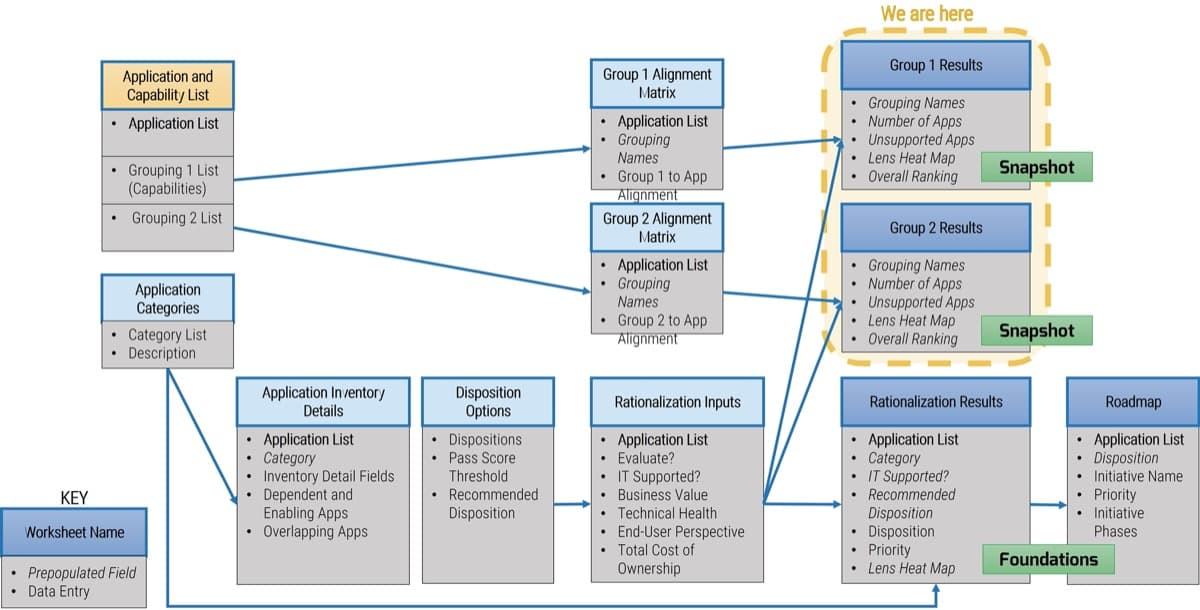

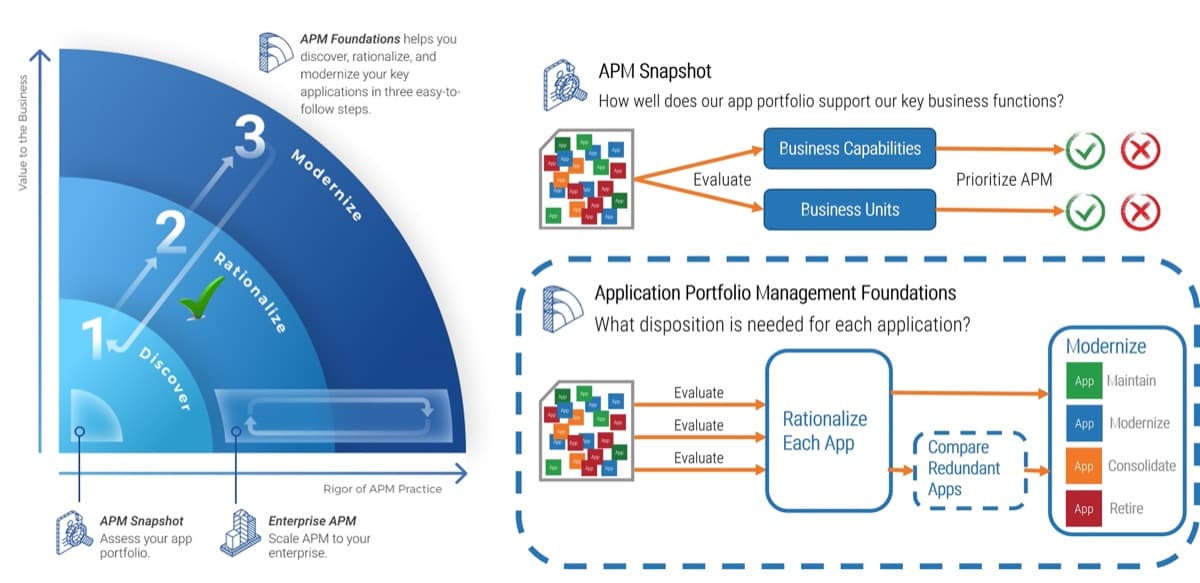

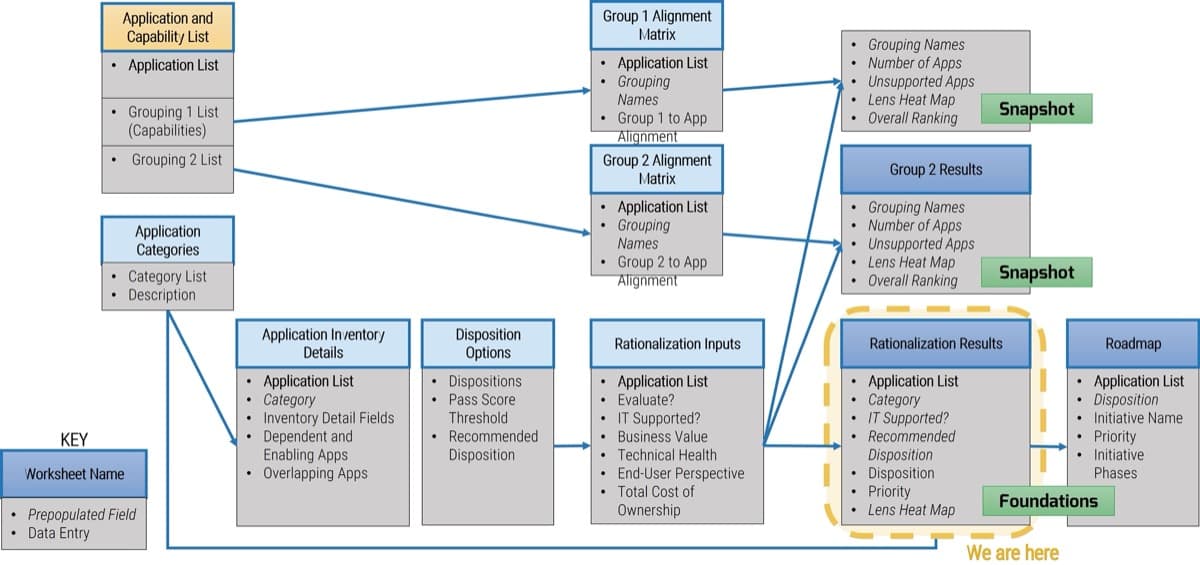

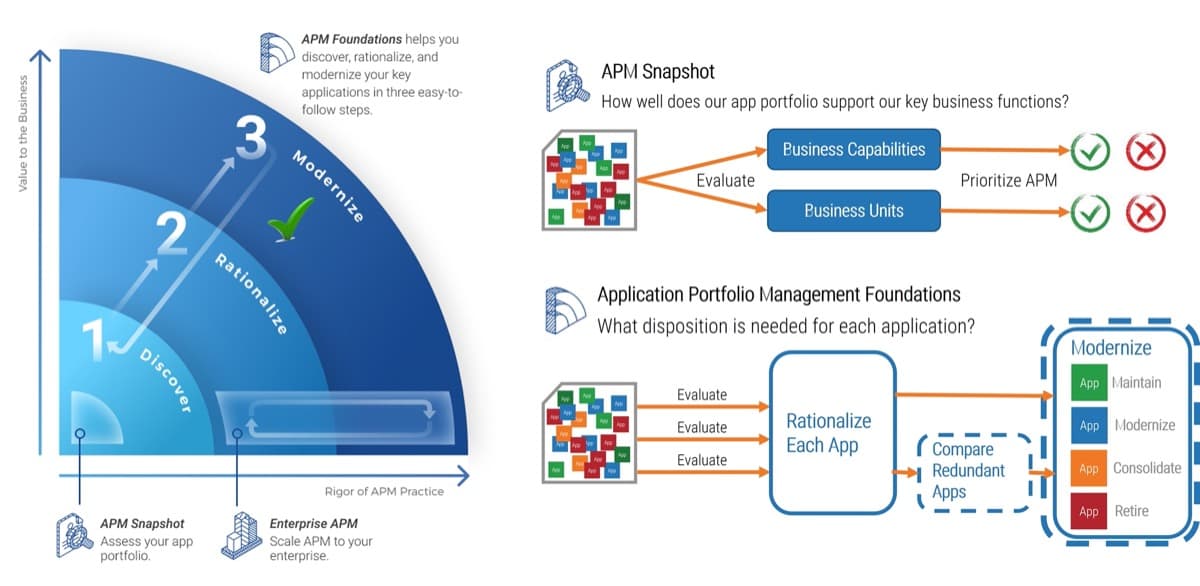

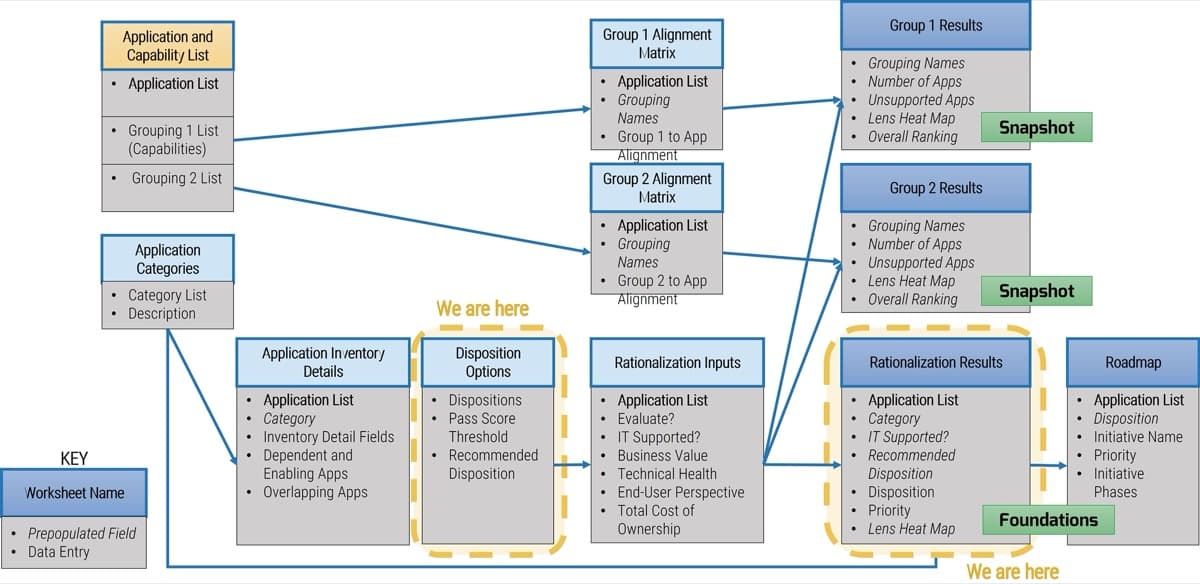

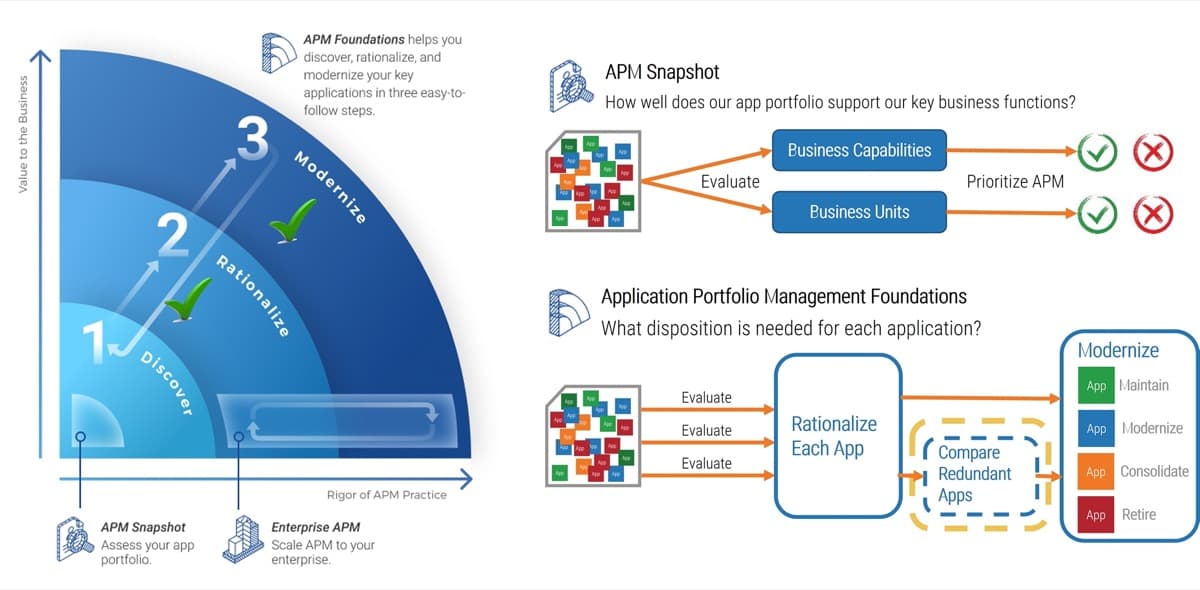

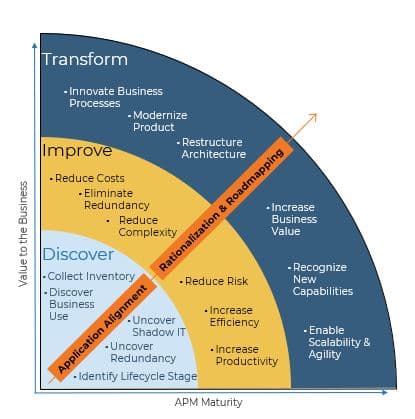

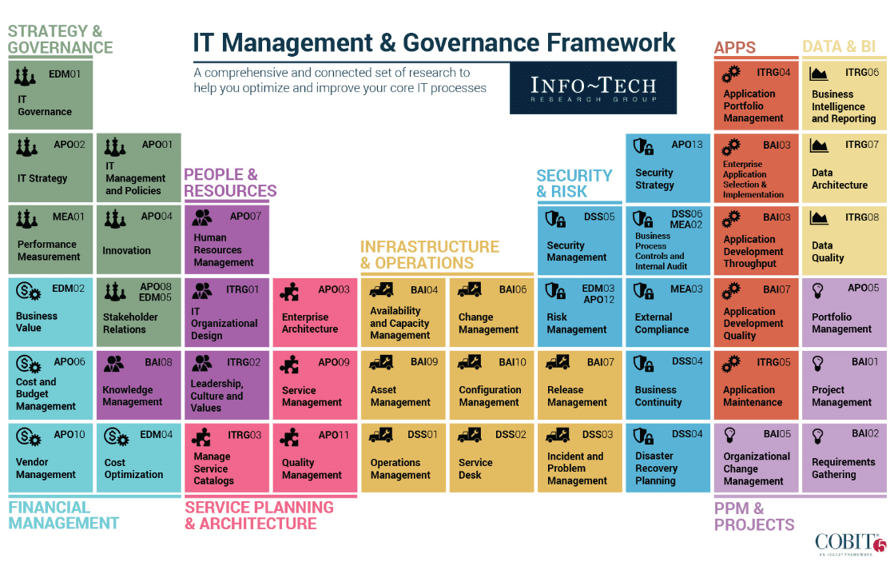

Application portfolio management

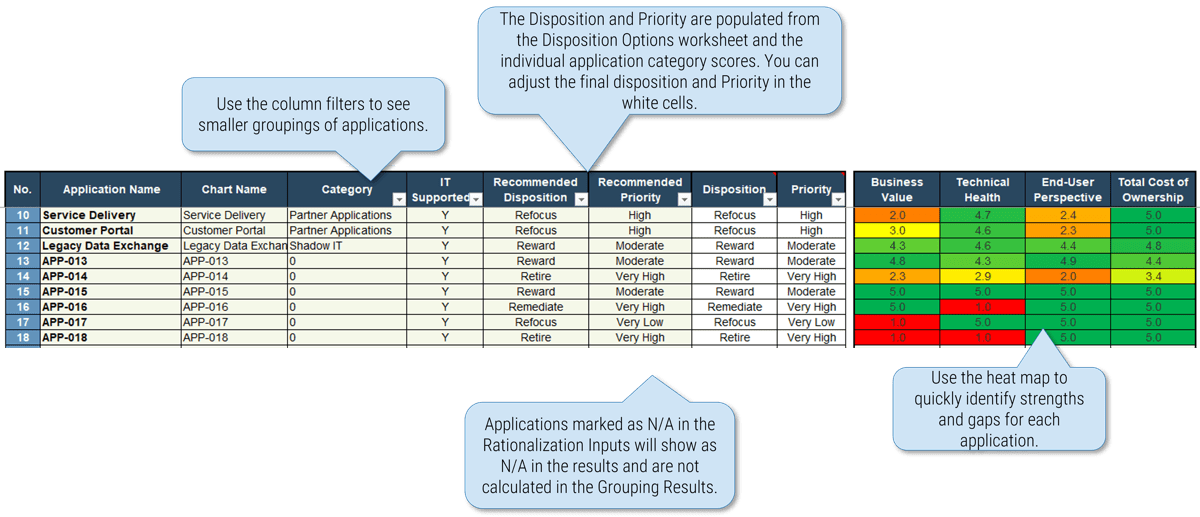

See an overview of the APM journey and how we can support the pieces in this journey.

Ensure your application portfolio delivers the best possible return on investment.

Effective maintenance ensures the long-term value of your applications.

Move beyond maintenance to ensuring exceptional value from your apps.

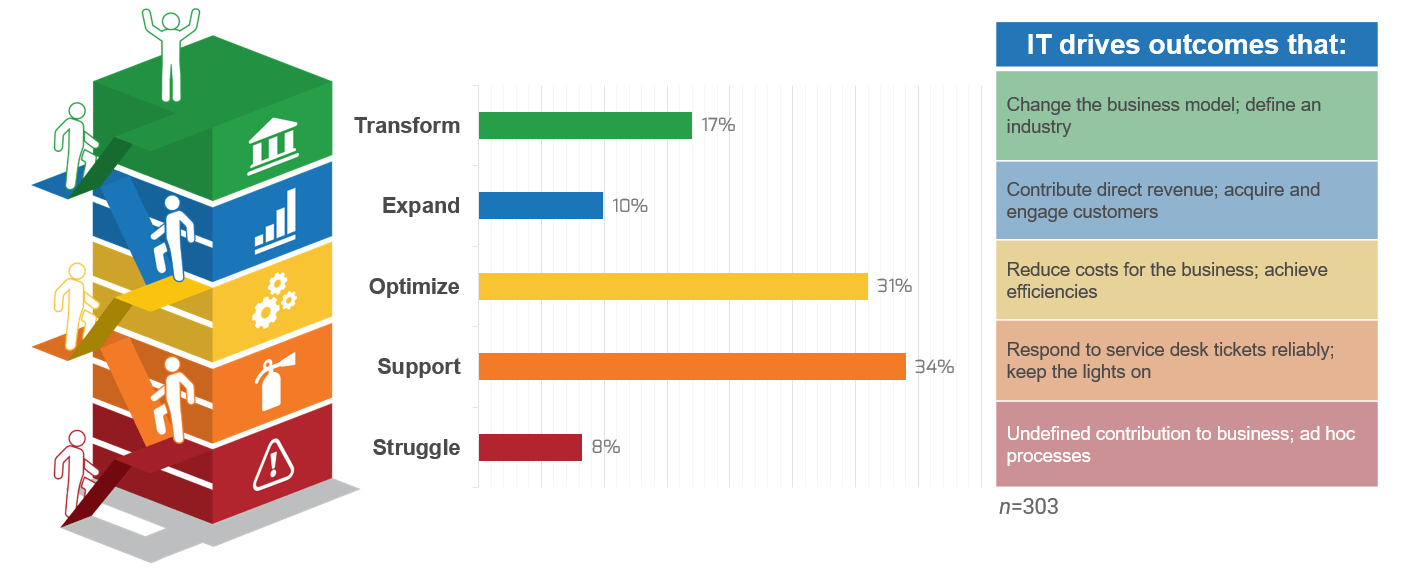

Delivering value starts with embracing what your department can do.

Empower the business to implement its own applications with a trusted business-IT relationship.

Facilitate ongoing alignment between Agile teams and the business with a set of targeted service offerings.

Related Info-Tech Research

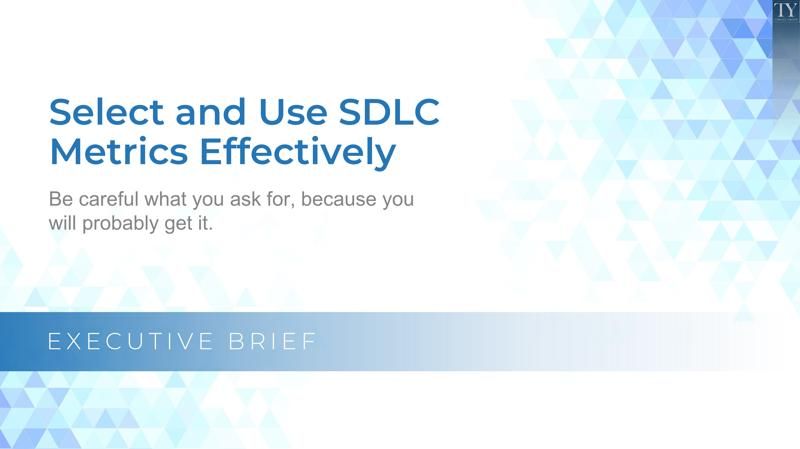

Value, delivery metrics, estimation

Focus product delivery on business value-driven outcomes.

Be careful what you ask for, because you will probably get it.

Develop data-driven insights to help you decide which applications to retire, upgrade, re-train on, or maintain to meet

the demands of the business.

Mature your IT department by measuring what matters.

Don’t let bad estimates ruin good work.

Commit to achievable software releases by grounding realistic expectations.

Expand on the financial model to give your initiative momentum.

Deliver more projects by giving yourself the voice to say “no” or “not yet” to new projects.

Facilitate ongoing alignment between Agile teams and the business with a set of targeted service offerings.

Related Info-Tech Research

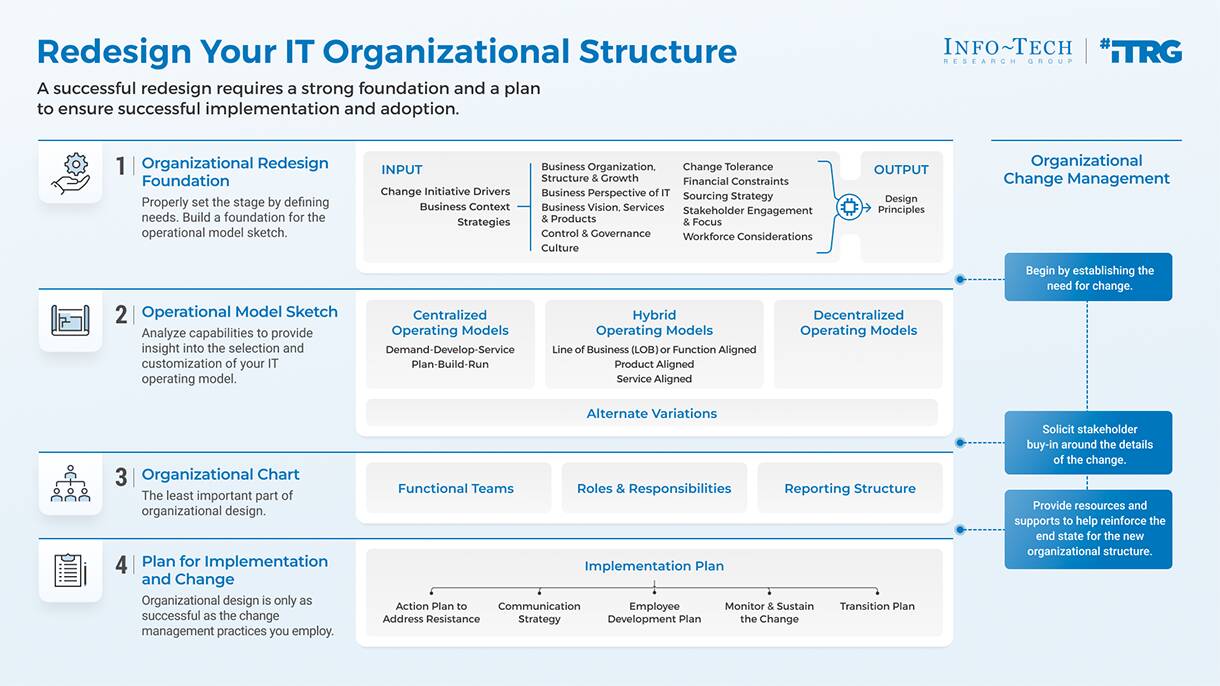

Organizational design and performance

Focus product delivery on business value-driven outcomes.

Have the right people in the right place, at the right time.

Reorganizations are inherently disruptive. Implement your new structure with minimal pain for staff while maintaining IT

performance throughout the change.

Don’t just measure engagement, act on it.

Set holistic measures to inspire employee performance.

Phase 1

Establish the Foundation for Product Ownership

Mature and Scale Product Ownership

This phase will walk you through the following activities:

1.1.1 Define enablers and blockers of product management

1.1.2 Define your product management roles and names

1.1.3 Assess your product management readiness

1.2.1 Identify your primary product owner perspective

1.2.2 Define your product owner RACI

This phase involves the following participants:

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Delivery managers

-

Business analysts

Step 1.1

Establish an environment for product owner success

Activities

1.1.1 Define enablers and blockers of product management

1.1.2 Define your product management roles and names

1.1.3 Assess your product management readiness

Establish the foundation for product ownership

This step involves the following participants:

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Delivery managers

-

Business analysts

Outcomes of this step

- Enablers and blockers

- Role definitions

Empower product owners as the true owners of their product

Product ownership requires decision-making authority and accountability for the value realization from those decisions. POs are more than a proxy for stakeholders, aggregators for changes, and the communication of someone else’s priorities.

“A Product Owner in its most beneficial form acts like an Entrepreneur, like a 'mini-CEO'. The Product Owner is someone

who really 'owns' the product.”

– Robbin Schuurman,

“Tips for Starting Technical Product Managers”

Info-Tech Best Practice

Implement Info-Tech’s Product Owner Capability Model to help empower and hold product owners accountable for the

maturity and success of their product. The product owner must understand how their product fits into the organization’s

mission and strategy in order to align to enterprise value.

Product and service owners share the same foundation and capabilities

For the purpose of this blueprint, product/service and product owner/service owner are used interchangeably. The term

“product” is used for consistency but applies to services, as well.

Product = Service

Common foundations: Focus on continuous improvement, ROI, and value realization. Clear vision, goals, roadmap, and backlog.

“Product” and “service” are terms that each organization needs to define to fit its culture and customers (internal and

external). The most important aspect is consistent use and understanding of:

-

External products

-

Internal products

-

External services

-

Internal services

-

Products as a service (PaaS)

-

Productizing services (SaaS)

Define product ownership to match your culture and customers

Characteristics of a discrete product:

-

Has end users or consumers

-

Delivers quantifiable value

-

Evolves or changes over time

-

Has predictable delivery

-

Has definable boundaries

-

Has a cost to produce and operate

-

Has a discrete backlog and roadmap of improvements

What does not need a product owner?

-

Individual features

-

Transactions

-

Unstructured data

-

One-time solutions

-

Non-repeatable processes

-

Solutions that have no users or consumers

-

People or teams

Info-Tech Insight

-

Products are long-term endeavors that don’t end after the project finishes.

-

Products mature and improve their ability to deliver value.

-

Products have a discrete backlog of changes to improve the product itself, separate from operational requests fulfilled by the product or service.

Need help defining your products or services? Download our blueprint Deliver Digital Products at Scale.

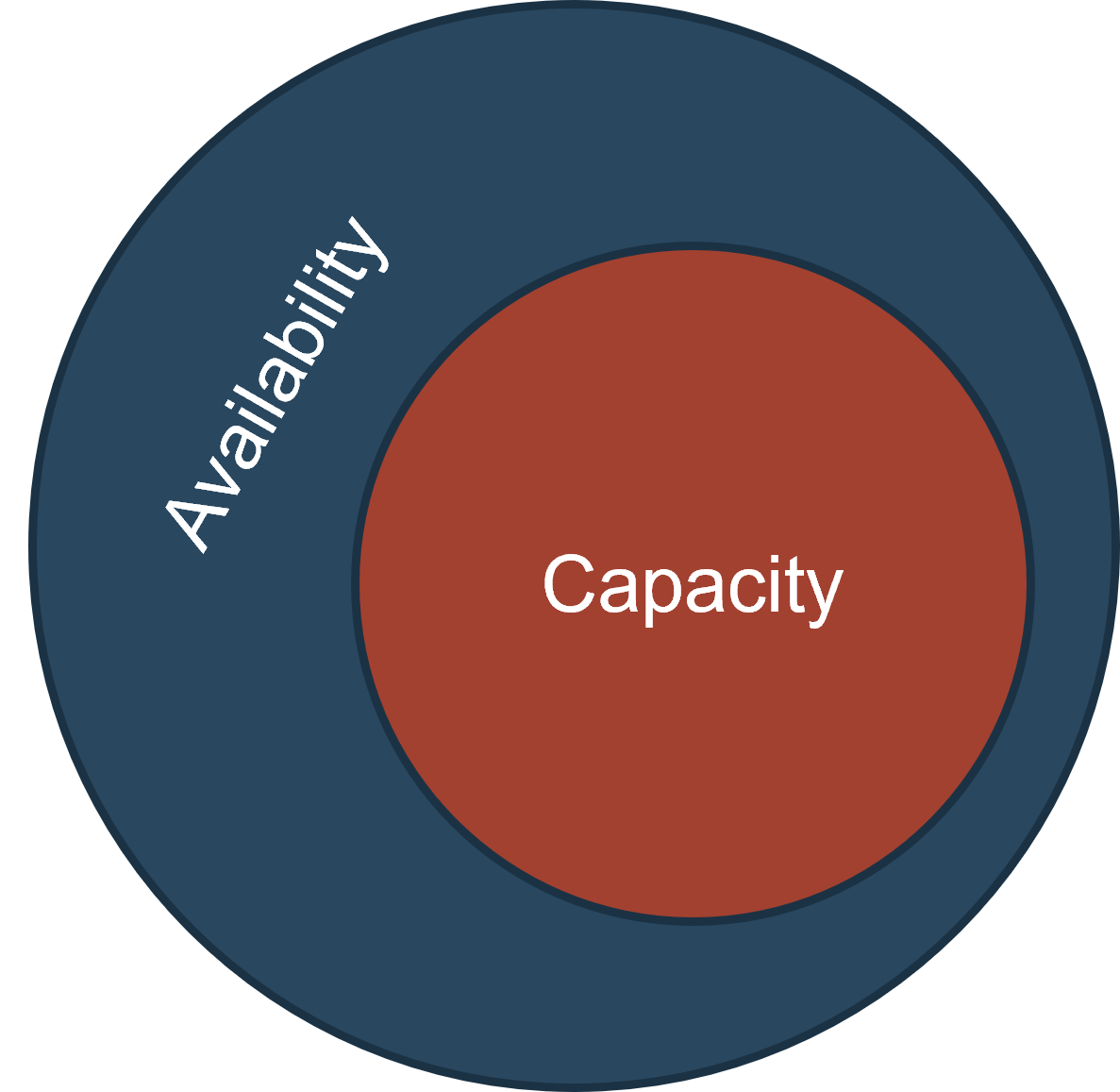

Connect roadmaps to value realization with KPIs

" loading="lazy">

Info-Tech Insight

Every roadmap item should have an expected realized value once it is implemented. The associate KPIs or OKRs determine

if our goal was met. Any gap in value feedback back into the roadmap and backlog refinement.

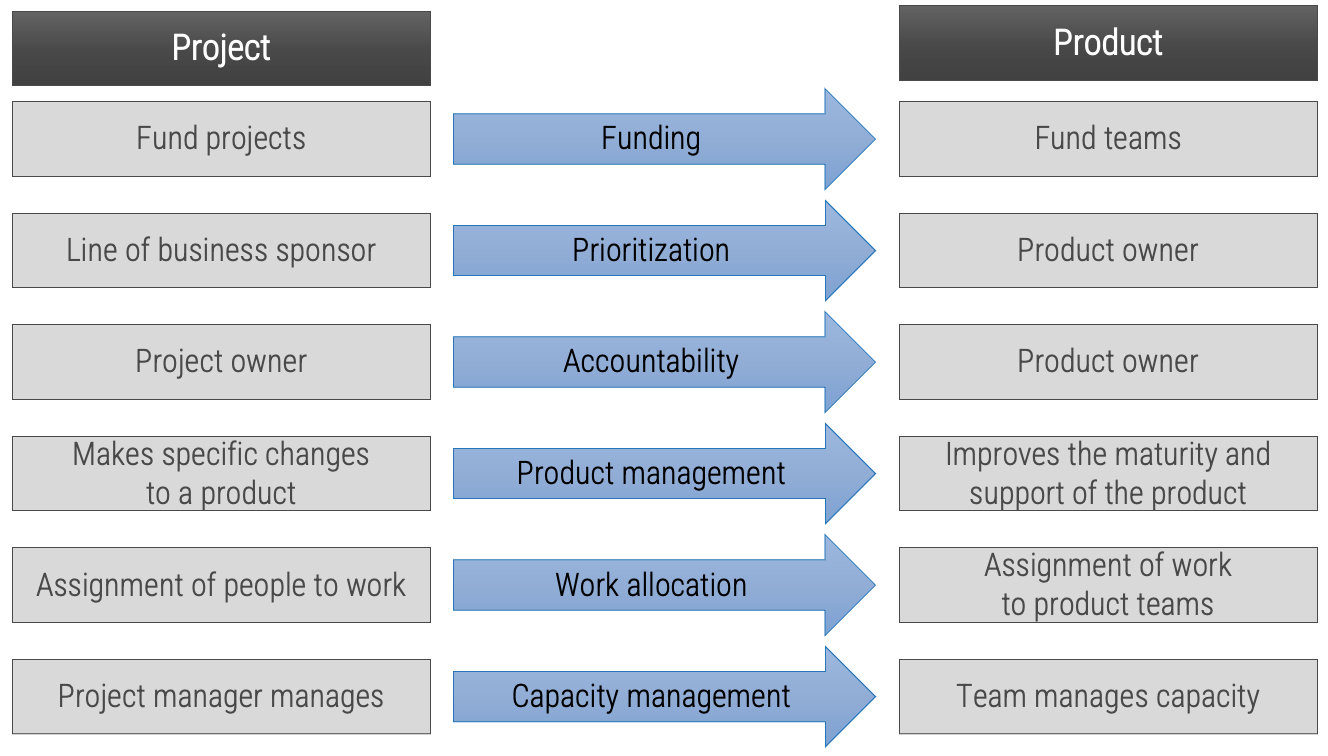

Identify the differences between a project-centric and a product-centric organization

Info-Tech Insight

Product delivery requires significant shifts in the way you complete development work and deliver value to your users. Make the changes that support improving end-user value and enterprise alignment.

Projects can be a mechanism for funding product changes and improvements

Projects withing products

Regardless of whether you recognize yourself as a product-based or project-based shop, the same basic principles should apply.

You go through a period or periods of project-like development to build a version of an application or product.

You also have parallel services along with your project development, which encompasses a more product-based view. These may range from basic support and maintenance to full-fledged strategy teams or services like sales and marketing.

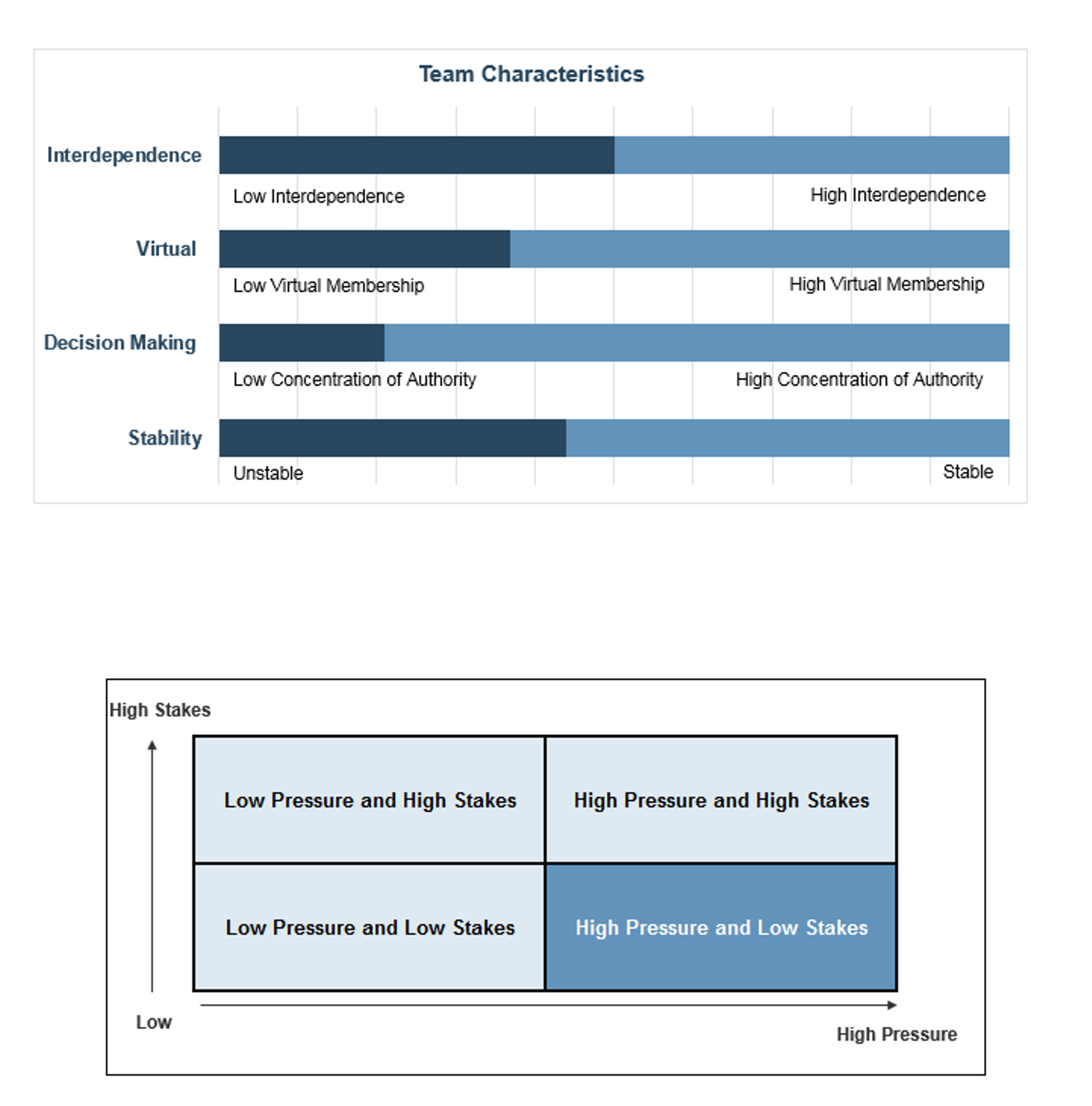

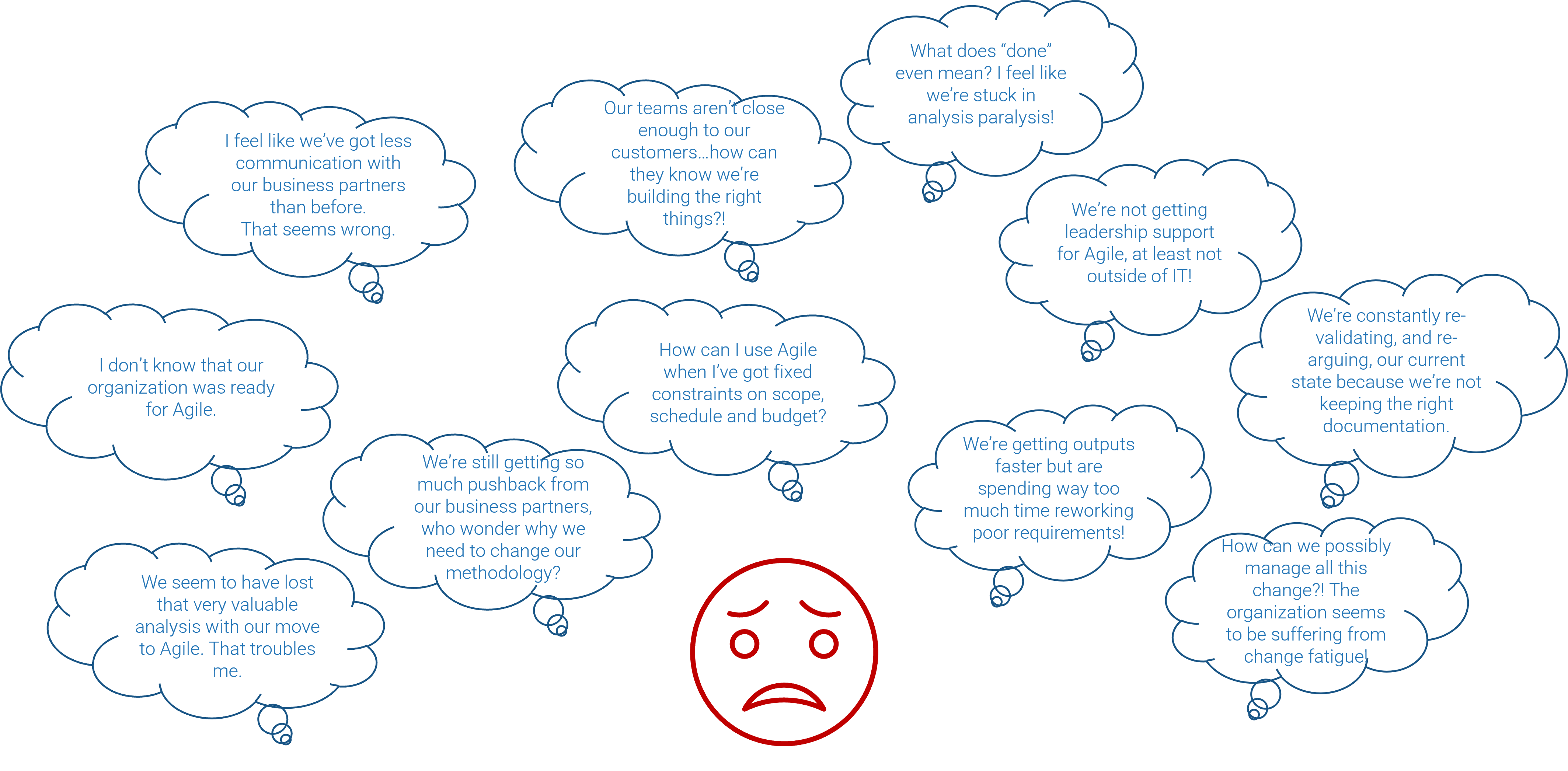

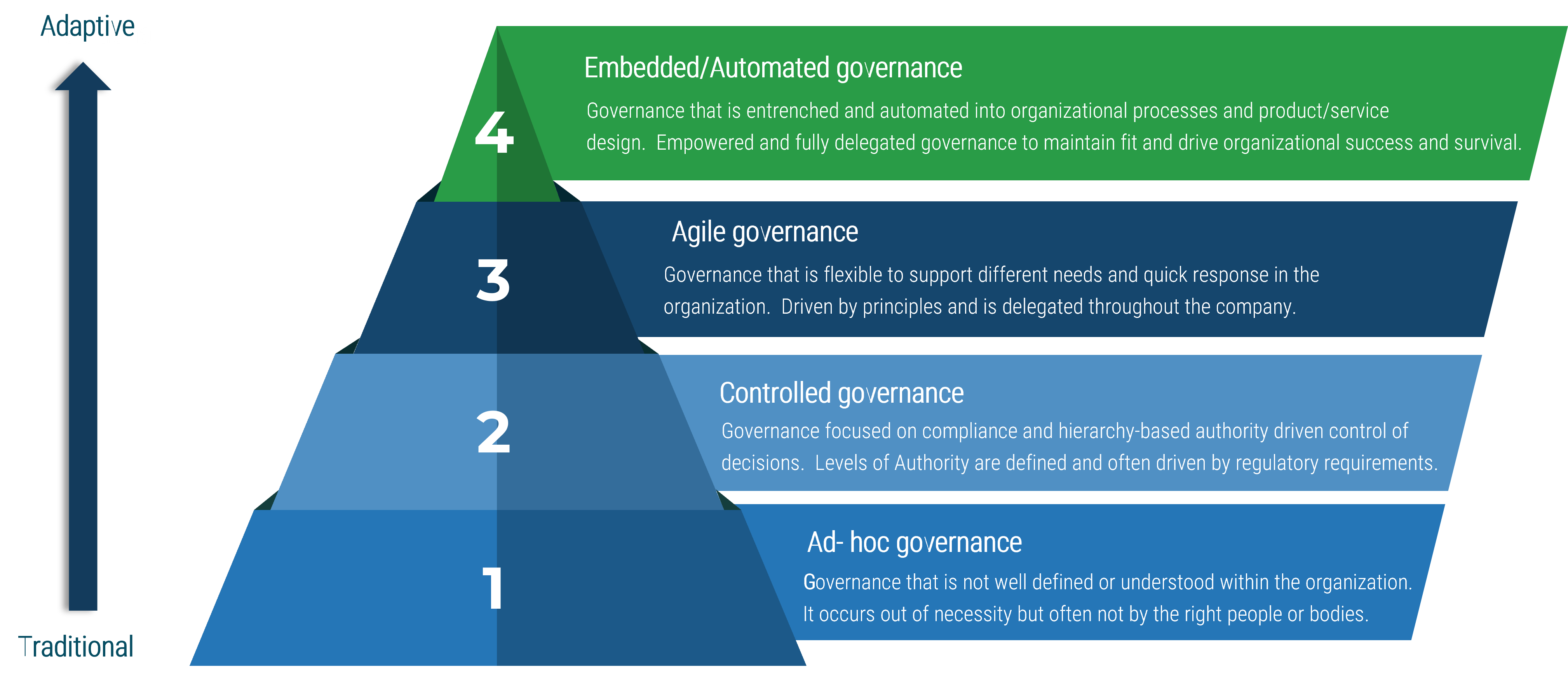

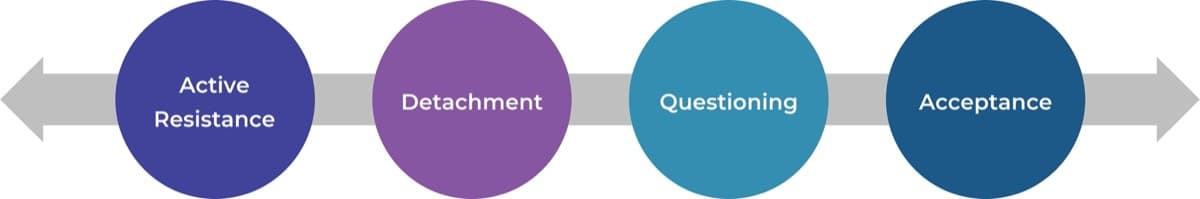

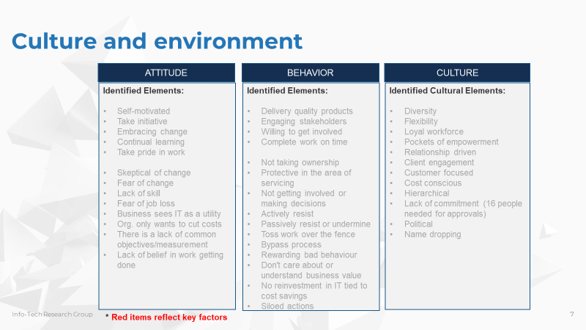

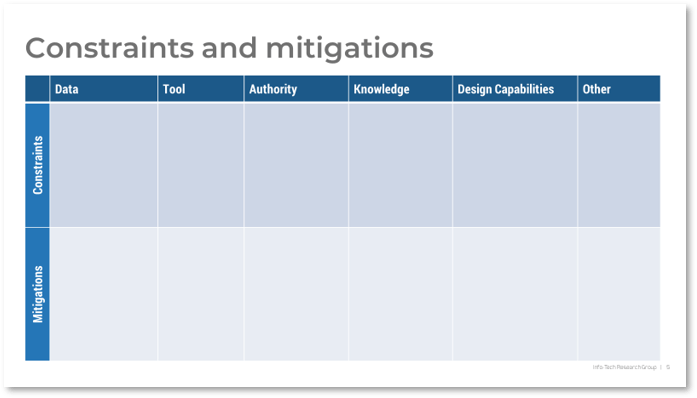

Recognize common barriers to product management

The transition to product ownership is a series of behavioral and cultural changes supported by processes and governance. It takes time and consistency to be successful.

-

Command and control structures

-

Lack of ownership and accountability

-

High instability in the market, demand, or organization

-

Lack of dedicated teams align to delivery, service, or product areas

-

Culture of one-off projects

-

Lack of identified and engaged stakeholders

-

Lack of customer exposure and knowledge

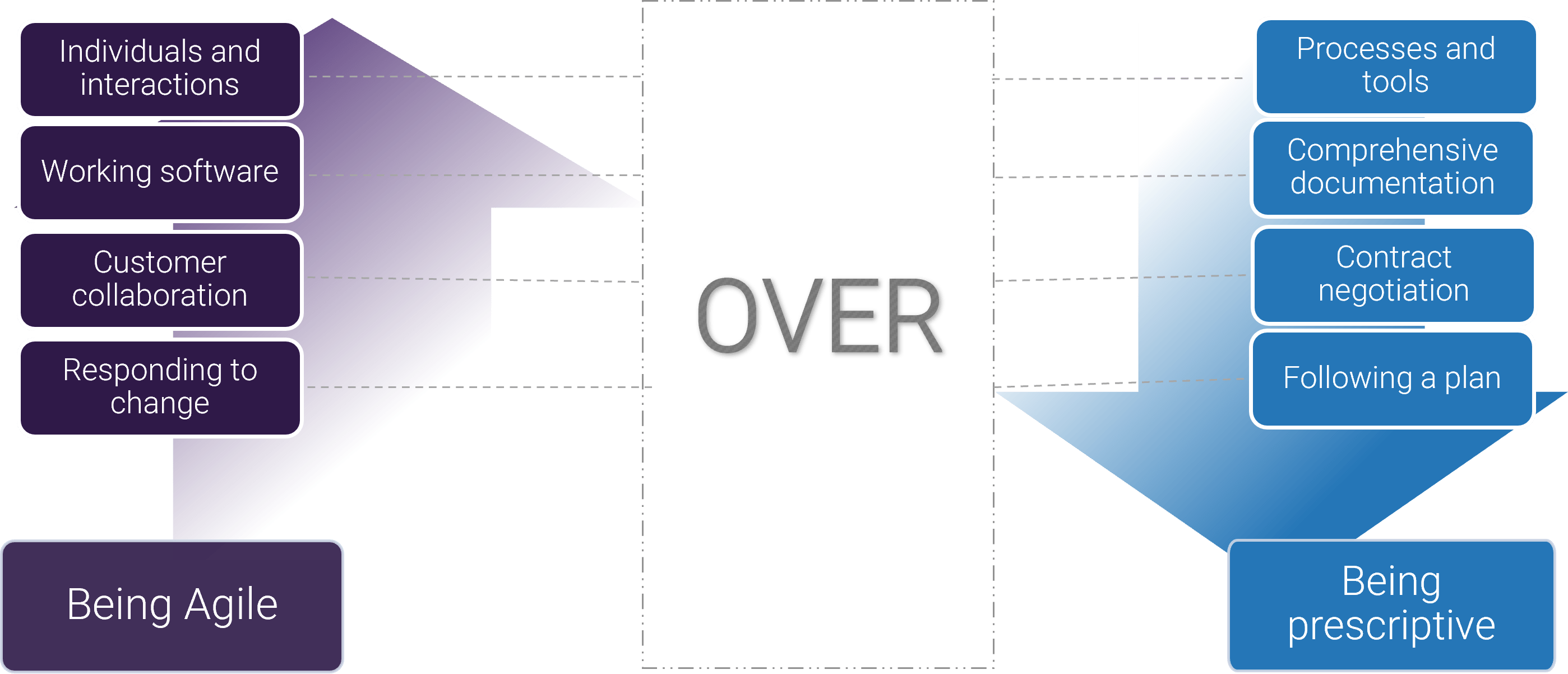

Agile’s four core values

“…while there is value in the items on the right, we value the items on the left more.”

Source: “The Agile Manifesto”

We value...

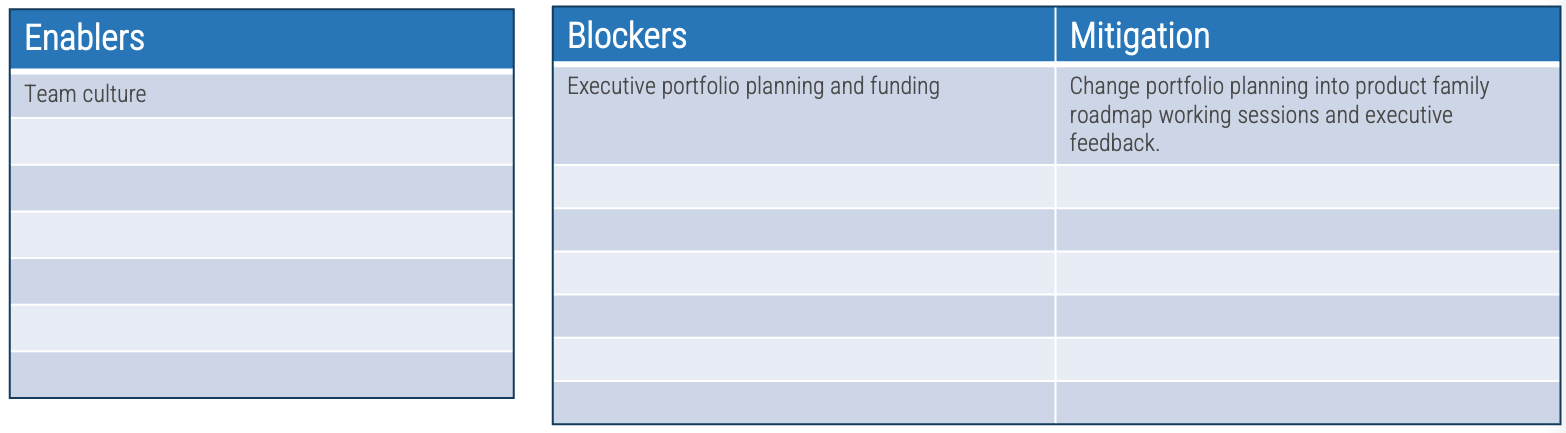

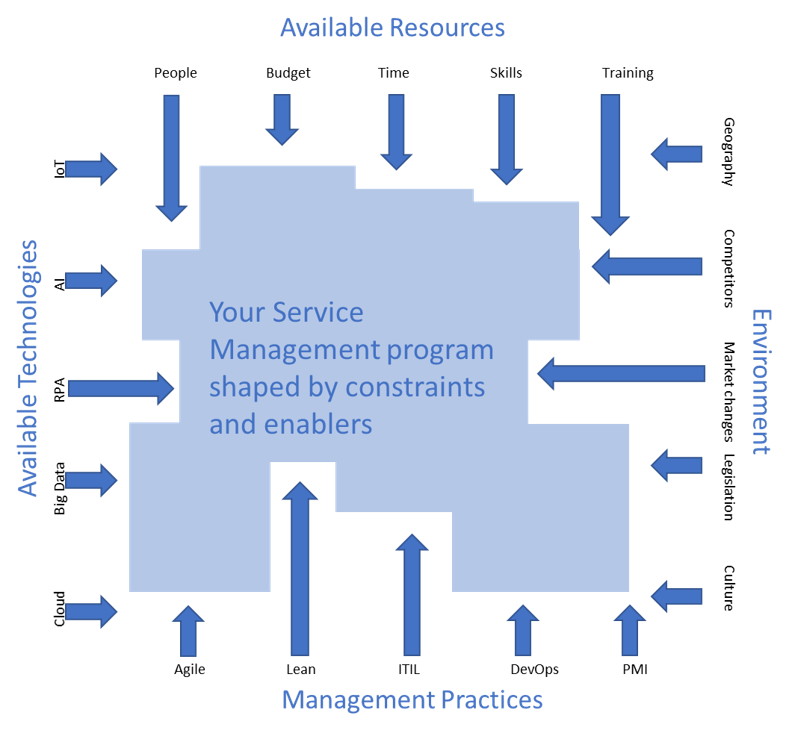

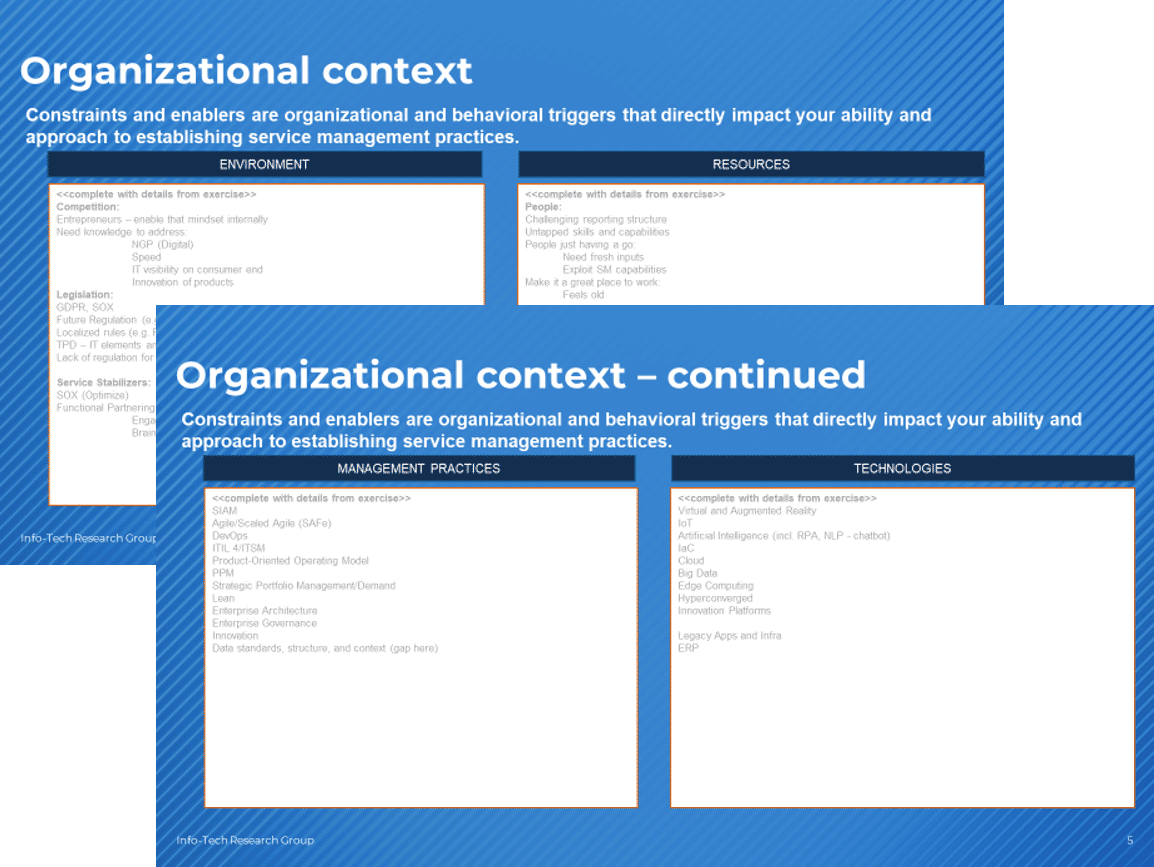

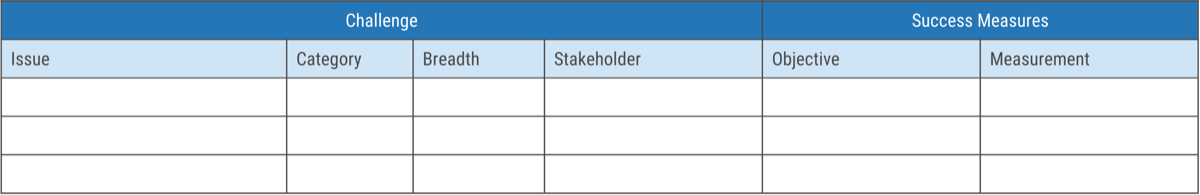

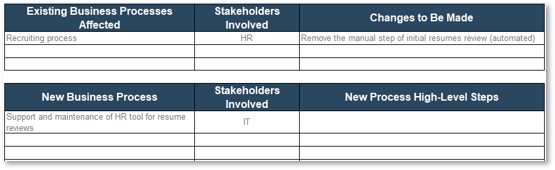

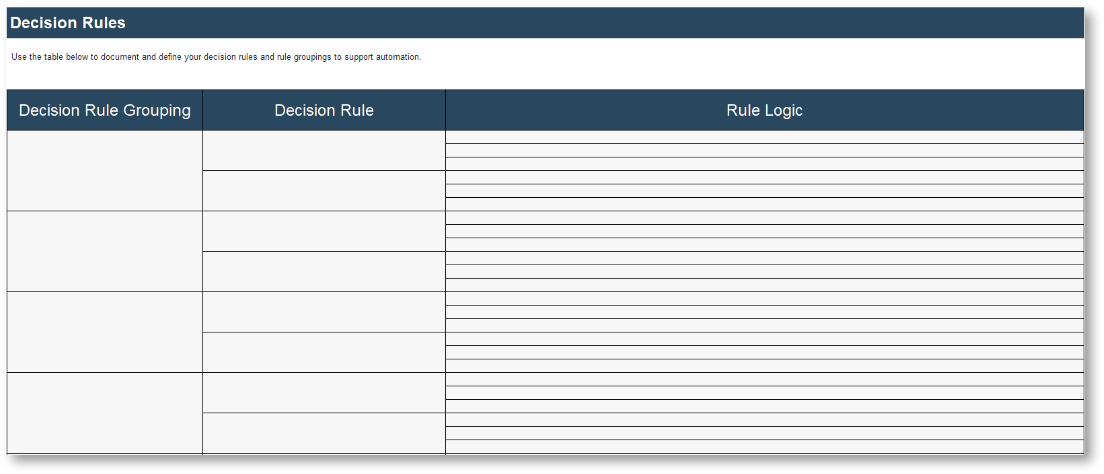

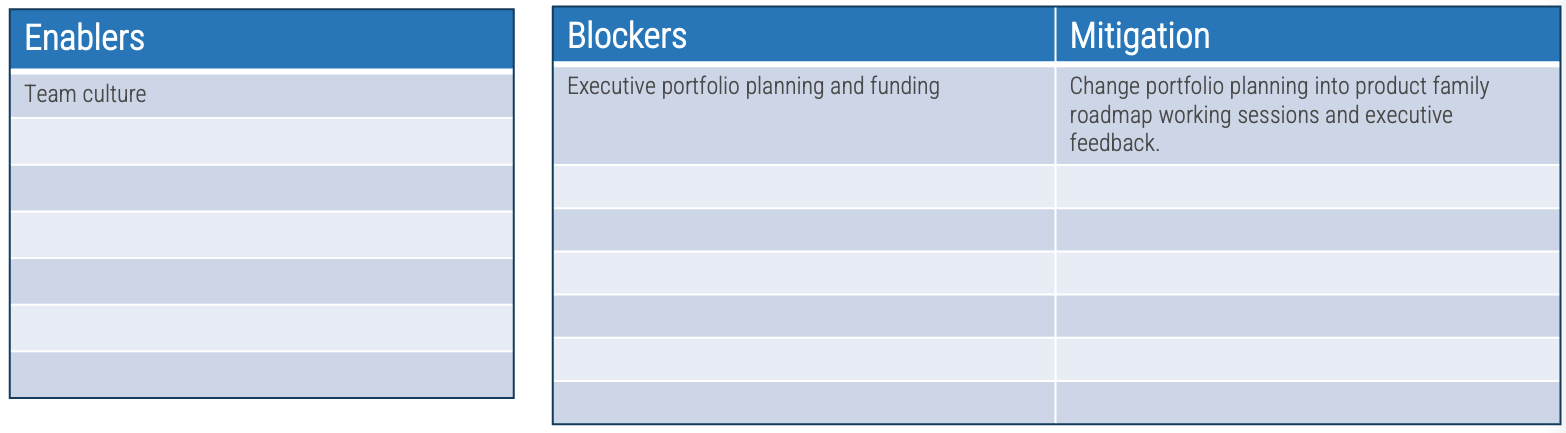

Exercise 1.1.1 Define enablers and blockers of product management

1 hour

-

Identify and mitigate blockers of product management in your organization.

-

What enablers will support strong product owners?

-

What blockers will make the transition to product management harder?

-

For each blocker, also define at least one mitigating step.

Output

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Business analysts

Capture in the Mature and Scale Product Ownership Playbook.

Align enterprise value through product families

Effective product delivery requires thinking about more than just a single product

Good application and product management begins with strengthening good practices for a single or small set of applications, products, and services.

Product portfolio

Groups of product families within an overall value stream or capability grouping.

Project portfolio manager

Product family

A collection of related products. Products can be grouped along architectural, functional, operational, or experiential patterns.

Product family manager

Product

Single product composed of one or more applications and services.

Product owner

Info-Tech Insight

Define the current roles that will perform the product management function or define consistent role names to product owners and managers.

Exercise 1.1.2 Define your product management roles and names

1-2 hour

-

Identify the roles in which product management activities will be owned.

-

Define a common set of role names and describe the role.

-

Map the level of accountability for each role: Product or Product Family

-

Product owner perspectives will be defined in the next step.

Output

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Business analysts

Capture in the Mature and Scale Product Ownership Playbook.

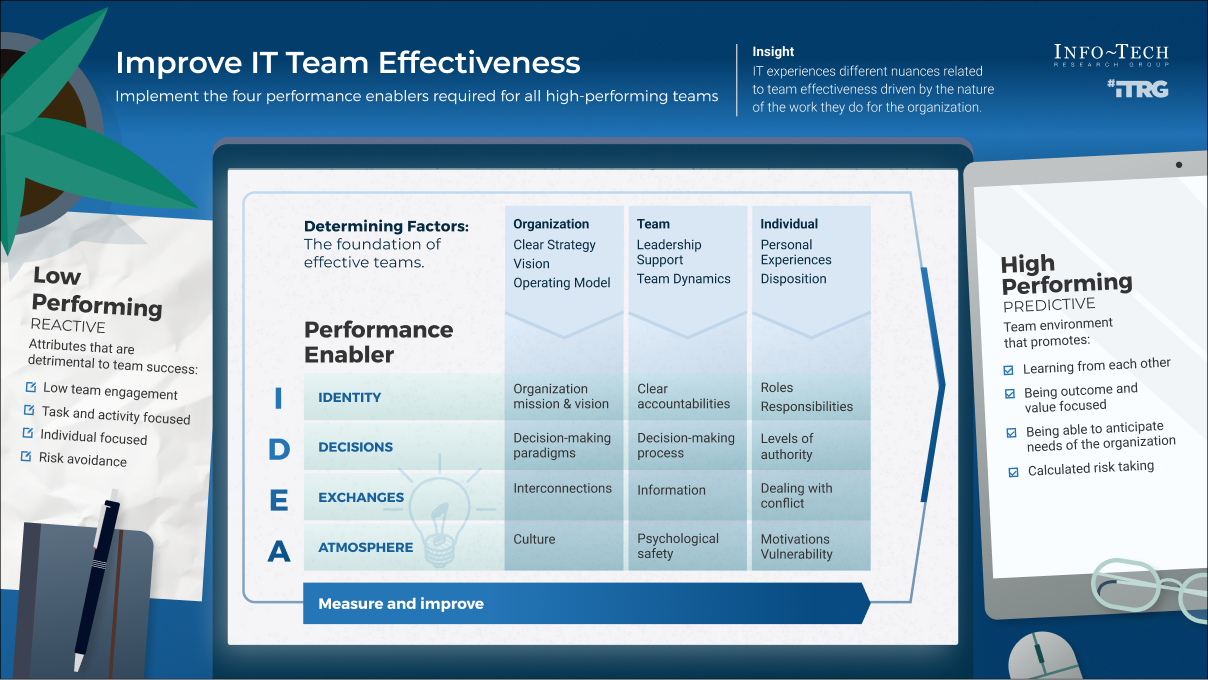

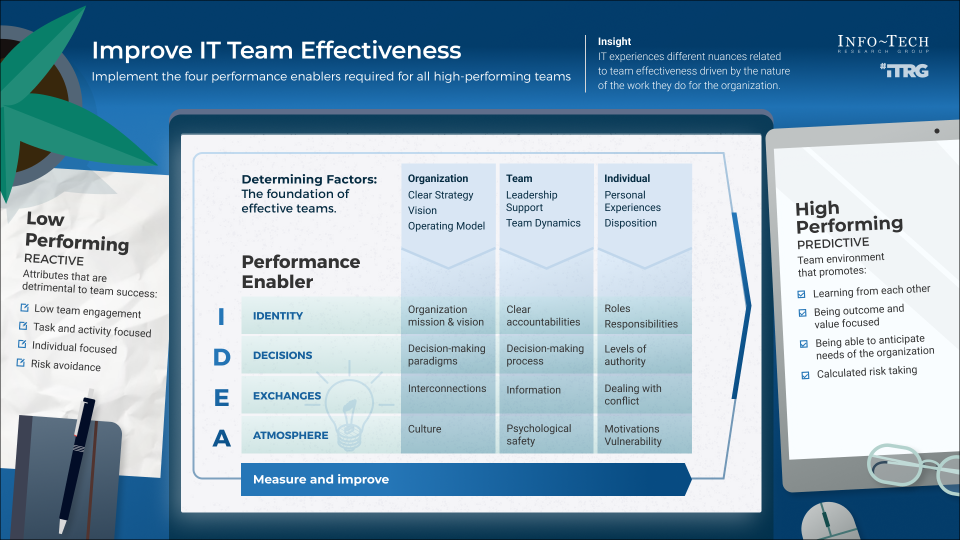

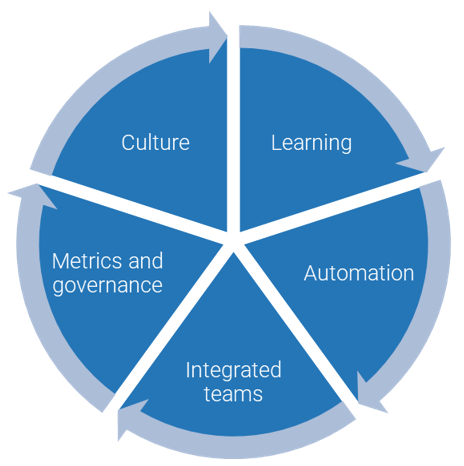

Use CLAIM to guide your journey

Value is best created by self-managing teams who deliver in frequent, short increments supported by leaders

who coach them through challenges.

Product-centric delivery and Agile are a radical change in how people work and think. Structured,

facilitated learning is required throughout the transformation to help leaders and practitioners make the

shift.

Product management, Agile, and DevOps have inspired SDLC tools that have become a key part of delivery

practices and work management.

Self-organizing teams that cross business, delivery, and operations are essential to gain the full benefits

of product-centric delivery.

Successful implementations require the disciplined use of metrics that support developing better teams

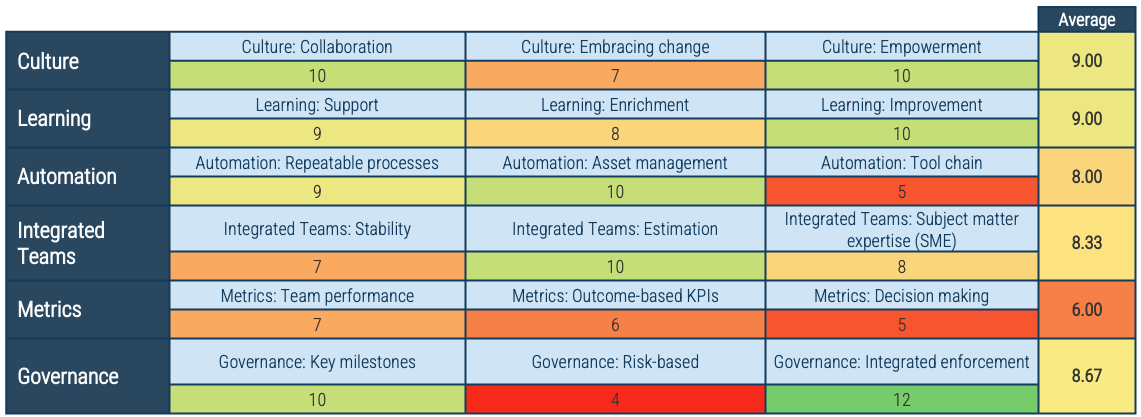

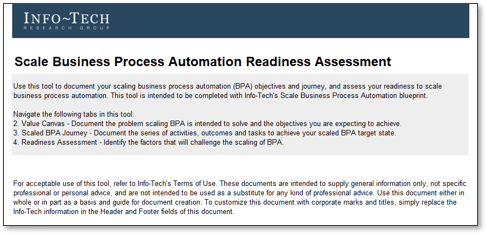

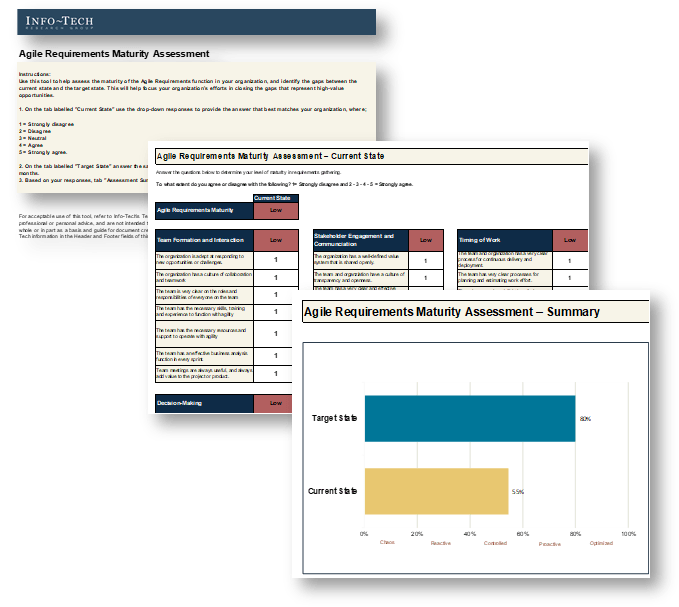

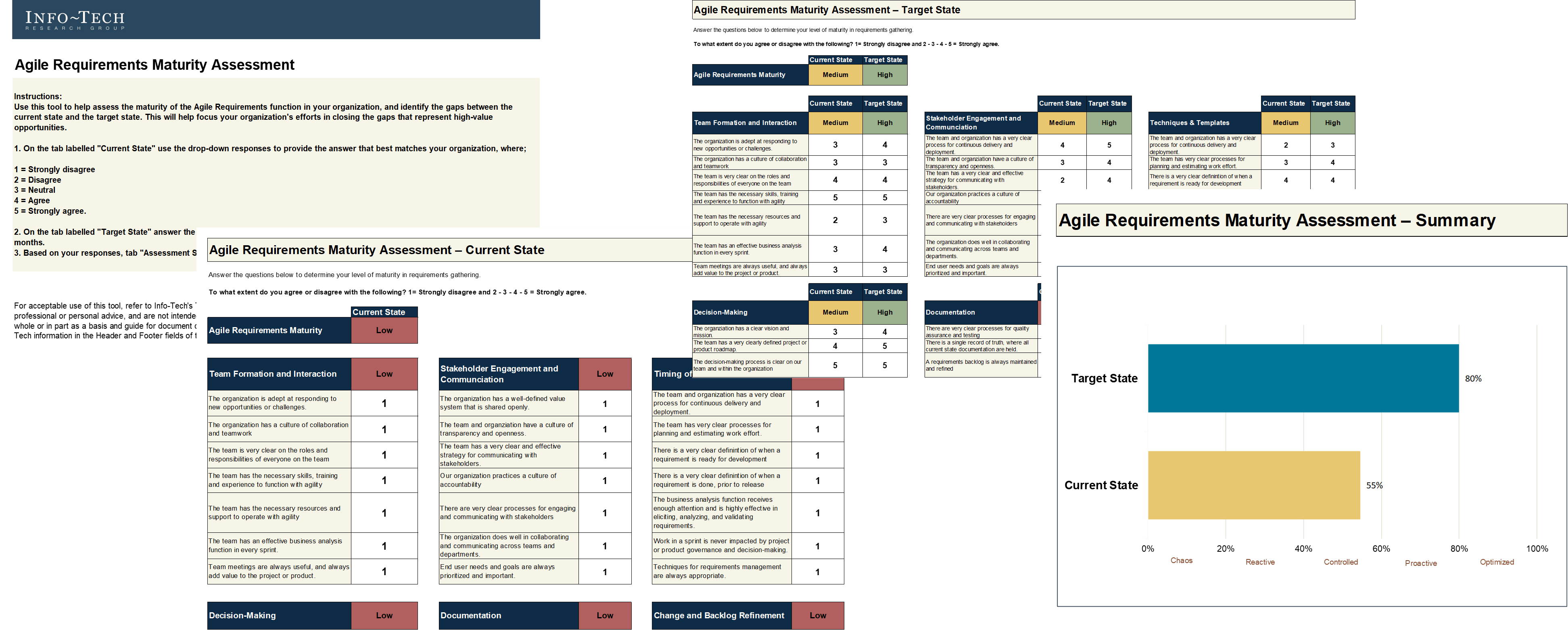

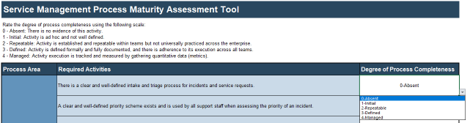

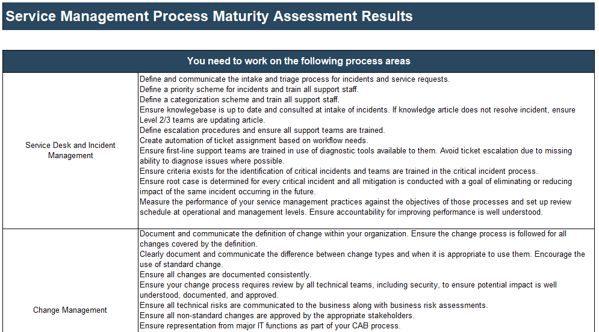

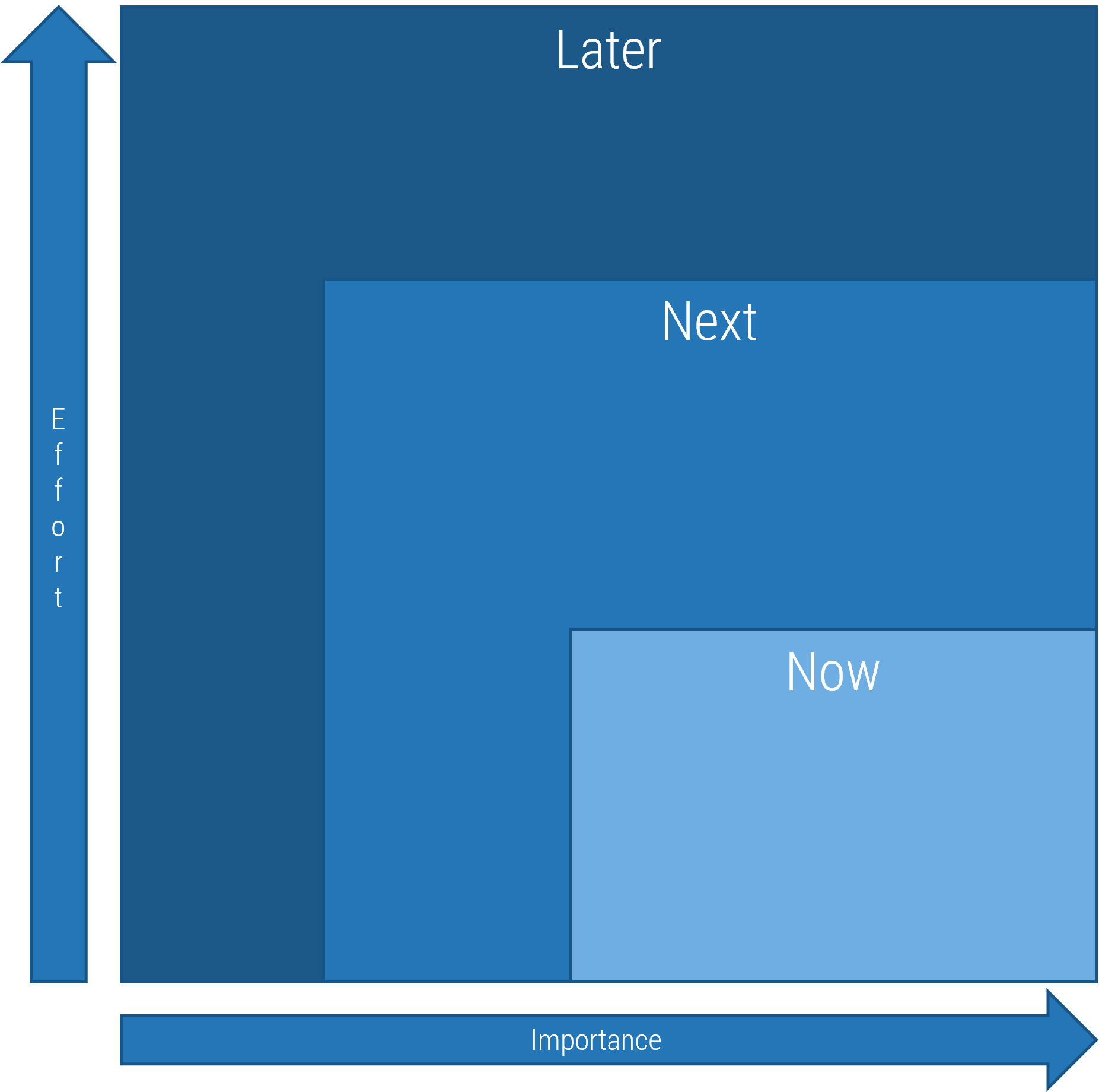

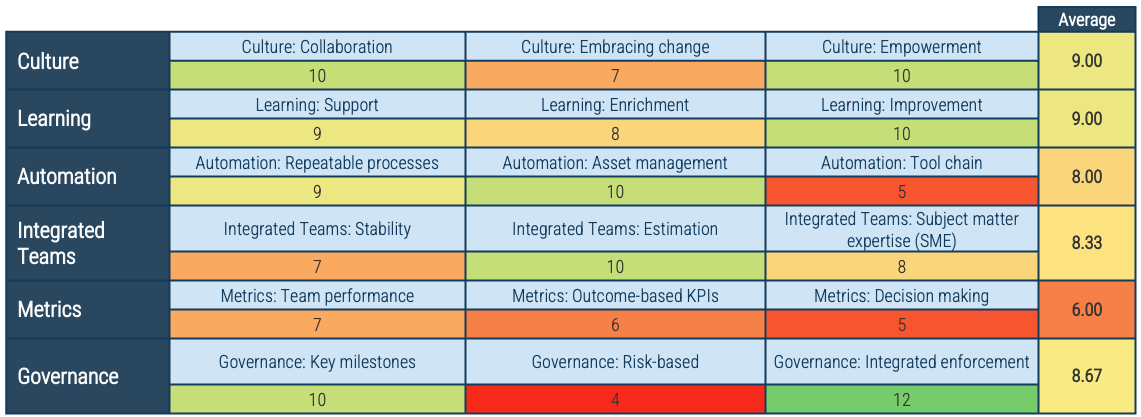

Exercise 1.1.3 Assess your product management readiness

1 hour

-

Open and complete the Mature and Scale Product Ownership Readiness Assessment in your Playbook or the provided Excel tool.

-

Discuss high and low scores for each area to reach a consensus.

-

Record your results in your Playbook.

Output

-

Assessment of product management readiness based on Info-Tech’s CLAIM+G model.

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Business analysts

Capture in the Mature and Scale Product Ownership Readiness Assessment.

Communicate reasons for changes and how they will be implemented

Leaders of successful change spend considerable time developing a powerful change message; that is, a compelling narrative that articulates the desired end state, and that makes the change concrete and meaningful to staff.

The organizational change message should:

Step 1.2

Establish your product ownership model

Activities

1.2.1 Identify your primary product owner perspective

1.2.2 Define your product owner RACI

Establish the foundation for product ownership

This step involves the following participants:

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Delivery managers

-

Business analysts

Outcomes of this step

-

Product owner perspective mapping

-

Product owner RACI

Recognize the product owner perspectives

Product owners represent one of three primary perspectives. Although all share the same capabilities, how they approach their responsibilities is influenced by their primary perspective.

Info-Tech Best Practice

Product owners must translate needs and constraints from their perspective into the language of their audience. Kathy Borneman, Digital Product Owner at SunTrust Bank, noted the challenges of finding a common language between lines of business and IT (e.g. what is a unit?).

Identify and align to product owner perspectives to ensure product success

Product owner perspectives

-

Each product owner perspective provides important feedback, demand, and support for the product.

-

Where a perspective is represented by a distinct role, the perspective is managed with that product owner.

-

If separate roles don’t exist, the product owner must evaluate their work using two or three perspectives.

-

The ultimate success of a product, and therefore product owner, is meeting the end-user value of the business product

owner, tool support of the technical product owner, and manual processing support of the operations product owner.

Line of business (LOB) product owners

LOB product owners focus on the products and services consumed by the organization’s external consumers and users. The

role centers on the market needs, competitive landscape, and operational support to deliver products and services.

Business perspective

-

Alignment to enterprise strategy and priorities

-

Growth: market penetration and/or revenue

-

Perception of product value

-

Quality, stability, and predictability

-

Improvement and innovation

-

P&L

-

Market threats and opportunities

-

Speed to market

-

Service alignment

-

Meet or exceed individual goals

Relationship to Operations

-

Customer satisfaction

-

Speed of delivery and manual processing

-

Continuity

Relationship to Technical

-

Enabler

-

Analysis and insight

-

Lower operating and support costs

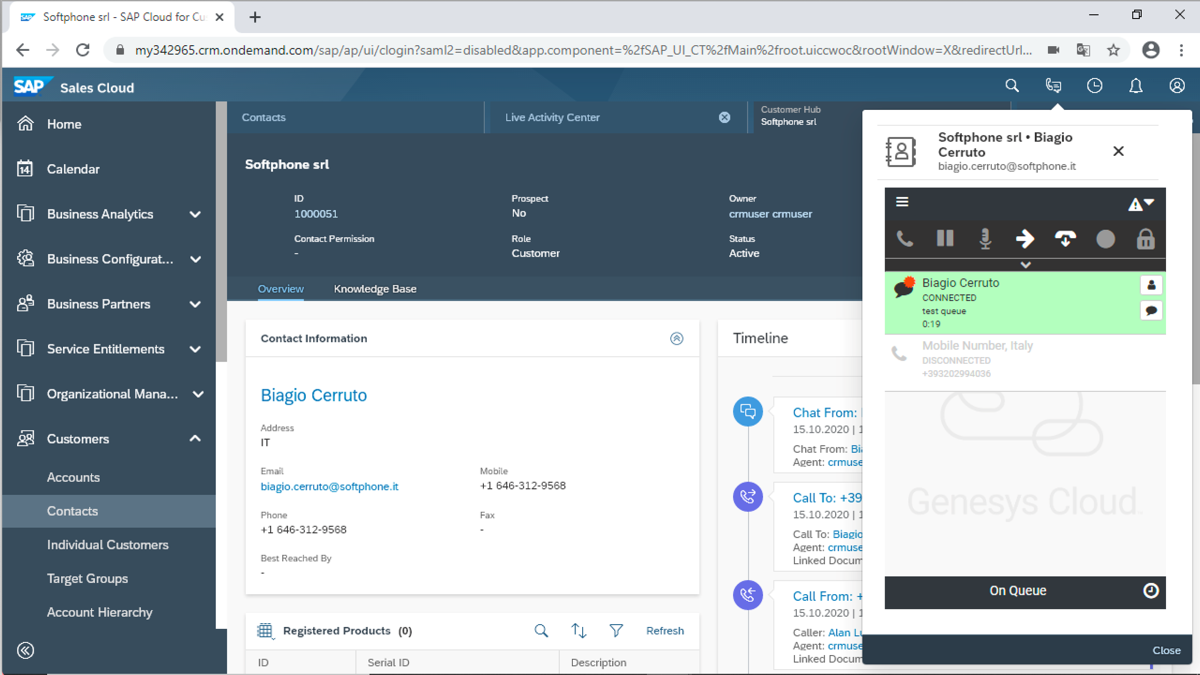

Technical product owners

Technical product owners are responsible for the IT systems, tools, platforms, and services that support business operations. Often they are identified as application or platform managers.

Technical perspective

-

Application, application suite, or group of applications

-

Core platforms and tools

-

Infrastructure and networking

-

Third-party technology services

-

Enable business operations

-

Direct-to-customer product or service

-

Highly interconnected

-

Need for continuous improvement

-

End-of-life management

-

Internal value proposition and users

Relationship to Business

-

Direct consumers

-

End users

-

Source of funding

Relationship to Operations

-

End users

-

Process enablement or automation

-

Support, continuity, and manual intervention

Operations (service) product owners

Operational product owners focus on the people, processes, and tools needed for manual processing and decisions when automation is not cost-effective. Operational product owners are typically called service owners due to the nature of

their work.

Operational perspective

-

Business enablement

-

Continuity

-

Problem, incident, issue resolution

-

Process efficiency

-

Throughput

-

Error/defect avoidance

-

Decision enablement

-

Waste reduction

-

Limit time in process

-

Disaster recovery

Relationship to Business

-

Revenue enablement

-

Manual intervention and processing

-

End-user satisfaction

Relationship to Technical

-

Process enabler

-

Performance enhancement

-

Threat of automation

Exercise 1.2.1 Identify your primary product owner perspective

1 hour

-

Identify which product owner perspective represents your primary focus.

-

Determine where the other perspectives need to be part of your product roadmap or if they are managed by other product owners.

Output

-

Identification of primary product owner perspective.

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Business analysts

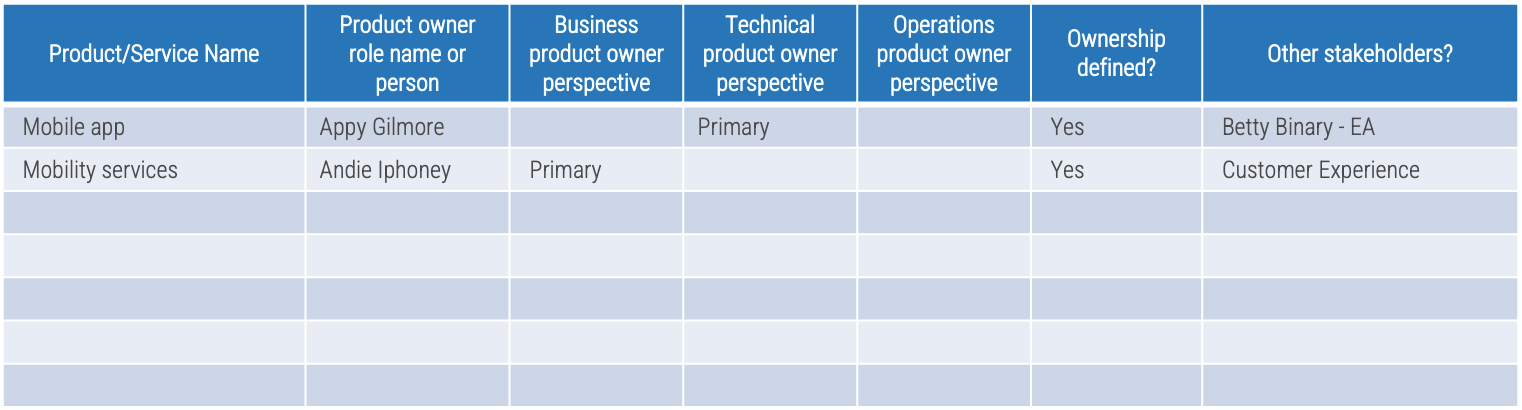

Capture in the Mature and Scale Product Ownership Playbook.

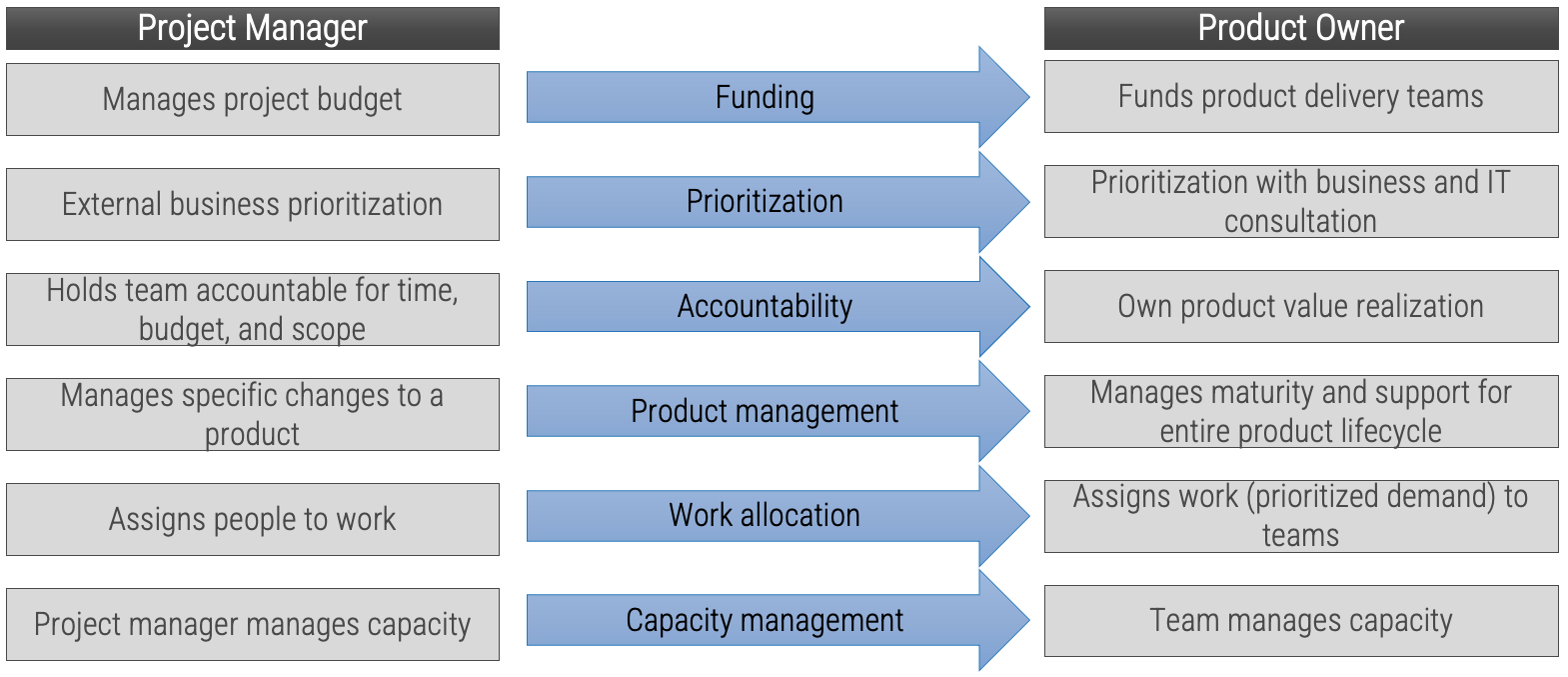

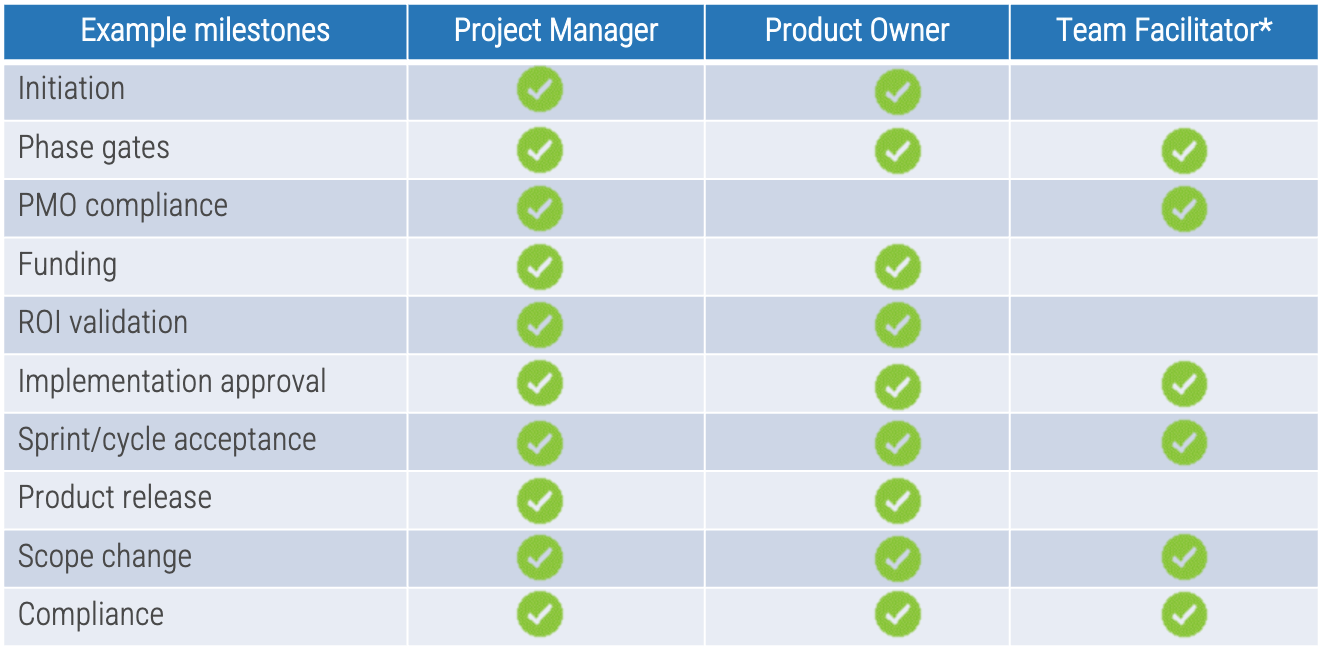

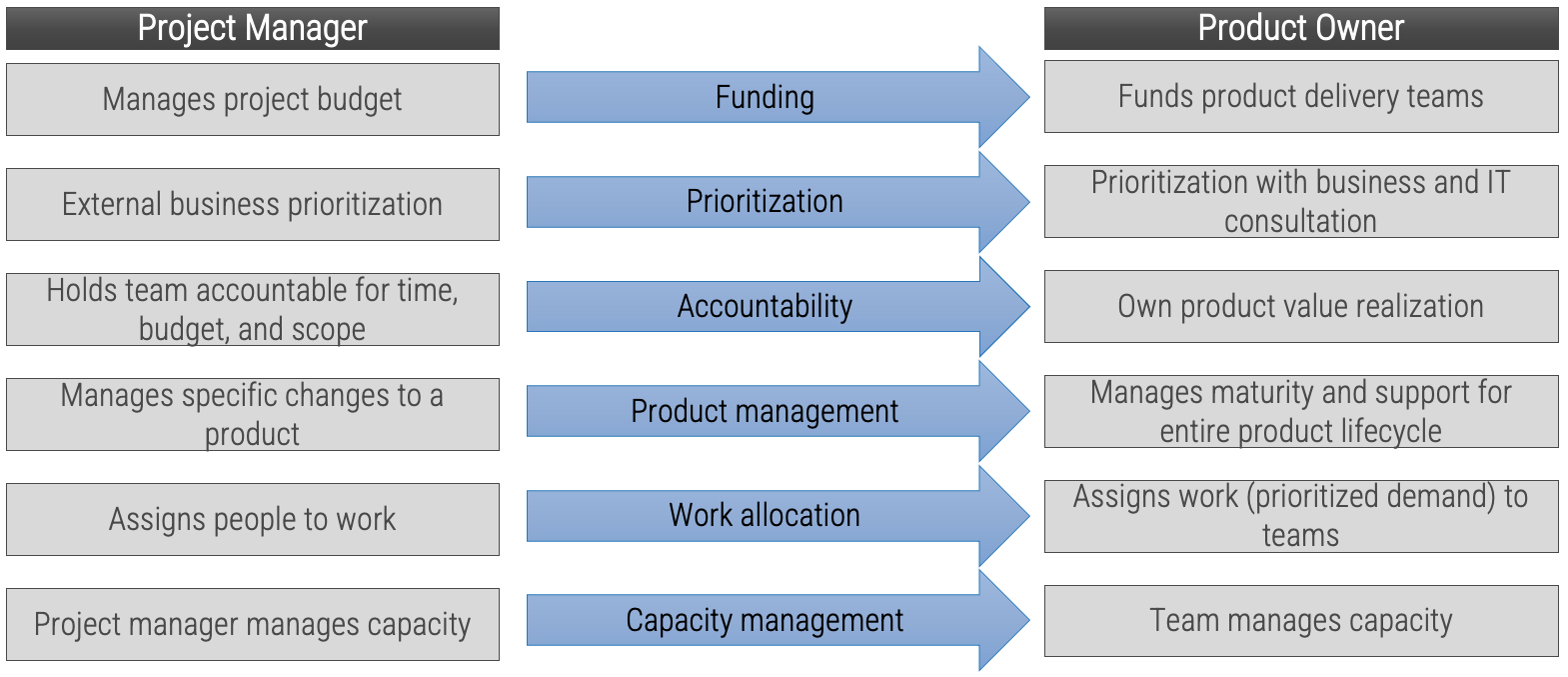

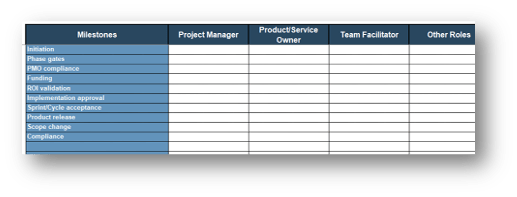

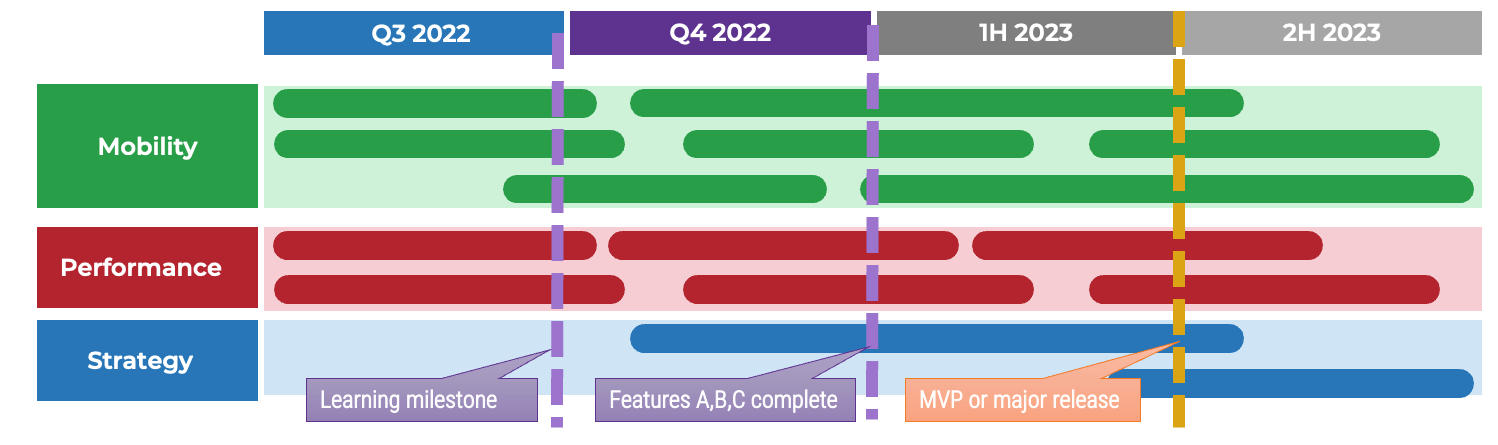

Realign differences between project managers and product owners

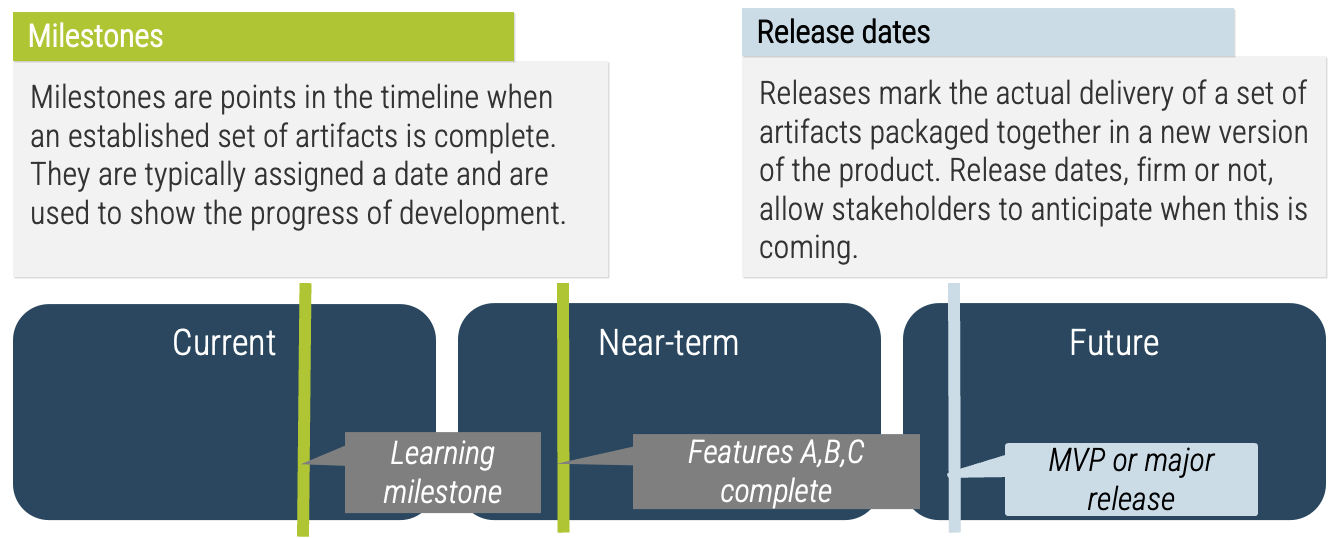

Manage and communicate key milestones

Successful product owners understand and define the key milestones in their product delivery lifecycles. These need to

be managed along with the product backlog and roadmap.

Info-Tech Best Practice

Product ownership isn’t just about managing the product backlog and development cycles. Teams need to manage key

milestones such as learning milestones, test releases, product releases, phase gates, and other organizational

checkpoints.

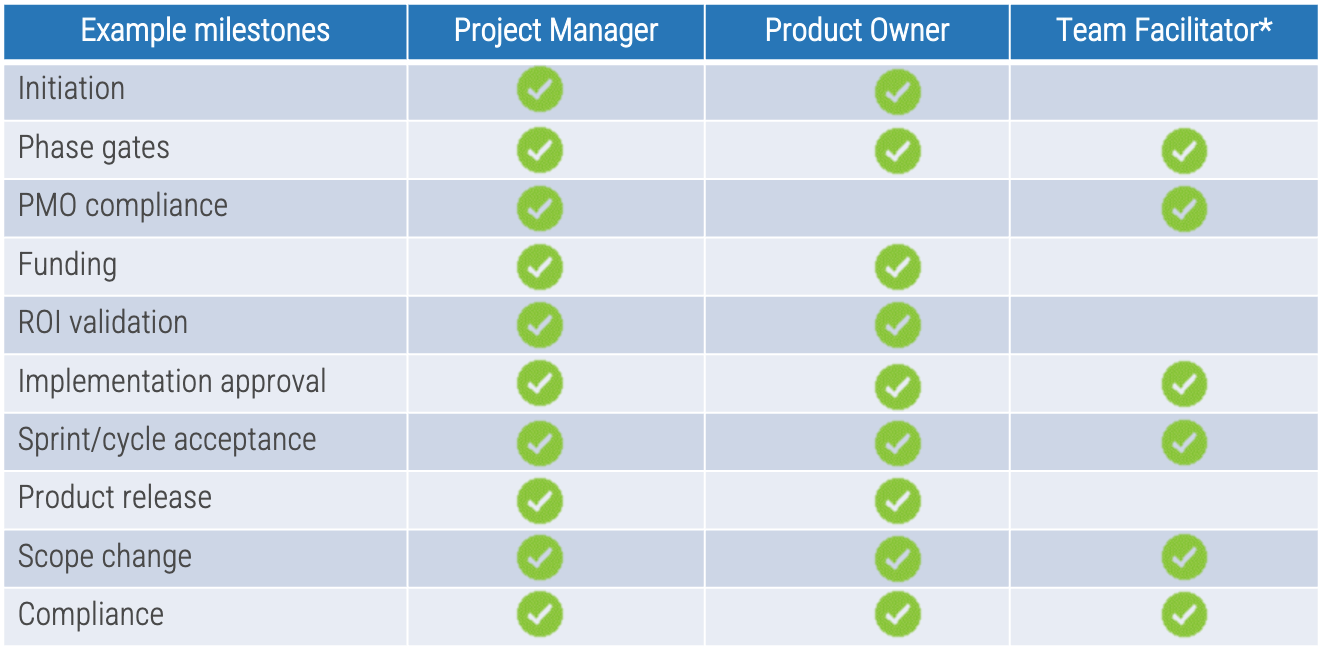

Define who manages each key milestone

Key milestones must be proactively managed. If a project manager is not available, those responsibilities need to be

managed by the product owner or Scrum Master. Start with responsibility mapping to decide which role will be

responsible.

*Scrum Master, Delivery Manager, Team Lead

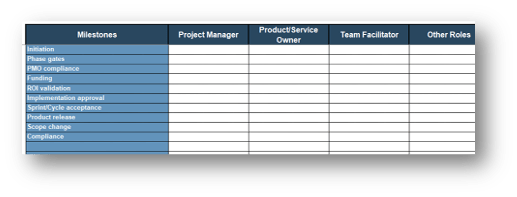

Exercise 1.2.2 Define your product owner RACI

60 minutes

-

Review your product and project delivery methodologies to identify key milestones (including approvals, gates, reviews, compliance checks, etc.). List each milestone on a flip chart or whiteboard.

-

For each milestone, define who is accountable for the completion.

-

For each milestone, define who is responsible for executing the milestone activity. (Who does the work that allows the

milestone to be completed?)

-

Review any responsibility and accountability gaps and identify opportunities to better support and execute your

operating model.

-

If you previously completed

Deliver Digital Products at Scale

, review and update your RACI in the

Mature and Scale

Product Ownership Workbook

.

Output

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Business analysts

Capture in the Mature and Scale Product Ownership Playbook.

Phase 2

Align Product Owners to Products

Mature and Scale Product Ownership

This phase will walk you through the following activities:

2.1.1 Assign resources to your products and families

2.2.1 Visualize relationships to identify key influencers

2.2.2 Group stakeholders into categories

2.2.3 Prioritize your stakeholders

This phase involves the following participants:

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Delivery managers

-

Business analysts

Step 2.1

Assign product owners to products

Activities

2.1.1 Assign resources to your products and families

Align product owners to products

This step involves the following participants:

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Delivery managers

-

Business analysts

Outcomes of this step

- Product resource assignment

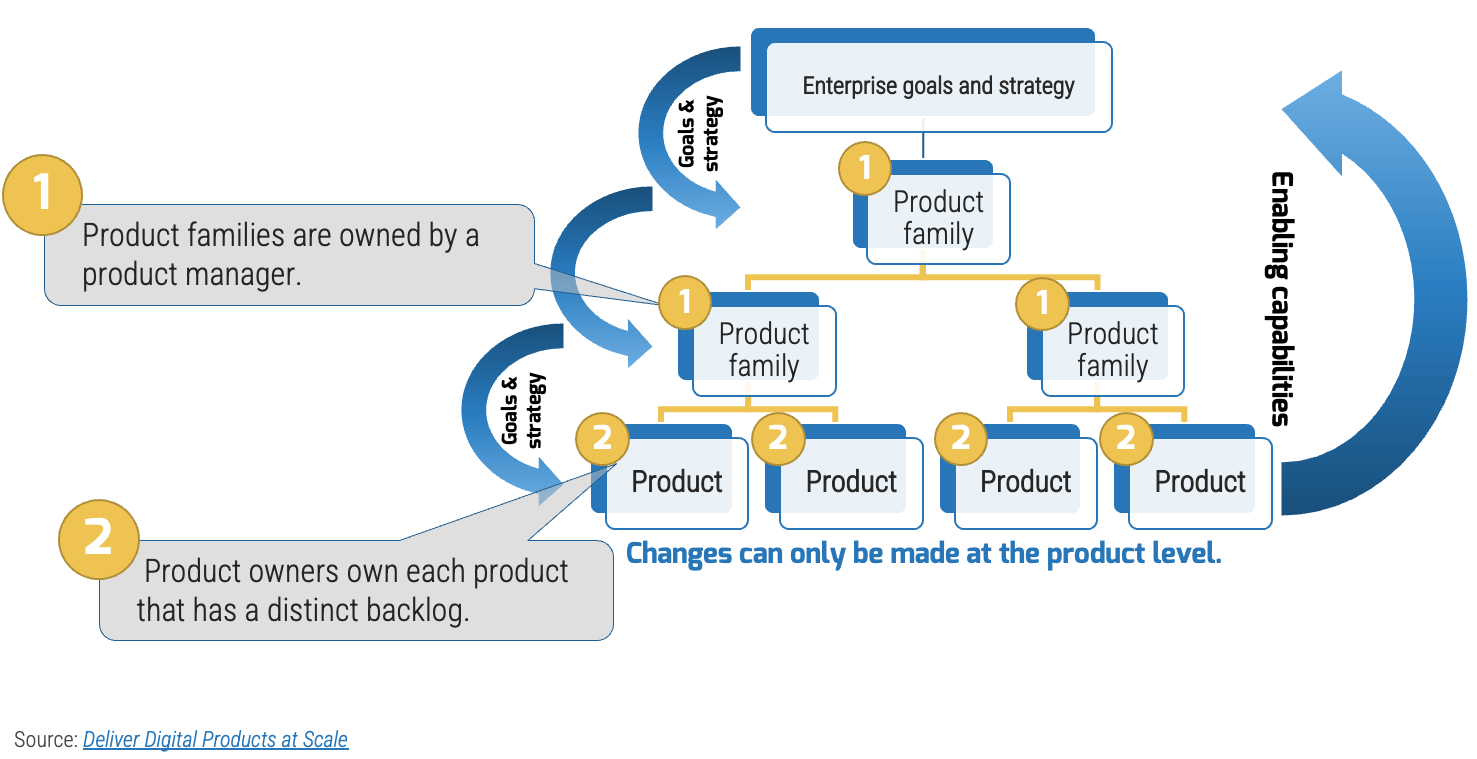

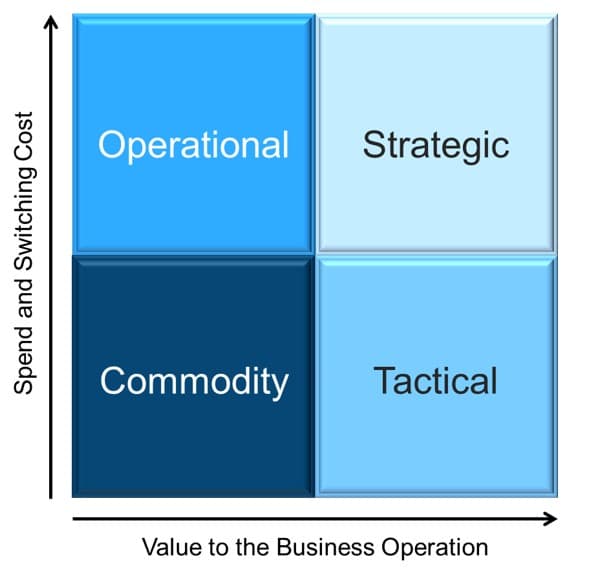

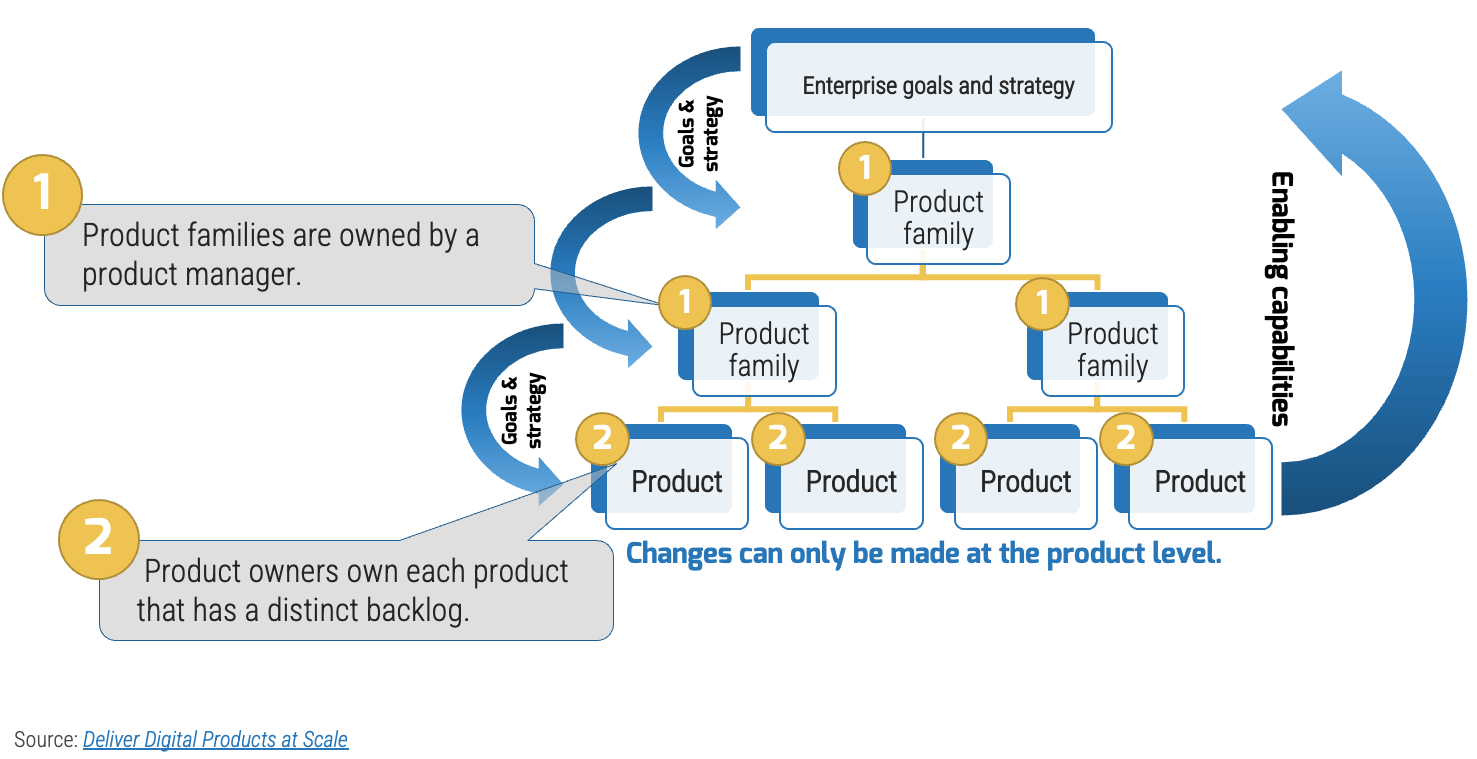

Match your product management role definitions to your product family levels

Using the role definitions, you created in Exercise 1.1.2, determine which roles correspond to which levels of your

product families.

Product portfolio

Groups of product families within an overall value stream or capability grouping.

Project portfolio manager

Product family

A collection of related products. Products can be grouped along architectural, functional, operational, or

experiential

patterns.

Product family manager

Product

Single product composed of one or more applications and services.

Product owner

Info-Tech Insight

Define the current roles that will perform the product management function or define consistent role names

to product owners and managers.

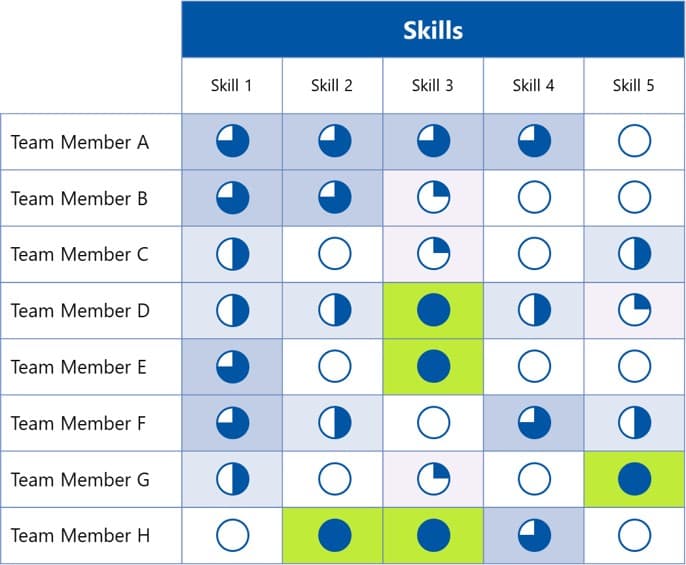

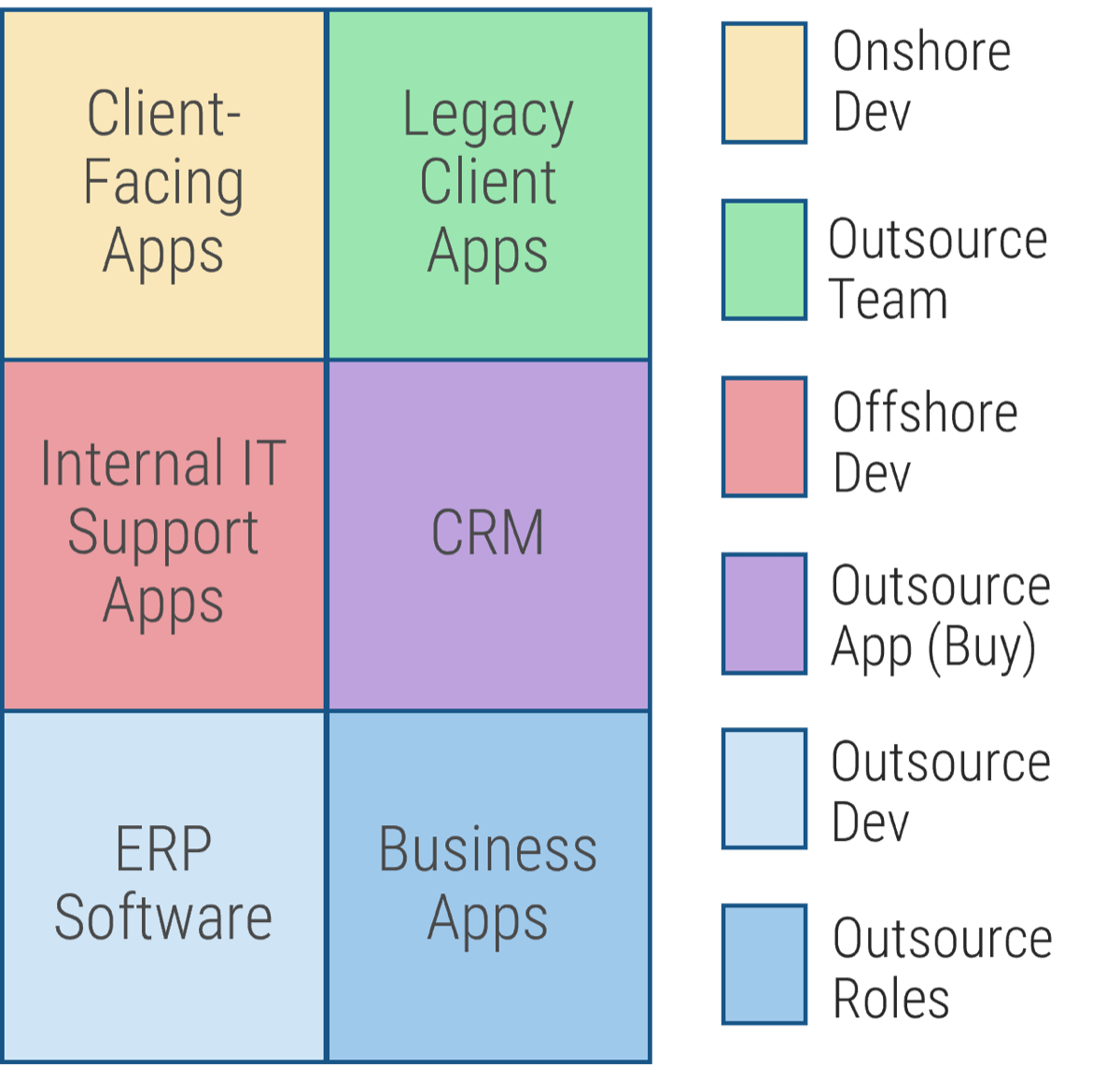

Assign resources throughout your product families

Info-Tech Insight

-

Start by assigning resources to each product or product family box.

-

A product owner can be responsible for more than one product.

-

Ownership of more than one product does not mean they share the same backlog.

-

For help organizing your product families, please download

Deliver Digital Products at Scale.

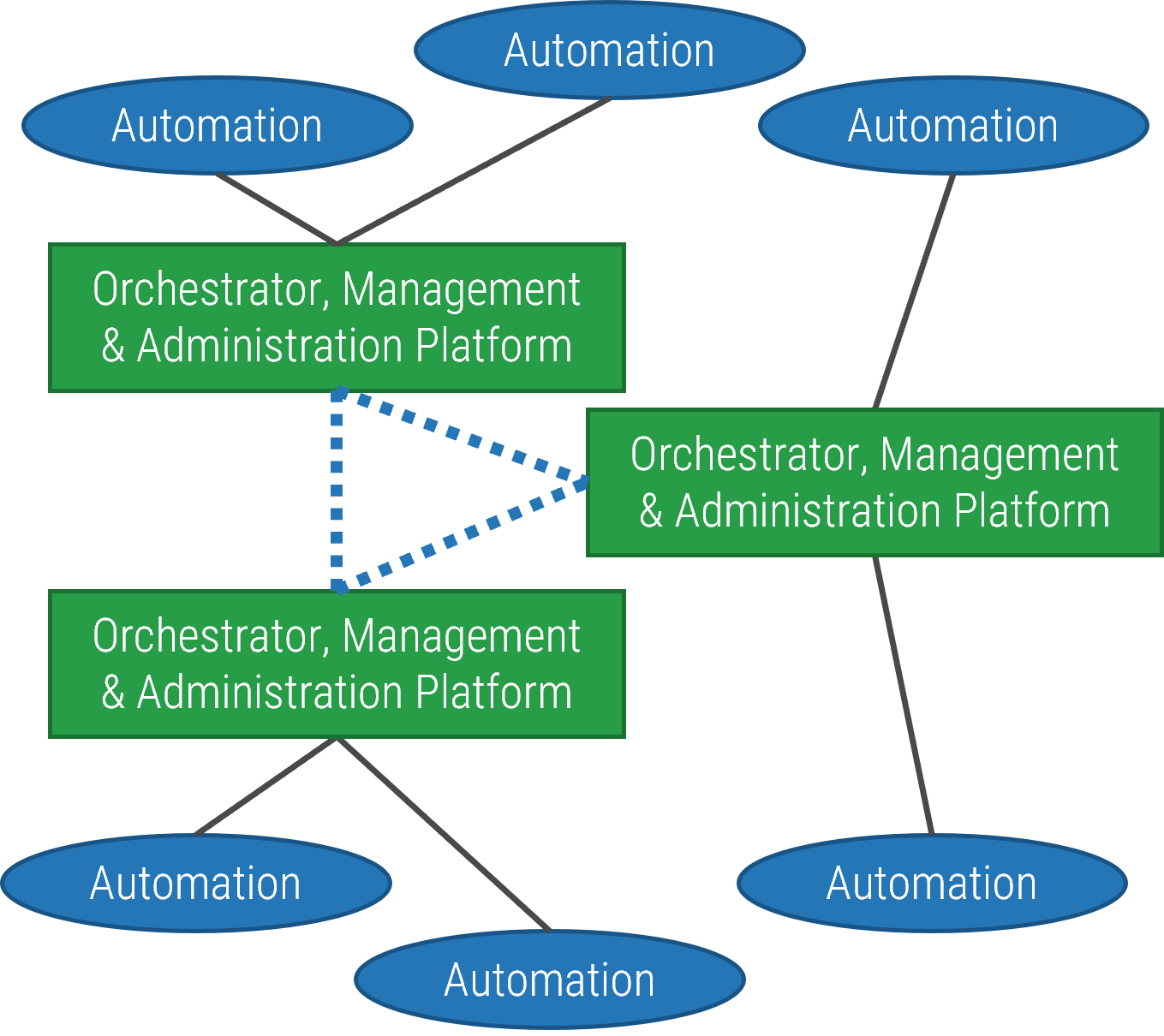

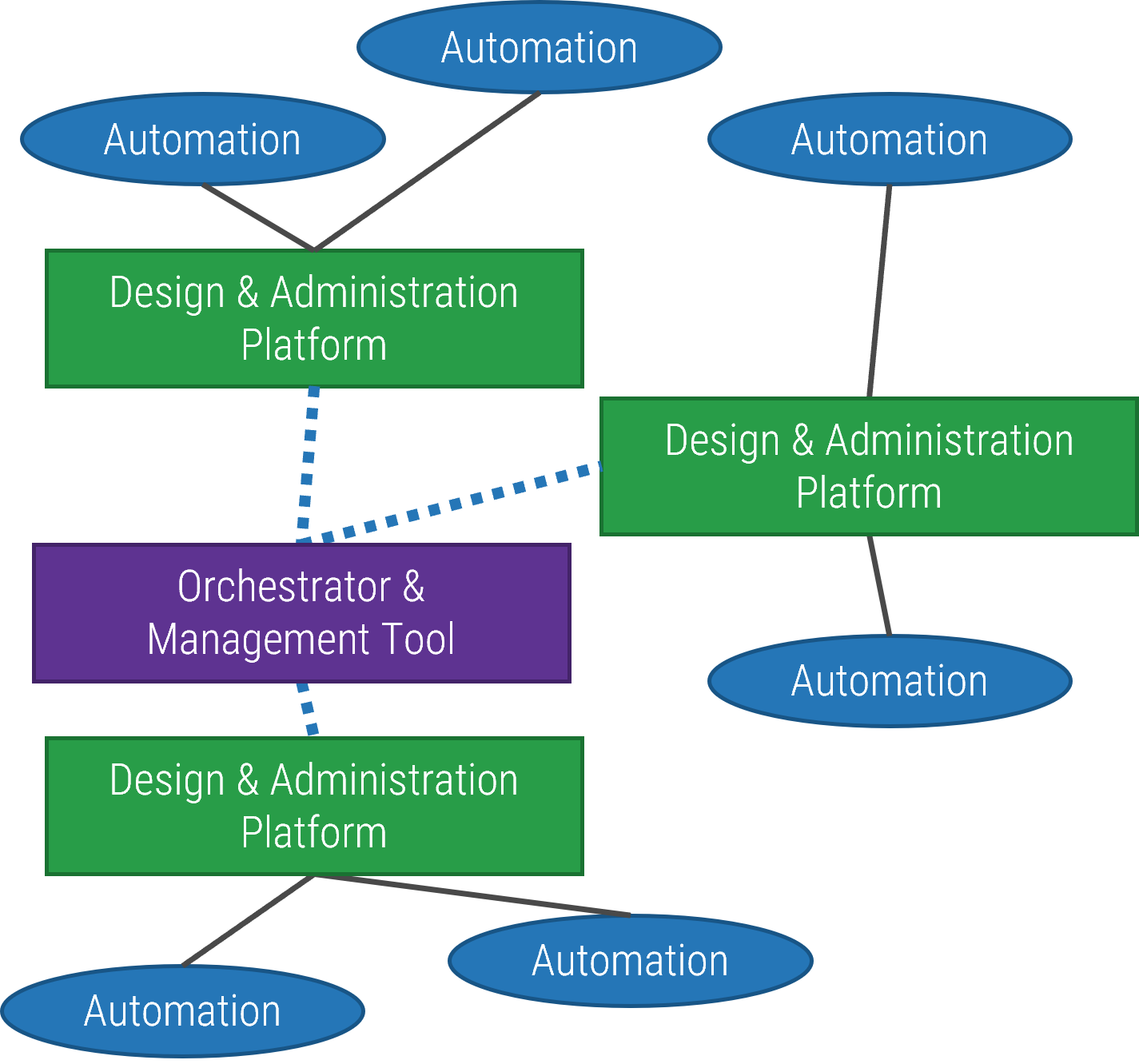

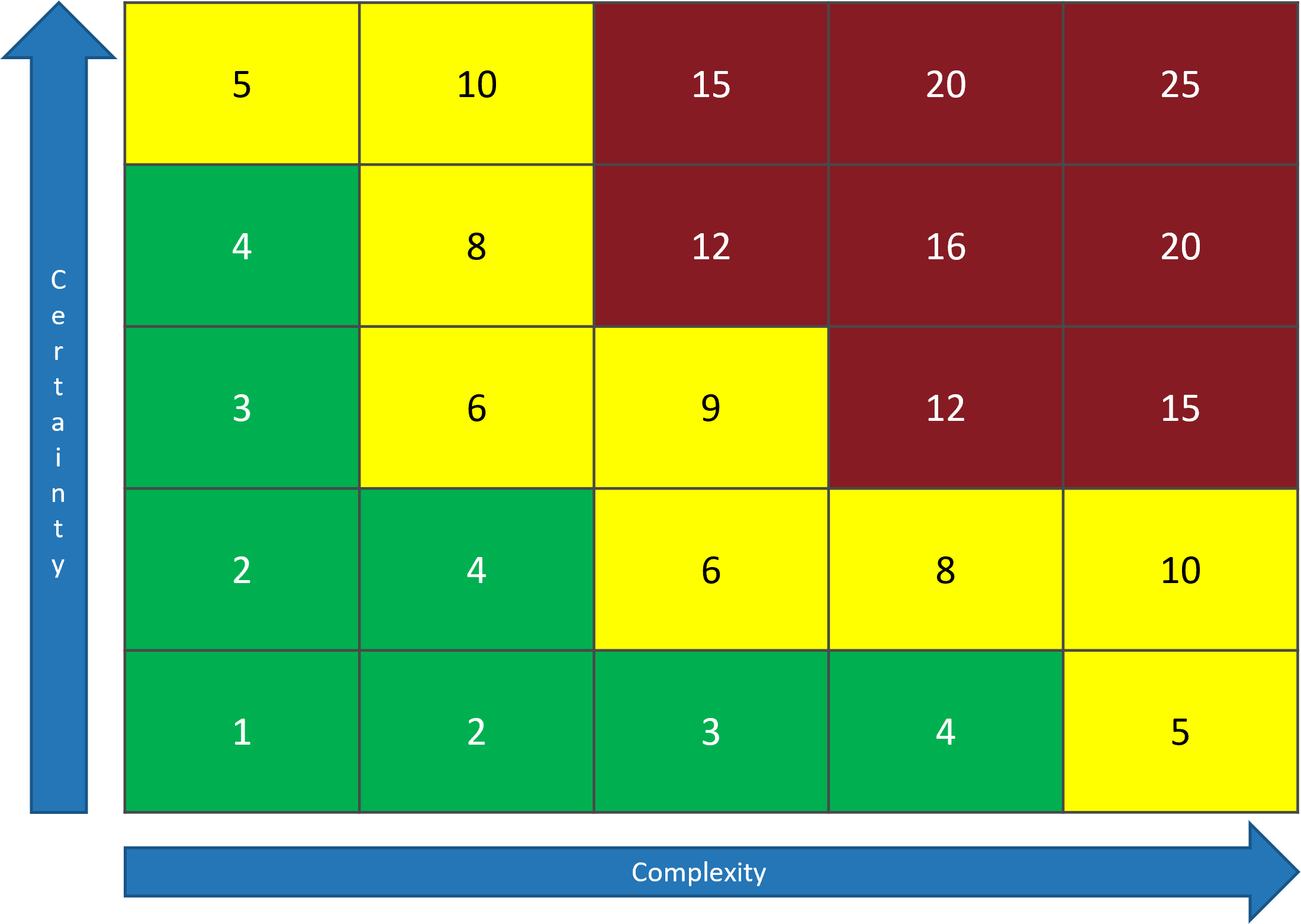

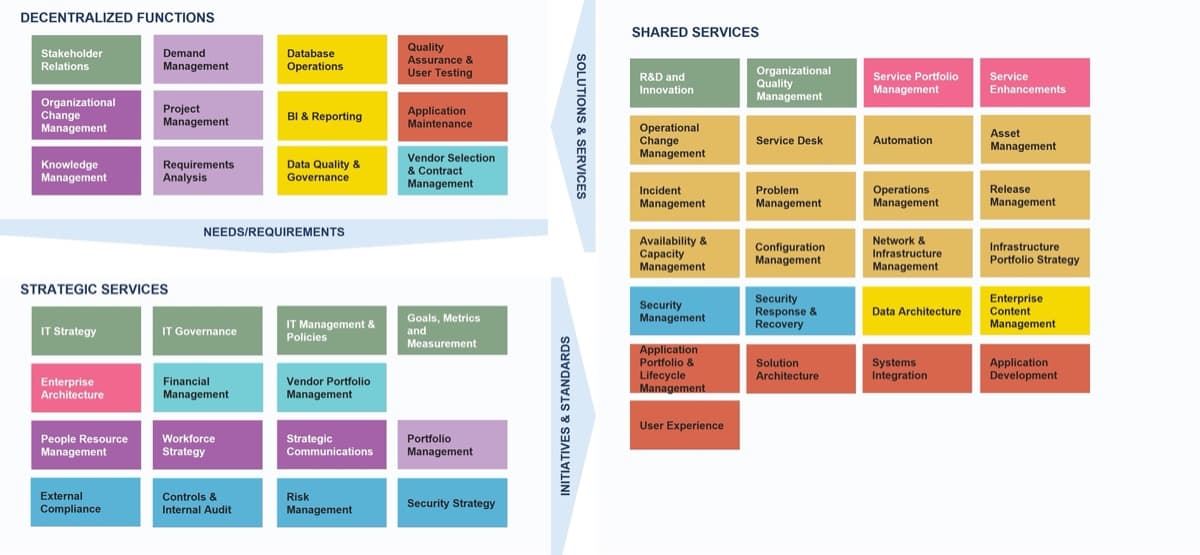

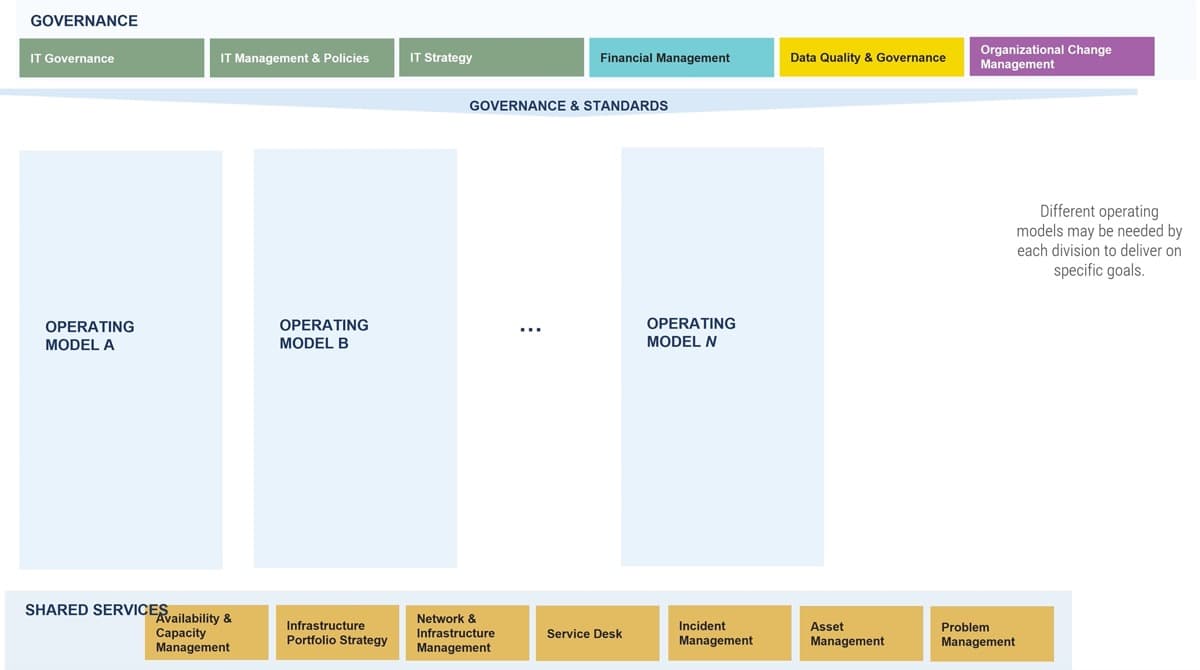

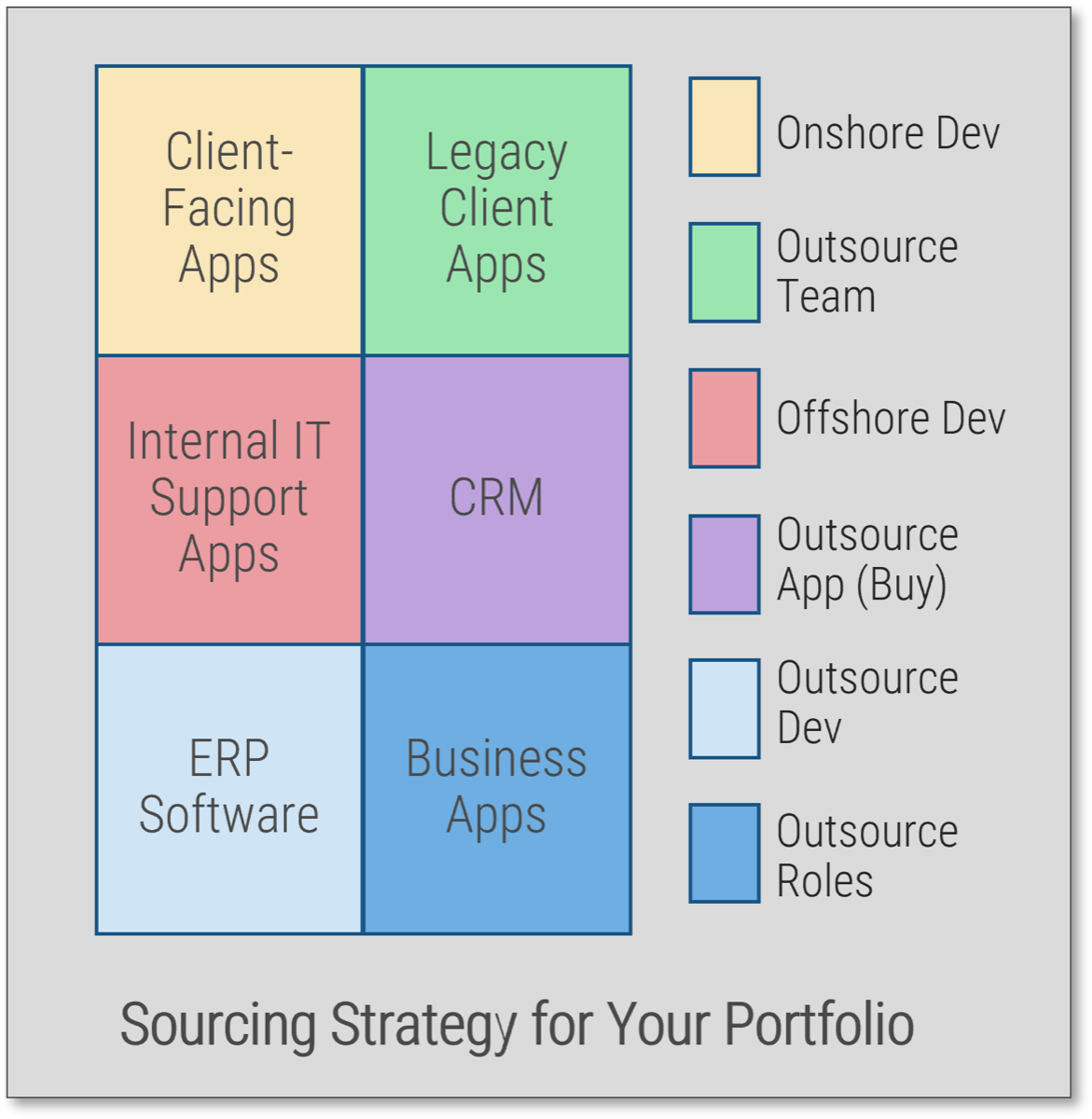

Understand special circumstances

In Deliver Digital Products at

Scale

, products were grouped into families using Info-Tech’s five scaling patterns. Assigning owners to

Enterprise Applications and Shared Services requires special consideration.

Value stream alignment

-

Business architecture

-

Value stream

-

Capability

-

Function

-

Market/customer segment

-

Line of business (LoB)

-

Example: Customer group > value stream > products

Enterprise applications

-

Enabling capabilities

-

Enterprise platforms

-

Supporting apps

-

Example: HR > Workday/Peoplesoft > Modules

Supporting: Job board, healthcare administrator

Shared Services

-

Organization of related services into service family

-

Direct hierarchy does not necessarily exist within the family

-

Examples: End-user support and ticketing,

workflow and collaboration tools

Technical

-

Domain grouping of IT infrastructure, platforms, apps, skills, or languages

-

Often used in combination with Shared Services grouping or LoB-specific apps

-

Examples: Java, .NET, low-code, database, network

Organizational alignment

-

Used at higher levels of the organization where products are aligned under divisions

-

Separation of product managers from organizational structure is no longer needed because the management

team owns the

product management role

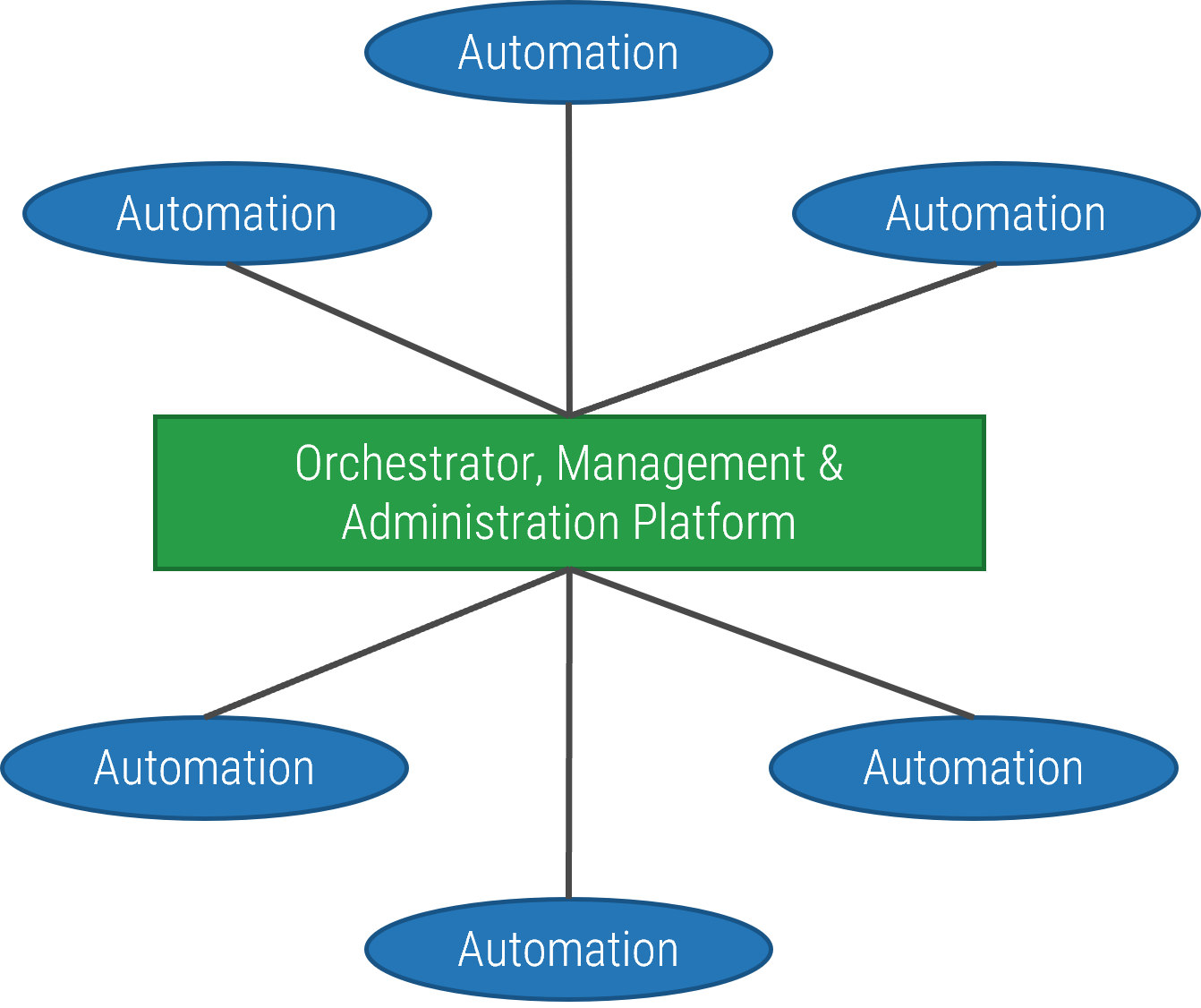

Map the source of demand to each product

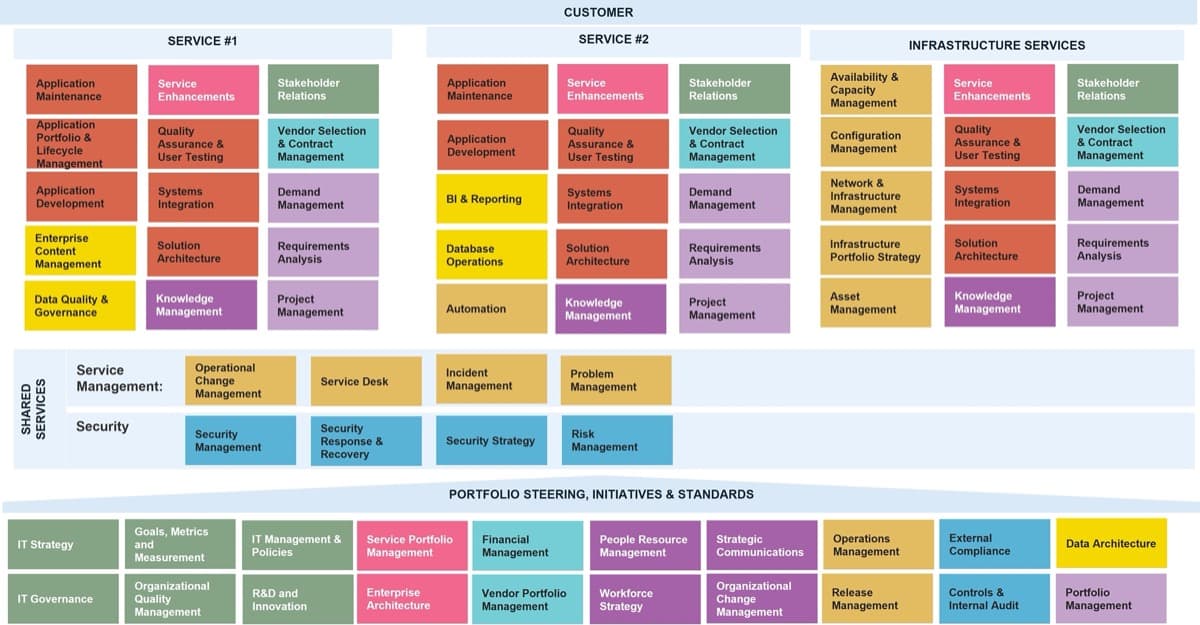

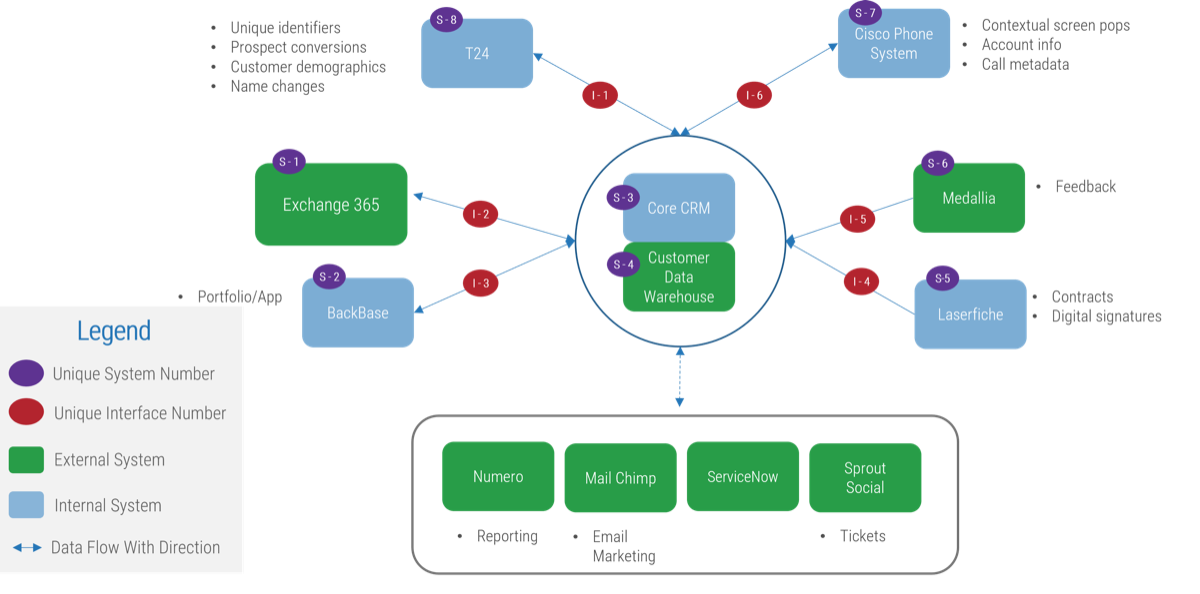

With enterprise applications and shared services, your demand comes from other product and service owners rather than end customers in a value stream.

Enterprise applications

-

Primary demand comes from the operational teams and service groups using the platform.

-

Each group typically has processes and tools aligned to a module or portion of the overall platform.

-

Product owners determine end-user needs to assist with process improvement and automation.

-

Product family managers help align roadmap goals and capabilities across the modules and tools to ensure consistency and the alignment of changes.

Shared services

-

Primary demand for shared services comes from other product owners and service managers whose solution or application is dependent on the shared service platform.

-

Families are grouped by related themes (e.g. workflow tools) to increase reusability, standard enterprise solutions, reduced redundancy, and consistent processes across multiple teams.

-

Product owners manage the individual applications or services within a family.

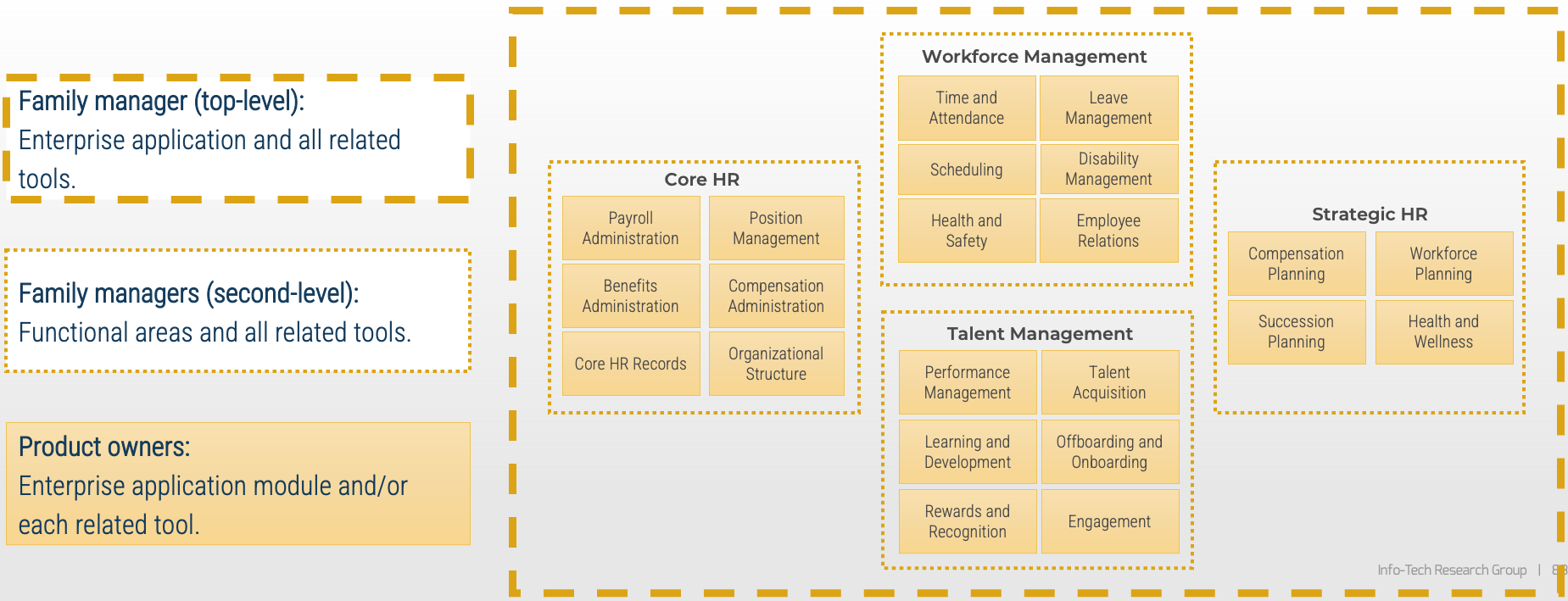

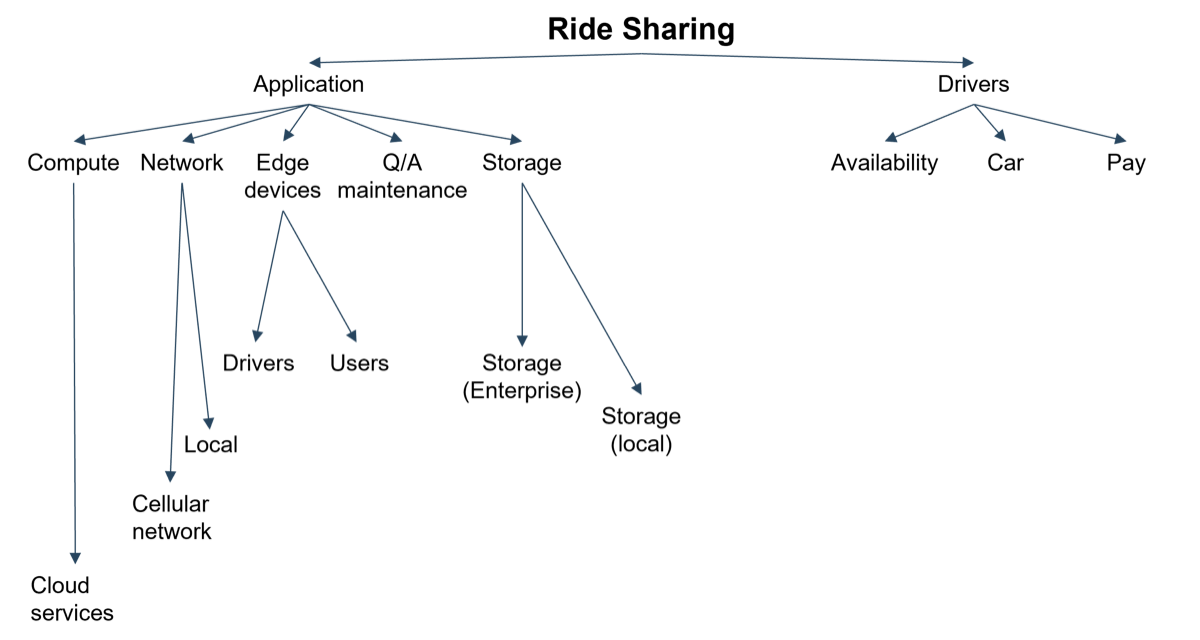

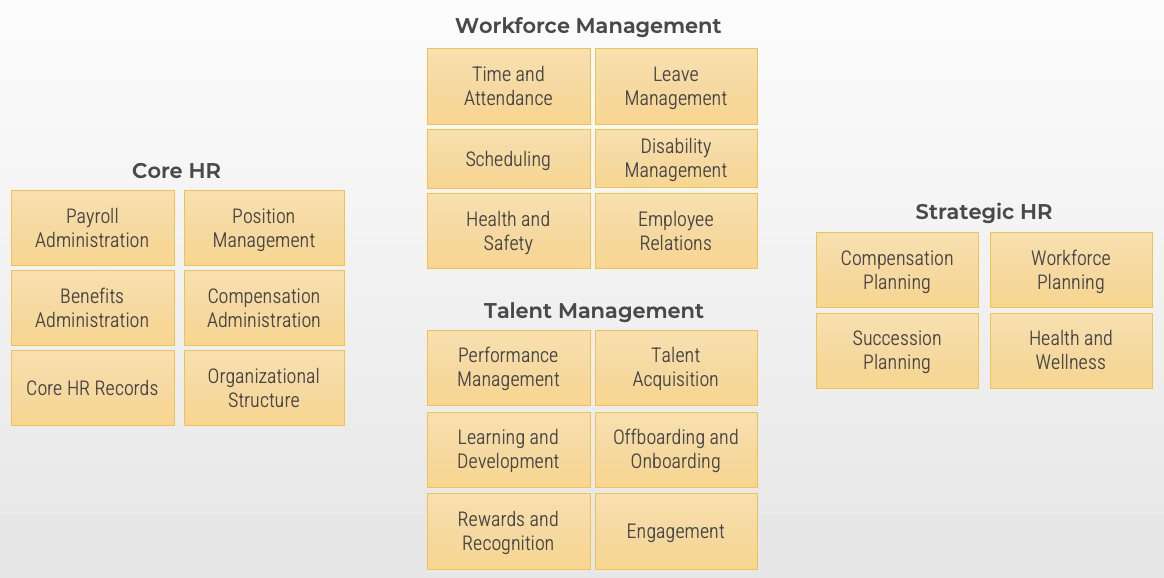

Pattern: Enterprise applications

A division or group delivers enabling capabilities and the team’s operational alignment maps directly to the

modules/components of an enterprise application and other applications that support the specific business function.

Example:

-

Human resources is one corporate function. Within HR, however, there are subfunctions that operate independently.

-

Each operational team is supported by one or more applications or modules within a primary HR system.

-

Even though the teams work independently, the information they manage is shared with, or ties into processes used by other teams. Coordination of efforts helps provide a higher level of service and consistency.

For additional information about HRMS, please download

Get the Most Out of Your HRMS.

Assigning owners to enterprise applications

Align your enterprise application owners to your operating teams that use the enterprise applications. Effectively, your service managers will align with your platform module owners to provide integrated awareness and planning.

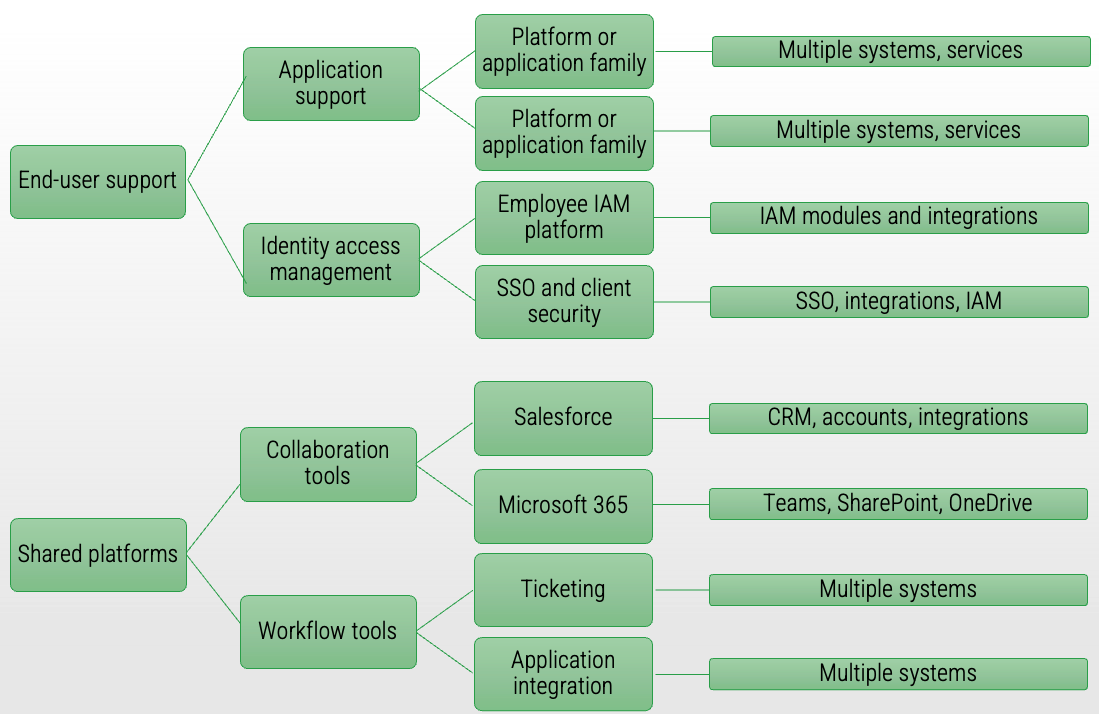

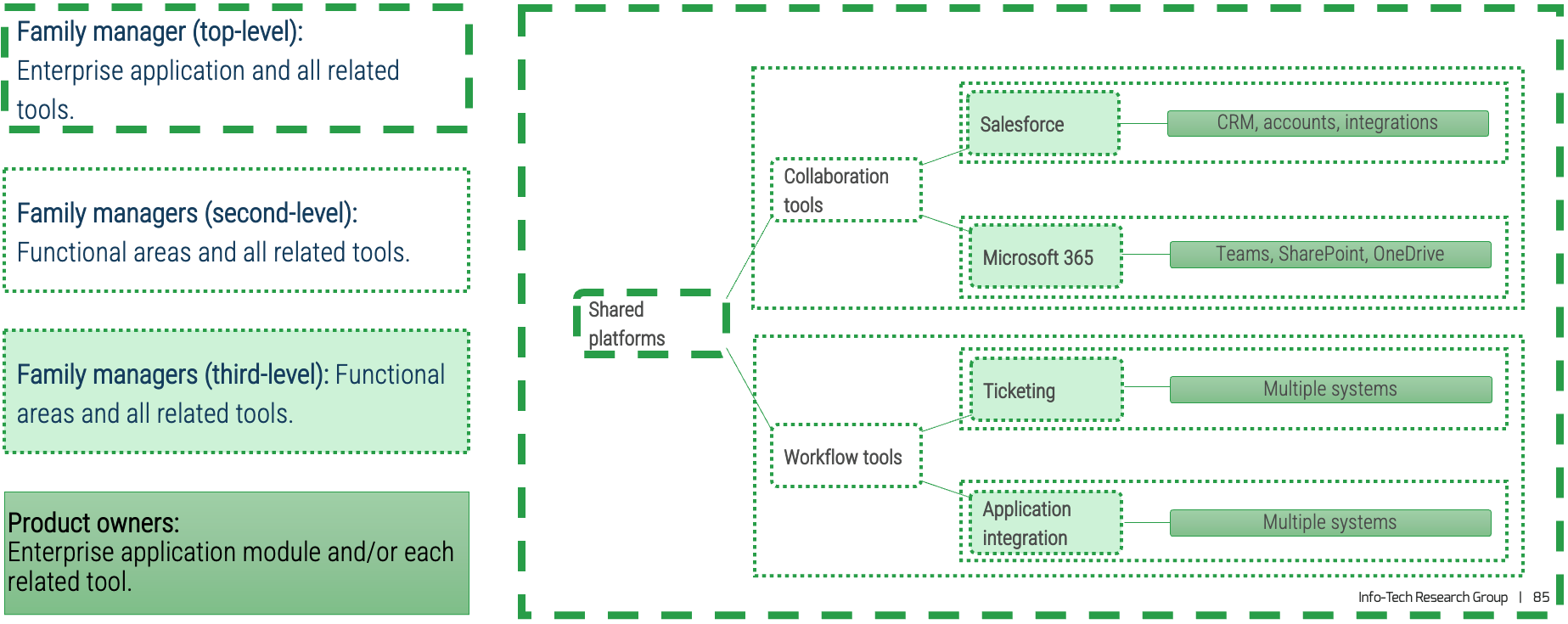

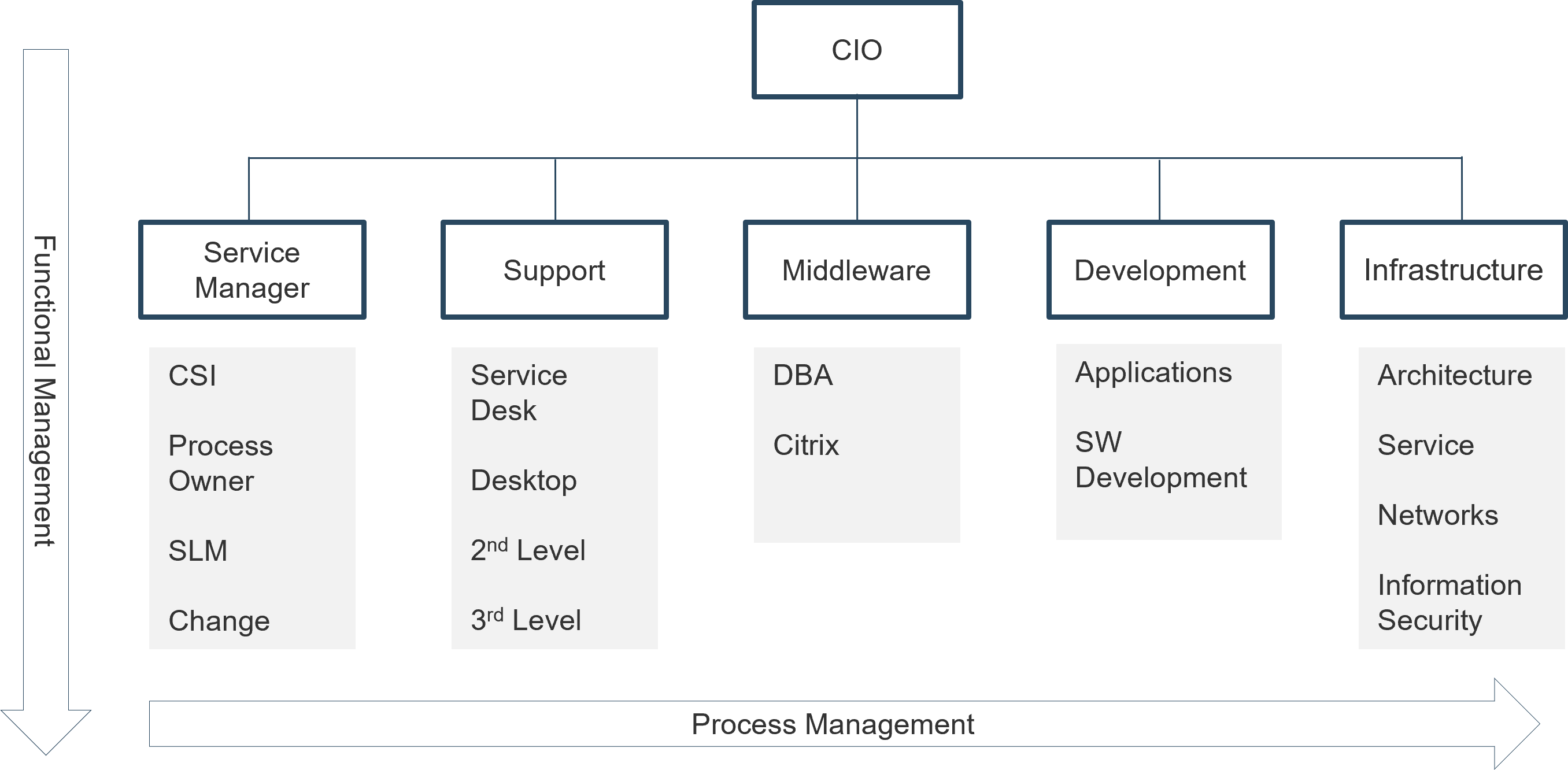

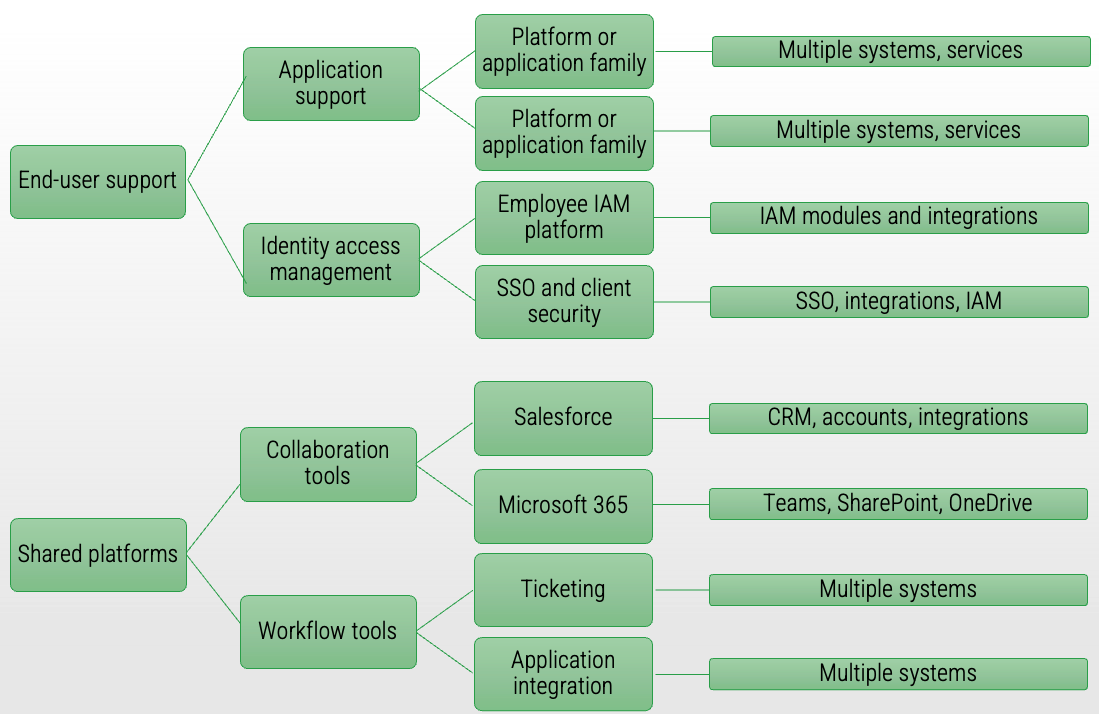

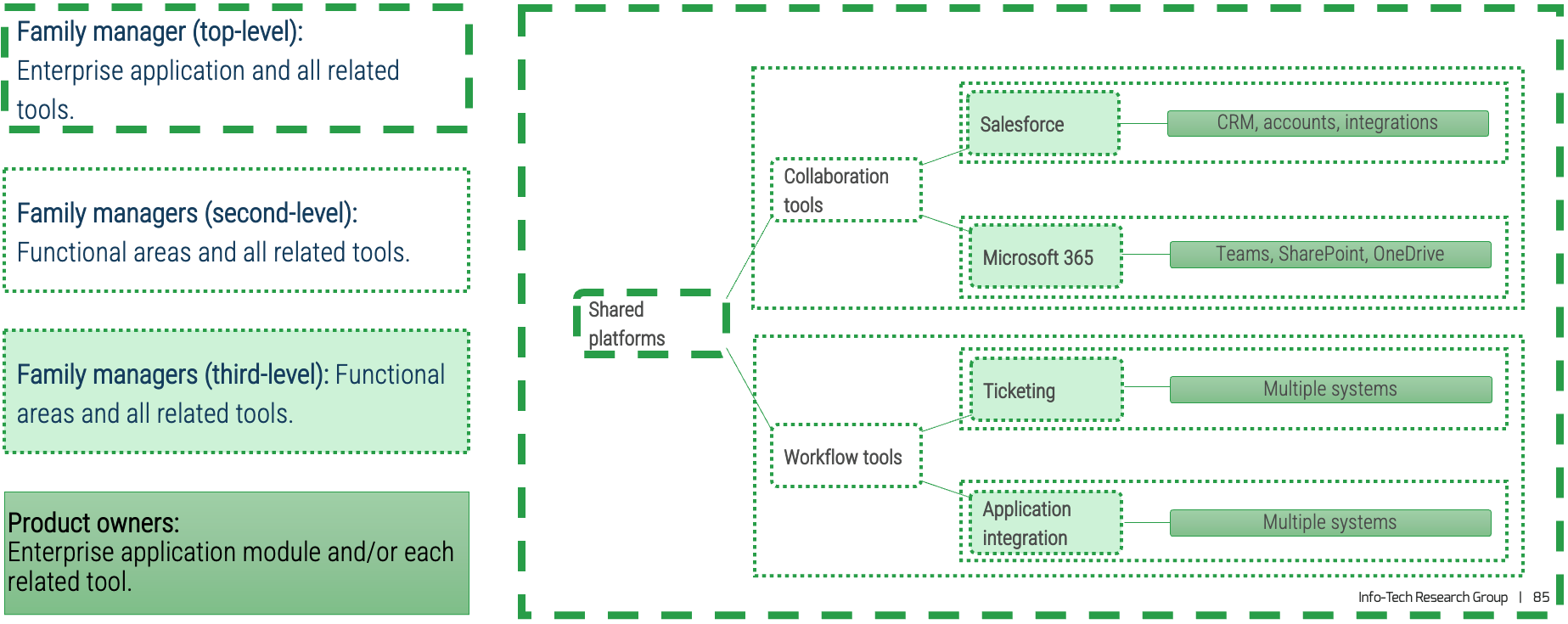

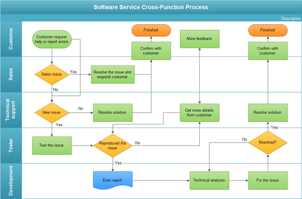

Pattern: Shared services

Grouping by service type, knowledge area, or technology allows for specialization while families align service delivery to shared business capabilities.

Example:

-

Recommended for governance, risk, and compliance; infrastructure; security; end-user support; and shared platforms (workflow, collaboration, imaging/record retention). Direct hierarchies do not necessarily exist within the shared service family.

-

Service groupings are common for service owners (also known as support managers, operations managers, etc.).

-

End-user ticketing comes through a common request system, is routed to the team responsible for triage, and then is routed to a team for resolution.

-

Collaboration tools and workflow tools are enablers of other applications, and product families might support multiple apps or platforms delivering that shared capability.

Assigning owners to shared services

Assign owners by service type, knowledge area, or technology to provide alignment of shared business capabilities and common solutions.

Map sources of demand and influencers

Use the stakeholder analysis to define the key stakeholders and sources of demand for enterprise applications and shared services. Extend your mapping to include their stakeholders and influencers to uncover additional sources of demand and prioritization.

Info-Tech Insight

Your product owner map defines the influence landscape your product operates. It is every bit as important as the teams who enhance, support, and operate your product directly.

Combine your product owner map with your stakeholder map to create a comprehensive view of influencers.

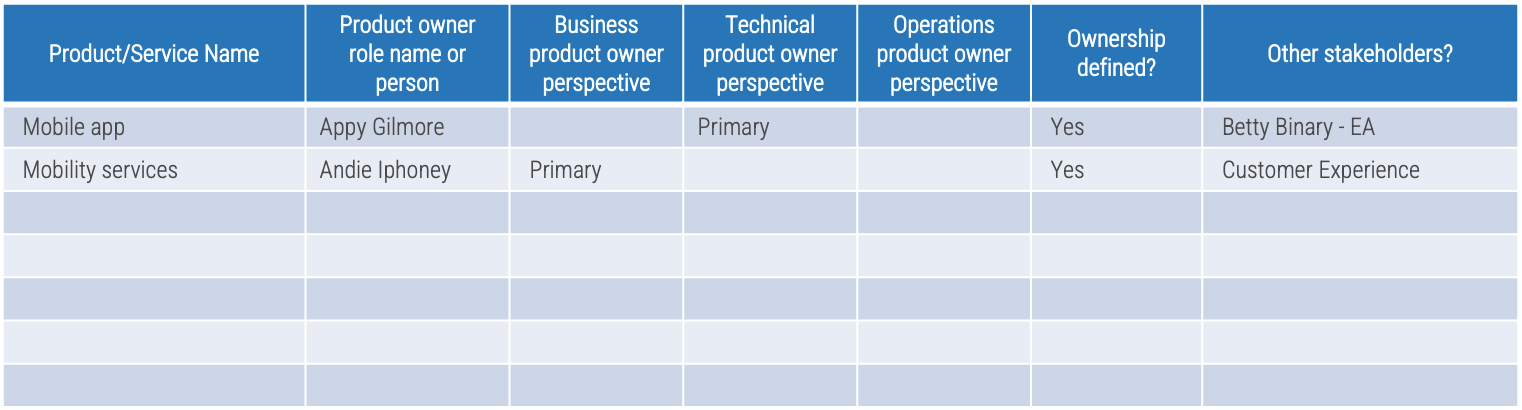

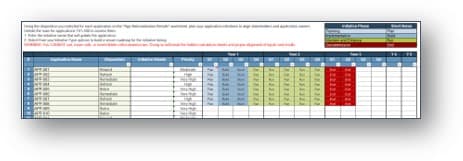

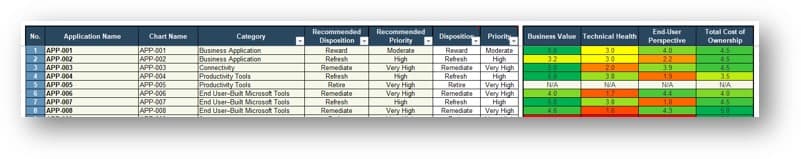

Exercise 2.1.1 Assign resources to your products and families

1-4 hours

-

Use the product families you completed in

Deliver Digital Products at Scale

to determine which products and product families need a resource assigned. Where the same resource fills more than one role, they are the product owner or manager for each independently.

-

Product families that are being managed as products (one backlog for multiple products) should have one owner until the family is split into separate products later.

-

For each product and family, define the following:

-

Who is the owner (role or person)?

-

Is ownership clearly defined?

-

Are there other stakeholders who make decisions for the product?

-

Record the results in the

Mature and Scale Product Ownership Workbook

on the Product Owner Mapping worksheet.

Output

-

Product owner and manager resource alignment.

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Business analysts

Capture in the Mature and Scale Product Ownership Playbook.

Step 2.2

Manage stakeholder influence

Activities

2.2.1 Visualize relationships to identify key influencers

2.2.2 Group stakeholders into categories

2.2.3 Prioritize your stakeholders

Align product owners to products

This step involves the following participants:

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Delivery managers

-

Business analysts

Outcomes of this step

- Stakeholder management strategy

Develop a product owner stakeholder strategy

Stakeholders are a critical cornerstone to product ownership. They provide the context, alignment, and

constraints that

influence or control what a product owner can accomplish.

Product owners operate within a network of stakeholders who represent different perspectives within the

organization.

First, product owners must identify members of their stakeholder network. Next, they should devise a

strategy for managing stakeholders.

Without a stakeholder strategy, product owners will encounter obstacles, resistance, or unexpected changes.

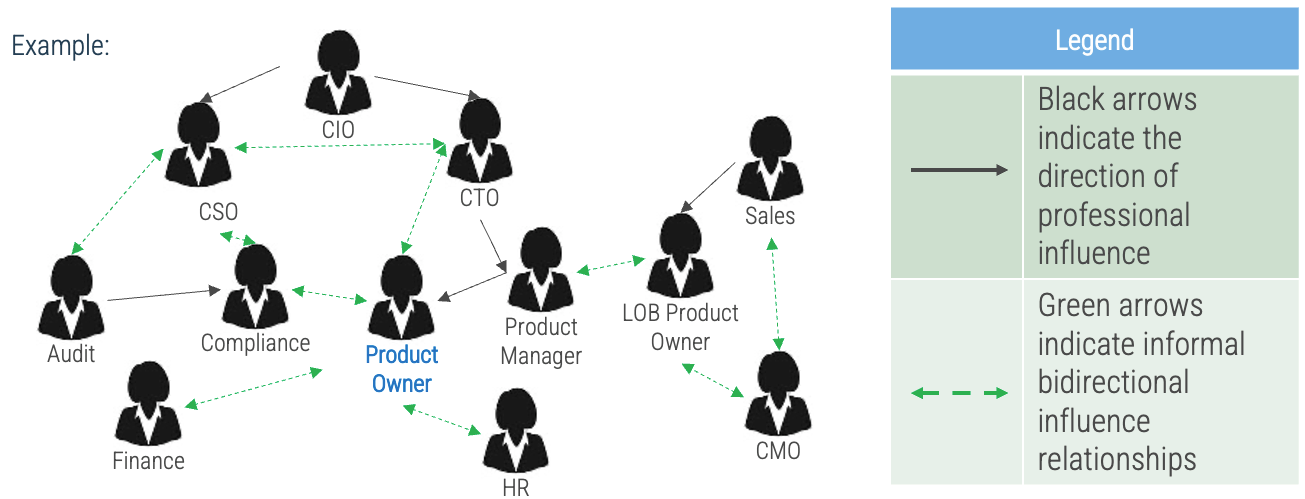

Create a stakeholder network map to product roadmaps and prioritization

Follow the trail of breadcrumbs from your direct stakeholders to their influencers to uncover hidden stakeholders.

Info-Tech Insight

Your stakeholder map defines the influence landscape your product operates. It is every bit as important as the teams who enhance, support, and operate your product directly.

Use connectors to determine who may be influencing your direct stakeholders. They may not have any formal authority within the organization, but they may have informal yet substantive relationships with your stakeholders.

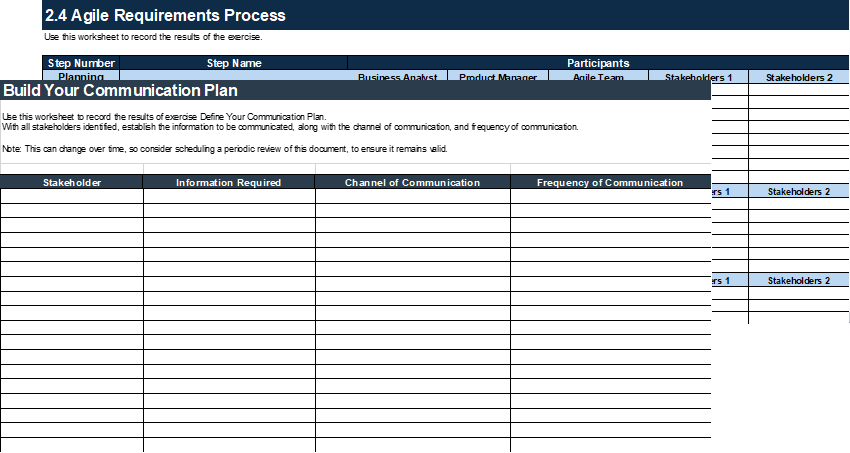

Exercise 2.2.1 Visualize relationships to identify key influencers

1 hour

-

List direct stakeholders for your product.

-

Determine the stakeholders of your stakeholders and consider adding each of them to the stakeholder list.

-

Assess who has either formal or informal influence over your stakeholders; add these influencers to your stakeholder list.

-

Construct a diagram linking stakeholders and their influencers together.

-

Use black arrows to indicate the direction of professional influence.

-

Use dashed green arrows to indicate informal bidirectional influence relationships.

-

Record the results in the

Mature and Scale

Product Ownership Workbook

.

Output

-

Relationships among stakeholders and influencers

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Business analysts

Capture in the Mature and Scale Product Ownership Playbook.

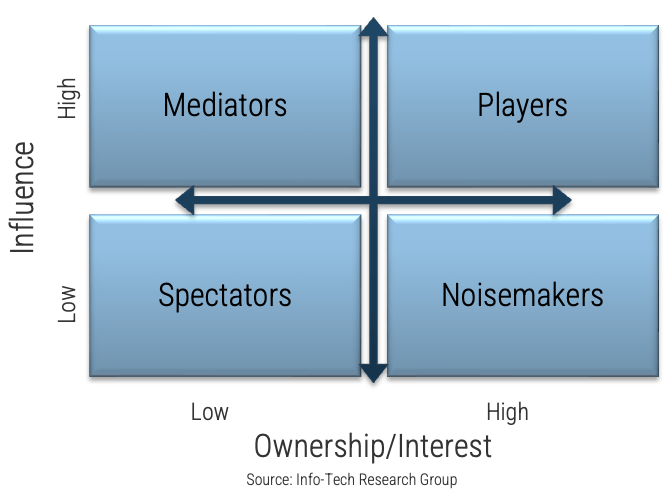

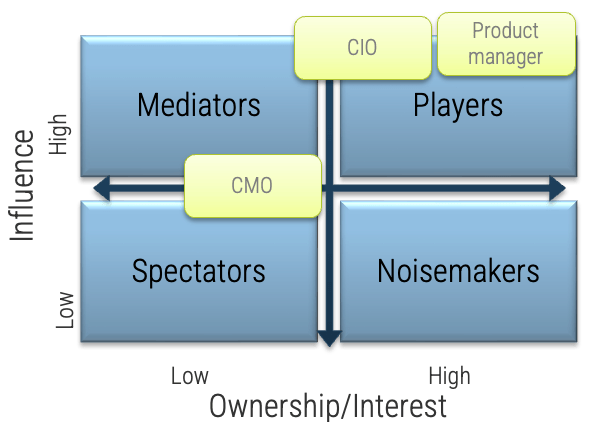

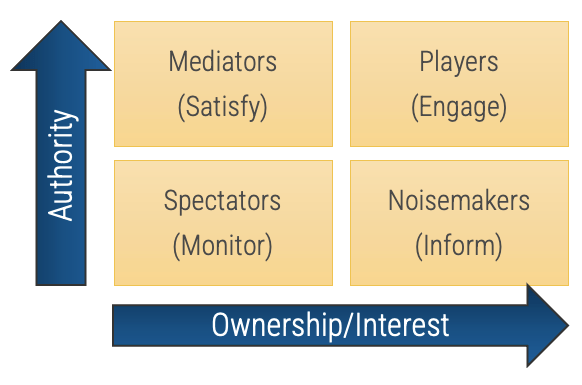

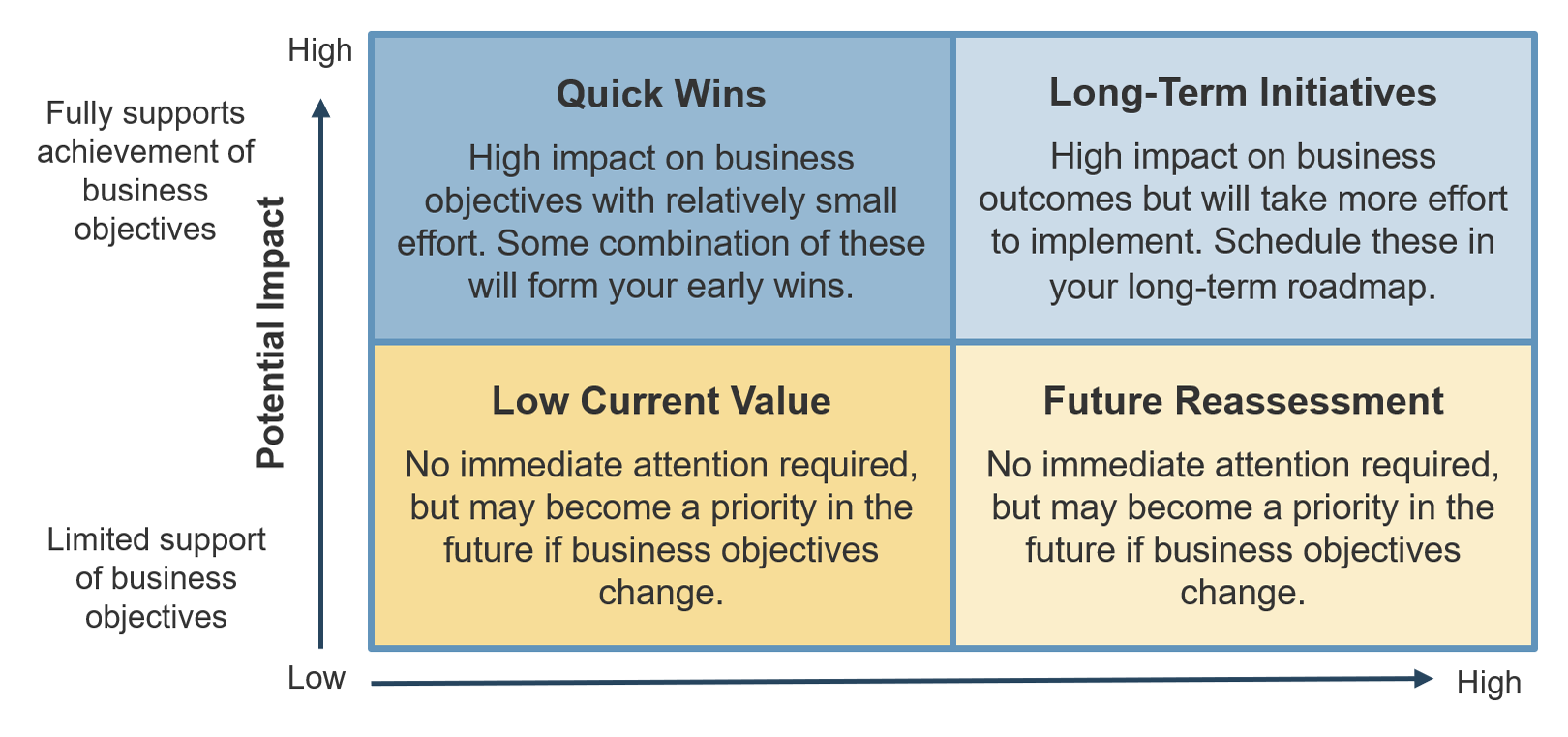

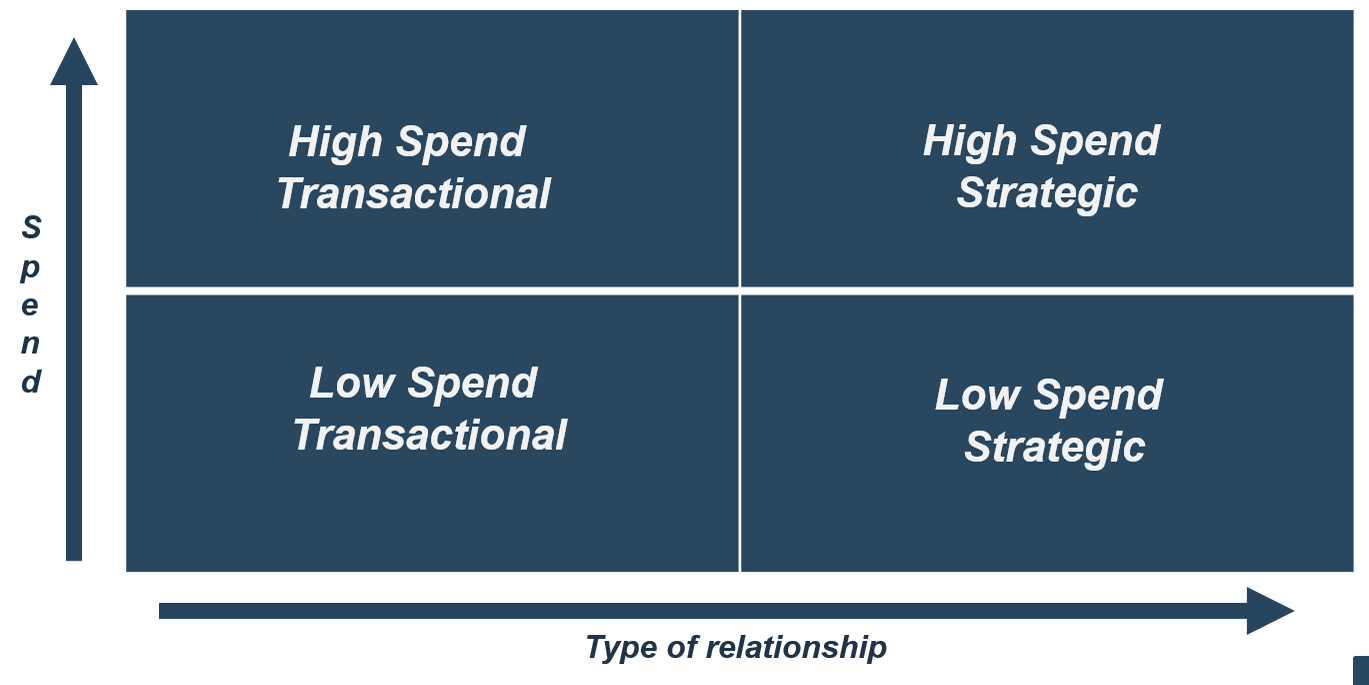

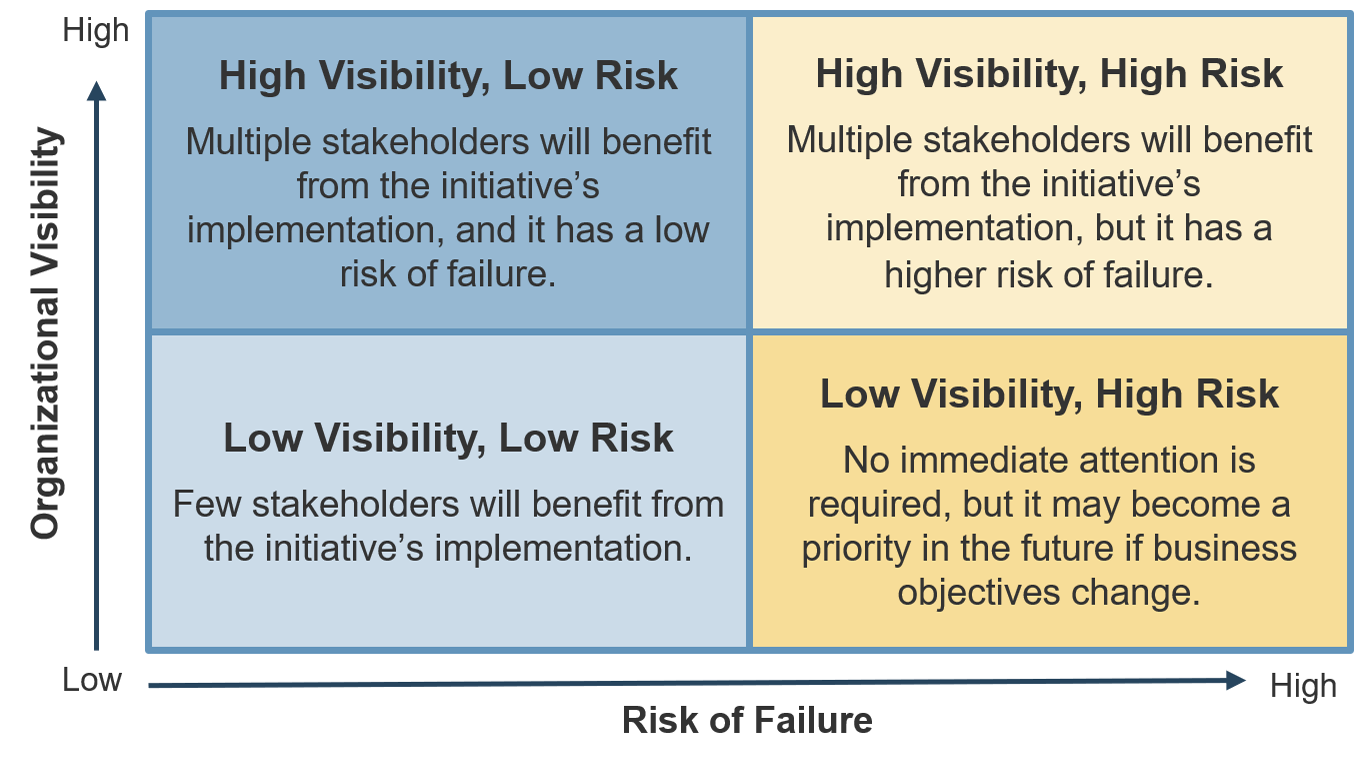

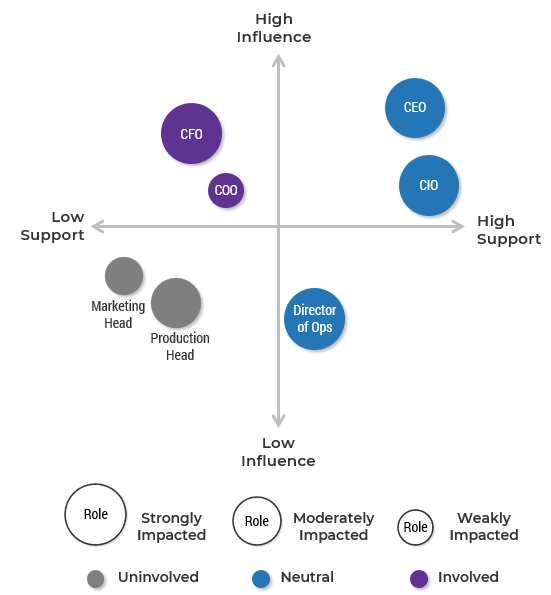

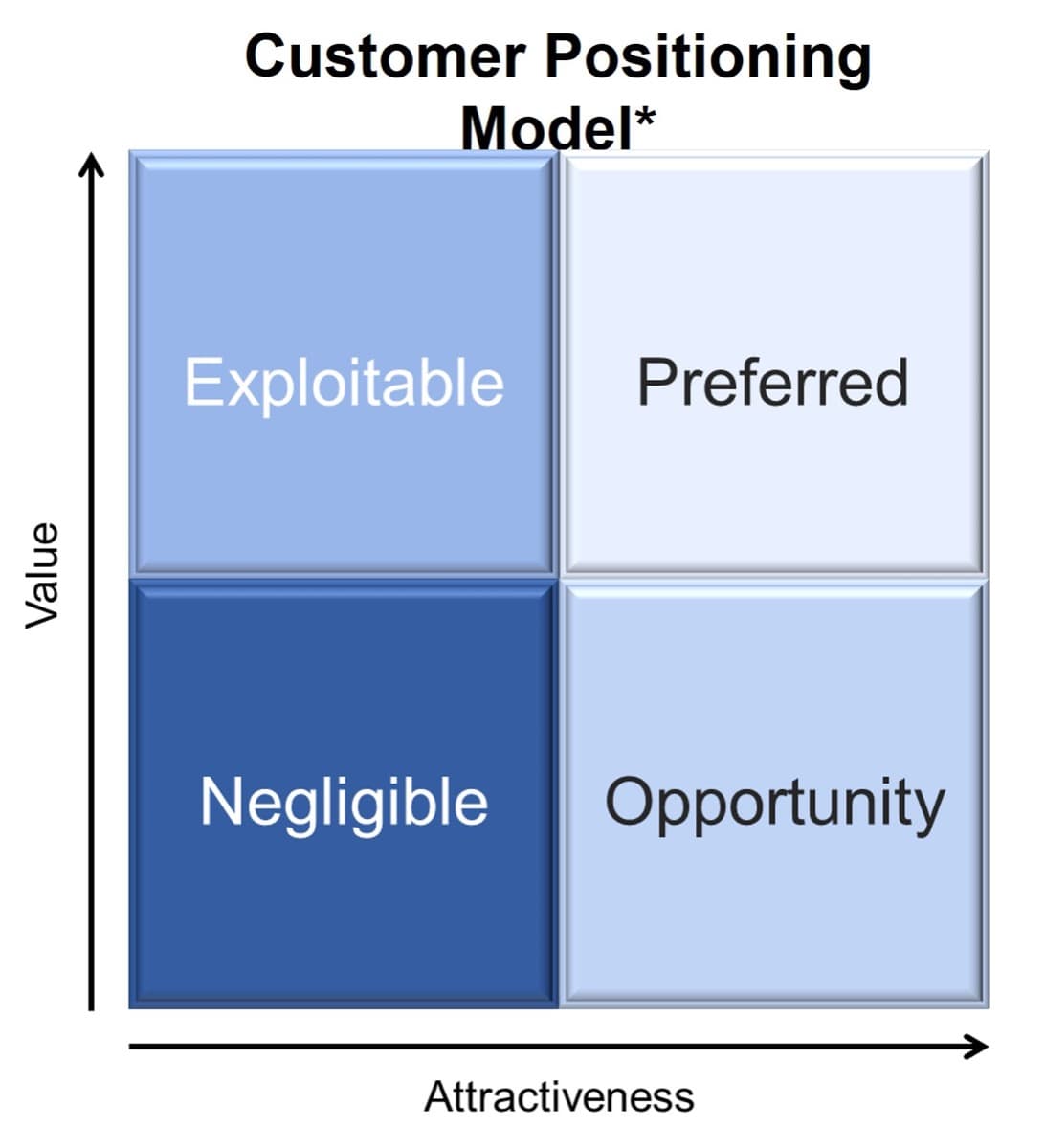

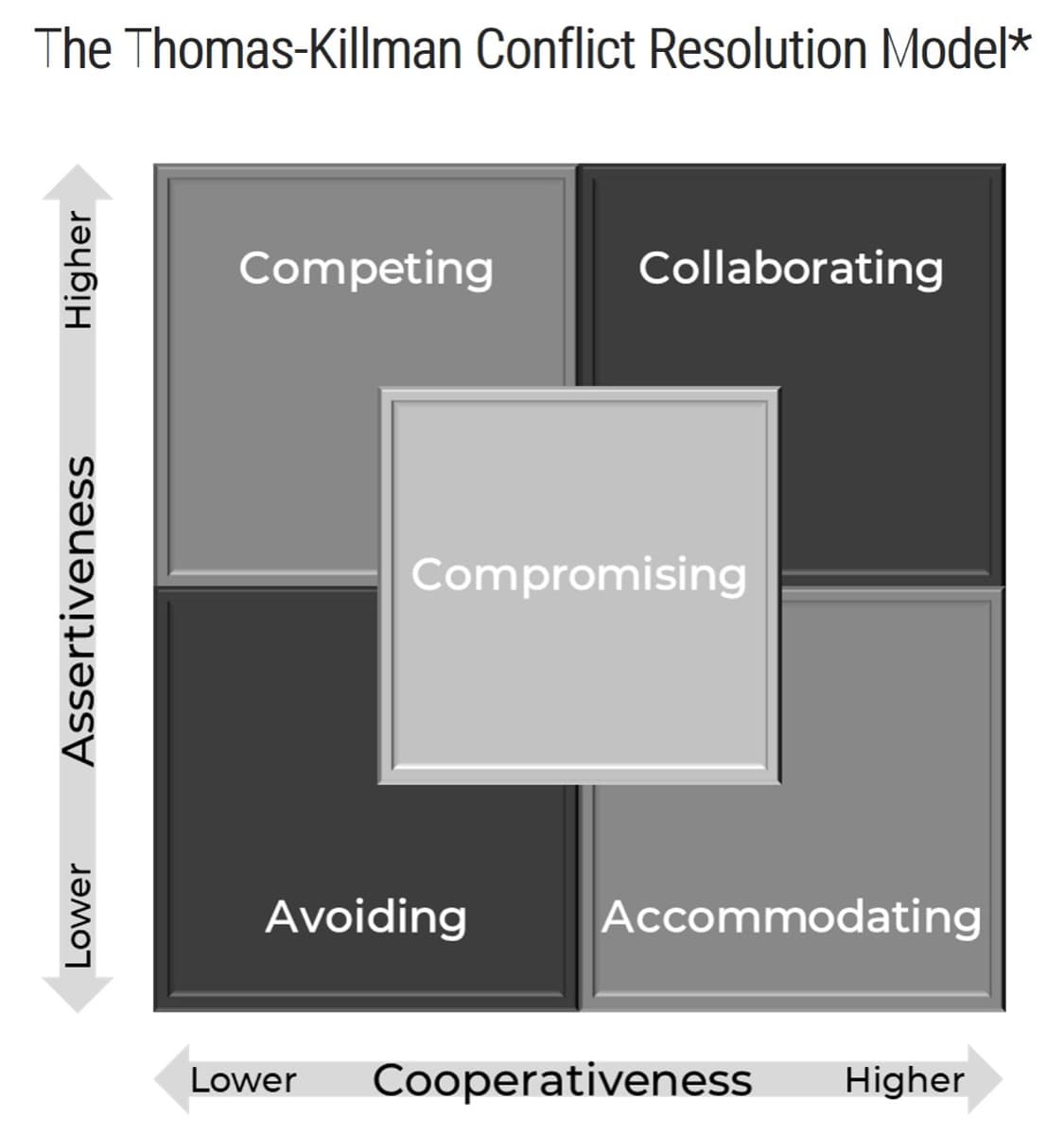

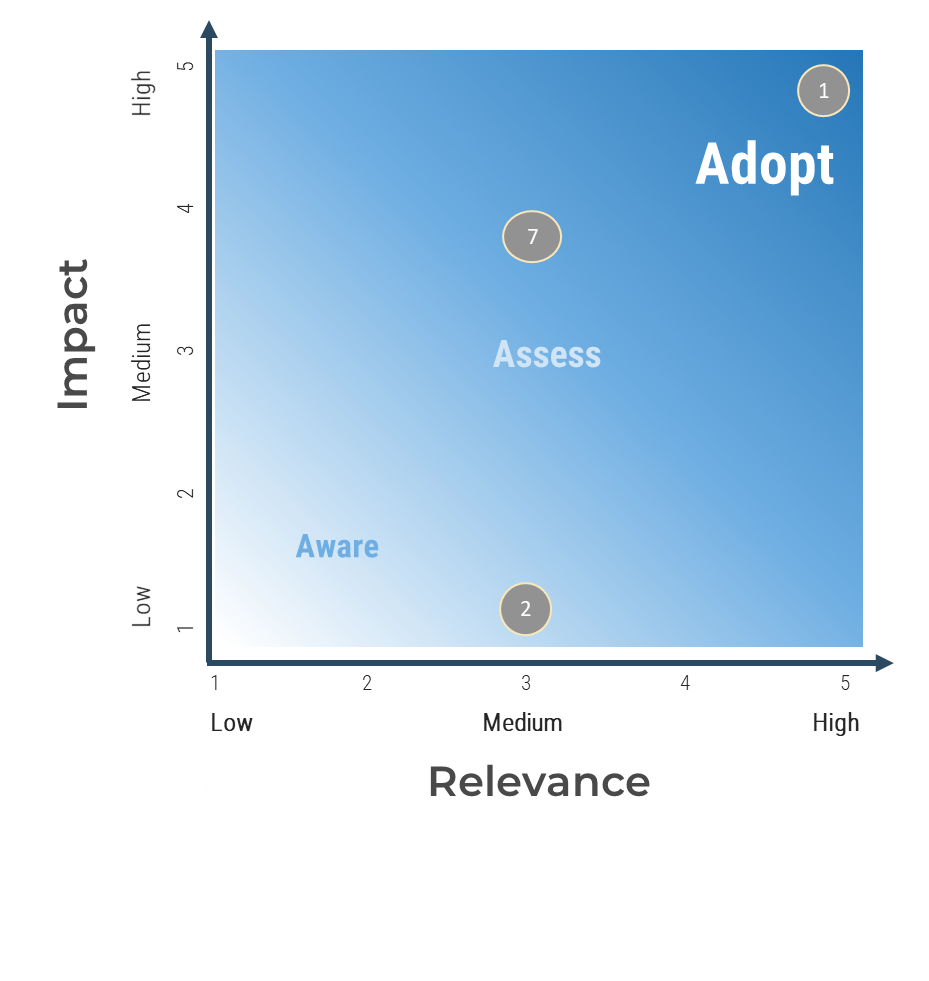

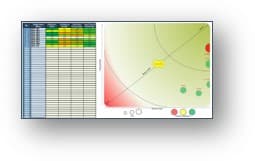

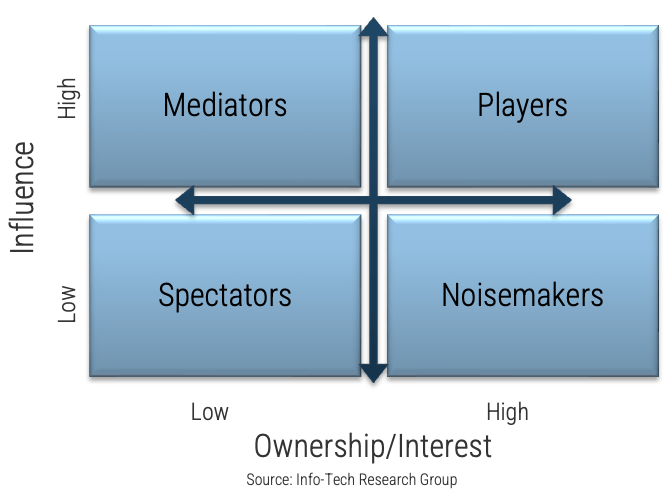

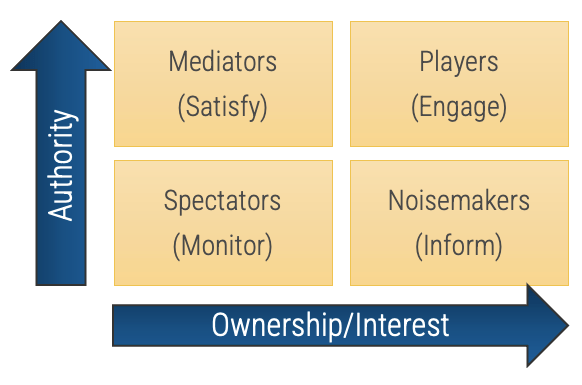

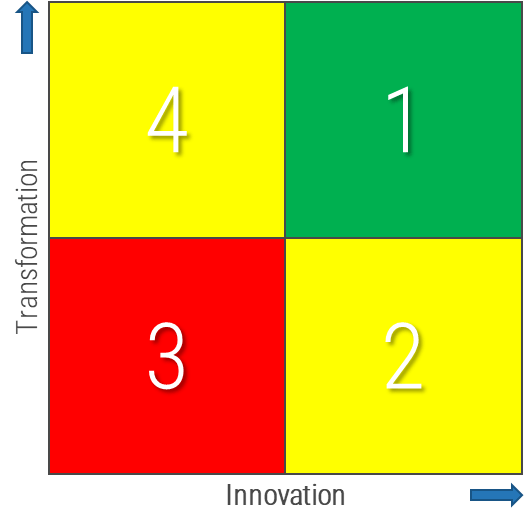

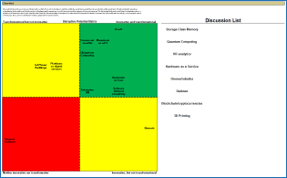

Categorize your stakeholders with a prioritization map

A stakeholder prioritization map helps product owners categorize their stakeholders by their level of influence and ownership in the product and/or teams.

There are four areas on the map, and the stakeholders within each area should be treated differently.

-

Players have a high interest in the initiative and the influence to effect change over the initiative. Their support is critical, and a lack of support can cause significant impediments to the objectives.

-

Mediators have a low interest but significant influence over the initiative. They can help to provide balance and objective opinions to issues that arise.

-

Noisemakers have low influence but high interest. They tend to be very vocal and engaged, either positively or negatively but have little ability to enact their wishes.

-

Spectators are generally apathetic and have little influence over or interest in the initiative.

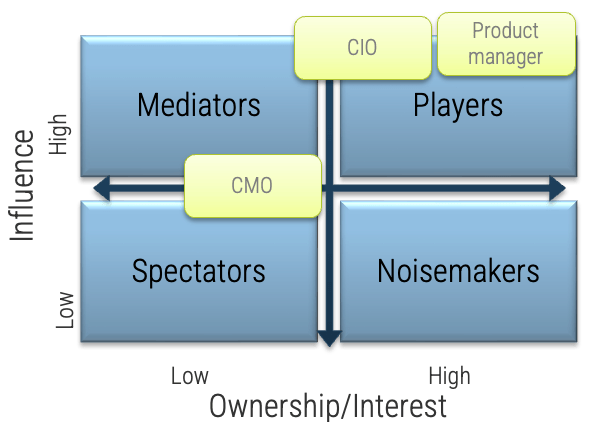

Exercise 2.2.2 Group stakeholders into categories

1 hour

-

Identify your stakeholders’ interest in and influence on your Agile implementation as high, medium, or low by rating the attributes below.

-

Map your results to the model below to determine each stakeholder’s category.

-

Record the results in the

Mature and Scale

Product Ownership Workbook

.

Output

-

Categorization of stakeholders and influencers

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

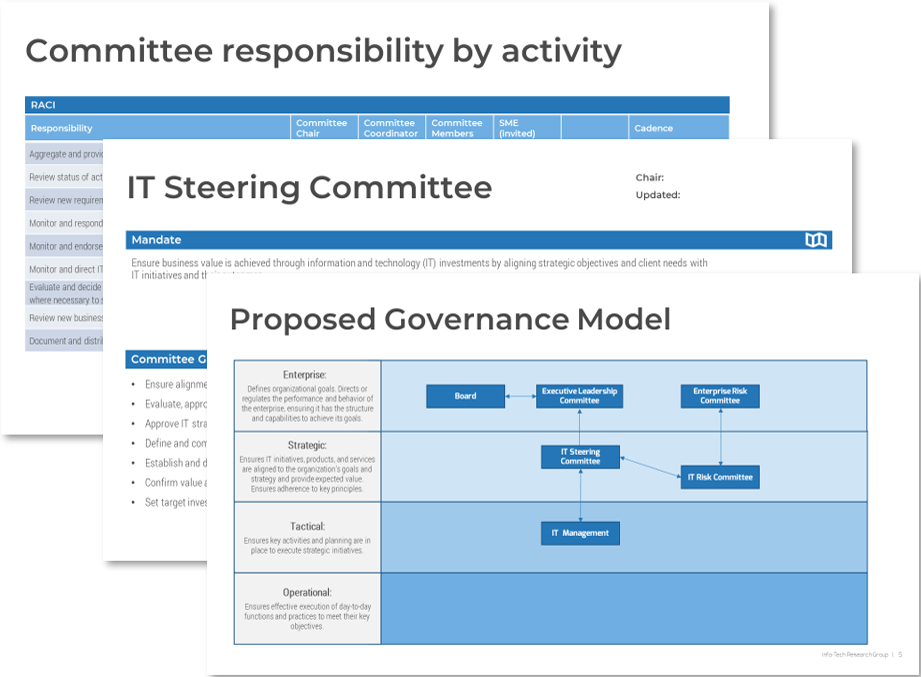

-

Business analysts

Capture in the Mature and Scale Product Ownership Playbook.

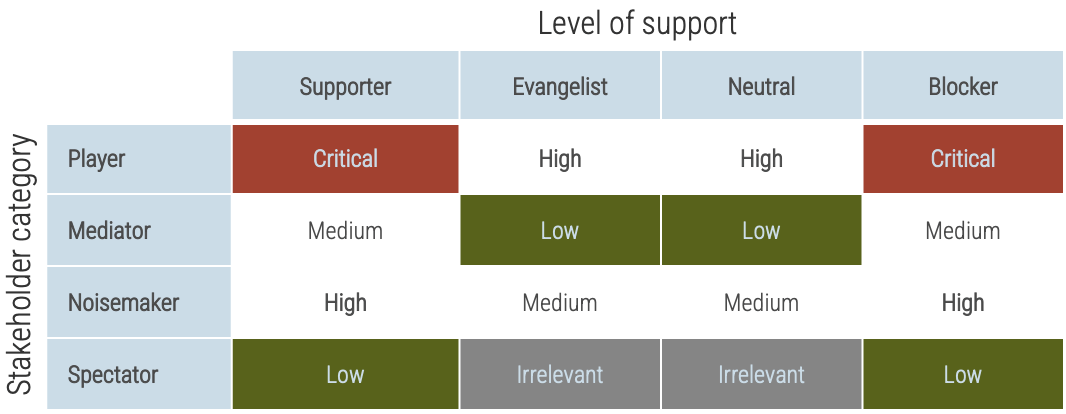

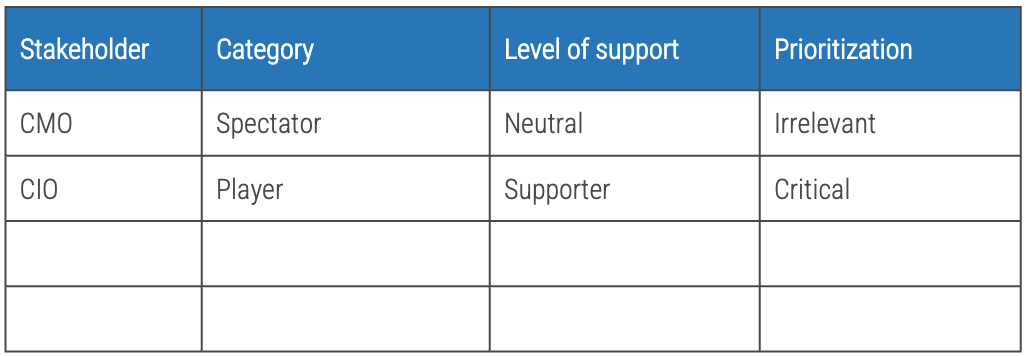

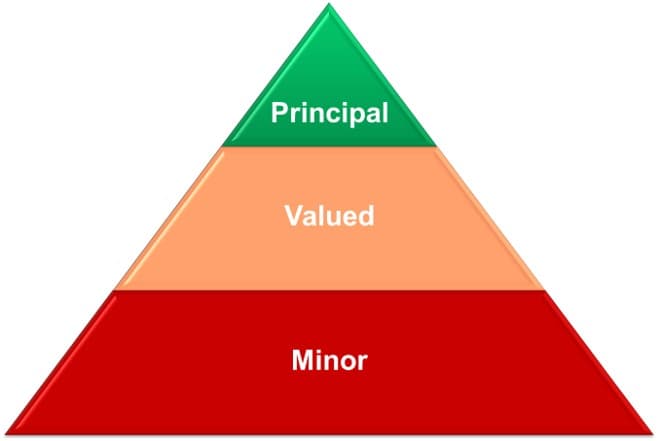

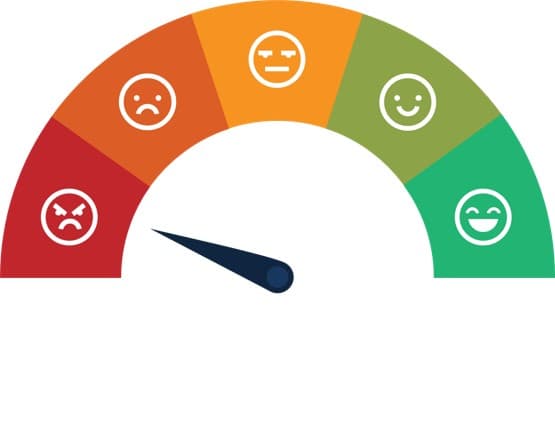

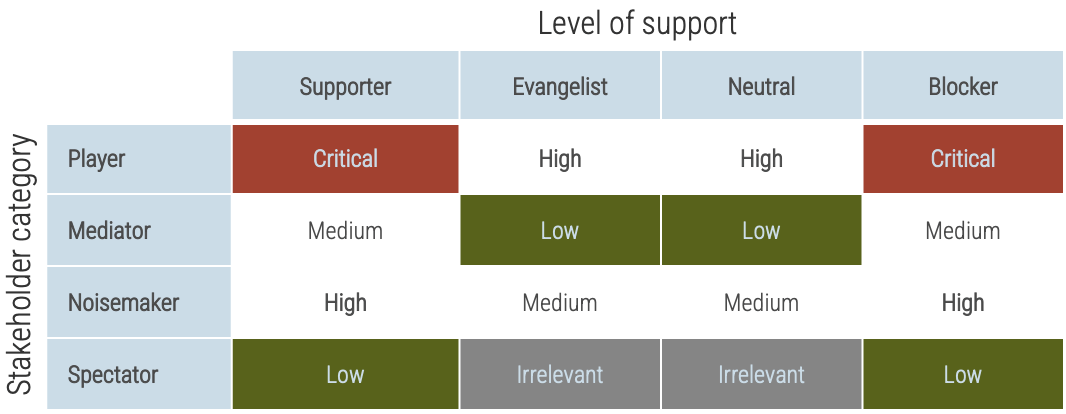

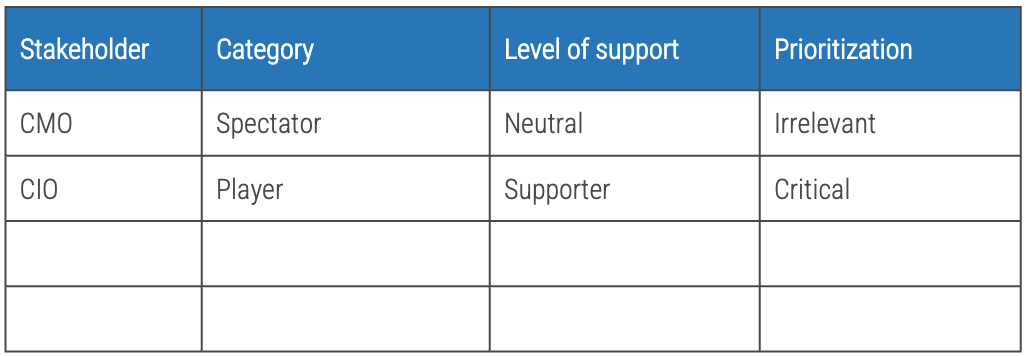

Prioritize your stakeholders

There may be too many stakeholders to be able to manage them all. Focus your attention on the stakeholders that matter most.

Consider the three dimensions of stakeholder prioritization: influence, interest, and support. Support can be determined by rating the following question: How likely is it that your stakeholder would recommend your product? These parameters are used to prioritize which stakeholders are most important and should receive your focused attention. The table to the right indicates how stakeholders are ranked.

Exercise 2.2.3 Prioritize your stakeholders

1 hour

-

Identify the level of support of each stakeholder by answering the following question: How likely is it that your stakeholder would endorse your product?

-

Prioritize your stakeholders using the prioritization scheme on the previous slide.

-

Record the results in the

Mature and Scale

Product Ownership Workbook

.

Output

-

Stakeholder and influencer prioritization

Participants

-

Product owners

-

Product managers

-

Development team leads

-

Portfolio managers

-

Business analysts

Capture in the Mature and Scale Product Ownership Playbook.

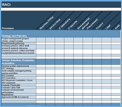

Define strategies for engaging stakeholders by type

Type

|

Quadrant

|

Actions

|

Players

|

High influence, high interest – actively engage

|

Keep them updated on the progress of the project. Continuously involve players in the process and maintain their engagement and interest by demonstrating their value to its success.

|

Mediators

|

High influence, low interest – keep satisfied

|

They can be the game changers in groups of stakeholders. Turn them into supporters by gaining their confidence and trust and including them in important decision-making steps. In turn, they can help you influence other stakeholders.

|

Noisemakers

|

Low influence, high interest – keep informed

|

Try to increase their influence (or decrease it if they are detractors) by providing them with key information, supporting them in meetings, and using mediators to help them.

|

Spectators

|

Low influence, low interest – monitor

|

They are followers. Keep them in the loop by providing clarity on objectives and status updates.

|

Info-Tech Insight

Each group of stakeholders draws attention and resources away from critical tasks. By properly identifying your stakeholder groups, the product owner can develop corresponding actions to manage stakeholders in each group. This can dramatically reduce wasted effort trying to satisfy spectators and noisemakers while ensuring the needs of mediators and players are met.

Phase 3

Mature Product Owner Capabilities

Mature and Scale Product Ownership

This phase will walk you through the following activities:

3.1.1 Assess your real Agile skill proficiency

3.2.1 Assess your vision capability proficiency

3.2.2 Assess your leadership capability proficiency

3.2.3 Assess your PLM capability proficiency

3.2.4 Identify your business value drivers and sources of value

3.2.5 Assess your value realization capability proficiency

This phase involves the following participants:

-

Product owners

-

Product managers

Step 3.1

Assess your Agile product owner readiness

Activities

3.1.1 Assess your real Agile skill proficiency

Mature product owner capabilities

This step involves the following participants:

-

Product owners

-

Product managers

Outcomes of this step

- Real Agile skill proficiency assessment

Why focus on core skills?

They are the foundation to achieve business outcomes

The right skills development is only possible with proper assessment and alignment against outcomes.

Being successful at Agile is more than about just doing Agile

The following represents the hard skills needed to “Do Agile”:

-

Engineering skills. These are the skills and competencies required for building brand-new valuable

software.

-

Technician skills. These are the skills and competencies required for maintaining and operating the

software delivered to stakeholders.

-

Framework/Process skills. These are the specific knowledge skills required to support engineering or

technician skills.

-

Tools skills. This represents the software that helps you deliver other software.

While these are important, they are not the whole story. To effectively deliver software, we believe in the

importance of

being Agile over simply doing Agile.

Adapted from: “Doing

Agile” Is Only Part of the Software Delivery Pie

Focus on these real Agile skills

Agile skills

- Accountability

- Collaboration

- Comfort with ambiguity

- Communication

- Empathy

- Facilitation

- Functional decomposition

- Initiative

- Process discipline

- Resilience

Info-Tech research shows these are the real Agile skills to get started with

Skill Name

|

Description

|

Accountability

|

Refers to the state of being accountable. In an Agile context, it implies transparency, dedication, acting responsibly, and doing what is necessary to get the job done.

|

Collaboration

|

Values diverse perspectives and working with others to achieve the best output possible. Effective at working toward individual, team, department, and organizational goals.

|

Comfort with ambiguity

|

Allows you to confidently take the next steps when presented with a problem without having all the necessary information present.

|

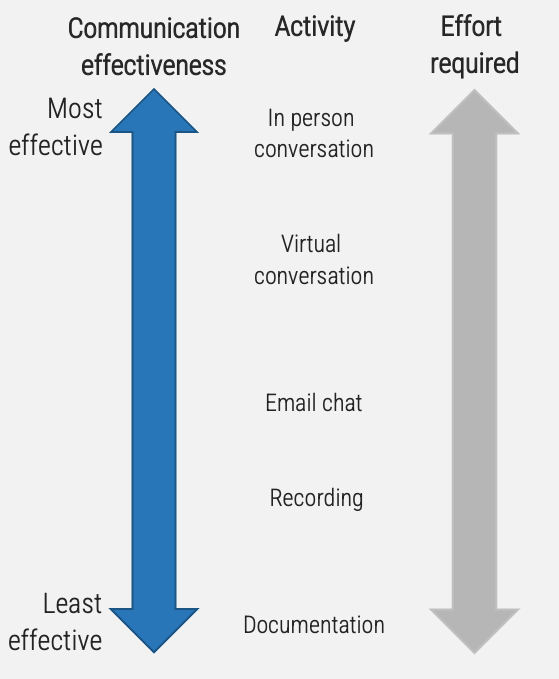

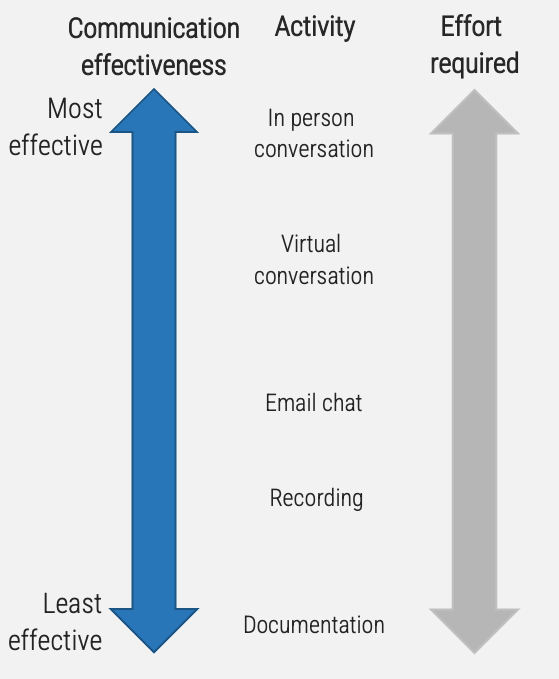

Communication

|

Uses different techniques to share information, concerns, or emotions when a situation arises, and it allows you to vary your approach depending on the current phase of development.

|

Empathy

|

Is the ability to understand and share the feelings of another to better serve your team and your stakeholders.

|

Facilitation

|

Refers to guiding and directing people through a set of conversations and events to learn and achieve a shared understanding.

|

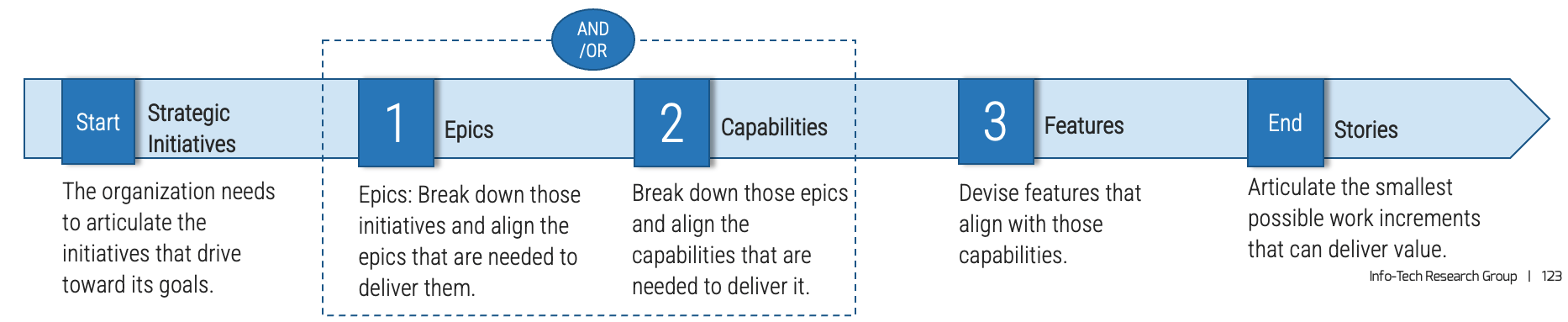

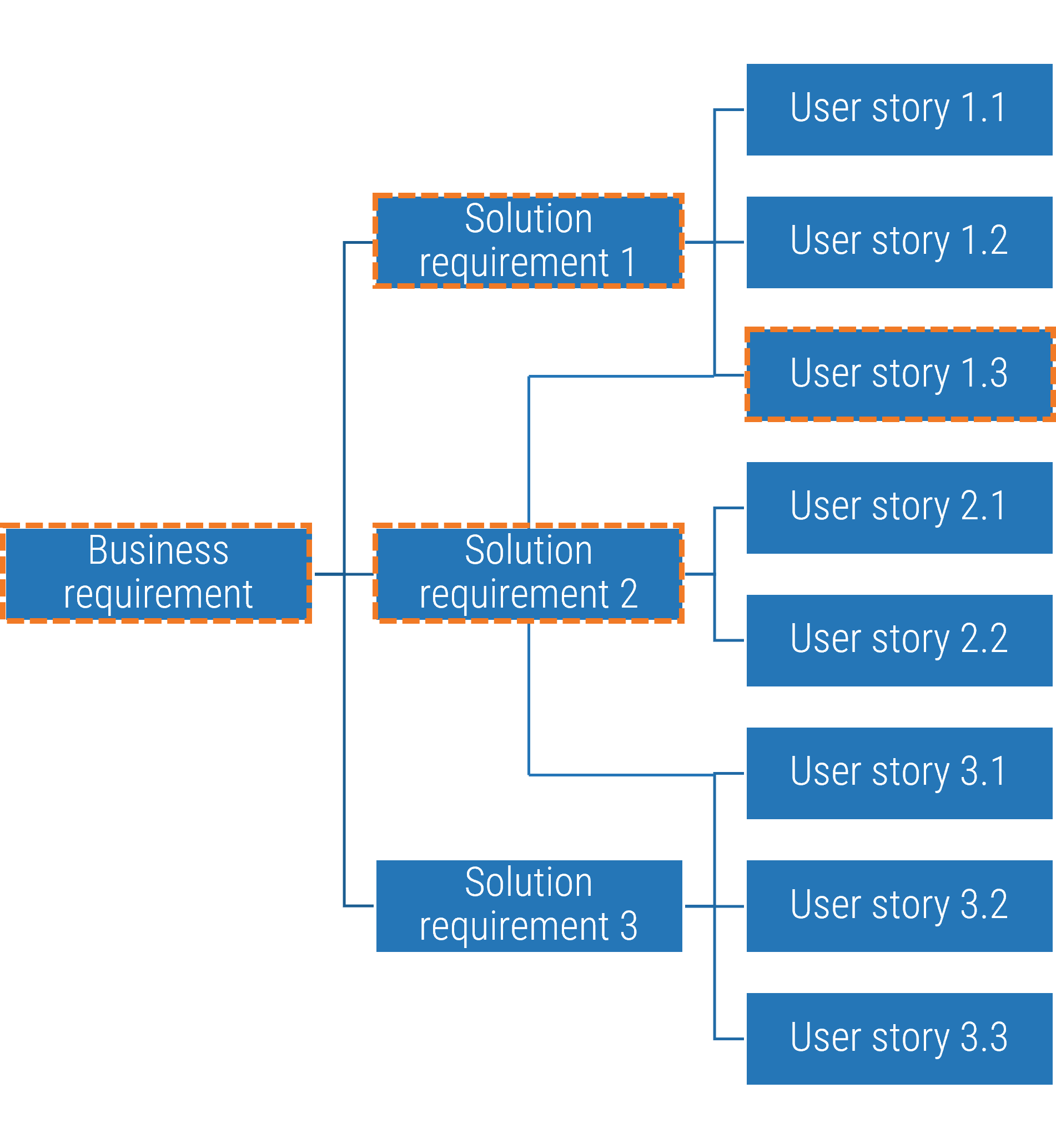

Functional decomposition

|

Is being able to break down requirements into constituent epics and stories.

|

Initiative

|

Is being able to anticipate challenges and then act on opportunities that lead to better business outcomes.

|

Process discipline

|

Refers to the focus of following the right steps for a given activity at the right time to achieve the right outcomes.

|

Resilience

|

Refers to the behaviors, thoughts, and actions that allow a person to recover from stress and adversity.

|

Accountability

An accountable person:

-

Takes ownership of their own decisions and actions and is responsible for the quality of results.

-

Recognizes personal accountabilities to others, including customers.

-

Works well autonomously.

-

Ensures that the mutual expectations between themselves and others are clearly defined.

-

Takes the appropriate actions to ensure that obligations are met in a timely manner.

-

As a leader, takes responsibility for those being led.

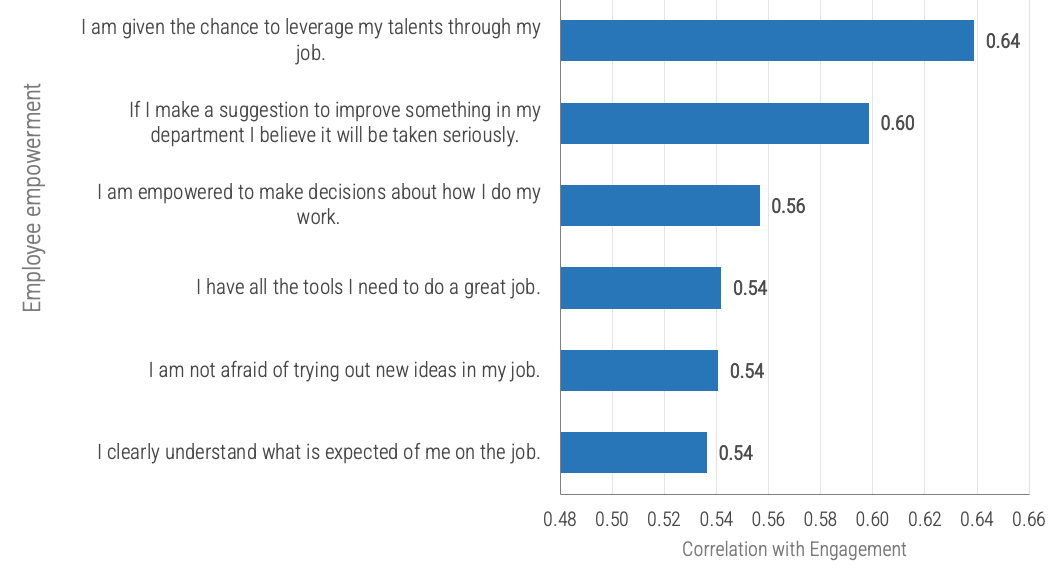

Accountability drives high performance in teams and organizations

-

The performance level of teams depends heavily on accountability and who demonstrates it:

-

In weak teams, there is no accountability.

-

In mediocre teams, supervisors demonstrate accountability.

-

In high-performance teams, peers manage most performance problems through joint accountability. (Grenny, 2014)

-

According to Bain & Company, accountability is the third most important attribute of high-performing companies. Some of the other key attributes include honest, performance-focused, collaborative, and innovative. (Mankins, 2013)

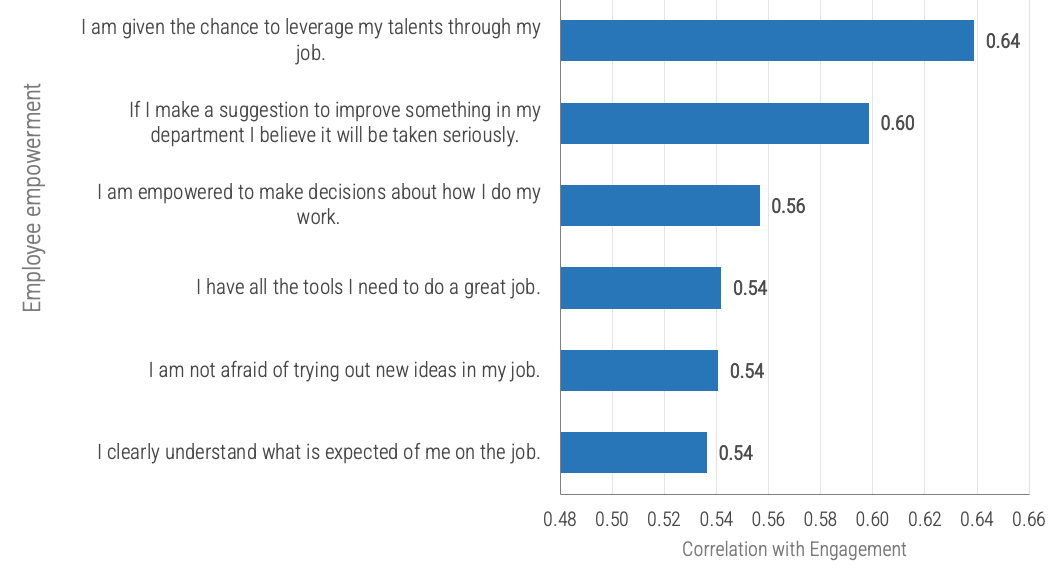

All components of the employee empowerment driver have a strong, positive correlation with engagement.

Source: McLean & Company Engagement Database, 2018; N=71,794

Accountability

Your Score: ____

1 - Foundational: Transitioning and Growing

|

2 - Capable/Competent: Core Contributor

|

3 - Influential: Gifted Improver

|

4 - Transformational: Towering Strength

|

-

Alerts others to possible problems in a timely manner.

-

Seeks appropriate support to solve problems.

-

Actively contributes to the creation and evaluation of possible solutions.

-

Acts on solutions selected and decisions made as directed.

-

Makes effective decisions about how to complete work tasks.

-

Demonstrates the capability of breaking down concrete issues into parts and synthesizing information succinctly.

-

Collects and analyzes information from a variety of sources.

|

-

Seeks information and input to fully understand the cause of problems.

-

Takes action to address obstacles and problems before they impact performance and results.

-

Initiates the evaluation of possible solutions to problems.

-

Makes effective decisions about work task prioritization.

-

Appropriately assesses risks before deciding.

-

Effectively navigates through ambiguity, using multiple data points to analyze issues and identify trends.

-

Does not jump to conclusions.

-

Draws logical conclusions and provides opinions and recommendations with confidence.

-

Takes ownership over decisions and their consequences.

|

-

Demonstrates broad knowledge of information sources that can be used to assess problems and make decisions.

-

Invests time in planning, discovery, and reflection to drive better decisions.

-

Effectively leverages hard data as inputs to making decisions.

-

Garners insight from abstract data and makes appropriate decisions.

-

Coaches others in effective decision-making practices.

-

Has the authority to solve problems and make decisions.

-

Thinks several steps ahead in deciding the best course of action, anticipating likely outcomes, risks, or implications.

-

Establishes metrics to aid in decision-making, for self and teams

|

-

Prioritizes objective and ambiguous information and analyzes this when making decisions.

-

Solicits a diverse range of opinions and perspectives as inputs to decision making.

-

Applies frameworks to decision making, particularly in situations that have little base in prior experience.

-

Makes effective decisions about organizational priorities.

-

Holds others accountable for their decisions and consequences.

-

Creates a culture of empowerment and trust to facilitate effective problem solving and decision making.

-

Makes sound decisions that have organization-wide consequences and that influence future direction.

|

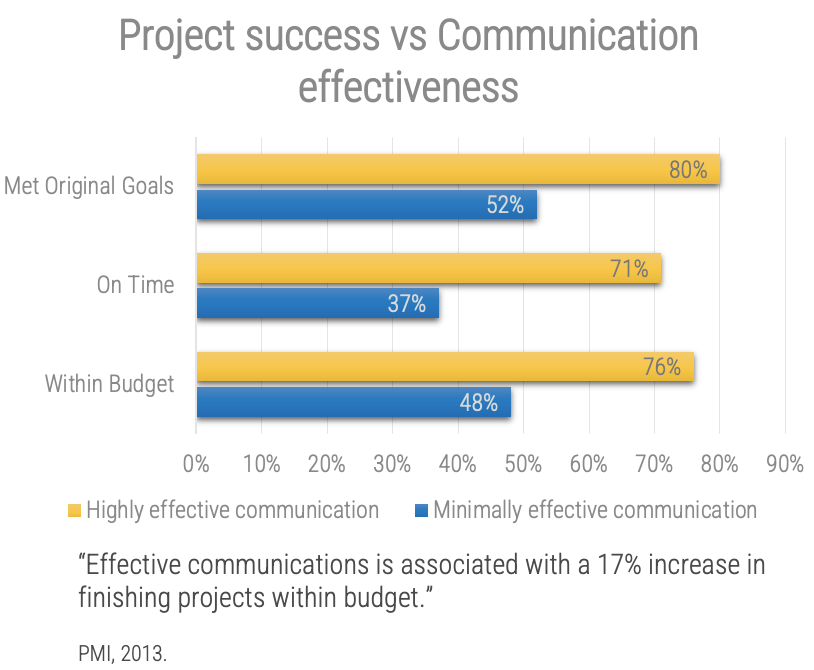

Collaboration as a skill

The principles and values of Agile revolve around collaboration.

-

Works well with others on specialized and cross-functional teams.

-

Can self-organize while part of a team.

-

Respects the commitments that others make.

-

Identifies and articulates dependencies.

-

Values diverse perspectives and works with others to achieve the best output possible.

-

Effective at working toward individual, team, department, and organizational goals.

Collaboration

The Agile Manifesto has three principles that focus on collaboration:

-

The business and developers must work together daily throughout the project.

-

Build projects around motivated individuals. Give them the environment and support they need and trust them to get the job done.

-

The most efficient and effective method of conveying information to and within a development team is face-to-face conversation.

Effective collaboration supports Agile behaviors, including embracing change and the ability to work iteratively.

Collaboration

Your Score: ____

1 - Foundational: Transitioning and Growing | 2 - Capable/Competent: Core Contributor | 3 - Influential: Gifted Improver | 4 - Transformational: Towering Strength |

-

Understands role on the team and the associated responsibilities and accountabilities.

-

Treats team members with respect.

-

Contributes to team decisions and to the achievement of team goals and objectives.

-

Demonstrates a positive attitude.

-

Works cross-functionally to achieve common goals and to support the achievement of other team/department goals.

-

Values working in a diverse team and understands the importance of differing perspectives to develop unique solutions or ideas.

|

-

Fosters team camaraderie, collaboration, and cohesion.

-

Understands the impact of one's actions on the ability of team members to do their jobs.

-

Respects the differences other team members bring to the table by openly seeking others' opinions.

-

Helps the team accomplish goals and objectives by breaking down shared goals into smaller tasks.

-

Approaches challenging team situations with optimism and an open mind, focusing on coming to a respectful conclusion.

-

Makes suggestions to improve team engagement and effectiveness.

-

Supports implementation of team decisions.

-

Professionally gives and seeks feedback to achieve common goals.

-

Values working in a diverse team and understands the importance of differing perspectives to develop unique solutions or ideas.

|

-

Motivates the team toward achieving goals and exceeding expectations.

-

Reaches out to other teams and departments to build collaborative, cross-functional relationships.

-

Creates a culture of collaboration that leverages team members' strengths, even when the team is remote or virtual.