Further reading

Mergers & Acquisitions: The Buy Blueprint

For IT leaders who want to have a role in the transaction process when their business is engaging in an M&A purchase.

EXECUTIVE BRIEF

Analyst Perspective

Don’t wait to be invited to the M&A table, make it.

Brittany Lutes

Research Analyst,

CIO Practice

Info-Tech Research Group

Ibrahim Abdel-Kader

Research Analyst,

CIO Practice

Info-Tech Research Group

IT has always been an afterthought in the M&A process, often brought in last minute once the deal is nearly, if not completely, solidified. This is a mistake. When IT is brought into the process late, the business misses opportunities to generate value related to the transaction and has less awareness of critical risks or inaccuracies.

To prevent this mistake, IT leadership needs to develop strong business relationships and gain respect for their innovative suggestions. In fact, when it comes to modern M&A activity, IT should be the ones suggesting potential transactions to meet business needs, specifically when it comes to modernizing the business or adopting digital capabilities.

IT needs to stop waiting to be invited to the acquisition or divestiture table. IT needs to suggest that the table be constructed and actively work toward achieving the strategic objectives of the business.

Executive Summary

Your Challenge

There are four key scenarios or entry points for IT as the acquiring organization in M&As:

- IT can suggest an acquisition to meet the business objectives of the organization.

- IT is brought in to strategy plan the acquisition from both the business’ and IT’s perspectives.

- IT participates in due diligence activities and valuates the organization potentially being acquired.

- IT needs to reactively prepare its environment to enable the integration.

Consider the ideal scenario for your IT organization.

Common Obstacles

Some of the obstacles IT faces include:

- IT is often told about the transaction once the deal has already been solidified and is now forced to meet unrealistic business demands.

- The business does not trust IT and therefore does not approach IT to define value or reduce risks to the transaction process.

- The people and culture element are forgotten or not given adequate priority.

These obstacles often arise when IT waits to be invited into the transaction process and misses critical opportunities.

Info-Tech's Approach

Prepare for a growth/integration transaction by:

- Recognizing the trend for organizations to engage in M&A activity and the increased likelihood that, as an IT leader, you will be involved in a transaction in your career.

- Creating a standard strategy that will enable strong program management.

- Properly considering all the critical components of the transaction and integration by prioritizing tasks that will reduce risk, deliver value, and meet stakeholder expectations.

Info-Tech Insight

As the number of merger, acquisition, and divestiture transactions continues to increase, so too does IT’s opportunity to leverage the growing digital nature of these transactions and get involved at the onset.

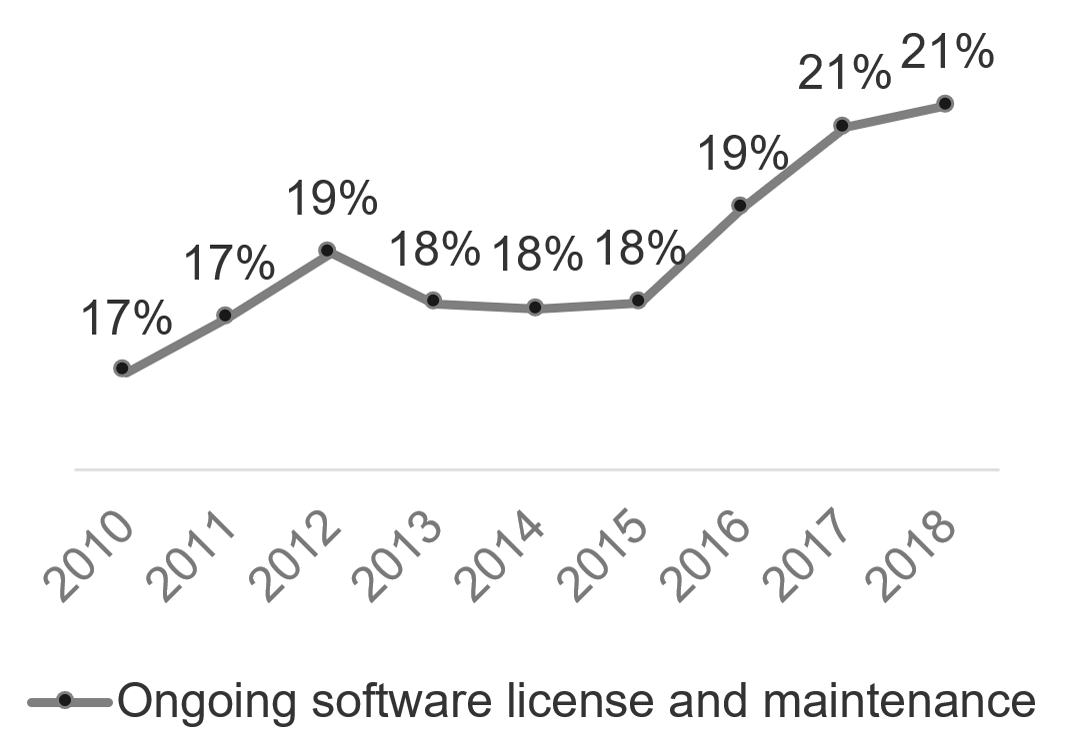

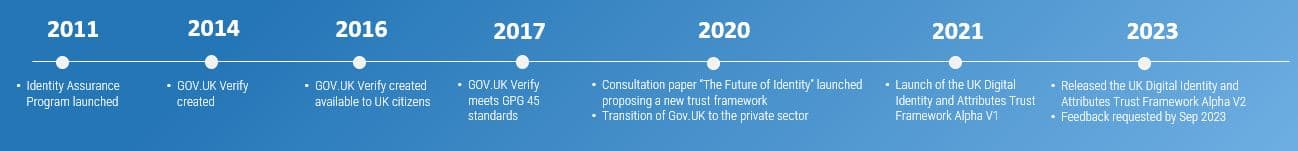

The changing M&A landscape

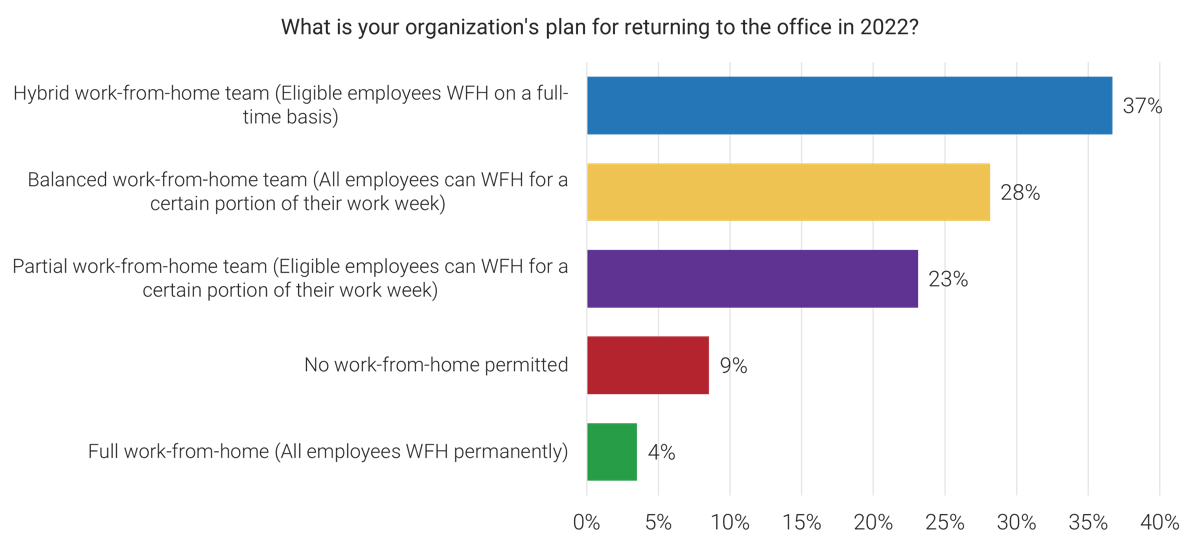

Businesses will embrace more digital M&A transactions in the post-pandemic world

- When the pandemic occurred, businesses reacted by either pausing (61%) or completely cancelling (46%) deals that were in the mid-transaction state (Deloitte, 2020). The uncertainty made many organizations consider whether the risks would be worth the potential benefits.

- However, many organizations quickly realized the pandemic is not a hindrance to M&A transactions but an opportunity. Over 16,000 American companies were involved in M&A transactions in the first six months of 2021 (The Economist). For reference, this had been averaging around 10,000 per six months from 2016 to 2020.

- In addition to this transaction growth, organizations have increasingly been embracing digital. These trends increase the likelihood that, as an IT leader, you will engage in an M&A transaction. However, it is up to you when you get involved in the transactions.

The total value of transactions in the year after the pandemic started was $1.3 billion – a 93% increase in value compared to before the pandemic. (Nasdaq)

Virtual deal-making will be the preferred method of 55% of organizations in the post-pandemic world. (Wall Street Journal, 2020)

Your challenge

IT is often not involved in the M&A transaction process. When it is, it’s often too late.

- The most important driver of an acquisition is the ability to access new technology (DLA Piper), and yet 50% of the time, IT isn’t involved in the M&A transaction at all (IMAA Institute, 2017).

- Additionally, IT’s lack of involvement in the process negatively impacts the business:

- Most organizations (60%) do not have a standardized approach to integration (Steeves and Associates).

- Weak integration teams contribute to the failure of 70% of M&A integrations (The Wall Street Journal, 2019).

- Less than half (47%) of organizations actually experience the positive results sought by the M&A transaction (Steeves and Associates).

- Organizations pursuing M&A and not involving IT are setting themselves up for failure.

Only half of M&A deals involve IT (Source: IMAA Institute, 2017)

Common Obstacles

These barriers make this challenge difficult to address for many organizations:

- IT is rarely afforded the opportunity to participate in the transaction deal. When IT is invited, this often happens later in the process where integration will be critical to business continuity.

- IT has not had the opportunity to demonstrate that it is a valuable business partner in other business initiatives.

- One of the most critical elements that IT often doesn’t take the time or doesn’t have the time to focus on is the people and leadership component.

- IT waits to be invited to the process rather then actively involving themselves and suggesting how value can be added to the process.

In hindsight, it’s clear to see: Involving IT is just good business.

47% of senior leaders wish they would have spent more time on IT due diligence to prevent value erosion. (Source: IMAA Institute, 2017)

“40% of acquiring businesses discovered a cybersecurity problem at an acquisition.” (Source: Okta)

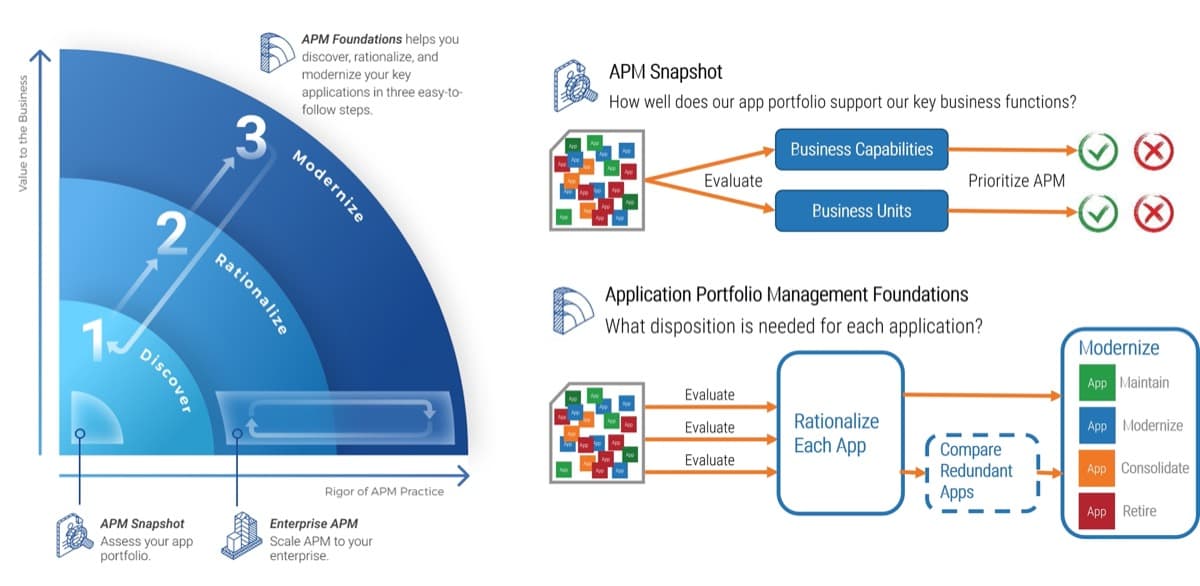

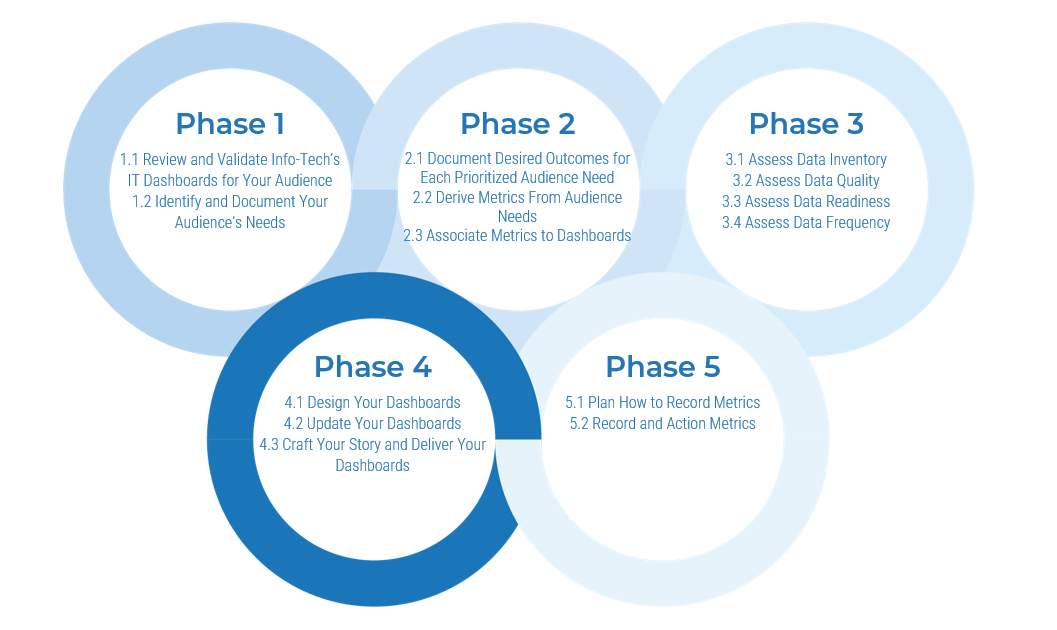

Info-Tech's approach

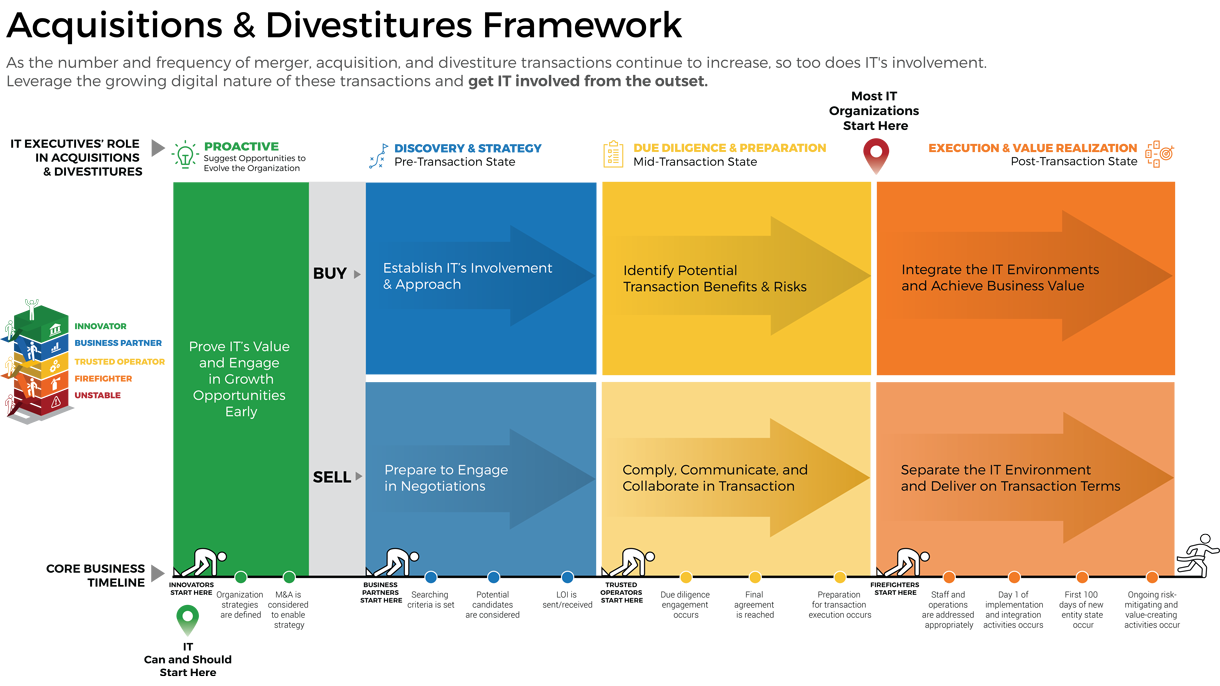

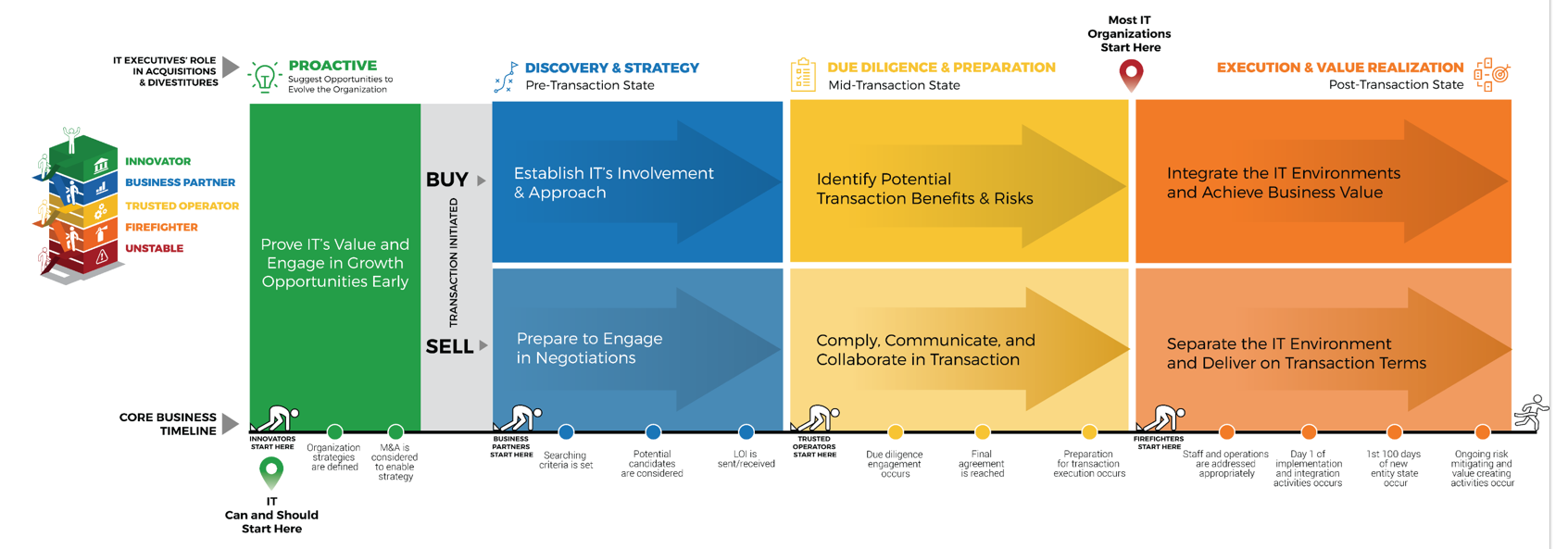

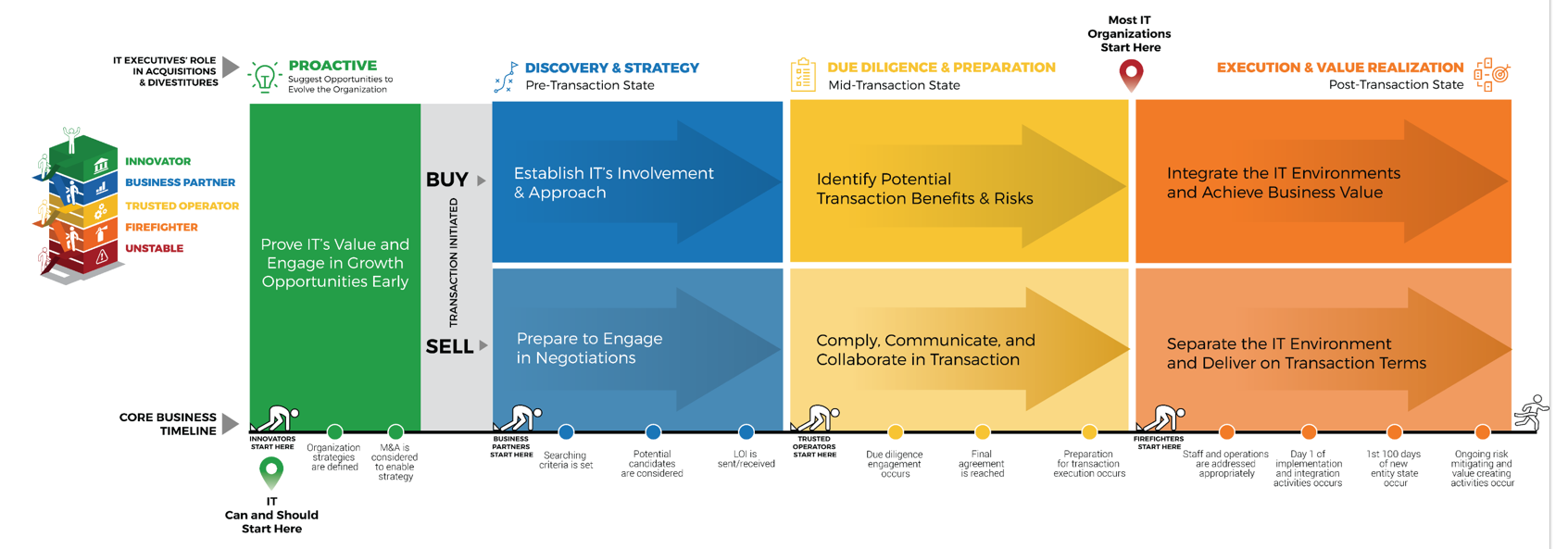

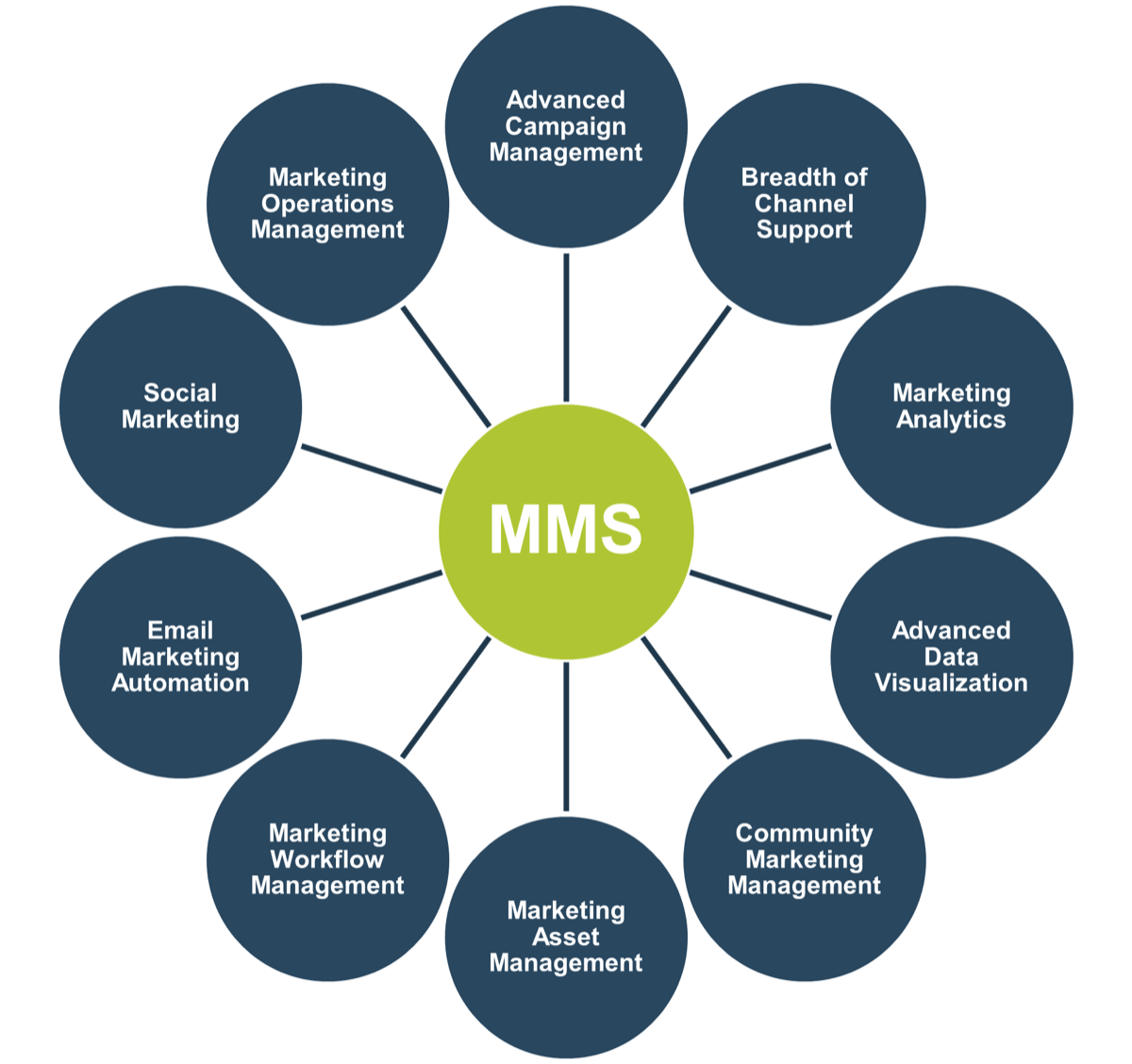

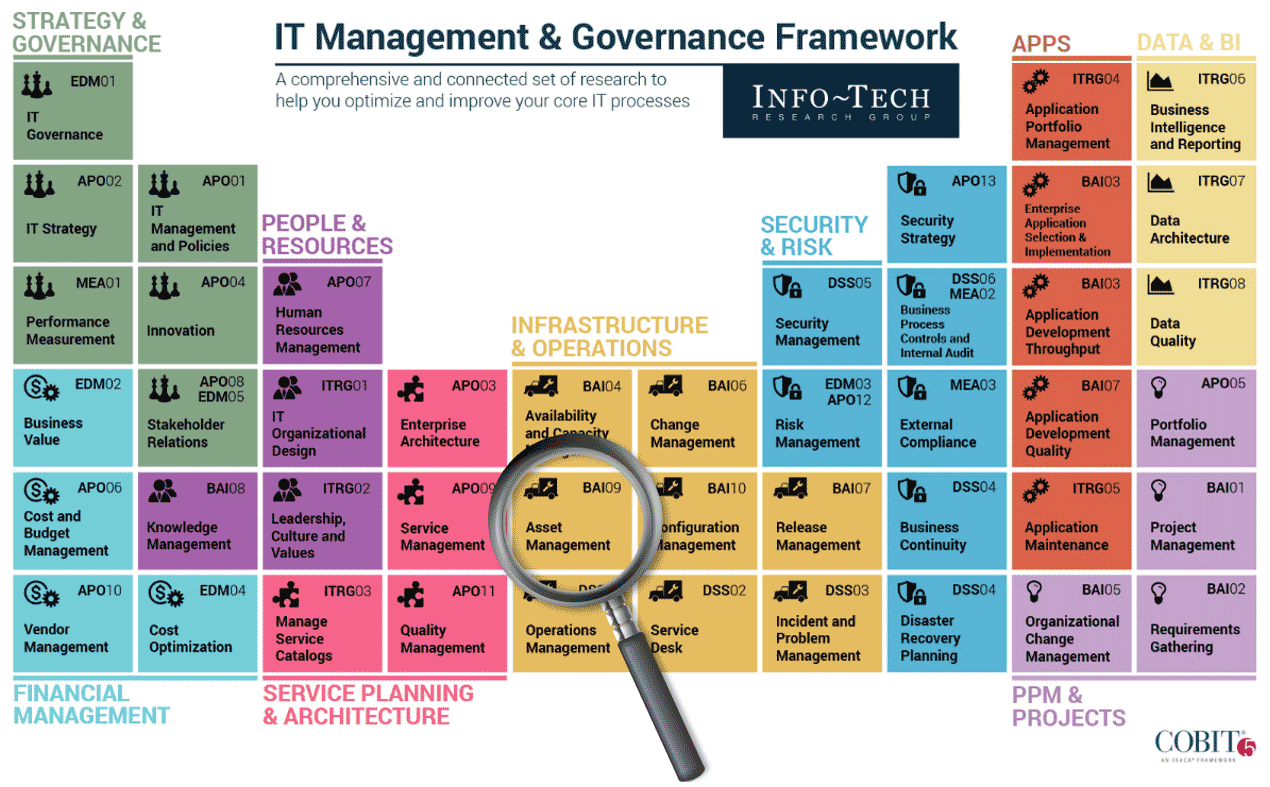

Acquisitions & Divestitures Framework

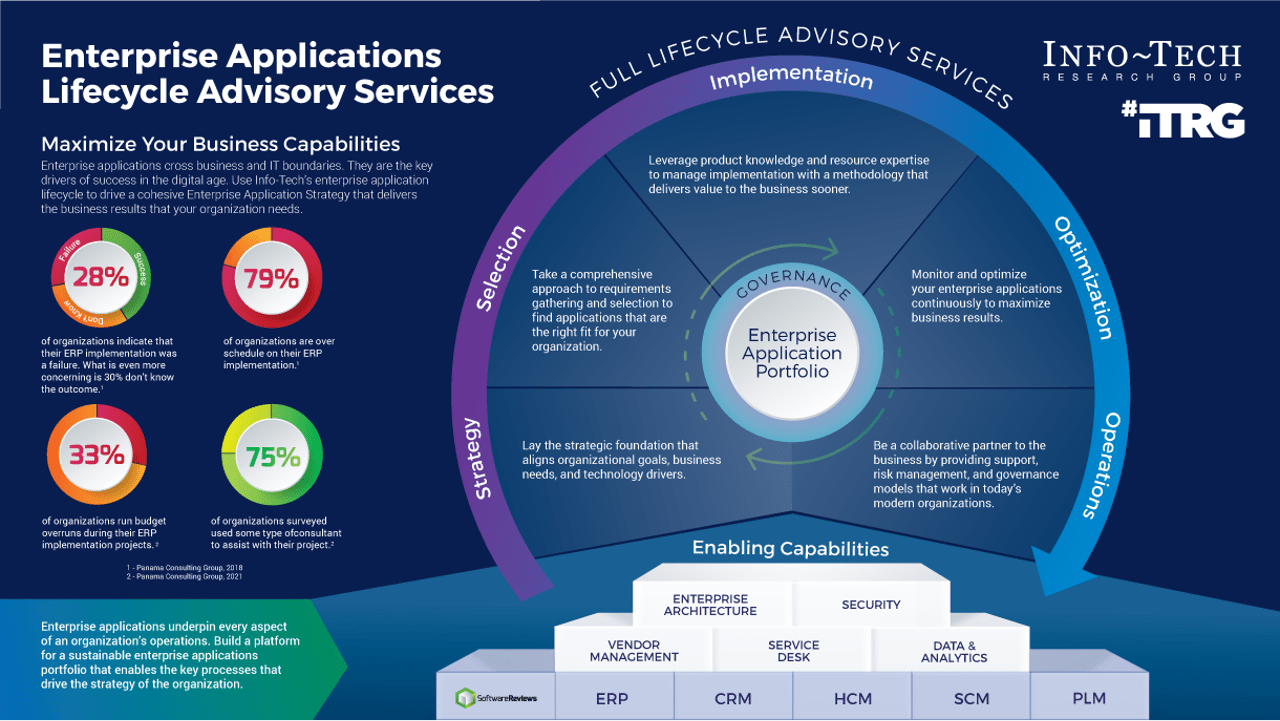

Acquisitions and divestitures are inevitable in modern business, and IT’s involvement in the process should be too. This progression is inspired by:

- The growing trend for organizations to increase, decrease, or evolve through these types of transactions.

- Transactions that are driven by digital motivations, requiring IT’s expertise.

- A maturing business perspective of IT, preventing the difficulty that IT is faced with when invited into the transaction process late.

- There never being such a thing as a true merger, making the majority of M&A activity either acquisitions or divestitures.

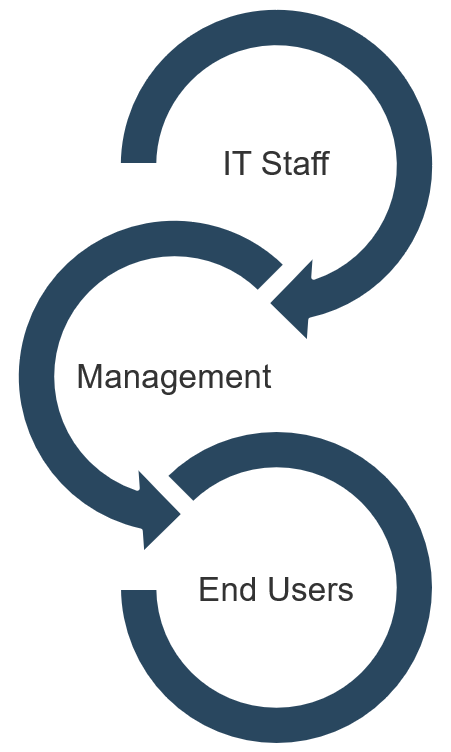

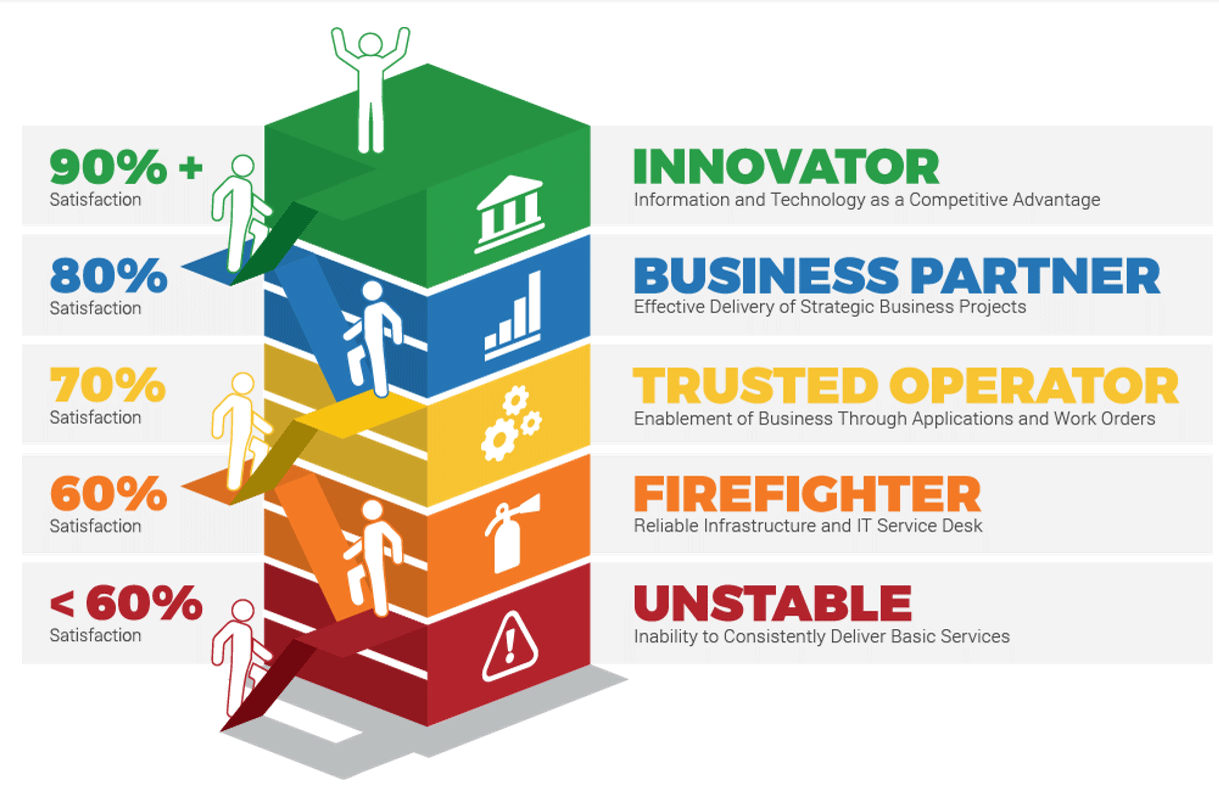

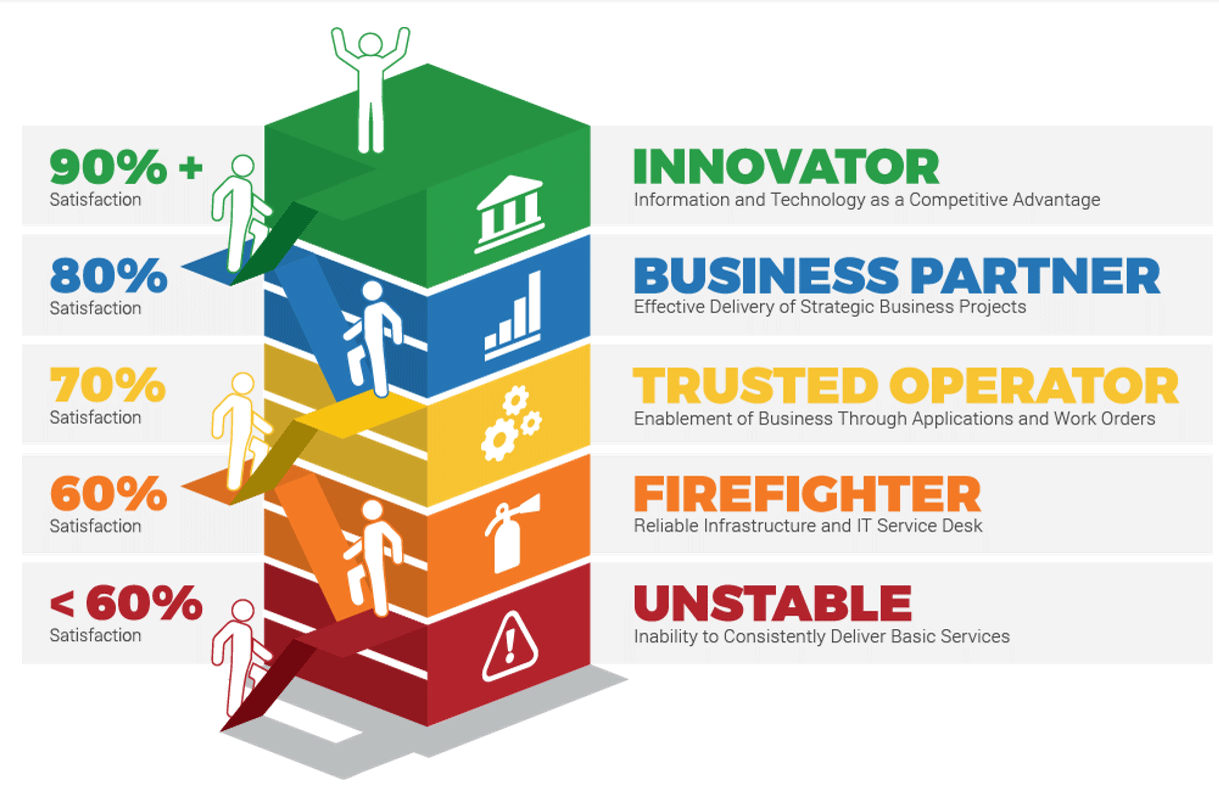

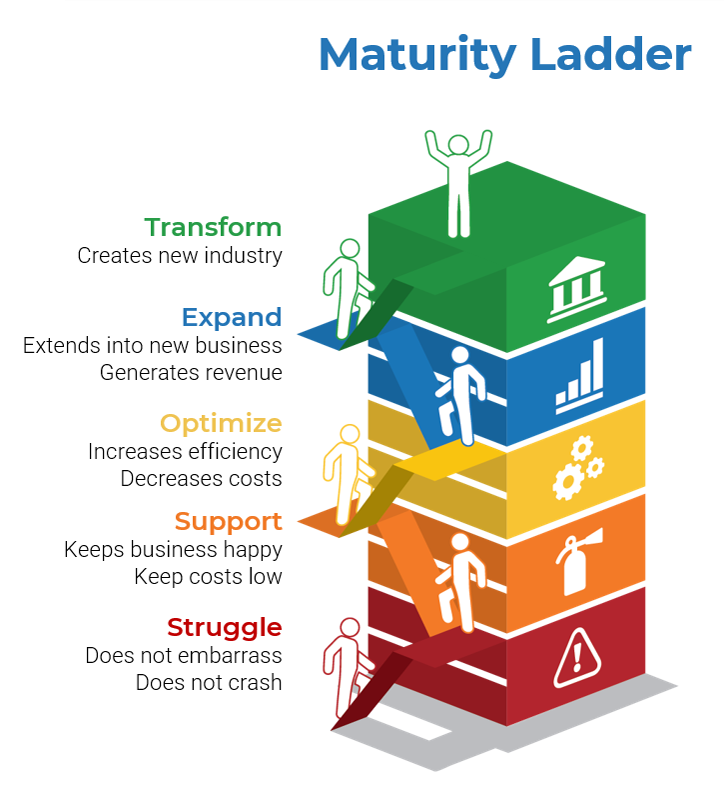

The business’ view of IT will impact how soon IT can get involved

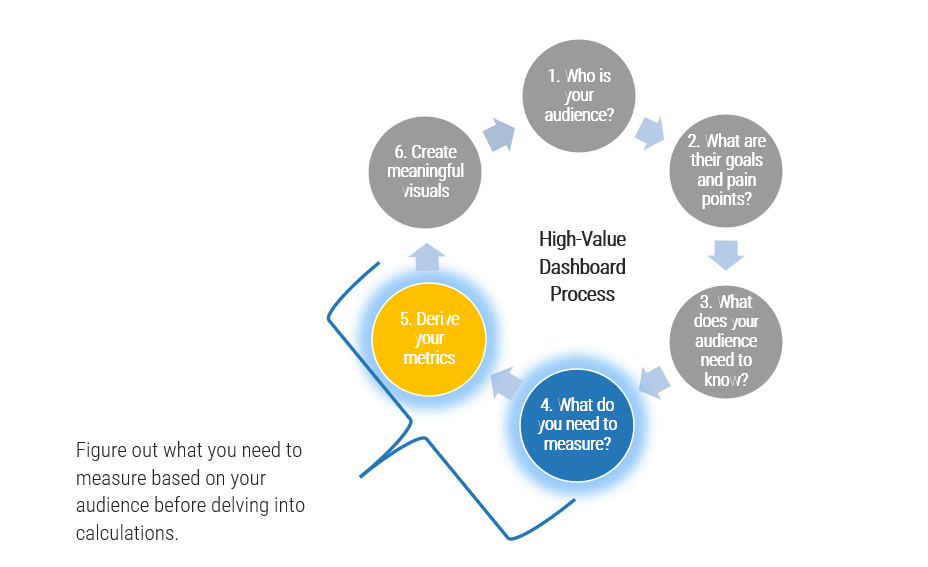

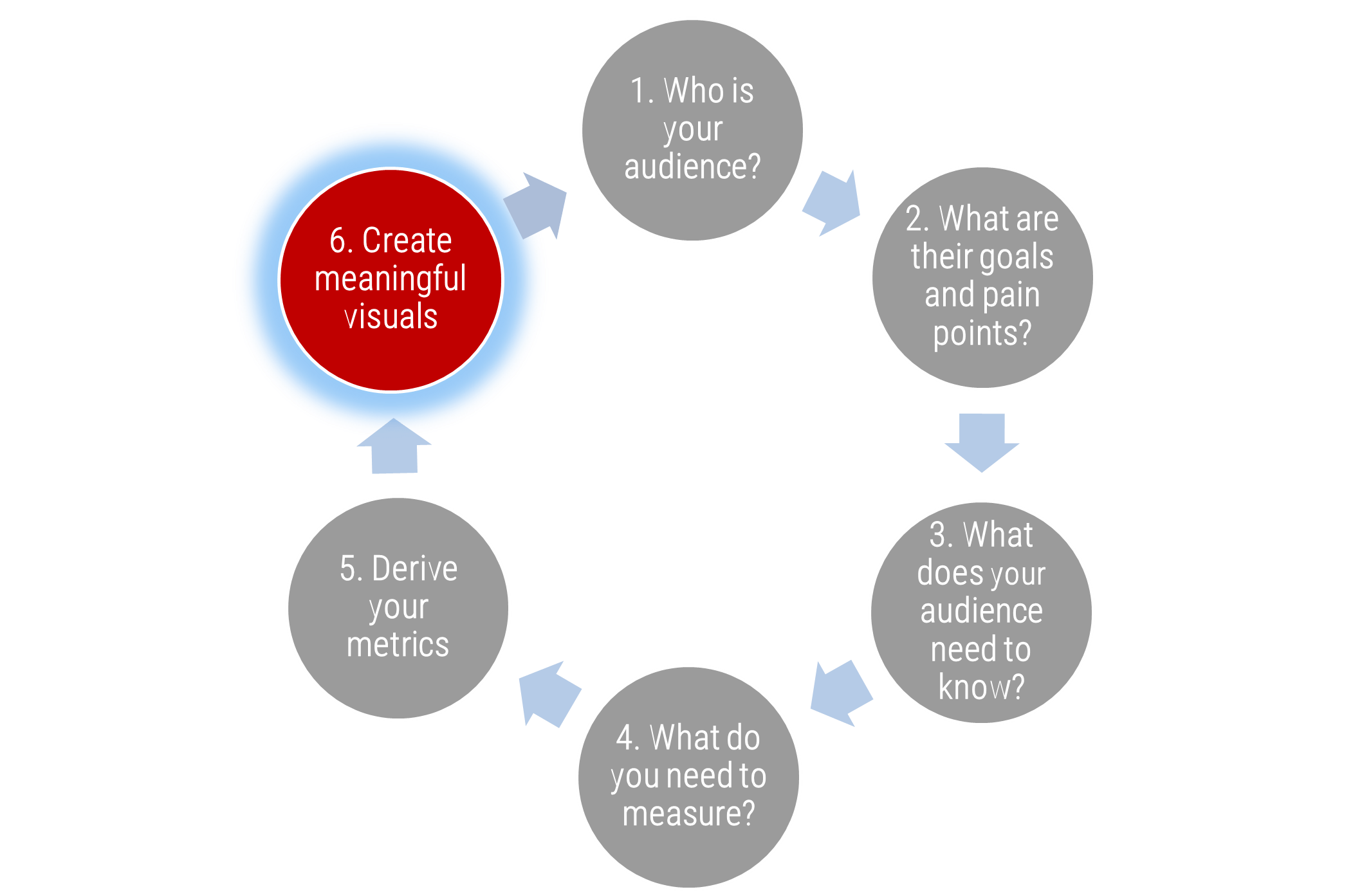

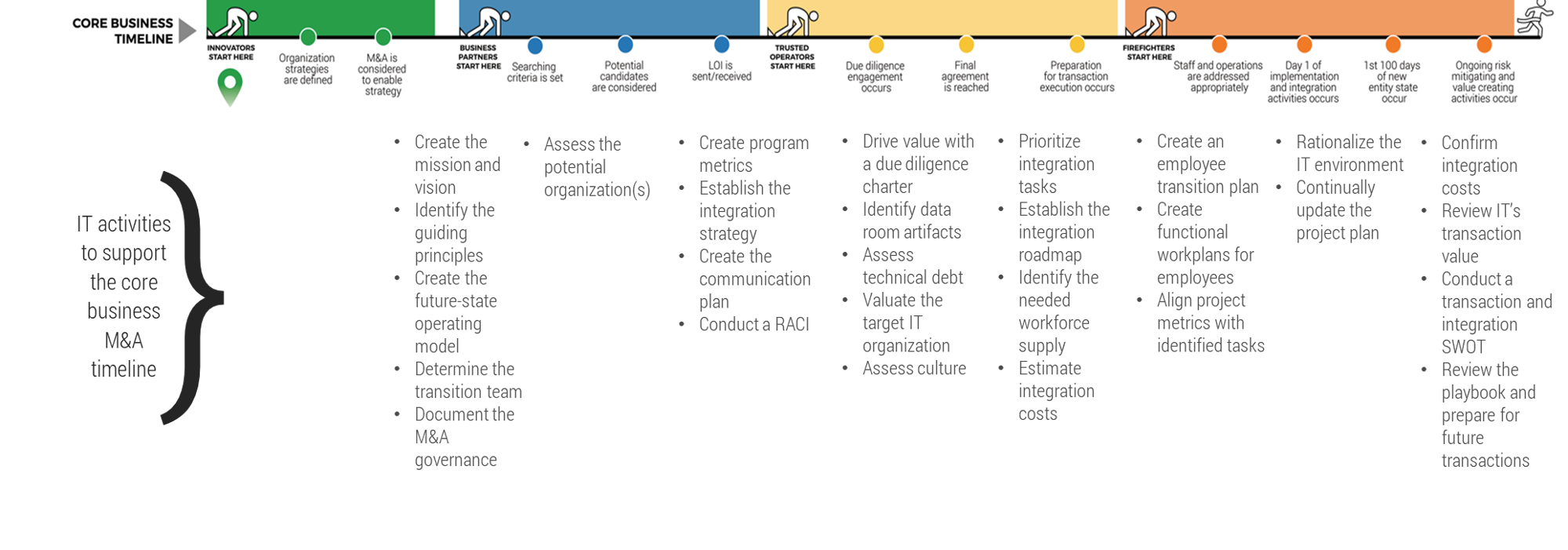

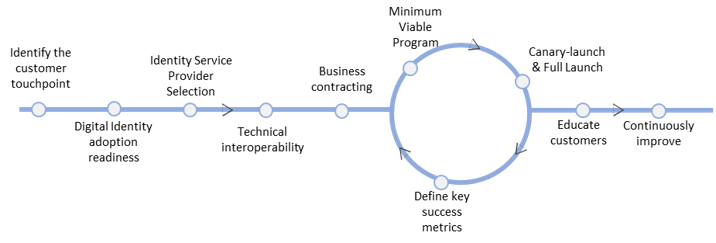

There are four key entry points for IT

- Innovator: IT suggests an acquisition to meet the business objectives of the organization.

- Business Partner: IT is brought in to strategy plan the acquisition from both the business’ and IT’s perspective.

- Trusted Operator: IT participates in due diligence activities and valuates the organization potentially being acquired.

- Firefighter: IT reactively engages in the integration with little time to prepare.

Merger, acquisition, and divestiture defined

Merger

A merger looks at the equal combination of two entities or organizations. Mergers are rare in the M&A space, as the organizations will combine assets and services in a completely equal 50/50 split. Two organizations may also choose to divest business entities and merge as a new company.

Acquisition

The most common transaction in the M&A space, where an organization will acquire or purchase another organization or entities of another organization. This type of transaction has a clear owner who will be able to make legal decisions regarding the acquired organization.

Divestiture

An organization may decide to sell partial elements of a business to an acquiring organization. They will separate this business entity from the rest of the organization and continue to operate the other components of the business.

Info-Tech Insight

A true merger does not exist, as there is always someone initiating the discussion. As a result, most M&A activity falls into acquisition or divestiture categories.

Buying vs. selling

The M&A process approach differs depending on whether you are the executive IT leader on the buy side or sell side

This blueprint is only focused on the buy side:

- More than two organizations could be involved in a transaction.

- Examples of buy-related scenarios include:

- Your organization is buying another organization with the intent of having the purchased organization keep its regular staff, operations, and location. This could mean minimal integration is required.

- Your organization is buying another organization in its entirety with the intent of integrating it into your original company.

- Your organization is buying components of another organization with the intent of integrating them into your original company.

- As the purchasing organization, you will probably be initiating the purchase and thus will be valuating the selling organization during due diligence and leading the execution plan.

The sell side is focused on:

- Examples of sell-related scenarios include:

- Your organization is selling to another organization with the intent of keeping its regular staff, operations, and location. This could mean minimal separation is required.

- Your organization is selling to another organization with the intent of separating to be a part of the purchasing organization.

- Your organization is engaging in a divestiture with the intent of:

- Separating components to be part of the purchasing organization permanently.

- Separating components to be part of a spinoff and establish a unit as a standalone new company.

- As the selling organization, you could proactively seek out suitors to purchase all or components of your organization, or you could be approached by an organization.

For more information on divestitures or selling your entire organization, check out Info-Tech’s Mergers & Acquisitions: The Sell Blueprint.

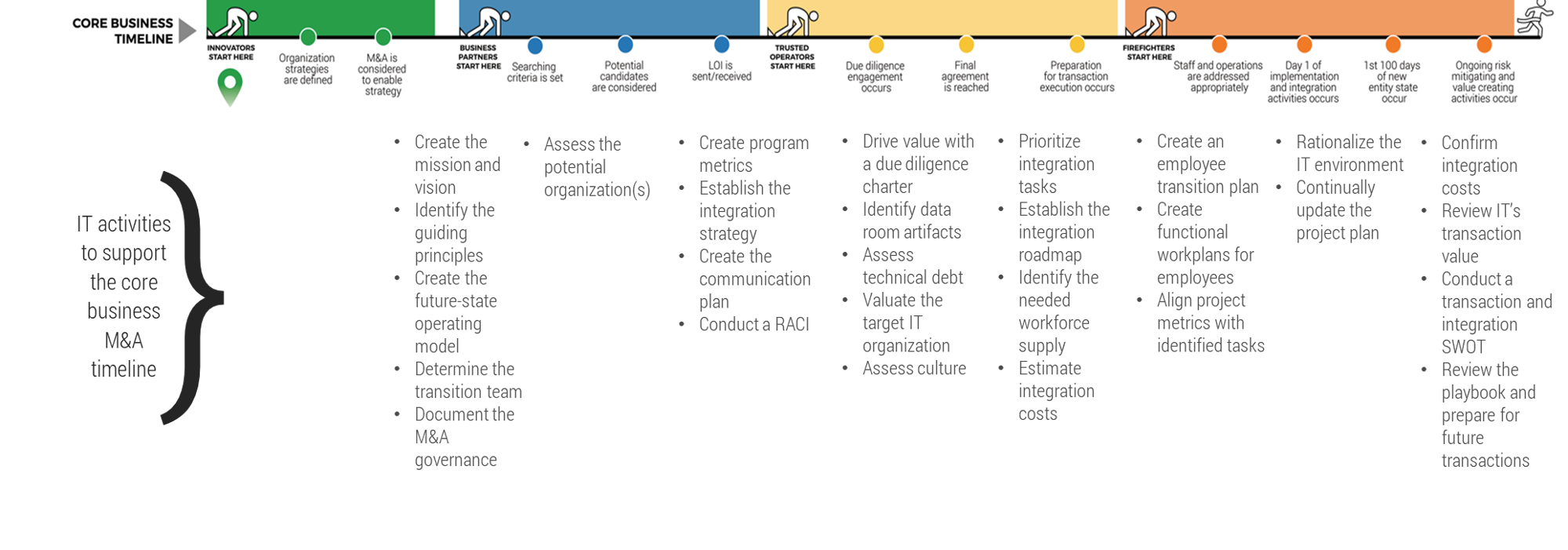

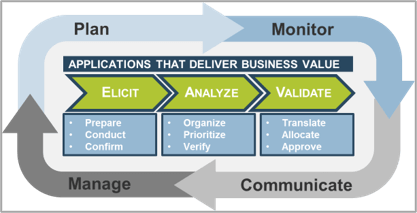

Core business timeline

For IT to be valuable in M&As, you need to align your deliverables and your support to the key activities the business and investors are working on.

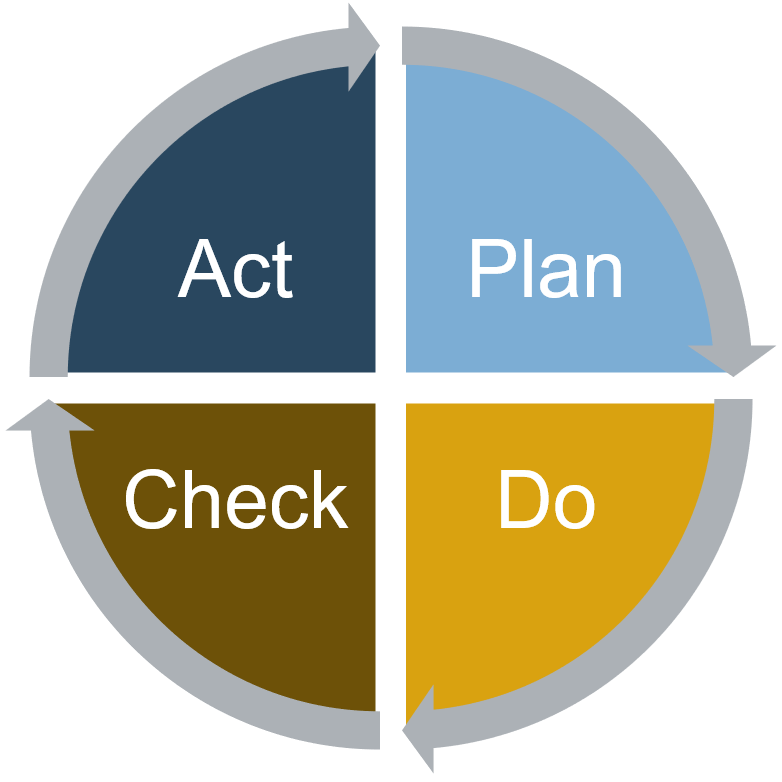

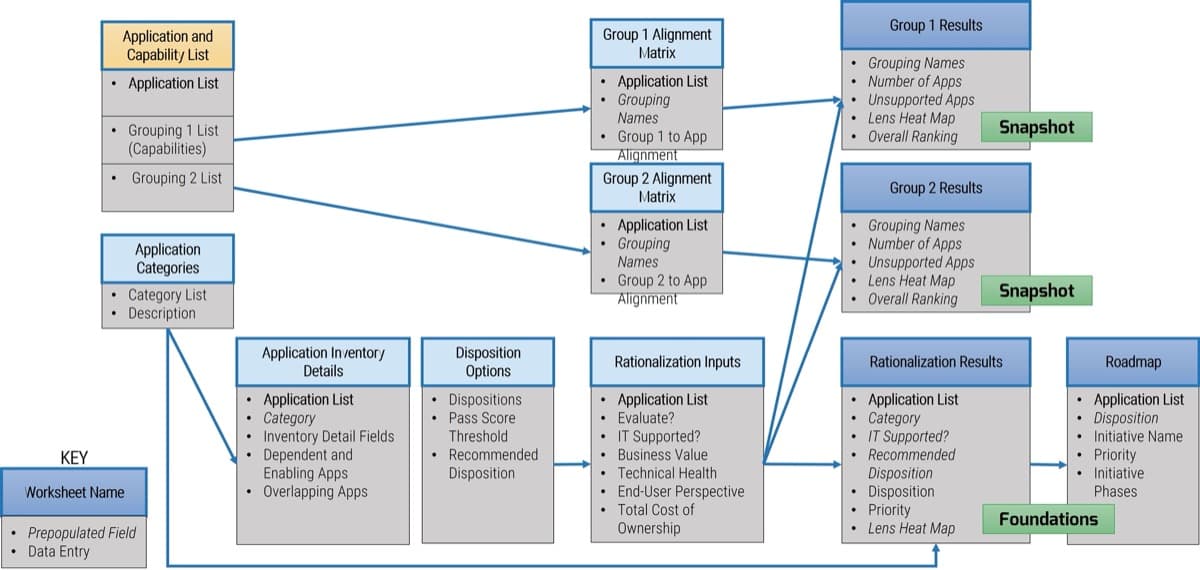

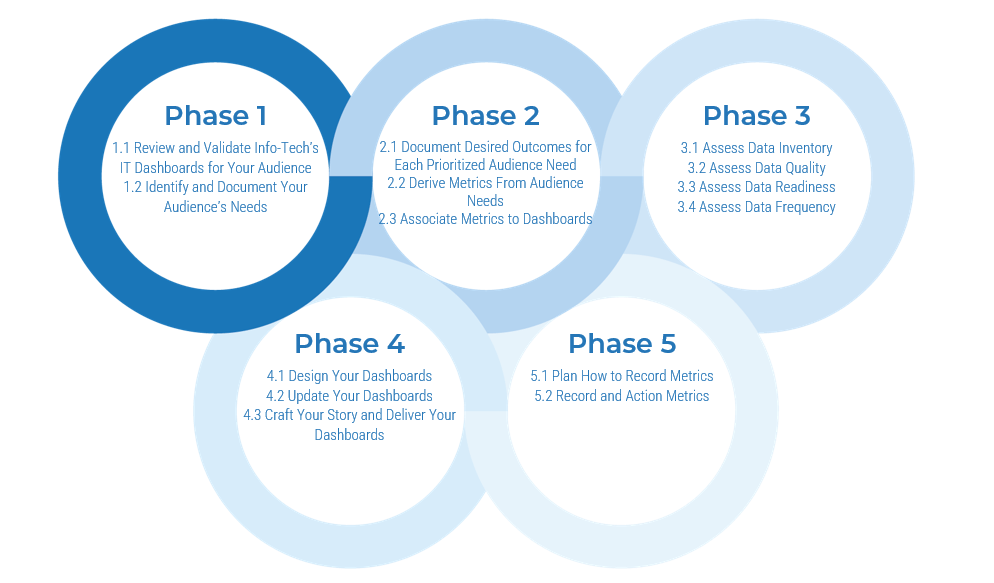

Info-Tech’s methodology for Buying Organizations in Mergers, Acquisitions, or Divestitures

|

|

1. Proactive

|

2. Discovery & Strategy

|

3. Due Diligence & Preparation

|

4. Execution & Value Realization

|

Phase Steps

|

- Identify Stakeholders and Their Perspective of IT

- Assess IT’s Current Value and Future State

- Drive Innovation and Suggest Growth Opportunities

|

- Establish the M&A Program Plan

- Prepare IT to Engage in the Acquisition

|

- Assess the Target Organization

- Prepare to Integrate

|

- Execute the Transaction

- Reflection and Value Realization

|

Phase Outcomes

|

Be an innovative IT leader by suggesting how and why the business should engage in an acquisition or divestiture.

|

Create a standardized approach for how your IT organization should address acquisitions.

|

Evaluate the target organizations successfully and establish an integration project plan.

|

Deliver on the integration project plan successfully and communicate IT’s transaction value to the business.

|

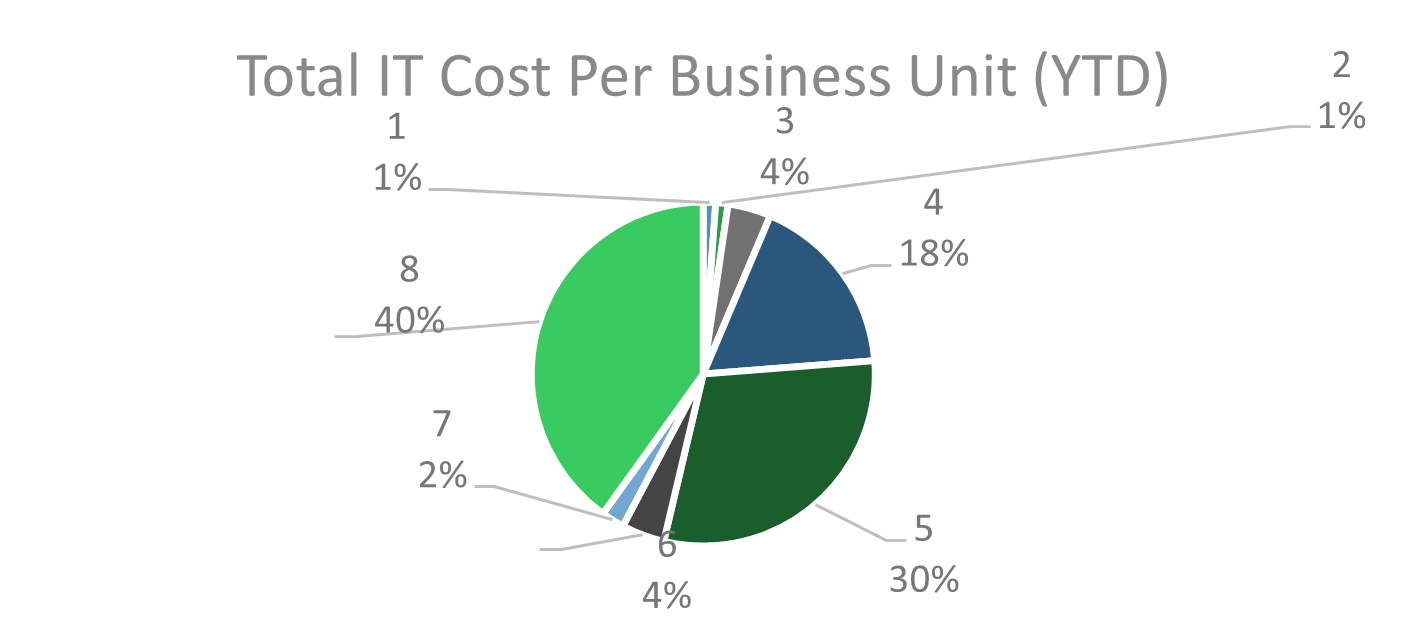

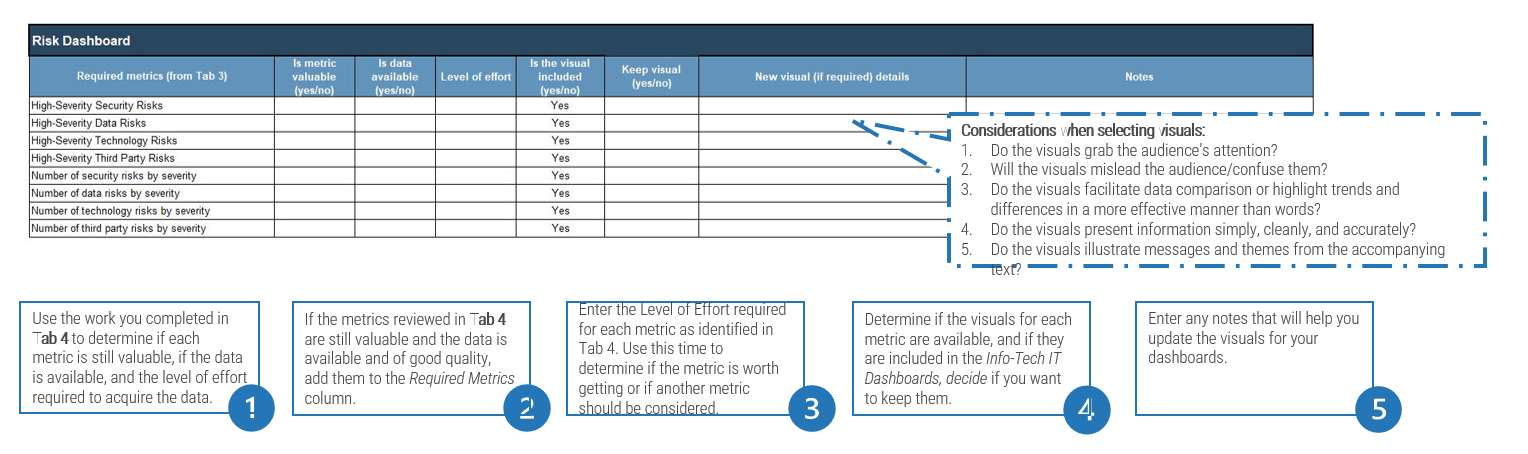

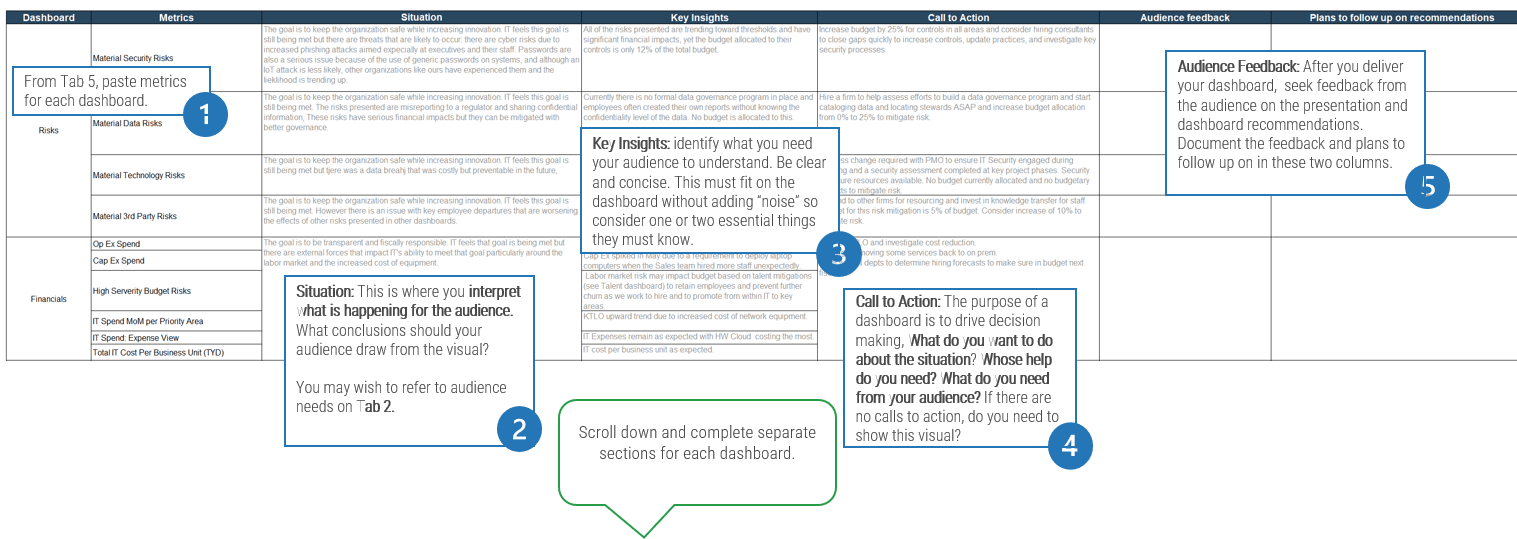

Potential metrics for each phase

1. Proactive | 2. Discovery & Strategy | 3. Due Diligence & Preparation | 4. Execution & Value Realization |

- % Share of business innovation spend from overall IT budget

- % Critical processes with approved performance goals and metrics

- % IT initiatives that meet or exceed value expectation defined in business case

- % IT initiatives aligned with organizational strategic direction

- % Satisfaction with IT's strategic decision-making abilities

- $ Estimated business value added through IT-enabled innovation

- % Overall stakeholder satisfaction with IT

- % Percent of business leaders that view IT as an Innovator

|

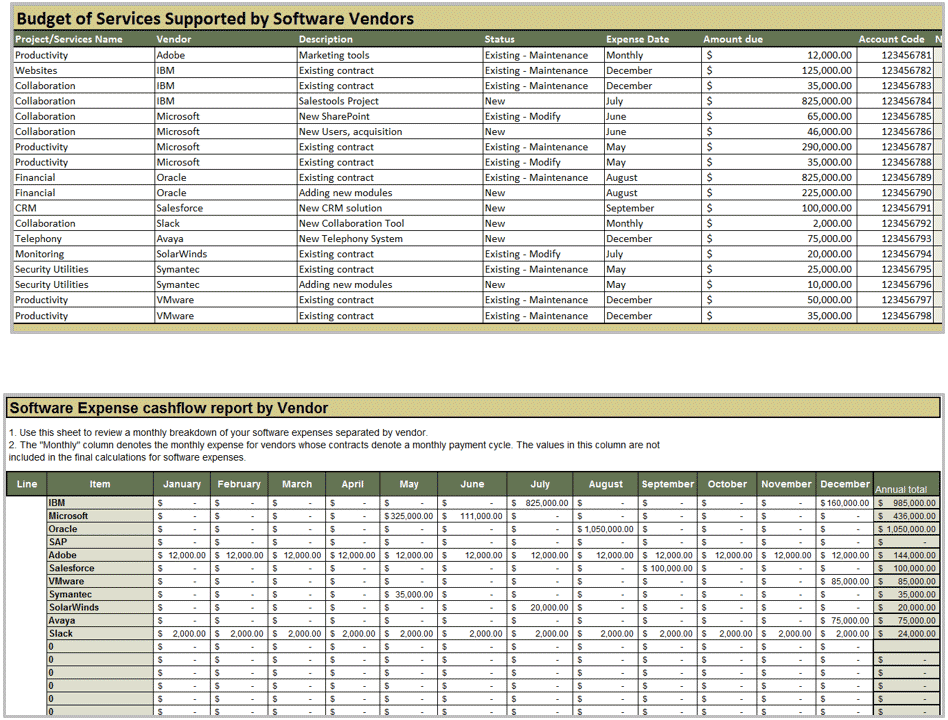

- % IT budget as a percent of revenue

- % Assets that are not allocated

- % Unallocated software licenses

- # Obsolete assets

- % IT spend that can be attributed to the business (chargeback or showback)

- % Share of CapEx of overall IT budget

- % Prospective organizations that meet the search criteria

- $ Total IT cost of ownership (before and after M&A, before and after rationalization)

- % Business leaders that view IT as a Business Partner

|

- % Defects discovered in production

- $ Cost per user for enterprise applications

- % In-house-built applications vs. enterprise applications

- % Owners identified for all data domains

- # IT staff asked to participate in due diligence

- Change to due diligence

- IT budget variance

- Synergy target

|

- % Satisfaction with the effectiveness of IT capabilities

- % Overall end-customer satisfaction

- $ Impact of vendor SLA breaches

- $ Savings through cost-optimization efforts

- $ Savings through application rationalization and technology standardization

- # Key positions empty

- % Frequency of staff turnover

- % Emergency changes

- # Hours of unplanned downtime

- % Releases that cause downtime

- % Incidents with identified problem record

- % Problems with identified root cause

- # Days from problem identification to root cause fix

- % Projects that consider IT risk

- % Incidents due to issues not addressed in the security plan

- # Average vulnerability remediation time

- % Application budget spent on new build/buy vs. maintenance (deferred feature implementation, enhancements, bug fixes)

- # Time (days) to value realization

- % Projects that realized planned benefits

- $ IT operational savings and cost reductions that are related to synergies/divestitures

- % IT staff–related expenses/redundancies

- # Days spent on IT integration

- $ Accurate IT budget estimates

- % Revenue growth directly tied to IT delivery

- % Profit margin growth

|

The IT executive’s role in the buying transaction is critical

And IT leaders have a greater likelihood than ever of needing to support a merger, acquisition, or divestiture.

-

Reduced Risk

IT can identify risks that may go unnoticed when IT is not involved.

-

Increased Accuracy

The business can make accurate predictions around the costs, timelines, and needs of IT.

-

Faster Integration

Faster integration means faster value realization for the business.

-

Informed Decision Making

IT leaders hold critical information that can support the business in moving the transaction forward.

-

Innovation

IT can suggest new opportunities to generate revenue, optimize processes, or reduce inefficiencies.

The IT executive’s critical role is demonstrated by:

Reduced Risk

47% of senior leaders wish they would have spent more time on IT due diligence to prevent value erosion (IMAA Institute, 2017).Increased Accuracy

87% of respondents to a Deloitte survey effectively conducted a virtual deal, with a focus on cybersecurity and integration (Deloitte, 2020).Faster Integration

Integration costs range from as low as $4 million to as high as $3.8 billion, making the process an investment for the organization (CIO Dive).Informed Decision Making

Only 38% of corporate and 22% of private equity firms include IT as a significant aspect in their transaction approach (IMAA Institute, 2017).Innovation

Successful CIOs involved in M&As can spend 70% of their time on aspects outside of IT and 30% of their time on technology and delivery (CIO).

Playbook benefits

IT Benefits

- IT will be seen as an innovative partner to the business, and its suggestions and involvement in the organization will lead to benefits, not hindrances.

- Develop a streamlined method to valuate the potential organization being purchased and ensure risk management concerns are brought to the business’ attention immediately.

- Create a comprehensive list of items that IT needs to do during the integration that can be prioritized and actioned.

Business Benefits

- The business will get accurate and relevant information about the organization being acquired, ensuring that the anticipated value of the transaction is correctly planned for.

- Fewer business interruptions will happen, because IT can accurately plan for and execute the high-priority integration tasks.

- The business can make a fair offer to the purchased organization, having properly valuated all aspects being bought, including the IT environment.

Insight summary

Overarching Insight

As an IT executive, take control of when you get involved in a growth transaction. Do this by proactively identifying acquisition targets, demonstrating the value of IT, and ensuring that integration of IT environments does not lead to unnecessary and costly decisions.

Proactive Insight

CIOs on the forefront of digital transformation need to actively look for and suggest opportunities to acquire or partner on new digital capabilities to respond to rapidly changing business needs.

Discovery & Strategy Insight

IT organizations that have an effective M&A program plan are more prepared for the buying transaction, enabling a successful outcome. A structured strategy is particularly necessary for organizations expected to deliver M&As rapidly and frequently.

Due Diligence & Preparation Insight

Most IT synergies can be realized in due diligence. It is more impactful to consider IT processes and practices (e.g. contracts and culture) in due diligence rather than later in the integration.

Execution & Value Realization Insight

IT needs to realize synergies within the first 100 days of integration. The most successful transactions are when IT continuously realizes synergies a year after the transaction and beyond.

Blueprint deliverables

Key Deliverable: M&A Buy Playbook

The M&A Buy Playbook should be a reusable document that enables your IT organization to successfully deliver on any acquisition transaction.

M&A Buy One-Pager

See a one-page overview of each phase of the transaction.

M&A Buy Case Studies

Read a one-page case study for each phase of the transaction.

M&A Integration Project Management Tool (SharePoint)

Manage the integration process of the acquisition using this SharePoint template.

M&A Integration Project Management Tool (Excel)

Manage the integration process of the acquisition using this Excel tool if you can’t or don’t want to use SharePoint.

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit

|

Guided Implementation

|

Workshop

|

Consulting

|

| "Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful."

|

"Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track."

|

"We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place."

|

"Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project."

|

Diagnostics and consistent frameworks used throughout all four options

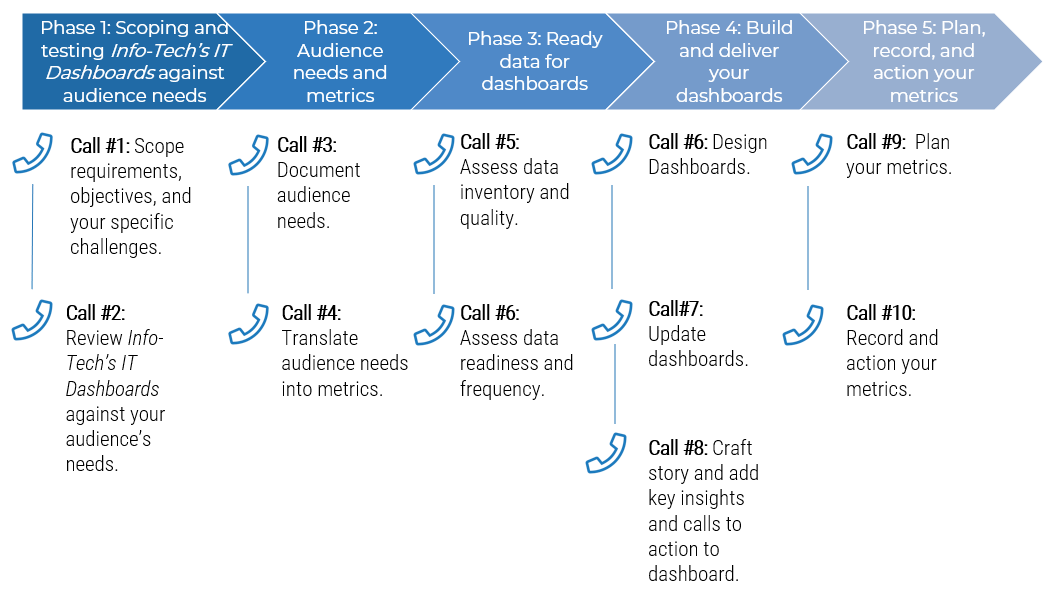

Guided Implementation

What does a typical GI on this topic look like?

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is between 6 to 10 calls over the course of 2 to 4 months.

Proactive Phase

- Call #1: Scope requirements, objectives, and your specific challenges.

Discovery & Strategy Phase

- Call #2: Determine stakeholders and their perspectives of IT.

- Call #3: Identify how M&A could support business strategy and how to communicate.

Due Diligence & Preparation Phase

- Call #4: Establish a transaction team and acquisition strategic direction.

- Call #5: Create program metrics and identify a standard integration strategy.

- Call #6: Assess the potential organization(s).

- Call #7: Identify the integration program plan.

Execution & Value Realization Phase

- Call #8: Establish employee transitions to retain key staff.

- Call #9: Assess IT’s ability to deliver on the acquisition transaction.

The Buy Blueprint

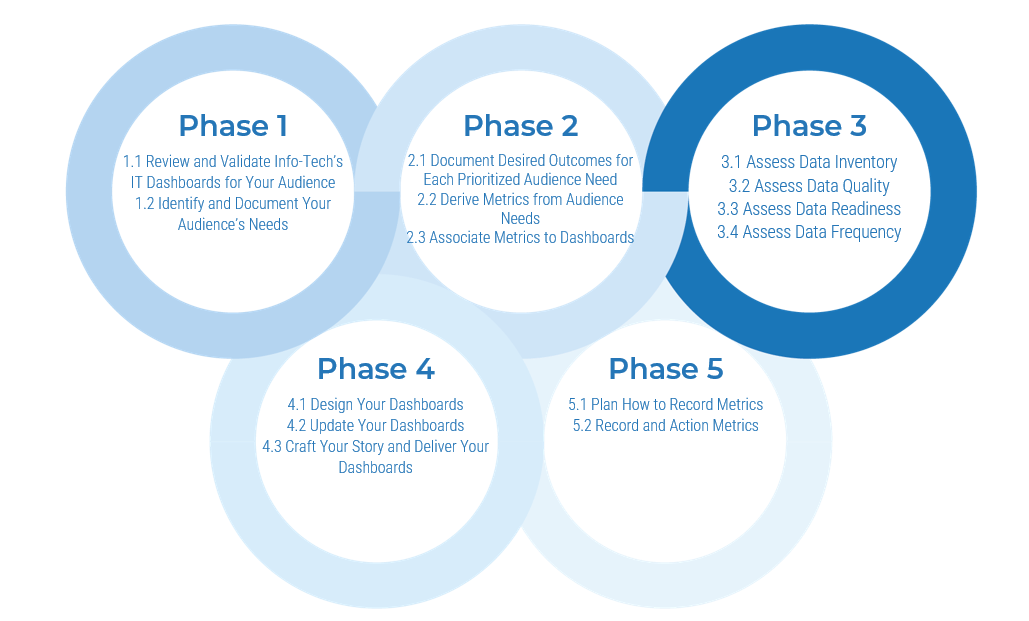

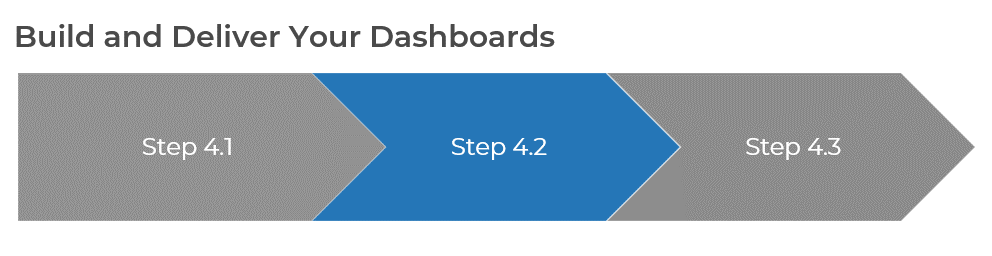

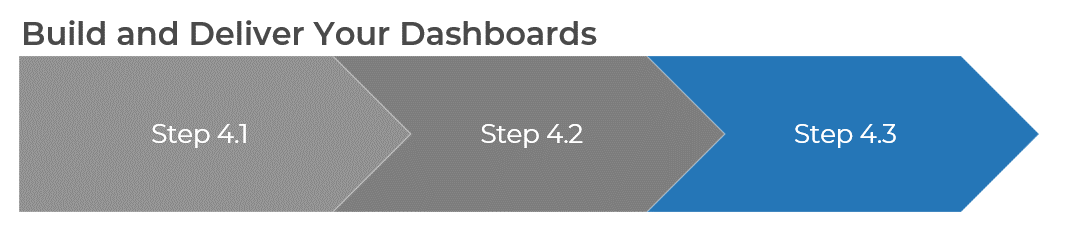

Phase 1

Proactive

Phase 1

|

Phase 2

|

Phase 3

|

Phase 4

|

- 1.1 Identify Stakeholders and Their Perspective of IT

- 1.2 Assess IT’s Current Value and Future State

- 1.3 Drive Innovation and Suggest Growth Opportunities

|

- 2.1 Establish the M&A Program Plan

- 2.2 Prepare IT to Engage in the Acquisition

|

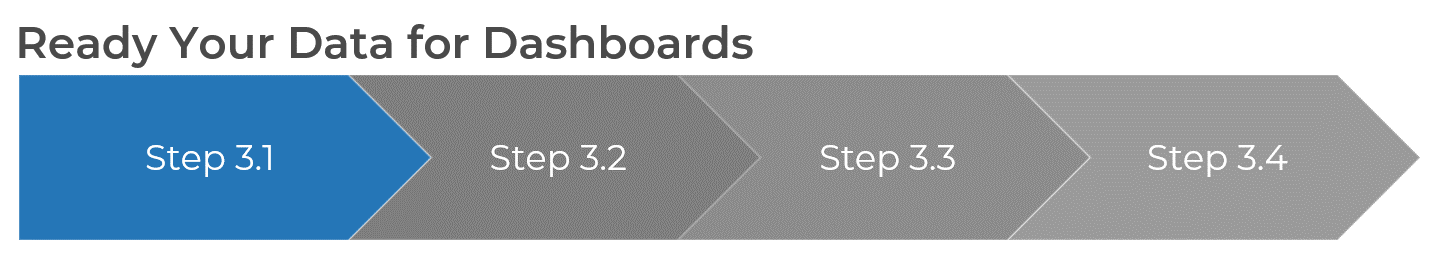

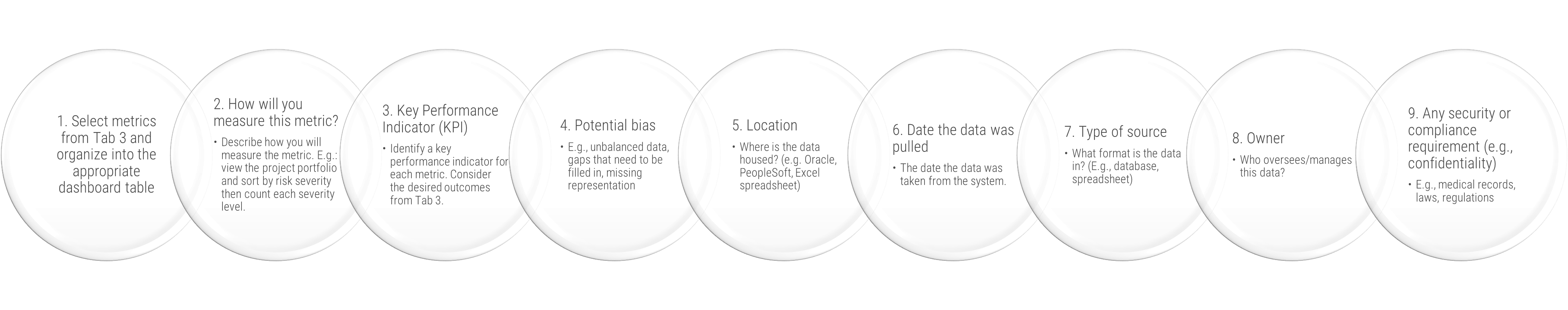

- 3.1 Assess the Target Organization

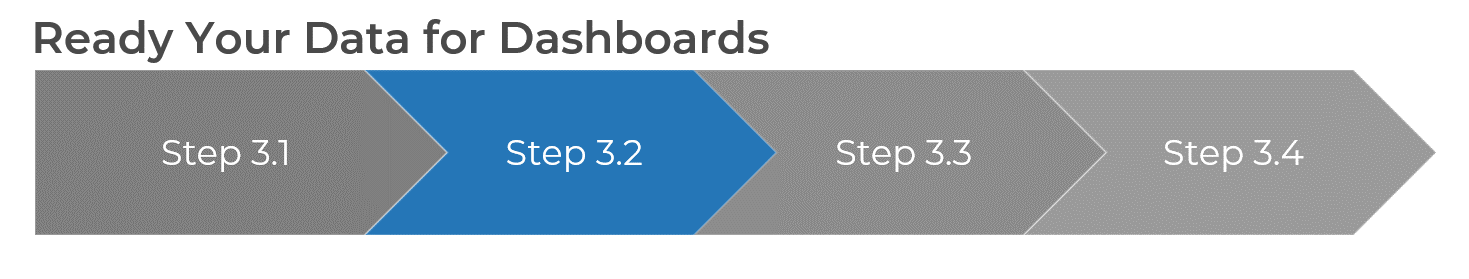

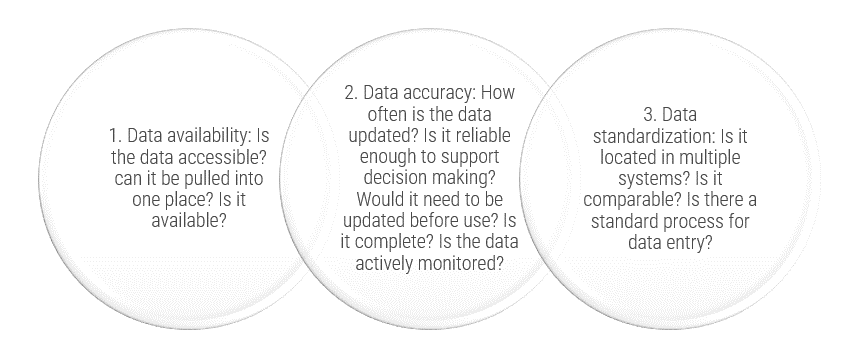

- 3.2 Prepare to Integrate

|

- 4.1 Execute the Transaction

- 4.2 Reflection and Value Realization

|

This phase will walk you through the following activities:

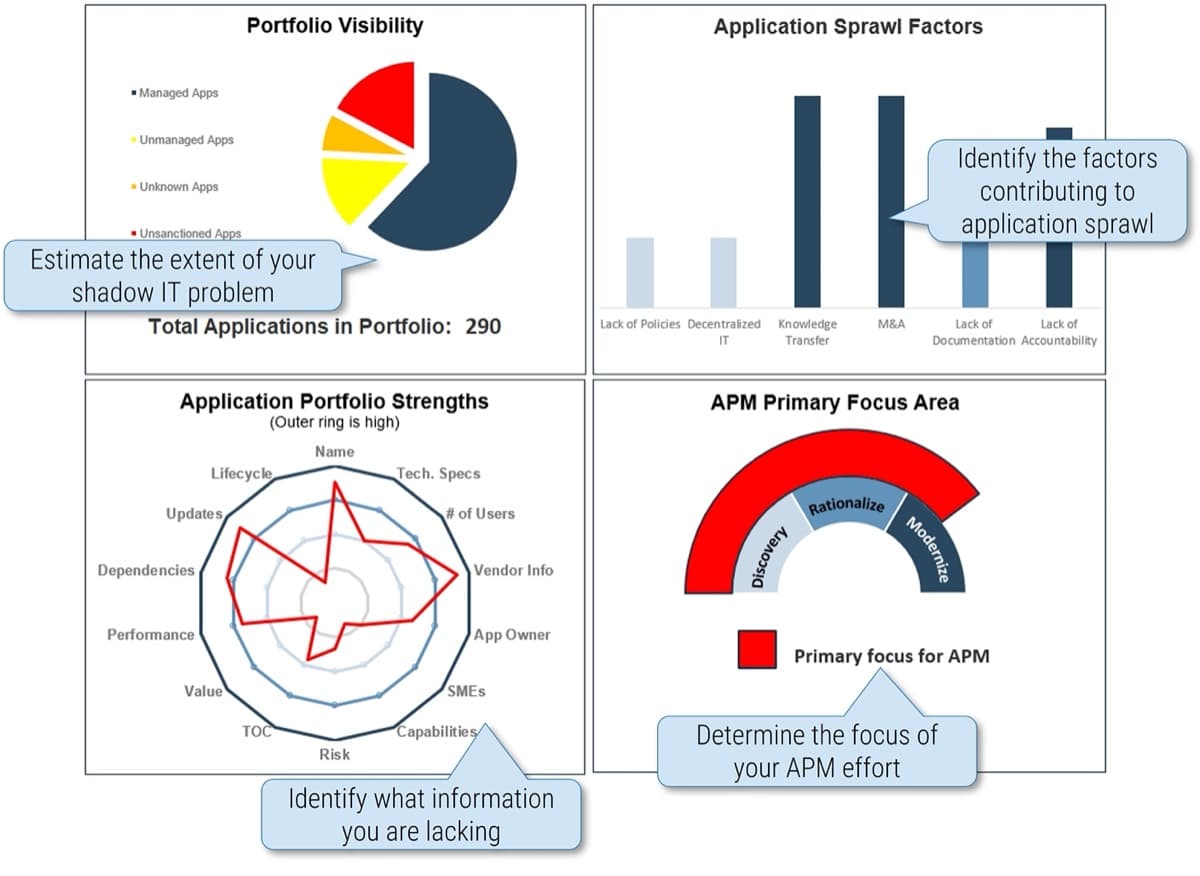

- Conduct the CEO-CIO Alignment diagnostic

- Conduct the CIO Business Vision diagnostic

- Visualize relationships among stakeholders to identify key influencers

- Group stakeholders into categories

- Prioritize your stakeholders

- Plan to communicate

- Valuate IT

- Assess the IT/digital strategy

- Determine pain points and opportunities

- Align goals to opportunities

- Recommend growth opportunities

This phase involves the following participants:

- IT and business leadership

What is the Proactive phase?

Embracing the digital drivers

As the number of merger, acquisition, or divestiture transactions driven by digital means continues to increase, IT has an opportunity to not just be involved in a transaction but actively seek out potential deals.

In the Proactive phase, the business is not currently considering a transaction. However, the business could consider one to reach its strategic goals. IT organizations that have developed respected relationships with the business leaders can suggest these potential transactions.

Understand the business’ perspective of IT, determine who the critical M&A stakeholders are, valuate the IT environment, and examine how it supports the business goals in order to suggest an M&A transaction.

In doing so, IT isn’t waiting to be invited to the transaction table – it’s creating it.

Goal: To support the organization in reaching its strategic goals by suggesting M&A activities that will enable the organization to reach its objectives faster and with greater-value outcomes.

Proactive Prerequisite Checklist

Before coming into the Proactive phase, you should have addressed the following:

- Understand what mergers, acquisitions, and divestitures are.

- Understand what mergers, acquisitions, and divestitures mean for the business.

- Understand what mergers, acquisitions, and divestitures mean for IT.

Review the Executive Brief for more information on mergers, acquisitions, and divestitures for purchasing organizations.

Proactive

Step 1.1

Identify M&A Stakeholders and Their Perspective of IT

Activities

- 1.1.1 Conduct the CEO-CIO Alignment diagnostic

- 1.1.2 Conduct the CIO Business Vision diagnostic

- 1.1.3 Visualize relationships among stakeholders to identify key influencers

- 1.1.4 Group stakeholders into categories

- 1.1.5 Prioritize your stakeholders

- 1.16 Plan to communicate

This step involves the following participants:

- IT executive leader

- IT leadership

- Critical M&A stakeholders

Outcomes of Step

Understand how the business perceives IT and establish strong relationships with critical M&A stakeholders.

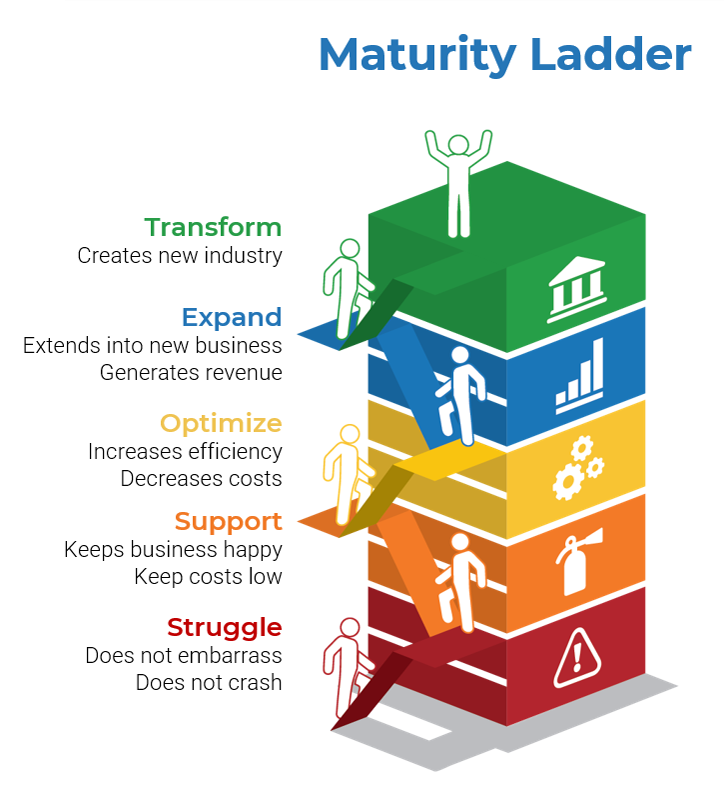

Business executives' perspectives of IT

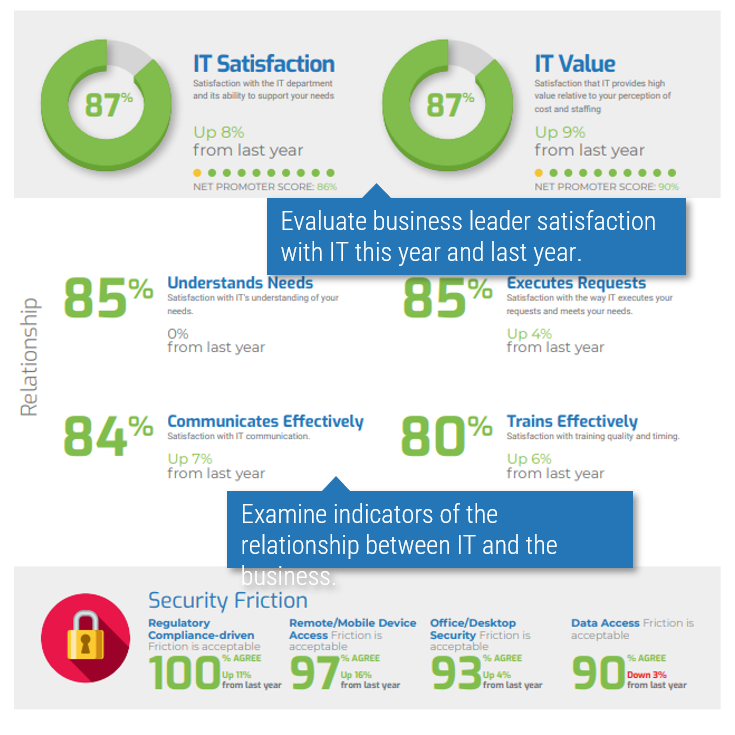

Leverage diagnostics and gain alignment on IT’s role in the organization

- To suggest or get involved with a merger, acquisition, or divestiture, the IT executive leader needs to be well respected by other members of the executive leadership team and the business.

- Specifically, the Proactive phase relies on the IT organization being viewed as an Innovator within the business.

- Identify how the CEO/business executive currently views IT and where they would like IT to move within the Maturity Ladder.

- Additionally, understand how other critical department leaders view IT and how they view the partnership with IT.

Misalignment in target state requires further communication between the CIO and CEO to ensure IT is striving toward an agreed-upon direction.

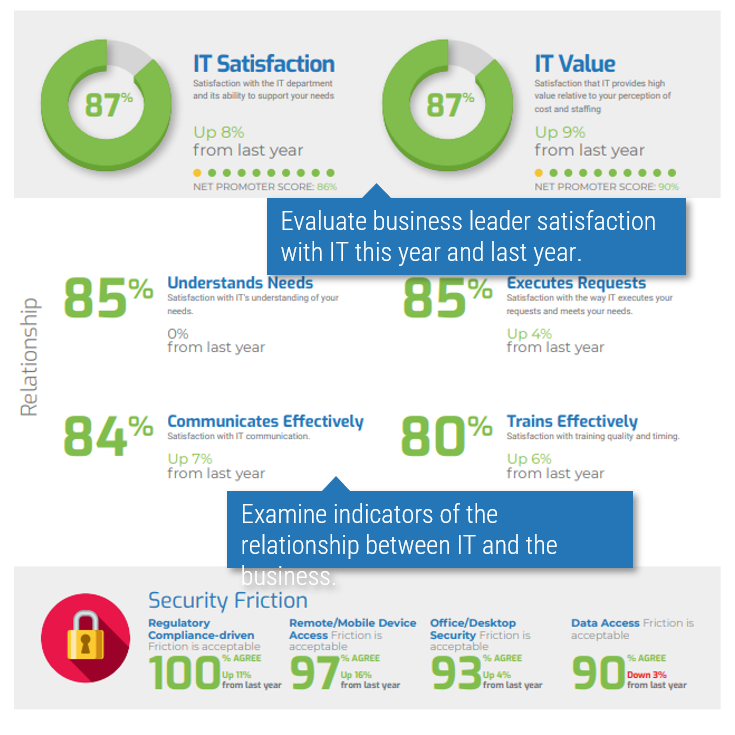

Info-Tech’s CIO Business Vision (CIO BV) diagnostic measures a variety of high-value metrics to provide a well-rounded understanding of stakeholder satisfaction with IT.

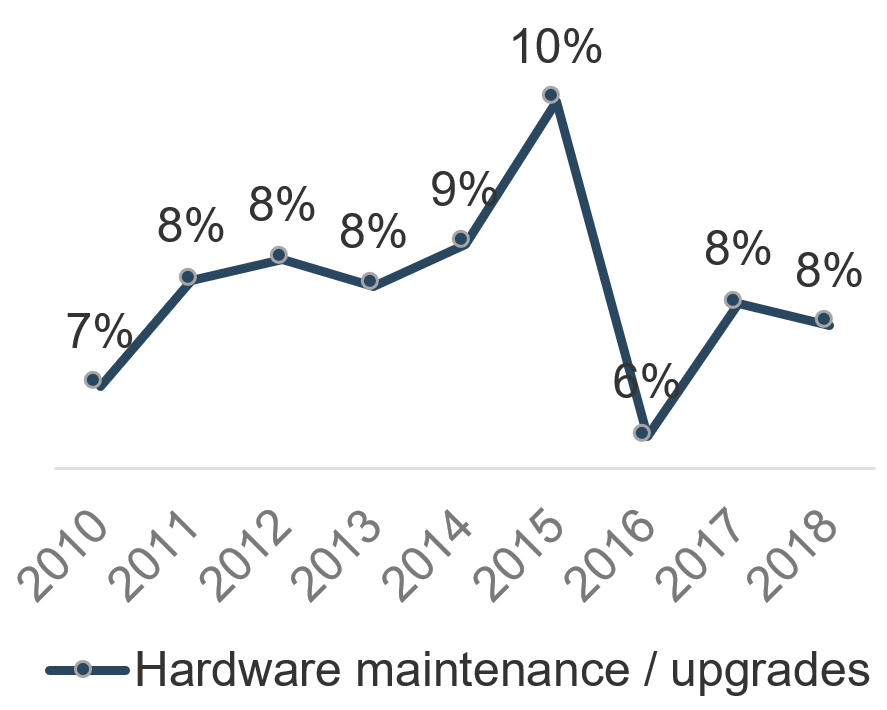

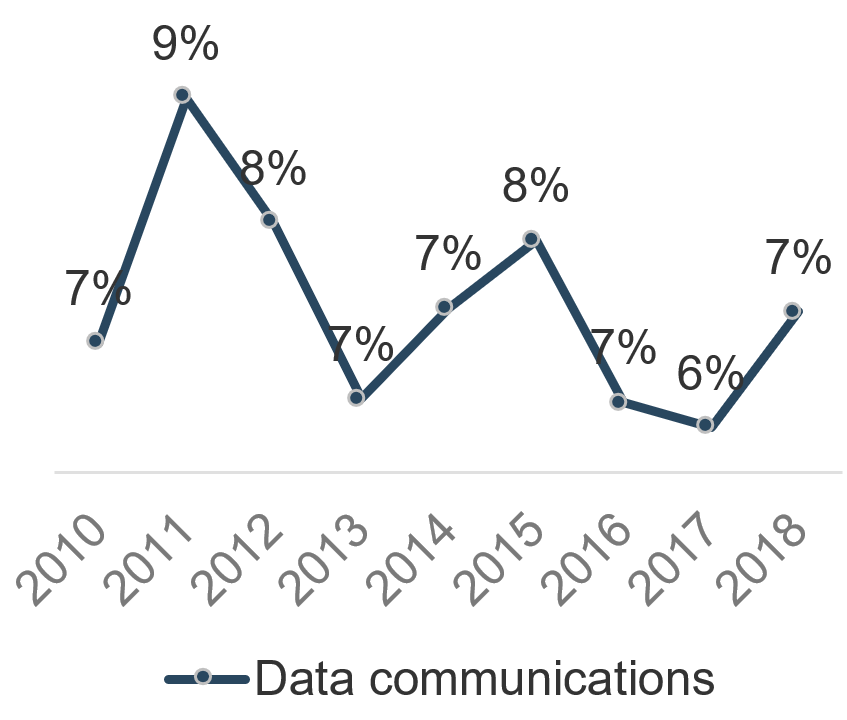

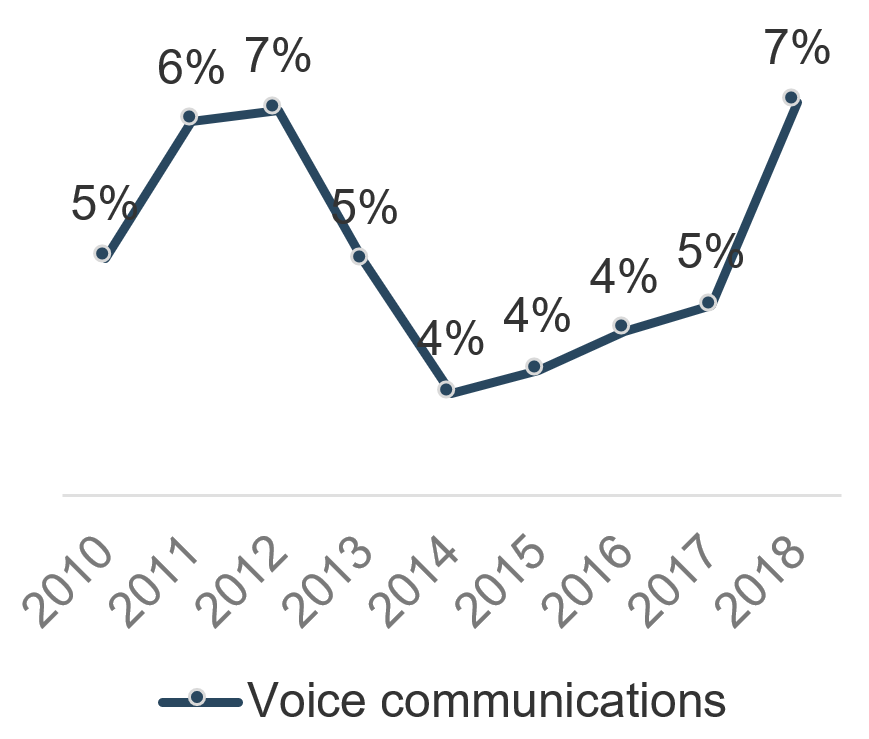

Business Satisfaction and Importance for Core Services

The core services of IT are important when determining what IT should focus on. The most important services with the lowest satisfaction offer the largest area of improvement for IT to drive business value.

1.1.1 Conduct the CEO-CIO Alignment diagnostic

2 weeks

Input: IT organization expertise and the CEO-CIO Alignment diagnostic

Output: An understanding of an executive business stakeholder’s perception of IT

Materials: CEO-CIO Alignment diagnostic, M&A Buy Playbook

Participants: IT executive/CIO, Business executive/CEO

- The CEO-CIO Alignment diagnostic can be a powerful input. Speak with your Info-Tech account representative to conduct the diagnostic. Use the results to inform current IT capabilities.

- You may choose to debrief the results of your diagnostic with an Info-Tech analyst. We recommend this to help your team understand how to interpret and draw conclusions from the results.

- Examine the results of the survey and note where there might be specific capabilities that could be improved.

- Determine whether there are any areas of significant disagreement between the you and the CEO. Mark down those areas for further conversations. Additionally, take note of areas that could be leveraged to support growth transactions or support your rationale in recommending growth transactions.

Download the sample report.

Record the results in the M&A Buy Playbook.

1.1.2 Conduct the CIO Business Vision diagnostic

2 weeks

Input: IT organization expertise, CIO BV diagnostic

Output: An understanding of business stakeholder perception of certain IT capabilities and services

Materials: CIO Business Vision diagnostic, Computer, Whiteboard and markers, M&A Buy Playbook

Participants: IT executive/CIO, Senior business leaders

- The CIO Business Vision (CIO BV) diagnostic can be a powerful tool for identifying IT capability focus areas. Speak with your account representative to conduct the CIO BV diagnostic. Use the results to inform current IT capabilities.

- You may choose to debrief the results of your diagnostic with an Info-Tech analyst. We recommend this to help your team understand how to interpret the results and draw conclusions from the diagnostic.

- Examine the results of the survey and take note of any IT services that have low scores.

- Read through the diagnostic comments and note any common themes. Especially note which stakeholders identified they have a favorable relationship with IT and which stakeholders identified they have an unfavorable relationship. For those who have an unfavorable relationship, identify if they will have a critical role in a growth transaction.

Download the sample report.

Record the results in the M&A Buy Playbook.

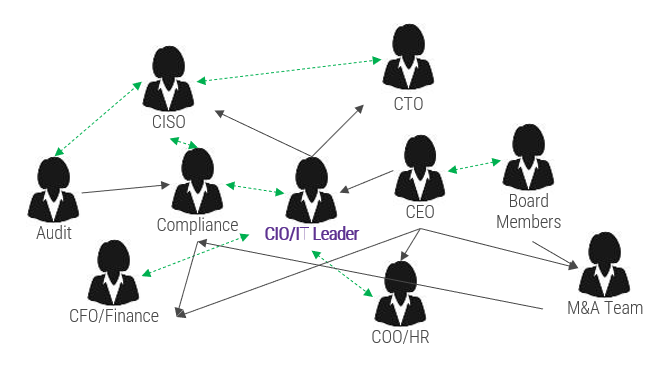

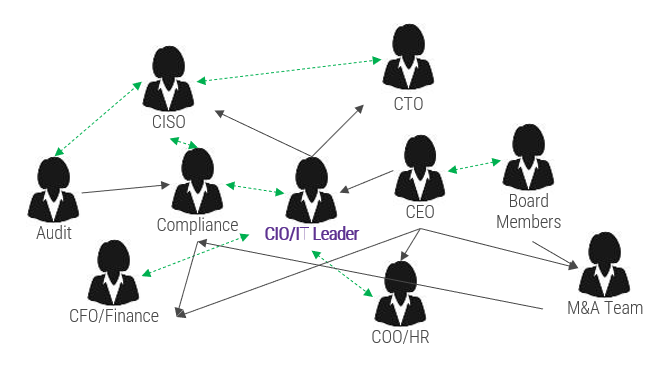

Create a stakeholder network map for M&A transactions

Follow the trail of breadcrumbs from your direct stakeholders to their influencers to uncover hidden stakeholders.

Example:

Legend

- Black arrows indicate the direction of professional influence

- Dashed green arrows indicate bidirectional, informal influence relationships

Info-Tech Insight

Your stakeholder map defines the influence landscape that the M&A transaction will occur within. This will identify who holds various levels of accountability and decision-making authority when a transaction does take place.

Use connectors to determine who may be influencing your direct stakeholders. They may not have any formal authority within the organization, but they may have informal yet substantial relationships with your stakeholders.

1.1.3 Visualize relationships among stakeholders to identify key influencers

1-3 hours

Input: List of M&A stakeholders

Output: Relationships among M&A stakeholders and influencers

Materials: M&A Buy Playbook

Participants: IT executive leadership

- The purpose of this activity is to list all the stakeholders within your organization that will have a direct or indirect impact on the M&A transaction.

- Determine the critical stakeholders, and then determine the stakeholders of your stakeholders and consider adding each of them to the stakeholder list.

- Assess who has either formal or informal influence over your stakeholders; add these influencers to your stakeholder list.

- Construct a diagram linking stakeholders and their influencers together.

- Use black arrows to indicate the direction of professional influence.

- Use dashed green arrows to indicate bidirectional, informal influence relationships.

Record the results in the M&A Buy Playbook.

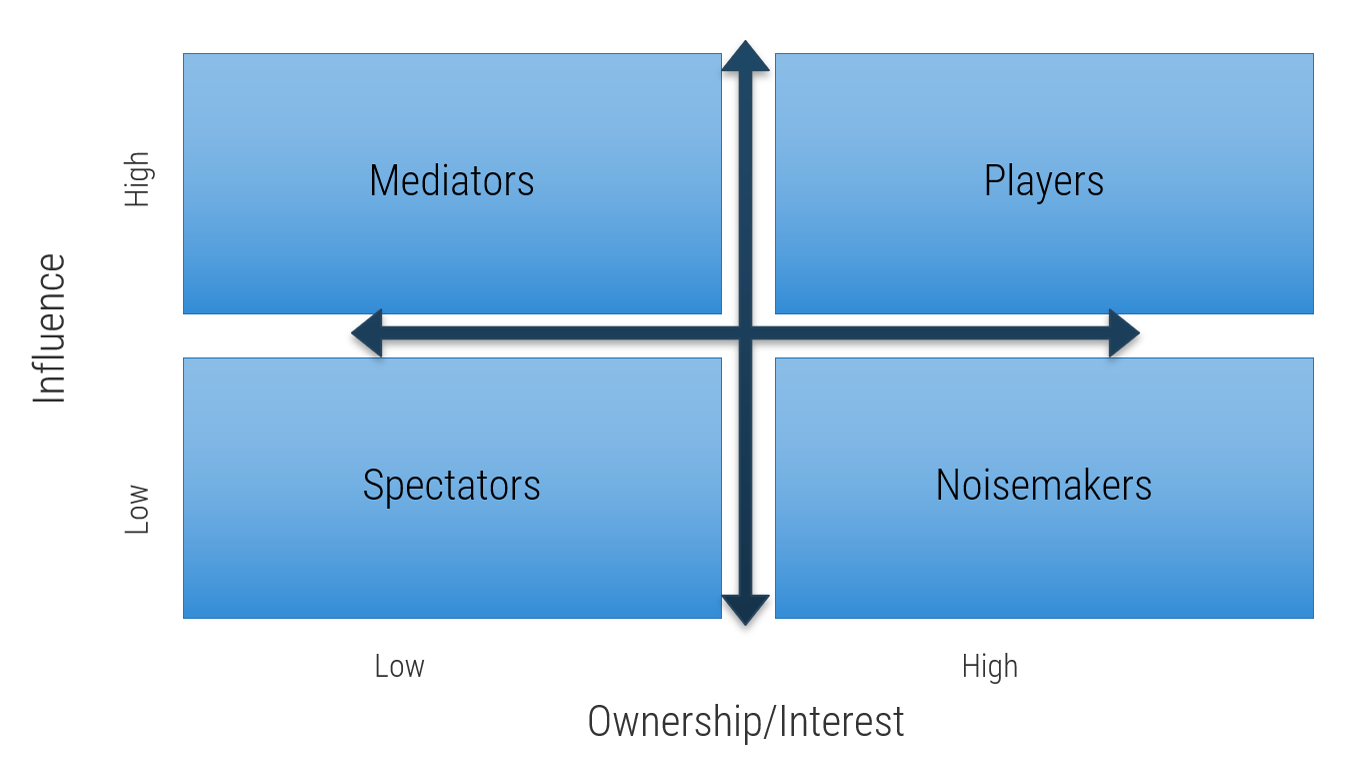

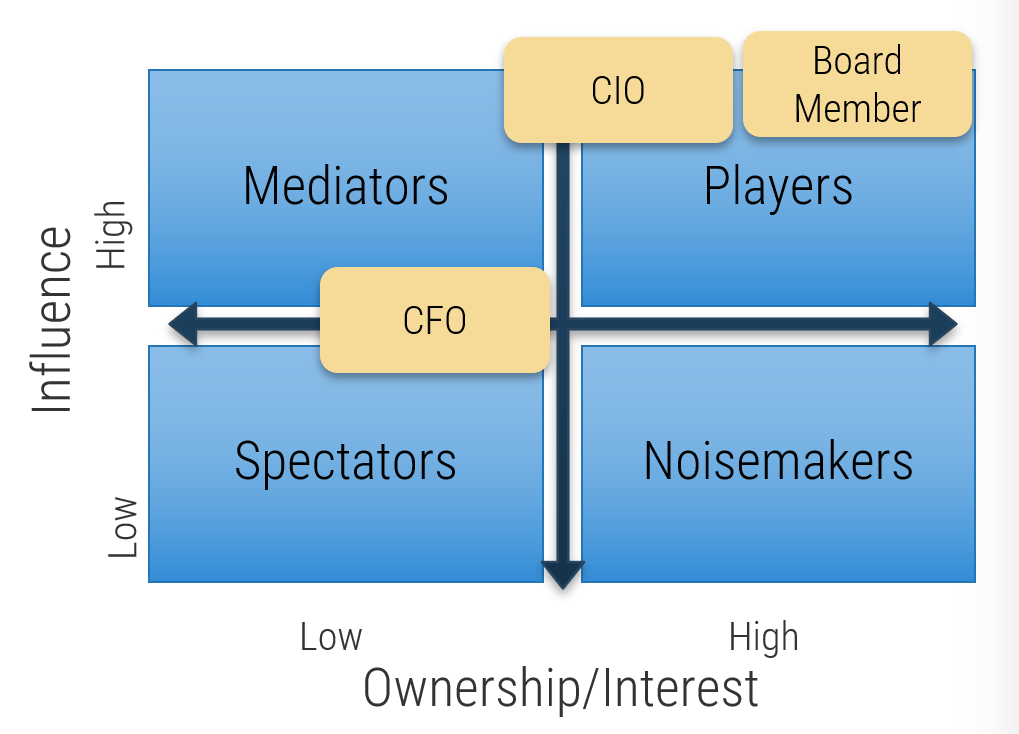

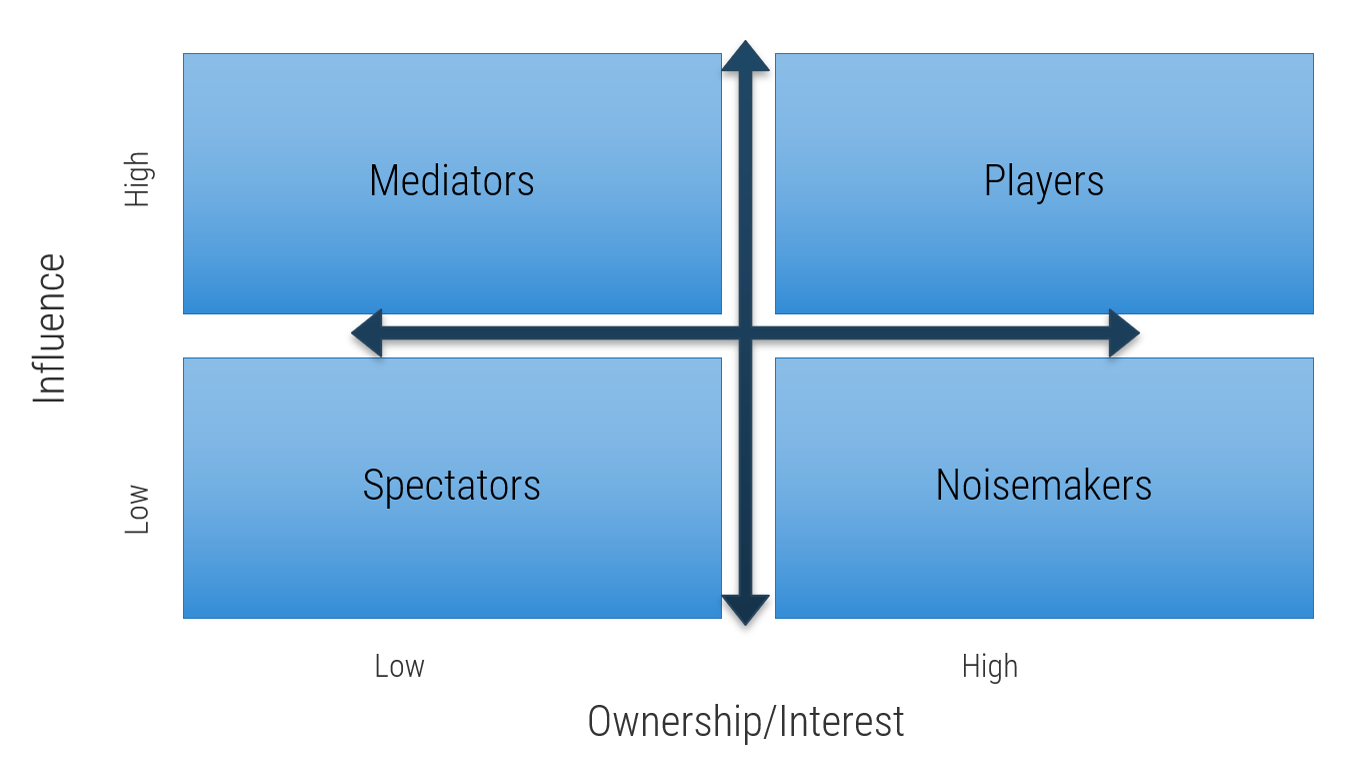

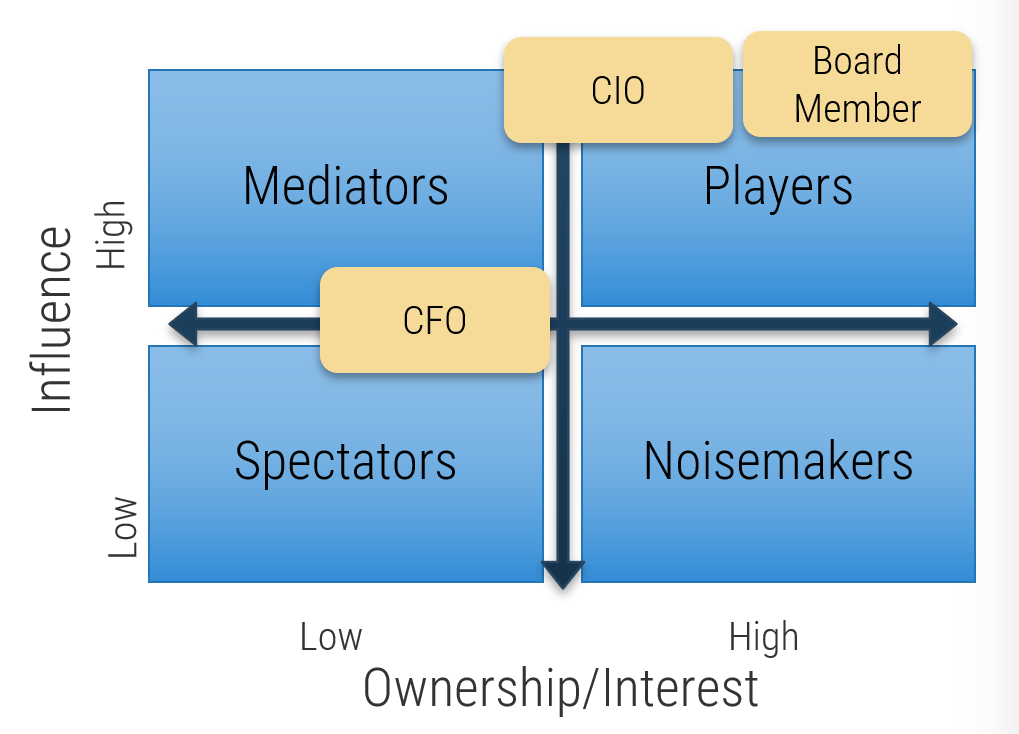

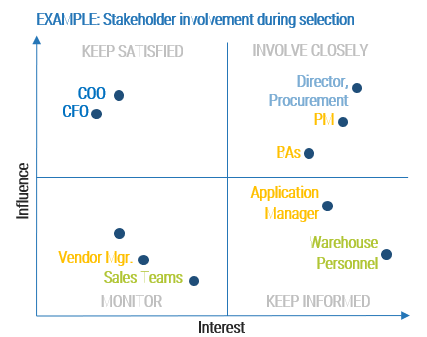

Categorize your stakeholders with a prioritization map

A stakeholder prioritization map helps IT leaders categorize their stakeholders by their level of influence and ownership in the merger, acquisition, or divestiture process.

There are four areas in the map, and the stakeholders within each area should be treated differently.

Players – players have a high interest in the initiative and the influence to effect change over the initiative. Their support is critical, and a lack of support can cause significant impediment to the objectives.

Mediators – mediators have a low interest but significant influence over the initiative. They can help to provide balance and objective opinions to issues that arise.

Noisemakers – noisemakers have low influence but high interest. They tend to be very vocal and engaged, either positively or negatively, but have little ability to enact their wishes.

Spectators – generally, spectators are apathetic and have little influence over or interest in the initiative.

1.1.4 Group stakeholders into categories

30 minutes

Input: Stakeholder map, Stakeholder list

Output: Categorization of stakeholders and influencers

Materials: Flip charts, Markers, Sticky notes, M&A Buy Playbook

Participants: IT executive leadership, Stakeholders

- Identify your stakeholders’ interest in and influence on the M&A process as high, medium, or low by rating the attributes below.

- Map your results to the model to the right to determine each stakeholder’s category.

Level of Influence

- Power: Ability of a stakeholder to effect change.

- Urgency: Degree of immediacy demanded.

- Legitimacy: Perceived validity of stakeholder’s claim.

- Volume: How loud their “voice” is or could become.

- Contribution: What they have that is of value to you.

Level of Interest

How much are the stakeholder’s individual performance and goals directly tied to the success or failure of the product?

Record the results in the M&A Buy Playbook.

Prioritize your stakeholders

There may be too many stakeholders to be able to manage them all. Focus your attention on the stakeholders that matter most.

|

|

|

|

Level of Support

|

|

|

|

|

|

Supporter

|

Evangelist

|

Neutral

|

Blocker

|

| Stakeholder Category

|

Player

|

Critical

|

High

|

High

|

Critical

|

|

|

Mediator

|

Medium

|

Low

|

Low

|

Medium

|

|

|

Noisemaker

|

High

|

Medium

|

Medium

|

High

|

|

|

Spectator

|

Low

|

Irrelevant

|

Irrelevant

|

Low

|

Consider the three dimensions for stakeholder prioritization: influence, interest, and support. Support can be determined by answering the following question: How significant is that stakeholder to the M&A or divestiture process?

These parameters are used to prioritize which stakeholders are most important and should receive your focused attention.

1.1.5 Prioritize your stakeholders

30 minutes

Input: Stakeholder matrix

Output: Stakeholder and influencer prioritization

Materials: Flip charts, Markers, Sticky notes, M&A Buy Playbook

Participants: IT executive leadership, M&A/divestiture stakeholders

- Identify the level of support of each stakeholder by answering the following question: How significant is that stakeholder to the M&A transaction process?

- Prioritize your stakeholders using the prioritization scheme on the previous slide.

Stakeholder

|

Category

|

Level of Support

|

Prioritization

|

| CMO

|

Spectator

|

Neutral

|

Irrelevant

|

| CIO

|

Player

|

Supporter

|

Critical

|

Record the results in the M&A Buy Playbook.

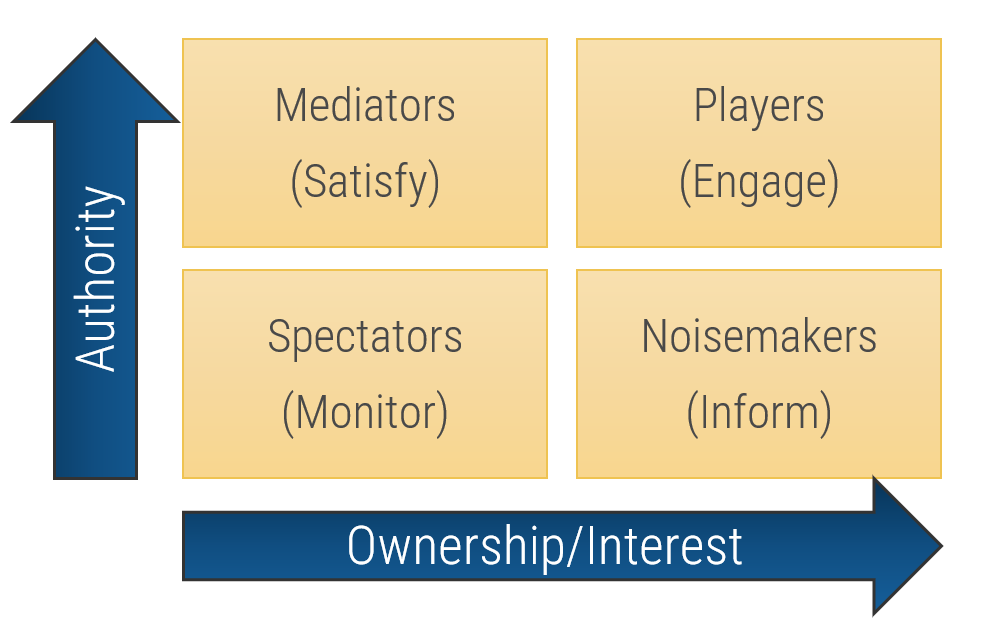

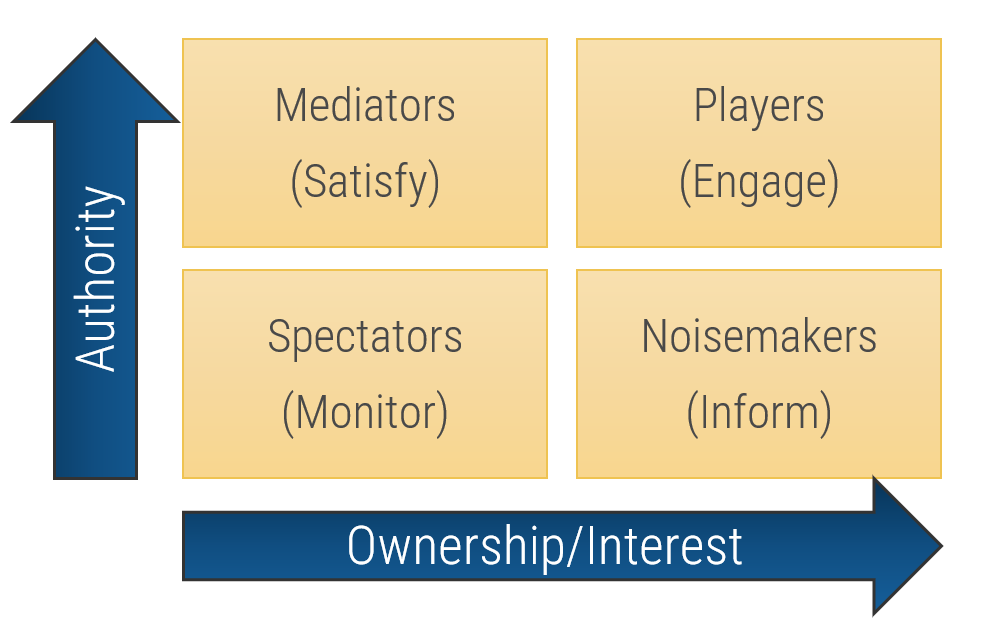

Define strategies for engaging stakeholders by type

Type

|

Quadrant

|

Actions

|

| Players

|

High influence, high interest – actively engage

|

Keep them updated on the progress of the project. Continuously involve Players in the process and maintain their engagement and interest by demonstrating their value to its success.

|

| Mediators

|

High influence, low interest – keep satisfied

|

They can be the game changers in groups of stakeholders. Turn them into supporters by gaining their confidence and trust and including them in important decision-making steps. In turn, they can help you influence other stakeholders.

|

| Noisemakers

|

Low influence, high interest – keep informed

|

Try to increase their influence (or decrease it if they are detractors) by providing them with key information, supporting them in meetings, and using Mediators to help them.

|

| Spectators

|

Low influence, low interest – monitor

|

They are followers. Keep them in the loop by providing clarity on objectives and status updates.

|

Info-Tech Insight

Each group of stakeholders draws attention and resources away from critical tasks. By properly identifying stakeholder groups, the IT executive leader can develop corresponding actions to manage stakeholders in each group. This can dramatically reduce wasted effort trying to satisfy Spectators and Noisemakers while ensuring the needs of Mediators and Players are met.

1.1.6 Plan to communicate

30 minutes

Input: Stakeholder priority, Stakeholder categorization, Stakeholder influence

Output: Stakeholder communication plan

Materials: Flip charts, Markers, Sticky notes, M&A Buy Playbook

Participants: IT executive leadership, M&A/divestiture stakeholders

The purpose of this activity is to make a communication plan for each of the stakeholders identified in the previous activities, especially those who will have a critical role in the M&A transaction process.

- In the M&A Buy Playbook, input the type of influence each stakeholder has on IT, how they would be categorized in the M&A process, and their level of priority. Use this information to create a communication plan.

- Determine the methods and frequency of communication to keep the necessary stakeholder satisfied and maintain or enhance IT’s profile within the organization.

Record the results in the M&A Buy Playbook.

Proactive

Step 1.2

Assess IT’s Current Value and Method to Achieve a Future State

Activities

- 1.2.1 Valuate IT

- 1.2.2 Assess the IT/digital strategy

This step involves the following participants:

- IT executive leader

- IT leadership

- Critical stakeholders to M&A

Outcomes of Step

Identify critical opportunities to optimize IT and meet strategic business goals through a merger, acquisition, or divestiture.

How to valuate your IT environment

And why it matters so much

- Valuating your current organization’s IT environment is a critical step that all IT organizations should take, whether involved in an M&A or not, to fully understand what it might be worth.

- The business investments in IT can be directly translated into a value amount. For every $1 invested in IT, the business might be gaining $100 in value back or possibly even loosing $100.

- Determining, documenting, and communicating this information ensures that the business takes IT’s suggestions seriously and recognizes why investing in IT is so critical.

- There are three ways a business or asset can be valuated:

- Cost Approach: Look at the costs associated with building, purchasing, replacing, and maintaining a given aspect of the business.

- Market Approach: Look at the relative value of a particular aspect of the business. Relative value can fluctuate and depends on what the markets and consequently society believe that particular element is worth.

- Discounted Cash Flow Approach: Focus on what the potential value of the business could be or the intrinsic value anticipated due to future profitability.

(Source: “Valuation Methods,” Corporate Finance Institute)

Four ways to create value through digital

- Reduced costs

- Improved customer experience

- New revenue sources

- Better decision making

(Source: McKinsey & Company)

1.2.1 Valuate IT

1 day

Input: Valuation of data, Valuation of applications, Valuation of infrastructure and operations, Valuation of security and risk

Output: Valuation of IT

Materials: Relevant templates/tools listed on the following slides, Capital budget, Operating budget, M&A Buy Playbook

Participants: IT executive/CIO, IT senior leadership

The purpose of this activity is to demonstrate that IT is not simply an operational functional area that diminishes business resources. Rather, IT contributes significant value to the business.

- Review each of the following slides to valuate IT’s data, applications, infrastructure and operations, and security and risk. These valuations consider several tangible and intangible factors and result in a final dollar amount.

- Input the financial amounts identified for each critical area into a summary slide. Use this information to determine where IT is delivering value to the organization.

Info-Tech Insight

Consistency is key when valuating your IT organization as well as other IT organizations throughout the transaction process.

Record the results in the M&A Buy Playbook.

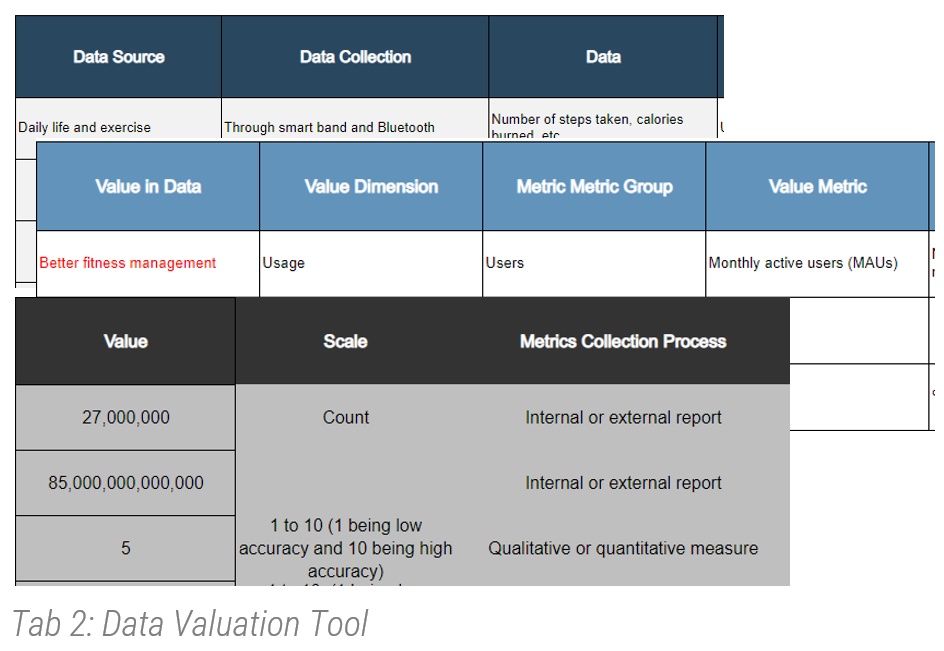

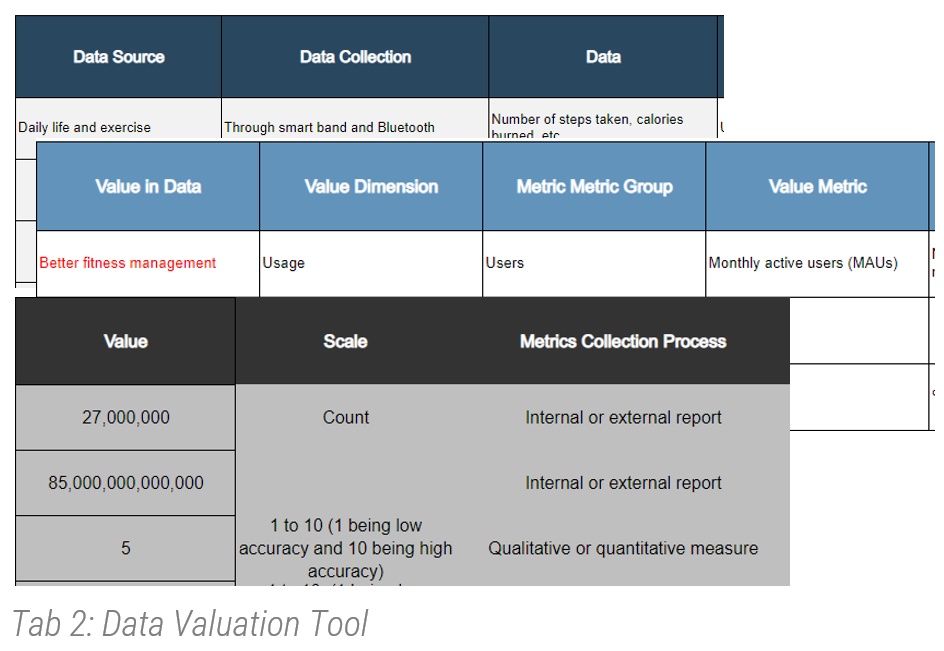

Data valuation

Data valuation identifies how you monetize the information that your organization owns.

Create a data value chain for your organization

When valuating the information and data that exists in an organization, there are many things to consider.

Info-Tech has two tools that can support this process:

- Information Asset Audit Tool: Use this tool first to take inventory of the different information assets that exist in your organization.

- Data Valuation Tool: Once information assets have been accounted for, valuate the data that exists within those information assets.

Data Collection

|

Insight Creation

|

Value Creation

|

Data Valuation

|

01 Data Source

02 Data Collection Method

03 Data

|

04 Data Analysis

05 Insight

06 Insight Delivery

|

07 Consumer

08 Value in Data

|

09 Value Dimension

10 Value Metrics Group

11 Value Metrics

|

Instructions

- Using the Data Valuation Tool, start gathering information based on the eight steps above to understand your organization’s journey from data to value.

- Identify the data value spectrum. (For example: customer sales service, citizen licensing service, etc.)

- Fill out the columns for data sources, data collection, and data first.

- Capture data analysis and related information.

- Then capture the value in data.

- Add value dimensions such as usage, quality, and economic dimensions.

- Remember that economic value is not the only dimension, and usage/quality has a significant impact on economic value.

- Collect evidence to justify your data valuation calculator (market research, internal metrics, etc.).

- Finally, calculate the value that has a direct correlation with underlying value metrics.

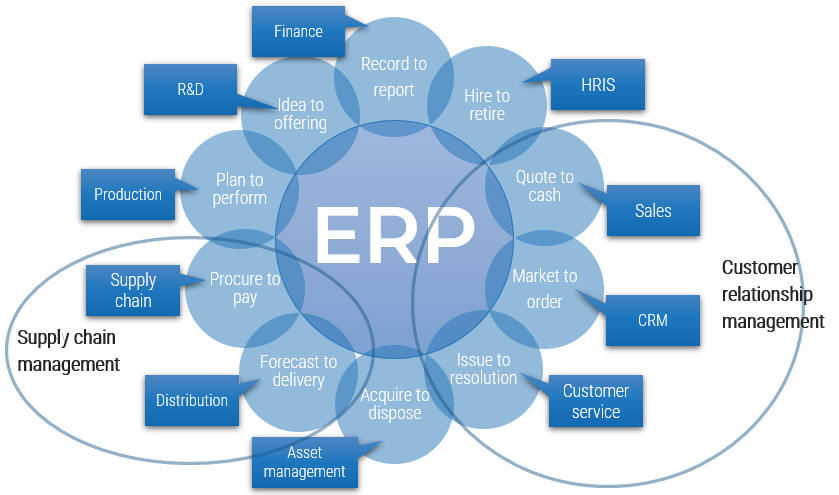

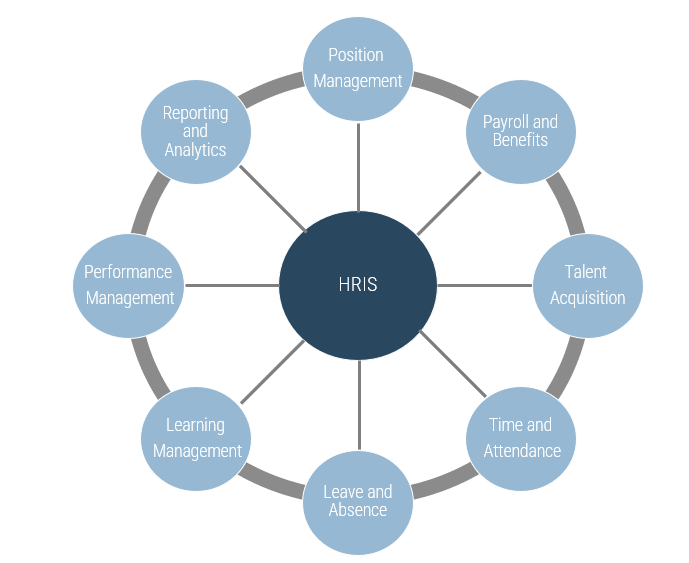

Application valuation

Calculate the value of your IT applications

When valuating the applications and their users in an organization, consider using a business process map. This shows how business is transacted in the company by identifying which IT applications support these processes and which business groups have access to them. Info-Tech has a business process mapping tool that can support this process:

- Enterprise Integration Process Mapping Tool: Complete this tool first to map the different business processes to the supporting applications in your organization.

Instructions

- Start by calculating user costs. This is the product of the (# of users) × (% of time spent using IT) × (fully burdened salary).

- Identify the revenue per employee and divide that by the average cost per employee to calculate the derived productivity ratio (DPR).

- Once you have calculated the user costs and DPR, multiply those total values together to get the application value.

User Costs

|

|

|

Total User Costs

|

Derived Productivity Ratio (DPR)

|

|

Total DPR

|

Application Value

|

| # of users

|

% time spent using IT

|

Fully burdened salary

|

Multiply values from the 3 user costs columns

|

Revenue per employee

|

Average cost per employee

|

(Revenue P.E) ÷ (Average cost P.E)

|

(User costs) X (DPR)

|

- Once the total application value is established, calculate the combined IT and business costs of delivering that value. IT and business costs include inflexibility (application maintenance), unavailability (downtime costs, including disaster exposure), IT costs (common costs statistically allocated to applications), and fully loaded cost of active (full-time equivalent [FTE]) users.

- Calculate the net value of applications by subtracting the total IT and business costs from the total application value calculated in step 3.

IT and Business Costs

|

|

|

|

Total IT and Business Costs

|

Net Value of Applications

|

| Application maintenance

|

Downtime costs (include disaster exposure)

|

Common costs allocated to applications

|

Fully loaded costs of active (FTE) users

|

Sum of values from the four IT and business costs columns

|

(Application value) – (IT and business costs)

|

(Source: CSO)

Infrastructure valuation

Assess the foundational elements of the business’ information technology

The purpose of this exercise is to provide a high-level infrastructure valuation that will contribute to valuating your IT environment.

Calculating the value of the infrastructure will require different methods depending on the environment. For example, a fully cloud-hosted organization will have different costs than a fully on-premises IT environment.

Instructions:

- Start by listing all of the infrastructure-related items that are relevant to your organization.

- Once you have finalized your items column, identify the total costs/value of each item.

- For example, total software costs would include servers and storage.

- Calculate the total cost/value of your IT infrastructure by adding all of values in the right column.

Item

|

Costs/Value

|

| Hardware Assets Total Value

|

+$3.2 million

|

| Hardware Leased/Service Agreement

|

-$

|

| Software Purchased

|

+$

|

| Software Leased/Service Agreement

|

-$

|

| Operational Tools

|

|

| Network

|

|

| Disaster Recovery

|

|

| Antivirus

|

|

| Data Centers

|

|

| Service Desk

|

|

| Other Licenses

|

|

| Total:

|

|

For additional support, download the M&A Runbook for Infrastructure and Operations.

Risk and security

Assess risk responses and calculate residual risk

The purpose of this exercise is to provide a high-level risk assessment that will contribute to valuating your IT environment. For a more in-depth risk assessment, please refer to the Info-Tech tools below:

- Risk Register Tool

- Security M&A Due Diligence Tool

Instructions

- Review the probability and impact scales below and ensure you have the appropriate criteria that align to your organization before you conduct a risk assessment.

- Identify the probability of occurrence and estimated financial impact for each risk category detail and fill out the table on the right. Customize the table as needed so it aligns to your organization.

Probability of Risk Occurrence

|

Occurrence Criteria

(Classification; Probability of Risk Event Within One Year)

|

| Negligible

|

Very Unlikely; ‹20%

|

| Very Low

|

Unlikely; 20 to 40%

|

| Low

|

Possible; 40 to 60%

|

| Moderately Low

|

Likely; 60 to 80%

|

| Moderate

|

Almost Certain; ›80%

|

Note: If needed, you can customize this scale with the severity designations that you prefer. However, make sure you are always consistent with it when conducting a risk assessment.

Financial & Reputational Impact

|

Budgetary and Reputational Implications

(Financial Impact; Reputational Impact)

|

| Negligible

|

(‹$10,000; Internal IT stakeholders aware of risk event occurrence)

|

| Very Low

|

($10,000 to $25,000; Business customers aware of risk event occurrence)

|

| Low

|

($25,000 to $50,000; Board of directors aware of risk event occurrence)

|

| Moderately Low

|

($50,000 to $100,000; External customers aware of risk event occurrence)

|

| Moderate

|

(›$100,000; Media coverage or regulatory body aware of risk event occurrence)

|

Risk Category Details

|

Probability of Occurrence

|

Estimated Financial Impact

|

Estimated Severity (Probability X Impact)

|

| Capacity Planning

|

| Enterprise Architecture

|

| Externally Originated Attack

|

| Hardware Configuration Errors

|

| Hardware Performance

|

| Internally Originated Attack

|

| IT Staffing

|

| Project Scoping

|

| Software Implementation Errors

|

| Technology Evaluation and Selection

|

| Physical Threats

|

| Resource Threats

|

| Personnel Threats

|

| Technical Threats

|

| Total:

|

1.2.2 Assess the IT/digital strategy

4 hours

Input: IT strategy, Digital strategy, Business strategy

Output: An understanding of an executive business stakeholder’s perception of IT, Alignment of IT/digital strategy and overall organization strategy

Materials: Computer, Whiteboard and markers, M&A Buy Playbook

Participants: IT executive/CIO, Business executive/CEO

The purpose of this activity is to review the business and IT strategies that exist to determine if there are critical capabilities that are not being supported.

Ideally, the IT and digital strategies would have been created following development of the business strategy. However, sometimes the business strategy does not directly call out the capabilities it requires IT to support.

- On the left half of the corresponding slide in the M&A Buy Playbook, document the business goals, initiatives, and capabilities. Input this information from the business or digital strategies. (If more space for goals, initiatives, or capabilities is needed, duplicate the slide).

- On the other half of the slide, document the IT goals, initiatives, and capabilities. Input this information from the IT strategy and digital strategy.

For additional support, see Build a Business-Aligned IT Strategy.

Record the results in the M&A Buy Playbook.

Proactive

Step 1.3

Drive Innovation and Suggest Growth Opportunities

Activities

- 1.3.1 Determine pain points and opportunities

- 1.3.2 Align goals with opportunities

- 1.3.3 Recommend growth opportunities

This step involves the following participants:

- IT executive leader

- IT leadership

- Critical M&A stakeholders

Outcomes of Step

Establish strong relationships with critical M&A stakeholders and position IT as an innovative business partner that can suggest growth opportunities.

1.3.1 Determine pain points and opportunities

1-2 hours

Input: CEO-CIO Alignment diagnostic, CIO Business Vision diagnostic, Valuation of IT environment, IT-business goals cascade

Output: List of pain points or opportunities that IT can address

Materials: Computer, Whiteboard and markers, M&A Buy Playbook

Participants: IT executive/CIO, IT senior leadership, Business stakeholders

The purpose of this activity is to determine the pain points and opportunities that exist for the organization. These can be external or internal to the organization.

- Identify what opportunities exist for your organization. Opportunities are the potential positives that the organization would want to leverage.

- Next, identify pain points, which are the potential negatives that the organization would want to alleviate.

- Spend time considering all the options that might exist, and keep in mind what has been identified previously.

Opportunities and pain points can be trends, other departments’ initiatives, business perspectives of IT, etc.

Record the results in the M&A Buy Playbook.

1.3.2 Align goals with opportunities

1-2 hours

Input: CEO-CIO Alignment diagnostic, CIO Business Vision diagnostic, Valuation of IT environment, IT-business goals cascade, List of pain points and opportunities

Output: An understanding of an executive business stakeholder’s perception of IT, Foundations for growth strategy

Materials: Computer, Whiteboard and markers, M&A Buy Playbook

Participants: IT executive/CIO, IT senior leadership, Business stakeholders

The purpose of this activity is to determine whether a growth or separation strategy might be a good suggestion to the business in order to meet its business objectives.

- For the top three to five business goals, consider:

- Underlying drivers

- Digital opportunities

- Whether a growth or reduction strategy is the solution

- Just because a growth or reduction strategy is a solution for a business goal does not necessarily indicate M&A is the way to go. However, it is important to consider before you pursue suggesting M&A.

Record the results in the M&A Buy Playbook.

1.3.3 Recommend growth opportunities

1-2 hours

Input: Growth or separation strategy opportunities to support business goals, Stakeholder communication plan, Rationale for the suggestion

Output: M&A transaction opportunities suggested

Materials: M&A Buy Playbook

Participants: IT executive/CIO, Business executive/CEO

The purpose of this activity is to recommend a merger, acquisition, or divestiture to the business.

- Identify which of the business goals the transaction would help solve and why IT is the one to suggest such a goal.

- Leverage the stakeholder communication plan identified previously to give insight into stakeholders who would have a significant level of interest, influence, or support in the process.

Info-Tech Insight

With technology and digital driving many transactions, leverage this opening and begin the discussions with your business on how and why an acquisition would be a great opportunity.

Record the results in the M&A Buy Playbook.

By the end of this Proactive phase, you should:

Be prepared to suggest M&A opportunities to support your company’s goals through growth or acquisition transactions

Key outcome from the Proactive phase

Develop progressive relationships and strong communication with key stakeholders to suggest or be aware of transformational opportunities that can be achieved through growth or reduction strategies such as mergers, acquisitions, or divestitures.

Key deliverables from the Proactive phase

- Business perspective of IT examined

- Key stakeholders identified and relationship to the M&A process outlined

- Ability to valuate the IT environment and communicate IT’s value to the business

- Assessment of the business, digital, and IT strategies and how M&As could support those strategies

- Pain points and opportunities that could be alleviated or supported through an M&A transaction

- Acquisition or buying recommendations

The Buy Blueprint

Phase 2

Discovery & Strategy

| Phase 1 | Phase 2 | Phase 3 | Phase 4 |

- 1.1 Identify Stakeholders and Their Perspective of IT

- 1.2 Assess IT’s Current Value and Future State

- 1.3 Drive Innovation and Suggest Growth Opportunities

|

- 2.1 Establish the M&A Program Plan

- 2.2 Prepare IT to Engage in the Acquisition

|

- 3.1 Assess the Target Organization

- 3.2 Prepare to Integrate

|

- 4.1 Execute the Transaction

- 4.2 Reflection and Value Realization

|

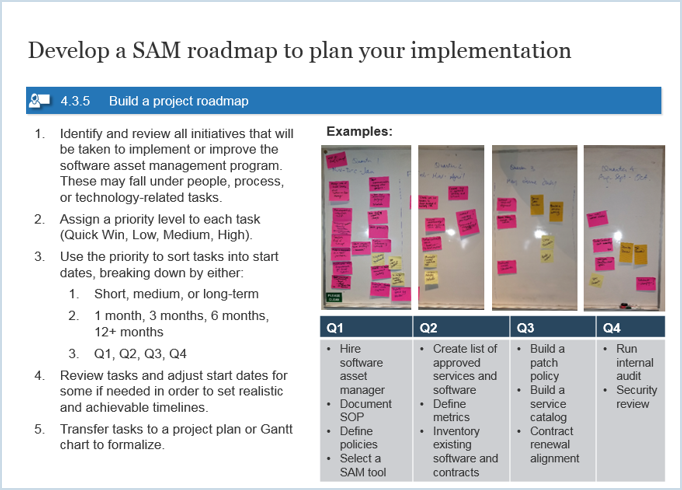

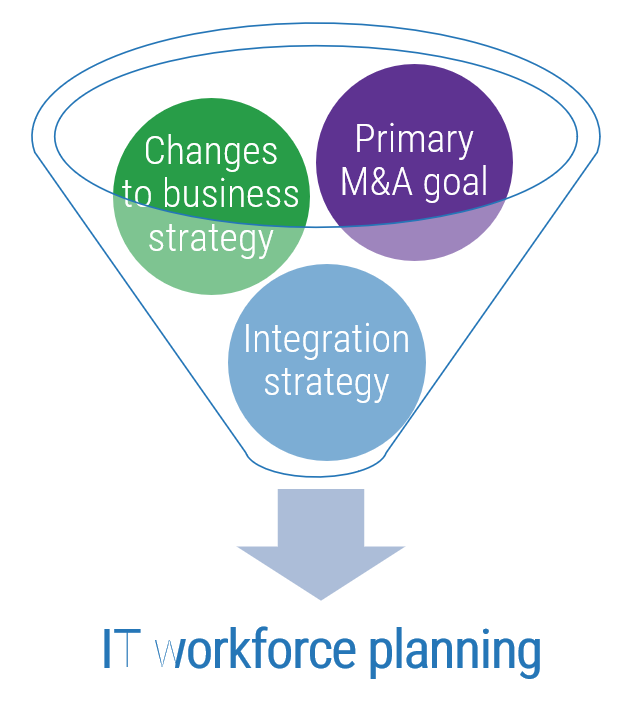

This phase will walk you through the following activities:

- Create the mission and vision

- Identify the guiding principles

- Create the future-state operating model

- Determine the transition team

- Document the M&A governance

- Create program metrics

- Establish the integration strategy

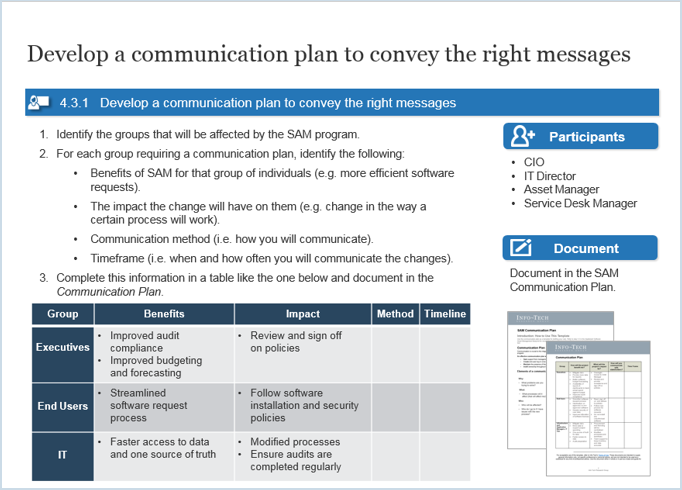

- Conduct a RACI

- Create the communication plan

- Assess the potential organization(s)

This phase involves the following participants:

- IT executive/CIO

- IT senior leadership

- Company M&A team

Workshop Overview

Contact your account representative for more information.

workshops@infotech.com 1-888-670-8889

| Pre-Work | Day 1 | Day 2 | Day 3 | Day 4 | Day 5 |

| Establish the Transaction Foundation | Discover the Motivation for Acquiring | Formalize the Program Plan | Create the Valuation Framework | Strategize the Transaction | Next Steps and Wrap-Up (offsite) |

Activities |

- 0.1 Conduct the CIO Business Vision and CEO-CIO Alignment diagnostics

- 0.2 Identify key stakeholders and outline their relationship to the M&A process

- 0.3 Identify the rationale for the company's decisions to pursue an acquisition

|

- 1.1 Review the business rationale for the acquisition

- 1.2 Assess the IT/digital strategy

- 1.3 Identify pain points and opportunities tied to the acquisition

- 1.4 Create the IT vision statement, create the IT mission statement, and identify IT guiding principles

|

- 2.1 Create the future-state operating model

- 2.2 Determine the transition team

- 2.3 Document the M&A governance

- 2.4 Establish program metrics

|

- 3.1 Valuate your data

- 3.2 Valuate your applications

- 3.3 Valuate your infrastructure

- 3.4 Valuate your risk and security

- 3.5 Combine individual valuations to make a single framework

|

- 4.1 Establish the integration strategy

- 4.2 Conduct a RACI

- 4.3 Review best practices for assessing target organizations

- 4.4 Create the communication plan

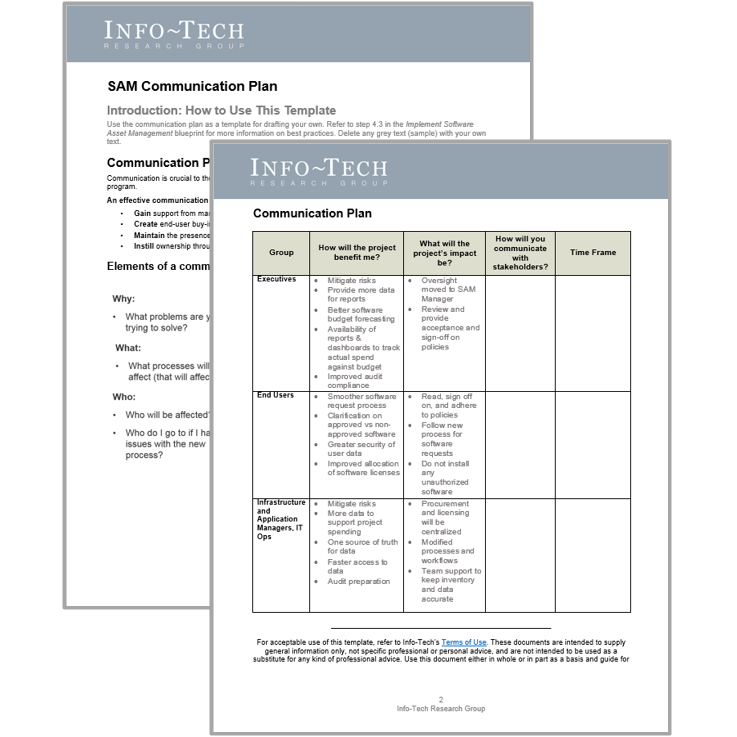

|

- 5.1 Complete in-progress deliverables from previous four days

- 5.2 Set up review time for workshop deliverables and to discuss next steps

|

Deliverables |

- Business perspectives of IT

- Stakeholder network map for M&A transactions

|

- Business context implications for IT

- IT’s acquisition strategic direction

|

- Operating model for future state

- Transition team

- Governance structure

- M&A program metrics

|

- IT valuation framework

|

- Integration strategy

- RACI

- Communication plan

|

- Completed M&A program plan and strategy

- Prepared to assess target organization(s)

|

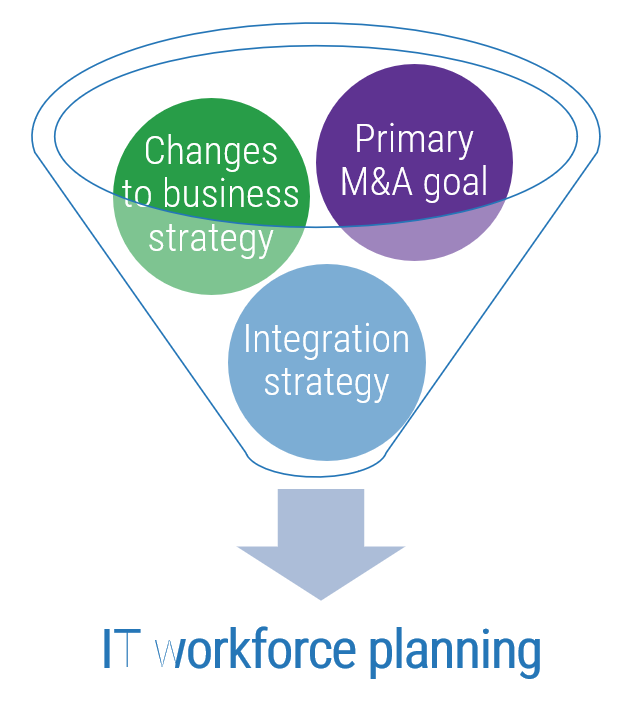

What is the Discovery & Strategy phase?

Pre-transaction state

The Discovery & Strategy phase during an acquisition is a unique opportunity for many IT organizations. IT organizations that can participate in the acquisition transaction at this stage are likely considered a strategic partner of the business.

For one-off acquisitions, IT being invited during this stage of the process is rare. However, for organizations that are preparing to engage in many acquisitions over the coming years, this type of strategy will greatly benefit from IT involvement. Again, the likelihood of participating in an M&A transaction is increasing, making it a smart IT leadership decision to, at the very least, loosely prepare a program plan that can act as a strategic pillar throughout the transaction.

During this phase of the pre-transaction state, IT will also be asked to participate in ensuring that the potential organization being sought will be able to meet any IT-specific search criteria that was set when the transaction was put into motion.

Goal: To identify a repeatable program plan that IT can leverage when acquiring all or parts of another organization’s IT environment, ensuring customer satisfaction and business continuity

Discovery & Strategy Prerequisite Checklist

Before coming into the Discovery & Strategy phase, you should have addressed the following:

- Understand the business perspective of IT.

- Know the key stakeholders and have outlined their relationships to the M&A process.

- Be able to valuate the IT environment and communicate IT's value to the business.

- Understand the rationale for the company's decisions to pursue an acquisition and the opportunities or pain points the acquisition should address.

Discovery & Strategy

Step 2.1

Establish the M&A Program Plan

Activities

- 2.1.1 Create the mission and vision

- 2.1.2 Identify the guiding principles

- 2.1.3 Create the future-state operating model

- 2.1.4 Determine the transition team

- 2.1.5 Document the M&A governance

- 2.1.6 Create program metrics

This step involves the following participants:

- IT executive/CIO

- IT senior leadership

- Company M&A team

Outcomes of Step

Establish an M&A program plan that can be repeated across acquisitions.

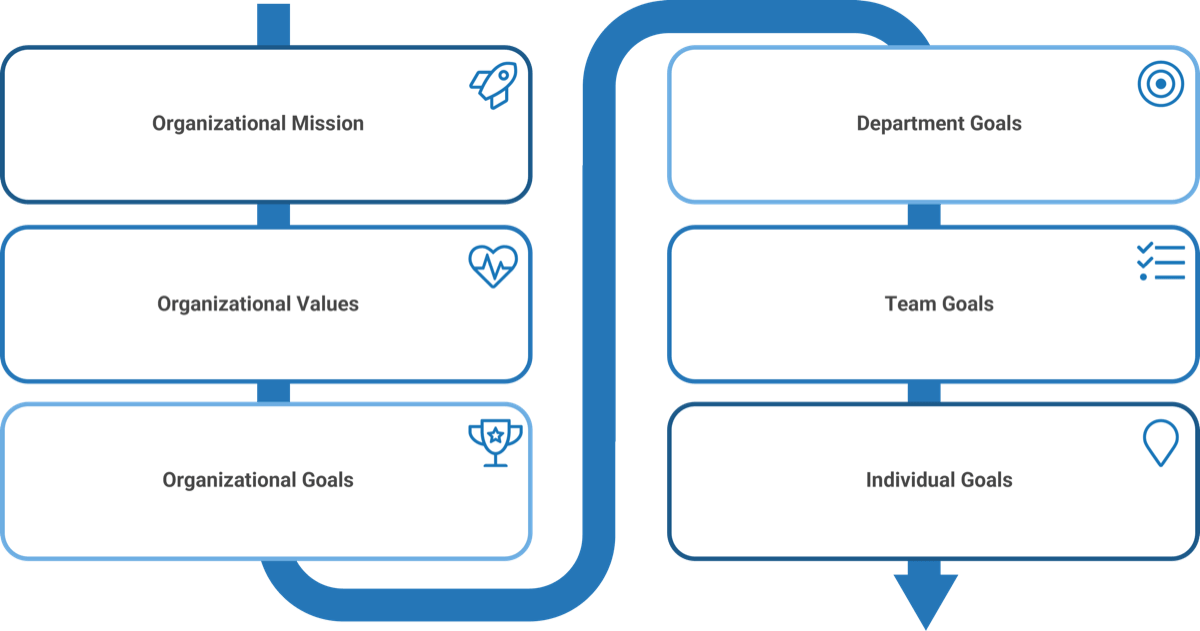

The vision and mission statements clearly articulate IT’s aspirations and purpose

The IT vision statement communicates a desired future state of the IT organization, whereas the IT mission statement portrays the organization’s reason for being. While each serves its own purpose, they should both be derived from the business context implications for IT.

|

|

Vision Statements

|

Mission Statements

|

Characteristics

|

- Describe a desired future

- Focus on ends, not means

- Concise

- Aspirational

- Memorable

|

- Articulate a reason for existence

- Focus on how to achieve the vision

- Concise

- Easy to grasp

- Sharply focused

- Inspirational

|

Samples

|

To be a trusted advisor and partner in enabling business innovation and growth through an engaged IT workforce. (Source: Business News Daily)

|

IT is a cohesive, proactive, and disciplined team that delivers innovative technology solutions while demonstrating a strong customer-oriented mindset. (Source: Forbes, 2013)

|

2.1.1 Create the mission and vision statements

2 hours

Input: Business objectives, IT capabilities, Rationale for the transaction

Output: IT’s mission and vision statements for growth strategies tied to mergers, acquisitions, and divestitures

Materials: Flip charts/whiteboard, Markers, M&A Buy Playbook

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to create mission and vision statements that reflect IT’s intent and method to support the organization as it pursues a growth strategy.

- Review the definitions and characteristics of mission and vision statements.

- Brainstorm different versions of the mission and vision statements.

- Edit the statements until you get to a single version of each that accurately reflects IT’s role in the growth process.

Record the results in the M&A Buy Playbook.

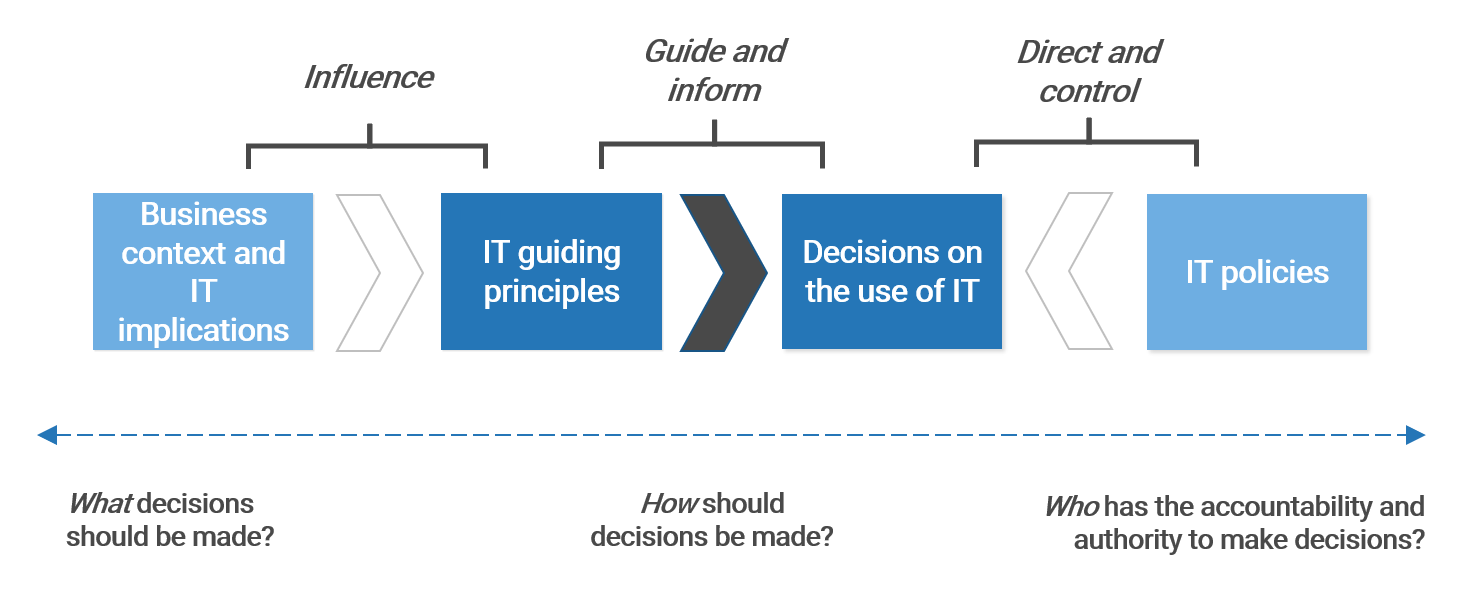

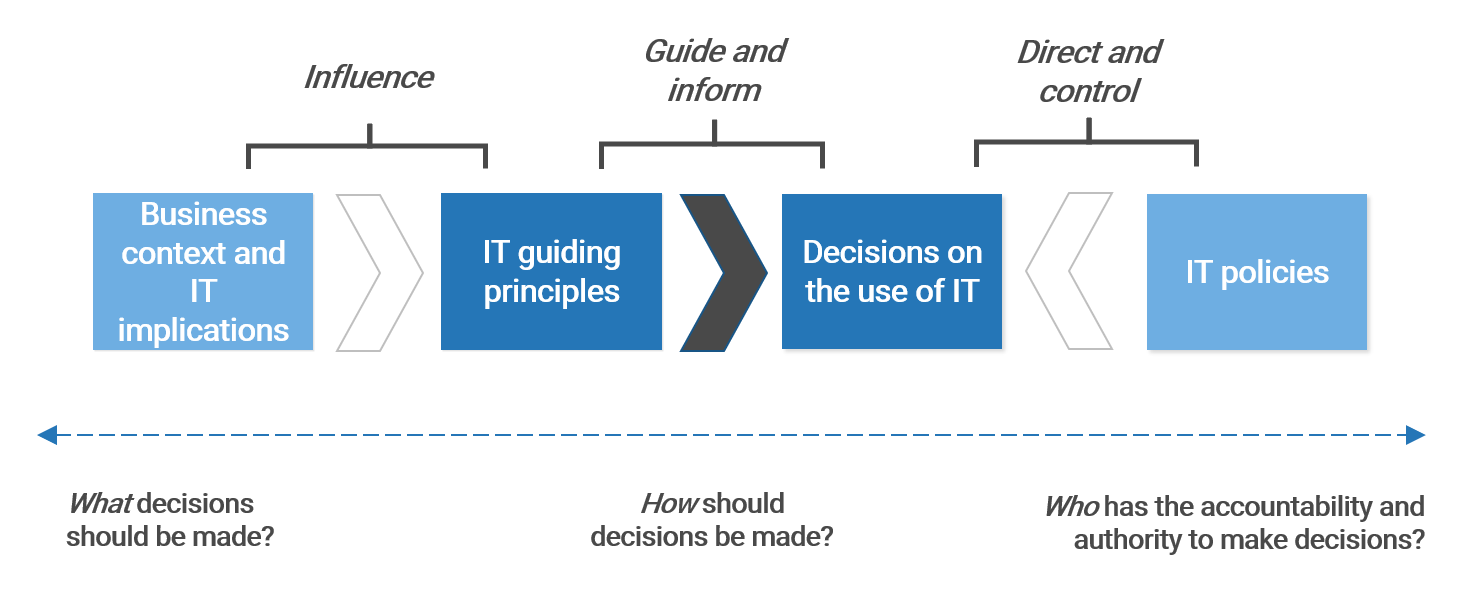

Guiding principles provide a sense of direction

IT guiding principles are shared, long-lasting beliefs that guide the use of IT in constructing, transforming, and operating the enterprise by informing and restricting IT investment portfolio management, solution development, and procurement decisions.

IT principles must be carefully constructed to make sure they are adhered to and relevant

Info-Tech has identified a set of characteristics that IT principles should possess. These characteristics ensure the IT principles are relevant and followed in the organization.

Approach focused. IT principles should be focused on the approach – how the organization is built, transformed, and operated – as opposed to what needs to be built, which is defined by both functional and non-functional requirements.

Business relevant. Create IT principles that are specific to the organization. Tie IT principles to the organization’s priorities and strategic aspirations.

Long lasting. Build IT principles that will withstand the test of time.

Prescriptive. Inform and direct decision making with actionable IT principles. Avoid truisms, general statements, and observations.

Verifiable. If compliance can’t be verified, people are less likely to follow the principle.

Easily Digestible. IT principles must be clearly understood by everyone in IT and by business stakeholders. IT principles aren’t a secret manuscript of the IT team. IT principles should be succinct; wordy principles are hard to understand and remember.

Followed. Successful IT principles represent a collection of beliefs shared among enterprise stakeholders. IT principles must be continuously communicated to all stakeholders to achieve and maintain buy-in.

In organizations where formal policy enforcement works well, IT principles should be enforced through appropriate governance processes.

Consider the example principles below

IT Principle Name

|

IT Principle Statement

|

| 1. Risk Management

|

We will ensure that the organization’s IT Risk Management Register is properly updated to reflect all potential risks and that a plan of action against those risks has been identified.

|

| 2. Transparent Communication

|

We will ensure employees are spoken to with respect and transparency throughout the transaction process.

|

| 3. Integration for Success

|

We will create an integration strategy that enables the organization and clearly communicates the resources required to succeed.

|

| 4. Managed Data

|

We will handle data creation, modification, integration, and use across the enterprise in compliance with our data governance policy.

|

| 5. Establish a single IT Environment

|

We will identify, prioritize, and manage the applications and services that IT provides in order to eliminate redundant technology and maximize the value that users and customers experience.

|

| 6. Compliance With Laws and Regulations

|

We will operate in compliance with all applicable laws and regulations for both our organization and the potentially purchased organization.

|

| 7. Defined Value

|

We will create a plan of action that aligns with the organization’s defined value expectations.

|

| 8. Network Readiness

|

We will ensure that employees and customers have immediate access to the network with minimal or no outages.

|

| 9. Operating to Succeed

|

We will bring all of IT into a central operating model within two years of the transaction.

|

2.1.2 Identify the guiding principles

2 hours

Input: Business objectives, IT capabilities, Rationale for the transaction, Mission and vision statements

Output: IT’s guiding principles for growth strategies tied to mergers, acquisitions, and divestitures

Materials: Flip charts/whiteboard, Markers, M&A Buy Playbook

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to create the guiding principles that will direct the IT organization throughout the growth strategy process.

- Review the role of guiding principles and the examples of guiding principles that organizations have used.

- Brainstorm different versions of the guiding principles. Each guiding principle should start with the phrase “We will…”

- Edit and consolidate the statements until you have a list of approximately eight to ten statements that accurately reflect IT’s role in the growth process.

- Review the guiding principles every six months to ensure they continue to support the delivery of the business’ growth strategy goals.

Record the results in the M&A Buy Playbook.

Create two IT teams to support the transaction

IT M&A Transaction Team

- The IT M&A Transaction Team should consist of the strongest members of the IT team who can be expected to deliver on unusual or additional tasks not asked of them in normal day-to-day operations.

- The roles selected for this team will have very specific skills sets or deliver on critical integration capabilities, making their involvement in the combination of two or more IT environments paramount.

- These individuals need to have a history of proving themselves very trustworthy, as they will likely be required to sign an NDA as well.

- Expect to have to certain duplicate capabilities or roles across the M&A transaction team and operational team.

IT Operational Team

- This group is responsible for ensuring the business operations continue.

- These employees might be those who are newer to the organization but can be counted on to deliver consistent IT services and products.

- The roles of this team should ensure that end users or external customers remain satisfied.

Key capabilities to support M&A

Consider the following capabilities when looking at who should be a part of the M&A transaction team.

Employees who have a significant role in ensuring that these capabilities are being delivered will be a top priority.

Infrastructure

- Systems Integration

- Data Management

Business Focus

- Service-Level Management

- Enterprise Architecture

- Stakeholder Management

- Project Management

Risk & Security

- Privacy Management

- Security Management

- Risk & Compliance Management

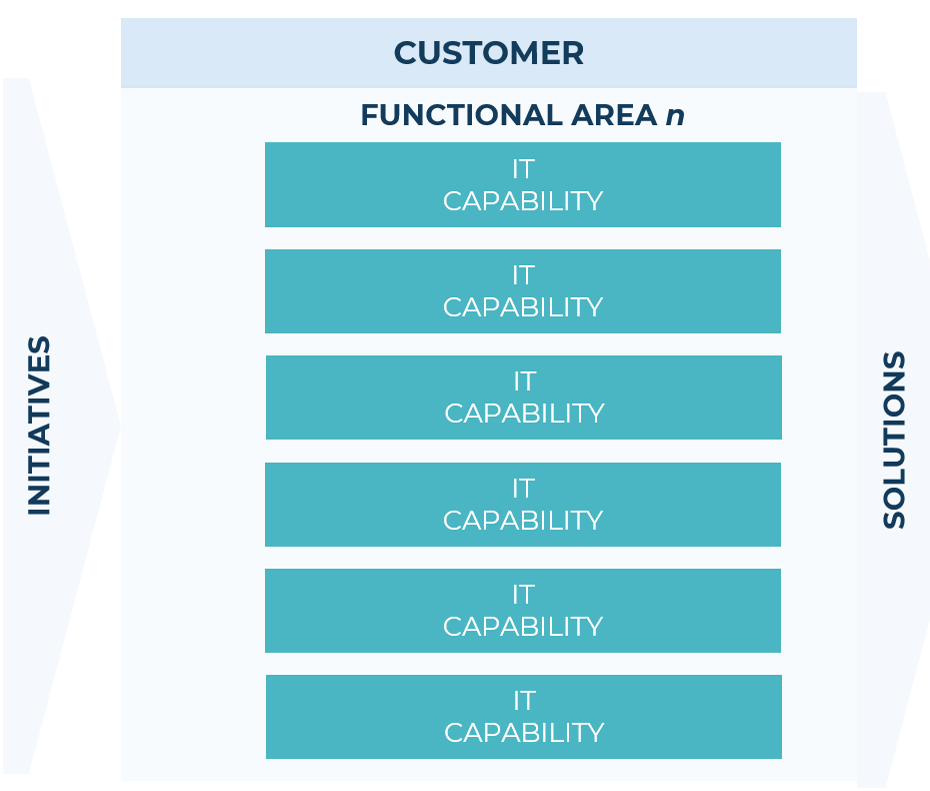

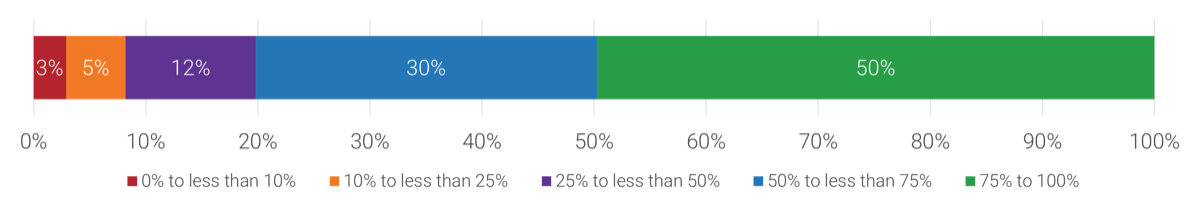

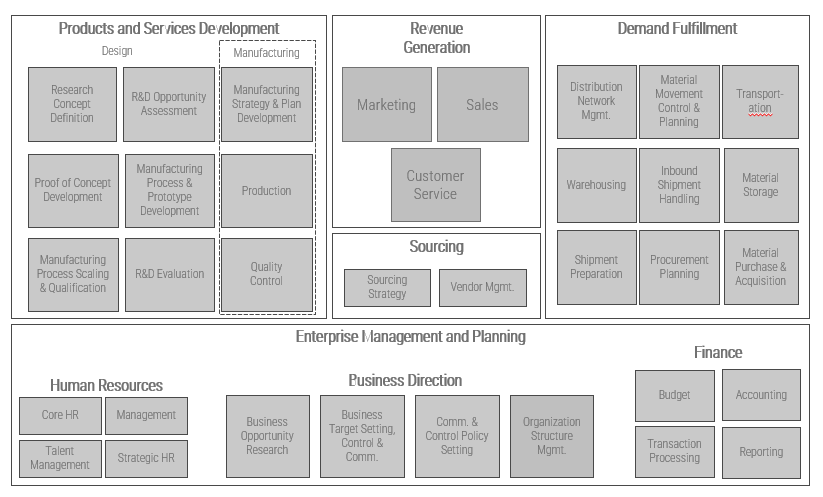

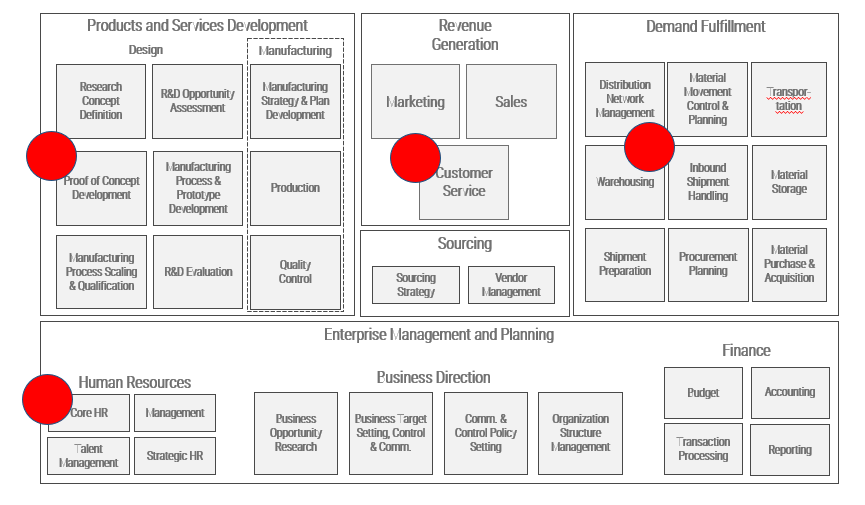

Build a lasting and scalable operating model

An operating model is an abstract visualization, used like an architect’s blueprint, that depicts how structures and resources are aligned and integrated to deliver on the organization’s strategy.

It ensures consistency of all elements in the organizational structure through a clear and coherent blueprint before embarking on detailed organizational design.

The visual should highlight which capabilities are critical to attaining strategic goals and clearly show the flow of work so that key stakeholders can understand where inputs flow in and outputs flow out of the IT organization.

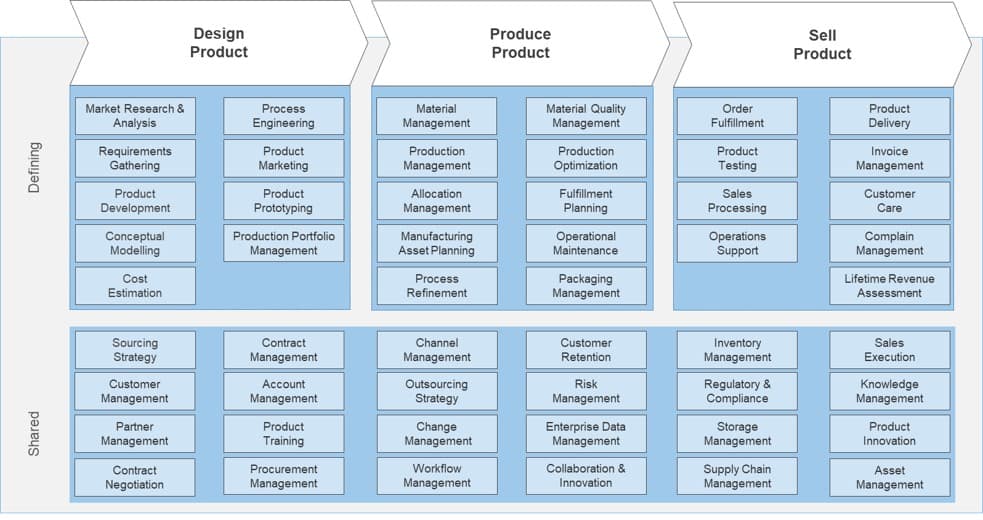

As you assess the current operating model, consider the following:

- Does the operating model contain all the necessary capabilities your IT organization requires to be successful?

- What capabilities should be duplicated?

- Are there individuals with the skill set to support those roles? If not, is there a plan to acquire or develop those skills?

- A dedicated project team strictly focused on M&A is great. However, is it feasible for your organization? If not, what blockers exist?

Info-Tech Insight

Investing time up-front getting the operating model right is critical. This will give you a framework to rationalize future organizational changes, allowing you to be more iterative and allowing your model to change as the business changes.

2.1.3 Create the future-state operating model

4 hours

Input: Current operating model, IT strategy, IT capabilities, M&A-specific IT capabilities, Business objectives, Rationale for the transaction, Mission and vision statements

Output: Future-state operating model

Materials: Operating model, Capability overlay, Flip charts/whiteboard, Markers, M&A Buy Playbook

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to establish what the future-state operating model will be if your organization needs to adjust to support a growth transaction.

- Ensuring that all the IT capabilities are identified by the business and IT strategy, document your organization’s current operating model.

- Identify what core capabilities would be critical to the buying transaction process and integration. Highlight and make copies of those capabilities in the M&A Buy Playbook.

- Arrange the capabilities to clearly show the flow of inputs and outputs. Identify critical stakeholders of the process (such as customers or end users) if that will help the flow.

- Ensure the capabilities that will be decentralized are clearly identified. Decentralized capabilities do not exist within the central IT organization but rather in specific lines of businesses or products to better understand needs and deliver on the capability.

An example operating model is included in the M&A Buy Playbook. This process benefits from strong reference architecture and capability mapping ahead of time.

Record the results in the M&A Buy Playbook.

2.1.4 Determine the transition team

3 hours

Input: IT capabilities, Future-state operating model, M&A-specific IT capabilities, Business objectives, Rationale for the transaction, Mission and vision statements

Output: Transition team

Materials: Reference architecture, Organizational structure, Flip charts/whiteboard, Markers

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to create a team that will support your IT organization throughout the transaction. Determining which capabilities and therefore which roles will be required ensures that the business will continue to get the operational support it needs.

- Based on the outcome of activity 2.1.3, review the capabilities that your organization will require on the transition team. Group capabilities into functional groups containing capabilities that are aligned well with one another because they have similar responsibilities and functionalities.

- Replace the capabilities with roles. For example, stakeholder management, requirements gathering, and project management might be one functional group. Project management and stakeholder management might combine to create a project manager role.

- Review the examples in the M&A Buy Playbook and identify which roles will be a part of the transition team.

For more information, see Redesign Your Organizational Structure

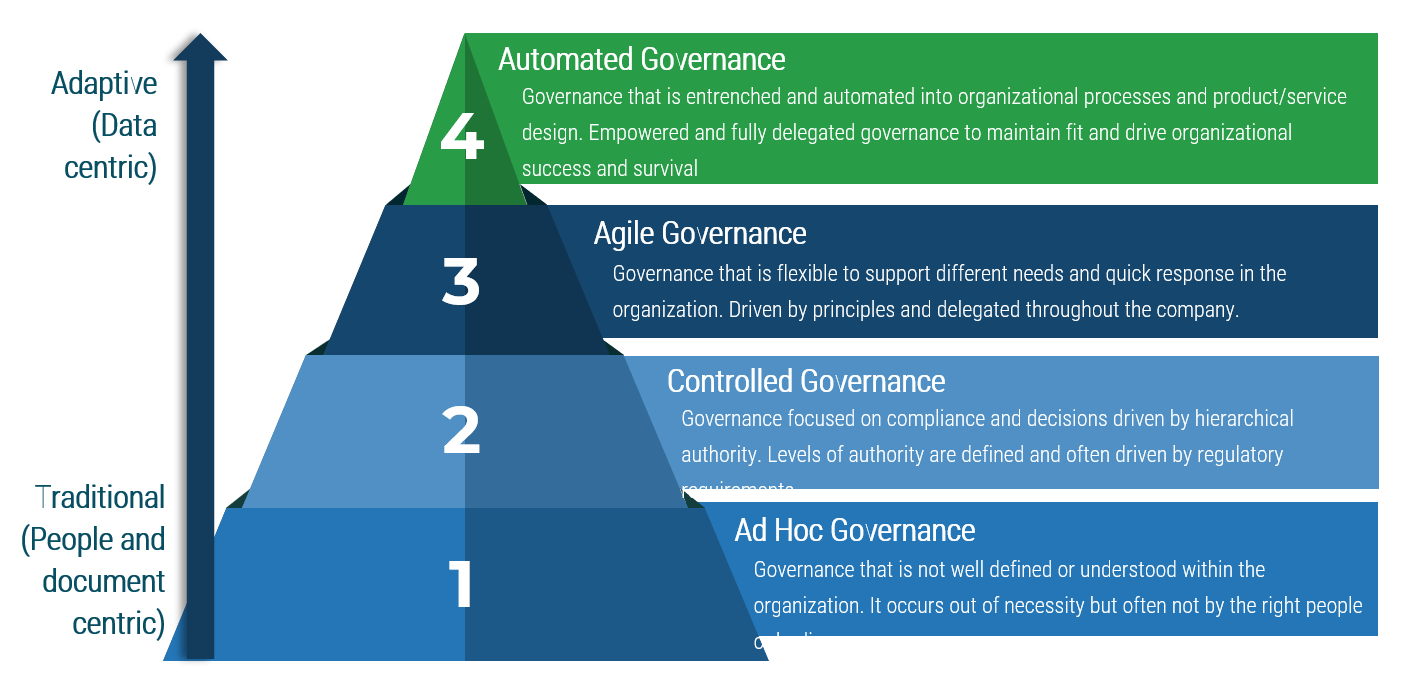

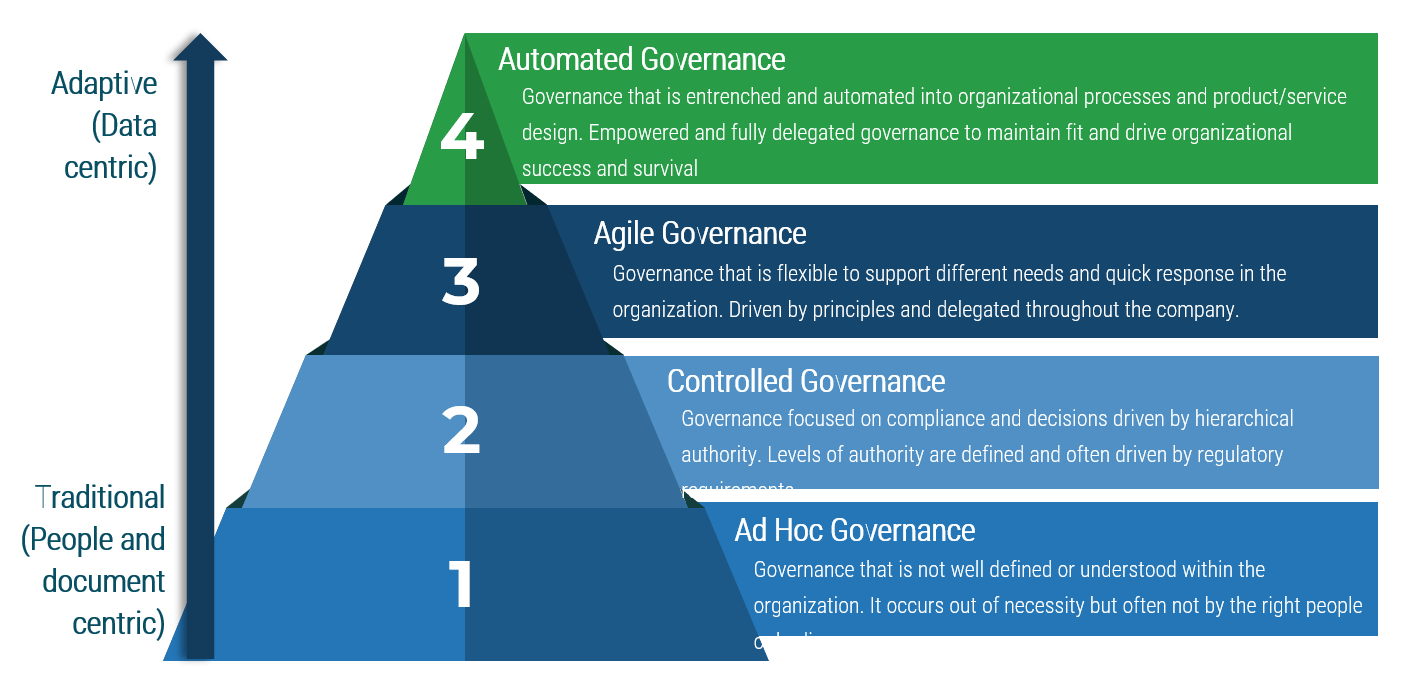

What is governance?

And why does it matter so much to IT and the M&A process?

- Governance is the method in which decisions get made, specifically as they impact various resources (time, money, and people).

- Because M&A is such a highly governed transaction, it is important to document the governance bodies that exist in your organization.

- This will give insight into what types of governing bodies there are, what decisions they make, and how that will impact IT.

- For example, funds to support integration need to be discussed, approved, and supplied to IT from a governing body overseeing the acquisition.

- A highly mature IT organization will have automated governance, while a seemingly non-existent governance process will be considered ad hoc.

2.1.5 Document M&A governance

1-2 hours

Input: List of governing bodies, Governing body committee profiles, Governance structure

Output: Documented method on how decisions are made as it relates to the M&A transaction

Materials: Flip charts/whiteboard, Markers, M&A Buy Playbook

Participants: IT executive/CIO, IT senior leadership, Company M&A team

The purpose of this activity is to determine the method in which decisions are made throughout the M&A transaction as it relates to IT. This will require understanding both governing bodies internal to IT and those external to IT.

- First, determine the other governance structures within the organization that will impact the decisions made about M&A. List out these bodies or committees.

- Create a profile for each committee that looks at the membership, purpose of the committee, decision areas (authority), and the process of inputs and outputs. Ensure IT committees that will have a role in this process are also documented. Consider the benefits realized, risks, and resources required for each.

- Organize the committees into a structure, identifying the committees that have a role in defining the strategy, designing and building, and running.

Record the results in the M&A Buy Playbook.

Current-state structure map – definitions of tiers

Strategy: These groups will focus on decisions that directly connect to the strategic direction of the organization.

Design & Build: The second tier of groups will oversee prioritization of a certain area of governance as well as design and build decisions that feed into strategic decisions.

Run: The lowest level of governance will be oversight of more-specific initiatives and capabilities within IT.

Expect tier overlap. Some committees will operate in areas that cover two or three of these governance tiers.

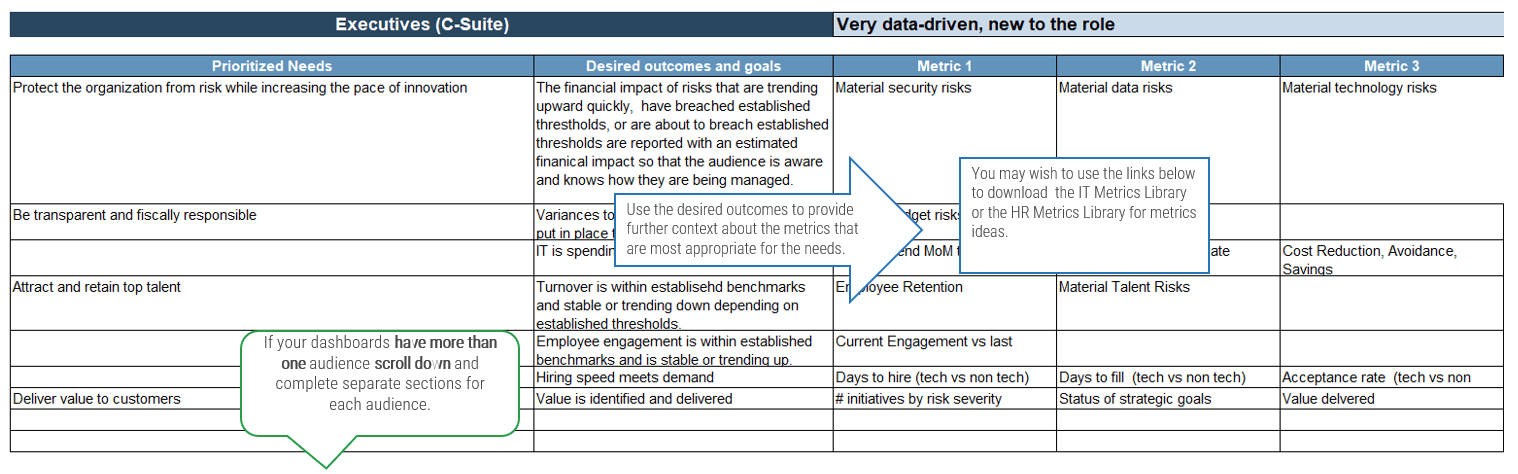

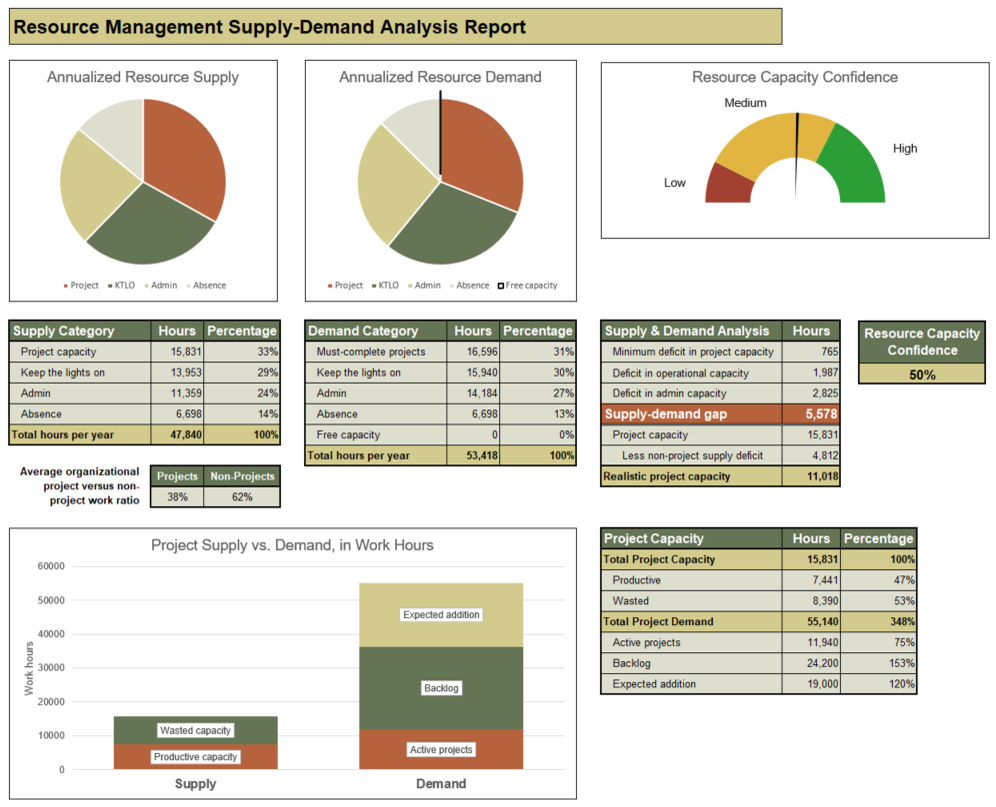

Measure the IT program’s success in terms of its ability to support the business’ M&A goals

Upper management will measure IT’s success based on your ability to support the underlying reasons for the M&A. Using business metrics will help assure business stakeholders that IT understands their needs and is working with the business to achieve them.

Business-Specific Metrics

- Revenue Growth: Increase in the top line as seen by market expansion, product expansion, etc. by percentage/time.

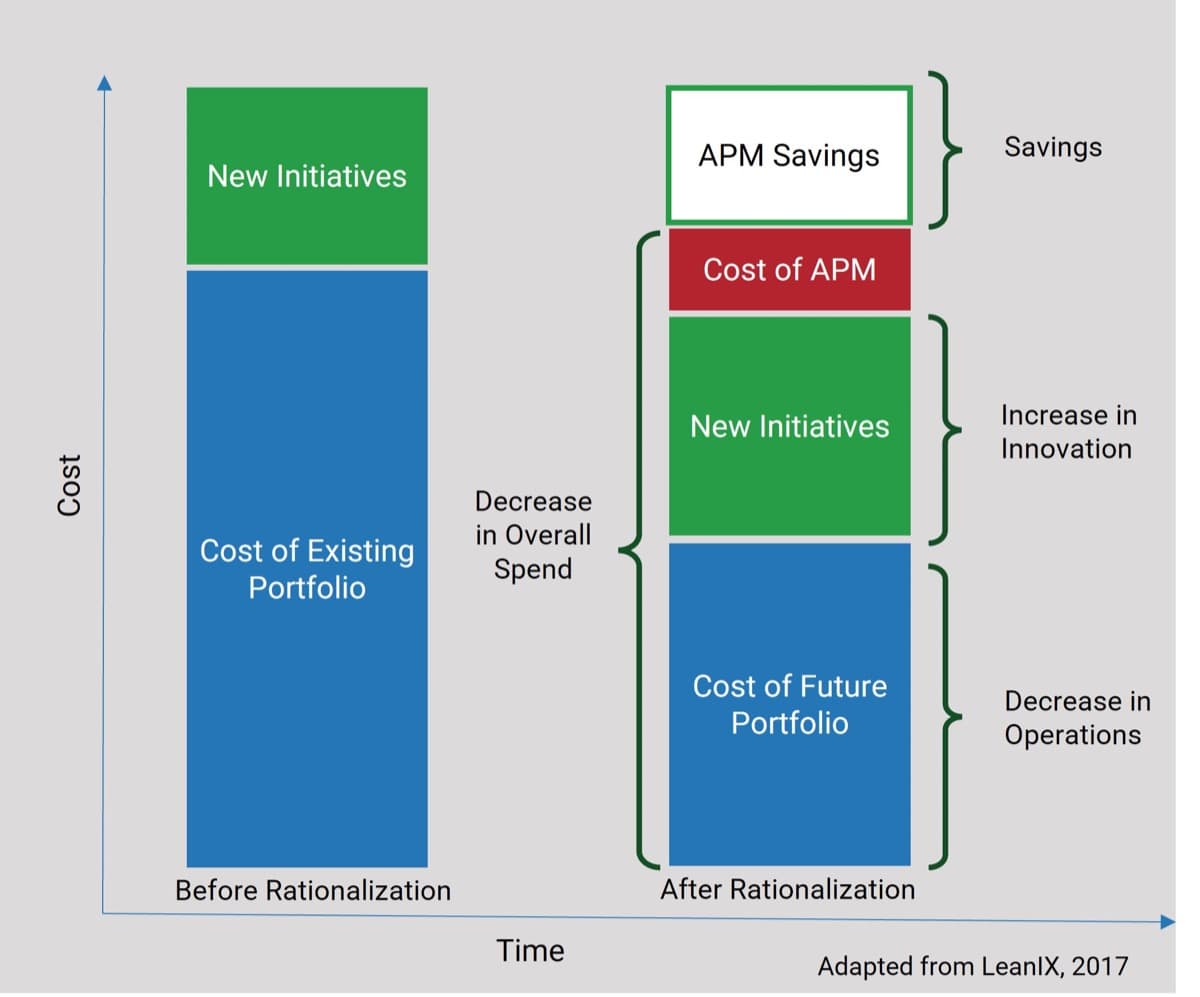

- Synergy Extraction: Reduction in costs as determined by the ability to identify and eliminate redundancies over time.

- Profit Margin Growth: Increase in the bottom line as a result of increased revenue growth and/or decreased costs over time.

IT-Specific Metrics

- IT operational savings and cost reductions due to synergies: Operating expenses, capital expenditures, licenses, contracts, applications, infrastructure over time.

- Reduction in IT staff expense and headcount: Decreased budget allocated to IT staff, and ability to identify and remove redundancies in staff.

- Meeting or improving on IT budget estimates: Delivering successful IT integration on a budget that is the same or lower than the budget estimated during due diligence.

- Meeting or improving on IT time-to-integration estimates: Delivering successful IT integration on a timeline that is the same or shorter than the timeline estimated during due diligence.

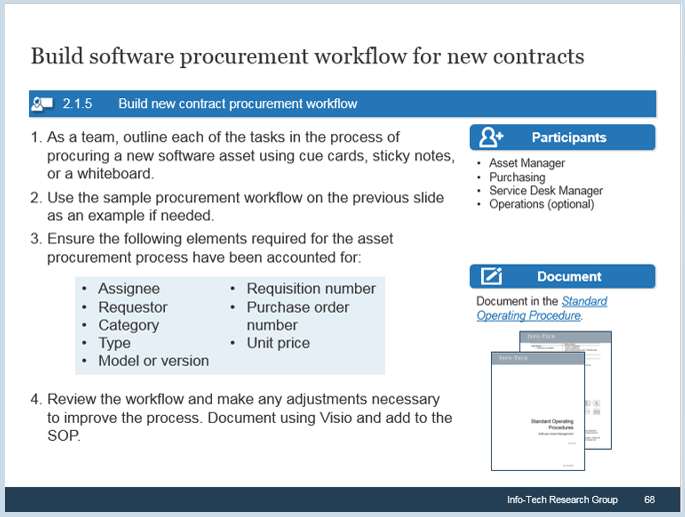

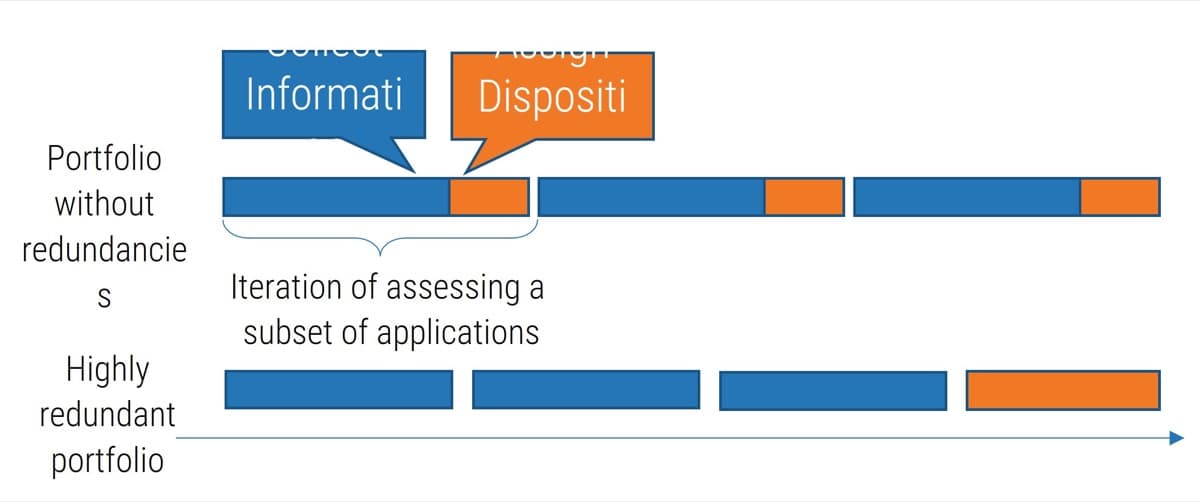

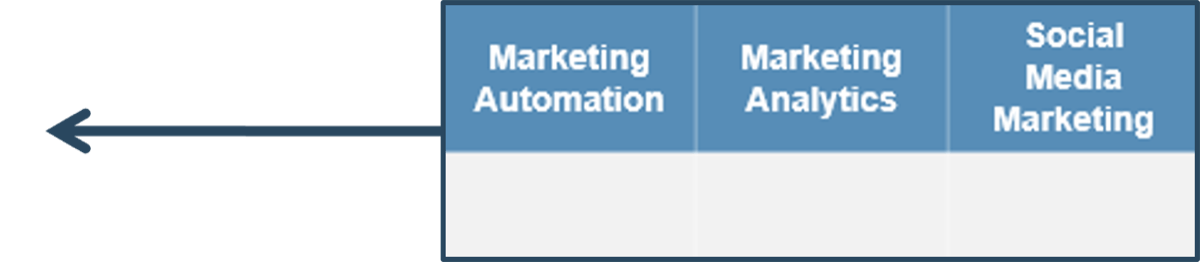

- Business capability support: Delivering the end state of IT that supports the expected business capabilities and growth.